REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(Jurisdiction of incorporation or organization) |

(Address of principal executive offices) |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer |

☒ | Emerging growth company | ||||

| US GAAP ☐ | |

Other ☐ | ||||||

| by the International Accounting Standards Board | ☒ |

Page |

||||||

| 1 | ||||||

| 8 | ||||||

| 11 | ||||||

| ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 17 | ||||

| ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE | 17 | ||||

| ITEM 3. |

KEY INFORMATION | 17 | ||||

| A. |

Reserved | 17 | ||||

| B. |

Capitalization and Indebtedness | 17 | ||||

| C. |

Reasons for the Offer and Use of Proceeds | 17 | ||||

| D. |

Risk Factors | 18 | ||||

| ITEM 4. |

INFORMATION ON THE COMPANY | 64 | ||||

| A. |

History and Development of the Company | 64 | ||||

| B. |

Business Overview | 65 | ||||

| C. |

Organizational Structure | 79 | ||||

| D. |

Property, Plants and Equipment | 80 | ||||

| ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 80 | ||||

| ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 98 | ||||

| A. |

Directors and Executive Officers | 98 | ||||

| B. |

Compensation | 105 | ||||

| C. |

Board Practices | 106 | ||||

| D. |

Employees | 106 | ||||

| E. |

Share Ownership | 106 | ||||

| ITEM 7. |

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 107 | ||||

| A. |

Major Shareholders | 107 | ||||

| B. |

Related Party Transactions | 108 | ||||

| C. |

Interests of Experts and Counsel | 111 | ||||

| ITEM 8. |

FINANCIAL INFORMATION | 111 | ||||

| A. |

Consolidated Statements and Other Financial Information | 111 | ||||

| B. |

Significant Changes | 112 | ||||

| ITEM 9. |

THE OFFER AND LISTING | 112 | ||||

| A. |

Offer and Listing Details | 112 | ||||

| B. |

Plan of Distribution | 112 | ||||

| C. |

Markets | 112 | ||||

| D. |

Selling Shareholders | 112 | ||||

| E. |

Dilution | 112 | ||||

| F. |

Expenses of the Issue | 113 | ||||

| ITEM 10. |

ADDITIONAL INFORMATION | 113 | ||||

| A. |

Share Capital | 113 | ||||

| B. |

Memorandum and Articles of Association | 113 | ||||

| C. |

Material Contracts | 113 | ||||

| D. |

Exchange Controls | 114 | ||||

| E. |

Taxation | 114 | ||||

| F. |

Dividends and Paying Agents | 127 | ||||

| G. |

Statement by Experts | 127 | ||||

| H. |

Documents on Display | 127 | ||||

| I. |

Subsidiary Information | 127 | ||||

| ITEM 11. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 128 | ||||

| ITEM 12. |

DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 128 | ||||

| ITEM 13. |

DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 128 | ||||

| ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 128 | ||||

| ITEM 15. |

CONTROLS AND PROCEDURES | 128 | ||||

| ITEM 16. |

[RESERVED] | 129 | ||||

| ITEM 16A. |

AUDIT COMMITTEE FINANCIAL EXPERT | 129 | ||||

| ITEM 16B. |

CODE OF ETHICS | 129 | ||||

| ITEM 16C. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES | 129 | ||||

| ITEM 16D. |

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 130 | ||||

| ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 130 | ||||

| ITEM 16F. |

CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | 130 | ||||

| ITEM 16G. |

CORPORATE GOVERNANCE | 131 | ||||

| ITEM 16H. |

MINE SAFETY DISCLOSURE | 140 | ||||

| ITEM 16I. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | 140 | ||||

| 141 | ||||||

| ITEM 17. |

FINANCIAL STATEMENTS | 141 | ||||

| ITEM 18. |

FINANCIAL STATEMENTS | 141 | ||||

| ITEM 19. |

EXHIBITS | 141 | ||||

| 144 | ||||||

| • | Target Merger Sub merged with and into Nettar, the separate existence of Target Merger Sub ceased and Nettar was the surviving company of such merger and became a direct, wholly-owned subsidiary of the Company (the “Initial Merger”); |

| • | immediately following confirmation of the effective filing of the Initial Merger, SPAC Merger Sub merged with and into CF V, the separate existence of SPAC Merger Sub ceased and CF V was the surviving corporation of such merger and became a direct wholly owned subsidiary of the Company (the “CF V Merger”); |

| • | the single share of the Company outstanding immediately prior to the Mergers was cancelled for no consideration; |

| • | as a result of the Initial Merger, the ordinary shares and preference shares of Nettar that were issued and outstanding immediately prior to the effective time of the Initial Merger (other than (i) any treasury shares or share held by the Company or any of its affiliates and (ii) any dissenting shares) were automatically cancelled and ceased to exist in exchange for (x) in the case of the Company’s Chief Executive Officer, Emiliano Kargieman, newly issued Class B Ordinary Shares of the Company and (y) in all other cases, Class A Ordinary Shares of the Company, as determined in accordance with the Merger Agreement; |

| • | as a result of the CF V Merger, each CF V Unit issued and outstanding immediately prior to the effective time of the CF V Merger (the “CF V Merger one-third of one CF V Warrant and, immediately following the separation of each CF V Unit, (a) each share of CF V Class B Common Stock automatically converted into one share of CF V Class A Common Stock (the “Initial Conversion”) and (b) immediately following the Initial Conversion, each share of CF V Class A Common Stock that was issued and outstanding immediately prior to the CF V Merger Effective Time (other than any treasury share held by CF V or share held by any subsidiary of CF V), was cancelled and ceased to exist in exchange for the right to receive Class A Ordinary Shares in accordance with the Merger Agreement; |

| • | each CF V Warrant outstanding immediately prior to the CF V Merger Effective Time was assumed by the Company and converted into a warrant exercisable for that number of Class A Ordinary Shares as determined in accordance with the Merger Agreement; |

| • | all Convertible Notes of Nettar converted into Nettar Preference Shares as determined in accordance with the Merger Agreement; |

| • | all Nettar Preference Shares outstanding immediately prior to the effective time of the Initial Merger (other than dissenting shares) were converted into a number of Class A Ordinary Shares as determined in the Merger Agreement; |

| • | all options to purchase ordinary shares of Nettar were assumed by the Company and became options to purchase Class A Ordinary Shares (the “Assumed Options”) as determined in accordance with the Merger Agreement; and |

| • | the Columbia Warrants outstanding immediately prior to the effective time of the Initial Merger became exercisable for that number of Class A Ordinary Shares as determined in accordance with the Merger Agreement. |

| • | the Liberty Investor has the right to nominate two directors (including any successors) for election to the Board by the Company’s shareholders (the “ |

| • | The Sponsor and Mr. Kargieman will vote their Class A Ordinary Shares and Class B Ordinary Shares, (and those held by any persons over which they have voting control), in favor of the election of the Liberty Director nominees. |

| • | Secretary Steven Terner Mnuchin will be nominated for election as non-executive Chairman to the Board to serve as one of the Liberty Directors. For so long as Secretary Mnuchin is a Liberty Director, he shall be the non-executive Chairman of the Board, and the Sponsor and Mr. Kargieman shall not be required to vote for any person designated by the Liberty Investor to replace Secretary Mnuchin unless such party consents in writing to such replacement, such consent not to be unreasonably withheld. |

| • | Mr. Kargieman will cause any transferee of any Class B Ordinary Shares held by him to agree, as a condition to such transfer, to all of his obligations under the Liberty Letter Agreement (other than in the case of a transfer to a transferee that would result in automatic conversion of such Class B Ordinary Shares into Class A Ordinary Shares in accordance with the Company’s Governing Documents). |

| • | The Liberty Investor’s right to nominate the Liberty Directors will cease immediately following the occurrence of a Cessation Event, and the terms of any then-serving Liberty Directors will expire at the next election of directors (but in no event more than one year after the Cessation Event). |

| • | The Company will (a) take all necessary action to cause the Liberty Directors to be elected to the Board; (b) maintain in effect at all times directors and officers indemnity insurance coverage reasonably satisfactory to the Liberty Investor; (c) provide for indemnification, exculpation and advancement of expenses to the fullest extent permitted under applicable law in the Company’s Governing Documents; (d) not increase or decrease the maximum number of directors permitted to serve on the Board without the prior written consent of the Liberty Investor; and (e) not take any action, including making or recommending any amendment to the Company Governing Documents that could reasonably be expected to adversely affect the Liberty Investor’s rights under the Liberty Restated Letter Agreement; in addition to Secretary Mnuchin, the Liberty Investor nominated General Joseph F. Dunford Jr. to the Board; |

| • | in addition to the Liberty Directors, the Board initially included Ted Wang, Brad Halverson, and another person designated by Mr. Kargieman who is reasonably acceptable to the Liberty Investor, and in compliance with NASDAQ listing requirements; such person designated by Mr. Kargieman is Marcos Galperin; |

| • | the Liberty Investor has the right to nominate one Liberty Director to serve on each committee of the Board, subject to certain conditions; |

| • | for so long as Mr. Kargieman and his affiliates beneficially own at least one-third of the number of shares of the Company owned by him on the Closing Date (subject to customary adjustments for corporate events), Mr. Kargieman has the right to designate two directors for election to the Board by the Company’s shareholders, one of whom will be Mr. Kargieman and the other shall be reasonably acceptable to the Liberty Investor and the Sponsor, initially Marcos Galperin, and the Sponsor and the Liberty Investor will vote any shares held by them in favor of the election of such persons; and |

| • | for so long as the Sponsor and its affiliates beneficially own at least one-third of the number of shares of the Company owned by them on the Closing Date (subject to customary adjustments for corporate events), Howard Lutnick will be designated for election by the Board to the Company’s shareholders and Mr. Kargieman and the Liberty Investor will vote any shares held by them in favor of the election of Mr. Lutnick. |

| • | any acquisition by the Company of any equity interests, assets, properties, or business of any person; |

| • | any merger, consolidation, or other business combination involving the Company; |

| • | any transaction or series of related transactions involving a change of control (as defined in the Liberty Restated Letter Agreement); or |

| • | any equity split, payment of distributions, or any similar recapitalization. |

| • | 2,500,000 warrants, each providing the right to purchase one (1) Class A Ordinary Share at an exercise price of $10.00 per share (the “$10.00 Liberty Advisory Fee Warrants”), which were issued at the Liberty Closing; and |

| • | for so long as a Cessation Event has not occurred, $1.25 million to be paid in cash on the eighteen (18) month anniversary of the Liberty Closing and on the last day (or, if not a business day, the immediately following business day) of each of the following five (5) successive three-month anniversaries of such 18-month anniversary (each, an “Advisory Fee Cash Payment” and, together, the “Advisory Fee Cash Payments”), representing aggregate Advisory Fee Cash Payments of up to $7,500,000. From and after a Cessation Event, no Advisory Fee Cash Payments shall be payable by the Company. |

| • | the benefits from the Business Combination; |

| • | the Company’s ability to maintain the listing of the Class A Ordinary Shares or Public Warrants on Nasdaq; |

| • | the Company’s future financial performance, including any expansion plans and opportunities; |

| • | the Company’s success in retaining or recruiting, or changes required in, its officers, key employees or directors; |

| • | changes in the Company’s strategy, future operations, financial condition, estimated revenue and losses, projected costs, prospects and plans; |

| • | the Company’s ability to coordinate with the U.S. National Oceanic and Atmospheric Administration (“NOAA”) Commercial Remote Sensing Regulatory Affairs agency to assure an understanding of regulations as they evolve; |

| • | the implementation, market acceptance and success of the Company’s business model; |

| • | the Company’s expectations surrounding capital requirements as it seeks to build and launch more satellites; |

| • | the Company’s expectations surrounding the growth of its commercial platform as a part of its revenues; |

| • | the Company’s expectations surrounding the insurance it will maintain going forward; |

| • | the Company’s ability to conduct remaps of the planet with increasing regularity or frequency as it increases its number of satellites; |

| • | the Company’s ability to productize its internal data analytics platform; |

| • | the Company’s plans to build out its constellation of satellites to 202 by 2025; |

| • | the Company’s ability to launch satellites less expensively than its competitors; and |

| • | the Company’s ability to increase satellite production to meet demand and reach its mapping goals. |

| • | the ability of the Company to grow and manage growth profitably, maintain relationships with customers, compete within its industry and retain its key employees; |

| • | the possibility the Company may be adversely impacted by other economic, business, and/or competitive factors; |

| • | future exchange and interest rates; |

| • | the Company is highly dependent on the services of its executive officers; |

| • | the Company may experience difficulties in managing its growth and expanding its operations; |

| • | the success of the Company’s business will be highly dependent on its ability to effectively market and sell its Earth Observation (“EO”) services, including to commercial customers, and to convert contracted revenues and its pipeline of potential contracts into actual revenues, which can be a costly process; |

| • | the Company may face risks and uncertainties associated with defense-related contracts, which may have a material adverse effect on its business; |

| • | if the Company is unable to scale production of its satellites as planned, its business and results of operations could be materially and adversely affected; |

| • | the Company is dependent on third parties to transport and launch its satellites into space and any delay could have a material adverse impact on its business, financial condition, and results of operations; |

| • | the market may not accept the Company’s geospatial intelligence, imagery and related data analytic products and services, and its business is dependent upon its ability to keep pace with the latest technological changes; |

| • | the Company’s ability to grow its business depends on the successful production, launch, commissioning and/or operation of its satellites and related ground systems, software and analytic technologies, which is subject to many uncertainties, some of which are beyond its control; |

| • | the market for geospatial intelligence, imagery and related data analytics has not been established with precision, is still emerging and may not achieve the growth potential the Company expects or may grow more slowly than expected; |

| • | if the Company’s satellites fail to operate as intended, it could have a material adverse effect on its business, financial condition, and results of operations; |

| • | satellites are subject to production and launch delays, launch failures, damage or destruction during launch, the occurrence of which can materially and adversely affect the Company’s operations; and |

| • | other risks and uncertainties described in this Report, including those under the section entitled “Risk Factors.” |

ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

ITEM 3. |

KEY INFORMATION |

| A. | [Reserved. ] |

| B. | Capitalization and Indebtedness. |

| C. | Reasons for the Offer and Use of Proceeds. |

D. |

Risk Factors |

| • | The Company is an early stage company that has not demonstrated a sustained ability to generate revenues. If it does not generate revenue as expected, its financial condition will be materially and adversely affected. |

| • | The success of the Company’s business will be highly dependent on its ability to effectively market and sell its EO services and to convert contracted revenues and its pipeline of potential contracts into actual revenues, which can be a costly process. |

| • | The Company’s sales efforts involve considerable time and expense and the Company’s sales cycle is often long and unpredictable. |

| • | The Company may face risks and uncertainties associated with defense-related contracts, which may have a material adverse effect on its business. |

| • | If the Company is unable to scale production of its satellites as planned, its business and results of operations could be materially and adversely affected. |

| • | The Company is dependent on third parties to transport and launch its satellites into space and any delay could have a material and adverse impact on its business, financial condition, and results of operations. |

| • | Although the Company designs many of its key satellite components, the Company relies on third party vendors and manufacturers to build and provide its satellite components, products or services and the inability of these vendors and manufacturers to meet the Company’s needs could have a material adverse effect on its business. |

| • | The Company depends on ground station and cloud-based computing infrastructure operated by third parties for value added services, and any errors, disruption, performance problems or failure in their or its operational infrastructure could materially and adversely affect the Company’s business, financial condition and results of operations. |

| • | The Company’s customer contracts may require it to meet certain minimum service requirements which can vary significantly from customer to customer. Any failure to meet its service requirements may materially and adversely affect the Company’s business, results of operations and financial condition. |

| • | The market may not accept the Company’s geospatial intelligence, imagery and related data analytic products and services, and its business is dependent upon its ability to keep pace with the latest technological changes. |

| • | The Company may not be able to identify suitable acquisition candidates or consummate acquisitions on acceptable terms, or the Company may be unable to successfully integrate acquisitions, which could disrupt it operations and materially and adversely impact its business and operating results. |

| • | The Company faces competition for geospatial intelligence, imagery and related data analytic products and services which may limit its ability to gain market share. |

| • | The Company’s products and services are complex and could have unknown defects or errors, which may increase its costs, harm its reputation with customers, give rise to costly litigation, or divert its or its customers’ resources from other purposes. |

| • | The Company’s business is capital intensive, and it may not be able to raise adequate capital to finance its business strategies, including funding future satellites, or it may be able to do so only on terms that significantly restrict its ability to operate its business. |

| • | The Company’s ability to grow its business depends on the successful production, launch, commissioning and/or operation of its satellites and related ground systems, software and analytic technologies, which is subject to many uncertainties, some of which are beyond its control. |

| • | The market for geospatial intelligence, imagery and related data analytics has not been established with precision, is still emerging and may not achieve the growth potential the Company expects or may o w more slowly than expected. |

| • | If the Company’s satellites and related equipment have shorter useful lives than it anticipates, it may be required to recognize impairment charges. |

| • | If the Company’s satellites fail to operate as intended, it could have a material adverse effect on its business, financial condition and results of operations. |

| • | Satellites are subject to production and launch delays, launch failures, damage or destruction during launch, the occurrence of which could materially and adversely affect the Company’s operations. |

| • | The Company typically purchases pre-launch and launch insurance coverage for its satellites to address the risk of potential systemic anomalies, failures, collisions with its satellites or other satellites or debris, or catastrophic events that occur prior to or during launch. However, such insurance may be insufficient or unavailable on acceptable cost and terms, if at all. |

| • | Coordination results may adversely affect the Company’s ability to use its satellites in certain orbital locations for its proposed service or coverage area or may delay its ability to launch satellites and thereby operate its proposed services. |

| • | Prolonged unfavorable weather conditions could negatively impact the Company’s operations. |

| • | To date, based on the structure of the Company’s business and operations and informal discussion with regulators, the Company does not believe its satellite operations are subject to U.S. regulation. If it is determined by a U.S. regulatory authority that the Company’s operations are subject to U.S. law, the Company could be subject to penalties and other adverse consequences as a result of noncompliance. |

| • | If the Company is successful in becoming a U.S. governmental contractor, its business will be subject to significant U.S. regulations, and reductions or changes in U.S. government spending, including the U.S. defense budget, could reduce its revenue and adversely affect its business. |

| • | The Company’s business with governmental entities is subject to the policies, priorities, regulations, mandates, and funding levels of such governmental entities and may be negatively impacted by any change thereto. |

| • | The Company’s business is subject to a wide variety of additional extensive and evolving government laws and regulations. Failure to comply with such laws and regulations could have a material adverse effect on the Company’s business. |

| • | The Company is subject to the orbital slot and spectrum access requirements of the International Telecommunication Union (“ITU”) and the regulatory and licensing requirements in each of the countries in which it provides services, operates facilities, or licenses terminals, and the Company’s business is sensitive to regulatory changes internationally and in those countries. |

| • | Data breaches or incidents involving the Company’s technology or products could damage its business, reputation and brand and substantially harm its business and results of operations. |

| • | The Company’s technologies contain “open source” software, and any failure to comply with the terms of one or more of these open source licenses could negatively affect its business. |

| • | The Company relies on the significant experience and specialized expertise of its senior management, engineering, sales and operational staff and must retain and attract qualified and highly skilled personnel in order to grow its business successfully. If the Company is unable to build, expand, and deploy additional members its management, engineering, sales and operational staff in a timely manner, or at all, or to hire, retain, train, and motivate such personnel, its growth and long-term success could be adversely impacted. |

| • | The ability of the Company’s management to operate the business successfully is largely dependent upon the efforts of certain key personnel of the Company. The loss of such key personnel could negatively impact the operations and financial results of the combined business. |

| • | The dual class structure of the Ordinary Shares has the effect of concentrating voting control with certain shareholders of the Company and limiting its other shareholders’ ability to influence corporate matters and could discourage others from pursuing any change of control transactions that holders of Class A Ordinary Shares may view as beneficial. |

| • | Failure to maintain effective internal controls over financial reporting could have a material adverse effect on the Company’s business, operating results and stock price. |

| • | The Company is an “emerging growth company” and, as a result of the reduced disclosure and governance requirements applicable to emerging growth companies, the Class A Ordinary Shares may be less attractive to investors. |

| • | Changes in government administration and national and international priorities, including developments in the geo-political environment, could have a significant impact on national or international defense spending priorities and the efficient handling of routine contractual matters. These changes could have a negative impact on the Company’s business in the future. |

| • | The Company may compete directly with other suppliers or align with a prime or subcontractor competing for a contract. The Company may not be awarded the contract if the pricing or product offering is not competitive, either at the Company’s level or the prime or subcontractor level. In addition, in the event the Company is awarded a contract, it is subject to protests by losing bidders of contract awards that can result in the reopening of the bidding process and changes in governmental policies or regulations and other political factors. In addition, the Company may be subject to multiple rebid requirements over the life of a defense program in order to continue to participate in a program, which can result in the loss of the contract or significantly reduce the Company’s revenue or margin from the program. The government’s requirements for more frequent technology refreshes on defense programs may lead to increased costs and lower long-term revenues. |

| • | Consolidation among defense industry contractors has resulted in a few large contractors with increased bargaining power relative to the Company. The increased bargaining power of these contractors may adversely affect the Company’s ability to compete for contracts and, as a result, may materially and adversely affect its business or results of operations in the future. |

| • | The Company’s usage policy currently restricts usage of its data and platforms for peaceful use only, and that may limit the Company’s ability to compete for and win certain defense related contracts. |

| • | prepare high throughput production factories for production to build a large number of satellites (at least 100 annually); |

| • | acquire sufficient quantities of third-party components and supplies; |

| • | recruit and train new staff while maintaining its desired quality levels; |

| • | implement an effective supplier strategy and supply chain management system; and |

| • | adopt manufacturing and quality control processes, which it must successfully introduce and scale for production at any new production facilities. |

| • | the Company may not be able to identify suitable acquisition candidates or to consummate acquisitions on acceptable terms; |

| • | the Company may not be able to obtain the necessary financing, on favorable terms or at all, to finance any or all of its potential acquisitions; and |

| • | acquired technologies, products or businesses may not perform as the Company expects and the Company may fail to realize the anticipated benefits from the acquisition. |

| • | timing in finalizing satellite design and specifications; |

| • | performance of satellites meeting design specifications; |

| • | failure of satellites as a result of technological or manufacturing difficulties, design issues or other unforeseen matters; |

| • | engineering and/or manufacturing performance failing or falling below expected levels of output or efficiency; |

| • | increases in costs of materials and supplied components; |

| • | changes in project scope; |

| • | its ability to obtain additional applicable approvals, licenses or certifications from regulatory agencies, if required, and maintaining current approvals, licenses or certifications; |

| • | performance of its manufacturing facilities despite risks that disrupt productions, such as natural disasters, catastrophic events or labor disputes; |

| • | performance of a limited number of suppliers for certain raw materials and supplied components, the accuracy of supplier representations as to the suitability of such raw materials and supplied components for its products, and their willingness to do business with it; |

| • | performance of its internal and third-party resources that support its research and development activities; |

| • | its ability to protect its intellectual property critical to the design and function of its satellites and its geospatial intelligence, imagery and related data analytic products and services; |

| • | its ability to continue funding and maintaining its research and development activities; |

| • | successful completion of demonstration missions; and |

| • | the impact of the COVID-19 pandemic on it, its customers and suppliers, and the global economy. |

| • | The Company’s potential future contracts with U.S. and international defense contractors or directly with the U.S. government may be on a commercial item basis, eliminating the requirement to disclose and certify cost data. To the extent that there are interpretations or changes in the Federal Acquisition Regulations (“FAR”) regarding the qualifications necessary to sell commercial items, there could be a material impact on the Company’s business and operating results. For example, there have been legislative proposals to narrow the definition of a “commercial item” (as defined in the FAR) or to require cost and pricing data on commercial items that could limit or adversely impact the Company’s ability to contract under commercial item terms. Changes could be accelerated due to changes in the Company’s mix of business, in federal regulations, or in the interpretation of federal regulations, which may subject the Company to increased oversight by the Defense Contract Audit Agency (“DCAA”) for certain of the Company’s products or services. Such changes could also trigger contract coverage under the Cost Accounting Standards (“CAS”), further impacting the Company’s commercial operating model and requiring compliance with a defined set of business systems criteria. Growth in the value of certain contracts may increase the Company’s compliance burden, requiring the Company to implement new business systems to comply with such requirements. Failure to comply with applicable CAS requirements could adversely impact the Company’s ability to win future CAS-type contracts. |

| • | The Company would be subject to the Defense Federal Acquisition Regulation Supplement (“DFARS”) and the Department of Defense (“DoD”) and federal cybersecurity requirements, in connection with any defense work the Company performs in the future for the U.S. government and defense prime contractors. Amendments to DoD cybersecurity requirements, such as through amendments to the FAR or DFARS, may increase the Company’s costs or delay the award of contracts if it is unable to certify that it satisfies such cybersecurity requirements. |

| • | The U.S. government or a defense prime contractor customer could require the Company to relinquish data rights to a product in connection with performing work on a defense contract, which could lead to a loss of valuable technology and intellectual property in order to participate in a government program. |

| • | The Company may enter into cost reimbursable contracts with the U.S. government or a defense prime contractor customer that could offset the Company’s cost efficiency initiatives. |

| • | The Company would be subject to various U.S. federal export-control statutes and regulations, which may affect its business with, among others, international defense customers. In certain cases, the export of the Company’s products and technical data to foreign persons, and the provision of technical services to foreign persons related to such products and technical data, may require licenses from the U.S. Department of Commerce or the U.S. Department of State. The time required to obtain these licenses, and the restrictions that may be contained in these licenses, may result in the Company being at a competitive disadvantage with international suppliers who are not subject to U.S. federal export control statutes and regulations. In addition, violations of these statutes and regulations can result in civil and, under certain circumstances, criminal liability as well as administrative penalties which could have a material adverse effect on the Company’s business, financial condition, and results of operations. |

| • | Sales to U.S. prime defense contractor customers as part of foreign military sales (“FMS”) programs combine several different types of risks and uncertainties highlighted above, including risks related to government contracts, risks related to defense contracts, timing and budgeting of foreign governments, and approval from the U.S. and foreign governments related to the programs, all of which may be impacted by macroeconomic and geopolitical factors outside of the Company’s control. |

| • | The Company may in the future derive a portion of its revenue from programs with governments and government agencies that are subject to security restrictions (e.g., contracts involving classified information, classified contracts, and classified programs), which preclude the dissemination of information and technology that is classified for national security purposes under applicable law and regulation. In general, access to classified information, technology, facilities, or programs requires appropriate personnel security clearances, is subject to additional contract oversight and potential liability, and may also require appropriate facility clearances and other specialized infrastructure. Therefore, certain of the Company’s employees with appropriate security clearances may require access to classified information in connection with the performance of a U.S. government contract. The Company must comply with security requirements pursuant to the National Industrial Security Program Operating Manual (“NISPOM”) administered by the Defense Counterintelligence and Security Agency (“DCSA”), and other U.S. government security protocols when accessing sensitive information. Failure to comply with the NISPOM or other security requirements may subject the Company to civil or criminal penalties, loss of access to sensitive information, loss of a U.S. government contract, or potentially debarment as a government contractor. Further, the DCSA has transitioned its review of a contractor’s security program to focus on the protection of controlled unclassified information and assets. Failure to meet DCSA’s new, broader requirements could adversely impact the ability to win new business as a government contractor. |

| • | The Company may need to invest additional capital to build out higher level security infrastructure at certain of its facilities to be awarded contracts related to defense programs with higher level security requirements. Failure to invest in such infrastructure may limit the Company’s ability to obtain new contracts with defense programs. |

| • | The Company may be required to have certain products that it purchases manufactured in the United States and other relatively high-cost manufacturing locations under the Buy American Act or other regulations, and the Company may not manufacture all products in locations that meet these requirements, which may preclude the Company’s ability to sell some products or services. |

| • | Terminate existing contracts for convenience with short notice; |

| • | Reduce orders under or otherwise modify contracts; |

| • | For contracts subject to the Truthful Cost or Pricing Data Act, reduce the contract price or cost where it was increased because a contractor or subcontractor furnished cost or pricing data during negotiations that was not complete, accurate, and current; |

| • | For some contracts, (i) demand a refund, make a forward price adjustment, or terminate a contract for default if a contractor provided inaccurate or incomplete data during the contract negotiation process and (ii) reduce the contract price under triggering circumstances, including the revision of price lists or other documents upon which the contract award was predicated; |

| • | Cancel multi-year contracts and related orders if funds for contract performance for any subsequent year become unavailable; |

| • | Decline to exercise an option to renew a multi-year contract; |

| • | Claim rights in solutions, systems, or technology produced by us, appropriate such work-product for their continued use without continuing to contract for our services, and disclose such work-product to third parties, including other government agencies and our competitors, which could harm our competitive position; |

| • | Prohibit future procurement awards with a particular agency due to a finding of organizational conflicts of interest based upon prior related work performed for the agency that would give a contractor an unfair advantage over competing contractors, or the existence of conflicting roles that might bias a contractor’s judgment; |

| • | Subject the award of contracts to protest by competitors, which may require the contracting federal agency or department to suspend our performance pending the outcome of the protest and may also result in a requirement to resubmit offers for the contract or in the termination, reduction, or modification of the awarded contract; |

| • | Suspend or debar the Company from doing business with the applicable government; and |

| • | Control or prohibit the export of its services. |

| • | Specialized disclosure and accounting requirements unique to government contracts; |

| • | Financial and compliance audits that may result in potential liability for price adjustments, recoupment of government funds after such funds have been spent, civil and criminal penalties, or administrative sanctions such as suspension or debarment from doing business with the U.S. government; |

| • | Public disclosures of certain contract and company information; |

| • | Mandatory socioeconomic compliance requirements, including labor requirements, non-discrimination and affirmative action programs and environmental compliance requirements; and |

| • | Requirements to procure certain materials, components and parts from supply sources approved by the customer. |

| • | a limited availability of market quotations for its securities; |

| • | reduced liquidity for its securities; |

| • | a determination that Class A Ordinary Shares are a “penny stock” which will require brokers trading in the Class A Ordinary Shares to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for its securities; |

| • | a limited amount of news and analyst coverage; and |

| • | a decreased ability to issue additional securities or obtain additional financing in the future. |

| • | actual or anticipated fluctuations in the Company’s quarterly financial results or the quarterly financial results of companies perceived to be similar to it; |

| • | changes in the market’s expectations about the Company’s operating results; |

| • | success of competitors; |

| • | the Company’s operating results failing to meet the expectation of securities analysts or investors in a particular period; |

| • | changes in financial estimates and recommendations by securities analysts concerning the Company or the industries in which the Company operates; |

| • | operating and share price performance of other companies that investors deem comparable to the Company; |

| • | the Company’s ability to market new and enhanced products and technologies on a timely basis; |

| • | changes in laws and regulations affecting the Company’s business; |

| • | the Company’s ability to meet compliance requirements; |

| • | commencement of, or involvement in, litigation involving the Company; |

| • | changes in the Company’s capital structure, such as future issuances of securities or the incurrence of additional debt; |

| • | the volume of Class A Ordinary Shares available for public sale; |

| • | any major change in the Board or management; |

| • | sales of substantial amounts of Ordinary Shares by the Company’s directors, executive officers or significant shareholders or the perception that such sales could occur; and |

| • | general economic and political conditions such as recessions, interest rates, international currency fluctuations and acts of war or terrorism. |

| • | the U.S. court issuing the judgment had jurisdiction in the matter and Satellogic either submitted to such jurisdiction or was resident or carrying on business within such jurisdiction and was duly served with process; |

| • | the judgment given by the U.S. court was not in respect of penalties, taxes, fines or similar fiscal or revenue obligations of Satellogic; |

| • | in obtaining judgment there was no fraud on the part of the person in whose favor judgment was given or on the part of the court; |

| • | recognition or enforcement of the judgment in the BVI would not be contrary to public policy; and |

| • | the proceedings pursuant to which judgment was obtained were not contrary to natural justice. |

| • | to recognize or enforce judgments against Satellogic of courts of the United States based on certain civil liability provisions of U.S. securities laws; and |

| • | to impose liabilities against Satellogic in original actions brought in BVI, based on certain civil liability provisions of U.S. securities laws that are penal in nature. |

ITEM 4. |

INFORMATION ON THE COMPANY |

| A. | History and Development of the Company |

| B. | Business Overview |

| • | Superior Unit Economics. |

| • | Superior design and technology. trade-off between the resolution achieved and the capture capability. This is why our NewSpace competitors are only able to capture approximately one-tenth of data per day per satellite in comparison to our satellites. Our solution to this problem is centered around our patented and unique camera design that utilizes adaptive optics allowing us to collect approximately 10 times more data from orbit than any of our competitors using a very small aperture. Additionally, our camera design has afforded us the ability to create a compact satellite design resulting in 3 times lower mass and lower launch costs. |

| • | Vertically integrated. non-mission specific components built for a wide range of applications as our competitors do), we lower the cost of our materials by a factor of 10x. Our cost to deploy a high resolution imaging satellite in orbit today, including launch costs, is approximately $1 million compared to our NewSpace competitors’ average cost of approximately $10 million with an average of 10x less capacity. |

| • | High frequency remaps. |

| • | Leverage the existing government and defense and intelligence market to help finance the constellation build-out. |

| • | Expand the high resolution EO market and democratize access to data for the commercial market. |

| • | Continue investment in R&D to innovate product offerings and satellite re-design. |

| • | Leverage our modular satellite design, multiple-payload systems, scaled manufacturing and satellite operations to deliver novel data streams and services from orbit. |

| • | Execute strategic acquisitions and partnerships related to new, complimentary, or adjacent technologies as well as continued vertical integration within our existing supply chain. |

| • | Monitoring hydroelectric plants in high frequency to build predictive models of energy output as well as drainage in the reservoir from the surrounding basin |

| • | Oil field and pipeline monitoring |

| • | Precision agriculture |

| • | Supply chain management (agriculture) |

| • | Tree counting (forestry) |

| • | Crop management (agriculture & forestry) |

| • | Planning for renewable energy projects |

| • | Precise estimation of commodities output |

| • | Yield prediction and harvesting (agriculture & forestry) |

| • | Energy output |

| • | Mineral output |

| • | Geospatial risk modeling (e.g., flood, drought, fire, environmental) |

| • | Real time impact assessment, disaster management and claims estimation (e.g., storm damage, earthquakes, forest fires, oil spills, etc.) |

| • | Real time planetary health |

| • | Sea level, temperature and acidity |

| • | Fractures in polar ice caps |

| • | Global temperature |

| • | Water distribution |

| • | Illegal activities (e.g., deforestation, mining, poaching, smuggling, etc.) |

| • | Design through launch |

| • | Fast iteration between product innovation, production and launch |

| • | Owning the design to manufacturing helps eliminate third-party cost |

| • | In-orbit operations |

| • | Own and control data capture of the earth’s surface |

| • | Utilize third-party ground station infrastructure to reduce costs |

| • | Imagery & Solutions commercialization |

| • | Capture and own high-resolution total earth imagery. Unconstrained use of imagery |

| • | Use internal data science capabilities to transform images into insights |

| SATELLITE NAME |

SATELLITE GENERATION |

LAUNCH DATE |

PAYLOADS* |

STATUS |

USEFUL LIFE |

|||||||||||||||

NewSat-6 |

Mark IV-a |

Sep 2, 2020 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-7 |

Mark IV-a |

Jan 15, 2020 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-8 |

Mark IV-b |

Jan 15, 2020 | MS, HS, IoT | Operative | 3 Years | |||||||||||||||

NewSat-9 |

Mark IV-b |

Nov 6, 2020 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-10 |

Mark IV-b |

Nov 6, 2020 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-11 |

Mark IV-b |

Nov 6, 2020 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-12 |

Mark IV-c |

Nov 6, 2020 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-13 |

Mark IV-c |

Nov 6, 2020 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-14 |

Mark IV-c |

Nov 6, 2020 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-15 |

Mark IV-c |

Nov 6, 2020 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-16 |

Mark IV-c |

Nov 6, 2020 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-17 |

Mark IV-c |

Nov 6, 2020 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-18 |

Mark IV-c |

Nov 6, 2020 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-19 |

Mark IV-e |

Jun 30, 2021 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-20 |

Mark IV-e |

Jun 30, 2021 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-21 |

Mark IV-e |

Jun 30, 2021 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-22 |

Mark IV-e |

Jun 30, 2021 | MS, HS | Operative | 3 Years | |||||||||||||||

NewSat-23 |

Mark IV-g |

Apr 1, 2022 | MS, HS | Commissioning | 3 Years | |||||||||||||||

NewSat-24 |

Mark IV-g |

Apr 1, 2022 | MS, HS | Commissioning | 3 Years | |||||||||||||||

NewSat-25 |

Mark IV-g |

Apr 1, 2022 | MS, HS | Commissioning | 3 Years | |||||||||||||||

NewSat-26 |

Mark IV-g |

Apr 1, 2022 | MS, HS | Commissioning | 3 Years | |||||||||||||||

NewSat-27 |

Mark V-a |

Apr 1, 2022 | MS, HS | Commissioning | 3 Years | |||||||||||||||

| (*) | MS = Multispectral / HS = Hyperspectral / IoT = Internet of things |

| • | Get it done |

| • | Be purpose driven |

| • | Never stop learning |

| • | Push the limits |

| • | Go beyond ego |

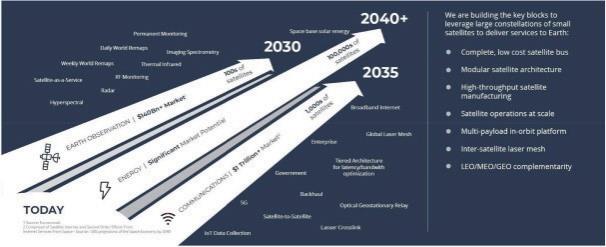

| • | Complete, low-cost satellite bus |

| • | Modular satellite architecture |

| • | High-throughput satellite manufacturing |

| • | Satellite operations at scale |

| • | Multi-payload, in-orbit platform |

| • | Inter-satellite laser mesh |

| • | LEO/MEO/GEO complementarity |

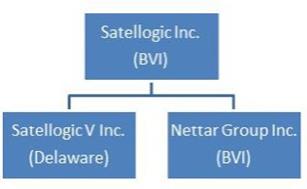

C. |

Organizational Structure |

| (1) | The diagram above only shows selected subsidiaries of the Company. |

| (2) | All lines represent 100% ownership unless otherwise indicated. |

D. |

Property, Plants and Equipment |

ITEM 4A. |

UNRESOLVED STAFF COMMENTS |

ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

Item 5.A |

Operating Results |

| • | Target Merger Sub merged with and into Nettar, the separate existence of Target Merger Sub ceased and Nettar was the surviving company of such merger and became a direct, wholly-owned subsidiary of the Company; |

| • | immediately following confirmation of the effective filing of the Initial Merger, CF V merged with and into SPAC Merger Sub, the separate existence of SPAC Merger Sub ceased and CF V was the surviving corporation of such merger and became a direct wholly owned subsidiary of the Company; |

| • | the single share of the Company outstanding immediately prior to the Mergers was cancelled for no consideration; |

| • | as a result of the Initial Merger, the ordinary shares and preference shares of Nettar that were issued and outstanding immediately prior to the effective time of the Initial Merger (other than (i) any treasury shares or share held by the Company or any of its affiliates and (ii) any dissenting shares) were automatically cancelled and ceased to exist in exchange for (x) in the case of the Company’s Chief Executive Officer, Emiliano Kargieman, such number of newly issued Class B Ordinary Shares, of the Company and (y) in all other cases, Class A Ordinary Shares of the Company, as determined in the Merger Agreement; |

| • | as a result of the CF V Merger, each CF V Unit issued and outstanding immediately prior to the effective time of the CF V Merger (the “CF V Merger Effective Time”) was automatically separated and the holder thereof was deemed to hold one share of CF V Class A Common Stock and one-third of one CF V Warrant and, immediately following the separation of each CF V Unit, (a) each share of CF V Class B Common Stock automatically converted into one share of CF V Class A Common Stock (the “Initial Conversion”) and (b) immediately following the Initial Conversion, each share of CF V Class A Common Stock that was issued and outstanding immediately prior to the CF V Merger Effective Time (other than any treasury share held by CF V or share held by any subsidiary of CF V), was cancelled and ceased to exist in exchange for the right to receive Class A Ordinary Shares in accordance with the Merger Agreement; |

| • | each CF V Warrant outstanding immediately prior to the CF V Merger Effective Time was assumed by the Company and converted into a warrant exercisable for that number of Class A Ordinary Shares as determined in accordance with the Merger Agreement; |

| • | all Convertible Notes of Nettar converted into Nettar Preference Shares as determined in accordance with the Merger Agreement; |

| • | all Nettar Preference Shares outstanding immediately prior to the effective time of the Initial Merger (other than dissenting shares) were converted into a number of Class A Ordinary Shares as determined in the Merger Agreement; |

| • | all options to purchase ordinary shares of Nettar were assumed by the Company and became options to purchase Class A Ordinary Shares as determined in accordance with the Merger Agreement; |

| • | the Columbia Warrants outstanding immediately prior to the effective time of the Initial Merger was assigned to Satellogic and became a warrant exercisable for that number of Class A Ordinary Shares as determined in accordance with the Merger Agreement; |

| • | All Class A Ordinary Shares purchased by the PIPE Subscribers pursuant to the PIPE Subscription Agreements (except those 1,150,000 Class A Ordinary Shares which certain PIPE Subscribers elected to offset their subscription requirements with CF V Class A Common Stock) were issued to the PIPE Subscribers; and |

| • | 2,500,000 PIPE Warrants were issued to a certain PIPE Subscriber. |

| • | the Liberty Investor has the right to nominate two Liberty Directors (including any successors) for election to the Board by the Company’s shareholders, which director nominees must be reasonably acceptable to the Company. In this regard, the parties have further agreed that: |

○ |

The Sponsor and Mr. Kargieman will vote their Class A Ordinary Shares and Class B Ordinary Shares, (and those held by any persons over which they have voting control), in favor of the election of the Liberty Director nominees. |

○ |

Secretary Mnuchin will be nominated for election as non-executive Chairman to the Board, to serve as one of the Liberty Directors. For so long as Secretary Mnuchin is a Liberty Director, he shall be the non-executive Chairman of the Board, and the Sponsor and Mr. Kargieman shall not be required to vote for any person designated by the Liberty Investor to replace Secretary Mnuchin unless such party consents in writing to such replacement, such consent not to be unreasonably withheld. |

○ |

Mr. Kargieman will cause any transferee of any Class B Ordinary Shares held by him to agree, as a condition to such transfer, to all of his obligations under the Liberty Letter Agreement (other than in the case of a transfer to a transferee that would result in automatic conversion of such Class B Ordinary Shares into Class A Ordinary Shares in accordance with the Company’s Governing Documents). |

○ |

The Liberty Investor’s right to nominate the Liberty Directors will cease immediately following the occurrence of a Cessation Event, and the terms of any then-serving Liberty Directors will expire at the next election of directors (but in no event more than one year after the Cessation Event). |

○ |

The Company will (a) take all necessary action to cause the Liberty Directors to be elected to the Board; (b) maintain in effect at all times directors and officers indemnity insurance coverage reasonably satisfactory to the Liberty Investor; (c) provide for indemnification, exculpation and advancement of expenses to the fullest extent permitted under applicable law in the Company’s Governing Documents; (d) not increase or decrease the maximum number of directors permitted to serve on the Board without the prior written consent of the Liberty Investor; and (e) not take any action, including making or recommending any amendment to the Company Governing Documents that could reasonably be expected to adversely affect the Liberty Investor’s rights under the Liberty Letter Agreement; |

| • | in addition to the Liberty Directors, the Board will initially include Ted Wang, Brad Halverson, and another person designated by Mr. Kargieman who is reasonably acceptable to the Liberty Investor, and in compliance with NASDAQ listing requirements; |

| • | the Liberty Investor has the right to nominate one Liberty Director to serve on each committee of the Board, subject to certain conditions; |

| • | for so long as Mr. Kargieman and his affiliates beneficially own at least one-third of the number of shares of the Company owned by him on the date of the Closing (subject to customary adjustments for corporate events), Mr. Kargieman will have the right to designate two directors for election to the Board by the Company’s shareholders, one of whom will be Mr. Kargieman and the other shall be reasonably acceptable to the Liberty Investor and the Sponsor, who will initially be Marcos Galperin, and the Sponsor and the Liberty Investor will vote any shares held by them in favor of the election of such persons; and |

| • | for so long as the Sponsor and its affiliates beneficially own at least one-third of the number of shares of the Company owned by them on the date of the Closing (subject to customary adjustments for corporate events), Mr. Lutnick will be nominated for election by the Board to the Company’s shareholders and Mr. Kargieman and the Liberty Investor will vote any shares held by them in favor of the election of Mr. Lutnick. |

| • | any acquisition by the Company of any equity interests, assets, properties, or business of any person; |

| • | any merger, consolidation, or other business combination involving the Company; |

| • | any transaction or series of related transactions involving a change of control (as defined in the Liberty Letter Agreement); or |

| • | any equity split, payment of distributions, or any similar recapitalization. |

| • | 2,500,000 warrants, each providing the right to purchase one (1) Class A Ordinary Share at an exercise price of $10.00 per share (the “Liberty Advisory Fee Warrants”), which were issued on the Liberty Closing; and |

| • | for so long as a Cessation Event has not occurred, $1.25 million to be paid in cash on the eighteen (18) month anniversary of the Liberty Closing and on the last day (or, if not a business day, the immediately following business day) of each of the following five (5) successive three-month anniversaries of such 18-month anniversary (each, an “Advisory Fee Cash Payment” and, together, the “Advisory Fee Cash Payments”), representing aggregate Advisory Fee Cash Payments of up to $7,500,000. From and after a Cessation Event, no Advisory Fee Cash Payments shall be payable by the Company. |

| • | Superior Unit Economics. |

| • | Superior design and technology. a trade-off between the resolution achieved and the capture capability. This is why our NewSpace competitors are only able to capture approximately one-tenth of data per day per satellite in comparison to our satellites. Our solution to this problem is centered around our patented and unique camera design that utilizes adaptive optics allowing us to collect approximately 10x more data from orbit than any of our competitors using a very small aperture. Our camera design has afforded us the ability to create a compact satellite design resulting in 3x lower mass and lower launch costs. |

| • | Vertically integrated. sourcing non-mission specific components built for a wide range of applications as our competitors do), we lower the cost of our materials by a factor of 10x. Our cost to deploy a high-resolution imaging satellite in orbit today, including launch costs, is approximately $1 million compared to our NewSpace competitors’ average cost of approximately $10 million with an average of 10x less capacity. |

| • | High frequency remaps. |

| • | Leverage the existing government and defense and intelligence market to help finance constellation build-out. |

| • | Expand the high resolution EO market and democratize access to data for the commercial market. |

| • | Continue investment in R&D to innovate product offerings and satellite re-design. |

| • | Leverage our modular satellite design, multiple-payload systems, scaled manufacturing and satellite operations to deliver novel data streams and services from orbit. |

| • | Execute strategic acquisitions and partnerships related to new, complimentary, or adjacent technologies as well as continued vertical integration within our existing supply chain. |

Year Ended December 31, |

||||||||||||

(in thousands of US dollars) |

2021 |

2020 |

2019 |

|||||||||

| Revenue |

$ | 4,247 | $ | — | $ | — | ||||||

| Net loss |

$ | (117,741 | ) | $ | (113,926 | ) | $ | (20,765 | ) | |||

| EBITDA |

$ | (95,379 | ) | $ | (103,108 | ) | $ | (12,341 | ) | |||

| Adjusted EBITDA |

$ | (30,695 | ) | $ | (17,497 | ) | $ | (15,500 | ) | |||

| Free cash flow |

$ | (38,936 | ) | $ | (26,589 | ) | $ | (22,370 | ) | |||

Year Ended December 31, |

2021 vs. 2020 |

|||||||||||||||||||

(in thousands of US dollars) |

2021 |

2020 |

2019 |

$ Change |

% Change |

|||||||||||||||

| Statement of Profit or Loss Data |

| |||||||||||||||||||

| Revenue |

$ | 4,247 | $ | — | $ | — | $ | 4,247 | 100 | % | ||||||||||

| Cost of sales |

(1,876 | ) | — | — | 1,876 | 100 | % | |||||||||||||

| Administrative expenses |

(36,649 | ) | (8,127 | ) | (4,324 | ) | 28,522 | 351 | % | |||||||||||

| Research and development |

(9,640 | ) | (5,879 | ) | (6,372 | ) | 3,761 | 64 | % | |||||||||||

| Depreciation expense |

(10,825 | ) | (3,182 | ) | (4,238 | ) | 7,643 | 240 | % | |||||||||||

| Other operating expenses, net |

(14,002 | ) | (5,475 | ) | (5,763 | ) | 8,527 | 156 | % | |||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating loss |

$ |

(68,745 |

) |

$ |

(22,663 |

) |

$ |

(20,697 |

) |

$ |

46,082 |

203 |

% | |||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Finance costs, net |

(11,769 | ) | (7,488 | ) | (4,103 | ) | 4,281 | 57 | % | |||||||||||

| Embedded derivative (expense) income |

(42,102 | ) | (84,224 | ) | 4,230 | (42,122 | ) | (50 | %) | |||||||||||

| Gain on extinguishment of debt |

3,576 | — | — | 3,576 | 100 | % | ||||||||||||||

| Other financial income (expense) |

1,067 | 597 | (112 | ) | 470 | 79 | % | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before income tax |

$ |

(117,973 |

) |

$ |

(113,778 |

) |

$ |

(20,682 |

) |

$ |

4,195 |

4 |

% | |||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Income tax benefit (expense) |

232 | (148 | ) | (83 | ) | (380 | ) | -257 | % | |||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ |

(117,741 |

) |

$ |

(113,926 |

) |

$ |

(20,765 |

) |

$ |

3,815 |

3 |

% | |||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

Year Ended December 31, |

||||||||||||

(in thousands of US dollars) |

2021 |

2020 |

2019 |

|||||||||

| Net loss |

$ | (117,741 | ) | $ | (113,926 | ) | $ | (20,765 | ) | |||

| Plus finance costs, net |

11,769 | 7,488 | 4,103 | |||||||||

| Less income tax (benefit) expense |

(232 | ) | 148 | 83 | ||||||||

| Plus depreciation expense |

10,825 | 3,182 | 4,238 | |||||||||

| |

|

|

|

|

|

|||||||

| EBITDA |

$ |

(95,379 |

) |

$ |

(103,108 |

) |

$ |

(12,341 |

) | |||

| |

|

|

|

|

|

|||||||

| Plus professional fees related to merger transaction |

16,263 | — | — | |||||||||

| Less other financial (income) expense |

(1,067 | ) | (597 | ) | 112 | |||||||

| Less gain on extinguishment of debt |

(3,576 | ) | — | — | ||||||||

| Plus embedded derivative expense (income) |

42,102 | 84,224 | (4,230 | ) | ||||||||

| Plus share-based compensation |

10,962 | 1,984 | 959 | |||||||||

| |

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | (30,695 |

) |

$ | (17,497 |

) |

$ | (15,500 |

) | |||

| |

|

|

|

|

|

|||||||

(in thousands of US dollars) |

Year Ended December 31, |

|||||||||||

2021 |

2020 |

2019 |

||||||||||

| Net cash flows Used in Operating Activities |

$ | (27,720 | ) | $ | (17,330 | ) | $ | (14,069 | ) | |||

| Less purchases of satellites and other property and equipment |

11,216 | 9,259 | 8,301 | |||||||||

| |

|

|

|

|

|

|||||||

| Free Cash Flow |

$ |

(38,936 |

) |

$ |

(26,589 |

) |

$ |

(22,370 |

) | |||

| |

|

|

|

|

|

|||||||

Year Ended December 31, |

||||||||||||

(in thousands of US dollars) |

2021 |

2020 |

2019 |

|||||||||

| Net cash flows: |

||||||||||||

| Net cash flows used in operating activities |

$ | (27,720 | ) | $ | (17,330 | ) | $ | (14,069 | ) | |||

| Net cash flows used in investing activities |

(11,213 | ) | (9,245 | ) | (8,301 | ) | ||||||

| Net cash flows from financing activities |

27,900 | 17,780 | 27,016 | |||||||||

| |

|

|

|

|

|

|||||||

| Net change in cash and cash equivalents |

$ |

(11,033 |

) |

$ |

(8,795 |

) |

$ |

4,646 |

||||

| |

|

|

|

|

|

|||||||

Year Ended December 31, |

||||||||||||

(in thousands of US dollars) |

2021 |

2020 |

2019 |

|||||||||

| Net loss |

$ | (117,741 | ) | $ | (113,926 | ) | $ | (20,765 | ) | |||

| Adjustments for the impact of non-cash items (1) |

72,288 | 95,883 | 5,395 | |||||||||

| |

|

|

|

|

|

|||||||

| Net loss adjusted for the impact of non-cash items |

(45,453 | ) | (18,043 | ) | (15,370 | ) | ||||||

| Changes in assets and liabilities |

||||||||||||

| Accounts receivable - trade (2) |

(2,986 | ) | 7 | 12 | ||||||||

| Prepaids and other current assets (3) |

(1,706 | ) | (228 | ) | (170 | ) | ||||||

| Accounts payable - trade (4) |

2,135 | 555 | (251 | ) | ||||||||

| Other (5) |

20,290 | 379 | 1,710 | |||||||||

| |

|

|

|

|

|

|||||||

| Net cash provided by operating activities |

$ |

(27,720 |

) |

$ |

(17,330 |

) |

$ |

(14,069 |

) | |||

| |

|

|

|

|

|

|||||||

| (1) | Includes items such as depreciation, changes in the fair value of embedded derivative instruments, interest expense, income tax expense, share-based compensation expense, allowance for doubtful accounts, gain on debt extinguishment and changes in foreign currency and others. |

| (2) | The change is primarily due to higher accounts receivable from our commercial space technology customer. |

| (3) | The change is primarily due to higher prepaids from software licenses and higher advances to suppliers. |

| (4) | The change is primarily due to the timing of payments. |

| (5) | The change is primarily due to higher accrued professional fees related to the Business Combination and higher other taxes payable due to higher headcount and higher value-added taxes due to increased business activities. |

ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

| A. | Directors and Executive Officers |

Name |

Age |

Class |

Committees |

Independence | ||||||

| Emiliano Kargieman |

46 | Class III | None | Non-Independent | ||||||

| Ted Wang |

52 | Class I | Audit | Independent | ||||||

| Marcos Galperin |

49 | Class III | None | Independent | ||||||

| Brad Halverson |

61 | Class III | Audit (Chairperson) | Independent | ||||||

| Howard Lutnick |

60 | Class II | None | Non-Independent | ||||||

| Steven Terner Mnuchin |

59 | Class I | None | Non-Independent | ||||||

| Joseph Dunford |

66 | Class I | None | Independent | ||||||

| Tom Killalea |

55 | Class II | Audit | Independent | ||||||

| Miguel Gutiérrez |

64 | Class II | None | Independent | ||||||

| • | appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm; |

| • | discussing with our independent registered public accounting firm their independence from management; |

| • | reviewing, with our independent registered public accounting firm, the scope and results of their audit; |

| • | approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm; |

| • | overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the annual financial statements that we file with the SEC; |

| • | overseeing our financial and accounting controls and compliance with legal and regulatory requirements; |

| • | reviewing our policies on risk assessment and risk management; |

| • | reviewing related person transactions; and |

| • | establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters. |

| • | Determining the qualifications, qualities, skills and other expertise required to be a director and to develop, and recommend to the Board for its approval, criteria to be considered in selecting nominees for director. |

| • | Evaluating the current composition, organization and governance of the Board and its committees, determining future requirements and making recommendations to the Board for approval consistent with the criteria approved by our Board. |

| • | Searching for, identifying, evaluating and selecting, or recommending for selection by the Board, candidates to fill new positions or vacancies on the Board consistent with the criteria approved by our Board, and reviewing any candidates recommended by shareholders. |

| • | Reviewing and considering any nominations of director candidates validly made by stockholders in accordance with applicable laws, rules and regulations and the provisions of the Company’s certificate of incorporation and bylaws. |

| • | Evaluating the performance of individual members of the Board eligible for re-election, and selecting, or recommending for the selection of the Board, the director nominees by class for election to the Board by the shareholders at the annual meeting of shareholders or any special meeting of shareholders at which directors are to be elected. |

| • | Considering the Board’s leadership structure, including the appointment of a lead independent director of the Board, for specific purposes, and making such recommendations to the Board with respect thereto as the Nominating and Corporate Governance Committee deems appropriate. |

| • | Developing and reviewing periodically the policies and procedures for considering stockholder nominees for election to the Board. |

| • | Evaluating the “independence” of directors and director nominees against the independence requirements of the securities exchange on which the Company’s securities are listed, applicable rules and regulations promulgated by the SEC and other applicable laws. |

| • | Approving, or recommending to the Board for approval, and periodically reviewing the policies and procedures for director candidates, stockholder communications policy and external communications policy, and approve, or recommend to the Board for approval, any changes deemed appropriate. |

| • | reviewing and approving the corporate goals and objectives, evaluating the performance of and reviewing and approving (either alone or, if directed by the Board, in conjunction with a majority of the independent members of the Board) the compensation of our Chief Executive Officer; |

| • | overseeing an evaluation of the performance of and reviewing and setting or making recommendations to our Board regarding the compensation of our other executive officers; |

| • | reviewing and approving or making recommendations to our Board regarding our incentive compensation and equity-based plans, policies and programs; |

| • | reviewing and approving all employment agreement and severance arrangements for our executive officers; |

| • | making recommendations to our Board regarding the compensation of our directors; and |

| • | retaining and overseeing any compensation consultants. |

Name |

Age |

Title |

||||

| Emiliano Kargieman | 46 | Chief Executive Officer | ||||

| Rick Dunn | 53 | Chief Financial Officer | ||||

| Aviv Cohen | 50 | Chief Operations Officer | ||||

| Gerardo Richarte | 47 | Chief Information Security Officer | ||||

| Rebeca Brandys | 46 | General Counsel |

ITEM 7. |

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

| • | each person known to by us to be the beneficial owner of more than 5% of the Ordinary Shares; |

| • | each of our directors and executive officers; and |

| • | all of our directors and executive officers as a group. |

Name and Address of Beneficial Owner** |

Class A Ordinary Shares Number ofShares Beneficially Owned |

% of Class |

Class B Ordinary Shares Number ofShares Beneficially Owned |

% of Class |

Approximate Percentage of Outstanding Class A Ordinary Shares |

|||||||||||||||

Directors and Executive Officers (1) |

||||||||||||||||||||

Emiliano Kargieman |

— | — | 13,662,658 | 100.0 | % | 15.1 | % | |||||||||||||

Rick Dunn (2) |

673,431 | * | % | — | — | % | * | % | ||||||||||||

Aviv Cohen (3) |

523,790 | * | % | — | — | % | * | % | ||||||||||||

Gerardo Richarte (4) |

1,806,364 | 2.3 | % | — | — | % | 1.9 | % | ||||||||||||

Rebeca Brandys (5) |

67,154 | * | % | — | — | % | * | % | ||||||||||||

Ted Wang (6) |

578,296 | * | % | — | — | % | * | % | ||||||||||||

Marcos Galperin |

26,328 | * | % | — | — | % | * | % | ||||||||||||

Brad Halverson |

— | * | % | — | — | % | — | % | ||||||||||||

Steven Terner Mnuchin(7) |

40,000,000 | 41.2 | % | — | — | % | 36.1 | % | ||||||||||||

Howard Lutnick(8) |

13,776,353 | 17.8 | % | — | — | % | 15.1 | % | ||||||||||||

Joseph Dunford |

— | — | % | — | — | % | — | % | ||||||||||||

Tom Killalea |

325,635 | * | % | — | — | % | * | % | ||||||||||||

Miguel Gutiérrez |

— | — | % | — | — | % | — | % | ||||||||||||

All executive officers and directors as a group (13 individuals) |

57,777,351 | 58.4 | % | 13,662,658 | 100 | % | 63.4 | % | ||||||||||||

5% or More Shareholders: |

||||||||||||||||||||

Cantor Fitzgerald L.P.(8) |

13,776,353 | 17.8 | % | — | — | % | 15.1 | % | ||||||||||||

Pitanga Invest Ltd.(9) |

10,656,546 | 13.8 | % | — | — | % | 11.8 | % | ||||||||||||

Hannover Holdings S.A.(10) |

7,558,158 | 9.8 | % | — | — | % | 8.3 | % | ||||||||||||

Liberty Strategic Capital (SATL) Holdings, LLC(7) |

40,000,000 | 41.2 | % | — | — | % | 36.1 | % | ||||||||||||

| * | Indicates less than 1% ownership |

| ** | Assumes the maximum number of Additional Shares have been issued and that the Forfeited Share Re-issuance has occurred. |

| (1) | Unless otherwise noted, the business address of each of the following entities or individuals is c/o Satellogic Inc., Ruta 8 Km 17,500, Edificio 300 Oficina 324 Zonamérica Montevideo, 91600, Uruguay. |

| (2) | Includes 541,336 options to purchase Class A Ordinary Shares |

| (3) | Consists of 523,790 options to purchase Class A Ordinary Shares. |

| (4) | Includes 276,980 options to purchase Class A Ordinary Shares. |

| (5) | Consists of 67,154 options to purchase Class A Ordinary Shares. |