The Netherlands |

4911 |

Not Applicable | ||

(Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

| Alexander Lynch, Esq. Heather Emmel, Esq. Weil, Gotshal & Manges LLP 767 5th Avenue New York, NY 10153 (212) 310-8000 |

Large accelerated filer |

☐ |

Accelerated filer |

☐ | |||

Non-accelerated filer |

☒ |

Smaller reporting company |

☐ | |||

Emerging growth company |

☒ | |||||

| ii | ||||

| ii | ||||

| ii | ||||

| iii | ||||

| iii | ||||

| v | ||||

| vii | ||||

| viii | ||||

| 1 | ||||

| 7 | ||||

| 9 | ||||

| 15 | ||||

| 45 | ||||

| 55 | ||||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| 65 | ||||

| 87 | ||||

| 97 | ||||

| 108 | ||||

| 111 | ||||

| 113 | ||||

| 116 | ||||

| 122 | ||||

| 130 | ||||

| 135 | ||||

| 135 | ||||

| 135 | ||||

| 135 | ||||

| 136 | ||||

| F-1 | ||||

| II-1 |

| • | changes in our strategy, future operations, financial position, estimated revenues and losses, projected costs, margins, cash flows, prospects and plans; |

| • | the impact of health epidemics, including the coronavirus (“ COVID-19 |

| • | expansion plans and opportunities; and |

| • | the outcome of any known and unknown litigation and regulatory proceedings. |

| • | the ability to maintain the listing of the Ordinary Shares on NYSE; |

| • | the risk that the Business Combination disrupts current plans and operations of the Company as a result of the announcement and consummation of the transactions described herein; |

| • | the Company’s ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and the ability of the Company to grow and manage growth profitably; |

| • | costs related to the Business Combination; |

| • | changes in applicable laws or regulations; |

| • | the effect of the COVID-19 pandemic on the Company’s business; |

| • | the ability to implement business plans, forecasts, and other expectations, and identify and realize additional opportunities; |

| • | the possibility that the Company may be adversely affected by other economic, business, and/or competitive factors; and |

| • | other risks and uncertainties described in this prospectus, including those under the section entitled “Risk Factors . ” |

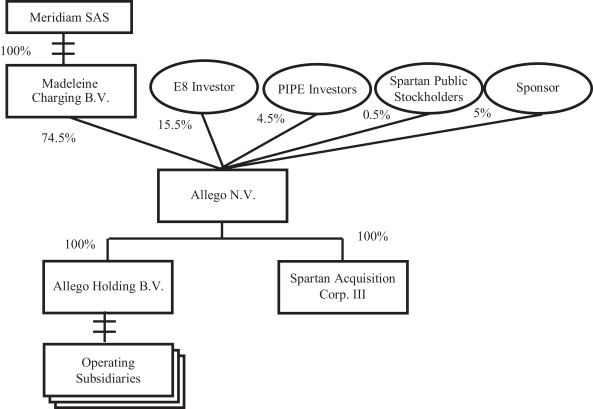

| • | each of Madeleine and E8 Investor, contributed to Allego all of the issued and outstanding Allego Holding Shares held by it, in exchange for 197,837,067 and 41,097,994 Ordinary Shares, respectively (the “ Share Contribution |

| • | each share of Spartan Founders Stock converted into one share of Spartan Class A Common Stock on a one-for-one |

| • | Spartan investors obtained ownership interests in Allego through a reverse triangular merger, whereby at the effective time thereof (the “ Effective Time Spartan Merger |

| • | Allego was converted into a Dutch public limited liability company ( naamloze vennootschap |

| • | Subscribers subscribed for Ordinary Shares in the Private Placement. |

| • | Madeleine agreed, subject to certain exceptions or with the consent of the Board, not to Transfer (as defined in the Registration Rights Agreement) securities received by it pursuant to the Business Combination Agreement until the date that is 180 days after the Closing or earlier if, subsequent to the Closing, (A) the last sale price of the Ordinary Shares equals or exceeds $12.00 per share for any 20 trading days within any 30-trading day period commencing at least 120 days after the Closing or (B) Allego consummates a liquidation, merger, stock exchange or other similar transaction which results in all of Allego’s shareholders having the right to exchange their Ordinary Shares for cash, securities or other property. |

| • | E8 Investor agreed, subject to certain exceptions, not to Transfer (as defined in the Registration Rights Agreement) securities received by it in the E8 Part B Share Issuance until the date that is 18 months after the Closing or earlier if, subsequent to the Closing, Allego consummates a liquidation, merger, stock exchange or other similar transaction which results in all of Allego’s shareholders having the right to exchange their Ordinary Shares for cash, securities or other property. |

| • | not being required to comply with the auditor attestation requirements for the assessment of our internal control over financial reporting provided by Section 404 of the Sarbanes-Oxley Act of 2002 (the “ Sarbanes-Oxley Act |

| • | reduced disclosure obligations regarding executive compensation; and |

| • | not being required to hold a nonbinding advisory vote on executive compensation or seek shareholder approval of any golden parachute payments not previously approved. |

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| • | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

| • | Allego is an early stage company with a history of operating losses, and expects to incur significant expenses and continuing losses for the near term and medium term. |

| • | Allego has experienced rapid growth and expects to invest substantially in growth for the foreseeable future. If it fails to manage growth effectively, its business, operating results and financial condition could be adversely affected. |

| • | Allego’s estimates of market opportunity and forecasts of market growth may prove to be inaccurate. |

| • | Allego currently faces competition from a number of companies and expects to face significant competition in the future as the market for EV charging develops. |

| • | Allego may need to raise additional funds or debt and these funds may not be available when needed. |

| • | If Allego fails to offer high-quality support to its customers and fails to maintain the availability of its charging points, its business and reputation may suffer. |

| • | Allego relies on a limited number of suppliers and manufacturers for its hardware and equipment and charging stations. A loss of any of these partners or issues in their manufacturing and supply processes could negatively affect its business. |

| • | Allego’s business is subject to risks associated with the price of electricity, which may hamper its profitability and growth. |

| • | Allego is dependent on the availability of electricity at its current and future charging sites. Delays and/or other restrictions on the availability of electricity would adversely affect Allego’s business and results of operations. |

| • | Allego’s EV driver base will depend upon the effective operation of Allego’s EVCloud TM platform and its applications with mobile service providers, firmware from hardware manufacturers, mobile operating systems, networks and standards that Allego does not control. |

| • | If Allego is unable to attract and retain key employees and hire qualified management, technical, engineering and sales personnel, its ability to compete and successfully grow its business would be harmed. |

| • | Allego is expanding operations in many countries in Europe, which will expose it to additional tax, compliance, market, local rules and other risks. |

| • | New alternative fuel technologies may negatively impact the growth of the EV market and thus the demand for Allego’s charging stations and services. |

| • | The European EV market currently benefits from the availability of rebates, scrappage schemes, tax credits and other financial incentives from governments to offset and incentivize the purchase of EVs. The reduction, modification, or elimination of such benefits could cause reduced demand for EVs and EV charging, which would adversely affect Allego’s financial results. |

| • | Allego’s business may be adversely affected if it is unable to protect its technology and intellectual property from unauthorized use by third-parties. |

| • | Allego’s technology could have undetected defects, errors or bugs in hardware or software which could reduce market adoption, damage its reputation with current or prospective customers, and/or expose it to product liability and other claims that could materially and adversely affect its business. |

| • | The securities being offered in this prospectus represent a substantial percentage of our outstanding Ordinary Shares, and the sales of such securities could cause the market price of our Ordinary Shares to decline significantly. |

| • | Members of Allego’s management have limited experience in operating a public company. |

| • | The exclusive forum clause set forth in the Warrant Agreement may have the effect of limiting an investor’s rights to bring legal action against Allego and could limit the investor’s ability to obtain a favorable judicial forum for disputes with us. |

| • | Future sales, or the perception of future sales, of our Ordinary Shares being offered in this prospectus by us or the Selling Securityholders or pursuant to future offerings by shareholders with registration rights could cause the market price for our Ordinary Shares and Warrants to decline significantly. |

| • | Madeleine owns a significant amount of Allego’s voting shares and its interests may conflict with those of other stockholders. |

| Ordinary Shares to be issued upon exercise of all Warrants |

13,799,948 |

| Ordinary Shares offered by the Selling Securityholders |

68,132,943 |

| Offering Price |

The exercise price for the Ordinary Shares that may be issued upon exercise of Warrants is $11.50 per share. |

| The Ordinary Shares offered by the Selling Securityholders under this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the Selling Securityholders may determine. See the section entitled “ Plan of Distribution |

| Use of Proceeds |

We will receive up to an aggregate of $158,699,402 if all the Warrants are exercised to the extent such Warrants are exercised for cash. We expect to use the net proceeds from the exercise of the Warrants for general corporate purposes. We will not receive any proceeds from the sale of the Ordinary Shares to be offered by the Selling Securityholders. We believe the likelihood that Warrant holders will exercise their Warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the market price of our Ordinary Shares. If the market price for our Ordinary Shares is less than $11.50 per share, we believe the Warrant holders will be less likely to exercise their Warrants. As of May 18, 2022, the closing price of our Ordinary Shares was $8.26. |

| Dividend policy |

We intend to retain all available funds and any future earnings to fund the further development and expansion of our business. Under Dutch law, Allego may only pay dividends and other distributions from our reserves to the extent its shareholders’ equity ( eigen vermogen |

| it concerns a distribution of profits) after adoption of Allego’s statutory annual accounts by the General Meeting from which it appears that such dividend distribution is allowed. Subject to those restrictions, any future determination to pay dividends or other distributions from its reserves will be at the discretion of the Board and will depend upon a number of factors, including our results of operations, financial condition, future prospects, contractual restrictions, restrictions imposed by applicable law and other factors we deem relevant. |

| Registration Rights and Lock-Up Agreement |

Certain of our shareholders are subject to certain restrictions on transfer until the termination of applicable lock-up periods. See “Certain Relationships and Related Person Transactions |

| Market for our securities |

Our Ordinary Shares and Warrants are listed on the NYSE under the symbols “ALLG” and ALLG.WS,” respectively. |

| Risk factors |

Investing in our securities involves substantial risks. See “ Risk Factors |

Balance Sheet Data: |

As of December 31, 2021 |

As of December 31, 2020 |

||||||

| Assets: |

||||||||

| Current Assets: |

||||||||

| Cash |

$ | 4,160 | $ | — | ||||

| Prepaid expenses |

875,400 | — | ||||||

| |

|

|

|

|||||

| Total Current Assets |

879,560 | — | ||||||

| Investments held in Trust Account |

552,053,864 | — | ||||||

| Deferred offering costs |

— | 93,774 | ||||||

| |

|

|

|

|||||

| Total Assets |

$ | 552,933,424 | $ | 93,774 | ||||

| |

|

|

|

|||||

| Total Liabilities |

$ | 62,198,326 | $ | 70,824 | ||||

| Class A common stock subject to possible redemption |

552,000,000 | — | ||||||

| Total stockholders’ equity (deficit) |

(61,264,902 | ) | 22,950 | |||||

| Total Liabilities, Class A Common Stock Subject to Possible Redemption and Stockholders’ Equity (Deficit) |

$ | 552,933,424 | $ | 93,774 | ||||

| |

|

|

|

|||||

Statement of Operations Data: |

For the Year Ended December 31, 2021 |

From the Period from December 23, 2020 (inception) through December 31, 2020 |

||||||

| Loss from operations |

$ | (9,252,908 | ) | $ | — | |||

| Net loss |

$ | (12,632,433 | ) | $ | (2,050 | ) | ||

| Weighted average shares outstanding of Class A common stock |

48,999,452 | — | ||||||

| Basic and diluted net loss per share, Class A common stock |

$ | (0.20 | ) | $ | — | |||

| Weighted average shares outstanding of Class B common stock |

13,597,808 | 12,000,000 | ||||||

| Basic and diluted net loss per share, Class B common stock |

$ | (0.20 | ) | $ | (0.00 | ) | ||

For the financial year ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

| (in €’000) |

||||||||||||

| Total revenue from contracts with customers |

86,291 | 44,249 | 25,822 | |||||||||

| Cost of sales (excluding depreciation and amortization expense) |

(61,122 | ) | (30,954 | ) | (20,911 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Gross profit |

25,169 |

13,295 |

4,911 |

|||||||||

| Other income |

10,853 | 5,429 | 3,475 | |||||||||

| Selling and distribution expenses |

(2,472 | ) | (3,919 | ) | (6,068 | ) | ||||||

| General and administrative expenses |

(337,451 | ) | (47,468 | ) | (39,199 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Operating loss |

(303,901 |

) |

(32,663 |

) |

(36,881 |

) | ||||||

| Finance costs |

(15,419 | ) | (11,282 | ) | (5,947 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Loss before income tax |

(319,320 |

) |

(43,945 |

) |

(42,828 |

) | ||||||

| Income taxes |

(352 | ) | 689 | (276 | ) | |||||||

| |

|

|

|

|

|

|||||||

| Loss for the year |

(319,672 |

) |

(43,256 |

) |

(43,104 |

) | ||||||

As of December 31, |

||||||||

2021 |

2020 |

|||||||

| (in € ‘000) |

||||||||

| ASSETS |

||||||||

| Non-current assets |

100,382 | 75,236 | ||||||

| Current assets |

119,018 | 46,430 | ||||||

| |

|

|

|

|||||

| Total assets |

219,400 |

121,666 |

||||||

| |

|

|

|

|||||

| EQUITY AND LIABILITIES |

||||||||

| Total Equity |

(76,652 |

) |

(73,744 |

) | ||||

| Liabilities |

||||||||

| Non-current liabilities |

239,358 | 171,894 | ||||||

| Current liabilities |

56,694 | 23,516 | ||||||

| |

|

|

|

|||||

| Total liabilities |

296,052 |

195,410 |

||||||

| |

|

|

|

|||||

| Total equity and liabilities |

219,400 |

121,666 |

||||||

| |

|

|

|

|||||

Pro Forma Combined |

||||

in € ‘000, except share and per share information |

||||

| Revenue from contracts with customers |

||||

| Charging Sessions |

26,108 | |||

| Service revenue from the sale of charging equipment |

37,253 | |||

| Service revenue from installation services |

19,516 | |||

| Service revenue from operation and maintenance of charging equipment |

3,414 | |||

| Total revenue from contracts with customers |

86,291 | |||

| Cost of sales (excluding depreciation and amortization expenses) |

(61,122 | ) | ||

| |

|

|||

| Gross profit |

25,169 |

|||

| Other income/(expenses) |

(121,537 | ) | ||

| Selling and distribution expenses |

(2,472 | ) | ||

| General and administrative expenses |

(412,571 | ) | ||

| Franchise expenses |

— | |||

| |

|

|||

| Operating loss |

(511,411 |

) | ||

| Finance costs |

(15,419 | ) | ||

| |

|

|||

| Loss before income tax |

(526,830 |

) | ||

| Income tax |

(352 | ) | ||

| |

|

|||

| Loss for the year |

(527,182 |

) | ||

| |

|

|||

| Attributable to: |

||||

| Equity holders of the Company |

(527,182 |

) | ||

| |

|

|||

| Pro forma weighted average number of shares outstanding basic and diluted |

266,665,712 | |||

| Loss per share: |

||||

| Basic and diluted loss per ordinary share |

(1.98 | ) | ||

| |

|

|||

Pro Forma Combined |

||||

in € ‘000, except share and per share information |

||||

| Total current assets |

233,707 | |||

| Total assets |

334,089 | |||

| Total equity |

107,275 | |||

| Total current liabilities |

56,694 | |||

| Total liabilities |

226,814 | |||

| • | conformity with applicable business customs, including translation into foreign languages and associated expenses; |

| • | ability to find and secure sites in new jurisdictions; |

| • | availability of reliable and high quality contractors for the development of its sites and more globally installation challenges; |

| • | challenges in arranging, and availability of, financing for customers; |

| • | difficulties in staffing and managing foreign operations in an environment of diverse culture, laws, and customers, and the increased travel, infrastructure, and legal and compliance costs associated with European operations; |

| • | differing driving habits and transportation modalities in other markets; |

| • | different levels of demand among commercial customers; |

| • | quality of wireless communication that can hinder the use of its software platform with charging stations in the field; |

| • | compliance with multiple, potentially conflicting and changing governmental laws, regulations, certifications, and permitting processes including environmental, banking, employment, tax, information security, privacy, and data protection laws and regulations such as the European Union General Data Protection Regulation ( “GDPR” |

| • | compliance with the United Kingdom Anti-Bribery Act; |

| • | safety requirements as well as charging and other electric infrastructures; |

| • | difficulty in establishing, staffing and managing foreign operations; |

| • | difficulties in collecting payments in foreign currencies and associated foreign currency exposure; |

| • | restrictions on operations as a result of the dependence on subsidies to fulfill capitalization requirements; |

| • | restrictions on repatriation of earnings; |

| • | compliance with potentially conflicting and changing laws of taxing jurisdictions, the complexity and adverse consequences of such tax laws, and potentially adverse tax consequences due to changes in such tax laws; and |

| • | regional economic and political conditions. |

| • | perceptions about EV features, quality, safety, performance and cost; |

| • | perceptions about the limited range over which EVs may be driven on a single battery charge; |

| • | competition, including from other types of alternative fuel vehicles as hydrogen or fuel cells; |

| • | concerns regarding the stability of the electrical grid; |

| • | the decline of an EV battery’s ability to hold a charge over time; |

| • | availability of service for EVs; |

| • | consumers’ perception about the convenience and cost of charging EVs; |

| • | government regulations and economic incentives, including adverse changes in, or expiration of, favorable tax incentives related to EVs, EV charging stations or decarbonization generally; and |

| • | concerns about the future viability of EV manufacturers. |

| • | current and future competitors may independently develop similar trade secrets or works of authorship, such as software; |

| • | know-how and other proprietary information Allego purports to hold as a trade secret may not qualify as a trade secret under applicable laws; and |

| • | proprietary designs, software design and technology embodied in Allego’s offers may be discoverable by third-parties through means that do not constitute violations of applicable laws. |

| • | expenditure of significant financial and product development resources, including recalls, in efforts to analyze, correct, eliminate or work around errors or defects; |

| • | loss of existing or potential customers or partners; |

| • | interruptions or delays in sales; |

| • | delayed or lost revenue; |

| • | delay or failure to attain market acceptance; |

| • | delay in the development or release of new functionality or improvements; |

| • | negative publicity and reputational harm; |

| • | sales credits or refunds; |

| • | exposure of confidential or proprietary information; |

| • | diversion of development and customer service resources; |

| • | breach of warranty claims; |

| • | contractual penalties with services customers as it doesn’t meet its contractual obligations; |

| • | legal claims under applicable laws, rules and regulations; and |

| • | an increase in collection cycles for accounts receivable or the expense and risk of litigation. |

| • | the timing and volume of new site acquisitions; |

| • | the timing of new electricity grid connections and permits; |

| • | the cost of electricity; |

| • | fluctuations in service costs, particularly due to unexpected costs of servicing and maintaining charging stations; |

| • | weaker than anticipated demand for charging stations, whether due to changes in government incentives and policies or due to other conditions; |

| • | fluctuations in sales and marketing or research and development expenses; |

| • | supply chain interruptions and manufacturing or delivery delays; |

| • | the timing and availability of new solutions and services relative to customers’ and investors’ expectations; |

| • | the length of the sales and installation cycle for a particular customer; |

| • | the impact of COVID-19 on Allego’s workforce, or those of its customers, suppliers, vendors or business partners; |

| • | disruptions in sales, operations, IT services or other business activities or Allego’s inability to attract and retain qualified personnel; and |

| • | unanticipated changes in regional, federal, state, local or foreign government incentive programs, which can affect demand for EVs. |

| • | Allego did not design and maintain formal accounting policies, procedures, including those around risk assessments, and controls, including segregation of duties, over accounts and disclosures to achieve complete, accurate and timely financial accounting, reporting and disclosures, including segregation of duties and adequate controls related to the preparation and review of journal entries. Further, Allego did not maintain sufficient entity level controls to prevent and correct material misstatements. |

| • | Allego did not design and maintain sufficient controls regarding the identification and assessment of recurring transactions in revenue recognition, including modification to contracts, inventory management and valuation, and lease accounting as well as the proper accounting of unusual significant transactions such as in areas of share-based payments, purchase options, and related parties. |

| • | Allego did not design and maintain effective controls over certain information technology (“ IT |

| • | Madeleine agreed, subject to certain exceptions or with the consent of the Board, not to Transfer (as defined in the Registration Rights Agreement) securities received by it pursuant to the Business Combination Agreement until the date that is 180 days after the Closing or earlier if, subsequent to the Closing, (A) the last sale price of the Ordinary Shares equals or exceeds $12.00 per share for any 20 trading days within any 30-trading day period commencing at least 120 days after the Closing or (B) Allego consummates a liquidation, merger, stock exchange or other similar transaction which results in all of Allego’s shareholders having the right to exchange their Ordinary Shares for cash, securities or other property. |

| • | E8 Investor agreed, subject to certain exceptions, not to Transfer (as defined in the Registration Rights Agreement) securities received by it in the E8 Part B Share Issuance until the date that is 18 months after the Closing or earlier if, subsequent to the Closing, Allego consummates a liquidation, merger, stock exchange or other similar transaction which results in all of Allego’s shareholders having the right to exchange their Ordinary Shares for cash, securities or other property. |

| • | the audited consolidated financial statements of Spartan as of December 31, 2021 and for the year then ended and the related notes thereto included elsewhere in this prospectus; and |

| • | the audited consolidated financial statements of Allego Holding as of December 31, 2021 and for the year then ended and the related notes thereto included elsewhere in this prospectus. |

| • | Allego Holding’s shareholders have the largest voting interest in Allego; |

| • | Allego Holding’s senior management is the senior management of Allego; |

| • | The business of Allego Holding will comprise the ongoing operations of Allego; and |

| • | Allego Holding is the larger entity, in terms of substantive operations and employee base. |

Allego Holding Historical IFRS |

Spartan Historical, as Converted |

IFRS Policy and Presentation Alignment |

Transaction Accounting Adjustments |

Pro Forma Combined |

||||||||||||||||||||||||||||

| U.S. GAAP | FN | FN | ||||||||||||||||||||||||||||||

| USD | EUR(1) | |||||||||||||||||||||||||||||||

| ASSETS |

||||||||||||||||||||||||||||||||

| Non-Current Assets |

||||||||||||||||||||||||||||||||

| Property, plant and equipment |

41,544 | — | — | — | — | 41,544 | ||||||||||||||||||||||||||

| Intangible assets |

8,333 | — | — | — | — | 8,333 | ||||||||||||||||||||||||||

| Right-of-use |

30,353 | — | — | — | — | 30,353 | ||||||||||||||||||||||||||

| Deferred tax assets |

570 | — | — | — | — | 570 | ||||||||||||||||||||||||||

| Other financial assets |

19,582 | — | — | — | — | 19,582 | ||||||||||||||||||||||||||

| Investments held in trust account |

— | 552,054 | 487,766 | — | (487,766 | ) | (4 |

) |

— | |||||||||||||||||||||||

| Other non-current assets |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total non-current assets |

100,382 | 552,054 | 487,766 | — | (487,766 | ) | 100,382 | |||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Current Assets |

||||||||||||||||||||||||||||||||

| Inventories |

9,231 | — | — | — | — | 9,231 | ||||||||||||||||||||||||||

| Prepayments |

11,432 | — | — | 773 | (2 |

) |

— | 12,205 | ||||||||||||||||||||||||

| Trade and other receivables |

42,077 | — | — | — | — | 42,077 | ||||||||||||||||||||||||||

| Contract assets |

1,226 | — | — | — | — | 1,226 | ||||||||||||||||||||||||||

| Cash and cash equivalents |

24,652 | 4 | 4 | — | 113,912 | (4 |

) |

138,568 | ||||||||||||||||||||||||

| Other financial assets |

30,400 | — | — | — | — | 30,400 | ||||||||||||||||||||||||||

| Prepaid expenses |

— | 875 | 773 | (773 | ) | (2 |

) |

— | — | |||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total current assets |

119,018 | 879 | 777 | — | 113,912 | 233,707 | ||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total Assets |

219,400 |

552,933 |

488,543 |

— |

(373,854 |

) |

334,089 |

|||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Allego Holding Historical IFRS |

Spartan Historical, as Converted |

IFRS Policy and Presentation Alignment |

Transaction Accounting Adjustments |

Pro Forma Combined |

||||||||||||||||||||||||||||

| U.S. GAAP | FN | FN | ||||||||||||||||||||||||||||||

| USD | EUR(1) | |||||||||||||||||||||||||||||||

| EQUITY AND LIABILITIES |

||||||||||||||||||||||||||||||||

| Equity |

||||||||||||||||||||||||||||||||

| Share capital |

1 | — | — | 1 | (2 |

) |

31,999 | (5 |

) |

32,001 | ||||||||||||||||||||||

| Share premium |

61,888 | — | — | — | 286,241 | (6 |

) |

348,129 | ||||||||||||||||||||||||

| Reserves |

4,195 | — | — | — | — | 4,195 | ||||||||||||||||||||||||||

| Retained earnings |

(142,736 | ) | — | — | (54,132 | ) | (2 |

) |

(80,182 | ) | (7 |

) |

(277,050 | ) | ||||||||||||||||||

| Preferred stock, $0.0001 par value; 1,000,000 shares authorized; none issued and outstanding |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Class A common stock, $0.0001 par value; 250,000,000 shares authorized; none issued and outstanding |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Class B common stock, $0.0001 par value; 20,000,000 shares authorized; 13,800,000 shares issued and outstanding |

— | 1 | 1 | (1 | ) | (2 |

) |

— | — | |||||||||||||||||||||||

| Additional paid-in capital |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Accumulated deficit |

— | (61,266 | ) | (54,132 | ) | 54,132 | (2 |

) |

— | — | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total equity |

(76,652 | ) | (61,265 | ) | (54,131 | ) | — | 238,058 | 107,275 | |||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Commitments and Contingencies |

||||||||||||||||||||||||||||||||

| Class A common stock, $0.0001 par value; 49,726,570 Shares subject to possible Redemption at $10.00 per share |

— | 552,000 | 487,719 | (487,719 | ) | (3 |

) |

— | — | |||||||||||||||||||||||

| Non-current liabilities |

||||||||||||||||||||||||||||||||

| Borrowings |

213,128 | — | — | 487,719 | (3 |

) |

(587,912 | ) | (8 |

) |

112,935 | |||||||||||||||||||||

| Lease liabilities |

26,097 | — | — | — | — | 26,097 | ||||||||||||||||||||||||||

| Deferred tax liabilities |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| Provisions |

133 | — | — | — | — | 133 | ||||||||||||||||||||||||||

| Due to related party |

— | — | (4 |

) |

— | |||||||||||||||||||||||||||

| Warrants |

— | 35,035 | 30,955 | — | — | 30,955 | ||||||||||||||||||||||||||

| Deferred underwriting commissions |

— | 19,320 | 17,070 | — | (17,070 | ) | (4 |

) |

— | |||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total non-current liabilities |

239,358 | 54,365 | 48,034 | 487,719 | (604,991 | ) | 170,120 | |||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Current liabilities |

||||||||||||||||||||||||||||||||

| Trade and other payables |

29,333 | — | — | 6,921 | (2 |

) |

(6,921 | ) | (4 |

) |

29,333 | |||||||||||||||||||||

| Accounts payable |

— | 89 | 79 | (79 | ) | (2 |

) |

— | — | |||||||||||||||||||||||

| Current tax liabilities |

401 | — | — | — | — | 401 | ||||||||||||||||||||||||||

| Contract liabilities |

21,192 | — | — | — | — | 21,192 | ||||||||||||||||||||||||||

| Accrued expenses |

— | 7,546 | 6,667 | (6,667 | ) | (2 |

) |

— | — | |||||||||||||||||||||||

| Franchise tax payable |

— | 198 | 175 | (175 | ) | (2 |

) |

— | — | |||||||||||||||||||||||

| Lease liabilities |

5,520 | — | — | — | — | 5,520 | ||||||||||||||||||||||||||

| Provisions |

248 | — | — | — | — | 248 | ||||||||||||||||||||||||||

| Notes payable |

— | — | — | — | — | — | ||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total current liabilities |

56,694 | 7,833 | 6,921 | — | (6,921 | ) | 56,694 | |||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total liabilities |

296,052 | 62,198 | 54,955 | 487,719 | (611,912 | ) | 226,814 | |||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total liabilities and equity |

219,400 | 552,933 | 488,543 | — | (373,854 | ) | 334,089 | |||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| (1) | The historical financial information of Spartan was prepared in accordance with U.S. GAAP and presented in USD. The historical financial information was translated from USD to EUR using the historical closing exchange rate, as of December 31, 2021, of $1.13 per EUR. |

| (2) | Reflects the reclassification adjustments to align Spartan’s historical financial statement balances with the presentation of Allego Holding’s financial statements. |

| (3) | Reflects the U.S. GAAP to IFRS conversion adjustment related to the reclassification of Spartan’s historical mezzanine equity (Spartan Class A Common Stock subject to possible redemption) into Non-current Liabilities (Borrowings). |

| (4) | Reflects pro forma adjustments to cash to reflect the following: |

| Reclassification of cash held in trust account |

487,766 | |||

| Proceeds from Private Placement |

132,532 | |||

| Payment of cash in exchange for the redemption of approximately 54 million Spartan Class A Shares |

(477,979 | ) | ||

| Payment of deferred underwriting commission |

(17.070 | ) | ||

| Payment of transaction costs incurred after December 31, 2021 in connection with the Business Combination |

(4,407 | ) | ||

| Payment of outstanding payables of Spartan |

(6,930 | ) | ||

| |

|

|||

| Total Cash Adjustment |

113,912 |

|||

| |

|

| (5) | Reflects adjustments to share capital for the following items: |

| a. | Elimination of historical Allego Holding share capital; |

| b. | The issuance of 236.7 million Ordinary Shares to shareholders of Allego Holding immediately prior to the Share Contribution; |

| c. | The issuance of 15 million Ordinary Shares to Subscribers in the Private Placement in exchange for $150 million / €132.5 million; |

| d. | The issuance of 14.9 million Ordinary Shares in exchange for 1.1 million unredeemed shares of Spartan Class A Common Stock and 13.8 million shares of Spartan Founders Stock; and |

| e. | The elimination of historical pro forma share capital of Spartan. |

| Issuance of 236.7 million Ordinary Shares to shareholders of Allego Holding immediately prior to the Share Contribution |

28,412 | |||

| Issuance of 15 million Ordinary Shares to Subscribers in the Private Placement |

1,800 | |||

| Issuance of 14.9 million Ordinary Shares to Spartan Stockholders |

1,789 | |||

| Elimination of historical Allego Holding share capital |

(1 | ) | ||

| Elimination of historical pro forma Spartan share capital |

(1 | ) | ||

| |

|

|||

| Total Share Capital Adjustment |

31,999 |

|||

| |

|

| (6) | Reflects adjustments to share premium for the following items: |

| a. | The reduction in share premium corresponding to the elimination of historical share capital of Allego Holding and issuance of Ordinary Shares; |

| b. | Share premium for the amount of the Private Placement over the nominal share value of Ordinary Shares issued; |

| c. | The fair value of Ordinary Shares issued to Spartan Stockholders, less the nominal share value of Ordinary Shares issued; |

| d. | The capitalization within share premium of certain qualifying transaction costs. Adjustment (4) above reflects the total payment of approximately €4.4 million for transaction costs incurred after December 31, 2021 which are not already included within the historical figures. Allego capitalized certain qualifying transaction costs through December 31, 2021 assuming 50% of Spartan Class A Shareholders would exercise redemption rights. Actual redemptions are higher, thus certain portion of previously capitalized transaction costs are released from share premium as an expense resulting in an increase to Share Premium; |

| e. | Immediately prior to the Closing all of Allego Holding’s outstanding shareholder loans will be converted into equity. As no new shares will be issued the full amount is an increase to share premium. |

| Offset to share premium in the amount of share capital for Ordinary Shares issued to shareholders of Allego Holding immediately prior to the Share Contribution, less historical Allego Holding share capital |

(28,411 | ) | ||

| Private Placement of $150 million / €132.5 million, less the nominal share value of shares issued |

130,732 | |||

| Fair value of Ordinary Shares issued to Spartan Stockholders, less the nominal share value of shares issued |

83,299 | |||

| Adjustment to capitalized transaction costs based upon actual redemptions and additional transaction costs incurred after December 31, 2021 |

428 | |||

| Conversion of Allego Holding shareholder loans into equity |

100,193 | |||

| |

|

|||

| Total Share Premium Adjustment |

286,241 |

|||

| |

|

| (7) | Reflects adjustments to retained earnings for the following items: |

| a. | The elimination of historical Spartan retained earnings; |

| b. | The recording of an expense in accordance with IFRS 2 for the excess of fair value of shares issued to Spartan Stockholders over the fair value of Spartan’s identifiable net assets acquired, representing compensation for services; and |

| c. | The portion of transaction costs incurred in connection with the Business Combination which is not offset in share premium as seen in adjustment (6) above. |

| Elimination of historical Spartan retained earnings |

54,132 | |||

| Expense arising under IFRS 2 for the excess of the fair value of shares issued to Spartan Stockholders over and above the fair value of Spartan’s identifiable net assets |

(129,479 | ) | ||

| Portion of additional transaction costs in connection with the Business Combination which is expensed |

(4,835 | ) | ||

| |

|

|||

| Total Retained Earnings Adjustment |

(80,182 |

) | ||

| |

|

| (8) | Reflects adjustments to borrowings for the following items: |

| a. | The elimination of shares held for redemption, included within Borrowings, which are all either redeemed by shareholders or converted into Ordinary Shares |

| b. | Immediately prior to the Closing all of Allego Holding’s outstanding shareholder loans will be converted into equity. |

| Elimination of historical shares held for redemption |

(487,719 | ) | ||

| Conversion of Allego Holding shareholder loans into equity |

(100,193 | ) | ||

| |

|

|||

| Total Borrowings Adjustment |

(587,912 |

) | ||

| |

|

Allego Holding Historical IFRS |

Spartan Historical , as Converted |

IFRS Policy and Presentation Alignment |

Transaction Accounting Adjustments |

Pro Forma Combined |

||||||||||||||||||||||||||||

| U.S. GAAP | FN | FN | ||||||||||||||||||||||||||||||

| USD | EUR(1) |

|||||||||||||||||||||||||||||||

| Revenue from contracts with customers |

||||||||||||||||||||||||||||||||

| Charging sessions |

26,108 | — | — | — | — | 26,108 | ||||||||||||||||||||||||||

| Service revenue from the sale of charging equipment |

37,253 | — | — | — | — | 37,253 | ||||||||||||||||||||||||||

| Service revenue from installation services |

19,516 | — | — | — | — | 19,516 | ||||||||||||||||||||||||||

| Service revenue from operation and maintenance of charging equipment |

3,414 | — | — | — | — | 3,414 | ||||||||||||||||||||||||||

| Total revenue from contracts with customers |

86,291 | — | — | — | — | 86,291 | ||||||||||||||||||||||||||

| Cost of sales (excluding depreciation and amortization expenses) |

(61,122 | ) | — | — | — | — | (61,122 | ) | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Gross profit |

25,169 | — | — | — | — | 25,169 | ||||||||||||||||||||||||||

| Other income/(expenses) |

10,853 | (3,380 | ) | (2,857 | ) | — | (129,533 | ) | (4 |

) |

(121,537 | ) | ||||||||||||||||||||

| Selling and distribution expenses |

(2,472 | ) | — | — | — | — | (2,472 | ) | ||||||||||||||||||||||||

| General and administrative expenses |

(337,451 | ) | (9,055 | ) | (7,654 | ) | (167 | ) | (2 |

) |

(67,299 | ) | (3 |

) |

(412,571 | ) | ||||||||||||||||

| Franchise expenses |

— | (197 | ) | (167 | ) | 167 | (2 |

) |

— | — | ||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Operating loss |

(303,901 | ) | (12,632 | ) | (10,678 | ) | — | (196,832 | ) | (511,411 | ) | |||||||||||||||||||||

| Finance costs |

(15,419 | ) | — | — | — | — | (15,419 | ) | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Loss before income tax |

(319,320 | ) | (12,632 | ) | (10,678 | ) | — | (196,832 | ) | (526,830 | ) | |||||||||||||||||||||

| Income tax |

(352 | ) | — | — | — | — | (352 | ) | ||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Loss for the year |

(319,672 | ) | (12,632 | ) | (10,678 | ) | — | (196,832 | ) | (527,182 | ) | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Attributable to: |

||||||||||||||||||||||||||||||||

| Equity holders of the Company |

(319,672 |

) |

(12,632 |

) |

(10,678 |

) |

— |

(196,832 |

) |

(527,182 |

) | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Loss per share: |

||||||||||||||||||||||||||||||||

| Basic and diluted loss per ordinary share |

(1.98 | ) | ||||||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| (1) | The historical financial information of Spartan was prepared in accordance with U.S. GAAP and presented in USD. The historical financial information was translated from USD to EUR using the average exchange rate over the period, of $1.18 per EUR. |

| (2) | Reflects the reclassification adjustments to align Spartan’s historical financial statement balances with the presentation of Allego Holding’s financial statements. |

| (3) | Reflects adjustments to general and administrative expenses for the following items: |

| a. | The additional expense to be recognized by Allego Holding related to the share-based payments made in exchange for consulting services and key management compensation equaling €361.4 million of equity-settled share-based compensation, less the €298.9 million of expense already included within the income statement of Allego Holding. |

| b. | Additional transaction costs incurred after December 31, 2021 which are expensed through Other income/(expense). |

| Additional expense related to share-based expense for consulting fees and key management compensation |

(62,464 | ) | ||

| Portion of transaction costs incurred after December 31, 2021 in connection with the Business Combination which is expensed |

(4,835 | ) | ||

| |

|

|||

| General and Administrative Expenses Adjustment |

(67,299 |

) | ||

| |

|

| (4) | Reflects adjustments to Other income/(expense) expenses for the following items: |

| a. | Elimination of interest income earned on the balance held within the trust account. |

| b. | Expense for the excess of the fair value of Ordinary Shares issued over the fair value of Spartan’s identifiable net assets acquired recognized in other income/(expenses) in accordance with IFRS 2 in the amount of €129.5. A one percent change in Spartan’s market price per share would result in a change of €0.8 million in the estimated expense. |

| Elimination of interest income earned on the balance held within the trust account |

(54 | ) | ||

| Expense arising under IFRS 2 for the excess of the fair value of shares issued to Spartan stockholders over and above the fair value of Spartan’s identifiable net assets |

(129,479 | ) | ||

| |

|

|||

| Other income/(expense) Adjustment |

(129,533 | ) | ||

| |

|

Year Ended December 31, 2021 |

||||

| Net loss attributable to equity holders of the company (in EUR thousands) |

(527,182 | ) | ||

| Basic and diluted pro forma weighted average number of shares outstanding 1 |

266,665,712 | |||

| Net loss per share attributable to equity holders of the company, basic and diluted |

(1.98 | ) | ||

| (1) | Excludes public and private warrants exercisable for 13,800,000 and 9,360,000 shares, respectively, as their impact is antidilutive. |

| As of December 31, 2021 (pro forma for Business Combination and Private Placement) |

(€ in thousands) |

|||

| Non-current assets |

100,382 | |||

| Cash and cash equivalents |

138,568 | |||

| Other current assets |

95,139 | |||

| |

|

|||

| Total assets |

334,089 |

|||

| Current liabilities |

56,694 | |||

| Non-current liabilities |

170,120 | |||

| |

|

|||

| Total liabilities |

226,814 |

|||

| Share capital |

32,001 | |||

| Share Premium |

348,129 | |||

| |

|

|||

| Reserves |

4,195 | |||

| |

|

|||

| Retained Earnings |

(277,050 | ) | ||

| |

|

|||

| Total shareholders’ equity |

107,275 |

|||

| |

|

|||

| • | Charging points network for third-parties one-off, long-term operations and maintenance contracts, with typical terms ranging from between 4 to 5 years, and such contracts generate recurring revenues. Depending on the requirements, Allego can organize the supply of chargers, including home charging and installations for specific customers such as OEMs. Hardware and charging points management are standardized across the range of solutions offered by Allego’s platform in order to maximize synergies with Allego’s other services. |

| • | Platform services TM platform for them to manage their chargers. These services generate recurring revenues and are typically for 5-year terms. Platform services enable Allego to create technological relationships with customers with a very high retention effect. |

| • | Site development IRR 15-year contracts. Allego also manages payments through its SmoovTM app. |

| • | Commercial |

| • | Fleet |

| • | Policies related to CO2 reduction |

| • | Openness: standard and interoperability |

| • | Free access to the grid in order to streamline grid connectivity |

| • | Increasing its leadership in fast and ultra-fast charging by investing in its owned public charging points network. This segment is anticipated to become the largest segment of Allego’s services. |

| • | Developing its services business to complement its public charging points network. The objective is twofold, triggering more traffic on the Allego network and securing long-term relationships with BtoB customers. |

| • | Offering new functionalities to EV drivers that use the Allego network or its services with enhanced features of Allego’s software platform. |

For the year ended December 31, |

||||||||||||

2021 |

2020 |

2019 |

||||||||||

| Utilization rate |

6.90 | % | 5.34 | % | 6.11 | % | ||||||

For the year ended December 31, |

Year-over-year Change For the year ended December 31, 2021 to 2020 |

|||||||||||||||

(in € million) |

2021 |

2020 |

Change (€) |

Change (%) |

||||||||||||

| Revenue |

86.3 | 44.2 | 42.1 | 95 | % | |||||||||||

| Cost of sales (excluding depreciation and amortization expenses) |

(61.1 | ) | (31.0 | ) | (30.1 | ) | 97 | % | ||||||||

| Gross profit |

25.2 |

13.2 |

12.0 |

91 |

% | |||||||||||

| Other income/(expenses) |

10.9 | 5.4 | 5.5 | 102 | % | |||||||||||

| Selling and distribution expenses |

(2.5 | ) | (3.9 | ) | 1.4 | -36 | % | |||||||||

| General and administrative expenses |

(337.5 | ) | (47.5 | ) | (290.0 | ) | 611 | % | ||||||||

| Operating loss |

(303.9 |

) |

(32.8 |

) |

(271.1 |

) |

827 |

% | ||||||||

| Finance costs |

(15.4 | ) | (11.3 | ) | (4.1 | ) | 36 | % | ||||||||

| Loss before income tax |

(319.3 |

) |

(44.1 |

) |

(275.2 |

) |

624 |

% | ||||||||

| Income tax |

(0.4 | ) | 0.7 | (1.1 | ) | -157 |

% | |||||||||

| Loss for the year |

(319.7 |

) |

(43.4 |

) |

(276.3 |

) |

638 |

% | ||||||||

For the year ended December 31, |

Change |

Change |

||||||||||||||

| (in € million) |

2021 |

2020 |

€ |

% |

||||||||||||

| Type of goods or service |

||||||||||||||||

| Charging sessions |

26.1 | 14.9 | 11.2 | 75 | % | |||||||||||

| Service revenue from the sale of charging equipment |

37.3 | 15.2 | 22.1 | 145 | % | |||||||||||

| Service revenue from installation services |

19.5 | 12.3 | 7.2 | 59 | % | |||||||||||

| Service revenue from operation and maintenance of charging equipment |

3.4 | 1.9 | 1.5 | 79 | % | |||||||||||

| Total revenue from external customers |

86.3 |

44.2 |

42.1 |

95 |

% | |||||||||||

For the year ended December 31, |

Year-over-year Change For the year ended December 31, 2020 to 2019 |

|||||||||||||||

(in € million) |

2020 |

2019 |

Change (€) |

Change (%) |

||||||||||||

| Revenue |

44.2 | 25.8 | 18.4 | 71 | % | |||||||||||

| Cost of sales (excluding depreciation and amortization expenses) |

(31.0 | ) | (20.9 | ) | (10.1 | ) | 48 | % | ||||||||

| Gross profit |

13.2 |

4.9 |

8.3 |

169 |

% | |||||||||||

| Other income/(expenses) |

5.4 | 3.5 | 1.9 | 54 | % | |||||||||||

| Selling and distribution expenses |

(3.9 | ) | (6.1 | ) | 2.2 | -36 | % | |||||||||

| General and administrative expenses |

(47.5 | ) | (39.2 | ) | (8.3 | ) | 21 | % | ||||||||

| Operating loss |

(32.8 |

) |

(36.9 |

) |

4.1 |

-11 |

% | |||||||||

| Finance costs |

(11.3 | ) | (5.9 | ) | (5.4 | ) | 92 | % | ||||||||

| Loss before income tax |

(44.1 |

) |

(42.8 |

) |

(1.3 |

) |

3 |

% | ||||||||

| Income tax |

0.7 | (0.3 | ) | 1.0 | -333 | % | ||||||||||

| Loss for the year |

(43.4 |

) |

(43.1 |

) |

(0.3 |

) |

1 |

% | ||||||||

For the year ended December 31, |

Change |

Change |

||||||||||||||

(in € million) |

2020 |

2019 |

€ |

% |

||||||||||||

| Type of goods or service |

||||||||||||||||

| Charging sessions |

14.9 | 9.5 | 5.4 | 57 | % | |||||||||||

| Service revenue from the sale of charging equipment |

15.2 | 9.1 | 6.1 | 67 | % | |||||||||||

| Service revenue from installation services |

12.3 | 6.9 | 5.4 | 78 | % | |||||||||||

| Service revenue from operation and maintenance of charging equipment |

1.9 | 0.3 | 1.6 | 533 | % | |||||||||||

| Total revenue from external customers |

44.2 |

25.8 |

18.4 |

71 |

% | |||||||||||

2021 |

||||||||||||

| (in €’000) |

As Previously Reported |

Adjustments |

Revised |

|||||||||

| Revenue from contracts with customers |

20,418 | 0 | 20,418 | |||||||||

| Cost of sales (excluding depreciation and amortization expenses) |

(13,705 | ) | 0 | (13,705 | ) | |||||||

| Gross profit |

6,713 |

0 |

6,713 |

|||||||||

| Other income |

2,322 | 0 | 2,322 | |||||||||

| Selling and distribution expenses |

(1,142 | ) | 0 | (1,142 | ) | |||||||

| General and administrative expenses |

(126,908 | ) | (17,113 | ) | (144,021 | ) | ||||||

| Operating loss |

(119,015 |

) |

(17,113 |

) |

(136,128 |

) | ||||||

| Finance costs |

(7,031 | ) | 0 | (7,031 | ) | |||||||

| Loss before income tax |

(126,046 |

) |

(17,133 |

) |

(143,179 |

) | ||||||

| Income tax |

(597 | ) | 0 | (597 | ) | |||||||

| Loss for the half-year |

(126,643 |

) |

(17,133 |

) |

(143,776 |

) | ||||||

| Basic and diluted loss per ordinary share |

(1,266 | ) | (171 | ) | (1,437 | ) | ||||||

Year ended December 31, |

||||||||||||

| (in € million) | 2021 |

2020 |

2019 |

|||||||||

| Cash flows used in operating activities |

(9.2 | ) | (34.4 | ) | (56.9 | ) | ||||||

| Cash flows used in investing activities |

(15.4 | ) | (15.3 | ) | (13.6 | ) | ||||||

| Cash flows provided by (used in) financing activities |

41.0 | 36.7 | 90.6 | |||||||||

| Net increase (decrease) in cash and cash equivalents |

16.4 |

(13.0 |

) |

20.1 |

||||||||

Year ended December 31 |

||||||||||||

| (in € million) | 2021 |

2020 |

2019 |

|||||||||

| Loss for the year |

(319.7 |

) |

(43.4 |

) |

(43.1 |

) | ||||||

| Income tax |

0.4 | (0.7 | ) | 0.3 | ||||||||

| Finance costs |

15.4 | 11.3 | 5.9 | |||||||||

| Amortization and impairments of intangible assets |

2.7 | 3.7 | 2.3 | |||||||||

| Depreciation and impairments of right-of-use |

3.4 | 1.8 | 1.3 | |||||||||

| Depreciation, impairments and reversal of impairments of property, plant and equipment |

5.6 | 4.8 | 4.7 | |||||||||

| EBITDA |

(292.2 |

) |

(22.5 |

) |

(28.6 |

) | ||||||

| Fair value gains/(losses) on derivatives (purchase options) |

(2.9 | ) | — | — | ||||||||

| Share-based payment expenses |

291.8 | 7.1 | — | |||||||||

| Transaction costs |

11.8 | — | — | |||||||||

| Bonus payments to consultants |

0.6 | — | — | |||||||||

| Lease buyouts |

— | 0.1 | — | |||||||||

| Business Optimization Costs |

— | 1.8 | 0.8 | |||||||||

| Reorganization and Severance |

0.1 | 3.8 | — | |||||||||

| Operational EBITDA |

9.2 |

(9.7 |

) |

(27.8 |

) | |||||||

| Cash generated from operations |

(9.2 |

) |

(34.4 |

) |

(56.9 |

) | ||||||

| Capital expenditures |

(15.6 | ) | (18.4 | ) | (17.0 | ) | ||||||

| Proceeds from investment grants |

1.7 | 3.2 | 3.3 | |||||||||

| Free cash flow |

(23.1 |

) |

(49.6 |

) |

(70.6 |

) | ||||||

| • | Revenue from charging sessions; |

| • | Revenue from the sale of charging equipment to customers; |

| • | Revenue from installation services; and |

| • | Revenue from the operation and maintenance of charging equipment owned by customers. |

| • | the moment when the customer has the legal title and the physical possession of the charging equipment once the delivery on premise takes place; or |

| • | the moment when the customer has not taken physical possession of the charging equipment and the delivery on premise has not taken place, but the customer has requested Allego to hold onto the charging equipment, and has the ability to direct the use of, and obtain substantially all of the remaining benefits from the charging equipment. |

Name |

Age |

Position | ||||

| Mathieu Bonnet |

48 | Chief Executive Officer and Director | ||||

| Ton Louwers |

55 | Chief Operating Officer and Chief Financial Officer | ||||

| Alexis Galley |

57 | Chief Technical Officer | ||||

| Jane Garvey |

77 | Director | ||||

| Christian Vollmann |

44 | Director | ||||

| Julia Prescot |

63 | Director | ||||

| Julian Touati |

40 | Director | ||||

| Thomas Josef Maier |

63 | Director | ||||

| Sandra Lagumina |

54 | Director | ||||

| Patrick Sullivan |

61 | Director | ||||

| Ronald Stroman |

70 | Director | ||||

| • | Audit Committee — $25,000 (chairperson), $10,000 (other members) |

| • | Compensation Committee — $25,000 (chairperson), $10,000 (other members) |

| • | Nominating and Corporate Governance Committee — $25,000 (chairperson), $10,000 (other members) |

| • | Mathieu Bonnet, Chief Executive Officer |

| • | Ton Louwers, Chief Financial Officer (since September 1, 2021) and Chief Operational Officer |

| • | Alexis Galley, Chief Technology Officer |

| • | Clive Pitt, Chief Financial Officer (until September 1, 2021) |

| All executive officers |

(in € ‘000) |

|||

| Base compensation(1) |

1,053 | |||

| Additional benefit payments(2) |

157 | |||

| Total compensation |

1,210 | |||

| (1) | Base compensation represents the cash compensation paid annually to our executive officers (or their companies), as well as any social security payment relating to premiums paid in addition to the cash salary for mandatory employee insurances required by Dutch law and paid to the tax authorities. |

| (2) | Additional benefits include reimbursement of car and housing expenses. |

| • | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

| • | the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and imposing liability for insiders who profit from trades made within a short period of time; |

| • | the rules under the Exchange Act requiring the filing with the SEC of an annual report on Form 10-K (although we will file annual reports on a corresponding form for foreign private issuers), quarterly reports on Form 10-Q containing unaudited financial and other specified information (although we will file semi- annual reports on a current reporting form for foreign private issuers), or current reports on Form 8-K, upon the occurrence of specified significant events; |

| • | requirements to follow certain corporate governance practices, and may instead follow home country practices; and |

| • | Regulation Fair Disclosure or Regulation FD, which regulates selective disclosure of material non-public information by issuers. |

| • | audits of Allego’s financial statements; |

| • | the integrity of Allego’s financial statements; |

| • | our process relating to risk management and the conduct and systems of internal control over financial reporting and disclosure controls and procedures; |

| • | the qualifications, engagement, compensation, independence and performance of Allego’s independent auditor; and |

| • | the performance of Allego’s internal audit function. |

| • | determining and/or approving and recommending to the Allego Board for its approval the compensation of Allego’s executive officers and directors; and |

| • | reviewing and approving and recommending to the Allego Board for its approval incentive compensation and equity compensation policies and programs. |

| • | identifying, screening and recommending for appointment to the Allego Board individuals qualified to serve as directors; |

| • | developing, recommending to the Allego Board and reviewing Allego’s Corporate Governance Guidelines; |

| • | coordinating and overseeing the self-evaluation of the Allego Board and its committees; and |

| • | reviewing on a regular basis the overall corporate governance of Allego and recommending improvements to the Allego Board where appropriate. |

| • | preparing the business plan including a gap analyses; |

| • | formulating and recording Allego’s objectives mentioned in the business plan; |

| • | reporting about strategic developments; |

| • | overseeing Allego’s strategy and business development; and |

| • | submitting proposals to the Allego Board and reviewing possible acquisitions, divestments, joint ventures and other corporate alliances of Allego. |

| • | each holder of Ordinary Shares is entitled to one vote per Ordinary Share on all matters to be voted on by shareholders generally, including the appointment of directors; |

| • | there are no cumulative voting rights; |

| • | the holders of Ordinary Shares are entitled to dividends and other distributions as may be declared from time to time by Allego out of funds legally available for that purpose, if any; |

| • | upon Allego’s liquidation and dissolution, the holders of Ordinary Shares will be entitled to share ratably in the distribution of all of Allego’s assets remaining available for distribution after satisfaction of all Allego’s liabilities; and |

| • | the holders of Ordinary Shares have pre-emption rights in case of share issuances or the grant of rights to subscribe for shares, except if such rights are limited or excluded by the corporate body authorized to do so and except in such cases as provided by Dutch law and the Articles. |

| • | in whole and not in part; |

| • | at a price of $0.01 per Assumed Warrant; |

| • | upon a minimum of 30 days’ prior written notice of redemption, or the 30-day redemption period, to each warrantholder; and |

| • | if, and only if, the last reported sale price of the Ordinary Shares equals or exceeds $18.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within a 30-day trading period ending on the third trading day prior to the date on which Allego sends the notice of redemption to the warrantholders. |

| • | in whole and not in part; |

| • | at a price of $0.10 per Assumed Warrant, provided that holders will be able to exercise their Assumed Warrants on a cashless basis prior to redemption and receive that number of Ordinary Shares |

| determined in accordance with the Warrant Agreement, based on the redemption date and the “fair market value” of Ordinary Shares except as otherwise described below; |

| • | upon a minimum of 30 days’ prior written notice of redemption to each warrantholder; and |

| • | if, and only if, the last reported sale price of the Ordinary Shares equals or exceeds $10.00 per share (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) on the trading day prior to the date on which Allego sends the notice of redemption to the warrantholders. |

| • | if a competent court or arbitral tribunal has established, without having (or no longer having) the possibility for appeal, that the acts or omissions of such indemnified person that led to the financial |

| losses, damages, expenses, suit, claim, action or legal proceedings as described above are of an unlawful nature (including acts or omissions which are considered to constitute malice, gross negligence, intentional recklessness and/ or serious culpability attributable to such indemnified person); |

| • | to the extent that his or her financial losses, damages and expenses are covered under insurance and the relevant insurer has settled, or has provided reimbursement for, these financial losses, damages and expenses (or has irrevocably undertaken to do so); |

| • | in relation to proceedings brought by such indemnified person against Allego, except for proceedings brought to enforce indemnification to which he or she is entitled pursuant to the Articles, pursuant to an agreement between such indemnified person and Allego which has been approved by the Board or pursuant to insurance taken out by Allego for the benefit of such indemnified person; and |

| • | for any financial losses, damages or expenses incurred in connection with a settlement of any proceedings effected without Allego’s prior consent. |

| • | transferring the business or materially all of the business to a third-party; |

| • | entering into or terminating a long-lasting alliance of Allego or of a subsidiary either with another entity or company, or as a fully liable partner of a limited partnership or general partnership, if this alliance or termination is of significant importance for Allego; and |

| • | acquiring or disposing of an interest in the capital of a company by Allego or by a subsidiary with a value of at least one third of the value of the assets, according to the balance sheet with explanatory notes or, if Allego prepares a consolidated balance sheet, according to the consolidated balance sheet with explanatory notes in Allego’s most recently adopted annual accounts. |

| • | Madeleine agreed, subject to certain exceptions or with the consent of the Allego Board, not to Transfer (as defined in the Registration Rights Agreement) securities received by it pursuant to the Business Combination Agreement until the date that is 180 days after the Closing or earlier if, subsequent to the Closing, (A) the last sale price of the Ordinary Shares equals or exceeds $12.00 per share for any 20 trading days within any 30-trading day period commencing at least 120 days after the Closing or (B) Allego consummates a liquidation, merger, stock exchange or other similar transaction which results in all of Allego’s shareholders having the right to exchange their Ordinary Shares for cash, securities or other property. |

| • | E8 Investor agreed, subject to certain exceptions, not to Transfer (as defined in the Registration Rights Agreement) securities received by it in the E8 Part B Share Issuance until the date that is 18 months after the Closing or earlier if, subsequent to the Closing, Allego consummates a liquidation, merger, stock exchange or other similar transaction which results in all of Allego’s shareholders having the right to exchange their Ordinary Shares for cash, securities or other property. |

Name and Address of Beneficial Owner |

Number of Allego Ordinary Shares |

Percentage Of Allego Ordinary Shares |

||||||

Company Officers, Directors and 5% Holders |

||||||||

Madeleine |

238,935,061 | (1) | 89.43 | % | ||||

E8 Investor |

41,097,994 | (2) | 15.38 | % | ||||

Spartan Acquisition Sponsor III |

19,434,949 | (3) | 7.27 | % | ||||

Mathieu Bonnet |

— | — | ||||||

Julien Touati |

238,935,061 | (4) | 89.43 | % | ||||

Sandra Lagumina |

— | — | ||||||

Julia Prescot |

238,935,061 | (4) | 89.43 | % | ||||

Jane Garvey |

238,935,061 | (4) | 89.43 | % | ||||

Christian Vollman |

— | — | ||||||

Thomas Maier |

— | — | ||||||

Ton Louwers |

— | — | ||||||

Alexis Galley |

— | — | ||||||

Patrick Sullivan |

— | — | ||||||

Ronald Stroman |

— | — | ||||||

All Allego directors and executive offices as a group (11 Individuals) |

238,935,061 | (4) | 89.43 | % | ||||

| (1) | Interests held by Madeleine reflect 178,844,709 Ordinary Shares indirectly beneficially owned by Meridiam EI SAS (“ Meridiam EI Thoosa Meridiam Certain Relationships and Related Person Transactions L-2330 Luxembourg. |

| (2) | Investment decisions with respect to the Ordinary Shares held by E8 Investor are made by Messrs. Bruno Heintz and Jean-Marc Oury. Such Ordinary Shares are subject to the irrevocable voting power of attorney granted by E8 Investor to Madeleine in the PoA Agreement. See the section entitled “ Certain Relationships and Related Person Transactions |

| (3) | Consists of (i) 13,700,000 Ordinary Shares held by the Sponsor, (ii) 4,400,000 Ordinary Shares acquired by AP Spartan Energy Holdings III (PIPE), LLC (“ Pipe Holdings AP PPW ANRP (P2) NGL Debt ANRP Intermediate ANRP Advisors (P2) AP Spartan ANRP Advisors ANRP Capital Management APH Holdings Principal Holdings III GP KY1-9008. The address of each of ANRP Capital Management and APH Holdings is One Manhattanville Road, Suite 201, Purchase, New York, 10577. |

| (4) | Reflects Ordinary Shares held by affiliates of Meridiam that Mr. Touati, Ms. Prescot and Ms. Garvey may be deemed to indirectly beneficially own. |

Ordinary Shares |

||||||||||||||||||||

Securities Beneficially Owned prior to this Offering |

Maximum Number of Securities to be Sold in this Offering |

Securities Beneficially Owned after this Offering |

||||||||||||||||||

Name of Selling Securityholder |

Ordinary Shares |

Percentage(1) |

Ordinary Shares |

Ordinary Shares |

Percentage(1) |

|||||||||||||||

E8 Investor(2) |

41,097,994 | 15.38 | % | 41,097,994 | — | — | ||||||||||||||

Spartan Acquisition Sponsor III(3) |

19,434,949 | 7.27 | % | 19,434,949 | — | — | ||||||||||||||

Hedosophia Public Investments Limited(4) |

2,500,000 | * | 2,500,000 | — | — | |||||||||||||||

Palantir Technologies Inc.(5) |

2,000,000 | * | 2,000,000 | — | — | |||||||||||||||

Fisker Group Inc.(6) |

1,000,000 | * | 1,000,000 | — | — | |||||||||||||||

ECP Energy Transition Opportunities Fund A, LP(7) |

914,175 | * | 914,175 | — | — | |||||||||||||||

Kepos Alpha Master Fund L.P.(8) |

591,800 | * | 341,800 | 250,000 | * | |||||||||||||||

Landis+Gyr AG(9) |

500,000 | * | 500,000 | — | — | |||||||||||||||

Sycomore Eco Solutions(10) |

200,000 | * | 200,000 | — | — | |||||||||||||||

ECP Energy Transition Opportunities Fund B, LP(7) |

85,825 | * | 85,825 | — | — | |||||||||||||||

Kepos Carbon Transition Master Fund L.P.(11) |

63,775 | * | 58,200 | 5,575 | * | |||||||||||||||

| * | Less than one percent of outstanding Ordinary Shares. |

| (1) | In calculating the percentages, (a) the numerator is calculated by adding the aggregate number of Ordinary Shares held by such beneficial owner and the total number of Warrants held by such beneficial owner (if any); and (b) the denominator, unless otherwise noted, is calculated by adding the aggregate number of Ordinary Shares outstanding and the number of Ordinary Shares issuable upon the exercise of Warrants held by such beneficial owner, if any (but not the number of Ordinary Shares issuable upon the exercise of Warrants held by any other beneficial owner). |

| (2) | Investment decisions with respect to the Ordinary Shares held by E8 Investor are made by Messrs. Bruno Heintz and Jean-Marc Oury. Such Ordinary Shares are subject to the irrevocable voting power of attorney granted by E8 Investor to Madeleine in the PoA Agreement. See the section entitled “ Certain Relationships and Related Person Transactions |

| (3) | Consists of (i) 13,700,000 Ordinary Shares held by the Sponsor, (ii) 4,400,000 Ordinary Shares acquired by AP Spartan Energy Holdings III (PIPE), LLC (“ Pipe Holdings AP PPW ANRP (P2) NGL Debt ANRP Intermediate ANRP Advisors (P2) AP Spartan ANRP Advisors ANRP Capital Management APH Holdings Principal Holdings III GP |

| directors of Principal Holdings III GP, and as such may be deemed to have voting and dispositive control of the ordinary shares held of record by AP PPW, Pipe Holdings and the Sponsor. The address of each of the Sponsor, AP Spartan and Messrs. Rowan, Kleinman and Zelter is 9 West 57th Street, 43rd Floor, New York, New York 10019. The address of each of ANRP Advisors and Principal Holdings III GP is c/o Walkers Corporate Limited; Cayman Corporate Centre; 27 Hospital Road; George Town; Grand Cayman KY1-9008. The address of each of ANRP Capital Management and APH Holdings is One Manhattanville Road, Suite 201, Purchase, New York, 10577. |

| (4) | The board of directors of Hedosophia Public Investments Limited comprises Ian Osborne, Iain Stokes and Trina Le Noury and each director has shared voting and dispositive power with respect to the securities held by Hedosophia Public Investments Limited. Each of them disclaims beneficial ownership of the securities held by Hedosophia Public Investments Limited. The address of Hedosophia Public Investments Limited is Trafalgar Court, Les Banques, St Peter Port, Guernsey GY1 3QL. |

| (5) | Palantir Technologies Inc. is a corporation and is currently controlled by its board of directors. For more information, please see Palantir Technologies Inc.’s public filings with the SEC. Allego is a customer of Palantir Technologies Inc. The address of Palantir Technologies Inc. is 1555 Blake Street, Suite 250, Denver, CO 80202. |

| (6) | The Selling Securityholder is a wholly-owned direct subsidiary of Fisker Inc., a publicly held entity. Fisker Inc. exercises sole investment power over the Selling Securityholder’s securities. |