As filed with the United States Securities and Exchange Commission on June 3, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

___________________________

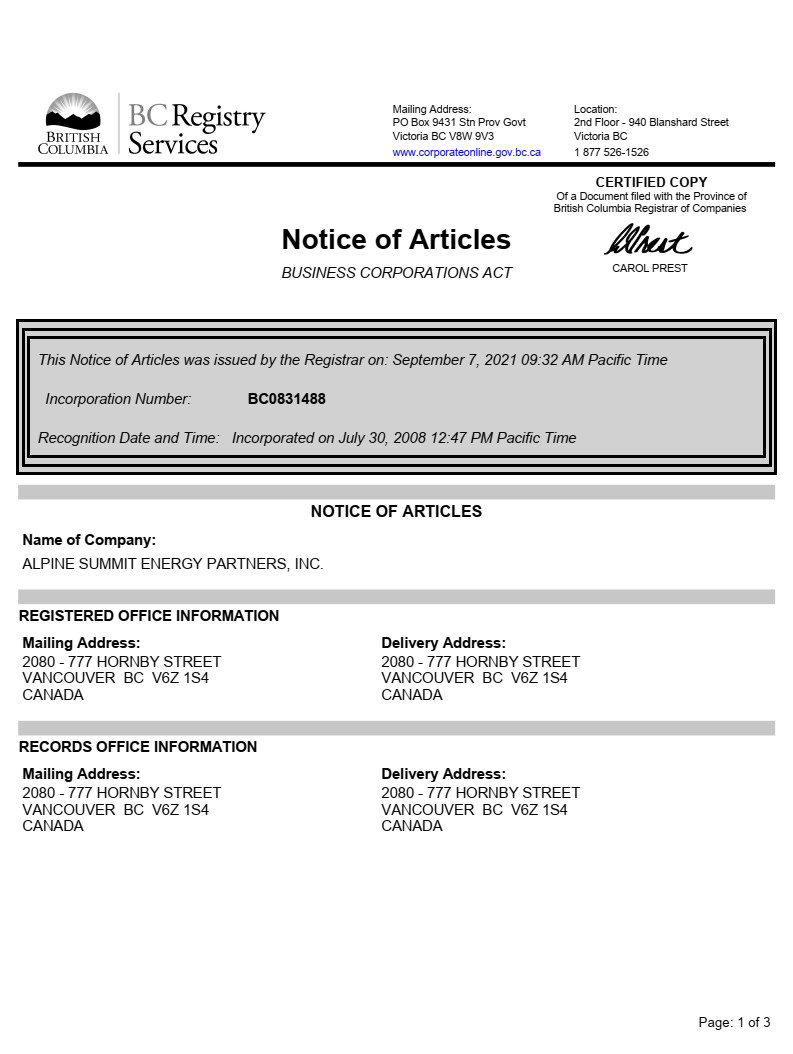

Alpine Summit Energy Partners, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

British Columbia |

Not Applicable |

|

(State or Other Jurisdiction of |

(I.R.S. Employer Identification No.) |

2200 HSBC Building

885 West Georgia Street

Vancouver, BC V6C 3E8

(Address, including area code, of Principal Executive Offices)

Alpine Summit Energy Partners, Inc. 2021 Stock and Incentive Plan

Alpine Summit Energy Partners, Inc. Deferred Share Unit Plan

(Full Title of the Plans)

Cogency Global Inc.

122 E 42nd Street, 18th Floor

New York, NY 10168

(212) 947-7200

(Telephone Number, including area code, of agent for service)

___________________________

Copies to:

James Guttman

Dorsey & Whitney LLP

TD Canada Trust Tower

Brookfield Place, 161 Bay Street, Suite 4310

Toronto, Ontario

Canada, M5J 2S1

(416) 367-7376

___________________________

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated Filer |

☐ |

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☐ |

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Registration Statement on Form S-8 of the Company (this "Registration Statement") relates to a maximum of 1,272,074 Shares issuable by the Company under its 2021 Incentive Plan, 277,443 Shares issuable by the Company under its DSU Plan, 473,370 Shares underlying outstanding restricted stock units previously issued under its 2021 Incentive Plan and 192,550 Shares underlying outstanding options previously issued under its 2021 Incentive Plan.

This Registration Statement also registers reoffers and resales on a continuous or delayed basis of 4,501,604 Shares previously issued and underlying awards previously granted under the Plans prior to the filing of this Registration Statement by certain of our current and former directors and officers, pursuant to the reoffer prospectus included herein, which was prepared pursuant to General Instruction C to Form S-8, in accordance with the requirements of Part I of Form F-3 (the "Reoffer Prospectus"). The Shares to be reoffered or resold pursuant to the Reoffer Prospectus by the selling securityholders identified in the Reoffer Prospectus (collectively, the "Selling Securityholders") may be deemed "restricted securities" under the Securities Act and the rules and regulations promulgated thereunder.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information specified in Item 1 and Item 2 of Part I of Form S-8 is omitted from this Registration Statement in accordance with the provisions of Rule 428 under the Securities Act and the introductory note to Part I of Form S-8. The documents containing the information specified in Part I of Form S-8 will be delivered to the participants in the equity benefit plans covered by this Registration Statement as specified by Rule 428(b)(1) under the Securities Act.

REOFFER PROSPECTUS

4,501,604 Shares

Alpine Summit Energy Partners, Inc.

Subordinate Voting Shares

This reoffer prospectus (this "reoffer prospectus") relates to 4,501,604 Subordinate Voting Shares, no par value (the "Shares"), of Alpine Summit Energy Partners, Inc., a British Columbia corporation (the "Company", the "Registrant", "we", "us" or "our"), which may be offered from time to time by certain securityholders that are our current or former officers and directors (collectively, the "Selling Securityholders") for their own accounts. The Shares have been, or will be, issued pursuant to options, deferred share units or restricted stock units granted to the Selling Securityholders pursuant to the Alpine Summit Energy Partners, Inc. 2021 Stock and Incentive Plan (the "2021 Incentive Plan") and the Alpine Summit Energy Partners, Inc. Deferred Share Unit Plan (the "DSU Plan", together with the 2021 Incentive Plan, the "Plans") prior to the filing of this Registration Statement. We will not receive any of the proceeds from the sale of the Shares by the Selling Securityholders made hereunder.

The Selling Securityholders may sell the Shares in a number of different ways and at varying prices, including sales in the open market, sales in negotiated transactions and sales by a combination of these methods. The Selling Securityholders may sell any, all or none of the Shares and we do not know when or in what amount the Selling Securityholders may sell their Shares hereunder following the effective date of the Registration Statement of which this reoffer prospectus forms a part. The price at which any of the Shares may be sold, and the commissions, if any, paid in connection with any such sale, are unknown and may vary from transaction to transaction. The Shares may be sold at the market price of the Shares at the time of a sale, at prices relating to the market price over a period of time, or at prices negotiated with the buyers of shares. The Shares may be sold through underwriters or dealers which the Selling Securityholders may select. If underwriters or dealers are used to sell the Shares, we will name them and describe their compensation in a prospectus supplement. We provide more information about how the Selling Securityholders may sell their Shares in the section titled "Plan of Distribution." The Selling Securityholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in connection with the registration and offering that are not borne by the Selling Securityholders will be borne by us.

Our Shares are listed on the TSX Venture Exchange (the "TSXV") under the symbol "ALPS.U". On May 31, 2022 the last reported sale price of our Shares on the TSXV was $5.75 per Share.

We are an "emerging growth company," as that term is defined under the federal securities laws and, as such, are subject to certain reduced public company reporting requirements.

Investing in our securities involves a high degree of risk that are described in the "Risk Factors" section beginning on page 5 of this reoffer prospectus.

The Securities and Exchange Commission (the "SEC") may take the view that, under certain circumstances, the Selling Securityholders and any broker-dealers or agents that participate with the Selling Securityholders in the distribution of the Shares may be deemed to be "underwriters" within the meaning of the Securities Act of 1933, as amended (the "Securities Act"). Commissions, discounts or concessions received by any such broker-dealer or agent may be deemed to be underwriting commissions under the Securities Act. See the section titled "Plan of Distribution."

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this reoffer prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this reoffer prospectus is June 3, 2022.

TABLE OF CONTENTS

Neither we nor the Selling Securityholders have authorized anyone to provide any information or to make any representations other than those contained in this reoffer prospectus or any accompanying prospectus supplement that we have prepared. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This reoffer prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this reoffer prospectus or any applicable prospectus supplement. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this reoffer prospectus or any prospectus supplement is accurate only as of the date on the front of those documents only, regardless of the time of delivery of this reoffer prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

FORWARD-LOOKING INFORMATION AND STATEMENTS

This reoffer prospectus and the documents incorporated by reference herein, contain certain forward-looking information and statements within the meaning of applicable securities laws (collectively, "forward-looking statements"), including management's assessment of the Company's future plans and operations specifically in relation to the remainder of 2022 and 2023. Such statements or information are generally identifiable by words such as "anticipate", "believe", "intend", "plan", "expect", "schedule", "indicate", "focus", "outlook", "propose", "target", "objective", "priority", "strategy", "estimate", "budget", "forecast", "would", "could", "will", "may", "future" or other similar words or expressions and include statements relating to or associated with individual wells, facilities, regions or projects as well as timing of any future event which may have an effect on the Company's operations and financial position. Forward-looking statements are based on expectations, forecasts, and assumptions made by the Company using information available at the time of the statement and historical trends which includes expectations and assumptions concerning: the accuracy of reserve estimates and valuations; performance characteristics of producing properties; access to third-party infrastructure; government policies and regulation; future production rates; accuracy of estimated capital expenditures; availability and cost of labor and services and owned or third-party infrastructure; royalties; development and execution of projects; the satisfaction by third parties of their obligations to the Company; and the receipt and timing for approvals from regulators and third parties. All statements and information concerning expectations or projections about the future and statements and information regarding the future business plan or strategy, timing or scheduling, production volumes with splits by commodity, production declines, expected and future activities and capital expenditures, commodity prices, costs, royalties, schedules, operating or financial results, future financing requirements, and the expected effect of future commitments are forward-looking statements.

The forward-looking statements are subject to known and unknown risks and uncertainties and other factors which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such statements. Such factors include, but are not limited to:

- changes in general, market and business conditions including commodity prices, interest rates and currency exchange;

- changes in supply and demand for the Company's products;

- a global public health crisis including the recent outbreak of the novel coronavirus (COVID-19) which causes volatility and disruptions in the supply, demand and pricing for natural gas, crude oil and natural gas liquids, global supply chains and financial markets, as well as declining trade and market sentiment and reduced mobility of people;

- the ability to obtain regulatory, stakeholder and third-party approvals and satisfy any associated conditions that are not within the Company's control for exploration and development activities and projects;

- the ability of the Company to obtain TSXV approval of the normal course issuer bid;

- successful and timely implementation of capital expenditures;

- risks associated with the development and execution of major project;

- risk that projects and opportunities intended to grow funds flow and/or reduce costs may not achieve the expected results in the time anticipated or at all;

- access to third-party pipelines and facilities and access to sales markets;

- volatility of commodity prices and the related effects of changing price differentials;

- the Company's ability to operate and access to facilities to meet forecast production;

- the ability of the Company to pay dividends to its shareholders;

- the timing of repayments in respect of the various development partnerships;

- the Company's ability to meet foreseeable obligations by actively monitoring its credit facilities through use of the loans/notes, asset sales, coordinating payment and revenue cycles each month, and an active commodity hedge program to mitigate commodity price risk and secure cash flows;

- the stability of royalty rates in future periods;

- operational risks and uncertainties associated with crude oil and gas activities including unexpected formations or pressures, reservoir performance, fires, blow-outs, equipment failures and other accidents, uncontrollable flows of natural gas and wellbore fluids, pollution and other environmental risks;

- changes in costs including production, royalty, transportation, general and administrative, and finance;

- ability to finance planned activities including infrastructure expansions which are required to meet future growth targets;

- adverse weather conditions which could disrupt production and affect drilling and completions resulting in increased costs and/or delay adding production;

- actions by government authorities including changes to taxes, fees, royalties, duties and government imposed compliance costs;

- changes to laws and government policies including environmental (and climate change), royalty, and tax laws and policies;

- counter-party risk with third parties to perform their obligations with whom the Company has material relationships;

- unplanned facility maintenance or outages or unavailability of third-party infrastructure which could reduce production or prevent the transportation of products to processing plants and sales markets;

- a major outage or environmental incident or unexpected event such as fires (including forest fires), hurricanes or equipment failures or similar events that would affect the Company's facilities or third-party infrastructure used by the Company;

- environmental risks (including climate change) and the cost of compliance with current and future environmental laws, including climate change laws along with risks relating to increased activism and opposition to fossil fuels;

- ability to access capital from internal and external sources (including the corporate credit facility);

- the risk that competing business objectives may exceed the Company's capacity to adapt and implement change;

- the potential for security breaches of the Company's information technology systems by malicious persons or entities, and the unavailability or failure of such systems to perform as anticipated as a result of such breaches;

- risks with transactions including closing an asset or property acquisition or disposition and the failure to realize anticipated benefits from any transaction;

- finding new crude oil and gas reserves that can be developed economically to replace reserves depleted by production;

- the accuracy of estimating reserves and future production and the future value of reserves;

- risk associated with commodity price hedging activities using derivatives and other financial instruments;

- maintaining debt levels at a reasonable multiple of funds flow;

- risk that the Company may be subject to litigation;

- the accuracy of cost estimates, some of which are provided at an early stage and before detailed engineering has been completed;

- risk associated with partner or joint arrangements to which the Company is a party;

- inability to secure labour, services or equipment on a timely basis or on favourable terms;

- increased competition from other industry participants for, among other things, capital, acquisitions of assets or undeveloped lands, and skilled personnel; and

- increased competition from companies that provide alternative sources of energy.

Statements relating to "reserves" or "resources" are forward-looking statements, including financial measurements such as net present value, as they involve the assessment, based on estimates and assumptions, that the reserves and resources described exist in the quantities predicted or estimated, and can be profitably produced in the future.

Readers are advised that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. The Company disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required under securities law.

Readers are cautioned that the foregoing list of factors is not exhaustive. The forward-looking statements contained in the reoffer prospectus, and the documents incorporated by reference herein, are expressly qualified by this cautionary statement.

Boe Presentation - Natural gas is converted to a barrel of oil equivalent ("Boe") using six thousand cubic feet ("Mcf") of natural gas equal to one barrel of crude oil unless otherwise stated. Boe may be misleading, particularly if used in isolation. A Boe conversion ratio of six Mcf to one barrel ("Bbl") is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. All Boe measurements and conversions in this report are derived by converting natural gas to crude oil in the ratio of six thousand cubic feet of natural gas to one barrel of crude oil.

PROSPECTUS SUMMARY

This summary highlights selected information from this reoffer prospectus and does not contain all of the information that is important to you in making an investment decision. This summary is qualified in its entirety by the more detailed information included in this reoffer prospectus, including the documents incorporated by reference herein. Potential investors should read the entire prospectus carefully, including the risks of purchasing our common stock discussed in "Risk Factors."

Overview

The Company is a United States energy developer and financial company focused on maximizing growth and return on equity. The Company is currently focusing its drilling activity in the Austin Chalk and Eagle Ford formations in the Giddings and Hawksville Fields, premier acreage locations which have produced substantial amounts of oil and gas for decades. Oil and gas migrates into the chalk through microfractures and fills the tectonic fractures and the Austin Chalk, which directly overlies the oil-sourcing Eagle Ford formation through micro fractures and fills the tectonic fractures and the porous matrix.

The Company plans on focusing on developing its existing and adjacent footprint over the next several years while also evaluating additional development projects that fit its investment criteria.

The Company's capital allocation strategy is designed to optimize return on capital and cash flow available for distribution to shareholders.

Recent Developments

During the first quarter of 2022, the Company had a number of highlights, including:

-

Maintaining average gross production of approximately 9,891 Boe/day for the three months ended March 31, 2022 (Net 8,801 Boe/day) an increase of 3% quarter over quarter and 83% year over year.

-

Brought 6 new wells onto production during the first quarter of 2022.

-

Successful repayment and reversion of the second development partnership that was formed during the third quarter of 2021, along with the concurrent closing of its fourth development partnership.

-

Closed Alpine Red Dawn 1 ("Red Dawn 1") development partnership during the first quarter of 2022. Red Dawn 1 consists of $50.4 million of drilling capital and supports the addition of a third rig to the existing two rig drilling program.

-

Closed a new corporate credit facility (the "Corporate Facility") in March 2022 with a total size of $30 million. The Corporate Facility is secured by working interests in a subset of the Company's producing assets and charges interest at the greater of 5.00% and Prime +1.75%. As of March 31, 2022, approximately $12.9 million was drawn on the Corporate Facility.

-

Paid monthly dividend of $0.03 per subordinate voting share ($3.00 per multiple voting share and $0.03 per proportionate voting share) during each month of the first quarter of 2022.

Emerging Growth Company

As a company with less than $1.07 billion in revenue during our most recently completed fiscal year, we qualify as an "emerging growth company" as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012. As an emerging growth company, we may take advantage of specified reduced disclosure and other exemptions from requirements that are otherwise applicable to public companies that are not emerging growth companies. These provisions include:

-

reduced disclosure about our executive compensation arrangements;

-

exemptions from non-binding stockholder advisory votes on executive compensation or golden parachute arrangements; and

-

exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting.

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.07 billion in annual revenues as of the end of a fiscal year, if we are deemed to be a large-accelerated filer under the rules of the SEC or if we issue more than $1.0 billion of non-convertible debt over a three-year period.

About This Offering

This reoffer prospectus relates to the public offering, which is not being underwritten, by the Selling Securityholders listed in this reoffer prospectus, of up to 4,501,604 Shares previously issued and underlying awards previously granted under the Plans prior to the filing of this Registration Statement to the Selling Securityholders. The Selling Securityholders may from time to time sell, transfer or otherwise dispose of any or all of the Shares covered by this reoffer prospectus through underwriters or dealers, directly to purchasers (or a single purchaser) or through broker-dealers or agents. We will receive none of the proceeds from the sale of the Shares by the Selling Securityholders. We will bear all expenses of registration incurred in connection with this offering, but all selling and other expenses incurred by the Selling Securityholders will be borne by them.

Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled "Risk Factors" that represent challenges that we face in connection with the successful implementation of our strategy and growth of our business. Before you invest in our Shares, you should carefully consider all the information in this reoffer prospectus, including matters set forth in the section captioned "Risk Factors."

Corporate Information

The Company was incorporated under the British Columbia Business Corporations Act on July 30, 2008 under the name "Red Pine Petroleum Ltd" ("Red Pine"). On April 8, 2021, Red Pine entered into a business combination agreement pursuant to which Red Pine agreed to complete the business combination with HB2 Origination, LLC, a limited liability company existing under the laws of Delaware, and change its name to "Alpine Summit Energy Partners, Inc." upon completion of the business combination.

Our principal executive offices are located at 2200 HSBC Building, 885 West Georgia Street, Vancouver, BC V6C 3E8. Our telephone number is (346) 264-2900. Our website address is https://www.alpinesummitenergy.com/. The information contained on our website or connected to our website is not incorporated by reference into, and should not be considered part of, this reoffer prospectus.

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described in this reoffer prospectus and the documents incorporated herein by reference, including the risks described under the heading "Risk Factors" in the Registrant's Annual Information Form filed as Exhibit 99.1 to our annual report on Form 40-F (File No. 000-56354), filed with the SEC on April 26, 2022, as amended on May 20, 2022, and subsequent reports filed with the SEC, together with the financial and other information contained or incorporated by reference in this reoffer prospectus. If any of the risks actually occur, our business, results of operations, financial condition, and prospects could be harmed. In that event, the trading price of our securities could decline, and you could lose part or all of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

DETERMINATION OF OFFERING PRICE

The Selling Securityholders will determine at what price they may sell the Shares, and such sales may be made at prevailing market prices or at privately negotiated prices. See "Plan of Distribution" below for more information.

USE OF PROCEEDS

The Shares offered hereby are being registered for the account of the Selling Securityholders named in this reoffer prospectus. All proceeds from the sales of Shares will go to the Selling Securityholders and we will not receive any proceeds from the resale of the Shares by the Selling Securityholders.

DESCRIPTION OF SECURITIES

The required disclosure is provided under the heading "Description of Capital Structure" in our Annual Information Form filed as Exhibit 99.1 to our annual report on Form 40-F, filed with the SEC on April 26, 2022.

MARKETS

Our Shares are listed for trading on the TSXV under the symbol "ALPS.U".

SELLING SECURITYHOLDERS

The following table sets forth information with respect to the Selling Securityholders and our Shares beneficially owned by the Selling Security holders as of June 1, 2022 and the percentage of beneficial ownership is calculated based on 33,866,461 our shares outstanding, comprised of 32,975,667 Subordinate Voting Shares, 8,748.47 Multiple Voting Shares and 15,947 Proportionate Voting Shares outstanding as of such date. The Selling Securityholders may offer all, some or none of the Shares covered by this reoffer prospectus. The Selling Securityholders identified below may have sold, transferred or otherwise disposed of some or all of their Shares since the date on which the information in the following table is presented in transactions exempt from, or not subject to, the registration requirements of the Securities Act. Information concerning the Selling Securityholders may change from time to time and, if necessary, we will amend or supplement this reoffer prospectus accordingly. We cannot give an estimate as to the number of Shares that will actually be held by the Selling Securityholders upon termination of this offering because the Selling Securityholders may offer some or all of their Shares under the offering contemplated by this reoffer prospectus or acquire additional Shares. We cannot advise you as to whether the Selling Securityholders will, in fact, sell any or all of such Shares.

We have determined beneficial ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Unless otherwise indicated below, to our knowledge, the persons and entities named in the tables have sole voting and sole investment power with respect to all securities that they beneficially own, subject to community property laws where applicable.

|

Name of Selling Securityholder(1) |

Subordinate |

Subordinate Voting |

Subordinate Voting |

% of Subordinate |

|

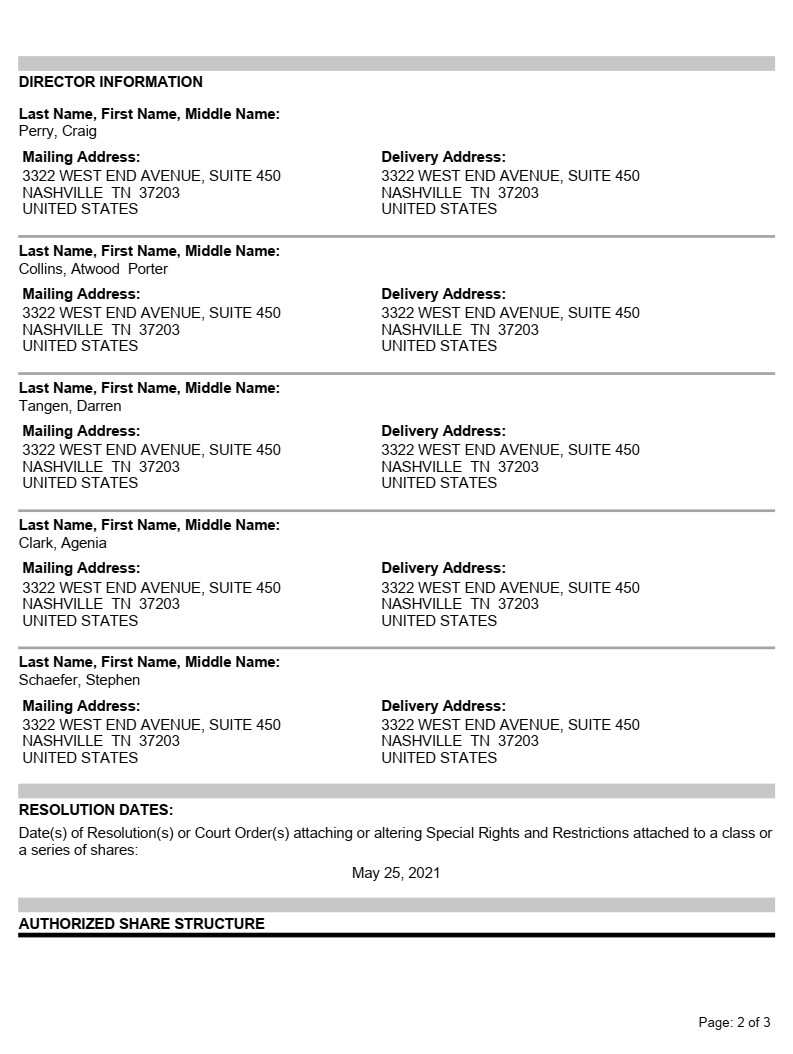

Craig Perry |

1,055,347 |

1,621,223 |

55,347 |

0.16% |

|

Michael McCoy |

725,955 |

403,420 |

541,947 |

1.60% |

|

William Wicker |

817,605 |

403,420 |

633,597 |

1.87% |

|

Travis Reagan Brown |

875,817 |

440,920 |

673,059 |

1.99% |

|

Chrystie Holmstrom |

501,863 |

561,080 |

239,025 |

0.71% |

|

Darren Moulds |

22,391 |

240,156 |

5,000 |

0.01% |

|

Darren Tangen |

906,172 |

661,366 |

618,076 |

1.83% |

|

Agenia Clark |

36,517 |

59,125 |

0 |

0.00% |

|

Atwood Porter Collins |

993,251 |

50,029 |

962,352 |

2.84% |

|

Stephen Schaefer |

1,102,753 |

60,865 |

1,066,236 |

3.15% |

* Less than one percent.

(1) The business address of each of these shareholders is 2200 HSBC Building, 885 West Georgia Street, Vancouver, BC V6C 3E8.

Listing of Subordinate Voting Shares

Our Shares are listed on the TSXV under the symbol "ALPS.U."

Other Material Relationships with the Selling Securityholders

Employment Agreements

We have entered into employment agreements and member services agreements with Craig Perry, Darren Moulds, Michael McCoy, William Wicker, Chrystie Holmstrom and Travis Reagan Brown.

Indemnification Agreements

Under the Company's articles and subject to the provisions of the Business Corporations Act (British Columbia) (the "BCBCA"), the Company indemnifies directors, former directors or alternate directors of the Company and their heirs and legal personal representatives against all eligible penalties to which such person is or may be liable, and the Company, after the final disposition of an eligible proceeding, pays the expenses actually and reasonably incurred by such person in respect of that proceeding. Under the Company's articles and subject to any restrictions in the BCBCA, the Company may indemnify any other person, including the officers, former officers and alternate officers of the Company.

A policy of directors' and officers' liability insurance is maintained by the Company which insures directors and officers against losses incurred as a result of claims against the directors and officers of the Company pursuant to the indemnity provisions under the Company's articles and the BCBCA.

PLAN OF DISTRIBUTION

We are registering the Shares hereunder to permit the Selling Securityholders to conduct public secondary trading of these Shares from time to time after the date of this reoffer prospectus. We will not receive any of the proceeds of the sale of the Shares. The aggregate proceeds to the Selling Securityholders from the sale of the Shares will be the purchase price of such shares less any discounts and commissions. We will not pay any brokers' or underwriters' discounts and commissions in connection with the registration and sale of the Shares. The Selling Securityholders reserve the right to accept and, together with their respective agents, to reject, any proposed purchases of Shares to be made directly or through agents.

The Shares may be sold from time to time to purchasers:

• directly by the Selling Securityholders, or

• through underwriters, broker-dealers, or agents, who may receive compensation in the form of discounts, commissions, or agent's commissions from the Selling Securityholders or the purchasers of the Shares.

Any underwriters, broker-dealers, or agents who participate in the sale or distribution of the Shares may be deemed to be "underwriters" within the meaning of the Securities Act. As a result, any discounts, commissions, or concessions received by any such broker-dealers or agents who are deemed to be underwriters will be deemed to be underwriting discounts and commissions under the Securities Act. Underwriters are subject to the reoffer prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities under the Securities Act and the Securities Exchange Act of 1934, as amended (the "Exchange Act"). We will make copies of this reoffer prospectus available to the Selling Securityholders for the purpose of satisfying the reoffer prospectus delivery requirements of the Securities Act. To our knowledge, there are currently no plans, arrangements, or understandings between the Selling Securityholders and any underwriter, broker-dealer, or agent regarding the sale of the Shares by the Selling Securityholders.

The Shares may be sold in one or more transactions at:

• fixed prices;

• prevailing market prices at the time of sale;

• prices related to such prevailing market prices;

• varying prices determined at the time of sale; or

• negotiated prices.

These sales may be effected in one or more transactions:

• on any national securities exchange or quotation service on which the Shares may be listed or quoted at the time of sale;

• in the over-the-counter market;

• in transactions otherwise than on such exchanges or services or in the over-the-counter market;

• any other method permitted by applicable law; or

• through any combination of the foregoing.

These transactions may include block transactions or crosses. Crosses are transactions in which the same broker acts as an agent on both sides of the trade.

At the time a particular offering of the Shares is made, a prospectus supplement, if required, will be distributed, which will set forth the name of the Selling Securityholders, the aggregate amount of Shares being offered, and the terms of the offering, including, to the extent required, (1) the name or names of any underwriters, broker-dealers, or agents, (2) any discounts, commissions, and other terms constituting compensation from the Selling Securityholders and (3) any discounts, commissions, or concessions allowed or reallowed to be paid to broker-dealers.

The Selling Securityholders will act independently of us in making decisions with respect to the timing, manner, and size of each resale or other transfer. There can be no assurance that the Selling Securityholders will sell any or all of the Shares. Further, we cannot assure you that the Selling Securityholders will not transfer, distribute, devise, or gift the Shares by other means not described in this reoffer prospectus. In addition, any Shares that qualify for sale under Rule 144 of the Securities Act may be sold under Rule 144 rather than under this reoffer prospectus. The Shares may be sold in some states only through registered or licensed brokers or dealers. In addition, in some states the Shares may not be sold unless they have been registered or qualified for sale or an exemption from registration or qualification is available and complied with.

The Selling Securityholders and any other person participating in the sale of the Shares will be subject to the Exchange Act. The Exchange Act rules include, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the Shares by the Selling Securityholders and any other person. In addition, Regulation M may restrict the ability of any person engaged in the distribution of the Shares to engage in market- making activities with respect to the particular Shares being distributed. This may affect the marketability of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

The Selling Securityholders may indemnify any broker or underwriter that participates in transactions involving the sale of the Shares against certain liabilities, including liabilities arising under the Securities Act.

LEGAL MATTERS

The validity of the Shares which are being offered under the Registration Statement of which this reoffer prospectus forms a part will be passed upon for the Company by Cassels Brock & Blackwell LLP.

EXPERTS

The audited annual financial statements of Alpine Summit Energy Partners, Inc. for the year ended December 31, 2021, and 2020 which are part of this Registration Statement and included in our annual report on Form 40-F filed with the SEC on April 26, 2022, as amended on May 20, 2022, have been audited by Weaver and Tidwell, L.L.P. and RSM Alberta LLP, to the extent and for the period set forth in their respective reports, which are incorporated herein by reference, and have been so incorporated in reliance upon such reports given upon the authority of said firm as an expert in auditing and accounting.

Information derived from the report titled "Alpine Summit Energy Partners Evaluation of Petroleum Reserves Based on Forecast Prices and Costs (US$)" prepared by McDaniel & Associates Consultants Ltd. dated March 11, 2022, evaluating certain oil and gas reserves as of December 31, 2021, is incorporated herein by reference and has been so incorporated in reliance upon such report given upon the authority of said firm as a technical expert.

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following discussion is a general summary of certain material U.S. federal income tax considerations for U.S. Holders and certain Non-U.S. Holders (each as defined below) relating to the acquisition, ownership and disposition of Subordinate Voting Shares acquired pursuant to this reoffer prospectus, but does not purport to be a complete analysis of all potential tax matters for consideration. In addition, this summary does not take into account the individual facts and circumstances of any particular U.S. Holder or Non-U.S. Holder that may affect the U.S. federal income tax consequences to such U.S. Holder or Non-U.S. Holder, including specific tax consequences to a U.S. Holder or Non-U.S. Holder under an applicable tax treaty. Accordingly, this summary is not intended to be, and should not be construed as, legal or U.S. federal income tax advice with respect to any particular U.S. Holder or Non-U.S. Holder. Except as specifically set forth below, this summary does not discuss applicable tax reporting requirements.

This discussion is based on the U.S. Internal Revenue Code of 1986, as amended (the "Code"), Treasury Regulations promulgated thereunder, judicial decisions, and published rulings and administrative pronouncements of the United States Internal Revenue Service (the "IRS"), in each instance in effect as of the date hereof. These authorities may change or be subject to differing interpretations. Any such change or differing interpretation may be applied retroactively in a manner that could adversely affect a holder of Subordinate Voting Shares. This summary does not discuss the potential effects, whether adverse or beneficial, of any proposed legislation that, if enacted, could be applied on a retroactive or prospective basis. Alpine has not sought and will not seek any rulings from the IRS, or an opinion from legal counsel, regarding the matters discussed below. There can be no assurance the IRS or a court will not take a contrary position to that discussed below regarding the tax consequences of the acquisition, ownership and disposition of Subordinate Voting Shares acquired pursuant to this reoffer prospectus.

This discussion is limited to U.S. Holders and certain Non-U.S. Holders that hold Subordinate Voting Shares as a "capital asset" within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address all U.S. federal income tax consequences relevant to a holder's particular circumstances, including the impact of the U.S. federal estate, gift, or other non-income tax, or any state, local, or non-U.S. tax, consequences of the acquisition, ownership and disposition of Subordinate Voting Shares acquired pursuant to this reoffer prospectus or the impact of the U.S. federal alternative minimum tax or the U.S. Medicare contribution tax on net investment income. In addition, it does not address consequences relevant to holders subject to special rules, including, without limitation holders that:

• are banks, insurance companies, or other financial institutions;

• are regulated investment companies or real estate investment trusts;

• are brokers, dealers or traders in securities or foreign currencies, or that use the mark-to-market method of accounting for U.S. federal income tax purposes;

• are tax-exempt organizations, governmental organizations, qualified retirement plans, individual retirement accounts, or other tax-deferred accounts;

• hold Subordinate Voting Shares as part of a hedge, straddle, or as part of a conversion transaction or other integrated transaction;

• acquire Subordinate Voting Shares as compensation for services or through the exercise or cancellation of employee stock options or warrants;

• have a "functional currency" other than the U.S. dollar;

• own or have owned, directly, indirectly, or constructively 10% or more of the voting power or value of Alpine;

• are "controlled foreign corporations," "passive foreign investment companies," or corporations that accumulate earnings to avoid, or which has the result of avoiding, U.S. federal income tax;

• are partnerships or other entities or arrangements treated as partnerships for U.S. federal income tax purposes (and investors therein);

• are S corporations (and shareholders thereof);

• are corporations organized outside the United States that are nonetheless classified as domestic corporations for U.S. federal income tax purposes;

• are deemed to sell Subordinate Voting Shares under the constructive sale provisions of the Code;

• are U.S. expatriates, former citizens of the U.S., or former long-term residents of the U.S.;

• are U.S. Holders that hold Subordinate Voting Shares in connection with a trade or business, permanent establishment, or fixed base outside the United States or are otherwise

• are subject to the alternative minimum tax or the tax on net investment income; and

• are required to accelerate the recognition of any item of gross income with respect to Subordinate Voting Shares as a result of such income being recognized on an applicable financial statement or are otherwise subject to special U.S. tax accounting rules.

If an entity classified as a partnership for U.S. federal income tax purposes holds Subordinate Voting Shares, the tax treatment of a partner (or other owner) in such partnership generally will depend on the status of the partner (or other owner), the activities of the entity treated as a partnership for U.S. federal income tax purposes, and certain determinations made at the partner (or other owner) level. Accordingly, entities treated as partnerships holding Subordinate Voting Shares and the partners (or other owners) in such entities should consult their own tax advisors regarding the U.S. federal income tax consequences to them.

THIS DISCUSSION IS FOR INFORMATIONAL PURPOSES ONLY AND IS NOT TAX ADVICE. PROSPECTIVE INVESTORS SHOULD CONSULT THEIR OWN TAX ADVISORS WITH RESPECT TO THE APPLICATION OF THE U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS AS WELL AS ANY TAX CONSEQUENCES OF THE ACQUISITION, OWNERSHIP AND DISPOSITION OF SUBORDINATE VOTING SHARES ACQUIRED PURSUANT TO THIS REOFFER PROSPECTUS ARISING UNDER THE U.S. FEDERAL ESTATE OR GIFT TAX LAWS OR UNDER THE LAWS OF ANY STATE, LOCAL OR NON-U.S. TAXING JURISDICTION OR UNDER ANY APPLICABLE INCOME TAX TREATY.

Definition of a U.S. Holder

For purposes of this discussion, a "U.S. Holder" is any beneficial owner of Subordinate Voting Shares that is, for U.S. federal income tax purposes:

• an individual who is a citizen or resident of the U.S.;

• a corporation, including any entity treated as a corporation for U.S. federal income tax purposes, created or organized in or under the laws of the U.S., any state within the U.S. or the District of Columbia;

• an estate the income of which is subject to U.S. federal income tax regardless of its source; or

• a trust that (1) is subject to the primary supervision of a U.S. court and the control of one or more "United States persons" (within the meaning of Section 7701(a)(30) of the Code), or (2) has a valid election in effect to be treated as a United States person for U.S. federal income tax purposes.

Tax Classification as a U.S. Domestic Corporation

Pursuant to Section 7874(b) of the Code and the Treasury Regulations promulgated thereunder, notwithstanding that Alpine is organized under the provisions of the BCBCA, solely for U.S. federal income tax purposes, Alpine is classified as a U.S. domestic corporation.

A number of significant and complicated U.S. federal income tax consequences may result from such classification, and this summary does not attempt to describe all such U.S. federal income tax consequences. Section 7874 of the Code and the Treasury Regulations promulgated thereunder do not address all the possible tax consequences that arise from Alpine being treated as a U.S. domestic corporation for U.S. federal income tax purposes. Accordingly, there may be additional or unforeseen U.S. federal income tax consequences to Alpine that are not discussed in this summary.

Generally, Alpine will be subject to U.S. federal income tax on its worldwide taxable income (regardless of whether such income is "U.S. source" or "foreign source") and will be required to file a U.S. federal income tax return annually with the IRS. Alpine anticipates that it will also be subject to tax in Canada. It is unclear how the foreign tax credit rules under the Code will operate in certain circumstances, given the treatment of Alpine as a U.S. domestic corporation for U.S. federal income tax purposes and the taxation of Alpine in Canada. Accordingly, it is possible that Alpine will be subject to double taxation with respect to all or part of its taxable income. It is anticipated that such U.S. and Canadian tax treatment will continue indefinitely and that the Subordinate Voting Shares will be treated indefinitely as shares in a U.S. domestic corporation for U.S. federal income tax purposes, notwithstanding future transfers.

Tax Considerations for U.S. Holders

Distributions

Distributions made on Subordinate Voting Shares generally will be included in a U.S. Holder's income as ordinary dividend income to the extent of the current and accumulated earnings and profits (determined under U.S. federal income tax principles) of Alpine as of the end of the taxable year of Alpine in which the distribution occurs. However, with respect to dividends received by certain non-corporate U.S. Holders (including individuals), such dividends may be eligible to be taxed at the applicable long-term capital gains rates (currently at a maximum tax rate of 20%), provided certain holding period and other requirements are satisfied. Dividends received by a corporate holder of Subordinate Voting Shares may be eligible for a dividends received deduction, subject to applicable limitations.

Distributions in excess of the current and accumulated earnings and profits of Alpine will be treated as a return of capital to the extent of a U.S. Holder's adjusted tax basis in Subordinate Voting Shares and thereafter as capital gain from the sale or exchange of such Subordinate Voting Shares, which will be taxable according to rules discussed under the heading "- Sale or Other Disposition," below.

Dividends generally will be subject to Canadian withholding tax. However, dividends will not constitute foreign source income for U.S. foreign tax credit limitation purposes because Alpine, even though organized as a Canadian corporation, will be treated as a U.S. corporation for U.S. federal income tax purposes, as described above under the heading "Tax Classification as a U.S. Domestic Corporation". Therefore, U.S. Holders may not be able to claim a U.S. foreign tax credit for any Canadian withholding tax unless such U.S. Holders have sufficient other foreign source income.

Sale or Other Taxable Disposition

Upon the sale or other taxable disposition of Subordinate Voting Shares, a U.S. Holder generally will recognize capital gain or loss equal to the difference between (i) the amount of cash and the fair market value of any property received upon such taxable disposition and (ii) the U.S. Holder's adjusted tax basis in Subordinate Voting Shares surrendered in exchange therefor. Such capital gain or loss will be long-term capital gain or loss if a U.S. Holder's holding period in Subordinate Voting Shares is more than one year at the time of the sale or other taxable disposition. Long-term capital gains of non-corporate taxpayers are generally taxed at a lower maximum marginal tax rate than the maximum marginal tax rate applicable to ordinary income. There are currently no preferential tax rates for long-term capital gains of a U.S. Holder that is a corporation. Deductions for capital losses are subject to complex limitations under the Code.

Foreign Tax Credit Limitations

Because it is anticipated that Alpine will be subject to tax both as a U.S. domestic corporation and as a Canadian corporation, a U.S. Holder may pay, through withholding, Canadian tax, as well as U.S. federal income tax, with respect to dividends paid on its Subordinate Voting Shares. For U.S. federal income tax purposes, a U.S. Holder may elect for any taxable year to receive either a credit or a deduction for all foreign income taxes paid by the holder during the year. Complex limitations apply to the foreign tax credit, including a general limitation that the credit cannot exceed the proportionate share of a taxpayer's U.S. federal income tax that the taxpayer's foreign source taxable income bears to the taxpayer's worldwide taxable income. In applying this limitation, items of income and deduction must be classified, under complex rules, as either foreign source or U.S. source. The status of Alpine as a U.S. domestic corporation for U.S. federal income tax purposes will cause dividends paid by Alpine to be treated as U.S. source rather than foreign source for this purpose. As a result, a foreign tax credit may be unavailable for any Canadian tax paid on dividends received from Alpine. Similarly, to the extent a sale or disposition of the Subordinate Voting Shares by a U.S. Holder results in Canadian tax payable by the U.S. Holder (for example, because the Subordinate Voting Shares constitute taxable Canadian property within the meaning of the Tax Act), a U.S. foreign tax credit may be unavailable to the U.S. Holder for such Canadian tax. In each case, however, the U.S. Holder should be able to take a deduction for the U.S. Holder's Canadian tax paid, provided that the U.S. Holder has not elected to credit other foreign taxes during the same taxable year.

The foreign tax credit rules are complex, and each U.S. Holder should consult its own tax advisors regarding these rules.

Foreign Currency

The amount of any distribution paid to a U.S. Holder in foreign currency, or the amount of proceeds paid in foreign currency on the sale, exchange or other taxable disposition of Subordinate Voting Shares, generally will be equal to the U.S. dollar value of such foreign currency based on the exchange rate applicable on the date of receipt (regardless of whether such foreign currency is converted into U.S. dollars at that time). A U.S. Holder will have a basis in the foreign currency equal to its U.S. dollar value on the date of receipt. Any U.S. Holder who converts or otherwise disposes of the foreign currency after the date of receipt may have a foreign currency exchange gain or loss that would be treated as ordinary income or loss, and generally will be U.S. source income or loss for foreign tax credit purposes. Different rules apply to U.S. Holders who use the accrual method of tax accounting. Each U.S. Holder should consult its own U.S. tax advisors regarding the U.S. federal income tax consequences of receiving, owning, and disposing of foreign currency.

Information Reporting and Backup Withholding

U.S. backup withholding (currently at a rate of 24%) is imposed upon certain payments to persons that fail (or are unable) to furnish the information required pursuant to U.S. information reporting requirements. Distributions to U.S. Holders will generally be exempt from backup withholding, provided the U.S. Holder meets applicable certification requirements, including providing a U.S. taxpayer identification number on a properly completed IRS Form W-9, or otherwise establishes an exemption. Alpine must report annually to the IRS and to each U.S. Holder the amount of distributions and dividends paid to that U.S. Holder and the proceeds from the sale or other disposition of Subordinate Voting Shares, unless such U.S. Holder is an exempt recipient.

Backup withholding does not represent an additional tax. Any amounts withheld from a payment to a U.S. Holder under the backup withholding rules will generally be allowed as a credit against such U.S. Holder's U.S. federal income tax liability, and may entitle such U.S. Holder to a refund, provided the required information and returns are timely furnished by such U.S. Holder to the IRS. Moreover, certain penalties may be imposed by the IRS on a U.S. Holder who is required to furnish information but does not do so in the proper manner. U.S. Holders should consult their own tax advisors regarding the application of backup withholding in their particular circumstances and the availability of and procedure for obtaining an exemption from backup withholding under current Treasury Regulations.

Tax Considerations for Non-U.S. Holders

Definition of a Non-U.S. Holder

For purposes of this discussion, a "Non-U.S. Holder" is any beneficial owner of Subordinate Voting Shares that is neither a "U.S. Holder" nor an entity treated as a partnership for U.S. federal income tax purposes.

Distributions

Distributions of cash or property on Subordinate Voting Shares will constitute dividends for U.S. federal income tax purposes to the extent paid from Alpine's current or accumulated earnings and profits, as determined under U.S. federal income tax principles. Distributions in excess thereof will first constitute a return of capital and be applied against and reduce a Non-U.S. Holder's adjusted tax basis in its Subordinate Voting Shares, but not below zero, and thereafter be treated as capital gain and will be treated as described under "- Sale or Other Taxable Disposition" below. If Alpine is a "USRPHC" (as defined below under the heading "- Sale or Other Taxable Disposition") and does not qualify for the "Regularly Traded Exception" (as defined below under the heading "- Sale or Other Taxable Disposition"), distributions which constitute a return of the Non-U.S. Holder's investment will be subject to withholding unless an application for a withholding certificate is filed to reduce or eliminate such withholding.

Subject to the discussions under "- Information Reporting and Backup Withholding" and under "- FATCA" below, any dividend paid to a Non-U.S. Holder of Subordinate Voting Shares that is not effectively connected with the Non-U.S. Holder's conduct of a trade or business within the U.S. will be subject to U.S. federal withholding tax at a rate of 30% of the gross amount of such distribution, or such lower rate as may be specified under an applicable income tax treaty. In order to receive a reduced treaty rate, a Non-U.S. Holder must provide its financial intermediary with an IRS Form W-8BEN or IRS Form W-8BEN-E, as applicable (or an appropriate successor form), properly certifying such holder's eligibility for the reduced rate. If a Non-U.S. Holder holds Subordinate Voting Shares through a financial institution or other agent acting on the Non-U.S. Holder's behalf, the Non-U.S. Holder will be required to provide appropriate documentation to such agent, and the Non-U.S. Holder's agent will then be required to provide such (or a similar) certification to Alpine, either directly or through other intermediaries. A Non-U.S. Holder that does not timely furnish the required certification, but that qualifies for a reduced treaty rate, may obtain a refund of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS. Non-U.S. Holders should consult their own tax advisors regarding their entitlement to benefits under any applicable income tax treaty.

Dividends paid to a Non-U.S. Holder that are effectively connected with the Non-U.S. Holder's conduct of a trade or business in the U.S. (or, if required by an applicable income tax treaty, are attributable to a U.S. permanent establishment, or fixed base, of the Non-U.S. Holder) generally will be exempt from the withholding tax described above and instead will be subject to U.S. federal income tax on a net income basis at the regular graduated U.S. federal income tax rates in the same manner as if the Non-U.S. Holder were a U.S. person. In such case, Alpine will not have to withhold U.S. federal tax so long as the Non-U.S. Holder timely complies with the applicable certification and disclosure requirements. In order to obtain this exemption from withholding tax, a Non-U.S. Holder must provide its financial intermediary with an IRS Form W-8ECI properly certifying its eligibility for such exemption. Any such effectively connected dividends received by a corporate Non-U.S. Holder may be subject to an additional "branch profits tax" at a rate of 30% (or such lower rate as may be specified by an applicable income tax treaty), as adjusted for certain items. Non-U.S. Holders should consult their own tax advisors regarding any applicable tax treaties that may provide for different rules.

Sale or Other Taxable Disposition

Subject to the discussions under "- Information Reporting and Backup Withholding" and under "- FATCA" below, any gain realized on the sale or other disposition of Subordinate Voting Shares by a Non-U.S. Holder generally will not be subject to U.S. federal income tax unless:

• the gain is effectively connected with the Non-U.S. Holder's conduct of a trade or business in the U.S. (or, if required by an applicable income tax treaty, is attributable to a U.S. permanent establishment, or fixed base, of the Non-U.S. Holder);

• the Non-U.S. Holder is an individual who is present in the United States for 183 days or more in the taxable year of disposition, and certain other conditions are met; or

• Alpine is or has been a "United States real property holding corporation (a "USRPHC") under Section 897 of the Code at any time during the shorter of the five-year period ending on the date of disposition and such Non-U.S. Holder's holding period for the Subordinate Voting Shares, in which case, subject to the exception discussed below, such gain will be subject to U.S. federal net income tax at graduated rates as if the gain or loss were effectively connected with the conduct of a U.S. trade or business.

A Non-U.S. Holder who has gain that is described in the first bullet point immediately above will be subject to U.S. federal income tax on the gain derived from the sale or other disposition pursuant to regular graduated U.S. federal income tax rates in the same manner as if it were a U.S. person. In addition, a corporate Non-U.S. Holder described in the first bullet point immediately above may be subject to the branch profits tax equal to 30% of its effectively connected earnings and profits (or at such lower rate as may be specified by an applicable income tax treaty), as adjusted for certain items.

A Non-U.S. Holder who meets the requirements described in the second bullet point immediately above will be subject to U.S. federal income tax at a rate of 30% (or a lower tax rate specified by an applicable tax treaty) on the gain derived from the sale or other disposition, which gain may be offset by certain U.S. source capital losses (even though the individual is not considered a resident of the U.S.), provided the Non-U.S. Holder has timely filed U.S. federal income tax returns with respect to such losses.

With respect to the third bullet point above, Alpine believes it currently is, and anticipates remaining, a USRPHC. Because the determination of whether Alpine is a USRPHC depends, however, on the fair market value of Alpine's "United States real property interests" ("USRPIs") relative to the fair market value of Alpine's non-U.S. real property interests and other business assets, there can be no assurance Alpine currently is a USRPHC or will remain one in the future. Even if Alpine is or were to become a USRPHC, gain arising from the sale or other taxable disposition by a Non-U.S. Holder of Subordinate Voting Shares will not be subject to U.S. federal income tax if the Subordinate Voting Shares are "regularly traded," as defined by applicable Treasury Regulations, on an established securities market (the "Regularly Traded Exception"), and such Non-U.S. Holder owned, actually and constructively, 5% or less of the common shares of Alpine throughout the shorter of the five-year period ending on the date of the sale or other taxable disposition or the Non-U.S. Holder's holding period. Non-U.S. Holders should consult with their own tax advisors regarding the consequences to them of investing in a USRPHC. As a USRPHC, a Non-U.S. Holder will be taxed as if any gain or loss were effectively connected with the conduct of a trade or business as described above, and a 15% withholding tax generally would apply to the gross proceeds from the sale of Subordinate Voting Shares, in the event that (i) such holder owned, actually and constructively, more than 5% of the common shares of Alpine at any time during the shorter of the five-year period ending on the date of the sale or other taxable disposition or the Non-U.S. Holder's holding period, or (ii) the Regularly Traded Exception is not satisfied during the relevant period with respect to the security sold. Alpine's Subordinate Voting Shares are currently listed on the TSX-V and are currently quoted on OTCQX. There can be no assurance that the Subordinate Voting Shares will satisfy the Regularly Traded Exception at any particular point in the future. Non-U.S. Holders should consult their own tax advisors regarding the consequences if Alpine is, has been, or will be a USRPHC and regarding potentially applicable income tax treaties that may provide for different rules.

Information Reporting and Backup Withholding

With respect to distributions and dividends on Subordinate Voting Shares, Alpine must report annually to the IRS and to each Non-U.S. Holder the amount of distributions and dividends paid to such Non-U.S. Holder and any tax withheld with respect to such distributions and dividends, regardless of whether withholding was required with respect thereto. Copies of the information returns reporting such dividends and distributions and withholding also may be made available to the tax authorities in the country in which the Non-U.S. Holder resides or is established under the provisions of an applicable income tax treaty, tax information exchange agreement or other arrangement. A Non-U.S. Holder will be subject to backup withholding for dividends and distributions paid to such Non-U.S. Holder unless either (i) such Non-U.S. Holder certifies under penalty of perjury that it is not a U.S. person (as defined in the Code), which certification is generally satisfied by providing a properly executed IRS Form W-8BEN, IRS Form W-8BEN-E, or IRS Form W-8ECI (or appropriate successor form), and the payor does not have actual knowledge or reason to know that such holder is a U.S. person, or (ii) such Non-U.S. Holder otherwise establishes an exemption.

With respect to sales or other dispositions of Subordinate Voting Shares, information reporting and, depending on the circumstances, backup withholding will apply to the proceeds of a sale or other disposition of Subordinate Voting Shares within the U.S. or conducted through certain U.S.-related financial intermediaries, unless either (i) such Non-U.S. Holder certifies under penalty of perjury that it is not a U.S. person (as defined in the Code), which certification is generally satisfied by providing a properly executed IRS Form W-8BEN, IRS Form W-8BEN-E, or IRS Form W-8ECI (or appropriate successor form), and the payor does not have actual knowledge or reason to know that such holder is a U.S. person, or (ii) such Non-U.S. Holder otherwise establishes an exemption.

Whether with respect to distributions and dividends, or the sale or other disposition of Subordinate Voting Shares, backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be allowed as a refund or a credit against a Non-U.S. Holder's U.S. federal income tax liability, if any, provided the required information is timely furnished to the IRS.

FATCA

Withholding taxes may be imposed pursuant to "FATCA" (generally, Sections 1471 through 1474 of the Code) on certain types of payments made to non-U.S. financial institutions and certain other non-U.S. entities. Specifically, except as discussed below, a 30% withholding tax may be imposed on dividends on, or gross proceeds from the sale or other disposition (including certain distributions treated as a sale or other disposition) of, Subordinate Voting Shares paid to a "foreign financial institution" or a "non-financial foreign entity" (each as defined in the Code).

Such 30% FATCA withholding will not apply to a foreign financial institution if such institution undertakes certain diligence and reporting obligations, or otherwise qualifies for an exemption from these rules. The diligence and reporting obligations include, among others, entering into an agreement with the U.S. Department of Treasury pursuant to which the foreign financial institution must (i) undertake to identify accounts held by certain "specified United States persons" or "United States-owned foreign entities" (each as defined in the Code), (ii) annually report certain information about such accounts, and (iii) withhold 30% on certain payments to non-compliant foreign financial institutions and certain other account holders. Foreign financial institutions located in jurisdictions that have an intergovernmental agreement with the U.S. governing FATCA may be subject to different rules.

The 30% FATCA withholding will not apply to a non-financial foreign entity which either certifies that it does not have any "substantial United States owners" (as defined in the Code), furnishes identifying information regarding each substantial United States owner, or otherwise qualifies for an exemption from these rules.

Under the applicable Treasury Regulations and administrative guidance, withholding under FATCA generally applies currently to payments of dividends on Subordinate Voting Shares. While these withholding obligations would also apply to payments of gross proceeds from a sale or other disposition of Subordinate Voting Shares, proposed Treasury Regulations, which state that taxpayers may rely on such proposed regulations until final regulations are issued, eliminate this requirement. Non-U.S. Holders should consult their own tax advisors with respect to the potential tax consequences of FATCA to their investment in Subordinate Voting Shares.

WHERE YOU CAN FIND MORE INFORMATION

We are required to file certain periodic reports and other information with the SEC as required by the Exchange Act. You can read our SEC filings, including this reoffer prospectus, over the internet at the SEC's website at www.sec.gov. As we are a Canadian issuer, we also file continuous disclosure documents with the Canadian securities regulatory authorities, which documents are available on the System for Electronic Document Analysis and Retrieval website maintained by the Canadian Securities Administrators at www.sedar.com.

Our website address is https://www.alpinesummitenergy.com/. The information contained on, or that may be accessed through, our website is not a part of, and is not incorporated into, this reoffer prospectus.

INFORMATION INCORPORATED BY REFERENCE

We incorporate information into this reoffer prospectus by reference, which means that we disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this reoffer prospectus, except to the extent superseded by information contained in this reoffer prospectus or by information contained in documents filed with the SEC after the date of this reoffer prospectus. This reoffer prospectus incorporates by reference the documents set forth below that have been previously filed with the SEC; provided, however, that, except as noted below, we are not incorporating any documents or information deemed to have been furnished rather than filed in accordance with the rules of the SEC. These documents contain important information about us and our financial condition.

(a) our annual report on Form 40-F filed with the SEC on April 26, 2022, as amended on May 20, 2022;

(b) our listing application filed as Exhibit 99.39 to our registration statement on Form 40-F, as filed with the SEC on October 12, 2021 (excluding Schedule C, Schedule D, Schedule E, Schedule G, and Schedule H, and any information relating to the Austin Chalk and Eagle Ford Acreage property in Texas, United States derived from the report titled "Evaluation of Petroleum Reserves of HB2" prepared by McDaniel & Associates Consultants Ltd. dated May 10, 2021);

(c) our current reports on Form 6-K furnished to the SEC on May 25, 2022 and June 1, 2022.

(d) all other reports filed by the Registrant under Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act") since December 31, 2021; and

(e) the description of the Shares contained in our registration statement on Form 40-F, as filed with the SEC on October 12, 2021 (File No. 000-56354), including any amendment or report filed for the purpose of amending such description.

In addition, all subsequent annual reports on Form 20-F, Form 40-F or Form 10-K, and all subsequent filings on Form 10-Q or 8-K that we file pursuant to the Exchange Act, prior to the termination of this offering, are hereby incorporated by reference into this prospectus. Also, we may incorporate by reference reports on Form 6-K that we furnish subsequent to the date of this prospectus by stating in those Form 6-Ks that they are being incorporated by reference into this prospectus.

For purposes of this reoffer prospectus, any statement contained in a document incorporated, or deemed to be incorporated, by reference herein shall be deemed to be modified or superseded for purposes of this reoffer prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this reoffer prospectus.

We will provide without charge upon written or oral request to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any and all of the documents which are incorporated by reference in this reoffer prospectus but not delivered with this reoffer prospectus (other than exhibits unless such exhibits are specifically incorporated by reference in such documents). You may request a copy of these documents by writing or telephoning us at:

2200 HSBC Building

885 West Georgia Street

Vancouver, BC V6C 3E8

(346) 264-2900

4,501,604 Shares

ALPINE SUMMIT ENERGY PARTNERS, INC.

Subordinate Voting Shares

REOFFER PROSPECTUS

June 3, 2022

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents which have been and will in the future be filed by the Company with the SEC are incorporated into this Registration Statement by reference:

(a) our annual report on Form 40-F, as amended, for the year ended December 31, 2021;

(b) all other reports filed by the Registrant under Section 13(a) or 15(d) of the Exchange Act since December 31, 2021; and

(c) the description of the Shares contained in our registration statement on Form 40-F, as filed with the SEC on October 12, 2021, including any amendment or report filed for the purpose of amending such description.

All documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference to this Registration Statement and to be a part hereof from the date of filing such documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which is also deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Section 160 of the Business Corporations Act (British Columbia) (the "BCBCA") authorizes a company to indemnify past and present directors and officers of the company and past and present directors and officers of a corporation of which the company is or was a shareholder, against liabilities incurred in connection with the provision of their services as such. However a company must not provide an indemnity if the director or officer did not act honestly and in good faith with a view to the best interests of the company, or, in the case of a proceeding other than a civil proceeding, if he or she did not have reasonable grounds for believing that his or her conduct was lawful. Section 165 of the BCBCA provides that a company may purchase and maintain liability insurance for the benefit of such directors and officers.

Under the Company's articles and subject to the provisions of the BCBCA, the Company shall indemnify a director, former director or alternate director of the Company and his or her heirs and legal personal representatives against all eligible penalties to which such person is or may be liable, and the Company shall, after the final disposition of an eligible proceeding, pay the expenses actually and reasonably incurred by such person in respect of that proceeding. Under the Company's articles and subject to any restrictions in the BCBCA, the Company may indemnify any other person, including the officers, former officers and alternate officers of the Company.

A policy of directors' and officers' liability insurance is maintained by the Company which insures directors and officers against losses incurred as a result of claims against the directors and officers of the Company pursuant to the indemnity provisions under the Company's articles and the BCBCA.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the Company pursuant to the foregoing provisions, the Company has been informed that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Item 7. Exemption from Registration Claimed.

The shares being reoffered and resold pursuant to the Reoffer Prospectus were deemed to be exempt from registration under the Securities Act in reliance on Section 4(a)(2) of the Securities Act and/or Rule 701 promulgated thereunder, as transactions by an issuer not involving a public offering or pursuant to a written compensatory benefit plan.

Item 8. Exhibits

Item 9. Undertakings.

a. The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;