UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-179

Name of registrant as specified in charter: Central Securities Corporation

Address of principal executive offices:

630 Fifth Avenue

Suite 820

New York, New York 10111

Name and address of agent for service:

Central Securities Corporation, Wilmot H. Kidd, Chief Executive Officer

630 Fifth Avenue

Suite 820

New York, New York 10111

Registrant’s telephone number, including area code: 212-698-2020

Date of fiscal year end: December 31, 2018

Date of reporting period: December 31, 2018

Item 1. Reports to Stockholders.

CENTRAL SECURITIES CORPORATION

NINETIETH ANNUAL REPORT

2018

SIGNS OF THE TIMES

“One bright morning earlier this year your correspondent travelled from New York to the University of Chicago to attend a conference on the threat to prosperity posed by monopolies. The journey began with an alarm beeping on a handset made by Apple (which has a 62% market share in America), then a bumpy taxi ride to the airport paid for using a piece of plastic issued by one of the three firms, American Express, MasterCard and Visa, that control 95% of the credit-card market. In the terminal, breakfast was scoffed from a supersized fast-food chain, where emails were checked using Google, which has 60% of the browser market.

“The mobile signal was transmitted on one of the three networks that control 78% of the telecoms market. The flight was with one of the four airlines that control 69% of the journeys within America. In Chicago your correspondent checked into the LondonHouse hotel, which looks like a boutique but turns out to be part of Hilton, which controls 12% of all rooms in America, and 25% of the new rooms being built. The booking was made on Expedia, which has 27% of the North American online travel market.

“The firms involved in the journey made profits of $151bn and had a median return on capital of 29% last year. An equally weighted basket of their shares — call it the monopoly money portfolio —beat global stockmarkets by 484% over the past decade. Collectively, 17% of the companies’ shares are owned by just three investment mega-managers, BlackRock, Vanguard and State Street.” (The Economist, November 17, 2018)

“For a few sweet months of 2018, all of Silicon Valley was wrapped up in frenzied easy money and a fantasy of remaking the world order with cryptocurrencies and a related technology called the blockchain. A flood of joy hit the Bay Area. The New York Times ran with the trend in an article with the headline ‘Everyone is Getting Hilariously Rich and You’re Not.’ It was temporarily true.

“And just as the American public had been given every possible blockchain explainer that could be written, the whole thing collapsed. The bubble popped.

“Today the price of Bitcoin —- $19,783 last December — is $3,810. Litecoin was $366 a coin; it’s now $30. Ethereum was $1,400 in January; today it’s $130.” (Nellie Bowles, The New York Times, December 28, 2018)

“Small and midsize companies are fading from stock markets, leaving far fewer publicly traded companies. Many of the smaller companies are bought by larger organizations or are enticed to stay private by the sharp rise in venture capital money, both of which allow them to avoid the volatility and scrutiny that come with going public. The number of listed companies peaked in the late-1990s, before the dot-com bust, plummeting 52 percent by 2016.” (Erin Griffith and Matt Phillips, The New York Times, November 27, 2018)

“The World Economic Forum estimates that 90 percent of the world’s plastic waste ends up in the ocean, and that currently there are 50 million tons of plastic in the world’s oceans that could take centuries to degrade. This year the forum warned that there would be more plastic than fish in weight in oceans by 2050.” (Ceylan Yeginsu, The New York Times, October 25, 2018)

[ 2 ]

CENTRAL SECURITIES CORPORATION

(Organized on October 1, 1929 as an investment company, registered as such with the

Securities and Exchange Commission under the provisions of the Investment Company Act of 1940)

25-YEAR HISTORICAL DATA

| Per Share of Common Stock | ||||||||||||||||||||

| Net | Source of dividends and distributions |

Total dividends |

Unrealized appreciation | |||||||||||||||||

| Year Ended December 31, |

Total net assets |

asset value |

Ordinary income* |

Long-term capital gains* |

and distributions |

of investments at end of year | ||||||||||||||

| 1993 | $ | 218,868,360 | $ | 17.90 | $ | 111,304,454 | ||||||||||||||

| 1994 | 226,639,144 | 17.60 | $ | .22 | $ | 1.39 | $ | 1.61 | 109,278,788 | |||||||||||

| 1995 | 292,547,559 | 21.74 | .33 | 1.60 | 1.93 | 162,016,798 | ||||||||||||||

| 1996 | 356,685,785 | 25.64 | .28 | 1.37 | 1.65 | 214,721,981 | ||||||||||||||

| 1997 | 434,423,053 | 29.97 | .34 | 2.08 | 2.42 | 273,760,444 | ||||||||||||||

| 1998 | 476,463,575 | 31.43 | .29 | 1.65 | 1.94 | 301,750,135 | ||||||||||||||

| 1999 | 590,655,679 | 35.05 | .26 | 2.34 | 2.60 | 394,282,360 | ||||||||||||||

| 2000 | 596,289,086 | 32.94 | .32 | 4.03 | 4.35 | 363,263,634 | ||||||||||||||

| 2001 | 539,839,060 | 28.54 | .22 | 1.58 | ** | 1.80 | ** | 304,887,640 | ||||||||||||

| 2002 | 361,942,568 | 18.72 | .14 | 1.11 | 1.25 | 119,501,484 | ||||||||||||||

| 2003 | 478,959,218 | 24.32 | .11 | 1.29 | 1.40 | 229,388,141 | ||||||||||||||

| 2004 | 529,468,675 | 26.44 | .11 | 1.21 | 1.32 | 271,710,179 | ||||||||||||||

| 2005 | 573,979,905 | 27.65 | .28 | 1.72 | 2.00 | 302,381,671 | ||||||||||||||

| 2006 | 617,167,026 | 30.05 | .58 | 1.64 | 2.22 | 351,924,627 | ||||||||||||||

| 2007 | 644,822,724 | 30.15 | .52 | 1.88 | 2.40 | 356,551,394 | ||||||||||||||

| 2008 | 397,353,061 | 17.79 | .36 | 2.10 | 2.46 | 94,752,477 | ||||||||||||||

| 2009 | 504,029,743 | 22.32 | .33 | .32 | .65 | 197,256,447 | ||||||||||||||

| 2010 | 593,524,167 | 26.06 | .46 | .44 | .90 | 281,081,168 | ||||||||||||||

| 2011 | 574,187,941 | 24.96 | .43 | .57 | 1.00 | 255,654,966 | ||||||||||||||

| 2012 | 569,465,087 | 24.53 | .51 | .43 | .94 | 247,684,116 | ||||||||||||||

| 2013 | 648,261,868 | 26.78 | .12 | 3.58 | 3.70 | 305,978,151 | ||||||||||||||

| 2014 | 649,760,644 | 26.18 | .16 | 1.59 | 1.75 | 293,810,819 | ||||||||||||||

| 2015 | 582,870,527 | 23.53 | .12 | 1.86 | 1.98 | 229,473,007 | ||||||||||||||

| 2016 | 674,683,352 | 27.12 | .30 | .68 | .98 | 318,524,775 | ||||||||||||||

| 2017 | 826,331,789 | 32.86 | .28 | .72 | 1.00 | 460,088,116 | ||||||||||||||

| 2018 | 765,342,588 | 30.02 | .56 | .89 | 1.45 | 392,947,674 | ||||||||||||||

| Dividends and distributions for the 25-year period: | $7.63 | $38.07 | $45.70 | |||||||||||||||||

| * | Computed on the basis of the Corporation’s status as a “regulated investment company” for Federal income tax purposes. Dividends from ordinary income include short-term capital gains. |

| ** | Includes non-taxable return of capital of $.55. |

The Common Stock is listed on the NYSE American under the symbol CET. On December 31, 2018, the closing market price was $24.83 per share.

[ 3 ]

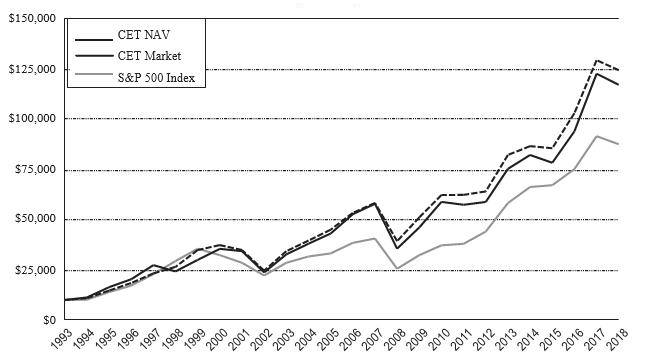

25-YEAR INVESTMENT RESULTS

ASSUMING AN INITIAL INVESTMENT OF $10,000

(unaudited)

Average Annual Total Return |

Central’s

NAV Return |

Central’s

Market Return |

S&P 500 | ||

| 1 Year | –3.88% | –4.51% | –4.39% | ||

| 5 Year | 8.64% | 9.24% | 8.47% | ||

| 10 Year | 12.22% | 12.66% | 13.10% | ||

| 15 Year | 8.97% | 8.88% | 7.76% | ||

| 20 Year | 8.05% | 8.21% | 5.61% | ||

| 25 Year | 10.60% | 10.34% | 9.06% | ||

| Value of $10,000 invested for a 25-year period | $124,251 | $116,997 | $87,431 |

The Corporation’s total returns reflect changes in market price or net asset value, as applicable, and assume reinvestment of all distributions. Distributions that are payable only in cash are assumed to be reinvested on the payable date of the distribution at the market price or net asset value, as applicable. Distributions that may be taken in shares are assumed to be reinvested at the price designated by the Corporation. Total returns do not reflect any transaction costs on investments or the deduction of taxes that investors may pay on distributions or the sale of shares.

The Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500 Index”) is an unmanaged benchmark of large U.S. corporations that assumes reinvestment of all distributions, and excludes the effect of fees, expenses, taxes, and sales charges.

Performance data represents past performance and does not guarantee future investment results.

[ 4 ]

To the Stockholders of

CENTRAL SECURITIES CORPORATION:

Financial statements for the year 2018, as reported upon by our independent registered public accounting firm, and other pertinent information are submitted herewith.

Comparative net assets are as follows:

| December 31, 2018 |

December 31, 2017 |

|||||||

| Net assets | $ | 765,342,588 | $ | 826,331,789 | ||||

| Net assets per share of Common Stock | 30.02 | 32.86 | ||||||

| Shares of Common Stock outstanding | 25,496,847 | 25,143,616 |

Comparative operating results are as follows:

| Year 2018 | Year 2017 | |||||||

| Net investment income | $ | 13,684,841 | $ | 6,911,428 | ||||

| Per share of Common Stock | ..54 | * | ..28 | * | ||||

| Net realized gain from investment transactions | 19,176,502 | 20,731,782 | ||||||

| Increase (decrease) in net unrealized appreciation | ||||||||

| of investments | (67,140,442 | ) | 141,563,341 | |||||

| Increase (decrease) in net assets resulting from operations | (34,279,099 | ) | 169,206,551 |

| * | Per-share data are based on the average number of Common shares outstanding during the year. |

The Corporation declared two distributions to holders of Common Stock in 2018, $.25 per share paid on June 26 in cash and $1.20 per share paid on December 20 in cash or in additional shares of Common Stock at the stockholder’s option. For Federal income tax purposes, of the $1.45 paid, $.56 represents ordinary income and $.89 represents long-term capital gains. Separate tax notices have been mailed to stockholders. With respect to state and local taxes, the character of distributions may vary. Stockholders should consult with their tax advisors on this matter.

In the distribution paid in December, the holders of 44% of the outstanding shares of Common Stock elected stock, and they received 494,048 Common shares at a price of $27.07 per share.

During 2018, the Corporation purchased 153,010 shares of its Common Stock at an average price of $26.03 per share. The Corporation may from time to time purchase its Common Stock in such amounts and at such prices as the Board of Directors deems advisable in the best interests of stockholders. Purchases may be made in the open market or in private transactions directly with stockholders.

[ 5 ]

Central’s net asset value, adjusted for the reinvestment of distributions to shareholders, decreased by 3.9% during 2018. Over the same period, Central’s shares decreased by 4.5%. For comparative purposes, the S&P 500 Index decreased by 4.4%, while the Russell 2000, a broad index composed of smaller companies decreased by 11.0%.

Long-term returns on an annualized basis are shown below.

| Years | NAV Return | Market Return | S&P 500 | |||

| 10 | 12.2% | 12.7% | 13.1% | |||

| 20 | 8.1% | 8.2% | 5.6% | |||

| 30 | 11.9% | 12.2% | 9.9% | |||

| 40 | 13.8% | 14.1% | 11.5% |

After a moderate increase during the first nine months, the major stock market indexes declined abruptly in the fourth quarter last year. Against this backdrop, we made few portfolio changes during the year. Our annual portfolio turnover rate was 8%. During the year, Central purchased three new holdings and sold seven, ending the year with 36. The new investments were Kemper Corporation, Cogent Communications and Star Group. We sold Cable One, Tiffany, Murphy Oil, Kennedy-Wilson, Encore Capital, Freeport-McMoRan and General Electric. At year end, Central’s ten largest investments (shown on page 8) comprised 56% of net assets.

The five most significant positive contributors to Central’s 2018 results, in order of importance, were Plymouth Rock, Motorola Solutions, Keysight Technologies, Merck and Amazon. The biggest detractors were Coherent, Capital One, Citigroup, TRI-Pointe and Hess. Coherent deserves special mention. It was the largest contributor to Central’s results in 2016 and 2017 before becoming the largest detractor last year. Still, combining all three years it handily outpaced the S&P 500, returning an average of 17% per year. This experience illustrates one of the more difficult situations long-term investors face: what action to take, if any, when after a significant multi-year gain, an important holding undergoes a large drawdown. In this case, we reevaluated the holding and chose to maintain our investment. We remain confident in Coherent’s management and market position. It should be noted that during this period, our Coherent holding has not remained constant. We reduced our holding by 23% since the beginning of 2017 before adding shares in the second half of 2018.

Central’s largest and most important investment continues to be Plymouth Rock, a privately-held company in which we invested at its inception in 1982. The Plymouth Rock Group of Companies together write and manage over $1.2 billion in personal and commercial auto, homeowners and umbrella insurance in Massachusetts, New Hampshire, Connecticut, New York, New Jersey and Pennsylvania. We currently own 23% of Plymouth Rock.

Plymouth Rock had a productive year in 2018. Among other things, the company entered the New York market. Shareholders may find Plymouth Rock’s annual reports to stockholders at www.plymouthrock.com/about/financial-information/annual-reports. The reports include audited financial statements and a letter from CEO Jim Stone which reviews notable events and achievements of the previous year and sets forth plans for the coming year. Taken together, the reports provide a detailed history of the company. It is expected that the company’s 2018 annual report will be available in April.

[ 6 ]

The electronification of trading has been much commented upon both in the financial press and by experienced investors. One observer has estimated that truly active investors comprise only about 10% of daily trading activity. Market participants have different time horizons: some focus on seconds, minutes and hours; others focus on months and years; and still others focus on multiple years. In recent years, more stock market activity is thought to be generated by those focused on the shortest time horizons, the “so called” high-frequency traders who trade electronically using algorithms they have developed. Some investors have complained that this has introduced an unacceptable level of market volatility and risk and that it should be curtailed or more closely regulated. Others are pleased with the low costs and effectiveness of electronic markets. Central invests with a long-term view and does not trade actively. Thus, electronic trading has not had a significant effect on Central’s investment operations.

Looking forward, investors are confronted with some serious concerns and questions. Is the international regime of free trade existing since World War II breaking down, and are investors facing a world with less trade each year rather than more? World debt is $247 trillion according to the Institute of International Finance. Many countries and companies are vulnerable to a protracted rise in interest costs, constraining global central bank flexibility. The debt and growing wealth inequality have concerned many economists and are most likely behind the populist movements experienced by democracies around the world. These issues have combined to create a more uncertain investing environment.

Central is an independent, internally-managed investment company. We invest for long-term growth of capital. It is our goal to own a limited number of companies that generate superior returns. Honest and capable management working in the interest of all shareholders is of the utmost importance in our consideration of new investments. We attempt to purchase investments at a reasonable price in relation to their probable and potential intrinsic value looking out three to five years. We then want to be able to hold them through the inevitable stock market ups and downs. We believe Central’s ability to take a long-term view has been and will continue to be advantageous to shareholders.

Stockholder’s inquiries are welcome.

| Wilmot H. Kidd | John C. Hill | Andrew J. O’Neill |

630 Fifth Avenue

New York, New York 10111

January 30, 2019

[ 7 ]

TEN LARGEST INVESTMENTS

December 31, 2018

(unaudited)

| % of | Year | |||||||

| Cost | Value | Net | First | |||||

| (mil.) | (mil.) | Assets | Acquired | |||||

| The Plymouth Rock Company Incorporated | $ 0.7 | $ 170.5 | 22.3% | 1982 | ||||

| Plymouth Rock underwrites and services over $1.2 billion in automobile | ||||||||

| and homeowner’s insurance premiums in the Northeast. Founded in | ||||||||

| 1982, it has grown both organically and by acquisition. | ||||||||

| Intel Corporation | 7.6 | 39.4 | 5.2 | 1986 | ||||

| Intel is one of the world’s largest semiconductor makers, based on | ||||||||

| revenue of $63 billion. It develops advanced integrated circuits for | ||||||||

| industries such as computing, data storage and communications. | ||||||||

| Analog Devices, Inc. | 6.2 | 38.6 | 5.0 | 1987 | ||||

| Analog Devices designs, manufactures and markets integrated circuits | ||||||||

| used in analog and digital signal processing and power management. It | ||||||||

| has $6.2 billion in global product sales to industrial, communications, | ||||||||

| automotive and consumer end-markets. | ||||||||

| Coherent, Inc. | 13.5 | 37.0 | 4.8 | 2007 | ||||

| Coherent is a leading producer of commercial and scientific laser systems | ||||||||

| and components to diverse end-markets including flat-panel display, | ||||||||

| microelectronics and materials processing, with $1.9 billion in sales. | ||||||||

| Motorola Solutions, Inc. | 14.1 | 34.5 | 4.5 | 2000 | ||||

| Motorola Solutions, with sales of $6.4 billion, is a leading provider of | ||||||||

| emergency-response and public-safety communication infrastructure, | ||||||||

| devices, software and services to governments and enterprises globally. | ||||||||

| Hess Corporation | 31.2 | 28.4 | 3.7 | 2017 | ||||

| Hess Corporation engages in the exploration, development, production, | ||||||||

| transportation, purchase and sale of crude oil, natural gas liquid and natural | ||||||||

| gas. Hess has production operations in the U.S., Asia and South America. | ||||||||

| Capital One Financial Corporation | 17.8 | 22.7 | 3.0 | 2013 | ||||

| Capital One is one of the 10 largest banks in the U.S., with assets of over | ||||||||

| $360 billion and deposits of over $240 billion. It generates revenues of | ||||||||

| $25 billion. | ||||||||

| Amazon.com, Inc. | 3.8 | 19.5 | 2.6 | 2014 | ||||

| Amazon.com provides online retail shopping services and, through the | ||||||||

| Amazon Web Services segment, technology services. Amazon generates | ||||||||

| revenues of $178 billion. | ||||||||

| Rayonier Inc. | 21.1 | 19.4 | 2.5 | 2014 | ||||

| Rayonier is a real estate investment trust with 2.6 million acres of | ||||||||

| timberlands in the Southern and Pacific Northwest regions of the United | ||||||||

| States and in New Zealand. | ||||||||

| The Bank of New York Mellon Corporation | 8.4 | 18.8 | 2.5 | 1993 | ||||

| Bank of New York is a global leader in custodial services, securities | ||||||||

| processing and asset management with $34 trillion in assets under | ||||||||

| custody and $1.8 trillion under management. | ||||||||

[ 8 ]

DIVERSIFICATION OF INVESTMENTS

December 31, 2018

(unaudited)

| Percent of Net Assets December 31, |

|||||||||||

| Issues | Cost | Value | 2018 | 2017(a) | |||||||

| Common Stocks: | |||||||||||

| Insurance | 5 | $ 28,750,437 | $ 210,871,880 | 27.6 | % | 20.7 | % | ||||

| Technology Hardware and Equipment | 4 | 45,814,469 | 96,509,922 | 12.6 | 17.5 | ||||||

| Semiconductor | 2 | 13,769,771 | 78,044,700 | 10.2 | 9.5 | ||||||

| Diversified Financial | 5 | 45,772,300 | 67,584,300 | 8.8 | 10.1 | ||||||

| Diversified Industrial | 3 | 8,960,292 | 47,338,000 | 6.2 | 6.5 | ||||||

| Health Care | 3 | 30,744,887 | 44,443,250 | 5.8 | 5.2 | ||||||

| Banks | 3 | 33,967,435 | 43,668,400 | 5.7 | 6.5 | ||||||

| Communications Services | 4 | 33,721,827 | 33,009,760 | 4.3 | 4.1 | ||||||

| Energy | 1 | 31,227,477 | 28,350,000 | 3.7 | 3.5 | ||||||

| Real Estate and Homebuilding | 2 | 32,222,317 | 27,034,000 | 3.5 | 4.4 | ||||||

| Retailing | 1 | 3,814,861 | 19,525,610 | 2.6 | 3.1 | ||||||

| Other | 3 | 12,405,344 | 17,739,269 | 2.3 | 2.0 | ||||||

| Short-Term Investments | 3 | 50,606,599 | 50,606,599 | 6.6 | 6.7 | ||||||

(a) Certain amounts from 2017 have been adjusted to conform to 2018 presentation.

PRINCIPAL PORTFOLIO CHANGES

October 1 to December 31, 2018

(Common Stock unless specified otherwise)

(unaudited)

| Number of Shares | |||||

| Held | |||||

| Purchased | Sold | December 31, 2018 | |||

| Alphabet Inc. | 1,000 | 16,000 | |||

| Brady Corporation | 80,000 | 320,000 | |||

| Freeport-McMoRan Inc. | 150,000 | — | |||

| General Electric Company | 500,000 | — | |||

| Star Group, L.P. | 40,000 | 494,108 | |||

| Wells Fargo & Company | 20,000 | 250,000 | |||

[ 9 ]

STATEMENT OF INVESTMENTS

December 31, 2018

| Shares | Value | ||

| COMMON STOCKS 93.3% | |||

| Banks 5.7% | |||

| 280,000 | Citigroup Inc. | $ 14,576,800 | |

| 180,000 | JPMorgan Chase & Co. | 17,571,600 | |

| 250,000 | Wells Fargo & Company | 11,520,000 | |

| 43,668,400 | |||

| Communications Services 4.3% | |||

| 16,000 | Alphabet Inc. Class A (a) | 16,719,360 | |

| 200,000 | Cogent Communications Holdings, Inc. | 9,042,000 | |

| 210,000 | Liberty Global plc Class C (a) | 4,334,400 | |

| 200,000 | Liberty Latin America Ltd. Class C (a) | 2,914,000 | |

| 33,009,760 | |||

| Consumer Services 0.4% | |||

| 30,000 | Wynn Resorts Ltd. | 2,967,300 | |

| Diversified Financial 8.8% | |||

| 150,000 | American Express Company | 14,298,000 | |

| 400,000 | The Bank of New York Mellon Corporation | 18,828,000 | |

| 10 | Berkshire Hathaway Inc. Class A (a) | 3,060,000 | |

| 300,000 | Capital One Financial Corporation | 22,677,000 | |

| 210,000 | The Charles Schwab Corporation | 8,721,300 | |

| 67,584,300 | |||

| Diversified Industrial 6.2% | |||

| 320,000 | Brady Corporation Class A | 13,907,200 | |

| 700,000 | Heritage-Crystal Clean, Inc. (a) | 16,107,000 | |

| 65,000 | Roper Technologies, Inc. | 17,323,800 | |

| 47,338,000 | |||

| Energy 3.7% | |||

| 700,000 | Hess Corporation | 28,350,000 | |

| Health Care 5.8% | |||

| 85,000 | Johnson & Johnson | 10,969,250 | |

| 200,000 | Medtronic plc | 18,192,000 | |

| 200,000 | Merck & Co., Inc. | 15,282,000 | |

| 44,443,250 | |||

| Insurance 27.6% | |||

| 19,000 | Alleghany Corporation (a) | 11,843,080 | |

| 200,000 | Kemper Corporation | 13,276,000 | |

| 100,000 | Kinsale Capital Group, Inc. | 5,556,000 | |

| 28,424 | The Plymouth Rock Company Incorporated | ||

| Class A (b)(c) | 170,544,000 | ||

| 160,000 | Progressive Corporation | 9,652,800 | |

| 210,871,880 | |||

| Real Estate and Homebuilding 3.5% | |||

| 700,000 | Rayonier Inc. | 19,383,000 | |

| 700,000 | TRI Pointe Group, Inc. (a) | 7,651,000 | |

| 27,034,000 | |||

[ 10 ]

| Shares | Value | ||

| Retailing 2.6% | |||

| 13,000 | Amazon.com, Inc. (a) | $ 19,525,610 | |

| Semiconductor 10.2% | |||

| 450,000 | Analog Devices, Inc. | 38,623,500 | |

| 840,000 | Intel Corporation | 39,421,200 | |

| 78,044,700 | |||

| Software and Services 1.3% | |||

| 100,000 | Microsoft Corporation | 10,157,000 | |

| Technology Hardware and Equipment 12.6% | |||

| 350,000 | Coherent, Inc. (a) | 36,998,500 | |

| 295,000 | Keysight Technologies, Inc. (a) | 18,313,600 | |

| 300,000 | Motorola Solutions, Inc. | 34,512,000 | |

| 1,387,100 | Ribbon Communications Inc. (a) | 6,685,822 | |

| 96,509,922 | |||

| Utilities 0.6% | |||

| 494,108 | Star Group, L.P. | 4,614,969 | |

| Total Common Stocks (cost $321,171,417) | 714,119,091 | ||

SHORT-TERM INVESTMENTS 6.6%

| Money Market Fund 1.6% | |||

| 12,637,542 | Fidelity Institutional Money Market Fund Treasury | ||

| Only Portfolio- Class I | 12,637,542 | ||

| Principal | |||

| U.S. Treasury Bills 5.0% | |||

| $38,000,000 | U.S. Treasury Bills 2.32% – 2.41%, | ||

| due 1/8/19 – 1/22/19 (d) | 37,969,057 | ||

| Total Short-term Investments (cost $50,606,599) | 50,606,599 | ||

| Total Investments (cost $371,778,016) (99.9%) | 764,725,690 | ||

| Cash, receivables and other assets | |||

| less liabilities (0.1%) | 616,898 | ||

Net Assets (100%) |

$ 765,342,588 |

| (a) | Non-dividend paying. |

| (b) | Affiliate as defined in the Investment Company Act of 1940 and restricted. See Note 5 and Note 6. |

| (c) | Valued based on Level 3 inputs – see Note 2. |

| (d) | Valued based on Level 2 inputs – see Note 2. |

See accompanying notes to financial statements.

[ 11 ]

STATEMENT OF ASSETS AND LIABILITIES

December 31, 2018

| Assets: | ||||||

| Investments: | ||||||

| Securities of unaffiliated companies | ||||||

| (cost $320,460,817) (Note 2) | $ 543,575,091 | |||||

| Securities of affiliated companies (cost $710,600) | ||||||

| (Notes 2, 5 and 6) | 170,544,000 | |||||

| Short-term investments (cost $50,606,599) (Note 2) | 50,606,599 | $ 764,725,690 | ||||

| Cash, receivables and other assets: | ||||||

| Cash | 230,919 | |||||

| Dividends receivable | 410,246 | |||||

| Other assets | 94,658 | 735,823 | ||||

| Total Assets | 765,461,513 | |||||

| Liabilities: | ||||||

| Accrued expenses and other liabilities | 118,925 | |||||

| Total Liabilities | 118,925 | |||||

| Net Assets | $ 765,342,588 | |||||

| Net Assets are represented by: | ||||||

| Common Stock $1 par value: authorized | ||||||

| 40,000,000 shares; issued 25,565,531 (Note 3) | $ 25,565,531 | |||||

| Surplus: | ||||||

| Paid-in | $ 346,267,704 | |||||

| Total distributable earnings, including net unrealized | ||||||

| appreciation of investments (Note 1) | 395,261,079 | 741,528,783 | ||||

| Treasury Stock, at cost (68,684 shares of | ||||||

| Common Stock) (Note 3) | (1,751,726 | ) | ||||

| Net Assets | $ 765,342,588 | |||||

| Net Asset Value Per Common Share | ||||||

| (25,496,847 shares outstanding) | $30.02 | |||||

See accompanying notes to financial statements.

[ 12 ]

STATEMENT OF OPERATIONS

For the year ended December 31, 2018

Investment Income

| Income: | ||||||||

| Dividends from affiliated companies (Note 5) | $ | 9,714,755 | ||||||

| Dividends from unaffiliated companies | 8,977,724 | |||||||

| Interest | 785,436 | $ | 19,477,915 | |||||

| Expenses: | ||||||||

| Investment research | 2,651,231 | |||||||

| Administration and operations | 1,690,039 | |||||||

| Occupancy and office operating expenses | 488,702 | |||||||

| Directors’ fees | 262,470 | |||||||

| Software and information services | 173,144 | |||||||

| Legal, auditing and tax preparation fees | 143,361 | |||||||

| Franchise and miscellaneous taxes | 91,506 | |||||||

| Transfer agent, registrar and custodian | ||||||||

| fees and expenses | 91,423 | |||||||

| Stockholder communications and meetings | 69,268 | |||||||

| Miscellaneous | 131,930 | 5,793,074 | ||||||

| Net investment income | 13,684,841 | |||||||

| Net Realized And Unrealized Gain (Loss) | ||||||||

| On Investments | ||||||||

| Net realized gain from unaffiliated companies | 19,176,502 | |||||||

| Decrease in net unrealized appreciation of investments | ||||||||

| in unaffiliated companies | (92,722,042 | ) | ||||||

| Increase in net unrealized appreciation of investments | ||||||||

| in affiliated companies (Note 5) | 25,581,600 | |||||||

| Net loss on investments | (47,963,940 | ) | ||||||

| Decrease In Net Assets Resulting From | ||||||||

| Operations | $ | (34,279,099 | ) |

See accompanying notes to financial statements.

[ 13 ]

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended December 31, 2018 and 2017

| 2018 | 2017 | |||||||

| From Operations: | ||||||||

| Net investment income | $ | 13,684,841 | $ | 6,911,428 | ||||

| Net realized gain from investment transactions | 19,176,502 | 20,731,782 | ||||||

| Increase (decrease) in net unrealized appreciation | ||||||||

| of investments | (67,140,442 | ) | 141,563,341 | |||||

| Increase (decrease) in net assets resulting | ||||||||

| from operations | (34,279,099 | ) | 169,206,551 | |||||

| Distributions To Stockholders (a): | ||||||||

| From distributable earnings | (36,422,535 | ) | (24,811,031 | ) | ||||

| From Capital Share Transactions: (Notes 3 and 8) | ||||||||

| Distribution to stockholders reinvested in | ||||||||

| Common Stock | 13,373,879 | 8,708,796 | ||||||

| Issuance of shares of Common Stock to directors | ||||||||

| and employees | 321,120 | 260,399 | ||||||

| Cost of treasury stock purchased | (3,982,566 | ) | (1,716,278 | ) | ||||

| Increase in net assets from capital | ||||||||

| share transactions | 9,712,433 | 7,252,917 | ||||||

| Total increase (decrease) in net assets | (60,989,201 | ) | 151,648,437 | |||||

| Net Assets: | ||||||||

| Beginning of year | 826,331,789 | 674,683,352 | ||||||

| End of year (b) | $ | 765,342,588 | $ | 826,331,789 |

| (a) | Distributions from net investment income and net realized gain are no longer required to be separately disclosed. See Note 1. For the year ended December 31, 2017, distributions from net investment income were $6,698,990 and distributions from net realized gain from investment transactions were $18,112,041. |

| (b) | Disclosure of undistributed net investment income at the end of the year is no longer required. See Note 1. As of December 31, 2017, end of year net assets included undistributed net investment income of $600,181. |

See accompanying notes to financial statements.

[ 14 ]

STATEMENT OF CASH FLOWS

For the year ended December 31, 2018

| Cash Flows From Operating Activities: | ||||||

| Decrease in net assets from operations | $(34,279,099) | |||||

| Adjustments to decrease in net assets | ||||||

| from operations: | ||||||

| Proceeds from securities sold | $ | 70,170,665 | ||||

| Purchases of securities | (62,973,243 | ) | ||||

| Net decrease in short-term investments | 4,375,084 | |||||

| Net realized gain from investments | (19,176,502 | ) | ||||

| Decrease in net unrealized appreciation | ||||||

| of investments | 67,140,442 | |||||

| Non-cash stock compensation | 321,120 | |||||

| Depreciation and amortization | 4,402 | |||||

| Changes in operating assets and liabilities: | ||||||

| Decrease in dividends receivable | 57,654 | |||||

| Increase in other assets | (17,089 | ) | ||||

| Decrease in payable for securities purchased | (990,062 | ) | ||||

| Decrease in accrued expenses and | ||||||

| other liabilities | (33,477 | ) | ||||

| Total adjustments | 58,878,994 | |||||

| Net cash provided by operating activities | 24,599,895 | |||||

| Cash Flows From Financing Activities: | ||||||

| Dividends and distributions paid | (23,048,656 | ) | ||||

| Treasury stock purchased | (3,982,566 | ) | ||||

| Cash used in financing activities | (27,031,222) | |||||

| Net decrease in cash | (2,431,327) | |||||

| Cash at beginning of year | 2,662,246 | |||||

| Cash at end of year | $230,919 | |||||

| Supplemental Disclosure Of Cash Flow Information: | ||||||

| Non-cash financing activities not included herein consist of: | ||||||

| Reinvestment of dividends and distributions | ||||||

| to stockholders | $13,373,879 | |||||

| Issuance of shares of Common Stock to directors | ||||||

| and employees | $321,120 |

See accompanying notes to financial statements.

[ 15 ]

NOTES TO FINANCIAL STATEMENTS

1. Significant Accounting Policies—Central Securities Corporation (the “Corporation”) is registered under the Investment Company Act of 1940, as amended, as a non-diversified, closed-end management investment company. The following is a summary of the significant accounting policies consistently followed by the Corporation in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles.

Security Valuation—Marketable common stocks are valued at the last or closing sale price or, if unavailable, at the closing bid price. Investments in money market funds are valued at net asset value per share. Other short-term investments are valued at amortized cost, which approximates fair value. Securities for which no ready market exists are valued at estimated fair value pursuant to procedures adopted by the Board of Directors. The determination of fair value involves subjective judgments. As a result, using fair value to price a security may result in a price materially different from the price used by other investors or the price that may be realized upon the actual sale of the security.

Federal Income Taxes—It is the Corporation’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income and net capital gains to its stockholders. Management has analyzed positions taken on the Corporation’s tax returns and has determined that no provision for income taxes is required in the accompanying financial statements. The Corporation’s Federal, state and local tax returns for the current and previous three fiscal years remain subject to examination by the relevant taxing authorities.

Use of Estimates—The preparation of financial statements in accordance with generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported. Actual results may differ from those estimates.

Other—Security transactions are accounted for as of the trade date, and cost of securities sold is determined by specific identification. Dividend income and distributions to stockholders are recorded on the ex-dividend date. Interest income is accrued daily.

Recently Issued Accounting Pronouncements—In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update 2016-02, “Leases.” The new standard generally requires a lessee for an operating lease to recognize on its statement of assets and liabilities (1) an asset for its right to use the underlying asset over the lease term and (2) an offsetting liability representing its obligation to make lease payments over the lease term. The new standard is effective for years beginning after December 15, 2018, including interim periods within those years. The new standard is expected to result in an increase in the Corporation’s total assets and total liabilities, but is not expected to have a material effect on net assets.

In August 2018, the Securities and Exchange Commission released its Final Rule on Disclosure Update and Simplification (the “Final Rule”), which is intended to simplify an issuer’s disclosure compliance efforts by removing redundant or outdated disclosure requirements without significantly altering the mix of information provided to investors. Effective with the current reporting period, the Corporation adopted the Final Rule. As a result, the Corporation no longer presents the components of distributable earnings on the Statement of Assets and Liabilities or the sources of distributions to shareholders and the amount of undistributed net investment income on the Statements of Changes in Net Assets.

[ 16 ]

NOTES TO FINANCIAL STATEMENTS — Continued

In August 2018, the FASB issued Accounting Standards Update 2018-13, “Fair Value Measurement (Topic 820) — Disclosure Framework — Changes to the Disclosure Requirements for Fair Value Measurement” (“ASU 2018-13”), which introduces new fair value disclosure requirements as well as eliminates and modifies certain existing fair value disclosure requirements. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years, with earlier adoption permitted. Management is evaluating the implications of ASU 2018-13, and any impact on the financial statement disclosures has not yet been determined.

2. Fair Value Measurements—The Corporation’s investments are categorized below in three broad hierarchical levels based on market price observability as follows:

| • | Level 1—Quoted prices in active markets for identical investments; |

| • | Level 2—Other significant observable inputs obtained from independent sources, for example, quoted prices in active markets for similar investments; |

| • | Level 3—Significant unobservable inputs including the Corporation’s own assumptions based upon the best information available. The Corporation’s only Level 3 investment is The Plymouth Rock Company Incorporated Class A Common Stock (“Plymouth Rock”). |

The designated Level for a security is not necessarily an indication of the risk associated with investing in that security.

The Corporation’s investments as of December 31, 2018 are classified as follows:

| Level 1 | Level 2 | Level 3 | Total Value | |||||

| Common stocks | $543,575,091 | — | $170,544,000 | $714,119,091 | ||||

| Short-term investments | 12,637,542 | $37,969,057 | — | 50,606,599 | ||||

| Total | $556,212,633 | $37,969,057 | $170,544,000 | $764,725,690 |

The following is a reconciliation of the change in the value of Level 3 investments:

| Balance as of December 31, 2017 | $144,962,400 |

| Change in unrealized appreciation of investments in affiliated | |

| companies included in decrease in net assets from operations | 25,581,600 |

| Balance as of December 31, 2018 | $170,544,000 |

Unrealized appreciation of Level 3 investments still held as of December 31, 2018 increased during the year by $25,581,600, which is included in the above table.

In valuing the Plymouth Rock Level 3 investment as of December 31, 2018, management used a number of significant unobservable inputs to develop a range of possible values for the investment. It used a comparable company approach that utilized the following valuation multiples from selected publicly traded companies: price-to-book value (range: 0.6 – 3.3); price-to-earnings (range: 7.6 – 87.7); and price-to-revenue (range 0.5 – 1.5). Management also used a discounted cash flow model based on a forecasted return on equity ranging from 8%-9% and a weighted average cost of capital of 11%. An independent valuation of Plymouth Rock’s shares was also considered. The value obtained from weighting the three approaches described above (with greater weight given to the comparable company approach) was then discounted for lack of marketability by 20% and 40%, a range management believes market participants would apply. The resulting range of values, together with the underlying support, other information about Plymouth Rock’s financial condition and results of operations, its corporate

[ 17 ]

NOTES TO FINANCIAL STATEMENTS — Continued

governance, the insurance industry outlook and transacted values in Plymouth Rock’s shares were also considered. These values as multiples of Plymouth Rock’s book value were also considered. Based upon all of the above information, the Corporation’s directors selected the value for the investment which implied a discount for lack of marketability in the higher end of the above range.

Significant increases (decreases) in the value of the price-to-book value multiple, price-to-earnings multiple, price-to-revenue multiple and return on equity in isolation would have resulted in a higher (lower) range of fair value measurements. Significant increases (decreases) in the value of the discount for lack of marketability or weighted average cost of capital in isolation would have resulted in a lower (higher) range of fair value measurements.

3. Common Stock and Dividend Distributions—The Corporation purchased 153,010 shares of its Common Stock in 2018 at an average price of $26.03 per share representing an average discount from net asset value of 19.4%. It may from time to time purchase Common Stock in such amounts and at such prices as the Board of Directors may deem advisable in the best interests of the stockholders. Purchases will only be made at less than net asset value per share, thereby increasing the net asset value of shares held by the remaining stockholders. Shares so acquired may be held as treasury stock available for stock distributions, or may be retired.

The Corporation declared two distributions to holders of Common Stock in 2018, $.25 per share paid on June 26 in cash and $1.20 per share paid on December 20 in cash or in additional shares of Common Stock at the stockholder’s option. In connection with the December 20 distribution, 84,326 treasury shares were distributed and 409,722 shares of Common Stock were issued, all at a price of $27.07 per share.

The tax character of dividends and distributions paid during the year was ordinary income, $14,065,080 and long-term capital gain, $22,357,455; for 2017, it was $6,947,102 and $17,863,929, respectively. As of December 31, 2018, for tax purposes, undistributed ordinary income was $705,940 and undistributed long-term realized capital gain was $1,842,143. Dividends and distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. Financial statements are adjusted for permanent book-tax differences; such adjustments were not material for the year ended December 31, 2018.

4. Investment Transactions—The aggregate cost of securities purchased and the aggregate proceeds of securities sold during the year ended December 31, 2018, excluding short-term investments, were $62,973,243 and $70,170,665, respectively.

As of December 31, 2018, the tax cost of investments was $371,778,016. Net unrealized appreciation was $392,947,674 consisting of gross unrealized appreciation and gross unrealized depreciation of $415,710,608 and $22,762,934, respectively.

5. Affiliated Companies—Plymouth Rock is an affiliated company as defined in the Investment Company Act of 1940 due to the Corporation’s ownership of 5% or more of the company’s outstanding voting securities. During the year ended December 31, 2018, unrealized appreciation from the Corporation’s investment in Plymouth Rock increased by $25,581,600 and the Corporation received dividends of $9,714,755 from Plymouth Rock. The Chief Executive Officer of the Corporation is a director of Plymouth Rock.

6. Restricted Securities—The Corporation may from time to time invest in securities the resale of which is restricted. On December 31, 2018, the Corporation’s restricted securities consisted of 28,424 shares of Plymouth Rock Class A stock that were acquired on December 15, 1982 at a cost of $710,600.

[ 18 ]

NOTES TO FINANCIAL STATEMENTS — Continued

This security had a value of $170,544,000 at December 31, 2018, which was equal to 22.3% of the Corporation’s net assets. The Corporation does not have the right to demand registration of this security.

7. Bank Line of Credit—The Corporation has entered into a $25 million uncommitted, secured revolving line of credit with UMB Bank, n.a. (“UMB”), the Corporation’s custodian. All borrowings are payable on demand of UMB. Interest on any borrowings is payable monthly at a rate based on the federal funds rate, subject to a minimum annual rate of 2.50%. No borrowings were made during the year ended December 31, 2018.

8. Compensation and Benefit Plans—The aggregate remuneration paid to all officers during the year ended December 31, 2018 was $3,513,840.

Officers and other employees participate in a 401(k) profit sharing plan. The Corporation has agreed to contribute 3% of each participant’s qualifying compensation to the plan, which is immediately vested. Contributions in excess of 3% may be made at the discretion of the Board of Directors and vest after three years of service. During the year ended December 31, 2018, the Corporation contributed $241,061 to the plan, which represented 15% of total qualifying compensation.

The Corporation maintains an incentive compensation plan (the “2012 Plan”) which permits the granting of awards of unrestricted stock, restricted stock, restricted stock units and cash to full-time employees and non-employee directors of the Corporation. The 2012 Plan provides for the issuance of up to 1,000,000 shares of the Corporation’s Common Stock over the ten-year life of the 2012 Plan, of which 931,963 remain available for future grants at December 31, 2018. The 2012 Plan limits the amount of shares that can be awarded to any one person in total or within a certain time period. Any award made under the 2012 Plan may be subject to performance conditions. The 2012 Plan is administered by the Corporation’s Compensation and Nominating Committee.

A summary of awards of unrestricted shares of Common Stock granted and issued in 2018 is presented below. The fair value of unrestricted stock is the average of the high and low prices of the Corporation’s Common Stock on the grant date.

| Officers and | Non-employee | |||

| employees | directors | |||

| Number of shares granted | 13,459 | 3,000 | ||

| Number of shares surrendered for withholding taxes | (4,266) | n/a | ||

| Number of shares issued | 9,193 | 3,000 | ||

| Weighted average grant date fair value | $25.96 | $27.49 |

Pursuant to the terms of the 2012 Plan, each non-employee director is awarded 500 shares of vested unrestricted Common Stock at initial election to the Board of Directors and annually after re-election at the Corporation’s annual meeting. The aggregate value of these awards made in 2018 was $82,470. This amount plus cash payments of $180,000 made to all non-employee directors are included in Directors’ fees expense in the accompanying Statement of Operations.

9. Operating Lease Commitment—The Corporation has an operating lease for office space that expires on June 30, 2019. Rent expense for the year ended December 31, 2018 was $426,644. Future minimum rental commitments under the lease are $187,442 in 2019. The lease agreement contains escalation clauses relating to operating costs and real property taxes.

[ 19 ]

FINANCIAL HIGHLIGHTS

The following table shows per share operating performance data, total returns, ratios and supplemental data for each year in the five-year period ended December 31, 2018. This information has been derived from information contained in the financial statements and market price data for the Corporation’s shares.

The Corporation’s total returns reflect changes in market price or net asset value, as applicable, and assume reinvestment of all distributions. Distributions that are payable only in cash are assumed to be reinvested at the market price or net asset value, as applicable, on the payable date of the distribution. Distributions that may be taken in shares are assumed to be reinvested at the price designated by the Corporation.

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Per Share Operating Performance: | ||||||||||||||||||||

| Net asset value, beginning of year | $ | 32.86 | $ | 27.12 | $ | 23.53 | $ | 26.18 | $ | 26.78 | ||||||||||

| Net investment income (a) | .54 | .28 | .19 | .14 | .13 | |||||||||||||||

| Net realized and unrealized gain (loss) | ||||||||||||||||||||

| on securities (a) | (1.91 | ) | 6.52 | 4.41 | (.83 | ) | 1.12 | |||||||||||||

| Total from investment operations | (1.37 | ) | 6.80 | 4.60 | (.69 | ) | 1.25 | |||||||||||||

| Less: | ||||||||||||||||||||

| Dividends from net investment income | .55 | .27 | .20 | .12 | .14 | |||||||||||||||

| Distributions from capital gains | .90 | .73 | .78 | 1.86 | 1.61 | |||||||||||||||

| Total distributions | 1.45 | 1.00 | .98 | 1.98 | 1.75 | |||||||||||||||

| Net change from capital share | ||||||||||||||||||||

| transactions | (.02 | ) | (.06 | ) | (.03 | ) | .02 | (.10 | ) | |||||||||||

| Net asset value, end of year | $ | 30.02 | $ | 32.86 | $ | 27.12 | $ | 23.53 | $ | 26.18 | ||||||||||

| Per share market value, end of year | $ | 24.83 | $ | 27.40 | $ | 21.79 | $ | 19.02 | $ | 21.97 | ||||||||||

| Total return based on market (%) | (4.51 | ) | 30.55 | 19.97 | (4.71 | ) | 9.52 | |||||||||||||

| Total return based on NAV (%) | (3.88 | ) | 25.63 | 20.44 | (1.23 | ) | 5.35 | |||||||||||||

| Ratios/Supplemental Data: | ||||||||||||||||||||

| Net assets, end of year (000) | $ | 765,343 | $ | 826,332 | $ | 674,683 | $ | 582,871 | $ | 649,761 | ||||||||||

| Ratio of expenses to average | ||||||||||||||||||||

| net assets (%) | .69 | .75 | .88 | .72 | .67 | |||||||||||||||

| Ratio of net investment income to | ||||||||||||||||||||

| average net assets (%) | 1.63 | .92 | .75 | .56 | .47 | |||||||||||||||

| Portfolio turnover rate (%) | 8.04 | 6.03 | 9.48 | 25.48 | 13.07 | |||||||||||||||

| (a) | Based on the average number of shares outstanding during the year. |

See accompanying notes to financial statements.

[ 20 ]

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders of

Central Securities Corporation:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Central Securities Corporation (the “Corporation”), including the statement of investments, as of December 31, 2018, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively, the “financial statements”) and the financial highlights for each of the years in the five-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Corporation as of December 31, 2018, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Corporation’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Corporation in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risk of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our procedures included confirmation of securities owned as of December 31, 2018, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

KPMG LLP

We or our predecessor firms have served as the Corporation’s auditor since 1930.

New York, NY

February 4, 2019

[ 21 ]

OTHER INFORMATION

Direct Registration

The Corporation utilizes direct registration, a system that allows for book-entry ownership and the electronic transfer of the Corporation’s shares. Stockholders may find direct registration a convenient way of managing their investment. Stockholders wishing certificates may request them.

A pamphlet which describes the features and benefits of direct registration, including the ability of shareholders to deposit certificates with our transfer agent, can be obtained by calling Computershare Trust Company at 1-800-756-8200, calling the Corporation at 1-866-593-2507 or visiting our website: www.centralsecurities.com under Contact Us.

Proxy Voting Policies and Procedures

The policies and procedures used by the Corporation to determine how to vote proxies relating to portfolio securities and the Corporation’s proxy voting record for the twelve-month period ended June 30, 2018 are available: (1) without charge, upon request, by calling us at our toll-free telephone number (1-866-593-2507), (2) on the Corporation’s website at www.centralsecurities.com and (3) on the Securities and Exchange Commission’s website at www.sec.gov.

Quarterly Portfolio Information

The Corporation files its complete schedule of portfolio holdings with the SEC for the first and the third quarter of each fiscal year on Form N-Q. The Corporation’s Form N-Q filings are available on the SEC’s website at www.sec.gov. Those forms may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Privacy Policy

In order to conduct its business, the Corporation, through its transfer agent, Computershare Trust Company, collects and maintains certain nonpublic personal information about our stockholders of record in connection with their transactions in shares of our securities. This information includes the shareholder’s address, tax identification number and number of shares. We do not collect or maintain personal information about stockholders whose shares are held in “street name” by a financial institution such as a bank or broker.

We do not disclose any nonpublic personal information about our stockholders to third parties unless necessary to process a transaction, service an account or as otherwise permitted by law.

To protect your personal information internally, we restrict access to nonpublic personal information about our stockholders to those employees who need to know that information to provide services to our stockholders.

Forward-Looking Statements

This report may contain “forward-looking statements” within the meaning of the Securities Exchange Act of 1934. You can identify forward-looking statements by words such as “believe,” “expect,” “may,” “anticipate,” and other similar expressions when discussing prospects for particular portfolio holdings and/or markets, generally. By their nature, all forward-looking statements involve risks and uncertainties, and actual results could differ materially from those contemplated by the forward-looking statements. We cannot assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise.

[ 22 ]

BOARD OF DIRECTORS AND OFFICERS

| Principal Occupation (last | ||||

| five years) and position with | Other Public Company | |||

| Name (age) | the Corporation (if any) | Directorships held by Directors | ||

| Independent Directors | ||||

| L. PRICE BLACKFORD (67) | Managing Director, Scott-Macon, | None | ||

| Director since 2012 | Ltd. (investment banking) since | |||

| 2013; Senior Advisor, Sagent | ||||

| Advisors (investment banking) | ||||

| prior thereto | ||||

| SIMMS C. BROWNING (78) | Retired 2003; Vice President, | None | ||

| Director since 2005 | Neuberger Berman, LLC (asset | |||

| management) prior thereto | ||||

| DONALD G. CALDER (81) | Chairman, Clear Harbor Asset | Brown-Forman Corporation | ||

| Director since 1982 | Management, LLC since 2010; | (beverages) until 2010; Carlisle | ||

| President G.L. Ohrstrom & Co. | Companies (industrial | |||

| Inc. (private investment firm) | conglomerate) until 2009 and | |||

| prior thereto | Roper Technologies, Inc. | |||

| (manufacturing) until 2008 | ||||

| DAVID C. COLANDER (71) | Professor of Economics, | None | ||

| Director since 2009 | Middlebury College | |||

| JAY R. INGLIS (84) | Retired since 2014; Vice | None | ||

| Director since 1973 | President and General Counsel, | |||

| International Claims | ||||

| Management, Inc. prior thereto | ||||

| Interested Directors | ||||

| WILMOT H. KIDD (77) | Chairman and Chief Executive | Silvercrest Asset Management | ||

| Director since 1972 | Officer, Central Securities | Group, Inc. | ||

| Corporation; President, Central | ||||

| Securities Corporation 1973-2018 | ||||

| WILMOT H. KIDD IV (39) | Independent photographer, | None | ||

| Director since 2017 | cinematographer and | |||

| film producer. | ||||

| Other Officers | ||||

| JOHN C. HILL (45) | President since 2018 and Vice President since 2016; | |||

| Analyst, Davis Advisors, 2009-2016 | ||||

| MARLENE A. KRUMHOLZ (55) | Vice President since 2009 and Secretary since 2001 | |||

| ANDREW J. O’NEILL (46) | Vice President since 2011, Investment Analyst since 2009 | |||

| LAWRENCE P. VOGEL (62) | Treasurer since 2010 and Vice President since 2009 | |||

The Corporation is a stand-alone investment company. The address of each Director and officer is c/o Central Securities Corporation, 630 Fifth Avenue, New York, New York 10111. All Directors serve for a term of one year and are elected by stockholders at the Corporation’s annual meeting. Officers serve at the pleasure of the Board of Directors.

[ 23 ]

BOARD OF DIRECTORS

Wilmot H. Kidd, Chairman

L. Price Blackford, Lead Independent Director

Simms C. Browning

Donald G. Calder

David C. Colander

Jay R. Inglis

Wilmot H. Kidd IV

C. Carter Walker, Jr., Director Emeritus

OFFICERS

Wilmot H. Kidd, Chief Executive Officer

John C. Hill, President

Marlene A. Krumholz, Vice President and Secretary

Andrew J. O’Neill, Vice President

Lawrence P. Vogel, Vice President and Treasurer

OFFICE

630 Fifth Avenue

New York, NY 10111

212-698-2020

866-593-2507 (toll-free)

www.centralsecurities.com

TRANSFER AGENT AND REGISTRAR

Computershare Trust Company, N.A.

P.O. Box 505000, Louisville, KY 40233

800-756-8200

www.computershare.com/investor

CUSTODIAN

UMB Bank, n.a.

Kansas City, MO

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

KPMG LLP

New York, NY

[ 24 ]

Item 2. Code of Ethics.

| (a) | The Registrant has adopted a code of ethics that applies to its principal executive officer and principal financial officer. |

| (b) | No information need be disclosed pursuant to this paragraph. |

| (c) | Not applicable. |

| (d) | The registrant has not granted any waivers, including implicit waivers from a provision of this code of ethics. |

| (e) | Not applicable. |

| (f) | This code of ethics is filed as an attachment on this form. |

Item 3. Audit Committee Financial Experts.

| (a) | The Board of Directors of the Corporation has determined that none of the members of its Audit Committee meet the definition of “Audit Committee Financial Expert” as the term has been defined by the Securities and Exchange Commission (“SEC”). The Board of Directors considered the possibility of adding a member that would qualify as an Audit Committee Financial Expert, but has determined that the Audit Committee collectively has sufficient expertise to perform its duties. In addition, the Audit Committee’s charter authorizes the Audit Committee to engage a financial expert should it determine that such assistance is required. |

Item 4. Principal Accountant Fees and Services.

| 2018 | 2017 | ||||||

| Audit fees | $ | 96,500 | (1) | $ | 94,000 | (1) | |

| Audit-related fees | 0 | 0 | |||||

| Tax fees | 22,500 | (2) | 22,000 | (2) | |||

| All other fees | 0 | 0 | |||||

| Total fees | $ | 119,000 | $ | 116,000 | |||

| (1) | Includes fees for review of the semi-annual report to stockholders and audit of the annual report to stockholders. |

| (2) | Includes fees for services performed with respect to tax compliance and tax planning. |

Pursuant to its charter, the Audit Committee is responsible for recommending the selection, approving compensation and overseeing the independence, qualifications and performance of the independent accountants. The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent accountants. In assessing requests for services by the independent accountants, the Audit Committee considers whether such services are consistent with the auditor’s independence; whether the independent accountants are likely to provide the most effective and efficient service based upon their familiarity with the Corporation; and whether the service could enhance the Corporation’s ability to manage or control risk or improve audit quality. The Audit Committee may delegate pre-approval authority to one

or more of its members. Any pre-approvals by a member under this delegation are to be reported to the Audit Committee at its next scheduled meeting.

All of the non-audit and tax services provided by KPMG LLP for fiscal year 2018 (described in the footnotes to the table above) and related fees were approved in advance by the Audit Committee.

Item 5. Audit Committee of Listed Registrants. The registrant has a separately-designated standing audit committee. Its members are: L. Price Blackford, Simms C. Browning, Donald G. Calder, David C. Colander and Jay R. Inglis

Item 6. Investments.

(a) Schedule is included as a part of the report to shareholders filed under Item 1 of this Form.

(b) Not applicable.

Item 7. Disclose Proxy Voting Policies and Procedures for Closed-End Management Companies.

CENTRAL SECURITIES CORPORATION

PROXY VOTING GUIDELINES

Central Securities Corporation is involved in many matters of corporate governance through the proxy voting process. We exercise our voting responsibilities with the primary goal of maximizing the long-term value of our investments. Our consideration of proxy issues is focused on the investment implications of each proposal.

Our management evaluates and votes each proxy ballot that we receive. We do not use a proxy voting service. Our Board of Directors has approved guidelines in evaluating how to vote a particular proxy ballot. We recognize that a company’s management is entrusted with the day-to-day operations of the company, as well as longer term strategic planning, subject to the oversight of the company’s board of directors. Our guidelines are based on the belief that a company’s shareholders have a responsibility to evaluate company performance and to exercise the rights and duties pertaining to ownership.

When determining whether to invest in a particular company, one of the key factors we consider is the ability and integrity of its management. As a result, we believe that recommendations of management on any issue, particularly routine issues, should be given substantial weight in determining how proxies should be voted. Thus, on most issues, our votes are cast in accordance with the company’s recommendations. When we believe management’s recommendation is not in the best interest of our stockholders, we will vote against management’s recommendation.

Due to the nature of our business and our size, it is unlikely that conflicts of interest will arise in our voting of proxies of public companies. We do not engage in investment banking nor do we have private advisory clients or any other businesses. In the unlikely event that we determine that a conflict does arise on a proxy voting issue, we will defer that proxy vote to our independent directors.

We have listed the following, specific examples of voting decisions for the types of proposals that are frequently presented. We generally vote according to these guidelines. We may, on occasion, vote otherwise when we believe it to be in the best interest of our stockholders:

Election of Directors – We believe that good governance starts with an independent board, unfettered by significant ties to management, in which all members are elected annually. In addition, key board committees should be entirely independent.

- We support the election of directors that result in a board made up of a majority of independent directors who do not appear to have been remiss in the performance of their oversight responsibilities.

- We will withhold votes for non-independent directors who serve on the audit, compensation or nominating committees of the board.

- We consider withholding votes for directors who missed more than one-fourth of the scheduled board meetings without good reason in the previous year.

- We generally oppose the establishment of classified boards of directors and will support proposals that directors stand for election annually.

- We generally oppose limits to the tenure of directors or requirements that candidates for directorships own large amounts of stock before being eligible for election.

Compensation - We believe that appropriately designed equity-based compensation plans can be an effective way to align the interests of long-term shareholders and the interests of management, employees, and directors. We are opposed to plans that substantially dilute our ownership interest in the company, provide participants with excessive awards, or have inherently objectionable structural features without offsetting advantages to the company’s shareholders.

We evaluate proposals related to compensation on a case-by case basis.

- We generally support stock option plans that are incentive based and not excessive.

- We generally oppose the ability to re-price options without compensating factors when the underlying stock has fallen in value.

- We support measures intended to increase the long-term stock ownership by executives including requiring stock acquired through option exercise to be held for a substantial period of time.

- We generally support stock purchase plans to increase company stock ownership by employees, provided that shares purchased under the plan are acquired for not less than 85% of their market value.

- We generally oppose change-in-control provisions in non-salary compensation plans, employment contracts, and severance agreements which benefit management and would be costly to shareholders if triggered.

Corporate Structure and Shareholder Rights - We generally oppose anti-takeover measures and other proposals designed to limit the ability of shareholders to act on possible transactions. We support proposals when management can demonstrate that there are sound financial or business reasons.

- We generally support proposals to remove super-majority voting requirements and oppose amendments to bylaws which would require a super-majority of shareholder votes to pass or repeal certain provisions.

- We will evaluate proposals regarding shareholders rights plans (“poison pills”) on a case-by-case basis considering issues such as the term of the arrangement and the level of review by independent directors.

- We will review proposals for changes in corporate structure such as changes in the state of incorporation or mergers individually. We generally oppose proposals where management does not offer an appropriate rationale.

- We generally support share repurchase programs.

- We generally support the general updating of or corrective amendments to corporate charters and by-laws.

- We generally oppose the elimination of the rights of shareholders to call special meetings.

Approval of Independent Auditors – We believe that the relationship between the company and its auditors should be limited primarily to the audit engagement and closely related activities that do not, in the aggregate, raise the appearance of impaired independence.

- We generally support management’s proposals regarding the approval of independent auditors.

- We evaluate on a case-by-case basis instances in which the audit firm appears to have a substantial non-audit relationship with the company or companies affiliated with it.

Social and Corporate Responsibility Issues - We believe that ordinary business matters are primarily the responsibility of management and should be approved solely by the corporation’s board of directors. Proposals in this category, initiated primarily by shareholders, typically request that the company disclose or amend certain business practices. We generally vote with management on these types of proposals, although we may make exceptions in certain instances where we believe a proposal has substantial economic implications.

- We generally oppose shareholder proposals which apply restrictions related to social, political, or special interest issues which affect the ability of the company to do business or be competitive and which have significant financial impact.

- We generally oppose proposals which require that the company provide costly, duplicative, or redundant reports, or reports of a non-business nature.

Item 8. Portfolio Managers of Closed-End Management Investment Companies. As of the date of this filing, Mr. Wilmot H. Kidd, Chief Executive Officer, Mr. John C. Hill, President, and Mr. Andrew J. O’Neill, Vice President, manage the Corporation’s investments. Mr. Kidd served as President since 1973 and was elected Chief Executive Officer in 2018. Mr. Hill joined the Corporation as a Vice President in 2016 and was elected President in 2018. He had previously worked as an investment analyst with Davis Selected Advisers LP since 2009. Mr. O’Neill joined the Corporation in 2009, and was elected Vice President in 2011. Mr. Kidd, Mr. Hill and Mr. O’Neill do not manage any other accounts, and accordingly, the Registrant is not aware of any material conflicts with their management of the Corporation’s investments.

Mr. Kidd’s, Mr. Hill’s and Mr. O’Neill’s compensation consists primarily of a fixed base salary and a bonus. All or a portion of their bonus may be paid in shares of stock of the Corporation. Their compensation is reviewed and approved annually by the Compensation and Nominating Committee of the Board of Directors (the “Committee”), which is comprised solely of independent directors. Their compensation may be adjusted from year to year based on the Committee’s perception of overall performance and their management responsibilities.

Mr. Kidd’s, Mr. Hill’s and Mr. O’Neill’s bonus in 2018 was at the discretion of the Committee. Mr. Kidd, Mr. Hill and Mr. O’Neill also participate in the Corporation’s 401k Profit Sharing Plan, pursuant to which the Corporation contributed a percentage of their eligible compensation.

As of December 31, 2018, the value of Mr. Kidd’s and Mr. O’Neill’s investment in Central Securities common stock each exceeded $1 million, and Mr. Hill’s was between $500,001 - $1,000,000.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

| Period | (a) Total Number of Shares (or Units) Purchased | (b) Average Price Paid per Share (or Unit) | (c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | (d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs |

| Month #1 (July 1 through July 31) | 0 | NA | NA | NA |

| Month #2 (August 1 through August 31) | 0 | NA | NA | NA |

| Month #3 (September 1 through September 30) | 0 | NA | NA | NA |

| Month #4 (October 1 through October 31) | 33,382 | $26.68 | NA | NA |

| Month #5 (November 1 through November 30) | 50,944 | $26.31 | NA | NA |

| Month #6 (December 1 through December 31) | 68,684 | $25.50 | NA | NA |

| Total | 153,010 | $26.03 | NA | NA |

Item 10. Submission of Matters to a Vote of Security Holders. There have been no changes to the procedures by which shareholders may recommend nominees to the registrant’s board of directors since such procedures were last described in the Corporation’s proxy statement dated February 7, 2018.

Item 11. Controls and Procedures.

(a) The Principal Executive Officer and Principal Financial Officer of Central Securities Corporation (the “Corporation”) have concluded that the Corporation’s Disclosure Controls and Procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) are effective based on their evaluation of the Disclosure Controls and Procedures as of a date within 90 days of the filing date of this report.

(b) There have been no changes in the Corporation’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Corporation’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

(a) Not applicable.

(b) Not applicable.

Item 13. Exhibits.

| (a) | (1) Any code of ethics, or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy the Item 2 requirements through filing of an exhibit. Attached hereto. |

(2) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act. Attached hereto.

| (3) | Not Applicable. |

| (4) | Not Applicable. |

| (b) | Certifications pursuant to Rule 30a-2(b) under the 1940 Act are attached hereto. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Central Securities Corporation

By: /s/ Wilmot H. Kidd

Wilmot H. Kidd

Chief Executive Officer

February 12, 2019

Date

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capabilities and on the dates indicated.

By: /s/ Wilmot H. Kidd

Wilmot H. Kidd

Chief Executive Officer

February 12, 2019

Date

By: /s/ Lawrence P. Vogel

Lawrence P. Vogel

Vice President and Treasurer

February 12, 2019

Date