SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

UNDER THE SECURITIES ACT OF 1933

(Translation of Registrant’s name into English)

| |

Island of Guernsey

|

| |

1099

|

| |

Not Applicable

|

|

| |

(State or other jurisdiction of

incorporation or organization) |

| |

(Primary Standard Industrial

Classification Code Number) |

| |

(I.R.S. Employer

Identification No.) |

|

Oak House, Hirzel Street

St Peter Port, Guernsey, GY1 3RH

+44 (0) 1481 740521

122 East 42nd Street, 18th Floor

New York, NY 10168

(212) 947-7200

| |

Andrew Weisberg, Esq.

Oliver Wright, Esq. White & Case LLP 1221 Avenue of the Americas New York, New York 10020-1095 Tel: (212) 819 8200 Fax: (212) 354 8113 |

| |

Gary Felthun, Esq.

Craig Atkinson, Esq. White & Case LLP Katherine Towers, 1st Floor 1 Park Lane, Wierda Valley 2196 Sandton, Johannesburg Republic of South Africa Tel: + 27 11 341 4000 Fax: + 27 11 327 1900 |

| |

Michael Kaplan, Esq.

Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 Tel: (212) 450 4000 Fax: (212) 701 5800 |

| |

Reuven Young, Esq.

Davis Polk & Wardwell London LLP 5 Aldermanbury Square London United Kingdom EC2V 7HR Tel: +44 20 7418 1300 Fax: +44 20 7418 1400 |

| |

Ezra Davids, Esq.

Ryan Wessels, Esq. Bowman Gilfillan, Inc. 11 Alice Lane, Sandton Johannesburg Republic of South Africa, 2196 Tel: +27 11 669 9320 Fax: +27 11 669 9111 |

|

| | | ||||||||||||||

|

Title of each class of

securities to be registered |

| | |

Proposed maximum

aggregate offering price(1)(2) |

| | |

Amount of

registration fee |

| ||||||

|

Ordinary Shares, no par value per share

|

| | | | US$ | | | | | | US$ | | | ||

| | | | | | iii | | | |

| | | | | | xiii | | | |

| | | | | | xvi | | | |

| | | | | | xviii | | | |

| | | | | | 1 | | | |

| | | | | | 24 | | | |

| | | | | | 72 | | | |

| | | | | | 73 | | | |

| | | | | | 74 | | | |

| | | | | | 76 | | | |

| | | | | | 78 | | | |

| | | | | | 79 | | | |

| | | | | | 110 | | | |

| | | | | | 131 | | | |

| | | | | | 152 | | | |

| | | | | | 193 | | | |

| | | | | | 210 | | | |

| | | | | | 219 | | | |

| | | | | | 223 | | | |

| | | | | | 232 | | | |

| | | | | | 247 | | | |

| | | | | | 248 | | | |

| | | | | | 256 | | | |

| | | | | | 263 | | | |

| | | | | | 264 | | | |

| | | | | | 264 | | | |

| | | | | | 265 | | | |

| | | | | | 267 | | | |

| | | | | | F-1 | | |

Environmental, social and governance matters.”

| | | |

2019

|

| |

2020

|

| |

2021

|

| |

YTD 2022(1)

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |

High

|

| |

Low

|

| |

Average

|

| |

High

|

| |

Low

|

| |

Average

|

| |

High

|

| |

Low

|

| |

Average

|

| |

|

| |

|

| |

|

| ||||||||||||||||||||||||||||||||||||||

| (US$/ounce) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||||

|

Platinum

|

| | | | 977 | | | | | | 782 | | | | | | 863 | | | | | | 1,068 | | | | | | 593 | | | | | | 878 | | | | | | 1,294 | | | | | | 911 | | | | | | 1,090 | | | | | | 1,151 | | | | | | 931 | | | | | | 1,023 | | |

|

Palladium

|

| | | | 1,971 | | | | | | 1,267 | | | | | | 1,538 | | | | | | 2,781 | | | | | | 1,557 | | | | | | 2,194 | | | | | | 3,000 | | | | | | 1,576 | | | | | | 2,396 | | | | | | 3,015 | | | | | | 1,854 | | | | | | 2,333 | | |

|

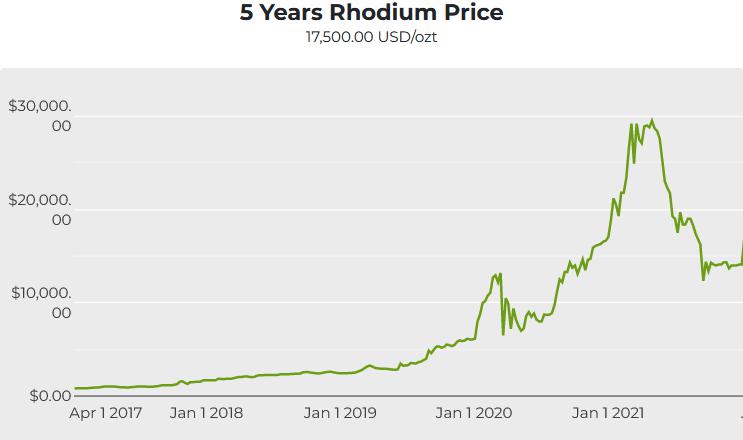

Rhodium

|

| | | | 6,150 | | | | | | 2,460 | | | | | | 3,902 | | | | | | 17,050 | | | | | | 5,160 | | | | | | 11,216 | | | | | | 29,800 | | | | | | 11,250 | | | | | | 20,047 | | | | | | 22,200 | | | | | | 14,500 | | | | | | 18,273 | | |

![[MISSING IMAGE: tm2127701d15-fc_ourcorp4clr.jpg]](tm2127701d15-fc_ourcorp4clr.jpg)

offering

| | | |

For the Year Ended December 31,

|

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands, except as

otherwise indicated) |

| |||||||||||||||||

|

Revenue

|

| | | | 265,520 | | | | | | 277,572 | | | | | | 181,339 | | |

|

Cost of operations

|

| | | | (184,252) | | | | | | (156,213) | | | | | | (186,671) | | |

|

Gross profit (loss)

|

| | | | 81,268 | | | | | | 121,359 | | | | | | (5,332) | | |

|

Administrative and general expenses

|

| | | | (32,511) | | | | | | (22,610) | | | | | | (19,610) | | |

|

Other (expense) income

|

| | | | 526 | | | | | | (233) | | | | | | 849 | | |

|

Loss on disposal of assets

|

| | | | (3,125) | | | | | | — | | | | | | — | | |

|

Foreign exchange gain (loss)

|

| | | | 5,015 | | | | | | 2,028 | | | | | | (1,377) | | |

|

Operating profit (loss)

|

| | | | 51,173 | | | | | | 100,544 | | | | | | (25,470) | | |

|

Finance income

|

| | | | 5,532 | | | | | | 3,992 | | | | | | 6,704 | | |

|

Finance costs

|

| | | | (4,146) | | | | | | (7,103) | | | | | | (9,126) | | |

|

Share of loss of investments accounted for using the equity method

|

| | | | (786) | | | | | | (1,130) | | | | | | (1,512) | | |

|

Profit (loss) before income tax

|

| | | | 51,773 | | | | | | 96,303 | | | | | | (29,404) | | |

|

Income tax credit (expense)

|

| | | | (18,601) | | | | | | 99,891 | | | | | | (20) | | |

|

Profit (loss) for the year

|

| | | | 33,172 | | | | | | 196,194 | | | | | | (29,424) | | |

| Profit (loss) attributable to: | | | | | | | | | | | | | | | | | | | |

|

Owners of the Company

|

| | | | 33,733 | | | | | | 196,712 | | | | | | (28,754) | | |

|

Non-controlling interest

|

| | | | (561) | | | | | | (518) | | | | | | (670) | | |

|

Profit (loss) for the year

|

| | | | 33,172 | | | | | | 196,194 | | | | | | (29,424) | | |

| Other comprehensive (loss) income: | | | | | | | | | | | | | | | | | | | |

|

Exchange differences on loan designated as net investment

|

| | | | 608 | | | | | | 38,311 | | | | | | (12,078) | | |

|

Exchange differences on translation from functional to presentation currency

|

| | | | (95,182) | | | | | | (63,617) | | | | | | 34,600 | | |

|

Movement in other reserves

|

| | | | 83 | | | | | | 2 | | | | | | (23) | | |

|

Other comprehensive share of investment accounted for using the equity method

|

| | | | (90) | | | | | | (466) | | | | | | (356) | | |

|

Total other comprehensive (loss) income

|

| | | | (94,581) | | | | | | (25,770) | | | | | | 22,143 | | |

|

Total comprehensive income (loss) for the year

|

| | | | (61,410) | | | | | | 170,424 | | | | | | (7,281) | | |

| Total comprehensive income (loss) attributable to: | | | | | | | | | | | | | | | | | | | |

|

Owners of the Company

|

| | | | (60,848) | | | | | | 170,942 | | | | | | (6,611) | | |

|

Non-controlling interest

|

| | | | (561) | | | | | | (518) | | | | | | (670) | | |

|

Total comprehensive income (loss) for the year

|

| | | | (61,409) | | | | | | 170,424 | | | | | | (7,281) | | |

| Earnings per share: | | | | | | | | | | | | | | | |||||

|

Weighted average number of shares (in millions of shares)

|

| | | | 3,095 | | | | | | 3,095 | | | | | | 3,095 | | |

|

Profit (loss) per ordinary share – basic and diluted (US$)(1)

|

| | | | 0.01 | | | | | | 0.06 | | | | | | (0.01) | | |

| | | |

As of December 31,

|

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||

| Assets | | | | | | | | | | | | | | | | | | | |

| Non-current assets | | | | | | | | | | | | | | | | | | | |

|

Mining assets

|

| | | | 708,902 | | | | | | 773,275 | | | | | | 798,395 | | |

|

Intangible assets

|

| | | | 30,540 | | | | | | 33,564 | | | | | | 34,740 | | |

|

Property, plant and equipment

|

| | | | 92,625 | | | | | | 92,498 | | | | | | 111,093 | | |

|

Loans receivable

|

| | | | 19,063 | | | | | | 16,506 | | | | | | 16,916 | | |

|

Restricted cash investments and guarantees

|

| | | | 18,432 | | | | | | 18,090 | | | | | | 15,885 | | |

|

Deferred tax asset

|

| | | | 76,138 | | | | | | 101,949 | | | | | | — | | |

|

Total non-current assets

|

| | | | 945,700 | | | | | | 1,035,882 | | | | | | 977,029 | | |

| Current assets | | | | | | | | | | | | | | | | | | | |

|

Inventories

|

| | | | 10,208 | | | | | | 11,818 | | | | | | 9,718 | | |

|

Trade and other receivables

|

| | | | 82,816 | | | | | | 133,893 | | | | | | 70,130 | | |

|

Loans receivable

|

| | | | 637 | | | | | | — | | | | | | — | | |

|

Cash and cash equivalents

|

| | | | 140,595 | | | | | | 62,986 | | | | | | 43,393 | | |

|

Total current assets

|

| | | | 234,256 | | | | | | 208,697 | | | | | | 123,241 | | |

|

Total assets

|

| | | | 1,179,956 | | | | | | 1,244,579 | | | | | | 1,100,270 | | |

| Equity and liabilities | | | | | | | | | | | | | | | | | | | |

| Equity attributable to owners of the Company | | | | | | | | | | | | | | | | | | | |

|

Share capital

|

| | | | 2,549,583 | | | | | | 2,549,583 | | | | | | 2,549,583 | | |

|

Other components of equity

|

| | | | (616,842) | | | | | | (521,743) | | | | | | (458,128) | | |

|

(Accumulated losses)

|

| | | | (831,400) | | | | | | (865,651) | | | | | | (1,100,208) | | |

|

Total equity attributable to owners of the Company

|

| | | | 1,101,341 | | | | | | 1,162,189 | | | | | | 991,247 | | |

|

Non-controlling interests

|

| | | | (7,687) | | | | | | (7,126) | | | | | | (6,608) | | |

|

Total equity

|

| | | | 1,093,654 | | | | | | 1,155,063 | | | | | | 984,639 | | |

| Non-current liabilities | | | | | | | | | | | | | | | | | | | |

|

Long-term borrowings

|

| | | | 5,289 | | | | | | 26,976 | | | | | | 36,643 | | |

|

Share-based payment obligations

|

| | | | 445 | | | | | | — | | | | | | — | | |

|

Decommissioning and rehabilitation provision

|

| | | | 18,782 | | | | | | 16,787 | | | | | | 22,163 | | |

|

Total non-current liabilities

|

| | | | 24,516 | | | | | | 43,763 | | | | | | 58,806 | | |

| Current liabilities | | | | | | | | | | | | | | | | | | | |

|

Short-term borrowings

|

| | | | — | | | | | | 14,408 | | | | | | 13,453 | | |

|

Share-based payment obligations

|

| | | | 1,505 | | | | | | — | | | | | | — | | |

|

Trade payables and accrued liabilities

|

| | | | 29,029 | | | | | | 26,134 | | | | | | 23,477 | | |

|

Revolving commodity facility

|

| | | | 31,252 | | | | | | 5,211 | | | | | | 19,895 | | |

|

Total current liabilities

|

| | | | 61,786 | | | | | | 45,753 | | | | | | 56,825 | | |

|

Total liabilities

|

| | | | 86,302 | | | | | | 89,516 | | | | | | 115,631 | | |

|

Total equity and liabilities

|

| | | | 1,179,956 | | | | | | 1,244,579 | | | | | | 1,100,270 | | |

| | | |

For the Year

Ended December 31, |

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||

|

Cash and cash equivalents at the beginning of the year

|

| | | | 62,986 | | | | | | 43,393 | | | | | | 38,093 | | |

|

Net cash generated from operating activities

|

| | | | 120,107 | | | | | | 52,798 | | | | | | 8,941 | | |

|

Net cash used in investing activities

|

| | | | (20,082) | | | | | | (10,995) | | | | | | (4,574) | | |

|

Net cash used in financing activities

|

| | | | (10,281) | | | | | | (23,933) | | | | | | (474) | | |

|

Net increase in cash and cash equivalents

|

| | | | 89,744 | | | | | | 17,870 | | | | | | 3,893 | | |

|

Exchange gain on cash and cash equivalents

|

| | | | (12,135) | | | | | | 1,723 | | | | | | 1,408 | | |

|

Cash and cash equivalents at the end of the year

|

| | | | 140,595 | | | | | | 62,986 | | | | | | 43,393 | | |

| | | |

For the Year

Ended December 31, |

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands, except as

otherwise indicated) |

| |||||||||||||||||

| EBITDA(1) | | | | | 59,243 | | | | | | 113,063 | | | | | | 11,755 | | |

|

HEPS – basic and diluted (US$)(2)

|

| | | | 0.01 | | | | | | 0.06 | | | | | | (0.01) | | |

| | | |

For the Year Ended

December 31, |

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||

|

Profit (loss) for the year

|

| | | | 33,172 | | | | | | 196,194 | | | | | | (29,424) | | |

|

Income tax (credit) expense

|

| | | | 18,601 | | | | | | (99,891) | | | | | | 20 | | |

|

Depreciation and amortization

|

| | | | 8,856 | | | | | | 13,649 | | | | | | 38,737 | | |

|

Net finance (income) costs

|

| | | | (1,386) | | | | | | 3,111 | | | | | | 2,422 | | |

| EBITDA | | | | | 59,243 | | | | | | 113,063 | | | | | | 11,755 | | |

| | | |

For the Year Ended

December 31, |

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands, except as

otherwise indicated) |

| |||||||||||||||||

|

Profit (loss) attributable to owners of the Company

|

| | | | 33,733 | | | | | | 196,712 | | | | | | (28,754) | | |

| Effect of remeasurement items net of tax: | | | | | | | | | | | | | | | | | | | |

|

Profit on disposal of fixed assets

|

| | | | (17) | | | | | | (43) | | | | | | — | | |

|

Impairment of mining assets

|

| | | | — | | | | | | — | | | | | | 278 | | |

|

Loss on mining assets sold

|

| | | | 3,141 | | | | | | — | | | | | | — | | |

|

Tax effect

|

| | | | (875) | | | | | | 13 | | | | | | — | | |

|

Headline earnings (loss)

|

| | | | 35,982 | | | | | | 196,682 | | | | | | (28,476) | | |

|

Weighted average number of shares (in millions of shares)

|

| | | | 3,095 | | | | | | 3,095 | | | | | | 3,095 | | |

|

HEPS – basic and diluted (US$)(a)

|

| | | | 0.01 | | | | | | 0.06 | | | | | | (0.01) | | |

| | | |

For the Year Ended

December 31, |

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||

|

Profit (loss) for the year

|

| | | | 33,172 | | | | | | 196,194 | | | | | | (29,424) | | |

|

Income tax (credit) expense

|

| | | | 18,601 | | | | | | (99,891) | | | | | | 20 | | |

|

Depreciation and amortization

|

| | | | 8,856 | | | | | | 13,649 | | | | | | 38,737 | | |

|

Net finance (income) costs

|

| | | | (1,386) | | | | | | 3,111 | | | | | | 2,422 | | |

|

Foreign exchange gain (loss)

|

| | | | (5,015) | | | | | | (2,028) | | | | | | 1,377 | | |

|

Adjusted EBITDA

|

| | | | 54,228 | | | | | | 111,035 | | | | | | 13,132 | | |

| | | |

As of December 31,

|

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||

|

Long-term borrowings

|

| | | | 5,289 | | | | | | 26,976 | | | | | | 36,643 | | |

|

Short-term borrowings

|

| | | | — | | | | | | 14,408 | | | | | | 13,453 | | |

|

Amount outstanding under the revolving commodity facility

|

| | | | 31,252 | | | | | | 5,211 | | | | | | 19,895 | | |

|

Total borrowings

|

| | | | 36,541 | | | | | | 46,595 | | | | | | 69,991 | | |

|

Cash and cash equivalents

|

| | | | (140,595) | | | | | | (62,986) | | | | | | (43,393) | | |

|

Net debt

|

| | | | (104,054) | | | | | | (16,391) | | | | | | 26,598 | | |

| | | |

For the Year Ended

December 31, |

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands, except as

otherwise indicated) |

| |||||||||||||||||

|

Cost of operations

|

| | | | (184,252) | | | | | | (156,213) | | | | | | (186,671) | | |

|

Depreciation and amortization of operating assets

|

| | | | 7,956 | | | | | | 13,383 | | | | | | 37,546 | | |

|

Inventory adjustments

|

| | | | 2,331 | | | | | | (2,175) | | | | | | (843) | | |

|

Cash cost of operations

|

| | | | (173,965) | | | | | | (145,005) | | | | | | (149,968) | | |

|

Cash cost of operations per ounce (in US$)(1)

|

| | |

|

1,782

|

| | | |

|

1,126

|

| | | |

|

1,178

|

| |

| | | |

For the Year Ended December 31,

|

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

|

Reef delivered to the ROM pad (tonnes)(1)

|

| | | | 2,255,720 | | | | | | 3,952,626 | | | | | | 4,121,807 | | |

|

Reef processed (tonnes)(2)

|

| | | | 3,114,647 | | | | | | 3,414,661 | | | | | | 3,870,515 | | |

|

Reef milled (tonnes)(3)

|

| | | | 2,978,319 | | | | | | 3,089,285 | | | | | | 3,517,579 | | |

|

Average milled head grade (g/t)

|

| | | | 1.42 | | | | | | 1.79 | | | | | | 1.57 | | |

|

Average recovery rate (%)

|

| | | | 72 | | | | | | 71 | | | | | | 70 | | |

|

Average recovered grade (g/t)

|

| | | | 1.01 | | | | | | 1.29 | | | | | | 1.11 | | |

| 4E dispatched and sold (ounces): | | | | | | | | | | | | | | | | | | | |

|

Platinum

|

| | | | 62,534 | | | | | | 82,110 | | | | | | 81,825 | | |

|

Palladium

|

| | | | 26,042 | | | | | | 34,099 | | | | | | 33,217 | | |

|

Rhodium

|

| | | | 6,514 | | | | | | 9,798 | | | | | | 10,017 | | |

|

Gold

|

| | | | 2,551 | | | | | | 2,747 | | | | | | 2,257 | | |

|

Total 4E dispatched and sold

|

| | | | 97,641 | | | | | | 128,754 | | | | | | 127,316 | | |

|

Reserve Area

|

| |

Tonnage

(Mt) |

| |

PGM Grade (g/t)

|

| |

Contained PGM

|

| |

Base Metal

Grade (%) |

| |

Contained

Cu + Ni (kt) |

| |||||||||||||||||||||||||||||||||

| |

4E

|

| |

6E

|

| |

(4E Moz)

|

| |

(6E Moz)

|

| |

Ni

|

| |

Cu

|

| ||||||||||||||||||||||||||||||||

|

West Pit

|

| | | | 13.1 | | | | | | 1.62 | | | | | | 1.88 | | | | | | 0.69 | | | | | | 0.79 | | | | | | 0.062 | | | | | | 0.019 | | | | | | 9.9 | | |

|

East Pit

|

| | | | 20.5 | | | | | | 1.56 | | | | | | 1.82 | | | | | | 1.0 | | | | | | 1.2 | | | | | | 0.060 | | | | | | 0.009 | | | | | | 14.0 | | |

|

Central Underground Block

|

| | | | 12.8 | | | | | | 4.76 | | | | | | 6.05 | | | | | | 2.0 | | | | | | 2.5 | | | | | | 0.020 | | | | | | 0.004 | | | | | | 2.7 | | |

|

East Underground Block

|

| | | | 31.4 | | | | | | 4.21 | | | | | | 5.06 | | | | | | 4.3 | | | | | | 5.1 | | | | | | 0.040 | | | | | | 0.020 | | | | | | 18.0 | | |

|

Total Probable Mineral Reserves

|

| | |

|

77.8

|

| | | |

|

3.17

|

| | | |

|

3.83

|

| | | |

|

8.0

|

| | | |

|

9.6

|

| | | |

|

0.046

|

| | | |

|

0.014

|

| | | |

|

44.6

|

| |

|

Resource Area

|

| |

Tonnage

(Mt) |

| |

PGM Grade (g/t)

|

| |

Contained PGM

|

| |

Base Metal

Grade (%) |

| |

Contained

Cu + Ni (kt) |

| |||||||||||||||||||||||||||||||||

| |

4E

|

| |

6E

|

| |

(4E Moz)

|

| |

(6E Moz)

|

| |

Ni

|

| |

Cu

|

| ||||||||||||||||||||||||||||||||

| Measured Mineral Resources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||

|

West Pit

|

| | | | 0.001 | | | | | | 3.89 | | | | | | 4.79 | | | | | | 0.0001 | | | | | | 0.0001 | | | | | | 0.002 | | | | | | 0.001 | | | | | | 0.00 | | |

|

East Underground Block

|

| | | | 0.3 | | | | | | 5.76 | | | | | | 7.06 | | | | | | 0.05 | | | | | | 0.07 | | | | | | 0.018 | | | | | | 0.004 | | | | | | 0.07 | | |

|

Total Measured Mineral Resources

|

| | |

|

0.3

|

| | | |

|

5.76

|

| | | |

|

7.06

|

| | | |

|

0.05

|

| | | |

|

0.07

|

| | | |

|

0.018

|

| | | |

|

0.004

|

| | | |

|

0.07

|

| |

| Indicated Mineral Resources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||

|

West Pit

|

| | | | 11.1 | | | | | | 2.89 | | | | | | 3.29 | | | | | | 1.03 | | | | | | 1.18 | | | | | | 0.126 | | | | | | 0.025 | | | | | | 16.80 | | |

|

Central Underground Block

|

| | | | 4.2 | | | | | | 6.59 | | | | | | 8.58 | | | | | | 0.90 | | | | | | 1.13 | | | | | | 0.028 | | | | | | 0.010 | | | | | | 1.62 | | |

|

East Underground Block

|

| | | | 42.7 | | | | | | 3.70 | | | | | | 4.33 | | | | | | 5.07 | | | | | | 5.81 | | | | | | 0.089 | | | | | | 0.027 | | | | | | 49.45 | | |

|

Total Indicated Mineral Resources

|

| | |

|

58.0

|

| | | |

|

3.75

|

| | | |

|

4.44

|

| | | |

|

7.00

|

| | | |

|

8.12

|

| | | |

|

0.092

|

| | | |

|

0.025

|

| | | |

|

67.87

|

| |

|

Total Measured Indicated Mineral Resources

|

| | |

|

58.3

|

| | | |

|

3.76

|

| | | |

|

4.46

|

| | | |

|

7.05

|

| | | |

|

8.19

|

| | | |

|

0.091

|

| | | |

|

0.025

|

| | | |

|

67.94

|

| |

| Inferred Mineral Resources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||

|

Central Underground Block

|

| | | | 9.1 | | | | | | 6.54 | | | | | | 8.23 | | | | | | 1.90 | | | | | | 2.40 | | | | | | 0.035 | | | | | | 0.012 | | | | | | 4.31 | | |

|

East Underground Block

|

| | | | 96.9 | | | | | | 4.59 | | | | | | 5.41 | | | | | | 14.29 | | | | | | 16.85 | | | | | | 0.080 | | | | | | 0.025 | | | | | | 102.37 | | |

|

West Pit low grade stockpiles

|

| | | | 55.8 | | | | | | 0.70 | | | | | | 0.80 | | | | | | 1.26 | | | | | | 1.43 | | | | | | — | | | | | | — | | | | | | — | | |

|

Total Inferred Mineral

Resources |

| | | | 161.8 | | | | | | 3.36 | | | | | | 3.98 | | | | | | 17.46 | | | | | | 20.69 | | | | | | 0.050 | | | | | | 0.016 | | | | | | 106.68 | | |

|

Mineral Reserves

|

| |

Tonnage

(Mt) |

| |

Grade

(%) |

| |

Content

(kt) |

| ||||||

| Probable Mineral Reserves | | | | | | | | | | | | | | | | |

|

West Pit

|

| | | | 4.8 | | | | | | 11.9 | | | |

574

|

|

|

East Underground Block

|

| | | | 24.3 | | | | | | 23.1 | | | |

5,613

|

|

|

Probable Mineral Reserves

|

| | |

|

29.1

|

| | | |

|

21.3

|

| | |

6,187

|

|

|

Mineral Resources

|

| |

Tonnage

(Mt) |

| |

Grade

(%) |

| |

Content

(kt) |

| ||||||

| Indicated Mineral Resources | | | | | | | | | | | | | | | | |

|

West Pit

|

| | | | 3.4 | | | | | | 19.9 | | | |

684

|

|

|

East Underground Block

|

| | | | 23.6 | | | | | | 29.4 | | | |

6,944

|

|

|

Total Indicated Mineral Resources

|

| | | | 27.0 | | | | | | 28.2 | | | |

7,628

|

|

| Inferred Mineral Resources | | | | | | | | | | | | | | | | |

|

Central Underground Block

|

| | | | 11.7 | | | | | | 26.5 | | | |

3,110

|

|

|

East Underground Block

|

| | | | 47.5 | | | | | | 29.4 | | | |

13,974

|

|

|

Total Inferred Mineral Resources

|

| | | | 59.2 | | | | | | 28.9 | | | |

17,084

|

|

|

Reserve Area

|

| |

Tonnage

(Mt) |

| |

PGM Grade (g/t)

|

| |

Contained PGM

|

| |

Base Metal

Grade (%) |

| |

Contained

Cu + Ni (kt) |

| |||||||||||||||||||||||||||||||||

| |

4E

|

| |

6E

|

| |

(4E Moz)

|

| |

(6E Moz)

|

| |

Ni

|

| |

Cu

|

| ||||||||||||||||||||||||||||||||

|

Mphahlele (UG2)

|

| | | | 22.7 | | | | | | 3.63 | | | | | | 4.36 | | | | | | 2.66 | | | | | | 3.18 | | | | | | 0.088 | | | | | | 0.050 | | | | | | 31.4 | | |

|

Total Probable Mineral

Reserves |

| | |

|

22.7

|

| | | |

|

3.63

|

| | | |

|

4.36

|

| | | |

|

2.66

|

| | | |

|

3.18

|

| | | |

|

0.088

|

| | | |

|

0.050

|

| | | |

|

31.4

|

| |

|

Resource Area

|

| |

Tonnage

(Mt) |

| |

PGM Grade (g/t)

|

| |

Contained PGM

|

| |

Base Metal

Grade (%) |

| |

Contained

Cu + Ni (kt) |

| |||||||||||||||||||||||||||||||||

| |

4E

|

| |

6E

|

| |

(4E Moz)

|

| |

(6E Moz)

|

| |

Ni

|

| |

Cu

|

| ||||||||||||||||||||||||||||||||

| Measured Mineral Resources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Merensky

|

| | | | 0.6 | | | | | | 3.00 | | | | | | 3.80 | | | | | | 0.06 | | | | | | 0.08 | | | | | | 0.21 | | | | | | 0.12 | | | | | | 2.0 | | |

|

UG2

|

| | | | 0.3 | | | | | | 5.12 | | | | | | 6.14 | | | | | | 0.04 | | | | | | 0.05 | | | | | | 0.12 | | | | | | 0.08 | | | | | | 0.5 | | |

|

Total Measured Mineral Resources

|

| | | | 0.9 | | | | | | 3.61 | | | | | | 4.47 | | | | | | 0.10 | | | | | | 0.13 | | | | | | 0.18 | | | | | | 0.11 | | | | | | 2.5 | | |

| Indicated Mineral Resources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Merensky

|

| | | | 12.1 | | | | | | 3.00 | | | | | | 3.75 | | | | | | 1.17 | | | | | | 1.46 | | | | | | 0.20 | | | | | | 0.12 | | | | | | 38.1 | | |

|

UG2

|

| | | | 3.2 | | | | | | 5.06 | | | | | | 6.06 | | | | | | 0.51 | | | | | | 0.62 | | | | | | 0.12 | | | | | | 0.07 | | | | | | 6.1 | | |

|

Total Indicated Mineral Resources

|

| | |

|

15.3

|

| | | |

|

3.43

|

| | | |

|

4.23

|

| | | |

|

1.68

|

| | | |

|

2.08

|

| | | |

|

0.18

|

| | | |

|

0.11

|

| | | |

|

44.2

|

| |

|

Total Measured and Indicated Mineral Resources

|

| | | | 16.2 | | | | | | 3.45 | | | | | | 4.25 | | | | | | 1.78 | | | | | | 2.21 | | | | | | 0.18 | | | | | | 0.11 | | | | | | 46.7 | | |

| Inferred Mineral Resources | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Merensky

|

| | | | 23.3 | | | | | | 3.12 | | | | | | 3.91 | | | | | | 2.33 | | | | | | 2.92 | | | | | | 0.20 | | | | | | 0.12 | | | | | | 73.8 | | |

|

UG2

|

| | | | 25.6 | | | | | | 5.11 | | | | | | 6.12 | | | | | | 4.21 | | | | | | 5.04 | | | | | | 0.12 | | | | | | 0.07 | | | | | | 48.8 | | |

|

Total Inferred Mineral Resources

|

| | | | 48.9 | | | | | | 4.16 | | | | | | 5.06 | | | | | | 6.54 | | | | | | 7.96 | | | | | | 0.16 | | | | | | 0.10 | | | | | | 122.7 | | |

|

Resource Area

|

| |

Percent

Attributable to SPM |

| |

Tonnage

(Mt) |

| |

PGM Grade (g/t)

|

| |

Contained PGM

|

| |

Base Metal

Grade (%) |

| |

Contained

Cu + Ni (kt) |

| ||||||||||||||||||||||||||||||||||||

| |

4E

|

| |

6E

|

| |

(4E Moz)

|

| |

(6E Moz)

|

| |

Ni

|

| |

Cu

|

| ||||||||||||||||||||||||||||||||||||||

|

Inferred Mineral Resources

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Merensky

|

| | | | 100% | | | | | | 58.4 | | | | | | 8.12 | | | | | | 8.91 | | | | | | 15.2 | | | | | | 16.7 | | | | | | 0.239 | | | | | | 0.078 | | | | | | 185.0 | | |

|

UG2

|

| | | | 100% | | | | | | 90.4 | | | | | | 5.52 | | | | | | 6.76 | | | | | | 16.0 | | | | | | 19.6 | | | | | | 0.064 | | | | | | 0.003 | | | | | | 60.2 | | |

|

Total Inferred Mineral Resources

|

| | | | | | | | | | 148.8 | | | | | | 6.54 | | | | | | 7.60 | | | | | | 31.2 | | | | | | 36.3 | | | | | | 0.132 | | | | | | 0.032 | | | | | | 245.2 | | |

| | | |

As of December 31, 2021

|

| ||||||||||||

| |

Actual

|

| |

As Adjusted(1)

|

| | ||||||||||

| |

(in US$ thousands)

|

| ||||||||||||||

| Long-term borrowings | | | | | | | | | | | | | | | | |

|

Unsecured

|

| | | | 5,289 | | | |

|

| | |||||

|

Secured

|

| | | | — | | | | | | | | | |||

|

Total long-term borrowings

|

| | | | 5,289 | | | | | | | | | | ||

| Short-term borrowings | | | | | | | | | | | | | | | ||

|

Unsecured

|

| | | | — | | | | | | | | | | ||

|

Secured

|

| | | | — | | | | | | | | | | ||

|

Total short-term borrowings

|

| | | | — | | | | | | | | | |||

|

Revolving commodity facility

|

| | | | 31,252 | | | | | | | | | | ||

|

Total borrowings

|

| | |

|

36,541

|

| | | | | | | | | ||

| Equity attributable to owners of the Company | | | | | | | | | | | | | | | ||

|

Share capital

|

| | | | 2,549,583 | | | | | | | | | | ||

|

Other components of equity

|

| | | | (616,842) | | | | | | | | | | ||

|

(Accumulated losses) / Retained profit

|

| | | | (831,400) | | | | | | | | | | ||

|

Total equity attributable to owners of the Company

|

| | | | 1,101,341 | | | | | | | | | | ||

|

Non-controlling interests

|

| | | | (7,687) | | | | | | | | | | ||

|

Total equity

|

| | |

|

1,093,654

|

| | | | | | | | | ||

|

Total capitalization(2)

|

| | | | 1,130,195 | | | | | | | | | | ||

| |

Assumed initial public offering price per ordinary share

|

| | | US$ | | | |

| |

Consolidated net tangible book value per ordinary share as of December 31, 2021, after giving effect to the Reverse Share Split

|

| | | US$ | | | |

| |

Increase in consolidated net tangible book value per ordinary share attributable to existing shareholders

|

| | | US$ | | | |

| |

Pro forma consolidated net tangible book value per share after this offering

|

| | | US$ | | | |

| |

Dilution per ordinary share to new investors in this offering

|

| | | US$ | | | |

| |

Percentage of dilution in consolidated net tangible book value per ordinary share to new investors

|

| | | | % | | |

| | | |

Shares Purchased

|

| |

Total Consideration

|

| |

Average Price

Per Share |

| |||||||||||||||

| |

Number

|

| |

Percent

|

| |

Amount

|

| |

Percentage

|

| ||||||||||||||

|

Existing shareholders

|

| | | | | | | | | | % | | | |

US$

|

| | | | % | | | |

US$

|

|

|

New investors

|

| | | | | | | | | % | | | |

US$

|

| | | | % | | | |

US$

|

| |

| Total | | | |

|

|

| | | | | 100% | | | |

US$

|

| | | | 100% | | | |

US$

|

|

|

Year

|

| |

Period-end

|

| |

Average(1)

|

| |

Low

|

| |

High

|

| ||||||||||||

|

2017

|

| | | | 12.38 | | | | | | 13.32 | | | | | | 12.27 | | | | | | 14.49 | | |

|

2018

|

| | | | 14.43 | | | | | | 13.25 | | | | | | 11.52 | | | | | | 15.50 | | |

|

2019

|

| | | | 14.12 | | | | | | 14.45 | | | | | | 13.31 | | | | | | 15.43 | | |

|

2020

|

| | | | 14.62 | | | | | | 16.46 | | | | | | 14.02 | | | | | | 19.23 | | |

| 2021 | | | | | 15.90 | | | | | | 14.78 | | | | | | 13.42 | | | | | | 16.19 | | |

|

Month

|

| |

Period-end

|

| |

Average(1)

|

| |

Low

|

| |

High

|

| ||||||||||||

|

November 2021

|

| | | | 16.19 | | | | | | 15.53 | | | | | | 14.90 | | | | | | 16.19 | | |

|

December 2021

|

| | | | 15.90 | | | | | | 15.87 | | | | | | 15.55 | | | | | | 16.08 | | |

|

January 2022

|

| | | | 15.56 | | | | | | 15.52 | | | | | | 15.10 | | | | | | 16.05 | | |

|

February 2022

|

| | | | 15.35 | | | | | | 15.23 | | | | | | 14.97 | | | | | | 15.55 | | |

|

March 2022

|

| | | | 14.52 | | | | | | 15.00 | | | | | | 14.51 | | | | | | 15.40 | | |

|

April 2022 (through April 19)

|

| | | | 14.49 | | | | | | 14.63 | | | | | | 14.48 | | | | | | 14.75 | | |

| | | |

US$/ounce

|

| |||||||||||||||

| |

High

|

| |

Low

|

| |

Average

|

| |||||||||||

|

2019

|

| | | | 977 | | | | | | 782 | | | | | | 863 | | |

|

2020

|

| | | | 1,068 | | | | | | 593 | | | | | | 879 | | |

| 2021 | | | | | 1,294 | | | | | | 911 | | | | | | 1,090 | | |

| | | |

US$/ounce

|

| |||||||||||||||

| |

High

|

| |

Low

|

| |

Average

|

| |||||||||||

|

2019

|

| | | | 1,971 | | | | | | 1,267 | | | | | | 1,538 | | |

|

2020

|

| | | | 2,781 | | | | | | 1,557 | | | | | | 2,194 | | |

| 2021 | | | | | 3,000 | | | | | | 1,576 | | | | | | 2,396 | | |

| | | |

US$/ounce

|

| |||||||||||||||

| |

High

|

| |

Low

|

| |

Average

|

| |||||||||||

|

2019

|

| | | | 6,150 | | | | | | 2,460 | | | | | | 3,902 | | |

|

2020

|

| | | | 17,050 | | | | | | 5,160 | | | | | | 11.216 | | |

| 2021 | | | | | 29,800 | | | | | | 11,250 | | | | | | 20,047 | | |

| | | |

US$/ounce

|

| |||||||||||||||

| |

High

|

| |

Low

|

| |

Average

|

| |||||||||||

|

2019

|

| | | | 1,792 | | | | | | 1,270 | | | | | | 1,394 | | |

|

2020

|

| | | | 2,066 | | | | | | 1,477 | | | | | | 1,771 | | |

| 2021 | | | | | 1,946 | | | | | | 1,682 | | | | | | 1,799 | | |

| | | |

R/ounce

|

| |||||||||||||||

| |

High

|

| |

Low

|

| |

Average

|

| |||||||||||

|

2019

|

| | | | 24,244 | | | | | | 14,915 | | | | | | 19,003 | | |

|

2020

|

| | | | 41,528 | | | | | | 22,855 | | | | | | 34,659 | | |

| 2021 | | | | | 59,160 | | | | | | 26,645 | | | | | | 40,316 | | |

| | | |

For the Year Ended December 31,

|

| | | ||||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| | |||||||||||||

|

Reef delivered to the ROM pad (tonnes)(1)

|

| | | | 2,255,720 | | | | | | 3,952,626 | | | | | | 4,121,807 | | | | ||

|

Reef processed (tonnes)(2)

|

| | | | 3,114,647 | | | | | | 3,414,661 | | | | | | 3,870,515 | | | | ||

|

Reef milled (tonnes)(3)

|

| | | | 2,978,319 | | | | | | 3,089,285 | | | | | | 3,517,579 | | | | ||

|

Average milled head grade (g/t)

|

| | | | 1.42 | | | | | | 1.79 | | | | | | 1.57 | | | | ||

|

Average recovery rate (%)

|

| | | | 72 | | | | | | 71 | | | | | | 70 | | | | | |

|

Average recovered grade (g/t)

|

| | | | 1.01 | | | | | | 1.29 | | | | | | 1.11 | | | | ||

| 4E dispatched and sold (ounces): | | | | | | | | | | | | | | | | | | | | | ||

|

Platinum

|

| | | | 62,534 | | | | | | 82,110 | | | | | | 81,825 | | | | ||

|

Palladium

|

| | | | 26,042 | | | | | | 34,099 | | | | | | 33,217 | | | | ||

|

Rhodium

|

| | | | 6,514 | | | | | | 9,798 | | | | | | 10,017 | | | | ||

|

Gold

|

| | | | 2,551 | | | | | | 2,747 | | | | | | 2,257 | | | | ||

|

Total 4E dispatched and sold

|

| | | | 97,641 | | | | | | 128,754 | | | | | | 127,316 | | | | ||

| | | |

Payable Production

|

| |||

| |

(ounces)

|

| |||||

| Year | | | | | | | |

|

2009

|

| | | | 27,685 | | |

|

2010

|

| | | | 60,067 | | |

|

2011

|

| | | | 69,946 | | |

|

2012

|

| | | | 105,601 | | |

|

2013

|

| | | | 149,193 | | |

|

2014

|

| | | | 154,412 | | |

|

2015

|

| | | | 176,014 | | |

|

2016

|

| | | | 165,461 | | |

|

2017

|

| | | | 132,691 | | |

|

2018

|

| | | | 150,375 | | |

|

2019

|

| | | | 127,316 | | |

|

2020

|

| | | | 128,754 | | |

| 2021 | | | | | 97,641 | | |

| | | |

For the Year Ended

December 31, |

| | | | | | | |||||||||

| | | |

2021

|

| |

2020

|

| |

Variation

|

| |||||||||

| | | |

(in US$ thousands)

|

| | | | | | | |||||||||

|

Revenue

|

| | | | 265,520 | | | | | | 277,572 | | | | | | (4.3)% | | |

|

Cost of operations

|

| | | | (184,252) | | | | | | (156,213) | | | | | | 17.9% | | |

|

Gross profit

|

| | |

|

81,268

|

| | | |

|

121,359

|

| | | | | (33.0)% | | |

|

Administrative and general expenses

|

| | | | (32,511) | | | | | | (22,610) | | | | | | 43.8% | | |

|

Other (expense) income

|

| | | | 526 | | | | | | (233) | | | | | | n.m. | | |

|

Loss on disposal of assets

|

| | | | (3,125) | | | | | | — | | | | | | n.m. | | |

|

Foreign exchange gain

|

| | | | 5,015 | | | | | | 2,028 | | | | | | 147.3% | | |

|

Operating profit

|

| | |

|

51,173

|

| | | |

|

100,544

|

| | | | | (49.1)% | | |

|

Finance income

|

| | | | 5,532 | | | | | | 3,992 | | | | | | 38.6% | | |

|

Finance costs

|

| | | | (4,146) | | | | | | (7,103) | | | | | | (41.6)% | | |

|

Share of loss of investments accounted for using the equity method

|

| | | | (786) | | | | | | (1,130) | | | | | | (30.4)% | | |

|

Profit before income tax

|

| | |

|

51,773

|

| | | |

|

96,303

|

| | | | | (46.2)% | | |

|

Income tax credit (expense)

|

| | | | (18,601) | | | | | | 99,891 | | | | | | n.m. | | |

|

Profit for the year

|

| | |

|

33,172

|

| | | |

|

196,194

|

| | | | | (83.1)% | | |

| | | |

For the Year Ended

December 31, |

| | | | | | | |||||||||

| | | |

2021

|

| |

2020

|

| |

Variation

|

| |||||||||

| | | |

(in US$ thousands)

|

| | | | | | | |||||||||

|

Platinum

|

| | | | 66,033 | | | | | | 66,571 | | | | | | (0.8)% | | |

|

Palladium

|

| | | | 56,236 | | | | | | 78,506 | | | | | | (28.4)% | | |

|

Rhodium

|

| | | | 106,720 | | | | | | 110,879 | | | | | | (3.8)% | | |

|

Gold

|

| | | | 4,159 | | | | | | 4,718 | | | | | | (11.8)% | | |

| 4E | | | | | 233,148 | | | | | | 260,674 | | | | | | (10.6)% | | |

|

Other minerals

|

| | | | 25,785 | | | | | | 18,216 | | | | | | 41.6% | | |

|

Total revenue from contracts with customers

|

| | |

|

258,933

|

| | | |

|

278,890

|

| | | | | (7.2)% | | |

|

Commodity price adjustment

|

| | | | 6,587 | | | | | | (1,318) | | | |

n.m.

|

| |||

|

Total revenue

|

| | |

|

265,520

|

| | | |

|

277,572

|

| | | | | (4.3)% | | |

| | | |

For the Year Ended

December 31, |

| | | | | | | |||||||||

| | | |

2021

|

| |

2020

|

| |

Variation

|

| |||||||||

| | | |

(in US$ thousands)

|

| | | | | | | |||||||||

| On-mine operations | | | | | | | | | | | | | | | | | | | |

|

Materials and mining costs

|

| | | | (90,733) | | | | | | (70,821) | | | | | | 28.1% | | |

|

Total on-mine operations costs

|

| | | | (90,733) | | | | | | (70,821) | | | | | | 28.1% | | |

| Concentrator plant operations | | | | | | | | | | | | | | | | | | | |

|

Materials and other costs

|

| | | | (31,878) | | | | | | (27,931) | | | | | | 14.1% | | |

|

Utilities

|

| | | | (16,912) | | | | | | (14,457) | | | | | | 17.0% | | |

|

Total concentrator plant operations

|

| | | | (48,790) | | | | | | (42,388) | | | | | | 15.1% | | |

| Beneficiation | | | | | | | | | | | | | | | | | | | |

|

Smelting and refining costs

|

| | | | (12,835) | | | | | | (13,068) | | | | | | (1.8)% | | |

|

Total beneficiation costs

|

| | | | (12,835) | | | | | | (13,068) | | | | | | (1.8)% | | |

| Other costs | | | | | | | | | | | | | | | | | | | |

|

Transportation

|

| | | | (435) | | | | | | (509) | | | | | | (14.5)% | | |

|

Salaries

|

| | | | (21,172) | | | | | | (18,219) | | | | | | 16.2% | | |

|

Total other costs

|

| | | | (21,607) | | | | | | (18,728) | | | | | | 15.4% | | |

| | | | | | (173,965) | | | | | | (145,005) | | | | | | 20.0% | | |

|

Amortization and depreciation of operating assets

|

| | | | (7,956) | | | | | | (13,383) | | | | | | (40.6)% | | |

|

Inventory adjustments

|

| | | | (2,331) | | | | | | 2,175 | | | |

n.m.

|

| |||

|

Total cost of operations

|

| | |

|

(184,252)

|

| | | |

|

(156,213)

|

| | | | | 17.9% | | |

| | | |

For the Year Ended

December 31, |

| | | | | | | |||||||||

| | | |

2021

|

| |

2020

|

| |

Variation

|

| |||||||||

| | | |

(in US$ thousands)

|

| | | | | | | |||||||||

|

Employee expenses

|

| | | | (10,943) | | | | | | (8,832) | | | | | | 23.9% | | |

|

Other administrative and general expenses

|

| | | | (5,320) | | | | | | (2,316) | | | | | | 129.7% | | |

|

Consulting and professional fees

|

| | | | (3,805) | | | | | | (2,041) | | | | | | 86.4%. | | |

|

Community projects

|

| | | | (3,586) | | | | | | (2,274) | | | | | | 57.7% | | |

|

Security

|

| | | | (1,867) | | | | | | (1,786) | | | | | | 4.5% | | |

|

Insurance fees

|

| | | | (1,350) | | | | | | (691) | | | | | | 95.4% | | |

|

Royalty expense

|

| | | | (1,269) | | | | | | (1,363) | | | | | | (6.9)% | | |

|

Consumables

|

| | | | (1,268) | | | | | | (1,172) | | | | | | 8.2% | | |

|

Amortization and depreciation

|

| | | | (900) | | | | | | (266) | | | | | | 238.3% | | |

|

IT related costs

|

| | | | (857) | | | | | | (572) | | | | | | 49.8% | | |

|

Learnerships and bursaries

|

| | | | (500) | | | | | | (705) | | | | | | (29.1)% | | |

|

Audit fees

|

| | | | (483) | | | | | | (294) | | | | | | 64.3% | | |

|

Rehabilitation and management fees

|

| | | | (363) | | | | | | (298) | | | | | | 21.8% | | |

|

Total administrative and general expenses

|

| | |

|

(32,511)

|

| | | | | (22,610) | | | | | | 43.8% | | |

| | | |

For the Year Ended December 31,

|

| |

Variation

|

| ||||||||||||

| |

2020

|

| |

2019

|

| ||||||||||||||

| |

(in US$ thousands)

|

| | | | | | | |||||||||||

|

Revenue

|

| | | | 277,572 | | | | | | 181,339 | | | | | | 53.1% | | |

|

Cost of operations

|

| | | | (156,213) | | | | | | (186,671) | | | | | | (16.3)% | | |

|

Gross profit (loss)

|

| | |

|

121,359

|

| | | |

|

(5,332)

|

| | | | | n.m. | | |

|

Administrative and general expenses

|

| | | | (22,610) | | | | | | (19,610) | | | | | | 15.3% | | |

|

Other (expense) income

|

| | | | (233) | | | | | | 849 | | | | | | (127.4)% | | |

|

Foreign exchange gain (loss)

|

| | | | 2,028 | | | | | | (1,377) | | | | | | n.m. | | |

|

Operating profit (loss)

|

| | |

|

100,544

|

| | | |

|

(25,470)

|

| | | | | n.m. | | |

|

Finance income

|

| | | | 3,992 | | | | | | 6,704 | | | | | | (40.5)% | | |

|

Finance costs

|

| | | | (7,103) | | | | | | (9,126) | | | | | | (22.2)% | | |

|

Share of loss of investments accounted for using the equity method

|

| | | | (1,130) | | | | | | (1,512) | | | | | | (25.3)% | | |

|

Profit (loss) before income tax

|

| | |

|

96,303

|

| | | |

|

(29,404)

|

| | | | | n.m. | | |

|

Income tax credit (expense)

|

| | | | 99,891 | | | | | | (20) | | | | | | n.m. | | |

|

Profit (loss) for the year

|

| | |

|

196,194

|

| | | |

|

(29,424)

|

| | | | | n.m. | | |

| | | |

For the Year Ended December 31,

|

| |

Variation

|

| ||||||||||||

| |

2020

|

| |

2019

|

| ||||||||||||||

| |

(in US$ thousands)

|

| | | | | | | |||||||||||

| Platinum | | | | | 66,571 | | | | | | 69,633 | | | | | | (4.4)% | | |

| Palladium | | | | | 78,506 | | | | | | 53,572 | | | | | | 46.5% | | |

| Rhodium | | | | | 110,879 | | | | | | 39,900 | | | | | | 177.9% | | |

| Gold | | | | | 4,718 | | | | | | 2,958 | | | | | | 59.5% | | |

|

4E

|

| | | | 260,674 | | | | | | 166,063 | | | | | | 57.0% | | |

|

Other minerals

|

| | | | 18,216 | | | | | | 17,379 | | | | | | 4.8% | | |

|

Total revenue from contracts with customers

|

| | |

|

278,890

|

| | | |

|

183,442

|

| | | | | 52.0% | | |

|

Commodity price adjustment

|

| | | | (1,318) | | | | | | (2,103) | | | | | | (37.3)% | | |

|

Total revenue

|

| | |

|

277,572

|

| | | |

|

181,339

|

| | | | | 53.1% | | |

| | | |

For the Year Ended December 31,

|

| |

Variation

|

| ||||||||||||

| |

2020

|

| |

2019

|

| ||||||||||||||

| |

(in US$ thousands)

|

| | | | | | | |||||||||||

| On-mine operations | | | | | | | | | | | | | | | | | | | |

|

Materials and mining costs

|

| | | | (70,821) | | | | | | (68,132) | | | | | | 3.9% | | |

|

Total on-mine operations costs

|

| | | | (70,821) | | | | | | (68,132) | | | | | | 3.9% | | |

| Concentrator plant operations | | | | | | | | | | | | | | | | | | | |

|

Materials and other costs

|

| | | | (27,931) | | | | | | (31,005) | | | | | | (9.9)% | | |

|

Utilities

|

| | | | (14,457) | | | | | | (15,884) | | | | | | (9.0)% | | |

|

Total concentrator plant operations

|

| | | | (42,388) | | | | | | (46,889) | | | | | | (9.6)% | | |

| Beneficiation | | | | | | | | | | | | | | | | | | | |

|

Smelting and refining costs

|

| | | | (13,068) | | | | | | (14,333) | | | | | | (8.8)% | | |

|

Total beneficiation costs

|

| | | | (13,068) | | | | | | (14,333) | | | | | | (8.8)% | | |

| Other costs | | | | | | | | | | | | | | | | | | | |

|

Transportation

|

| | | | (509) | | | | | | (563) | | | | | | (9.6)% | | |

|

Salaries

|

| | | | (18,219) | | | | | | (20,051) | | | | | | (9.1)% | | |

|

Total other costs

|

| | | | (18,728) | | | | | | (20,614) | | | | | | (9.1)% | | |

| | | | | | (145,005) | | | | | | (149,968) | | | | | | (3.3)% | | |

|

Amortization and depreciation of operating assets

|

| | | | (13,383) | | | | | | (37,546) | | | | | | (64.4)% | | |

|

Inventory adjustments

|

| | | | 2,175 | | | | | | 843 | | | | | | 158.0% | | |

|

Total cost of operations

|

| | |

|

(156,213)

|

| | | |

|

(186,671)

|

| | | | | (16.3)% | | |

| | | |

For the Year Ended December 31,

|

| |

Variation

|

| ||||||||||||

| |

2020

|

| |

2019

|

| ||||||||||||||

| |

(in US$ thousands)

|

| | | | | | | |||||||||||

|

Employee expenses

|

| | | | (8,832) | | | | | | (7,295) | | | | | | 21.1% | | |

|

Other administrative and general expenses

|

| | | | (2,316) | | | | | | (2,439) | | | | | | (5.0)% | | |

|

Community projects

|

| | | | (2,274) | | | | | | (3,970) | | | | | | (42.7)% | | |

|

Consulting and professional fees

|

| | | | (2,041) | | | | | | — | | | | | | n.m. | | |

|

Security

|

| | | | (1,786) | | | | | | (1,568) | | | | | | 13.9% | | |

|

Royalty expense

|

| | | | (1,363) | | | | | | (861) | | | | | | 58.3% | | |

|

Consumables

|

| | | | (1,172) | | | | | | (11) | | | | | | n.m. | | |

|

Learnerships and bursaries

|

| | | | (705) | | | | | | (623) | | | | | | 13.2% | | |

|

Insurance fees

|

| | | | (691) | | | | | | (613) | | | | | | 12.7% | | |

|

IT related costs

|

| | | | (572) | | | | | | (461) | | | | | | 24.1% | | |

|

Rehabilitation and management fees

|

| | | | (298) | | | | | | (317) | | | | | | (6.0)% | | |

|

Audit fees

|

| | | | (294) | | | | | | (262) | | | | | | 12.2% | | |

|

Amortization and depreciation

|

| | | | (266) | | | | | | (1,190) | | | | | | (77.6)% | | |

|

Total administrative and general expenses

|

| | | | (22,610) | | | | | | (19,610) | | | | | | 15.3% | | |

| | | |

For the Year

Ended December 31, |

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||

|

Cash and cash equivalents at the beginning of the year

|

| | | | 62,986 | | | | | | 43,393 | | | | | | 38,093 | | |

|

Net cash generated from operating activities

|

| | | | 120,107 | | | | | | 52,798 | | | | | | 8,941 | | |

|

Net cash used in investing activities

|

| | | | (20,082) | | | | | | (10,995) | | | | | | (4,574) | | |

|

Net cash used in financing activities

|

| | | | (10,281) | | | | | | (23,933) | | | | | | (474) | | |

|

Net increase in cash and cash equivalents

|

| | | | 89,744 | | | | | | 17,870 | | | | | | 3,893 | | |

|

Exchange gain on cash and cash equivalents

|

| | | | (12,135) | | | | | | 1,723 | | | | | | 1,408 | | |

|

Cash and cash equivalents at the end of the year

|

| | | | 140,595 | | | | | | 62,986 | | | | | | 43,393 | | |

| | | |

As of December 31,

|

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||

| Short-term borrowings: | | | | | | | | | | | | | | | |||||

|

IDC Loan(1)

|

| | | | — | | | | | | 14,408 | | | | | | 13,453 | | |

| | | | | | — | | | | | | 14,408 | | | | | | 13,453 | | |

| Long-term borrowings: | | | | | | | | | | | | | | | |||||

|

Corridor Mining Loan(2)

|

| | | | 5,289 | | | | | | 5,365 | | | | | | 5,135 | | |

|

IDC Loan(1)

|

| | | | — | | | | | | 21,611 | | | | | | 31,508 | | |

| | | | | | 5,289 | | | | | | 26,976 | | | | | | 36,643 | | |

|

Total borrowings

|

| | | | 5,289 | | | | | | 41,384 | | | | | | 50,096 | | |

| | | |

As of December 31, 2021

|

| |||||||||||||||||||||

| |

Between 1-12 months

|

| |

Between 12-24 months

|

| |

Greater than 24 months

|

| |

Total

|

| ||||||||||||||

| |

(in US$ thousands)

|

| | | | | | | | | | | | | | | | | | | |||||

|

Long-term borrowings(1)

|

| | | | — | | | | | | — | | | | | | 5,672 | | | | | | 5,672 | | |

|

Short-term borrowings

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Trade payables and accrued liabilities

|

| | | | 29,031 | | | | | | — | | | | | | — | | | | | | 29.031 | | |

|

Investec Revolving Commodity Facility

|

| | | | 31,252 | | | | | | — | | | | | | — | | | | | | 31,252 | | |

|

Total financial liabilities

|

| | |

|

60,283

|

| | | |

|

—

|

| | | |

|

5,672

|

| | | |

|

65,955

|

| |

| | | |

Payments Due By Period

|

| |||||||||||||||||||||

| |

Less than 1 year

|

| |

1-3 years

|

| |

More than 3 years

|

| |

Total

|

| ||||||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||||||||

|

Mining costs(1)

|

| | | | 30,352 | | | | | | — | | | | | | — | | | | | | 30,352 | | |

|

Open purchase orders

|

| | | | 10,398 | | | | | | — | | | | | | — | | | | | | 10,398 | | |

|

Total

|

| | |

|

40,750

|

| | | | | — | | | | | | — | | | | |

|

40,750

|

| |

| | | |

As of December 31,

|

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||

|

AA+

|

| | | | 74,859 | | | | | | 28,343 | | | | | | 18,916 | | |

|

AA

|

| | | | 53,725 | | | | | | 51,157 | | | | | | 38,544 | | |

|

BBB+

|

| | | | 30,443 | | | | | | 1,440 | | | | | | 1,799 | | |

|

Other

|

| | | | — | | | | | | 136 | | | | | | 19 | | |

|

Total cash and cash equivalents and restricted cash investments and guarantees

|

| | | | 159,027 | | | | | | 81,076 | | | | | | 59,278 | | |

| | | |

Average rate

|

| |

Spot rate as of

December 31, |

| ||||||||||||||||||||||||||||||

| | | |

2021

|

| |

2020

|

| |

2019

|

| |

2021

|

| |

2020

|

| |

2019

|

| ||||||||||||||||||

|

USD 1 = ZAR

|

| | | | 14.78 | | | | | | 16.47 | | | | | | 14.45 | | | | | | 15.90 | | | | | | 14.62 | | | | | | 14.12 | | |

| | | |

As of December 31,

|

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||

|

Cash and cash equivalents

|

| | | | 30,443 | | | | | | 3,334 | | | | | | 1,527 | | |

|

Loans receivable

|

| | | | 14,863 | | | | | | 12,369 | | | | | | — | | |

|

Total

|

| | |

|

45,306

|

| | | | | 15,703 | | | | | | 1,527 | | |

| | | |

For the Year Ended December 31,

|

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||

| Impact on statement of profit or loss (pre-tax) | | | | | | | | | | | | | | | |||||

|

USD/ZAR increase by 20% (2020: 20%; 2019: 30%)

|

| | | | 7,551 | | | | | | 2,617 | | | | | | 25 | | |

|

USD/ZAR decrease by 20% (2020: 20%; 2019: 20%)

|

| | | | (19,417) | | | | | | (6,730) | | | | | | (27) | | |

| | | |

Average for the Year Ended December 31,

|

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||

|

4E basket price USD

|

| | | | 2,679 | | | | | | 2,031 | | | | | | 1,300 | | |

|

USD 1 = ZAR

|

| | | | 14.78 | | | | | | 16.47 | | | | | | 14.45 | | |

|

4E basket price ZAR

|

| | | | 39,484 | | | | | | 33,143 | | | | | | 18,775 | | |

| | | |

For the Year Ended December 31,

|

| |||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| |||||||||||||||||

| Impact on statement of profit or loss (pre-tax) | | | | | | | | | | | | | | | |||||

|

Increase by 10% in 4E basket price

|

| | | | 4,491 | | | | | | 12,846 | | | | | | 6,766 | | |

|

Decrease by 20% in 4E basket price

|

| | | | (16,509) | | | | | | (37,969) | | | | | | (13,531) | | |

| | | |

For the Year Ended December 31,

|

| | ||||||||||||||

| |

2021

|

| |

2020

|

| |

2019

|

| |||||||||||

| |

(in US$ thousands)

|

| | ||||||||||||||||

|

Impact on statement of profit or loss (pre-tax)

|

| | | | | | | | | | | | | | |||||

|

Increase of 1% in prime overdraft rate

|

| | | | 815 | | | | | | (164) | | | | | | (266) | | |

|

Decrease of 0.5% in prime overdraft rate

|

| | | | (408) | | | | | | 82 | | | | | | 133 | | |

| | | |

2019

|

| |

2020

|

| |

2021

|

| |

YTD 2022(1)

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |

High

|

| |

Low

|

| |

Average

|

| |

High

|

| |

Low

|

| |

Average

|

| |

High

|

| |

Low

|

| |

Average

|

| | | | | | | | | | | | | | | | | | | |||||||||||||||||||||||||||||

|

(US$/ounce)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Platinum

|

| | | | 977 | | | | | | 782 | | | | | | 863 | | | | | | 1,068 | | | | | | 593 | | | | | | 878 | | | | | | 1,294 | | | | | | 911 | | | | | | 1,090 | | | | | | 1,151 | | | | | | 931 | | | | | | 1,023 | | |

|

Palladium

|

| | | | 1,971 | | | | | | 1,267 | | | | | | 1,538 | | | | | | 2,781 | | | | | | 1,557 | | | | | | 2,194 | | | | | | 3,000 | | | | | | 1,576 | | | | | | 2,396 | | | | | | 3,015 | | | | | | 1,854 | | | | | | 2,333 | | |

|

Rhodium

|

| | | | 6,150 | | | | | | 2,460 | | | | | | 3,902 | | | | | | 17,050 | | | | | | 5,160 | | | | | | 11,216 | | | | | | 29,800 | | | | | | 11,250 | | | | | | 20,047 | | | | | | 22,200 | | | | | | 14,500 | | | | | | 18,273 | | |

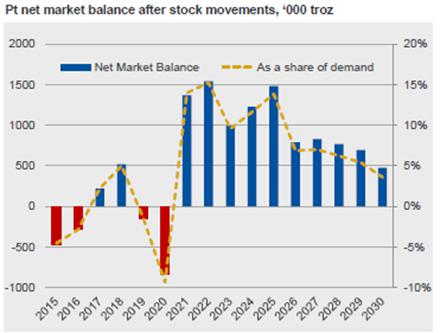

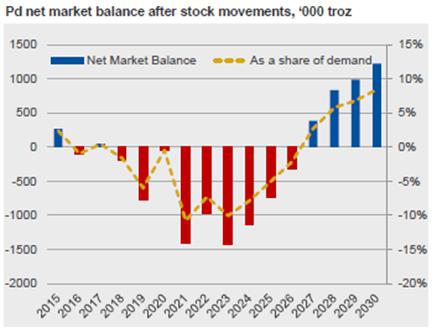

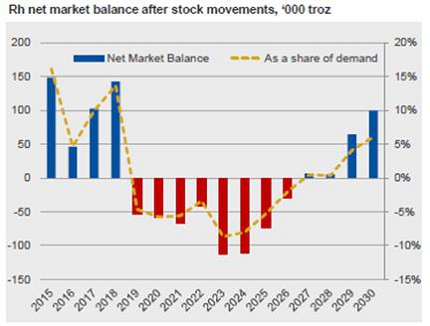

| | | |

Platinum (Moz)

|

| |

Palladium (Moz)

|

| |

Rhodium (Moz)

|

| |||||||||||||||||||||||||||||||||||||||||||||

| |

2020

|

| |

2025

|

| |

2030

|

| |

2020

|

| |

2025

|

| |

2030

|

| |

2020

|

| |

2025

|

| |

2030

|

| |||||||||||||||||||||||||||||

|

Autocatalyst demand

|

| | | | 2,224 | | | | | | 3,410 | | | | | | 4,655 | | | | | | 8,497 | | | | | | 10,800 | | | | | | 11,185 | | | | | | 925 | | | | | | 1,325 | | | | | | 1,580 | | |

|

Hydrogen demand

|

| | | | 64 | | | | | | 152 | | | | | | 636 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | |

|

Jewelry demand

|

| | | | 1,137 | | | | | | 1,426 | | | | | | 1,497 | | | | | | 84 | | | | | | 85 | | | | | | 72 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | |

|

Other demand

|

| | | | 5,497 | | | | | | 6,011 | | | | | | 6,404 | | | | | | 2,970 | | | | | | 3,175 | | | | | | 3,230 | | | | | | 80 | | | | | | 86 | | | | | | 62 | | |

|

Total demand

|

| | | | 8,922 | | | | | | 10,999 | | | | | | 13,193 | | | | | | 11,551 | | | | | | 14,060 | | | | | | 14,487 | | | | | | 1,005 | | | | | | 1,411 | | | | | | 1,642 | | |

|

Annual growth

|

| |

2020 – 2030 CAGR: 4.0%

|

| |

2020 – 2030 CAGR: 2.3%

|

| |

2020 – 2030 CAGR: 5.0%

|

| |||||||||||||||||||||||||||||||||||||||||||||

![[MISSING IMAGE: tm2127701d1-tbl_light4clr.jpg]](tm2127701d1-tbl_light4clr.jpg)

![[MISSING IMAGE: tm2127701d1-tbl_heavy4clr.jpg]](tm2127701d1-tbl_heavy4clr.jpg)

| | | |

Temperature

|

| |

Distance

|

| |

Time

|

| |

Speed

|

| |

Elevation

|

|

|

NEDC (EU)

|

| |

20-30°C

|

| |

11km

|

| |

20 mins

|

| |

Max 120 km/h

|

| |

0m

|

|

|

WLTP (global)

|

| |

20-30˚X

|

| |

23κµ

|

| |

30 µινσ

|

| |

Max 131 km/h

|

| |

0m

|

|

|

RDE (EU/China)

|

| |

-7˚X -35˚X

|

| |

90km

|

| |

90-120 mins

|

| |

Max 160 km/h

|

| |

0-1300m

|

|

![[MISSING IMAGE: tm2127701d15-lc_pgmnor4clr.jpg]](tm2127701d15-lc_pgmnor4clr.jpg)

![[MISSING IMAGE: tm2127701d1-lc_pgmwest4clr.jpg]](tm2127701d1-lc_pgmwest4clr.jpg)

![[MISSING IMAGE: tm2127701d1-lc_pgmchina4clr.jpg]](tm2127701d1-lc_pgmchina4clr.jpg)

| | | |

Share of Automotive Sales

Requiring Autocatalysts |

| |

Automotive Sales (Millions)

|

| |

Market Share

|

| |

CAGR

|

| |||||||||||||||||||||

| |

2020

|

| |

2030

|

| |

2020

|

| |

2030

|

| |

2020 – 2030

|

| ||||||||||||||||||||

|

ICE Petrol

|

| |

100%

|

| | | | 61 | | | | | | 53 | | | | | | 75% | | | | | | 50% | | | | | | -1.4% | | |

|

ICE Diesel

|

| |

100%

|

| | | | 14 | | | | | | 14 | | | | | | 17% | | | | | | 13% | | | | | | -0.1% | | |

|

HEV

|

| |

Approximately 95%

|

| | | | 3 | | | | | | 12 | | | | | | 4% | | | | | | 11% | | | | | | 13.8% | | |

|

PHEV

|

| |

Approximately 95%

|

| | | | 1 | | | | | | 6 | | | | | | 1% | | | | | | 5% | | | | | | 17.6% | | |

|

BEV

|

| |

0%

|

| | | | 2 | | | | | | 22 | | | | | | 3% | | | | | | 21% | | | | | | 24.9% | | |

|

FCEV

|

| |

0%

|

| | | | 0 | | | | | | 0 | | | | | | 0% | | | | | | 0% | | | | | | 15.8% | | |

|

PFCEV

|

| |

0%

|

| | | | 0 | | | | | | 0 | | | | | | 0% | | | | | | 0% | | | | | | 33.9% | | |

|

Autocatalyst Usage

|

| | | | | | | 97% | | | | | | 79% | | | | | | | | | | | | | | | | | | | | |

![[MISSING IMAGE: tm2127701d1-ph_illus4clr.jpg]](tm2127701d1-ph_illus4clr.jpg)

![[MISSING IMAGE: tm2127701d1-bc_global4clr.jpg]](tm2127701d1-bc_global4clr.jpg)

| | | |

2019 demand

(koz) |

| |

2020 demand

(koz) |

| |

2030 demand

(koz) |

| |

CAGR 2019-2030

|

| |

CAGR 2020-2030

|

| |||||||||||||||

|

Platinum

|

| | | | 2,858 | | | | | | 2,224 | | | | | | 4,655 | | | | | | 4.5% | | | | | | 7.7% | | |

|

Palladium

|

| | | | 9,672 | | | | | | 8,497 | | | | | | 11,185 | | | | | | 1.3% | | | | | | 2.8% | | |

|

Rhodium

|

| | | | 1,023 | | | | | | 925 | | | | | | 1,580 | | | | | | 4.0% | | | | | | 5.5% | | |

| Total | | | | | 13,553 | | | | | | 11,646 | | | | | | 17,420 | | | | | | 2.3% | | | | | | 4.1% | | |

![[MISSING IMAGE: tm2127701d1-pc_autocat4clr.jpg]](tm2127701d1-pc_autocat4clr.jpg)

|

Industrial Use

|

| |

Platinum Favorable Characteristic and Key Trends

|

|

| Jewelry | | |

•

Strength and resistance to tarnish.

•

Largest market China driven by fabrication industry.

•

Demand driven by economic spending and preference vs. gold.

|

|

|

Industrial Use

|

| |

Platinum Favorable Characteristic and Key Trends

|

|

| Glass | | |

•

Widely used in the production of display glass with rhodium owing to its high temperature tolerance and inert nature.

•

Fiberglass is widely used in automotive, due to its light weight and high strength, insulation in the construction industry and as components for photovoltaic (solar) panels and wind turbines.

|

|

| Chemical | | |

•

Steady source of demand from growth in production of paraxylene, nitric acid, ‘active pharmaceutical ingredients’ and silicones.

|

|

| Petroleum Refining | | |

•

Utilized in ‘reforming’ and ‘isomerization’, which create the higher octane components for gasoline

|

|

| Hard Discs | | |

•

Commonly used to provide thermal stability and to enhance data storage capability in hard disk drives.

•

Platinum and minor PGM ruthenium have enabled hard disk manufacturers to produce massive leaps forward in storage density.

•

Solid state drives use interconnected flash memory chips and therefore do not utilize platinum.

|

|

| Other Industries | | |

•

Used in a wide array of other, niche applications.

•

Healthcare devices such as surgical instruments, hearing devices, cardiac rhythm management, knee and hip implants, spinal fixation instruments and stents are an emerging source of demand that may all use platinum metal or compounds.

|

|

|

Industrial Use

|

| |

Palladium Favorable Characteristic and Key Trends

|

|

| Electronics | | |

•

Wide usage in multi-layer ceramic capacitors, widely utilized in consumer electronics including computers, digital televisions, automotive vehicles and smartphones.

•

5G enabled products use higher volumes of these capacitors, as do automotive electronics and electrification.

|

|

| Chemical | | |

•

Used in the production of vinyl acetate monomer, purified terephthalic acid, hydrogen peroxide, catchment gauzes in nitric acid synthesis, and for removal of acetylene during the production of methyl ethylene glycol from coal.

•

Palladium salts are also used for electro plating purposes.

|

|

| Dental | | |

•

Used to be particularly prominent in Japan, also stimulated with subsidies.

•

However, this has been in decline for years due to substitution from more esthetically pleasing ceramic materials.

|

|

![[MISSING IMAGE: tm2127701d1-org_overvi4clr.jpg]](tm2127701d1-org_overvi4clr.jpg)

(MW of Capacity)

![[MISSING IMAGE: tm2127701d1-bc_annual4clr.jpg]](tm2127701d1-bc_annual4clr.jpg)

(Gigawatts of Accumulated Capacity)

![[MISSING IMAGE: tm2127701d1-bc_announ4clr.jpg]](tm2127701d1-bc_announ4clr.jpg)

(kozpa)

![[MISSING IMAGE: tm2127701d1-bc_platinum4clr.jpg]](tm2127701d1-bc_platinum4clr.jpg)

(kozpa)

![[MISSING IMAGE: tm2127701d1-bc_totplat4clr.jpg]](tm2127701d1-bc_totplat4clr.jpg)

(kozpa)

![[MISSING IMAGE: tm2127701d1-bc_totpalla4clr.jpg]](tm2127701d1-bc_totpalla4clr.jpg)

(kozpa)

![[MISSING IMAGE: tm2127701d1-bc_rhodium4clr.jpg]](tm2127701d1-bc_rhodium4clr.jpg)

| | | |

Platinum (Moz)

|

| |

Palladium (Moz)

|

| |

Rhodium (Moz)

|

| |||||||||||||||||||||||||||||||||||||||||||||

| |

2020

|

| |

2025

|

| |

2030

|

| |

2020

|

| |

2025

|

| |

2030

|

| |

2020

|

| |

2025

|

| |

2030

|

| |||||||||||||||||||||||||||||

|

Mined supply

|

| | | | 5,471 | | | | | | 6,949 | | | | | | 8,632 | | | | | | 6,705 | | | | | | 8,155 | | | | | | 9,507 | | | | | | 719 | | | | | | 832 | | | | | | 930 | | |

|

Recycled supply

|

| | | | 4,545 | | | | | | 5,240 | | | | | | 5,320 | | | | | | 4,592 | | | | | | 5,635 | | | | | | 6,305 | | | | | | 338 | | | | | | 500 | | | | | | 833 | | |

|

Total supply

|

| | | | 10,016 | | | | | | 12,189 | | | | | | 13,952 | | | | | | 11,297 | | | | | | 13,790 | | | | | | 15,812 | | | | | | 1,057 | | | | | | 1,332 | | | | | | 1,762 | | |

|

Annual growth

|

| |

2020 – 2030 CAGR: 3.4%

|

| |

2020 – 2030 CAGR: 3.4%

|

| |

2020 – 2030 CAGR: 5.2%

|

| |||||||||||||||||||||||||||||||||||||||||||||

![[MISSING IMAGE: tm2127701d1-pc_saprod4clr.jpg]](tm2127701d1-pc_saprod4clr.jpg)

![[MISSING IMAGE: tm2127701d1-pc_prillsplit4c.jpg]](tm2127701d1-pc_prillsplit4c.jpg)

![[MISSING IMAGE: tm2127701d1-bc_approxi4clr.jpg]](tm2127701d1-bc_approxi4clr.jpg)

![[MISSING IMAGE: tm2127701d1-lc_index4clr.jpg]](tm2127701d1-lc_index4clr.jpg)

![[MISSING IMAGE: tm2127701d15-bc_mined4c.jpg]](tm2127701d15-bc_mined4c.jpg)

![[MISSING IMAGE: tm2127701d15-bc_western4clr.jpg]](tm2127701d15-bc_western4clr.jpg)

|

Operator

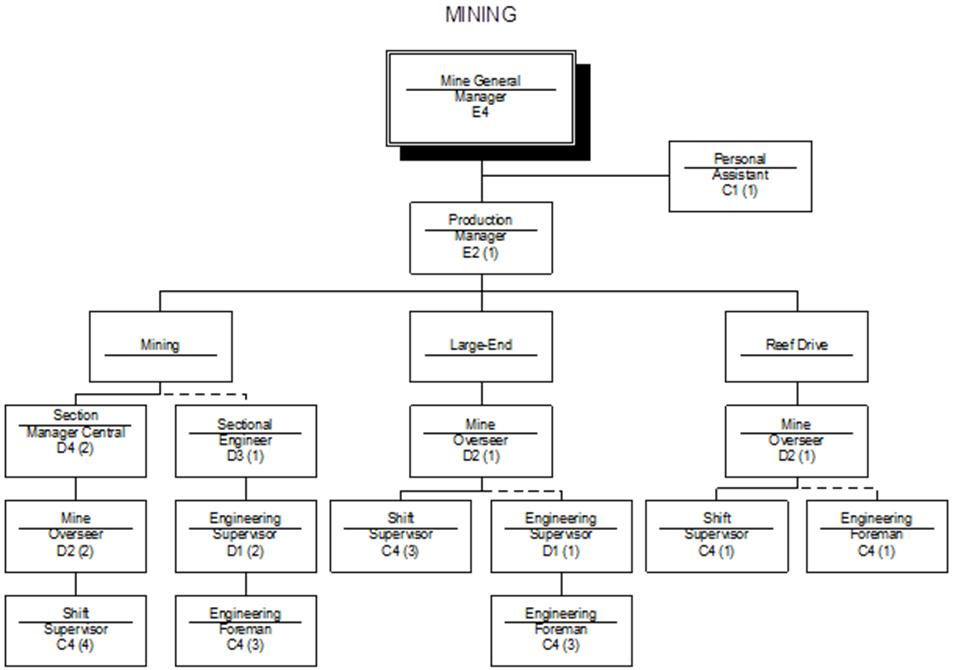

|