Exhibit 99.1

Automated Vending & Unattended Retail Feb 2023 Investor Deck — Confidential Refreshing USA + Integrated Wellness

Disclaim e r This Presentation has been prepared in connection making an evaluation with respect to a proposed business combination (the “Transaction”) between Integrated Wellness Acquisition Corp . (“WEL”) and Refreshing USA LLC (the “Company”), and IWAC Holdings Inc . (“Pubco”) . This Presentation does not purport to contain all of the information that may be required to evaluate a possible transaction . This Presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice . No representation or warranty, express or implied, is or will be given by WEL, Pubco or the Company or any of their respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of a possible transaction, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto . Accordingly, none of WEL, Pubco or the Company or any of their respective affiliates, directors, officers, employees or advisers or any other person shall be liable for any direct, indirect or consequential loss or damages suffered by any person as a result of relying on any statement in or omission from this Presentation and any such liability is expressly disclaimed . This Presentation contains references to trademarks and service marks belonging to other entities . Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or Ρ symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names . We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies . Forward - Looking Statements This Presentation includes “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended (the “Securities Act”), and Section 21 E of the Securities Exchange Act of 1934 , as amended (the “Exchange Act”) . Statements regarding WEL and the Company’s expectations with respect to anticipated financial impacts of the proposed Transaction, the timing of the completion of the proposed Transaction, Refreshing USA’s projected financial and operational performance, new product offerings that Refreshing USA may introduce, and related matters, as well as all other statements other than statements of historical fact included in this Presentation, are forward - looking statements . When used in this Presentation, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions, as they relate to WEL or the Company’s management team, identify forward - looking statements . Such forward - looking statements are based on the beliefs of management, as well as assumptions made by, and information currently available to, WEL’s and the Company’s management . Actual results could differ materially from those contemplated by the forward - looking statements as a result of certain factors detailed in WEL’s and Pubco’s filings with the SEC . Most of these factors are outside the control of WEL and Pubco and are difficult to predict . In addition to factors disclosed in WEL and Pubco’s filings with the SEC, the following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward - looking statements : the risk that the Transaction may not be completed in a timely manner or at all, which may adversely affect the price of the securities of WEL ; the risk that the transaction may not be completed by WEL’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by WEL ; inability to meet the closing conditions to the Transaction, including the occurrence of any event, change, legal proceedings instituted against the Company or against WEL related to the Merger Agreement or the management team, or other circumstances that could give rise to the termination of the Merger Agreement ; the inability to complete the Transaction contemplated by the Merger Agreement due to the failure to obtain approval of WEL’s shareholders and the receipt of certain governmental and regulatory approvals ; changes in Pubco’s capital structure ; redemptions exceeding a maximum threshold or the failure to maintain the listing of WEL’s securities or failure of Pubco to meet The New York Stock Exchange’s initial listing standards in connection with the consummation of the contemplated Transaction ; costs related to the Transaction contemplated by Merger Agreement and the failure to realize anticipated benefits of the Transaction or to realize estimated pro forma results and underlying assumptions, including with respect to estimated shareholder redemptions ; a delay or failure to realize the expected benefits from the proposed Transaction including the Company’s ability to effectively develop and successfully market new products, solutions and services, and to effectively address cost reductions and other changes in its industry ; risks related to disruption of management’s time from ongoing business operations due to the proposed Transaction ; changes in the markets in which Refreshing competes, including with respect to its competitive landscape, technology evolution or the impact of regulatory changes on solutions, services, labor matters, international economic, political, legal, compliance and business factors ; developments and uncertainties in domestic and foreign trade policies and regulations, and other regulations which may cause contractions or affect growth rates and cyclicality of markets Refreshing serves ; disruptions relating to war, terrorism, widespread protests and civil unrest, man - made and natural disasters, public health issues and other events ; changes in domestic and global general economic conditions ; risk that Refreshing may not be able to execute its growth strategies ; security breaches or other disruptions of Refreshing information technology systems or violations of data privacy laws ; risks related to the ongoing COVID - 19 pandemic and response, including new variants of the virus ; the pace of recovery in the markets in which Refreshing operates ; global supply chain disruptions and potential staffing shortages at potential customers which may have a trickle - down effect on Refreshing ; the risk that Refreshing may not be able to develop and maintain effective internal controls ; changes in interest rates ; increased competition and the ability to generate sufficient cash to fulfill obligations ; loss of certain key officers ; loss of continued relationships with customers or bus operators ; and Pubco’s success at managing the foregoing items . The forward - looking statements are based upon management’s beliefs and assumptions ; and other risks and uncertainties to be identified in the Form S - 4 registration/proxy statement (when available) relating to the Transaction, including those under “Risk Factors” therein, and in other filings with the SEC made by WEL or Pubco . Each of WEL, Pubco and the Company undertake no obligation to update these statements for revisions or changes after the date of this Presentation except as required by law . The financial projections presented in this Presentation represent the current estimates by the Company’s management of future performance based on various assumptions, which may or may not prove to be correct . The Company’s independent registered public accounting firm has not audited, reviewed, compiled or performed any procedures with respect to the projections and accordingly they did not express an opinion or provide any other form of assurance with respect thereto . These projections should not be relied upon as being necessarily indicative of future results . The assumptions and estimates underlying these projections are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks that could cause actual results to differ materially from those contained in these projections . Accordingly, there can be no assurance that these projections will be realized . Further, industry experts may disagree with these assumptions and with management's view of the market and the prospects for the Company . Additional Information and Where to Find It In connection with the proposed Transaction, Pubco intends to file a Registration Statement on Form S - 4 (the “Form S - 4 ”) with the SEC, which will include a preliminary prospectus with respect to its securities to be issued in connection with the Transaction and a preliminary proxy statement with respect to WEL’s shareholder meeting at which WEL’s shareholders will be asked to vote on the proposed Transaction . Each of WEL, Pubco and the Company urge investors, shareholders, and other interested persons to read, when available, the Form S - 4 , including the proxy statement/prospectus, any amendments thereto, and any other documents filed with the SEC, before making any voting or investment decision because these documents will contain important information about the proposed Transaction . After the Form S - 4 has been filed and declared effective, WEL will mail the definitive proxy statement/prospectus to shareholders of WEL as of a record date to be established for voting on the Transaction . WEL’s shareholders will also be able to obtain a copy of such documents, without charge, by directing a request to : Integrated Wellness Acquisition Corp . , 148 N Main Street, Florida, NY 10921 ; e - mail : investor@integratedwellnessholdings . com . These documents, once available, can also be obtained, without charge, at the SEC’s website www . sec . gov . Participants in the Solicitation WEL, Pubco and their respective directors and officers may be deemed participants in the solicitation of proxies of WEL’s shareholders in connection with the proposed Transaction . Security holders may obtain more detailed information regarding the names, affiliations, and interests of certain of Pubco and WEL’s executive officers and directors in the solicitation by reading WEL’s final prospectus filed with the SEC on December 9 , 2021 , and the proxy statement/prospectus and other relevant materials filed with the SEC in connection with the Transaction when they become available . Information concerning the interests of Pubco and WEL’s participants in the solicitation, which may, in some cases, be different from those of their shareholders generally, will be set forth in the proxy statement/prospectus relating to the Transaction when it becomes available . These documents can be obtained free of charge from the source indicated above . The Company and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of WEL in connection with the proposed Transaction . A list of the names of such directors and executive officers and information regarding their interests in the proposed Transaction will be included in the proxy statement/prospectus for the proposed Transaction . No Offer or Solicitation This Presentation does not constitute an offer to sell or a solicitation of an offer to buy, or the solicitation of any vote or approval in any jurisdiction in connection with the proposed Transaction or any related transactions, nor shall there be any sale, issuance or transfer of securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful . Any offering of securities or solicitation of votes regarding the proposed transaction will be made only by means of a proxy statement/prospectus that complies with applicable rules and regulations promulgated under the Securities Act, and Exchange Act, or pursuant to an exemption from the Securities Act or in a transaction not subject to the registration requirements of the Securities Act . 1 Strictly confidential

Transaction Summary Ryan Wear Founder & CEO Jeremy Briggs Director of Finance James Ma c Pherson CFO and Director Integrated Wellness Acquisition Corp V a lua t i o n Capital S t ruc t ure Ownership Opportunity Today’s Presenters Transaction Highlights • Pro - forma enterprise value of $197.97 MM • EV / 22E EBITDA implied multiple of 14.0x • Profitable company with no net debt • No capital required for closing • Free Cash Flow positive • 100% rollover equity from Refreshing equityholders • Refreshing equityholders expected to maintain majority ownership of the combined company • A US national independent automated vending and unattended retailers • Low churn and diversified client base • Proven track record of sales growth (65% CAGR) and profitability growth (36% CAGR) in 20 - 22 • 19% EBITDA Margins 2 Strictly confidential

WEL Investment Thesis A US national independent unattended retailer Founder - led and experienced management team Strong financial performance and growth profile Major organic and non - organic growth opportunities Economies of scale and growing margins 3 Strictly confidential

$5.7 $10.5 $14.1 Proven track record of growth and profitability Business model with low customer turnover and a diversified customer base Revenue ($ in millions) EBITDA (1) ($ in millions) NOTE: (All data in millions, except per share price) 1. See slide 15 $16.8 $47.1 $75.7 2022E (2) 4 2. Represents unaudited fiscal year 2022 results prepared by Company Management 3. Audited Strictly confidential 2022E (2) 2021A (3) 2020A (3) 2020A (3) 2021A (3)

Illustrative Transaction Overview Sources (1) Refreshing Equity (4) $1 6 0. 0 0 SPAC Cash in Trust $11 7 . 7 8 Total Sources (3) $2 77 . 7 8 Uses (1) Refreshing Equity $1 6 0. 0 0 Cash to Balance Sheet $105. 7 8 Transaction Expenses (4) $12 .0 0 Total Uses (3), (5) $2 77 . 7 8 Pro Forma Valuation (1) Share Price ($ / sh.) $10. 0 0 Pro Forma Shares Outstanding 3 0. 3 8 Implied Equity Value $ 303 . 7 5 (+) Debt 0. 0 0 ( - ) Pro Forma Cash $(105. 7 8) Enterprise Value (3), (5) $19 7 .97 EV / 2022E EBITDA 14. 0x Pro Forma Valuation Transaction Structure • Refreshing to combine with Integrated Wellness Acquisition Corp (WEL) • WEL is a NYSE - listed SPAC with ~$117.78 MM cash currently held in trust (1) Valuation • Transaction implies a pro forma enterprise value of ~$197.97 MM and pro forma equity value of ~$303.75 MM (3) , (4) , (5) • Expected to close in Q2 of 2023 (2) Capital Structure • The Transaction is expected to result in ~$105.78 MM of cash proceeds to fund growth and expansion (3) , (5) • Existing Refreshing equityholders to roll over 100% of their equity and will own 52.67% of the pro forma combined company at closing (3) , (4) NOTE: (All data in millions, except per share price) 1. As of September 30, 2022 2. Timing dependent upon the SEC review process and the satisfaction of other closing conditions 3. Based on $117.78 MM cash from WEL’s trust account and assumes no redemptions by WEL shareholders 4. Excludes Earnouts and reflects the conversion of Refreshing’s outstanding convertible notes and/or preferred stock, which will convert into common stock of the combined company 5. Estimate of Refreshing and WEL’s aggregate investment banking, deferred underwriting, legal, SEC and stock exchange, printing and consulting fees and expenses Sources: 1. Company Filings, Management Accounts 52.67% Refreshing Shareholders 37.86% WEL Shareholders 9.47% WEL Sponsor 5 Strictly confidential

Our Services >25,000 Vending Machines Instantly recognizable products at the touch of a button Servicing >500 Office Coffee Locations National and regional coffees, brewed to perfection ~1,000 Micro Markets On - site convenience store, customized for each individual consumer 24/7 Remote monitoring 6 Strictly confidential

Highly diversified customer base with low churn Currently in ~ 3,000 schools, universities, hospitals, and corporate offices No single customer represents more than 10% in total revenue Revenue Breakdown by Client Type 18% Grade Schools 18% Univer s it ies 18% Hospitals 9% O t h er 37% Corpo r a t e Offices 7 Strictly confidential

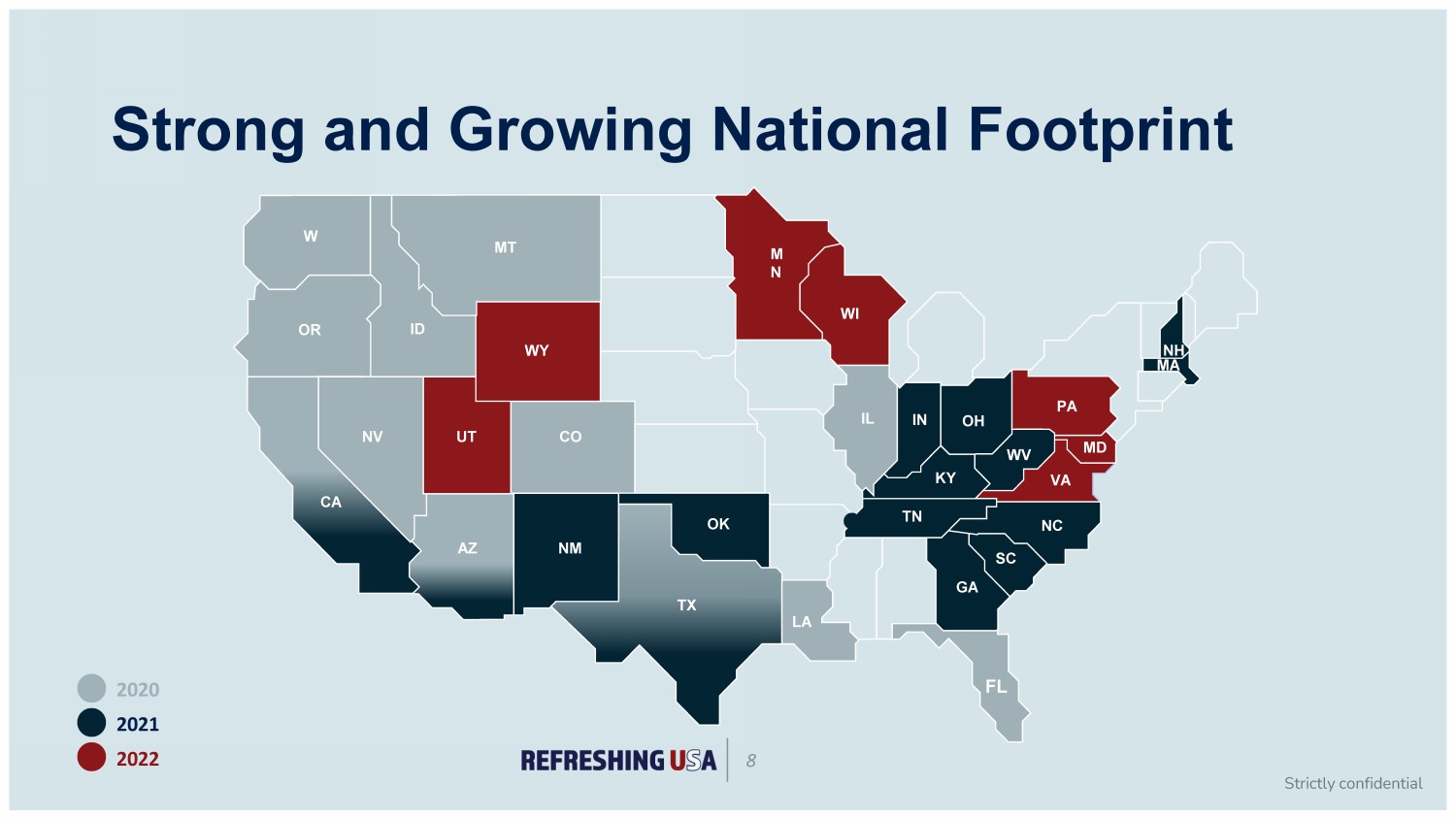

Strong and Growing National Footprint 2020 2021 M N 2022 8 Strictly confidential WI IL IN OH KY WV TN VA MD PA NH MA NC SC GA FL LA TX OK NM AZ CA NV UT CO WY ID MT W OR

Growth Opportunities Organic growth • Leverage national footprint to add significant new accounts: • Targeting Fortune 500 companies - high - value contracts • Low execution risk: • Utilizing existing infrastructure (incl. network of warehouses, fleet, IT, purchasing power, inventory management, etc) • Long - term contracts and captive customers • Machines can be re - used and upgraded with minimal costs • Capitalize on shifting dynamics in unattended retail spaces (micro markets) 9 Strictly confidential • Strong future pipeline of M&A • M&A Criterion • Accretive on a per share basis, target acquisition price is 0 . 5 - 1 . 0 x sales and 3 - 6 x cash flow • Cost efficiency drivers • leverage purchasing power to improve gross margins • Telemetry stack is updated thereby reducing G&A. • Public listing may allow for additional optionality of transaction structure: mix of cash, debt and stock M&A strategy • Wholesale Distribution: • Using existing footprint for 3rd party distribution • Technology: • Enhanced data capture to offer digital advertisements, and customer incentive programs • White label / specialty products : • Ability to promote “white label” products and increase profit margins Leveraging infrastructure

2022E / Rev enue Growth 2022E EBITDA Margin Operational Benchmarking 19% 4% 2% 2% 8% 8% 17% 9% 19% 61% 16% 7% 53% 27% 4% 39% 17% 8% Comparable Companies Food and Beverage Distributors Automated Vending and Food Service ’22 Avg. 12% ’22 Avg. 3% ’22 Avg. 25% ’22 Avg. 19% Source: Refreshing USA, Capital IQ, and Public Company Filings. Revenue Growth and EBITDA Margin estimates as of Jan - 2023. 10 Strictly confidential

2022E EV / Revenue 2022E EV / EBITDA Trading Multiples 14.0x 10.5x 7.9x 11.3x 14.7x 11.1x 8.7x 16.2x 9.5x Comparable Companies 2.6x 1.1x 0.4x 0.2x 0.2x 0.8x 1.5x 1.5x 1.8x Food and Beverage Distributors Automated Vending and Food Service ’22 Avg. 0.3x ’22 Avg. 9.9x ’22 Avg. 1.3x ’22 Avg. 12.0x Source: Refreshing USA, Capital IQ, and Public Company Filings. Revenue and EBITDA estimates as of Jan - 2023. 11 Strictly confidential

Contact Scott@integratedwellnessholdings.com 12 Strictly confidential Scott Powell | Director Integrated Wellness (917) 721 - 9480

AN N EX Jan 2023 13 Strictly confidential

Annex EBITDA Reconciliation EBITDA Reconciliation ($ in thousands) Fiscal Year Ending (est) Fiscal Year Ending Fiscal Year Ending 12/31/2022 12/31/2021 12/31/2020 NET INCOME AFTER TAXES $9,551 $6,241 $3,894 Add Back Taxes 2,544 1,659 1,035 Depreciation & Amortization 2,033 2,551 747 Interest 20 -- -- EBITDA $14,148 $10,451 $5,676 14 Strictly confidential