UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT

ANNUAL REPORT PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended December 31, 2021

| Sky Limit Venture Corp. |

| (Exact name of registrant as specified in its charter) |

Commission File Number: 024-11613

| California |

| 81-2983268 |

| (State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

|

| 12338 Valley Blvd., Suite C El Monte, CA |

| 91732 |

| (Address of principal executive offices) |

| (Zip Code) |

(626) 434-9606

Registrant’s telephone number, including area code

Common Stock

(Title of each class of securities issued pursuant to Regulation A)

In this report, the term “Sky Limit Venture Corp.”, “Sky Limit” “SKYL” or “the Company” or “us” or “our(s)” or “we” refers to Sky Limit Venture Corp.

This report may contain forward-looking statements and information relating to, among other things, the Company, its business plan and strategy, and its industry. These forward-looking statements are based on the beliefs of, assumptions made by, and information currently available to the Company’s management. When used in this report, the words “estimate,” “project,” “believe,” “anticipate,” “intend,” “expect” and similar expressions are intended to identify forward-looking statements, which constitute forward looking statements. These statements reflect management’s current views with respect to future events and are subject to risks and uncertainties that could cause the Company’s actual results to differ materially from those contained in the forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. The Company does not undertake any obligation to revise or update these forward-looking statements to reflect events or circumstances after such date or to reflect the occurrence of unanticipated events.

| i |

Item 1. Business.

Sky Limit Venture Corp.

Company Information

Sky Limit Venture, Corp. (the “Company”, “SKYL”, “Sky Limit”) was incorporated May 24, 2016, under the laws of the State of California. The Company was formed for the sole purpose of renewable energy, solar panel and energy storage installation, research and development.

Sky Limit Venture Corp provides a variety of clean energy solutions for residential and commercial customers. It is also focusing on research and development of recycled electric vehicle lithium batteries. It is developing a process to improve and repurpose these batteries for outdoor use. The company is in the midst of designing and building a technology application to monitor lithium batteries to measure the power being generated. This monitoring technology will provide customers a peace of mind that their equipment is producing, electricity as desired. In addition, the company is soon to be assessing whether or not it could enter into the building and operating of large utility scale solar farms in order to sell the clean energy that is generated; however, at this time the Company has not taken any substantive steps in order to make any entry into that market. Sky Limit Venture plan on holding equity on these projects we develop with a goal of becoming a utility that generate clean energy nationally and internationally. We strive to become a comprehensive source for our customers clean and efficient energy needs.

Sky Limit Venture Corp is involved in every step of the renewable energy process, including sales, design, permitting, development, installation, construction, and repairs. Our customers can choose from a variety of financing options including PPA and Lease programs. The company continues to expand its services to offer a one stop contractor. Providing customer convenience of coordinating with one contractor vs multiple contractors. The company services include installation of residential and commercial solar photovoltaic systems, electric vehicle charging stations, installation of new roofing, re-roofing, solar roof, installation of energy generation and battery storage. Additionally, the company is continuing research and development of recycled electric vehicle lithium batteries to repurpose for outdoor use. It is also creating an application to monitor the battery life span for equipment failures.

On May 26, 2021, the Company increased the number of authorized shares of stock from 1,000,000 to 1,000,000,000, with the California Secretary of State.

On July 7, 2021, the Company filed an amendment to its Articles of Incorporation (the “Amendment”) with the Secretary of State of the State of California, which, among other things, authorized 1,000,000 shares out of our 1,000,000,000 shares authorized as preferred shares, leaving 999,000,000 shares of common stock authorized, and established the designation, powers, rights, privileges, preferences and restrictions of the Series A Preferred Stock, $0.001 par value per share (the “Series A Preferred Stock”) as well as designating a par value of $0.001 to the Common Stock.

Among other provisions, each one (1) share of the Series A Preferred Stock shall have voting rights equal to (x) 0.019607 multiplied by the total issued and outstanding shares of common stock of the Company eligible to vote at the time of the respective vote (the “Numerator”), divided by (y) 0.49, minus (z) the Numerator. For purposes of illustration only, if the total issued and outstanding shares of common stock of the Company eligible to vote at the time of the respective vote is 80,000,000, the voting rights of one share of the Series A Preferred Stock shall be equal to 1,632,583 from the following calculation: (0.019607 x 80,000,000) / 0.49) – (0.019607 x 80,000,000) = 1,632,583).

One Hundred-One (101) shares of Series A Preferred Stock were authorized and One Hundred-One (101) shares of Series A Preferred Stock were issued to our CEO, Mark Senelath. At December 31, 2021, Series A Preferred Stock had 165,214,879 votes.

The Series A Preferred Stock has no dividend rights, no liquidation rights and no redemption rights, and was created primarily to be able to obtain a quorum and conduct business at shareholder meetings. All shares of the Series A Preferred Stock shall rank (i) senior to the Company’s common stock and any other class or series of capital stock of the Company hereafter created, (ii) pari passu with any class or series of capital stock of the Company hereafter created and specifically ranking, by its terms, on par with the Series A Preferred Stock and (iii) junior to any class or series of capital stock of the Company hereafter created specifically ranking, by its terms, senior to the Series A Preferred Stock, in each case as to distribution of assets upon liquidation, dissolution or winding up of the Company, whether voluntary or involuntary.

| 2 |

On August 5, 2021, the Company, with the approval of a majority of its shareholders completed a forward split of the Company’s common stock. The Company split and converted all of the issued and outstanding shares of the Corporation’s $0.001 par value common stock on an Eight Thousand (8,000) to One (1) basis to increase the number of issued and outstanding shares of the Corporation’s common stock from 10,000 to 80,000,000 shares. The Company has filed the forward split with the California Secretary of State.

Sky Limit Venture, Corp., headquarters is located at 12338 Valley Blvd., Unit C, El Monte, CA 91732. The Company phone number is 626-434-9606. Our website is www.skylimitenergy.com.

BUSINESS

The following description of our business contains forward-looking statements relating to future events or our future financial or operating performance that involve risks and uncertainties, as set forth above under “Special Note Regarding Forward-Looking Statements.” Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors described in the Annual Report, including those set forth above in the Special Cautionary Note Regarding Forward-Looking Statements or under the heading “Risk Factors” or elsewhere in this Annual Report on Form 1K.

Our Business Overview

Sky Limit Venture Corp., provides a variety of clean energy solutions for residential and commercial customers. It is also focusing on research and development of recycled electric vehicle lithium batteries. It has developed a process to improve and repurpose these batteries for outdoor use. The company is amid designing and building a technology application to monitor lithium batteries to measure the power being generated. We are working on this monitoring application to provide customers peace of mind that their equipment is producing electricity. We strive to become a comprehensive source for our customers clean and efficient energy needs.

Sky Limit Venture Corp., is involved in every step of the process, including sales, design, permitting, development, installation, construction, and repairs. Our customers can choose from a variety of financing options including PPA and Lease programs. The company continues to expand its services to offer a one stop contractor. Providing customer convenience of coordinating with one contractor vs multiple contractors. The company services include installation of residential and commercial solar photovoltaic systems, electric vehicle charging stations, installation of new roofing, re-roofing, solar roof, installation of energy generation and battery storage. Additionally, the company is continuing research and development of recycled electric vehicle lithium batteries to repurpose for outdoor use. It is also creating an application to monitor the battery life span for equipment failures.

We provide customers with the opportunity to power their homes with solar energy. We are able to offer savings to our solar-only customers compared to utility-based retail rates with little to no up-front expense on the part of the customer, and we are able to provide energy resiliency and reliability to our solar plus energy storage customers through energy storage technology. We do all of this under long-term solar and solar plus energy storage service agreements with our customers, which provide us with predictable, contracted cash flows.

The services we provide are integral to our customers’ value proposition. These include operations and maintenance, monitoring, repairs and replacements, equipment upgrades, onsite power optimization for the customer (for both supply and demand), the ability to efficiently switch power sources among the solar panel, grid and energy storage system, as appropriate, and diagnostics.

Residential Solar Power System Design and Installation

We currently provide marketing, sales, design, construction, installation, maintenance, support and related solar power system services to residential and commercial customers in the United States in locations in which the economics are favorable to solar power. We will provide our customers with a single point of contact for their system design, engineering work, building permit, rebate approval, utility hookup and subsequent maintenance.

We will concentrate on the design and integration of grid-tied solar power systems. These systems are electrically connected to the utility grid so that excess energy produced during the day flows backwards through the utility’s electric meter, actually running the electric meter backwards. The meter will run backwards when the power produced by the solar system is greater than the power needs of the structure. During the evenings or on cloudy days, energy is drawn from the grid normally and the meter runs forwards. Most utilities serving the areas in which we install systems allow for “net metering.” Customers on net metering only pay for the net amount of energy they consume during the year, essentially getting full retail credit for the energy they transmit back onto the utility grid during the day.

| 3 |

Energy Storage Systems.

Our proposed energy storage systems increase our customers’ independence from the centralized utility and provide on-site backup power when there is a grid outage due to storms, wildfires, other natural disasters and general power failures caused by supply or transmission issues. In addition, at times it can be more economic to consume less energy from the grid or, alternatively, to export solar energy back to the grid. Recent technological advancements for energy storage systems allow the system to adapt to pricing and utility rate shifts by controlling the inflows and outflows of power, allowing customers to increase the value of their solar plus storage system. The energy storage system will charge during the day, making the energy it stores available to the home when needed. It will also feature software that can customize power usage for the individual customer, providing backup power, optimizing solar energy consumption vs. grid consumption or preventing export to the grid as appropriate. The software is going to be tailored based on utility regulation, economic indicators and grid conditions. The combination of energy control, increased energy resilience and independence from the grid is strong incentive for customers to adopt solar and energy storage. As energy storage systems and their related software features become more advanced, we expect to see increased adoption of energy storage systems.

We believe that integrated energy storage systems enhance the reliability, resiliency and predictability of home solar energy in certain markets, increasing the overall value proposition to consumers. We expect customer demand for our future energy storage products, to increase over time. We also expect continued requests by our customers that we retrofit their existing solar energy systems energy storage service to provide more resiliency.

Products

Sky Limit Venture Corp offers competitive pricing and variety of services and product lines:

|

| · | Solar photovoltaic installation and repair |

|

| · | Electrical vehicle charging station installation |

|

| · | Electrical wiring or re-wiring installation |

|

| · | Energy efficiency roofing installation |

|

| · | Solar roof and re-roof installation |

|

| · | Energy storage installation |

|

| · | Sales of Lease, Loan and PPA products up to 25 years |

|

| · | Generator installation and repair |

|

| · | Research and develop recycled electric vehicle lithium batteries |

|

| · | Repurpose recycled battery for outdoor use |

|

| · | Training facility for internal and external personnel and businesses |

The company is in the midst of a process patent for the use of recycled electric vehicle batteries with goals of utilizing a technology application to monitor battery production and leverage data for improvements.

Our solar installation workmanship covers up to 25 years and roofing up to 50 years to provide our customers peace of mind.

| 4 |

Markets and Marketing

The renewable energy market involves suppliers, distributors, manufacturers, and contractors; therefore, Sky Limit Venture Corp., has established and maintains loyal business relationships with all parties. Our relationships have allowed the company to provide high quality materials at competitive prices for our customers. Consequently, Sky Limit Venture Corp., is highly competitive and provides added value to our Customers.

The renewable energy sector in California and Nevada markets are currently mandating (1) 50% renewable portfolio standard by year 2030. California is leading the way with the most solar installation of 27,897.04MW, whereas Nevada is 3,587.32MW based on SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insight 2020 Q3. (2) Both states are to be carbon free by the year 2045 for California and 2050 Nevada. (3) California also mandating zero emission by year 2035, which means no more gas, diesel and CNG engine vehicles. These are just a few named states that are adopting the clean energy movement. Arizona, Texas, Florida, New Jersey, South Carolina are also strong contributors.

Technology for solar modules and battery storage is constantly advancing, making it more affordable to create a more clean and sustainable Energy. Renewable Energy is one of the fastest growing industry worldwide. Showing continued growth from solar photovoltaic systems to electrification of vehicles. Due to the ever-changing climate, we strive to stay relevant and adapt to ongoing environmental and regulatory changes and continuing to expand our business model to branch out with complimentary services.

We found that customer experiences with contractors typically have a negative connotation. We want to change this perception. After many published sources about how customers do not trust contractors for many reasons, the CEO of Sky Limit Venture Corp., is developing a strategic plan to overcome this issue.

Market Opportunity

The utility-based electricity sector is being disrupted as distributed solar technology offers homeowners the option to generate solar energy on-site at the point of consumption while lowering their energy costs and reducing their environmental footprint. Residential solar is the fastest growing segment of the distributed solar market. The number of residential solar energy systems in the United States is expected to increase from approximately 19.2 GW installed in 2020 to an estimated 324 GW being installed over the next 10 years. In order to meet the clean energy goals set by industry and the Biden administration the annual installs will need to grow to more than 80 GW by 2030, with cumulative totals nearing 600 GW by the end of the decade, according to Solar Energy Industry Association (“SEIA”) (www.seia.org/solar-industry-research-data).

Growth in the residential solar market has been driven in part by the introduction of third-party ownership of residential solar systems through power purchase agreements or lease arrangements that allow the homeowner to benefit from governmental incentives and tax credits without burdening the homeowner with the upfront capital expenditure of purchasing a solar energy system. Recently there has been increased customer demand to own the solar energy system, which in turn has led to innovative financing solutions through various contract structures that offer a homeowner the option to purchase a solar energy system through third-party loan financing. In such a loan offering, a homeowner may or may not receive ongoing operating, maintenance and monitoring services from their installer, similar to those customary in power purchase agreements and lease arrangements.

Declining Capex Costs for Residential Solar

Rooftop residential solar has benefited from a rapid decline in costs. According to SEIA, the cost of a residential solar system has dropped more than 70% over the last decade. Prices in the fourth quarter of 2020 were at their lowest levels in history, across all market segments. SEIA goes on further to state that the pre-incentive price of an average sized residential system has dropped from $40,000 in 2010 to roughly $20,000 in 2021, with recent utility-scale prices ranging from $16/MWh - $35/MWh, which is competitive with all other forms of generation. (www.seia.org/solar-industry-research-data).

| 5 |

Developments in Energy Storage Solutions

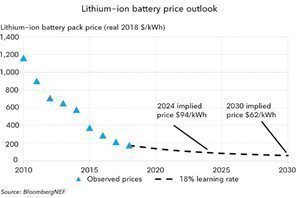

Recent developments in energy storage technology and power usage management may reduce the variability of solar energy availability to the customer. As advances in technology cause the price of energy storage systems to decline, more customers will be able to afford such systems. Including energy storage with the customer’s solar energy system allows the power generated by the solar energy system to be available to the customer on a more consistent basis. In addition, the general availability of power sourced from the battery, coupled with the variability of utility rates for power based on time-of-day, means that, depending on the time of day, it may be more cost-efficient for the customer to draw energy from the energy storage system or the utility grid (or vice versa). As the technology governing the energy storage system improves, we expect these existing cost-saving mechanisms will allow for a better matching of supply and demand based on the customer’s energy usage. The ability to store energy may reduce the industry’s reliance on net energy metering policies, thereby expanding the addressable market for residential solar. In addition, energy storage system costs have declined due to technology improvements, manufacturing scale, competition among manufacturers, greater product integration and deepening industry expertise.14 According to Bloomberg NEF (“BNEF”), the volume-weighted average price of a lithium-ion battery pack has fallen 89% from a price of $1,160 per kilowatt hour in 2010, in real terms, and is expected to decline further to $137 per kilowatt hour in 2020. BNEF predicts that by 2023, the average prices will be close to $100 per kilowatt hour due to further expected technological improvements. BNEF also states that during 2020 for the first-time battery packs prices of less than $100/kWh have been reported. (https://about.bnef.com/blog/battery-pack-prices-cited-below-100-kwh-for-the-first-time-in-2020-while-market-average-sits-at-137-kwh/)

Sales and Marketing

The company’s growth strategy is to network at clean energy conferences, seminars nationwide and internationally. This is done by attending frequent symposiums, seminars, workshops, and conferences. Increase company’s traffic through our website verbiage in English and Spanish while using the correct meta tags, key words, and SEO to show up on first page of Google. An ever-growing social media presence is considered crucial today’s business environment. We will maintain and advertise on Twitter, Facebook, Instagram, LinkedIn, YouTube, and Yelp. These social media sites offer several benefits, such as increase exposure to potential customers, lowering marketing expenses, reaching target audiences, building brand loyalty customers, boosting SEO, increasing traffic while being mobile friendly.

Building an email and phone number list to integrate with an autoresponder software. This way, we can send company’s newsletters, new services, new products, updates, and any promotions. We will potentially seek mergers and/or acquisitions with inverters manufacturers to integrate our battery technology and application with their product line. This way, we do not need to reinvent a new product to save time and money. Sky Limit Venture Corp builds a loyal business relationship with all manufacturers by becoming their certified installer, service provider and dealer. This way, when there are services needed by the manufacturer, we can generate a new source of income stream. Currently our main sales are driven by our internal sale teams, outside sales agents and marketing companies in the states of California, Illinois, Texas and soon Nevada. The key to our success is our proactively communication with all customers, business partners and suppliers.

| 6 |

Our Strategy

Our goal is to become one of the largest providers of solar energy in the world. We plan to achieve this strategy by providing every home and business an alternative to their energy bill that is cleaner and cheaper than their current energy provider. We intend to:

|

| Rapidly grow our customer base. We intend to invest significantly in additional sales, marketing and operations personnel and leverage strategic relationships with new and existing industry leaders to further expand our business and customer base. . |

|

| Continue to offer lower priced energy. We plan on reducing costs by continuing to leverage our buying power with our suppliers, developing additional proprietary software to further ensure that our integrated team operates as efficiently as possible, and working with fund investors to develop innovative financing solutions to lower our cost of capital and offer lower-priced products to our customers. Also, we plan on reducing our costs and increasing our profits by becoming large enough to effectively negotiate better power purchase agreements with the regional electricity companies as a supplier of energy. |

|

| Leverage our brand and long-term customer relationships to provide complementary products. We plan to continue to invest in and develop complementary energy products, software and services, such as energy storage and energy management technologies, to offer further cost-savings to our customers. We also plan to expand our energy efficiency business to commercial customers. |

|

| Expand into new locations. We intend to continue to expand into new locations, initially targeting those markets where climate, government regulations and incentives position solar energy as an economically compelling alternative to utilities. |

Sales

We plan to secure financing that enables our customers to access solar energy for little to no upfront cost to them, as well as expand our solar installation, renewable energy initiatives and energy storage products.

Residential Solar

The key elements of our integrated approach to providing distributed residential solar energy include:

|

| · | Professional consultation. We deploy our direct-to-home sales force to provide in-person professional consultations to prospective customers to evaluate the feasibility of installing a solar energy system at their residence. Our sales closing and referral rates are enhanced by homeowners’ responsiveness to our direct-to-home, neighborhood-by-neighborhood outreach strategy. |

|

|

|

|

|

| · | Design and engineering. We have developed a streamlined process that enables us to design and install a custom solar energy system that delivers significant customer savings. This process, which incorporates proprietary software, standardized templates and data derived from on-site surveys, allows us to design each system to comply with complex and varied state and local regulations and optimize system performance on a per panel basis. We continue to pursue technology innovation to integrate accurate system design into the initial in-person sales consultation as a competitive tool to enhance the customer experience and increase sales close rates. |

|

|

|

|

|

| · | Installation. We are a licensed contractor in the markets we serve and are responsible for each customer installation. Once we complete the system design, we obtain the necessary building permits and begin installation. Upon completion, we schedule the required inspections and arrange for interconnection to the power grid. By directly handling these logistics, we control quality and streamline the system installation process for our customers. Throughout this process, we apprise our customers of the project status with regular updates from our account representatives. We minimize costs, ensure quality and deliver high levels of customer satisfaction by controlling the entire installation process. |

| 7 |

|

| · | Monitoring and service. We monitor the performance of our solar energy systems, leveraging a combination of internally developed solutions as well as capabilities provided by our suppliers. Currently, a substantial majority of our existing solar energy systems use SolarEdge and Enphase communications gateway device paired with its monitoring service. We leverage the SolarEdge monitoring and Enlighten communications gateway and monitoring service to collect performance data and use this data to ensure we deliver quality operations and maintenance services for our solar energy systems. If services are required, our strong local presence enables rapid response times. |

|

|

|

|

|

| · | Referrals. We believe our commitment to delivering high levels of customer satisfaction and our concentrated geographic deployment strategy have generated a significant amount of sales through customer referrals, which increase our neighborhood penetration rates, lower our customer acquisition costs and accelerate our growth. Our financial returns also benefit from the cost savings derived from increasing the density of installations in a neighborhood. |

Manufacturing Materials and Installation

We purchase major components such as solar panels and inverters directly from multiple manufacturers. We screen these suppliers and components based on expected cost, reliability, warranty coverage, ease of installation and other ancillary costs. As of April 28, 2022, our primary solar panel suppliers were REC Solar and LG among others, and our primary inverter suppliers were SolarEdge and Enphase among others. We typically enter into master contractual arrangements with our major suppliers that define the general terms and conditions of our purchases, including warranties, product specifications, indemnities, delivery and other customary terms. We typically purchase solar panels and inverters on an as-needed basis from our suppliers at then-prevailing prices pursuant to purchase orders issued under purchase agreements.

We generally do not have any supplier arrangements that contain long-term pricing or volume commitments; although at times in the past we have made limited purchase commitments to ensure sufficient supply of components.

If we fail to develop, maintain and expand our relationships with these or other suppliers, our ability to meet anticipated demand for our solar energy systems may be adversely affected, or we may only be able to offer our systems at higher costs or after delays. If one or more of the suppliers that we rely upon to meet anticipated demand ceases or reduces production due to its financial condition, acquisition by a competitor or otherwise, it may be difficult to quickly identify alternative suppliers or to qualify alternative products on commercially reasonable terms, and our ability to satisfy this demand may be adversely affected.

Our racking systems are manufactured by contract manufacturers in the United States of America.

We generally source the hundreds of other products related to our solar energy systems and energy efficiency upgrades services, through a variety of distributors.

We currently operate in California states. We manage inventory through a centralized storage and distribution facility and distribute inventory to local installers as needed. This operational scale is fundamental to our business, as our field teams currently complete more than 20 residential installations each month, while our project management teams simultaneously manage projects as they move through the stages of engineering, permitting, installation and monitoring.

We offer a range of warranties and performance guarantees for our solar energy systems. We generally provide warranties of between 10 to 20 years on the generating and non-generating parts of the solar energy systems we sell, together with a pass-through of the inverter and module manufacturers’ warranties that generally range from 5 to 25 years. In the States that we sell the electricity generated by a solar energy system, we compensate customers if their system produces less energy than our guarantee in any given year by refunding overpayments. We also provide ongoing service and repair during the entire term of the customer relationship. To date costs associated with such ongoing service and repair have not been material, but there are no assurances that in the future those costs will not increase.

| 8 |

Engineering and Construction

The key leadership in our engineering and construction group resides within our company, which provides us with the in-house capabilities required to evaluate a project’s design and construction process. We will rely as necessary upon additional personnel from third-party sources, including Greenlancer, with respect to the construction of our projects. We also typically enter into fixed-price construction contracts for our projects’ construction with a guaranteed completion date to encourage completion on time and within budget.

Project design involves close and frequent communication with both field development personnel as well as the construction contractor in order to develop a project that conforms to local geotechnical and topographic characteristics while accommodating permitting and real estate restrictions. The developer also strives to integrate experience obtained from operating projects in order to design projects with optimal maintenance and equipment-availability profiles. During construction, we are responsible for overseeing the construction contractor and ancillary-vendor activities to ensure that the construction schedule is met. Collaboration among engineers and managers on each of our projects and our major equipment suppliers allows us to efficiently transition from construction to commercial operations and to identify and process technical improvements over the life-cycle of each project.

Our engineering and construction team is comprised of highly experienced project and construction managers and includes personnel who have supervised the design and completion of construction of 5000 solar power projects representing over 35 MW over the last 11 years. We set, and ensure compliance with, design specifications and take an active role in supervising field work, safety compliance, quality control and adherence to project schedules. Each project has a dedicated resident construction manager, and other engineering and construction functions are centralized, which allows the group to efficiently scale its resources to support our developing global platform and growth strategy.

Distributed Generation and Renewable Energy

Distributed generation and renewable energy are two promising areas for growth in the global electric power industry. Distributed generation (sometimes known as “Off-Grid”) is defined as point-of-use electricity generation that either supplements or bypasses the electric utility grid. Distributive generation employs technologies such as solar power, micro turbines and fuel cells. The move to distributed power will come from capacity constraints, increased demand for power reliability and the economic challenges of building new centralized generation and transmission facilities.

Renewable energy is defined as energy supplies that derive from non-depleting sources such as solar, wind and certain types of biomass. Renewable energy reduces dependence on imported and increasingly expensive oil and natural gas. In addition, growing environmental pressures, increasing economic hurdles of large power generation facilities and U.S. National Security interests are favorable drivers for renewable energy. Renewable energy, including solar and wind power, is the fastest growing segment of the energy industry worldwide.

Solar power is both distributed and renewable. Subsequent to installation, solar power is an environmentally benign, locally sourced renewable energy source that can play an immediate and significant role in assisting global economic development, forging sustainable global environmental and energy policies, and protecting national security interests.

Solar Power: The Technology

Solar power generation uses interconnected photovoltaic cells to generate electricity from sunlight. The photovoltaic process (PV) captures packets of light (photons) and converts that energy into electricity (volts). Most photovoltaic cells are constructed using specially processed silicon. When sunlight is absorbed by a semiconductor, the photon knocks the electrons loose from the atoms, allowing the electrons to flow through the material to produce electricity. This generated electricity is direct current (DC).

Light can be separated into different wavelengths with a wide range of energies. These photons may be reflected, absorbed or passed right through the PV cell. Solar cell technology only has the ability to capture the energy of photons within a specific range. Lower wavelength photons create heat, resulting in higher solar cell temperatures and lower conversion rate to energy. Higher wavelength photons have lower levels of energy and thus do not generate electricity.

Many interconnected cells are packaged into solar modules, which protect the cells and collect the electricity generated. Solar power systems are comprised of multiple solar modules along with related power electronics. Solar power technology, first used in the space program in the late 1950s, has experienced growing worldwide commercial use for over 25 years in both on-grid and off-grid applications.

| 9 |

On-grid applications provide supplemental electricity to customers that are served by an electric utility grid, but choose to generate a portion of their electricity needs on-site. The On-grid segment is typically the most difficult to compete in since electricity generated from coal, nuclear, natural gas, hydro and wind is generally at much lower rates. Despite the unfavorable cost comparisons, On-grid applications have been the fastest growing part of the solar power market. This growth is primarily driven by the worldwide trend toward deregulation and privatization of the electric power industry, as well as by government initiatives, including incentive programs to subsidize and promote solar power systems in several countries, including Japan, Germany and the United States. On-grid applications include residential and commercial rooftops, as well as ground-mounted mini-power plants.

Despite the benefits of solar power, there are also certain risks and challenges faced by solar power. Solar power is heavily dependent on government subsidies to promote rapid introduction and acceptance by mass markets. Solar is an inert process that makes it difficult to compare against other non-inert technologies when comparing costs as current solar modules are generally warranted for a 25 year life. When the costs of producing solar are compared to other energy sources, solar power is more expensive than grid-based energy, nuclear, wind, etc. Different solar technologies carry different efficiencies. Traditional PV solar cells carry efficiencies ranging from 15% to 20% per cell.

Competition

The markets we plan to serve are highly fragmented with numerous small and regional participants and several large nationally based companies. Competition in the markets we plan to serve will be based on a number of considerations, including our ability to excel at timeliness of delivery, technology, applications experience, know-how, reputation, product warranties, service and price. Demand for our product can vary period over period depending on conditions in the markets we serve. We believe our future product quality reliability, and safety supported by advanced manufacturing and operational excellence will differentiate us from many of our competitors, including those competitors who often offer products at a lower price.

Overall, the competitive environment of the renewable energy industry is very tense despite its market size. The Company competes with other distributors, installers such as SunRun, Tesla, SunPower, Sunnova, to name some of the other renewable energy companies that are currently in our industry. These competitors possess significantly greater financial and non-financial resources, manufacturing capacity, well established business models and distribution channels and branding.

Energy Generation and Storage

Energy Storage Systems

The market for energy storage products is also highly competitive, and both established and emerging companies have introduced products that are similar to our product portfolio or that are alternatives to the elements of our systems. We compete with these companies based on price, energy density and efficiency. We believe that the specifications and features of our products, our strong brand and the modular, scalable nature of our energy storage products give us a competitive advantage in our markets.

Solar Energy Systems

The primary competitors to our solar energy business are the traditional local utility companies that supply energy to our potential customers. We compete with these traditional utility companies primarily based on price and the ease by which customers can switch to electricity generated by our solar energy systems. We also compete with solar energy companies that provide products and services similar to ours. Many solar energy companies only install solar energy systems, while others only provide financing for these installations. We believe we have a significant expansion opportunity with our offerings and that the regulatory environment is increasingly conducive to the adoption of renewable energy systems.

| 10 |

Government Incentives

Increasing concerns regarding additional energy requirements, grid architecture and distributed generation goals, security of energy supply, consequences of greenhouse gas emissions and fossil-fuel prices have resulted in support for governmental policies and programs at the federal, state, local and provincial level of our markets that support electricity generation from renewable energy sources such as solar power. These programs provide for various incentives and financial mechanisms, including, in the United States, accelerated tax depreciation, tax credits, cash grants and rebate programs, which serve to reduce the cost and to accelerate the adoption of renewable generation facilities. These incentives help catalyze private sector investments in renewable generation and efficiency measures, including the installation and operation of solar power.

The United States has established various incentives and financial mechanisms to reduce the cost of solar energy and to accelerate the adoption of solar energy. These incentives, include tax credits, cash grants, tax abatements, rebates and renewable energy credits or green certificates and net energy metering, or “net metering,” programs. These incentives help catalyze private sector investments in solar energy and efficiency measures. Set forth below is a summary of the various programs and incentives that we expect will apply to our business.

Energy Storage System Incentives and Policies

While the regulatory regime for energy storage projects is still under development, there are various policies, incentives and financial mechanisms at the federal, state and local levels that support the adoption of energy storage.

For example, energy storage systems that are charged using solar energy may be eligible for the solar energy-related U.S. federal tax credits described below. The Federal Energy Regulatory Commission (“FERC”) has also taken steps to enable the participation of energy storage in wholesale energy markets. In addition, California and a number of other states have adopted procurement targets for energy storage, and behind-the-meter energy storage systems qualify for funding under the California Self Generation Incentive Program.

Solar Energy System Incentives and Policies

U.S. federal, state and local governments have established various policies, incentives and financial mechanisms to reduce the cost of solar energy and to accelerate the adoption of solar energy. These incentives include tax credits, cash grants, tax abatements and rebates.

In particular, Sections 48 and 25D of the U.S. Internal Revenue Code currently provide a tax credit of 26% of qualified commercial or residential expenditures for solar energy systems, which may be claimed by our customers for systems they purchase, or by us for arrangements where we own the systems. These tax credits are currently scheduled to decline and/or expire in 2023 and beyond.

Patents, Trademarks and Licenses

We currently do not have any patents. We have trademarked our logo. We are not party to any license, franchise, concession, or royalty agreements or any labor contracts.

Employment Agreements

As of this filing, Sky Limit Venture currently is not a party to any material employment agreements.

Regulation

We face extensive government regulation both within and outside the U.S. relating to the development, installation, marketing, sale and distribution of our renewable energy products, software and services. The following sections describe certain significant regulations that we are subject to. These are not the only regulations that our businesses must comply with. For a description of risks related to the regulations that our businesses are subject to, please refer to the section entitled “Risk Factors—Risks Related to Our Businesses.”

We are not a “regulated utility” in the United States under applicable national, state or other local regulatory regimes where we conduct business.

To operate our systems we obtain interconnection agreements from the applicable local primary electricity utility. Depending on the size of the solar energy system and local law requirements, interconnection agreements are between the local utility and either us or our customer. In almost all cases, interconnection agreements are standard form agreements that have been pre-approved by the local public utility commission or other regulatory body with jurisdiction over interconnection agreements. As such, no additional regulatory approvals are required once interconnection agreements are signed. We maintain a utility administration function, with primary responsibility for engaging with utilities and ensuring our compliance with interconnection rules.

| 11 |

Our operations are subject to stringent and complex federal, state and local laws and regulations governing the occupational health and safety of our employees and wage regulations. For example, we are subject to the requirements of the federal Occupational Safety and Health Act, as amended, or OSHA, and comparable state laws that protect and regulate employee health and safety. We have a robust safety department led by a safety professional, and we expend significant resources to comply with OSHA requirements and industry best practices.

Federal and/or state prevailing wage requirements, which generally apply to any “public works” construction project that receives public funds, may apply to installations of our solar energy systems on government facilities. The prevailing wage is the basic hourly rate paid on public works projects to a majority of workers engaged in a particular craft, classification or type of work within a particular area. Prevailing wage requirements are established and enforced by regulatory agencies. Our Officers and Directors monitor and coordinate our continuing compliance with these regulations.

Solar Energy—Net Metering

Most states in the U.S. make net energy metering, or net metering, available to solar customers. Net metering typically allows solar customers to interconnect their solar energy systems to the utility grid and offset their utility electricity purchases by receiving a bill credit for excess energy generated by their solar energy system that is exported to the grid. In certain jurisdictions, regulators or utilities have reduced or eliminated the benefit available under net metering or have proposed to do so.

Environmental Regulation

We will be subject to environmental laws and regulations in the jurisdictions in which we install solar and other renewable energy products. While we incur costs in the ordinary course of business to comply with these laws, regulations and permit requirements, we do not expect that the costs of compliance will have a material impact on our business, financial condition or results of operations. We also do not anticipate material capital expenditures for environmental controls for our projects in the next several years. These laws and regulations frequently change and often become more stringent, or subject to more stringent interpretation or enforcement, and therefore future changes could require us to incur materially higher costs.

Seasonality

We do not expect any seasonality in our business.

Property

Our mailing address is 12338 Valley Blvd., Unit C, El Monte, CA 91732. The Company phone number is 626-434-9606. Our website is www.Skylimitenergy.com and our email address is Info@skylimitenergy.com.

Employees

We currently have 11 full-time employees of our business or operations We anticipate adding additional employees in the next 12 months, as needed.

Intellectual Property

We may rely on a combination of patent, trademark, copyright, and trade secret laws in the United States as well as confidentiality procedures and contractual provisions to protect our technologies, databases, and our brand.

We will implement a policy of requiring key employees and consultants to execute confidentiality agreements upon the commencement of an employment or consulting relationship with us. Our future employee agreements also require relevant employees to assign to us all rights to any inventions made or conceived during their employment with us. In addition, we have a policy of requiring individuals and entities with which we discuss potential business relationships to sign non-disclosure agreements. Our agreements with clients include confidentiality and non-disclosure provisions.

Legal Proceedings

We may from time to time be involved in various claims and legal proceedings of a nature we believe are normal and incidental to our business. These matters may include product liability, intellectual property, employment, personal injury cause by our employees, and other general claims. We are not presently a party to any legal proceedings that, in the opinion of our management, are likely to have a material adverse effect on our business. Regardless of outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources and other factors.

| 12 |

Item 2. Management Discussion and Analysis of Financial Condition and Results of Operations.

You should read the following discussion and analysis of our financial condition and results of our operations together with our consolidated financial statements and the notes thereto appearing elsewhere in this Annual Report. This discussion contains forward-looking statements reflecting our current expectations, whose actual outcomes involve risks and uncertainties. Actual results and the timing of events may differ materially from those stated in or implied by these forward-looking statements due to a number of factors, including those discussed in the sections entitled “Risk Factors”, “Cautionary Statement regarding Forward-Looking Statements” and elsewhere in this Annual Report. Please see the notes to our Financial Statements for information about our Critical Accounting Policies and Recently Issued Accounting Pronouncements.

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR ENDED DECEMBER 31, 2021

The following management’s discussion and analysis (“MD&A”) of financial results is dated May 2, 2022 and reviews the business of Sky Limit Venture Corp. (the “Company” or “Sky Limit”), for the year ended December 31, 2021, and should be read in conjunction with the accompanying annual consolidated financial statements and related notes for the year ended December 31, 2021. This MD&A and the accompanying annual consolidated financial statements and related notes for the year ended December 31, 2021, have been reviewed by the and approved by the Company’s Board of Directors.

This MD&A contains certain forward-looking statements, such as statements regarding potential mineralization, resources and research results, and future plans and objectives of the Company, that are subject to various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements contained herein are made as of the date of this MD&A and the Company disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management’s estimates or opinions should change, or otherwise.

Management’s Discussion and Analysis

The Company has had $1,486,113 and $4,218,032 in revenues from operations for the years ended December 31, 2021 and 2020. The Company generates revenue from the design and installation of solar power systems and accessories.

Plan of Operation for the Next Twelve Months

The Company believes that the proceeds of the Regulation A Offering will satisfy its cash requirements for the next twelve months. To complete the Company’s entire deployment of its current and proposed products and its business plan, it may have to raise additional funds in the next twelve months. Contemporaneously we will work to expand its services to further its goal of becoming a one stop contractor. Providing customer convenience of coordinating with one contractor vs multiple contractors. The company services include installation of residential and commercial solar photovoltaic systems, electric vehicle charging stations, installation of new roofing, re-roofing, solar roof, installation of energy generation and battery storage.

The Company expects to increase the number of employees at the corporate level, as warranted.

| 13 |

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates include assumptions about collection of accounts and notes receivable, the valuation and recognition of stock-based compensation expense, the valuation and recognition of derivative liability, valuation allowance for deferred tax assets and useful life of fixed assets.

RESULTS OF OPERATIONS

Results for the years ended December 31, 2021 and 2020.

| Working Capital |

| December 31, 2021 $ |

|

| December 31, 2020 $ |

| ||

| Cash |

|

| 37,954 |

|

|

| 190,790 |

|

| Current Assets |

|

| 37,954 |

|

|

| 190,790 |

|

| Current Liabilities |

|

| 586,423 |

|

|

| 496,331 |

|

| Working Capital (Deficit) |

|

| (548,469 | ) |

|

| (305,541 | ) |

| Cash Flows |

| December 31, 2021 $ |

|

| December 31, 2020 $ |

| ||

| Cash Flows from (used in) Operating Activities |

|

| (657,950 | ) |

|

| (299,566 | ) |

| Cash Flows from (used in) Investing Activities |

|

| 0 |

|

|

| (5,000 | ) |

| Cash Flows from (used in) Financing Activities |

|

| 505,114 |

|

|

| 442,626 |

|

| Net Increase (decrease) in Cash During Period |

|

| (152,836 | ) |

|

| 138,060 |

|

Revenues

The Company’s revenues were $1,486,113 for the year ended December 31, 2021, as compared to $4,218,032 the year ended 2020. Revenues decreased year over year primarily due to Covid as well as labor and supply chain disruptions. The Company also saw lower customer demand in 2021. Also, city delays for permitting slowed, which affected the period in which revenues could be earned.

Cost of Revenues

The Company’s cost of revenues was $1,356,371 for the year ended December 31, 2021, as compared to $3,071,738 the year ended 2020. Costs decreased for the year ended 2021 due to shortages due to supply chain delays and a lack of customer demand for products in 2021. The Company was unable to purchase products in bulk quantities, therefore, certain jobs could not be obtained since product was not available at a reasonable cost. In 2021, the Company stopped working with a large sales dealer. Also, in 2021, the Company used fewer independent contractors and brought the labor supply in-house. Additionally, with rising inflation, the ability to purchase product was diminished. Finally, with an overall decrease in revenues, there was less of a need to purchase supplies and materials.

| 14 |

Gross Profit

For the year ended December 31, 2021, the Company’s gross profit was $129,742 as compared to a gross profit of $1,071,294 for the year ended December 31, 2020. Gross profit decreased due to the decrease in revenues for the year ended 2021. Also, the gross profit percentage in 2021 as compared to 2020 was 9% and 27%, respectively. The overall decrease related to higher costs to complete jobs. Additionally, higher profit generating revenue types such as financed projects made up 90% of total revenues in 2020 as compared to 51% in 2021.

General and Administrative Expenses

General and administrative expenses consisted primarily of consulting fees, professional fees, and employee compensations. For the year ended December 31, 2021, general and administrative expenses were $833,828 as compared to $929,591 for the year ended December 31, 2020.

Other Income (Expense)

Other expense consisted of interest expense of $(91,706) and amortization of debt discount of $(5,729), for the year ended December 31, 2021, as compared to $(19,575) and $(521) for the year ended December 31, 2020.

During 2021, the Company recognized other income related to forgiveness of a PPP loan totalling $126,157.

Net Income (Loss)

Our net loss for the year ended December 31, 2021, was $(675,364), as compared to a net income of $196,607 for the year ended December 31, 2020. The net income was mainly attributable to our revenues decreasing along with a significantly smaller gross profit percentage in 2021 as compared to 2020, while general and administrative expenses remaining similar at $833,828 during 2021 and $929,591 in 2020, and is further influenced by the matters discussed in the other sections of the MD&A.

Liquidity and Capital Resources

The ability of the Company to continue as a going concern is dependent on the Company’s ability to raise additional capital and further expand its business. Since its inception, the Company has been mainly funded by related and third parties through capital investment and borrowing of funds.

At December 31, 2021, the Company had total current assets of $37,954. Current assets consist primarily of cash.

At December 31, 2021, the Company had total current liabilities of $586,423. Current liabilities consisted primarily of accounts payable and accrued expenses, accrued interest payable, accrued interest payable – related parties, notes payable, loans payable – related parties, and contract liabilities (deferred revenue).

We had negative working capital in the amount of $548,469 and $305,541 as of December 31, 2021 and December 31, 2020, respectively.

Cashflow from Operating Activities

During the years ended December 31, 2021 and 2020, there was cash used in operating activities in the amounts of $(657,950) and $(299,566), respectively. Operating cash flows consist primarily of changes related to depreciation, contract liabilities (deferred revenue) and forgiveness of government loans.

Cashflow from Investing Activities

There was $0 cash used in investing activities for the year ended December 31, 2021, as compared to $5,000 for the year ended December 31, 2020. In 2020 the cash outflows related to cash paid to acquire vehicles.

Cashflow from Financing Activities

During years ended December 31, 2021 and 2020, cash provided by financing activities was $505,114 and $442,626, respectively. Cash flows from financing activities consisted primarily of cash proceeds from the issuance of debt, repayments of debt, advances, and owner contributions and distributions.

| 15 |

Going Concern and Management’s Plans

These consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business.

As reflected in the accompanying consolidated financial statements, for the year ended December 31, 2021, the Company had:

| • | Net income of $(675,364); and |

| • | Net cash used in operations was $657,950 |

Additionally, at December 31, 2021, the Company had:

| • | Accumulated deficit of $1,678,623 |

| • | Stockholders’ deficit of $828,810; and |

| • | Working capital deficit of $548,469 |

The Company has cash on hand of $37,954 at December 31, 2021. The Company expects to generate sufficient revenues and positive cash flows from operations sufficiently to meet its current obligations. However, the Company may seek to raise debt or equity based capital at favorable terms, though such terms are not certain.

These factors create substantial doubt about the Company’s ability to continue as a going concern within the twelve month period subsequent to the date that these consolidated financial statements are issued. The consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern. Accordingly, the consolidated financial statements have been prepared on a basis that assumes the Company will continue as a going concern and which contemplates the realization of assets and satisfaction of liabilities and commitments in the ordinary course of business.

Management’s strategic plans include the following:

| • | Execute business operations during fiscal year December 31, 2021, |

| • | Pursuing additional capital raising opportunities, |

| • | Continuing to explore and execute prospective partnering or distribution opportunities; and |

| • | Identifying unique market opportunities that represent potential positive short-term cash flow. |

| • | Expand product and services offerings to a larger surrounding geographic area. |

Future Financings.

We will continue to rely on equity sales of the Company’s common shares in order to continue to fund business operations. Issuances of additional shares will result in dilution to existing shareholders. There is no assurance that the Company will achieve any additional sales of the equity securities or arrange for debt or other financing to fund our business plan.

Since inception, we have financed our cash flow requirements through issuance of common stock, loans from related and third parties. As we expand our activities, we may, and most likely will, continue to experience net negative cash flows from operations, pending receipt of revenues. Additionally, we anticipate obtaining additional financing to fund operations through common stock offerings, to the extent available, or to obtain additional financing to the extent necessary to augment our working capital. In the future we will need to generate sufficient revenues from sales in order to eliminate or reduce the need to sell additional stock or obtain additional loans. There can be no assurance we will be successful in raising the necessary funds to execute our business plan.

We anticipate that we will incur operating losses in the next twelve months. Our lack of operating history makes predictions of future operating results difficult to ascertain. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies in their early stage of development, particularly companies in new and rapidly evolving markets. Such risks for us include, but are not limited to, an evolving and unpredictable business model and the management of growth.

To address these risks, we must, among other things, obtain a customer base, implement and successfully execute our business and marketing strategy, continually develop and upgrade our business model, marketing and websites, respond to competitive developments, and attract, retain and motivate qualified personnel. There can be no assurance that we will be successful in addressing such risks, and the failure to do so can have a material adverse effect on our business prospects, financial condition and results of operations.

| 16 |

Critical Accounting Policies.

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

Use of Estimates

Preparing consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and revenues and expenses during the reported period. Actual results could differ from those estimates, and those estimates may be material.

Changes in estimates are recorded in the period in which they become known. The Company bases its estimates on historical experience and other assumptions, which include both quantitative and qualitative assessments that it believes to be reasonable under the circumstances.

Revenue Recognition

The Company generates revenue from the design and installation of solar power systems. The Company recognizes revenue according to ASC 606, Revenue from Contracts with Customers. When the customer obtains control over the promised goods or services, the Company records revenue in the amount of consideration that can be expected to be received in exchange for those goods and services.

The Company applies the following five-step model to determine revenue recognition:

| • | Identification of a contract with a customer |

| • | Identification of the performance obligations in the contact |

| • | Determination of the transaction price |

| • | Allocation of the transaction price to the separate performance allocation |

| • | Recognition of revenue when performance obligations are satisfied |

The Company only applies the five-step model when it is probable that the Company will collect the consideration it is entitled to in exchange for the goods or services it transfers to the customer. At contract inception and once the contract is determined to be within the scope of ASC 606, the Company assesses the goods or services promised within each contract and determines those that are performance obligations and assesses whether each promised good or service is distinct. The Company sells solar power systems to residential customers in Southern California. Generally, the cycle from contract inception to project completion is typically one to three months.

The Company’s contracts contain a single performance obligation (installation of solar systems), as the promise to transfer the individual goods or services is not separately identifiable from other promises in the contracts and, therefore, not distinct, as a result, the entire transaction price is allocated to this single performance obligation.

The Company recognizes as revenues the amount of the transaction price that is allocated to the respective performance obligation when the performance obligation is satisfied. Accordingly, the Company recognizes revenues when the customer obtains control of the Company’s products and services, which occurs upon both city and utility inspections being completed, at this time, the customer has permission to operate their solar system.

Our customer contracts generally have performance obligations which are satisfied at a point in time. The performance obligation is for the delivery of the stand-alone solar power systems and related installation services. Customer contracts are generally fixed-price purchase order fulfillment contracts, and the transaction price is in the contract. Revenue is recognized when obligations under the terms of the contract with our customer are satisfied

| 17 |

For our contracts with customers, payment terms vary as follows:

|

| 1. | Finance companies | |

|

|

| a. | Up to 80% of the contract price, as funded through an unrelated finance company, upon the completion of a solar system installation. Amounts remitted to the Company are net of dealer fees, which is the amount recognized as earned revenues. |

|

|

| b. | The balance due upon successful city and utility inspections. |

|

|

|

|

|

|

| 2. | Customer self-pay | |

|

|

| a. | Up to 50% of the contract price received at the completion of a solar system installation. |

|

|

| b. | The balance due upon successful city and utility inspections. |

The Company has contract liabilities or deferred revenue. The Company will recognize revenue when the performance obligation is met.

The Company does not offer any price concessions or rebates.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Recent Accounting Standards

Changes to accounting principles are established by the FASB in the form of ASU’s to the FASB’s Codification. We consider the applicability and impact of all ASU’s on our financial position, results of operations, stockholders’ deficit, cash flows, or presentation thereof.

In June 2016, the FASB issued ASU 2016-13 - Financial Instruments-Credit Losses- Measurement of Credit Losses on Financial Instruments. Codification Improvements to Topic 326, Financial Instruments – Credit Losses, have been released in November 2018 (2018-19), November 2019 (2019-10 and 2019-11) and a January 2020 Update (2020-02) that provided additional guidance on this Topic. This guidance replaces the current incurred loss impairment methodology with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. For SEC filers meeting certain criteria, the amendments in this ASU are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019.

For SEC filers that meet the criteria of a smaller reporting company (including this Company) and for non-SEC registrant public companies and other organizations, the amendments in this ASU are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2022. Early adoption will be permitted for all organizations for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019.

We adopted this pronouncement on January 1, 2021; however, the adoption of this standard did not have a material effect on the Company’s financial statements.

In December 2019, the FASB issued ASU 2019-12, “Simplifying the Accounting for Income Taxes.” This guidance, among other provisions, eliminates certain exceptions to existing guidance related to the approach for intra period tax allocation, the methodology for calculating income taxes in an interim period and the recognition of deferred tax liabilities for outside basis differences. This guidance also requires an entity to reflect the effect of an enacted change in tax laws or rates in its effective income tax rate in the first interim period that includes the enactment date of the new legislation, aligning the timing of recognition of the effects from enacted tax law changes on the effective income tax rate with the effects on deferred income tax assets and liabilities. Under existing guidance, an entity recognizes the effects of the enacted tax law change on the effective income tax rate in the period that includes the effective date of the tax law. ASU 2019-12 is effective for interim and annual periods beginning after December 15, 2020, with early adoption permitted.

We adopted this pronouncement on January 1, 2021; however, the adoption of this standard did not have a material effect on the Company’s financial statements.

| 18 |

In August 2020, the FASB issued ASU 2020-06, “Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity”, to reduce complexity in applying U.S. GAAP to certain financial instruments with characteristics of liabilities and equity. ASU 2020-06 is effective for interim and annual periods beginning after December 15, 2023, with early adoption permitted.

We adopted this pronouncement on January 1, 2021; however, the adoption of this standard did not have a material effect on the Company’s financial statements.

Quantitative and Qualitative Disclosures about Market Risk

In the ordinary course of our business, we are not exposed to market risk of the sort that may arise from changes in interest rates or foreign currency exchange rates, or that may otherwise arise from transactions in derivatives.

Contingencies

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company, but which will only be resolved when one or more future events occur or fail to occur. The Company’s management, in consultation with its legal counsel as appropriate, assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company, in consultation with legal counsel, evaluates the perceived merits of any legal proceedings or unasserted claims, as well as the perceived merits of the amount of relief sought or expected to be sought therein. If the assessment of a contingency indicates it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates a potentially material loss contingency is not probable, but is reasonably possible, or is probable, but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss, if determinable and material, would be disclosed. Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed.

Management regularly evaluates the accounting policies and estimates that are used to prepare the financial statements. In general, management’s estimates are based on historical experience, on information from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

Relaxed Ongoing Reporting Requirements

Upon the completion of our Regulation A Offering, we may elect to become a public reporting company under the Exchange Act. If we elect to do so, we will be required to publicly report on an ongoing basis as an “emerging growth company” (as defined in the Jumpstart Our Business Start ups Act of 2012, which we refer to as the JOBS Act) under the reporting rules set forth under the Exchange Act. For so long as we remain an “emerging growth company”, we may take advantage of certain exemptions from various reporting requirements that are applicable to other Exchange Act reporting companies that are not “emerging growth companies”, including but not limited to:

-not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act;

-taking advantage of extensions of time to comply with certain new or revised financial accounting standards;

-being permitted to comply with reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and

-being exempt from the requirement to hold a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

| 19 |

We expect to take advantage of these reporting exemptions until we are no longer an emerging growth company. We would remain an “emerging growth company” for up to five years, although if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of any June 30, before that time, we would cease to be an “emerging growth company” as of the following June 30.

If we elect not to become a public reporting company under the Exchange Act, we will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 2 issuers. The ongoing reporting requirements under Regulation A are more relaxed than for “emerging growth companies” under the Exchange Act. The differences include, but are not limited to, being required to file only a semi-annual report, annual report and an exit report, rather than annual and quarterly reports.

In either case, we will be subject to ongoing public reporting requirements that are less rigorous than Exchange Act rules for companies that are not “emerging growth companies”, and our stockholders could receive less information than they might expect to receive from more mature public companies.

Item 3. Directors and Officers

MANAGEMENT