UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: ______

Commission

File Number:

(Exact name of Registrant as specified in its charter)

| Not applicable | ||

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Locafy Limited

+

(Address of principal executive offices)

Gavin Burnett

Locafy Limited

246A Churchill Avenue

Subiaco WA 6008, Australia

Tel: +61 409 999 339

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| The Capital Market | ||||

| The Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the shell company report:

On June 30, 2022, the issuer had ordinary shares, no par value per share, outstanding.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Emerging growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | Other ☐ | ||

| by the International Accounting Standards Board | ☒ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ☐

TABLE OF CONTENTS

| 2 |

BASIS OF PRESENTATION

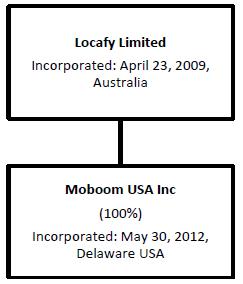

Except as otherwise indicated, references in this Annual Report on Form 20-F (“Annual Report”) to “Locafy,” “the Company,” “the Group,” “we,” “us” and “our” refer to Locafy Limited, a company incorporated under the laws of Australia, and its directly owned subsidiary on a consolidated basis.

We express all amounts in this Annual Report in U.S. dollars, except where otherwise indicated. References to “$” and “US$” are to U.S. dollars and references to “A$” are to Australian dollars. Except as otherwise noted, conversions from Australian Dollars into U.S. Dollars were made at the rate of A$1.0000 to US$0.6889, which was the daily exchange rate published by the Reserve Bank of Australia on June 30, 2022.

We have made rounding adjustments to some of the figures included in this Annual Report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

PRESENTATION OF FINANCIAL INFORMATION

We report under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). None of the financial statements were prepared in accordance with generally accepted accounting principles in the United States. We present our financial statements in Australian dollars.

The consolidated financial statements and accompanying notes thereto presented in this Annual Report have been audited by Grant Thornton Audit Pty Ltd, our independent registered public accounting firm.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business”. Forward-looking statements can often be identified by the use of terminology such as “subject to”, “believe,” “anticipate,” “plan,” “expect,” “intend,” “estimate,” “project,” “may,” “will,” “should,” “would,” “could,” “can,” the negatives thereof, variations thereon and similar expressions, or by discussions of strategy. Forward-looking statements are any statements that look to future events and include, but are not limited to, statements regarding our business strategy; trends, opportunities and risks affecting our business, industry and financial results; future expansion or growth plans and potential for future growth; our ability to attract new clients to purchase our solution; our strategy of expanding our business through strategic acquisitions and to integrate such acquisitions with our business and personnel; our ability to retain customer base and induce them to license additional products; our ability to accurately forecast future revenues and appropriately plan our expenses; market acceptance of our solutions; our expectations regarding implementation of remedial measures; our expectations regarding future revenues generated by our solutions; our ability to attract and retain qualified employees and key personnel; and the impact of the novel coronavirus (COVID-19) pandemic on our business, results of operations, cash flows, financial condition and liquidity.

Forward-looking statements are neither historical facts nor assurances of future performance, and are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following:

● |

our expenses, future revenues, capital requirements and our needs for financing; |

| 3 |

| ● | our ability to successfully commercialize, develop, market or sell new products or adopt new technology platforms; | |

| ● | the possibility that our customers may not renew maintenance agreements or purchase additional professional services; | |

| ● | our ability to attract and retain qualified personnel; | |

| ● | our ability to adequately manage our growth; | |

| ● | our ability to maintain good relations with our partners; | |

| ● | our reliance on relationships with third parties; | |

| ● | our ability to adequately protect our intellectual property and proprietary rights; | |

| ● | our ability to comply with continued listing requirements of The Nasdaq Capital Market’s (“Nasdaq”); | |

| ● | our ability to compete effectively; | |

| ● | the availability of suitable acquisition targets; | |

| ● | our ability to maintain effective internal controls; and | |

| ● | the other factors set forth under the heading “Risk Factors” of this Annual Report. |

The forward-looking statements contained in this Annual Report are based on current expectations, assumptions, and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments will be those that have been assumed or anticipated. These forward-looking statements are subject to a number of risks and uncertainties (some of which are beyond our control) that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors”. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. The forward-looking statements contained in this Annual Report represent our expectations as of the date of this Annual Report (or as the date they are otherwise stated to be made) and are subject to change after such date. However, we disclaim any intention or obligation or undertaking to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable securities laws.

| 4 |

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

A. Directors and Senior Management

Not applicable.

B. Advisers

Not applicable.

C. Auditors

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

| 5 |

D. Risk Factors

RISK FACTOR SUMMARY

Investing in our securities is speculative and involves substantial risk. You should carefully consider all of the information in this Annual Report prior to investing in our securities. There are numerous risk factors related to our business that are described under “Risk Factors” on page 6 and elsewhere in this Annual Report. These risks could materially and adversely impact our business, results of operations, financial condition and future prospects, which could cause the trading price of our ordinary shares to decline and could result in a loss of your investment. Among these important risks are the following:

| ● | Our recent growth may not be indicative of our future growth, and we may not be able to sustain our revenue growth rate in the future. Our growth also makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful. |

| ● | The market and technology space in which we participate are competitive, new, and rapidly changing, and if we do not compete effectively, introduce new features or products successfully, make enhancements to our existing products and services, or if our products and services do not perform as well as our competitors’, then our business, results of operations, and financial condition could be harmed. | |

| ● | We use third-party services and technologies in connection with our business, and any disruption to the provision of these services and technologies to us could result in negative publicity and a slowdown in the growth of our user base, which could materially and adversely affect our business, financial condition and results of operations. | |

| ● | If we fail to manage our growth effectively, we may be unable to execute our business plan or maintain high levels of service and customer satisfaction. | |

| ● | We will face additional risks as we offer new products and services, transact with a broader array of clients and counterparties, and expose ourselves to new geographical markets. | |

| ● | Real or perceived errors, failures, vulnerabilities, or bugs in our technology could harm our business, results of operations, financial condition, and our reputation could be harmed. | |

| ● | If there are interruptions or performance problems associated with the technology or infrastructure used to operate our technology, customers may experience service outages, other organizations may be reluctant to use our technology, and our reputation could be harmed. | |

| ● | We face cybersecurity risks that could result in damage to our reputation and/or subject us to fines, payment of damages, lawsuits and restrictions on our use of data. | |

| ● | If we are unable to attract new users and organizations, our revenue growth and profitability will be harmed. | |

| ● | Any inability to deal with and manage our development and growth could have a material adverse effect on our business, operations, financial performance and prospects. | |

| ● | If we are not able to introduce new features or products successfully and to make enhancements to our existing products and services, our business and results of operations could be adversely affected. | |

| ● | If we are not able to maintain and enhance our brand and increase market awareness of our company and products, our business, results of operations and financial condition may be adversely affected. | |

| ● | We cannot guarantee that our future monetization strategies will be successfully implemented or generate sustainable revenues and profit. | |

| ● | We have been reliant on government subsidies and research and development grants in the past and we cannot ensure that our existing capital will be sufficient to meet our capital requirements. |

| 6 |

| ● | Compliance with the rapidly evolving landscape of global data privacy and security laws may be challenging, and any failure or perceived failure to comply with such laws, or other concerns about our practices or policies with respect to the processing of personal data, could damage our reputation and deter current and potential customers and end users from using our platform and products and services or subject us to significant compliance costs or penalties, which could materially and adversely affect our business, financial condition and results of operations. | |

| ● | We rely on key personnel and employees with the technical know-how to lead and operate our businesses. |

| ● | If we fail to adequately protect our proprietary rights, our competitive position could be impaired and we may lose valuable assets, generate reduced revenue, and incur costly litigation to protect our rights. | |

| ● | We face the risk that third parties will claim that we infringe on their intellectual property rights, which could result in costly license fees or expensive litigation. | |

| ● | We may need additional capital, and financing may not be available on terms acceptable to us, or at all. | |

| ● | The COVID-19 pandemic and its continuing effects have significantly impacted the global economy and markets and may continue to do so, which could adversely affect our business, financial condition and the trading price of our securities. | |

| ● | As a company primarily based outside of the United States, our business is subject to economic, political, regulatory and other risks associated with international operations. | |

| ● | The requirements of being a U.S. public company may strain our resources, divert management’s attention and affect our ability to attract and retain qualified board members. | |

| ● | We are a “foreign private issuer” and may have disclosure obligations that are different from those of U.S. domestic reporting companies. As a foreign private issuer, we are subject to different U.S. securities laws and rules than a domestic U.S. issuer, which could limit the information publicly available to our shareholders. | |

| ● | We may lose our “foreign private issuer” status in the future, which could result in additional costs and expenses to us. | |

| ● | We are an “emerging growth company,” and any decision on our part to comply only with certain reduced reporting and disclosure requirements applicable to emerging growth companies could make our ordinary shares less attractive to investors. | |

| ● | If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, shareholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our ordinary shares. | |

| ● | Substantial future sales of our ordinary shares, or the perception that these sales could occur, may cause the price of our ordinary shares to drop significantly, even if our business is performing well. | |

| ● | We do not anticipate paying cash dividends and, accordingly, shareholders must rely on share appreciation for any return on their investment. | |

| ● | Investors in this offering will pay a much higher price than the book value of our ordinary shares and, as a result, you will incur immediate and substantial dilution of your investment. | |

| ● | Nasdaq may delist our securities from its exchange, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions. | |

| ● | We are governed by the corporate laws of Australia, which in some cases have a different effect on shareholders than the corporate laws of the United States and may have the effect of delaying or preventing a change in control. | |

| ● | U.S. civil liabilities may not be enforceable against us, our directors, our officers or certain experts named in this Annual Report. |

As a result of these risks and other risks described under “Risk Factors,” there is no guarantee that we will experience growth or profitability in the future.

| 7 |

RISK FACTORS

You should consider carefully the following risk factors, as well as the other information in this Annual Report, including our financial statements and notes thereto. If any of the following risks were to actually occur, our business, financial conditions, results of operations and prospects could be materially adversely affected and the value of our securities could decline. The risks and uncertainties described below in this Annual Report for the year ended June 30, 2022, are not the only risks facing us. We may face additional risks and uncertainties not currently known to us or that we currently deem to be immaterial. This Annual Report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of a number of factors, including the risks described below. See “Cautionary Note Regarding Forward-Looking Statements.”

Risks Relating to our Business and Industry

Our recent growth may not be indicative of our future growth, and we may not be able to sustain our revenue growth rate in the future. Our growth also makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

We have experienced growth since the inception of our operations. Our revenue increased by 92.6% from year- end 2021 to year-end 2022. However, you should not rely on the revenue growth of any prior quarterly or annual period as an indication of our future performance. We cannot assure you that we will be able manage our growth at the same rate as we did in the past, or avoid any decline in the future. To maintain our growth, we need to attract more customers, scale up our business and continue to improve our technology, among other things. Moreover, our current and planned staffing, systems, policies, procedures and controls may not be adequate to support our future operations. To effectively manage the expected growth of our operations and personnel, we will also be required to refine our operational, financial and management controls and reporting systems and procedures. If we fail to efficiently manage the expansion of our business, our costs and expenses may increase faster than we planned and we may not successfully attract a sufficient number of customers and end users in a cost-effective manner, respond timely to competitive challenges, or otherwise execute our business strategies. Our growth requires significant financial resources and will continue to place significant demands on our management. There is no guarantee that we will be able to effectively manage any future growth in an efficient, cost-effective and timely manner, or at all. Our past growth is not necessarily indicative of results that we may achieve in the future. If we fail to effectively manage the growth of our business and operations, our reputation, results of operations and overall business and prospects could be negatively impacted.

The market and technology space in which we participate are competitive, new, and rapidly changing, and if we do not compete effectively, introduce new features or products successfully, make enhancements to our existing products and services, or if our products and services do not perform as well as our competitors’, then our business, results of operations, and financial condition could be harmed.

Our market is subject to rapidly evolving products and technological change, and our future success depends on our technology. Products, services and technologies developed by others may render our products, services or technology obsolete or non-competitive. To attract new customers and end users and keep our existing ones engaged, we must introduce new products and services and upgrade our existing offerings to meet their evolving preferences. It is difficult to predict the preferences of a particular customer or a specific group of customers. Changes and upgrades to our existing products may not be well received by our customers and end users, and newly introduced products or services may not achieve success as expected. Moreover, the functionality, reliability or security of our technology or our ability to adequately maintain, develop, update or enhance our technology each depends on numerous factors, many of which are beyond our control, and any failure in respect of any of the foregoing may cause the level of usage and customer satisfaction to decline. This may result in reduced sales, loss of customers, damage to reputation, an inability to attract new clients and potential claims for breach of contract or other litigation.

| 8 |

Our future revenue and growth also depends on our ability to develop enhancements, new features and products, and services that utilize our technology. Enhancements, new features and products, and services that we develop may not be introduced in a timely or cost-effective manner, may contain errors or defects, may have interoperability difficulties with our platform or other products and services or may not achieve the broad market acceptance necessary to generate significant revenue. The failure to successfully develop enhancements, services, features, products or other new solutions may materially adversely impact our future operations and financial performance, competitive position and business prospects.

We use third-party services and technologies in connection with our business, and any disruption to the provision of these services and technologies to us could result in negative publicity and a slowdown in the growth of our user base, which could materially and adversely affect our business, financial condition and results of operations.

Our business depends, in part, on services provided by, and relationships with, various third parties. For example, we rely on contracts with third-party suppliers such as AWS, which provides cloud hosting services. If these contracts and services are terminated or suffer a disruption in the future and we are not able to replace or accommodate for those events in a timely and cost-effective manner, our operations and financial performance, competitive position and business prospects may be adversely impacted.

We are faced with uncertainties related to our research and development.

Our products and services are the subject of continuous research and development and must be continually and substantially developed in order to gain and maintain competitive and technological advantage, and in order to meaningfully improve the usability, scalability and accuracy of our products and services. There are no guarantees that we will be able to undertake such research and development successfully or cost effectively. Failure to successfully undertake such research and development, anticipate technical problems, or estimate research and development costs or timeframes accurately may adversely affect our results and viability.

We may be unable to execute our business plans or maintain high levels of service and customer satisfaction, which may adversely affect our business, operating results or financial condition.

To continue to grow our business, it is important that existing customers renew their subscriptions when existing contracts expire and that we expand our relationships with existing customers. Customers have no obligation to renew their subscriptions and may decide not to renew their subscriptions with a similar contract period, at the same prices and terms, or at all. In the past, some of our customers have elected not to continue to use our services. Any failure to maintain high-quality technical support, or a market perception that we do not maintain high-quality technical support, could adversely affect client retention, our reputation, our ability to sell our applications to existing and prospective clients, and, as a result, our business, operating results or financial condition. Our ability to retain customers and expand deployments with them may decline or fluctuate as a result of a number of factors, including customer satisfaction, functionality, reliability, customer support, prices, competitor prices, customer experience, new feature releases and overall performance of our technology.

Further, our solutions are inherently complex and may in the future contain, or develop, undetected defects or errors. Any defects in our platform could adversely affect our reputation, impair our ability to sell our applications in the future and result in significant costs to us. The costs incurred in correcting any platform defects may be substantial and could adversely affect our business, operating results or financial condition.

Our growth strategy is largely dependent upon increasing the number of customers that use our technology. As we seek to increase our sales, we may face upfront sales costs and longer sales cycles, higher customer acquisition costs, more complex customer requirements and volume discount requirements. We may also be required to enter into customized contractual arrangements with certain customers, particularly large enterprises, pursuant to which we are required to offer more favorable pricing terms in exchange for larger total contract values that accompany large deployments. As we continue to expand our sales efforts, we will need to continue to increase investment in sales and marketing. There is no assurance that such investments will succeed and contribute to additional customer acquisition, and in turn result in revenue growth.

| 9 |

There can be no assurance that we will successfully commercialize our technology or our products and services or that existing product markets will continue to grow or that new markets will develop. If we are unable to increase sales to customers, our business, financial condition, operations and overall financial performance may suffer.

We will face additional risks as we offer new products and services, transact with a broader array of clients and counterparties, and expose ourselves to new geographical markets.

We are committed to providing new products and services in order to strengthen our market position in the industries that we operate in. We expect to expand our product and service offerings as permitted by relevant regulatory authorities, transact with new clients not in our traditional client base, and enter into new markets. If we are unable to achieve the expected results with respect to our offering of new products and services, our new client base, and in new geographical markets, our business, financial condition, and results of operations could be materially and adversely affected.

We may not be able to successfully identify, consummate or integrate acquisitions, and acquisitions may adversely affect our financial leverage.

Part of our business strategy may, from time to time, include pursuing synergistic acquisitions. We have expanded, and plan to continue to expand, our business by making strategic acquisitions and regularly seeking suitable acquisition targets to enhance our growth. In September 2022, we acquired Jimmy Kelley Digital, a marketing firm headquartered in Austin, Texas. We may fund such acquisitions using cash on hand or accessing the capital markets. To the extent we finance such acquisitions with debt, the incurrence of such debt may result in a significant increase in our interest expense and financial leverage.

Further, the pursuit of acquisitions may pose certain risks to us. We may not be able to identify acquisition candidates that fit our criteria for growth and profitability. Even if we are able to identify such candidates, we may not be able to acquire them on terms or financing satisfactory to us. We will incur expenses and dedicate attention and resources associated with the review of acquisition opportunities, whether or not we consummate such acquisitions.

Additionally, even if we are able to acquire suitable targets on agreeable terms, we may not be able to successfully integrate their operations with ours. Achieving the anticipated benefits of any acquisition will depend in significant part upon whether we integrate such acquired businesses and personnel, as the case may be, in an efficient and effective manner. We may not be able to achieve the anticipated operating and cost synergies or long-term strategic benefits of our acquisitions within the anticipated timing or at all. For example, elimination of duplicative costs may not be fully achieved or may take longer than anticipated. The benefits from any acquisition may be offset by the costs incurred in integrating the businesses and operations. We may also assume liabilities in connection with acquisitions to which we would not otherwise be exposed. An inability to realize any or all of the anticipated synergies or other benefits of an acquisition as well as any delays that may be encountered in the integration process, which may delay the timing of such synergies or other benefits, could have an adverse effect on our business, results of operations and financial condition.

Real or perceived errors, failures, vulnerabilities, or bugs in our technology could harm our business, results of operations, financial condition, and our reputation could be harmed.

We will need to ensure that our technology continues to be developed, updated and enhanced to add new features. The success of any enhancement or new feature depends on several factors, including our understanding of market demand, timely execution, successful introduction or integration and market acceptance. We may not successfully develop new content and features or enhance our technology to meet customer needs or demands. In addition, new content and features or enhancements may not achieve adequate acceptance in the market.

| 10 |

Errors, failures, vulnerabilities or bugs may occur in our technology, particularly when updates are deployed or new features or enhancements are rolled out. In addition, utilization of our technology in complicated, large-scale customer environments may expose errors, failures, vulnerabilities or bugs. Any such errors, failures, vulnerabilities or bugs may not be identified until after updates are deployed or new features or enhancements are rolled out. As a provider of technology solutions, our brand and reputation are particularly sensitive to such errors, failures, vulnerabilities or bugs given that our customers’ proprietary information will be available through the technology. Any unauthorized access to customers’ proprietary information by third parties or loss in customer data could expose us to significant liability.

Real or perceived errors, failures, vulnerabilities or bugs in our technology could result in negative publicity, loss of competitive position, loss of customer data, loss of or delay in market acceptance or claims for losses suffered or incurred by customers, all of which could adversely impact our business and our future operations and financial performance, competitive position and business prospects.

If there are interruptions or performance problems associated with the technology or infrastructure used to operate our technology, customers may experience service outages, other organizations may be reluctant to use our technology, and our reputation could be harmed.

Our technology is hosted through data centers provided by AWS, a provider of cloud infrastructure services. Our operations therefore depend on the virtual cloud infrastructure hosted by AWS as well as the information stored in these virtual data centers and which third-party Internet service providers transmit. Any incident affecting AWS’s infrastructure could negatively affect the availability, functionality or reliability of our technology. A prolonged AWS service disruption affecting our technology, or AWS no longer being willing to offer its cloud infrastructure services, could damage our reputation, expose us to liability, cause us to lose customers or otherwise adversely impact our business.

While our agreement with AWS is ongoing for an indefinite term and may be terminated by us for any reason upon the delivery of adequate notice, or by either party if the other party is in material breach of the agreement and such agreement remains uncured for a period of 30 days, AWS may also terminate our agreement for any reason by providing us at least 30 days’ advance notice, immediately upon notice to us if its relationship with a third-party partner who provides software or other technology used to provide its cloud infrastructure services expires, terminates or requires AWS to change the way it provides the software or other technology, or in order to comply with the law or requests of governmental entities. AWS may also change or discontinue any of its virtual cloud infrastructure services from time to time, temporarily suspend our right to access or use any portion of the virtual cloud infrastructure and may modify our agreement at any time upon requisite notice to us. While alternative cloud infrastructure services are available, we may incur significant costs and delays if we are required to transition to a new service provider, and alternative cloud infrastructure providers may provide services on terms less favorable to those offered by AWS.

We face cyber security risks that could result in damage to our reputation and/or subject us to fines, payment of damages, lawsuits and restrictions on our use of data.

Our information systems and data, including those we maintain with our third-party service providers, may be subject to cyber security breaches in the future. Computer programmers and hackers may be able to penetrate our network security and misappropriate, copy or pirate our confidential information or that of third parties, create system disruptions or cause interruptions or shutdowns of our internal systems and services. Our technology may become subject to denial-of-service attacks, where a website is bombarded with information requests eventually causing the website to overload, resulting in a delay or disruption of service. Computer programmers and hackers also may be able to develop and deploy viruses, worms and other malicious software programs that attack our products or otherwise exploit any security vulnerabilities of our products. Certain of our employees have access to sensitive information about our clients’ employees. While we conduct background checks of our employees and limit access to systems and data, it is possible that one or more of these individuals may circumvent these controls, resulting in a security breach.

There is also a growing trend of advanced persistent threats being launched by organized and coordinated groups against corporate networks to breach security for malicious purposes.

| 11 |

The techniques used to obtain unauthorized, improper, or illegal access to our systems, our data or customers’ data, disable or degrade service, or sabotage systems are constantly evolving and have become increasingly complex and sophisticated, may be difficult to detect quickly, and often are not recognized or detected until after they have been launched. Although we have developed systems and processes designed to protect our data and customer data and to prevent data loss and other security breaches and expect to continue to expend significant resources to bolster these protections, there can be no assurance that these security measures will provide absolute security. Any actual or perceived breach of our security could damage our reputation, cause existing clients to discontinue the use of our solution, prevent us from attracting new clients, or subject us to third-party lawsuits, regulatory fines or other actions or liabilities, any of which could adversely affect our business, operating results or financial condition.

Disruptions in the availability of our technology, through cyber-attacks or otherwise, could damage our computer or telecommunications systems, impact our ability to service our customers, adversely affect our operations and the results of operations, and have an adverse effect on our reputation. The costs to us to eliminate or alleviate security problems, bugs, viruses, worms, malicious software programs and security vulnerabilities could be significant, and the efforts to address these problems could result in interruptions, delays, cessation of service and loss of existing or potential customers and may impede our sales, distribution and other critical functions. We may also be subject regulatory penalties and litigation by customers and other parties whose information has been compromised, all of which could have a material adverse effect on our business, results of operations and cash flows.

If we are unable to attract new users and organizations, our revenue growth and profitability will be harmed.

Our ability to broaden our customer base and achieve broader market acceptance of our technology will depend to a significant extent on the ability of our sales and marketing team to drive our sales pipeline and cultivate relationships to drive revenue growth.

We have invested in, and plan to continue, expanding our sales and marketing activities. Identifying, recruiting, and training sales personnel will require significant time, expense, and attention. We also plan to dedicate significant resources to sales and marketing programs. If we are unable to hire, develop, and retain talented sales or marketing personnel, if our new sales or marketing personnel are unable to achieve desired productivity levels in a reasonable period of time, or if our sales and marketing programs are not effective, our ability to broaden our customer base and achieve broader market acceptance of our technology could be harmed. In addition, the investments we make in our sales and marketing team will occur in advance of experiencing benefits from such investments, making it difficult to determine in a timely manner if we are efficiently allocating resources in these areas.

If we fail to offer high-quality customer experience, our business and reputation will suffer.

Our business model is based on recurring revenue arising from customers. A poor user experience may not necessarily be anticipated but may affect the growth of customer numbers and repeat purchases or ongoing contracts for the use of our software services. Factors that may contribute to poor customer experience include:

| ● | ease of setting up and commencing use of the products offered; | |

| ● | simplicity, functionality and reliability of customer usage; and | |

| ● | quality of services provided. |

Poor user experiences may result in a decline in the level of usage of our products, the loss of customers, adverse publicity, litigation and regulatory investigations. If any of these occur, it may adversely impact our operations and financial performance, position and prospects.

Any inability to deal with and manage our development and growth could have a material adverse effect on our business, operations, financial performance and business prospects.

Achievement of our objectives will largely depend on the ability of the board of directors and management to successfully implement our development and growth strategy. However, there can be no assurance that our board of directors and management will successfully implement our development and growth strategy. Failure by our board of directors and management to properly implement and manage the strategic direction of the Company and our business would adversely affect our financial performance.

| 12 |

As we target rapid sales growth, this may bring challenges in recruiting sufficient qualified personnel to manage growth and maintain the desired quality of service and support. If any of the foregoing inabilities or challenges occurs, our business may be adversely impacted.

Failure to set optimal prices for our products could adversely impact our business, results of operations and financial condition.

We derive substantially all of our revenue from license subscription fees earned from customers using our technology as well as from advertising fees earned from customers publishing their content on our digital property network. We also offer tiered, volume-based discounts to our largest customers and in some cases, customers are contracted to some level of minimum revenue commitment. If competitors introduce new products or services at prices that are more competitive than ours for similar products and services, we may be unable to attract new customers or retain existing customers based on our historical pricing. Further, as we expand internationally, we also must determine the appropriate price to enable us to compete effectively internationally. As a result, in the future we may be required or choose to reduce our prices or change our pricing model, which could adversely affect our business, results of operations and financial condition.

We cannot guarantee that our future monetization strategies will be successfully implemented or generate sustainable revenues and profit.

We have developed a diversified revenue model and plan to explore additional opportunities to monetize our customer base and technology by, for example, promoting additional value-added services to end users to generate more subscription fees. If these efforts fail to achieve our anticipated results, we may not be able to increase or maintain our revenue growth. Specifically, in order to increase the number of our customers and end users and their levels of spending, we will need to address a number of challenges, including providing consistent quality products and services; continuing to innovate and stay ahead of our competitors; and improving the effectiveness and efficiency of our sales and marketing efforts. If we fail to address any of these challenges, we may not be successful in increasing the number of our customers and end users and their expenditures with us, which could have a material adverse impact on our business, financial condition and results of operations.

We have been reliant on government subsidies and research and development grants in the past and we cannot ensure that our existing capital will be sufficient to meet our capital requirements.

To date, a substantial but declining portion of our operations have been funded through government subsidies and research and development grants. Such subsidies and grants accounted for 15.9% and 26.4% of the sum of our revenue and other income (referred to herein as “total income”) for the years ended June 30, 2022 and June 30, 2021, respectively. We expect to generate revenues primarily through license subscription fees from our customer-base and through the acquisition of additional online directories and databases to grow the number of business profiles within our network and hence the opportunity to generate increased advertising revenues.

We believe that our existing capital and other sources of liquidity will be sufficient to meet our capital requirements, however, the adequacy of our available funds to meet our operating and capital requirements will depend on many factors, including our ability to achieve revenue growth and maintain favorable operating margins; the cost, progress and results of our future research and product development; the effect of competing technological and market developments; and costs incurred in enforcing and defending certain of the patents and other intellectual property rights upon which our technologies are based, to the extent such rights are challenged.

We cannot be certain that in the future alternative financing sources, including previously received government subsidies and research and development grants, will be available to us at such times or in the amounts we need or whether we can negotiate commercially reasonable terms or at all, or that our actual cash requirements will not be greater than anticipated. If we are unable to obtain future financing through the methods we described above or through other means, our business may be materially impaired and we may be unable to complete our business objectives and may be required to cease operations, curtail one or more product development or commercialization programs, significantly reduce expenses, sell assets, seek a merger or joint venture partner, file for protection from creditors or liquidate all our assets. Additionally, though we have engaged qualified external consultants to assist us with the preparation of our grant applications, our government subsidies remain subject to review and potential audits, and we may be required to repay all or portion of the grant with penalties, as applicable, if we are deemed ineligible for such subsidies following such audits.

| 13 |

If we are not able to maintain and enhance our brand and increase market awareness of our company and products, our business, results of operations and financial condition may be adversely affected.

We believe that maintaining and enhancing the “Locafy” brand identity and increasing market awareness of our company and products, is critical to achieving widespread acceptance of our platform, to strengthen our relationships with our existing customers and to our ability to attract new customers. The successful promotion of our brand will depend largely on our continued marketing efforts, our ability to continue to offer high quality products, and our ability to successfully differentiate our products and platform from competing products and services. Our brand promotion activities may not be successful or yield increased revenue.

Negative publicity about us, our products or our platform could materially and adversely impact our ability to attract and retain customers, our business, results of operations and financial condition.

The promotion of our brand also requires us to make substantial expenditures, and we anticipate that these expenditures will increase as our market becomes more competitive and as we expand into new markets. To the extent that these activities increase revenue, this revenue may not be enough to offset the increased expenses we incurred. If we do not successfully maintain and enhance our brand, our business may not grow, our pricing power may be reduced relative to our competitors and we may lose customers, all of which would adversely affect our business, results of operations and financial condition.

Compliance with the rapidly evolving landscape of global data privacy and security laws may be challenging, and any failure or perceived failure to comply with such laws, or other concerns about our practices or policies with respect to the processing of personal data, could damage our reputation and deter current and potential customers and end users from using our platform and products and services or subject us to significant compliance costs or penalties, which could materially and adversely affect our business, financial condition and results of operations.

Failure to comply with the increasing number of data protection laws in the jurisdictions in which we operate, as well as concerns about our practices with regard to the collection, use, storage, retention, transfer, disclosure, and other processing of personal data, the security of personal data, or other privacy-related matters, such as cybersecurity breaches, misuse of personal data and data sharing without necessary safeguards, including concerns from our customers, employees and third parties with whom we conduct business, even if unfounded, could damage our reputation and operating results. As we seek to expand our business, we are, and may increasingly become, subject to various laws, regulations and standards, as well as contractual obligations, relating to data privacy and security in the jurisdictions in which we operate. The regulatory and legal frameworks regarding data privacy and security issues in many jurisdictions are constantly evolving and developing and can be subject to significant changes from time to time, including in ways that may result in conflicting requirements among various jurisdictions. Interpretation and implementation standards and enforcement practices are similarly in a state of flux and are likely to remain uncertain for the foreseeable future. As a result, we may not be able to comprehensively assess the scope and extent of our compliance responsibility at a global level and we may fail to fully comply with the applicable data privacy and security laws, regulations and standards. Moreover, these laws, regulations and standards may be interpreted and applied differently over time and from jurisdiction to jurisdiction, and it is possible that they will be interpreted and applied in ways that may have a material and adverse impact on our business, financial condition and results of operations.

In certain jurisdictions in which we operate, stringent, extra-territorial data protection laws exist which increase our compliance burden and the risk of scrutiny. For example, the General Data Protection Regulation (EU) 2016/679 (“GDPR”), which applies to the collection, use, storage, retention, transfer, disclosure, and other processing of personal data obtained from individuals located in the European Union (“EU”) and in the United Kingdom (“UK”) or by businesses operating within the EU or the UK, became effective on May 25, 2018 and has resulted, and will continue to result, in significantly greater compliance burdens and costs for companies with customers, end users, or operations in the EU. The GDPR, which in post-Brexit UK is known as the “UK GDPR,” places stringent obligations and operational requirements on us as both a processor and controller of personal data and could make it more difficult or more costly for us to use and share personal data. Under the GDPR, data protection supervisory authorities are given various enforcement powers, including levying fines of up to 20 million Euros or up to 4% of an organization’s annual worldwide turnover, whichever is greater, for the preceding financial year, for non-compliance. Data subjects also have the right to be compensated for damages suffered as a result of a controller or processor’s non-compliance with the GDPR. While the GDPR provides a more harmonized approach to data protection regulation across the EU member states and the UK, it also gives EU member states and the UK certain areas of discretion and therefore laws and regulations in relation to certain data processing activities may differ on a member state by member state basis, which could further limit our ability to use and share personal data and could require localized changes to our operating model. In addition to the GDPR, the EU also has released a proposed Regulation on Privacy and Electronic Communications, or the ePrivacy Regulation, to replace the EU’s current Privacy and Electronic Communications Directive, or the ePrivacy Directive, to, among other things, better align EU member states and the rules governing online tracking technologies and electronic communications, such as unsolicited marketing and cookies, with the requirements of the GDPR. While the ePrivacy Regulation was originally intended to be adopted on May 25, 2018 (alongside the GDPR), it is currently going through the European legislative process, and commentators now expect it to be adopted after 2024. The current draft of the ePrivacy Regulation significantly increases fining powers to the same levels as GDPR and may require us to change our operational model and incur additional compliance expenses. Additional time and effort may need to be spent addressing the new requirements in the potential ePrivacy Regulation as compared to the GDPR.

| 14 |

Under the GDPR, restrictions are placed on transfers of personal data outside of the European Economic Area and the UK to countries which have not been deemed “adequate” by the European Commission (including the United States). As a global business, with customers and end users worldwide, we are susceptible to any changes in legal requirements affecting international data flows. The Court of Justice of the European Union (“CJEU”) issued a decision on July 16, 2020, invalidating the EU-US Privacy Shield Framework, which provided one mechanism for lawful cross-border transfers of personal data between the EU and the U.S. While the decision did not invalidate the use of standard contractual clauses, another mechanism for making lawful cross-border transfers, the decision has called the validity of standard contractual clauses into question under certain circumstances, and has made the legality of transferring personal data from the EU to the U.S. or various other jurisdictions outside of the EU more uncertain. Specifically, the CJEU stated that companies must now assess the validity of standard contractual clauses on a case-by-case basis, taking into consideration whether the standard contractual clauses provide sufficient protection in light of any access by the public authorities of the third country to where the personal data is transferred, and the relevant aspects of the legal system of such third country. In response, the European Data Protection Board recently published new versions of the standard contractual clauses that purport to address the CJEU’s decision. Due to this evolving regulatory guidance, we may need to invest in additional technical, legal and organization safeguards in the future to avoid disruptions to data flows within our business and to and from our customers and service providers. Furthermore, this uncertainty, and its eventual resolution, may increase our costs of compliance, impede our ability to transfer data and conduct our business, and harm our business or results of operations.

Outside of the EU and UK, many jurisdictions have adopted or are adopting new data privacy and security laws, which may result in additional expenses to us and increase the risk of non-compliance. For example, in the United States, various federal and state regulators, including governmental agencies like the Federal Trade Commission, have adopted, or are considering adopting, laws and regulations concerning personal data and data security. This patchwork of legislation and regulation may give rise to conflicts or differing views of personal privacy rights. For example, certain state laws may be more stringent or broader in scope, or offer greater individual rights, with respect to personal data than federal, international or other state laws, and such laws may differ from each other, all of which may complicate compliance efforts. One such comprehensive privacy law in the United States is the California Consumer Privacy Act (“CCPA”), which came into effect on January 1, 2020. Among other things, the CCPA requires companies that process information of California residents to make new detailed disclosures to consumers about such companies’ data collection, use and sharing practices, gives California residents expanded rights to access and delete their personal information, and to opt out of certain personal information sharing with (and sales of personal information to) third parties. The CCPA provides for civil penalties for violations, as well as a private right of action for certain data breaches that result in the loss of personal data. This private right of action is expected to increase the likelihood of, and risks associated with, data breach litigation. The CCPA was amended in September 2018, November 2019 and September 2020, and it is possible that further amendments will be enacted, but even in its current form it remains unclear how various provisions of the CCPA will be interpreted and enforced. Additionally, a new privacy law, the California Privacy Rights Act (“CPRA”), was approved by California voters in the election of November 3, 2020. The CPRA, which will take effect in most material respects on January 1, 2023, modifies the California Consumer Privacy Act significantly, including by expanding consumers’ rights with respect to certain sensitive personal information and creating a new state agency to oversee implementation and enforcement efforts, potentially resulting in further uncertainty and requiring us to incur additional costs and expenses in an effort to comply. Other state laws , such as the Colorado Privacy Act passed in 2021, the Utah Consumer Privacy Act passed in 2022, and the Virginia Consumer Data Privacy Act passed in 2021, are changing rapidly and there have been ongoing discussions and proposals in the U.S. Congress with respect to new federal data privacy and security laws to which we would become subject if enacted. All of these evolving compliance and operational requirements impose significant costs that are likely to increase over time, may require us to modify our data processing practices and policies, divert resources from other initiatives and projects, and could restrict the way products and services involving data are offered, all of which may have a material and adverse impact on our business, financial condition and results of operations.

| 15 |

In addition to government regulation, privacy advocates and industry groups have and may in the future propose self-regulatory standards from time to time. These and other industry standards may legally or contractually apply to us, or we may elect to comply with such standards. We expect that there will continue to be new proposed laws and regulations concerning data privacy and security, and we cannot yet determine the impact such future laws, regulations and standards may have on our business. New laws, amendments to or re-interpretations of existing laws, regulations, standards and other obligations may require us to incur additional costs and restrict our business operations. For example, there is an increasing trend of jurisdictions requiring data localization, which may prohibit companies from storing data relating to resident individuals in data centers outside the relevant jurisdiction or, at a minimum, require a complete set of the data to be stored in data centers within the relevant jurisdiction. Because the interpretation and application of laws, regulations, standards and other obligations relating to data privacy and security are still uncertain, it is possible that these laws, regulations, standards and other obligations may be interpreted and applied in a manner that is inconsistent with our data processing practices and policies or the features of our products and services. If so, in addition to the possibility of fines, lawsuits, regulatory investigations, public censure, other claims and penalties, and significant costs for remediation and damage to our reputation, we could be materially and adversely affected if legislation or regulations are expanded to require changes in our data processing practices and policies or if governing jurisdictions interpret or implement their legislation or regulations in ways that negatively impact our business, financial condition and results of operations. Furthermore, the developing requirements relating to clear and prominent privacy notices (including in the context of obtaining informed and specific consents to the collection and processing of personal data, where applicable) may potentially deter end users from consenting to certain uses of their personal data. In general, negative publicity of us or our industry regarding actual or perceived violations of our end users’ privacy-related rights, including fines and enforcement actions against us or other similarly placed businesses, also may impair users’ trust in our privacy practices and make them reluctant to give their consent to share their data with us. Any inability to adequately address data privacy or security-related concerns, even if unfounded, or to comply with applicable laws, regulations, standards and other obligations relating to data privacy and security, could result in additional cost and liability to us, harm our reputation and brand, damage our relationships with consumers and have a material and adverse impact on our business, financial condition and results of operations.

With regard to our commercial arrangements, we and our counterparties, including business partners and external service providers, might be subject to contractual obligations regarding the processing of personal data. While we believe our and our counterparties’ conduct under these agreements is in material compliance with all applicable laws, regulations, standards, certifications and orders relating to data privacy or security, we or our counterparties may fail, or be alleged to have failed, to be in full compliance. In the event that our acts or omissions result in alleged or actual failure to comply with applicable laws, regulations, standards, certifications and orders relating to data privacy or security, we may incur liability. While we endeavor to include indemnification provisions or other protections in such agreements to mitigate liability and losses stemming from our counterparties’ acts or omissions, we may not always be able to negotiate for such protections and, even where we can, there is no guarantee that our counterparties will honor such provisions or that such protections will cover the full scope of our liabilities and losses.

While we strive to comply with our internal data privacy guidelines as well as all applicable data privacy and security laws and regulations, and contractual obligations in respect of personal data, there is no assurance that we are able to comply with these laws, regulations and contractual obligations in all respects. Any failure or perceived failure by us, external service providers or business partners to comply may result in proceedings or actions against us, including fines and penalties or enforcement orders (including orders to cease processing activities) being levied on us by government agencies or proceedings or actions against us by our business partners, customers or end-users, including class action privacy litigation in certain jurisdictions, and could damage our reputation and discourage current and future users from using our products and services, which could materially and adversely affect our business, financial condition and results of operations. In addition, compliance with applicable laws on data privacy requires substantial expenditure and resources, including to continually evaluate our policies and processes and adapt to new requirements that are or become applicable to us on a jurisdiction-by-jurisdiction basis, which would impose significant burdens and costs on our operations or may require us to alter our business practices. Concerns about the security of personal data also could lead to a decline in general Internet usage, which could result in a decrease in demand for our products and services and have a material and adverse effect on our business, financial condition and results of operations. Furthermore, if the local government authorities in our target markets require real-name registration for users of our platform, the growth of our customer and end-user bases may slow down and our business, financial condition and results of operations may be adversely affected.

| 16 |

We rely on key personnel and employees with the technical know-how to lead and operate our businesses.

We depend on the expertise, experience and efforts of our executive officers and other key employees. A failure to attract and retain executive, business development, technical and other key personnel could reduce our revenues and operational effectiveness. There is a continuing demand for relevant qualified personnel, and we believe that our future growth and success will depend upon our ability to attract, train and retain such personnel.

Competition for personnel in our industry is intense, and there is a limited number of persons with knowledge of, and experience in, this industry. There can be no assurance that we will maintain sufficiently qualified personnel or hire additional qualified personnel on a timely basis, or that we will be able to retain our key management personnel. An inability to attract or maintain a sufficient number of requisite personnel, particularly those with the requisite technical expertise, could have a material adverse effect on our performance or on our ability to capitalize on market opportunities or meet our stated objectives.

If we fail to adequately protect our proprietary rights, our competitive position could be impaired and we may lose valuable assets, generate reduced revenue, and incur costly litigation to protect our rights.

We use intellectual property and technology developed in the course of our business. A substantial part of our commercial success will depend on our ability to establish and protect our intellectual property to maintain our software source code.

A component of the underlying technology on which our technology is built is patented in the United States (Patent Number US 9286274). However, the granting of a patent does not guarantee validity since it may be revoked on the grounds of invalidity at any time during its life and, at any point, an alleged infringer may assert that the patent is invalid. The granting of the patent also does not guarantee that the patentee has freedom to operate the invention claimed in the patent because, for example, the working of a patented invention may be prevented by the existence of another patent. In addition, there are limitations associated with patent protection and, generally speaking, a patent issued in one jurisdiction will not prevent unauthorized exploitation of the invention in other jurisdictions.

Further to the above, the commercial value of our intellectual property assets is dependent on any relevant legal protections. These legal mechanisms, however, do not guarantee that the intellectual property will be protected or that our competitive position will be maintained. No assurance can be given that employees or third parties will not, knowingly or unknowingly, breach confidentiality agreements, infringe or misappropriate our intellectual property or commercially sensitive information or that competitors will not be able to produce non-infringing competitive products. Competition in retaining and sustaining protection of technologies and the complex nature of technologies can lead to expensive and lengthy disputes for which there can be no guaranteed outcome. There can be no assurance that any intellectual property which we (or entities we deal with) may have an interest in now or in the future will afford us commercially significant protection of technologies or that any of the projects that may arise from technologies will have commercial applications.

In addition, there can be no assurance that we will implement adequate measures to protect our intellectual property. Failure in the measures implemented to protect our intellectual property may result in an erosion of any potential competitive position. Additionally, securing rights to (or developing) technologies complementing our existing intellectual property will also play an important part in our commercial success. There is no guarantee that such rights can be secured or such technologies can be developed.

| 17 |

Our results of operations may be harmed if we are subject to a protracted infringement claim, a claim that results in a significant damage award, a third-party infringement claim, or a claim that results in an injunction.

There is a risk that the validity, ownership or authorized use of intellectual property relevant to us and our technology may be successfully challenged by third parties or that third parties may assert intellectual property infringement, unfair competition or like claims against us under copyright, trade secret, patent or other laws. If a third party accuses us of infringing on its intellectual property rights or if a third party commences litigation against us for the infringement of intellectual property rights, we may incur significant costs in defending such action, whether or not it ultimately prevails. Typically, intellectual property litigation is expensive and may result in the inability to use the intellectual property in question. While we are not aware of any claims of this nature in relation to any of the intellectual property rights in which we have or will acquire an interest, such claims, if made, may harm, directly or indirectly, our business and operations. Costs that we incur in defending third-party infringement actions may also include diversion of management’s and technical personnel’s time and attention from normal commercial operations.

In addition, parties making claims against us may be able to obtain injunctive or other equitable relief that could prevent us from further using our technology and intellectual property or commercializing our products. In the event of a successful claim of infringement against us, we may be required to pay damages and other costs and obtain one or more licenses from the prevailing third party. If we are not able to obtain these licenses at a reasonable cost, if at all, it could encounter delays in commercializing our products or product introductions and loss of substantial resources while we attempt to develop alternative products. Defense of any lawsuit or failure to obtain any of these licenses could prevent us from commercializing available products and could cause us to incur substantial expense.

Any of these events could adversely impact our business and our future operations and financial performance, position and prospects.

There is substantial doubt about our ability to continue as a going concern.

Our independent registered public accounting firm has issued an opinion on our consolidated financial statements included in this Annual Report that states that there is substantial doubt in respect of the assumption that we will continue as a going concern. We have incurred substantial operating losses and have used cash in our operating activities for the past few years. As of and for the year ended June 30, 2022, we had a net loss of $5,090,327 and net cash used in operating activities of $4,240,436. Our consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary should we be unable to continue as a going concern. We also cannot be certain that additional financing, if needed, will be available on acceptable terms, or at all, and our failure to raise capital when needed could limit our ability to continue our operations. There remains substantial doubt about our ability to continue as a going concern for the next twelve months from the date the consolidated financial statements were issued.

To date, we have experienced negative cash flow from development of our technology, as well as from the costs associated with building a sales force to market our product and services. We expect to incur substantial net losses for the foreseeable future in order to further develop and commercialize our product. We also expect that our selling, general and administrative expenses will continue to increase due to the additional costs associated with market development activities and expanding our staff to sell and support our product. Our ability to achieve or, if achieved, sustain profitability is based on numerous factors, many of which are beyond our control, including the market acceptance of our products, competitive product development and our market penetration and margins. We may never be able to generate sufficient revenue to achieve or, if achieved, sustain profitability.

Because of the numerous risks and uncertainties associated with further development and commercialization of our technology and any future tests, we are unable to predict the extent of any future losses or when we will become profitable, if ever. We may never become profitable, and you may never receive a return on an investment in our securities. An investor in our securities must carefully consider the substantial challenges, risks and uncertainties inherent in the development in our industry. We may never develop our technology and our business may fail.

| 18 |

We may need additional capital, and financing may not be available on terms acceptable to us, or at all.

Our independent registered public accounting firm has issued an opinion on our consolidated financial statements included in this Annual Report that states that there is substantial doubt in respect of the assumption that we will continue as a going concern, there is a risk that we may need additional cash resources in the future to fund our growth plans or if we experience adverse changes in business conditions or other developments. We may also need additional cash resources in the future if we find and wish to pursue opportunities for new investments, acquisitions, capital expenditures or similar actions. If we determine that our cash requirements exceed the amount of cash and cash equivalents we have on hand at the time, we may seek to issue equity or debt securities or obtain credit facilities. We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all. The issuance and sale of additional equity would result in further dilution to our shareholders. One or more new debt financings could subject us to any or all of the following risks:

| ● | default and foreclosure on our assets if our operating revenue is insufficient to repay debt obligations; | |

| ● | acceleration of obligations to repay the indebtedness (or other outstanding indebtedness), even if we make all principal and interest payments when due, if we breach any covenants that require the maintenance of certain financial ratios or reserves without a waiver or renegotiation of that covenant; | |

| ● | our inability to obtain necessary additional financing if the debt security contains covenants restricting our ability to obtain such financing while the debt security is outstanding; | |

| ● | diverting a substantial portion of cash flow to pay principal and interest on such debt, which would reduce the funds available for expenses, capital expenditures, acquisitions and other general corporate purposes; and | |

| ● | creating potential limitations on our flexibility in planning for and reacting to changes in our business and in the industry in which we operate. |

The occurrence of any of these risks could adversely affect our operations or financial condition.

The market for our solutions among may be limited if prospective clients demand customized features and functions that we do not offer.