Table of Contents

Cayman Islands |

3826 |

Not Applicable | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

| Jonathan B. Stone, Esq. Paloma Wang, Esq. Skadden, Arps, Slate, Meagher & Flom LLP 42/F, Edinburgh Tower, The Landmark 15 Queen’s Road Central Hong Kong Tel: +852 3740-4700 |

Peter X. Huang, Esq. Skadden, Arps, Slate, Meagher & Flom LLP 30/F, China World Office 2 No. 1, Jian Guo Men Wai Avenue Beijing 100004, P.R. China Tel: +86 10-6535-5500 |

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission, or “SEC,” is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 14, 2022

PRELIMINARY PROSPECTUS

Prenetics Global Limited

60,441,798 CLASS A ORDINARY SHARES,

6,041,007 WARRANTS TO PURCHASE CLASS A ORDINARY SHARES AND

7,792,898 CLASS A ORDINARY SHARES UNDERLYING WARRANTS

This prospectus relates to the offer and resale from time to time by the selling securityholders or their pledgees, donees, transferees, assignees or other successors-in-interest that receive any of the securities being registered hereunder as a gift, distribution, or other non-sale related transfer (collectively, the “Selling Securityholders”) of up to (A) 60,441,798 Class A Ordinary Shares, which includes (i) 7,198,200 Class A Ordinary Shares issued in the PIPE Investment at an effective price of $7.75 per share, pursuant to the Amended PIPE Subscription Agreements, (ii) 7,740,000 Class A Ordinary Shares issued to the Forward Purchase Investors at an effective price of $7.75 per share (assuming no value is assigned to the Artisan Private Warrants issued to the Forward Purchase Investors referred to in clause (B)), pursuant to the Amended Forward Purchase Agreements and the Deeds of Amendment to Deed of Novation and Amendment, (iii) 6,933,558 Class A Ordinary Shares issued to the Sponsor pursuant to the Initial Merger, which shares were exchanged from the Artisan Public Shares which were issued upon conversion of the Founder Shares originally issued as set forth in the immediately following paragraph, (iv) 100,000 Class A Ordinary Shares issued to certain Artisan directors pursuant to the Initial Merger, which shares were exchanged from the Artisan Public Shares which were issued upon conversion of the Founder Shares originally issued as set forth in the immediately following paragraph, (v) 9,713,864 Class A Ordinary Shares issuable upon the conversion of 9,713,864 Class B Ordinary Shares issued to Da Yeung Limited pursuant to the Acquisition Merger, which shares were exchanged from ordinary shares and Series A preferred shares of Prenetics originally issued by Prenetics at a weighted average effective price of $0.04 per share, as adjusted for the Exchange Ratio, (vi) 1,881,844 Class A Ordinary Shares issued to Avrom Boris Lasarow pursuant to the Acquisition Merger, which shares were exchanged from ordinary shares of Prenetics originally issued by Prenetics at an effective price of $1.60 per share, as adjusted for the Exchange Ratio, (vii) 3,840,716 Class A Ordinary Shares issued to For Excelsiors Limited pursuant to the Acquisition Merger, which shares were exchanged from ordinary shares of Prenetics originally issued by Prenetics at a weighted average effective price of $0.03 per share, as adjusted for the Exchange Ratio, (viii) 12,660,138 Class A Ordinary Shares issued to Prudential Hong Kong Limited pursuant to the Acquisition Merger, which shares were exchanged from Series C preferred shares of Prenetics originally issued by Prenetics at an effective price of $1.60 per share, as adjusted for the Exchange Ratio, (ix) 9,206,785 Class A Ordinary Shares issued to Genetel Bioventures Limited pursuant to the Acquisition Merger, which shares were exchanged from ordinary shares of Prenetics originally issued by Prenetics at a weighted average effective price of $0.07 per share, as adjusted for the Exchange Ratio, (x) 789,282 Class A Ordinary Shares issued to Cui Zhanfeng pursuant to the Acquisition Merger, which shares were exchanged from ordinary shares of Prenetics originally issued by Prenetics at an effective price of $2.25 per share, as adjusted for the Exchange Ratio, and (xi) 377,411 Class A Ordinary Shares issued to Lucky Rider Investments Limited pursuant to the Acquisition Merger, which shares were exchanged from Series D preferred shares of Prenetics originally issued by Prenetics at an effective price of $2.25 per share, as adjusted for the Exchange Ratio; (B) 6,041,007 Warrants (“Private Warrants”) issued to the Sponsor and the Forward Purchase Investors pursuant to the Initial Merger, which were exchanged from Artisan Private Warrants originally issued to the Sponsor at a purchase price of $1.50 and to the Forward Purchase Investors (together with the issuance of Class A Ordinary Shares) pursuant to the Amended Forward Purchase Agreements and the Deeds of Amendment to Deed of Novation and Amendment; and (C) up to 7,792,898 Class A Ordinary Shares issuable upon exercises of the Private Warrants.

Prior to the consummation of Artisan’s IPO, the Sponsor purchased 8,625,000 Founder Shares for an aggregate purchase price of $25,000, or approximately $0.003 per share. Artisan subsequently effected a share recapitalization and issued an additional 1,500,000 Founder Shares to the Sponsor for no consideration. The Sponsor subsequently transferred an aggregate of 100,000 Founder Shares to certain Artisan directors for no consideration and an aggregate of 750,000 Founder Shares to the Forward Purchase Investors pursuant to the Forward Purchase Agreements, and forfeited 141,442 Founder Shares as the over-allotment option of the underwriters of Artisan’s IPO was not exercised in full, resulting in the Sponsor owning 9,133,558 Founder Shares. Pursuant to the Sponsor Agreement and the Initial Merger, all 9,133,558 Founder Shares were converted into Artisan Public Shares which were then exchanged for an aggregate of 6,933,558 Class A Ordinary Shares upon the closing of the Initial Merger. This resulted in an effective price of approximately $0.004 per share for each of the shares received by the Sponsor pursuant to the Initial Merger and being registered for resale by the Sponsor (or its transferrees) pursuant to this registration statement. On June 9, 2022, the Sponsor distributed the 6,933,558 Class A Ordinary Shares and 4,541,007 Private Warrants held by it to its two members on a pro rata basis, Woodbury Capital Management Limited and M13 Capital Management Holdings Limited.

We are registering the offer and resale of these securities to satisfy certain registration rights we have granted. The Selling Securityholders may offer all or part of the securities for resale from time to time through public or private transactions in amounts, at prices and on terms determined at the time of offering. The Selling Securityholders may offer and sell these securities directly to purchasers, through agents in ordinary brokerage transactions, in underwritten offerings, directly to market makers of our shares or through any other means described in the section entitled “Plan of Distribution” herein. In connection with any sales of securities offered hereunder, the Selling Securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, or the “Securities Act.”

We will not receive any proceeds from the sale of the securities by the Selling Securityholders, except with respect to amounts received by the Company upon exercise of the Warrants to the extent such Warrants are exercised for cash. Assuming the exercise of all outstanding warrants for cash, we would receive aggregate proceeds of approximately $154.6 million. However, we will only receive such proceeds if all the Warrant holders exercise all of their Warrants. The exercise price of our Warrants is $8.91 per 1.29 shares (or an effective price of $6.91 per share), subject to adjustment. We believe that the likelihood that warrant holders determine to exercise their warrants, and therefore the

Table of Contents

amount of cash proceeds that we would receive, is dependent upon the market price of our Class A Ordinary Shares. If the market price for our Class A Ordinary Shares is less than the exercise price of the warrants (on a per share basis), we believe that warrant holders will be very unlikely to exercise any of their warrants, and accordingly, we will not receive any such proceeds. There is no assurance that the warrants will be “in the money” prior to their expiration or that the warrant holders will exercise their warrants. On December 12, 2022, the closing price of our Class A Ordinary Shares was $1.87 per share. Holders of the Private Warrants have the option to exercise the Private Warrants on a cashless basis in accordance with the Existing Warrant Agreement. To the extent that any warrants are exercised on a cashless basis, the amount of cash we would receive from the exercise of the warrants will decrease.

Our Class A Ordinary Shares and Warrants are listed on the Nasdaq Stock Market LLC, or “NASDAQ,” under the trading symbols “PRE” and “PRENW,” respectively. On December 12, 2022, the closing price for our Class A Ordinary Shares on NASDAQ was $1.87 per share. On December 12, 2022, the closing price for our Warrants on NASDAQ was $0.121 per unit.

In connection with and prior to the Business Combination, holders of 28,878,277 Artisan Public Shares exercised their right to redeem their shares for cash at a price of approximately $10.01 per share, for an aggregate price of $288.9 million, which represented approximately 85.1% of the total Artisan Public Shares then outstanding. The Class A Ordinary Shares being offered for resale pursuant to this prospectus represent approximately 48.3% of the total outstanding Class A Ordinary Shares (assuming and after giving effect to the issuance of shares upon exercise of all outstanding Warrants) as of December 5, 2022, and the warrants being offered for resale pursuant to this prospectus represent approximately 34.8% of our outstanding Warrants as of December 5, 2022. Given the substantial number of securities being registered for potential resale by the selling securityholders pursuant to this registration statement, the sale of such securities by the selling securityholders, or the perception in the market that the selling securityholders may or intend to sell all or a significant portion of such securities, could increase the volatility of the market price of our Class A Ordinary Shares or Warrants or result in a significant decline in the public trading price of our Class A Ordinary Shares or Warrants. Even though the current trading price of the Class A Ordinary Shares is below $10.00, which is the price at which the units were issued in Artisan’s IPO, the Sponsor (or its transferrees) and certain other selling securityholders have an incentive to sell their Class A Ordinary Shares because they will still profit on sales due to the lower price at which they purchased their shares compared to the price at which public investors in Artisan’s IPO purchased their shares or the current trading price of our Class A Ordinary Shares. Public investors may not experience a similar rate of return on the securities they purchase due to differences in the purchase prices that they paid and the current trading price. Based on the closing prices of our Class A Ordinary Shares and Warrants referenced above, (i) the selling securityholders that were formerly securityholders of Prenetics may experience profit ranging from nil to $1.84 per share, (ii) the Sponsor (or its transferrees) may experience profit of up to $1.87 per share, or up to approximately $12.97 million in the aggregate, and (iii) the Artisan Directors may experience profit of up to $1.87 per share, or up to approximately $187,000 in the aggregate.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

We are an “emerging growth company” under applicable U.S. federal securities laws and, as such, are eligible for certain reduced public company reporting requirements. See “Prospectus Summary — Emerging Growth Company.”

We are a “foreign private issuer” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company disclosure and reporting requirements. See “Prospectus Summary — Foreign Private Issuer.”

Throughout this prospectus, unless the context indicates otherwise, references to “Prenetics” refer to Prenetics Holding Company Limited, formerly known as Prenetics Group Limited, a Cayman Islands holding company, references to “Prenetics HK” refer to Prenetics Limited, a wholly owned subsidiary of Prenetics, and references to “Prenetics Group” refer to Prenetics Holding Company Limited, together as a group with its subsidiaries, including its operating subsidiaries, and, prior to the termination of the VIE agreements on November 26, 2021, the VIE Entity (as defined below). Prenetics HK, Prenetics EMEA Limited, Oxsed Limited, Prenetics Innovation Labs Private Limited and Prenetics Africa (Pty) Limited, the operating subsidiaries of Prenetics’ based in the United Kingdom, Hong Kong, India and South Africa, respectively (collectively, “Prenetics Operating Subsidiaries”), conduct our daily operations. As a result of the Business Combination, Prenetics has become a wholly owned subsidiary of ours. We are a Cayman Islands holding company and not an operating company. Investors purchasing our securities are purchasing equity interests in the Cayman Islands holding company and are not purchasing equity interests of Prenetics Operating Subsidiaries.

Recently, the Chinese government announced that it would increase supervision of mainland Chinese firms listed offshore. Under the new measures, China will improve regulation of cross-border data flows and security, police illegal activity in the securities market and punish fraudulent securities issuances, market manipulation and insider trading. China will also monitor sources of funding for securities investment and control leverage ratios. The Cyberspace Administration of China (“CAC”) has also opened a cybersecurity probe into several large U.S.-listed technology companies focusing on anti-monopoly and financial technology regulation and, more recently with the passage of the PRC Data Security Law, how companies collect, store, process and transfer data.

We face various legal and operational risks and uncertainties relating to our operations in Hong Kong. Historically, Prenetics HK held a minority interest in a genomics business in mainland China through Shenzhen Discover Health Technology Co., Ltd. (the “VIE Entity”), a PRC limited liability company, by entering into a series of contractual arrangements with the VIE Entity and its nominee shareholders through Prenetics HK’s wholly owned PRC subsidiary, Qianhai Prenetics Technology (Shenzhen) Co., Ltd. (the “WFOE”). On November 26, 2021, the agreements governing the VIE Entity were terminated with immediate effect. As a result, our corporate structure no longer contain any variable interest entity, or VIE. While the current corporate structure does not contain any VIE and we have no intention establishing any VIEs in PRC in the future, if in the future our structure were to contain a VIE, the PRC regulatory authorities could disallow the VIE structure, which would likely result in a material adverse change in our operations, and our securities may decline significantly in value or become worthless. Although currently we do not have any business operations in mainland China nor do we have any VIE structure and we believe that the laws and regulations of the PRC applicable in mainland China do not currently have any material impact on our business, financial condition or results of operations, we face risks and uncertainties associated with the complex and evolving PRC laws and regulations and as to whether and how the recent PRC government statements and regulatory developments, such as those relating to VIE,

Table of Contents

data and cyberspace security, and anti-monopoly concerns, would be applicable to the company such as Prenetics or Prenetics HK given its substantial operations in Hong Kong and the Chinese government’s significant oversight authority over the conduct of business in Hong Kong.

Should the Chinese government seek to affect operations of any company with any level of operations in Hong Kong, or should certain PRC laws and regulations or these statements or regulatory actions become applicable to us in the future, it would likely have a material adverse impact on our business, financial condition and results of operations, ability to accept foreign investments and our ability to offer or continue to offer securities to investors on a U.S. or other international securities exchange, any of which may cause the value of our securities to significantly decline or become worthless. For example, if the recent PRC regulatory actions on data security or other data-related laws and regulations were to apply to us it could become subject to certain cybersecurity and data privacy obligations, including the potential requirement to conduct a cybersecurity review for its listing at a foreign stock exchange, and the failure to meet such obligations could result in penalties and other regulatory actions against it and may materially and adversely affect its business and results of operations. Furthermore, the Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020. The HFCAA states that if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC will prohibit our shares from being traded on a national securities exchange or in the over-the-counter trading market in the United States. Since our auditor is located in China, a jurisdiction where the PCAOB has been unable to conduct inspections without the approval of the Chinese authorities, our auditor is not currently inspected by the PCAOB, which may impact our ability to remain listed on a United States stock exchange. On December 16, 2021, the PCAOB issued a report on its determinations that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, and our auditor is subject to this determination. In accordance with the HFCA Act, our securities could be prohibited from being traded on a national securities exchange or in the over-the-counter trading market in the United States in 2025 if the PCAOB is unable to inspect or investigate completely auditors located in China, or in 2024 if proposed changes to the law, or the Accelerating Holding Foreign Companies Accountable Act, are enacted. As a result, the Nasdaq may determine to delist our securities. The related risks and uncertainties could cause the value of our securities to significantly decline. On August 26, 2022, the PCAOB signed a Statement of Protocol with the CSRC and the Ministry of Finance, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. For more details, see “Risk Factors — Risks Relating to Our Business and Industry — Risks Relating to Doing Business in Hong Kong — Our securities may be delisted or prohibited from being traded “over-the-counter” under the Holding Foreign Companies Accountable Act, or the HFCA Act, in 2025 if the PCAOB is unable to inspect or investigate completely auditors located in China, or as early as 2024 if proposed changes to the law are enacted. The delisting or the cessation of trading “over-the-counter” of our securities, or the threat of being delisted or prohibited, may materially and adversely affect the value and/or liquidity of your investment.” In light of the PRC government’s expansion of authority in Hong Kong, there are risks and uncertainties which we cannot foresee for the time being, and rules and regulations in China can change quickly with little or no advance notice. The PRC government may intervene or influence our current and future operations in Hong Kong and mainland China at any time, or may exert more control over offerings conducted overseas and/or foreign investment in companies like us. For a detailed description of risks relating to doing business in Hong Kong, see “Risk Factors — Risks Relating to Doing Business in Hong Kong.”

In February 2019, Prenetics HK invested in a genomics business in mainland China in the amount of RMB29,250,000 (equivalent to $4,236,765) through its VIE Entity. Since the date of the initial investment through the date of this prospectus, no transfer of cash, dividends or distributions has been made between us or our subsidiaries, on one hand, and the VIE Entity, on the other. Between Prenetics HK and its subsidiaries, the cash was transferred from Prenetics HK to its subsidiaries in the form of capital contributions and through intercompany advances. No transfer of cash has been made between Prenetics and its subsidiaries. Neither Prenetics HK nor Prenetics has declared or paid dividends in the past, nor have any dividends or distributions been made by a subsidiary to Prenetics HK or Prenetics. If needed, cash may be transferred between Prenetics HK and its subsidiaries in the United Kingdom, India and South Africa through intercompany fund advances and capital contributions, and there are currently no restrictions of transferring funds between Prenetics HK and its subsidiaries in the United Kingdom, India and South Africa. However, there also can be no assurance that the PRC government will not intervene or impose restrictions on our ability to transfer or distribute cash within our organization, which could result in an inability or prohibition on making transfers or distributions to entities outside of Hong Kong and adversely affect its business. Under our cash management policy, the amount of intercompany transfer of funds is determined based on the working capital needs of the subsidiaries and intercompany transactions and is subject to internal approval process and funding arrangements. Our management review and monitor our cash flow forecast and working capital needs of the subsidiaries on a regular basis. In addition, we have not faced difficulties or limitations on our ability to transfer cash between subsidiaries in United Kingdom, India, Singapore and South Africa. Cash generated from Prenetics HK is used to fund operations of its subsidiaries, and no funds were transferred from our subsidiaries in the United Kingdom to fund operations of Prenetics HK for the year ended on December 31, 2019, December 31, 2020, and December 31, 2021. For a detailed description of the intercompany transfer of cash within our group, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operation — Liquidity and Capital Resources.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 14 of this prospectus and other risk factors contained in the documents incorporated by reference herein for a discussion of information that should be considered in connection with an investment in our securities.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PROSPECTUS DATED , 2022

Table of Contents

TABLE OF CONTENTS

| ii | ||||

| iii | ||||

| iv | ||||

| v | ||||

| vii | ||||

| 1 | ||||

| 12 | ||||

| 14 | ||||

| 62 | ||||

| 63 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 78 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

114 | |||

| 139 | ||||

| 149 | ||||

| 151 | ||||

| 154 | ||||

| 161 | ||||

| 168 | ||||

| 171 | ||||

| 178 | ||||

| 183 | ||||

| 184 | ||||

| 185 | ||||

| ENFORCEABILITY OF CIVIL LIABILITIES AND AGENT FOR SERVICE OF PROCESS IN THE UNITED STATES |

186 | |||

| 187 | ||||

| F-1 |

You should rely only on the information contained or incorporated by reference in this prospectus or any supplement. Neither we nor the Selling Securityholders have authorized anyone else to provide you with different information. The securities offered by this prospectus are being offered only in jurisdictions where the offer is permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any date other than the date on the front of each document. Our business, financial condition, results of operations and prospects may have changed since that date.

Except as otherwise set forth in this prospectus, neither we nor the Selling Securityholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-1 filed with the SEC by Prenetics Global Limited. The Selling Securityholders named in this prospectus may, from time to time, sell the securities described in this prospectus in one or more offerings. This prospectus includes important information about us, the securities being offered by the Selling Securityholders and other information you should know before investing. Any prospectus supplement may also add, update, or change information in this prospectus. If there is any inconsistency between the information contained in this prospectus and any prospectus supplement, you should rely on the information contained in that particular prospectus supplement. This prospectus does not contain all of the information provided in the registration statement that we filed with the SEC. You should read this prospectus together with the additional information about us described in the section below entitled “Where You Can Find More Information.” You should rely only on information contained in this prospectus. We have not, and the Selling Securityholders have not, authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date on the front cover of the prospectus. You should not assume that the information contained in this prospectus is accurate as of any other date.

The Selling Securityholders may offer and sell the securities directly to purchasers, through agents selected by the Selling Securityholders, to or through underwriters or dealers or through any other means described in “Plan of Distribution.” A prospectus supplement, if required, may describe the terms of the plan of distribution and set forth the names of any agents, underwriters or dealers involved in the sale of securities.

References to “U.S. Dollars,” “USD,” “US$” and “$” in this prospectus are to United States dollars, the legal currency of the United States. Discrepancies in any table between totals and sums of the amounts listed are due to rounding. Certain amounts and percentages have been rounded; consequently, certain figures may add up to be more or less than the total amount and certain percentages may add up to be more or less than 100% due to rounding. In particular and without limitation, amounts expressed in millions contained in this prospectus have been rounded to a single decimal place for the convenience of readers.

Throughout this prospectus, unless otherwise designated, the terms “we,” “us,” “our,” “PubCo,” “the Company” and “our company” refer to Prenetics Global Limited and its subsidiaries and consolidated affiliated entities. References to “Prenetics” refers to Prenetics Holding Company Limited.

ii

Table of Contents

FINANCIAL STATEMENT PRESENTATION

The audited consolidated statements of financial position of Prenetics Group Limited and its subsidiaries as of December 31, 2021 and 2020, and the related consolidated statements of profit or loss and other comprehensive income, changes in equity and cash flows for each of the years in the three-year period ended December 31, 2021, and the related notes, included in this prospectus have been prepared in accordance with IFRS as issued by the International Accounting Standards Board (“IASB”) and are presented in U.S. Dollars. On May 17, 2022, Prenetics Group Limited changed its name to Prenetics Holding Company Limited.

The unaudited condensed consolidated financial statements of Prenetics Global Limited as of June 30, 2022 and for the six-month periods ended June 30, 2021 and 2022 included in this prospectus have been prepared in accordance with International Accounting Standards (“IAS”) 34 Interim Financial Reporting, issued by the IASB, and should be read in conjunction with the audited consolidated financial statements of Prenetics Group Limited, included elsewhere in this prospectus. On May 18, 2022, Prenetics Global Limited completed a public listing and additional capitalization by the acquisition of a special purpose acquisition company, Artisan Acquisition Corp., with Prenetics Holding Company Limited being identified as the acquirer for accounting purposes. Accordingly, the unaudited condensed consolidated financial statements of Prenetics Global Limited have been presented as a continuation of the consolidated financial statements of the Prenetics Group Limited, except for the capital structure.

We refer in various places in this prospectus to non-IFRS financial measures, including Adjusted EBITDA and Adjusted gross profit, which are more fully explained in “Prospectus Summary — Unaudited Financial Information and Non-IFRS Financial Measures.” The presentation of non-IFRS information is not meant to be considered in isolation or as a substitute for our consolidated financial results prepared in accordance with IFRS.

iii

Table of Contents

INDUSTRY AND MARKET DATA

Our industry and market position information that appears in this prospectus is from independent market research carried out by Frost & Sullivan (“F&S”), which was commissioned by us. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates.

Such information is supplemented where necessary with our own internal estimates and information obtained from discussions with our customers, taking into account publicly available information about other industry participants and our management’s judgment where information is not publicly available. This information appears in “Prospectus Summary,” “Market Opportunities,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and other sections of this prospectus.

Industry reports, publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. In some cases, we do not expressly refer to the sources from which this data is derived. While we have compiled, extracted, and reproduced industry data from these sources, we have not independently verified the data. We are responsible for the industry and market data contained in this prospectus. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

iv

Table of Contents

FORWARD-LOOKING STATEMENTS

This prospectus and any prospectus supplement include statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results of operations or financial condition and therefore are, or may be deemed to be, “forward-looking statements.” These forward-looking statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believe,” “estimate,” “anticipate,” “expect,” “seek,” “project,” “intend,” “plan,” “may,” “will” or “should” or, in each case, their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies, future market conditions or economic performance and developments in the capital and credit markets and expected future financial performance, the markets in which we operate, as well as the possible or assumed future results of operations of our Company. Such forward-looking statements are based on available current market material and management’s expectations, beliefs and forecasts concerning future events impacting us. Factors that may impact such forward-looking statements include:

| • | Changes in applicable laws or regulations, or the application thereof to us, including, without limitation, changes in PRC laws and regulations that currently do not apply to us but may become applicable to us; |

| • | Developments related to the COVID-19 pandemic, including, among others, with respect to stay-at-home orders, social distancing measures, the success of vaccine rollouts, numbers of COVID-19 cases and the occurrence of new COVID-19 strains; |

| • | The regulatory environment and changes in laws, regulations or policies in the jurisdictions in which we operate; |

| • | Our ability to successfully compete in highly competitive industries and markets; |

| • | Our ability to continue to adjust our offerings to meet market demand, attract customers to choose our products and services and grow our ecosystem; |

| • | Political instability in the jurisdictions in which we operate; |

| • | The overall economic environment and general market and economic conditions in the jurisdictions in which we operate; |

| • | Our ability to execute our strategies, manage growth and maintain our corporate culture as we grow; |

| • | Our anticipated investments in new products, services, collaboration arrangements, technologies and strategic acquisitions, and the effect of these investments on our results of operations; |

| • | Our ability to develop and protect intellectual property; |

| • | Changes in the need for capital and the availability of financing and capital to fund these needs; |

| • | Anticipated technology trends and developments and our ability to address those trends and developments with our products and services; |

| • | The safety, affordability, convenience and breadth of our products and services; |

| • | Man-made or natural disasters, health epidemics, and other outbreaks including war, acts of international or domestic terrorism, civil disturbances, occurrences of catastrophic events and acts of God such as floods, earthquakes, wildfires, typhoons and other adverse weather and natural conditions that may directly or indirectly affect our business or assets; |

| • | The loss of key personnel and the inability to replace such personnel on a timely basis or on acceptable terms; |

v

Table of Contents

| • | Exchange rate fluctuations; |

| • | Changes in interest rates or rates of inflation; |

| • | Legal, regulatory and other proceedings; |

| • | Our ability to maintain the listing of our securities on NASDAQ; and |

| • | The results of any future financing efforts. |

The forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. In light of these risks and uncertainties, you should keep in mind that any event described in a forward-looking statement made in this prospectus or elsewhere might not occur.

vi

Table of Contents

CONVENTIONS AND FREQUENTLY USED TERMS

Throughout this prospectus, unless otherwise designated, the terms “we,” “us,” “our,” “PubCo,” “the Company” and “our company” refer to Prenetics Global Limited and its subsidiaries and consolidated affiliated entities. References to “Prenetics” refer to Prenetics Holding Company Limited, formerly known as Prenetics Group Limited, a Cayman Islands holding company. References to “Prenetics HK” refer to Prenetics Limited, a wholly owned subsidiary of Prenetics. References to “Prenetics Group” refer to Prenetics Holding Company Limited, together as a group with its subsidiaries, including its operating subsidiaries, and, prior to the termination of the VIE agreements on November 26, 2021, the VIE Entity (as defined below). Prenetics HK, Prenetics EMEA Limited, Oxsed Limited, Prenetics Innovation Labs Private Limited and Prenetics Africa (Pty) Limited, the operating subsidiaries of Prenetics’ based in the United Kingdom, Hong Kong, India and South Africa, respectively (collectively, “Prenetics Operating Subsidiaries”), that conduct our daily operations. As a result of the Business Combination, Prenetics has become a wholly owned subsidiary of ours.

Unless otherwise stated or unless the context otherwise requires in this prospectus:

“Acquisition Merger” means the merger between Prenetics Merger Sub and Prenetics, with Prenetics being the surviving entity and becoming a wholly owned subsidiary of PubCo;

“Amended Forward Purchase Agreements” means (i) the Forward Purchase Agreement entered into as of March 1, 2021 with Aspex Master Fund; and (ii) the Forward Purchase Agreement entered into as of March 1, 2021 with Pacific Alliance Asia Opportunity Fund L.P., as amended by the Deeds of Novation and Amendment;

“Artisan” means Artisan Acquisition Corp., an exempted company limited by shares incorporated under the laws of the Cayman Islands;

“Artisan Articles” means Artisan’s amended and restated memorandum and articles of association adopted by special resolution dated May 13, 2021;

“Artisan Directors” means William Keller, Mitch Garber, Fan Yu, Sean O’Neill;

“Artisan Merger Sub” means AAC Merger Limited, an exempted company limited by shares incorporated under the laws of the Cayman Islands and a direct wholly owned subsidiary of PubCo;

“Artisan Private Warrants” means the warrants sold to the Sponsor in the private placement consummated concurrently with the IPO, each entitling its holder to purchase one Artisan Public Share at an exercise price of $11.50 per share, subject to adjustment;

“Artisan Public Share” means a Class A ordinary share, par value $0.0001 per share, of Artisan;

“Artisan Public Shareholder” means a holder of Artisan Public Shares issued as part of the Units issued in the IPO;

“Artisan Public Warrants” means the redeemable warrants issued in the IPO, each entitling its holder to purchase one Artisan Public Share at an exercise price of $11.50 per share, subject to adjustment;

“Artisan Shares” means the Artisan Public Shares and Founder Shares;

“Artisan Warrants” means the Artisan Public Warrants and the Artisan Private Warrants;

“Business Combination” means the Initial Merger, the Acquisition Merger and the other transactions contemplated by the Business Combination Agreement;

vii

Table of Contents

“Business Combination Agreement” means the business combination agreement, dated September 15, 2021 (as amended by an Amendment to Business Combination Agreement dated as of March 30, 2022 and as may be further amended, supplemented, or otherwise modified from time to time), by and among PubCo, Artisan, Artisan Merger Sub, Prenetics Merger Sub and Prenetics;

“Cayman Islands Companies Act” means the Companies Act (As Revised) of the Cayman Islands;

“China” or “PRC,” in each case, means the People’s Republic of China, including Hong Kong and Macau and excluding, solely for the purpose of this prospectus, Taiwan. The term “Chinese” has a correlative meaning for the purpose of this prospectus;

“Class A Exchange Ratio” means a ratio equal to 1.29;

“Class A Ordinary Share” means a Class A ordinary share, par value $0.0001 per share, of PubCo;

“Class B Ordinary Share” means a convertible Class B ordinary share, par value $0.0001 per share, of PubCo;

“Class B Recapitalization” means, (i) the conversion of 9,133,558 Founder Shares held by Sponsor into 5,374,851 Artisan Public Shares, (ii) the conversion of an aggregate of 100,000 Founder Shares held by the Artisan independent directors into 77,519 Artisan Public Shares, and (iii) the surrender and forfeiture by Sponsor of 1,316,892 Private Placement Warrants, in each case of (i), (ii) and (iii) pursuant to and subject to the terms and conditions of the Sponsor Agreement immediately prior to the Initial Merger, and (iv) the conversion of all the Founder Shares held by the Forward Purchase Investors on a one-for-one basis pursuant to and subject to the terms and conditions of the Deeds of Amendment to the Deeds of Novation and Amendment immediately prior to the Initial Closing;

“Closing” means the closing of the Acquisition Merger;

“Closing Date” means May 18, 2022, the date of the Closing;

“Continental” means Continental Stock Transfer & Trust Company;

“Deeds of Novation and Amendment” means (i) the Deed of Novation and Amendment entered into by Artisan, Sponsor, PubCo and Aspex Master Fund, dated as of September 15, 2021 (pursuant to such amendment, Aspex Master Fund committed to subscribe for and purchase 3,000,000 Class A Ordinary Shares and 750,000 Warrants for an aggregate purchase price equal to $30 million); and (ii) the Deed of Novation and Amendment entered into by Artisan, Sponsor, PubCo and Pacific Alliance Asia Opportunity Fund L.P., dated as of September 15, 2021 (pursuant to such amendment, Pacific Alliance Asia Opportunity Fund L.P. committed to subscribe for and purchase 3,000,000 Class A Ordinary Shares and 750,000 Warrants for an aggregate purchase price equal to $30 million);

“Dissenting Artisan Shares” means Artisan Shares that are (i) issued and outstanding immediately prior to the Initial Merger Effective Time and (ii) held by Artisan shareholders who have validly exercised their Dissent Rights (and not waived, withdrawn, lost or failed to perfect such rights);

“ESOP” means the 2021 Share Incentive Plan of Prenetics adopted on June 16, 2021, as may be amended from time to time;

“Exchange Ratio” means a ratio equal to 2.033097981;

“Existing Warrant Agreement” means the warrant agreement, dated May 13, 2021, by and between Artisan and Continental;

viii

Table of Contents

“Extraordinary General Meeting” means an extraordinary general meeting of shareholders of Artisan held at 10:00 AM Eastern Time, on May 9, 2022 at Appleby (Cayman) Ltd., 71 Fort Street, George Town, Grand Cayman KY1-1104, Cayman Islands and virtually over the Internet via live audio webcast at https://www.cstproxy.com/artisanacquisition/2022;

“Forward Purchase Investors” means Aspex Master Fund and Pacific Alliance Asia Opportunity Fund L.P.;

“Founder Share” means a Class B ordinary share, par value $0.0001 per share, of Artisan;

“Initial Closing” means the closing of the Initial Merger;

“Initial Merger” means the merger between Artisan and Artisan Merger Sub, with Artisan Merger Sub being the surviving entity and remaining as a wholly owned subsidiary of PubCo;

“IPO” means Artisan’s initial public offering, which was consummated on May 18, 2021;

“mainland China” means the People’s Republic of China, excluding, solely for the purpose of this prospectus, Hong Kong, Macau and Taiwan. The term “mainland Chinese” has a correlative meaning for the purpose of this prospectus;

“Management Shareholder Support Agreement Amendment Deed” means that certain Deed of Amendment entered into on March 30, 2022 by and among Prenetics, Artisan, PubCo, Danny Yeung and Dr. Lawrence Tzang which amends the Prenetics Shareholder Support Agreement dated as of September 15, 2021 by and among Prenetics, Artisan, PubCo, Danny Yeung and Dr. Lawrence Tzang;

“NASDAQ” means the Nasdaq Stock Market;

“Plan of Initial Merger” means the plan of merger for the Initial Merger by and among Artisan, Artisan Merger Sub and PubCo;

“Prenetics” means Prenetics Holding Company Limited, formerly known as Prenetics Group Limited, an exempted company limited by shares incorporated under the laws of the Cayman Islands;

“Prenetics Group” means Prenetics Holding Company Limited, together as a group with its subsidiaries, including its operating subsidiaries, and, prior to the termination of the VIE agreements on November 26, 2021, Shenzhen Discover Health Technology Co., Ltd., or the “VIE Entity”;

“Prenetics HK” means Prenetics Limited, a limited liability company incorporated in Hong Kong;

“Prenetics Merger Sub” means PGL Merger Limited, an exempted company limited by shares incorporated under the laws of the Cayman Islands and a direct wholly owned subsidiary of PubCo;

“Prenetics Operating Subsidiaries” means, collectively, the operating subsidiaries of Prenetics Holding Company Limited, which include Prenetics Limited, Prenetics EMEA Limited, Oxsed Limited, Prenetics Innovation Labs Private Limited and Prenetics Africa (Pty) Limited.

“PubCo” means Prenetics Global Limited, an exempted company limited by shares incorporated under the laws of the Cayman Islands, or as the context requires, PubCo and its subsidiaries and consolidated affiliated entities;

“SEC” means the U.S. Securities and Exchange Commission;

“Sponsor” means Artisan LLC, a limited liability company registered under the laws of the Cayman Islands;

ix

Table of Contents

“Sponsor Agreement” means that certain Sponsor Forfeiture and Conversion Agreement entered into on March 30, 2022 by and among Prenetics, Artisan, PubCo, Sponsor and the independent directors of Artisan;

“Sponsor Support Agreement Amendment Deed” means that certain Deed of Amendment entered into on March 30, 2022 by and among Prenetics, Artisan, PubCo, Sponsor and the directors of Artisan which amends the Sponsor Support Agreement;

“Units” means the units issued in the IPO, each consisting of one Artisan Public Share and one-third of one Artisan Public Warrant;

“U.S. Dollars,” “US$,” “USD” and “$” means United States dollars, the legal currency of the United States;

“Warrants” means warrants of PubCo, each entitling its holder to purchase 1.29 Class A Ordinary Share at an exercise price of $8.91 per 1.29 shares, subject to adjustment pursuant to the terms of the Assignment, Assumption and Amendment Agreement and the Existing Warrant Agreement.

x

Table of Contents

PROSPECTUS SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in the securities covered by this prospectus. You should read the following summary together with the more detailed information in this prospectus, any related prospectus supplement and any related free writing prospectus, including the information set forth in the section titled “Risk Factors” in this prospectus, any related prospectus supplement and any related free writing prospectus in their entirety before making an investment decision.

Overview

We are a major diagnostics and genetics testing products and services provider, with a team of more than 600 employees and operations across nine locations, including the U.K., Hong Kong, India, South Africa and Southeast Asia. Our business was founded in 2014 with the mission to bring health closer to millions of people globally and decentralize healthcare by making the three pillars — Prevention, Diagnostics and Personalized Care — comprehensive and accessible to anyone, at anytime and anywhere. We intend to construct a global healthcare ecosystem to disrupt and decentralize the conventional healthcare system and improve its customers’ wellbeing through comprehensive genetic and diagnostic testing.

Recent Development

Completion of Business Combination

On May 18, 2022, we completed the Business Combination and the PIPE Financing, On May 18, 2022, Class A Ordinary Shares and Warrants commenced trading on the NASDAQ under the symbols “PRE” and “PRENW,” respectively.

1

Table of Contents

Financial Results as of / for the Nine Months Ended September 30, 2022

Unaudited consolidated statements of financial position

(Expressed in United States dollars unless otherwise indicated)

| September 30, 2022 US$ |

December 31, 2021 US$ |

|||||||

| Assets |

||||||||

| Property, plant and equipment |

10,974,095 | 13,037,192 | ||||||

| Intangible assets |

800,422 | 23,826,282 | ||||||

| Goodwill |

— | 3,978,065 | ||||||

| Deferred tax assets |

7,696 | 79,702 | ||||||

| Deferred expenses |

7,393,072 | — | ||||||

| Other non-current assets |

334,524 | 693,548 | ||||||

|

|

|

|

|

|||||

| Non-current assets |

19,509,809 | 41,614,789 | ||||||

|

|

|

|

|

|||||

| Inventories |

8,210,825 | 6,829,226 | ||||||

| Trade receivables |

61,076,651 | 47,041,538 | ||||||

| Deferred expenses |

4,535,245 | — | ||||||

| Deposits, prepayments and other receivables |

6,356,168 | 7,817,756 | ||||||

| Amounts due from related companies |

— | 9,060 | ||||||

| Financial assets at fair value through profit or loss |

25,226,919 | 9,906,000 | ||||||

| Cash and cash equivalents |

144,686,487 | 35,288,952 | ||||||

|

|

|

|

|

|||||

| Current assets |

250,092,295 | 106,892,532 | ||||||

|

|

|

|

|

|||||

| Total assets |

269,602,104 | 148,507,321 | ||||||

|

|

|

|

|

|||||

| Liabilities |

||||||||

| Deferred tax liabilities |

224,189 | 659,498 | ||||||

| Preference shares liabilities |

— | 486,404,770 | ||||||

| Warrant liabilities |

10,073,250 | — | ||||||

| Lease liabilities |

2,488,780 | 3,600,232 | ||||||

|

|

|

|

|

|||||

| Non-current liabilities |

12,786,219 | 490,664,500 | ||||||

|

|

|

|

|

|||||

| Trade payables |

9,077,855 | 9,979,726 | ||||||

| Accrued expenses and other current liabilities |

16,395,020 | 36,280,298 | ||||||

| Contract liabilities |

5,579,759 | 9,587,245 | ||||||

| Lease liabilities |

1,857,982 | 1,666,978 | ||||||

| Trade financing |

9,741,503 | — | ||||||

| Tax payable |

6,894,415 | 1,223,487 | ||||||

|

|

|

|

|

|||||

| Current liabilities |

49,546,534 | 58,737,734 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

62,332,753 | 549,402,234 | ||||||

|

|

|

|

|

|||||

| Equity |

||||||||

| Share capital (US$0.0001 par value, 500,000,000 shares authorized and 110,979,347 shares issued (December 31, 2021: US$0.0001 par value, 500,000,000 shares authorized and 14,932,033 shares issued)) |

11,098 | 1,493 | ||||||

| Reserves |

207,343,283 | (400,811,431 | ) | |||||

|

|

|

|

|

|||||

| Total equity/(equity deficiency) attributable to equity shareholders of the Company |

207,354,381 | (400,809,938 | ) | |||||

| Non-controlling interests |

(85,030 | ) | (84,975 | ) | ||||

|

|

|

|

|

|||||

| Total equity/(equity deficiency) |

207,269,351 | (400,894,913 | ) | |||||

|

|

|

|

|

|||||

| Total equity and liabilities |

269,602,104 | 148,507,321 | ||||||

|

|

|

|

|

|||||

2

Table of Contents

Unaudited consolidated statements of profit or loss and other comprehensive income

(Expressed in United States dollars unless otherwise indicated)

| For the nine months ended | ||||||||

| September 30, 2022 US$ |

September 30, 2021 US$ |

|||||||

| Revenue |

223,440,544 | 211,136,492 | ||||||

| Direct costs |

(118,888,842 | ) | (128,770,734 | ) | ||||

|

|

|

|

|

|||||

| Gross profit |

104,551,702 | 82,365,758 | ||||||

| Other income and other net (losses)/gains |

(744,692 | ) | 199,305 | |||||

| Selling and distribution expenses (included equity-settled share-based payment expenses of $106,909 (2021: $15,624)) |

(10,798,052 | ) | (11,575,835 | ) | ||||

| Research and development expenses (included equity-settled share-based payment expenses of $3,857,617 (2021: $2,723,370)) |

(11,913,427 | ) | (5,104,080 | ) | ||||

| Restructuring costs in relation to UK and diagnostic business |

||||||||

| - Impairment losses on intangible assets |

(19,109,580 | ) | — | |||||

| - Impairment losses on goodwill |

(3,272,253 | ) | — | |||||

| - Impairment losses on property, plant and equipment |

(1,738,467 | ) | — | |||||

| - Write-off of prepayment |

(3,549,298 | ) | — | |||||

| Administrative and other operating expenses (included equity-settled share-based payment expenses of $24,172,462 (2021: $9,926,392)) |

(81,359,051 | ) | (45,349,553 | ) | ||||

|

|

|

|

|

|||||

| (Loss)/profit from operations |

(27,933,118 | ) | 20,535,595 | |||||

| Fair value loss on financial assets at fair value through profit or loss |

(1,674,184 | ) | — | |||||

| Share-based payment on listing* |

(89,546,601 | ) | — | |||||

| Fair value loss on convertible securities |

— | (29,054,669 | ) | |||||

| Fair value loss on preference shares liabilities |

(60,091,353 | ) | (71,885,207 | ) | ||||

| Fair value loss on warrant liabilities |

(3,301,827 | ) | — | |||||

| Write-off on amount due from a shareholder |

— | (106,179 | ) | |||||

| Gain on bargain purchase |

— | 117,238 | ||||||

| Other finance costs |

(4,082,155 | ) | (2,775,251 | ) | ||||

|

|

|

|

|

|||||

| Loss before taxation |

(186,629,238 | ) | (83,168,473 | ) | ||||

| Income tax expense |

(5,432,092 | ) | (5,105,364 | ) | ||||

|

|

|

|

|

|||||

| Loss for the period |

(192,061,330 | ) | (88,273,837 | ) | ||||

|

|

|

|

|

|||||

| Other comprehensive income for the period |

||||||||

| Item that may be reclassified subsequently to profit or loss: |

||||||||

| Exchange difference on translation of: |

||||||||

| - financial statements of subsidiaries and a joint venture outside Hong Kong |

(7,602,604 | ) | (1,006,600 | ) | ||||

|

|

|

|

|

|||||

| Total comprehensive income for the period |

(199,663,934 | ) | (89,280,437 | ) | ||||

|

|

|

|

|

|||||

| Loss attributable to: |

||||||||

| Equity shareholders of Prenetics |

(192,061,275 | ) | (88,266,295 | ) | ||||

| Non-controlling interests |

(55 | ) | (7,542 | ) | ||||

|

|

|

|

|

|||||

| (192,061,330 | ) | (88,273,837 | ) | |||||

|

|

|

|

|

|||||

Note:

| * | The acquisition of the net assets of Artisan on May 18, 2022 does not meet the definition of a business under IFRS and has therefore been accounted for as a share-based payment. The excess of fair value of Prenetics shares issued over the fair value of Artisan’s identifiable net assets acquired represents compensation for the service of a stock exchange listing for its shares and is expensed as incurred. |

3

Table of Contents

Unaudited consolidated statements of profit or loss and other comprehensive income

(Expressed in United States dollars unless otherwise indicated) (continued)

| For the nine months ended | ||||||||

| September 30, 2022 US$ |

September 30, 2021 US$ |

|||||||

| Total comprehensive income attributable to: |

||||||||

| Equity shareholders of Prenetics |

(199,663,879 | ) | (89,272,895 | ) | ||||

| Non-controlling interests |

(55 | ) | (7,542 | ) | ||||

|

|

|

|

|

|||||

| (199,663,934 | ) | (89,280,437 | ) | |||||

|

|

|

|

|

|||||

| Loss per share |

||||||||

| Basic loss per share |

(2.73 | ) | (2.90 | ) | ||||

| Diluted loss per share |

(2.73 | ) | (2.90 | ) | ||||

| Weighted average number of common shares: |

||||||||

| Basic |

70,371,679 | 30,396,578 | ||||||

| Diluted |

70,371,679 | 30,396,578 | ||||||

Non-IFRS Financial Measures

To supplement our consolidated financial statements prepared in accordance with International Financial Reporting Standards (“IFRS”), we are providing non-IFRS measures, Adjusted EBITDA, adjusted gross profit and adjusted profit for the period. These non-IFRS financial measures are not based on any standardized methodology prescribed by IFRS and are not necessarily comparable to similarly-titled measures presented by other companies. We believe these non-IFRS financial measures are useful to investors in evaluating our ongoing operating results and trends.

We are excluding from some or all of its non-IFRS operating results (1) Equity-settled share-based payment expenses, (2) depreciation and amortization, (3) finance income and exchange gain or loss, and (4) other discretionary items determined by management. These non-IFRS financial measures are limited in value because they exclude certain items that may have a material impact on the reported financial results. We account for this limitation by analyzing results on an IFRS basis as well as a non-IFRS basis and also by providing IFRS measures in our public disclosures.

4

Table of Contents

In addition, other companies, including companies in the same industry, may not use the same non-IFRS measures or may calculate these metrics in a different manner than management or may use other financial measures to evaluate their performance, all of which could reduce the usefulness of these non-IFRS measures as comparative measures. Because of these limitations, our non-IFRS financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with IFRS. Investors are encouraged to review the non-IFRS reconciliations provided in the tables below.

Reconciliation of Loss from Operations under IFRS and Adjusted EBITDA (Non-IFRS)

| For the nine months ended | ||||||||

| September 30, 2022 US$ |

September 30, 2021 US$ |

|||||||

| (Loss)/profit from operations under IFRS |

(27,933,118 | ) | 20,535,595 | |||||

| Employee equity-settled share-based payment expenses |

28,338,511 | 12,975,035 | ||||||

| Depreciation and amortization |

6,209,748 | 4,345,417 | ||||||

| Restructuring costs in relation to UK and diagnostic business |

||||||||

| - Impairment losses on intangible assets |

19,109,580 | — | ||||||

| - Impairment losses on goodwill |

3,272,253 | — | ||||||

| - Impairment losses on property, plant and equipment |

1,738,467 | — | ||||||

| - Write-off of prepayment |

3,549,298 | — | ||||||

| Other strategic financing, transactional expense and non-recurring expenses |

10,941,228 | 2,415,383 | ||||||

| Finance income, exchange gain or loss, net |

967,707 | (333,798 | ) | |||||

|

|

|

|

|

|||||

| Adjusted EBITDA (Non-IFRS) |

46,193,674 | 39,937,632 | ||||||

|

|

|

|

|

|||||

Reconciliation of Gross Profit under IFRS and Adjusted Gross Profit (Non-IFRS)

| For the nine months ended | ||||||||

| September 30, 2022 US$ |

September 30, 2021 US$ |

|||||||

| Gross profit under IFRS |

104,551,702 | 82,365,758 | ||||||

| Depreciation and amortization |

1,364,314 | 801,870 | ||||||

|

|

|

|

|

|||||

| Adjusted gross profit (Non-IFRS) |

105,916,016 | 83,167,628 | ||||||

|

|

|

|

|

|||||

5

Table of Contents

Reconciliation of Loss attributable to Equity Shareholders of Prenetics under IFRS and Adjusted Profit for the Period (Non-IFRS)

| For the nine months ended | ||||||||

| September 30, 2022 US$ |

September 30, 2021 US$ |

|||||||

| Loss attributable to equity shareholders of Prenetics under IFRS |

(192,061,275 | ) | (88,266,295 | ) | ||||

| Employee equity-settled share-based payment expenses |

28,338,511 | 12,975,035 | ||||||

| Other strategic financing, transactional expense and non-recurring expenses |

10,941,228 | 2,415,383 | ||||||

| Share-based payment on listing |

89,546,601 | — | ||||||

| Fair value loss on convertible securities |

— | 29,054,669 | ||||||

| Fair value loss on preference shares liabilities |

60,091,353 | 71,885,207 | ||||||

| Fair value loss on warrant liabilities |

3,301,827 | — | ||||||

| Fair value loss on financial assets at fair value through profit or loss |

1,674,184 | — | ||||||

| Restructuring costs in relation to UK and diagnostic business |

||||||||

| - Impairment losses on intangible assets |

19,109,580 | — | ||||||

| - Impairment losses on goodwill |

3,272,253 | — | ||||||

| - Impairment losses on property, plant and equipment |

1,738,467 | — | ||||||

| - Write-off of prepayment |

3,549,298 | — | ||||||

|

|

|

|

|

|||||

| Adjusted profit for the period (Non-IFRS) |

29,502,027 | 28,063,999 | ||||||

|

|

|

|

|

|||||

Emerging Growth Company

We qualify as an “emerging growth company” as defined in the JOBS Act, and we will remain an “emerging growth company” until the earliest to occur of (i) the last day of the fiscal year (a) following the fifth anniversary of the closing of the Business Combination, (b) in which we have total annual gross revenue of at least $1.235 billion or (c) in which we are deemed to be a large accelerated filer, which means the market value of our shares held by non-affiliates exceeds $700 million as of the last business day of our prior second fiscal quarter, we have been subject to Exchange Act reporting requirements for at least 12 calendar months; and filed at least one annual report, and (ii) the date on which we issued more than $1.0 billion in non-convertible debt during the prior three-year period. We intend to take advantage of exemptions from various reporting requirements that are applicable to most other public companies, whether or not they are classified as “emerging growth companies,” including, but not limited to, an exemption from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that our independent registered public accounting firm provide an attestation report on the effectiveness of our internal control over financial reporting and reduced disclosure obligations regarding executive compensation.

In addition, Section 102(b)(1) of the JOBS Act exempts “emerging growth companies” from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with certain other public companies difficult or impossible because of the potential differences in accounting standards used.

6

Table of Contents

Furthermore, even after we no longer qualify as an “emerging growth company,” as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including, but not limited to, the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. In addition, we will not be required to file annual reports and financial statements with the SEC as promptly as U.S. domestic companies whose securities are registered under the Exchange Act, and are not required to comply with Regulation FD (Fair Disclosure), which restricts the selective disclosure of material information.

Foreign Private Issuer

We are subject to the information reporting requirements of the Securities Exchange Act of 1934, or “the Exchange Act,” that are applicable to “foreign private issuers,” and under those requirements we file reports with the SEC. As a foreign private issuer, we are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, we are not required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We also have four months after the end of each fiscal year to file our annual reports with the SEC and are not required to file current reports as frequently or promptly as U.S. domestic reporting companies. Furthermore, our officers, directors and principal shareholders are exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we are also not subject to the requirements of Regulation FD promulgated under the Exchange Act. These exemptions and leniencies reduce the frequency and scope of information and protections available to you in comparison to those applicable to shareholders of U.S. domestic reporting companies.

Our Corporate Information

We are an exempted company limited by shares incorporated on July 21, 2021 under the laws of the Cayman Islands. Our registered office is at Unit 701-706, K11 Atelier King’s Road, 728 King’s Road, Quarry Bay, Hong Kong and our telephone number is +852-2210-9588. Our website is https://www.prenetics.com/. The information contained in, or accessible through, our website does not constitute a part of this prospectus.

The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers, such as we, that file electronically, with the SEC at www.sec.gov.

Our agent for service of process in the United States is Cogency Global Inc., 122 East 42nd Street, 18th Floor New York, N.Y. 10168.

7

Table of Contents

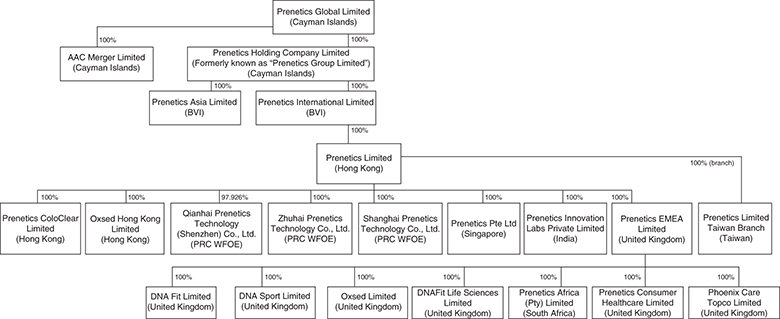

Our Organizational Structure

The following diagram depicts a simplified organizational structure of the Company as of the date hereof.

Summary Risk Factors

An investment in our Class A Ordinary Shares and Warrants involves significant risks. Below is a summary of certain material risks we face. These risks are more fully described under “Risk Factors.” You should carefully consider such risks before making an investment decision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition, results of operations or prospects could be materially and adversely affected by any of these risks.

We face various legal and operational risks associated with doing business in Hong Kong, which could result in a material change in our operations in Hong Kong, cause the value of our securities to significantly decline or become worthless, and significantly limit or completely hinder our ability to accept foreign investments and offer or continue to offer securities to foreign investors. These risks include, but are not limited to:

| • | We are a Cayman Islands holding company with operations primarily conducted through our operating subsidiaries. Accordingly, our shareholders will be holding equity interest in a Cayman Islands holding company and not equity of our operating subsidiaries. |

| • | Historically, we held a minority interest in a genomics business in mainland China through Shenzhen Discover Health Technology Co., Ltd. (the “VIE Entity”), a PRC limited liability company, by entering into a series of contractual arrangements with the VIE Entity and its nominee shareholders through our wholly owned PRC subsidiary, Qianhai Prenetics Technology (Shenzhen) Co., Ltd. (the “WFOE”). On November 26, 2021, the agreements governing the VIE Entity were terminated with immediate effect. As a result, our corporate structure no longer contains any VIE. While our current corporate structure does not contain any VIE and we have no intention establishing any VIEs in PRC in the future, if in the future our structure were to contain a VIE, the PRC regulatory authorities could disallow the VIE structure, which would likely result in a material adverse change in our operations, and our securities may decline significantly in value or become worthless. |

| • | Our business, financial condition and results of operations, and/or the value of our securities or our ability to offer or continue to offer securities to investors may be materially and adversely affected to the extent the laws and regulations of the PRC become applicable to us. In that case, we may be subject |

8

Table of Contents

| to the risks and uncertainties associated with the evolving laws and regulations in the PRC, their interpretation and implementation, and the legal and regulatory system in the PRC more generally, including with respect to the enforcement of laws and the possibility of changes of rules and regulations with little or no advance notice. Although we currently do not have any business operations in mainland China, and our corporate structure does not contain any variable interest entity, given our substantial operations in Hong Kong and the Chinese government’s significant oversight authority over the conduct of business in Hong Kong, and we face risks and uncertainties associated with the complex and evolving PRC laws and regulations and as to whether and how the PRC government statements and regulatory developments, such as those relating to VIE, data and cyberspace security, and anti-monopoly concerns, would be applicable to a company like us. The Chinese government may, in the future, seek to affect operations of any company with any level of operations in mainland China or Hong Kong, including its ability to offer securities to investors, list its securities on a U.S. or other foreign exchange, conduct its business or accept foreign investment. Should the Chinese government seek to affect operations of any company with any level of operations in Hong Kong, or should certain PRC laws and regulations or these statements or regulatory actions become applicable to us in the future, it would likely have a material adverse impact on our business, financial condition and results of operations, our ability to accept foreign investments and our ability to offer or continue to offer securities to investors on a U.S. or other international securities exchange, any of which may cause the value of our securities to significantly decline or become worthless. For example, if the PRC regulatory actions on data security or other data-related laws and regulations were to apply to us, we could become subject to certain cybersecurity and data privacy obligations, including the potential requirement to conduct a cybersecurity review for our listing at a foreign stock exchange, and the failure to meet such obligations could result in penalties and other regulatory actions against us and may materially and adversely affect our business and results of operations. |

| • | Our securities may be delisted or prohibited from being traded “over-the-counter” under the HFCA Act if we have filed an annual report containing an audit report issued by a registered public accounting firm that the PCAOB has determined it is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction and is identified by the SEC as a “Commission-Identified Issuer” for three consecutive years. On December 16, 2021, the PCAOB issued a report on its determinations that it is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, and our auditor is subject to this determination. The delisting or the cessation of trading “over-the-counter” of our securities, or the threat of being delisted or prohibited, may materially and adversely affect the value and/or liquidity of your investment. In accordance with the HFCA Act, our securities could be prohibited from being traded on a national securities exchange or in the over-the-counter trading market in the United States in 2025 if the PCAOB is unable to inspect or investigate completely auditors located in China, or in 2024 if proposed changes to the law, or the Accelerating Holding Foreign Companies Accountable Act, are enacted. The related risks and uncertainties could cause the value of our securities to significantly decline. |