UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

For the fiscal year ended

OR

OR

1934

Date of event requiring this shell company report……………….

Commission File Number:

(Exact name of Registrant as specified in its charter)

| Not applicable | ||

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Shanghai

(Address of Principal Executive Offices)

Shanghai

Tel:

Email: alex.xu@multi-metaverse.com

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

Securities registered or to be registered pursuant

to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934. Yes ☐

Indicate by check mark whether the registrant:

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Emerging growth company |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange

Act.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

TABLE OF CONTENTS

i

INTRODUCTION

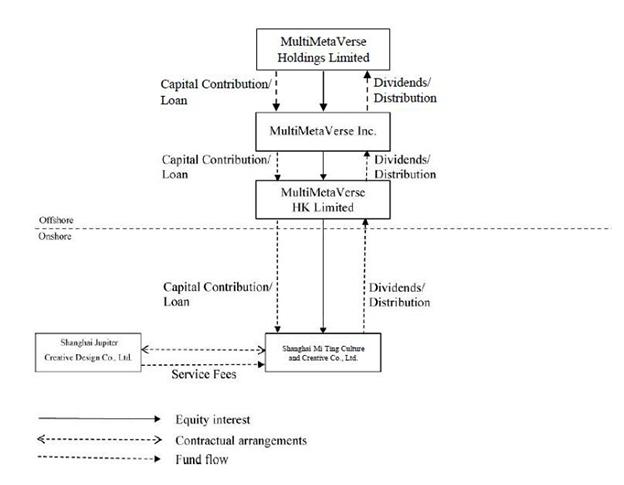

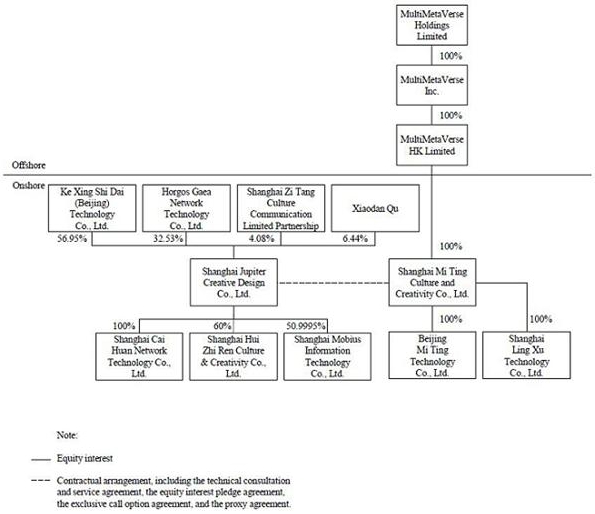

We are a holding company primarily operating in China through our subsidiaries and contractual arrangements (the “VIE Agreements”) with variable interest entities (the “VIEs”), namely Shanghai Jupiter Creative Design Co., Ltd., a limited liability company established under PRC law (“Shanghai Jupiter”), and its subsidiaries. PRC laws, regulations, and rules restrict and impose conditions on direct foreign investment in certain types of business, and we will therefore operate these businesses in China through VIEs. Such structure involves unique risks to investors. Moreover, if the PRC government finds these contractual arrangements non-compliant with the restrictions on direct foreign investment in the relevant industries, or if the relevant PRC laws, regulations, and rules or the interpretation thereof change in the future, we could be subject to severe penalties or be forced to relinquish our interests in the VIEs or forfeit our rights under the contractual arrangements. We and investors in our ordinary shares and warrants will face uncertainty about potential future actions by the PRC government, which could affect the enforceability of the contractual arrangements with Shanghai Jupiter and, consequently, significantly our financial condition and results of operations. If we are unable to claim our right to control the assets of the VIEs. Our ordinary shares and warrants may decline in value or become worthless. See “Item 3. Key Information—3.D. Risk Factors— Risks Related to MMV’s Corporate Structure.”

We face various risks and uncertainties related to doing business in China. The PRC government has significant authority to exert influence on the ability of a China-based company, such as us, to conduct its business and accept foreign investments. For example, we face risks associated with regulatory approvals on offshore securities offerings, oversight on cybersecurity and data privacy. The PRC government has recently published new policies that significantly affected various industries, and we cannot rule out the possibility that it will in the future further release regulations or policies regarding our industry that could adversely affect our business, financial condition and results of operations. For a detailed description of risks relating to doing business in China, see “Item 3. Key Information—3.D. Risk Factors—Risks Related to Doing Business in China.”

Unless otherwise stated or unless the context otherwise requires, the terms “Company,” “the registrant,” “our company,” “the company,” “we,” “us,” “our,” “ours” and “MMV” refer to MultiMetaVerse Holdings Limited, a British Virgin Islands business company, and its subsidiaries, and in the context of describing our operations and consolidated financial information, the VIEs. References to “Legacy MMV” refer to MultiMetaVerse Inc., a Cayman Islands exempted company and a wholly owned subsidiary of MMV.

Our consolidated financial statements are presented in U.S. dollars. All references in this annual report to “$,” “U.S. $,” “U.S. dollars” and “dollars” mean U.S. dollars, unless otherwise noted.

We completed a merger with Model Performance Acquisition Corp. on January 4, 2023 and MMV’s Class A ordinary shares and warrants began trading on the Nasdaq Stock Exchange on January 5, 2023. Model Performance Acquisition Corp., a British Virgin Islands business company (“MPAC”), Model Performance Mini Corp., a British Virgin Islands business company (“PubCo”), Model Performance Mini Sub Corp., a Cayman Islands exempted company and wholly-owned subsidiary of PubCo (the “Merger Sub”), and MultiMetaVerse Inc., a Cayman Islands exempted company (“Legacy MMV”), entered into a Merger Agreement dated as of August 6, 2021 (as amended on January 6 and September 29, 2022, the “Merger Agreement”). The Merger Agreement provided for a business combination which was effected in two steps: (i) MPAC reincorporated to British Virgin Islands by merging with and into PubCo, with PubCo remaining as the surviving publicly traded entity (the “Reincorporation Merger”); (ii) following the Reincorporation Merger, Merger Sub merged with and into Legacy MMV, resulting in Legacy MMV being a wholly owned subsidiary of PubCo (the “Acquisition Merger,” together with Reincorporation Merger, the “Business Combination”).

Further, in this annual report:

| ● | “ACGN” means animation, comic, game and novel. |

| ● | “Board” means the board of directors of MMV. |

| ● | “Business Combination” means the merger contemplated by the Merger Agreement. |

| ● | “Closing Date” means the date of the consummation of the Business Combination. |

| ● | “Code” means the Internal Revenue Code of 1986, as amended. |

| ● | “Combination Period” means the period of time by which an initial business combination must be completed by MPAC. |

| ● | “Continental” means Continental Stock Transfer & Trust Company, MPAC and MMV’s transfer agent. |

| ● | “Effective Time” means the time at which the Business Combination becomes effective. |

| ● | “Exchange Act” means the Securities Exchange Act of 1934, as amended. |

| ● | “Existing Charter” means MPAC’s Memorandum and Articles of Association, as amended and restated on September 28, 2022. |

| ● | “founder shares” means the outstanding Class B ordinary shares of MPAC issued to the Sponsor for an aggregate purchase price of $25,001 in January 2021. |

| ● | “GAAP” means accounting principles generally accepted in the United States of America. |

| ● | “Initial Shareholders” means the Sponsor and other initial holders of MPAC Class B ordinary shares. |

| ● | “IPO” refers to the initial public offering of 5,000,000 units of MPAC consummated on April 12, 2021. |

ii

| ● | “IRS” means the United States Internal Revenue Service. |

| ● | “MMV Class A ordinary shares” means the Class A ordinary shares, no par value per share, of MMV. |

| ● | “MMV Class B ordinary shares” means the Class B ordinary shares, no par value per share, of MMV. |

| ● | “MMV Ordinary Shares” means the MMV Class A ordinary shares and MMV Class B ordinary shares, collectively. |

| ● | “MMV Warrant” means a warrant of MMV issued to MPAC Warrant holders and the MMV Ordinary Shares underlying such warrants. |

| ● | “MPAC Class A ordinary shares” means the Class A ordinary shares, no par value per share, of Model Performance Acquisition Corp. |

| ● | “MPAC Class B ordinary shares” means the Class B ordinary shares, no par value per share, of Model Performance Acquisition Corp. |

| ● | “MPAC ordinary shares” means MPAC Class A ordinary shares and MPAC Class B ordinary shares, collectively. |

| ● | “MPAC preferred shares” means the preferred shares, with no par value per share, of Model Performance Acquisition Corp. |

| ● | “MPAC Private Placement Warrants” means MPAC Warrants issued to the Sponsor as part of the MPAC Private Placement Units in a private placement simultaneously with the closing of MPAC’s IPO. |

| ● | “MPAC Public Warrants” means the MPAC Warrants issued as part of the units in MPAC’s IPO. |

| ● | “MPAC preferred shares” means the preferred shares, with no par value per share, of Model Performance Acquisition Corp. |

| ● | “MPAC Warrant” means redeemable warrant of MPAC entitling the holder to purchase one MPAC Class A ordinary shares at a price of $11.50 per whole share. |

| ● | “ODI Filings” means the formalities and filings of overseas direct investment of Chinese enterprises, including but not limited to fulfilling the filing, approval or registration procedures in the development and reform authorities, the competent commercial authorities, and foreign exchange administration authorities and competent banks authorized by such authorities. |

| ● | “Original Animation Brand” means animations that were first published and solely owned by the animation production company, whereas other animation brands may be adapted from comic books, games and other forms of ACGN brands. |

| ● | “PIPE Investment” means the issuance of 450,000 MMV Ordinary Shares to a certain investor for an aggregate of $4,500,000 in a private placement subsequent to the closing of the Business Combination. |

| ● | “Plans of Merger” means (i) the Plan of Merger in connection with the Reincorporation Merger and (ii) the Plan of Merger in connection with the Acquisition Merger, collectively. |

| ● | “MPAC Private Placement Units” mean the units issued to the Sponsor in a private placement simultaneously with the closing of MPAC’s IPO. |

| ● | “MPAC public shareholders” means holders of public MPAC Class A ordinary shares. |

| ● | “public shares” means the MPAC Class A ordinary shares sold in the IPO, whether they were purchased in the IPO or thereafter in the open market. |

| ● | “SEC” means the U.S. Securities and Exchange Commission. |

| ● | “Securities Act” means the Securities Act of 1933, as amended. |

| ● | “Share Incentive Award” means the MMV’s Share Incentive Award scheme. |

| ● | “Sponsor” means First Euro Investments Limited, a British Virgin Islands business company. |

iii

FORWARD-LOOKING INFORMATION

This annual report contains forward-looking statements that involve risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward- looking. Forward-looking statements in this annual report may include, for example, statements about:

| ● | Our business strategies and outcomes; |

| ● | our financial performance following the Business Combination; |

| ● | government regulations governing business operations, and in particular those governing the gaming and entertainment industry; |

| ● | macro-economic conditions in China; |

| ● | the impact of the COVID-19 pandemic on our business and the actions we may take in response thereto; and |

| ● | the outcome of any known and unknown litigation and regulatory proceedings. |

These forward-looking statements are based on information available as of the date of this annual report, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

You should not place undue reliance on these forward-looking statements. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements.

This annual report also contains statistical data and estimates that we obtained from industry publications and reports generated by third-party providers of market intelligence. These industry publications and reports generally indicate that the information contained therein was obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information.

iv

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

A. [Reserved.]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

1

D. Risk Factors

Risks Related to MMV’s Business and Industry

MMV’s limited operating history makes it difficult to predict its future prospects, business and financial performance.

MMV, a BVI holding company, was established in 2021 for restructuring purposes in relation to the Business Combination, and Shanghai Jupiter controlled by MMV through contractual arrangements, which holds the proprietary brand Aotu World, was established in 2015. MMV’s short operating history may not serve as an adequate basis for evaluating its prospects and future operating results, including MMV’s key operating data, net revenue, cash flows and operating margins. In addition, the animation and gaming industry in China and in the global market is volatile and will continue to evolve. As a result, you may not be able to discern the market dynamics that MMV is subject to and assess MMV’s business prospects.

MMV has encountered, and may continue to encounter, risks, challenges and uncertainties frequently experienced by companies at an early stage, including those relating to MMV’s ability to adapt to the industry, to maintain and monetize MMV’s user base and to introduce new content including animation, games and other entertainment genres under various proprietary brands. If MMV is unable to successfully address these risks and uncertainties, its business, financial condition, and results of operations could be materially and adversely affected.

Furthermore, MMV’s primary business operation is limited to the PRC market. While expanding business operation into the global markets by way of product publication or M&A is a key part of its business development strategy, MMV has no actual business experience operating in the global markets. MMV’s limited operating experience in the PRC may not be compatible or translate well to the global markets, and it may encounter commercial, cultural and regulatory risks, uncertainties it had never encountered before. These risks and uncertainties due to MMV’s limited operation history may adversely affect its business operation and financial performance.

MMV operates in a highly competitive market, and may not be able to compete effectively which could have a material adverse effect on MMV’s business, financial condition and results of operations.

MMV faces significant competition from other animation and gaming companies and other players in the online entertainment market. Some of MMV’s competitors, including both global and PRC market participants, have a longer operating history, a large user base, or greater financial resources than MMV does. MMV’s competitors may compete with MMV in a variety of ways, including attracting the same target users and UGC creators, produce similar styled animations and games, conducting brand promotions and other marketing activities, and making investments in and acquisitions of MMV’s business partners. In addition, MMV faces competition for leisure time, attention and discretionary spending of its players. Other forms of entertainment, such as offline, traditional online, personal computer and console games, television, movies, sports and the internet, together represent much larger or more well-established markets and may be perceived by MMV’s players to offer greater variety, affordability, interactivity and enjoyment. Consumer tastes and preferences for leisure time activities are also subject to sudden or unpredictable change on account of new innovations, developments or product launches. If any of MMV’s competitors achieves greater market acceptance than MMV does or is able to offer more attractive content, or that MMV’s consumers do not find MMV’s games to be compelling or if other existing or new leisure time activities are perceived by MMV’s players to offer greater variety, affordability, interactivity and overall enjoyment, MMV’s user base and MMV’s market share may decrease, which may materially and adversely affect MMV’s business, financial condition, and results of operations.

2

MMV operates in a new and rapidly changing industry, which presents significant uncertainty and business risks and makes it difficult to evaluate MMV’s business and prospects. MMV’s ability to generate revenue could suffer if the PRC gaming market does not develop as anticipated.

The online gaming and interactive entertainment industries are relatively new and continue to evolve. Whether these industries grow and whether MMV’s online business will ultimately succeed, will be affected by, among other things, developments in social networks, mobile platforms, legal and regulatory developments (such as the passage of new laws or regulations or the extension of existing laws or regulations to online gaming and related activities), taxation of gaming activities, data and information privacy and payment processing laws and regulations, and other actors that MMV is unable to predict and which are beyond MMV’s control. Given the dynamic evolution of these industries, it can be difficult to plan strategically, including as it relates to product launches in new or existing jurisdictions that may be delayed or denied, and it is possible that competitors will be more successful than MMV is at adapting to change and pursuing business opportunities. Additionally, as the online gaming industry advances, including with respect to regulation in new and existing jurisdictions, MMV may become subject to additional compliance-related costs, including as it relates to licensing and taxes. Consequently, MMV cannot provide assurance that MMV’s online and interactive offerings will grow at the rates expected, or be successful in the long term. If MMV’s products do not obtain popularity or maintain popularity, or if they fail to grow in a manner that meets its expectations, or if MMV cannot offer MMV’s product offerings in particular jurisdictions that may be material to MMV’s business, results of operations and financial condition could be harmed.

In addition, the growth of the online gaming industry in China and the level of demand and market acceptance of MMV’s games are subject to a high degree of uncertainty. MMV’s ability to formulate and execute publishing, distribution and marketing strategies will be significantly affected by MMV’s ability to anticipate and adapt to relatively rapid changes in the tastes and preferences of MMV’s current and potential users. New and different types of entertainment may increase in popularity at the expense of online games.

As China’s market for online games has evolved rapidly in recent years, it is extremely difficult to accurately predict user acceptance and demand for MMV’s existing and potential new games, and the future size, composition and growth of this market. Given the limited history and rapidly evolving nature of the market for online games, MMV cannot predict how much its users will be willing to spend on in-game purchases or whether users will have concerns over security, reliability, cost and quality of service associated with online games. If acceptance of MMV’s games is different than anticipated, MMV’s ability to maintain or increase MMV’s revenues and profits could be materially and adversely affected.

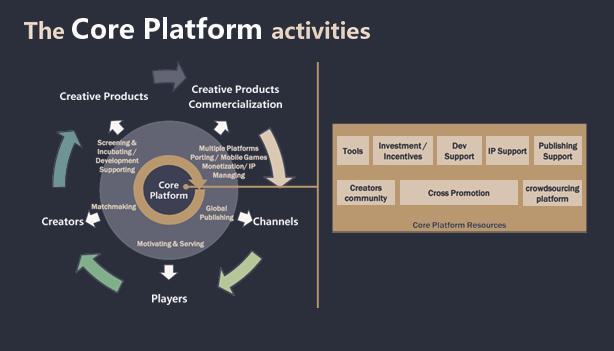

MMV’s business depends on its ability to offer high-quality content that meets user preferences and demands.

MMV’s success depends on its ability to offer high-quality content focused on animation and games. The breadth, depth, and quality of its content are fundamental in maintaining the attractiveness and value to its users. MMV relies on its experience from past and current operations to offer, manage, and refine its high-quality content, which may not be effective as user preferences and market trends change. If MMV is unable to expand into new high quality content by diversifying its products under its Aotu World brand as well as developing new proprietary brand to diversify its animation or gaming product pipeline, its ability to keep content offerings comprehensive and up-to-date may be adversely affected. The quality of its content may be compromised if MMV is not able to continue to maintain in-depth and meaningful engagement of its user group. If MMV is unable to keep up with evolving user preferences, it may experience a decline in the attractiveness of its products to its user base.

User generated content, or UGCs, and professional generated user content, or PUGCs, are critical to MMV’s content offering. MMV encourages and supports UGC and PUGC creators in providing content to sustain its popularity among users and as an effective for product development inspiration. MMV also provides continuous support to UGC creators to encourage ongoing and future creation. Any failure in encouraging, supporting, and incentivizing UGC creators may materially and adversely affect the breadth, depth, and quality of its content offerings.

MMV, in part, relies on the engagement of PUGC creators for brand and product development. If MMV determines that the PUGC creators and their concepts or developing products have commercial potential, MMV may formally engage these PUGC creators to establish the contractual basis for their commercial cooperation. However, MMV cannot assure you that it may reach an agreement with the PUGC creators to develop the product candidate. If MMV is unable to reach an agreement with the PUGC creators, its content offerings, product development and pipeline may be adversely affected. Furthermore, even if MMV is able to reach an agreement with the PUGC creators, MMV cannot assure you that the commercial terms of the agreement will be favorable to MMV or that the product under the cooperation agreement will ultimately be developed or achieve favorable financial results for MMV.

If MMV is unable to continue to offer high-quality content and enhance its content offerings, the reputation and attractiveness of its brand could be compromised, and it may experience a decline in its user base, which could materially and adversely affect its business and results of operations.

3

MMV may not be able to duplicate the success of Aotu World brand by successfully creating new original animations and proprietary brands.

MMV’s current pipeline of products, including animation series and mobile games, still mostly relies on the Aotu World brand. For a game to remain popular and to retain players, MMV must constantly enhance, expand and upgrade the game with new features, offers, and content that players find attractive. As a result, each of MMV’s games require significant product development, marketing and other resources to develop, launch and sustain popularity through regular upgrades, expansions and new content. While MMV strives to diversify its product portfolio by developing additional proprietary animation and gaming brands, it cannot assure you that it will be successful in developing such brands or that the new brands developed will be popular among the consumers and users or achieve commercial success. If MMV is unable to develop any additional brands or enjoy commercial success for the new brands, or if MMV is unable to develop commercially viable mobile games under these brands, which MMV consider as its primary method of revenue generation, its business, financial condition, and results of operations may be materially and adversely affected.

The success of MMV’s business depends on the quality of MMV’s strategy and MMV’s ability to execute on it.

MMV’s business strategy makes a number of assumptions about the current and future state of the industry that MMV operates in, including but not limited to environmental factors such as the current and future state of the markets and economies that MMV operates in, the current and expected future actions of governments in China and around the world, the current and future capacity and effectiveness of MMV’s competitors, and the current and future desires and wants and means of MMV’s users. MMV’s strategy also makes assumptions about the current and future state of MMV’s own business, including its capacity and effectiveness and its ability to respond to all of the aforementioned environmental factors, amongst others. All of these assumptions are informed by data and information that is publicly available and which MMV gathers for itself and by its ability to process and understand such data and information. Any or all of MMV’s assumptions may prove to be faulty and/or our data and/or information may be inaccurate or incomplete, in which case our strategy may prove to be incorrect or inadequate for the demands of our industry. Even if MMV’s strategy is a good one, MMV cannot be certain that its business is equipped to execute the plans and actions that might be necessary to achieve success. If any of MMV’s assumptions are incorrect and/or its strategy is ineffective and/or MMV is unable to execute on its strategy then its business, financial condition, results of operations, prospects and cash flows might be negatively impacted.

Damage to MMV’s brand and reputation could materially and adversely affect MMV’s business, financial condition and results of operations.

The growth of MMV’s business partially depends on the recognition of MMV’s brand and reputation.

MMV believes that the recognition and success of MMV’s brand rely on the devotion and sentiment of MMV’s followers, users and business partners, which has contributed to managing MMV’s user acquisition costs and contributed to the growth of MMV’s business.

Maintaining, protecting and enhancing MMV’s brand and reputation, in particular its proprietary Aotu World brand, depends largely on several factors including, but not limited to, MMV’s ability to:

| ● | strengthen its proprietary brand, Aotu World and develop new animation and games under the brand; |

| ● | develop additional attractive proprietary brands for animation and game development; |

| ● | maintain relationships with business partners; |

| ● | comply with relevant laws and regulations; |

| ● | compete effectively against existing and future competitors; |

| ● | preserve MMV’s reputation and goodwill generally; |

4

| ● | develop and maintain positive perception and brand recognition; |

| ● | provide high-quality and entertaining content; |

| ● | maintain brand recognition, provide satisfactory services; |

| ● | maintain trust and credibility that MMV has established; and |

| ● | attract users and UGC creators to maintain MMV’s UGC-enabled approach. |

It is possible also that MMV’s brand and reputation may also be adversely affected by the UGC created by its UGC creators which may be perceived as inappropriate, hostile, or illegal, or by information that is perceived as misleading. MMV may fail to identify and respond to such objectionable content or user activity, or otherwise address user concerns in a timely manner, which could erode the trust in MMV’s brand and damage its reputation. Any governmental or regulatory inquiry, investigation, or action based on the objectionable content or user activity in MMV’s user base, MMV’s business practices, or failure to comply with laws and regulations, could damage MMV’s brand and reputation, regardless of the outcome.

To maintain a balance between user experience and realizing the commercial potential of its operation is very important. Current users may find MMV’s commercial efforts counter-productive to their overall content experience. If MMV fails to balance user experience as MMV further enhances the monetization of its brand and products, MMV’s brand and reputation may be adversely affected.

MMV has experienced, and may continue to experience, governmental, regulatory, investor, media, and other third-party scrutiny of MMV’s community, content, copyright, data privacy, or other business practices. Actions of MMV’s employees, users, or business partners, or other issues, may also harm MMV’s brand and reputation.

There is no assurance that MMV can maintain its brand name, reputation, and ability to produce high-quality content. If MMV fails to promote and maintain its brand or preserve MMV’s reputation, or if MMV incurs excessive expenses in this effort, MMV’s business, financial condition, and results of operations could be materially and adversely affected.

Any failure by MMV to attract and sustain its target audience and maintain an engaged user base could materially and adversely affect MMV’s long term growth and future financial performance.

MMV’s success and continued growth is driven by its highly engaged user base. MMV, and in particular the products under its Aotu World brand, has experienced support from its users since its market introduction. MMV’s users and fans support and also participate and contribute to the development of the Aotu World brand by generating a large volume of UGC. MMV retains users and attracts new users with its high- quality and entertaining content, and any failure by MMV to attract, maintain and engage its user base may affect the quality and quantity of UGC. MMV cannot assure you that it will sustain or continue to attract users in this age group as this generation of users matures and the consumer demand preference changes over time.

MMV also deploys specific strategies to encourage and promote UGC in order to elevate user participation to strengthen the user base. If MMV experiences a decline in the depth, breadth, quantity or quality of MMV’s content, or MMV’s strategies and user growth efforts turn out to be ineffective, MMV may not be able to attract more users effectively or may experience a decline in MMV’s user base. Currently, MMV primarily relies on and benefits from the user base it has accumulated. If MMV fails to attract, sustain and engage its user base, it could result in a reduction of purchase of MMV’s merchandise and in-game items, result in high customer acquisition cost, and other results which could materially and adversely affect MMV’s business, financial condition and results of operations.

5

MMV utilizes a free-to-play business model, which depends on players making optional in-game purchases for virtual items, and failure to monetize effectively through such revenue model may adversely affect MMV’s business.

MMV’s games are available to players free of charge, and MMV generates almost all of its gaming related revenues from voluntary in-game purchases made by players. Free-to-play model helps to attract wider range of audience and increase the potential paying users by lowering the initial cost to zero. Paying users usually spend money in MMV’s games because of the perceived value of the virtual items that MMV offers for purchase. The perceived value of these virtual items can be impacted by various actions that MMV takes in the games, such as offering discounts, giving away virtual items in promotions or providing easier non-paid means to secure such virtual items.

Furthermore, MMV has established game policies against unauthorized and inappropriate user behavior. For example, MMV does not allow gamers to sell or transfer virtual items or to exchange virtual items for any real-world asset. Virtual items offered in MMV’s games have no monetary value outside of its games. Nonetheless, some of MMV’s users or third parties sell or purchase MMV’s virtual items through unauthorized third parties in exchange for real money or other real-world assets. MMV generates no revenue from these unauthorized transactions and does not permit, or facilitate, these unauthorized transactions. Notwithstanding MMV’s measures and efforts to deter such behavior, MMV does not have effective controls over these unauthorized transactions. Any such unauthorized purchase and sale could impede MMV’s revenue and profit growth by reducing revenue from authorized transactions, creating downward pressure on the prices MMV charges for its virtual items, and increasing MMV’s costs associated with developing technological measures to curtail unauthorized transactions and responding to dissatisfied gamers.

If MMV fails to manage its game economies properly, players may be less likely to spend money in the games, which could have a material adverse effect on MMV’s business, financial condition and results of operations.

MMV’s new games may attract players away from MMV’s existing games, which may have a material adverse effect on our business, financial conditions, results of operations and prospects.

MMV’s new games may attract players away from MMV’s existing games and shrink the player base of MMV’s existing games, which could in turn make those existing games less attractive to other players, resulting in decreased revenue from MMV’s existing games. Players of MMV’s existing games may also spend less money purchasing virtual items in MMV’s existing games than they would have spent if they had continued playing MMV’s existing games without the introduction of new games. The occurrence of any of the above may have a material adverse effect on MMV’s business, financial condition, results of operations and prospects.

MMV may not be successful in developing new games, and if we are unable to effectively control our research and development costs, our results of operations may be materially and adversely affected.

MMV is currently operating and updating a live mobile game named Aotu World the Game, which was originally developed by a related party, and also developing new pipeline games internally. MMV cannot assure you that the live game it operates and updates will maintain its commercial value, nor the new games it develops will be commercially successful. MMV operates in a market characterized by rapidly developing technologies, evolving industry standards, frequent new game launches and updates and changing player preferences and demands. MMV’s ability to effectively monetize primarily depends on its ability to provide its users with game products with the art style, genre and gameplay that they love. Any failure on MMV’s part to act effectively in any of these areas may materially and adversely affect our business, financial condition and results of operations.

The seasonality of MMV’s business could exacerbate negative impacts on MMV’s operations.

MMV’s business is normally subject to seasonal variations based on the timings of animated series and mobile games releases. Release dates can be determined by several factors, including timing of vacation and holiday periods and competition in the market. Due to the construct of the user group of MMV’s brands and products, the growth of active users for mobile games tends to occur during school holidays, especially during the extended summer school breaks and lunar New Year holiday period. Similarly, spending by MMV’s active users for mobile games tends to increase during the same periods due to users’ extended gameplay time. These seasonal fluctuations tend to be consistent from year to year, but it affects MMV’s quarterly performance.

Also, revenues in MMV’s merchandise products business are influenced by both seasonal consumers purchasing behavior and the timing of animated series releases. Accordingly, if a short-term negative impact on MMV’s business occurs during a time of high seasonal demand, the effect could have a disproportionate effect on MMV’s results for the year.

6

MMV’s monetization scheme and lack of product diversification may not be able to sustain its business operation, monetization plan and future growth.

MMV generates a substantial portion of its revenue from its mobile game and merchandise sales. In 2021 and 2022, revenue from online mobile game and merchandise sales in total accounted for 61.7% and 52.8% of MMV’s revenue, respectively. At the current time, the games and merchandises marketed by MMV as well as the animation series and UGC are under its proprietary Aotu World brand. The monetization of this proprietary brand through mobile games and merchandise sales is only at the early stages. While the Aotu World brand is popular among its target audience and user group, the brand users may not respond to MMV’s further monetization of the brand with the same level of support, and may not increase their spending for expenditures related to gameplay or purchase additional brand merchandises. Therefore, MMV cannot assure you that the revenue generated under this single brand is sufficient to sustain its business operation, monetization, and future growth.

MMV relies on certain third-party service providers to provide services that are critical to MMV’s business, which exposes MMV to various risks that may materially and adversely affect MMV’s reputation, business, financial condition and results of operations.

MMV currently uses numerous third-party suppliers and service providers to provide services that are critical to MMV’s businesses. MMV have engaged third-party or related service providers to provide online payment for gameplay and merchandise purchase, content distribution, data support, cybersecurity and maintenance services and other services. MMV has limited control over the operations of such third-parties and any significant interruption in their operations may have an adverse impact on MMV’s operations.

For example, MMV relies on certain third parties to broadcast its animation series and distribute its mobile games, any interruption or deterioration of business relationship with these distributors may materially affect MMV’s business operation and financial results. This is significant as MMV relies on its animation series to promote its brand. In addition to television broadcastings, MMV broadcasts its animation series on various video platforms, and MMV continues to rely on these video platforms to promote its brand. In January and November 2019, and January 2022, MMV signed online broadcasting agreements with an affiliate of Bilibili Inc. for Bilibili’s exclusive online broadcasting of MMV’s Aotu World the Animation in the PRC. While MMV believes this exclusive strategic cooperation with Bilibili Inc. will enhance its brand reputation, MMV cannot assure you that this exclusive right will benefit its brand and sufficient to promote its brand in the long term. If this arrangement with Bilibili Inc. is unable to maintain or achieve greater viewership results, MMV’s brand may be affected. In addition, the damages in reputation or otherwise of MMV’s animation series may also affect the commercial appeal and financial results for other entertainment genres, such as its mobile game, under the same brand.

Furthermore, MMV generates a substantial portion of its revenue from the operation of its mobile game, and relies on certain application stores and other gaming platforms to promote and market its mobile games to its users. If MMV’s relationship with these application stores or gaming platforms deteriorates or is interrupted for any reason, these platforms may suspend or terminate their services to MMV. If such event occurs, MMV’s users may not have access or find an alternative method to access MMV’s mobile games, which may adversely affect MMV’s operation and financial results. In addition to providing hosting service to MMV’s mobile games, some of these application stores and gaming platforms may collect payments from users for certain in-game purchases. These application stores and gaming platforms revert the scheduled payments to MMV periodically. However, these application stores and gaming platforms, for any reason, may fail to provide payment to MMV or fail to do so in a timely manner. If such event occurs, MMV’s business operation, financial results, and in particular, its cash flow may be adversely affected.

If any third-party service provider breaches its obligations under the contractual arrangements to provide relevant service to MMV, or revert payment to MMV for products provided and services rendered, or refuses to renew these service agreements on terms acceptable to MMV, MMV may not be able to find a suitable alternative service provider. Similarly, any failure of or significant quality deterioration in such service provider’s service platform or system could materially and adversely affect MMV’s reputation, business, financial condition and results of operations.

7

MMV relies on third-party platforms to distribute MMV’s games and collect revenues generated on such platforms, any interruption of these platforms may cause adverse effect on MMV’s business.

MMV distributes its mobile games through the Apple App Store and various channels, including Android-based app stores and platforms, and its gross revenue generated from players is subject to revenue sharing to distribution channels and service fees to payment providers. Consequently, MMV’s prospects and expansion depend on MMV’s continued relationships with these providers, and any other emerging platform providers that are widely adopted by our target players. MMV and MMV’s distributors are subject to the standard terms and conditions of these platform providers for application developers, which govern the content, promotion, distribution, operation of games and other applications on their platforms, as well as the terms of the payment processing services provided by the platforms, and which the platform providers can change unilaterally with little or no notice. MMV’s business would be harmed if:

| ● | the platform providers discontinue or limit MMV or MMV’s distributors’ access to their platforms; |

| ● | governments or private parties, such as internet providers, impose bandwidth restrictions or increase charges or restrict or prohibit access to those platforms; |

| ● | the platforms increase the fees they charge MMV or MMV’s distributors; |

| ● | the platforms modify their algorithms, communication channels available to developers, respective terms of service or other policies; |

| ● | the platforms decline in popularity; |

| ● | the platforms adopt changes or updates to their technology that impede integration with other software systems or otherwise require MMV to modify MMV’s technology or update MMV’s games in order to ensure players can continue to access MMV’s games and content with ease; |

| ● | the platforms elect or are required to change how they label free-to-play games or take payment for in- game purchases; |

| ● | the platforms block or limit access to the genres of games that MMV or MMV’s distributors provide in any jurisdiction; |

| ● | the platforms impose restrictions or spending caps or make it more difficult for players to make in- game purchases of virtual items; |

| ● | the platforms change how the personal information of players is made available to developers or develop or expand their own competitive offerings; or |

| ● | MMV or MMV’s distributors are unable to comply with the platform providers’ terms of service. |

If MMV’s platform providers do not perform their obligations in accordance with MMV platform agreements, MMV could be adversely impacted.

In addition, if MMV does not adhere to the terms and conditions of its platform providers, the platform providers may take actions to limit the operations of, suspend or remove MMV’s games from the platform, and/or MMV may be exposed to liability or litigation.

If any events described above or similar to those described above were to occur on short-term or long-term basis, or if these third-party platforms experience issues that impact the ability of players to download or access MMV’s games, access social features, or make in-game purchases, they could have a material adverse effect on MMV’s brands and reputation, as well as MMV’s business, financial condition and results of operations.

8

MMV relies on third-party manufacturers for the production of its Aotu World brand merchandises, any interruption of the manufacturing process or distribution channel may materially hinder MMV’s merchandise sales.

MMV generates a substantial portion of its revenue primarily through merchandise sales. However, MMV does not possess the capacity to manufacture its line of products and does not intend to expand its operation to include such capability. Therefore, MMV relies on business partners to manufacture its products. If MMV’s manufacturers are unable to manufacture the Aotu World brand products to meet the quality standard demanded by its consumers or mandated by law, MMV’s reputation and brand recognition may suffer as a result. In addition, if MMV’s manufacturers are unable to delivers the goods in a timely manner, MMV’s revenue for merchandise sales may be adversely affected.

Furthermore, MMV currently conducts its merchandise sales through online vendor platforms and offline distribution channels. MMV cannot assure you that any increase in distribution channels will ultimately increase the sales of its merchandise. Any interruption of MMV’s current distribution channel or the failure to expand its distribution capacity at a profitable level may have a material and adverse effect on MMV’s merchandise sales and revenue generation.

In addition, online vendors and offline distributors often collect and hold payments for merchandise sales on behalf of MMV. MMV cannot assure you that these vendors and distributors will perform its obligation under the commercial agreements or provide payment to MMV in a timely manner or at all. If the vendors or distributors breach their obligations to make payment, the financial shortfall may adversely affect MMV’s financial operation.

MMV may not be able to protect its proprietary brand and intellectual property, and as a result, its business, financial condition, and results of operations may be adversely impacted.

MMV relies on a combination of copyright, patent, trademark, technical knowhow, domain name, and trade secret protection laws in China and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect MMV’s intellectual properties and brand. MMV also prides itself to be an open-source company that encourages UGC development and has made its proprietary brand, related supporting technical knowhow, and other IP supports available to its users for the creation of UGC content. However, the use of its proprietary brand by the UGC creators are limited to non-commercial use only, and any commercial development using MMV’s proprietary brand and IP requires further commercial negotiation with MMV in order to protect MMV’s commercial interests. While MMV actively monitors the UGC, it cannot assure you that MMV will sufficiently protect its proprietary brand due to the large volume of UGC created and the breadth of the internet and virtual world.

Furthermore, MMV has observed incidents of counterfeited Aotu World brand merchandises or the unauthorized manufacturing and online sales of Aotu World products. While MMV actively monitors the unauthorized sales of its merchandise online, it does not have the capacity to monitor unauthorized sales by offline merchants, and cannot assure you that its online monitoring will sufficiently protect its merchandise sales from infringement. If MMV is unable to protect its brand merchandise sales, its business, financial condition, and results of operations may be adversely impacted.

MMV also strives to broaden its content offering and growth through developing additional proprietary brands and investing in technology. However, there can be no assurance that (i) MMV’s pending applications for intellectual property rights will be approved, (ii) all of MMV’s intellectual property rights will be adequately protected, or (iii) MMV’s intellectual property rights will not be challenged by third-parties or found by a judicial authority to be invalid or unenforceable. Third-parties may also take the position that MMV is infringing their rights, and MMV may not be successful in defending these claims. Additionally, MMV may not be able to enforce and defend its proprietary rights or prevent infringement or misappropriation, without substantial expense to MMV and a significant diversion of management time and attention from business strategy.

Protection of intellectual property rights in China may not be as effective as in other jurisdictions, and, as a result, MMV may not be able to adequately protect its intellectual property rights, which could adversely affect its business and competitive position. These violations of intellectual property rights, whether or not successfully defended, may also discourage content creation. In addition, any unauthorized use of MMV’s intellectual properties by third-parties may adversely affect MMV’s business and reputation. MMV’s content, in particular its animation series, may be potentially subject to unauthorized copying and illegal digital dissemination without an economic return. MMV adopts a variety of measures to mitigate such risks, including by litigation and through technology measures. However, MMV cannot assure you that such measures will be effective in protecting its right against unfair competition, defamation or other rights associated with the use of MMV’s intellectual property.

9

In addition, while MMV typically requires its employees, consultants, contractors and UGC creators who may be involved in the development of intellectual properties to execute agreements assigning such intellectual properties, MMV may be unsuccessful in executing such an agreement with each party who in fact develops intellectual properties that MMV views as its own. In addition, such agreements may not be self- executing such that the intellectual properties subject to such agreements may not be assigned to MMV without additional assignments being executed, and MMV may fail to obtain such assignments. In addition, such agreements may be breached. Accordingly, MMV may be forced to bring claims against third-parties, or defend claims that they may bring against MMV related to the ownership of such intellectual properties.

Furthermore, managing or preventing unauthorized use of intellectual properties is difficult and expensive, and MMV may need to resort to legal proceedings to enforce or defend intellectual properties or to determine the enforceability, scope and validity of MMV’s proprietary rights or those of others. Such litigation or proceedings and an adverse determination in any such litigation could result in substantial costs and diversion of resources and management attention.

Shanghai

Jupiter and Gaea Mobile Limited (“Gaea Mobile”), a related party of MMV in Hong Kong, signed an “Aotu World License

Agreement” ( )

on 1 January 2020 and a supplementary agreement on 1 July 2021 to grant Gaea Mobile exclusive rights to publish and operate Aotu World

the Game in regions outside of Mainland China (excluding Hong Kong, Macau and Taiwan) which may involve possible intellectual property

risks from Gaea Mobile’s commercialization rights, potential disputes arising from Gaea Mobile’s free use of trademark in

relation to mobile game LOGO and ICON, and other unpredictable effects due to uncertainties arising from long time authorization of the

Aotu World License Agreement.

)

on 1 January 2020 and a supplementary agreement on 1 July 2021 to grant Gaea Mobile exclusive rights to publish and operate Aotu World

the Game in regions outside of Mainland China (excluding Hong Kong, Macau and Taiwan) which may involve possible intellectual property

risks from Gaea Mobile’s commercialization rights, potential disputes arising from Gaea Mobile’s free use of trademark in

relation to mobile game LOGO and ICON, and other unpredictable effects due to uncertainties arising from long time authorization of the

Aotu World License Agreement.

MMV has been, and may continue to be, subject to claims and allegations relating to intellectual property and other causes.

MMV’s success depends largely on MMV’s ability to utilize its technology to create and develop proprietary brands as the source for animation and gaming entertainment. Companies in the internet, technology, and media industries own, and are seeking to obtain, a large number of patents, copyrights, trademarks, know-how, and trade secrets, and they are frequently involved in litigation based on allegations of infringement, misappropriation or other violations of intellectual property rights, such as trademark and copyrights. There may be patents issued or pending that are held by others that cover significant aspects of MMV’s technologies, products, or services, and such third-parties may attempt to enforce such rights against MMV. Although MMV has set up screening processes to try to filter out content that is subject to claims of copyright or other intellectual property protection, MMV may not be able to identify, remove, or disable all potentially infringing content that may exist. As a result, third-parties may take action and file claims against MMV if they believe that certain content available in MMV’s community violates their copyrights or other intellectual property rights.

MMV may from time to time receive claims that MMV infringes the intellectual property rights of others. Moreover, MMV may be subject to claims by third-parties who maintain that MMV’s service providers’ technology infringes third-party’s intellectual property rights. If MMV fails to successfully defend against such claim or does not prevail in such litigation, it could be required to modify, redesign or cease operating the games, pay monetary amounts as damages or enter into royalty or licensing arrangements with the valid intellectual property holders. Any royalty or licensing arrangements that MMV may seek in such circumstances may not be available to it on commercially reasonable terms or at all. Also, if MMV acquires technology licenses from third parties, MMV’s exposure to infringement actions may increase because MMV must rely upon these third parties to verify the origin and ownership of such technology. This exposure to liability could result in disruptions in MMV’s business that could materially and adversely affect MMV’s results of operations.

Some of MMV’s employees were previously employed at other companies, including MMV’s competitors. MMV may hire additional personnel to expand its development team and technical support team as its business grows. To the extent these employees were involved in the development of content or technology similar to MMV’s at their former employers, MMV may become subject to claims that these employees or MMV has appropriated these employees’ former employers’ proprietary information or intellectual properties. If MMV fails to successfully defend such claims against itself, MMV may be exposed to liabilities which could have a material adverse effect on the Group’s business.

10

MMV is currently not a party to any material legal or administrative proceedings but is subject to legal or administrative actions for defamation, negligence, copyright and trademark infringement, unfair competition, breach of service terms, or other purported injuries resulting from the content MMV provides or the nature of MMV’s services. Such legal and administrative actions, with or without merits, may be expensive and time-consuming and may result in significant diversion of resources and management attention from MMV’s business operations. Furthermore, such legal or administrative actions may adversely affect MMV’s brand image and reputation.

MMV’s business generates and processes a large amount of data, and the improper use or disclosure of such data may harm MMV’s reputation and business.

MMV’s business generates and processes a large quantity of personal, transaction, demographic and behavioral data. MMV faces risks inherent in handling large volumes of data and in protecting the security of such data, including those relating to:

| ● | protecting the data in and hosted on MMV’s system, including against attacks on MMV’s system by outside parties or fraudulent behavior by MMV’s employees; |

| ● | addressing concerns related to privacy and sharing, safety, security and other factors; and |

| ● | complying with applicable laws, rules and regulations relating to the collection, use, disclosure or security of personal information, including any requests from regulatory and government authorities relating to such data. |

MMV is subject to the laws and regulations of the PRC and other countries and regions relating to the collection, use, retention, security and transfer of personally identifiable information with respect to MMV’s customers and employees. These laws continue to develop and may vary from jurisdiction to jurisdiction. Complying with emerging and changing international requirements may cause MMV to incur substantial costs or require MMV to change its business practices. Any failure, or perceived failure, by MMV to comply with any privacy policies or regulatory requirements or privacy-protection-related laws, rules and regulations could result in proceedings or actions against MMV by government authorities or others. These proceedings or actions may subject MMV to significant penalties and result in negative publicity, require MMV to change its business practices, increase its costs and severely disrupt its business.

In addition, the secure transmission of confidential information, such as users’ debit and credit card numbers and expiration dates, billing addresses and other personal information, over public networks, including MMV’s websites and games, is essential for maintaining user confidence. MMV does not have control over the security measures of its third-party payment channel partners, and their security measures may not be adequate. MMV could be exposed to litigation and possible liability if MMV fails to safeguard confidential user information, which could harm MMV’s reputation and its ability to attract or retain users, and may materially and adversely affect MMV’s business.

If content in MMV’s online UGC community is found to be objectionable or in violation of any PRC laws or regulations, MMV may be subject to administrative actions or negative publicity.

Content in MMV’s UGC community may draw social attention, which may cause controversies. Moreover, the PRC government and regulatory authorities have adopted regulations governing content and information over the internet. Under these regulations, internet content providers are prohibited from posting, reproducing, transmitting, or displaying over the internet content that, among other things, violates PRC laws and regulations, impairs the national dignity of China or the public interest, or is obscene, superstitious, fraudulent, violent, or defamatory. Internet content providers are also prohibited from displaying content that may be deemed by relevant government authorities as “socially destabilizing” or leaking “state secrets” of China. The PRC government and regulatory authorities strengthen the regulation on internet content from time to time. For example, the PRC Cybersecurity Law, which took effect on June 1, 2017, provides that, among other things, a network operator must keep record of and report any instances of public dissemination of prohibited content and failure to do so may result in revocation of its Value-Added Telecommunications Business Operating License and termination of business. With respect to audio-visual and live streaming content, the Circular on Issues Concerning Strengthening the Administration of Online Live Streaming of Audio-Visual Programs requires online audio-visual live streaming service providers to monitor the living streaming content, and to have an established emergency reaction plan to replace content that violates PRC laws and regulations. The Administrative Regulations on Online Live Streaming Services requires online live streaming service providers to establish review platforms for live streaming content. In addition, the Administrative Provisions on Online Audio-Visual Information Services provides that online audio-visual information service providers are the principals responsible for managing the security of information content, and should establish and improve their internal policies on user registration, scrutiny of information publication, and information security management, and that they must report users’ production, publication, and dissemination of prohibited content. Moreover, the Regulations on Administration of Network Short Video Platforms requires that all short videos to be reviewed before being broadcasted. Any failure to comply with the aforementioned regulations may cause negative publicity and subject MMV to fines or other penalties, which could materially and adversely affect MMV’s business, reputation, and results of operations.

11

MMV cannot assure you that MMV can identify all objectionable or illicit content due to the large amount of content uploaded by MMV’s users every day. Failure to identify and prevent illegal or inappropriate content from being uploaded to MMV’s community may subject MMV to negative publicity or liability, such as limiting the dissemination of content, and suspension or removal of its contents from various distribution channels.

Laws and rules, governmental or judicial interpretations, and implementations may change in a manner that could render MMV’s current efforts insufficient. If government actions or sanctions are brought or pending against MMV, or if there is publicity that government actions or sanctions have been brought or otherwise are pending against MMV, its reputation and brand image could be harmed, MMV may lose users and business partners, and MMV’s revenue and results of operation may be materially and adversely affected.

Many of MMV’s products and services utilize open source software, which may pose particular risks to MMV’s proprietary software, products, and services in a manner that negatively affects MMV’s business.

MMV uses open source software in its products and services and will continue to use open source software in the future. There is a risk that open source software licenses could be construed in a manner that imposes unanticipated conditions or restrictions on MMV’s ability to provide or distribute MMV’s products or services. Additionally, MMV may face claims from third-parties claiming ownership of, or demanding release of, the open source software or derivative works that MMV developed using such software.

These claims could result in litigation and could require MMV to make MMV’s software source code freely available, purchase a costly license or cease offering the implicated products or services unless and until MMV can re-engineer them to avoid infringement. This re-engineering process could require significant additional research and development resources, and MMV may not be able to complete it successfully.

Certain data and information in this annual report relied on MMV were obtained from third- party data and polls. These metrics were not independently verified by MMV and may not be accurate.

Certain numbers and information in this annual report were obtained and provided from numerous sources including management data, third-party data or numbers generally estimated by calculating the number of followers, times viewed, and search results hits for Aotu World to generally assess its popularity and user base support. These metrics were not independently verified. Such databases, third party information, and calculations may not accurately reflect actual statistics or numbers and MMV does not have access to specific rating numbers and has not been afforded the ability to systematically monitor viewership numbers on online platforms. Similarly, any statistical data in any third-party publications also include projections based on a number of assumptions. If any one or more of the assumptions underlying the market data is later found to be incorrect, actual results may differ from the projections based on these assumptions.

Furthermore, MMV monitors the number of registered users of Aotu World the Game, it has not implemented any criteria to measure and distinguish active users among the aggregate registered players. MMV has not independently verified the databases and information contained in such third-party publications and reports which may not accurately reflect actual statistics or numbers. Such data may differ from estimates or similarly titled metrics published by other third parties due to differences in methodology and assumptions, technical errors and other inherent challenges in measuring such data and information. For example, certain users may register multiple user accounts, or there could be dummy device accounts or simulator accounts, which may skew the accuracy of the number of users on MMV’s platform. Furthermore, the top-up amounts recorded by MMV may not accurately reflect the actual top-up statistics due to the use of coupons, refunds, bad debts and different statistical periods. Therefore, MMV cannot guarantee that the user base or top-up amounts related statistics reported in this annual report fully and accurately present MMV’s actual user base or top-up amounts statistics.

MMV believes that the data and information, and reports contained therein is generally believed to be reliable, but MMV does not guarantee the accuracy and completeness of such information.

12

MMV relies on third-party online payment channels for payment collection. Any interruption of their services or unintended leakage of confidential information may materially and adversely affect our reputation and business.

MMV relies on major third-party payment channels, such as Alipay and WeChat Pay, to facilitate and collect game players’ payment for in-game virtual items and end customers’ payment for merchandise. MMV is subject to various risks and uncertainties associated with these third-party online payment channels. Any interruption in their payment services could adversely affect MMV’s payment collection, and in turn, its revenue.

In all online payment transactions through third-party payment channels, secured transmission of consumers’ confidential information, including credit card and bank account numbers, personal information and billing addresses, over public networks, is essential for maintaining consumer confidence. MMV does not have control over the security measures of the third-party payment channels, and their security measures may not be adequate at present or may not be adequate with the expected increased usage of online payment systems. MMV could be exposed to litigation and potential liabilities if MMV fails to safeguard consumers’ confidential information, which could harm MMV’s reputation and its ability to attract or retain consumers and may have a material adverse effect on its business.

Furthermore, MMV’s payment channels are subject to various laws and regulations regulating electronic funds transfers and virtual currencies, which could change or be reinterpreted in a way that will adversely affect their compliance. If MMV’s payment channels experience any non-compliance incidents, they may be subject to fines and higher transaction fees and even lose their ability to accept online payments from MMV’s consumers, which in turn would materially and adversely affect MMV’s ability to monetize our game player base.

MMV has incurred significant losses historically and may continue to experience significant losses in the future.

For the years ended December 31, 2021 and 2022, Legacy MMV incurred net loss of US$32.7 million and US$12.8 million, respectively. MMV cannot assure you that MMV will be able to generate profits or positive operating cash flow in the future. MMV’s ability to achieve profitability and positive operating cash flow principally depends on its ability to further expand MMV’s user base and increase its revenue, but MMV cannot assure you that MMV’s user base will continue to maintain the growth momentum. MMV also needs to continue enhancing its monetization to increase MMV’s revenue. MMV may experience losses and negative operating cash flow in the future due to its continued spending in product development, M&A and investments in technology. In addition, MMV’s ability to achieve and sustain profitability is affected by various factors, some of which are beyond MMV’s control, such as changes in macroeconomic conditions or competitive dynamics in the industry. If MMV cannot effectively maintain or achieve revenue growth at scale, or is unable to maintain and enhance MMV’s profitability and liquidity, MMV’s business, financial condition, and results of operations may be materially and adversely affected.

MMV has a substantial amount of indebtedness and other liabilities and is exposed to liquidity constraints, which could make it difficult to obtain additional financing on favorable terms or at all and could adversely affect its financial condition, results of operations, and ability to repay its debts.

MMV has incurred a substantial amount of debts to finance its brand and product development, infrastructure investment, and other operational expenses. Legacy MMV had working capital (defined as total current assets deducted by total current liabilities) deficits of US$1.3 million and surplus of US$1.1 million, as of December 31, 2021 and 2022, respectively. Legacy MMV had total shareholders’ deficit of US$10.0 million and US$17.4 million, as of December 31, 2021 and 2022, respectively. Historically, MMV has not been profitable nor generated positive net operating cash flows. As of December 31, 2022, Legacy MMV had US$13.6 million loans and accrued interests due to its major shareholders and other related parties, and US$5.8 million trading and other amounts due to its related parties affiliated to its major shareholders. MMV may resort to additional financing such as obtaining additional loans from financial institutions. If MMV is unable to obtain financing on favorable terms, it could hamper MMV’s ability to obtain financing and meets its principal and interest payment obligations to its creditors. As a result, MMV may be exposed to liquidity constraints. In order to provide additional liquidity to its operations, MMV could be forced to reduce its planned capital expenditures, implement austerity measures, and/or sell additional non- strategic assets in order to raise funds. A reduction in its capital expenditure program could adversely affect its financial condition and results of operations, in particular, MMV’s ability to achieve its anticipated growth or even maintain the operations of its current spaces.

13

In addition, as a holding company, MMV may rely on dividends and other distributions on equity paid by its subsidiaries, including WFOE and other subsidiaries based in the PRC for its cash and financing requirements. If WFOE or any other subsidiaries in PRC incurs debt on its own behalf in the future, the instruments governing such debt may restrict its ability to pay dividends to MMV. Current PRC regulations permit WFOE to pay dividends to MMV through the Hong Kong Subsidiary only out of its accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. MMV is permitted under the laws of British Virgin Islands to provide funding to its subsidiaries in Hong Kong and mainland China through loans or capital contributions without restrictions on the amount of the funds. Hong Kong Subsidiary is also permitted under the laws of Hong Kong SAR to provide funding to MMV through dividend distributions without restrictions on the amount of the funds. As of the date of this annual report, MMV has not transferred funds to the WFOE. In the future, however, cash proceeds raised from overseas financing activities, including the Business Combination, may be transferred by MMV to the WFOE via capital contribution or shareholder loans. As of the date of this annual report, there have not been any such dividends or other distributions from WFOE to the Hong Kong Subsidiary. In addition, none of MMV’s subsidiaries have ever issued any dividends or distributions to MMV or their respective shareholders outside of China. As of the date of this annual report, Shanghai Jupiter has not remitted any services fees to the WFOE.

Failure to comply with the terms of MMV’s indebtedness could result in default, which could have an adverse effect on MMV’s cash flow and liquidity.

MMV may from time to time enter into credit facilities and debt financing arrangements containing financial and other covenants that could, among other things, restrict MMV’s business and operations. If MMV breaches any of these covenants, including the failure to maintain certain financial ratios, MMV’s lenders may be entitled to accelerate MMV’s debt obligations. Any default under the credit facility could result in the repayment of these loans prior to maturity as well as the inability to obtain additional financing, which in turn may have a material adverse effect on MMV’s cash flow and liquidity.

MMV has recorded negative cash flows from operating activities historically and may experience significant cash outflows or has net current liabilities in the future.