|

Leo Borchardt +44 20 7418 1334 leo.borchardt@davispolk.com davispolk.com |

Davis Polk & Wardwell London LLP 5 Aldermanbury Square |

December 29, 2022

| Re: | Forbion European Acquisition Corp. |

Form 10-K for the year ended December 31, 2021

Filed April 14, 2022

Form 10-Q for the quarterly period ended September 30, 2022

Filed November 10, 2022

File No. 001-41148

Ms. Jennifer Monick

Mr. Eric McPhee

Office of Real Estate & Construction

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street N.E.

Washington, D.C. 20549

Ladies and Gentlemen:

On behalf of our client, Forbion European Acquisition Corp., a Cayman Islands exempted company (the “Company”), we are responding to the comments from the Staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) relating to (i) the Company’s Form 10-K for the fiscal year ended December 31, 2021 and (ii) the Company’s Form 10-Q for the quarterly period ended September 30, 2022, contained in the Staff’s letter dated December 15, 2022 (the “Comment Letter”).

Set forth below are the Company’s responses to the Staff’s comments included in the Comment Letter. For convenience, the Staff’s comments included in the Comment Letter are repeated below in italics, followed by the Company’s responses to such comments as well as a summary of the responsive actions taken.

Form 10-K for the year ended December 31, 2021

Notes to Financial Statements

Note 4 - Private Placement, page F-15

1. We note you have classified the 5,195,000 private placements warrants as equity. Please provide us with your analysis under ASC 815-40 to support your accounting treatment for these warrants. As part of your analysis, please address whether there are any terms or provisions in the warrant agreement that provide for potential changes to the settlement amounts that are dependent upon the characteristics of the holder of the warrant, and if so, how you analyzed those provisions in accordance with the guidance in ASC 815-40. Your response should address, but not be limited to, your disclosure that “If the Private Placement Warrants are held by holders other than the Sponsor or its permitted transferees, the Private Placement Warrants are redeemable by the Company in all redemption scenarios and exercisable by the holders on the same basis as the warrants included in the Units sold in the Public Offering.”

Response:

The Company respectfully acknowledges the Staff’s comment and confirms that the private placement warrants are correctly classified as equity instruments. The private placement warrants are not redeemable, and transfers are restricted. There is no scenario in which the private placement warrants become treated as public warrants and eligible for redemption. Accordingly, there is no scenario in which the holder of the instruments becomes a fair value input that would violate the indexation requirements under ASC 815-40.

Davis Polk & Wardwell London LLP is a limited liability partnership formed under the laws of the State of New York, USA and is authorised and regulated by the Solicitors Regulation Authority with registration number 566321. Davis Polk includes Davis Polk & Wardwell LLP and its associated entities

Please refer to the warrant memo attached as Exhibit A hereto for the full analysis on the Company’s warrants. Also, the Company will include in future Forms 10-Q and Forms 10-K to be filed with the Commission prior to the completion of its initial business combination and, if appropriate, any proxy and/or registration statement to be filed with the Commission in connection with the Company’s initial business combination, appropriate revised disclosure to reflect the content of the attached warrant memo.

General

2. With a view toward disclosure, please tell us whether your sponsor is, is controlled by, or has substantial ties with a non-U.S. person. If so, please revise your disclosure in future filings to include disclosure that addresses how this fact could impact your ability to complete your initial business combination. For instance, discuss the risk to investors that you may not be able to complete an initial business combination with a U.S. target company should the transaction be subject to review by a U.S. government entity, such as the Committee on Foreign Investment in the United States (CFIUS), or ultimately prohibited. Disclose that as a result, the pool of potential targets with which you could complete an initial business combination may be limited. Further, disclose that the time necessary for government review of the transaction or a decision to prohibit the transaction could prevent you from completing an initial business combination and require you to liquidate. Disclose the consequences of liquidation to investors, such as the losses of the investment opportunity in a target company, any price appreciation in the combined company, and the warrants, which would expire worthless. Please include an example of your intended disclosure in your response.

Response:

The Company respectfully acknowledges the Staff’s comment and confirms that the Company’s sponsor, Forbion Growth Sponsor FEAC I B.V., is controlled by, and has substantial ties with, non-U.S. persons domiciled principally in The Netherlands. The Company does not believe that any such relationships would materially impair the ability of the Company to complete a business combination. The Company will, however, include in future Forms 10-Q and Forms 10-K to be filed with the Commission prior to the completion of its initial business combination and, if appropriate, any proxy and/or registration statement to be filed with the Commission in connection with the Company’s initial business combination, the following language highlighting the risk to investors that the Company may not be able to complete an initial business combination with a U.S. target company should the transaction be subject to review by a U.S. government entity, such as the Committee on Foreign Investment in the United States (CFIUS).

“We may not be able to complete an initial business combination with a U.S. target company if such initial business combination is subject to U.S. foreign investment regulations or review by a U.S. government entity, such as the Committee on Foreign Investment in the United States (“CFIUS”).

Our Sponsor is controlled by, and has substantial ties with, non-U.S. persons domiciled principally in The Netherlands. Acquisitions and investments by non-U.S. Persons in certain U.S. business may be subject to rules or regulations that limit foreign ownership. In addition, CFIUS is an interagency committee authorized to review certain transactions involving investments by foreign persons in U.S. businesses that have a nexus to, amongst other things, critical technologies, critical infrastructure and/or sensitive personal data in order to determine the effect of such transactions on the national security of the United States. For so long as our Sponsor retains a material ownership interest in us, we may be deemed a “foreign person” under such rules and regulations, any proposed business combination between us and a U.S. business engaged in a regulated industry or which may affect national security could be subject to such foreign ownership restrictions, CFIUS review and/or mandatory filings. If our potential initial business combination with a U.S. business falls within the scope of foreign ownership restrictions, we may be unable to consummate an initial business combination with such business. In addition,

| 2 |

if our potential business combination falls within CFIUS’s jurisdiction, we may be required to make a mandatory filing or determine to submit a voluntary notice to CFIUS, or to proceed with the initial business combination without notifying CFIUS and risk CFIUS intervention, before or after closing the initial business combination. CFIUS may decide to block or delay our initial business combination, impose conditions to mitigate national security concerns with respect to such initial business combination or order us to divest all or a portion of any U.S. business of the combined company if we proceed without first obtaining CFIUS clearance. These potential limitations and risks may limit the attractiveness of a transaction with us or prevent us from pursuing certain initial business combination opportunities that we believe would otherwise be beneficial to us and our shareholders. As a result, the pool of potential targets with which we could complete an initial business combination may be limited and we may be adversely affected in competing with other special purpose acquisition companies which do not have similar foreign ownership issues. Moreover, the process of government review, whether by CFIUS or otherwise, could be lengthy. Because we have only a limited time to complete our initial business combination, our failure to obtain any required approvals within the requisite time-period may require us to liquidate. If we liquidate, our public shareholders may only receive their pro rata share of amounts held in the trust account, and our warrants will expire worthless. This will also cause you to lose any potential investment opportunity in a target company and the chance of realizing future gains on your investment through any price appreciation in the combined company.”

Form 10-Q for the quarterly period ended September 30, 2022

Signatures, page 31

3. We note that your Form 10-Q filings do not appear to have been signed by your principal financial or chief accounting officer. Please tell us how you have complied with General Instruction G to Form 10-Q or revise your filings to comply.

Response:

The Company respectfully acknowledges and agrees with the Staff’s comment. The signature pages of the Form 10-Q filings inadvertently omitted the signatures of the Company’s principal financial officer and principal accounting officer. The Company will file amendments to the Forms 10-Q for the quarterly periods ended September 30, 2021, March 31, 2022, June 30, 2022, and September 30, 2022 with the Staff electronically via EDGAR solely to amend the signature pages of such Forms 10-Q to include the signature of the Company’s principal financial officer and principal accounting officer as required by General Instruction G of Form 10-Q.

*****

We hope that the foregoing has been responsive to the Staff’s comments. To the extent that you have any questions regarding the responses contained in this letter, please do not hesitate to contact me at +44 20 7418 1334 or leo.borchardt@davispolk.com. Thank you for your time and attention.

Very truly yours,

/s/ Leo Borchardt

Leo Borchardt, Esq.

| cc: | Cyril Lesser, Chief Financial Officer |

Forbion European Acquisition Corp.

| 3 |

Exhibit A

Warrant Memo

| 4 |

Purpose

The purpose of this memo is to determine the accounting classification and treatment of Public and Private Placement Warrants of Forbion European Acquisition Corp. (“Forbion”, “we” or the “Company”).

Summary Conclusion

The Public Warrants and Private Placement Warrants should be classified as equities.

Company Background

Forbion was incorporated as a Cayman Islands exempted company on August 9, 2021. The Company was incorporated for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar Business Combination with one or more businesses or entities (the “Business Combination”).

The Company’s ability to commence operations is contingent upon obtaining adequate financial resources through the Proposed Offering of 11,000,000 units (each, a “Unit” and collectively, the “Units”) at a purchase price of $10.00 per unit (or 12,650,000 Units if the underwriter’s over-allotment option is exercised in full). Each Unit consists of one ordinary share (such ordinary shares included in the Units being offered, the “Public Shares”), one-third of one redeemable warrant (each, a “Public Warrant”). Each whole warrant entitles the holder to purchase one Class A Ordinary Share at a price of $11.50. Each warrant will become exercisable on the later of 30 days after the completion of the Business Combination and will expire 5 years after the completion of the Business Combination, or earlier upon redemption or liquidation. The Company has granted the underwriter a 45-day option to purchase up to an additional 1,650,000 Units to cover over-allotments, if any. The Sponsor has committed to purchase an aggregate of 4,700,000 warrants (or 5,195,000 warrants if the underwriters’ over-allotment option is exercised in full) (the “Private Placement Warrants”), each exercisable to purchase one Class A Ordinary Share at $11.50 per share, at a price of $1.50 per Private Placement Warrant in a private placement to the Sponsor that will close simultaneously with the Proposed Public Offering.

1

Features of Public Warrants:

| • | Each of the Class A Ordinary Share, and warrants may trade separately on the 52th day following the date of the Prospectus. |

| • | Each warrant entitles the holder to purchase one ordinary share at a price of $11.50 per share, subject to adjustment, at any time commencing on the later of 30 days after the completion of an initial Business Combination (“IBC”). |

| • | Each warrant may be exercised only during the period (the “Exercise Period”) commencing thirty (30) days after the first date of a Business Combination, and terminating at the earliest to occur of: (x) at 5:00 p.m., New York City time on the date that is five (5) years after the date on which the Company completes its IBC, (y) the liquidation of the Company, and (z) other than with respect to the Private Placement Warrants, the Working Capital Warrants and Extension Warrants, at 5:00 p.m., New York City time on the Redemption Date. |

| • | The warrant exercise price is $11.50 per share, subject to adjustment herein. In addition, if (x) the Company issues additional Ordinary Shares or equity-linked securities for capital raising purposes in connection with the closing of the IBC at an issue price or effective issue price of less than $9.20 per Ordinary Share (with such issue price or effective issue price to be determined in good faith by the Board and, in the case of any such issuance to the initial shareholders or their affiliates, without taking into account any Class B Ordinary Shares held by such shareholders or their affiliates, as applicable, prior to such issuance (the “Newly Issued Price”)), (y) the aggregate gross proceeds from such issuances represent more than 60% of the total equity proceeds, and interest thereon, available for funding the IBC on the date of the completion of the Company’s IBC (net of redemptions), and (z) the volume weighted average trading price of the Ordinary Shares during the 20 trading day period starting on the trading day prior to the day on which the Company consummates the Business Combination (such price, the “Market Value”) is below $9.20 per share, the Warrant Price shall be adjusted (to the nearest cent) to be equal to 115% of the higher of the Market Value and the Newly Issued Price, and the $18.00 per share redemption trigger price described in Section 6.1 below shall be adjusted (to the nearest cent) to be equal to 180% of the higher of the Market Value and the Newly Issued Price. |

| • | The outstanding warrants may be redeemed, at the option of the Company, at any time while they are exercisable and prior to their expiration, at the office of the Warrant Agent, upon notice to the Registered Holders of the Warrants, at a Redemption Price of $0.01 per warrant; provided that (a) the Reference Value equals or exceeds $18.00 per share (subject to adjustment), and (b) there is an effective registration statement covering the Ordinary Shares issuable upon exercise of the warrants, and a current prospectus relating thereto, available throughout the 30-day Redemption Period or the Company has elected to require the exercise of the warrants on a “cashless basis” pursuant to subsection. |

| • | The warrants will expire on the date that is five (5) years after the date on which the Company completes its IBC, or earlier upon redemption or liquidation. |

| • | Net cash settlement is prohibited per the agreement. |

Features of Private Warrants:

Private Placement Warrants have terms and provisions that are identical to the terms and provisions governing the Public Warrants with the exception that the Private Placements Warrants:

| • | May be exercised on a cash or cashless basis; |

| • | Are not transferable; and |

| • | Are not redeemable. |

2

As noted below, the above provisions related to the Private Placement Warrants do not create a scenario in which the holder of the warrant is an input to its fair value. Such scenarios violate the equity indexation provisions of ASC 815-40 and would require the warrants to be accounted for as liabilities.

Background

On April 12, 2021, John Coates, Acting Director, Division of Corporation Finance, and Paul Munter, Acting Chief Accountant, issued a statement on the accounting of warrants issued by special purchase acquisition companies like the Company entitled “Staff Statement on Accounting and Reporting Considerations for Warrants Issued by Special Purpose Acquisition Companies (“SPACs”)” to highlight the potential accounting implications of certain terms that may be common in warrants included in SPAC transactions and to discuss the financial reporting considerations that apply if a registrant and its auditors determine there is an error in any previously-filed financial statements.

As per the release (https://www.sec.gov/news/public-statement/accounting-reporting-warrants-issued-spacs#_ftn10), the guidance as discussed below focused on Indexation and Tender Offer Provisions.

Indexation

U.S. Generally Accepted Accounting Principles (“GAAP”) includes guidance that entities must consider in determining whether to classify contracts that may be settled in its own stock, such as warrants, as equity of the entity or as an asset or liability. Evaluation of this guidance requires an evaluation of the specific terms of the contract and also of an entity’s specific facts and circumstances.

An equity-linked financial instrument (or embedded feature) must be considered indexed to an entity’s own stock in order to qualify for equity classification. While many instruments include a fixed strike price or a fixed number of shares used to calculate the settlement amount, other instruments may include variables that could affect the settlement amount. Such variables do not preclude a conclusion that the instrument is indexed to an entity’s own stock if the variables would be inputs to the fair value of a fixed-for-fixed forward or option on equity shares. To assist in an entity’s evaluation, GAAP includes a list of such inputs.

We recently evaluated a fact pattern relating to the terms of warrants that were issued by a SPAC. In this fact pattern, the warrants included provisions that provided for potential changes to the settlement amounts dependent upon the characteristics of the holder of the warrant. Because the holder of the instrument is not an input into the pricing of a fixed-for-fixed option on equity shares, OCA staff concluded that, in this fact pattern, such a provision would preclude the warrants from being indexed to the entity’s stock, and thus the warrants should be classified as a liability measured at fair value, with changes in fair value each period reported in earnings.

3

Tender Offer Provisions

GAAP further includes a general principle that if an event that is not within the entity’s control could require net cash settlement, then the contract should be classified as an asset or a liability rather than as equity. However, GAAP provides an exception to this general principle whereby equity classification would not be precluded if net cash settlement can only be triggered in circumstances in which the holders of the shares underlying the contract also would receive cash. Scenarios where this exception would apply include events that fundamentally change the ownership or capitalization of an entity, such as a change in control of the entity, or a nationalization of the entity.

We recently evaluated a fact pattern involving warrants issued by a SPAC. The terms of those warrants included a provision that in the event of a tender or exchange offer made to and accepted by holders of more than 50% of the outstanding shares of a single class of ordinary shares, all holders of the warrants would be entitled to receive cash for their warrants. In other words, in the event of a qualifying cash tender offer (which could be outside the control of the entity), all warrant holders would be entitled to cash, while only certain of the holders of the underlying ordinary shares would be entitled to cash. OCA staff concluded that, in this fact pattern, the tender offer provision would require the warrants to be classified as a liability measured at fair value, with changes in fair value reported each period in earnings.

The evaluation of the accounting for contracts in an entity’s own equity, such as warrants issued by a SPAC, requires careful consideration of the specific facts and circumstances for each entity and each contract. OCA is available for consultation on accounting and financial reporting issues, including relating to an entity’s specific fact pattern on issues similar to those described above or on other instruments and accounting issues.

Authoritative Guidance

| • | Accounting Standards Codification No. 815 – Derivatives and Hedging (“ASC 815”) |

| • | Accounting Standards Codification No. 480 – Distinguishing liabilities from equity (“ASC 480”) |

Interpretive Guidance

| • | EY Financial Reporting Development– Issuer’s accounting for debt and equity financings (the “EY FRD”) |

| • | Deloitte - Accounting and SEC Reporting Considerations for SPAC Transactions |

4

Accounting Issue: How should the Company classify the Public and Private Warrants?

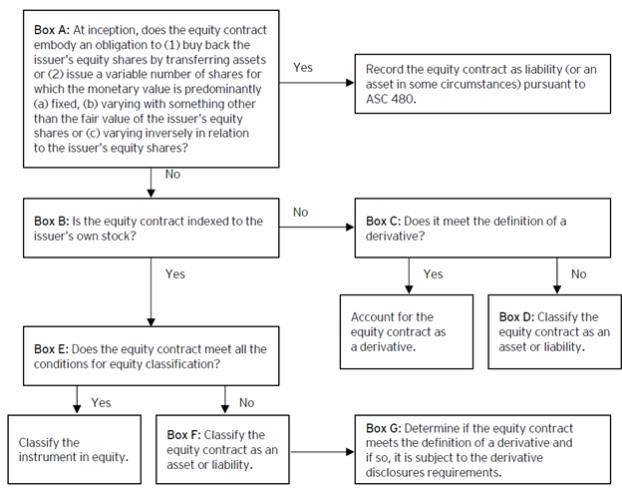

In determining the classification of the Public and Private Placement Warrants, management has considered the accounting guidance contained within ASC 815 as well as ASC 480. The guidance below is done in steps to determine whether the Public and Private Placement Warrants are freestanding or embedded, liabilities in accordance with ASC 480, indexed to the Company’s stock, meet the definition of a derivative (if not considered indexed to the Company’s stock) or meet the qualifications of equity classification (if indexed to the Company’s stock).

Accounting Guidance

ASC 815-10 Overall

The following table contained within EY FRD section 4.2 walks through the analysis of whether an equity contract is considered a liability or equity.

5

Viewing a Contract as Freestanding or Embedded

Step 1 – Are the Public and Private Placement Warrants Freestanding or Embedded?

The first step is to determine whether the Public Warrants and Private Placement Warrants are freestanding financial instruments. A freestanding financial instrument is one that meets either of the following conditions:

| a. | It is entered into separately and apart from any of the entity’s other financial instruments or equity transactions. |

| b. | It is entered into in conjunction with some other transaction and is legally detachable and separately exercisable. |

The notion of an embedded derivative, as discussed in paragraph 815-15-25-1, does not contemplate features that may be sold or traded separately from the contract in which those rights and obligations are embedded. Assuming they meet this Subtopic’s definition of a derivative instrument, such features shall be considered attached freestanding derivative instruments rather than embedded derivatives by both the writer and the current holder.

Accounting Analysis and Conclusions

Public Warrants

The Public Warrants were issued collectively with the Units issued in the Initial Public Offering. ) Each Unit will consist of one Class A ordinary share and one-third of one redeemable warrant (“Public Warrant”). Each whole Public Warrant will entitle the holder to purchase one Class A ordinary share at an exercise price of $11.50 per whole share. The Public Warrants are publicly traded under a separate ticker from the Company’s shares of common stock and therefore, are considered legally detachable and separable. As such, the Public Warrants are considered to be freestanding instruments, as they are legally detachable from the Unit and the ordinary shares and are separately exercisable.

Private Placement Warrants

The Private Placement Warrants were issued on a standalone basis and are separately exercisable. The Private Placement Warrants are freestanding instruments.

Step 2 – Are the Public and Private Placement Warrants within the scope of ASC 480 to be classified as a liability?

The next step is to assess whether the warrants are within the scope of ASC 480. A freestanding written call option on a company’s own shares (i.e., a warrant) would typically be excluded from ASC 480. The following instruments would be classified as a liability within the scope of ASC 480 (based on 480-10-25):

| 1. | Mandatorily redeemable financial instruments issued in the form of shares. |

| 2. | Obligations that require or may require repurchase of the issuer’s equity shares by transferring assets (e.g., written put options and forward purchase contracts), and |

| 3. | Certain obligations to issue a variable number of shares where at inception the monetary value of the obligation is based solely or predominantly on: |

| a. | A fixed monetary amount known at inception, for example, a payable settleable with a variable number of the issuer’s equity shares, |

| b. | Variations in something other than the fair value of the issuer’s equity shares, for example, a financial instrument indexed to the S&P 500 and settleable with a variable number of the issuer’s equity shares, or |

| c. | Variations inversely related to changes in the fair value of the issuer’s equity shares, for example, a written put option that could be net share settled. |

6

The warrants do not meet the criteria in ASC 480-10-25, above, for liability classification and therefore are not within the scope of ASC 480. Specifically:

| 1. | The warrants are not mandatorily redeemable, so criterion 1, above, is not applicable. The Company has the option to call the Private Placement Warrants in Section 6.1, but this is not mandatory redemption. |

| 2. | The warrants represent an obligation to issue ordinary share of the Company. They do not represent an obligation of the Company to purchase its own equity shares (criterion 2, above). |

| 3. | The warrants obligate the Company to issue a fixed number of ordinary shares at the exercise price, so criterion 3, above, is also not applicable. The adjustment provisions for Split-Ups; Extraordinary Dividends; Aggregation of Shares, and the related Adjustments in Exercise Price may potentially result in a variable number of shares to be issued but as these adjustments are intended to maintain the economic value of the warrants after such significant events, the provisions do not result in the warrants being within the scope of ASC 480. The adjustments in the down round provision also do not result in the warrants being within the scope of ASC 480. |

Management notes that the warrants do not exhibit any of the characteristics in ASC 480 and, therefore, would not be classified as liabilities under ASC 480.

Step 3 – Are the Public and Private Placement Warrants indexed to the Company’s common stock (Box B)?

Accounting guidance

The guidance in ASC 815-40 must be applied to freestanding instruments, regardless of whether the instrument meets the definition of a derivative. If an instrument is not considered indexed to the reporting entity’s own stock, it should be classified as an asset or a liability and recorded at fair value with changes in fair value recorded in the income statement. This applies to freestanding instruments that meet the definition of a derivative, and those that do not.

Accounting Analysis

The outstanding Public and Private Placement Warrants are freestanding financial instruments that were issued in connection with the Company’s Initial Public Offering which would allow for the potential future purchase of shares. They have been determined to be freestanding instruments and were evaluated for inclusion in Topic 480 above and were not within the scope of that standard.

Accounting guidance

Indexed to a Company’s Own Stock (ASC 815-40-15)

ASC 815-40-15 addresses when an instrument, or embedded component that meets the definition of a derivative, is considered indexed to a reporting entity’s own stock. The guidance requires a reporting entity to evaluate an instruments contingent exercise provisions and then the instruments settlement provisions, using the following two-step assessment outlined in ASC 815-40-15-5 through 15-8 with implementation guidance in ASC 815-40-55-26 through 55-48:

Step 1 — Evaluate any exercise contingencies — Exercise contingencies based on an observable market or index that is not based on the issuer’s stock or operations preclude an instrument from being considered indexed to an entity’s own stock.

7

Step 2 — Evaluating whether each settlement provision is consistent with a fixed-for-fixed equity instrument — Any settlement amount not equal to the difference between the fair value of a fixed number of the entity’s equity shares and a fixed monetary amount precludes an instrument from being considered indexed to an entity’s own stock (with a certain exception for variables that would be inputs to the valuation model for a fixed-for-fixed forward or option contract).

Exercise contingency is defined as “a provision that entitles the entity (or the counterparty) to exercise an equity-linked financial instrument (or embedded feature) based on changes in an underlying, including the occurrence (or nonoccurrence) of a specified event. Provisions that accelerate the timing of the entity’s (or the counterparty’s) ability to exercise an instrument and provisions that extend the length of time that an instrument is exercisable are examples of exercise contingencies.”

ASC 815-40-15-7A states that “an exercise contingency would not preclude an instrument (or embedded feature) from being considered indexed to an entity’s own stock provided that it is not based on (a) an observable market, other than the market for the issuer’s stock (if applicable), or (b) an observable index, other than an index calculated or measured solely by reference to the issuer’s own operations (for example, sales revenue of the issuer, EBITDA of the issuer, net income of the issuer, or total equity of the issuer).” If the evaluation of Step 1 does not preclude an instrument from being considered indexed to the entity’s own stock, the analysis would proceed to Step 2. ASC 815-40-15-7B goes on to state that “provisions that accelerate the timing of the entity’s (or the counterparty’s) ability to exercise an instrument and provisions that extend the length of time that an instrument is exercisable are examples of exercise contingencies.”

Step One – Exercise Contingencies

Any contingent provision that affects the holder’s ability to exercise the instrument or embedded component must be evaluated. ASC 815-40-20 defines an exercise contingency as “a provision that entitles the entity (or the counterparty) to exercise an equity-linked financial instrument (or embedded feature) based on changes in an underlying, including the occurrence (or nonoccurrence) of a specified event. Provisions that accelerate the timing of the entity’s (or the counterparty’s) ability to exercise an instrument and provisions that extend the length of time that an instrument is exercisable are examples of exercise contingencies.”

Accounting analysis

Section 3.3.5 of the proposed warrant agreement (Maximum Percentage) contains an exercise contingency. Additionally, the Company’s call option in Section 6.1 is considered an exercise contingency. In applying Step 1, an exercise contingency does not preclude an instrument from being considered indexed to an entity’s own stock provided that it is not based on either of the following, according to ASC 815-40-15-7B:

| a. | An observable market, other than the market for the issuer’s stock (if applicable) |

| b. | An observable index, other than an index calculated or measured solely by reference to the issuer’s own operations (e.g., sales revenue of the issuer, earnings before interest, taxes, depreciation and amortization of the issuer, net income of the issuer, or total equity of the issuer) |

8

The exercise contingencies in Section 3.3.5 and Section 6.1 (public warrants only) are not based on an observable market or an observable index, so the evaluation of Step 1 does not preclude the warrant from being considered indexed to the entity’s own ordinary shares.

Step Two – Settlement Provisions

An instrument shall be considered indexed to an entity’s own stock if its settlement amount will equal the difference between the following:

| a. | The fair value of a fixed number of the entity’s equity shares. |

| b. | A fixed monetary amount or a fixed amount of a debt instrument issued by the entity. |

The strike price or the number of shares used to calculate the settlement amount is not considered fixed if the terms of the instrument or embedded component allow for any potential adjustment (except as discussed below), regardless of the probability of the adjustment being made or whether the reporting entity can control the adjustment.

ASC 815-40-15-7E discusses the exception to the “fixed for fixed” rule. This exception allows an instrument to be considered indexed to the reporting entity’s own stock even if adjustments to the settlement amount can be made, provided those adjustments are based on standard inputs used to determine the value of a “fixed for fixed” forward or option on equity shares.

A fixed-for-fixed forward or option on equity shares has a settlement amount that is equal to the difference between the price of a fixed number of equity shares and a fixed strike price. The fair value inputs of a fixed-for-fixed forward or option on equity shares may include the entity’s stock price and additional variables, including all of the following:

| a. | Strike price of the instrument |

| b. | Term of the instrument |

| c. | Expected dividends or other dilutive activities |

| d. | Stock borrow cost |

| e. | Interest rates |

| f. | Stock price volatility |

| g. | The entity’s credit spread |

| h. | The ability to maintain a standard hedge position in the underlying shares. |

Settlement adjustments designed to protect a holder’s position from being diluted by a transaction initiated by an issuer will generally not prevent a freestanding instrument or embedded component from being considered indexed to the issuer’s own stock provided the adjustments are limited to the effect that the dilutive event has on the shares underlying instrument. Common examples of acceptable adjustments include the occurrence of a stock split, rights offering, stock dividend, or a spin-off. In addition, settlement adjustments due to issuances of shares for an amount below current fair value, or repurchases of shares for an amount that exceeds the current fair value of those shares, should also be acceptable.

Accounting analysis

Public / Private Warrants

Management analyzed the adjustments to the exercise price under Step 2 of ASC 815-40-15-7. The warrant agreement provides for an adjustment to the number of common shares issuable under the warrants and/or adjustment to the exercise price, in the following provisions:

Anti-Dilution Adjustments

Split-Ups. If after the date hereof, and subject to the provisions of Section 4.6 below, the number of outstanding Ordinary Shares is increased by a share capitalization payable in Ordinary Shares, or by a split-up of Ordinary Shares or other similar event, then, on the effective date of such share capitalization, split-up or similar event, the number of Ordinary Shares issuable on exercise of each Warrant shall be

9

increased in proportion to such increase in the outstanding Ordinary Shares. A rights offering to holders of the Ordinary Shares entitling holders to purchase Ordinary Shares at a price less than the “Historical Fair Market Value” (as defined below) shall be deemed a share capitalization of a number of Ordinary Shares equal to the product of (i) the number of Ordinary Shares actually sold in such rights offering (or issuable under any other equity securities sold in such rights offering that are convertible into or exercisable for Ordinary Shares) and multiplied by (ii) one (1) minus the quotient of (x) the price per Ordinary Share paid in such rights offering divided by (y) the Historical Fair Market Value. For purposes of this subsection 4.1.1, (i) if the rights offering is for securities convertible into or exercisable for Ordinary Shares, in determining the price payable for Ordinary Shares, there shall be taken into account any consideration received for such rights, as well as any additional amount payable upon exercise or conversion and (ii) “Historical Fair Market Value” means the volume weighted average price of the Ordinary Shares as reported during the ten (10) trading day period ending on the trading day prior to the first date on which the Ordinary Shares trade on the applicable exchange or in the applicable market, regular way, without the right to receive such rights. No Ordinary Shares shall be issued at less than their par value.

Extraordinary Dividends. If the Company, at any time while the Warrants are outstanding and unexpired, shall pay a dividend or make a distribution in cash, securities or other assets to the holders of Ordinary Shares on account of such Ordinary Shares (or other shares of the Company’s share capital into which the Warrants are convertible), other than (a) as described in subsection 4.1.1 above, (b) Ordinary Cash Dividends (as defined below), (c) to satisfy the redemption rights of the holders of Ordinary Shares in connection with a proposed initial Business Combination, (d) to satisfy the redemption rights of the holders of Ordinary Shares in connection with a shareholder vote to amend the Company’s amended and restated memorandum and articles of association (as amended from time to time, the “Charter”) (A) to modify the substance or timing of the Company’s obligation to allow redemption in connection with our initial business combination or to redeem 100% of the Ordinary Shares included in the Units sold in the Offering (the “Public Shares”) if the Company does not complete the Business Combination within the period set forth in the Charter or (B) with respect to any other material provisions relating to shareholders’ rights or pre-initial Business Combination activity or (e) in connection with the redemption of Public Shares upon the failure of the Company to complete its initial Business Combination and any subsequent distribution of its assets upon its liquidation (any such non-excluded event being referred to herein as an “Extraordinary Dividend”), then the Warrant Price shall be decreased, effective immediately after the effective date of such Extraordinary Dividend, by the amount of cash and/or the fair market value (as determined by the Board, in good faith) of any securities or other assets paid on each Ordinary Share in respect of such Extraordinary Dividend. For purposes of this subsection 4.1.2, “Ordinary Cash Dividends” means any cash dividend or cash distribution which, when combined on a per share basis, with the per share amounts of all other cash dividends and cash distributions paid on the Ordinary Shares during the 365-day period ending on the date of declaration of such dividend or distribution does not exceed $0.50 (which amount shall be adjusted to appropriately reflect any of the events referred to in other subsections of this Section 4 and excluding cash dividends or cash distributions that resulted in an adjustment to the Warrant Price or to the number of Ordinary Shares issuable on exercise of each Warrant) but only with respect to the amount of the aggregate cash dividends or cash distributions equal to or less than $0.50.

Aggregation of Shares. If after the date hereof, and subject to the provisions of Section 4.6 hereof, the number of outstanding Ordinary Shares is decreased by a consolidation, combination, reverse share split or reclassification of Ordinary Shares or other similar event, then, on the effective date of such consolidation, combination, reverse share split, reclassification or similar event, the number of Ordinary Shares issuable on exercise of each Warrant shall be decreased in proportion to such decrease in outstanding Ordinary Shares.

Adjustments in Warrant Price. Whenever the number of Ordinary Shares purchasable upon the exercise of the Warrants is adjusted, as provided in subsection 4.1.1 or Section 4.2 above, the Warrant Price shall be adjusted (to the nearest cent) by multiplying such Warrant Price immediately prior to such adjustment by a fraction (x) the numerator of which shall be the number of Ordinary Shares purchasable upon the exercise of the Warrants immediately prior to such adjustment, and (y) the denominator of which shall be the number of Ordinary Shares so purchasable immediately thereafter.

10

Split-Ups; Extraordinary Dividends; Aggregation of Shares, and the related Adjustments in Exercise Price Analysis: ASC 815-40-55-42 states that for these types of events, if the adjustment to the strike price is based on a mathematical formula that determines the direct effect that the occurrence of such dilutive events should have on price of the underlying shares, this does not preclude an instrument from being considered indexed to the Company’s own stock, as the only variables that could affect the settlement amount would be inputs to the fair value of a fixed-for-fixed option on equity shares. As a result, these sections do not preclude the Public Warrants from being considered indexed to the Company’s own ordinary shares.

Down-round

If (x) the Company issues additional Ordinary Shares or equity-linked securities for capital raising purposes in connection with the closing of the initial Business Combination at an issue price or effective issue price of less than $9.20 per Ordinary Share (with such issue price or effective issue price to be determined in good faith by the Board and, in the case of any such issuance to the initial shareholders (as defined in the Prospectus) or their affiliates, without taking into account any Class B Ordinary Shares (as defined below) held by such shareholders or their affiliates, as applicable, prior to such issuance (the “Newly Issued Price”)), (y) the aggregate gross proceeds from such issuances represent more than 60% of the total equity proceeds, and interest thereon, available for funding the initial Business Combination on the date of the completion of the Company’s initial Business Combination (net of redemptions), and (z) the volume weighted average trading price of the Ordinary Shares during the 20 trading day period starting on the trading day prior to the day on which the Company consummates the Business Combination (such price, the “Market Value”) is below $9.20 per share, the Warrant Price shall be adjusted (to the nearest cent) to be equal to 115% of the higher of the Market Value and the Newly Issued Price, and the $18.00 per share redemption trigger price described in Section 6.1 below shall be adjusted (to the nearest cent) to be equal to 180% of the higher of the Market Value and the Newly Issued Price.

Down round Analysis:

The possibility of a market price transaction occurring at a price below $9.20 per share is not an input to the valuation of a standard “fixed for fixed” instrument on the Company’s own stock. However, the guidance in ASC 815-10-15-75A (ASU 2017-11) effectively makes an exception with respect to down round features to the base model for determining when an instrument is considered solely indexed to a company’s own stock. ASU 2017-11 allows companies to exclude a down round feature when determining whether a financial instrument is considered indexed to the entity’s own stock. Specifically, the ASU amended Step 2 of the above analysis, as follows:

“ASC 815-40-15-5D When classifying a financial instrument with a down round feature, the feature is excluded from the consideration of whether the instrument is indexed to the entity’s own stock for the purposes of applying paragraphs 815-40-15-7C through 15-7I (Step 2).”

ASU 2017-11 defines a down round feature as:

A feature in a financial instrument that reduces the strike price of an issued financial instrument if the issuer sells shares of its stock for an amount less than the currently stated strike price of the issued financial instrument or issues an equity-linked financial instrument with a strike price below the currently stated strike price of the issued financial instrument.

A down round feature may reduce the strike price of a financial instrument to the current issuance price, or the reduction may be limited by a floor or on the basis of a formula that results in a price that is at a discount to the original exercise price but above the new issuance price of the shares, or may reduce the strike price to below the current issuance price. A standard antidilution provision is not considered a down round feature.

11

ASU 2017-11 requires a company to recognize the value of a down round feature only when it is triggered and the strike price has been adjusted downward. For equity-classified freestanding equity-linked financial instruments, such as warrants, an entity will treat the value of the effect of the down round, when triggered, as a dividend and a reduction of income available to common shareholders in computing basic earnings per share.

Section 4.3.2 of the warrant agreement meets the above definition of a down round feature. As a result, this section does not preclude the Public/Private Warrants from being considered indexed to the Company’s own stock.

Conclusion: None of the above provisions preclude the Public or Private Warrants from being considered indexed to the Company’s own ordinary shares.

Step 3 – Do the Public Warrants meet all of the conditions for equity classification (Box E)?

Accounting Guidance

Evaluation of Classified in Shareholders’ Equity (ASC 815-40-25)

ASC 815-40-25-1 and 25-2 provide the general framework for determining whether an instrument that is considered indexed to an issuer’s own stock should be classified as a liability (or in some cases, an asset) or equity.

The initial balance sheet classification of contracts generally is based on the concept that:

| a. | Contracts that require net cash settlement are assets or liabilities. |

| b. | Contracts that require settlement in shares are equity instruments. |

Further, an entity shall observe both of the following:

| a. | If the contract provides the counterparty with the choice of net cash settlement or settlement in shares, Subtopic ASC 815-40-25 assumes net cash settlement. |

| b. | If the contract provides the entity with a choice of net cash settlement or settlement in shares, ASC 815-40-25 assumes settlement in shares. |

Therefore, contracts that are settled by gross physical delivery of shares or net share settlement may be equity instruments. Contracts that require or permit the investor to require a reporting entity to net cash settle are accounted for as assets or liabilities at fair value with changes in fair value recorded in earnings. Contracts that a reporting entity could be required to settle in cash should be accounted for as an asset or liability at fair value, regardless of whether net cash settlement would only occur under a remote scenario.

For a shares-settled contract to be classified as equity, each of the following additional conditions in ASC 815-40-25 (post-adoption of ASU 2020-06) must also be met to ensure that the issuer has the ability to settle the contract in shares (all of the conditions must be met).

| a. | Entity has sufficient authorized and unissued shares. The entity has sufficient authorized and unissued shares available to settle the contract after considering all other commitments that may require the issuance of ordinary shares during the maximum period the derivative instrument could remain outstanding. |

The Company has sufficient authorized and unissued shares available to settle the contract after considering all other commitments that may require the issuance of ordinary shares during the maximum period the instruments can remain outstanding.

12

| b. | Contract contains an explicit share limit. The contract contains an explicit limit on the number of shares to be delivered in a share settlement. |

The contract contains an explicit limit on the number of shares to be delivered in a share settlement.

| c. | No required cash payment (with the exception of penalty payments) if entity fails to timely file. There is no requirement to net cash settle the contract in the event the entity fails to make timely filings with the Securities and Exchanges Commission (SEC). |

The Warrant Agreement states that the Company “may” require holders to settle the warrant on a cashless basis, but it is not explicitly required.

| d. | No cash-settled top-off or make-whole provisions. There are no cash settled top-off or make-whole provisions. |

The Agreement does not include any make-whole provision.

The above conditions are intended to identify situations in which net cash settlement could be forced upon the issuer by investors or in any other circumstance, regardless of likelihood, except for (1) liquidation of the company or (2) a change in control in which the company’s shareholders also receive cash.

Conclusion – Public

Based on the analysis performed above, management has concluded that the Public Warrants are indexed to the Company’s common stock and meet each of the specific criteria to be classified as equity instruments.

How should the Company classify the Private Placement Warrants?

Conclusion – Private Placement

The Private Placement Warrants are to be issued in the same form as the Public Warrants as indicated in Section 2.6:

The Private Placement Warrants and the Working Capital Warrants shall be identical to the Public Warrants, except that the Private Placement Warrants and the Working Capital Warrants: (i) may be exercised for cash or on a “cashless basis,” pursuant to subsection 3.3.1(c) hereof, (ii) may not be transferred, assigned or sold, and (iii) shall not be redeemable by the Company pursuant to Section 6.1 hereof; provided, however, that in the case of clause (ii), the Private Placement Warrants and the Working Capital Warrants may be transferred by the holders thereof….

The above provisions make the Private Placement Warrants not eligible for redemption and not transferable. Thus there is no scenario in which the holder of the instrument becomes an input to its fair value thus conflicting with the ‘fixed for fixed’ criteria required for the warrant to be considered indexed to own equity. Accordingly, the Private Placement Warrants are classified as equity instruments.

13