As filed with the Securities and Exchange Commission on May 12, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 46-2007094 | ||

(State or other jurisdiction of incorporation) | (IRS Employer Identification No.) |

7371

Primary Standard Industrial Classification Code Number

Cyngn

Inc.

1015 O’Brien Dr.

Menlo Park, CA 94025

(650) 924-5905

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Lior

Tal

Chief Executive Officer

Cyngn Inc.

1015 O’Brien Dr.

Menlo Park, CA 94025

(650) 924-5905

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Gregory Sichenzia, Esq.

Marcelle S. Balcombe, Esq.

Sichenzia Ross Ference LLP

1185 Avenue of the Americas, 31st Floor

New York, New York 10036

Phone: (212) 930-9700

Approximate date of commencement of proposed sale of the securities to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☐ | ☒ | |

| Accelerated filer | ☐ | Smaller reporting company | |

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act.

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED MAY 12, 2022 |

12,903,226 Shares of Common Stock

Pursuant to this prospectus, the selling stockholders identified herein are offering on a resale basis an aggregate of 12,903,226 shares of common stock, par value $0.00001 per share, of Cyngn Inc., of which (i) 3,790,322 shares are issued and outstanding, (ii) 2,661,291 shares are issuable upon exercise of pre-funded warrants, or the “Pre-Funded Warrants”, each exercisable into one share of common stock at an exercise price per share of $0.001, without expiration, and (iii) 6,451,613 shares are issuable upon exercise of common warrants, or the “Common Warrants”, each exercisable into one share of common stock at an exercise price per share of $2.98, expiring on April 29, 2027. We refer to the Pre-Funded Warrants and the Common Warrants, collectively, as the “Private Placement Warrants”. The outstanding shares of common stock and the Private Placement Warrants were issued to the selling stockholders in connection with a private placement offering we completed on April 29, 2022, or the “Private Placement”.

We will not receive any of the proceeds from the sale by the selling stockholders of the common stock. Upon any exercise of the Private Placement Warrants by payment of cash, however, we will receive the exercise price of the Private Placement Warrants.

The selling stockholders may sell or otherwise dispose of the common stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell or otherwise dispose of the common stock covered by this prospectus in the section entitled “Plan of Distribution” on page 67 of this prospectus. For information on the selling stockholders, see the section entitled “Selling Stockholders” on page 28 of this prospectus. Discounts, concessions, commissions and similar selling expenses attributable to the sale of common stock covered by this prospectus will be borne by the selling stockholders. We will pay all expenses (other than discounts, concessions, commissions and similar selling expenses) relating to the registration of the common stock with the Securities and Exchange Commission, or the SEC.

Our common stock is listed on The Nasdaq Capital Market under the symbol “CYN.” On May 10, 2021, the last reported sale price per share of our common stock was $5.04.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 4 of this prospectus for a discussion of information that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus. For investors outside the United States: Neither we nor the selling stockholders have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

Unless the context otherwise requires, references to “we,” “our,” “us,” or the “Company” in this prospectus mean Cyngn Inc., a Delaware corporation.

ii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Company Overview

We are an autonomous vehicle (AV) technology company that is focused on addressing industrial uses for autonomous vehicles. We believe that technological innovation is needed to enable adoption of autonomous industrial vehicles that will address the substantial industry challenges that exist today. These challenges include labor shortages, lagging technological advancements from incumbent vehicle manufacturers, and high upfront investment commitment.

Industrial sites are typically rigid environments with consistent standards as opposed to city streets that have more variable environmental and situational conditions and diverse regulations. These differences in operational design domains (ODD) will be major factors that make proliferation of industrial AVs in private settings achievable with less time and resources than AVs on public roadways. Namely, safety and infrastructure challenges are cited as roadblocks that have delayed AVs from operating on public roadways at scale. Our focus on industrial AVs simplifies these challenges because industrial facilities (especially those belonging to a single end customer that operates similarly at different sites) share much more in common than different cities do. Furthermore, our end customers own their infrastructure and can make changes more easily than governments can on public roadways.

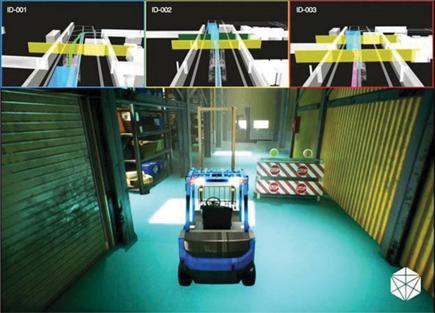

With these challenges in mind, we are developing an EAS that leverages advanced in-vehicle autonomous driving technology and incorporates leading supporting technologies like data analytics, fleet management, cloud, and connectivity. EAS provides a differentiated solution that we believe will drive pervasive proliferation of industrial autonomy and create value for customers at every stage of their journey towards full automation and the adoption of Industry 4.0.

EAS is a suite of technologies and tools that we divide into three complementary categories:

| 1. | DriveMod, our modular industrial vehicle autonomous driving software; |

| 2. | Cyngn Insight, our customer-facing tool suite for monitoring and managing AV fleets (including remotely operating vehicles) and aggregating/analyzing data; and |

| 3. | Cyngn Evolve, our internal tool suite and infrastructure that facilitates artificial intelligence (AI) and machine learning (ML) training to continuously enhance our algorithms and models and provides a simulation framework (both record/rerun and synthetic scenario creation) to ensure that data collected in the field can be applied to validating new releases. |

Legacy automation providers manufacture specialized industrial vehicles with integrated robotics software for rigid tasks, limiting automation to narrow uses. Unlike these specialized vehicles, EAS can be compatible with the existing vehicle assets in addition to new vehicles that have been purpose built for autonomy by vehicle manufacturers. EAS is operationally expansive, vehicle agnostic, and compatible with indoor and outdoor environments. By offering flexible autonomous services, we aim to remove barriers to industry adoption.

We understand that scaling of autonomy solutions will require an ecosystem made up of different technologies and services that are enablers for AVs. Our approach is to forge strategic collaborations with complementary technology providers that accelerate AV development and deployment, provide access to new markets, and create new capabilities. Our focus on designing DriveMod to be modular will combine with our experience deploying AV technology on diverse industrial vehicle form factors, which will be difficult for competitors to replicate.

1

We expect our technology to generate revenue through two main methods: deployment and EAS subscriptions. Deploying our EAS requires us and our integration partners to work with a new client to map the job site, gather data, and install our AV technology within their fleet and site. We anticipate that new deployments will yield project-based revenues based on the scope of the deployment. After deployment, we expect to generate revenues by offering EAS through a Software as a Service (SaaS) model, which can be considered the AV software component of Robotics as a Service (RaaS). Although we have not offered, and have no present intention to offer, the robotic assets ourselves directly to the end customer, our software can be part of a combined offering with third parties, such as an OEM.

RaaS is a subscription model that allows customers to use robots/vehicles without purchasing the hardware assets upfront. We will seek to achieve sustained revenue growth largely from ongoing SaaS-style EAS subscriptions that enable companies to tap into our ever-expanding suite of AV and AI capabilities as organizations transition into full industrial autonomy.

Although EAS is not yet commercially available and both the components and the combined solution are still under development, components of EAS have already been used for a paid customer trial and pilot deployments. We have not yet derived any recurring revenues from EAS and intend to start marketing EAS to customers in 2022. We expect EAS to continually be developed and enhanced according to evolving customer needs, which will take place concurrently while other completed features of EAS are commercialized. We expect annual R&D expenditures in the foreseeable future to equal or exceed that of 2019 and 2020. We also expect that limited paid pilot deployments in 2022 and 2023 will offset some of the ongoing R&D costs of continually developing EAS. We target scaled deployments to begin in 2024.

Our go-to-market strategy is to acquire new customers that use industrial vehicles in their mission-critical and daily operations by (a) leveraging the relationships and existing customers of our network of strategic partners, (b) bringing AV capabilities to industrial vehicles as a software service provider, and (c) executing a robust in-house sales and marketing effort to nurture a pipeline of industrial organizations. Our focus is on acquiring new customers who are either looking (a) to embed our technology into their vehicle product roadmaps or (b) to apply autonomy to existing fleets with our vehicle retrofits. In turn, our customers are any organizations that could utilize our EAS solution, including OEMs that supply industrial vehicles, end customers that operate their own industrial vehicles, or service providers that operate industrial vehicles for end customers.

As OEMs and leading industrial vehicle users seek to increase productivity, reinforce safer working environments, and scale their operations, we believe we are uniquely positioned to deliver a dynamic autonomy solution via our EAS to a wide variety of industrial uses. Our long-term vision is for EAS to become a universal autonomous driving solution with minimal marginal cost for companies to adopt new vehicles and expand their autonomous fleets across new deployments. We have already deployed DriveMod software on nine different vehicle form factors that range from stockchasers and stand-on floor scrubbers to 14-seat shuttles and 5-meter-long cargo vehicles demonstrating the extensibility of our AV building blocks. These deployments were prototypes or part of proof-of-concept projects. Of these deployments, two were at customer sites. For one deployment we were paid $166,000 and the other was part of our normal R&D activities.

Our strategy upon establishing a customer relationship with an OEM, is to seek to embed our technology into their vehicle roadmap and expand our services to their many clients. Once we solidify an initial AV deployment with a customer, we intend to seek to expand within the site to additional vehicle platforms and/or expand the use of similar vehicles to other sites operated by the customer. This “land and expand” strategy can repeat iteratively across new vehicles and sites and is at the heart of why we believe industrial AVs that operate in geo-fenced, constrained environments are poised to create value.

Meanwhile, over $16 billion has been invested into passenger AV development over the last several years with negligible revenues generated and constant delays. The $200B annual industrial equipment market (projected by 2027) is substantial, but it does not justify billions of dollars of annual research & development spend. These leading passenger AV companies will need to take the approach of first capturing the trillion-dollar markets of passenger AV to achieve their desired returns.

2

THE OFFERING

| Issuer | Cyngn Inc. | |

| Securities Offered by the Selling Stockholders | 3,790,322 shares of our common stock, 6,451,613 shares common stock issuable upon the exercise of warrants and 2,661,291 shares of common stock issuable upon the exercise of pre-funded warrants or an aggregate of 12,903,226 shares of common stock. | |

| Trading Market | The common stock offered in this prospectus is listed on The Nasdaq Capital Market under the symbol “CYN.” | |

| Common Stock Outstanding Before this Offering | 30,894,752 shares | |

| Common Stock Outstanding After this Offering | 40,007,656(1) shares | |

| Use of Proceeds | We will not receive any of the proceeds from the sale of the shares of our common stock being offered for sale by the selling stockholders. Upon the exercise of the warrants for an aggregate of 9,112,904 shares of common stock by payment of cash however, we will receive the exercise price of the warrants, or an aggregate of approximately $19,228,468 from the investors in the Private Placement. | |

| Plan of Distribution | The selling stockholders may sell all or a portion of the shares of common stock beneficially owned by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. Registration of the common stock covered by this prospectus does not mean, however, that such shares necessarily will be offered or sold. See “Plan of Distribution.” | |

| Risk Factors | Please read “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the securities offered in this prospectus. |

| (1) | The number of shares of common stock shown above to be outstanding after this offering is based on 30,894,752 shares outstanding as of the date of this prospectus and assumes the exercise of (i) the warrants into 6,451,613 shares of common stock and (ii) pre-funded warrants held by the selling stockholders into 2,661,291 shares of common stock. |

3

RISK FACTORS

An investment in the Company’s common stock involves a high degree of risk. In determining whether to purchase the Company’s common stock, an investor should carefully consider all of the material risks described below, together with the other information contained in this prospectus before making a decision to purchase the Company’s securities. An investor should only purchase the Company’s securities if he or she can afford to suffer the loss of his or her entire investment.

Autonomous driving is an emerging technology and involves significant risks and uncertainties.

We develop and deploy a suite of autonomous driving software products that are compatible with existing sensors and hardware to enable autonomous driving on industrial vehicle platforms manufactured and designed by OEMs and other third-party industrial vehicle suppliers. Our autonomous driving technology is highly dependent on internally developed software, as well as on partnerships with third parties such as industrial OEMs and other suppliers.

We partner with OEMs that are seeking to manufacture purpose-built industrial vehicles capable of incorporating our autonomous driving technology. The collaborative partnerships are established through mutually beneficial, non-binding memorandums of understanding or partnership agreements for the purpose of joint go-to-market efforts. In addition to OEMs, we depend on other third parties to produce hardware components, and, in some cases adjacent software solutions, that support our core suite of autonomous driving software products and tools. The timely development and performance of our autonomous driving programs is dependent on the materials, cooperation, and quality delivered by these partners. Further, we do not control the initial design of the industrial vehicles we work with and therefore have limited influence over the production and design of systems for braking, gear shifting, and steering. There can be no assurance that these systems and supporting technologies can be developed and validated at the high reliability standard required for deployment of autonomous industrial vehicles using our technology in a cost-effective and timely manner. Our dependence on these relationships exposes us to the risk that components manufactured by OEMs or other suppliers could contain defects that would cause our autonomous driving technology not to operate as intended.

Our autonomous driving technology is currently available as a private beta release, during which phase, we will prepare for scaled commercialization in 2024. Although we believe that our algorithms, data analysis and processing, and artificial intelligence technology are promising, we cannot assure you that our technology will achieve the necessary reliability for scaled commercialization of autonomous industrial vehicles. For example, we are still improving our technology in terms of handling edge cases, unique environments, and discrete objects. There can be no assurance that our data analytics and artificial intelligence could predict every single potential issue that may arise during the operation of an autonomous industrial vehicle utilizing our autonomous vehicle technology. Furthermore, the release and adoption of EAS and our other technologies and products may not be successful and may take longer than anticipated. If the development of EAS and our other technologies and products is delayed or customers do not adopt and buy our solutions to the extent we anticipate, our business and operating results will be adversely impacted.

We have a limited operating history in a new market and face significant challenges as our industry is rapidly evolving.

You should consider our business and prospects in light of the risks and challenges we face as a new entrant into a novel industry, including, among other things, with respect to our ability to:

| ● | design, integrate, and deploy safe, reliable, and quality autonomous vehicle software products and tools for industrial vehicles with our partners on an ongoing basis; |

| ● | navigate an evolving and complex regulatory environment; |

| ● | successfully produce with OEM partners a line of purpose-built autonomous industrial vehicles on the timeline we estimate; |

| ● | improve and enhance our software and autonomous technology; |

| ● | establish and expand our customer base; |

| ● | successfully market our autonomous driving solutions and our other products and services; |

4

| ● | properly price our products and services; |

| ● | improve and maintain our operational efficiency; |

| ● | maintain a reliable, secure, high-performance, and scalable technology infrastructure; |

| ● | attract, retain, and motivate talented employees; |

| ● | anticipate and adapt to changing market conditions, including technological developments and changes in competitive landscape; and |

| ● | build a well-recognized and respected brand. |

If we fail to address any or all of these risks and challenges, our business may be materially and adversely affected. There are also a number of additional challenges to the execution and adoption of autonomous vehicle technology in industrial markets, many of which are not within our control, including market acceptance of autonomous driving, governmental licensing requirements, concerns regarding data security and privacy, actual and threatened litigation (whether or not a judgment is rendered against us), and the general perception that an autonomous vehicle is not safe because there is no human driver. There can be no assurance that the market will accept our technology, in which case our future business, results of operations and financial condition could be adversely affected.

The autonomous industrial vehicle industry is in its early stages and is rapidly evolving. Our autonomous driving technology has not yet been commercialized at scale. We cannot assure you that we will be able to adjust to changing market or regulatory conditions quickly or cost-effectively. If we fail to do so, our business, results of operations, and financial condition will be adversely affected.

Our business model has yet to be tested and any failure to commercialize our strategic plans would have an adverse effect on our operating results and business.

You should be aware of the difficulties normally encountered by a relatively new enterprise that is beginning to scale its business, many of which are beyond our control, including unknown future challenges and opportunities, substantial risks and expenses in the course of entering new markets and undertaking marketing activities. The likelihood of our success must be considered in light of these risks, expenses, complications, delays, and the competitive environment in which we operate. There is, therefore, substantial uncertainty that our business plan will prove successful, and we may not be able to generate significant revenue, raise additional capital, or operate profitably. We will continue to encounter risks and difficulties frequently experienced by early commercial stage companies, including securing market acceptance for our product and service offerings, scaling up our infrastructure and headcount. We may encounter unforeseen expenses, difficulties, or delays in connection with our growth. In addition, as a result of the capital-intensive nature of our business, we can be expected to continue to sustain substantial operating expenses without generating sufficient revenue to cover expenditures. Any investment in our company is therefore highly speculative and could result in the loss of your entire investment.

Our future business depends in large part on our ability to continue to develop and successfully commercialize our suite of software products and tools. Our ability to develop, deliver, and commercialize at scale our technology to support or perform autonomous operation of industrial vehicles is still unproven.

Our technology suite is currently available as a private beta release which will need to be continually developed and enhanced for scaled commercialization. Our continued enhancement of our autonomous driving technology is and will be subject to risks, including with respect to:

| ● | our ability to continue to enhance our data analytics and software technology; |

| ● | designing, developing, and securing necessary components on acceptable terms and in a timely manner; |

| ● | our ability to attract and retain customers; |

5

| ● | our ability to pay for research and development costs; |

| ● | our ability to attract, recruit, hire, and train skilled employees; |

| ● | our ability to fund the development and commercialization of our technology; and |

| ● | our ability to enter into strategic relationships with key members in the industrial vehicles and industrial automation industries and component suppliers. |

We operate in a highly competitive market and will face competition from both established competitors and new market entrants.

The market for autonomous industrial vehicles and industrial automation solutions is highly competitive. Many companies are seeking to develop autonomous driving and delivery solutions. Competition in these markets is based primarily on technology, innovation, quality, safety, reputation, and price. Our future success will depend on our ability to further develop and protect our technology in a timely manner and to stay ahead of existing and new competitors. Our competitors in this market are working towards commercializing autonomous driving technology and may have substantial financial, marketing, research and development, and other resources.

In addition, we also face competition from traditional industrial vehicle and solution companies. Traditional vehicle and solution providers operating with human drivers are still the predominant operators in the market. Because of the long history of such traditional companies serving our potential customers and industries, there may be many constituencies in the market that would resist a shift towards autonomous industrial vehicles, which could include lobbying and marketing campaigns, particularly because our technology will displace machine operators and drivers.

In addition, the market leaders in our target industries, such as Industrial Material Handling (IMH) may start, or have already started, pursuing large scale deployment of autonomous industrial vehicle technology on their own. These companies may have more operational and financial resources than we do. We cannot guarantee that we will be able to effectively compete with them.

We may also face competition from component suppliers and other technology and industrial solution companies if they decide to expand vertically and develop their own autonomous industrial vehicles, some of whom have significantly greater resources than we do. We do not know how close these competitors are to commercializing autonomous driving systems.

Many established and new market participants have entered or have announced plans to enter the autonomous industrial vehicle market. Most of these participants have significantly greater financial, manufacturing, marketing, and other resources than we do and may be able to devote greater resources to the design, development, manufacturing, distribution, promotion, sale, and support of their products. If existing competitors or new entrants commercialize earlier than expected, our competitive advantage could be adversely affected.

Business collaboration with third parties is subject to risks and these relationships may not lead to significant revenue.

Strategic business relationships are and will continue to be an important factor in the growth and success of our business. We have alliances and partnerships, through mutually beneficial non-binding memoranda of understanding or partnering arrangements with other companies in the industrial equipment, automation and automotive industries to help us in our efforts to continue to enhance our technology, commercialize our solutions, and drive market acceptance.

Collaboration with these third parties is subject to risks, some of which are outside our control. For example, certain agreements with our partners grant our partner or us the right to terminate such agreements for cause or without cause. If any of our collaborations with third parties are terminated, it may delay or prevent our efforts to deploy our software products and tools on purpose-built autonomous industrial vehicles at scale. In addition, such agreements may contain certain exclusivity provisions which, if triggered, could preclude us from working with other businesses with superior technology or with whom we may prefer to partner with for other reasons. We could experience delays to the extent our partners do not meet agreed upon timelines or experience capacity constraints. We could also experience disagreement in budget or funding for joint development projects. There is also a risk of other potential disputes with partners in the future, including with respect to intellectual property rights. Our ability to successfully commercialize could also be adversely affected by perceptions about the quality of our or our partners’ vehicles or products.

6

Risks Related to Our Financial Position and Need for Additional Capital

Losses for the foreseeable future.

We incurred net losses of $7.8 million and $8.3 million for the years ended December 31, 2021, and 2020, respectively. We have not recognized a material amount of revenue to date, and we had accumulated deficit of $116.5 million and $108.7 million as of December 31, 2021 and December 31, 2020, respectively. We have developed and tested our autonomous driving technology but there can be no assurance that it will be commercially successful at scale. Our potential profitability is dependent upon a number of factors, many of which are beyond our control. If we are unable to achieve and sustain profitability, the value of our business and common stock may significantly decrease.

We expect the rate at which we will incur losses to be significantly higher in future periods as we:

| ● | design, develop, and deploy our autonomous vehicle software products and tools on industrial vehicle platforms with OEM partners and end customers. |

| ● | seek to achieve and commercialize deployments of level 4 autonomy for industrial vehicles; |

| ● | seek to expand our commercial deployments, on a nationwide basis in the United States and internationally; |

| ● | expand our design, development, maintenance, and repair capabilities; |

| ● | respond to competition in the autonomous driving market and from traditional industrial solution providers; |

| ● | respond to evolving regulatory developments in the nascent autonomous industrial vehicle and industrial automation markets; |

| ● | increase our sales and marketing activities; and |

| ● | increase our general and administrative functions to support our growing operations and for being a public reporting company. |

Because we will incur the costs and expenses from these efforts before we receive any incremental revenue, our losses in future periods will be significant. In addition, we may find that these efforts are more expensive than we currently anticipate or that these efforts may not result in revenue, which would further increase our losses. In particular, we expect to incur substantial and potentially increasing research and development (“R&D”) costs as we continue to develop and enhance EAS and other technology and products for commercialization. While our R&D costs were $5.0 million and $5.1 million during the years ended December 31, 2021 and 2020, respectively, and are likely to grow in the future, we have no recurring revenues. Further, because we account for R&D as an operating expense, these expenditures will adversely affect our results of operations in the future. Our R&D program may not produce successful results, and our new products may not achieve market acceptance, create additional revenue, or become profitable.

We have a limited operating history, which makes it difficult to forecast our future results of operations.

We were founded in 2013. As a result of our limited operating history, our ability to accurately forecast our future results of operations is limited and subject to a number of uncertainties, including our ability to plan for and model future growth. Our historical performance should not be considered indicative of our future performance. Further, in future periods, our revenue growth could fluctuate for a number of reasons, including shifts in our offering and revenue mix, slowing demand for our offering, increasing competition, decreased effectiveness of our sales and marketing organization, and our sales and marketing efforts to acquire new customers, failure to retain existing customers, changing technology, a decrease in the growth of our overall market, or our failure, for any reason, to continue to take advantage of growth opportunities. We anticipate that we will encounter, risks and uncertainties frequently experienced by growing companies in rapidly changing industries, such as the risks and uncertainties described in this report.

If our assumptions regarding these risks and uncertainties and our future revenue growth are incorrect or change, or if we do not address these risks successfully, our operating and financial results could differ materially from our expectations, and our business could suffer.

7

We expect fluctuations in our financial results making it difficult to project future results.

Our results of operations may fluctuate in the future due to a variety of factors, many of which are outside of our control. As a result, our past results may not be indicative of our future performance. In addition to the other risks described herein, factors that may affect our results of operations include the following:

| ● | changes in our revenue mix and related changes in revenue recognition; |

| ● | changes in actual and anticipated growth rates of our revenue, customers, and key operating metrics; |

| ● | fluctuations in demand for or pricing of our offering; |

| ● | our ability to attract new customers; |

| ● | our ability to retain our existing customers, particularly large customers; |

| ● | customers and potential customers opting for alternative products, including developing their own in-house solutions; |

| ● | investments in new offerings, features, and functionality; |

| ● | fluctuations or delays in development, release, or adoption of new features and functionality for our offering; |

| ● | delays in closing sales which may result in revenue being pushed into the next quarter; |

| ● | changes in customers’ budgets and in the timing of their budget cycles and purchasing decisions; |

| ● | our ability to control costs; |

| ● | the amount and timing of payment for operating expenses, particularly research and development and sales and marketing expenses; |

| ● | timing of hiring personnel for our research and development and sales and marketing organizations; |

| ● | the amount and timing of costs associated with recruiting, educating, and integrating new employees and retaining and motivating existing employees; |

| ● | the effects of acquisitions and their integration; |

| ● | general economic conditions, both domestically and internationally, as well as economic conditions specifically affecting industries in which our customers participate; |

| ● | the impact of new accounting pronouncements; |

| ● | changes in revenue recognition policies that impact our technology license revenue; |

| ● | changes in regulatory or legal environments that may cause us to incur, among other things, expenses associated with compliance; |

| ● | the impact of changes in tax laws or judicial or regulatory interpretations of tax laws, which are recorded in the period such laws are enacted or interpretations are issued and may significantly affect the effective tax rate of that period; |

8

| ● | health epidemics or pandemics, such as the COVID-19 pandemic; |

| ● | changes in the competitive dynamics of our market, including consolidation among competitors or customers; and |

| ● | significant security breaches of, technical difficulties with, or interruptions to, the delivery and use of our offering. |

Any of these and other factors, or the cumulative effect of some of these factors, may cause our results of operations to vary significantly. If our quarterly results of operations fall below the expectations of investors and securities analysts who follow our stock, the price of our common stock could decline substantially, and we could face costly lawsuits, including securities class action suits.

We may need to raise additional funds and these funds may not be available to us on attractive terms when we need them, or at all.

The commercialization of autonomous vehicles is capital intensive. This includes autonomous industrial vehicles outfitted with our technology and purpose-built autonomous industrial vehicles manufactured by OEMs we intend to partner with. To date, we have financed our operations primarily through the issuance of equity securities in private placements. We may need to raise additional capital to continue to fund our commercialization activities, sales and marketing efforts, enhancement of our technology and to improve our liquidity position. Our ability to obtain the necessary financing to carry out our business plan is subject to a number of factors, including general market volatility, investor acceptance of our business plan, regulatory requirements and the successful development of our autonomous technology. These factors may make the timing, amount, terms, and conditions of such financing unattractive or unavailable to us.

We may raise these additional funds through the issuance of equity, equity related, or debt securities. To the extent that we raise additional financing by issuing equity securities or convertible debt securities, our stockholders may experience substantial dilution, and to the extent we engage in debt financing, we may become subject to restrictive covenants that could limit our flexibility in conducting future business activities. Financial institutions may request credit enhancement such as third-party guarantee and pledge of equity interest in order to extend loans to us. We cannot be certain that additional funds will be available to us on attractive terms when required, or at all. If we cannot raise additional funds when we need them, our financial condition, results of operations, business, and prospects could be materially adversely affected.

We may be subject to risks associated with potential future acquisitions.

Although we have no current acquisition plans, if appropriate opportunities arise, we may acquire additional assets, products, technology or businesses that are complementary to our existing business. Any future acquisitions and the subsequent integration of new assets and businesses would require significant attention from our management and could result in a diversion of resources from our existing business, which in turn could have an adverse effect on our operations, and consequently our results of operations and financial condition. Acquired assets or businesses may not generate the financial results we expect. Acquisitions could result in the use of substantial amounts of cash, potentially dilutive issuances of equity securities, significant goodwill impairment charges, amortization expenses for other intangible assets and exposure to potential unknown liabilities of the acquired business. Moreover, the costs of identifying and consummating acquisitions may be significant.

9

Risks Related to Our Business Operations

Our success depends largely on the continued services of our senior management team, technical engineers, and certain key employees.

We rely on our executive officers and key employees in the areas of business strategy, research and development, marketing, sales, services, and general and administrative functions. From time to time, there may be changes in our executive management team or key employees resulting from the hiring or departure of executives or key employees, which could disrupt our business. We do not maintain key-man insurance for any member of our senior management team or any other employee. We do not have employment agreements with our executive officers or other key personnel that require them to continue to work for us for any specified period and, therefore, they could terminate their employment with us at any time. The loss of one or more of our executive officers or key employees could have a serious adverse effect on our business.

To execute our growth plan, we must attract and retain highly qualified personnel. Competition for these personnel is intense in the technology industry, especially for engineers with high levels of experience in artificial intelligence and designing and developing autonomous driving related algorithms. Furthermore, it can be difficult to recruit personnel from other geographies to relocate to our California locations. We may also need to recruit highly qualified technical engineers internationally and therefore subject us to the compliance of relevant immigration laws and regulations. We have, from time to time, experienced, and we expect to continue to experience, difficulty in hiring and retaining employees with appropriate qualifications. Many of the companies with which we compete for experienced personnel have greater resources than we have and can offer more attractive compensation packages for new employees. If we hire employees from competitors or other companies, their former employers may attempt to assert that these employees or our company have breached their legal obligations, resulting in a diversion of our time and resources and potentially in litigation. In addition, job candidates and existing employees often consider the value of the share incentive awards they receive in connection with their employment. If the perceived value of our share awards declines, it may adversely affect our ability to recruit and retain highly skilled employees. If we fail to attract new personnel on a timely basis or fail to retain and motivate our current personnel, we may not be able to commercialize and then expand our solutions and services in a timely manner and our business and future growth prospects could be adversely affected.

If we fail to manage our growth effectively, we may be unable to execute our business plan, maintain high levels of service, or adequately address competitive challenges.

We expect to invest in our growth for the foreseeable future. Any growth in our business is expected to place a significant strain on not only our managerial, administrative, operational, and financial resources, but also our infrastructure. We plan to continue to expand our operations in the future. Our success will depend in part on our ability to manage this growth effectively and execute our business plan. To manage the expected growth of our operations and personnel, we will need to continue to improve our operational, financial, and management controls and our reporting systems and procedures.

We rely heavily on information technology or IT, systems to manage critical business functions. To manage our growth effectively, we must continue to improve and expand our infrastructure, including our IT, financial, and administrative systems and controls. In particular, we may need to significantly expand our IT infrastructure as the amount of data we store and transmit increases over time, which will require that we both utilize existing IT products and adopt new technology. If we are not able to scale our IT infrastructure in a cost-effective and secure manner, our ability to offer competitive solutions will be harmed and our business, financial condition, and operating results may suffer.

We must also continue to manage our employees, operations, finances, research and development, and capital investments efficiently. Our productivity and the quality of our solutions may be adversely affected if we do not integrate and train our new employees quickly and effectively or if we fail to appropriately coordinate across our executive, research and development, technology, service development, analytics, finance, human resources, marketing, sales, operations, and customer support teams. As we continue to grow, we will incur additional expenses, and our growth may continue to place a strain on our resources, infrastructure, and ability to maintain the quality of our solutions. If we do not adapt to meet these evolving challenges, or if the current and future members of our management team do not effectively manage our growth, the quality of our solutions may suffer and our corporate culture may be harmed. Failure to manage our future growth effectively could cause our business to suffer, which, in turn, could have an adverse impact on our business, financial condition, and operating results.

10

Our management team has limited experience managing a public company.

Our management team has limited experience managing a publicly-traded company, interacting with public company investors, and complying with the increasingly complex laws pertaining to public companies. Our management team may not successfully or efficiently manage our transition to being a public company subject to significant regulatory oversight and reporting obligations under the federal securities laws and the continuous scrutiny of securities analysts and investors. These new obligations and constituents will require significant attention from our senior management and could divert their attention away from the day-to-day management of our business, which could adversely affect our business, financial condition, and operating results.

We may be subject to product liability or warranty claims that could result in significant direct or indirect costs, including reputational harm, increased insurance premiums or the need to self-insure, which could adversely affect our business and operating results.

Our technology is used for autonomous driving, which presents the risk of significant injury, including fatalities. We may be subject to claims if one of our or a customer’s industrial vehicles is involved in an accident and persons are injured or purport to be injured or if property is damaged. Any insurance that we carry may not be sufficient or it may not apply to all situations. If we experience such an event or multiple events, our insurance premiums could increase significantly or insurance may not be available to us at all. Further, if insurance is not available on commercially reasonable terms, or at all, we might need to self-insure. In addition, lawmakers or governmental agencies could pass laws or adopt regulations that limit the use of autonomous driving or industrial automation technology or increase liability associated with its use. Any of these events could adversely affect our brand, relationships with users, operating results, or financial condition.

If our autonomous driving software fails to perform as expected our ability to market, sell or lease our autonomous driving software could be harmed.

Our autonomous industrial vehicle software products and tools as well as the vehicles, sensors, and hardware they utilize and are deployed on may contain defects in design and manufacture that may cause them not to perform as expected or require repair. For example, our autonomous vehicle software will require modification and updates over the life of the vehicle it is deployed on. Software products are inherently complex and often contain defects and errors when first introduced. There can be no assurance that we will be able to detect and fix any defects in the industrial vehicles’ hardware or software prior to commencing user sales or during the life of the vehicle. Autonomous industrial vehicles utilizing our suite of products and tools may not perform consistent with users’ expectations or consistent with other vehicles that may become available. Any product defects or any other failure of our software, supportive hardware, or deployment vehicle platform or to perform as expected could harm our reputation, result in adverse publicity, lost revenue, delivery delays, product recalls, product liability claims, and significant warranty and other expenses, and could have a material adverse impact on our business, financial condition, operating results, and prospects.

If we are unable to establish and maintain confidence in our long-term business prospects among users, securities and industry analysts, and within our industries, or are subject to negative publicity, then our financial condition, operating results, business prospects, and access to capital may suffer materially.

Users may be less likely to purchase or use our technology and the industrial vehicles it is deployed on if they are not convinced that our business will succeed or that our service and support and other operations will continue in the long term. Similarly, suppliers and other third parties will be less likely to invest time and resources in developing business relationships with us if they are not convinced that our business will succeed. Accordingly, in order to build and maintain our business, we must maintain confidence among users, suppliers, securities and industry analysts, and other parties in our long-term financial viability and business prospects. Maintaining such confidence may be particularly complicated by certain factors including those that are largely outside of our control, such as our limited operating history at scale, user unfamiliarity with our solutions, any delays in scaling manufacturing, delivery, and service operations to meet demand, competition and uncertainty regarding the future of autonomous vehicles, and our performance compared with market expectations.

11

Pandemics and epidemics, including the ongoing COVID-19 pandemic, natural disasters, terrorist activities, political unrest, and other manmade problems such as war could have a material adverse impact on our business, results of operations, financial condition and cash flows or liquidity.

Our business is vulnerable to damage or interruption from pandemics and epidemics, including the ongoing COVID-19 pandemic, natural disasters, terrorist attacks, political unrest, acts of war, including the current conflict between Russia and Ukraine, and similar events.

During the ongoing global COVID-19 pandemic, the capital markets are experiencing pronounced volatility, which may adversely affect investor’s confidence and, in turn may affect our ability to raise additional capital.

In addition, the COVID-19 pandemic has caused us to modify our business practices (such as employee travel plan and cancellation of physical participation in meetings, events, and conference), and we may take further actions as required by governmental authorities or that we determine are in the best interests of our employees, users, and business partners. In addition, the business and operations of our manufacturers, suppliers, and other business partners have also been adversely impacted by the COVID-19 pandemic and may be further adversely impacted in the future, which could result in delays in our ability to commercialize our suite of autonomous vehicle software products and tools.

As a result of social distancing, travel bans, and quarantine measures, access to our facilities, users, management, support staff, and professional advisors has been limited, which in turn has impacted, and will continue to impact, our operations, and financial condition.

The extent to which COVID-19 impacts our, and those of our partners and potential users, business, results of operations, and financial condition will depend on future developments, which are uncertain and cannot be predicted, including, but not limited to, the occurrence of a “second wave,” duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. Even if the COVID-19 outbreak subsides, we may continue to experience materially adverse impacts to our business as a result of its global economic impact, including any recession that has occurred or may occur in the future.

Other considerations related to the current conflict between Russia and Ukraine that may affect the Company include possible cyberattacks and potential disruptions in the banking systems and capital market, as well as supply chain and increased costs and expenditures on domestic and internationally-sourced materials and services. As an example, we engage third-party software development engineers who reside in Russia. Due to the current conflict, we may experience an interruption in the services provided by these parties.

We are also vulnerable to natural disasters and other calamities. Although we have servers that are hosted in an offsite location, our backup system does not capture data on a real-time basis, and we may be unable to recover certain data in the event of a server failure. We cannot assure you that any backup systems will be adequate to protect us from the effects of fire, floods, typhoons, earthquakes, power loss, telecommunications failures, break-ins, war, riots, terrorist attacks or similar events. Any of the foregoing events may give rise to interruptions, breakdowns, system failures, technology platform failures or internet failures, which could cause the loss or corruption of data or malfunctions of software or hardware as well as adversely affect our ability to provide services.

12

Risks Related to Our Intellectual Property, Information Technology and Data Privacy

We may become subject to litigation brought by third parties claiming infringement, misappropriation or other violation by us of their intellectual property rights.

The industry in which our business operates is characterized by a large number of patents, some of which may be of questionable scope, validity or enforceability, and some of which may appear to overlap with other issued patents. As a result, there is a significant amount of uncertainty in the industry regarding patent protection and infringement. In recent years, there has been significant litigation globally involving patents and other intellectual property rights. Third parties may in the future assert, that we have infringed, misappropriated or otherwise violated their intellectual property rights. As we face increasing competition and as a public company, the possibility of intellectual property rights claims against us grows. Such claims and litigation may involve one or more of our competitors focused on using their patents and other intellectual property to obtain competitive advantage, or patent holding companies or other adverse intellectual property rights holders who have no relevant product revenue, and therefore our own pending patents and other intellectual property rights may provide little or no deterrence to these rights holders in bringing intellectual property rights claims against us. There may be intellectual property rights held by others, including issued or pending patents and trademarks, that cover significant aspects of our technologies or business methods, and we cannot assure that we are not infringing or violating, and have not infringed or violated, any third-party intellectual property rights or that we will not be held to have done so or be accused of doing so in the future. In addition, because patent applications can take many years until the patents issue, there may be applications now pending of which we are unaware, which may later result in issued patents that our products may infringe. We expect that in the future we may receive notices that claim we or our collaborators have misappropriated or misused other parties’ intellectual property rights, particularly as the number of competitors in our market grows.

To defend ourselves against any intellectual property claims brought by third parties, whether with or without merits, can be time-consuming and could result in substantial costs and a diversion of our resources. These claims and any resulting lawsuits, if resolved adversely to us, could subject us to significant liability for damages, impose temporary or permanent injunctions against our products, technologies or business operations, or invalidate or render unenforceable our intellectual property.

If our technology is determined to infringe a valid and enforceable patent, or if we wish to avoid potential intellectual property litigation on any alleged infringement, misappropriation or other violation of third party intellectual property rights, we may be required to do one or more of the following: (i) cease development, sales, or use of our products that incorporate or use the asserted intellectual property right; (ii) obtain a license from the owner of the asserted intellectual property right, which may be unavailable on commercially reasonable terms, or at all, or which may be non-exclusive, thereby giving our competitors and other third parties access to the same technologies licensed to us; (iii) pay substantial royalties or other damages; or (iv) redesign our technology or one or more aspects or systems of our autonomous industrial vehicles to avoid any infringement or allegations thereof. The aforementioned options sometimes may not be commercially feasible. Additionally, in our ordinary course of business, we agree to indemnify our customers, partners, and other commercial counterparties for any infringement arising out of their use of our intellectual property, along with providing standard indemnification provisions, so we may face liability to our users, business partners or third parties for indemnification or other remedies in the event that they are sued for infringement.

We may also in the future license third party technology or other intellectual property, and we may face claims that our use of such in-licensed technology or other intellectual property infringes, misappropriates or otherwise violates the intellectual property rights of others. In such cases, we will seek indemnification from our licensors. However, our rights to indemnification may be unavailable or insufficient to cover our costs and losses.

We also may not be successful in any attempt to redesign our technology to avoid any alleged infringement. A successful claim of infringement against us, or our failure or inability to develop and implement non-infringing technology, or license the infringed technology on acceptable terms and on a timely basis, could materially adversely affect our business and results of operations. Furthermore, such lawsuits, regardless of their success, would likely be time-consuming and expensive to resolve and would divert management’s time and attention from our business, which could seriously harm our business. Also, such lawsuits, regardless of their success, could seriously harm our reputation with users and in the industry at large.

13

Our business may be adversely affected if we are unable to adequately establish, maintain, protect, and enforce our intellectual property and proprietary rights or prevent third parties from making unauthorized use of our technology and other intellectual property rights.

Our intellectual property is an essential asset of our business. Failure to adequately protect our intellectual property rights could result in our competitors offering similar products, potentially resulting in the loss of our competitive advantage, and a decrease in our revenue which would adversely affect our business prospects, financial condition, and operating results. Our success depends, at least in part, on our ability to protect our core technology and intellectual property. We rely on a combination of intellectual property rights, such as patents, trademarks, copyrights, and trade secrets (including know-how), in addition to employee and third-party nondisclosure agreements, intellectual property licenses, and other contractual rights, to establish, maintain, protect, and enforce our rights in our technology, proprietary information, and processes. Intellectual property laws and our procedures and restrictions provide only limited protection and any of our intellectual property rights may be challenged, invalidated, circumvented, infringed or misappropriated. If we fail to protect our intellectual property rights adequately, we may lose an important advantage in the markets in which we compete. While we take measures to protect our intellectual property, such efforts may be insufficient or ineffective, and any of our intellectual property rights may be challenged, which could result in them being narrowed in scope or declared invalid or unenforceable. Other parties may also independently develop technologies that are substantially similar or superior to ours. We also may be forced to bring claims against third parties, or defend claims that they may bring against us, to determine the ownership of what we regard as our intellectual property. However, the measures we take to protect our intellectual property from unauthorized use by others may not be effective and there can be no assurance that our intellectual property rights will be sufficient to protect against others offering products, services, or technologies that are substantially similar or superior to ours and that compete with our business.

Litigation may be necessary in the future to enforce our intellectual property rights and to protect our trade secrets. Our efforts to enforce our intellectual property rights may be met with defenses, counterclaims, and countersuits attacking the validity and enforceability of our intellectual property. Any litigation initiated by us concerning the violation by third parties of our intellectual property rights is likely to be expensive and time-consuming and could lead to the invalidation of, or render unenforceable, our intellectual property, or could otherwise have negative consequences for us. Furthermore, it could result in a court or governmental agency invalidating or rendering unenforceable our patents or other intellectual property rights upon which the suit is based. We will not be able to protect our intellectual property if we are unable to enforce our rights or if we do not detect unauthorized use of our intellectual property. Our inability to protect our proprietary technology against unauthorized copying or use, as well as any costly litigation or diversion of our management’s attention and resources, could delay the introduction and implementation of new technologies, result in our substituting inferior or more costly technologies into our products or injure our reputation. Moreover, policing unauthorized use of our technologies, trade secrets, and intellectual property may be difficult, expensive, and time-consuming, particularly in foreign countries where the laws may not be as protective of intellectual property rights as those in the United States and where mechanisms for enforcement of intellectual property rights may be weak. If we fail to meaningfully establish, maintain, protect, and enforce our intellectual property and proprietary rights, our business, operating results, and financial condition could be adversely affected.

Changes in U.S. patent law could diminish the value of patents in general, thereby impairing our ability to protect our products.

There are a number of recent changes to the patent laws that may have a significant impact on our ability to protect our technology and enforce our intellectual property rights. For example, the Leahy-Smith America Invents Act (the “AIA”) enacted in September 2011, resulted in significant changes in patent legislation. An important change introduced by the AIA is that, as of March 16, 2013, the United States transitioned from a “first-to-invent” to a “first-to-file” system for deciding which party should be granted a patent when two or more patent applications are filed by different parties claiming the same invention. Under a “first-to-file” system, assuming the other requirements for patentability are met, the first inventor to file a patent application generally will be entitled to a patent on the invention regardless of whether another inventor had made the invention earlier. A third party that files a patent application in the United States Patent and Trademark Office (“USPTO”) after that date but before us could therefore be awarded a patent covering an invention of ours even if we made the invention before it was made by the third party. Circumstances could prevent us from promptly filing patent applications on our inventions.

14

The AIA also includes a number of significant changes that affect the way patent applications will be prosecuted and also may affect patent litigation. These include allowing third party submission of prior art to the USPTO during patent prosecution and additional procedures to attack the validity of a patent by USPTO administered post-grant proceedings, including post-grant review, inter partes review, and derivation proceedings. Because of a lower evidentiary standard in USPTO proceedings compared to the evidentiary standard in United States federal courts necessary to invalidate a patent claim, a third party could potentially provide evidence in a USPTO proceeding sufficient for the USPTO to hold a claim invalid even though the same evidence would be insufficient to invalidate the claim if first presented in a district court action. Accordingly, a third party may attempt to use the USPTO procedures to invalidate our patent claims that would not have been invalidated if first challenged by the third party as a defendant in a district court action. The AIA and its implementation could increase the uncertainties and costs surrounding the prosecution of our patent applications and the enforcement or defense of our issued patents, all of which could have a material adverse effect on our business, financial condition, results of operations, and prospects.

Further, the standards applied by the USPTO and foreign patent offices in granting patents are not always applied uniformly or predictably. For example, there is no uniform worldwide policy regarding patentable subject matter or the scope of claims allowable for business methods. As such, we do not know the degree of future protection that we will have on our technologies, products, and services. While we will endeavor to try to protect our technologies, products, and services with intellectual property rights such as patents, as appropriate, the process of obtaining patents is time-consuming, expensive, and sometimes unpredictable.

Additionally, the U.S. Supreme Court has ruled on several patent cases in recent years, such as Impression Products, Inc. v. Lexmark International, Inc., Association for Molecular Pathology v. Myriad Genetics, Inc., Mayo Collaborative Services v. Prometheus Laboratories, Inc. and Alice Corporation Pty. Ltd. v. CLS Bank International, either narrowing the scope of patent protection available in certain circumstances or weakening the rights of patent owners in certain situations. In addition to increasing uncertainty with regard to our ability to obtain patents in the future, this combination of events has created uncertainty with respect to the value of patents, once obtained.

Depending on decisions by the U.S. Congress, the federal courts, and the USPTO, the laws and regulations governing patents could change in unpredictable ways that could weaken our ability to obtain new patents or to enforce our existing patents and patents that we might obtain in the future.

Our patent applications may not issue as patents, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours.

We cannot be certain that we are the first inventor of the subject matter to which we have filed a particular patent application, or if we are the first party to file such a patent application. If another party has filed a patent application to the same subject matter as we have, we may not be entitled to the protection sought by the patent application. Further, the scope of protection of issued patent claims is often difficult to determine. As a result, we cannot be certain that the patent applications that we file will issue, or that our issued patents will be broad enough to protect our proprietary rights or otherwise afford protection against competitors with similar technology. In addition, the issuance of a patent is not conclusive as to its inventorship, scope, validity or enforceability. Our competitors may challenge or seek to invalidate our issued patents, or design around our issued patents, which may adversely affect our business, prospects, financial condition or operating results. Also, the costs associated with enforcing patents, confidentiality and invention agreements, or other intellectual property rights may make aggressive enforcement impracticable.

We may not be able to protect our intellectual property rights throughout the world.

Filing, prosecuting, maintaining, defending, and enforcing patents and other intellectual property rights on our product candidates in all countries throughout the world would be prohibitively expensive, and our intellectual property rights in some countries outside the United States can be less extensive than those in the United States. In addition, the laws of some foreign countries do not protect intellectual property rights to the same extent as federal and state laws in the United States. Consequently, we may not be able to prevent third parties from practicing our inventions in all countries outside the United States, or from selling or importing products made using our inventions in and into the United States or other jurisdictions. Competitors may use our technologies in jurisdictions where we have not obtained patent protection or other intellectual property rights to develop their own products and may export otherwise infringing, misappropriating, or violating products to territories where we have patent or other intellectual property protection, but enforcement rights are not as strong as those in the United States. These products may compete with our product candidates, and our patents or other intellectual property rights may not be effective or sufficient to prevent them from competing.

15

Many companies have encountered significant problems in protecting and defending intellectual property rights in foreign jurisdictions. The legal systems of some countries do not favor the enforcement of patents and other intellectual property rights, which could make it difficult for us to stop the infringement, misappropriation, or other violation of our intellectual property rights generally. Proceedings to enforce our intellectual property rights in foreign jurisdictions could result in substantial costs and divert our efforts and attention from other aspects of our business, could put our patents at risk of being invalidated or interpreted narrowly and our patent applications at risk of not issuing, and could provoke third parties to assert claims against us. We may not prevail in any lawsuits that we initiate, and the damages or other remedies awarded, if any, may not be commercially meaningful.

Many countries, including European Union countries, India, Japan, and China, have compulsory licensing laws under which a patent owner may be compelled under specified circumstances to grant licenses to third parties. In addition, many countries limit the enforceability of patents against government agencies or government contractors. In those countries, we may have limited remedies if patents are infringed or if we are compelled to grant a license to a third party, which could materially diminish the value of those patents. This could limit our potential revenue opportunities. Accordingly, our efforts to enforce our intellectual property rights around the world may be inadequate to obtain a significant commercial advantage from the intellectual property that we develop or license, which could adversely affect our business, financial condition, results of operations, and prospects.

In addition to patented technology, we rely on our unpatented proprietary technology, trade secrets, processes, and know-how.