UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported):

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

(Address of principal executive offices (zip code))

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered under Section 12(g) of the Exchange Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A |

Securities registered pursuant to Section 12(b) of the Act: None

EXPLANATORY NOTE

JUMPSTART OUR BUSINESS STARTUPS ACT

The Company qualifies as an “emerging growth company” as defined in Section 101 of the Jumpstart our Business Startups Act (the “JOBS Act”) as we do not have more than $1,070,000,000 in annual gross revenue and did not have such amount as of December 31, 2022 our last fiscal year. We are electing to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act.

We may lose our status as an emerging growth company on the last day of our fiscal year during which (i) our annual gross revenue exceeds $2,000,000,000 or (ii) we issue more than $2,000,000,000 in non-convertible debt in a three-year period. We will lose our status as an emerging growth company if at any time we are deemed to be a large accelerated filer. We will lose our status as an emerging growth company on the last day of our fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement.

As an emerging growth company, we are exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”) and Section 14A(a) and (b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such sections are provided below:

Section 404(b) of the Sarbanes-Oxley Act requires a public company’s auditor to attest to, and report on, management’s assessment of its internal controls.

Sections 14A(a) and (b) of the Exchange Act, implemented by Section 951 of the Dodd-Frank Act, require companies to hold shareholder advisory votes on executive compensation and golden parachute compensation.

As long as we qualify as an emerging growth company, we will not be required to comply with the requirements of Section 404(b) of the Sarbanes-Oxley Act and Section 14A(a) and (b) of the Exchange Act.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K or Form 8-K and other reports filed by us from time to time with the Securities and Exchange Commission (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, our management as well as estimates and assumptions made by our management. When used in the filings the words “anticipate”, “believe”, “estimate”, “expect”, “future”, “intend”, “plan” or the negative of these terms and similar expressions as they relate to us or our management identify forward looking statements. Such statements reflect the current view of our management with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report entitled “Risk Factors”) as they relate to our industry, our operations and results of operations, and any businesses that we may acquire. Should one or more of the events described in these risk factors materialize, or should our underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the U.S. federal securities laws, we do not intend to update any of the forward-looking statements to conform them to actual results. The following discussion should be read in conjunction with our pro forma financial statements and the related notes that will be filed herein.

Item 1.01 Entry into Material Definitive Agreement

On November 6, 2023, Plasma Innovative Inc. (“PMIN,” or the “Company”) entered into a share exchange agreement (the “Share Exchange Agreement”) with ESG Inc. (“ESG”) and the shareholders of ESG (the “ESG Shareholders”). Under the Share Exchange Agreement, One Hundred Percent (100%) of the ownership interest of ESG was exchanged for 10,432,800 shares of common stock of PMIN issued to the ESG Shareholders. The former stockholders of ESG, when added to their existing PMIN holdings, have a majority of the issued and outstanding common stock following the share exchange transaction. The transaction has been accounted for as a recapitalization of the Company, whereby ESG is the accounting acquirer.

Immediately after completion of such share exchange, the Company has a total of 25,899,468 issued and outstanding shares, with authorized share capital for common shares of 65,000,000.

Consequently, the Company continues to not fall all under the definition of shell company as define in Rule 12b-2 under the Exchange Act of 1934, as amended (the “Exchange Act”) and ESG is now a wholly owned subsidiary.

Item 2.01 Completion of Acquisition or Disposition of Assets

As described in Item 1.01 above, on November 6, 2023 we acquired all the issued and outstanding shares of ESG pursuant to the Share Exchange Agreement and ESG became our wholly owned subsidiaries. The acquisition was accounted for as a recapitalization effected by a share exchange, wherein ESG is considered the acquirer for accounting and financial reporting purposes.

As a result of the acquisition of all the issued and outstanding shares of ESG, we have now assumed ESG’s business operations as our own.

Description of Business

Company Overview

We were incorporated on July 22, 2021. Plasma Innovative Inc., a Nevada corporation, is an emerging cold plasma application company. We intended to use our proprietary, cold plasma technology to treat crops and plant seeds for agriculture. However, we have decided that it is in the best interest of our shareholders to cease operations in the plasma application in the agriculture sector.

On November 6, 2023, Plasma Innovative Inc. (“PMIN,” or the “Company”) entered into a share exchange agreement (the “Share Exchange Agreement”) with ESG Inc. (“ESG”), a Nevada corporation, and the shareholders of ESG (the “ESG Shareholders”), whereby One Hundred Percent (100%) of the ownership interest of ESG was exchanged for 10,432,800 shares of common stock of PMIN issued to the ESG Shareholders. The transaction has been accounted for as a recapitalization of the Company, whereby ESG is the accounting acquirer.

Immediately after completion of such share exchange, the Company has a total of 25,899,468 issued and outstanding shares, with authorized share capital for common share of 65,000,000.

Business Overview

Following the Share Exchange Agreement, Plasma Innovative Inc. (“PMIN” or the “Company”) is a US public company incorporated in Nevada on July 22, 2021, entered into an agreement on November 6, 2023 to acquire all the outstanding shares of ESG, which now operates as the Company’s wholly owned subsidiaries. While the Company was formed to use our proprietary, cold plasma technology to treat crops and plant seeds for agriculture, we have ceased such operations.

ESG Inc. was incorporated in October 2022 as a Nevada holding corporation and is headquartered at Kennett Square, PA and develops and operates sustainable plant-based ingredients and food production and distribution with the substantial experience of its management team, including experience and relationships in the industry of mushroom, agriculture and food in the world and the capital markets in the States.

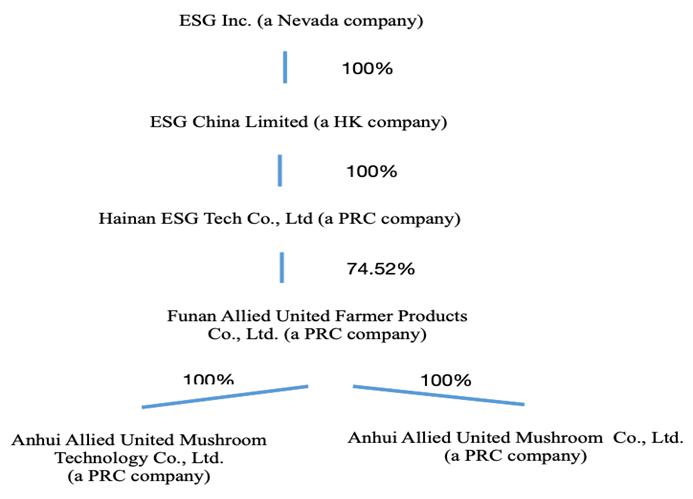

On September 28, 2023, ESG Inc. entered into a share exchange agreement with Funan Allied United Farmer Products Co., Ltd., a China corporation (“AUFP”), the shareholders of AUFP, (each a “Shareholder,” and collectively, the “Shareholders”), and Hainan ESG Technology Co., Ltd., a China corporation (“Hainan ESG”). Pursuant to such agreement, the Shareholders exchanged their equity of AUFP to Hainan ESG for shares of common stock of ESG, and ESG has agreed to offer the ESG shares. Following this transaction, AUFP became a 74.52% subsidiary of ESG through Hainan ESG.

Neither PMIN nor ESG are Chinese operating company. They are Nevada holding companies that operate business through Funan Allied United Farmer Products Co., Ltd., which owns Anhui Allied United Mushroom Technology Co., Ltd. and Anhui Allied United Mushroom Co., Ltd., all of whom are Chinese operating companies.

The Company exercises control over the operations of its subsidiaries. On February 17, 2023, the China Securities Regulatory Commission, or CSRC, issued the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures, which became effective on March 31, 2023. Pursuant to the Trial Measures, domestic companies that seek to offer or list securities overseas, both directly and indirectly, should fulfill the filing procedure and report relevant information to the CSRC. Since there is no offering, nor listing, we have not sought CSRC approval. Instead, we have relied on the legal opinion attached hereto as Exhibit 99.1.

Our subsidiaries are formed and operating in the Peoples Republic of China (together, the “Material PRC Company”) and have been duly established and is validly existing as a company under the laws of the Peoples Republic of China (“PRC Laws”) and has received all authorizations required by the Peoples Republic of China (the “Governmental Authorizations”) for its establishment to the extent such Governmental Authorizations are required under applicable PRC Laws, and its business license is in full force and effect. The Material PRC Company has the capacity and authority to own assets, to conduct business, and to sue and be sued in its own name under PRC Laws. The articles of association, business license and other constitutional documents (if any) of the Material PRC Company complies with the requirements of applicable PRC Laws and are in full force and effect. The Material PRC Company has not taken any corporate action, nor has any legal proceedings commenced against it, for its liquidation, winding up, dissolution, or bankruptcy, for the appointment of a liquidation committee, team of receivers or similar officers in respect of its assets or for any adverse suspension, withdrawal, revocation or cancellation of its business license.

All of the equity interests of the Material PRC Company are owned by ESG, through ESG China Limited, a Hong Kong company, and Hainan ESG Technology Co., Ltd, a PRC company, and we believe the Material PRC Company has obtained all necessary Governmental Authorizations. The equity interests of the Material PRC Company are owned by ESG, through its subsidiaries, free and clear of any pledge or other encumbrance under PRC Laws, and there are no outstanding rights, warrants or options to acquire, or instruments convertible into or exchangeable for, any equity interest in the Material PRC Company under PRC Laws.

All of our operations are conducted by our subsidiaries and through our wholly-foreign-owned entity (“WFOE”) based in China which involves unique risks to investors.

The legal and operational risks associated with being based in or having the majority of the Company’s operations in China could result in a material change in the value of the securities we are registering for sale or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Please see the Risk Factor titled “We are faced with risks and uncertainties as a foreign enterprise under PRC laws”.

Regulatory Permission

As substantially all of our operations are currently conducted by our PRC Subsidiaries in China, we are subject to the associated legal and operational risks, including risks related to the legal, political and economic policies of the Chinese government, the relations between China and the United States, or Chinese or United States regulations, which risks could result in a material change in our operations and/or cause the value of our ordinary shares to significantly decline or become worthless, and affect our ability to offer or continue to offer securities to investors. Recently, the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, and adopting new measures to extend the scope of cybersecurity reviews.

On July 6, 2021, the relevant PRC government authorities made public the Opinions on Strictly Cracking Down Illegal Securities Activities, which provided that the administration and supervision of overseas-listed China-based companies will be strengthened, and the special provisions of the State Council on overseas issuance and listing of shares by such companies will be revised, clarifying the responsibilities of domestic industry competent authorities and regulatory authorities. However, the Opinions on Strictly Cracking Down Illegal Securities Activities were only issued recently, leaving uncertainties regarding the interpretation and implementation of these opinions. It is possible that any new rules or regulations may impose additional requirements on us.

The Regulations on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the M&A Rules, adopted by six PRC regulatory agencies in 2006 and amended in 2009, requires an overseas special purpose vehicle formed for listing purposes through acquisitions of PRC domestic companies and controlled by PRC companies or individuals to obtain the approval of the China Securities Regulatory Commission, or the CSRC, prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange.

On December 28, 2021, the Cyberspace Administration of China (the “CAC”) jointly with the relevant authorities formally published Measures for Cybersecurity Review (2021) which took effect on February 15, 2022 and replace the former Measures for Cybersecurity Review (2020). Measures for Cybersecurity Review (2021) stipulates that operators of critical information infrastructure purchasing network products and services, and online platform operator (together with the operators of critical information infrastructure, the “Operators”) carrying out data processing activities that affect or may affect national security, shall conduct a cybersecurity review, any online platform operator who controls more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if it seeks to be listed in a foreign country.

According to the Notice by the General Office of the State Council of Comprehensively Implementing the List-based Management of Administrative Licensing Items (No. 2 [2022] of the General Office of the State Council) and its attachment, the List of Administrative Licensing Items Set by Laws, Administrative Regulations, and Decisions of the State Council (2022 Edition), as of the date hereof, our PRC subsidiaries has received from PRC authorities all requisite licenses, permissions or approvals needed to engage in the businesses currently conducted in China. As of the date hereof, neither we nor our PRC Subsidiaries (i) are required to obtain permissions from any PRC authorities to operate or issue our ordinary shares to foreign investors, (ii) are subject to permission requirements from the CSRC, the CAC or any other entity that is required to approve our PRC subsidiaries’ operations, or (iii) have received or were denied such permissions by any PRC authorities.

The only permission required for operations is the business license of the PRC subsidiaries. The business license in PRC is a permit issued by Market Supervision and Administration that allows the company to conduct specific business within the government’s geographical jurisdiction. As of the date hereof, our PRC subsidiaries have received from PRC authorities all requisite licenses, permissions or approvals needed to engage in the businesses currently conducted in China, and no permission or approval has been denied. At present, we do not believe our operations require any other approvals and or permissions of Chinese authorities.

If we were required to obtain approval from the CSRC in the future and were denied permission from Chinese authorities to list or become quoted on U.S. exchanges and/or quotation servicers, we will not be able to continue to be quoted or listed on U.S. exchanges, which would materially affect the interests of the investors. It is uncertain when and whether the Company will be required to obtain permission from the PRC government to list or become quoted on U.S. exchanges in the future, and even when such permission is obtained, whether it will be denied or rescinded. Although the Company is currently not required to obtain permission from any of the PRC central or local government to obtain such permission and has not received any denial to list or become quoted on the U.S. exchange, our operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to its business or industry; if we inadvertently conclude that such approvals are not required when they are, or applicable laws, regulations, or interpretations change and we are required to obtain approval in the future.

On December 24, 2021, the China Securities Regulatory Commission, or the CSRC, issued Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Administration Provisions”), and the Administrative Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (the “Measures”), which were open for public comments by January 23, 2022. The Administration Provisions and Measures for overseas listings lay out specific requirements for filing documents and include unified regulation management, strengthening regulatory coordination, and cross-border regulatory cooperation. Domestic companies seeking to list abroad must carry out relevant security screening procedures if their businesses involve supervisions such as foreign investment security and cyber security reviews. Companies endangering national security are among those off-limits for overseas listings. We believe the Company is not effected by this based upon the legal opinion attached hereto as Exhibit 99.1.

On February 17, 2023, with the approval of the State Council, the CSRC released the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”) and five supporting guidelines, which will come into effect on March 31, 2023. According to the Trial Measures, among other requirements, (1) domestic companies that seek to offer or list securities overseas, both directly and indirectly, should fulfill the filing procedures with the CSRC; if a domestic company fails to complete the filing procedures, such domestic company may be subject to administrative penalties; and (2) where a domestic company seeks to indirectly offer and list securities in an overseas market, the issuer shall designate a major domestic operating entity responsible for all filing procedures with the CSRC, and such filings shall be submitted to the CSRC within three business days after the submission of the overseas offering and listing application. On the same day, the CSRC also held a press conference for the release of the Trial Measures and issued the Notice on Administration for the Filing of Overseas Offering and Listing by Domestic Companies, which clarifies that (1) on or prior to the effective date of the Trial Measures, domestic companies that have already submitted valid applications for overseas offering and listing but have not obtained approval from overseas regulatory authorities or stock exchanges may reasonably arrange the timing for submitting their filing applications with the CSRC, and must complete the filing before the completion of their overseas offering and listing; (2) a six-month transition period will be granted to domestic companies which, prior to the effective date of the Trial Measures, have already obtained the approval from overseas regulatory authorities or stock exchanges, but have not completed the indirect overseas listing; if domestic companies fail to complete the overseas listing within such six-month transition period, they shall file with the CSRC according to the requirements; and (3) the CSRC will solicit opinions from relevant regulatory authorities and complete the filing of the overseas listing of companies with contractual arrangements which duly meet the compliance requirements, and support the development and growth of these companies.

With respect to the domestic company, non-compliance with the Trial Measures or an overseas listing completed in breach of it may result in a warning or a fine ranging from RMB 1 million to RMB10 million. Furthermore, the directly responsible executives and other directly responsible personnel of the domestic company may be warned, or fined between RMB 500,000 and RMB 5 million and the controlling shareholder, actual controllers, and other legally appointed persons of the domestic company may be warned, or fined between RMB 1 million and RMB 10 million. If, during the filing process, the domestic company conceals important factors or the content is materially false, and securities are not issued, they are subject to a fine of RMB1 million to RMB10 million. With respect to the directly responsible executives and other directly responsible personnel of the domestic company, they are subject to a warning and fine between RMB 500,000 and RMB 5 million, and with respect to the controlling shareholder, actual controllers, and other legally appointed persons of the domestic company, they are subject to a warning and fine between RMB 1 million and RMB 10 million.

The Trial Measures have come into effect. After March 31, 2023, any failure or perceived failure by the domestic company or PRC subsidiaries to comply with the above confidentiality and archives administration requirements under the Trial Measures and other PRC laws and regulations may result in that the relevant entities would be held legally liable by competent authorities and referred to the judicial organization to be investigated for criminal liability if suspected of committing a crime.

According to a translated copy of the current and effective regulations promulgated by the China Securities Regulatory Commission, that is, the “Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies” Article 2 states, “Direct overseas offering and listing by domestic companies refers to such overseas offering and listing by joint-stock company incorporated domestically. Indirect overseas offering and listing by domestic companies refers to such overseas offering and listing by a company in the name of an overseas incorporated entity, whereas the company’s major business operations are located domestically, and such offering and listing is based on the underlying equity, assets, earnings or other similar rights of a domestic company”. Article 16 states, “Subsequent securities offerings of an issuer in the same overseas market where it has previously offered and listed securities shall be filed with the CSRC within 3 working days after the offering is completed.

According to a translated copy of the current and effective regulations promulgated by the China Securities Regulatory Commission, that is, the “Regulations on Strengthening the Confidentiality and Archives Management Work Related to the Overseas Issuance and Listing of Securities” Article 3 states, “A domestic company that plans to, either directly or through its overseas listed entity, publicly disclose or provide to relevant entities or individuals including securities companies, securities service providers, and overseas regulators, documents and materials that contain state secrets or government work secrets, shall first obtain approval from competent authorities according to law, and file with the secrecy administrative department at the same level. Where there is ambiguity or dispute over the identification of a state secret, a request shall be submitted to the competent secrecy administrative department for determination; where there is ambiguity or dispute over the identification of a government work secret, a request shall be submitted to the competent government authority for determination.” Further, Article 4 states that, “A domestic company that plans to, either directly or through its overseas listed entity, publicly disclose or provide to relevant entities or individuals including securities companies, securities service providers, and overseas regulators, other documents and materials that, if divulged, will jeopardize national security or public interest, shall strictly fulfill relevant procedures stipulated by applicable national regulations.” Accordingly, as the Company does not believe its operations fall into the above legal provisions, the Company does not believe that it is required to seek authorizations from Chinese authorities.

On December 28, 2021, the Cyberspace Administration of China (the “CAC”) jointly with the relevant authorities formally published Measures for Cybersecurity Review (2021) which took effect on February 15, 2022 and replace the former Measures for Cybersecurity Review (2020). Measures for Cybersecurity Review (2021) stipulates that operators of critical information infrastructure purchasing network products and services, and online platform operator (together with the operators of critical information infrastructure, the “Operators”) carrying out data processing activities that affect or may affect national security, shall conduct a cybersecurity review, any online platform operator who controls more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if it seeks to be listed in a foreign country.

At present, we do not believe our operations require the approval and or permission of Chinese authorities, based upon the legal opinion attached hereto as Exhibit 99.1. This is because the Company’s business is food supply, which we were informed by counsel does not require the approval and permission of the Chinese government. Please see related legal opinion attached hereto as Exhibit 99.1. The “Special Management Measures for Foreign Investment Access (Negative List) (2021 Edition)” and “Market Access Negative List (2022 Edition)” issued by the Chinese government do not include the industry and business the Company is involved in. The Company will settle amounts owed under the WFOE structure by transferring dividends, or distributions between the holding company and its subsidiaries, or to investors, which have not yet occurred. We intend to rely primarily on dividends paid by the WFOE for our cash needs, including the funds necessary to pay dividends and other cash distributions, if any, to our shareholders, to service any debt we may incur and to pay our operating expenses. The Company has made no such distributions to date nor has it received any distributions from the WFOE to date, and the Company has no current cash management policies in place. The Company will look to implement one in the near future. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, our WFOE may experience difficulties in completing the administrative procedures necessary to pay distributions from its profits, if any. Furthermore, if our WFOE incurs debt on its own in the future, the instruments governing the debt may restrict their ability to pay distributions or make other payments. If the Company or our subsidiaries are unable to receive all of the revenues from our operations, we may be unable to pay dividends on our Shares.

Cash dividends, if any, on the Company’s Shares will be paid in U.S. dollars. If the Company is considered a PRC tax resident enterprise for tax purposes, any dividends paid to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax at a rate of up to 10.0%.

There are no legal, arbitral or governmental proceedings, regulatory investigations or other governmental decisions, rulings, orders, or actions before any Governmental Agencies in progress or pending in the PRC to which the Company or the Material PRC Company is a party or to which any assets of the Material PRC Company is a subject.

All dividends declared and payable upon the equity interests in the WFOE may be converted into foreign currency and freely transferred out of the PRC free of any deductions in the PRC, provided that (i) the declaration and payment of such dividends complies with applicable PRC Laws and the constitutional documents of the WFOE, and (ii) the remittance of such dividends out of the PRC complies with the procedures required by the relevant PRC Laws relating to foreign exchange administration.

We face uncertainties with respect to indirect transfers of equity interests in PRC resident enterprises by their non-PRC holding companies.

Adverse changes in economic and political policies of the PRC government could have a material and adverse effect on overall economic growth in China, which could materially and adversely affect our business. General macroeconomic conditions may materially and adversely affect our business, prospects, results of operations and financial position. The PRC government’s control over foreign currency conversion may adversely affect our business and results of operations and our ability to remit dividends.

There is no tax or duty payable by or on behalf of the Material PRC Company under applicable PRC Laws in connection with the creation, allotment and issuance Common Shares, provided that each person taking the aforementioned actions is not subject to PRC tax by reason of citizenship, permanent establishment, residence or otherwise subject to PRC tax imposed on or measured by net income or net profits.

There are no reporting obligations to any Governmental Agency under PRC Laws on those holders of Common Shares who are not deemed to be PRC residents as defined under applicable PRC Laws, to the extent that no reporting obligation is triggered by the purchase or holding of Common Shares under the PRC anti-monopoly laws, rules and regulations.

We currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, contractual requirements, business prospects and other factors the board of directors deem relevant, and subject to the restrictions contained in any future financing instruments.

All of our business operations are conducted in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. Although the PRC economy has been transitioning from a planned economy to a more market-oriented economy since the late 1970s, the PRC government continues to exercise significant control over China’s economic growth through direct allocation of resources, monetary and tax policies, and a host of other government policies such as those that encourage or restrict investment in certain industries by foreign investors, control the exchange between the Renminbi and foreign currencies, and regulate the growth of the general or specific market. While the Chinese economy has experienced significant growth in the past 30 years, growth has been uneven, both geographically and among various sectors of the economy. As the PRC economy has become increasingly linked with the global economy, China is affected in various respects by downturns and recessions of major economies around the world. The various economic and policy measures enacted by the PRC government to forestall economic downturns or bolster China’s economic growth could materially affect our business. Any adverse change in the economic conditions in China, in policies of the PRC government or in laws and regulations in China could have a material adverse effect on the overall economic growth of China and market demand for our outsourcing services. Such developments could adversely affect our businesses, lead to reduction in demand for our services and adversely affect our competitive position.

The PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value. Since the late 1970s, the PRC government has been building a comprehensive system of laws and regulations governing economic matters in general. The overall effect has been to significantly enhance the protections afforded to various forms of foreign investments in China. We conduct our business primarily through our WFOE, and the WFOE is established in China. These companies are generally subject to laws and regulations applicable to foreign investment in China. However, since these laws and regulations are relatively new and the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involves uncertainties, which may limit legal protections available to us. In addition, some regulatory requirements issued by certain PRC government authorities may not be consistently applied by other government authorities (including local government authorities), thus making strict compliance with all regulatory requirements impractical, or in some circumstances impossible. For example, we may have to resort to administrative and court proceedings to enforce the legal protection that we enjoy either by law or contract.

ESG the Driving Force behind the Company

ESG’s core business philosophy is to develop and operate sustainable and technology-driving food businesses consistent with the principles of Environmental, Sustainable and Governance investing.

An explanation of the three domains of Environmental, Sustainable and corporate Governance -- is critical to understanding ESG’s development of its own business.

Environmental and Sustainable criteria include technology and equipment application, energy use, waste, pollution, natural resource conservation, and treatment of animals and natural resources and help us avoid a company that might pose a greater financial risk due to their environmental or other practices. The United Nations projects that the world’s population is to reach 8.5 billion by 2030, 9.7 billion by 2050 and exceed 11 billion in 2100. Food production needs to meet the projected demands in the coming years. Thus, food production should be technology-driven, environmentally friendly, sustainable and not have a negative impact on the ecosystem and natural resources. Thus the “E and S” in ESG is the first keen focus in developing and operating our business.

Corporate Governance deals with a company’s top-down leadership and how it governs itself in an ethical, transparent and manner devoid of conflicts of interest and focuses on executive pay, audits, internal controls, and shareholder rights. We see an ever-increasing consumer and investor demand for sustainable food production and distribution. We believe that many consumers will expect that food is produced under stringent scrutiny for food safety and that ethical policies underlie every part of the process. We believe they will be willing to pay a premium for food sourced through such channels. In addition, we expect governments everywhere will promulgate and enforce stricter food safety regulations, which should eliminate a large number of food producers who will be unable to comply with these respective regulations. These market conditions will require food companies to embrace new means of production and technology. We believe this will lead to consolidation in various segments of the food industry, in which only forward-thinking participants like ESG will survive and prosper.

Our Operating Subsidiary Companies

PMIN is a holding company of ESG, which, itself, is a holding company engaged in sustainable food production and distribution directly or indirectly through our subsidiaries. ESG currently owns operating subsidiaries in China. Our operating subsidiaries are involved in direct mushroom composing, growing, food production, distribution as well as import and export of food. We believe that the growing global demand for sustainable high-quality food presents a unique opportunity to operate companies engaged in this critical area that is being paid increasing attention by global investors.

Funan Allied United Farmer Product Co., Ltd. (“AUFP”) was created in 2017 in China by US mushroom industry participants with the support of strategic investors to revolutionize China’s mushroom industry and create enhanced standards for food safety, sustainability, greenness, and resulting high-quality food products to serve Chinese consumers and regional Asian export markets. AUFP engages in the research and development, composting, cultivation, processing, packaging, and distribution of high-quality white button mushrooms from Fuyang, China. As a bio-sustainable and resources-recyclable company, with wheat straw and animal manure as the major raw materials, kinds of agricultural waste, AUFP is dedicated to building Fuyang into the hub to supply high-quality mushroom, compost and organic fertilizer in Asia with the support of industrial experts and capital.

Currently, AUFP owns approximately 56 acres of industrial land use rights and built bunkers, tunnels and growing facilities, totaling approximately 300,000 square feet, with annual production of Phase III compost of 21,600 tons and fresh white button mushrooms of 7300 tons. With the completion of the expansion of bunkers and tunnels, composting facilities, AUFP anticipates increasing production capacity to 90,000 tons of Phase IIII compost, of which two-thirds are planned to be sold to third party’s farms.

As an AUFP’s subsidiary, Anhui Allied United Mushroom Technology Co., Ltd. (“AUMT”) operates a Phase III compost manufacturing facility to distribute to its own and third-party growing facilities in China and east and southeast Asia while Anhui Allied United Mushroom Co. Ltd. (“AUM”), an AUFP subsidiary, is a company engaged in growing, packing and distributing fresh white button mushrooms in China.

AUFP received the highest quality certification “Green Food” in China. Along with its subsidiaries, AUFP recorded a consolidated revenue of USD 7.25 million and USD 6.1 million for the years ended December 31, 2022 and 2021, respectively.

Anhui Allied United Mushroom Technology Co., Ltd.

Anhui Allied United Mushroom Technology Co., Ltd. (“AUMT”) was created in China in March 2018, to manufacture white button mushroom compost.

White button mushroom compost is a unique living organism. It varies according to the environment where it is produced. Making mushroom compost is a complex process that AUMT has been perfecting. AUMT uses the art of the state phase III composting process to make compost under the supervision of a team of specialists, taking raw materials from the local area, for our own farms and other mushrooms growers.

Phase III composting process is composed of:

Phase I: Bales of straw are mixed with animal manure, water and gypsum. When mixed, the material is filled into large aerated concrete vessels, called bunkers. During this phase the compost reaches temperatures of 80 degrees Celsius. After 7–13 days the Phase I process is completed, ready for the Phase II process to begin.

Phase II: The material is removed from the bunkers and filled into closed tunnels, where we monitor and control a series of temperature changes – the most important of which is pasteurization. Pasteurization helps remove any unwanted organisms from the compost. The next and most important stage of Phase II is the conditioning of the compost. This means that microbes convert ammonia and amines into protein. Phase II takes approximately 5–6 days. The climate controlled “tunnel” heats the compost to 58 degrees Celsius for pasteurization and then conditions it at 48 degrees Celsius.

Phase III: Once the Phase II process is completed, the compost is cooled and removed from the Phase 2 tunnels. Mushroom spawn is added and the compost is then refilled into Phase III tunnels. Spawn is usually made with rye or millet grain that has been sterilized and inoculated with mushroom tissue (mycelium). This Phase III incubation process takes 15-17 days. During this time mycelium grows throughout the substrate. After the 15-17 days incubation period, the Phase III compost is loaded into specially designed trucks for transport to the growing facility.

Currently AUMT owns 3 bunkers, 9 tunnels and related auxiliary facilities and equipment and produces approximately 1,800 tons of Phase III compost monthly. Under the ongoing expansion of composting facility, AUMT anticipates having 9 bunkers and 31 tunnels with the capacity of 90,000 tons annually of Phase III compost to supply gradually from January 2024.

Anhui Allied United Mushroom Co., Ltd.

Anhui Allied United Mushroom Co., Ltd. (“AUM”) was created in China in April, 2018, to grow fresh white button mushroom and provide white button mushroom growing management services. AUM produces high quality fresh white button mushrooms.

The growing process is composed of the following steps:

As the mushroom compost is filled into the growing rooms, a layer of peat is applied to the surface of the Phase III compost. The layer is called the casing layer and is essential for the formation of the mushrooms. Over a 3-4 days period, the mushroom tissue grows throughout the compost and up through the casing layer.

The environment is then altered to simulate an autumn day, which promotes the formation of mushrooms. As a result, tiny mushroom heads (pins) begin to appear. During the next two weeks the levels of moisture, temperature, humidity, carbon dioxide and air movement are carefully monitored.

The pins eventually grow into mushrooms. The mushrooms are picked by hand to maintain the highest possible quality. All our mushrooms are cooled quickly after harvesting and are packed and transported in refrigerated trucks to wholesale markets or supermarkets.

Currently, AUM owns approximately 335,000 square feet of growing area, with annual production of fresh white button mushroom of approximately 20,000,000 LBS.

Market Overview

Health Diet Trend

We believe that people are searching for vegan and plant-based options for every aspect of their lifestyle. Mushrooms are a nutritious vegetarian delicacy and contain many vitamins and minerals but are low on sugar and fat. We believe that they are becoming a preferable and quality ingredient source for plant-based food. As an innovative food company with the whole production chain of mushrooms, we are committed to innovating and providing sustainable mushroom-based food and its ingredients.

Mushrooms are popular in most of the developed countries and are becoming accepted in many developing countries. The market for mushrooms is growing rapidly because of their rich nutritional value and special taste aroma, and flavor. The global plant-based food market is expected to reach 77.8 billion U.S. dollars in 2025. The forecast projects that by 2030 the market will have more than doubled. (https://www.statista.com/statistics/1280394/global-plant-based-food-market-value/).

Quality Phase III Compost and Strong Demand

We believe that the key factor for the successful growing of white button mushrooms is composting. Composting is a delicate and difficult business, especially in large-scale and commercial indoor growing. ESG believes it is positioning itself as the compost provider in the Asian Pacific area with its management expertise and experience in composting and advantages of being near a raw material supply.

Our Competitive Strengths

Experienced Management

ESG’s management is composed of professionals in mushroom composting, growing, food processing and marketing, and the food industry, as well as in capital markets and public companies. We have experienced experts in white button mushroom production and, especially, composting, on our management team. Experienced and senior experts are the most important asset to ESG. ESG is designing and executing a comprehensive training system to continue to build up the management team for our operations and the provisions of management service.

Focusing Key Stages of Food Production

ESG is focusing on the composting business and food processing business, especially mushroom related, which is two ends of the most value added.

ESG is focusing on research and development in connection with the improvement of mushroom composting production and of the production of mushroom based food and its ingredients. We concentrate ESG’s capital and efforts on key stages.

Production Location in the raw material base

A location near the supply of excellent raw materials such as wheat straw and animal manure is very important in order to control the cost of production and the quality of mushroom. ESG’s current and planned production facilities are located in excellent places of raw materials to be collected such as Funan in China.

Employees

We currently have around 20 full-time management employees and 40 full time operating workers along with 185 part time harvesters and runners.

Intellectual Property

ESG has 1 invention Patent, 14 Utility Model Patent, registered and 17 Utility Model Patent to file with pending effectiveness. They are:

| IP number | IP name | Filing Date | Filer | Status |

| CN102318825A | process for food production of improving phlegm-damp constitution | 2011.10.14 | AUFP | Granted |

| CN201820981543.X | A bisporus compost raw material mixing equipment | 2018.06.25 | AUFP | Granted |

| CN201821015764.8 | A processing equipment for canned mushrooms | 2018.06.25 | AUFP | Granted |

| CN201821036925.1 | Nutrient feeding equipment for planting Agaricus bisporus | 2019.07.02 | AUFP | Granted |

| CN201821036736.4 | A culture bed for growing Agaricus bisporus | 2018.06.29 | AUFP | Granted |

| CN201821037117.7 | A compost laying equipment for Agaricus bisporus planting | 2019.06.25 | AUFP | Granted |

| 2.02221E+12 | An environmental monitoring device for storage of Agaricus bisporus fermented material | 2022.05.18 | AUMT | Granted |

| 2.02221E+12 | A kind of fermented material storage device for Agaricus bisporus that is easy to clean | 2022.05.25 | AUMT | Granted |

| 2.02221E+12 | Fermentation tank for bisporus fermentation material | 2022.05.31 | AUMT | Granted |

| 2.02221E+12 | Edible fungus Agaricus bisporus fermentation material production system | 2022.06.14 | AUMT | Granted |

| 2.02222E+12 | A kind of aseptic production platform for the production of Agaricus bisporus fermented material | 2022.06.30 | AUMT | Granted |

| 2.02222E+12 | A discharge mechanism for production equipment of Agaricus bisporus fermented material | 2022.07.13 | AUMT | Granted |

| 2.02222E+12 | A kind of environmental control system of Agaricus bisporus fermented material | 2022.07.20 | AUMT | Granted |

| 2.02223E+12 | A sealing component and fermentation storage device | 2022.09.30 | AUMT | Granted |

| 2.02223E+12 | An adjustment component and a bisporus fermentation chamber | 2022.11.07 | AUMT | Granted |

| 2.02321E+12 | A kind of Agaricus bisporus planting watering structure | 2023.05.26 | AUM | filed |

| 2.02321E+12 | A carbon dioxide sensor with a dust-proof structure | 2023.05.26 | AUM | filed |

| 2.02321E+12 | Ventilation structure of Agaricus bisporus planting room | 2023.05.26 | AUM | filed |

| 2.02321E+12 | A kind of multi-layer mushroom drying machine | 2023.06.05 | AUM | filed |

| 2.02321E+12 | A highly airtight fermentation storage tank | 2023.06.05 | AUM | filed |

| 2.02321E+12 | A layered fermentation bin for Agaricus bisporus | 2023.06.05 | AUM | filed |

| 202321405549X | A kind of quick cleaning equipment for mushrooms | 2023.06.05 | AUM | filed |

| 2.02322E+12 | A shaking sorting structure for Agaricus bisporus | 2023.06.19 | AUM | filed |

| 2.02322E+12 | A kind of multi-layer fermentation tank | 2023.06.19 | AUM | filed |

| 2.02322E+12 | A soil-covering device for cultivation of Agaricus bisporus fermented material in shallow baskets | 2023.07.10 | AUM | filed |

| 2.02322E+12 | A bisporus picking machine | 2023.07.10 | AUM | filed |

| 2.02322E+12 | A kind of indoor Agaricus bisporus planting frame | 2023.07.10 | AUM | filed |

| 2.02322E+12 | A spliced edible fungus cultivation frame | 2023.07.10 | AUM | filed |

| 2.02322E+12 | A kind of mushroom weighing equipment | 2023.08.03 | AUM | filed |

| 2.02322E+12 | A kind of edible fungus culture substrate mixing machine | 2023.08.03 | AUM | filed |

| 2.02322E+12 | A kind of mushroom seeding device | 2023.08.03 | AUM | filed |

| 2.02321E+12 | A mushroom planting adjustable awning | 2023.05.26 | AUM | filed |

Reports to Security Holders

You may read and copy any materials the Company files with the Commission in the Commission’s Public Reference Section, Room 1580, 100 F Street N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Section by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, which can be found at http://www.sec.gov.

Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information contained in this report before deciding to invest in our common stock.

Risks Related to our Business

We face risks related to health epidemics that could impact our sales and operating results.

Our business could be adversely affected by the effects of a widespread outbreak of contagious disease, including COVID-19. Although the impact of COVID-19 was temporary on our business and operations in 2021 due to some shutdowns in China, any outbreak of contagious diseases in the future, and other adverse public health developments, particularly in China, could have a material and adverse effect on our business operations. These could include disruptions or restrictions on our ability to our operations, as well as temporary closures of our facilities and ports or the facilities of our customers and third-party service providers. Any disruption or delay of our customers or third-party service providers would likely impact our operating results and the ability of the Company to continue as a going concern. In addition, a significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of China and many other countries, resulting in an economic downturn that could affect demand for our products and significantly impact our operating results.

The COVID-19 has had a significant impact on our operations for the year ended December 31, 2021 and had a temporary impact on our operations for the year ended December 31, 2022.

Our ability to manufacture and/or sell our products may be impaired by damage or disruption to our manufacturing, warehousing or distribution capabilities and/or distributors as a result of the impact from COVID-19. This damage or disruption could result from events or factors that are impossible to predict or are beyond our control, such as raw material scarcity, pandemics, government shutdowns, disruptions in logistics, supplier capacity constraints, adverse weather conditions, natural disasters, fire, terrorism or other events. In December 2019, COVID-19 emerged. Because of the shelter-in-place orders and travel restrictions mandated by the Chinese government, the production and sales activities of the Company stopped during the end of January and February 2020, which adversely impacted the Company’s production and sales during that period. Although the production and sales resumed at the end of March 2020, the COVID-19 outbreak has had a significant adverse impact on our business and operations during the fiscal year ended December 31, 2021. The continued uncertainties associated with COVID-19 may cause the Company’s revenue and cash flows to underperform in the next 12 months. A resurgence could negatively affect the sales. The extent of the future impact of COVID-19 is still highly uncertain and cannot be predicted as of the date of this report. If COVID-19 further impacts its production and sales, the Company’s financial condition, results of operations, and cash flows could continue to be adversely affected.

The loss of any of our key customers could reduce our revenues and our profitability.

Our key customers in fiscal year 2022 were distributor in Shanghai China and processor in Fujian province China. If we cannot maintain long-term relationships with these major customers, the loss of our sales to them could have an adverse effect on our business, financial condition and results of operations. There can be no assurance that we will maintain or improve the relationships with these customers, or that we will be able to continue to supply these customers at current levels or at all. In addition, having a relatively small number of customers/distributors may cause our quarterly results to be inconsistent, depending upon these customers’ daily capacity to sell.

Our failure to comply with PRC food safety laws may require us to incur significant costs.

Manufacturers in the Chinese food industry are subject to compliance with PRC food safety laws and regulations. Such laws require manufacturers to comply with regulations with respect to food, food additives, packaging, and food production sites, facilities and equipment. Failure to comply with PRC food safety laws may result in fines, suspension of operations and, in more extreme cases, criminal proceedings against an enterprise and its management. The Chinese government may also change the existing laws or regulations or impose additional or stricter laws or regulations, compliance with which may cause us to incur significant capital expenditures, which we may be unable to pass on to our customers through higher prices for our products.

We lack product and business diversification. Accordingly, our future revenues and earnings are more susceptible to fluctuations than a more diversified company.

Our primary business activities have historically focused on fresh white button mushrooms products although we are planning to build food processing facility. Because our focus is limited in this way, any risk affecting the fresh mushrooms industry or consumers’ desire for fresh mushrooms products could disproportionately affect our business. Our current lack of product and business diversification could inhibit the opportunities for growth of our business, revenues and profits.

Governmental support to the agriculture industry and/or our business may decrease or disappear.

Currently the Chinese government is supporting agriculture with tax exemption, especially e-commerce in agriculture. In addition, our local government has been supporting our company by providing subsidies from time to time. These beneficial policies may change, so the support we receive from the government may decrease or disappear, which may impact our development.

Beneficial tax incentives may disappear.

We operate our business through our Chinese subsidiaries. Currently the agriculture industry is highly supported by the Chinese government. For example, to further strengthen and standardize the support of comprehensive agricultural development to the characteristic industries with agricultural advantages, the Chinese National Office of Comprehensive Agricultural Development has decided to carry out the compilation of The Plan for Comprehensive Agricultural Development to Support the Agricultural Advantage and Characteristic Industries (2019-2021) (the “New Plan”). Mushrooms are emphasized and classified as a “dominant and characteristic industry,” which may become the objects of policy-support issue in the future. However, the New Plan has not yet been formally approved and the final result remains to be further observed.

As an agricultural production enterprise, we are enjoying certain tax benefits, including a tax waiver of VAT and income tax. If the tax policies change in a way that some or all of the tax benefits we presently receive are cancelled, we may need to pay much higher taxes which will reduce or eliminate our profit margin.

We are subject to extensive regulations by the Chinese government.

The food industry is subject to extensive regulations by Chinese government agencies. Among other things, these regulations govern the manufacturing, importation, processing, packaging, storage, exportation, distribution and labelling of our products. New or amended statutes and regulations, increased production at our existing facilities, and our expansion into new operations and jurisdictions may require us to obtain new licenses and permits and could require us to change our methods of operations at costs that could be substantial.

Failure to make adequate contributions to Housing Provident Fund for certain employees of our PRC subsidiaries could subject us to labor disputes or complaint and adversely affect our financial condition.

Pursuant to the Regulations on Management of Housing Provident Fund (“HPF”), promulgated by the State Council on April 3, 1999 and amended on March 24, 2002, PRC enterprises must register with relevant HPF management center, open special HPF accounts at a designated bank and make timely HPF contributions for their employees. In accordance with the Regulations on Management of Housing Provident Fund and the Rules for Administrative Enforcement of Housing Provident Fund in Anhui Province, an enterprise that fails to register with HPF management center or open accounts for its employees shall be ordered to do so within the prescribed time; if a PRC company fails to comply within the prescribed time, it could be fined between RMB10,000 and RMB50,000.

Furthermore, if such enterprise fails to pay in full or in part its HPF contributions, such enterprise will be ordered by the HPF enforcement authorities to make such contributions, and may be compelled by the people’s court that has jurisdiction over the matter to make such contributions. Pursuant to the relevant HPF laws and regulations, HPF contributions are only required for employees with urban housing registration. For employees with rural housing registration, contributions are voluntary and are not required. In addition, there are discrepancies in the interpretation and enforcement of such regulations at the national and local level. Local and national enforcement practices at times vary significantly.

Our PRC subsidiaries have not opened HPF accounts for their employees (almost all of them are with rural housing registration). Regarding those employees who our PRC subsidiaries make no contribution to HPF, our PRC subsidiaries has employment contract with them to clarify salary to include contribution and employee has obligation to deal with it by themself. Although our PRC subsidiaries do this way, they may still potentially be ordered by HPF enforcement authorities to make full contribution, and face litigation by employees in relation to their failure to make full contribution. As of the date of this report, our PRC subsidiaries have not received any demand or order from the competent authorities with respect their HPF contribution. To the extent the PRC subsidiaries are required to make such payment, our financial condition will likely be adversely affected.

Mushrooms are subject to risks related to diseases, pests, and system malfunction.

Mushrooms are exposed to diseases and pests. Pests and diseases during the cultivation process may significantly decrease the quantity of quality mushrooms, which may impact our revenue.

Temperature can have a significant impact on the growth and the quality of mushrooms. Although our growing facilities are indoor under the control of AI monitor, we are still potential to encounter the malfunction of cooling, airflow, and heating system.

Our farms may fail to comply with the legal requirements and our quality standards and be negatively impacted by the quality of our raw materials.

Our farms are responsible for complying with the legal requirements. It is possible that we fail to comply with any PRC law relating to food safety during the composting and growing. If the governmental agency determines we are not eligible to continue the operation, we will need to pause. Our farms may also be negatively impacted by bad quality of raw materials so fail to comply with our quality standards.

Increases in our raw materials costs may negatively affect our operating results.

The price of the raw materials we use may be inelastic when we wish to purchase supplies. We cannot guarantee that we will be able to control our material expenses. In addition, as we are competing based upon low cost, we will risk losing customers by increasing our selling prices. To the extent our cost increase beyond the price we can charge our customers, our operating results could be harmed.

We may require additional financing in the future and our operations could be curtailed if we are unable to obtain required additional financing when needed.

While we do not anticipate seeking additional financing in the immediate future, any additional equity may result in dilution to the holders of our outstanding shares of capital stock. Additional debt financing may include conditions that would restrict our freedom to operate our business, such as conditions that:

| ● | increase our vulnerability to general adverse economic and industry conditions; | |

| ● | require us to dedicate a portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow to fund capital expenditures, working capital and other general corporate purposes; and | |

| ● | limit our flexibility in planning for, or reacting to, changes in our business and our industry. |

We cannot guarantee that we will be able to obtain any additional financing on terms that are acceptable to us, or at all.

We are substantially dependent upon our senior management on current stage.

We are highly dependent on our senior management to manage our business and operations. In particular, we rely substantially on our Chief Executive Officer Zhi Yang on current stage.

Failure to manage our growth could strain our management, operational and other resources, which could materially and adversely affect our business and prospects.

Our growth strategy includes building food processing facility, developing export customers of our existing fresh mushroom and Phase III compost, and increasing varieties of agricultural and food products. Pursuing these strategies has resulted in, and will continue to result in substantial demands on management resources. In particular, the management of our growth will require, among other things:

| ● | stringent cost controls and sufficient liquidity; | |

| ● | strengthening of financial and management controls; | |

| ● | increased marketing, sales and support activities; and | |

| ● | hiring and training of new personnel. |

If we are not able to manage our growth successfully, our business and prospects would be materially and adversely affected.

An insufficient amount of insurance could expose us to significant costs and business disruption.

While we have purchased insurance to cover certain events, the amounts and scope of coverage could leave our business inadequately protected from loss. If we were to incur substantial losses or liabilities due to fire, explosions, floods, other natural disasters or accidents or business interruption, our results of operations could be materially and adversely affected.

If we fail to protect our intellectual property rights, it could harm our business and competitive position.

We rely on a combination of patents, trademark, domain name laws and non-disclosure agreements and other methods to protect our intellectual property rights.

Implementation of PRC intellectual property-related laws have historically been lacking, primarily because of ambiguities in the PRC laws and enforcement difficulties. Accordingly, intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other western countries. Furthermore, policing unauthorized use of proprietary technology is difficult and expensive, and we may need to resort to litigation to enforce or defend patents issued to us or to determine the enforceability, scope and validity of our proprietary rights or those of others. Such litigation and an adverse determination in any such litigation, if any, could result in substantial costs and diversion of resources and management attention, which could harm our business and competitive position.

We may be exposed to trademark infringement and other claims by third parties which, if successful, could disrupt our business and have a material adverse effect on our financial condition and results of operations.

If we sell our branded products internationally, and as litigation becomes more common in China, we face a higher risk of being the subject of claims for trademark infringement, invalidity or indemnification relating to other parties’ proprietary rights. The defense of trademark suits, including of trademark infringement suits, and related legal and administrative proceedings can be both costly and time consuming and may significantly divert the efforts and resources of our management personnel. Furthermore, an adverse determination in any such litigation or proceedings to which we may become a party could cause us to:

| ● | pay damage awards; | |

| ● | seek licenses from third parties; | |

| ● | pay ongoing royalties; | |

| ● | redesign our branded products; or | |

| ● | be restricted by injunctions, |

each of which could effectively prevent us from pursuing some or all of our business and result in our customers or potential customers deferring or limiting their purchase or use of our products. This could have a material adverse effect on our financial condition and results of operations.

There are implications of being an emerging growth company.

As a company with less than $2.0 billion in revenue during its last fiscal year, we qualify as an “emerging growth company” as defined in the JOBS Act. For as long as a company is deemed to be an emerging growth company, it may take advantage of specified reduced reporting and other regulatory requirements that are generally unavailable to other public companies. These provisions include:

| - | a requirement to have only two years of audited financial statements and only two years of related Management’s Discussion and Analysis included in an initial public offering registration statement; | |

| - | an exemption to provide less than five years of selected financial data in an initial public offering registration statement; | |

| - | an exemption from the auditor attestation requirement in the assessment of our internal controls over financial reporting; | |

| - | an exemption from the adoption of new or revised financial accounting standards until they would apply to private companies; | |

| - | an exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer; and | |

| - | reduced disclosure about our executive compensation arrangements. |

An emerging growth company is also exempt from Section 404(b) of the Sarbanes Oxley Act, which requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting. Similarly, as a Smaller Reporting Company we are exempt from Section 404(b) of the Sarbanes-Oxley Act and our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting until such time as we cease being a Smaller Reporting Company.

As an emerging growth company, we are exempt from Section 14A (a) and (b) of the Exchange Act which require stockholder approval of executive compensation and golden parachutes.

Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We would cease to be an emerging growth company upon the earliest of:

| - | the first fiscal year following the fifth anniversary of the filing of this Form 10; | |

| - | the first fiscal year after our annual gross revenues are $2 billion or more; | |

| - | the date on which we have, during the previous three-year period, issued more than $2 billion in non-convertible debt securities; or | |

| - | as of the end of any fiscal year in which the market value of our Common Stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year. |

Risks Related to Doing Business in China

Because all of our operations are in China, our business is subject to the complex and rapidly evolving laws and regulations there. The PRC government may exercise significant oversight and discretion over the conduct of our business and may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of our common stock.

As a business operating in the PRC, we are subject to the laws and regulations of the PRC, which can be complex and evolve rapidly. The PRC government has the power to exercise significant oversight and discretion over the conduct of our business, and the regulations to which we are subject may change rapidly and with little notice to us or our shareholders. As a result, the application, interpretation, and enforcement of new and existing laws and regulations in the PRC are often uncertain. In addition, these laws and regulations may be interpreted and applied inconsistently by different agencies or authorities, and inconsistently with our current policies and practices. New laws, regulations, and other government directives in the PRC may also be costly to comply with, and such compliance or any associated inquiries or investigations or any other government actions may:

● Delay or impede our development,

● Result in negative publicity or increase our operating costs,

● Require significant management time and attention, and

● Subject us to remedies, administrative penalties and even criminal liabilities that may harm our business, including fines assessed for our current or historical operations, or demands or orders that we modify or even cease our business practices.

The promulgation of new laws or regulations, or the new interpretation of existing laws and regulations, in each case that restrict or otherwise unfavorably impact the ability or manner in which we conduct our business and could require us to change certain aspects of our business to ensure compliance, which could decrease demand for our products, reduce revenues, increase costs, require us to obtain more licenses, permits, approvals or certificates, or subject us to additional liabilities. To the extent any new or more stringent measures are required to be implemented, our business, financial condition and results of operations could be adversely affected as well as materially decrease the value of our common stock.

The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to customer rights, taxation, employment, property and other matters. The central or local governments of China may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties. Given recent statements by the Chinese government indicating an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, any such action could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or become worthless.

Recently, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Severely Cracking Down on Illegal Securities Activities According to Law, or the Opinions, which was made available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies. Effective measures, such as promoting the construction of relevant regulatory systems, will be taken to deal with the risks and incidents of China-concept overseas listed companies. Such future administrative measure or actions may have material adverse effects on the offering of our securities to investors, our proposed listing in the U.S. or our business operation, for example in the event that it is required that we should obtain permission from the Chinese government to offer our securities to investors or list on U.S. exchanges, it is unpredictable whether such permission can be obtained by us, as the case may be, or, if permission is obtained, whether it could be later denied or rescinded. If we, including our subsidiaries, do not receive or maintain such permissions or approvals, or inadvertently conclude that such permissions or approvals are not required, it could significantly limit or completely hinder our ability to offer or continue to offer our securities to investors, list in the U.S. and cause the value of our securities to significantly decline or become worthless. As of the date hereof, we have not received any inquiry, notice, warning, or sanctions from PRC government authorities in connection with the Opinions.