UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Amendment No. 1)

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: N/A

Commission File Number:

(Exact name of Registrant as specified in its charter)

Not Applicable |

| |

(Translation of Registrant’s name into English) |

| (Jurisdiction of incorporation or organization) |

(Address of principal executive offices)

Swvl Holdings Corp

Telephone Number: +

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading |

| Name of each exchange |

|

| The | ||

|

| The |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Outstanding as of December 31, 2022:

Outstanding as of October 30, 2023:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ |

| Accelerated filer | ☐ |

☒ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting over Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP ☐ |

|

| Other ☐ | ||

| the International Accounting Standards Board | ☒ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

SWVL HOLDINGS CORP

TABLE OF CONTENTS

1 | ||

2 | ||

3 | ||

4 | ||

4 | ||

4 | ||

4 | ||

39 | ||

51 | ||

51 | ||

71 | ||

76 | ||

80 | ||

81 | ||

81 | ||

92 | ||

93 | ||

94 | ||

94 | ||

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 94 | |

94 | ||

95 | ||

97 | ||

97 | ||

97 | ||

98 | ||

i

Explanatory Note

INTRODUCTION

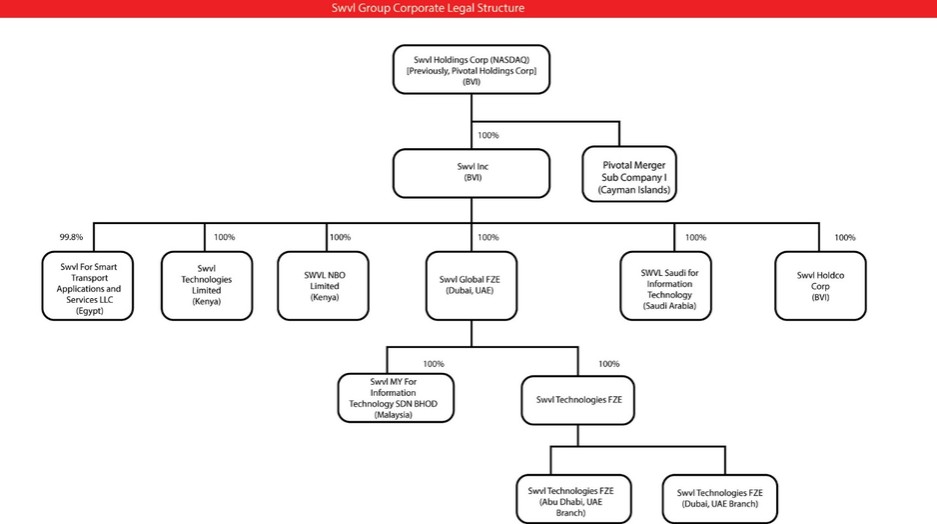

On March 31, 2022, Swvl Holdings Corp (“Holdings”), formerly known as Pivotal Holdings Corp, a British Virgin Islands business company limited by shares incorporated under the laws of the British Virgin Islands, consummated the transactions contemplated by the Business Combination Agreement (the “Business Combination Agreement”), dated as of July 28, 2021, as amended, by and among Holdings, Queen’s Gambit Growth Capital, a Cayman Islands exempted company with limited liability (“SPAC”), Swvl Inc., a British Virgin Islands business company limited by shares incorporated under the laws of the British Virgin Islands (“Swvl”), Pivotal Merger Sub Company I, a Cayman Islands exempted company with limited liability and wholly owned subsidiary of Holdings (“Cayman Merger Sub”) and Pivotal Merger Sub Company II Limited, a British Virgin Islands business company limited by shares incorporated under the laws of the British Virgin Islands and wholly owned subsidiary of SPAC (“BVI Merger Sub”), pursuant to which Swvl became a wholly owned subsidiary of Holdings. On April 1, 2022, Swvl’s ordinary shares (“Ordinary Shares”) and public warrants (“Warrants”) (together, the “Swvl Securities”) began trading on the Nasdaq Global Market under the symbols “SWVL” and “SWVLW”, respectively. In July 2023, Swvl received approval from the Nasdaq Stock Market LLC of its request to transfer the listing of its Ordinary Shares and Warrants to the Nasdaq Capital Market from the Nasdaq Global Market, and effective July 19, 2023, the Ordinary Shares and Warrants are traded on the Nasdaq Capital Market.

Unless otherwise stated or the context otherwise requires, for the purposes of this Report, “Swvl”, “we”, “us”, “our”, or the “Company” refer to the business of Holdings and its subsidiaries.

In addition, on January 25, 2023, Swvl implemented a one-for-25 reverse stock split of its Ordinary Shares. Unless the context expressly dictates otherwise, all references to share and per share amounts referred to in this annual report on Form 20-F give effect to the reverse stock split.

1

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains or may contain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve significant risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements include information about our possible or assumed future results of operations or our performance. Words such as “anticipate,” “appear,” “approximate,” “believe,” “continue,” “could,” “estimate,” “expect,” “foresee,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “would” and variations of such words and similar expressions (or the negative version of such words or expressions) may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. The risk factors and cautionary language referred to in this Report provide examples of risks, uncertainties and events that may cause actual results to differ materially from the expectations described in our forward-looking statements, including among other things, the items identified in the section of this Report entitled “Item 3.D. Risk Factors.”

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

2

FREQUENTLY USED TERMS

Unless the context otherwise requires, references in this Report to:

| ● | “B2B” are to “business to business”; |

| ● | “B2C” are to “business to consumer”; |

| ● | “bookings” are to seats that have been reserved by riders on a ride; |

| ● | “Business Combination Agreement” are to that certain Business Combination Agreement, dated as of July 28, 2021, by and among Swvl Inc., SPAC, Holdings, Cayman Merger Sub and BVI Merger Sub, as amended; |

| ● | “Business Combination” are to the transactions effected by the Business Combination Agreement; |

| ● | “BVI” are to the British Virgin Islands; |

| ● | “BVI Companies Act” are to the BVI Business Companies Act (As Revised); |

| ● | “captains” are to drivers using Swvl’s platform; |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934; |

| ● | “Holdings” are to Swvl Holdings Corp, a British Virgin Islands business company limited by shares incorporated under the laws of the British Virgin Islands, formerly known as Pivotal Holdings Corp, and unless otherwise stated or the context otherwise requires, for the purposes of this Report, “Swvl”, “we”, “us”, “our” and the “Company” refer to the business of Holdings and its subsidiaries; |

| ● | “IFRS” are to International Financial Reporting Standards as issued by the IASB; |

| ● | “Ordinary Shares” are to Swvl’s Class A Ordinary Shares, par value $0.0025 per share listed on the Nasdaq Capital Market under the trading symbol “SWVL”; |

| ● | “Nasdaq” are to The Nasdaq Stock Market LLC; |

| ● | “riders” are to persons filling seats on rides; |

| ● | “Sarbanes-Oxley Act” are to the Sarbanes-Oxley Act of 2002; |

| ● | “seats” are to physical spaces on rides that can be booked by riders; |

| ● | “SEC” are to the Securities and Exchange Commission; |

| ● | “Securities Act” are to the Securities Act of 1933, as amended; |

| ● | “service provider” are to any employee, officer, director, individual independent contractor or individual consultant of Swvl or any Swvl Subsidiary; |

| ● | “Sponsor Warrants” are to Swvl’s private warrants initially issued in a private placement to Queen’s Gambit Holdings, LLC. |

| ● | “Swvl Board” are to the board of directors of Swvl Holdings Corp. |

| ● | “Swvl Securities” are to Swvl’s Ordinary Shares and Warrants. |

| ● | “Warrants” are to Swvl’s public warrants listed on the Nasdaq Capital Market under the trading symbol “SWVLW.” |

3

PART I

ITEM 1.IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A.Directors and Senior Management

Not applicable.

B.Advisors

Not applicable.

C.Auditors

Not applicable.

ITEM 2.OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3.KEY INFORMATION

A. | [Reserved] |

B.Capitalization and Indebtedness

Not applicable.

C.Reasons for the Offer and Use of Proceeds

Not applicable.

D.Risk Factors

Summary

An investment in our securities involves substantial risks and uncertainties that may adversely affect our business, financial condition and results of operations and cash flows. Some of the more significant challenges and risks relating to an investment in our company include, among other things, the following:

| ● | Swvl’s limited operating history and rapidly evolving business make it particularly difficult to evaluate Swvl’s prospects and the risks and challenges Swvl may encounter. |

| ● | Swvl faces competition and could lose market share to competitors, which could adversely affect Swvl’s business, financial condition and operating results. |

| ● | The mass transit ridesharing market is still in relatively early stages of growth and if the market does not continue to grow, grows more slowly than Swvl expects or fails to grow as large as Swvl expects, Swvl’s business, financial condition and operating results could be adversely affected. |

| ● | If Swvl fails to cost-effectively attract and retain qualified drivers to use its platform, or to increase utilization of Swvl’s platform by Swvl’s currently contracted drivers, Swvl’s business, financial condition and operating results could be harmed. |

| ● | If Swvl fails to cost-effectively attract and retain new riders or to increase utilization of its platform by existing riders, Swvl’s business, financial condition and operating results could be harmed. |

4

| ● | Swvl depends on its key personnel and other highly skilled personnel, and if Swvl fails to attract, retain, motivate or integrate its personnel, Swvl’s business, financial condition and operating results could be adversely affected. |

| ● | Swvl’s reputation, brand and the network effects among the drivers and riders using Swvl’s platform are important to its success, and if Swvl is not able to maintain and continue developing its reputation, brand and network effects, its business, financial condition and operating results could be adversely affected, and the recent market exits might impact the reputation and brand for Swvl in the markets they operated in with their original brand name and was exited later. |

| ● | Swvl’s company culture has contributed to its success and if Swvl cannot maintain this culture as it grows, its business, financial condition and operating results could be harmed. |

| ● | Swvl’s growth strategy will subject it to additional costs, compliance requirements and risks, and Swvl’s expansion plans may not be successful. |

| ● | Swvl has not historically maintained insurance coverage for its operations. Swvl may not be able to mitigate the risks facing its business and could incur significant uninsured losses, which could adversely affect its business, financial condition and operating results. |

| ● | There is no guaranty that we will be able to generate the revenue necessary to support our cost structure or obtain the level of financing necessary for our operations. |

| ● | Our ongoing divestment of old businesses and services is inherently risky, and could disrupt our current operations. We may not be able to realize the intended and anticipated benefits from our divestments, which could affect the value of these decisions to our business and our ability to meet our financial obligations and targets in the short or medium term. |

| ● | Any actual or perceived security or privacy breach could interrupt Swvl’s operations and adversely affect its reputation, brand, business, financial condition and operating results. Swvl has previously experienced a data breach that resulted in the exposure of its customers’ personal information. |

| ● | If Swvl fails to effectively predict rider demand, to set pricing and routing accordingly or to run routes that are consistent with the availability of drivers using its platform, Swvl’s business, financial condition and operating results could be adversely affected. |

| ● | If Swvl is not able to successfully develop new offerings on its platform and enhance its existing offerings, Swvl’s business, financial condition and operating results could be adversely affected. |

| ● | Swvl’s metrics and estimates, including the key metrics included in this Report, are subject to inherent challenges in measurement, and real or perceived inaccuracies in those metrics may harm Swvl’s reputation and negatively affect Swvl’s business, financial condition and operating results. |

| ● | Any failure to offer high-quality user support may harm Swvl’s relationships with users and could adversely affect Swvl’s reputation, brand, business, financial condition, and operating results. |

| ● | Systems failures and resulting interruptions in the availability of Swvl’s website, applications, platform, or offerings could adversely affect Swvl’s business, financial condition, and operating results. |

| ● | Swvl has identified material weaknesses in its internal control over financial reporting. If for any reason Swvl is unable to remediate these material weaknesses and otherwise to maintain proper and effective internal controls over financial reporting in the future, Swvl’s ability to produce accurate and timely consolidated financial statements may be impaired, which may harm Swvl’s operating results, Swvl’s ability to operate its business or investors’ views of Swvl |

5

| ● | Uncertainties with respect to the legal systems in the jurisdictions in which Swvl operates, including changes in laws and the adoption and interpretation of new laws and regulations, could adversely affect Swvl’s business, financial condition and operating results. |

| ● | As Swvl expands its offerings, it may become subject to additional laws and regulations, and any actual or perceived failure by Swvl to comply with such laws and regulations or manage the increased costs associated with such laws and regulations could adversely affect Swvl’s business, financial condition, and operating results. |

| ● | Failure to protect or enforce Swvl’s intellectual property rights could harm Swvl’s business, financial condition and operating results. |

| ● | Claims by others that Swvl infringed their proprietary technology or other intellectual property rights could harm Swvl’s business, financial condition and operating results. |

| ● | Changes in laws or regulations relating to privacy, data protection or the protection or transfer of personal data, or any actual or perceived failure by Swvl to comply with such laws and regulations or any other obligations relating to privacy, data protection or the protection or transfer of personal data, could adversely affect Swvl’s business. |

| ● | Swvl’s business would be adversely affected if the drivers using its platform were classified as employees. |

| ● | Swvl may not be able to maintain the listing of its securities on Nasdaq. |

| ● | Swvl’s management team has limited experience managing a public company, which may result in difficulty adequately operating and growing Swvl’s business. |

| ● | Swvl is an “emerging growth company”, and the reduced disclosure requirements applicable to emerging growth companies may make Swvl Securities less attractive to investors. As a foreign private issuer, Swvl is not subject to U.S. proxy rules and is subject to Exchange Act reporting obligations that, to some extent, are more lenient and less frequent than those of a U.S. domestic public company. |

| ● | The other risks and uncertainties are discussed in this “Risk Factors” section. |

Risks Related to Operational Factors Affecting Swvl

Swvl’s limited operating history and evolving business make it particularly difficult to evaluate Swvl’s prospects and the risks and challenges Swvl may encounter.

While Swvl has primarily focused on mass transit ridesharing services since Swvl launched in 2017, Swvl’s business continues to evolve. Beginning in 2020, Swvl reevaluated and adjusted its pricing methodologies and expanded its business offerings to include transport as a service (“TaaS”) and (in the future) software as a service (“SaaS”). While it is difficult to evaluate the prospects and risks of any business, Swvl’s relatively new and evolving business makes it particularly difficult to assess Swvl’s prospects and the risks and challenges it may encounter. Risks and challenges Swvl has faced or expects to face include its ability to:

| ● | forecast its revenue and budget for and manage expenses; |

| ● | attract new qualified drivers and new riders to use its platform and have existing qualified drivers and riders continue to use its platform in a cost-effective manner; |

| ● | comply with existing or developing and new or modified laws and regulations applicable to Swvl’s business and the data it processes, including in jurisdictions where such regulations may still be developing or changing rapidly; |

| ● | plan for and manage expenditures for Swvl’s current and future offerings, including expenses relating to Swvl’s growth strategy; |

6

| ● | deploy and ensure utilization of the vehicles operating on Swvl’s platform; |

| ● | anticipate and respond to macroeconomic changes and changes in the markets in which Swvl operates; |

| ● | maintain and enhance the value of Swvl’s reputation and brand; |

| ● | effectively manage Swvl’s growth and business operations; |

| ● | successfully expand Swvl’s geographic reach; |

| ● | successfully expand Swvl’s TaaS business and launch Swvl’s SaaS business; |

| ● | hire, integrate and retain talented personnel; and |

| ● | successfully develop new platform features and offerings to enhance the experience of riders, drivers and corporate customers (as well as schools and municipalities). |

If Swvl fails to address the risks and difficulties that it faces, including those associated with the challenges listed above as well as those described elsewhere in this “Risk Factors” section, Swvl’s business, financial condition and operating results could be adversely affected. Further, because Swvl has limited historical financial data, operates in a rapidly evolving market and its growth strategy is premised on international expansion, any predictions about Swvl’s future revenue and expenses may not be as accurate as they would be if Swvl had a longer operating history or operated in a more predictable market. If Swvl’s assumptions regarding these risks and uncertainties, which Swvl uses to plan and operate its business, are incorrect or change, or if it does not address these risks successfully, Swvl’s operating results could differ materially from its expectations and Swvl’s business, financial condition and operating results could be adversely affected.

Swvl faces competition and could lose market share to competitors, which could adversely affect Swvl’s business, financial condition and operating results.

Swvl believes that its principal competition for ridership is public transportation services. Swvl’s business model is premised in part on promoting the safety, efficiency and convenience of its offerings to convert public transportation users into riders on Swvl’s platform. While Swvl has previously been successful in attracting and retaining new riders, public transportation is often available at a lower price and with a greater variety of routes than the rides Swvl offers. In addition, public transportation operators in Swvl’s markets may in the future make improvements or implement measures to enhance the safety, efficiency and convenience of their networks. If current and potential riders do not view the advantages of Swvl’s platform as outweighing the difference in price, or if the successful introduction of such improvements or measures weakens the competitive advantages of Swvl’s offerings, Swvl may be unable to retain existing riders or attract new riders and its business, financial condition and operating results may be adversely affected.

Swvl also faces competition from other traditional transportation companies in regard of their business to business offerings in addition to other ridesharing companies and car hire and taxi companies. The xridesharing market in particular is intensely competitive and is characterized by rapid changes in technology, shifting rider needs and preferences and frequent introductions of new services and offerings. Swvl expects competition to increase, both from existing competitors and new entrants in the markets in which Swvl operates or plans to operate, and such competitors may be well-established and enjoy greater resources or other strategic advantages. If Swvl is unable to anticipate or successfully react to these competitive challenges in a timely manner, Swvl’s competitive position could weaken, or fail to improve, and Swvl could experience a decline in revenue or growth stagnation that could adversely affect Swvl’s business, financial condition and operating results.

Certain of Swvl’s current and potential competitors have greater financial, technical, marketing, research and development and other resources, greater name recognition, longer operating histories or a larger global user base than Swvl does. Such competitors may be able to devote greater resources to the development, promotion and sale of offerings and offer lower prices in certain markets than Swvl does, which could adversely affect Swvl’s business, financial condition and operating results. These and other factors may allow Swvl’s competitors to derive greater revenue and profits from their existing user bases, attract and retain qualified drivers and riders at lower costs or respond more quickly to new and emerging technologies and trends. Current and potential competitors may also establish cooperative or strategic relationships, or consolidate, amongst themselves or with third parties that may further enhance their resources and offerings.

7

Swvl believes that its ability to compete effectively depends upon many factors both within and beyond Swvl’s control, including:

| ● | the popularity, utility, ease of use, performance and reliability of Swvl’s offerings; |

| ● | Swvl’s reputation, including the perceived safety of Swvl’s platform, and brand strength; |

| ● | Swvl’s pricing models and the prices of its offerings; |

| ● | Swvl’s ability to attract and retain qualified drivers and riders to use its platform; |

| ● | Swvl’s ability to develop new offerings, including the expansion of its TaaS business and launch of its SaaS business; |

| ● | Swvl’s ability to continue leveraging and enhancing its data analytics capabilities; |

| ● | Swvl’s ability to establish and maintain relationships with strategic partners and third-party service providers; |

| ● | Swvl’s ability to deploy and ensure utilization of the vehicles operating on its platform; |

| ● | changes mandated by, or that Swvl elects to make to address, legislation, regulatory authorities or litigation, including settlements, judgments, injunctions and consent decrees; |

| ● | Swvl’s ability to attract, retain and motivate talented employees; |

| ● | Swvl’s ability to raise additional capital as needed; and |

| ● | acquisitions or consolidation within Swvl’s industry. |

If Swvl is unable to compete successfully, Swvl’s business, financial condition and operating results could be adversely affected.

The mass transit ridesharing market is still in relatively early stages of growth and if the market does not continue to grow, grows more slowly than Swvl expects or fails to grow as large as Swvl expects, Swvl’s business, financial condition and operating results could be adversely affected.

Post COVID-19, he mass transit ridesharing market was growing, but it is still relatively new, and it is uncertain to what extent market acceptance will continue to grow. Swvl’s success depends to a substantial extent on the willingness of people to widely adopt mass transit ridesharing. If the public does not perceive Swvl’s offerings as beneficial, or chooses not to adopt them as a result of concerns regarding public health or safety, affordability or for other reasons, then the market for Swvl’s offerings may not further develop, may develop more slowly than Swvl expects or may not achieve the growth potential Swvl expects. Any of the foregoing risks and challenges could adversely affect Swvl’s business, financial condition and operating results.

If Swvl fails to cost-effectively attract and retain qualified drivers to use its platform, or to increase utilization of Swvl’s platform by existing drivers using its platform, Swvl’s business, financial condition and operating results could be harmed.

Swvl’s continued growth depends in part on its ability to cost-effectively attract and retain qualified drivers who satisfy Swvl’s screening criteria and procedures to use its platform and to increase utilization of Swvl’s platform by existing drivers.

To attract and retain qualified drivers to use its platform, Swvl has, among other things, offered bonus payments and other incentives to high-performing drivers, and historically provided financial assistance to support drivers during the COVID-19 pandemic. If Swvl does not continue to provide drivers with compelling opportunities to earn income and other incentive programs for using its platform, or if drivers become dissatisfied with Swvl’s requirements for drivers to use its platform, Swvl may fail to attract new drivers to use its platform, retain current drivers to use its platform or increase their utilization of its platform, or Swvl may experience complaints, negative publicity, or services disruptions that could adversely affect its users and its business.

8

The incentives Swvl provides to attract drivers could fail to attract and retain qualified drivers to use its platform or fail to increase utilization of its platform by existing drivers, or could have other unintended adverse consequences. In addition, changes in certain laws and regulations, labor and employment laws, licensing requirements or background check requirements, may result in a shift or decrease in the pool of qualified drivers, which may result in increased competition for the services of qualified drivers or higher costs of recruitment, operation and retention with respect to drivers providing services through the Swvl platform. Other factors outside of Swvl’s control, such as the COVID-19 pandemic or other concerns about personal health and safety, or concerns about the availability of government or other assistance programs if drivers continue to drive using Swvl’s platform, may also reduce the number of drivers available through Swvl’s platform or utilization of Swvl’s platform by drivers, or impact Swvl’s ability to attract new drivers to use its platform. If Swvl fails to attract qualified drivers to use its platform on favorable terms, fails to increase utilization of its platform by existing drivers or loses qualified drivers using its platform to competitors, Swvl may not be able to meet the demand of riders, including maintaining competitive prices for riders, and Swvl’s business, financial condition and operating results could be adversely affected.

If Swvl fails to cost-effectively attract and retain new riders or to increase utilization of its platform by existing riders, Swvl’s business, financial condition and operating results could be harmed.

Swvl’s success depends in part on its ability to cost-effectively attract and retain new riders and increase utilization of Swvl’s platform by current riders. Riders have a wide variety of options for transportation, including public transportation, taxis and other ridesharing offerings. Rider preferences may also change from time to time with the advent of new mobility technologies, different behaviors and attitudes towards the environment and new urban planning practices (including increased focus on public transportation and public-private partnerships with respect to mobility). To expand its rider base, Swvl must appeal to new riders who have historically used other forms of transportation or other ridesharing platforms. Swvl believes that its paid marketing initiatives have been critical in promoting awareness of Swvl’s brand and offerings, which in turn leads to new riders using Swvl for the first time and drives rider Utilization (calculated as Total Bookings divided by Total Available Seats, over the period of measurement). Further, as Swvl continues to expand into new geographic areas, it will be relying in part on referrals from existing riders to attract new riders. However, Swvl’s brand and ability to build trust with existing and new riders may be adversely affected by complaints and negative publicity about Swvl, its offerings, its policies, including its pricing algorithms, drivers using its platform, or its competitors, even if factually incorrect or based on isolated incidents. Further, if existing and new riders do not perceive the transportation services provided by drivers using Swvl’s platform to be reliable, safe and affordable, or if Swvl fails to offer new and relevant offerings and features on its platform, Swvl may not be able to attract or retain riders or to increase their utilization of its platform.

As Swvl continues to expand into new geographic areas, it will be relying in part on referrals from existing riders to attract new riders, and therefore must ensure that its existing riders remain satisfied with its offerings. If Swvl fails to continue to grow its rider base, retain existing riders or increase the overall utilization of its platform by existing riders, Swvl’s business, financial condition and operating results could be adversely affected.

Swvl depends on its key personnel and other highly skilled personnel, and if Swvl fails to attract, retain, motivate or integrate its personnel, Swvl’s business, financial condition and operating results could be adversely affected.

Swvl’s success depends in part on the continued service of its co-founder and Chief Executive Officer, senior management team, key technical employees and other highly skilled personnel, and on Swvl’s ability to identify, hire, develop, motivate, retain and integrate highly qualified personnel for all areas of its organization. In addition, in 2022, Swvl began to implement a portfolio optimization program to reduce costs, which included the reduction of headcount across Swvl’s business. Swvl may not be successful in attracting and retaining qualified personnel to fulfill its current or future needs. Swvl’s competitors may be successful in recruiting and hiring members of Swvl’s management team or other key employees, and it may be difficult to find suitable replacements on a timely basis, on competitive terms, or at all, particularly after Swvl began implementing its cost reduction plan. If Swvl is unable to attract and retain the necessary personnel, particularly in critical areas of its business, Swvl may not achieve its strategic goals.

9

Swvl faces intense competition for highly skilled personnel. To attract and retain top talent, Swvl has had to offer, and Swvl believes it needs to continue to offer, competitive compensation and benefits packages. Job candidates and existing personnel often consider the value of the equity awards they receive in connection with their employment. If the perceived value of Swvl’s equity or equity awards declines or Swvl is unable to provide competitive compensation packages, Swvl’s ability to attract and retain highly qualified personnel may be adversely affected and Swvl may experience increased attrition. Swvl may need to invest significant amounts of cash and equity to attract and retain new employees and expend significant time and resources to identify, recruit, train and integrate such employees, and Swvl may never realize returns on these investments. If Swvl is unable to effectively manage its hiring needs or successfully integrate new hires, Swvl’s efficiency, ability to meet forecasts and employee morale, productivity and retention could suffer, which could adversely affect Swvl’s business, financial condition and operating results.

Swvl’s reputation, brand and the network effects among the drivers and riders using Swvl’s platform are important to its success, and if Swvl is not able to maintain and continue developing its reputation, brand and network effects, its business, financial condition and operating results could be adversely affected, and the recent market exits might impact the reputation and brand for Swvl in the markets they operated in with their original brand name and was exited later.

Swvl believes that building a strong reputation and brand as a safe, reliable and affordable platform and continuing to increase the strength of the network effects among the drivers and riders using Swvl’s platform (i.e., the advantages that derive from having more drivers and riders using Swvl’s platform) are critical to its ability to attract and retain qualified drivers and riders. The successful development of Swvl’s reputation, brand and network effects depends on a number of factors, many of which are outside Swvl’s control. Negative perception of Swvl or its platform may harm Swvl’s reputation, brand and network effects, including as a result of:

| ● | complaints or negative publicity about Swvl or drivers or riders on its platform, its offerings or its policies and guidelines, including Swvl’s practices and policies with respect to drivers, or the ridesharing industry, even if factually incorrect or based on isolated incidents; |

| ● | illegal, negligent, reckless or otherwise inappropriate behavior by drivers, riders or third parties; |

| ● | a failure to offer riders competitive pricing and convenient service; |

| ● | a failure to provide the range of routes, dynamic routing, and ride types sought by riders; |

| ● | actual or perceived inaccuracies in demand prediction and other defects or errors in Swvl’s platform; |

| ● | actual or perceived disruptions in Swvl’s platform, site outages, payment disruptions or other incidents that impact the reliability of Swvl’s offerings; |

| ● | failure to protect Swvl’s customer personal data, or other privacy or data security breaches; |

| ● | litigation involving, or investigations by regulators into, Swvl’s business; |

| ● | users’ lack of awareness of, or compliance with, Swvl’s policies; |

| ● | Swvl’s policies or changes thereto that users or others perceive as overly restrictive, unclear or inconsistent with Swvl’s values or mission or that are not clearly articulated; |

| ● | a failure to enforce Swvl’s policies in a manner that users perceive as effective, fair and transparent; |

| ● | a failure to operate Swvl’s business in a way that is consistent with Swvl’s stated values and mission; |

| ● | inadequate or unsatisfactory user support service experiences; |

| ● | illegal or otherwise inappropriate behavior by Swvl’s management team or other employees or contractors; |

10

| ● | negative responses by drivers or riders to new offerings on Swvl’s platform; |

| ● | a failure to balance the interests of driver and riders; |

| ● | accidents or other negative incidents involving the use of Swvl’s platform; |

| ● | perception of Swvl’s treatment of employees or contractors and Swvl’s response to employee sentiment related to political or social causes or actions of management; |

| ● | political or social policies or activities; or |

| ● | any of the foregoing with respect to Swvl’s competitors, to the extent such resulting negative perception affects the public’s perception of Swvl or its industry as a whole. |

If Swvl does not successfully maintain and develop its brand, reputation and network effects and successfully differentiate its offerings from the offerings of competitors, Swvl’s business may not grow, Swvl may not be able to compete effectively and it could lose existing qualified drivers or existing riders or fail to attract new qualified drivers or new riders to use its platform, any of which could adversely affect Swvl’s business, financial condition and operating results.

Swvl’s company culture has contributed to its success and if Swvl cannot maintain this culture as it grows, its business, financial condition and operating results could be harmed.

Swvl believes that its culture, which promotes proactivity, taking ownership and putting riders and drivers first has been critical to its success. Swvl faces a number of challenges that may affect its ability to sustain its corporate culture, including:

| ● | failure to identify, attract, reward and retain people in leadership positions in Swvl’s organization who share and further Swvl’s culture, values and mission; |

| ● | Swvl’s rapid growth strategy, which involves increasing the size and geographic dispersion of Swvl’s workforce; |

| ● | shelter-in-place orders in certain jurisdictions where Swvl operates that have required many of Swvl’s employees to work remotely, as well as return to work arrangements and workplace strategies; |

| ● | the inability to achieve adherence to Swvl’s internal policies and core values, including Swvl’s diversity, equity and inclusion practices; |

| ● | competitive pressures to move in directions that may divert Swvl from its mission, vision and values; |

| ● | the continued challenges of the rapidly-evolving mass-transit ridesharing industry; |

| ● | the increasing need to develop expertise in new areas of business and operate across borders; |

| ● | potential negative perception of Swvl’s treatment of employees or Swvl’s response to employee sentiment related to political or social causes or actions of management; and |

| ● | the integration of new personnel and businesses from potential acquisitions. |

If Swvl is not able to maintain its corporate culture, Swvl’s business, financial condition and operating results could be adversely affected.

Swvl’s growth strategy will subject it to additional costs, compliance requirements and risks, and Swvl’s plans may not be successful.

Swvl intends to pursue steady growth strategy to expand its operations into new international markets. Swvl growth strategy for 2023 focuses on growth with keeping expansion cost in balance, as well as keeping a lot of operation functions centralized to help with cost management.

11

Swvl implemented a rapid growth strategy the first half of 2022, acquiring multiple entities to expand operations into new international markets, Swvl aimed to expand its Swvl Retail (as defined below) and Swvl Travel (as defined below) offerings in countries in the Middle East and Latin America, and to introduce its Swvl Business offerings in countries in Latin America, Western Europe and Southeast Asia, Operating in a large number of countries requires significant attention of Swvl’s management to oversee operations over a broad geographic area with varying legal and regulatory environments, competitive dynamics and cultural norms and customs and places significant burdens on Swvl’s operations, engineering, finance and legal and compliance functions. Swvl incurred significant operating expenses as a result of its international presence and its expansion plans was subject to a variety of challenges, including:

| ● | recruitment and retention of talented and capable employees in foreign countries while maintaining Swvl’s company culture in each of its markets; |

| ● | competition from local incumbents with existing knowledge of local markets that may market and operate more effectively and may enjoy greater local affinity or awareness; |

| ● | differing rider and driver demand dynamics, which may make Swvl’s offerings less successful; |

| ● | the need to adapt to new markets, including the need to localize Swvl’s offerings and marketing efforts to the preferences of local riders and drivers; |

| ● | public health concerns or emergencies, including the COVID-19 pandemic and other highly communicable diseases or viruses; |

| ● | compliance with varying laws and regulatory standards, including with respect to data privacy, cybersecurity, tax, trade compliance, environmental and other vehicle standards and local regulatory restrictions; |

| ● | the risk that local laws and business practices favor local competitors; |

| ● | compliance with the U.S. Foreign Corrupt Practices Act of 1977, as amended (the “FCPA”) and similar laws in other jurisdictions; |

| ● | obtaining any required government approvals, licenses or other authorizations; |

| ● | varying levels of Internet and mobile technology adoption and infrastructure; |

| ● | currency exchange restrictions or costs and exchange rate fluctuations; |

| ● | political, economic, or social instability, which may cause disruptions to Swvl’s business; |

| ● | operating in jurisdictions with reduced, nonexistent or unenforceable protection for intellectual property rights or where Swvl does not have registered intellectual property rights in its brand and/or technology; and |

| ● | limitations on the repatriation and investment of funds as well as foreign currency exchange restrictions. |

Swvl’s limited experience in operating its business in multiple countries increases the risk that any potential expansion efforts that Swvl may undertake will not be successful and that historically led to Swvl exit certain markets they were operating in due to difficulties in those markets and the funding available to maintain operation and growth. Swvl intends to invest substantial time and resources to expand its operations internationally. As a result, if Swvl is unable to manage these risks effectively, Swvl’s business, financial condition and operating results could be adversely affected.

12

If Swvl fails to effectively manage its growth and optimize its organizational structure, Swvl’s business, financial condition and operating results could be adversely affected.

Since its launch in 2017, Swvl has experienced rapid growth in its business, revenues and the number of users on its platform. Swvl expects this growth to be slower than prior periods, focusing on profitability of the new expansions or growth in existing markets given the current market conditions which increase the cost of capital to support growth activities.

This growth has placed, and will continue to place, significant demands on Swvl’s management and Swvl’s operational and financial infrastructure. The steps Swvl takes to manage its business operations, including policies for employees, and to align Swvl’s operations with Swvl’s strategies for growth, may adversely affect Swvl’s reputation and brand and its ability to recruit, retain and motivate highly skilled personnel.

Swvl’s ability to manage growth and business operations effectively and to integrate new employees, technologies and acquisitions into its existing business will require Swvl to continue to expand its operational and financial infrastructure and to continue to retain, attract, train, motivate and manage employees. Continued growth could strain Swvl’s ability to develop and improve its operational, financial and management controls, enhance its reporting systems and procedures, recruit, train and retain highly skilled personnel and maintain user satisfaction. Additionally, if Swvl does not effectively manage the growth of its business and operations, then Swvl’s reputation, brand, business, financial condition and operating results could be adversely affected.

Swvl has not historically maintained insurance coverage for its operations. Swvl may not be able to mitigate the risks facing its business and could incur significant uninsured losses, which could adversely affect its business, financial condition and operating results.

Swvl does not currently maintain any insurance policies to cover general business liabilities, business interruptions, crime, losses of key personnel or security breaches and incidents relating to its network systems or operations. As a result, any losses arising from or relating to, among other things, personal injury, property damage, labor and employment disputes, commercial disputes, fraudulent transactions or other criminal activity, business interruptions, noncompliance with applicable laws and regulations, infringement or misappropriation of intellectual property or security or privacy breaches, or the successful assertion of one or more claims against Swvl related to any of the foregoing, could require Swvl to service such losses or claims using internal resources, which would have an adverse effect on Swvl’s business, financial condition and operating results.

Swvl’s business depends on insurance coverage which is independently required to be maintained by the drivers using its platform.

Swvl is in the process of obtaining coverage for general business liabilities and cyber insurance. Swvl is also evaluating whether other types of insurance coverage may be appropriate for its business, such as transportation network company insurance. Nevertheless, Swvl may not obtain enough insurance to adequately mitigate the operations-related risks it faces, and some operations-related risks may not be covered at all. Swvl may have to pay high premiums, self-insured retentions or deductibles for the coverage Swvl does obtain. Swvl also may be unable to obtain cyber insurance coverage in certain countries at commercially reasonable rates or at all, and it may experience losses as a result. Additionally, if any of Swvl’s insurance providers becomes insolvent, such providers could be unable to pay any operations-related claims that Swvl makes. Certain losses may be excluded from insurance coverage.

Swvl maintains and provides medical insurance for all drivers and riders using its platform only in Egypt. To do so, Swvl relies on a limited number of third-party insurance service providers to service related claims. If any of Swvl’s third-party insurance service providers fails to service claims to Swvl’s expectations, discontinues or increases the cost of coverage or changes the terms of such coverage in a manner unfavorable to drivers, riders or to Swvl, Swvl cannot guarantee that it would be able to secure replacement coverage or services on reasonable terms in an acceptable time frame or at all. If Swvl cannot find alternate third-party insurance service providers on acceptable terms, Swvl may incur additional expenses related to servicing such ride-related claims using internal resources.

13

Insurance providers have raised premiums and deductibles for many types of claims, coverages and for a variety of commercial risk and are likely to do so in the future. As a result, Swvl’s insurance and claims expense could increase, or Swvl may decide to raise its deductibles or self-insured retentions when policies are renewed or replaced to manage pricing pressure. Swvl’s business, financial condition and operating results could be adversely affected if (i) cost per claim, premiums or the number of claims significantly exceeds Swvl’s historical experience, (ii) Swvl experiences a claim in excess of Swvl’s coverage limits, (iii) Swvl’s insurance providers fail to pay on Swvl’s insurance claims, (iv) Swvl experiences a claim for which coverage is not provided, (v) the number of claims and average claim cost under Swvl’s deductibles or self-insured retentions differs from historic averages or (vi) an insurance policy is cancelled or not renewed.

There is no guaranty that we will be able to generate the revenue necessary to support our cost structure or obtain the level of financing necessary for our operations.

We have incurred significant losses and negative cash flows from operations and incurred losses of $123.57 and $141.48 for the years ended December 31, 2022 and 2021, respectively. During the years ended December 31, 2022 and 2021, we had negative cash flows from operations of $117.46 and $62.13, respectively. We have funded our operations to date mainly through equity financing.

In 2023, we revised our capital structure to be funded through working capital and cashflows generated from operations, we are profitable in the largest operating market and aiming to achieve profitability and positive cashflow for the Group by end of 2023. We started also exploring opportunities for external debt financing from Banks and Financial institutions to obtain funding required to continue our operations. We monitor our cash flow projections on a current basis and take active measures to accelerate the working capital cycle. However, these cash flow projections are subject to various uncertainties concerning their fulfilment such as the ability to increase revenues by attracting and expanding its customer base or reducing cost structure. If we will not succeed in generating sufficient cash flow or completing additional financing, then it will need to continue our cost reduction plan that has been started. Our transition to profitable operations is dependent on generating a level of revenue adequate to support our cost structure. We expect to fund operations using cash on hand, through operational cash flows and raising additional proceeds. There are no assurances, however, we will be able to generate the revenue necessary to support our cost structure or that we will be successful in obtaining the level of financing necessary for its operations.

An inability to generate positive cash flow from operating activities for the near term may adversely affect our ability to raise needed capital through external debt for our business on reasonable terms, or at all, diminish supplier or customer willingness to enter into transactions with us, and have other adverse effects that may decrease our long-term viability. There can be no assurance that we will achieve positive cash flow in the near future or at all.

In May 2022, the Swvl Board resolved to implement a Portfolio Optimization Plan that focus on profitability by reducing costs and focus on high margin operations, There was a reduction in headcount by 32% and operations was reduced in multiple locations. The Swvl Board continue to monitor and follow the plan implementation, which lead to another additional wave of measures implemented on November 2022 that reduced headcount and completely discontinued operations in multiple locations, leaving only the locations that are cashflow positive and profitability was foreseeable in short term plans. The Company has also given termination notices to multiple vendors and contractors that provide services to the group. As a result, Swvl’s revised budget is expected to reduce the group’s monthly net cash used in operating activities, which reduces the expenses and cash requirements for the continued operation of the business. Moreover, the implementation of the Portfolio Optimization Plan or related initiatives may have adverse consequences on our employee morale, our culture, and our ability to attract and retain employees. In addition, from time to time, there may be changes in our senior management team that may be disruptive to our business. If our senior management team fails to work together effectively and to execute its plans and strategies, our business, financial condition, and results of operations could be adversely affected.

14

Our ongoing divestment of old businesses and services is inherently risky, and could disrupt our current operations. We may not be able to realize the intended and anticipated benefits from our divestments, which could affect the value of these decisions to our business and our ability to meet our financial obligations and targets in the short or medium term.

We have and expect to continue to divest existing services and exit certain countries and regions to enhance our operating infrastructure, to fund our operations, and to respond to competitive pressures. Entering into these types of arrangements entails many risks, any of which could materially harm our business, including: the diversion of management’s attention from other business concerns; the incurring of significant transaction costs; the loss of key employees; and unanticipated local or federal regulatory challenges that could cause us to fail to realize the anticipated benefits of such divestment. Any of the foregoing or other factors could harm our ability to achieve anticipated levels of profitability from divested businesses or to realize other anticipated benefits of divestments.

We may not be able to identify or consummate any future divestments on favorable terms, or at all. If we do effect a divestment, it is possible that the financial markets or investors will view the transaction negatively. No assurance can be given that such divestment will be successful and will not adversely affect our financial condition and operating results.

Illegal, improper or otherwise inappropriate activity of riders, drivers or other users, whether or not occurring while utilizing Swvl’s platform, could expose Swvl to liability and harm its business, brand, financial condition and operating results.

Illegal, improper or otherwise inappropriate activities by riders, drivers or other users, including the activities of individuals who may have previously engaged with, but are not then receiving or providing services offered through, Swvl’s platform could adversely affect Swvl’s brand, business, financial condition and operating results. These activities may include assault, theft, unauthorized use or sharing of rider or driver accounts and other misconduct. Such conduct could expose Swvl to liability or adversely affect Swvl’s brand or reputation.

While Swvl has taken measures to guard against these illegal, improper or otherwise inappropriate activities, these measures may prove inadequate to prevent such activities or Swvl may not be successful in implementing them effectively. Although Swvl requires certain qualification processes for drivers using its platform, including submission of criminal record checks in certain jurisdictions, these qualification processes may not expose all potentially relevant information and may be limited in certain jurisdictions according to national and local laws, and Swvl may fail to conduct such qualification processes adequately or identify information that could be relevant to a determination of driver eligibility.

Further, any negative publicity related to the foregoing, whether an incident occurred on Swvl’s platform, on Swvl’s competitors’ platforms, or on any ridesharing platform, could adversely affect Swvl’s reputation and brand or public perception of the ridesharing industry as a whole, which could negatively affect demand for Swvl’s platform and potentially lead to increased regulatory or litigation exposure. Any of the foregoing risks could harm Swvl’s business, financial condition and operating results.

Changes to Swvl’s pricing could adversely affect its ability to attract or retain qualified drivers and riders to use its platform.

Demand for Swvl’s offerings is sensitive to the price of rides. Many factors, including operating costs, legal and regulatory requirements or constraints and Swvl’s current and future competitors’ pricing and marketing strategies, could significantly affect Swvl’s pricing strategies. Competitors may offer, or may in the future offer, lower-priced or a broader range of offerings or use marketing strategies that enable them to attract or retain qualified drivers and riders at a lower cost than Swvl does.

Swvl uses pricing algorithms to set prices depending on the route, time of day and expected rates of Utilization. In the past, Swvl has made pricing changes and spent significant resources on marketing rider incentives, and there can be no assurance that Swvl will not be forced, through competitive pressures, regulation or otherwise, to reduce the price of rides for riders, to increase the rates Swvl offers for driver services or to increase Swvl’s marketing and other expenses to attract and retain qualified drivers and riders using its platform.

Furthermore, the economic sensitivity of drivers and riders using Swvl’s platform may vary by geographic location, and as Swvl expands into new markets, its pricing methodologies may not enable it to compete effectively in these locations. Local regulations may affect Swvl’s pricing in certain geographic locations, which could amplify these effects. For example, Swvl and other ridesharing companies have made commitments to the Egyptian Competition Authority not to set prices below certain profitability benchmarks with respect to their B2C ridesharing offerings in Egypt. Swvl has launched, and may in the future launch, new pricing strategies and initiatives, such as subscription packages and driver or rider loyalty programs. Swvl has also modified, and may in the future modify, existing pricing methodologies, such as its up-front pricing policy. Any of the foregoing actions may not ultimately be successful in attracting and retaining qualified drivers and riders.

15

Any actual or perceived security or privacy breach could interrupt Swvl’s operations and adversely affect its reputation, brand, business, financial condition and operating results. Swvl has previously experienced a data breach that resulted in the exposure of customer information.

Swvl’s business involves the collection, storage, transmission and other processing of Swvl’s users’ personal and other sensitive data. An increasing number of organizations, including large online and off-line merchants and businesses, other large Internet companies, financial institutions and government institutions, have disclosed breaches of their information security systems and other information security incidents, some of which have involved sophisticated and highly targeted attacks. Because techniques used to obtain unauthorized access to or to sabotage information systems change frequently and may not be known until launched, Swvl may be unable to anticipate, detect or prevent these attacks. Swvl has previously experienced a data breach. In July 2020, unauthorized parties gained access to a Swvl database containing identifiable information of its riders by exploiting a breach in certain third-party software used by Swvl. While such breach has not had a material impact on Swvl’s business or operations and Swvl has since implemented measures designed to restrict any similar data breach, unauthorized parties may in the future gain access to Swvl’s systems or facilities through various means, including gaining unauthorized access into Swvl’s systems or facilities or those of Swvl’s service providers, partners or users on Swvl’s platform, or attempting to fraudulently induce Swvl’s employees, service providers, partners, users or others into disclosing rider names, passwords, payment card information or other sensitive information, which may in turn be used to access Swvl’s information technology systems, or attempting to fraudulently induce Swvl’s employees, partners or others into manipulating payment information, resulting in the fraudulent transfer of funds to criminal actors. In addition, users on Swvl’s platform could have vulnerabilities on their own mobile devices that are entirely unrelated to Swvl’s systems and platform, but could mistakenly attribute their own vulnerabilities to Swvl. Further, breaches experienced by other companies may also be leveraged against Swvl. For example, credential stuffing and ransomware attacks are becoming increasingly common, and sophisticated actors can mask their attacks, making them increasingly difficult to identify and prevent. Certain efforts may be state-sponsored or supported by significant financial and technological resources, making them even more difficult to detect.

Although Swvl has developed systems and processes that are designed to protect users’ data, prevent data loss and prevent other privacy or security breaches, these measures cannot guarantee security. Swvl’s information technology and infrastructure may be vulnerable to cyberattacks or security breaches, and third parties may be able to access Swvl’s users’ payment card data and other personal information that are accessible through those systems. Swvl is still a growing company and may not have sufficient dedicated personnel or internal oversight to detect, identify, and respond to all privacy or security incidents. Additionally, as Swvl expands its operations, including sharing data with third parties or continuing the work-from-home practices of its employees (including increased use of video conferencing), Swvl’s exposure to cyberattacks or security breaches may increase. Further, employee error, malfeasance or other errors in the storage, use or transmission of personal information could result in an actual or perceived privacy or security breach or other security incident. Although Swvl has policies restricting the access to the personal information it stores, these policies may be breached or prove inadequate.

Any actual or perceived breach of privacy or security could interrupt Swvl’s operations, result in Swvl’s platform being unavailable, result in loss or improper disclosure of data, result in fraudulent transfer of funds, harm Swvl’s reputation and brand, damage Swvl’s relationships with strategic partners and third-party service providers, result in significant legal, regulatory and financial exposure and lead to loss of driver or rider confidence in, or decreased use of, Swvl’s platform, any of which could adversely affect Swvl’s business, financial condition and operating results. Any breach of privacy or security impacting any entities with which Swvl may share or disclose data could have similar effects. Further, any cyberattacks or security and privacy breaches directed at Swvl’s competitors could reduce confidence in the ridesharing industry as a whole and, as a result, reduce confidence in Swvl.

Additionally, responding to any privacy or security breach, including defending against claims, investigations or litigation in connection with any privacy or security breach, regardless of their merit, could be costly and divert management’s attention. Swvl does not currently maintain any insurance to cover security breaches and incidents or losses relating to its network systems or operations. As a result, the successful assertion of one or more large claims against Swvl could have an adverse effect on Swvl’s reputation, brand, business, financial condition and operating results.

16

Defects, errors or vulnerabilities in Swvl’s applications, backend systems or other technology systems and those of third-party technology providers could harm Swvl’s reputation and brand and adversely impact Swvl’s business, financial condition and operating results.

The software underlying Swvl’s platform is highly complex and may contain undetected errors or vulnerabilities, some of which may only be discovered after the code has been released. The third-party software that Swvl incorporates into its platform may also be subject to errors or vulnerability. Any errors or vulnerabilities discovered in Swvl’s code or third-party software could result in negative publicity, loss of users, loss of revenue and access or other performance issues. Such vulnerabilities could also be exploited by malicious actors and result in exposure of data of users on Swvl’s platform, or otherwise result in a data breach. Swvl may need to expend significant financial and development resources to analyze, correct, eliminate or work around errors or defects or to address and eliminate vulnerabilities. Any failure to timely and effectively resolve any such errors, defects or vulnerabilities could adversely affect Swvl’s business, financial condition and operating results as well as negatively impact Swvl’s reputation or brand.

Swvl relies on various third-party product and service providers and if such third parties do not perform adequately or terminate their relationships with Swvl, Swvl’s costs may increase and its business, financial condition and operating results could be adversely affected.

Swvl’s success depends in part on its relationships with third-party product and service providers. For example, Swvl relies on third-parties to fulfill various marketing, web hosting, payment, communications and data analytics services to support Swvl’s platform. If any of Swvl’s partners terminates its relationship with Swvl, or refuses to renew its agreement on commercially reasonable terms, Swvl would need to find an alternate provider, and may not be able to secure similar terms or replace such providers in an acceptable time frame. While Swvl does not own or operate vehicles, in the event that vehicle manufacturers issue recalls or the supply of vehicles or automotive parts is interrupted, affecting the vehicles operating on Swvl’s platform, the availability of vehicles on Swvl’s platform could become constrained.

In addition, Swvl’s business may be adversely affected to the extent the software and services used by Swvl’s third-party service providers do not meet expectations, contain errors or vulnerabilities, are compromised or experience outages. Swvl cannot be certain that its licensors are not infringing the intellectual property rights of others or that the suppliers and licensors have sufficient rights to the technology in all jurisdictions in which Swvl may operate. If Swvl is unable to obtain or maintain rights to any of this technology because of intellectual property infringement claims brought by third parties against suppliers, licensors or Swvl itself, or if Swvl is unable to continue to obtain the technology or enter into new agreements on commercially reasonable terms, Swvl’s ability to develop its platform containing that technology could be severely limited and its business could be harmed. If Swvl is unable to obtain necessary technology from third parties, it may be forced to acquire or develop alternate technology, which may require significant time and effort and may be of lower quality or performance standards. This would limit and delay Swvl’s ability to provide new or competitive offerings and increase Swvl’s costs. If alternate technology cannot be obtained or developed, Swvl may not be able to offer certain functionality as part of its offerings, which could adversely affect Swvl’s business, financial condition and operating results.

Any of these risks could increase Swvl’s costs and adversely affect Swvl’s business, financial condition and operating results. Further, any negative publicity related to any of Swvl’s strategic partners and third-party service providers, including any publicity related to quality standards or safety concerns, could adversely affect Swvl’s reputation and brand, and could potentially lead to increased regulatory or litigation exposure.

If Swvl fails to effectively predict rider demand, to set pricing and routing accordingly or to run routes that are consistent with the availability of drivers using its platform, Swvl’s business, financial condition and operating results could be adversely affected.

Swvl relies on its proprietary technology to predict and dynamically update routing in response to changes in demand, to optimize pricing in response to such demand and to maximize per-vehicle Utilization. If Swvl is unable to effectively predict and meet rider demand and to update its routing and pricing accordingly, Swvl may lose ridership and its revenues may decrease. In addition, riders’ price sensitivity varies by geographic location, among other factors, and if Swvl is unable to effectively account for such variability in its pricing methodologies, its ability to compete effectively in these locations could be adversely affected. Swvl’s success also depends, in part, on its ability to match route plans with the availability and preferences of the drivers using its platform. If Swvl is unable to determine and allocate routes in a manner consistent with the availability and preferences of such drivers, drivers may reduce or discontinue their participation on Swvl’s platform and may use competitors’ platforms. Any of the foregoing risks could adversely impact Swvl’s business, financial condition and operating results.

17

If Swvl is not able to successfully develop new offerings on its platform and enhance its existing offerings, Swvl’s business, financial condition and operating results could be adversely affected.

Swvl’s ability to attract new qualified drivers and new riders, retain existing qualified drivers and existing riders and increase utilization of its offerings will depend in part on its ability to successfully create and introduce new offerings and to improve upon and enhance existing offerings. As a result, Swvl may introduce significant changes to its existing offerings or develop and introduce new and unproven offerings. If any of Swvl’s new or enhanced offerings are unsuccessful, including as a result of any inability to obtain and maintain required permits or authorizations or other regulatory constraints or because they fail to generate sufficient return on Swvl’s investments, Swvl’s business, financial condition and operating results could be adversely affected.

Furthermore, new driver or rider demands regarding platform features, the availability of superior competitive offerings or a deterioration in the quality of Swvl’s offerings or ability to bring new or enhanced offerings to market quickly and efficiently could negatively affect the attractiveness of Swvl’s platform and the economics of Swvl’s business, requiring it to make substantial changes to and additional investments in its offerings or business model. In addition, Swvl frequently experiments with and tests different offerings and marketing strategies. If these experiments and tests are unsuccessful, or if the offerings and strategies Swvl introduces based on the results of such experiments and tests do not perform as expected, Swvl’s ability to attract new qualified drivers and new riders, retain existing qualified drivers and existing riders and maintain or increase utilization of Swvl’s offerings may be adversely affected.

Swvl’s market is characterized by rapid technology change, particularly across the anticipated SaaS and TaaS offerings, which require it to develop new products and product innovations, and any delays in such development could adversely affect market adoption of Swvl’s products and its financial results. Developing and launching new offerings or enhancements to the existing offerings on Swvl’s platform, such as Swvl’s launch of its TaaS offering in 2020 and its anticipated launch of its SaaS offering for use by corporate customers and other third parties, involves significant risks and uncertainties, including risks related to the reception of such offerings by existing and potential future drivers and riders, increases in operational complexity, unanticipated delays or challenges in implementing such offerings or enhancements, increased strain on Swvl’s operational and internal resources (including an impairment of Swvl’s ability to accurately forecast rider demand and the number of drivers using Swvl’s platform) and negative publicity in the event such new or enhanced offerings are perceived to be unsuccessful. Swvl intends to continue to scale its business rapidly, and significant new initiatives have in the past resulted in, and in the future may result in, operational challenges affecting Swvl’s business.

In addition, developing and launching new offerings and enhancements to Swvl’s existing offerings may involve significant up-front capital investments. Such investments may not generate a positive return on investment. Further, from time to time Swvl may reevaluate, discontinue and/or reduce these investments and decide to discontinue one or more of its offerings. Any of the foregoing risks and challenges could negatively impact Swvl’s ability to attract and retain qualified drivers and riders, its ability to increase utilization of its offerings and its visibility into expected operating results, and could adversely affect Swvl’s business, financial condition and operating results. Additionally, Swvl’s near-term operating results may be impacted by long-term investments in the future.

Swvl may require additional capital to support the growth of its business, which capital may not be available on terms acceptable to it, or at all. To the extent Swvl obtains additional capital through future issuances of Swvl Securities, such issuances could dilute the interests of existing shareholders.

Since commencing operations in 2017, Swvl has funded its operations and capital expenditures primarily through equity issuances, convertible note issuances, by the end of 2022 along with the economic downturn, Swvl shifted dependency to rely more on cash generated from operations rather than equity issuances to avoid dilution to shareholders. To support and grow its business, Swvl must have sufficient capital.

18