Exhibit 2.1

EXECUTION VERSION

AGREEMENT AND PLAN OF MERGER

dated

January 21, 2022

by and among

Arisz Acquisition Corp., a Delaware corporation,

as Parent,

and

Finfront Holding Company, a Cayman Islands exempted

company,

as the Company

TABLE OF CONTENTS

| |

Page |

| |

|

| Article I DEFINITIONS |

2 |

| |

|

| Article II REDOMESTICATION MERGER |

11 |

| |

|

| 2.1 |

Redomestication Merger |

11 |

| 2.2 |

Redomestication Merger Effective Time |

11 |

| 2.3 |

Effect of Redomestication Merger |

11 |

| 2.4 |

Charter Documents |

11 |

| 2.5 |

Directors and Officers of the Redomestication Merger Surviving Corporation |

11 |

| 2.6 |

Effect on Issued Securities of Parent |

12 |

| 2.7 |

Surrender of Parent Common Shares |

13 |

| 2.8 |

Lost Stolen or Destroyed Certificates |

13 |

| 2.9 |

Section 368 Reorganization |

13 |

| 2.10 |

Taking of Necessary Action; Further Action |

13 |

| |

|

|

| Article III ACQUISITION MERGER |

14 |

| |

|

| 3.1 |

Acquisition Merger |

14 |

| 3.2 |

Closing; Effective Time |

14 |

| 3.3 |

Board of Directors |

14 |

| 3.4 |

Effect of the Acquisition Merger |

14 |

| 3.5 |

Memorandum and Articles of Association of the Surviving Corporation |

15 |

| 3.6 |

Section 368 Reorganization |

15 |

| 3.7 |

Transfers of Ownership |

15 |

| |

|

|

| Article IV CONSIDERATION |

16 |

| |

|

| 4.1 |

Conversion of Shares |

16 |

| 4.2 |

Issuance of Merger Consideration |

17 |

| |

|

|

| Article V REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

18 |

| |

|

| 5.1 |

Corporate Existence and Power |

18 |

| 5.2 |

Authorization |

18 |

| 5.3 |

Governmental Authorization |

18 |

| 5.4 |

Non-Contravention |

19 |

| 5.5 |

Capitalization |

19 |

| 5.6 |

Subsidiaries |

19 |

| 5.7 |

Organizational Documents |

20 |

| 5.8 |

Corporate Records |

20 |

| 5.9 |

Assumed Names |

20 |

| 5.10 |

Consents |

20 |

| 5.11 |

Financial Statements |

20 |

| 5.12 |

Books and Records |

21 |

| 5.13 |

Absence of Certain Changes |

21 |

| 5.14 |

Properties; Title to the Company’s Assets |

21 |

| 5.15 |

Litigation |

22 |

| 5.16 |

Contracts |

22 |

| 5.17 |

Licenses and Permits |

24 |

| 5.18 |

Compliance with Laws |

24 |

| 5.19 |

Intellectual Property |

25 |

| 5.20 |

Customers and Suppliers |

28 |

TABLE OF CONTENTS CONTINUED

| 5.21 |

Accounts Receivable and Payable; Loans |

29 |

| 5.22 |

Pre-payments |

29 |

| 5.23 |

Employees; Employee Benefits |

29 |

| 5.24 |

Employment Matters |

29 |

| 5.25 |

Withholding |

30 |

| 5.26 |

Real Property |

30 |

| 5.27 |

Tax Matters |

31 |

| 5.28 |

Environmental Laws |

32 |

| 5.29 |

Finders’ Fees |

32 |

| 5.30 |

Powers of Attorney and Suretyships |

32 |

| 5.31 |

Directors and Officers |

32 |

| 5.32 |

International Trade Matters; Anti-Bribery Compliance |

32 |

| 5.33 |

Not an Investment Company |

33 |

| 5.34 |

Insurance |

33 |

| 5.35 |

Affiliate Transactions |

34 |

| 5.36 |

Compliance with Privacy Laws, Privacy Policies and Certain Contracts |

34 |

| 5.37 |

OFAC |

34 |

| 5.38 |

Board Approval |

35 |

| 5.39 |

Other Information |

35 |

| |

|

|

| Article VI REPRESENTATIONS AND WARRANTIES OF PARENT PARTIES |

35 |

| |

|

| 6.1 |

Corporate Existence and Power |

35 |

| 6.2 |

Corporate Authorization |

35 |

| 6.3 |

Governmental Authorization |

36 |

| 6.4 |

Non-Contravention |

36 |

| 6.5 |

Finders’ Fees |

36 |

| 6.6 |

Issuance of Shares |

36 |

| 6.7 |

Capitalization |

36 |

| 6.8 |

Information Supplied |

37 |

| 6.9 |

Trust Fund |

38 |

| 6.10 |

Listing |

38 |

| 6.11 |

Reporting Company |

38 |

| 6.12 |

No Market Manipulation |

38 |

| 6.13 |

Board Approval |

38 |

| 6.14 |

Parent SEC Documents and Financial Statements |

39 |

| 6.15 |

Litigation |

40 |

| 6.16 |

Compliance with Laws |

40 |

| 6.17 |

Money Laundering Laws |

40 |

| 6.18 |

OFAC |

40 |

| 6.19 |

Not an Investment Company |

40 |

| 6.20 |

Tax Matters |

40 |

| 6.21 |

PIPE Financing |

41 |

| |

|

|

| Article VII COVENANTS OF THE COMPANY AND THE PARENT PARTIES PENDING CLOSING |

42 |

| |

|

| 7.1 |

Conduct of the Business |

42 |

| 7.2 |

Access to Information |

44 |

| 7.3 |

Notices of Certain Events |

44 |

| 7.4 |

SEC Filings |

44 |

| 7.5 |

Financial Information |

45 |

| 7.6 |

Trust Account |

46 |

| 7.7 |

Directors’ and Officers’ Indemnification and Insurance |

46 |

| 7.8 |

Notice of Changes |

47 |

TABLE OF CONTENTS CONTINUED

| Article VIII COVENANTS OF THE COMPANY |

47 |

| |

|

| 8.1 |

Reporting and Compliance with Laws |

47 |

| 8.2 |

Reasonable Best Efforts to Obtain Consents |

47 |

| 8.3 |

Annual and Interim Financial Statements |

48 |

| |

|

|

| Article IX COVENANTS OF ALL PARTIES HERETO |

48 |

| |

|

| 9.1 |

Reasonable Best Efforts; Further Assurances |

48 |

| 9.2 |

Tax Matters |

48 |

| 9.3 |

Settlement of the Parent Parties’ Liabilities |

49 |

| 9.4 |

Compliance with SPAC Agreements |

49 |

| 9.5 |

Registration Statement |

50 |

| 9.6 |

PIPE Financing |

51 |

| 9.7 |

Confidentiality |

52 |

| |

|

|

| Article X CONDITIONS TO CLOSING |

52 |

| |

|

| 10.1 |

Condition to the Obligations of the Parties |

52 |

| 10.2 |

Conditions to Obligations of the Parent Parties |

53 |

| 10.3 |

Conditions to Obligations of the Company |

54 |

| |

|

|

| Article XI TERMINATION |

55 |

| |

|

| 11.1 |

Termination |

55 |

| 11.2 |

Breakup Fee |

57 |

| 11.3 |

Effect of Termination |

57 |

| |

|

|

| Article XII MISCELLANEOUS |

57 |

| |

|

| 12.1 |

Notices |

57 |

| 12.2 |

Amendments; No Waivers; Remedies |

58 |

| 12.3 |

Nonsurvival of Representations |

59 |

| 12.4 |

Arm’s Length Bargaining; No Presumption Against Drafter |

59 |

| 12.5 |

Publicity |

59 |

| 12.6 |

Expenses |

59 |

| 12.7 |

No Assignment or Delegation |

59 |

| 12.8 |

Governing Law |

59 |

| 12.9 |

Waiver of Jury Trial |

60 |

| 12.10 |

Submission to Jurisdiction |

60 |

| 12.11 |

Counterparts; Facsimile Signatures |

60 |

| 12.12 |

Entire Agreement |

61 |

| 12.13 |

Severability |

61 |

| 12.14 |

Construction of Certain Terms and References; Captions |

61 |

| 12.15 |

Further Assurances |

62 |

| 12.16 |

Third Party Beneficiaries |

62 |

| 12.17 |

Waiver |

62 |

AGREEMENT AND PLAN OF MERGER

This AGREEMENT AND PLAN OF

MERGER (the “Agreement”), dated as of January 21, 2022 (the “Signing Date”), by and among Arisz

Acquisition Corp., a Delaware corporation (“Parent”), and Finfront Holding Company, a Cayman Islands exempted

company (the “Company”).

W I T N E S E T H :

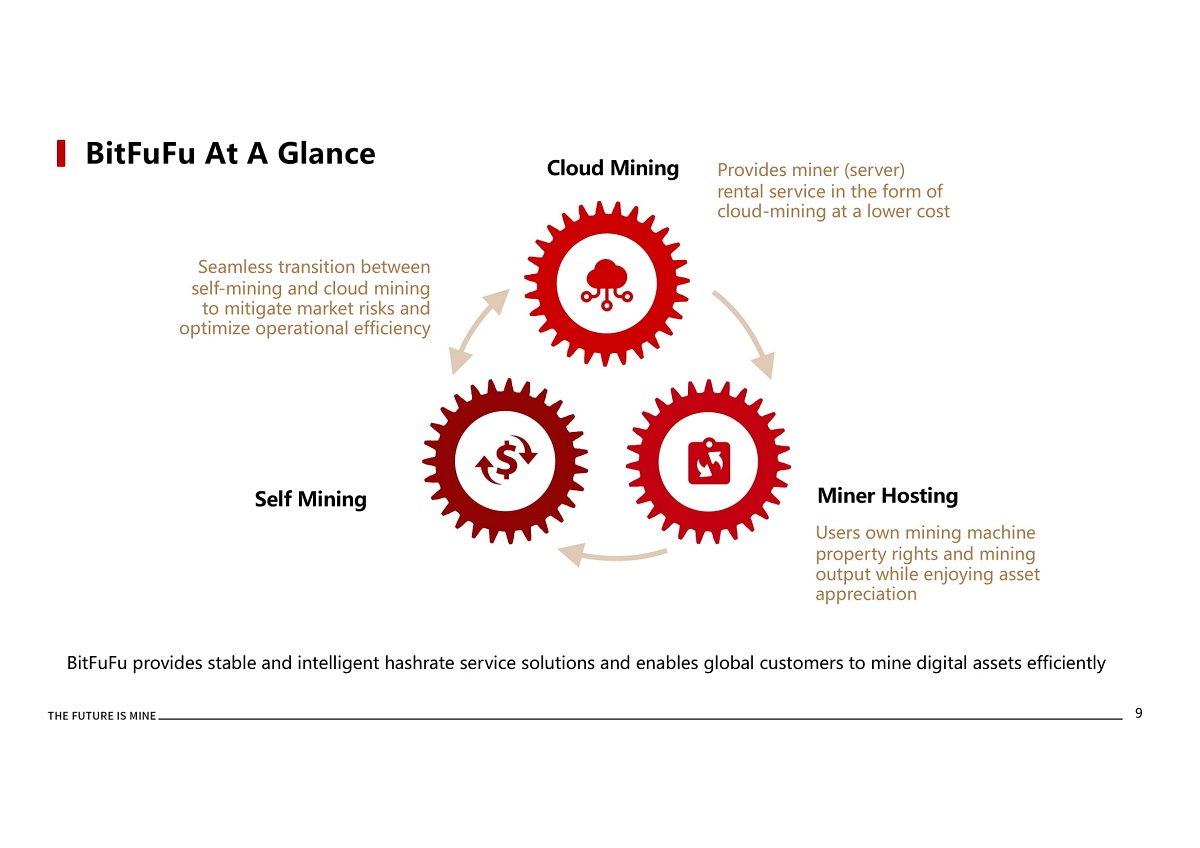

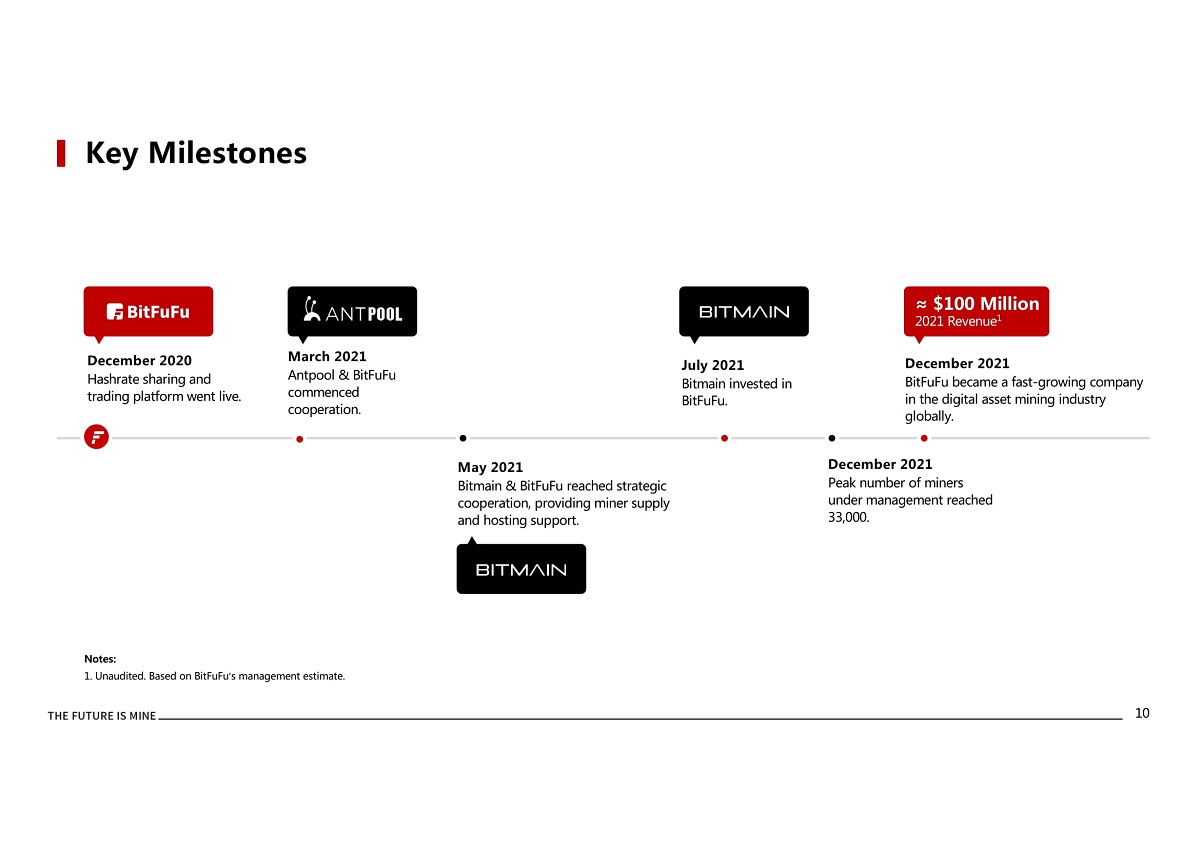

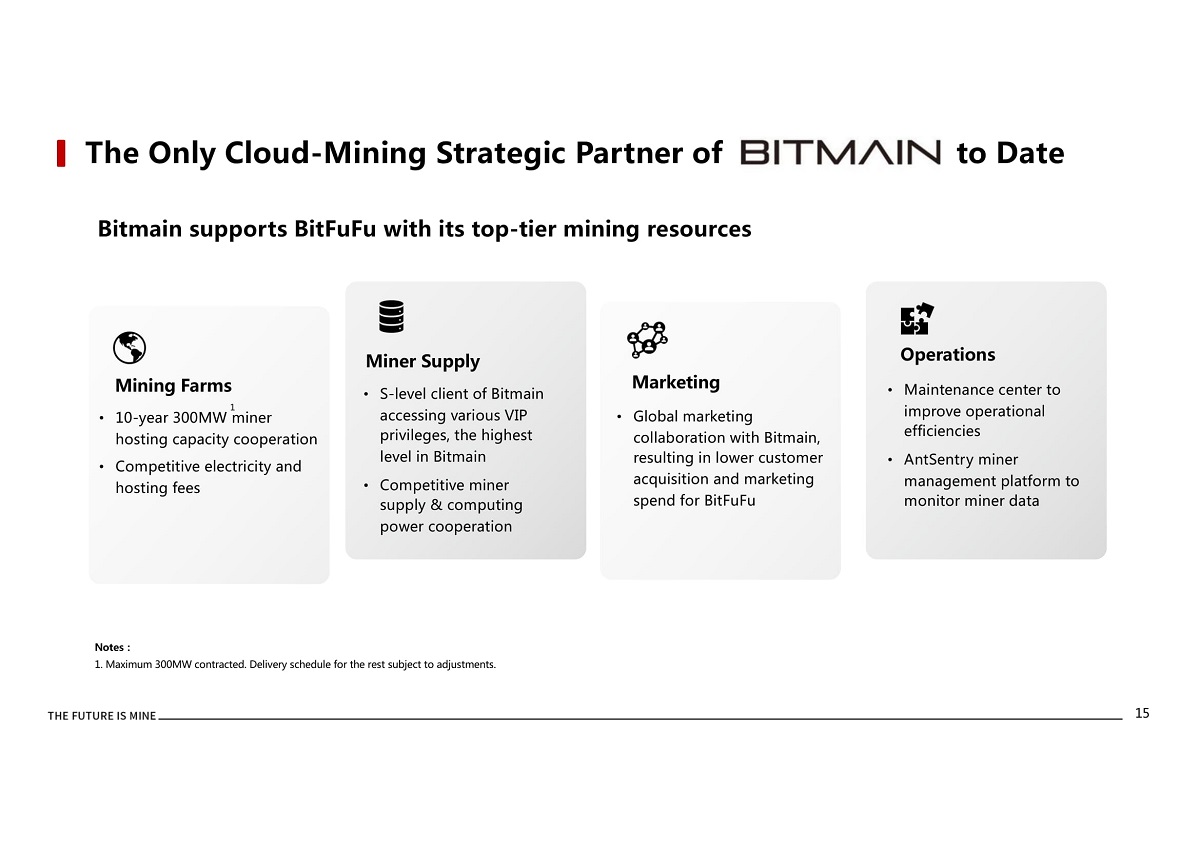

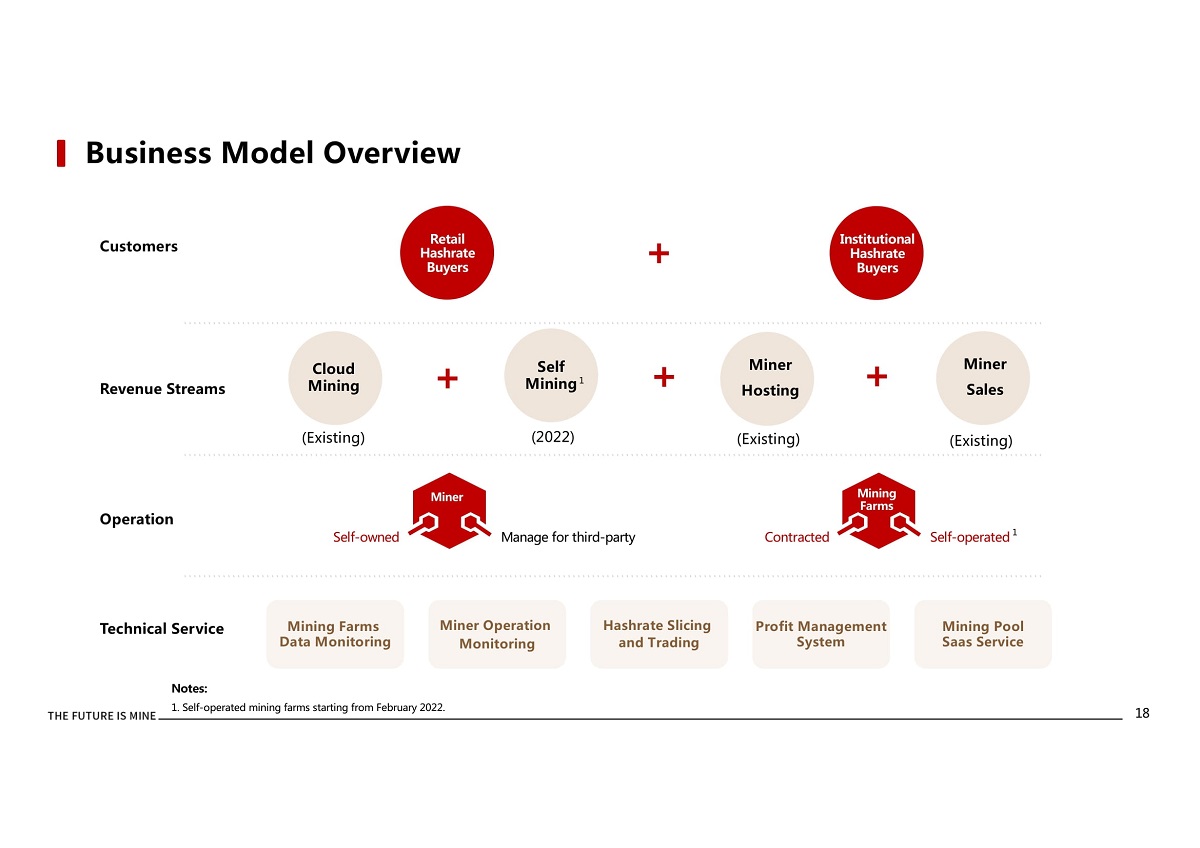

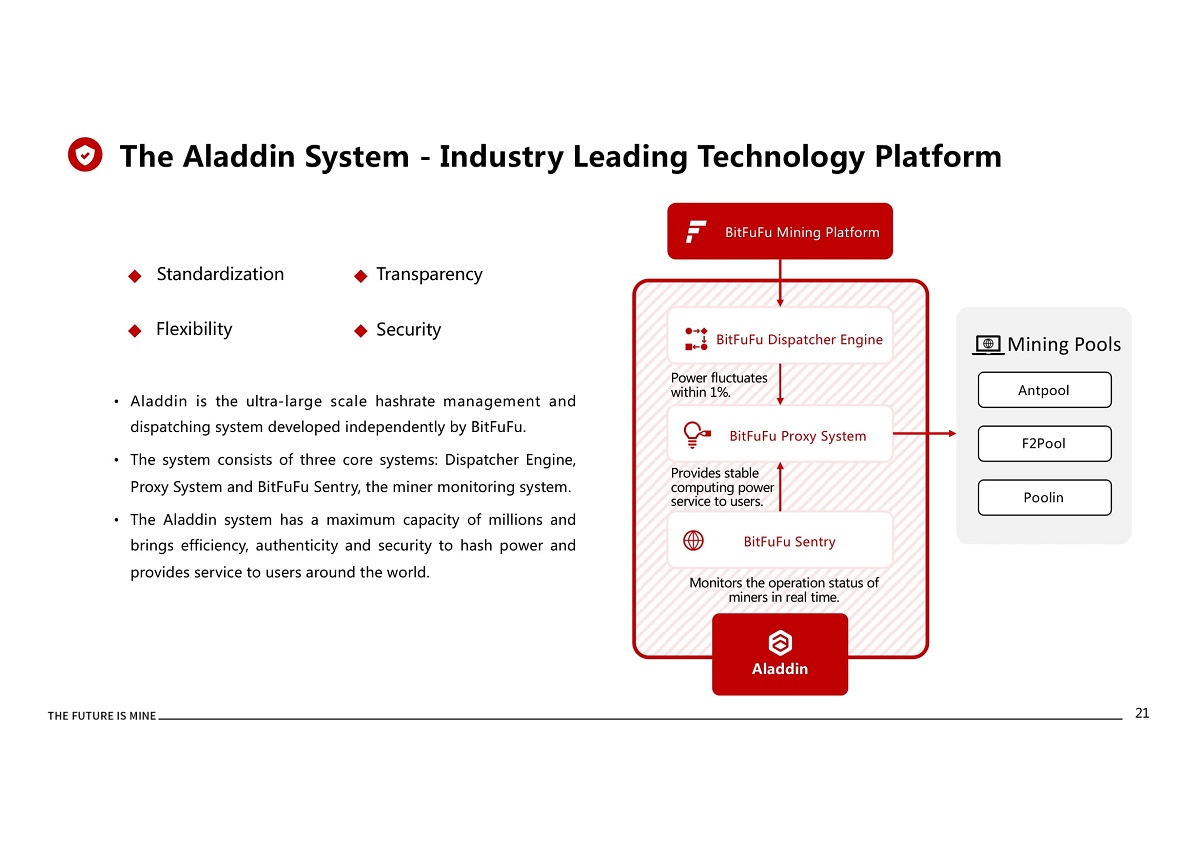

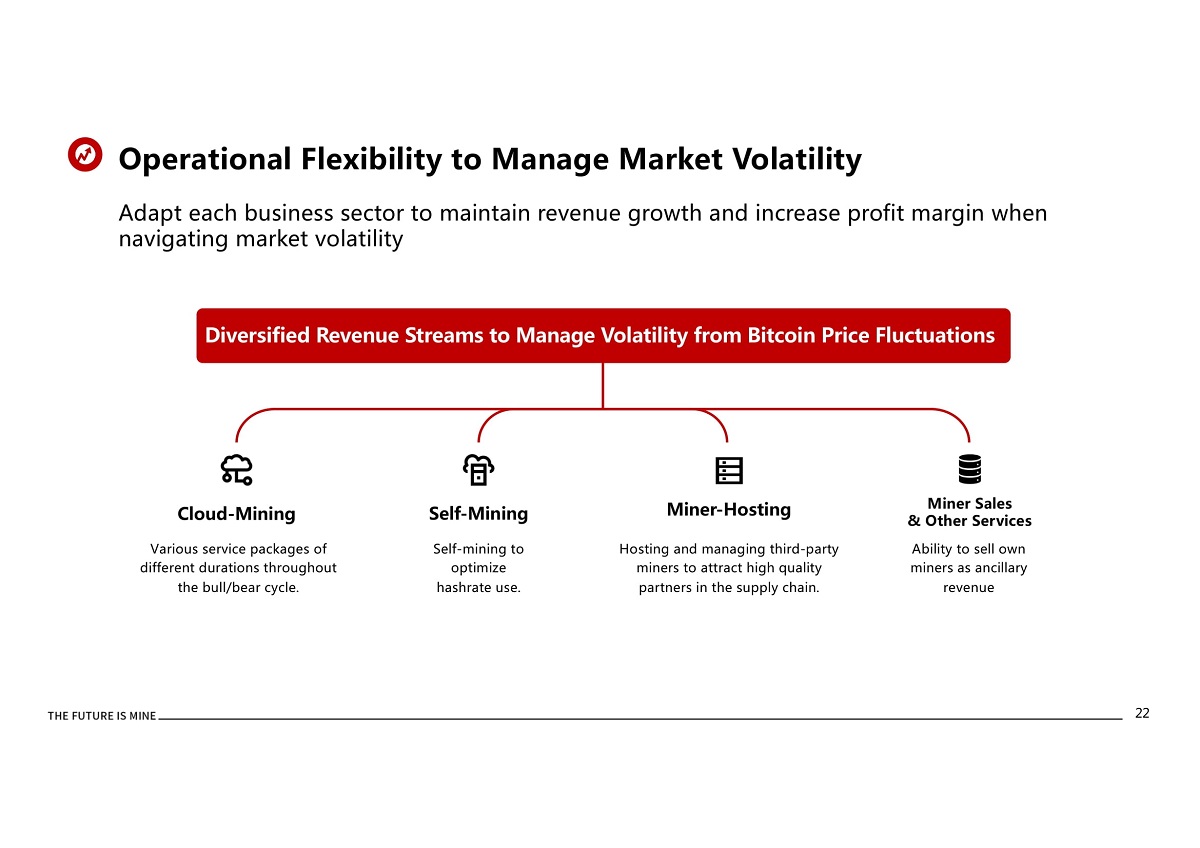

WHEREAS, the Company is in

the businesses of cloud mining, self-mining and miner hosting in connection with digital assets (the “Business”);

WHEREAS, Parent is a blank

check company formed for the sole purpose of entering into a share exchange, asset acquisition, share purchase, recapitalization, reorganization

or other similar business combination with one or more businesses or entities;

WHEREAS, BitFuFu Inc., a Cayman

Islands exempted and wholly owned subsidiary of the Parent (“Purchaser”), to be formed for the sole purpose of the

merger of Parent with and into Purchaser (the “Redomestication Merger”), in which Purchaser will be the surviving entity

(the “Redomestication Merger Surviving Corporation”);

WHEREAS, immediately after

the Redomestication Merger, the parties hereto desire to effect a merger of Boundary Holding Company, a Cayman Islands exempted company

and wholly owned subsidiary of Purchaser (“Merger Sub”), to be formed for the sole purpose of merging with and into

the Company (the “Acquisition Merger”) with the Company being the surviving entity and a wholly-owned subsidiary of

Purchaser (the “Surviving Corporation”);

WHEREAS, in connection with

the transactions contemplated by this Agreement, Purchaser will enter into subscription agreements (each, as amended or modified from

time to time, a “Subscription Agreement”), with the Purchaser Investors providing for aggregate investments in Purchaser

Ordinary Shares in a private placement of an amount not less than $50,000,000 and valued in an amount of at least $10.00 per Purchaser

Ordinary Share (the “PIPE Financing”);

WHEREAS, for U.S. federal

income tax purposes, Purchaser and Parent intend, and the Company acknowledges, that the Redomestication Merger will qualify as a “reorganization”

within the meaning of Section 368(a) of the Code, and the Boards of Directors of Parent and Purchaser have approved this Agreement and

intend that it constitute a “plan of reorganization” within the meaning of Treasury Regulation Sections 1.368-2(g) and 1.368-3;

WHEREAS, for U.S. federal

income tax purposes, the parties hereto intend that the Acquisition Merger will qualify as a “reorganization” within the meaning

of Section 368(a) of the Code, and the Company’s Board of Directors and the Boards of Directors of Purchaser and Merger Sub have

approved this Agreement and intend that it constitute a “plan of reorganization” within the meaning of Treasury Regulation

Sections 1.368-2(g) and 1.368-3;

WHEREAS, the Board of Directors

of the Company and the Shareholders of the Company have determined that this Agreement, the Acquisition Merger and the other transactions

contemplated by this Agreement are fair and advisable to, and in the best interests of, the Company and the Shareholders; and

WHEREAS, the Board of Directors

of Parent has determined that this Agreement, Redomestication Merger, the Acquisition Merger and the other transactions contemplated by

this Agreement are fair and advisable to, and in the best interests of, Parent and its shareholders.

NOW, THEREFORE, in consideration

of the premises set forth above, which are incorporated in this Agreement as if fully set forth below, and the representations, warranties,

covenants and agreements contained in this Agreement, and intending to be legally bound hereby, the parties accordingly agree as follows:

Article I

DEFINITIONS

The terms defined in the preamble

shall have the respective meanings ascribed thereto, and following terms, as used herein, have the following meanings:

1.1

“Action” means any legal action, suit, claim, investigation, hearing or Proceeding, including any audit, claim or assessment

for Taxes or otherwise.

1.2

“Additional Agreements” mean the Lock-up Agreement, the Shareholder Support Agreement, the Sponsor Support Agreement,

the Sponsor Registration Rights Agreement, and each other agreement, document, instrument or certificate contemplated by this Agreement

to be executed in connection with the Transactions.

1.3

“Affiliate” means, with respect to any Person, any other Person directly or indirectly Controlling, Controlled by,

or under common Control with such Person. For avoidance of any doubt, with respect to all periods subsequent to the Closing, Purchaser

is an Affiliate of the Company.

1.4

“ADRs” or American Depositary Receipts” means one or more certificates evidencing the ADSs.

1.5

“ADSs” means the American Depositary Shares, which may be in certificated or uncertificated form, representing the

Purchaser Ordinary Shares to be deposited by the Purchaser with a depositary bank pursuant to a deposit agreement by and between the Purchaser

and a depositary bank in the United States, in the form to be agreed to by the Purchaser, the Company, the Parent and the depositary bank.

1.6

“Books and Records” means all books and records, ledgers, employee records, customer lists, files, correspondence,

and other records of every kind (whether written, electronic, or otherwise embodied) owned or used by a Person or in which a Person’s

assets, the business or its transactions are otherwise reflected, other than stock books and minute books.

1.7

“Business Day” means any day other than a Saturday, Sunday or a legal holiday on which commercial banking institutions

in New York, New York are authorized to close for business.

1.8

“Cayman Companies Act” means the Companies Act of the Cayman Islands, as amended to date.

1.9

“Closing Payment Shares” means such number of Purchaser Ordinary Shares, including American Depositary Shares representing

certain Purchaser Ordinary Shares that are Class A ordinary shares of Purchaser, equal or equivalent to the Merger Consideration divided

by $10.00.

1.10

“Code” means the Internal Revenue Code of 1986, as amended.

1.11

“Company Formation Date” means December 2, 2020.

1.12

“Company Ordinary Shares” shall mean the ordinary shares, par value $0.00001 per share, of the Company as existing

as of the date hereof and immediately prior to the Effective Time.

1.13

“Contracts” means the Leases and all contracts, agreements, leases (including equipment leases, car leases and capital

leases), licenses, commitments, client contracts, statements of work (SOWs), sales and purchase orders and similar instruments, oral or

written, to which the Company and/or any of its Subsidiary is a party or by which any of its respective assets are bound, including any

entered into by the Company and/or any of its Subsidiary in compliance with this Agreement after the Signing Date and prior to the Closing.

1.14

“Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management

and policies of a Person, whether through the ownership of voting securities, by Contract or otherwise; and the terms “Controlled”

and “Controlling” shall have the meaning correlative to the foregoing.

1.15

“Data Protection Laws” means all applicable Laws in any applicable jurisdiction relating to the processing, privacy,

security, or protection of Personal Data, and all regulations or guidance issued thereunder.

1.16

“Deferred Underwriting Amount” means the portion of the underwriting discounts and commissions held in the Trust Account,

which the underwriters of the IPO are entitled to receive upon the Closing in accordance with the Investment Management Trust Agreement.

1.17

“DGCL” means the Delaware General Corporation Law (Title 8, Chapter 1 of the Delaware Code).

1.18

“Environmental Laws” shall mean all applicable Laws that prohibit, regulate or control any Hazardous Material or any

Hazardous Material Activity, including, without limitation, the Comprehensive Environmental Response, Compensation, and Liability Act

of 1980, the Resource Recovery and Conservation Act of 1976, the Federal Water Pollution Control Act, the Clean Air Act, the Hazardous

Materials Transportation Act and the Clean Water Act.

1.19

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

1.20

“Governmental Authority” means any United States or non-United States government entity, body or authority, including

(i) any United States federal, state or local government (including any town, village, municipality, district or other similar governmental

or administrative jurisdiction or subdivision thereof, whether incorporated or unincorporated), (ii) any non-United States government

or governmental authority or any political subdivision thereof, (iii) any United States or non-United States regulatory or administrative

entity, authority, instrumentality, jurisdiction, agency, body or commission, exercising, or entitled to exercise, any administrative,

executive, judicial, legislative, police, regulatory, or taxing authority or power, or (iv) any official of any of the foregoing acting

in such capacity.

1.21

“Hazardous Material” shall mean any material, emission, chemical, substance or waste that has been designated by any

Governmental Authority to be radioactive, toxic, hazardous, a pollutant or a contaminant.

1.22

“Hazardous Material Activity” shall mean the transportation, transfer, recycling, storage, use, treatment, manufacture,

removal, remediation, release, exposure of others to, sale, labeling, or distribution of any Hazardous Material or any product or waste

containing a Hazardous Material, or product manufactured with ozone depleting substances, including, any required labeling, payment of

waste fees or charges (including so-called e-waste fees) and compliance with any recycling, product take-back or product content requirements.

1.23

“HSR Act” means The Hart–Scott–Rodino Antitrust Improvements Act of 1976.

1.24

“Indebtedness” means with respect to any Person, (a) all obligations of such Person for borrowed money, or with respect

to deposits or advances of any kind (including amounts by reason of overdrafts and amounts owed by reason of letter of credit reimbursement

agreements) including with respect thereto, all interests, fees and costs and prepayment and other penalties, (b) all obligations of such

Person evidenced by bonds, debentures, notes or similar instruments, (c) all obligations of such Person under conditional sale or other

title retention agreements relating to property purchased by such Person, (d) all obligations of such Person issued or assumed as the

deferred purchase price of property or services (other than accounts payable to creditors for goods and services incurred in the ordinary

course of business), (e) all Indebtedness of others secured by (or for which the holder of such Indebtedness has an existing right, contingent

or otherwise, to be secured by) any lien or security interest on property owned or acquired by such Person, whether or not the obligations

secured thereby have been assumed, (f) all obligations of such Person under leases required to be accounted for as capital leases under

U.S. GAAP (as defined below), (g) all guarantees by such Person and (h) any agreement to incur any of the same.

1.25

“Intellectual Property” or “Intellectual Property Right” means all of the worldwide

intellectual property and proprietary rights associated with any of the following, whether registered, unregistered or registrable,

to the extent recognized in a particular jurisdiction: (a) trademarks and service marks, trade dress, product configurations,

trade names and other indications of origin, applications or registrations in any jurisdiction pertaining to the foregoing and all

goodwill associated therewith; (b) discoveries, inventions, ideas, Know-How, systems, technology, whether patentable or not,

and all issued patents, industrial designs, and utility models, and all applications pertaining to the foregoing, in any

jurisdiction, including re-issues, continuations, divisionals, continuations-in-part, re-examinations, renewals, counterparts,

extensions, validations, and other extensions of legal protestation pertaining thereto; (c) trade secrets and other rights in

confidential and other nonpublic information that derive economic value from not being generally known and not being readily

ascertainable by proper means, including the right in any jurisdiction to limit the use or disclosure thereof; (d) software;

(e) copyrights in writings, designs, software, mask works, content and any other original works of authorship in any medium,

including applications or registrations in any jurisdiction for the foregoing; (f) data and databases; (g) internet

websites, domain names and applications and registrations pertaining thereto; and (h) social media accounts, and all content

contained therein.

1.26

“Inventory” is defined in the UCC.

1.27

“Investment Management Trust Agreement” means the investment management trust agreement made as of November 17, 2021

by and between Parent and the Trustee.

1.28

“IPO” means the initial public offering of Parent pursuant to a prospectus dated November 17, 2021.

1.29

“IRS” means the U.S. Internal Revenue Service.

1.30

“Know-How” means all information, unpatented inventions (whether or not patentable), improvements, practices, algorithms,

formulae, trade secrets, techniques, methods, procedures, knowledge, results, protocols, processes, models, designs, drawings, specifications,

materials and any other information related to the development, marketing, pricing, distribution, cost, sales and manufacturing of products.

1.31

“Law” or “Laws” means any domestic or foreign, federal, state, municipality or local law, statute,

ordinance, code, principle of common law, act, treaty or order of general applicability of any applicable Governmental Authority, including

rule or regulation promulgated thereunder.

1.32

“Leases” all leases, subleases, licenses, concessions and other occupancy agreements (written or oral) for Real Property,

together with all fixtures and improvements erected on the premises leased thereby.

1.33

“Liabilities” means any and all liabilities, Indebtedness, claims, or obligations of any nature (whether absolute,

accrued, contingent or otherwise, whether known or unknown, whether direct or indirect, whether matured or unmatured and whether due or

to become due), including Tax Liabilities due.

1.34

“Lien” means, with respect to any asset, any mortgage, lien, pledge, charge, security interest or encumbrance of any

kind in respect of such asset, and any conditional sale or voting agreement or proxy, including any agreement to give any of the foregoing.

1.35

“Lock-up Agreement” means the agreement relating to the shares of the Redomestication Merger Surviving Corporation

to be effective as of the Closing, in substantially the form attached as Exhibit B.

1.36 “Material

Adverse Effect” or “Material Adverse Change” means a material adverse change or a material adverse effect

upon on the assets, Liabilities, condition (financial or otherwise), prospects, net worth, management, earnings, cash flows, business,

operations or properties of the Company and the Business, taken as a whole, whether or not arising from transactions in the ordinary

course of business, provided, however, that “Material Adverse Effect” or “Material Adverse Change” shall

not include any event, occurrence, fact, condition or change, directly or indirectly, arising out of or attributable to: (i) general

economic or political conditions; (ii) conditions generally affecting the industries in which the Company operates; (iii) any changes

in financial, banking or securities markets in general, including any disruption thereof and any decline in the price of any security

or any market index or any change in prevailing interest rates; (iv) acts of war (whether or not declared), armed hostilities or terrorism,

or the escalation or worsening thereof; (v) any action required or permitted by this Agreement or any action taken (or omitted to be

taken) with the written consent of or at the written request of the Parent Parties; (vi) any changes in applicable Laws or accounting

rules (including U.S. GAAP) or the enforcement, implementation or interpretation thereof; or (vii) any natural or man-made disaster or

acts of God, including the continued outbreak of the COVID-19 virus; unless any such any event, occurrence, fact, condition or change,

shall have a disproportionate effect on the Company and the Business as compared to comparable companies in the same industry.

1.37

“Merger Consideration” means One Billion Five Hundred Million Dollars ($1,500,000,000).

1.38

“Nasdaq” means the electronic dealer quotation system owned and operated by The Nasdaq Stock Market, Inc.

1.39

“Order” means any decree, order, judgment, writ, award, injunction, rule or consent of or by a Governmental Authority.

1.40

“Organizational Documents” means, with respect to any Person, its certificate of incorporation, certificate of formation,

articles of incorporation, articles of formation, bylaws, memorandum and articles of association, limited liability company agreement

or similar organizational documents, in each case, as amended.

1.41

“Parent Common Shares” means the shares of common stock, $0.0001 par value, of Parent.

1.42

“Parent Option” means each option to purchase Parent Common Shares.

1.43

“Parent Parties” means Parent, Purchaser and Merger Sub collectively, and “Parent Party” refers

to any one of them.

1.44

“Parent Rights” means the rights to receive one-twentieth (1/20) of one Parent Common Share upon the consummation of

an initial business combination.

1.45

“Parent Warrants” means the redeemable right to purchase three-fourths (3/4) of one Parent Common Share at a price

of $11.50 per whole share.

1.46

“Parent Unit” means a unit of Parent comprised of one Parent Common Share, one Parent Warrant and one Parent Right,

including all “private units” described in the Prospectus.

1.47

“PCAOB” means the Public Company Accounting Oversight Board.

1.48

“Permitted Liens” means (i) all defects, exceptions, restrictions, easements, rights of way and encumbrances disclosed

in policies of title insurance which have been made available to the Parent Parties; (ii) mechanics’, carriers’, workers’,

repairers’ and similar statutory Liens arising or incurred in the ordinary course of business for amounts (A) that are not delinquent,

(B) that are not material to the business, operations and financial condition of the Company and/or any of its Subsidiaries so encumbered,

either individually or in the aggregate, and (C) that not resulting from a breach, default or violation by the Company and/or any of its

Subsidiaries of any Contract or Law; and (iii) liens for Taxes not yet due and payable or which are being contested in good faith by appropriate

Proceedings (and for which adequate accruals or reserves have been established in accordance to U.S. GAAP).

1.49

“Person” means an individual, corporation, partnership (including a general partnership, limited partnership or limited

liability partnership), limited liability company, association, trust or other entity or organization, including a government, domestic

or foreign, or political subdivision thereof, or an agency or instrumentality thereof.

1.50

“Personal Data” means, with respect to any natural Person, such Person’s name, street address, telephone number,

e-mail address, photograph, social security number, tax identification number, driver’s license number, passport number, credit

card number, bank account number and other financial information, customer or account numbers, account access codes and passwords, any

other information that allows the identification of such Person or enables access to such Person’s financial information or that

is defined as “personal data,” “personally identifiable information,” “personal information,” “protected

health information” or similar term under any applicable Privacy Laws.

1.51

“Pre-Closing Period” means any period that ends on or before the Closing Date or with respect to a period that includes

but does not end on the Closing Date, the portion of such period through and including the day of the Closing.

1.52

“Principal Shareholder” means Chipring Technology Limited.

1.53

“Privacy Laws” means all applicable United States state and federal Laws, and the laws of other non-U.S. jurisdictions

applicable to the Company or any Subsidiary, relating to privacy and protection of Personal Data, including without limitation the General

Data Protection Regulation of the European Union, and any and all similar state and federal Laws relating to privacy, security, data protection,

data availability and destruction and data breach, including security incident notification.

1.54

“Proceeding” means any action, suit, proceeding, complaint, claim, charge, hearing, labor dispute, inquiry or investigation

before or by a Governmental Authority or an arbitrator.

1.55

“Purchaser Ordinary Shares” means, collectively, (i) the Class B ordinary shares of Purchaser, with respect to Chipring

Technology Limited and (ii) the Class A ordinary shares of Purchaser, with respect to all other shareholders. Each such Class B ordinary

shares shall have five (5) votes, and each such Class A ordinary shares shall have one (1) vote, with certain rights and privileges set

forth in the amended and restated Memorandum and Articles of Association of Redomestication Merger Surviving Corporation substantially

in the form attached hereto as Exhibit F.

1.56

“Purchaser Rights” means all Parent Rights upon their conversion in Redomestication Merger.

1.57

“Purchaser Units” means all the Parent Units upon their conversion in Redomestication Merger.

1.58

“Purchaser Warrants” means all the Parent Warrants upon their conversion in Redomestication Merger.

1.59

“Real Property” means, collectively, all real properties and interests therein (including the right to use), together

with all buildings, fixtures, trade fixtures, plant and other improvements located thereon or attached thereto; all rights arising out

of use thereof (including air, water, oil and mineral rights); and all subleases, franchises, licenses, permits, easements and rights-of-way

which are appurtenant thereto.

1.60

“Redomestication Merger Surviving Corporation Ordinary Shares” means the Class A ordinary shares of the Redomestication

Merger Surviving Corporation.

1.61

“Redomestication Merger Surviving Corporation Rights” means all the Parent Rights upon their conversion in Redomestication

Merger.

1.62

“Redomestication Merger Surviving Corporation Units” means all the Parent Units upon their conversion in Redomestication

Merger.

1.63

“Redomestication Merger Surviving Corporation Warrants” means all the Parent Warrants upon their conversion in Redomestication

Merger.

1.64

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002, as amended.

1.65

“SEC” means the Securities and Exchange Commission.

1.66

“Sensitive Data” means all confidential information, classified information, proprietary information, trade secrets

and any other information, the security or confidentiality of which is protected by Law or Contract, that is collected, maintained, stored,

transmitted, used, disclosed or otherwise processed by the Company. Sensitive Data also includes Personal Data which is held, stored,

collected, transmitted, transferred (including cross-border transfers), disclosed, sold or used by the Company.

1.67

“Securities Act” means the Securities Act of 1933, as amended.

1.68

“Sponsor” means Arisz Investment LLC, a Delaware limited liability company.

1.69

“Shareholder” means each holder of Company Ordinary Shares, and “Shareholders” refers to all of

them collectively.

1.70

“Shareholder Support Agreement” means the agreement entered into by a majority of the Shareholders, substantially in

the form attached hereto as Exhibit C, providing that, among other things, such Shareholders will vote their Company

Shares in favor of the Requisite Company Vote on the terms and subject to the conditions set forth in such agreement.

1.71

“Sponsor Registration Rights Agreement” means the amended and restated agreement governing the resale of the shares,

rights, warrants and units of the Redomestication Merger Surviving Corporation, in the form attached hereto as Exhibit D.

1.72

“Sponsor Support Agreement” means the agreement entered into by the Sponsor and its Affiliates, substantially in the

form attached hereto as Exhibit E, providing that, among other things, the Sponsor will vote its Parent Shares in favor of

the transactions contemplated by this Agreement on the terms and subject to the conditions set forth in such agreement.

1.73

“Subsidiary” or “Subsidiaries” means one or more entities of which at least fifty percent (50%)

of the capital stock or share capital or other equity or voting securities are Controlled or owned, directly or indirectly, by the respective

Person.

1.74

“Tangible Personal Property” means all tangible personal property and interests therein, including machinery, computers

and accessories, furniture, office equipment, communications equipment, automobiles, laboratory equipment and other equipment owned or

leased by the Company or any Company Subsidiary.

1.75

“Tax” means any federal, state, local or foreign tax, charge, fee, levy, custom, duty, deficiency, or other assessment

of any kind or nature imposed by any Taxing Authority (including any income (net or gross), gross receipts, profits, windfall profit,

sales, use, goods and services, ad valorem, franchise, license, withholding, employment, social security, workers compensation, unemployment

compensation, employment, payroll, transfer, excise, import, real property, personal property, intangible property, occupancy, recording,

minimum, alternative minimum, environmental or estimated tax), including any liability therefor as a transferee or successor, as a result

of Treasury Regulation Section 1.1502-6 or similar provision of applicable Law or as a result of any Tax sharing, indemnification or similar

agreement, together with any interest, penalties, additions to tax or additional amounts imposed with respect thereto.

1.76

“Taxing Authority” means the Internal Revenue Service and any other Governmental Authority responsible for the collection,

assessment or imposition of any Tax or the administration of any Law relating to any Tax.

1.77

“Tax Return” means any return, information return, declaration, claim for refund or credit, report or any similar

statement, and any amendment thereto, including any attached schedule and supporting information, whether on a separate,

consolidated, combined, unitary or other basis, that is filed or required to be filed with any Taxing Authority in connection with

the determination, assessment, collection or payment of a Tax or the administration of any Law relating to any Tax.

1.78

“Trust Amount” means the amount of cash available in the Trust Account after deducting redemptions of Parent/Purchaser

public shareholders.

1.79

“UCC” means the Uniform Commercial Code of the State of New York, or any corresponding or succeeding provisions of

Laws of the State of New York, or any corresponding or succeeding provisions of Laws, in each case as the same may have been and hereafter

may be adopted, supplemented, modified, amended, restated or replaced from time to time.

1.80

“U.S. GAAP” means U.S. generally accepted accounting principles, consistently applied.

1.81

“$” means U.S. dollars, the legal currency of the United States.

GLOSSARY

| “Affiliate Transaction” |

Section 5.35(a) |

| “Alternative Proposal” |

Section 7.1(b) |

| “Alternative Transaction” |

Section 7.1(b) |

| “Anti-Corruption Laws” |

Section 5.32(a) |

| “Additional Parent Parties SEC Documents” |

Section 6.14(a) |

| “Audited 2020/2021 Financial Statements” |

Section 7.5 |

| “Closing” |

Section 3.2 |

| “Closing Date” |

Section 3.2 |

| “Company Leases” |

Section 5.26(b) |

| “Computer Systems” |

Section 5.19(i) |

| “Continental” |

Section 4.2(b) |

| “D&O Indemnified Persons” |

Section 7.7(a) |

| “D&O Tail Insurance” |

Section 7.7(b) |

| “Effective Time” |

Section 3.2 |

| “Exchange Fund” |

Section 4.2(b) |

| “Excluded Shares” |

Section 4.1(c) |

| “Export Control Laws” |

Section 5.32(a) |

| “Financial Statements” |

Section 5.11(a) |

| “International Trade Control Laws” |

Section 5.32(a) |

| “IT Providers” |

Section 5.19(k) |

| “Labor Agreements” |

Section 5.24(a) |

| “Material Contracts” |

Section 5.16(a) |

| “Merger Sub Ordinary Shares” |

Section 6.7(c) |

| “Outside Date” |

Section 11.1(d)(i) |

| “Owned Intellectual Property” |

Section 5.19(a) |

| “Parent Parties Financial Statements” |

Section 6.14(b) |

| “Parent Party Shareholder Approval Matters” |

Section 9.5 |

| “Parent SEC Documents” |

Section 6.14(a) |

| “Per Share Merger Consideration” |

Section 4.1(a) |

| “Permits” |

Section 5.17 |

| “Plan of Merger” |

Section 3.2 |

| “PM1” |

Section 2.2 |

| “Privacy Policy” |

Section 5.19(j) |

| “Prohibited Party” |

Section 5.32(b) |

| “Prospectus” |

Section 9.5 |

| “Proxy Statement/Prospectus” |

Section 9.5 |

| “Purchaser Investor” |

Section 6.21 |

| “Purchaser Special Meeting” |

Section 9.5(a) |

| “Redomestication Merger Certificate” |

Section 2.2 |

| “Redomestication Merger Effective Time” |

Section 2.2 |

| “Redomestication Merger Surviving Corporation” |

Section 2.1 |

| “Registrar” |

Section 2.2 |

| “Registration Statement” |

Section 9.5 |

| “Required Purchaser Shareholder Approval” |

Section 10.1(e) |

| “Requisite Company Vote” |

Section 5.2 |

| “Sanctions Laws” |

Section 5.32(a) |

| “Scheduled Intellectual Property” |

Section 5.19(a) |

| “Standards Agreements” |

Section 5.19(n) |

| “Standards Body” |

Section 5.19(n) |

| “Stockholder Register” |

Section 2.6(a)(i) |

| “Surviving Corporation” |

Section 3.1 |

| “Trust Account” |

Section 6.9 |

| “Trust Fund” |

Section 6.9 |

| “Trustee” |

Section 6.9 |

Article II

REDOMESTICATION MERGER

2.1

Redomestication Merger. At the Redomestication Merger Effective Time, and subject to and upon the terms and conditions of this

Agreement, and in accordance with the applicable provisions of the Cayman Companies Act and the DGCL, respectively, Parent shall be merged

with and into Purchaser, the separate corporate existence of Parent shall cease and Purchaser shall continue as the surviving corporation.

Purchaser as the surviving corporation after Redomestication Merger is hereinafter sometimes referred to as the “Redomestication

Merger Surviving Corporation”.

2.2

Redomestication Merger Effective Time. The parties hereto shall cause Redomestication Merger to be consummated by filing a certificate

of merger (the “Redomestication Merger Certificate”) with the Secretary of State of the State of Delaware, in accordance

with the relevant provisions of the DGCL, and the filing of the Plan of Merger (the “PM1”) (and other documents required

by the Cayman Companies Act) with the Registrar of Companies of the Cayman Islands (the “Registrar”), in accordance

with the relevant provisions of the Cayman Companies Act. The effective time of Redomestication Merger shall be the later of the acceptance

of the Redomestication Merger Certificate and the time that PM1 are duly registered by the Registrar, or such later time as specified

in the Redomestication Merger Certificate and PM1, being the “Redomestication Merger Effective Time.”

2.3

Effect of Redomestication Merger. At the Redomestication Merger Effective Time, the effect of Redomestication Merger shall be as

provided in this Agreement, the Redomestication Merger Certificate, PM1 and the applicable provisions of the DGCL and the Cayman Companies

Act. Without limiting the generality of the foregoing, and subject thereto, at the Redomestication Merger Effective Time, all the property,

rights, privileges, agreements, powers and franchises, debts, liabilities, duties and obligations of Parent and Purchaser prior to the

Redomestication Merger Effective Time shall become the property, rights, privileges, agreements, powers and franchises, debts, liabilities,

duties and obligations of the Redomestication Merger Surviving Corporation, which shall include the assumption by the Redomestication

Merger Surviving Corporation of any and all agreements, covenants, duties and obligations of Parent set forth in this Agreement to be

performed after the Closing, and all securities of the Redomestication Merger Surviving Corporation issued and outstanding as a result

of the conversion under Section 2.6 hereof shall be listed on the public trading market on which the Parent Common Shares were

trading prior to Redomestication Merger.

2.4

Charter Documents. At the Redomestication Merger Effective Time, the Certificate of Incorporation and Bylaws of Parent, as in effect

immediately prior to the Redomestication Merger Effective Time, shall cease and the Memorandum and Articles of Association of the of Purchaser,

shall be amended and restated so that they read in their entirety as set forth substantially in the form attached hereto as Exhibit

F, and as so amended and restated, shall be the Memorandum and Articles of Association of the Redomestication Merger Surviving Corporation.

2.5

Directors and Officers of the Redomestication Merger Surviving Corporation. As of the Redomestication Merger Effective Time, the

board of directors of Parent shall be the board of directors of the Redomestication Merger Surviving Corporation.

2.6

Effect on Issued Securities of Parent.

(a)

Conversion of Parent Common Shares.

(i)

At the Redomestication Merger Effective Time, each issued and outstanding Parent Common Share (other than those described in Section

2.6(c) below) shall be converted automatically into one Purchaser Ordinary Share. At the Redomestication Merger Effective Time, all

Parent Common Shares shall cease to be issued and shall automatically be canceled and retired and shall cease to exist. The holders of

issued Parent Common Shares immediately prior to the Redomestication Merger Effective Time, as evidenced by the stockholder register of

Parent (the “Stockholder Register”), shall cease to have any rights with respect to such Parent Common Shares, except

as provided herein or by Law. Each certificate (if any) previously evidencing Parent Common Shares shall be exchanged for a certificate

representing the same number of Purchaser Ordinary Shares upon the surrender of such certificate in accordance with Section 2.7.

(ii)

Each holder of Parent Common Shares listed on the Stockholder Register shall thereafter have the right to receive the same number of Purchaser

Ordinary Shares only.

(b)

Conversion of Parent Rights, Parent Warrants and Parent Units. At the Redomestication Merger Effective Time, (i) all Parent Rights

shall be converted into Redomestication Merger Surviving Corporation Rights, (ii) all Parent Warrants shall be converted into Redomestication

Merger Surviving Corporation Warrants and (iii) all Parent Units shall be converted into Redomestication Merger Surviving Corporation

Units. At the Redomestication Merger Effective Time, each Parent Right, Parent Warrant and Parent Unit shall cease to be outstanding and

shall automatically be canceled and retired and shall cease to exist. Each of the Redomestication Merger Surviving Corporation Rights,

Redomestication Merger Surviving Corporation Warrants and Redomestication Merger Surviving Corporation Units shall have, and be subject

to, the same terms and conditions set forth in the applicable agreements governing the Parent Rights, the Parent Warrants and Parent Units,

respectively, that are outstanding immediately prior to the Redomestication Merger Effective Time. At or prior to the Redomestication

Merger Effective Time, Purchaser shall take all corporate action necessary to reserve for future issuance, and shall maintain such reservation

for so long as any of the Redomestication Merger Surviving Corporation Rights remain outstanding, a sufficient number of Redomestication

Merger Surviving Corporation Ordinary Shares for delivery upon the exercise of the Redomestication Merger Surviving Corporation Rights,

the Redomestication Merger Surviving Corporation Warrants and the Redomestication Merger Surviving corporation Units after the Redomestication

Merger Effective Time.

(c)

Cancellation of Parent Common Shares Owned by Parent. At the Redomestication Merger Effective Time, if there are any Parent Common

Shares that are owned by Parent as treasury shares or any Parent Common Shares owned by any direct or indirect wholly owned subsidiary

of Parent immediately prior to the Redomestication Merger Effective Time, such shares shall be canceled and extinguished without any

conversion thereof or payment therefor.

(d)

No Liability. Notwithstanding anything to the contrary in this Section 2.6, none of the Redomestication Merger Surviving Corporation,

Purchaser or any Party hereto shall be liable to any person for any amount properly paid to a public official pursuant to any applicable

abandoned property, escheat or similar law.

2.7

Surrender of Parent Common Shares. All securities issued upon the surrender of the Parent Common Shares in accordance with the

terms hereof, shall be deemed to have been issued in full satisfaction of all rights pertaining to such securities, provided that any

restrictions on the sale and transfer of the Parent Common Shares shall also apply to the Purchaser Ordinary Shares so issued in exchange.

2.8

Lost Stolen or Destroyed Certificates. In the event any certificates shall have been lost, stolen or destroyed, Purchaser shall

issue in exchange for such lost, stolen or destroyed certificates or securities, as the case may be, upon the making of an affidavit of

that fact by the holder thereof, such securities, as may be required pursuant to Section 2.7; provided, however, that the Redomestication

Merger Surviving Corporation may, in its discretion and as a condition precedent to the issuance thereof, require the owner of such lost,

stolen or destroyed certificates to deliver a bond in such sum as it may reasonably direct as indemnity against any claim that may be

made against Redomestication Merger Surviving Corporation with respect to the certificates alleged to have been lost, stolen or destroyed.

2.9

Section 368 Reorganization. For U.S. federal income tax purposes, Parent and Purchaser intend that the Redomestication Merger will

constitute a transaction that qualifies as a “reorganization” within the meaning of Section 368(a) of the Code to which each

of Parent and the Purchaser is a party under Section 368(b) of the Code (the “Redomestication Intended Tax Treatment”).

Parent and Purchaser hereby (i) adopt, and the Company acknowledges, this Agreement as a “plan of reorganization” within the

meaning of Treasury Regulation Section 1.368-2(g), (ii) agree to file and retain such information as shall be required under Treasury

Regulation Section 1.368-3, and (iii) agree to file all Tax and other informational returns on a basis consistent with the Redomestication

Intended Tax Treatment. Notwithstanding the foregoing or anything else to the contrary contained in this Agreement, the parties acknowledge

and agree that no party is making any representation or warranty as to the qualification of Redomestication Merger for the Redomestication

Intended Tax Treatment or as to the effect, if any, that any transaction consummated on, after or prior to the Redomestication Merger

Effective Time has or may have on any such reorganization status. Each of the parties acknowledges and agrees that each (i) has had the

opportunity to obtain independent legal and tax advice with respect to the transactions contemplated by this Agreement, and (ii) is responsible

for paying its own Taxes, including any adverse Tax consequences that may result if the Redomestication Merger is determined not to qualify

for the Redomestication Intended Tax Treatment.

2.10 Taking

of Necessary Action; Further Action. If, at any time after the Redomestication Merger Effective Time, any further action is

necessary or desirable to carry out the purposes of this Agreement and to vest the Redomestication Merger Surviving Corporation with

full right, title and possession to all assets, property, rights, privileges, powers and franchises of Parent and Purchaser, the

officers and directors of Parent and Purchaser are fully authorized in the name of their respective corporations or otherwise to

take, and will take, all such lawful and necessary action, so long as such action is not inconsistent with this Agreement.

Article III

ACQUISITION MERGER

3.1

Acquisition Merger. Upon and subject to the terms and conditions set forth in this Agreement, on the Closing Date, immediately

after the Redomestication Merger and in accordance with the applicable provisions of the Cayman Companies Act, Merger Sub shall be merged

with and into the Company. Following the Acquisition Merger, the separate corporate existence of Merger Sub shall cease, and the Company

shall continue as the surviving company in the Acquisition Merger (the “Surviving Corporation”) under the Cayman Companies

Act and become a wholly owned subsidiary of Purchaser.

3.2

Closing; Effective Time. Unless this Agreement is earlier terminated in accordance with Article XII, the closing of the Acquisition

Merger (the “Closing”) shall take place immediately after the Redomestication Merger at the offices of Loeb & Loeb

LLP, 345 Park Avenue, New York, New York on a date no later than three (3) Business Days after the satisfaction or waiver of all the conditions

set forth in Article X that are required to be satisfied prior to the Closing Date, or at such other place and time as the Company and

the Parent Parties may mutually agree upon. The parties may participate in the Closing via electronic means. The date on which the Closing

actually occurs is hereinafter referred to as the “Closing Date”. At the Closing, the parties hereto shall execute

a plan of merger (the “Plan of Merger”) in form and substance acceptable to the Parent Parties and the Company, and

the parties hereto shall cause the Acquisition Merger to be consummated by filing the Plan of Merger (and other documents required by

the Cayman Companies Act) with the Registrar in accordance with the provisions of the Cayman Companies Act. The Acquisition Merger shall

become effective at the time when the Plan of Merger is accepted by the Registrar in accordance with the Cayman Companies Act (the “Effective

Time”).

3.3

Board of Directors. Immediately after the Closing, the Surviving Corporation’s board of directors shall consist of at least

five (5) directors, three (3) of whom shall be independent directors under Nasdaq rules. Sponsor shall have the right, but not the obligation,

to designate, or cause to be designated, one (1) of the independent director to serve as a director of Purchaser until the next annual

shareholder meeting of Purchaser, and the Company shall have the right, but not the obligation, to designate, or cause to be designated,

the remaining directors.

3.4

Effect of the Acquisition Merger. At the Effective Time, the effect of the Acquisition Merger shall be as provided in this Agreement,

the Plan of Merger and the applicable provisions of the Cayman Companies Act. Without limiting the generality of the foregoing, and subject

thereto, at the Effective Time, all the property, rights, privileges, agreements, powers and franchises, debts, Liabilities, duties and

obligations of Merger Sub shall become the property, rights, privileges, agreements, powers and franchises, debts, Liabilities, duties

and obligations of the Surviving Corporation, which shall include the assumption by the Surviving Corporation of any and all agreements,

covenants, duties and obligations of Merger Sub set forth in this Agreement to be performed after the Effective Time.

3.5

Memorandum and Articles of Association of the Surviving Corporation. At the Effective Time, and without any further action on the

part of the Company or Merger Sub, the Memorandum and Articles of Association of the Company shall become the Memorandum and Articles

of Association of the Surviving Corporation until thereafter amended in accordance with its terms and as provided by law.

3.6

Stock Transfer Books. At the Effective Time, the stock transfer books of the Company shall be closed and thereafter there shall

be no further registration of transfers of Company Ordinary Shares on the records of the Company.

3.7

Rights Not Transferable. The rights of the Shareholders as of immediately prior to the Effective Time are personal to each such

Shareholder and shall not be assignable or otherwise transferable for any reason (except (i) by operation of Law or (ii) in the case of

a natural Person, by will or the Laws of descent and distribution). Any attempted transfer of such right by any Shareholder (otherwise

than as permitted by the immediately preceding sentence) shall be null and void.

3.8

Taking of Necessary Action; Further Action. If, at any time after the Effective Time, any further action is necessary or desirable

to carry out the purposes of this Agreement and to vest the Surviving Corporation with full right, title and interest in, to and under,

and/or possession of, all assets, property, rights, privileges, powers and franchises of Merger Sub and the Company, the officers and

directors of Merger Sub and the Company are fully authorized in the name of their respective corporations or otherwise to take, and will

take, all such lawful and necessary action, so long as such action is not inconsistent with this Agreement.

3.9

Section 368 Reorganization. For U.S. federal income tax purposes, each of the parties intends that the Acquisition Merger will

constitute a transaction that qualifies as a “reorganization” within the meaning of Section 368(a) of the Code to which each

of Purchaser, Merger Sub and the Company is a party under Section 368(b) of the Code (the “Acquisition Intended Tax Treatment”).

The parties to this Agreement hereby (i) adopt this Agreement as a “plan of reorganization” within the meaning of Treasury

Regulation Section 1.368-2(g), (ii) agree to file and retain such information as shall be required under Treasury Regulation Section 1.368-3,

and (iii) agree to file all Tax and other informational returns on a basis consistent with the Acquisition Intended Tax Treatment. Notwithstanding

the foregoing or anything else to the contrary contained in this Agreement, the parties acknowledge and agree that no party is making

any representation or warranty as to the qualification of the Acquisition Merger for the Acquisition Intended Tax Treatment or as to the

effect, if any, that any transaction consummated on, after or prior to the Acquisition Merger Effective Time has or may have on any such

reorganization status. Each of the parties acknowledge and agree that each (i) has had the opportunity to obtain independent legal and

tax advice with respect to the transactions contemplated by this Agreement, and (ii) is responsible for paying its own Taxes, including

any adverse Tax consequences that may result if the Acquisition Merger is determined not to qualify for the Acquisition Intended Tax Treatment.

3.10 Transfers

of Ownership. If any certificate for Purchaser Ordinary Shares is to be issued in a name other than that in which the Company

Ordinary Share certificate surrendered in exchange therefor is registered, it will be a condition of the issuance thereof that the

certificate so surrendered will be properly endorsed (or accompanied by an appropriate instrument of transfer) and otherwise in

proper form for transfer and that the person requesting such exchange will have paid to Purchaser or any agent designated by it any

transfer or other Taxes required by reason of the issuance of a certificate for securities of Purchaser in any name other than that

of the registered holder of the certificate surrendered, or established to the satisfaction of Purchaser or any agent designated by

it that such tax has been paid or is not payable.

Article IV

CONSIDERATION

4.1

Conversion of Shares.

(a)

Conversion of Company Ordinary Shares. At the Effective Time, by virtue of the Acquisition Merger and without any action on the

part of Parent, Purchaser, Merger Sub, the Company or the Shareholders, each Company Ordinary Share issued and outstanding immediately

prior to the Effective Time shall be canceled and automatically converted into the right to receive, without interest, the applicable

number of Purchaser Ordinary Shares for such number of Company Ordinary Shares (the “Per Share Merger Consideration”)

as specified on Exhibit A hereto. For avoidance of any doubt, each Shareholder will cease to have any rights with respect to its

Company Ordinary Shares, except the right to receive the Per Share Merger Consideration.

(b)

Share Capital of Merger Sub. Each share of Merger Sub that is issued and outstanding immediately prior to the Effective Time will,

by virtue of the Acquisition Merger and without further action on the part of the sole shareholder of Merger Sub, be converted into and

become one ordinary share of the Surviving Corporation (and such share of the Surviving Corporation into which the one Merger Sub Ordinary

Share is so converted shall be the only share of the Surviving Corporation that is issued and outstanding immediately after the Effective

Time). Each certificate evidencing ownership of Merger Sub Ordinary Shares will, as of the Effective Time, evidence ownership of such

share(s) of ordinary shares of the Surviving Corporation.

(c)

Treatment of Certain Company Shares. At the Effective Time, all Company Ordinary Shares that are owned by the Company (as treasury

shares or otherwise) or any of its direct or indirect Subsidiaries as of immediately prior to the Effective Time (collectively, the “Excluded

Shares”) shall be automatically canceled and extinguished without any conversion or consideration delivered in exchange thereof.

(d)

No Liability. Notwithstanding anything to the contrary in this Section 4.1, none of Surviving Corporation or any party hereto shall

be liable to any Person for any amount properly paid to a public official pursuant to any applicable abandoned property, escheat or similar

law.

(e)

Surrender of Certificates. All securities issued upon the surrender of Company Ordinary Shares in accordance with the terms hereof

shall be deemed to have been issued in full satisfaction of all rights pertaining to such securities, provided that any restrictions

on the sale and transfer of such Company Ordinary Shares shall also apply to the Closing Payment Shares so issued in exchange.

(f) Lost, Stolen or Destroyed Certificates. In the event any certificates for any Company

Ordinary Share shall have been lost, stolen or destroyed, Purchaser shall cause to be issued in exchange for such lost, stolen or destroyed

certificates and for each such share, upon the making of an affidavit of that fact by the holder thereof; provided, however, that

Purchaser may, in its discretion and as a condition precedent to the issuance thereof, require the owner of such lost, stolen or destroyed

certificates to deliver a bond in such sum as it may reasonably direct as indemnity against any claim that may be made against Purchaser

with respect to the certificates alleged to have been lost, stolen or destroyed.

(g)

Adjustments in Certain Circumstances. Without limiting the other provisions of this Agreement, if at any time during the period

between the date of this Agreement and the Effective Time, any change in the outstanding securities of the Company, the Parent Common

Shares or the Purchaser Ordinary Shares shall occur (other than the issuance of additional shares of the Company or Parent or Purchaser

as permitted by this Agreement), including by reason of any reclassification, recapitalization, share split (including a reverse share

split), or combination, exchange, readjustment of shares, or similar transaction, or any share dividend or distribution paid in shares,

then the Closing Payment Shares and any other amounts payable pursuant to this Agreement shall be appropriately adjusted to reflect such

change; provided, however, that this sentence shall not be construed to permit Parent, Purchaser, Merger Sub or the Company to

take any action with respect to its securities that is prohibited by the terms of this Agreement.

4.2

Issuance of Merger Consideration.

(a)

No Issuance of Fractional Shares. No certificates or scrip representing fractional Closing Payment Shares will be issued pursuant

to the Acquisition Merger, and instead any such fractional share that would otherwise be issued will be rounded to the nearest whole share.

(b)

Exchange Fund. On the Closing Date, Purchaser shall deposit, or shall cause to be deposited, with Continental Stock Transfer &

Trust Company (“Continental”), or an agreed-upon depositary bank, as applicable, for the benefit of the Shareholder,

for exchange in accordance with this Article IV, the Closing Payment Shares (such shares of Parent Common Stock, the “Exchange

Fund”). Purchaser shall cause Continental or the depositary bank, pursuant to irrevocable instructions, to pay the Merger Consideration

out of the Exchange Fund in accordance with Exhibit A and the other applicable provisions contained in this Agreement. The Exchange

Fund shall not be used for any other purpose other than as contemplated by this Agreement.

4.3 Withholding.

Purchaser, the Company and any other applicable withholding agent shall be entitled to deduct and withhold from the consideration

otherwise payable to any Person pursuant to this Agreement such amounts as are required to be deducted or withheld with respect to

the making of such payment under the Code, or under any provision of state, local or non-U.S. Tax Law. To the extent that amounts

are so deducted, withheld and timely paid over to the appropriate Taxing Authority in accordance with applicable Law, such amounts

shall be treated for all purposes under this Agreement as having been paid to the Person in respect of which such deduction and

withholding was made. Notwithstanding the foregoing, Purchaser shall use commercially reasonable efforts to reduce or eliminate any

such withholding, including providing recipients of consideration a reasonable opportunity to provide documentation establishing

exemptions from or reductions of such withholdings.

Article V

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

Except as set forth in the

disclosure schedules delivered by the Company to the Parent Parties simultaneously with the execution of this Agreement, the Company hereby

represents and warrants to the Parent Parties that each of the following representations and warranties is true, correct and complete

as of the date of this Agreement and shall be as of the Closing Date (or, if such representations and warranties are made with respect

to a certain date, as of such date). The parties hereto agree that any reference to a particular schedule shall be deemed to be an exception

to the representations and warranties of the relevant part(ies) that are contained in the corresponding section of this Agreement only;

provided that where it is readily apparent on the face of a disclosure under a particular schedule that such disclosure is, or may be

reasonably determined to be, relevant to the matters described under any other sections of this Agreement, such disclosure may also be

deemed to be relevant to such other sections. For the avoidance of doubt, unless the context otherwise required, the below representations

and warranties relate to the Company on a consolidated basis with its Subsidiaries.

5.1

Corporate Existence and Power. The Company is a corporation duly incorporated, validly existing and in good standing under the

Laws of the Cayman Islands, and each of its Subsidiaries is duly organized, validly existing and in good standing under the laws of the

jurisdiction in which it was formed. The Company has all requisite power and authority, corporate and otherwise, and all governmental

licenses, franchises, Permits, authorizations, consents and approvals necessary and required to own and operate its properties and assets

and to carry on the Business as presently conducted, other than as would not be reasonably expected to, individually or in the aggregate,

have a Material Adverse Effect. The Company is duly licensed or qualified to do business and is in good standing in each jurisdiction

in which the properties owned or leased by it or the operation of its Business as currently conducted makes such licensing or qualification

necessary, except where the failure to be so licensed, qualified or in good standing would not have a Material Adverse Effect. Schedule

5.1 lists all jurisdictions in which the Company is qualified to conduct business as a foreign corporation or other entity.

5.2

Authorization. The Company has all requisite power and authority to execute and deliver this Agreement and the Additional Agreements

to which it is a party and to consummate the transactions contemplated hereby and thereby. This Agreement and all Additional Agreements

to which the Company is or shall be a party have been duly authorized by all necessary action on the part of the Company, subject to the

authorization and approval of this Agreement, the Plan of Merger and the transactions contemplated hereby by way of a special resolution

of the Shareholders passed by the affirmative vote of holders of Company Ordinary Shares representing at least two-thirds of the votes

of the Company Ordinary Shares present and voting in person or by proxy at a meeting of the shareholders of the Company in accordance

with the Organizational Documents of the Company (the “Requisite Company Vote”). This Agreement constitutes, and, upon

their execution and delivery, each of the Additional Agreements will constitute, a valid and legally binding agreement of the Company

enforceable against the Company in accordance with their respective terms to which it is a party.

5.3

Governmental Authorization. Neither the execution, delivery nor performance by the Company of this Agreement or any Additional

Agreements to which it is a party requires any consent, approval, license or other action by or in respect of, or registration, declaration

or filing with, any Governmental Authority other than the filing of the Plan of Merger and other related documents required by the Cayman

Companies Act, except for SEC or Nasdaq approval required to consummate the transactions contemplated hereunder.

5.4

Non-Contravention. None of the execution, delivery or performance by the Company of this Agreement or any Additional Agreements

to which it is a party does or will (a) contravene or conflict with the Organizational Documents of the Company, (b) contravene or conflict

with or constitute a violation of any provision of any Law or Order binding upon or applicable to the Company, constitute a default under

or breach of (with or without the giving of notice or the passage of time or both) or violate or give rise to any right of termination,

cancellation, amendment or acceleration of any right or obligation of the Company or require any payment or reimbursement or to a loss

of any material benefit relating to the Business to which the Company are entitled under any provision of any Permit, Contract or other

instrument or obligations binding upon the Company or by which any of the Company Ordinary Shares or any of the Company’s assets

is or may be bound, (c) result in the creation or imposition of any Lien on any of the Company Ordinary Shares, (d) cause a loss of any

material benefit relating to the Business to which the Company is or may be entitled under any provision of any Permit or Contract binding

upon the Company, or (e) result in the creation or imposition of any Lien (except for Permitted Liens) on any of the Company’s material

assets, in the cases of (a) to (e), other than as would not be reasonably expected to, individually or in the aggregate, have a Material

Adverse Effect.

5.5

Capitalization.

(a)

The capital of the Company is US$50,000.00 divided into 5,000,000,000 shares of a par value of US$0.00001 each, of which 157,894,737 are

issued and outstanding as of the date hereof. All of the issued and outstanding Company Ordinary Shares have been duly authorized and

validly issued, are fully paid and non-assessable, and are not subject to any preemptive rights and have not been issued in violation

of any preemptive or similar rights of any Person. As of the date hereof, all of the issued and outstanding Company Ordinary Shares are

owned legally and beneficially by the Persons set forth on Part 1 of Exhibit A, and immediately prior to the Closing, all of the

issued and outstanding Company Ordinary Shares will be owned legally and beneficially by the Persons set forth on Part 2 of Exhibit

A. The only Company Ordinary Shares that will be issued and outstanding immediately after the Closing will be the Company Ordinary

Shares owned by Purchaser. Except for the Company Ordinary Shares, no other class in the share capital of the Company is authorized or

issued or outstanding.

(b)

There are no (a) outstanding subscriptions, options, warrants, rights (including phantom stock rights), calls, commitments, understandings,

conversion rights, rights of exchange, plans or other agreements of any kind providing for the purchase, issuance or sale of any share

of the Company; or (b) to the knowledge of the Company, agreements with respect to any of the Company Ordinary Shares, including any voting

trust, other voting agreement or proxy with respect thereto.

5.6

Subsidiaries. Schedule 5.6 sets forth the name of each Subsidiary of the Company, and with respect to each Subsidiary,

its jurisdiction of organization, its authorized shares or other equity interests (if applicable), and the number of issued and outstanding

shares or other equity interests and the record holders thereof. Other than as set forth on Schedule 5.6, (i) all of the outstanding

equity securities of each Subsidiary of the Company are duly authorized and validly issued, duly registered and non-assessable (if applicable),

were offered, sold and delivered in material compliance with all applicable securities Laws, and are owned by the Company or one of its

Subsidiaries free and clear of all Liens (other than those, if any, imposed by such Subsidiary’s Organizational Documents); (ii)

there are no Contracts to which the Company or any of its Affiliates is a party or bound with respect to the voting (including voting

trusts or proxies) of the shares or other equity interests of any Subsidiary of the Company other than the Organizational Documents of

any such Subsidiary; (iii) there are no outstanding or authorized options, warrants, rights, agreements, subscriptions, convertible securities

or commitments to which any Subsidiary of the Company is a party or which are binding upon any Subsidiary of the Company providing for

the issuance or redemption of any shares or other equity interests or convertible equity interests in or of any Subsidiary of the Company;

(iv) there are no outstanding equity appreciation, phantom equity, profit participation or similar rights granted by any Subsidiary of

the Company; (v) no Subsidiary of the Company has any limitation on its ability to make any distributions or dividends to its equity holders,

whether by Contract, Order or applicable Law; (vi) except for the equity interests of the Subsidiaries listed on Schedule 5.6,

the Company does not own or have any rights to acquire, directly or indirectly, any shares or other equity interests of, or otherwise

Control, any Person; (vii) none of the Company or its Subsidiaries is a participant in any joint venture, partnership or similar arrangement,

and (viii) except as set forth on Schedule 5.6, there are no outstanding contractual obligations of the Company or its Subsidiaries

to provide funds to, or make any investment (in the form of a loan, capital contribution or otherwise) in, any other Person.

5.7

Organizational Documents. Copies of the Organizational Documents of the Company and each Subsidiary have heretofore been made available

to the Parent Parties, and such copies are each true and complete copies of such instruments as amended and in effect on the date hereof.

Neither the Company nor any Subsidiary has taken any action in violation of its Organizational Documents.

5.8

Corporate Records. The register of shareholders or the equivalent documents of the Company and of each Subsidiary, and all proceedings

of the Company’s and each Subsidiary’s board of directors occurring since their respective dates of inception, including committees

thereof, and all consents to actions taken thereby, relating to all issuances and transfers of stock or shares, or material assets by

the Company and each such Subsidiary, have been made available to the Parent Parties, and are true, correct and complete copies of the

original register of members or the equivalent documents and minute book records of the Company or the Subsidiary, as applicable.

5.9

Assumed Names. Schedule 5.9 is a complete and correct list of all assumed or “doing business as” names currently

or previously used by the Company, including names on any websites. None of the Company or any Subsidiary has used any assumed or “doing

business as” name other than the names listed on Schedule 5.9 to conduct the Business.

5.10 Consents.

No Contracts binding upon the Company or by which any of the Company Ordinary Share, or any of the Company’s assets are bound,

require a consent, approval, authorization, order or other action of or filing with any Person as a result of the execution,

delivery and performance of this Agreement or any of the Additional Agreements or the consummation of the transactions contemplated

hereby or thereby.

5.11

Financial Statements.

(a)

Attached hereto as Schedule 5.11 are true, complete and correct copies of the unaudited consolidated balance sheets of the Company,