SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

Form 10-K

_____________________________________________

SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended December 31 , 2023

SECURITIES EXCHANGE ACT OF 1934

_____________________________________________

(Exact name of registrant as specified in its charter)

_____________________________________________

| (State or other jurisdiction of incorporation incorporation or organization) | Commission File Number | (I.R.S. Employer Identification No.) | ||||||||||||

(Address, including zip code and telephone number, including area code,

of the principal executive offices)

_____________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol(s) | Name of each exchange on which registered: | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes þ No

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. o Yes þ No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). þ Yes o No

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| ☐ | Large accelerated filer | ☑ | ☐ | Non-accelerated filer | Smaller reporting company | Emerging Growth Company | |||||||||||||||||||||||

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b) ☐

Indicate by check mark whether the Registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. ☐ Yes þ No

The aggregate market value of the common stock held by non-affiliates of Douglas Elliman Inc. as of June 30, 2023 was approximately $176.6 million.

At March 1, 2024, Douglas Elliman Inc. had 91,535,412 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III (Items 10, 11, 12, 13 and 14) from the definitive Proxy Statement for the 2024 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission no later than 120 days after the end of the Registrant’s fiscal year covered by this report.

Douglas Elliman Inc.

FORM 10-K

TABLE OF CONTENTS

| Page | ||||||||

| Reserved | ||||||||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | ||||||||

| Item 16. | Form 10-K Summary | |||||||

2

PART I

ITEM 1. BUSINESS

Overview

Douglas Elliman Inc. is engaged in the real estate services and property technology investment business and is seeking to acquire or invest in additional real estate services and property technology, or PropTech, companies. Douglas Elliman owns Douglas Elliman Realty, LLC, one of the largest residential brokerage companies in the New York metropolitan area, which includes New York City, Long Island, the Hamptons, Westchester, Connecticut and New Jersey, and also conducts operations in Florida, California, Texas, Colorado, Nevada, Massachusetts, Maryland, Virginia and Washington D.C. We also offer, including through our subsidiaries and ventures, ancillary services, such as property management, title and escrow services.

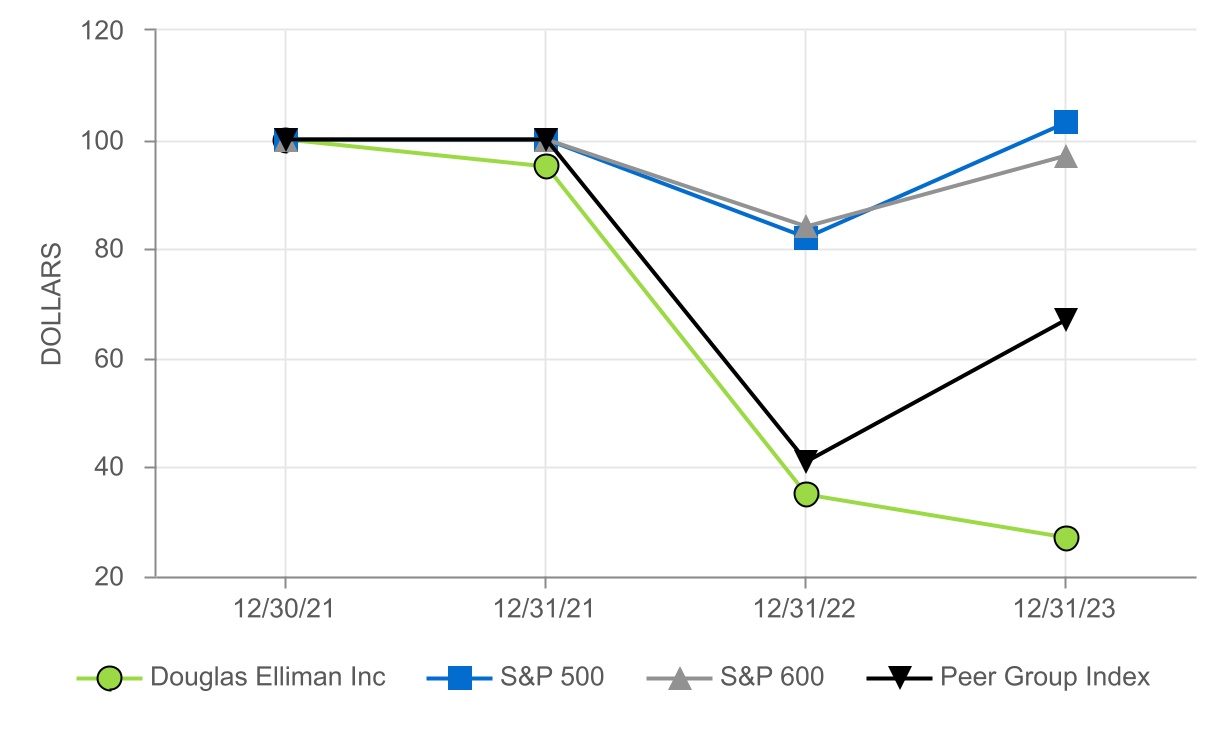

We are a Delaware corporation and were incorporated in 2021 in connection with the separation of Douglas Elliman from Vector Group Ltd., as an independent, publicly traded company, listed on the New York Stock Exchange (the “Distribution”). On December 29, 2021, Vector Group completed the Distribution of the common stock of Douglas Elliman to its stockholders and we began trading on the New York Stock Exchange under the symbol “DOUG” on December 30, 2021.

Strategy

Since its inception in 1911, Douglas Elliman has challenged the status quo of the real estate industry. We were founded on Douglas L. Elliman’s vision that New Yorkers would shift their preference for traditional homes to favor luxury apartments that were both sold and managed by comprehensive real estate companies. More than a century later, the Douglas Elliman brand is still associated with service, luxury and forward thinking — our markets are primarily international finance and technology hubs that are densely populated and offer housing inventory at premium price points. The average transaction value of a home we sold in 2023 was approximately $1.59 million — significantly higher than our principal competitors.

We are building on our record of innovation. Douglas Elliman is focused on digitizing, integrating and simplifying real estate activities for agents and elevating their clients’ experiences. We are bringing innovative, technology-driven PropTech solutions to Douglas Elliman by adopting new PropTech solutions for agents and their clients and also investing in select PropTech opportunities through our subsidiary, New Valley Ventures LLC. Our model is to source and use best-of-breed products and services that we believe will increase our efficiency. In addition to entering into business relationships with these PropTech companies, we are committed to creating over time a dynamic portfolio of PropTech companies by leveraging our relationships to provide them access to our agents and their clients, as well as our knowledge and experience. We believe these collaborative relationships are mutually beneficial because they keep Douglas Elliman both asset light and on the cutting edge of the industry by offering our agents innovative solutions and services that can be integrated into our technology. Furthermore, we maintain upside potential in the success of our PropTech partners in which we invest through minority stakes in their capital structures.

Douglas Elliman boasts a prestigious luxury brand that is complemented by a comprehensive suite of technology-enabled real estate services and investments. These distinguishing qualities position us to capitalize on opportunities in the U.S. residential real estate market. Despite various “agentless” models such as “iBuying,” approximately 89% of both buyers and sellers were assisted by a real estate agent or broker when purchasing or selling their home between July 2022 and June 2023, according to the National Association of Realtors, or NAR, highlighting the central role agents continue to play in real estate transactions. Agents are able to generate significant repeat business from clients and referrals, with 65% of home sellers and 56% of home buyers between July 2022 and June 2023 choosing to work with an agent they had used in the past or from a referral, according to the NAR. Repeat business, as well the ability to provide ancillary services, allows agents to extend their client relationships and generate significant lifetime value.

After a strong 2021, when existing home sales reported by the NAR reached their highest level since 2006, the residential real estate brokerage industry began experiencing significant challenges in the second quarter of 2022, which have continued to date. These challenges have been marked by a reduced inventory of homes available for sale, which we believe has been caused by elevated mortgage rates since early 2022. According to the NAR, sales of existing homes of 4.09 million in 2023, which was the lowest amount since 1995, declined from 5.03 million in 2022 and 6.12 million in 2021. By comparison, our transactions declined by 19% to 21,606 in 2023 from 26,573 in 2022. In the fourth quarter of 2023, our Gross Transaction Value and transactions of homes sold increased by approximately 5% and 5%, respectively, compared to the 2022 fourth quarter. We believe the increases in the fourth quarter of 2023 reflected the gradual stabilization of home purchasing activity during 2023. This trend resulted in our first year-over-year increases in quarterly revenue, Gross Transaction Value and transactions since the first quarter of 2022. Based on cash receipts in January and February 2024, we expect these modest increases to continue in the first quarter of 2024 and the NAR and other real estate industry consortiums are forecasting similar increases in the U.S. residential real estate market in 2024.

3

Despite these macroeconomic challenges, we believe our competitive advantages in the luxury markets distinguish us from our competitors and our comprehensive suite of real estate solutions, our industry-leading brand name, and our talented team of employees and agents set us apart in the industry. Douglas Elliman was recently named the most trusted real estate brokerage firm in the United States as part of the America’s Most Trusted Series by Lifestory Research. As the real estate brokerage industry evolves and addresses these challenges related to constrained inventory of homes as well as higher mortgage rates, we continue to pursue profitable growth opportunities through the expansion of our footprint, investments in cutting-edge PropTech companies through New Valley Ventures, continued recruitment of best-in-class talent, acquisitions (acqui-hires), and operational efficiencies. We will continue to employ a disciplined capital allocation strategy aimed at generating sustainable long-term value for our stockholders.

Real Estate Services

Large residential brokerage company with a recognized luxury brand. Douglas Elliman is one of the largest residential brokerage companies in the New York metropolitan area, which includes New York City, Long Island, the Hamptons, Westchester, Connecticut and New Jersey. Douglas Elliman has approximately 125 offices with approximately 6,600 real estate agents in the New York metropolitan area, as well as in Florida, California, Texas, Colorado, Nevada, Massachusetts, Maryland, Virginia and Washington, D.C. The Douglas Elliman name is synonymous with luxury.

Prominent new development sales and marketing firm. Douglas Elliman’s Development Marketing division, or DEDM, distinguishes our positioning and reputation in the luxury real estate segment. DEDM is sought after by well-known real estate developers as it offers expertise in sales, leasing, and marketing for new developments throughout key markets in the United States and internationally. Drawing upon decades of experience and market-specific knowledge, DEDM offers a multidisciplinary approach that includes comprehensive in-house research, planning and design, marketing and sales. DEDM ranks among the most prominent sales and marketing firms in New York and Florida, as well as Douglas Elliman’s other luxury markets, and employs approximately 83 in-house development professionals. Through a strategic global alliance with Knight Frank Residential, the world’s largest privately-owned property consultancy, DEDM markets properties to international audiences. We employ a hybrid broker model where our traditional residential real estate agents work in tandem with our DEDM professionals and leverage their extensive industry relationships for the benefit of DEDM clients. Agents are able to market and sell high profile developments that enhance their brands and provide additional commission revenue potential. We believe this model provides a competitive advantage to our DEDM business while also increasing the attractiveness of the Douglas Elliman platform to current and prospective agents.

Premium residential property management business. Douglas Elliman is also engaged in the management of cooperative, condominium and rental apartment buildings through its subsidiary, Residential Management Group, LLC, which conducts business as Douglas Elliman Property Management. Residential Management Group provides a full range of fee-based management services for approximately 465 properties representing approximately 54,700 units in New York City, Nassau County, Long Island City and Westchester County.

Full-service title insurance business. Douglas Elliman is also engaged in the provision of title insurance services through its subsidiary DE Title Services. DE Title Services acts in the capacity of a title insurance agent and sells title insurance to property buyers and mortgage lenders. DE Title Services is licensed as a title insurance agent in New York. In addition to DE Title Services, in June 2021, we acquired a 50% interest in Partners Land Services LLC, which is engaged in the provision of title insurance services in Florida. Douglas Elliman is actively exploring similar ventures in other real estate markets.

Leading provider of escrow services. In November 2020, Douglas Elliman acquired Portfolio Escrow, an escrow company that is a leader in the California escrow market. After execution of a home purchase contract, purchase funds are deposited by the buyer into a Portfolio Escrow trust account. After all parties agree that all contingencies of the sale contract have been satisfied, Portfolio Escrow delivers all pertinent documents for recording to the appropriate county clerk’s office, then releases funds to the seller and any other agreed-upon entity. Portfolio Escrow, as an escrow holder, is paid a fee equal to a percentage of the sales price.

PropTech Solutions Supporting Real Estate Services

Our PropTech strategy combines leveraging best-of-breed, proven legacy technologies and selectively partnering with early-stage, disruptive PropTech companies to support our real estate brokerage and services operations. This strategy supports our stakeholders, including our agents, their clients and our management team, by providing them with access to fast-changing and industry-leading technology. We believe technology innovation is best fostered in these smaller, purpose-built PropTech companies to develop new products rather than inside of a large company, such as Douglas Elliman, because in-house technology is generally more costly, takes longer to bring new technology to market and rarely generates the most cutting-edge solutions. By using PropTech solutions and offering a suite of cutting-edge applications, our open architecture technology

4

infrastructure provides users a “plug and play” environment where new features and functionality can be quickly added for the benefit of our agents and their clients. This ensures our technology remains state-of-the-art, vendor optionality is maintained, and our costs are minimized. Examples of our PropTech platform for Douglas Elliman’s agents and their clients are summarized below.

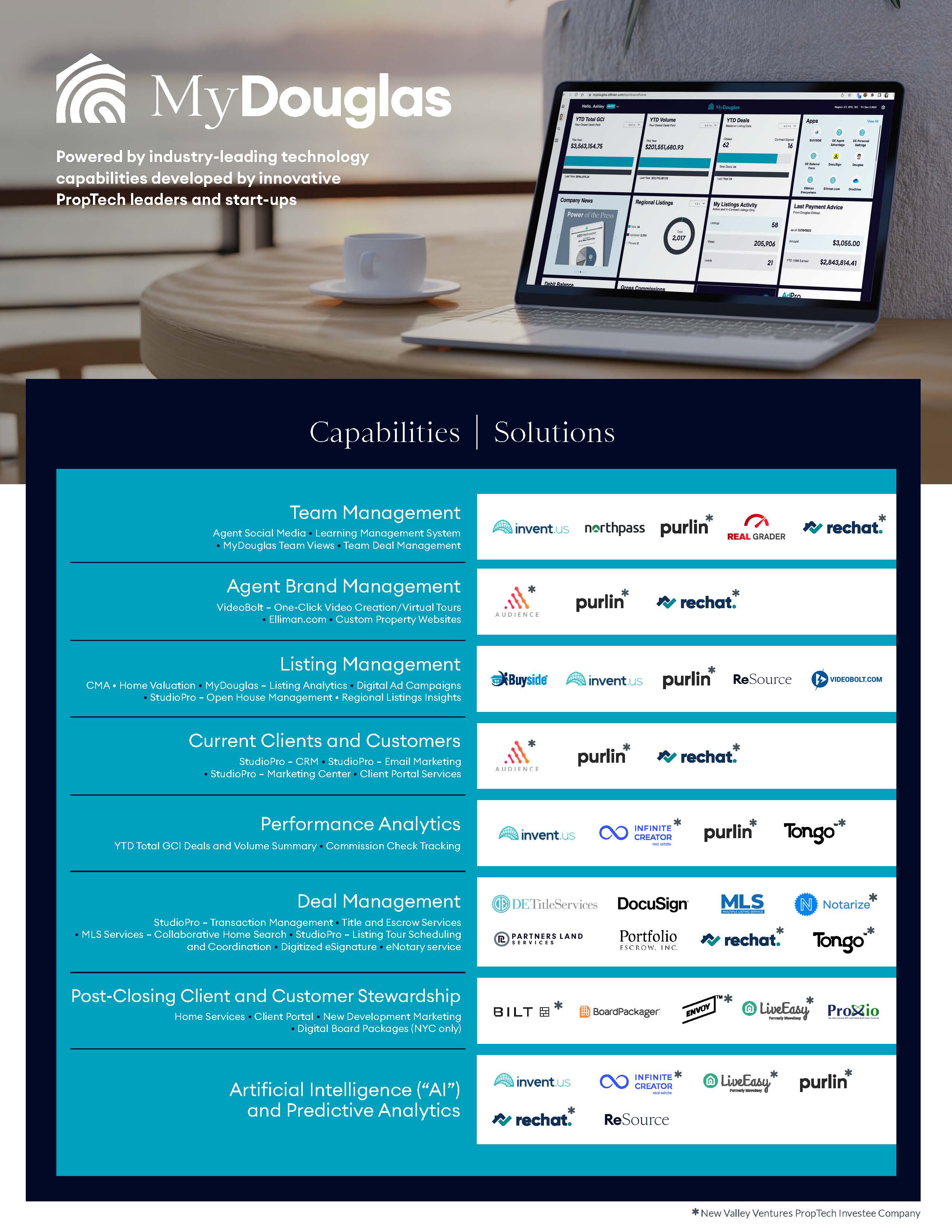

MyDouglas portal supports our agents in managing their business anytime, anywhere and on any device. Our MyDouglas agent portal is built on a native cloud SaaS technology foundation that is designed to rapidly adjust and incorporate new innovative solutions. The user-friendly portal incorporates automated and simplified workflows for agent interactions, expansive data-rich dashboards and reports backed by artificial intelligence, or AI, and integrated data assets. The technology is completely “plug and play” enabled, which supports our ability to quickly adjust our solutions in concert with the digital transformation happening in PropTech today.

Components of our MyDouglas solution include integrated customer relationship management, email marketing, marketing content creation and management, transaction management, video creation and virtual tours, comparative market analysis, home valuation tools, listing analytics, digital ad campaigns, open house management, new development sales and digital marketing, artificial intelligence, predictive analytics and more.

Elliman Everywhere offers robust virtual and mobile resources. Our Elliman Everywhere initiative provides agents with the robust virtual and mobile resources they desire and will need to transact business from anywhere in the world, including markets where we do not have offices. This cloud-based agent portal includes workflow processing, a commission system, customer acquisition tools, an Innovation Lab and more, enhancing the agent experience and agents’ efficiency.

MyLearning provides our agents and employees with additional development and growth opportunities. Our MyLearning platform enables Douglas Elliman agents and employees to access and participate in live and recorded on-demand training sessions directed at various experience levels and subjects, including professional development, entrepreneurialism, business writing, public speaking and marketing.

Elliman Essentials provides agents and employees with enhanced vendor access. Elliman Essentials provides a curated list of offerings from preferred vendors that Douglas Elliman’s approximately 6,600 agents and an additional 592 employees access to source products, services and experiences to enhance business practices and purchase closing gifts for customers. Elliman Essentials can be accessed on our intranet portal, MyDouglas.

Launched and expanded a new client and customer lifetime concierge solution. We are offering seasoned third-party products into Elliman Showroom, a white-glove homeowners engagement solution that provides access to services such as insurance, moving, telecommunications, utilities, solar home security and home services and facilitates the moving and home management needs of our agents. This simple, “do-it-yourself,” end-to-end digital homeowner engagement platform includes more than 40 direct partnerships and integrations across multiple industries. It leverages our investee and growing PropTech startup, LiveEasy.

5

PropTech Investments

In addition to leveraging PropTech solutions to support our real estate brokerage and services operations, we believe that by investing in early-stage PropTech companies, Douglas Elliman can gain differentiated access to innovative PropTech

6

services while benefiting from the expected growth and valuations of these firms without the need to build or fully acquire them. We believe investing in these PropTech companies and investment funds enables us to establish relationships with these companies (and funds’ portfolio companies) to seek preferred terms, become an early adopter of emerging technologies and achieve greater product integration with our users and technology applications. At the same time, we are actively seeking to capitalize on our unique real estate knowledge and experience by investing in PropTech companies that will both supplement and enhance the technology-based experience of Douglas Elliman’s agents and the general real estate industry as well as improve our operating efficiency. For example, the foundation for our agent communications platform and customer relationship management system was developed in consultation with one of our PropTech investee companies. We believe that these investments provide us with unique access to cutting-edge and industry-leading technology, providing us with valuable technology systems to improve the efficiency of Douglas Elliman’s businesses while also capturing some of the value created by the combination of our expertise in the real estate industry and the PropTech companies with which we partner.

As of December 31, 2023, New Valley Ventures had investments in PropTech companies and funds (at a carrying value) of approximately $13.4 million. This amounts to approximately 3% of the value of Douglas Elliman’s total assets, which totaled approximately $493 million, as of December 31, 2023.

As of December 31, 2023 our PropTech investments include:

• Rechat: a lead-to-close fully mobile technology dashboard for real estate agents including marketing, customer relationship management and transaction-management software. Douglas Elliman has a multi-year services agreement with Rechat for its agents, who are increasingly requesting and requiring superior access to technology and back-office support services. The Rechat technology is a key element of MyDouglas, Douglas Elliman’s primary agent portal designed to be our agents’ technology front door, and StudioPro, the cloud-based agent portal and marketing tool recently launched by Douglas Elliman that helps integrate all agent resources in one user-friendly suite.

• Purlin: an automated intelligence platform to aid in home buying, an agent “paid social media” integration in MyDouglas and Portfolio Escrow client and agent portals that also integrate with MyDouglas.

• Humming Homes: a tech-enabled home management service that is creating a new category of end-to-end home management. It has built a solution that provides single-family homeowners a digital experience and offers a dedicated in-person home management team with a single point of contact and 24/7 support. The service employs data and insights to avoid reactive and expensive home maintenance issues. The investment will complement Douglas Elliman’s business in the Hamptons and align Humming Homes’ geographical growth with Douglas Elliman’s footprint in locations such as Aspen, Florida and Southern California.

• LiveEasy: a client- and customer-facing digital concierge service designed to assist clients and customers moving into and “setting up” their new homes, while offering additional services to maintain their homes. In partnership with residential real estate brokerages, LiveEasy is delivered in a white-labeled format that features the name and contact information of the selling agent.

• Fyxify: a tech-enabled platform that utilizes direct scheduling and operating technology to avoid the inefficiencies of home repairs (for example: calling around, mystery repair costs and wasting time).

• Bilt: a leading loyalty program and co-branded credit card for renters to earn points on their rent payments. Douglas Elliman has joined the Bilt Rewards Alliance, a network of more than 2 million rental units across the country where renters can enroll in the loyalty program to earn points on rent paid. This platform enhances Douglas Elliman’s suite of offerings for both the renters and landlords it represents.

• Persefoni AI: a software-as-a-service, or “SaaS,” platform built to enable enterprises of all sizes to measure their carbon footprint accurately, dynamically, and regularly across all operations.

•Tongo: a financial program that gives real estate agents instant access to future commissions up to 60 days before closing.

• Guest House: a tech-enabled company focused on the home staging market.

• Alpaca: investment in Getaway House, Inc., a start-up company that provides cabin rental services in rural areas throughout the United States.

• Infinite Creator: investment in Infinite Creator, a do-it-yourself video creation app that allows any agent with a phone to walk through a guided process and film the key pieces for a high-end luxury presentation video.

7

•PropTech Venture Capital Funds: investments in the following venture capital funds providing New Valley Ventures with exposure to opportunities in the emerging PropTech industry.

◦Camber Creek Venture Capital Funds: two funds that invest in a diversified pipeline of new PropTech ventures. Camber Creek’s portfolio includes Notarize, a digitized notary service, and Curbio, a renovation firm designed to increase a property’s selling price. Camber Creek has also invested in Bilt.

◦Sum Ventures: a fund that invests in growth companies in PropTech, FinTech, and CleanTech industries.

◦MetaProp Venture Capital Fund: a fund advised or managed by a New York-based venture capital firm.

◦The Lab PropTech Fund: a fund advised or managed by a Miami-based firm that aims to invest in emerging technologies with a focus on residential real estate and construction services.

Other than the five private funds listed above in which New Valley Ventures invests as a limited partner, all of these companies currently provide technology or services to Douglas Elliman. Because these PropTech companies and funds are accounted for as investments, we have not recognized revenue from these PropTech investments to date and do not anticipate recognizing revenue from these PropTech investments in the future. However, we target earning an attractive rate of return from the capital appreciation of our PropTech investments.

In 2023, New Valley Ventures monetized two PropTech investments, EVPassport and Envoy, and recorded gains of $715,000 and $160,000 respectively, for the year ended December 31, 2023. In 2023, New Valley Ventures also determined that the fair value of its investment in Audience was zero and reported realized losses on convertible debt securities of $236,000 for the year ended December 31, 2023.

Our Competitive Strengths

Leading luxury brand with a strong presence in markets where we have brand recognition and brand equity. We have a presence in most major luxury real estate markets in the United States, including New York, Florida, California, Texas, Colorado, Nevada, Massachusetts as well as the Washington, D.C. Metro area, which includes Maryland, Virginia and Washington D.C. Further, we have established a reputation for luxury and trust, which we believe has differentiated our brand from those of our peers. To build on this established brand presence, Douglas Elliman produces owned content and generates earned media regarding a range of relevant topics — including brand initiatives, exclusive listings, new development projects and closed deals — that resonate with our clients and contribute to a strong share of voice across all major markets in which we operate, as compared to our principal real estate competitors, and enhances the professional credibility of agents and executives whose thought leadership is often sought by major global media outlets.

Experienced team of talented agents and employees. The residential real estate business is built upon personal relationships, and we have long believed Douglas Elliman’s team of approximately 809 employees and approximately 6,600 agents (including 5,150 Principal Agents) as of December 31, 2023 distinguishes us from other residential real estate brokerage firms. Forbes recognized Douglas Elliman in its 2021 list of America’s best large employers.

Leading new development marketing platform. DEDM offers leading expertise in sales, leasing, and marketing for new developments in New York City, Long Island, the Hamptons, New Jersey, South Florida, California, Massachusetts and Texas, as well as throughout the United States and internationally. We believe Douglas Elliman’s “hybrid” platform of involving both experienced new development experts and skilled brokerage professionals provides highly differentiated expertise and real-time market intelligence to its clients.

Technology that we believe is industry-leading and supports recruitment and retention of agents. We provide our agents with what we believe is the most advanced set of digital-and mobile-enabled tools and resources in the residential brokerage industry, including: cloud-based agent portal, workflow processing, commission system, customer acquisition tools, Innovation Lab, customer relationship management (“CRM”) and marketing tools. These tools are designed to support agent productivity, earnings potential and satisfaction and we believe they enhance our efforts to recruit and retain high-performing agents.

Growth Strategy

Expand our footprint into adjoining markets. We strategically aim to build on our leadership position in the New York metropolitan area, including New York City, Long Island, Westchester and the Hamptons, while entering and expanding in complementary markets as well as key markets in Florida, California, Texas, Colorado, Nevada, Massachusetts, Maryland, Virginia and Washington, D.C., where the Elliman brand has strong awareness and brand equity.

8

Continue executing the growth strategy of DEDM. Our hybrid DEDM platform matches experienced new development experts with skilled brokerage professionals to provide differentiated expertise and real time market intelligence to DEDM’s developer clients. We believe there is a clear path to growth through expansion into new markets.

Provide ancillary services to enhance the client experience and drive growth. We are seeking, through investment and acquisition, to expand and optimize our ancillary real estate services that allow our agents and our other businesses to enhance the client experience and drive growth in revenues and earnings. These services include escrow, title, mortgage finance, property management, notary, staging, renovation, security, moving, capital fundraising for developers, and more. We expect technology to be a key differentiator as we grow our ancillary services businesses, in terms of adoption by our agents, delivery to their clients and disruption of traditional business models not yet transformed by technology.

Invest in compelling PropTech opportunities that facilitate our growth and competitive differentiation. Our goal is to create over time a portfolio of PropTech companies in which we are invested and also leverage their technology for the benefit of our agents and their clients. We believe that investing strategically in disruptive, early-stage PropTech companies equips Douglas Elliman stakeholders with early and differentiated access to new technology built in entrepreneurial environments, while enabling PropTech investee companies to access our knowledge and experience through our commercial relationships to grow their own businesses. Concurrently, we believe investing in these PropTech companies enables us to establish relationships with these companies to seek preferred terms, become an early adopter of emerging technologies and achieve greater product integration with our users and IT systems, which enhances our competitive differentiation with agents and their clients. Furthermore, we maintain upside potential in the success of our PropTech partners in which we invest through minority stakes in their capital structures.

Continue to recruit best-in-class agents. Our recognized brand, combined with DEDM and the PropTech resources provided to our agents, support our ability to recruit experienced, high-performing agents. Leveraging regional recruiting teams, along with CRM and other necessary technology support, we seek to continue recruiting best-in-class talent at all levels.

Relentlessly pursue operational efficiencies. We have an ongoing, firm-wide focus on expense control, operational efficiency and profitability.

Human Capital

We have long believed that the diversity and talent of our people provides a competitive advantage to Douglas Elliman. As of December 31, 2023, we employed approximately 809 employees, of which 592 were employed by Douglas Elliman Realty LLC, 209 were employed at Douglas Elliman Property Management and eight were employed at Douglas Elliman’s corporate headquarters.

Real Estate Brokerage. The residential real estate business is built upon personal relationships and we have long believed Douglas Elliman’s team of employees as well as approximately 6,600 agents distinguish us from other residential real estate brokerage firms. Forbes recognized Douglas Elliman in its 2021 list of America’s best large employers and 2023 list of America’s best employers. We believe this recognition is a testament to the hard work and resiliency of the Douglas Elliman family. We are proud that women are well represented in our leadership as they comprise of 50% of our “Executive/Senior Level officers and managers” and 63% of our “First/Mid-Level officials and managers.”

While most of Douglas Elliman’s employees are located in the New York and Miami metropolitan areas, our agents are located in New York, Florida, California, Texas, Colorado, Nevada, Massachusetts, Maryland, Virginia and Washington, D.C. In an effort to continue to foster relationships with our employees and agents, Douglas Elliman’s management implemented the following initiatives:

•Hosted, and continue to host, company-wide virtual town halls, podcasts and communications across all regions. These town halls are intended to promote a spirit of camaraderie and educate our employees and agents.

•In addition, in 2023 we launched a Learning Management System to support employee continued professional development.

•In 2023, we launched the inaugural “Agents of Change” initiative. “Agents of Change” is a series of conversations designed to spotlight pressing social issues and celebrate the Douglas Elliman agents who are actively working to increase diversity and spark change in the real estate industry and society at large. The initial event, held in honor of Black History Month, involved listening to five members of the Douglas Elliman community discussing their personal and professional experiences as people of color working in residential real estate and highlighted the scope of the diversity, equity and inclusion challenges facing the industry. The series will be an ongoing process designed to foster a respectful and supportive workplace that enables Douglas Elliman to attract and retain a diverse workforce that represents its customers and its communities.

9

•We continued our Agents of Change initiative throughout 2023 and hosted events such as Stopping the Stigma Around Mental Health and Shattering the Glass Ceiling with successful and influential women in real estate.

•Continued to support diversity efforts, including sponsoring Aspen Gay Ski Week, matching employees’ and agents’ contributions to the NAACP Legal and Education Fund, the AAPI Community Fund and various other health and social charitable organizations.

•Launched our initial Diversity Equity & Inclusion survey for our employees and agents.

•Continued to support organizations benefiting victims of various Florida hurricanes, California wildfires, Texas and Puerto Rico flood disasters and the Ukraine Humanitarian Crisis Fund of the American Red Cross. Douglas Elliman also supports health driven organizations including God’s Love We Deliver, Project Angel Food, and the American Cancer Society.

•Supported the Israeli American Council following the attacks on October 7, 2023.

Douglas Elliman offers comprehensive benefit programs to its employees which provide them with, among other things, medical, dental, and vision healthcare; 401(k) matching contributions; paid parental leave; and paid vacation time.

We will continue to listen, while engaging and connecting with our employees and Douglas Elliman’s agents, to further our human capital management objectives.

Available Information

Our website address is www.elliman.com. We make available free of charge on the Investor Relations section of our website (https://investors.elliman.com/overview/default.aspx) our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the Securities and Exchange Commission. We also make available through our website other reports filed with the SEC under the Exchange Act, including our proxy statements and reports filed by officers and directors under Section 16(a) of that Act. Copies of these filings are also available on the SEC’s website. Copies of our Code of Business Conduct and Ethics, Corporate Governance Guidelines, Audit Committee charter, Compensation Committee charter and Corporate Responsibility and Nominating Committee charter have been posted on the Investor Relations section of our website and are also available in print to any stockholder who requests it. We do not intend for information contained in, or available through, our website to be part of this Annual Report on Form 10-K.

ITEM 1A.RISK FACTORS

Our business faces many risks. We have described below the known material risks that we and our subsidiaries face. There may be additional risks that we do not yet know of or that we do not currently perceive to be significant that may also impact our business or the business of our subsidiaries. Each of the risks and uncertainties described below could lead to events or circumstances that have a material adverse effect on the business, results of operations, cash flows, financial condition or equity of us or one or more of our subsidiaries, which in turn could negatively affect the value of our common stock. You should carefully consider and evaluate all information included in this report and any subsequent reports that we may file with the SEC or make available to the public before investing in our securities.

Risks Associated with Our Real Estate Business

We are subject to risks relating to the real estate industry.

The health of the U.S. real estate industry impacts our success and the industry is significantly affected by changes in economic and political conditions of the United States as well as real estate markets, which could adversely impact our real estate business, returns on our investments, trigger defaults in project financing, cause cancellations of property sales, reduce the value of our properties or investments and could affect our results of operations and liquidity. The real estate industry is cyclical and is significantly affected by changes in general and local economic conditions which are beyond our control. Because our revenue primarily consists of sales commissions and transaction fees, any industry slowdown could result in a decline in the total number of residential real estate transactions executed by our agents and could adversely affect our business, financial condition and results of operations.

These conditions include short-term and long-term interest rates, inflation, fluctuations in debt and equity capital markets, levels of unemployment, consumer confidence and the general economic condition of the United States and the global economy. The real estate market also depends upon the strength of financial institutions, which are sensitive to changes in the general macroeconomic environment. Lack of available credit or lack of confidence in the financial sector could adversely impact the real estate market.

10

Any of the following could be associated with cyclicality in the real estate market by halting or limiting a recovery in the residential real estate market, and have an adverse effect on our business by causing periods of lower growth or a decline in the number of home sales and/or property prices which in turn could adversely affect our revenue and profitability:

• periods of economic slowdown or recession;

• rising interest rates and inflation;

• the general availability of and cost of mortgage financing;

• a negative perception of the market for residential real estate;

• commission pressure from brokers who discount their commissions;

• an increase in the cost of homeowners’ insurance for owners of single-family homes and condominium associations;

• weak credit markets;

• a low level of consumer confidence in the economy and/or the real estate market;

• instability of financial institutions, which may result in, among other things, depository banks not honoring escrow and trust deposits held by certain of our subsidiaries;

• legislative, tax or regulatory changes that would adversely impact the real estate market, including, but not limited to, potential reform relating to Fannie Mae, Freddie Mac and other government sponsored entities that provide liquidity to the U.S. housing and mortgage markets, and potential limits on, or elimination of, the deductibility of certain mortgage interest expense and property taxes;

•adverse changes in economic and general business conditions in the New York metropolitan area or the other markets in which we operate;

• a decline in the affordability of homes;

• declining demand for real estate;

• declining home ownership rates, declining demand for real estate and changing social attitudes toward home ownership;

• acts of God, such as hurricanes, earthquakes and other natural disasters, or acts or threats of war or terrorism; and/or

• adverse changes in global, national, regional and local economic and market conditions, particularly in the New York metropolitan area and the other markets where we operate, including those relating to pandemics and health crises, such as the COVID-19 pandemic.

We are impacted by the performance of the real estate markets in the New York metropolitan area and there may be a reduction in the attractiveness of those markets as well as the other markets in which we operate.

Our business significantly depends on sales transactions for residential property in the New York metropolitan area, and we derived approximately 50% of our revenues in 2023, 52% of our revenues in 2022 and 55% of our revenues in 2021 from the New York metropolitan area. There may be a reduction in the attractiveness of the real estate markets of the New York metropolitan area and the other markets in which we operate.

The Tax Cuts and Jobs Act of 2017 (the “Tax Act”) limited mortgage interest deductions as well as state and local income and property tax deductions. The loss of the use of these deductions has encouraged residents of states with high income and property taxes and costs of housing to migrate to states with lower tax rates and housing costs. In 2023, approximately 65% of our closed sales occurred in New York, California, Connecticut, New Jersey and Massachusetts, and a migration of residents from these markets or a reduction in the attractiveness of these markets as a place to live could adversely impact demand for our products and services.

We are also impacted by the attractiveness of New York City as a place to live and invest in and its status as an international center for business and commerce. If New York City’s economy stagnates or contracts or if there are significant concerns or uncertainty regarding the strength of New York City’s economy due to domestic, international or global macroeconomic trends, or other factors (including, in particular, any matters which adversely affect New York City’s status as an international center for business and commerce or the economic benefits of New York City’s financial services industry), the New York metropolitan area may become a less attractive place to live, work, study or to own residential property for investment purposes. The attractiveness of New York City may also be negatively affected by other factors, including high residential property sales prices or rents (or a risk or perceived risk of a fall in sales prices in the future), high costs of living, the impact of the Tax Act, the impact of changes in state tax law, such as the real estate transfer tax on luxury property, and

11

negative perceptions surrounding quality of life, safety and security (including the risk or perceived risk of acts of terrorism or protests).

Any reduction in the attractiveness of New York City as a place to live or a place to invest in residential real estate and any matters which adversely affect New York City’s status as an international center for business and commerce could result in a reduction, by volume and/or by value, in residential property sales transactions in the New York metropolitan area.

There could be a lack of financing for homebuyers in the U.S. residential real estate market at favorable rates and on favorable terms.

The monetary policy of the U.S. government, and particularly the Federal Reserve Board, which regulates the supply of money and credit in the United States, significantly affects the availability of financing at favorable rates and on favorable terms, which in turn significantly affects the domestic real estate market.

We believe that low mortgage rates were a significant factor in the trend in increased homeowner equity and growth in home prices and sales in 2021. In March 2022, the Federal Reserve Board began increasing its primary policy interest rate as well as reducing the size of its balance sheet. Consequently, mortgage interest rates have significantly and rapidly increased. Changes in the Federal Reserve Board’s policies, the interest rate environment and mortgage market are beyond our control and difficult to predict. In 2022, the cost of financing for homebuyers increased significantly, which resulted in higher monthly payment costs that make homes less affordable to purchasers and these conditions continued in 2023. We believe these higher interest rates also reduced home inventory because many sellers considering a move faced higher monthly payment costs because of moving. Consequently, both of these trends resulted in a decline of transaction volume from 2021 to 2022 to 2023 and, if these trends continue, could eventually result in lower home prices.

In addition, the imposition of more stringent mortgage underwriting standards or a reduction in the availability of alternative mortgage products could also reduce homebuyers’ ability to access the credit markets on reasonable terms and adversely affect the ability and willingness of prospective buyers to finance home purchases or to sell their existing homes. This could result in a decline in the number of home sale transactions or mortgage and refinancing activity.

Declining home inventory levels have resulted in insufficient supply, which has negatively impacted home sale transactions.

The success of our business depends on the ability of our brokers and agents to sell homes. Home inventory levels have been declining in certain markets in recent years due to factors outside our control, including the pace of new housing construction, macroeconomic conditions, and, recently, the reluctance of sellers to move due to increases in mortgage costs of new homes and real estate industry businesses that purchase homes for long-term rental or corporate use. This decline has caused more homeowners to remain in their homes, reducing the volume of home sale transactions closed by our brokers and agents. Historically low home inventory levels could have a material adverse effect on our business, financial condition and results of operations.

Consumers may adopt alternatives to full-service agents.

A significant change in consumer sales that eliminates or minimizes the role of the agent in the real estate transaction process could have an adverse effect on our business. These options may include direct-buyer companies (also called iBuyers) that purchase directly from the seller at below-market rates in exchange for speed and convenience and then resell them shortly thereafter at market prices, and discounters who reduce the role of the agent to offer sellers a low commission or a flat fee while giving rebates to buyers. Consumer preferences regarding buying or selling houses and financing their home purchase will determine if these models reduce or replace the long-standing preference for full-service agents.

We depend on a strong brand, and any failure to maintain, protect and enhance the Douglas Elliman brand would have an adverse effect on our ability to grow our real estate brokerage business.

We have developed a strong brand that we believe has contributed significantly to the success of our business. Maintaining, protecting and enhancing Douglas Elliman as a premium real estate brokerage brand is critical to growing our business. If we do not successfully build and maintain a strong brand, our real estate brokerage business could be negatively impacted. Preserving and increasing the quality of the Douglas Elliman brand may require us to make substantial investments in areas such as marketing, community relations, outreach technology and employee training. Douglas Elliman actively engages in print and online advertisements, social media, targeted promotional mailings and email communications and engages on a regular basis in public relations and sponsorship activities. There is no assurance that those activities will maintain or enhance Douglas Elliman’s brand awareness.

12

Brand value can be severely damaged even by isolated incidents, particularly if the incidents receive considerable negative publicity or result in litigation. Some of these incidents may relate to the way we manage our relationship with our agents, our growth strategies or the ordinary course of our business or our brokerage business. Other incidents may arise from events that are or may be beyond our ability to control and may damage our brand, such as actions taken (or not taken) by one or more agents relating to health, safety, welfare or other matters; cybersecurity incidents; litigation and claims; failure to maintain high ethical and social standards for all of our operations and activities; failure to comply with local laws and regulations; and illegal activity targeted at Douglas Elliman or others. Douglas Elliman’s brand value could diminish significantly if any such incidents or other matters erode consumer confidence in it.

The failure of third-party vendors or partners to perform as we expect or appropriately manage risks, or our failure to adequately monitor third-party performance, could result in harm to our reputation and generate revenue.

We engage with third-party vendors and partners in a variety of ways, including strategic collaborations and the development and delivery of applications, employing key internal operational processes and critical client systems. In many instances, these third parties are in direct contact with our agents and customers to deliver services on our behalf or to fulfill their role in the applicable collaboration. In some instances, these third parties may be in possession of personal information of our customers, agents or employees. In other instances, these third parties may play a critical role in developing products and services central to our business strategy. Our third-party partners may encounter difficulties in the provision of required deliverables or may fail to provide us with timely services, which may delay us, and also may make decisions that may harm us or that are contrary to our best interests, including by pursuing opportunities outside of the applicable Company project or program, to the detriment of such project or program.

If our third-party partners or vendors (or their respective vendors) were to fail to perform as we expect, fail to appropriately manage risks, provide diminished or delayed services to our customers or face cybersecurity breaches of their information technology systems, or if we fail to adequately monitor their performance, our operations and reputation could be materially adversely affected, in particular any such failures related to the development of key products. Depending on the function involved, vendor or third-party application failure or error may lead to increased costs, business disruption, distraction to management, processing inefficiencies, the loss of or damage to intellectual property or sensitive data through security breaches or otherwise, effects on financial reporting, loss of customers, damage to our reputation, or litigation, regulatory claims and/or remediation costs (including claims based on theories of breach of contract, vicarious liability, negligence or failure to comply with laws and regulations). Third-party vendors and partners (or their respective vendors) may also fail to maintain or keep adequate levels of insurance, which could result in a loss to us or expose us to litigation. The actions of our third-party vendors and unaffiliated third-party developers are beyond our control. We face the same risks with respect to subcontractors that might be engaged by our third-party vendors and partners or their subcontractors.

The real estate brokerage business in our markets is extremely competitive.

We compete with other multi-office independent real estate organizations and with franchise real estate organizations competing in local areas. Competition is particularly intense in the densely populated metropolitan areas of New York City, South Florida and Los Angeles in which we operate. In addition, in the real estate brokerage industry, new participants face minimal barriers to entry into the market. We also compete for the services of qualified licensed agents. The ability of our brokerage offices to retain agents is generally subject to numerous factors, including the sales commissions they receive, advertising support and perception of brand value.

Our real estate brokerage business depends on the success of our agents.

Our real estate brokerage offices generate revenue in the form of commissions and service fees. Accordingly, our financial results depend upon the operational and financial success of our brokerage offices and our agents. As mentioned above, there is significant competition among brokerage firms for the services of high producing agents and we may be unable to recruit and retain agents.

Contractual obligations related to confidentiality and noncompetition may be ineffective or unenforceable against departing employees.

Our operations are dependent on the efforts, abilities and experience of our employees, and we compete for their services. We have contracts with certain employees that include provisions preventing them from competing with us both during and after the term of our employment contracts with them. Enforceability of the non-compete agreements that we have in place is not guaranteed, and contractual restrictions could be breached without discovery or adequate remedies.

13

On July 9, 2021, President Biden signed an executive order encouraging the Federal Trade Commission (“FTC”) to curtail unfair use of non-compete agreements and other agreements that may unfairly limit worker mobility. While we cannot predict how the initiatives set forth in the executive order will be implemented or, as a result, the impact that the executive order will have on our operations, there is now increased uncertainty regarding the long-term enforceability of our non-compete agreements. In January 2023, the FTC proposed a rule that, if enacted, would prohibit employers from entering into non-compete clauses with workers and require employers to rescind existing non-compete clauses. The FTC is expected to vote on a final rule in April 2024. It is unclear if and when a final rule will become effective and whether it would be subject to legal challenges. In addition, the New York state legislature passed legislation in 2023 that would have prohibited most non-compete agreements between employers and workers in New York State, although it was not ultimately enacted. It is possible that additional similar legislation may be introduced in the future. We are monitoring developments related to these proposed laws for any potential impact on the arrangements we enter into with third parties, including our real estate agents.

Douglas Elliman is subject to risks and operational limitations associated with its strategic alliance with Knight Frank Residential.

Douglas Elliman has entered into a strategic alliance with Knight Frank Residential, the world’s largest privately-owned property consultancy, to market certain luxury residential properties of at least $2 million to international audiences through co-branded offices, located in the various luxury markets where Douglas Elliman operates, and select top-tier agents. The agreement provides for the sharing of commissions and certain other payments in respect of jointly marketed properties. This strategic alliance subjects Douglas Elliman to some risks, including risks associated with the sharing of proprietary information between parties, non-performance by Douglas Elliman or Knight Frank Residential of obligations under the strategic alliance agreement, disputes over strategic or operational decisions or other matters and reputational risks, as well as litigation risks associated therewith. In particular, Douglas Elliman is subject to certain exclusivity and non-compete provisions in connection with marketing and selling properties outside the United States in various markets in which Knight Frank Residential operates, subject to certain exceptions. Although Douglas Elliman believes that the strategic alliance enhances its ability to serve its luxury customers, such restrictions could limit Douglas Elliman’s growth prospects.

Any decrease in our gross commission income or the percentage of commissions that we collect may harm our business, results of operations and financial condition. Our gross commission income or the percentage of commissions that we collect may decline.

Our business model depends upon our agents’ success in generating gross commission income, which we collect and from which we pay to them net commissions. Real estate commission rates vary somewhat by market, and although historical rates have been relatively consistent over time across markets, there can be no assurance that prevailing market practice will not change in a given market, or across the industry, in the future. Customary commission rates could change due to market forces locally or industry-wide, as well as due to regulatory or legal changes in such markets, including because of litigation or enforcement actions. In addition, there can be no assurance that we will be able to maintain the percentage of commission income that we collect from our agents. If industry conditions change, we may be forced to reduce the percentage of commissions that we collect from our agents. See — “Industry structure changes that disrupt the functioning of the residential real estate market, including as a result of litigation or regulatory action, could materially adversely affect our operations and financial results.”

Negligence or intentional actions of real estate agents engaged by us could materially and adversely affect our reputation and subject us to liability.

Our operations rely on the performance of real estate agents. If our agents were to provide lower quality services to our customers or engage in negligent or intentional misconduct, our image and reputation could be materially adversely affected. In addition, we could also be subject to litigation and regulatory claims arising out of their performance of brokerage services, which if adversely determined, could result in substantial financial or legal penalties.

There may be adverse financial and operational consequences to us if independent real estate agents are reclassified as employees.

Although the legal relationship between residential real estate brokers and licensed real estate agents throughout most of the real estate industry historically has been that of independent contractor, newer rules and interpretations of state and federal employment laws and regulations, including those governing employee classification and wage and hour regulations in our and other industries, may impact industry practices and our company owned brokerage operations.

Significant agent reclassification determinations in the absence of available exemptions from minimum wage or overtime laws, including damages and penalties for prior periods (if assessed), could be disruptive to our business or constrain our operations in certain jurisdictions.

14

We may not be able to maintain or establish relationships with multiple listing services (“MLSs”) and third-party listing services, which could limit the information we are able to provide to our agents and clients.

Our ability to attract agents and to appeal to clients depends upon providing a robust number of listings. To provide these listings, we maintain relationships with multiple listing services and other third-party listing providers and aggregators, as well as our agents themselves to include listing data in our services. Certain of our agreements with real estate listing providers are short-term agreements that may be terminated with limited notice. The loss of some of our existing relationships with listing providers, whether due to termination of agreements or otherwise, changes to our rights to use listing data, or an inability to continue to add new listing providers, may cause our listing data to omit information important to our agents or clients. Any loss or changes to our rights to use listing data or add listings, or any similar loss of rights in the markets we serve, could negatively impact agent and client confidence in the listing data we provide and reduce our ability to attract and retain agents.

Goodwill and indefinite-lived intangible asset impairment charges may adversely affect our operating results and financial condition.

We have a substantial amount of goodwill and other intangible assets on our balance sheet. As of December 31, 2023, we had approximately $32.2 million of goodwill and $73.0 million of trademarks and other intangible assets related to Douglas Elliman. Goodwill, trademarks and other identifiable intangible assets must be tested for impairment at least annually, or more frequently if indicators of potential impairment exist. The fair value of the goodwill assigned to a reporting unit could decline if projected revenues or cash flows were to be lower in the future due to the effects of the global economy or other causes. If the carrying value of intangible assets or of goodwill were to exceed its fair value, the asset would be written down to its fair value, with the impairment loss recognized as a non-cash charge in our consolidated statement of operations. Changes in our future outlook of the Douglas Elliman Realty, LLC reporting unit could result in an impairment loss.

The goodwill and indefinite-lived intangible asset impairment analyses are sensitive to changes in key assumptions used, such as discount rates, revenue growth rates, operating margin percentages of the business, and royalty rates as well as current market conditions affecting the residential real estate market industry including inventory levels and elevated mortgage rates. Disruptions in global credit and other financial markets and deteriorating economic conditions, including the impact of inflation or elevated interest rates, could, among other things, cause us to negatively adjust the key assumptions used in the valuations.

Given economic uncertainty and other factors affecting management’s assumptions underlying the valuation of our goodwill and indefinite-lived intangible assets, the assumptions and projections used in the analyses may not be realized and our current estimates could vary significantly in the future, which may result in an additional goodwill or indefinite-lived intangible asset impairment charge. We may experience additional unforeseen circumstances that adversely affect the value of our goodwill or intangible assets and trigger an evaluation of the amount of recorded goodwill and intangible assets. Future write-offs of goodwill or other intangible assets as a result of an impairment in the business could have a material adverse impact on our results of operations and stockholders’ equity.

In the quarterly period ended December 31, 2023, we utilized third-party valuation specialists to prepare a quantitative assessment of goodwill and trademark intangible assets related to Douglas Elliman, based on the current market conditions in the residential real estate brokerage industry. While the quantitative assessments did not result in impairment charges to goodwill or to the trademark intangible assets as of December 31, 2023, we could experience an impairment of goodwill and other intangible assets if current market conditions continue to deteriorate. Such a situation could then result in an impairment loss.

Industry structure changes that disrupt the functioning of the residential real estate market, including as a result of litigation or regulatory scrutiny, could materially adversely affect our operations and financial results.

Through our brokerages, we participate in MLS and are a member of the NAR and state real estate associations and, accordingly, are subject to each group’s rules, policies, data licenses, and terms of service. The rules of each MLS to which we belong can vary widely and are complex.

From time to time, certain industry practices, including NAR and MLS rules, have come under regulatory scrutiny and, more recently, have been subject to private litigation. There can be no assurances as to whether the Department of Justice (the “DOJ”) or FTC, their state counterparts, or other governmental body will determine that any industry practices or developments have an anti-competitive effect on the industry. Any such determination could result in industry investigations, legislative or regulatory action, private litigation or other actions, any of which could have the potential to disrupt our business.

15

On July 1, 2021, the DOJ announced its withdrawal from a settlement agreement reached during the prior administration with the NAR in relation to claims of anticompetitive behavior with respect to commissions received by buyers’ agents from sellers’ agents. The settlement previously required the NAR to adopt certain rule changes, such as increased disclosure of commission offers from sellers’ agents to buyers’ agents. In January 2023, a federal court ruled that the DOJ must uphold the settlement agreement. The DOJ appealed the district court’s January 2023 ruling. The appellate court heard argument on the appeal on December 1, 2023, but has not yet issued a decision. The withdrawal of the DOJ from this settlement and the executive order signed by President Biden on July 9, 2021, which, among other things, directs the FTC to consider additional rule making pertaining to the real estate industry, indicates increased regulatory scrutiny of the real estate industry.

In addition, private litigants have filed several antitrust suits against the NAR and certain real estate brokerage firms, some of which the DOJ has intervened in, that allege certain NAR and MLS rules are anti-competitive under federal and state antitrust laws and result in increased costs to consumers. Certain of these antitrust suits have resulted in settlement agreements, pursuant to which the settling real estate brokerage companies have agreed to injunctive relief that requires those companies to implement practice changes in their brokerage operations. On October 31, 2023, a federal jury in the Western District of Missouri found in favor of a class of plaintiffs of home sellers from April 2015 to June 2022 in three states, and awarded damages of approximately $1.78 billion (which is subject to statutory treble damages) for anticompetitive behavior in violation of federal antitrust laws arising from the NAR’s requirement that sellers’ agents for MLS-listed properties offer to pay a portion of commissions received on the sale of such properties to buyers’ agents (the Sitzer/Burnett case). Certain of the defendants have indicated that they intend to appeal the judgment in the Sitzer/Burnett case and final resolution is not expected in the near term. Douglas Elliman is not a defendant in the Sitzer/Burnett case.

Following the federal jury decision in the Sitzer/Burnett case on October 31, 2023, several additional putative class action lawsuits were filed against the NAR and additional real estate brokerage firms, including Douglas Elliman or its subsidiaries, alleging anticompetitive conduct similar to that in the Sitzer/Burnett case in violation of federal and state antitrust laws, consumer protection claims and allegations of unjust enrichment. Douglas Elliman is presently aware that it, Douglas Elliman Realty, LLC or one of its brokerage subsidiaries, is a named defendant in seven such matters in Missouri, Illinois, New York and Nevada, which are described in Note 13 to our combined consolidated financial statements included elsewhere in this Form 10-K. Douglas Elliman may become involved in additional legal proceedings concerning the same or similar claims. We are unable to reasonably estimate the financial impact of these matters.

Any of the foregoing litigation (including any related settlement agreement) or subsequent regulatory action, if successful, could result in significant changes or disruptions to industry practices of the residential real estate market, including changes or disruptions to buyers’ agent’s commissions, and could negatively affect our financial condition and results of operations. Such consequences may reduce our revenues, require additional expenditure, or distract our management’s attention from pursuing our growth strategy.

We could experience meaningful changes in industry operations or structure, as a result of governmental pressures, the result of litigation, changes to NAR or MLS rules, the actions of certain competitors or the introduction or growth of certain competitive models.

Infringement, misappropriation or dilution of the intellectual property of Douglas Elliman could harm our business.

We believe the trademark portfolio of Douglas Elliman has significant value and is an important factor in the marketing of our brand. We believe that this and other intellectual property are valuable assets that are critical to our success. We rely on a combination of protections provided by contracts, as well as copyright, trademark, and other laws, to protect our intellectual property from infringement, misappropriation or dilution. We have registered certain trademarks and service marks and have other trademark and service mark registration applications pending in the U.S. and foreign jurisdictions. Although we monitor our trademark portfolio both internally and through external search agents and impose an obligation on agents to notify us upon learning of potential infringement, there can be no assurance that we will be able to adequately maintain, enforce and protect our trademarks or other intellectual property rights.

We are not aware of any challenges to our right to use any of our brand names or trademarks. We are commonly involved in numerous proceedings, generally on a small scale, to enforce our intellectual property and protect our brand. Unauthorized uses or other infringement of our trademarks or service marks, including ones that are currently unknown to us, could diminish the value of our brand and may adversely affect our business. Failure to adequately protect our intellectual property rights could damage our brand and impair our ability to compete effectively. Even where we have effectively secured statutory protection for our trademarks and other intellectual property, our competitors may misappropriate our intellectual property. Defending or enforcing our trademark rights, branding practices and other intellectual property, and seeking an

16

injunction and/or compensation for misappropriation of confidential information, could result in the expenditure of significant resources and divert the attention of management.

Moreover, unauthorized third parties may use Douglas Elliman’s intellectual property to trade on the goodwill of our brand, resulting in consumer confusion or dilution. Any reduction of our brand’s goodwill, consumer confusion, or dilution is likely to impact sales.

We rely on licenses to use the intellectual property rights of third parties which are incorporated into our products and services. Failure to renew or expand existing licenses may require us to modify, limit or discontinue certain offerings.

We rely on products, technologies and intellectual property that we license from third parties for use in our services. There is no assurance that these third-party licenses, or support for such licensed products and technologies, will continue to be available to us on commercially reasonable terms, if at all. In the event that we cannot renew and/or expand existing licenses, we may be required to discontinue or limit our use of the products and technologies that include or incorporate licensed intellectual property.

We cannot be certain that our licensors are not infringing the intellectual property rights of others or that our suppliers and licensors have sufficient rights to the technology in all jurisdictions in which we may operate. Some of our license agreements may be terminated by our licensors for convenience. If we are unable to obtain or maintain rights to any of this technology because of intellectual property infringement claims brought by third parties against our suppliers and licensors or against us, or if we are unable to continue to obtain the technology or enter into new agreements on commercially reasonable terms, our ability to develop our services containing that technology could be severely limited and our business could be disrupted or otherwise harmed. Additionally, if we are unable to obtain necessary technology from third parties, we may be forced to acquire or develop alternate technology, which may require significant time and effort and may be of lower quality or performance standards. This would limit and delay our ability to provide new or competitive offerings and increase our costs. If alternate technology cannot be obtained or developed, we may not be able to offer certain functionality as part of our offerings.

We rely on traffic to our websites, including our flagship website, elliman.com, directed from search engines. If these websites fail to rank prominently in unpaid search results, traffic to these websites could decline and our business would be adversely affected.

Our success depends in part on our ability to attract users through unpaid internet search results on search engines. The number of users we attract to our websites, including our flagship website elliman.com, from search engines is due in large part to how and where our websites rank in unpaid search results. These rankings can be affected by several factors, many of which are not under our direct control, and they may change frequently. For example, a search engine may change its ranking algorithms, methodologies or design layouts. As a result, links to our websites may not be prominent enough to drive traffic to our websites, and we may not know how or otherwise be in a position to influence the results. In some instances, search engine companies may change these rankings to promote their own competing services or the services of one or more of our competitors. Our websites have experienced fluctuations in search result rankings in the past, and we anticipate fluctuations in the future. Any reduction in the number of users directed to our websites could adversely affect our real estate brokerage business and results of operations. Further, a failure of our websites or website-based technology, either due to malfunction, outside intrusion through hacking or otherwise, could significantly disrupt our business and lead to reduced revenue and reputational damage as we may not be able to effectively scale and adapt our existing technology and network infrastructure to ensure our platforms are accessible.

Cybersecurity incidents could disrupt our business operations or could result in the loss of critical and confidential information, which may adversely impact our reputation and harm our business.

Global cybersecurity threats and incidents can range from uncoordinated individual attempts that gain unauthorized access to information technology systems, both internally and externally, to sophisticated and targeted measures, known as advanced persistent threats, directed at us and our affiliated agents. In the ordinary course of our business, we collect and store sensitive data, including our proprietary business information and intellectual property, and personally identifiable information of our customers. Additionally, we increasingly rely on third-party providers, including cloud storage solution providers. The secure processing, maintenance and transmission of this information are critical to our operations and with respect to information collected and stored by our third-party service providers, we are reliant upon their security procedures. Our systems and the confidential information on them may also be compromised by employee misconduct or employee error. We and our third-party service providers have experienced, and expect to continue to experience, these types of internal and external threats and incidents, which can result, and have resulted, in the misappropriation and unavailability of critical data and confidential or proprietary information (our own and that of third parties, including personally identifiable information), the disruption of business operations and the loss of funds. For example, in April 2021, we determined that an unauthorized party gained access

17