UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended | |||||

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| For the transition period from to | |||||

Commission file number 001-41009

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of Principal Executive Offices)

(Zip Code)

(440 ) 439-7700

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | ☒ | |||||||||

Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. Yes ☐ No ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Based on the closing sales price as reported on The Nasdaq Global Select Market on June 30, 2022, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant on that date was approximately $91.0 million.

As of February 28, 2023, the registrant had 52,947,617 shares of Class A common stock and 87,115,600 shares of Class B common stock outstanding.

Documents Incorporated By Reference:

Table of Contents

| Page | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | [Reserved] | |||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

1

Special Note Regarding Forward-Looking Statements

You should read the following discussion and analysis of our financial condition and results of operations together with our consolidated financial statements and the related notes included elsewhere in this 10-K. This Annual Report on Form 10-K (the “Annual Report” or “10-K”) contains forward-looking statements that involve risks and uncertainties, as well as assumptions that, if they do not fully materialize or are proven incorrect, could cause our business and results of operations to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements can generally be identified by the use of forward-looking terminology, including, but not limited to, “may,” “could,” “seek,” “guidance,” “predict,” “potential,” “likely,” “believe,” “will,” “expect,” “anticipate,” “estimate,” “plan,” “intend,” “believe,” “forecast,” or variations of these terms and similar expressions, or the negative of these terms or similar expressions. Past performance is not a guarantee of future results or returns and no representation or warranty is made regarding future performance. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors beyond our control that could cause our actual results, performance or achievements to be materially different from the expected results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the following:

•Our ability to manage and maintain the growth rate of our business;

•Our ability to obtain quality merchandise in sufficient quantities;

•Disruption in our receiving and distribution system, including delays in the integration of our new distribution centers and the possibility that we may not realize the anticipated benefits of multiple distribution centers;

•The possibility of cyberattacks and our ability to maintain adequate cybersecurity systems and procedures;

•Loss, corruption and misappropriation of data and information relating to clients and employees;

•Changes in and compliance with applicable data privacy rules and regulations;

•Risks as a result of constraints in our supply chain;

•A failure of our vendors to meet our quality standards;

•Declines in general economic conditions that affect consumer confidence and consumer spending that could adversely affect our revenue;

•Our ability to anticipate changes in consumer preferences;

•Risks related to maintaining and increasing Showroom traffic and sales;

•Our ability to compete in our market;

•Our ability to adequately protect our intellectual property;

•Compliance with applicable governmental regulations;

•Effectively managing our eCommerce business and digital marketing efforts;

•Our reliance on third-party transportation carriers and risks associated with freight and transportation costs;

•The COVID-19 pandemic and its effect on our business; and

•Compliance with SEC rules and regulations as a public reporting company.

The risks, uncertainties and assumptions referred to above that could cause our results to differ materially from the results expressed or implied by such forward-looking statements include, but are not limited to, those discussed under Item 1A. Risk Factors, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations, and elsewhere in this Annual Report. All forward-looking statements included in this document are based on information available to us as of the date hereof, and we assume no obligation to update these forward-looking statements. These statements are based on information available to us as of the date of this 10-K. While we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or for any other reason.

2

Part I

Item 1. Business

Overview

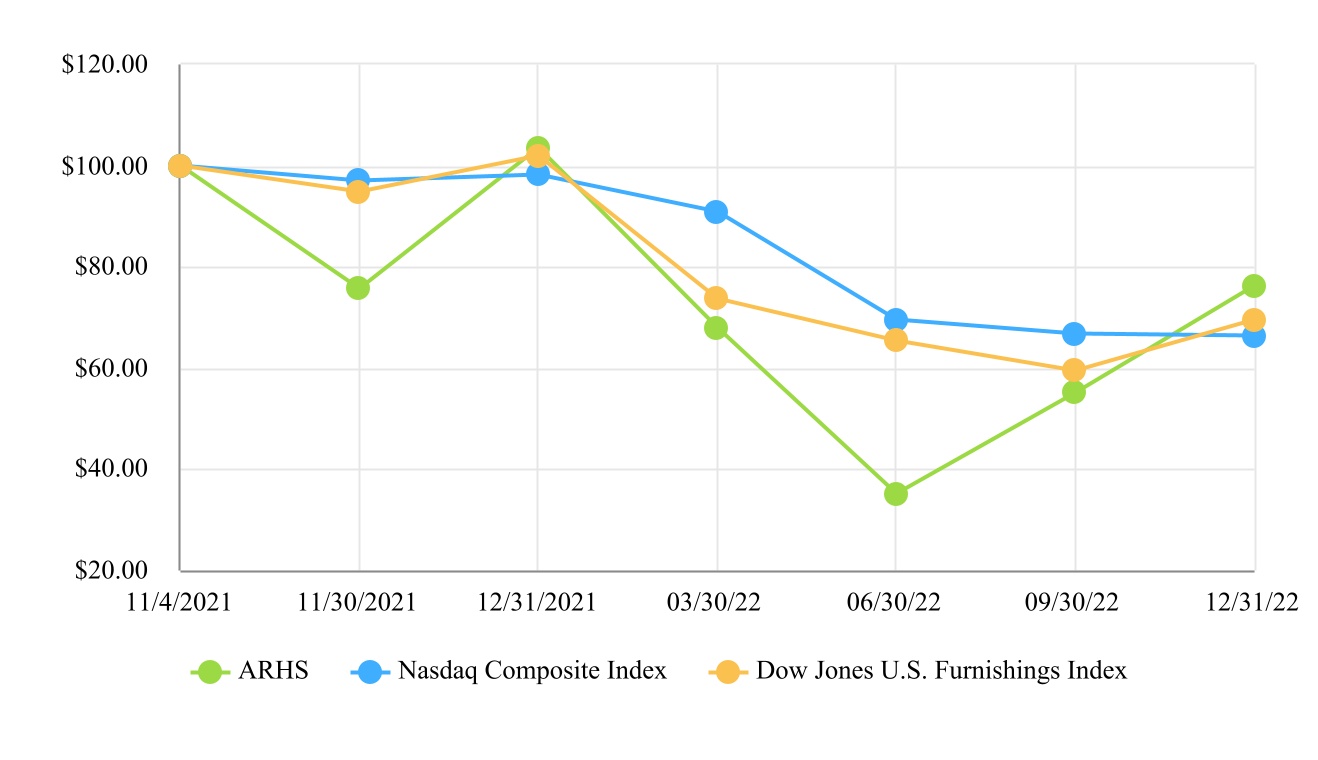

Founded in 1986 by John Reed, our current Chief Executive Officer (“CEO”) and his father, Arhaus, Inc. (“Arhaus,” “Company,” “we,” “us” or “our”) is a rapidly growing lifestyle brand and omni-channel retailer of premium home furnishings. We were founded on a simple idea: furniture should be responsibly sourced, lovingly made and built to last. Today, we partner with artisans around the world who share our vision, creating beautiful, premium and heirloom-quality home furnishings that clients can use for generations. On November 4, 2021, the Company completed its initial public offering (“IPO”) of its Class A common stock, which is traded on the Nasdaq Global Select Market (the “Nasdaq”) under the symbol “ARHS.”

Our vertical model, consisting of our design and product development teams, upholstery manufacturing capabilities, direct vendor sourcing, and direct-to-consumer selling, allows us to offer a differentiated approach to furniture and décor. We offer merchandise in a number of categories, including furniture, outdoor, lighting, textiles, and décor. Our curated assortments are presented across our sales channels in sophisticated, family friendly and unique lifestyle settings.

Based on third-party reports and publicly available data, we estimate the U.S. premium home furnishing market is approximately $100 billion, with the potential to grow at a compounded annual growth rate, or CAGR, of approximately 6% between 2022 and 2025. This attractive market is highly fragmented, served by many small independent furniture stores, which favorably positions us to grow profitably and gain market share. We believe we are well positioned within this market due to our unique approach, momentum, scale and growth strategies.

Our products are designed to be used and enjoyed throughout the home and are sourced directly from a network of more than 400 vendors with no wholesale or dealer markup. Our product development teams work alongside our direct sourcing partners to bring to market proprietary merchandise that is a great value to clients. These relationships, along with our vertical model, allow us to provide higher quality products at more competitive prices than both smaller independent operators and larger competitors.

We believe in providing a dynamic and welcoming experience in our Showrooms and online with the conviction that retail is theater. Our national omni-channel business positions our retail locations as Showrooms for our brand, while our website acts as a virtual extension of our Showrooms. Our theater-like Showrooms are highly inspirational and function as an invaluable brand awareness vehicle. Our seasoned sales associates and in-home designers provide expert advice and assistance to our client base that drives significant client engagement. Our omni-channel model allows clients to begin or end their shopping journey online, while also experiencing our theater-like Showrooms throughout the shopping journey. As of December 31, 2022, we operated 81 Showrooms, 65 with in-home interior designers. Our Showrooms span 29 states and consist of 72 traditional showrooms, 6 Design Studios and 3 Outlets.

Our business witnessed strong performance over the last three years. Our net revenue was $1,228.9 million, $796.9 million, and $507.4 million for the years ended December 31, 2022, 2021 and 2020, respectively. Demand comparable growth was 13.8%, 45.3%, and 24.7% in the years ended December 31, 2022, 2021 and 2020, respectively. Comparable growth was 51.6%, 51.0% and 0.9% in the years ended December 31, 2022, 2021 and 2020, respectively. Our long-standing direct sourcing partnerships were a significant contributor to our success, as many of our vendors increased capacity to help facilitate our net revenue growth. We benefited from these important, long-term relationships as our vendors worked with us to help meet the unprecedented increase in client demand and significant backlog.

During 2020, we experienced COVID-19 related disruptions to our business. In March 2020, we temporarily closed all of our Showrooms and Outlets. By June 30, 2020, we reopened all of our Showrooms and Outlet stores. We are proud of the incredible loyalty of our client base and our financial momentum over the past several years.

Our Competitive Strengths

A Differentiated Concept Delivering Livable Luxury

We provide a differentiated concept, redefining the premium home furnishing market by offering an attractive combination of design, quality, value and convenience. Artisan-crafted and globally curated, our products are highly differentiated from both small and large competitors. We create merchandise that offers livable luxury style with elements of durability and practicality. We serve our clients through our Showrooms, eCommerce platform, print and digital media and high-quality client service. In a

3

market characterized by small, independent competitors, we believe our premium lifestyle positioning, artisan-crafted style, superior quality, significant scale and level of convenience will enable us to increase our market share.

Highly Experiential Omni-Channel Approach

We strive to offer our products to our clients via our omni-channel approach and operate our business in a channel agnostic way. Leveraging our proprietary data and technology, we are able to meet our clients wherever they want to shop, whether online or in one of our 81 Showrooms. Our product development and omni-channel go-to-market capabilities, together with our fully integrated infrastructure and significant scale, enable us to offer a compelling combination of design, quality and value that we believe provides an unmatched experience.

Showroom. Our theater-like Showrooms, which average approximately 16,100 square feet, act as an exceptionally strong brand-building tool and drive significant traffic. Our Showrooms provide clients with an unparalleled experience, conveying our livable luxury concept designed to showcase product. Our highly trained and creative visual managers walk the floors daily to determine new ways to visually optimize and maximize the appeal and inspirational nature of our Showrooms. In addition to visual managers, we also employ enthusiastic and knowledgeable sales associates that fully engage our clients and provide expert service and advice.

eCommerce. Our online capabilities are a critical entry point into our ecosystem, providing our clients research and discovery tools and allowing them to begin or complete transactions online. Our online design services professionals and virtual tools complement our eCommerce platform by engaging clients and providing them with expert design advice and capabilities. Driven by investment in our digital platform, we believe we can increase our eCommerce penetration over time, accelerating growth and allowing clients to transact when, where and how they choose.

Print and Digital Media. We distribute two large catalogs each year, a January and a September edition, in both an online and physical format to millions of households, which has yielded strong results. We also distribute catalogs for specific categories such as outdoor furnishings, special collections and certain holidays. In addition, we advertise consistently across digital platforms and regularly partner with social media influencers to drive brand awareness. We employ a targeted approach with our print and digital media and also identify lifestyle-driven opportunities to reach potential clients, such as sending postcards or small mailers to people who have recently moved. Our print and digital media strategy drives both Showroom and eCommerce net revenue as it raises brand awareness and showcases new merchandise.

In-home Designer Services. We welcome all clients to use our complimentary in-home designer services with no appointment required. Our in-home designers, who work with clients in the Showroom and travel to our clients’ residences, work in unison with our Showrooms and eCommerce platform to drive client conversion, order size and overall experience. In-home designer services provide a more personalized client experience and since 2017 have produced average order values (AOVs) over three times that of a standard order. Clients that engage with our in-home designer services program exhibit a significantly higher repurchase rate, with approximately 40% making five or more purchases throughout their client lifetime. As of December 31, 2022, we had 84 in-home designers in 65 Showrooms compared to 54 in-home designers in 45 Showrooms as of December 31, 2020.

Strong Direct Global Sourcing Relationships

Our direct global sourcing relationships allow us to provide superior quality, differentiated customization and attractive value. We have longstanding relationships with our vendors which allow us a number of competitive advantages, including the ability to maintain consistent quality and ensure the majority of our products, approximately 95% based on net revenue in 2022, can only be purchased from Arhaus. Coupled with our direct global sourcing network, we maintain highly adept in-house product design and development experts that partner with our vendors to innovate and create highly customized offerings.

Superior and Consistent Unit Economics

Our inspirational, theater-like Showrooms have generated robust unit-level financial results, strong free cash flow and attractive, rapid returns on our investment. We have been successful across all geographic regions we have entered and have proven to be resilient to competitive entrants. Our Showrooms have performed well in large and small markets, urban and suburban locations and across various Showroom formats and layouts. Our average unit volumes are relatively consistent across the Northeast, West, Midwest and South regions. Further, our fully integrated and seamless omni-channel experience contributes significant uplift in our markets.

4

Our Growth Strategies

We believe there is a significant opportunity to drive sustainable growth and profitability by executing on the following strategies:

Increase Brand Awareness to Drive Net Revenue

We will continue to increase our brand awareness through an omni-channel approach which includes the growth of our Showroom footprint, enhanced digital marketing, improvement in website features and analytics and continued product assortment optimization:

Expand Showroom Footprint. Our Showrooms are a key component of our brand. We believe the expansion of our Showroom footprint will give more clients the opportunity to experience our inspirational and premium lifestyle concept, thereby increasing brand awareness and driving net revenue.

Enhance Digital Marketing Capabilities. Digital advertising, search, on-site offerings, and social media engagement are important branding and advertising vehicles. Using these engagement methods within our omni-channel model contributes significantly to our brand awareness, evidenced by approximately 80% of our eCommerce demand originating within 50 miles of a Showroom. We believe that continued investment in brand marketing, data-led insights and effective consumer targeting will expand and strengthen our client reach.

Grow eCommerce Platform. eCommerce represents our fastest growing channel, with net revenue increasing by approximately 43% in 2022 compared to 2021. We believe recent growth is related to our new website launched in the fourth quarter of 2021, our enhanced marketing efforts, attractive product assortment and improving brand awareness. We believe our digital platform provides clients with a convenient way to interact with our brand and full product assortment. Our eCommerce platform enables our clients to shop anywhere at any time and begin or complete transactions online. Our new website creates a more interactive process through the use of virtual shopping tools that allow clients to visualize our products in their homes. Our website is key to our omni-channel model and helps drive Showroom traffic, increases client engagement and streamlines product feedback, which ultimately results in client conversion.

Optimize Product Assortment. We continue building our product assortment to attract new clients and encourage repeat purchases from existing clients. We plan to expand our product portfolio across select categories and to continue to refine our existing product offering with new designs, materials, fabrics and colors to capture constantly evolving trends and client preferences.

Expand our Showroom Base and Capture Market Share

We have a Showroom presence in all four major geographic regions, and our top 10 Showrooms by net revenue are located in 9 different states. We have a significant whitespace opportunity both in existing and new markets. We have built a comprehensive and sophisticated infrastructure which we believe can support approximately 90 incremental Showrooms in over 40 new metropolitan statistical areas across the United States, 27 of which are currently in our pipeline. Our long-term plan anticipates opening between five to seven new Showrooms each year for the foreseeable future.

We employ a data-driven, thorough process to select and develop new Showroom locations. In selecting new locations, we evaluate data on specific market characteristics, demographics, client penetration and growth, along with considering the brand impact and opportunity of specific sites. In addition to our current Showroom model, our Design Studio format (approximately 5,000 sq. ft.) is an extension of our in-home design services and carries a highly curated product selection in smaller, attractive markets.

Enhance Omni-Channel Capabilities and Technology to Drive Growth

We have several initiatives that continue to enhance our omni-channel capabilities. Our approach begins in our visually captivating, theater-like Showrooms. Our Showrooms drive brand awareness and create meaningful marketing buzz and volume uplift when we open in new markets. Our unit growth strategy is highly complementary to our digital eCommerce platform. As Showrooms open in new markets, we experience significant growth in our eCommerce business and overall client engagement across channels.

Clients increasingly engage with us through digital methods including our website and social media. To capitalize on these trends and continue increasing our client base, we are investing in data analytics to improve the client journey from the moment

5

clients begin browsing online or enter our Showrooms. This will allow us to target clients with personalized digital offerings to increase online conversion and client lifetime value.

In the fourth quarter of 2021, we launched a new website to enhance our virtual Showroom experience. Our new website creates a more interactive shopping process through the use of virtual shopping tools to aid clients in visualizing our products in their homes.

To further strengthen client engagement and increase client interactions, we continue to expand our designer programs, both in-home and online. Similar in concept to our in-home designer program, our online designer platform provides clients with expert service and advice from our design professionals via online video chat and virtual design capabilities. We believe bolstering this component of the client experience will drive higher client satisfaction and result in larger total company AOV over time.

We are also investing in Showroom technology, including the installation of touch screen TVs and other augmented reality tools to enhance the client experience. Our new Design Studio format, which also leverages these state-of-the-art tools, has experienced overwhelmingly positive client receptivity, with the new format outperforming our expectations. We see tremendous growth potential across our omni-channel platform by increasing our ability to make data-driven decisions and maintaining a comprehensive focus on the client journey. We will continue to innovate and invest in value-added digital and technological capabilities across our omni-channel footprint.

Leverage Investments to Grow Net Revenue and Enhance Margins

We have the opportunity to further drive net revenue and enhance operating margins by continuing to focus on our distribution efficiency and manufacturing capacity.

Enhanced Distribution Efficiency and Capacity. We have made, and will continue to make, investments in our infrastructure including our distribution network, IT capabilities and geographic footprint to improve operational efficiency and ready our platform for the next stage of growth. Our existing distribution center and corporate office in Ohio was expanded by approximately 229,500 square feet in 2022. Our new North Carolina facility opened in December 2021 and has approximately 307,000 square feet of distribution capacity. Furthermore, our new Texas distribution center, opened in July 2022, added approximately 800,700 square feet. The additional distribution centers will help streamline shipping times and further support our rapidly growing demand and footprint.

Increasing Domestic Manufacturing Capacity. Our new North Carolina facility doubled our in-house upholstery manufacturing capacity, improved our production efficiency and increased production square footage from 150,000 to 190,000.

Our Industry and Market Opportunity

We operate within the approximately $400 billion U.S. home furnishings and décor market. We primarily compete in the large, growing and highly fragmented premium segment of this market, which we estimate accounts for approximately $100 billion of the total market based on third-party estimates of retail sales in 2022, publicly available industry data and our internal research. We believe that the premium segment has a potential CAGR of approximately 6% between 2022 and 2025.

Our Products, Sourcing and Product Development

We are a lifestyle brand and omni-channel retailer of premium home furnishings focused on providing livable luxury to clients. Our unique concept is dedicated to bringing clients heirloom quality, artisan-made furniture and décor. We travel the globe gathering inspiration for and curating our collection, as well as selecting vendors that provide quality materials and artisan craftsmanship. We have longstanding relationships with our vendors which allow us a number of competitive advantages, including the ability to maintain consistent quality and ensure the majority of our products, approximately 95% based on net revenue in 2022, can only be purchased from Arhaus. We offer a wide range of product categories designed to be used and enjoyed throughout the home, including furniture, outdoor, lighting, textiles, and décor.

Our furniture product offerings are comprised of bedroom, dining room, living room and home office furnishings and include sofas, dining tables and chairs, accent chairs, console and coffee tables, beds, headboards, dressers, desks, bookcases and modular storage, among many more items. Our outdoor product offerings include outdoor dining tables, chairs, chaises and other furniture, lighting, textiles, décor, umbrellas and fire pits. Our lighting product offerings consist of a variety of distinct and artistic lighting fixtures, including chandeliers, pendants, table and floor lamps, and sconces. Our textile product offerings include handcrafted indoor and outdoor rugs, bed linens, and pillows and throws. Décor ranges from wall art to mirrors, vases to candles, and many other decorative accessories.

6

Many of our products are conceived of, and developed by, our in-house design team of over 40 highly skilled and experienced members. We have and will continue to significantly invest in our product development capabilities, including key strategic hires made over the past few years. We believe these investments will allow us to enhance our competitive advantages of offering clients premium quality and customized product at a compelling value and ultimately drive net revenue growth.

Our sourcing strategy focuses on identifying and working with vendors, both in-house and external, who share our vision for creating heirloom-quality products with artisan craftsmanship. We seek to ensure the quality of our vendors’ products through periodic site visits, audits and inspections. We source these products directly, with no wholesale or dealer markup. This allows us to offer an exclusive assortment of products to our clients at an attractive value.

We have a diversified base of over 400 vendors, and our top 10 vendors represent approximately 60% of our net revenue. Only one of our vendors accounts for more than 10% of our net revenue, and one other vendor accounts for more than 5% of net revenue. In 2022, approximately 40% of our net revenues and products were produced or sourced from vendors located in the U.S.

In addition to product design and development, we have upholstery manufacturing capabilities which allow us to create intricate, high quality products at attractive prices and margins. Our ability to innovate, curate products, categories, and services, then rapidly scale across our fully integrated omni-channel infrastructure is a powerful platform for continued long-term growth. Our vertical model and direct sourcing furnish clients with superior quality products and compelling value at attractive profit margins. We reported gross margin as a percent of net revenue of 42.7%, 41.4% and 39.3% for the years ended December 31, 2022, 2021 and 2020, respectively.

Omni-Channel Approach

We distribute our products through an omni-channel model, and our clients can purchase our products in our Showrooms, through our eCommerce platform, via print and digital media and by utilizing our in-home designer services. Our retail locations are Showrooms for our brand, and our website acts as a virtual extension of our Showrooms. Our omni-channel model allows clients to begin or end their shopping experience online while also experiencing our theater-like Showrooms throughout the shopping process. We believe our omni-channel approach enables us to offer a compelling combination of design, quality and value.

Showrooms

As of December 31, 2022, we operated 81 Showrooms in 29 states. Our Showroom composition includes 72 traditional showrooms, 6 Design Studios and 3 Outlets. Our average Showroom size is approximately 16,100 square feet. Our theater-like Showrooms are highly inspirational and function as an invaluable brand awareness vehicle. Our Showrooms convey our carefully curated, livable luxury concept in a tangible format designed to showcase product in fully appointed rooms and to help clients reimagine their homes. Each Showroom may vary in product display and design elements depending on regional factors influencing client design preferences. Our Showroom layouts are constantly updated as our highly trained and creative visual managers determine new ways to optimize and maximize the appeal and inspirational nature of our Showrooms. Through our investment in technology, including the installation of touch screen TVs and other augmented reality tools, our seasoned sales associates provide valued insight and advice to our client base that drive significant client engagement. Our sales associates earn commissions, which can comprise a significant portion of their compensation.

The following lists the number of Showrooms in each U.S. state where we operate as of December 31, 2022:

7

| Locations | Showrooms | Locations | Showrooms | |||||||||||||||||

| Alabama | 1 | Minnesota | 1 | |||||||||||||||||

| Arizona | 2 | Missouri | 1 | |||||||||||||||||

| California | 6 | New Hampshire | 1 | |||||||||||||||||

| Colorado | 5 | New Jersey | 5 | |||||||||||||||||

| Connecticut | 1 | New York | 3 | |||||||||||||||||

| Florida | 7 | North Carolina | 2 | |||||||||||||||||

| Georgia | 2 | Ohio | 9 | |||||||||||||||||

| Illinois | 4 | Pennsylvania | 3 | |||||||||||||||||

| Indiana | 1 | South Carolina | 1 | |||||||||||||||||

| Kansas | 1 | Tennessee | 1 | |||||||||||||||||

| Kentucky | 2 | Texas | 6 | |||||||||||||||||

| Louisiana | 1 | Utah | 1 | |||||||||||||||||

| Maryland | 4 | Virginia | 4 | |||||||||||||||||

| Massachusetts | 2 | Wisconsin | 1 | |||||||||||||||||

| Michigan | 3 | |||||||||||||||||||

The following lists the composition of our Showrooms as of:

| December 31, 2022 | December 31, 2021 | ||||||||||

| Traditional showrooms | 72 | 71 | |||||||||

| Design Studios | 6 | 5 | |||||||||

| Outlets | 3 | 3 | |||||||||

| Total Showrooms | 81 | 79 | |||||||||

eCommerce

Our website allows our clients to shop our current product assortment and experience the unique lifestyle settings reflected in our Showrooms and print media. In the fourth quarter of 2021, we launched a new website to enhance our virtual Showroom experience. Our new website creates a more interactive shopping process through the use of virtual shopping tools to aid clients in visualizing our products in their homes.

Our website also provides our clients with the ability to chat with a designer through our online design services tools. We update our website regularly to reflect new products, product availability and special offers.

Print and Digital Media

Our January and September catalogs are distributed in both digital and physical formats. In addition to our two seasonal catalogs, we distribute catalogs for specific categories such as outdoor furnishings, special collections and certain holidays. We employ a targeted approach with our print and digital media and also identify lifestyle-driven opportunities to reach potential clients, such as sending postcards or small mailers to people who have recently moved. We also employ a digital strategy to reach clients and potential clients through social media, influencers and other digital marketing. We design and produce our catalogs and print and digital media in-house to ensure consistency with our brand.

In-home Designer Services

Our in-home designers, who work with clients in the Showroom and travel to our clients’ residences, work in unison with our Showrooms and eCommerce platform to drive client conversion, order size and overall experience. Our in-home designer services provide a more personalized client experience and, since 2017, have produced AOVs over three times that of a standard order. We welcome all clients to use our complimentary in-home designer services with no appointment required. Clients that engage with our in-home designer services program exhibit a significantly higher repurchase rate, with approximately 40% of those clients making five or more purchases throughout their client lifetime. As of December 31, 2022, we had 84 in-home designers in 65 Showrooms compared to 54 in-home designers in 45 Showrooms as of December 31, 2020.

8

Real Estate Strategy

Our Showrooms have historically been in high traffic locations, and we favor top tier locations near luxury and contemporary retailers that we believe are consistent with our target clients’ demographic and shopping preferences.

From January 1, 2021 to December 31, 2022, we successfully opened or relocated 14 new Showrooms in 14 markets, including 10 new markets. Our recent Showroom growth is summarized in the following table:

| December 31, 2022 | December 31, 2021 | |||||||||||||

| Showrooms open at beginning of period | 79 | 74 | ||||||||||||

Showrooms opened (1) | 4 | 10 | ||||||||||||

| Showrooms closed for relocations | (1) | (3) | ||||||||||||

| Showrooms closed permanently | (1) | (2) | ||||||||||||

| Showrooms open at end of period | 81 | 79 | ||||||||||||

(1) Showrooms opened during the respective periods includes both new and relocated Showrooms.

Based on recently commissioned studies and surveys conducted on our behalf, we believe there is potential to more than double our current Showroom base to over 165 locations in both new and existing markets. Illustrated by the success of our geographically diverse Showroom footprint, our omni-channel model has performed well in every region of the country, across retail formats and across market sizes. At December 31, 2022, our top 10 Showrooms by net revenue are located in 9 different states, and our model has proven successful in a variety of markets and economic cycles. Our goal is to open an average of five to seven new Showrooms per year for the foreseeable future, which indicates we could fulfill the whitespace potential within the next 15 years. We are disciplined in our approach to opening Showrooms in top tier locations and expect to continue our prudent approach as we continue to grow our Showroom footprint.

Distribution and Delivery

We manage the distribution and delivery of our products through our distribution centers in Boston Heights, Ohio, Dallas, Texas and Conover, North Carolina. Additionally, we partner with third-party vendors to provide home delivery services to our clients. These distribution centers serve all of our channels. Our Boston Heights, Ohio facility is approximately 1,003,500 square feet after our expansion, approximately 900,000 square feet of this facility is dedicated to distribution (the remainder serves as our corporate headquarters). Our Dallas, Texas facility is approximately 800,700 square feet and is managed by a third party. Our facility in North Carolina has approximately 497,000 square feet of space, with approximately 307,000 square feet dedicated to distribution.

Marketing and Advertising

We use a variety of marketing and advertising approaches to drive client traffic across all of our channels, strengthen and reinforce brand awareness, attract new clients and encourage repeat purchases from existing clients. We believe our Showrooms, catalogs, mailings, digital offerings and social media engagement, among other things, act as important branding and advertising vehicles.

Our print and digital media strategy serves as a key driver of net revenue through both our Showrooms and website. Our clients respond to the catalogs mailings and digital offerings across all of our channels, with net revenue trends closely correlating to the assortments that we emphasize and feature prominently in our media. We continue to evaluate and optimize our print and digital media strategy based on our experience.

In addition, we will continue to increase our brand awareness by expanding our Showroom footprint, enhancing digital marketing, and from our improved website features and analytics. We believe that increased brand awareness will lead to higher net revenue in our Showrooms and eCommerce business over time.

Seasonality

Our quarterly results depend upon a variety of factors, including the opening of new Showroom locations, the introduction of new merchandise assortments and categories, changes in our product offerings, shifts in quarter over quarter timing of various events such as holidays, Showroom closures, catalog releases, promotional events and the realization of the costs and benefits of our numerous strategic initiatives, among other things. As a result of these factors, our working capital requirements and demands on our product distribution and delivery network may fluctuate during the year. Unique factors in any given quarter

9

may affect comparisons between the quarters, and the results for any quarter are not necessarily indicative of the results that we may achieve for a full year.

Competition

The U.S. home furnishings and décor market is highly fragmented and competitive with approximately 22,000 retail establishments as of 2021, according to Bureau of Labor Statistics. We compete with national, regional and local home furnishing retailers, department stores, mail-order catalogs, online retailers focused on home furnishings, interior design trade and specialty showrooms, antique dealers and other merchants that provide unique items and custom-designed product offerings.

We believe we compete primarily on the basis of our design, quality and value. Our vertical model and deep network of direct sourcing relationships allow us to bring to market higher quality products at more competitive price points than our competitors. We believe our distinctive brand based on livable luxury, our strong direct global sourcing relationships, and our highly experiential omni-channel approach allow us to compete effectively and differentiate ourselves from competitors.

Intellectual Property

Our intellectual property has significant value and we vigorously protect it against infringement. The “Arhaus®,” “Arhaus Furniture®,” “Arhaus the Loft®,” “Arhaus Your Home®” and “Arhaus Table®” trademarks are registered in the United States Patent and Trademark Office. The “Arhaus®” trademark is also registered with the China National Intellectual Property Administration (CNIPA) and the Canadian Intellectual Property Office. Our trademark registrations are valid and subsisting and are renewable at the end of their term, except for “Arhaus Table®” which is scheduled to expire on July 28, 2025. In addition, we own the domain names “arhaus.com,” “arhaus.net,” and “arhausfurniture.com.” These domain names are renewable.

Human Capital

As of December 31, 2022, we had approximately 2,120 employees and 60 temporary employees, including approximately 130 part-time employees. As of that date, approximately 870 of our employees were based in our Showrooms, 500 of our employees were based in our distribution centers, 250 of our employees were based in our manufacturing facility, and 560 of our employees were based in our corporate headquarters. None of our employees are represented by a union, and we have had no labor-related work stoppages. We believe our relationship with our employees is positive.

We are currently managed by a group of experienced senior executives, including our Founder, Chairman and CEO, John Reed, and other key team members with substantial knowledge and understanding of the Company and the industry sector in which we operate. Our success and future growth depend largely upon the continued services of our management team, as well as our qualified associates across all parts of our organization, including our Showrooms, distribution centers and manufacturing facilities, many of whom have been promoted from within Arhaus.

Response to COVID-19 Pandemic

We remain focused on protecting our employees against COVID-19 and ensuring a healthy work environment. Our business leaders manage items such as developing health and safety protocols, responding to health and safety issues, interpreting government orders, and securing personal protective equipment as necessary as the pandemic evolves. We developed a comprehensive handbook to set and communicate work procedures necessary to facilitate COVID-19 health and safety measures, including proper social distancing during periods of high infection rates. When employees test positive for COVID-19, we follow adopted procedures including enhanced disinfecting that targets applicable areas. The affected employee is required to observe a quarantine period, monitor symptoms, and follow medical guidance prior to returning to work.

Diversity, Equity and Inclusion

We believe that much of our success is rooted in the diversity of our teams and our commitment to a diverse and inclusive culture. We value diversity at all levels and focus on extending our diversity and inclusion initiatives across our entire workforce. We continue to foster a culture of inclusion, diversity, and equity in which everyone is respected, valued, and has an equal opportunity to contribute and thrive. Our commitment is unwavering, and we are steadfast in maintaining our focus on building a workforce that represents the many customers we serve and the communities in which we operate.

We view continuous dialogue as an important tool in cultivating an inclusive culture. In 2019, we established an inclusion and diversity team comprised of a broad group of employees, including management, to encourage discussion and elicit feedback on Company policies to further our efforts to: (i) ensure that we have a safe and inclusive workplace; (ii) equip our people to

10

attract, develop, retain, and reward a diverse and inclusive workforce; (iii) be an inclusive and equitable corporate citizen; (iv) develop a governance and accountability model that will sustain inclusion and diversity; and (v) enhance our business results.

We are committed to equal opportunity and base workplace decisions solely on merit, qualifications, and other job-related, neutral, non-discriminatory criteria. We provide equal employment opportunity without regard to age, race, color, sex, sexual orientation, gender identity, national origin, citizenship, pregnancy, religion, disability, military status, genetic information, or other status protected by law. We are committed to providing a harassment-free work environment, and we prohibit retaliation, intimidation, threats, coercion, or discrimination against individuals who, in good faith, complain of unlawful discrimination or harassment.

Regulation and Legislation

We are subject to numerous regulations, including labor and employment laws, customs and trade laws, laws governing truth-in-advertising, consumer protection, privacy, safety, real estate, environmental and zoning and occupancy laws, and other laws and regulations that regulate retailers and govern the promotion and sale of merchandise and the operation of our Showrooms, manufacturing and distribution facilities in the United States and jurisdictions where we source products. We have policies intended to ensure that we conduct business in compliance with applicable laws and regulations. While we cannot predict policy changes by various regulatory agencies or unexpected operational or other developments, we believe we are in material compliance with laws applicable to our business.

Environmental, Health, and Safety Regulation

Our operations are subject to a variety of federal, state, local and foreign laws and regulations relating to health, safety and the protection of the environment. These environmental, health and safety laws and regulations include those relating to, among other things, the generation, storage, handling, use and transportation of hazardous materials; the emission and discharge of hazardous materials into the environment; and the health and safety of our employees. Liability for the improper release or disposal of waste can be joint and several, and there can be no assurance that we will not have to expend material amounts to remediate the consequences of the generation or disposal of waste in the future. Further, we may be responsible as a lessee operator for the costs of investigation, removal or remediation of hazardous substances located on or in or emanating from leased property, as well as any property damage. There can be no assurance that our future operations or property conditions will not result in the imposition of liability upon us under environmental laws or expose us to third-party actions.

We are also subject to certain reporting and labeling requirements under California’s Proposition 65, officially known as the Safe Drinking Water and Toxic Enforcement Act of 1986. Proposition 65 requires manufacturers, distributors, vendors, and retailers of a consumer product in California that contains certain listed chemicals to provide consumers with a clear and reasonable warning if exposure to that listed chemical poses a certain level of risk to the consumer. We have taken measures to comply with the requirements of Proposition 65, but there is no guarantee that we will not be subject to fines, penalties, and lawsuits and complaints in the future.

Failure to comply with such laws and regulations, which tend to become more stringent over time, can result in significant fines, penalties, costs, and liabilities, which may be joint and several, or restrictions on operations, civil or criminal sanctions, and could expose us to costs of investigation or remediation, as well as tort claims, and could negatively affect our business, financial condition or results of operations.

Information About Our Executive Officers

Refer to Item 10 of this annual report on Form 10-K for information on the Company's executive officers, which is incorporated herein by reference.

Available Information

We will make available, free of charge, on or through our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements and Forms 3, 4 and 5 filed on behalf of directors and executive officers, as well as any amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (“SEC”). We maintain our website at www.arhaus.com. The information contained on our website is not part of this Annual Report.

The SEC maintains a website that contains reports, proxy statements and other information regarding issuers that file electronically. The address of that website is www.sec.gov.

11

The charters for our Board of Directors’ Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee, as well as our Code of Business Conduct and Ethics, our Corporate Disclosure Policy and other related materials are available on our website.

12

Item 1A. Risk Factors

You should carefully consider all of the risks described below, which are not necessarily exhaustive, together with the other information contained in this report, including the financial statements. If any of the following risks occur, our business, financial condition or results of operations may be materially and adversely affected.

Summary Risk Factors

Investing in our Class A common stock involves a high degree of risk because our business is subject to numerous risks and uncertainties, as fully described below. The principal factors and uncertainties that make investing in our Class A common stock risky include, among others:

•risks associated with the incurrence of operating losses in the future or failure to achieve or maintain profitability in the future;

•fluctuations in the growth rate of our business and our high rates of growth in terms of revenue, earnings and margins, which may not be sustained in future periods;

•our ability to purchase quality merchandise in sufficient quantities at competitive prices, including products that are produced by artisan vendors;

•disruption in our receiving and distribution system or increased costs as a result of our recently opened distribution and manufacturing centers

•cybersecurity risks and costs associated with credit card fraud, identity theft and business interruption could result in unexpected expenses and loss of revenue;

•risks associated with receiving, processing, storing, using and sharing personal data that requires us to comply with complex and evolving governmental regulations related to data privacy and data protection that could expose us to litigation or damage our reputation;

•import and other international risks as a result of our reliance on foreign manufacturers and vendors to supply a significant portion of our merchandise;

•changes in the health of the high-end housing market, as well as declines in consumer confidence and consumer spending;

•risks associated with the interruption of supply and increased costs as a result of our reliance on third-party transportation carriers for shipment of our products;

•increased commodity prices or increased freight and transportation costs;

•our ability to timely and effectively deliver merchandise to our clients and manage our supply chain;

•risks posed by the COVID-19 pandemic or should another or similar outbreak of an infectious disease occur; and

•the dual class structure of our common stock, which has the effect of concentrating voting power with our Founder and the Founder Family Trusts, gives our Founder and the Founder Family Trusts substantial control over us, including over matters that require the approval of stockholders, and their interests may conflict with ours or those of our stockholders.

Risks Related to Our Business and Industry

We may incur operating losses in the future, and may not achieve or maintain profitability in the future.

We may incur operating losses in the future. We expect our operating expenses to increase in the future as we continue to expand our operating and retail infrastructure, including adding new Showrooms, increasing sales and marketing efforts, growing our eCommerce platform, enhancing our omni-channel capabilities, expanding into new geographies, developing new products, and in connection with legal, accounting, and other expenses related to operating as a public company. These efforts and additional expenses may be costlier than we expect, and we cannot guarantee that we will be able to increase our net revenue to offset our operating expenses. Our net revenue growth may slow or our net revenue may decline for a number of other reasons, including reduced demand for our products, increased competition, a decrease in the growth or reduction in size of our overall market, temporary and lasting impacts to our business from the COVID-19 pandemic, or if we cannot capitalize on growth opportunities. If our revenue does not grow at a greater rate than our operating expenses, we will not be able to maintain profitability.

13

We have experienced fluctuations in the growth rate of our business and our high rates of growth in terms of revenue, earnings and margins may not be sustained in future time periods.

Historically we have experienced fluctuations in the quarterly growth rate of our business. We may continue to experience fluctuations in our quarterly growth rate and financial performance. We are currently engaged in a number of initiatives to support the growth of our business which may result in costs and delays which may negatively affect our gross margin in the short term and may amplify fluctuations in our growth rate from quarter to quarter depending on the timing and extent of the realization of the costs and benefits of such initiatives.

Some factors affecting our business, including macroeconomic conditions and policies and changes in legislation, are not within our control. In prior periods, our results of operations have been adversely affected by weakness in the overall economic environment such as the initial periods of significant economic uncertainty and reduced economic activity as a result of the COVID-19 pandemic as well as slowdowns in the housing market. In addition, our business depends on consumer demand for our products and, consequently, is sensitive to a number of factors that influence consumer spending, including, among other things, the general state of the economy, capital and credit markets, consumer confidence, general business conditions, the availability and cost of consumer credit, the level of consumer debt, interest rates, level of taxes affecting consumers, housing prices, new construction and other activity in the housing sector and the state of the mortgage industry and other aspects of consumer credit tied to housing, including the availability and pricing of mortgage refinancing and home equity lines of credit. In particular, our business performance is linked to the overall strength of luxury consumer spending in markets in which we operate. Economic conditions affecting selected markets in which we operate are expected to have an impact on the strength of our business in those local markets, including with respect to the volatility in consumer demand and sentiment as the COVID-19 pandemic and its related impacts continue to evolve. Our business trends are frequently correlated closely with conditions in financial markets including the stock market. The global economic environment is currently in a period of widespread uncertainty as governments and central banks continue to respond to the impact of COVID-19, supply chain issues, and raising inflation on business conditions. In the event that equity and credit markets experience volatility and disruption, consumer demand for our product and our results of operations may be adversely affected.

In addition, our rates of revenue growth have fluctuated from quarter to quarter over the last three years and we expect volatility in the rates of our growth to continue in future quarterly periods. Unique factors in any given quarter may affect period-to-period comparisons in our revenue growth, including:

•the overall economic and general retail sales environment, including the effects of uncertainty relating to the COVID-19 pandemic or its related impacts on consumer spending, such as inflation and increased interest rates;

•the availability of our products and the impact of delays or disruption in our supply chain;

•consumer preferences and demand;

•the number, size and location of the Showrooms we open, close, remodel or expand in any period;

•our ability to efficiently source and distribute products;

•changes in our product offerings and the introduction, and timing thereof, of introduction of new products and new product categories;

•promotional events by us or our competitors;

•our competitors introducing similar products or merchandise formats;

•the distribution of our January and September catalogs each year;

•the timing of various holidays, including holidays with potentially heavy retail impact; and

•the success of our marketing programs.

Due to these factors, our results for any quarter are not necessarily indicative of the results that we may achieve for a full year. Our results of operations may also vary relative to corresponding periods in prior years. We may take certain pricing, merchandising or marketing actions that could have a disproportionate effect on our business, financial condition and results of operations in a particular quarter or selling season, and as a result we believe that period-to-period comparisons of our results of operations are not necessarily meaningful and cannot be relied upon as indicators of future performance.

14

We depend on our ability to purchase quality merchandise in sufficient quantities at competitive prices, including products that are produced by specialty and artisan vendors. Any disruptions we experience in our ability to obtain quality products in a timely fashion or in the quantities required could have a material adverse effect on our reputation, business, results of operations and financial performance.

Our business model includes offering exclusively designed, high-quality products, and we purchase the vast majority of our merchandise from a number of third-party vendors. Although we do not rely on one or a small group of vendors for a majority of our products, and we have longstanding relationships with many of our vendors, some vendors are the sole sources for particular products, and we may be dependent on particular vendors that produce popular items, and may not be able to easily find another source if a vendor discontinued selling to us. For example, we purchased upholstery products representing approximately 15% of our total net revenue in 2022 from McCreary Modern, Inc. If any of our vendors, including our significant or sole-source vendors, were unable or unwilling to continue to sell us product, we may be unable to replace quickly or effectively the products sold to us by such vendor, or do so on similar or favorable terms, which could have an adverse impact on our business.

Many of our products are produced by artisans, specialty vendors and other vendors that are small and may be undercapitalized, unable to scale production or have limited production capacity, and we have from time to time in prior periods, including the COVID-19 pandemic, experienced supply constraints that have affected our ability to supply high demand items or new products due to such capacity and other limits, including production and shipping delays related to the COVID-19 pandemic, in our vendor base. In addition, the expansion of our business into new markets or new product introductions could put pressure on our ability to source sufficient quantities of our products from such vendors. In the event that one or more of our vendors is unable or unwilling to meet the quantity or quality of our product requirements, we may not be able to develop relationships with new vendors in a manner that is sufficient to supply the shortfall. Even if we do identify such new vendors, we may experience product shortages, client backorders and delays as we transition our product requirements to incorporate alternative vendors. Our relationship with any new vendor would be subject to the same or similar risks as those of our existing vendors.

A number of our vendors, particularly our artisan vendors, may have limited financial or other resources and operating histories and may receive various forms of credit from us, including with respect to payment terms or other arrangements. We may advance a portion of the payments to be made to some vendors under our purchase orders prior to the delivery of the ordered products. These advance payments are normally unsecured. Vendors may become insolvent and their failure to repay our advances, and any failure to deliver products to us, could have a material adverse impact on our results of operations. There can be no assurance that the capacity of any particular vendor will continue to be able to meet our supply requirements in the future, as our vendors may be susceptible to production difficulties or other factors that negatively affect the quantity or quality of their production during future periods. A disruption in the ability of our significant vendors to access liquidity could also cause serious disruptions or an overall deterioration of their businesses, which could lead to a significant reduction in their ability to manufacture or ship products to us. Any difficulties that we experience in our ability to obtain products in sufficient quality and quantity from our vendors could have a material adverse effect on our business.

Disruption in our receiving and distribution system or increased costs as a result of our recently opened distribution and manufacturing centers could adversely affect our business.

We opened our second distribution center in Conover, NC during the fourth quarter of 2021 and our third distribution center in Dallas, Texas during 2022. We may not accurately anticipate all of the changing demands that our expanding operations will impose on our receiving and distribution system. We also may not realize all of the expected benefits of increased efficiency and capacity from the opening of these additional distribution centers, and we may experience increased costs in connection with our new distribution centers that we have not previously considered.

Any disruptions in our receiving and distribution system or increased costs as a result of our new distribution centers could have a material adverse effect on our reputation, business, financial condition, and results of operations.

15

We are subject to import and other international risks as a result of our reliance on foreign manufacturers and vendors to supply a significant portion of our merchandise.

Although our Showrooms are based solely in the United States, we rely on foreign manufacturers and vendors to supply a significant portion of our merchandise. Approximately 60% of our net revenue was generated from sales of products from vendors in foreign locations such as Italy, Mexico and Southeast Asia during 2022. Our significant international supply chain increases the risk that we will not have adequate and timely supplies of various products due to local political, economic, social or environmental conditions, political instability, international conflicts, acts of terrorism, natural disasters, epidemics (including the COVID-19 pandemic), transportation delays, dock strikes, inefficient freight requirements, restrictive actions by foreign governments, changes in foreign laws, trade policy and regulations affecting exports, or changes in U.S. laws, trade policy and regulations affecting imports or domestic distribution.

All of our products manufactured overseas and imported into the United States are subject to duties collected by the U.S. Customs Service. We may be subjected to additional duties or tariffs, significant monetary penalties, the seizure and forfeiture of the products we are attempting to import or the loss of import privileges if we or our vendors are found to be in violation of U.S. laws and regulations applicable to the importation of our products. Tariffs also can impact our or our vendors’ ability to source product efficiently or create other supply chain disruptions. The U.S. government has enacted certain tariffs and proposed additional tariffs on many items sourced from China, including certain furniture, furniture parts, and raw materials for domestic furniture manufacturing products imported into the United States. Although we have not historically purchased a significant amount of product from China, we may not be able to fully or substantially mitigate the impact of these or future tariffs, pass price increases on to our clients or secure adequate alternative sources of products, which would have a material adverse effect on our business, operating results and financial performance.

Changes in the health of the high-end housing market, as well as declines in consumer confidence and consumer spending, could adversely impact our revenue and results of operations.

Our business depends on client demand for our products and, consequently, is sensitive to a number of factors that influence consumers spending, including general economic conditions, client disposable income, fuel prices, recession and fears of recession, unemployment, war and fears of war, outbreaks of disease (such as the COVID-19 pandemic), adverse weather, availability of client credit, client debt levels, conditions in the housing market, interest rates, sales tax rates and rate increases, inflation, consumers’ confidence in future economic and political conditions, and client perceptions of personal well-being and security. In particular, past economic downturns have led to decreased discretionary spending, which adversely impacted our business. Consumer confidence and consumer spending may deteriorate significantly and could remain depressed for an extended period of time. Consumer demand for and purchases of discretionary items, including our merchandise, generally decline during periods when disposable income is limited, unemployment rates increase or there is economic uncertainty. An uncertain economic environment could also cause our vendors to go out of business or our banks to discontinue lending to us or our vendors, or it could cause us to undergo restructurings, any of which could adversely impact our business and operating results.

Moreover, as we target consumers of high-end home furnishings for our products, our sales are particularly affected by the financial health of higher-end consumers and demand levels from that consumer demographic. In addition, not all macroeconomic factors are highly correlated in their impact on lower-end housing versus higher-end consumers. Demand for lower priced homes and first time home buying may be influenced by factors such as employment levels, interest rates, demographics of new household formation and the affordability of homes for the first time home buyer. The higher-end of the housing market may be disproportionately influenced by other factors including the number of foreign buyers in higher-end real estate markets in the United States, the number of second and third homes being sold, stock market volatility and illiquid market conditions, global economic uncertainty, decreased availability of income tax deductions for mortgage interest and state income and property taxes, and the perceived prospect for capital appreciation in higher-end real estate. Shifts in consumption patterns in light of improvements relating to the COVID-19 pandemic may also have an impact on consumer spending in the high-end housing market. Further, in recent periods the stock market has experienced significant volatility as well as periods of significant decline, and rising house prices have dampened. Continued increases in interest rates may further

16

dampen growth in the U.S. housing market and may depress consumer optimism about the U.S. housing market and home buying in the higher-end of the housing market. We believe that our client purchasing patterns are influenced by economic factors including the health and volatility of the stock market. We have seen that previous declines in the stock market and periods of high volatility have been correlated with a reduction in client demand for our products.

There can be no assurance that some of the other macroeconomic factors described above will not adversely affect the higher-end client that we believe makes up the bulk of our client demand. We believe that a number of these factors have in the past had, and may in the future have, an adverse impact on the high-end retail home furnishings sector and affect our business and results. These factors may make it difficult for us to accurately predict our operating and financial results for future periods and some of these factors could contribute to a material adverse effect on our business and results of operations.

We are exposed to risks associated with the interruption of supply and increased costs as a result of our reliance on third-party transportation carriers for shipment of our products.

We rely upon, and have contracts with, third-party carriers to transport products from our vendors and to our distribution centers, third-party warehouses and Showrooms for delivery to our clients. As a result of our dependence on third-party providers, we are subject to risks, including labor disputes, union organizing activity, adverse weather, natural disasters, climate change, the closure of our carriers’ offices or a reduction in operational hours due to an economic slowdown or the inability to sufficiently ramp up operational hours during an economic recovery or upturn, availability of adequate trucking or railway providers, possible acts of terrorism, outbreaks of disease (such as the COVID-19 pandemic) or other factors affecting such carriers’ ability to provide delivery services and meet our shipping needs, disruptions or increased fuel costs and costs associated with any regulations to address climate change. Due to the outbreak of the COVID-19 pandemic, our third-party providers have experienced transportation disruptions and restrictions, labor shortages, vessel schedule changes, congestion and delays at ports, and a shortage of shipping containers needed to ship our products, which have adversely impacted our inventory levels and resulted in a high number of client backorders. Failure to deliver merchandise in a timely and effective manner could cause clients to cancel their orders and could damage our brand and reputation, which could have a material adverse effect on our business, financial condition, operating results and prospects. Our reputation for providing a high level of client service is dependent on such third-party transportation providers delivering our product shipments in a timely manner. Further, in the event of delays by a third-party carrier, we may have to transition to a different third-party carrier, and such transition can take months to effectuate. In addition, fuel costs have been volatile, and transportation companies continue to struggle to operate profitably, which could lead to increased fulfillment expenses. Any rise in fulfillment expenses could negatively affect our business and operating results.

Increased commodity prices or increased freight and transportation costs could adversely affect our results of operations.

Our operating results are significantly affected by changes in product costs due to commodity cost increases or inflation, including with respect to freight and transportation costs. Prices of certain commodities used in our merchandise, such as petroleum, resin, copper, steel, cotton and lumber, are subject to fluctuation arising from changes in currency exchange rates, tariffs and trade restrictions and labor, fuel, freight and other transportation costs. In recent years, we have faced significant inflationary pressure on freight costs, which were heightened by tariff-related shipment surges and port congestion.

Due to the uncertainty of commodity price fluctuations and inflation, we may not be able to pass some or all of these increased costs on to our clients, which results in lower margins. Even if we are able to pass these increased costs on to our clients, we may not be able to do so on a timely basis. Accordingly, any rapid and significant changes in commodity prices or other supply chain costs may have a material adverse effect on our gross margins, operating results and financial performance.

17

Our business and operating results may be harmed if we are unable to timely and effectively deliver merchandise to our clients and manage our supply chain.

If we are unable to effectively manage our inventory levels and the responsiveness of our supply chain, including predicting the appropriate levels and type of inventory to stock within our distribution centers, our business and operating results may be harmed. For example, we experienced elevated levels of demand for many of our products, and as a result, encountered delays in fulfilling this demand and replenishing to appropriate inventory levels. Furthermore, demand for our products is influenced by certain factors, like the popularity of certain Showroom aesthetics, cultural and demographic trends, marketing and advertising expenditures, and general economic conditions, all of which can change rapidly and result in a quick shift in consumer demand. As a result, consumer preferences cannot be predicted with certainty and may change between selling seasons. We must be able to stay current with preferences and trends in our brands and address the consumer tastes for each of our target consumer demographics. We may not always be able to respond quickly and effectively to changes in consumer taste and demand due to the amount of time and financial resources that may be required to bring new products to market or to constraints in our supply chain if our vendors do not have the capacity to handle elevated levels of demand for part or all of our orders or could experience delays in production for our products. If we misjudge either the market for our merchandise or our clients’ purchasing habits or we experience continued or lengthy delays in fulfilling client demand, our clients could shop with our competitors instead of us, which could harm our business. Additionally, much of our merchandise requires that we provide vendors with significant ordering lead times and we may not be able to source sufficient inventory if demand for a product is greater than anticipated. Alternatively, we may be required to mark down certain products to sell any excess inventory or to sell such inventory through our Outlets or other liquidation channels at prices that are significantly lower than our retail prices, any of which would negatively impact our business and operating results. The inability to respond quickly to market changes could have an impact on our expected growth potential and the growth potential of the market.

Our business has been and may continue to be affected by the significant and widespread risks posed by the COVID-19 pandemic or a similar outbreak of an infectious disease.

The global outbreak of COVID-19 and resulting health crisis has caused, and continues to cause, significant and widespread disruptions to the U.S. and global economies, financial and consumer markets, and our business. The COVID-19 outbreak in the first quarter of 2020 caused disruptions to our business operations. In our initial response to the COVID-19 health crisis, we undertook immediate adjustments to our business operations including temporarily closing all of our retail locations, minimizing expenses and delaying investments, including pausing some inventory orders while we assessed the status of our business. Our approach to the crisis evolved quickly as our business trends substantially improved during the second through fourth quarters of 2020 as a result of both the reopening of our Showrooms and also strong consumer demand for our products.