Exhibit 99.78

WONDERFI TECHNOLOGIES INC.

(formerly, Austpro Energy Corporation)

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED SEPTEMBER 30, 2021

December 15, 2021

TABLE OF CONTENTS

| GLOSSARY OF TERMS |

1 |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

7 |

| CORPORATE STRUCTURE |

11 |

| DESCRIPTION AND GENERAL DEVELOPMENT OF THE BUSINESS |

12 |

| RISK FACTORS |

22 |

| DIVIDENDS AND DISTRIBUTIONS |

36 |

| DESCRIPTION OF CAPITAL STRUCTURE |

36 |

| MARKET FOR SECURITIES |

37 |

| ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER |

39 |

| PRINCIPAL SHAREHOLDERS |

41 |

| DIRECTORS AND OFFICERS |

41 |

| AUDIT COMMITTEE |

44 |

| EXECUTIVE COMPENSATION |

46 |

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY INCENTIVE PLAN |

63 |

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS |

63 |

| PROMOTERS |

63 |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

64 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

64 |

| TRANSFER AGENT AND REGISTRAR |

64 |

| MATERIAL CONTRACTS |

64 |

| INTERESTS OF EXPERTS |

68 |

| ADDITIONAL INFORMATION |

68 |

| SCHEDULE A “AUDIT COMMITTEE CHARTER” |

A-1 |

GLOSSARY OF TERMS

The following is a glossary of

certain defined terms used throughout this AIF. This is not an exhaustive list of defined terms used in this AIF and additional terms

are defined throughout. Terms and abbreviations used in the financial statements of the Company and the Company’s MD&A attached

as schedules to this AIF are defined separately in such schedules, and the terms and abbreviations defined below are not used, except

where otherwise indicated. Words importing the singular, where the context requires, include the plural and vice versa, and words importing

any gender include all genders.

“a

change in control event” has the meaning ascribed to such term under “Equity Incentive Plan – Change in Control”;

“Affiliate” has the

meaning ascribed to such term in the BCBCA;

“Amalgamation”

means the amalgamation of DeFi and SubCo pursuant to Section 269 of the BCBCA pursuant to the terms of the Amalgamation Agreement;

“Amalgamation Agreement”

means the amalgamation agreement dated June 3, 2021, among Austpro, DeFi and SubCo with respect to the Amalgamation;

“API” has

the meaning ascribed to such term under “Description of the Business – Product and Service Offerings – Aggregator

Platform”;

“ASIC” has

the meaning scribed to such term under “Description of the Business – Product and Service Offerings – Aggregator

Platform”;

“Audit Committee”

means the audit committee of the Board;

“Austpro” has

the meaning ascribed to such term under “Description and General Development of the Business – History – Corporate

History”;

“Austpro Consolidation”

means the consolidation of the Austpro Shares on the basis of one (1) post-consolidation Austpro Share for each 8.727 pre-consolidation

Austpro Shares resulting in an aggregate of 1,700,192 Consolidation Shares to be completed prior to the Effective Time;

“BCBCA” means

the Business Corporations Act (British Columbia), as amended, including the regulations promulgated thereunder;

“Board” means the

board of directors of WonderFi;

“business day”

means a day other than a Saturday, Sunday or other day when banks in the City of Vancouver, British Columbia are not generally open for

business;

“Cashless

Exercise” has the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan

– Options”;

“CEO” means chief

executive officer;

“CFO” means chief

financial officer;

“Change

in Control” has the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan –

Change in Control”;

“Closing”

means the completion of the Amalgamation in accordance with the terms of the Amalgamation Agreement;

“Code” has the

meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan – Options”;

“Coinbase” means

Coinbase Inc., a public Delaware corporation that provides marketplace access to DeFi for crypto asset and fiat currency orders and transfers;

“Coinbase Custodial Services

Agreement” means the agreement signed effective May 28, 2021, between DeFi and Coinbase Custody providing the terms of Coinbase

Custody’s provision of custodial services to DeFi;

“Coinbase Custody”

means Coinbase Custody Trust Company, a limited liability company that provides third-party crypto asset custodial services to DeFi;

“Coinbase Institutional

Client Agreement” means the agreement signed effective May 25, 2021, between DeFi and Coinbase relating to Coinbase’s

provision of certain trading services to DeFi;

“Cold Storage” means

a way of holding cryptocurrency tokens offline, without internet access, typically through hardware wallets (like USB drives) or vaults;

“Common Shares” means

the common shares of the Company;

“Commencement Date”

has the meaning given such term under “Executive Compensation – Equity Incentive Plan – Termination of

Employment or Services”;

“Compensation, Nomination

and Governance Committee” means the compensation, nomination and governance committee of the Board;

“Compensation Securities”

includes stock options, convertible securities, exchangeable securities and similar instruments, including stock appreciation rights,

deferred share units and restricted share units granted or issued by a company or one of its subsidiaries (if any) for services provided

or to be provided, directly or indirectly to a company or any of its subsidiaries (if any);

“Consideration Shares”

means the Common Shares, following the completion of the Austpro Consolidation, to be issued to the DeFi Shareholders in connection with

the Amalgamation;

“crypto asset”

means a digital representation of value protected by a cryptographic distributed ledger system that can align with the colloquial reference

of a “cryptocurrency”;

“deferred compensation”

has the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan – Change in Control”;

“DeFi” means

DeFi Ventures Inc., a company incorporated under the BCBCA, that was amalgamated with the Subco pursuant to the Transaction to form WonderFi

Digital Inc., which now operates the business of DeFi;

“DeFi Shares” means

common shares in the capital of DeFi;

“DeFi Options” means stock options to acquire DeFi Shares;

“Director”

means the director appointed under the BCBCA;

“Director Fees”

has the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan – Deferred

Share Units”;

“DSU” has the

meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan – Deferred Share Units”;

“Employment Agreement”

has the meaning ascribed to such term under “Executive Compensation – Employment, Consulting and Management

Agreements”;

“Emprise” means

Emprise LP 2017;

“Emprise

Note” has the meaning ascribed to such term “Description and General Development of the Business – History –

Description and General Development of the Business – Developments During the Financial Year Ended September 30, 2020”;

“Emprise

Management Services Agreement” means the rent and accounting services agreement between Austpro and Emprise Management Services

Corp. dated October 1, 2018;

“ESA” has the meaning

ascribed to such term under “Information Concerning DeFi – Management Contracts”;

“Escrow Agent” means

Computershare Trust Company of Canada, the subscription receipt agent of DeFi;

“Escrow Release Conditions”

has the meaning ascribed to such term under “Material Contracts – Subscription Receipt Agreement”;

“Escrow

Release Deadline” has the meaning ascribed to such term under “Material Contracts – Subscription Receipt Agreement”;

“Escrowed Funds” has

the meaning ascribed to such term under “Material Contracts – Subscription Receipt Agreement”;

“ESG” means Environmental,

Social, and Corporate Governance;

“Ethereum” means a

decentralized, open-source blockchain-based platform with smart contract functionality;

“Ethereum 2.0”

is an upgrade to the Ethereum blockchain, launching in several phases, that aims to enhance the speed, efficiency and scalability

of the Ethereum network through use of the “Proof-of-Stake” consensus mechanism as opposed to the “Proof-of-Work”

consensus mechanism;

“Equity Incentive Plan”

means the equity incentive plan of WonderFi;

“EVM”

has the meaning ascribed to such term under “Description and General Development of the Business – Market Overview –

Building Blocks of Decentralized Finance”;

“FATF” has

the meaning ascribed to such term under “Risk Factors – Decentralized finance may face significant compliance challenges

if governments require adherence to the Financial Action Task Force (FATF) Virtual Asset Service Provider (VASP) Draft Guidelines”;

“FATF Guidelines”

has the meaning ascribed to such term under “Risk Factors – WonderFi’s Business – Decentralized finance

may face significant compliance challenges if governments require adherence to the Financial Action Task Force (FATF) Virtual Asset Service

Provider (VASP) Draft Guidelines”;

“Filing Statement”

means the filing statement dated August 20, 2021 and filed on the Company’s SEDAR profile, together with all schedules to this

Filing Statement;

“FTX” means FTX cryptocurrency

exchange, founded by Sam Bankman-Fried;

“Insider” means

(a) an officer, director or insider (within the meaning of the Securities Act (British Columbia)) of a Listed Issuer, (b) a promoter of

a Listed Issuer, (c) a Person identified as an Insider, individually or by virtue of their position, by a Listed Issuer, (d) if the Insider

is not an individual, each director, officer and “Control Person” of that Insider, and (e) such other Person as may

be designated from time to time by the NEO Exchange;

“In-the-Money Amount”

has the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan – Options”;

“Market Price”

has the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan – Options”;

“Named Executive Officers”

or “NEO” means, in relation to a company, each of the following individuals: (a) any individual who acted as CEO of

the company, or acted in a similar capacity, for any part of the most recently completed financial year, (b) any individual who acted

as CFO of the company, or acted in a similar capacity, for any part of the most recently completed financial year, (c) each of the three

most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than

the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000,

as determined in accordance with subsection 1.3(6) of Form 51-102F6 Statement of Executive Compensation, for that financial year,

and (d) each individual who would be a NEO under paragraph (c) but for the fact that the individual was neither an executive officer of

the company, nor acting in a similar capacity, at the end of that financial year;

“Native Ads” means

Native Ads, Inc.;

“Native Ads Agreement”

has the meaning ascribed to it under “Description and General Development of the Business – History – Developments

During the Financial Year Ended September 30, 2021”;

“NEO Exchange” means

the Neo Exchange Inc.;

“NEX Board” means

the trading forum for listed companies that no longer meet the TSXV’s ongoing listing requirements;

“NI 52-110” has the

meaning ascribed to such term under “Audit Committee – Composition of the Audit Committee”;

“NP 46-201” means

National Policy 46-201 – Escrow for Initial Public Offerings;

“NYDFS” has

the meaning ascribed to such term under “Material Contracts – Coinbase Custodial Services Agreement”;

“October

2021 Bought Deal” has the meaning ascribed to such term under “Description and General Development of the Business

– History – Subsequent events”;

“Options” means stock

options to acquire Common Shares;

“Person” includes

an individual or company;

“PIPEDA”

has the meaning ascribed to such term under “Risk Factors – Risk’s Related to WonderFi’s Business - Privacy

laws and regulations”;

“President’s List

Purchasers” has the meaning ascribed to such term under “Material Contracts – Subscription Receipt Agreement”;

“Proof-of-Stake”

means a class of consensus mechanisms or protocols for blockchains that work by selecting validators in proportion to their quantity

of holdings in the associated cryptocurrency;

“Proof-of-Work”

means the consensus mechanism that allows the Ethereum network to come

to consensus, or agree on things like account balances and the order of transactions;

“PSU”

has the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan – Performance

Share Units”;

“PSU Service Year”

has the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan – Performance Share Units”;

“REIT” has

the meaning ascribed to such term under “Audit Committee – Composition of the Audit Committee – Relevant Education

and Experience – Stephanie Li”;

“Related Person”

means:

| (a) | a “related party” as defined in Multilateral Instrument 61-101 Protection of Minority

Security Holders in Special Transactions, of WonderFi; |

| | | |

| (b) | a promoter of WonderFi, or, where the promoter is not an individual, an officer, director or Control

Person of the promoter; and |

| | | |

| (c) | such other Person as may be designated from time to time by the NEO Exchange; |

“RSU” has

the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan – Restricted Share Units”;

“RSU

Service Year” has the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan

– Restricted Share Units”;

“Securities Laws”

means securities legislation, securities regulations and securities rules, and the policies, notices, instruments and blanket orders

of applicable securities regulators, including the NEO Exchange, in force from time to time, and as may be amended from time to time,

that are applicable to an issuer;

“SEDAR” means the

System for Electronic Document Analysis and Retrieval;

“Serum” has

the meaning ascribed to such term under “Description and General Development of the Business – History – Subsequent

events”;

“SHA” has

the meaning scribed to such term under “Description of the Business – Product and Service Offerings - Aggregator Platform”;

“Share Based Award”

means an award under an equity incentive plan of equity-based instruments that do not have option like features, including, for greater

certainty, shares, DSUs, restricted shares, restricted share units, phantom shares, phantom share units and share equivalent units;

“SOC 1 Report”

has the meaning ascribed to such term under “Risk Factors –– Crypto assets in the custody of Coinbase Custody”;

“SOC

2 Report” has the meaning ascribed to such term under “Risk Factors –– Crypto assets in the custody of

Coinbase Custody”;

“Solana” has

the meaning ascribed to such term under “Description and General Development of the Business – History – Subsequent

events”;

“SubCo” has the

meaning ascribed to such term under “Description and General Development of the Business – History – Corporate History”;

“Subscription

Receipts” means the subscription receipts issued by DeFi pursuant to the Subscription Receipt Financing, as further described

in “Description and General Development of the Business – History – Developments During the Financial Year Ended

September 30, 2021”;

“Subscription Receipt Agent”

has the meaning ascribed to such term under “Material Contracts – Subscription Receipt Financing”;

“Subscription Receipt Agreement”

means the agreement in respect of the Subscription Receipt Financing;

“Subscription Receipt Financing”

means the brokered private placement of subscription receipts of DeFi (the “Subscription Receipts”) at a price

per Subscription Receipt of $1.00, for aggregate gross proceeds of $17,715,000 and each Subscription Receipt being exchangeable, without

additional consideration, for one DeFi Share, which shall be exchanged by the holder thereof for economically equivalent securities of

WonderFi, on a post-consolidated basis;

“Surviving Entity”

has the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan – Change in

Control”;

“Termination

Date” has the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan –

Termination of Employment or Services”;

“Transaction” means,

collectively, the Amalgamation, the Subscription Receipt Financing, the Austpro Consolidation, and all transactions contemplated by the

Amalgamation Agreement, as further described in “Description and General Development of the Business – History –

Corporate History”;

“TSXV” means the TSX

Venture Exchange Inc.;

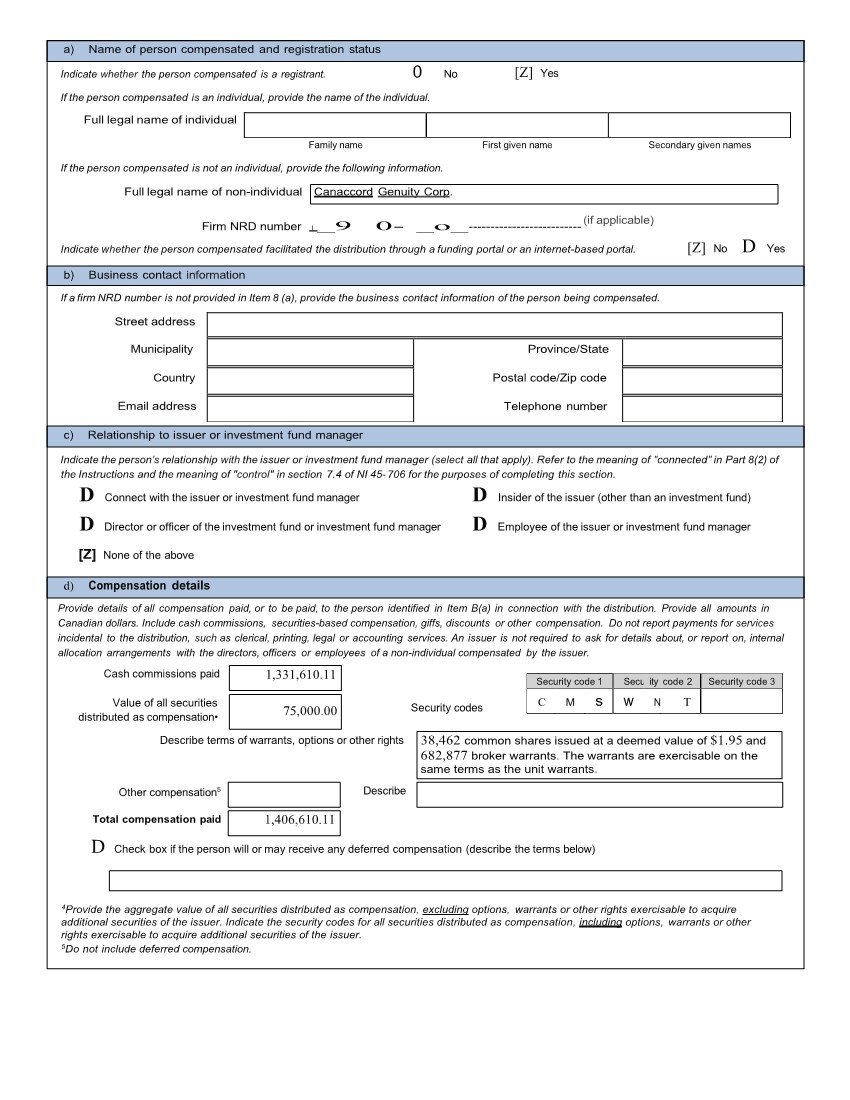

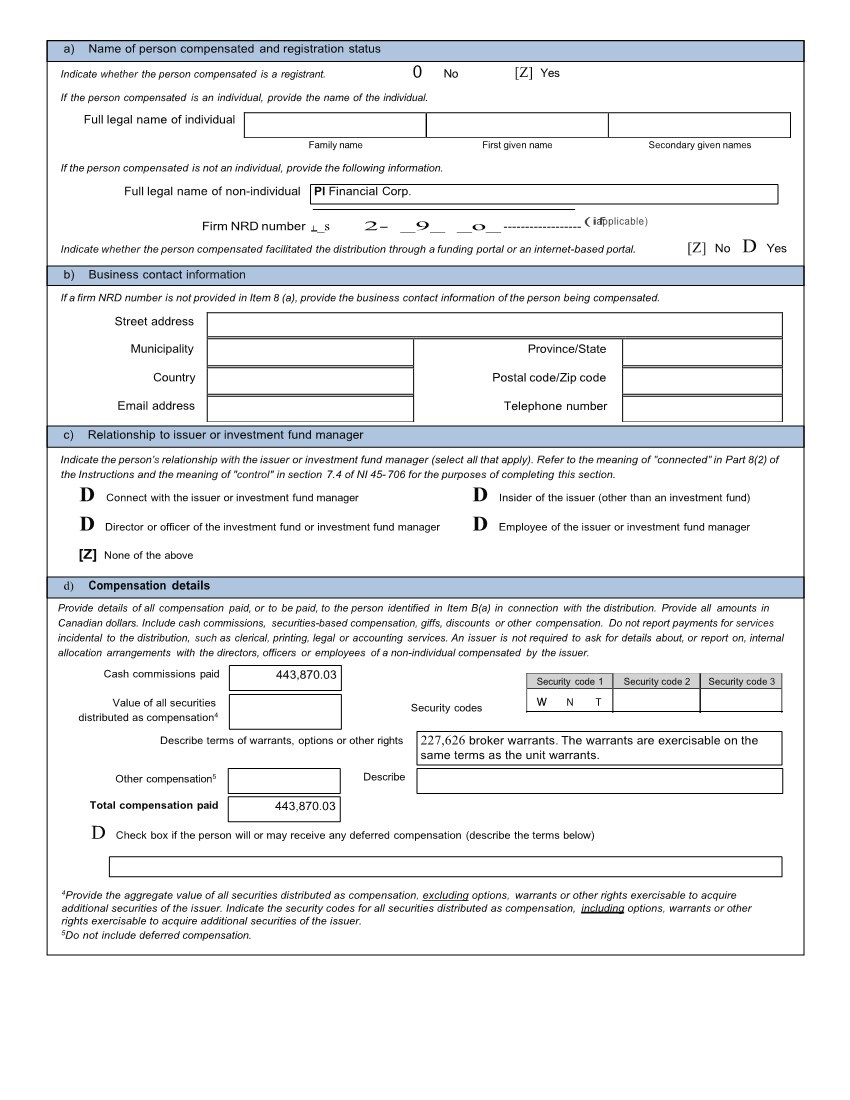

“Underwriting Agreement”

means the agreement between the Company and the underwriters, Canaccord Genuity Corp. and PI Financial Corp., pursuant to which the

underwriters agreed to buy an aggregate of 10,257,000 units of the Company at a price of $1.95 per unit, with each unit consisting of

one Common Share and one-half of one Common Share purchase warrant, for aggregate gross proceeds to the Company of $20,001,150;

“Virtual

Asset Service Provider”, or “VASP” has the meaning ascribed to such term under “Risk Factors –

Decentralized finance may face significant compliance challenges if governments require adherence to the Financial Action Task Force (FATF)

Virtual Asset Service Provider (VASP) Draft Guidelines”;

“voting power”

has the meaning ascribed to such term under “Executive Compensation – Equity Incentive Plan – Change in Control”;

“Warrant Agent” means

Computershare Trust Company of Canada, the agent to the Warrant Indenture;

“Warrant Indenture”

has the meaning ascribed to such term under “Description and General Development of the Business – History –

Subsequent events”, and is further described in “Material Contracts – Warrant Indenture”;

“Warrants” means the

warrants outstanding to acquire Common Shares;

“WonderFi” or the “Company”

means WonderFi Technologies Inc.;

“WonderFi

Escrow Agreement” means the Form 46-201F1 escrow agreement to be entered into among the Escrow Agent, WonderFi and certain shareholders

of WonderFi effective as of the Closing; and

“WonderFi Digital” has the meaning ascribed

to such term under “Description and General Development of the Business – History – Corporate History”.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Certain statements and information

contained in this AIF constitute forward-looking statements or forward-looking information (collectively “forward-looking statements”)

within the meaning of applicable Securities Laws. Forward-looking statements are often, but not always, identified by the use of words

or phrases such as “may”, “is expected to”, “anticipates”, “believes”, “estimates”,

“intends”, “plans”, and similar words suggesting future outcomes, or language suggesting an outlook, including

that certain actions, events or results “may”, “could”, “would”, “might” or “will”

occur or be achieved, and variations of any such words or phrases. In particular, this AIF contains forward-looking statements with respect

to:

| · | WonderFi’s future business strategy, including its intended product and

service offerings, its plan to invest funds not used in the deployment of its business lines into crypto assets, and its intention to

add additional products and revenue streams in the future; |

| · | expectations about the future price of crypto assets; |

| · | the expected growth of Ethereum 2.0 and its platform; |

| · | the timing of Ethereum’s transition to Ethereum 2.0, including its expected

transition from “Proof-of-Work” to “Proof-of-Stake”; |

| · | the expectation that WonderFi’s staking infrastructure providers will allow

WonderFi to participate as a validator on the Ethereum network, which may provide WonderFi with a stable stream of income, net of fees; |

| · | expectations regarding future competitive conditions; |

| · | the expected corporate governance policies of WonderFi; |

| · | completion of the remaining $10.0 million in approved purchases of digital assets weighted across key

assets that drive value in the decentralized finance sector; |

| · | the expected dividend policies of WonderFi; and |

| · | the impact of future regulatory action. |

Forward-looking statements in

this AIF are based on the current beliefs of management of the Company, as well as assumptions made by, and information currently available

to, Company, as applicable, regarding, among other things, the expected:

| · | success of the operations of WonderFi; |

| · | WonderFi’s ability to attract and retain key personnel; |

| · | legislative and regulatory environments of the jurisdictions where WonderFi will carry on business

or have operations; |

| · | impact of competition and the competitive response to WonderFi’s business strategy; |

| · | timing and amount of WonderFi’s capital and other expenditures; |

| · | conditions in cryptocurrency and financial markets, and the economy generally; and |

| · | ability of WonderFi to obtain additional financing, if and as needed, on satisfactory terms or at all. |

Furthermore, such forward-looking

statements involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions,

activities, results, performance or achievements of WonderFi to be materially different from any future plans, intentions, activities,

results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation:

| · | necessary approvals may not be acquired; |

| · | generating yields through WonderFi’s crypto assess is reliant on numerous blockchain technology

service providers and various decentralized protocols; |

| · | the crypto assets WonderFi will use to generate yield are highly volatile and subject to momentum risk; |

| · | WonderFi may suffer losses from staking and any other related operations conducted using treasury assets; |

| · | crypto asset transactions are irreversible and may result in significant losses; |

| · | entry into crypto asset development business; |

| · | WonderFi’s operating results will experience significant fluctuations due

to the highly volatile nature of crypto assets; |

| · | the future development and growth of decentralized finance is subject to a variety

of factors that are difficult to predict and evaluate. If decentralized finance does not grow as WonderFi expects, WonderFi’s business,

operating results, and financial position could be adversely affected; |

| · | WonderFi operates in a heavily regulated environment and any material changes or

actions could lead to negative adverse effects to the business model, operational results, and financial condition of WonderFi; |

| · | regulation of blockchain, crypto assets and protocols; |

| · | failure to protect its intellectual property; |

| · | reliance on third-party software; |

| · | use of open source software; |

| · | effectiveness and efficiency of advertising and promotional expenditures, brand maintenance and promotion; |

| · | requirement to attract and retain customers and users to WonderFi apps and products; |

| · | growth and consolidation in the industry; |

| · | WonderFi may require additional funding to finance operations that could be potentially dilutive to

current shareholders or increase default risk; |

| · | the COVID-19 pandemic may significantly impact financial markets and have an adverse effect on WonderFi’s

business, operational results, and financial condition; |

| · | crypto asset value risk; |

| · | changes in applicable law; |

| · | privacy laws and regulations; |

| · | decentralized finance may face significant compliance challenges if governments require adherence to

the FATF Guidelines; |

| · | changes to bank fees or practices, or payment card networks; |

| · | uninsured or uninsurable risks; |

| · | reliance on development and maintenance of the internet infrastructure; |

| · | risks related to potential interruption or failure of WonderFi’s information technology and communications

systems; |

| · | crypto assets in the custody of Coinbase; |

| · | risks related to potential undetected errors in WonderFi’s software; |

| · | lack of operating history; |

| · | WonderFi’s overarching strategy to bring high-quality, easy to access, and

compliant decentralized finance related services may not lead to the maximization of short-term or medium-term financial results; |

| · | general market adoption to crypto assets has been relatively limited to date and

further adoption is uncertain, which may result in adverse effects to WonderFi’s business, operating results, and financial condition; |

| · | if miners or validators on any of the blockchain networks WonderFi supports demand

high transaction fees, WonderFi’s operating results may be adversely affected; |

| · | WonderFi expects operating expenses to rise sharply as WonderFi continues to grow,

which may impact WonderFi’s ability to achieve or sustain profitability for a significant period of time; and |

| · | conflict of interest of management. |

Although the Company has attempted

to identify important factors that could cause actual actions, events, conditions, results, performance or achievements to differ materially

from those described in forward-looking statements, there may be other factors that cause actions, events, conditions, results, performance

or achievements to differ from those anticipated, estimated or intended. If any of these risks or uncertainties materialize, or if assumptions

underlying the forward-looking statements prove incorrect, actual results might vary materially from those anticipated in those forward-looking

statements. See “Risk Factors” for a discussion of certain factors investors should carefully consider before deciding

to invest in WonderFi.

Readers are cautioned that these

factors and risks are difficult to predict and that the assumptions used in the preparation of forward-looking statements, although considered

reasonably accurate at the time of preparation, may prove to be incorrect. Accordingly, readers are cautioned that WonderFi’s actual

results achieved could vary from the information provided in this AIF, and the variations may be material. Readers are also cautioned

that the foregoing list of factors is not exhaustive. Consequently, there is no representation by the Company that actual results achieved

will be the same, in whole or in part, as those set out in the forward-looking statements. To date, no securities regulatory authority

or regulator has reviewed or commented on any of the statements made in this AIF. Furthermore, the forward-looking statements contained

in this AIF are made as of the date of this AIF, and the Company does not undertake any obligation, except as required by applicable Securities

Laws, to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events

or otherwise. The forward-looking statements contained in this AIF are expressly qualified by this cautionary statement.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information

contained in this AIF concerning the Company’s industry and the markets in which it operates, including general expectations and

market position, market opportunities and market share, is based on information from independent industry organizations, other third-party

sources (including industry publications, surveys and forecasts) and management studies and estimates.

Unless otherwise indicated, the

Company’s estimates are derived from publicly available information released by independent industry analysts and third-party sources

as well as data from the Company’s internal research and knowledge of the Hemp market and economy, and include assumptions made

by the Company which management believes to be reasonable based on their knowledge of the Company’s industry and markets. The Company’s

internal research and assumptions have not been verified by any independent source, and it has not independently verified any third-party

information. While the Company believes the market position, market opportunity and market share information included in this AIF is generally

reliable, such information is inherently imprecise. In addition, projections, assumptions and estimates of the Company’s future

performance and the future performance of the industry and markets in which it operates are necessarily subject to a high degree of uncertainty

and risk due to a variety of factors, including those described under “Forward-Looking Statements” and “Risk

Factors”.

CURRENCY AND OTHER INFORMATON

Unless otherwise

indicated, all references to “$” are to Canadian dollars and references to “US$” are to United States

dollars.

United States Exchange Rate

The following table

sets forth: (i) the rates of exchange for United States dollars, expressed in Canadian dollars, in effect at the end of each of the

periods indicated; (ii) the average of exchange rates in effect during such periods; and (iii) the high and low exchange rates

during each such periods, in each case based on the rate of exchange in effect during each such periods, in each case based on the

rate of exchange in effect on each trading day as reported by the Bank of Canada on its website (the “Bank of Canada Daily

Exchange Rate”).

| | |

Years Ended Sept 30, | |

| | |

2021 | | |

2020 | | |

2019 | |

| Low for the period | |

$ | 1.2040 | | |

$ | 1.2970 | | |

$ | 1.2803 | |

| High for the period | |

$ | 1.3349 | | |

$ | 1.4496 | | |

$ | 1.3642 | |

| Rate at the end of the period | |

$ | 1.2741 | | |

$ | 1.3339 | | |

$ | 1.3243 | |

| Average | |

$ | 1.2642 | | |

$ | 1.3457 | | |

$ | 1.3270 | |

On December 15, 2021, the Bank of Canada

daily exchange rate was US$1.00 – $1.2764.

CORPORATE STRUCTURE

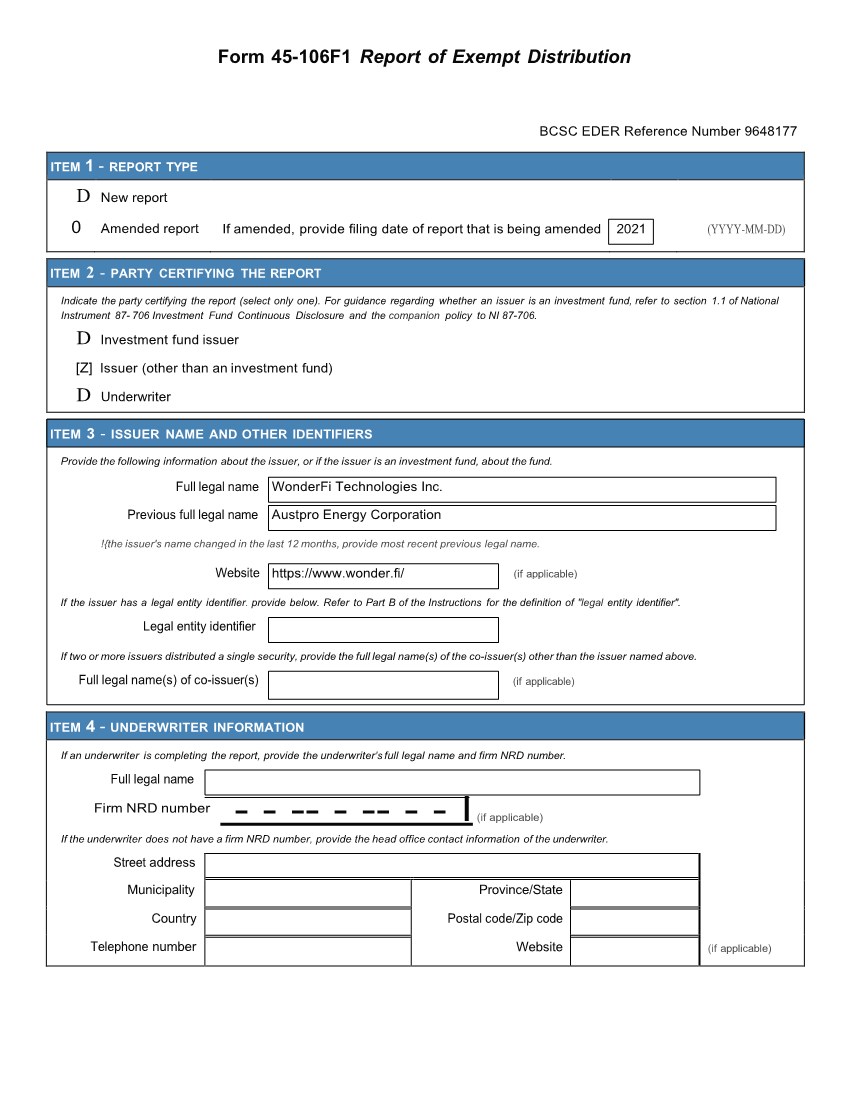

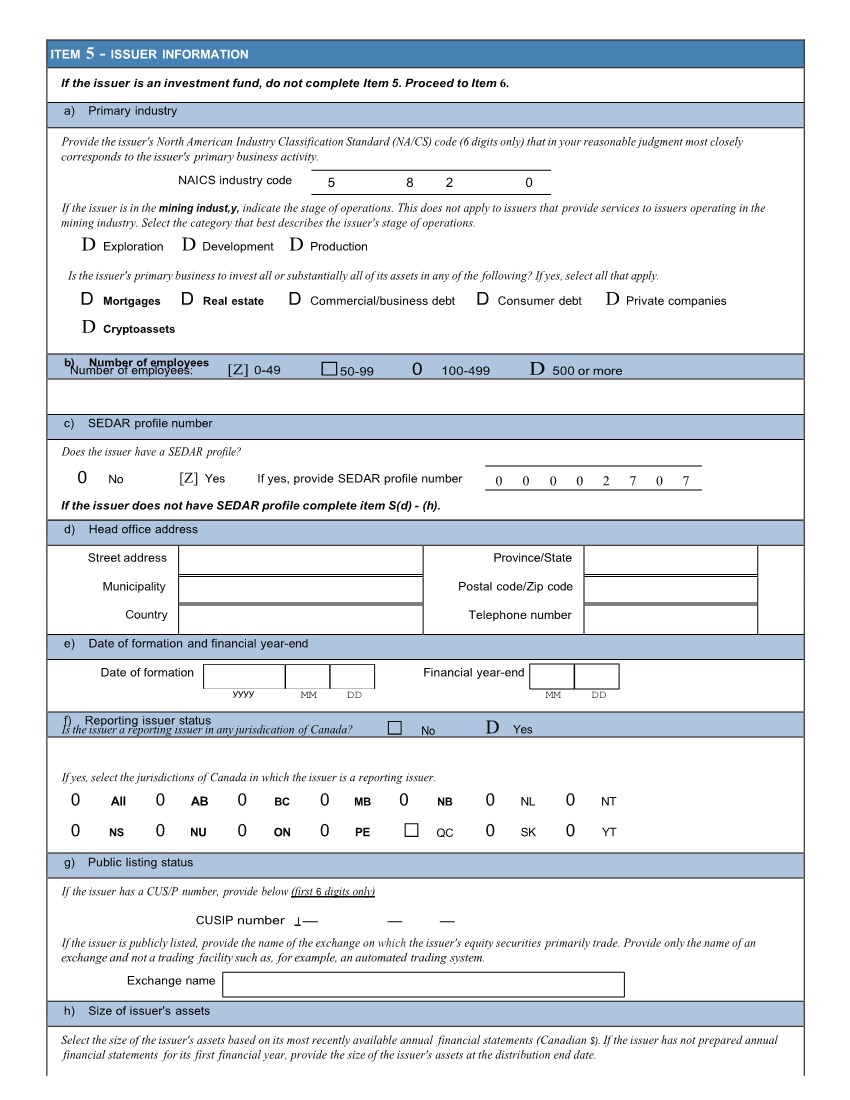

The Company was originally

incorporated under the name “Austra Resources Corporation” pursuant to the BCBCA on November 1, 1990. In connection with

a reverse take-over transaction, the Company changed its name to “WonderFi Technologies Inc.”. See Description and General

Development of The Business – History. WonderFi’s Common Shares trade on the NEO Exchange under the trading symbol “WNDR”.

The registered and head

office of WonderFi is located at Suite 250, 780 Beatty Street Vancouver, British Columbia V6B 2M1. WonderFi maintains a website at www.wonder.fi/.

Information contained on WonderFi’s website is not part of this AIF, nor is it incorporated by reference herein.

Material Amendments to

the Company’s Articles

On November 23, 2018, the

Company adopted a new set of articles of incorporation to remove the special rights and restrictions attached to its Common Shares, and

to replace the special rights and restrictions attached to its first preferred shares to ensure compliance with the BCBCA.

On November 29, 2018, the

Company consolidated its Common Shares on a 4 old for 1 new basis, pursuant to which the Company changed the authorized number of Common

Shares from 100,000,000 to 25,000,000.

On November 30, 2018, the

authorized number of Common Shares of the Company was changed to an unlimited amount.

On August 25, 2021, in

connection with the Transaction, the Company completed the Austpro Consolidation, a consolidation of its Common Shares on an 8.7279882

old to one new basis.

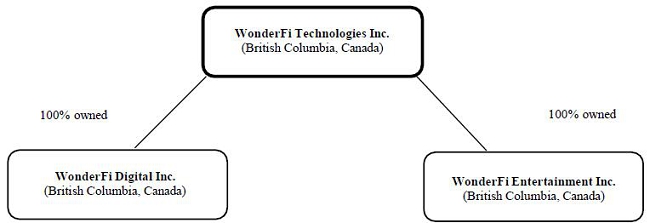

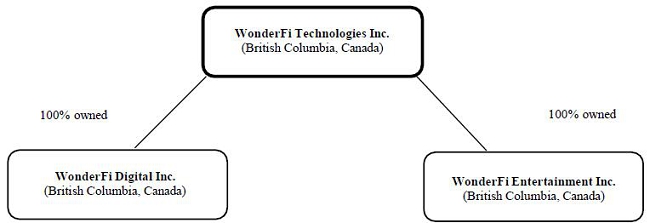

Intercorporate Relationships

The following table describes

the corporate structure of WonderFi and its subsidiary, their place of incorporation, continuance or formation, and the percentage of

the outstanding voting securities of each subsidiary that are beneficially owned, controlled or directed by WonderFi:

| Name

of Subsidiary |

Percentage

of Voting Securities

Owned |

Jurisdiction

of Incorporation or

Continuance |

| WonderFi

Digital Inc. |

100%

(direct) |

British

Columbia |

| WonderFi

Entertainment Inc |

100%

(direct) |

British

Columbia |

DESCRIPTION AND GENERAL DEVELOPMENT

OF THE BUSINESS

History

Corporate History

The Company was originally

incorporated under the BCBCA as “Austra Resources Corporation” pursuant to an amalgamation between Austra Resources Corporation

and Barkerville Mining Company Limited (N.P.L.) on November 1, 1990. Effective January 26, 1996, the Company changed its name to “Austpro

Energy Corporation” (“Austpro”).

Until 2001, the Company’s

principal business was the exploration and development of oil and gas properties. Following the disposition of its interests in oil and

gas properties in 2000 and 2001, the Company was then dissolved on February 13, 2006, and restored on May 30, 2006, under the BCBCA.

During this time the Company had no active business and was focused on identifying and evaluating opportunities for the acquisition of

an interest in a new business.

On August 30, 2021, the

Company acquired of all of the issued and outstanding shares of DeFi Ventures Inc. (“DeFi”) by way of a “three-cornered

amalgamation”, pursuant to which with DeFi and 1302107 B.C. Ltd., a wholly owned subsidiary of the Company (the “Subco”),

combined their businesses to form one corporation, WonderFi Digital Inc. (“WonderFi Digital”), a wholly-owned subsidiary

of the Company (the “Transaction”). In connection with the Transaction, the articles of the Company were amended to

change its name to “WonderFi Technologies Inc.” and the Company now carries on the business previously carried on by DeFi.

(For more information on the Transaction, see “Description and General Development of the Business – Significant Acquisitions

and Dispositions” or the Company’s filling statement filed on its SEDAR profile August 24, 2021.)

On December 7, 2021, the Company

incorporated a new wholly-owned subsidiary named WonderFi Entertainment Inc.

Developments During the

Financial Year Ended September 30, 2019

| · | On

November 30, 2018, 8,000,000 subscription receipts which had been issued by the Company on

September 27, 2018 automatically converted into 8,000,000 units of the Company for gross

proceeds of $400,000. Each unit consisted of one Common Share and one Common Share purchase

warrant, with each Common Share purchase warrant entitling the holder to acquire one additional

Common Share at a price of $0.06 per Common Share until November 30, 2019. |

| · | On

December 5, 2018, the Company granted 1,300,000 Options to directors, officers and a consultant

of the Company. The Options have an exercise price of $0.20 and are exercisable for a period

of five years. The Options vested immediately. |

Developments During the

Financial Year Ended September 30, 2020

| · | On

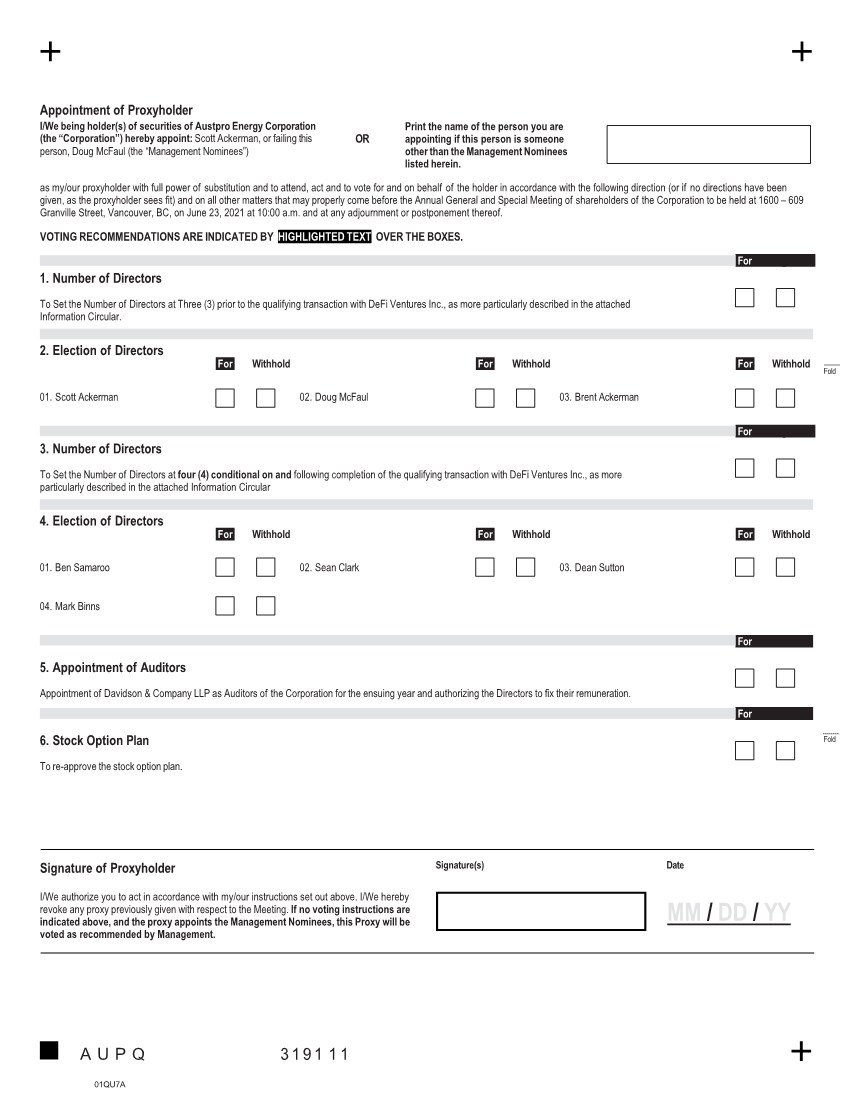

October 18, 2019, the Board appointed Davidson & Company, Chartered Professional Accountants,

as the Company’s new auditor, replacing MNP LLP, Chartered Professional Accountants. |

Developments During the

Financial Year Ended September 30, 2021

| · | On

October 29, 2020, the Company announced that it closed a non-brokered private placement

for proceeds of $132,000. This placement consisted of 1,100,000 units of the Company at a

price of $0.12 per unit. Each unit consists of one Common Share and one Common Share purchase

warrant, with each warrant entitling the holder to acquire an additional common share of

the Company at a price of $0.155 until October 29, 2021. |

| · | On January 30, 2021,

DeFi was incorporated, pursuant to the provisions of the BCBCA. |

| · | On

January 30, 2021, DeFi completed a non-brokered private placement, pursuant to which it issued

an aggregate of 15,000,000 common shares at a price of $0.002 per common share for aggregate

gross proceeds of $30,000. |

| · | On

February 16, 2021, DeFi completed a non-brokered private placement pursuant to which it issued

an aggregate of 1,538,461 common shares at a price of $0.13 per common share for gross proceeds

of $200,000. |

| · | On

March 5, 2021, DeFi completed a non-brokered private placement pursuant to which it issued

an aggregate of 7,460,000 common shares at a price of $0.25 per common share for gross proceeds

of $1,865,000. |

| · | On

March 5, 2021, Defi issued 461,537 Common Shares to advisor to settle outstanding consulting

fees in the amount of $115,384. |

| · | On

April 14, 2021, DeFi completed a brokered private placement pursuant to which it issued an

aggregate of 2,600,000 common shares at a price of $0.25 per common share for gross proceeds

of $650,000. |

| · | On

April 15, 2021, DeFi entered into a letter of intent with the Company, pursuant to which

the Company agreed to acquire all of the outstanding common shares of Defi. |

| · | On

May 21, 2021, DeFi completed a brokered private placement pursuant to which it issued an

aggregate of 9,000,000 common shares at a price of $0.25 per common share for gross proceeds

of $2,250,000. |

| · | On

May 25, 2021, Defi and Coinbase entered into the Coinbase Institutional Services Agreement.

Additional information can be found in “Material Contracts – Coinbase Institutional

Services Agreement”. |

| · | On

May 28, 2021, Defi and Coinbase Custody entered into the Coinbase Custodial Services Agreement.

Additional information can be found in “Material Contracts – Coinbase Custodial

Services Agreement”. |

| · | On

June 3, 2021, DeFi completed the Subscription Receipt Financing, pursuant to which it issued

an aggregate of 17,715,000 Subscription Receipts at a price of $1.00 per Subscription Receipt,

for aggregate gross proceeds of $17,715,000 pursuant to the terms of the Subscription Receipt

Agreement. Additional information can be found in “Material Contracts – Subscription

Receipt Agreement”. |

| · | On

June 3, 2021, in connection with the closing of the Subscription Receipt Financing, the Company,

DeFi and SubCo entered into the Amalgamation Agreement to give effect to the Transaction.

For more information on the Transaction and Amalgamation, see “Description and General

Development of the Business – Significant Acquisitions and Dispositions” |

| · | On

June 30, 2021, DeFi completed a non-brokered private placement pursuant to which it issued

an aggregate of 5,318,243 common shares at a price of $1.05 per common share for gross proceeds

of $5,584,155. |

| · | On

July 2, 2021, 85,714 DeFi common shares were issued to a service provider of DeFi as a settlement

for a promissory note valued at $89,999.70. |

| · | On

August 19, 2021, in connection with the closing of the Transaction, the Company’s Common

Shares were delisted at the close of the market from the NEX Board of the TSXV. |

| · | On

August 20, 2021, the Company’s Common Shares were listed on the NEO Exchange under

the symbol “AUS”, effective at the open of the market. The Common Shares were

listed on the NEO Exchange in a halted state, pending the closing of the Transaction. |

| · | On

August 25, 2021, in connection with the Transaction, the Company changed its name from Austpro

Energy Corporation to WonderFi Technologies Inc. |

| · | On

August 25, 2021, in connection with the Transaction, the Company completed the Austpro Consolidation,

a consolidation of its Common Shares on an 8.7279882 old to one new basis. |

| · | On

August 30, 2021, the Transaction closed and the aggregate gross proceeds of $17,715,000 from

the Subscription Receipt Financing were released from escrow. |

| · | On

August 30, 2021, in connection with Transaction, the Board appointed Crowe MacKay LLP, Chartered

Professional Accountants, as the Company’s new auditor, replacing Davidson & Company

LLP, Chartered Professional Accountants. |

| · | On

August 31, 2021, the Company’s Common Shares were listed on the NEO Exchange under

the symbol “WNDR”, effective at the open of the market. |

| · | On

September 7, 2021, the Company announced that it entered into a master services agreement

with Native Ads, Inc. to provide strategic digital media services, marketing and data analytics

services. Pursuant to the terms of the Native Ads Agreement, the Company will pay Native

Ads a total of US$250,000 over the span of twelve months. |

| · | On

September 7, 2021, the Company announced that it received approval from the Board to purchase

up to $6.8 million in digital assets weighted across key assets that drive value in the decentralized

finance sector. The first of these purchases was completed on September 6, 2021, and included

$1.8 million of Bitcoin, Ethereum, Uniswap, Compound, Aave, Maker and Yearn. |

| · | On

September 7, 2021, the Company announced that its Common Shares have begun trading on the

OTC Pink Market in the United States under the symbol “WONDF” and that the Company

is in the process of applying to up-list to the OTCQB Venture Market. |

| · | On

September 14, 2021, the Company announced that it will be using US dollar denominated stablecoins

in its treasury management strategy. |

| · | On

September 27, 2021, the Company announced that it has established and deployed Proof-of-Stake

validator nodes on the Ethereum network as part of its continued decentralized finance infrastructure

and portfolio management strategy. |

Director and Officer Appointments

On August 30, 2021, the Company

appointed the following directors and officers:

| Name |

Position |

| Ben

Samaroo |

Chief

Executive Officer and Director |

| Dean

Sutton |

Chief

Strategy Officer and Director |

| Cong

Ly |

Chief

Technology Officer |

| Steven

Krause |

Chief

Financial Officer |

| Sheona

Docksteader |

Corporate

Secretary |

| Mark

Binns |

Independent

Director |

| Sean

Clark |

Independent

Director |

| Name |

Position |

| Stephanie

Li |

Independent

Director |

On August 30, 2021, the following

directors and officers resigned:

| Name |

Position |

| Scott

Ackerman |

President,

CEO, CFO, Corporate Secretary and Director |

| Brent

Ackerman |

Independent

Director |

| Doug

McFaul |

Independent

Director |

Subsequent events

| · | On

October 5, 2021, the Company announced that, in collaboration with Circle Internet Financial,

LLC, that it intends to offer Circle’s USD Coin through the WonderFi App. |

| · | On

October 15, 2021, the Company announced that it has partnered with DeFi Pulse Inc., a firm

that designs indexes for decentralized finance, to offer digital assets indexes through the

WonderFi App. |

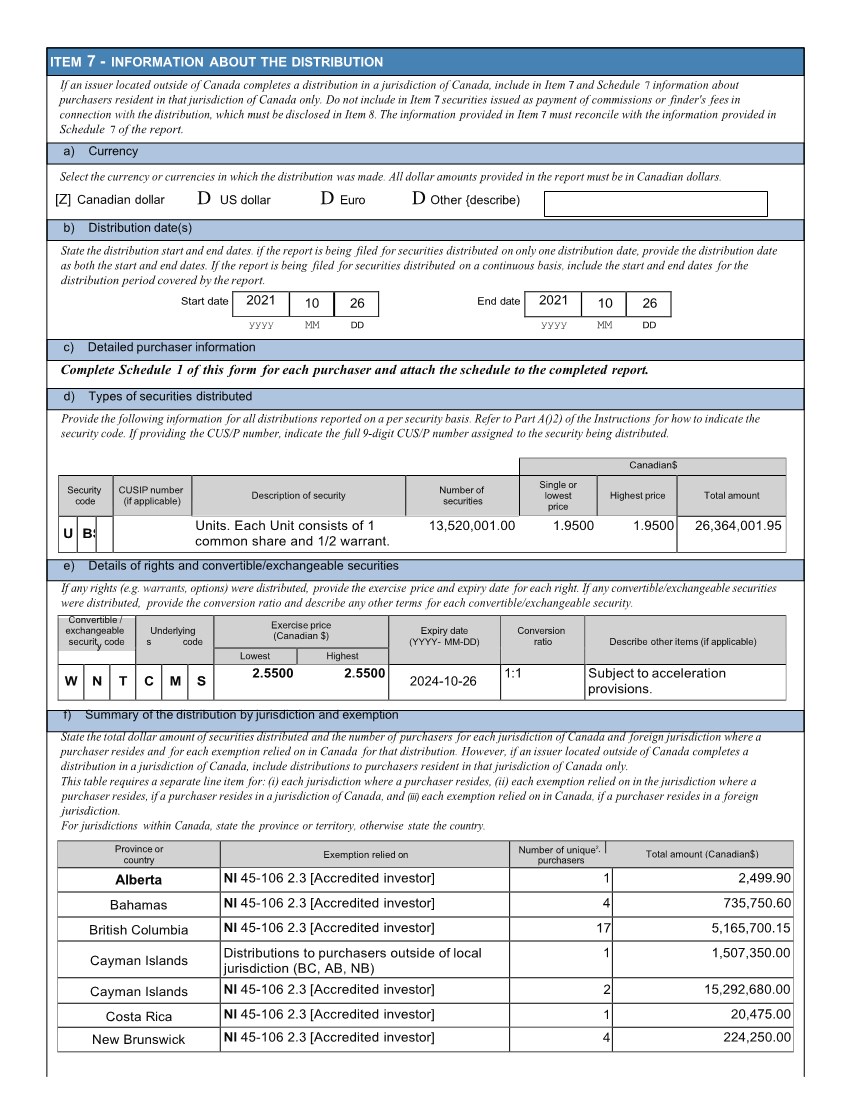

| · | On

October 26, 2021, the Company announced that it has closed its bought deal private placement

(the “October 2021 Bought Deal”). Through the October 2021 Bought Deal,

the Company issued 13,520,001 units at a price of $1.95 per unit, for gross proceeds of $26,364,002

pursuant to the terms of the Underwriting Agreement. Each unit consisted of one Common Share

of the Company and one-half of one Common Share purchase warrant. Each Warrant is exercisable

to acquire one Common Share at an exercise price of $2.55 until October 26, 2024 and is issued

pursuant to the terms of the warrant indenture (the “Warrant Indenture”)

(see “Material Contracts – Warrant Indenture”). |

| · | In

consideration of the services rendered by the underwriters in connection with the October

2021 Bought Deal, the Company paid: (a) a cash commission (the equal to 7.0% of the aggregate

gross proceeds of the offering (excluding proceeds derived from the sale of units to any

direct settlers for which a commission equal to 3.5% of the aggregate gross proceeds of the

portion of the offering sold to direct settlers was payable); and (b) a cash fee of $75,000

and $75,000 payable in Common Shares. As additional compensation for the rendered by the

underwriters, the Company issued to the underwriters 910,503 Broker Warrants. |

| · | On

November 1, 2021, the Company announced that it has approval to purchase up to $10 million

in digital assets weighted across key assets that drive value in the decentralized finance

sector. |

| · | On

November 3, 2021, the Company announced it has established and deployed addition proof of

stake validator nodes. |

| · | On

November 8, 2021, the Company announced an investment in the Solana ecosystem through the

Incentive Ecosystem Foundation, which includes Solana and Serum as the two largest weighted

assets. “Solana” is a programmable blockchain and “Serum”

is a non-custodial decentralized exchange operating on the Solana blockchain created by FTX,

Alamada Research and several other partners through the Serum Foundation. In addition, the

Company invested in Series B-1 round of FTX Trading. |

| · | On November 15, 2021,

the Company appointed Bill Koutsouras as a director and as Chairman of the Board. |

| · | On November 15, 2021,

Sean Clark resigned as a director of the Company. |

| · | On November 24, 2021,

the Company announced the listing of tokenized shares of WonderFi on FTX. |

| · | On

December 3, 2021, the Company announced that it has made a strategic investment of $5 million

into First Ledger Corp., the parent company of Bitbuy Technologies Inc.(“Bitbuy”),

Canada’s first approved crypto marketplace. The Company holds a non-interest bearing

convertible note due November 29, 2022 that is convertible into common shares of Bitbuy at

$5 per share. |

| · | On

December 7, 2021, the Company announced the launch of “Money Goals”, a financial

literacy initiative in partnership with Animal Capital and Josh Richards, focused on Gen

Z. |

| · | On

December 9, 2021, the Company announced that its WonderFi App will tentatively be released

on desktop on January 25, 2022, with a mobile app release to follow. |

Significant Acquisitions

and Dispositions

Effective June 3, 2021,

the Company, DeFi and SubCo entered into the Amalgamation Agreement, the terms of which were the result of arms’ length negotiation

between the Company and DeFi.

On August 30, 2021, pursuant

to the Amalgamation Agreement, the Company acquired all the issued and outstanding share capital of DeFi by way of a “three-cornered

amalgamation”, pursuant to which DeFi and the Subco combined their businesses to form one corporation, WonderFi Digital, a wholly

owned subsidiary of the Company. In connection with the completion of the Transaction, an aggregate of 59,188,675 Consideration Shares

were issued to the DeFi Shareholders, on an undiluted basis, at a deemed issue price, on a post Consolidation basis, of $1.00 per Common

Share. The Transaction constitutes a “reverse takeover”, or “RTO” (as defined in National Instrument

51 102 – Continuous Disclosure Obligations) of the Company by DeFi because, following the Closing, the DeFi Shareholders

owned approximately 97.2% of the outstanding Common Shares.

In connection with the closing

of the Transaction and pursuant to the Amalgamation Agreement, among other things:

| (a) | the

Company completed the Austpro Consolidation; |

| | | |

| (b) | the

Subscription Receipts were converted into DeFi Shares; |

| | | |

| (c) | all

Warrants and Options of the Company outstanding prior to the Amalgamation were surrendered

by the holders for cancellation; |

| | | |

| (d) | DeFi

and SubCo amalgamated and continue as WonderFi Digital; |

| | | |

| (e) | each

of DeFi and SubCo ceased to exist as entities separate from WonderFi Digital; |

| | | |

| (f) | each

DeFi Share were cancelled, and former DeFi Shareholders (including those that are entitled

to acquire DeFi Shares on conversion of the Subscription Receipts) received one Consideration

Share for each DeFi Share held; |

| | | |

| (g) | each

common share of SubCo was cancelled and replaced with one common share of WonderFi Digital

issued to WonderFi, such that WonderFi Digital is a wholly owned subsidiary of WonderFi; |

| | | |

| (h) | WonderFi

Digital issued to the Cmpanny one common share of WonderFi Digital for each post- consolidated

Common Share issued by the Company under the Amalgamation; |

| | | |

| (i) | all

of the property and assets of each of DeFi and SubCo became the property and assets of WonderFi

Digital, and WonderFi Digital is now liable for all of the liabilities and obligations of

each of DeFi and SubCo; and |

| | | |

| (j) | The

Company changed its name to “WonderFi Technologies Inc.”. |

For more information on the

Transaction, see the Company’s filling statement filed on its SEDAR profile August 24, 2021.

Description of the Business

Summary

WonderFi has a mission

to bring decentralized finance to the masses through a suite of products and tools which are built on the core principles of simplicity

and education.

Today, decentralized finance

is complex and fragmented, spanning across a wide range of applications that operate on numerous blockchain networks, protocols and layers.

In decentralized finance, there is an underlying expectation that users understand how to select, navigate and interact with these various

components; however, the required learning curve is prohibitive for most. Further, as the decentralized finance sector expands, it becomes

increasingly difficult for the average person to navigate the technological and financial terminology and nuances that are presented,

and as a result the literacy of users lags behind.

WonderFi believes that

these issues are preventing large-scale adoption of the technology, which inherently is meant to be democratized and accessible to all.

WonderFi seeks to solve this problem through its complementary suite of products, while also providing shareholders a proxy to the decentralized

finance sector through its common stock.

Intellectual Capital

Given that the industry

is in a nascent phase, WonderFi expects decentralized finance to undergo significant changes as it evolves and matures. This expectation

is reflected in WonderFi’s operational model, as it has allocated a significant portion of resources towards building a highly

capable engineering team consisting of industry experts that have deep knowledge of blockchain infrastructure and over 20 years of cumulative

experience building blockchain applications. WonderFi’s engineering team is supported by a small and agile team of decentralized

finance experts who guide product development; this structure has allowed for cost-efficiency while WonderFi is in the pre-revenue phase

of operations. The platform will be designed to be flexible and modular to adapt and grow as the sector evolves, and to anticipate user

needs and integrate new technology. The platform is being developed in-house, which requires WonderFi to continually invest in intellectual

capital. WonderFi believes this is a competitive advantage.

Product and Service Offerings

WonderFi’s business

model includes four interconnected pillars: platform, education, research and assets.

WonderFi’s flagship

product will be an aggregator platform that aims to solve the core problems in decentralized finance by aggregating and simplifying the

interactions between users and the core smart contracts that constitute decentralized finance applications. The platform will be non-custodial

and leverages application programming interface (“API”) integrations that will allow users to interact directly with

decentralized finance protocols. This architecture will allow users to retain control of their assets, rather than taking custody of

the client assets or transferring assets to a third-party. This approach results in zero efficiency loss for routing and allows WonderFi

to focus on optimizing user experience. The platform will be designed to abstract the complexities of decentralized finance in order

to provide a frictionless experience for users, while preserving the underlying functionality and value that leading decentralized finance

protocols provide.

WonderFi will vet protocols

to integrate with based on a commercial and technical due diligence process. This process includes assessments of smart contract audits

and other factors, with the goal of reducing the potential that users of the platform interact with malicious or unsafe protocols. Protocols

are open source, and, as such, there is no contract that will exist between the Company and each protocol, nor will WonderFi receive

any compensation from protocols that it integrates with.

Each decentralized finance

protocol that WonderFi intends to integrate its platform with is permissionless, meaning any user has access to the services offered

by that protocol. The Ethereum network currently utilizes a Proof-of-Work consensus mechanism but is transitioning to Proof-of-Stake

verification. Proof-of-Stake is demonstrably more environmentally sustainable because it requires orders of magnitude less energy consumption

and does not utilize specialized hardware that cannot be reused for other purposes, unlike application-specific integrated circuit (“ASIC”)

rigs, an integrated circuit chip customized for a particular use, that are specialized for solving the Secure Hash Algorithm (“SHA”)

256 bits cryptographic hash function.

In addition, each of protocols

that WonderFi will integrate with will utilize completely decentralized governance systems or have a plan to adopt decentralized governance

in the future. Decentralized governance is achieved through the use of a governance token, which is used to vote on proposed upgrades

or improvements to a given protocol. This process is similar to the democratic process, where a proposal is made, it is voted on by constituents,

and the majority decides whether it passes or not.

Decentralized finance presents

a steep learning curve for new and existing participants. WonderFi intends to provide high-quality resources for new entrants in the

market through the development of a learning center that will focus on presenting core concepts in a simplified manner, and will avoid

the use of jargon and terminology, which is often used within the existing decentralized finance user base. The learning center will

act as a lead generation funnel for WonderFi’s aggregation platform.

| 3) | Data Analysis, Research and Insights |

Obtaining accurate, real-time

data is of critical importance in financial markets, but is made more difficult in the decentralized financial markets due to the fragmentation

of market data across decentralized finance protocols and exchange platforms. WonderFi will be positioned to access a comprehensive range

of real-time data insights through the aggregation platform’s numerous direct API integrations with decentralized finance protocols

that span across the most widely adopted protocols, markets, and layers. Additionally, WonderFi will obtain supplemental data, analysis,

and research insights through the use of third-party providers, internal research activities and the use of customer activity data that

will be obtained from WonderFi’s aggregation platform. WonderFi intends to utilize these data sources and insights to guide product

development, asset allocation, business processes, and future protocol integrations. Data sets and insights may be leveraged into a product

to provide market data to third parties.

A portion of WonderFi’s

treasury will be held in crypto assets, which are then intended to be used to earn revenue through various yield generating opportunities.

This will provide WonderFi with the ability to generate revenue on assets that are held on the balance sheet. This approach will also

provide WonderFi with exposure to select crypto assets that are being efficiently utilized across the decentralized finance ecosystem.

WonderFi does not invest crypto assets on behalf of customers or provide investment advice to customers.

WonderFi will store all

compatible treasury assets with Coinbase. Coinbase is a SOC 1 Report/SOC 2 Report qualified custodian with a comprehensive insurance

policy on custodied assets and holds crypto assets in segregated cold- storage. Crypto assets that cannot be custodied with Coinbase

will be self-custodied by WonderFi in accordance with security processes and procedures that utilize multi-signature Cold Storage devices

and secure safety deposit boxes. See “Material Contracts” for more information.

In order to provide secure

access to yield generating opportunities for WonderFi’s crypto assets, WonderFi may also utilize third-party staking infrastructure

providers in conjunction with qualified custodians.

The asset selection process

will involve the use of ESG principles to guide asset selection decisions, and a formal methodology for asset selection, allocation across

yield generating opportunities and the monitoring of asset performance and security.

Specialized Skill and Knowledge

All aspects of WonderFi’s

business require specialized knowledge and technical skill. Such knowledge and skills include the areas of blockchain technology, research

and development, crypto assets, crypto asset market, technological security and scalability, sales and marketing, as well as legal compliance,

finance and accounting. WonderFi has found that it can locate and retain competent employees and consultants in such fields and believes

it will continue to be able to do so on an ongoing basis.

Government Regulation

WonderFi expects that wider

adoption of decentralized finance will lead to implementation of regulation and controls to safeguard users and expects that regulated

and compliant platforms will become increasingly important within the decentralized finance ecosystem. While the nature of regulation

of decentralized finance remains to be seen in many ways, WonderFi expects that regulation will involve technological scrutiny of smart

contracts that replace functions traditionally carried out by intermediaries. WonderFi regularly reviews regulatory developments in the

decentralized finance industry and will engage with the relevant regulatory bodies prior to launching the platform to retail customers.

Proprietary Software

WonderFi relies on a combination

of intellectual property laws, trade secrets, confidentiality procedures, contractual provisions and other measures to protect proprietary

information and technology. WonderFi’s employees, contracted service providers and management are required to sign agreements with

confidentiality and non-compete provisions, and acknowledgements that all intellectual property created on WonderFi’s behalf is

owned by WonderFi. WonderFi also seeks to limit the disclosure of its intellectual property by requiring third parties to execute confidentiality

agreements where applicable.

Research and Development

WonderFi believes that

research and development is a principal competitive advantage in its industry and that much of WonderFi’s future success will depend

on its ability to maintain its technological leadership by identifying and responding to emerging technological trends in the industry,

designing, developing and maintaining competitive solutions that take into account customers’ changing needs, and continuing to

enhance existing products by improving performance, adding support for new protocols and technology in the decentralized finance sector,

and adding features and functionality to meet the requirements of customers.

Changes to Contracts

No part of the Company’s

business is reasonably expected to be affected in the current financial year by either the renegotiation or termination of any contract.

Employees

WonderFi currently employs

a total of 17 individuals in Vancouver, Toronto and Halifax, and 6 contractors who work on a part-time or full-time basis and 1 intern.

WonderFi also utilizes temporary labour on an as-needed basis.

Lending

WonderFi does not undertake

any lending activities.

Bankruptcies, Receiverships

and Similar Proceedings

There has never been any

bankruptcy, receivership or similar proceedings against WonderFi and WonderFi has not been party to any voluntary bankruptcy, receivership

or similar proceedings.

Reorganizations

On August 30, 2021, pursuant

to the Amalgamation Agreement, the Company acquired all the issued and outstanding share capital of DeFi by way of a “three-cornered

amalgamation”, pursuant to which DeFi and Subco combined their businesses to form one corporation, WonderFi Digital, a wholly owned

subsidiary of the Company.

Competitive Landscape

Competition in the decentralized

finance industry is significant, as WonderFi faces direct competition from established emerging companies within the industry as well

as indirect competition from traditional financial institutions, which have become increasingly involved in the crypto asset space due

to rising demand from their customer base. Given decentralized finance’s nascent stage, WonderFi expects there to be an increasing

number of competitors entering the space in the near term, which will intensify competition as the industry matures. WonderFi relies

on its management team and Board to navigate the competitive landscape.

Cycles

It is the Company’s

view that the decentralized finance industry is not cyclical or subject to seasonal trends.

Market Overview

Limitations of Today’s

Financial System

The current financial system

has struggled to keep up with the speed of innovation occurring in the digital economy due to antiquated legacy financial infrastructure.

This infrastructure relies on a network of intermediaries spanning across banks, brokerage houses, clearinghouses, custodians, credit

agencies, and more. Often, a single financial transaction will require interactions with a number of intermediaries, which results in

an inefficient financial system that is expensive, limited by regional accessibility, and repressive towards innovation. Fintech companies

have emerged over the past two decades with the aim of tackling these problems; however, they have been severely limited in their ability

to drive meaningful change due to their inability to escape the archaic underlying infrastructure. As a result, many of these companies

have not been able to address the core problems facing the traditional financial system.

Building Blocks of Decentralized

Finance

Unlike centralized finance,

that relies on a rigid and largely physical infrastructure, decentralized finance is built on an expansive software-based infrastructure

that operates on the internet. This internet-native infrastructure relies on existing blockchain technology, pioneered by Bitcoin and

later expanded upon by projects like Ethereum. Blockchains are digital public ledgers that store a complete chronological history of

all transactions that have occurred on a given network. Crypto assets are represented on these blockchains as bits of code, similar to

an email, which allows for the frictionless transfer of value across these networks. This technology enabled the creation of a peer-to-peer

“internet of value” that does not require financial institutions or any other intermediaries to function. Bitcoin was the

first successful iteration of this technology and laid the foundational principles that would guide future blockchain development.

While Bitcoin succeeded

in creating a virtual store of value and value transfer network, it was not optimized for the development of additional applications

built on top of the underlying blockchain. The Ethereum network emerged in 2015 and was designed specifically for the use case of developing

distributed applications that enabled a wider range of peer-to-peer applications. Ethereum achieved this through the Ethereum Virtual

Machine (“EVM”). The EVM provides the network with the ability to create smart contracts, which are programs that

automatically execute some arbitrary logic upon receiving an input. Smart contracts replace the role of an intermediary in the decentralized

finance ecosystem and allow individuals to transact with one another in a trustless manner. Participants no longer need to place their

trust and property with a third-party, such as a bank, to facilitate transactions; they simply need to trust that the smart contract

will successfully complete the task it was designed to perform. While Bitcoin is a distributed ledger, Ethereum is a distributed supercomputer.

Following Ethereum’s

launch and subsequent success, a number of competing blockchains emerged with their own virtual machines, armed with the goal of solving

problems facing the Ethereum network, namely scalability and high transaction costs. The primary difference between Ethereum and the

majority of these competing chains was the consensus mechanism used to secure the network and record transactions on the blockchain.

Ethereum relied on Proof- of-Work, similar to Bitcoin, which required significant energy consumption to solve a complex computational

problem and suffered from scalability issues. A new consensus mechanism emerged in Proof-of-Stake, which was considerably less energy

intensive and allowed for higher transactional throughput. In the Proof-of-Stake model, validators replace the role of miners, who are

then selected at random to verify transactions and record blocks and must post assets as collateral as a commitment to good behaviour.

If a validator were to act maliciously in some manner, the network can slash up to 100% of that validator’s bond, thereby incentivizing

validators to act in good faith and accurately record transactions. Validators, like miners, are rewarded for their work with freshly

minted tokens. In recent years, these competing chains were able to prove that Proof-of-Stake was an effective consensus mechanism and

is why Ethereum made the decision to transition to Proof-of-Stake with Ethereum 2.0, which will be slowly phased in throughout 2021 and

into 2022. Even with a number of competing chains emerging and attracting strong developer communities to build various distributed applications,

a strong majority of development activity and liquidity continues to accumulate on the Ethereum network. For this reason, the Company

expects Ethereum to emerge as the blockchain of choice for decentralized finance; however, with strong development occurring in the field

of blockchain interoperability and various layer 2 scaling solutions, the Company remains open to exploring future integrations with

additional blockchains and side-chains.

Overview of Decentralized

Finance Applications

Decentralized finance protocols

provide individuals with the ability to participate in financial markets in a more efficient manner than was previously possible. This

efficient participation is enabled by smart contracts that replace intermediaries, and an underlying infrastructure that is inherently

less expensive to operate and more scalable. While decentralized finance is still in the early stages of development, several applications

exist and are functional at this stage, including peer-to-peer asset exchanges, decentralized lending and borrowing markets, and synthetic

asset markets. With a wide range of applications constituting the ever-growing decentralized finance ecosystem, the need for aggregation

services is necessary to promote large scale adoption of the technology. At their core, decentralized finance aggregators are highly

focused on simplifying the user experience and providing users with a dedicated platform to access a variety of decentralized finance

protocols. There have been numerous approaches to building decentralized finance aggregation platforms, with some taking a non-custodial

approach and providing users with the ability to interact with the core contracts on various protocols, while others take a custodial

approach and take on a role more similar to that of a traditional financial services company. At this stage of the industry life cycle,

it is difficult to determine which of these strategies will be dominant, if a combination of the two strategies will emerge as the winner,

or if a new model entirely will become the industry standard. For that reason, WonderFi is designing its non- custodial aggregator platform

to be flexible in order to adapt to expected innovations and customer preferences that will change competitive dynamics in the years

to come.

General Industry Trends

Crypto assets have been

moving to the forefront of mainstream financial markets as adoption has soared among both retail and institutional investors over the

past year. In 2021, the total market capitalization of crypto assets surpassed $2 trillion dollars, while the total value locked on decentralized

finance protocols has soared from approximately $1 billion in May of 2020, to over $60 billion in May of 2021. This had a profound impact

on the broader market’s perception of the crypto assets industry, and it is the belief of WonderFi’s management team that

this represents a macro trend that will lead to the disruption and gradual replacement of traditional financial infrastructure. DeFi

has strategically positioned their product and service offerings to capture value in this growing industry by becoming an industry leader

in providing infrastructure, technology, and access to a mainstream audience.

With changes that occurred

as a result of the COVID-19 pandemic, specifically expansionary monetary policy and shift to work from home, the case for a digitally

native financial system that is resistant to centralized manipulation has become stronger. This system could provide reduced exposure

to centralized currency regimes and contribute to a reduction in global wealth inequality by allowing individuals to participate in digital

economies outside of their geographical purview. This could benefit developing countries by creating an effective market for individuals

to sell their skills, as well as developed countries by providing them with access to a larger talent pool.

RISK FACTORS

Prior to making an investment

decision, investors should consider the investment risks set out below and those described elsewhere in this document, which are in addition

to the usual risks associated with an investment in a business at an early stage of development. The directors of WonderFi consider the

risks set out below to be the most significant to potential investors in WonderFi, but do not encompass all of the risks associated with

an investment in securities of WonderFi. If any of these risks materialize into actual events or circumstances or other possible additional

risks and uncertainties of which the directors are currently unaware or which they consider not to be material in relation to WonderFi’s

business, actually occur, WonderFi’s assets, liabilities, financial condition, results of operations (including future results

of operations), business and business prospects, are likely to be materially and adversely affected.

An investment in

WonderFi is speculative and involves a high degree of risk due to the nature of WonderFi’s business. The Risk Factors noted below

do not necessarily comprise all risks currently faced by WonderFi. Additional risks and uncertainties not presently known to WonderFi

or that WonderFi currently considers immaterial may also impair the business, operations and future prospects. If any of the known or

unknown risks and uncertainties occur, WonderFi’s future business may be harmed and WonderFi’s financial condition and results

of operations may suffer significantly.

Risks Related to Crypto

Assets

Generating yields through

WonderFi’s crypto assets is reliant on numerous blockchain technology service providers and various decentralized protocols which

expose the Company to potential loss, security breaches, and future ability to generate revenue

As part of WonderFi’s

business strategy, WonderFi invests funds not used in the deployment of its other business lines in crypto assets. These crypto assets

may be employed through various decentralized finance protocols to generate yields. Yield generated from WonderFi’s crypto assets

will be reliant on services offered by third-party blockchain technology service providers. WonderFi’s service providers will provide

WonderFi with access to custodial solutions, infrastructure that allows WonderFi to stake crypto assets and participate as a validator

on the Ethereum network, as well as the ability to utilize various assets held in custody across different decentralized finance protocols.

WonderFi’s custody providers will ensure the safety of owned crypto assets through the use of industry leading security technologies

as well as comprehensive insurance policies. WonderFi’s intended staking infrastructure providers will provide WonderFi with access

to the technology needed to participate as a validator on the Ethereum network, which may provide WonderFi with a stable stream of income,

net of fees. Finally, WonderFi’s decentralized finance integration service providers will provide WonderFi with the necessary technology

and partnerships to utilize assets held in custody across various decentralized finance protocols. In the event of a material business

disruption or security breach with any of WonderFi’s service providers, WonderFi would need to find suitable replacements in a

timely manner or face various risks, such as lost income or the permanent loss of crypto assets. While there are a number of reputable

service providers across all three categories in the market, there is no guarantee that WonderFi will be able to find a replacement on

commercial terms that would be agreeable. Failure to replace or find a suitable substitute provider for any of these services could result

in a significant impact on the yields generated from WonderFi’s crypto assets.

The use of protocols comes

with various risks, such as the potential for a malicious third-party to exploit a vulnerability in the codebase of a given smart contract