UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

For the quarterly period ended

OR

For the transition period from ______ to ______

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

| 33487 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including

area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☒ | Smaller reporting company | |||

| Emerging growth company |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☒ No ☐

As of August 14, 2024 the

registrant had

Table of Contents

i

PART I—FINANCIAL INFORMATION

Vocodia Holdings Corp

Condensed Consolidated Balance Sheets

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Prepaid expenses | ||||||||

| Other current assets | ||||||||

| Total Current Assets | ||||||||

| Non-Current Assets | ||||||||

| Property and equipment, net | ||||||||

| Right-of-use assets | ||||||||

| Deferred offering costs | ||||||||

| Other assets | ||||||||

| Total Non-Current Assets | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND SHAREHOLDERS' DEFICIT | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | $ | ||||||

| Accrued expenses | ||||||||

| Contract liabilities | ||||||||

| Related party payable | ||||||||

| Note payable | ||||||||

| Convertible notes payable, net | ||||||||

| Derivative liability | ||||||||

| Operating lease liability, current portion | ||||||||

| Total Current Liabilities | ||||||||

| Non-current Liability | ||||||||

| Operating lease liability, less current portion | ||||||||

| Total Non-Current Liability | ||||||||

| TOTAL LIABILITIES | ||||||||

| Commitments and contingencies | ||||||||

| Shareholders' Deficit | ||||||||

| Preferred stock, $ | ||||||||

| Series A Preferred Stock, | ||||||||

| Series B Preferred Stock, | ||||||||

| Common stock, $ | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total shareholders' deficit | ( | ) | ( | ) | ||||

| TOTAL LIABILITIES AND SHAREHOLDERS' DEFICIT | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

Vocodia Holdings Corp

Condensed Consolidated Statements of Operations

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Sales, net | $ | $ | $ | $ | ||||||||||||

| Cost of Sales | ||||||||||||||||

| Gross profit (Loss) | ( | ) | ( | ) | ( | ) | ||||||||||

| Operating Expenses | ||||||||||||||||

| General and administrative expenses | ||||||||||||||||

| Salaries and wages | ||||||||||||||||

| Research and development | ||||||||||||||||

| Total Operating Expenses | ||||||||||||||||

| Operating Loss | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other Income (Expense) | ||||||||||||||||

| Other income | ||||||||||||||||

| Change in fair value of derivative liability | ( | ) | ( | ) | ||||||||||||

| Loss on settlement of debt | ( | ) | ||||||||||||||

| Interest expense | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Total Other Income (Expense) | ( | ) | ( | ) | ( | ) | ||||||||||

| Loss Before Taxes | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Income Taxes | ||||||||||||||||

| Net Loss | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | |||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

Vocodia Holdings Corp

Condensed Consolidated Statements of SHAREHOLDERS’ Deficit

For the Three and Six Months Ended June 30, 2024

| Series A Preferred Stock | Series B Preferred Stock | Common Stock | Additional Paid-In | Accumulated | ||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Total | ||||||||||||||||||||||||||||

| Balance, January 1, 2024 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||

| Issuance of Series B Preferred Stock | ||||||||||||||||||||||||||||||||||||

| Common stock units issued for cash | ||||||||||||||||||||||||||||||||||||

| Deferred offering costs | - | - | - | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Issuance common stock for settlement of debt | ||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of debt | ||||||||||||||||||||||||||||||||||||

| Common stock issued for conversion of Series B Preferred Stock | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||

| Common stock issued for exercise of warrants | ( | ) | ||||||||||||||||||||||||||||||||||

| Series C warrants issued | - | - | - | |||||||||||||||||||||||||||||||||

| Stock based compensation | - | - | - | |||||||||||||||||||||||||||||||||

| Net loss | - | - | - | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance, March 31, 2024 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||||||||||

| Common stock issued for exercise of warrants | - | - | ||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance, June 30, 2024 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||

For the Three and Six Months Ended June 30, 2023

| Series A Preferred Stock | Series B Preferred Stock | Common Stock | Additional Paid-In | Accumulated | ||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Shares | Amount | Capital | Deficit | Total | ||||||||||||||||||||||||||||

| Balance, January 1, 2023 | $ | $ | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||||||||||

| Issuance of common stock and warrants for non-employee services | ||||||||||||||||||||||||||||||||||||

| Employee common stock compensation | ||||||||||||||||||||||||||||||||||||

| Common stock cancelled | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||

| Issuance of Series B Preferred Stock | ||||||||||||||||||||||||||||||||||||

| Issuance common stock for settlement of debt | ||||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance, March 31, 2023 | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||||||||||

| Issuance of common stock and warrants for non-employee services | - | - | ||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | ( | ) | ( | ) | |||||||||||||||||||||||||||||

| Balance, June 30, 2023 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Vocodia Holdings Corp

Condensed Consolidated Statements of Cash Flows

| Six Months Ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| Operating activities: | ||||||||

| Net Loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to cash used in operating activities: | ||||||||

| Depreciation | ||||||||

| Amortization of debt issuance costs | ||||||||

| Stock-based compensation | ||||||||

| Convertible note default penalty | ||||||||

| Change in fair value of derivative liability | ( | ) | ||||||

| Loss on settlement of debt | ||||||||

| Settlement of accounts payable | ( | ) | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses and other assets | ( | ) | ||||||

| Other assets | ( | ) | ||||||

| Accounts payable and accrued expenses | ||||||||

| Contract liability | ( | ) | ||||||

| Net change in operating right-of-use lease asset and liability | ( | ) | ( | ) | ||||

| Cash used in operating activities | ( | ) | ( | ) | ||||

| Investing activities: | ||||||||

| Purchase of property and equipment | ( | ) | ||||||

| Cash used in investing activities | ( | ) | ||||||

| Financing activities: | ||||||||

| Proceeds from issuance of common stock units | ||||||||

| Deferred offering costs | ( | ) | ( | ) | ||||

| Proceeds from exercise of warrants | ||||||||

| Proceeds from issuance of Series B Preferred stock | ||||||||

| Payment of debt issuance costs | ( | ) | ||||||

| Proceeds from related party payable | ||||||||

| Proceeds from notes payable | ||||||||

| Repayment of notes payable | ( | ) | ||||||

| Proceeds from convertible notes payable | ||||||||

| Repayment of convertible notes payable | ( | ) | ||||||

| Cash provided by financing activities | ||||||||

| Change in cash and cash equivalents | ( | ) | ||||||

| Cash and cash equivalents, beginning balances | ||||||||

| Cash and cash equivalents, ending balances | $ | $ | ||||||

| Supplemental cash flow information: | ||||||||

| Cash paid for interest | $ | $ | ||||||

| Cash paid for taxes | $ | $ | ||||||

| Non-Cash Investing and Financing Activities: | ||||||||

| Initial derivative liabilities recognized as a debt discount | $ | $ | ||||||

| Common stock cancellation | $ | $ | ||||||

| Series C warrants issued | $ | $ | ||||||

| Issuance common stock for settlement of debt | $ | $ | ||||||

| Issuance common stock for settlement of debt – related parties | $ | $ | ||||||

| Common stock issued for conversion of debt | $ | $ | ||||||

| Common stock issued for conversion of Series B Preferred Shares | $ | $ | ||||||

| Common stock issued for exercise of warrants | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

VOCODIA HOLDINGS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – ORGANIZATION AND GOING CONCERN

Organization and Business Overview

The Company and Business: Vocodia Holdings Corp

(“we”, “us”, “Vocodia”, “the Company”) was incorporated in the State of Wyoming on

Click Fish Media, Inc. (“CFM”) was incorporated in the State of Florida on November 29, 2019 and is an IT services provider.

On August 2, 2022, Vocodia purchased all outstanding

shares of CFM held by an owner under common ownership for $

Going Concern

The Company’s condensed consolidated financial

statements are prepared in accordance with Generally Accepted Accounting Principles (“GAAP”) of the United States including

the assumption of a going concern basis, which contemplates the realization of assets and liquidation of liabilities in the normal course

of business. However, as shown in the accompanying condensed consolidated financial statements, the Company had a net loss of approximately

$

Management recognizes that the Company must obtain additional resources to successfully develop its technology and implement its business plans. Through June 30, 2024, the Company has received funding in the form of indebtedness, from the sale stock subscriptions and the sale of units in its IPO. Management may continue to raise funds to support our operations in 2024 and beyond, however it has no plans to do so at this time. No assurances can be given that we will be successful. If management is not able to timely and successfully raise additional capital if necessary, the implementation of the Company’s business plan, financial condition and results of operations will be materially affected. These condensed consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Rule 8-03 of Regulation S-X. They do not include all information and notes required by GAAP for complete financial statements. However, except as disclosed herein, there has been no material change in the information disclosed in the Notes to Consolidated Financial Statements included in the Annual Report on Form 10-K of Vocodia Holdings Corp for the year ended December 31, 2023.

In the opinion of management, all adjustments (including normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the six months ended June 30, 2024 are not necessarily indicative of the results that may be expected for the year ending December 31, 2024.

Basis of Consolidation

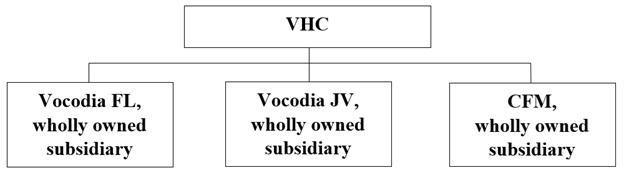

The financial statements have been prepared on a consolidated basis with those of the Company’s wholly owned subsidiaries, Vocodia FL, LLC, Vocodia JV, LLC, and CFM. All intercompany transactions and balances have been eliminated in consolidation.

5

Reclassification

Certain accounts from prior periods have been reclassified to conform to the current period presentation.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. The estimates and judgments will also affect the reported amounts for certain expenses during the reporting period. Actual results could differ from these good faith estimates and judgments Significant estimates are contained in the accompanying financial statements for the valuation of derivatives, the valuation allowance on deferred tax assets, share-based compensation, useful lives for depreciation and amortization of long-lived assets, and the incremental borrowing rate used on right-of-use asset.

Cash and Cash Equivalents

Cash and cash equivalents include cash in bank

accounts and money market funds with maturities of less than three months from inception, which are readily convertible to known amounts

of cash and which, in the opinion of management, are subject to an insignificant risk of loss in value. At June 30, 2024 and December

31, 2023, the Company had cash equivalents of $

Periodically, the Company may carry cash balances

at financial institutions in excess of the federally insured limit of $

Revenue Recognition

The Company recognizes revenue in an amount that reflects the consideration to which it expects to be entitled in exchange for the transfer of promised goods or services to customers. The Company follows a five-step process to achieve this core principle: (1) identify the contract with the customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations in the contract; and (5) recognize revenue when (or as) the entity satisfies a performance obligation.

The Company’s revenues are currently derived from three sources: (1) implementation fees, (2) offering its software as a service on a recurring monthly basis, and (3) generation and verification of leads. Implementation fees are charged for setting up or calibrating its software so that the AI can be used by the customer for its particular use case and are usually a one-time cost. The Company’s contracts with customers are structured with stated prices per service performed, which are not subject to uncertainty or probability of significant reversal; thus, do not represent variable consideration. The recurring monthly fees are charged for the ongoing use of the AI to continue to call/prospect for the Company’s customers, and are charged on a monthly recurring basis. The Company awards discounts to its customers on a discretionary basis. The Company will consider additional revenue streams as its technology develops and new opportunities present.

Fair Value of Financial Instruments

The Company follows accounting guidelines on fair value measurements for financial instruments measured on a recurring basis, as well as for certain assets and liabilities that are initially recorded at their estimated fair values. Fair Value is defined as the exit price, or the amount that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants as of the measurement date. The Company uses the following three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs to value its financial instruments:

| ● | Level 1: Observable inputs such as unadjusted quoted prices in active markets for identical instruments. |

| ● | Level 2: Quoted prices for similar instruments that are directly or indirectly observable in the marketplace. |

| ● | Level 3: Significant unobservable inputs which are supported by little or no market activity and that are financial instruments whose values are determined using pricing models, discounted cash flow methodologies, or similar techniques, as well as instruments for which the determination of fair value requires a significant judgment or estimation. |

Financial instruments measured at fair value are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires the Company to make judgments and consider factors specific to the asset or liability. The use of different assumptions and/or estimation methodologies may have a material effect on estimated fair values. Accordingly, the fair value estimates disclosed, or initial amounts recorded, may not be indicative of the amount that the Company or holders of the instruments could realize in a current market exchange.

6

The carrying amounts of the Company’s financial instruments including cash and cash equivalents, prepaid expenses, accounts payable, accrued liabilities and convertible debt approximate fair value due to the short-term maturities of these instruments.

| December 31, 2023 | Level 1 | Level 2 | Level 3 | Carrying Value | ||||||||||||

| Liabilities: | ||||||||||||||||

| Derivative Liability – Warrants | $ | $ | $ | $ | ||||||||||||

| Derivative Liability – Conversion feature | ||||||||||||||||

| Total Liabilities | $ | $ | $ | $ | ||||||||||||

Deferred Offering Costs

Pursuant to ASC 340-10-S99-1, costs directly attributable to an offering of equity securities are deferred and would be charged against the gross proceeds of the offering as a reduction of additional paid-in capital. Deferred offering costs consist of underwriting, legal, accounting, and other expenses incurred through the balance sheet date that are directly related to the proposed public offering. Should the proposed public offering prove to be unsuccessful, these deferred costs, as well as additional expenses to be incurred, will be expensed.

| June 30, 2024 | December 31, 2023 | |||||||

| General and administrative cash expenses | $ | $ | ||||||

| Share-based equity compensation | ||||||||

| Total | $ | $ | ||||||

For the three months ended June 30, 2024, the

Company had no additional expense or deferred offering costs. For the six months ended June 30, 2024, the Company recognized additional

expenses of $

Advertising

The Company expenses advertising costs as they

are incurred. Advertising expenses for the three months ended June 30, 2024 and 2023, were $

Share-Based Compensation

The Company accounts for employee and non-employee stock awards under ASC 718, Compensation – Stock Compensation, whereby equity instruments issued to employees for services are recorded based on the fair value of the instrument issued and those issued to nonemployees are recorded based on the fair value of the consideration received or the fair value of the equity instrument, whichever is more reliably measurable. Equity grants are amortized on a straight-line basis over the requisite service periods, which is generally the vesting period. If an award is granted, but vesting does not occur, any previously recognized compensation cost is reversed in the period related to the termination of service.

Warrants

The Company accounts for warrants as either equity-classified or liability-classified instruments based on an assessment of the warrant’s specific terms and applicable authoritative guidance in FASB ASC 480, Distinguishing Liabilities from Equity (“ASC 480”) and ASC 815, Derivatives and Hedging (“ASC 815”). The assessment considers whether the warrants are freestanding financial instruments pursuant to ASC 480, meet the definition of a liability pursuant to ASC 480, and whether the warrants meet all of the requirements for equity classification under ASC 815, including whether the warrants are indexed to the Company’s own ordinary shares and whether the warrant holders could potentially require “net cash settlement” in a circumstance outside of the Company’s control, among other conditions for equity classification. This assessment, which requires the use of professional judgment, is conducted at the time of warrant issuance and as of each subsequent quarterly period end date while the warrants are outstanding.

For issued or modified warrants that meet all of the criteria for equity classification, the warrants are required to be recorded as a component of additional paid-in capital at the time of issuance. For issued or modified warrants that do not meet all the criteria for equity classification, the warrants are required to be recorded at their initial fair value on the date of issuance, and each balance sheet date thereafter. Changes in the estimated fair value of the warrants are recognized as a non-cash gain or loss on the statements of operations. The fair value of the warrants was estimated using a Black-Scholes pricing model.

7

Net Income (Loss) Per Share of Common Stock

Net loss per share of common stock requires presentation of basic earnings per share on the face of the statements of operations for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic earnings per share computation. In the accompanying financial statements, basic loss per share is computed by dividing net loss by the weighted average number of shares of common stock outstanding during the year. Diluted earnings per share is computed by dividing net income by the weighted average number of shares of common stock and potentially dilutive outstanding shares of common stock during the period to reflect the potential dilution that could occur from common shares issuable through contingent share arrangements, warrants unless the result would be antidilutive.

The Company includes in basic earnings per share, common stock that

is issuable for the conversion of warrants for little or no cash upon the satisfaction of certain contingent conditions. The Company has

determined that the Series B and C warrants meet these conditions as of June 30, 2024, and have included

The dilutive effect of restricted stock units, options and warrants subject to vesting and other share-based payment awards is calculated using the “treasury stock method,” which assumes that the “proceeds” from the exercise of these instruments are used to purchase common shares at the average market price for the period. The dilutive effect of convertible securities is calculated using the “if-converted method.” Under the if-converted method, securities are assumed to be converted at the beginning of the period, and the resulting shares of common stock are included in the denominator of the diluted calculation for the entire period being presented.

| June 30, | June, 30 | |||||||

| 2024 | 2023 | |||||||

| Shares | Shares | |||||||

| Warrants | ||||||||

| Convertible notes payable | ||||||||

Recent Accounting Pronouncements

In November 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2023-07, Segment Reporting Topic 280, “Segment Reporting-Improvements to Reportable Segment Disclosures” which allows disclosure of one or more measures of segment profit or loss used by the chief operating decision maker to allocate resources and assess performance. Additionally, the standard requires enhanced disclosures of significant segment expenses and other segment items, as well as incremental qualitative disclosures on both an annual and interim basis. This guidance is effective for annual reporting periods beginning after December 15, 2023, and interim reporting periods after December 15, 2024. Early adoption is permitted and retrospective application is required for all periods presented. The Company is currently evaluating the impact of adopting this guidance on its Consolidated Financial Statements and disclosures included within Notes to Condensed Consolidated Financial Statements.

In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures,” which requires disaggregated information about a reporting entity’s effective tax rate reconciliation as well as information on income taxes paid. The guidance is effective for the Company’s fiscal years beginning after February 1, 2025, with early adoption permitted. The Company does not expect the adoption of this standard to have any material impact on its financial statements.

NOTE 3 – PROPERTY AND EQUIPMENT

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Furniture and Fixtures | $ | $ | ||||||

| Computer Equipment | ||||||||

| Total Property and Equipment | ||||||||

| Less: accumulated depreciation and amortization | ( | ) | ( | ) | ||||

| Property and Equipment, net | $ | $ | ||||||

During the three months ended June 30, 2024 and 2023, depreciation

expense relating to property and equipment was $

8

NOTE 4 – ACCOUNTS PAYABLE AND ACCRUED EXPENSES

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Accounts payable | $ | $ | ||||||

| Accrued expenses - other | ||||||||

| Insurance payable | ||||||||

| Accrued payroll | ||||||||

| Accrued interest | ||||||||

| Bank overdraft | ||||||||

| Accrued expenses | $ | $ | ||||||

NOTE 5 – OPERATING LEASES

| Three months ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| The components of lease expense were as follows: | ||||||||

| Short-term lease cost | $ | ( | ) | $ | ||||

| Operating lease cost | ||||||||

| Total lease cost | $ | $ | ||||||

| Six months ended | ||||||||

| June 30, | ||||||||

| 2024 | 2023 | |||||||

| The components of lease expense were as follows: | ||||||||

| Short-term lease cost | $ | $ | ||||||

| Operating lease cost | ||||||||

| Total lease cost | $ | $ | ||||||

| Supplemental cash flow information related to leases was as follows: | ||||||||

| Operating cash flows from operating leases | $ | $ | ||||||

| Weighted-average remaining lease term - operating leases (year) | ||||||||

| Weighted-average discount rate — operating leases | % | % | ||||||

| Year Ending December 31, | ||||

| 2024 (excluding the six months ended June 30, 2024) | $ | |||

| 2025 | ||||

| 2026 | ||||

| Thereafter | ||||

| Less: Imputed interest | ( | ) | ||

| Operating lease liabilities | $ | |||

9

NOTE 6 – NOTE PAYABLE AND CONVERTIBLE NOTES PAYABLE

Note payable

During the year ended December 31, 2023, the Company issued note payable

of $

In February 2024, the Company borrowed $

Convertible notes payable

During the years ended December 31, 2023 and 2022,

the Company issued $

The Convertible Notes include a conversion feature,

whereupon a successful Initial Public Offering (“IPO”) (the “Liquidity Event”), the Convertible Notes may be payable

to the holders by the Company delivering to the holders shares of common stock equal to the payment amount due at the date of the Liquidity

Event divided by the conversion price. As defined in the agreement, the conversion price is the product of the offering price per share

of common stock paid in a Liquidity Event and a

In connection with the issuance of the Convertible Notes, the Company

issued common stock purchase warrants to the holders of the Convertible Notes (the “Warrants”). The Warrants give the holders

the right, but not the obligation, to purchase shares of the Company obtained by dividing

The conversion feature and Warrants have been accounted for as a derivative liability, in accordance with ASC 815 (see Note 7).

During January 2024, the Company modified outstanding

2022 Original Issue Discount Convertible Notes with original principal and accrued interest, by agreeing to certain penalties, to extend

the maturity dates until

During February 2024, the Company modified certain 2023 Original Issue Discount Convertible Notes with original principal and accrued interest, to extend the maturity dates until February 28, 2024. The Company determined these to be a modification.

In February 2024, on completion of the IPO, all

outstanding 2023 and 2022 Original Issue Discount Convertible Notes with original principal and accrued interest have been settled. In

connection with settlements, the Company paid $

Prior to the modifications and settlements in

January and February 2024, the Company recognized a gain on change in fair value of derivative liability for the convertible debt of $

10

| Maturities | Stated Interest | Effective Interest | June 30, | December 31, | |||||||||||||||

| (calendar year) | Rate | Rate | 2024 | 2023 | |||||||||||||||

| August 2022 issuances | % | % | $ | $ | |||||||||||||||

| September 2022 issuances | % | % | |||||||||||||||||

| November 2022 issuances | % | % | |||||||||||||||||

| December 2022 issuances | % | % | |||||||||||||||||

| April 2023 issuances | % | % | |||||||||||||||||

| May 2023 issuances | % | % | |||||||||||||||||

| June 2023 issuances | % | % | |||||||||||||||||

| Total face value | |||||||||||||||||||

| Unamortized debt discount and issuance costs | ( | ) | |||||||||||||||||

| Total convertible notes | |||||||||||||||||||

| Current portion of convertible notes | ( | ) | |||||||||||||||||

| Long-term convertible notes | $ | $ | |||||||||||||||||

During the three months ended June 30, 2024 and 2023, the Company recorded

interest expense of $

NOTE 7 – DERIVATIVE LIABILITITES

Fair Value Assumptions Used in Accounting for Derivative Liabilities

ASC 815 requires us to assess the fair market value of derivative liabilities at the end of each reporting period and recognize any change in the fair market value as other income or expense. The Company determined our derivative liabilities to be a Level 3 fair value measurement and used the Black-Scholes pricing model to calculate the fair value as of issuance and at the IPO settlement date of February 26, 2024

The Black-Scholes model, which requires six basic data inputs: the exercise or strike price, expected term, the risk-free interest rate, the current stock price, the estimated volatility of the stock price in the future, and the dividend rate. Changes to these inputs could produce a significantly higher or lower fair value measurement. The current stock price is based on historical issuances. Expected volatility is based on the historical stock price volatility of comparable companies’ common stock, as our stock does not have sufficient historical trading activity. Risk free interest rates were obtained from U.S. Treasury rates for the applicable periods.

| 2024 | ||||

| Expected exercise price | $ | |||

| Expected conversion price | ||||

| Expected term | ||||

| Expected average volatility | % | |||

| Expected dividend yield | ||||

| Risk-free interest rate | % | |||

| Fair Value Measurements Using Significant Unobservable Inputs (Level 3) | ||||

| Balance - December 31, 2023 | $ | |||

| Settlement of derivative liability from conversion of debt | ( | ) | ||

| Settlement of derivative liability of warrants to Series C warrants | ( | ) | ||

| Change in fair value of the derivative | ( | ) | ||

| Balance – June 30, 2024 | $ | |||

11

NOTE 8 – SHAREHOLDERS’ EQUITY

The Company has authorized

Series A Preferred Stock

The Company has designated

The Series A Preferred Stockholders are not entitled to any dividends, or mandatory conversion right or liquidation preference, however, they do have a voluntary conversion right.

Holders of the Company’s Series A Preferred

Stock shall have the right to convert at a ratio of

As of June 30, 2024 and December 31, 2023,

Series B Preferred Stock

Effective September 27, 2023, the Company has

amended the certificate of designation to authorize

In January 2024, the Company issued an aggregate

of

As of June 30, 2024 and December 31, 2023,

Common Stock

Each share of Common Stock entitles the holder

to

During the six months ended June 30, 2024, the Company had the following common stock transactions:

| ● |

| ● |

| ● |

| ● |

As of June 30, 2024 and December 31, 2023,

For the six months ended June 30, 2024, the Company

recognized additional expenses of $

12

NOTE 9 – STOCK-BASED COMPENSATION

| June 30, | June, 30 | |||||||

| 2024 | 2023 | |||||||

| Research and development | $ | $ | ||||||

| June 30, | June 30, | |||||||

| 2024 | 2023 | |||||||

| Salaries and wages | $ | $ | ||||||

| Research and development and other service providers | ||||||||

| Professional fees – restricted stock awards | ||||||||

| $ | $ | |||||||

Warrants

During the six months ended June 30, 2024, the Company issued warrants as follows;

| ● |

| ● |

| ● |

| Warrants Outstanding | ||||||||||||

| Number of Warrants | Weighted Average Exercise Price | Weighted Average Remaining life (years) | ||||||||||

| Outstanding, January1, 2023 | $ | |||||||||||

| Granted | ||||||||||||

| Expired / cancelled | ||||||||||||

| Exercised | ||||||||||||

| Outstanding, December 31, 2023 | $ | |||||||||||

| Granted | ||||||||||||

| Expired / cancelled | ( | ) | ||||||||||

| Exercised | ( | ) | ||||||||||

| Outstanding, June 30, 2024 | $ | |||||||||||

The intrinsic value of the warrants as of June

30, 2024 is $

2022 Equity Compensation Plan

On November 9, 2023, the Company’s stockholders approved the 2022 Equity Compensation Plan, or the 2022 Plan. The 2022 Plan provides that grants may be in any of the following forms: incentive stock options, nonqualified stock options, stock units, stock awards, dividend equivalents and other stock-based awards. The 2022 Plan is administered and interpreted by the Compensation Committee of the Board of Directors, or the Committee. The Committee has the authority to determine the individuals to whom grants will be made under the 2022 Plan, determine the type, size and terms of the grants, determine the time when grants will be made and the duration of any applicable exercise or restriction period (subject to the limitations of the 2022 Plan) and deal with any other matters arising under the 2022 Plan. The Committee presently consists of three directors, each of whom is a non-employee director of the Company. All the employees of the Company and its subsidiaries are eligible for grants under the 2022 Plan. Non-employee directors of the Company are also eligible to receive grants under the 2022 Plan.

13

Restricted Stock Awards

On November 2, 2023, the Company issued

During the six months ended June 30, 2024 and

2023, the Company recorded stock-based compensation of $

| Unvested Outstanding at January 1, 2024 | $ | |||||||||||

| Granted | ||||||||||||

| Vested /Released | ( | ) | ( | ) | ||||||||

| Cancelled | ||||||||||||

| Unvested Outstanding at June 30, 2024 | $ |

NOTE 10 – RELATED PARTY TRANSACTIONS

Operating expense related party

During the three months ended June 30, 2024 and

2023, the Company incurred approximately $

During the six months ended June 30, 2024 and

2023, the Company incurred approximately $

Related party payable

On August 1, 2022, the Company entered into a

lending arrangement with a related party, the prior owner of Click Fish Media. The loan is for a two (

Related party management fees

During the three months ended June 30, 2024 and

2023, 47 Capital Management LLC, an entity wholly owned by the former CFO billed the Company $

During the three months ended June 30, 2024 and

2023, Thornhill Advisory Group, Inc. (f/k/a EverAsia Financial Group), an entity majority owned by the CFO, billed the Company $

Related party debt conversion to common stock

In January 2024,

In January 2024,

In January 2024,

14

NOTE 11 – COMMITMENTS AND CONTINGENCIES

From time to time, we may be involved in various disputes and litigation matters that arise in the ordinary course of business.

The Company received a letter dated August 28, 2023, from an attorney hired on behalf of a former employee of the Company. This former employee offered her resignation, which was accepted on July 12, 2023. This letter contains allegations that the former employee was sexually harassed and terminated wrongfully by the Company. The Company is of the opinion that allegations in this letter lack merit. The Company has reported this matter to its insurance carrier and outside counsel has been engaged. The Company denies liability and intends to continue to vigorously defend any action, although the probability of a favorable or unfavorable outcome is difficult to estimate as of this date. The result or impact of such allegations are uncertain, including whether or not they could result in damages and/or awards of attorneys’ fees or expenses. In December 2023 the former employee’s attorney requested that the parties attend mediation, however a date for said mediation has not been determined. Due to the uncertain outcome of the case, no amounts have been accrued.

On December 20, 2023, an individual filed a putative class action lawsuit against a customer of the Company that was using the Company’s DISA’s. Shortly thereafter, the individual filed a first amended complaint (FAC) adding the Company as a party. The FAC states that Plaintiff’s phone number has been on the National Do-Not-Call Registry since 2009. Despite this, Plaintiff alleges he received two prerecorded calls from the Company on behalf of its Customer on October 10 and November 28, 2023. Based on these alleged violations, Plaintiff asserts that the Company violated the Telephone Consumer Protection Act’s (TCPA) prerecorded call provision and the South Carolina Telephone Privacy Protection Act. In response to the FAC, both the Company and its Customer filed a motion to dismiss and motion to strike the class allegations. The motions are fully briefed, but the Court has yet to issue a ruling. The parties each exchanged discovery responses. The parties agreed to attend mediation on October 15, 2024. The Company denies liability and intends to continue to vigorously defend any action, although the probability of a favorable or unfavorable outcome is difficult to estimate as of this date. The result or impact of such allegations are uncertain, including whether or not they could result in damages and/or awards of attorneys’ fees or expenses.

ProofPositive LLC (“ProofPositive”) commenced an arbitration (“Arbitration”) before the American Arbitration Association (“AAA”) against the Company, Brian Podolak and his wife (under a pseudonym) (“Respondents”) on or about May 31, 2024. In the Arbitration, ProofPositive asserted a number of claims, including claims under the Arizona Securities Act, arising from Respondents’ alleged failure to pay sums purportedly due under a loan agreement and promissory note, an addendum and consulting agreement. The Company denies liability and intends to continue to vigorously defend any action, although the probability of a favorable or unfavorable outcome is difficult to estimate as of this date. The result or impact of such allegations are uncertain, including whether or not they could result in damages and/or awards of attorneys’ fees or expenses.

NOTE 12 – PREPAID EXPENSE

| June 30, | December 31, | |||||||

| 2024 | 2023 | |||||||

| Prepaid operating expense | $ | $ | ||||||

| Prepaid insurance | ||||||||

| Prepaid rent | ||||||||

| Prepaid expenses | $ | $ | ||||||

NOTE 13 – SUBSEQUENT EVENTS

As disclosed in the Company’s Form 8-K filed

with the SEC on August 5, 2024, the Company entered into a Securities Purchase Agreement on August 2, 2024 (the “SPA”) with

certain accredited investors (the “Purchasers”) for the sale of (i)

The Series C Preferred Stock are convertible into

shares of the Company’s common stock, $

The

Management evaluated all additional events subsequent to the balance sheet date through August 14, 2024, the date the condensed consolidated financial statements were available to be issued.

15

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and the related notes included elsewhere in this Quarterly Report on Form 10-Q. Our consolidated financial statements have been prepared in accordance with U.S. GAAP. In addition, our consolidated financial statements and the financial data included in this Quarterly Report on Form 10-Q K reflect our reorganization and have been prepared as if our current corporate structure had been in place throughout the relevant periods. Actual results could differ materially from those projected in the forward-looking statements. For additional information regarding these and other risks and uncertainties, please see the items listed above under the section captioned “Risk Factors”, as well as any other cautionary language contained in this Quarterly Report on Form 10-Q. Except as may be required by law, we undertake no obligation to update any forward-looking statements to reflect events after the date of this Quarterly Report on Form 10-Q.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements represent our expectations, beliefs, intentions, or strategies concerning future events, including, but not limited to, any statements regarding our assumptions about financial performance; the continuation of historical trends; growth strategies; the sufficiency of our cash balances for future liquidity and capital resource needs; the expected impact of changes in accounting policies on our results of operations, financial condition or cash flows; anticipated problems and our plans for future operations; our future financing plans and anticipated needs for working capital; and the economy in general or the future of the food production industry, all of which were subject to various risks and uncertainties. Such statements, when used in this Annual Report on Form 10-K and other reports, statements, and information we have filed with the Securities and Exchange Commission (“SEC”), in our press releases, presentations to securities analysts or investors, in oral statements made by or with the approval of an executive officer, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “continue,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. However, any statements contained in this Annual Report on Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. These statements are expressed in good faith and based upon a reasonable basis when made, but there can be no assurance that these expectations will be achieved or accomplished.

This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under Part I Item 1 “Business” and Part II Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as in other parts of this Quarterly Report on Form 10-Q. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors as described in this Quarterly Report on Form 10-Q generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Quarterly Report on Form 10-Q will in fact occur. In addition to the information expressly required to be included in this filing, we will provide such further material information, if any, as may be necessary to ensure that the required statements, in light of the circumstances under which they are made, are not misleading.

Although forward-looking statements in this Quarterly Report on Form 10-Q reflect the good faith judgment of our management, forward-looking statements are inherently subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially different from those discussed in these forward-looking statements. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Quarterly Report on Form 10-Q. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Quarterly Report on Form 10-Q, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the Securities and Exchange Commission (“SEC”) which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected.

This Quarterly Report on Form 10-Q also contains estimates, projections, and other information concerning our industry, our business, and particular markets, including data regarding the estimated size of those markets. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained this industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by market research firms and other third parties, industry, general publications, government data, and similar sources.

16

Overview

Vocodia Holdings Corp (“VHC”) was incorporated in the State of Wyoming on April 27, 2021 and is a conversational AI technology provider. Vocodia’s technology is designed to drive better sales and services for its customers. Clients turn to Vocodia for their product and service needs.

Business Summary

We are an AI software company that builds practical AI functions and makes them easily obtainable for businesses on cloud-based platform solutions at low costs and scalable to multiagent vast enterprise solutions.

Our operations include three wholly owned subsidiaries: (1) Vocodia FL, which was incorporated in the State of Florida on June 2, 2021 and manages all of VHC’s human resources and payroll functions, (2) Vocodia JV, which was incorporated in the State of Delaware on October 7, 2021 and was formed with the intention to conduct any and all joint ventures or acquisitions for VHC, which do not exist as of the date of this report, and (3) Click Fish Media, Inc. (“CFM”), which was incorporated in the State of Florida on November 26, 2019 and is an IT services provider. CFM was formerly owned by James Sposato, who is an officer and director of the Company. CFM was wholly acquired by the Company from Mr. Sposato per the Contribution Agreement. CFM was formerly owned by James Sposato, who is an officer and director of the Company. CFM was acquired by us from Mr. Sposato per the Contribution Agreement, dated August 1, 2022. In the Contribution Agreement, Mr. Sposato (“Contributor”), has contributed, assigned, transferred and delivered to us, the outstanding capital stock of CFM and we have accepted the contributed shares from the Contributor. As full consideration for the contribution, we have paid the Contributor consideration in the amount of $10.

An illustration of our organizational structure is provided below:

We aim to offer corporate clients scalable enterprise AI sales and customer service solutions intended to rapidly increase sales and service, while lowering employment costs.

We seek to enhance rapport and relationship building for customers, which is as necessary component to sales. We believe that there is a positive correlation between AI which sounds similar to a human voice over the phone and better customer rapport and customer service benefits. With our advanced AI, we believe that it will be difficult for customers to distinguish between speaking to a human sales representative and to an AI bot. We believe we can increase customer satisfaction and maximize potential service efficiency for our clients. Our goal is to provide quick training and deployment, potentially unlimited scalability, easy integration with existing corporate platforms and other benefits to our customers from AI’s efficiency. We strive to help our customers manage budgets and perform better than the high costs of existing sales and service personnel.

On February 26, 2024, we completed our initial public offering (the “IPO”) of 1,400,000 units, each consisting of one share of common stock, par value $0.0001 (“Common Stock”), one Series A Warrant to purchase one share of Common Stock at $4.25 (the “Series A Warrant”), and one Series B Warrant to purchase one share of Common Stock at $8.50 (the “Series B Warrant”), at a price to the public of $4.25 per Unit.

The gross proceeds from the IPO, before underwriting discounts and commissions and estimated offering expenses payable by us, were approximately $5,950,000. On February 22, 2024, our Common Stock, Series A Warrants and Series B Warrants began trading on the BZX Exchange, a division of Cboe Global Markets, under the ticker symbols “VHAI,” “VHAI+A” and “VHAI+B”, respectively.

17

Results of Operations

Comparison of the six months ended June 30, 2024 to the six months ended June 30, 2023

The following tables set forth selected consolidated statements of operations data and such data as a percentage of total revenues for each of the periods indicated:

| Six Months Ended | ||||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2024 | 2023 | Change | % | |||||||||||||

| Revenues | $ | 75 | $ | 243,200 | (243,125 | ) | -100 | % | ||||||||

| Cost of revenue | 56,259 | 183,369 | (127,110 | ) | -69 | % | ||||||||||

| Gross profit (loss) | (56,184 | ) | 59,831 | (116,015 | ) | -194 | % | |||||||||

| Operating costs and expenses: | ||||||||||||||||

| Operating expense | 4,399,453 | 3,712,395 | 687,058 | 19 | % | |||||||||||

| Other income (expenses) | (4,048,725 | ) | (1,688,256 | ) | (2,360,469 | ) | 140 | % | ||||||||

| Net loss | $ | (8,504,362 | ) | $ | (5,340,820 | ) | (3,163,542 | ) | 59 | % | ||||||

Revenue

Revenue decreased by $243,125, or 100%,, to $75 for the six months ended June 30, 2024 as compared to $243,200 for the six months ended June 30, 2023. Beginning in January 2024, we suspended sales of our DISA product in order to update its functionality so it could scale to the needs of our customers. As a result, we only earned $75 in revenue from integration, lead generation, and setup fees. We anticipate launching our improved DISA product in the third quarter of 2024. For the six months ended June 30, 2023, we had 1 paying client who subscribed to 10 DISAs at a selling price of $795 per DISA for one month for total revenue of $7,950 for the period. Additionally, we earned $235,250 in integration, lead generation, and setup fees, resulting in total revenue of $243,200.

Cost of Revenue

Cost of revenue decreased by $127,110, or 69%, to $56,259 for the six months ended June 30, 2024 from $183,369 for the six months ended June 30, 2023, primarily due to the reduction of costs related to the deployment of our DISAs.

Gross profit (loss)

The decrease in our gross profit of $116,015 to a gross loss of $56,184 for the six months ended June 30, 2024 from a gross profit of $59,831 for the six months ended June 30, 2023 is primarily attributable to the suspension of DISA sales during the six months, while our server expenses continued.

Operating Expenses

| Six Months Ended | ||||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2024 | 2023 | Change | % | |||||||||||||

| Operating Expenses | ||||||||||||||||

| General and administrative expenses | $ | 2,448,256 | $ | 771,707 | 1,676,549 | 217 | % | |||||||||

| Salaries and wages | 829,307 | 1,883,526 | (1,054,219 | ) | -56 | % | ||||||||||

| Software development and other service providers | 1,121,890 | 1,057,162 | 64,728 | 6 | % | |||||||||||

| Total Operating Expenses | $ | 4,399,453 | $ | 3,712,395 | 687,058 | 19 | % | |||||||||

18

Operating expense increased by $687,058 or 19% to $4,399,453 for the six months ended June 30, 2024 from $3,712,395 for the six months ended June 30, 2023. This increase is primarily due to the increase in general and administrative expenses related to operating a public company and software development costs related to improving our DISA products offset by a reduction in salaries and wages and stock-based compensation expenses paid to employees and service providers.

General and Administrative Expenses increased by $1,676,549 or 217% to $2,448,256 during the six months ended June 30, 2024 from $771,707 during the six months ended June 30, 2023. The increase is primarily a result of the Company’s increased costs related to being a public company related to insurance, professional fees, and investor relations.

Salaries and wages expense decreased by $1,054,219, or 56%, to $829,307 for the six months ended June 30, 2024 from $1,883,526 for the six months ended June 30, 2023, due to a reduction in staff in 2024 and a reduction in stock based compensation paid.

Research and development and other service providers expense increased by $64,728, or 6%, to $1,121,890 for the six months ended June 30, 2024 from $1,057,162 for the six months ended June 30, 2023, primarily related to accelerated investments in developing our next-generation AI-powered virtual agent platform. We are also incurring considerable data labeling expenses as we scale out language model training across multiple domains, industries and languages, which is essential for our virtual agents to provide highly contextualized and personalized customer experiences. Finally, we are developing advanced multimodal AI capabilities that we anticipate will intelligently interpret voice and text during customer interactions.

Total other income (expense)

During the six months ended June 30, 2024, we had other expense of $4,048,725, which consisted of other income of $75,068, a change in fair value of derivative liabilities of $115,296, a loss on the settlement of debt of $3,824,936 and interest expense of $414,153.

Comparison of the three months ended June 30, 2024 to the three months ended June 30, 2023

The following tables set forth selected consolidated statements of operations data and such data as a percentage of total revenues for each of the periods indicated:

| Three Months Ended | ||||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2024 | 2023 | Change | % | |||||||||||||

| Revenues | $ | 75 | $ | - | 75 | 100 | % | |||||||||

| Cost of revenue | 23,369 | 23,146 | 223 | 1 | % | |||||||||||

| Gross profit (loss) | (23,294 | ) | (23,146 | ) | (148 | ) | 1 | % | ||||||||

| Operating costs and expenses: | ||||||||||||||||

| Operating expense | 1,609,883 | 1,280,682 | 329,201 | 26 | % | |||||||||||

| Other income (expenses) | 74,185 | (1,112,026 | ) | 1,186,211 | -107 | % | ||||||||||

| Net loss | $ | (1,558,992 | ) | $ | (2,415,854 | ) | 856,862 | -35 | % | |||||||

Revenue increased by $75, or 100%, to $75 for the three months ended June 30, 2024 as compared to $0 for the three months ended June 30, 2023. Beginning in January 2024, we suspended sales of our DISA product in order to update its functionality so it could scale to the needs of our customers. As a result, we only earned $75 in revenue from integration, lead generation, and setup fees. We anticipate launching our improved DISA product in the third quarter of 2024.

Cost of Revenue

Cost of revenue increased by $223, or 1%, to $23,369 for the three months ended June 30, 2024 from $23,146 for the three months ended June 30, 2023, primarily due to increased cost of our cloud hosting platform.

Gross Loss

The increase in our gross loss of $148 to a gross loss of $23,294 for the three months ended June 30, 2024 from a gross loss of $23,146 for the three months ended June 30, 2023 is primarily attributable to the increased costs of our cloud server expenses.

19

Operating Expenses

| Three Months Ended | ||||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2024 | 2023 | Change | % | |||||||||||||

| Operating Expenses | ||||||||||||||||

| General and administrative expenses | $ | 834,244 | $ | 463,094 | $ | 371,150 | 80 | % | ||||||||

| Salaries and wages | 446,924 | 482,862 | (35,938 | ) | -7 | % | ||||||||||

| Software development and other service providers | 328,715 | 334,726 | (6,011 | ) | -2 | % | ||||||||||

| Total Operating Expenses | $ | 1,609,883 | $ | 1,280,682 | $ | 329,201 | 26 | % | ||||||||

Operating expense increased by $329,201 or 26% to $1,609,883 for the three months ended June 30, 2024 from $1,280,682 for the three months ended June 30, 2023 primarily due to the increase in general and administrative expenses related to operating a public company and software development costs related to improving our DISA products offset by a reduction in salaries and wages and stock based compensation expenses paid to employees and service providers.

General and Administrative Expenses increased by $371,150 or 80% to $834,244 during the three months ended June 30, 2024 from $463,094 during the three months ended June 30, 2023. The increase is primarily a result of the Company’s increased costs related to being a public company related to insurance, professional fees, and investor relations.

Salaries and wages expense decreased by $35,938, or 7%, to $446,924 for the three months ended June 30, 2024 from $482,862 for the three months ended June 30, 2023, due to a reduction in staff in 2024 and a reduction in stock based compensation paid.

Research and development and other service providers expense decreased by $6,011, or 2%, to $328,715 for the three months ended June 30, 2024 from $334,726 for the three months ended June 30, 2023, primarily related the elimination of software costs used in our technology stack.

Total other income (expense)

During the three months ended June 30, 2024, we had other income of $74,185, which consisted of dividend income of $14,207, a gain from settlement of accounts payable of $60,861, and interest expense of $883.

Liquidity and Capital Resources

The following table provides selected financial data about us as of June 30, 2024 and December 31, 2023

| June 30, | December 31, | |||||||||||||||

| 2024 | 2023 | Change | % | |||||||||||||

| Current assets | $ | 873,927 | $ | 12,770 | $ | 861,157 | 6744 | % | ||||||||

| Current liabilities | $ | 1,650,183 | $ | 7,894,129 | $ | (6,243,946 | ) | -79 | % | |||||||

| Working capital (deficiency) | $ | (776,256 | ) | $ | (7,881,359 | ) | $ | 7,105,103 | -90 | % | ||||||

Current assets increased by $861,157, or 6744%, to $873,927 as of June 30, 2024 from $12,770 as of December 31, 2023. The increase was primarily attributable to the sale of 1,400,000 units, comprised of 1,400,000 shares of common stock, Series A Warrants and Series B Warrants in our initial public offering at $4.25 per unit, for gross proceeds of $5,950,000 before underwriter fees and discounts offset by operating expenses.

Current liabilities decreased by $6,243,946, or 79%, to $1,650,183 as of June 30, 2024 from $7,894,129 as of December 31, 2023. The decrease was primarily attributable to conversion and settlement of approximately $3.7 million in convertible notes and associated $1.9 million in derivative liabilities, and the settlement of other trade liabilities subsequent to our initial public offering.

We believe we will not have sufficient cash on hand to support our operations for at least 12 months. As of June 30, 2024, we had a working capital deficiency of $776,256 and total cash of $627,847. As discussed below, this condition and other factors raise substantial doubt regarding our ability to continue as a going concern.

We intend to generally rely on cash from operations and equity and debt offerings to the extent necessary and available, to satisfy our liquidity needs. There are several factors that could result in the need to raise additional funds, including a decline in revenue, a lack of anticipated sales growth and increased costs. Our efforts are directed toward generating positive cash flow and, ultimately, profitability. As our efforts during our fiscal 2023 and the six months ended June 30, 2024 have not generated positive cash flows, we will need to raise additional capital. Should capital not be available to us at reasonable terms, other actions will become necessary, including implementing cost control measures and additional efforts to increase sales. We may also be required to take more strategic actions such as exploring strategic options for the sale of our company, the creation of joint ventures or strategic alliances under which we will pursue business opportunities, or other alternatives.

20

Cash Flow

| Six months Ended | ||||||||||||

| June 30, | ||||||||||||

| 2024 | 2023 | Change | ||||||||||

| Cash used in operating activities | $ | (4,557,406 | ) | $ | (1,602,982 | ) | $ | (2,954,424 | ) | |||

| Cash used in investing activities | $ | (2,131 | ) | $ | - | $ | (2,131 | ) | ||||

| Cash provided by financing activities | $ | 5,187,384 | $ | 998,116 | $ | 4,189,268 | ||||||

| Cash on hand | $ | 627,847 | $ | 92,760 | $ | 535,087 | ||||||

Cash Flow from Operating Activities

Six months ended June 30, 2024 and 2023

For the six months ended June 30, 2024 and 2023, we did not generate positive cash flows from operating activities. for the six months ended June 30, 2024, net cash flows used in operating activities was $4,557,406 compared to $1,602,982 during the six months ended June 30, 2023.

Cash flows used in operating activities for the six months ended June 30, 2024 was comprised of a net loss of $8,504,362, which was reduced by non-cash expenses of $4,115,874 for stock-based compensation, depreciation and amortization, convertible notes default penalties, change in fair value of derivative liabilities, loss on settlement of debts and offset by write-offs of accounts payable, and net change in working capital of $(168,918).

For the six months ended June 30, 2023, net cash flows used in operating activities was $1,602,982. During the six months ended June 30, 2023, we had a net loss of $5,340,820, which was reduced by non-cash expenses of $3,284,760 for stock-based compensation, depreciation and amortization, convertible notes default penalties, and change in fair value of derivative liabilities, and net change in working capital of $453,078.

Cash Flows from Investing Activities

During the six months ended June 30, 2024, cash used by investing activities of $2,131 included $2,131 for the purchase of computer equipment. During the six months ended June 30, 2023 cash used in investing activities was $0.

Cash Flows from Financing Activities

During the six months ended June 30, 2024, cash provided by financing activities of $5,187,384 included $5,372,787 from the sales of common stock units, $605,000 from the sale of 605 Preferred B shares, and $30,000 from the issuance of note payable, $61,073 from the exercise of warrant and $883 from proceeds from related party and was offset by deferred offering costs of $24,375 and the repayment of notes payable of $55,000 and convertible notes payable of $802,984. During the six months ended June 30, 2023, net cash provided by financing activities of $998,116 included proceeds of $155,000 from the sale of 155 Preferred B shares, proceeds from related party payables of $121,049 and proceeds from convertible notes payable of $800,000 and was offset by deferred offering costs of $27,933 and the payment of debt offering costs of $50,000.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements or relationships with unconsolidated entities or financial partnerships, such as entities often referred to as structured finance or special purpose entities.

Going Concern

The accompanying financial statements of the Company are prepared in accordance with U.S. GAAP applicable to a going concern, which contemplates realization of assets and the satisfaction of liabilities in the normal course of business within one year after the date the consolidated financial statements are issued.

In accordance with Financial Accounting Standards Board (“FASB”), Accounting Standards Update (“ASU”) No. 2014-15, Presentation of Financial Statements – Going Concern (Subtopic 205-40), the Company’s management evaluates whether there are conditions or events, considered in aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the accompanying financial statements are issued.

Critical Accounting Policies

Our accounting policies are more fully described in our unaudited financial statements. The preparation of financial statements in conformity with generally accepted accounting principles in the United States requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Although these estimates are based on our best knowledge of current and anticipated events, actual results could differ from the estimates.

21

We have identified the following accounting policies as those that require significant judgments, assumptions and estimates and that have a significant impact on our financial condition and results of operations. These policies are considered critical because they may result in fluctuations in our reported results from period to period, due to the significant judgments, estimates and assumptions about complex and inherently uncertain matters and because the use of different judgments, assumptions or estimates could have a material impact on our financial condition or results of operations. We evaluate our critical accounting estimates and judgments required by our policies on an ongoing basis and update them as appropriate based on changing conditions.

Fair Value of Financial Instruments. The Company accounts for financial instruments under Financial Accounting Standards Board (“FASB”) ASC 820, Fair Value Measurements. ASC 820 provides a framework for measuring fair value and requires disclosures regarding fair value measurements. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, based on the Company’s principal or, in absence of a principal, most advantageous market for the specific asset or liability.

The Company uses a three-tier fair value hierarchy to classify and disclose all assets and liabilities measured at fair value on a recurring basis, as well as assets and liabilities measured at fair value on a non-recurring basis, in periods subsequent to their initial measurement. The hierarchy requires the Company to use observable inputs when available, and to minimize the use of unobservable inputs, when determining fair value.

The three tiers are defined as follows:

| ● | Level 1 – Observable inputs that reflect quoted market prices (unadjusted) for identical assets or liabilities in active markets; |

| ● | Level 2 – Observable inputs other than quoted prices in active markets that are observable either directly or indirectly in the marketplace for identical or similar assets and liabilities; and |

| ● | Level 3 – Unobservable inputs that are supported by little or no market data, which require the Company to develop its own assumptions. |

The determination of fair value and the assessment of a measurement’s placement within the hierarchy requires judgment. Level 3 valuations often involve a higher degree of judgment and complexity. Level 3 valuations may require the use of various cost, market, or income valuation methodologies applied to unobservable management estimates and assumptions. Management’s assumptions could vary depending on the asset or liability valued and the valuation method used. Such assumptions could include estimates of prices, earnings, costs, actions of market participants, market factors, or the weighting of various valuation methods. The Company may also engage external advisors to assist us in determining fair value, as appropriate.

Derivative Liabilities. The Company analyzes all financial instruments with features of both liabilities and equity under FASB ASC Topic No. 480, (“ASC 480”), “Distinguishing Liabilities from Equity” and FASB ASC Topic No. 815, (“ASC 815”) “Derivatives and Hedging”. Derivative liabilities are adjusted to reflect fair value at each reporting period, with any increase or decrease in the fair value recorded in the results of operations (other income/expense) as change in fair value of derivative liabilities. The Company uses a binomial pricing model to determine fair value of these instruments.

Beneficial Conversion Features. For instruments that are not considered liabilities under ASC 480 or ASC 815, the Company applies ASC 470-20 to convertible securities with beneficial conversion features that must be settled in stock. ASC 470-20 requires that the beneficial conversion feature be valued at the commitment date as the difference between the effective conversion price and the fair market value of the common stock (whereby the conversion price is lower than the fair market value) into which the security is convertible, multiplied by the number of shares into which the security is convertible limited to the amount of the loan. This amount is recorded as a debt discount and amortized to interest expense in the Consolidated Statements of Operations.

Debt Discount. For certain notes issued, the Company may provide the debt holder with an original issue discount. The original issue discount is recorded as a debt discount, reducing the face amount of the note, and is amortized to interest expense over the life of the debt, in the Consolidated Statements of Operations.

Research and Development. The Company accounts for research and development costs in accordance with ASC subtopic 730-10, Research and Development (“ASC 730-10”).

22

Under ASC 730-10, all research and development costs must be charged to expense as incurred. Accordingly, internal research and development costs are expensed as incurred. Third-party research and development costs are expensed when the contracted work has been performed or as milestone results have been achieved as defined under the applicable agreement. Company-sponsored research and development costs related to both present and future products are expensed in the period incurred.

Stock-based Compensation. The Company accounts for our stock-based compensation under ASC 718 “Compensation – Stock Compensation” using the fair value-based method. Under this method, compensation cost is measured at the grant date based on the value of the award and is recognized over the service period, which is usually the vesting period. This guidance establishes standards for the accounting for transactions in which an entity exchanges it equity instruments for goods or services. It also addresses transactions in which an entity incurs liabilities in exchange for goods or services that are based on the fair value of the entity’s equity instruments or that may be settled by the issuance of those equity instruments.

The Company uses the fair value method for equity instruments granted to non-employees and use the Black-Scholes model for measuring the fair value of options.

The fair value of stock-based compensation is determined as of the date of the grant or the date at which the performance of the services is completed (measurement date) and is recognized over the vesting periods.

When determining fair value, the Company considers the following assumptions in the Black-Scholes model:

| ● | Exercise price, | |

| ● | Expected dividends, | |

| ● | Expected volatility, | |

| ● | Risk-free interest rate; and | |

| ● | Expected life of option |

Recent Accounting Standards. Changes to accounting principles are established by the FASB in the form of Accounting Standards Updates (“ASU’s”) to the FASB’s Codification. We consider the applicability and impact of all ASU’s on our financial position, results of operations, shareholders’ deficit, cash flows, or presentation thereof. Management has evaluated all recent accounting pronouncements as issued by the FASB in the form of Accounting Standards Updates (“ASU”) through the date these financial statements were available to be issued and found the following recent accounting pronouncements issued, but not yet effective accounting pronouncements, are not expected to have a material impact on the financial statements of the Company.