As filed with the United States Securities and Exchange Commission on August 17, 2021.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

___________________

Incannex Healthcare Limited

(Exact name of registrant as specified in its charter)

___________________

|

Australia |

2834 |

Not Applicable |

||

|

(State or other jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

Incannex Healthcare Limited

Suite 15, Level 12, 401 Docklands Drive

Docklands 3008, Victoria

Australia

+ 61 409 840 786

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

___________________

Vcorp Services, LLC

25 Robert Pitt Drive, Suite 204

Monsey, New York 10952

Tel: +1 888 528 2677

(Name, address, including zip code, and telephone number, including area code, of agent for service)

___________________

Copies to:

|

Andrew Reilly |

Jonathan Zimmerman |

___________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Calculation of Registration Fee

|

Title of Each Class of Securities to be Registered |

Proposed |

Amount of |

||||

|

Ordinary shares, no par value(1)(3) |

$ |

25,000,000 |

$ |

2,730 |

||

|

Underwriter’s warrants(2) |

$ |

1,875,000 |

$ |

205 |

||

|

Ordinary shares issuable upon exercise of the Underwriter’s warrants(4) |

|

— |

|

— |

||

|

Total |

$ |

26,875,000 |

$ |

2,935 |

||

____________

(1) All ordinary shares in the offering will be in the form of American Depositary Shares, or ADSs, with each ADS representing 50 ordinary shares. ADSs issuable upon deposit of the ordinary shares registered hereby are being registered pursuant to a separate registration statement on Form F-6.

(2) We have calculated the proposed maximum aggregate offering price of the ordinary shares underlying the underwriter’s warrants to purchase up to 7.5% of the amount of securities sold in this offering by assuming that (i) 2.5% of such warrants are exercisable at a price per share equal to 120% of the public offering price of the ADSs sold in this offering, (ii) 2.5% of such warrants are exercisable at a price per share equal to 135% of the public offering price of the ADSs sold in this offering, (iii) 2.5% of such warrants are exercisable at a price per share equal to 150% of the public offering price of the ADSs sold in this offering. All ordinary shares will be in the form of ADSs, with each ADS representing 50 ordinary shares. ADSs issuable upon deposit of the ordinary shares registered hereby are being registered pursuant to a separate registration statement on Form F-6.

(3) Includes ordinary shares (which may be in the form of ADSs) that the underwriter has an option to purchase. See “Underwriting.”

(4) No additional registration fee is payable pursuant to Rule 457(i) under the Securities Act.

(5) Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended, based on an estimate of the proposed maximum offering price.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated August 17, 2021

PRELIMINARY PROSPECTUS

American Depositary Shares

representing Ordinary Shares

$ per American Depositary Share

___________________

We are offering American depositary shares, or ADSs, in the United States, representing ordinary shares of Incannex Healthcare Limited (“Incannex” or the “Company”). Each ADS represents 50 ordinary shares, no par value, deposited with Deutsche Bank Trust Company Americas, as depositary.

The offering is being underwritten on a firm commitment basis. We have granted the underwriter an option to buy up to an additional ADSs to cover over-allotments. The underwriter may exercise this option at any time and from time to time during the 30-day period from the date of this prospectus.

Prior to this offering, there has been no public market for the ADSs. We have applied to list the ADSs on the Nasdaq Capital Market under the symbol “IXHL”.

Our ordinary shares are listed on the Australian Securities Exchange under the symbol “IHL.” On , 2021, the last reported sale price of our ordinary shares on the Australian Securities Exchange was A$ per ordinary share, equivalent to a price of US$ per ADS, after giving effect to the Australian dollar/U.S. dollar exchange rate of as of , 2021, and an ADS-to-ordinary share ratio of 1 to 50.

The final offering price per ADS in U.S. dollars will be determined through negotiations between us and the representatives of the underwriter and will be based, in part, on prevailing market prices of our ordinary shares on the Australian Securities Exchange, after taking into account market conditions and other factors. For a discussion of the other factors considered in determining the final offering price per ADS, see “Underwriting.”

|

No Exercise of |

Full Exercise of |

|||||||||||

|

Per Share |

Total |

Per Share |

Total |

|||||||||

|

Public offering price |

$ |

$ |

$ |

$ |

||||||||

|

Underwriting discounts and commissions(1) |

$ |

$ |

$ |

$ |

||||||||

|

Proceeds to us, before expenses |

$ |

$ |

$ |

$ |

||||||||

____________

(1) In addition, we have agreed to reimburse the underwriter for certain expenses. See “Underwriting” on page 115 of this prospectus for additional information.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” appearing on pages 9 of this prospectus and elsewhere in this prospectus and the accompanying base prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the ADSs to purchasers on or about , 2021 through the book-entry facilities of The Depository Trust Company.

___________________

Roth Capital Partners

The date of this prospectus is , 2021

|

Page |

||

|

1 |

||

|

5 |

||

|

7 |

||

|

9 |

||

|

33 |

||

|

34 |

||

|

35 |

||

|

36 |

||

|

37 |

||

|

39 |

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

40 |

|

|

47 |

||

|

84 |

||

|

93 |

||

|

94 |

||

|

95 |

||

|

98 |

||

|

107 |

||

|

Material United States Federal Income and Australian Tax Considerations |

108 |

|

|

114 |

||

|

115 |

||

|

120 |

||

|

121 |

||

|

121 |

||

|

121 |

We are responsible for the information contained in this prospectus and any free writing prospectus we prepare or authorize. We and the underwriter have not authorized anyone to provide you with different information. We and the underwriter take no responsibility for, and can provide no assurance as to the reliability of, any other information others may give you. We are not, and the underwriter are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than its date.

For investors outside the United States: neither we nor any of the underwriter have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus or any free writing prospectus must inform themselves about, and observe any restrictions relating to, the offering of the ADSs and the distribution of this prospectus and any free writing prospectus outside the United States.

We are incorporated under the laws of Australia, and a majority of our outstanding ordinary shares are owned by non-U.S. residents. Under the rules of the U.S. Securities and Exchange Commission, or the SEC, we are eligible for treatment as a “foreign private issuer.” As a foreign private issuer, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Our reporting and functional currency is the Australian dollar, and our financial statements included elsewhere in this prospectus are presented in Australian dollars. The consolidated financial statements and related notes included elsewhere in this prospectus have been prepared under the International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB, which differs in certain significant respects from U.S. Generally Accepted Accounting Principles, or GAAP.

i

All references in this prospectus to “US$” and “U.S. dollars” mean U.S. dollars and all references to “A$” or “$” mean Australian dollars, unless otherwise noted. Throughout this prospectus, all references to “ADSs” mean American depositary shares, each of which represents of our ordinary shares, no par value, and all references to “ADRs” mean the American depositary receipts that evidence the ADSs.

This prospectus contains translations of some Australian dollar amounts into U.S. dollars. Except as otherwise stated in this prospectus, all translations from Australian dollars to U.S. dollars are based on the exchange rate of US$0.7702 to A$1.00 published by the Reserve Bank of Australia as of December 31, 2020. No representation is made that the Australian dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars at such rate.

“Incannex”, the Incannex logo and other trademarks or service marks of Incannex appearing in this prospectus are the property of Incannex or its subsidiary. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their right thereto. All other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

ii

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in the ADSs. You should read this entire prospectus, and the registration statement of which this prospectus is a part, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision. Unless otherwise indicated or the context otherwise requires, “Incannex,” the “Company,” “our company,” “we,” “us” and “our” refer to Incannex Healthcare Limited and its consolidated subsidiary, taken as a whole.

Overview

Our legal name is Incannex Healthcare Limited (“Incannex”). We were incorporated in Australia in April 2001 under the name Mount Magnet South Limited. In November 2016, we changed name to Impression Healthcare Limited, and in June 2020, to Incannex Healthcare Limited. Incannex is listed on the ASX under the symbol “IHL”.

Since 2019, we have been conducting research and development for synthetic cannabidiol pharmaceutical products and psychedelic medicine therapies for treatment of a range of indications. Our mission is to create first-in-class pharmaceutical drugs and therapies for patients that we believe have unmet medical needs. We aim to be recognized as a leading specialty drug development company at the forefront of innovation, committed to restoring health and transforming the lives of patients through the development of novel pharmaceutical products and treatments.

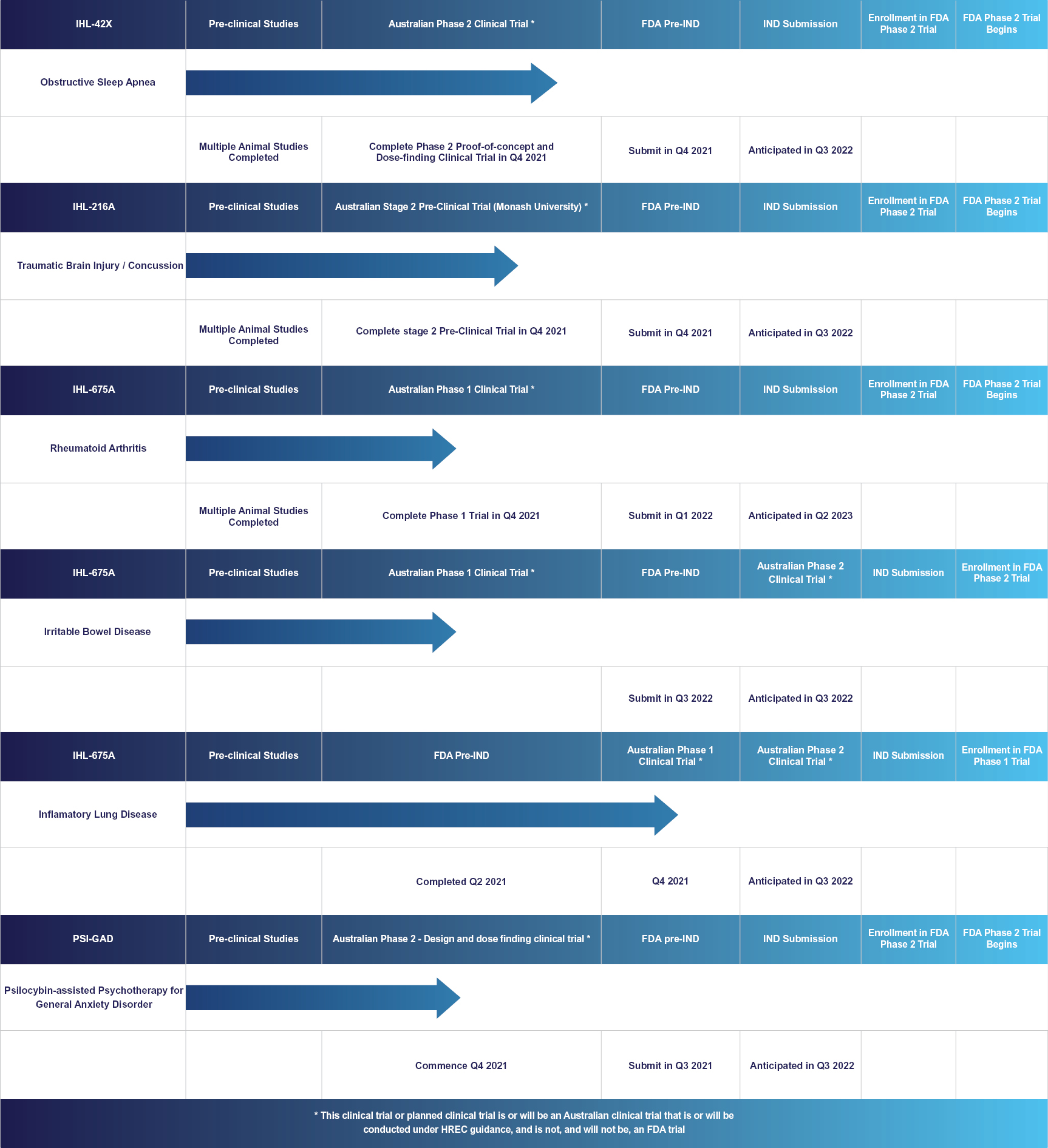

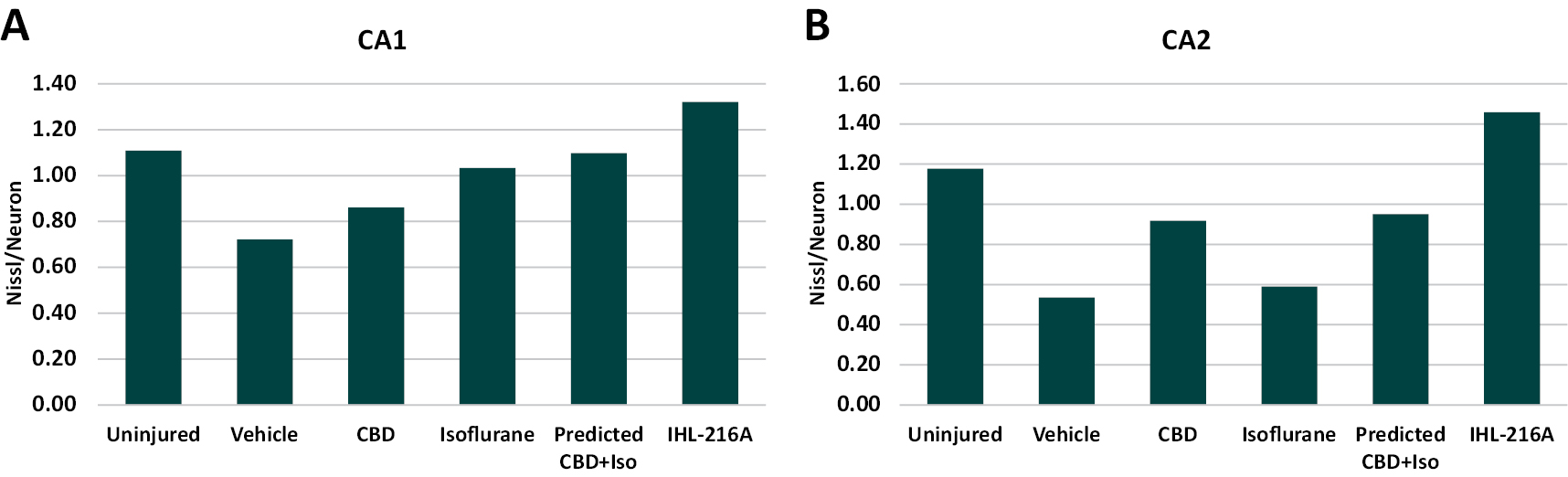

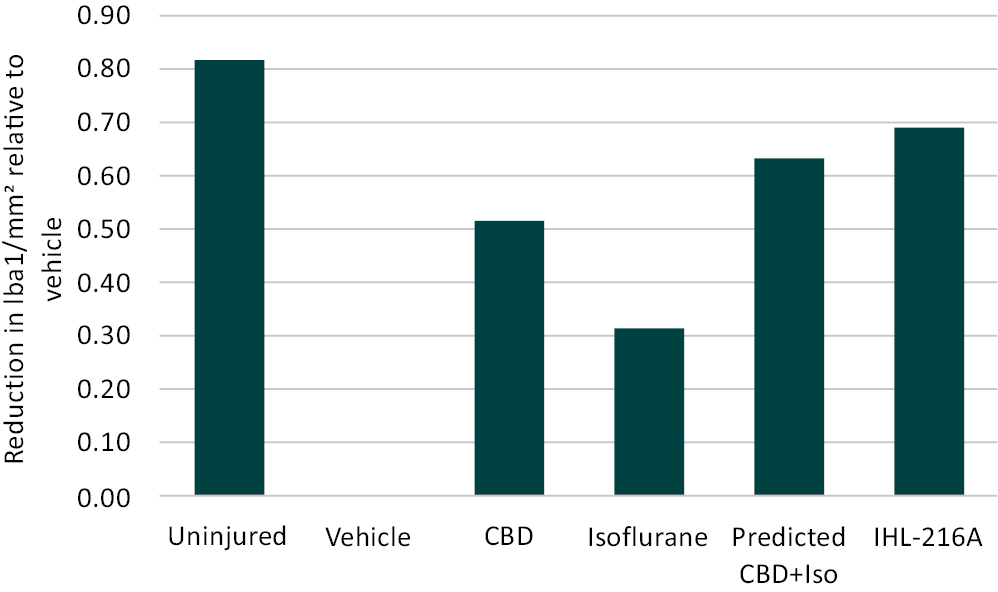

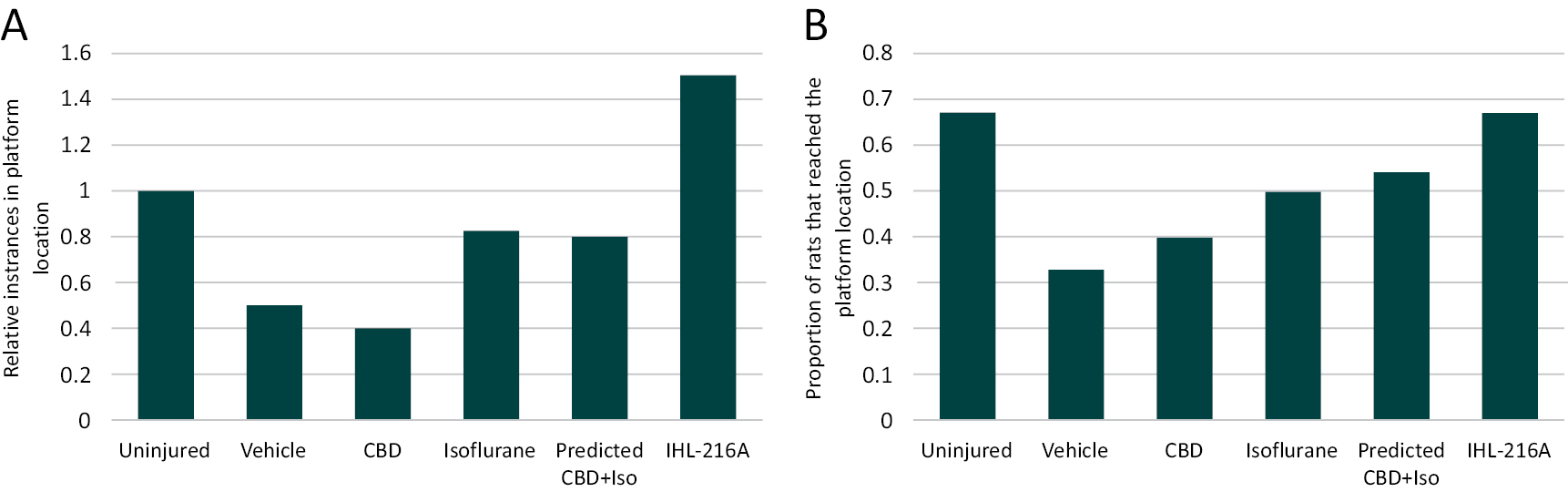

We are developing targeted and scientifically validated fixed-dose combinations of synthetic cannabidiol and psychedelic agents, applying proprietary insights in an effort to create long term value for our patients and shareholders. We focus on clinical indications that we believe represent unmet or inadequately addressed medical needs and also represent compelling commercial opportunities. In particular, we are developing three unique pharmaceutical compositions to target five indications: obstructive sleep apnea (“OSA”), traumatic brain injury (“TBI”)/concussion, rheumatoid arthritis, inflammatory bowel disease and inflammatory lung conditions (“ARDS”, “COPD”, Asthma, Bronchitis). We are also developing a treatment for generalized anxiety disorder (“GAD”) utilizing psilocybin combined with innovative psychotherapy methods. We are pursuing FDA registration and marketing approval for each product and therapy under development. Each indication represents major global markets and currently have either no, or limited, existing registered pharmacotherapy (drug) treatments available to the public. To support the development of such drug candidates, we have been implementing a strong patent filing strategy as we develop our drug candidates in conjunction with our medical and scientific advisory board and its collaborative partners, including Monash University, The Alfred Hospital and the University of Western Australia Centre for Sleep Science. See “Business” section for more information.

To achieve our commercial goals, we intend to advance our novel investigational drug candidates towards approval in the United States and elsewhere. We plan to take advantage of accelerated commercialization pathway options, such as breakthrough designation, accelerated approval, priority review, and/or fast track, to reduce the time and cost of development. We intend to develop future clinical candidates that target unmet medical needs. We also will continue to maintain a strong intellectual property portfolio to protect our assets in key global markets, including the United States, Europe, Japan, and Israel.

Corporate Information

Our registered office is located at Suite 15, Level 12, 401 Docklands Drive, Docklands 3008, Victoria, Australia and our telephone number is +61 409 840 786. Our website address is www.incannex.com.au. The information on, or accessible through, our website is not part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference. All information we file with the U.S. Securities and Exchange Commission (“SEC”) is available through the SEC’s Electronic Data Gathering, Analysis and Retrieval system, which may be accessed through the SEC’s website at www.sec.gov.

1

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

• exemption from the auditor attestation requirement of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, in the assessment of our internal controls over financial reporting; and

• to the extent that we no longer qualify as a foreign private issuer, (i) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (ii) exemptions from the requirements of holding a non-binding advisory vote on executive compensation, including golden parachute compensation.

We may take advantage of these exemptions until such time that we are no longer an emerging growth company. Accordingly, the information that we provide shareholders and holders of the ADSs may be different than you might obtain from other public companies. We will cease to be an emerging growth company upon the earliest to occur of (i) the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; (ii) the last day of the fiscal year in which we qualify as a “large accelerated filer”; (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; and (iv) the last day of the fiscal year in which the fifth anniversary of this offering occurs.

Implications of Being a Foreign Private Issuer

We are also considered a “foreign private issuer” under U.S. securities laws. In our capacity as a foreign private issuer, we are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our senior management, the members of our board of directors and our principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and sales of our securities. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. In addition, we are not required to comply with Regulation FD, which restricts the selective disclosure of material information.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We will remain a foreign private issuer until such time that 50% or more of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of the members of board of directors or our senior management are U.S. citizens or residents; (ii) more than 50% of our assets are located in the United States; or (iii) our business is administered principally in the United States.

Risk Factors Summary

Our business is subject to a number of risks of which you should be aware prior to making a decision to invest in our ADSs. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth in the section titled “Risk Factors” before deciding whether to invest in our ADSs. Among these important risks are, but not limited to, the following:

• We have a history of operating losses and may not achieve or maintain profitability in the future.

• We currently have no source of product revenue and may never become profitable.

• We will require additional financing and may be unable to raise sufficient capital, which could have a material impact on our research and development programs or commercialization of our drug candidates.

• We may find it difficult to enroll patients in our current and any future clinical trials, and patients could discontinue their participation in our current and any future clinical trials, which could delay or prevent our current and any future clinical trials of our drug candidates and make those trials more expensive to undertake.

2

• Positive results from preclinical studies of our drug candidates are not necessarily predictive of the results of our planned clinical trials of our drug candidates.

• Ongoing and future clinical trials of drug candidates may not show sufficient safety and efficacy to obtain requisite regulatory approvals for commercial sale.

Even if our drug candidates receive regulatory approval, they may still face development and regulatory difficulties that may delay or impair future sales of drug candidates.

• Because we rely on third party manufacturing and supply partners, our supply of research and development, preclinical and clinical development materials may become limited or interrupted or may not be of satisfactory quantity or quality.

• Future potential sales of our drug candidates may suffer if they are not accepted in the marketplace by physicians, patients and the medical community.

• Our drug candidates will be subject to controlled substance laws and regulations. Failure to receive necessary approvals may delay the launch of our drug candidates and failure to comply with these laws and regulations may adversely affect the results of our business operations.

• Intellectual property rights of third parties could adversely affect our ability to commercialize our drug candidates, such that we could be required to litigate with or obtain licenses from third parties in order to develop or market our drug candidates. Such litigation or licenses could be costly or not available on commercially reasonable terms.

• Our reliance on third parties requires us to share our trade secrets, which increases the possibility that a competitor will discover them or that our trade secrets will be misappropriated or disclosed.

• The trading price of the ADSs may be volatile, and purchasers of the ADSs could incur substantial losses.

• There has been no prior market for the ADSs and an active and liquid market for our securities may fail to develop, which could harm the market price of the ADSs.

• You will experience immediate and substantial dilution in the net tangible book value of the ADSs you purchase in this offering.

• As long as we remain subject to the rules of the ASX and Nasdaq, we will be unable to access equity capital without shareholder approval if such equity capital sales would result in an equity issuance above regulatory thresholds and, consequently, we may be unable to obtain financing sufficient to sustain our business if we are unsuccessful in soliciting requisite shareholder approvals.

• Our ADS holders are not shareholders and do not have shareholder rights.

• Australian takeovers laws may discourage takeover offers being made for us or may discourage the acquisition of large numbers of our shares.

• U.S. investors may have difficulty enforcing civil liabilities against our company, our directors or member of senior management and the experts named in this prospectus.

Special Note Regarding Forward-Looking Statements

This prospectus contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this prospectus, including statements regarding our future results of operations, financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would,” or the negative of these words or other similar terms or expressions.

3

We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of known and unknown risks, uncertainties, other factors and assumptions, including the risks described in “Risk Factors” and elsewhere in this prospectus, regarding, among other things:

• our product development and business strategy, including the potential size of the markets for our drug candidates and future development and/or expansion of our drug candidates in our markets;

• our current and future research and development activities, including clinical testing and manufacturing and the costs and timing thereof;

• the impact that the COVID-19 pandemic could have on business operations;

• sufficiency of our cash resources;

• our ability to commercialize drug candidates and generate product revenues;

• our ability to raise additional funding when needed;

• any statements concerning anticipated regulatory activities or licensing or collaborative arrangements, including our ability to obtain regulatory clearances;

• our research and development and other expenses;

• our operations and intellectual property risks;

• our ability to remain compliant with the Australian Securities Exchange (“ASX”) and Nasdaq’s continuing listing standards;

• any statement of assumptions underlying any of the foregoing; and

• other risks and uncertainties, including those listed under “Risk Factors.”

These risks are not exhaustive. Other sections of this prospectus may include additional factors that could harm our business and financial performance. New risk factors may emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in, or implied by, any forward-looking statements.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this prospectus primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. We undertake no obligation to update any forward-looking statements made in this prospectus to reflect events or circumstances after the date of this prospectus or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this prospectus. While we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and achievements may be different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

4

|

AADSs offered by us |

ADSs. |

|

|

Option to purchase additional ADSs |

The underwriter has an option for a period of 30 days from the date of this prospectus to purchase up to additional ADSs. |

|

|

Ordinary shares to be outstanding after this offering, including shares underlying ADSs |

shares (or shares if the underwriter exercises its option to purchase additional ADSs in full). |

|

|

American depositary shares |

Each ADS represents 50 ordinary shares. The ADSs are issued by the depositary. You will have the rights of an ADS holder as provided in the deposit agreement among us, the depositary and all owners and holders of ADSs issued thereunder. The depositary, through its custodian, will be the holder of the ordinary shares underlying the ADSs. |

|

|

You may surrender your ADSs to the depositary for cancellation to receive the ordinary shares underlying your ADSs. The depositary will charge you a fee for such a cancellation. |

||

|

We may amend or terminate the deposit agreement for any reason without your consent. Any amendment that imposes or increases fees or charges or that materially prejudices any substantial existing right you have as an ADS holder will not become effective as to outstanding ADSs until 30 days after notice of the amendment is given to ADS holders. If an amendment becomes effective, you will be bound by the deposit agreement as amended if you continue to hold your ADSs. |

||

|

To better understand the terms of the ADSs, you should carefully read the section titled “Description of American Depositary Shares.” We also encourage you to read the deposit agreement, which is filed as an exhibit to the registration statement of which this prospectus forms a part. |

||

|

Depositary |

Deutsche Bank Trust Company Americas. |

|

|

Use of proceeds |

We estimate that the net proceeds from the sale of the ADSs that we are selling in this offering will be approximately US$ million (or approximately US$ million if the underwriter’s option to purchase additional ADSs is exercised in full), based upon an assumed initial public offering price of $ per ADS, after giving effect to the Australian dollar/U.S. dollar exchange rate of as of , 2021, and an ADS-to-ordinary share ratio of 1-to-50, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

|

|

We intend to use the net proceeds from this offering, together with our existing cash, to further our clinical trials, for working capital and other general corporate purposes. See “Use of Proceeds” for additional information. |

5

|

Underwriter Warrants |

Upon the closing of this offering, we will issue warrants to the underwriter (the “Underwriter Warrants”) entitling it to purchase a number of ordinary shares, represented by ADSs, equal to 7.5% of the ADSs sold in this offering by us, in three tranches of 2.5% each: (i) the first tranche representing 2.5% of the ADSs sold in this offering having an exercise price equal to 120% of the public offering price of the ADSs in this offering, (ii) the second tranche representing 2.5% of the ADSs sold in this offering having an exercise price equal to 135% of the public offering price of the ADSs in this offering and (iii) the third tranche representing 2.5% of the ADSs sold in this offering having an exercise price equal to 150% of the public offering price of the ADSs in this offering. All ordinary shares will be in the form of ADSs, with each ADS representing 50 ordinary shares. The Underwriter Warrants will expire three (3) years after the effective date of the registration statement of which this prospectus forms a part. See “Underwriting.” |

|

|

Risk factors |

See “Risk Factors” and the other information included in this prospectus for a discussion of the risks you should carefully consider before investing in the ADSs. |

|

|

Proposed Nasdaq Capital Market symbol for the ADSs |

“IXHL” |

|

|

Australian Stock Exchange symbol for our ordinary shares |

“IHL” |

The number of ordinary shares (including ordinary shares underlying ADSs) that will be outstanding after this offering is based on 1,065,859,479 ordinary shares outstanding as of June 30, 2021 and excludes 337,184,818 ordinary shares issuable upon the exercise of outstanding options as of June 30, 2021, with a weighted-average exercise price of A$0.1655 per ordinary share.

In addition, unless we specifically state otherwise, the information in this prospectus assumes (i) no exercise by the underwriter of (a) its option to purchase up to additional ADSs or (b) their warrants to purchase (x) ADSs at an exercise price equal to 120% of the initial public offering price per ADS, (y) ADSs at an exercise price equal to 135% of the initial public offering price per ADS and (z) ADSs at an exercise price equal to 150% of the initial public offering price per ADS and (ii) no exercise of outstanding options to purchase ordinary shares.

6

Summary Consolidated Financial Data

The following tables summarize our consolidated financial and other data. The summary consolidated statement of profit or loss and other comprehensive income data for the six months ended December 31, 2020 and 2019 and the consolidated statement of financial position data as of December 31, 2020 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statement of profit or loss and other comprehensive income data for the years ended June 30, 2020 and 2019 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. Our audited consolidated financial statements have been prepared in accordance with IFRS, as issued by the IASB, as of and for the years ended June 30, 2020 and 2019.

You should read the consolidated financial and other data set forth below in conjunction with our consolidated financial statements and the accompanying notes, the information in “Selected Consolidated Financial and Other Data” and the information in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained elsewhere in this prospectus.

Consolidated Statement of Profit or Loss and Other Comprehensive Income Data

|

Six months ended December 31, |

Year ended June 30, |

|||||||||||

|

2020 |

2019 |

2020 |

2019 |

|||||||||

|

(in A$, except share amounts) |

(in A$, except share amounts) |

|||||||||||

|

Revenue |

1,177,163 |

|

7,350 |

|

604,884 |

|

— |

|

||||

|

Product costs |

(537,939 |

) |

(8,450 |

) |

(450,345 |

) |

— |

|

||||

|

Research and development costs |

(2,039,147 |

) |

(313,426 |

) |

(2,110,639 |

) |

(736,140 |

) |

||||

|

Loss after income tax expense from continuing operations |

(2,889,389 |

) |

(1,925,473 |

) |

(3,929,284 |

) |

(1,426,198 |

) |

||||

|

Net loss |

(2,889,389 |

) |

(2,212,004 |

) |

(4,697,636 |

) |

(2,718,399 |

) |

||||

|

Loss per share from continuing operations – basic and diluted (in A$ cents) |

(0.32 |

) |

(0.30 |

) |

(0.57 |

) |

(0.32 |

) |

||||

|

Loss per share from continuing operations and discontinued operations – basic and diluted (in A$ cents) |

(0.32 |

) |

(0.34 |

) |

(0.69 |

) |

(0.61 |

) |

||||

|

Weighted average number of ordinary shares outstanding – basic and diluted |

902,054,732 |

|

649,048,889 |

|

684,035,399 |

|

447,439,263 |

|

||||

|

Dividends per share |

— |

|

— |

|

— |

|

— |

|

||||

Consolidated Statement of Financial Position Data(1)(2)

|

As of December 31, 2020 |

||||||||||

|

Actual |

As Adjusted(1)(2) |

|||||||||

|

(in A$) |

(in US$) |

(in A$) |

in US$) |

|||||||

|

Cash |

11,840,308 |

|

9,119,405 |

|

||||||

|

Net assets |

11,802,503 |

|

9,090,287 |

|

||||||

|

Total assets |

12,180,952 |

|

9,381,769 |

|

||||||

|

Total liabilities |

378,449 |

|

291,481 |

|

||||||

|

Accumulated losses |

(35,407,592 |

) |

(27,270,927 |

) |

||||||

|

Issued capital |

45,076,484 |

|

34,717,907 |

|

||||||

7

____________

(1) The as adjusted statement of financial position data give effect to our receipt of net proceeds from the issuance and sale of ADSs at the assumed initial offering price of US$ per ADS, after giving effect to the ADS-to-ordinary share ratio of 1-to-50, after deducting underwriting commissions and estimated offering expenses payable by us.

(2) Each $1.00 increase or decrease in the assumed initial public offering price of US$ per ADS, after giving effect to the ADS-to-ordinary share ratio of 1-to-50, would increase or decrease, respectively, the amount of cash, working capital, total assets and total equity by A$ million (or US$ million), assuming the number of ADSs offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of ADSs we are offering. An increase or decrease of 1,000,000 in the number of ADSs we are offering would increase or decrease the amount of cash, working capital, total assets and total equity by A$ million (or US$ million), assuming the assumed initial public offering price per ADS remains the same and after deducting underwriting discounts and commissions. The as adjusted information is illustrative only and will be adjusted based on the actual initial public offering price and other terms of this offering determined at pricing.

8

Investing in the ADSs involves a high degree of risk. You should consider and read carefully all of the risks and uncertainties described below, as well as other information included in this prospectus, including our consolidated financial statements and related notes included elsewhere in this prospectus, before making an investment decision. If any of the following risks actually occur, it could harm our business, prospects, results of operations and financial condition. In such event, the trading price of the ADSs could decline and you might lose all or part of your investment.

Risks Related to Our Business

We have a history of operating losses and may not achieve or maintain profitability in the future.

We have experienced significant recurring operating losses and negative cash flows from operating activities since inception. For example, for the years ended June 30, 2020 and 2019, we had net losses of approximately A$4.7 million and approximately A$2.7 million, respectively, and approximately A$2.9 million and approximately A$2.2 million for the six months ended December 31, 2020 and 2019, respectively. As of December 31, 2020, we had accumulated losses of approximately A$35.4 million.

We are a clinical stage pharmaceutical development company and the success of our drug candidates is therefore uncertain. We focus on medicinal synthetic cannabinidiol pharmaceutical products and psychedelic medicine therapies.

We expect to continue to incur losses from operations for the foreseeable future and expect the costs of drug development to increase in the future as more patients are recruited to the clinical trials. In particular, we expect to continue to incur significant losses in the development of our clinical trials and drug candidates. Because of the numerous risks and uncertainties associated with the development, manufacturing, sales and marketing of our drug candidates, we may experience larger than expected future losses and may never become profitable.

Moreover, there is a substantial risk that we, or our development partners, may not be able to complete the development of our current drug candidates or develop other pharmaceutical products. It is possible that none of them will be successfully commercialized, which would prevent us from ever achieving profitability.

The increase in expenses may adversely impact our business if our sources of funding and revenue are insufficient.

We anticipate that as the costs related to the development of our clinical trials will increase, we will require additional funds to achieve our long-term goals of commercialization and further development of our drug candidates. In addition, we will require funds to pursue regulatory applications, defend intellectual property rights, contract manufacturing capacity, potentially develop marketing and sales capability and fund operating expenses. We intend to seek such additional funding through public or private financings and/or through licensing of our assets or other arrangements with corporate partners. However, such financing, licensing opportunities or other arrangements may not be available from any sources on acceptable terms, or at all. Any shortfall in funding could result in us having to curtail or cease our research and development activities, thereby harming our business, financial condition and results of operations.

In addition, because of the numerous risks and uncertainties associated with the development of our drug candidates, we are unable to predict the timing or amount of increased expenses, or when, or if, we will be able to achieve or maintain profitability. Our expenses could significantly increase beyond current expectations if the applicable regulatory authorities require further studies in addition to those currently anticipated. In any case, even if our drug candidates are approved for commercial sale, we anticipate incurring significant costs associated with the commercial launch of such drug candidates and there can be no guarantee that we will ever generate significant revenues.

We currently have no source of product revenue and may never become profitable.

Our drug candidates have not been approved for commercial sale, and we expect it to be several years before they are approved, if ever, and we are able to commence sales of our drug candidates. To date, we have not generated any revenue from the licensing or commercialization of our drug candidates and do not expect to receive revenue

9

from them for a number of years, if ever. We will not be able to generate product revenue unless and until our current drug candidates or any future drug candidates, alone or with future partners, successfully completes clinical trials, receives regulatory approval and is successfully commercialized. Although we may seek to obtain revenue from collaboration or licensing agreements with third parties, we currently have no such agreements that could provide us with material, ongoing future revenue and we may never enter into any such agreements.

We will require additional financing and may be unable to raise sufficient capital, which could have a material impact on our research and development programs or commercialization of our drug candidates.

We have historically devoted most of our financial resources to research and development, including pre-clinical and clinical development activities. To date, we have financed a significant amount of our operations through equity financings. The amount of our future net losses will depend, in part, on the rate of our future expenditures and our ability to obtain funding through equity or debt financings or strategic collaborations. The amount of such future net losses, as well as the possibility of future profitability, will also depend on our success in developing and commercializing products that generate significant revenue. Our failure to become and remain profitable would depress the value of our ADSs and could impair our ability to raise capital, expand our business, maintain our research and development efforts, diversify our product offerings or even continue our operations.

We anticipate that our expenses will increase substantially for the foreseeable future if, and as, we:

• continue our research and preclinical and clinical development of our drug candidates;

• expand the scope of our current proposed clinical studies for our drug candidates;

• initiate additional preclinical, clinical or other studies for our drug candidates;

• change or add additional manufacturers or suppliers;

• seek regulatory and marketing approvals for our drug candidates that successfully complete clinical studies;

• seek to identify and validate additional drug candidates;

• acquire or in-license other drug candidates and technologies;

• maintain, protect and expand our intellectual property portfolio;

• attract and retain skilled personnel;

• create additional infrastructure to support our operations as a publicly quoted company and our product development and planned future commercialization efforts;

• add an internal sales force; and

• experience any delays or encounter issues with any of the above.

Until our drug candidates become commercially available, we will need to obtain additional funding in connection with the further development of our drug candidates. Our ability to obtain additional financing will be subject to a number of factors, including market conditions, our operating performance and investor sentiment. As such, additional financing may not be available to us when needed, on acceptable terms, or at all. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our research and development programs or any future commercialization efforts or obtain funds by entering agreements on unattractive terms.

Furthermore, any additional equity fundraising in the capital markets may be dilutive for shareholders and any debt-based funding may bind us to restrictive covenants and curb our operating activities and ability to pay potential future dividends even when profitable. We cannot guarantee that future financing will be available in sufficient amounts or on acceptable terms, if at all. If we are unable to raise additional capital in sufficient amounts or on acceptable terms, we will be prevented from pursuing research and development efforts. This could harm our business, operating results and financial condition and cause the price of our ADSs to fall.

10

If we are unable to secure sufficient capital to fund our operations, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to third parties to develop and market drug candidates that we would otherwise prefer to develop and market ourselves. For example, additional strategic collaborations could require us to share commercial rights to our drug candidates with third parties in ways that we do not intend currently or on terms that may not be favorable to us. Moreover, we may also have to relinquish valuable rights to our technologies, future revenue streams, research programs or drug candidates or grant licenses on terms that may not be favorable to us.

We may find it difficult to enroll patients in our current and any future clinical trials, and patients could discontinue their participation in our current and any future clinical trials, which could delay or prevent our current and any future clinical trials of our drug candidates and make those trials more expensive to undertake.

Identifying and qualifying patients to participate in current and any future clinical trials of our drug candidates is critical to our success. The timing of our clinical trials depends on the speed at which we can recruit patients to participate in testing our drug candidates. Patients may be unwilling to participate in any future clinical trials because of negative publicity from adverse events in the biotechnology industry. Patients may be unavailable for other reasons, including competitive clinical trials for similar patient populations, and the timeline for recruiting patients, conducting trials and obtaining regulatory approval of potential products may be delayed. If we have difficulty enrolling a sufficient number of patients to conduct any future clinical trials as planned, we may need to delay, limit or discontinue those clinical trials. Clinical trial delays could result in increased costs, slower product development, setbacks in testing the safety and effectiveness of our technology or discontinuation of the clinical trials altogether.

Any failure to implement our business strategy could negatively impact our business, financial condition and results of operations.

The development and commercialization of our drug candidates is subject to many risks, including:

• additional clinical or pre-clinical trials may be required beyond what we currently expect;

• regulatory authorities may disagree with our interpretation of data from our preclinical studies and clinical studies or may require that we conduct additional studies;

• regulatory authorities may disagree with our proposed design of future clinical trials;

• regulatory authorities may delay approval of our drug candidates, thus preventing milestone payments from our collaboration partners;

• regulatory authorities may not accept data generated at our clinical study sites;

• we may be unable to obtain and maintain regulatory approval of our drug candidate in any jurisdiction;

• the prevalence and severity of any side effects of any drug candidate could delay or prevent commercialization, limit the indications for any approved drug candidate, require the establishment of a risk evaluation and mitigation strategy, or cause an approved drug candidate to be taken off the market;

• regulatory authorities may identify deficiencies in manufacturing processes;

• regulatory authorities may change their approval policies or adopt new regulations;

• the third party manufacturers we expect to depend on to supply or manufacture our drug candidates may not produce adequate supply;

• we, or our third party manufacturers, may not be able to source or produce current Good Manufacturing Practice (cGMP) materials for the production of our drug candidates;

• we may not be able to manufacture our drug candidates at a cost or in quantities necessary to make commercially successful products;

• we may not be able to obtain adequate supply of our drug candidates for our clinical trials;

11

• we may experience delays in the commencement of, enrolment of patients in and timing of our clinical trials;

• we may not be able to demonstrate that our drug candidates are safe and effective as a treatment for its indications to the satisfaction of regulatory authorities, and we may not be able to achieve and maintain compliance with all regulatory requirements applicable to our drug candidates;

• we may not be able to maintain a continued acceptable safety profile of our products following approval;

• we may be unable to establish or maintain collaborations, licensing or other arrangements;

• the market may not accept our drug candidates;

• we may be unable to establish and maintain an effective sales and marketing infrastructure, either through the creation of a commercial infrastructure or through strategic collaborations, and the effectiveness of our own or any future strategic collaborators’ marketing, sales and distribution strategy and operations will affect our profitability;

• we may experience competition from existing products or new products that may emerge;

• we and our licensors may be unable to successfully obtain, maintain, defend and enforce intellectual property rights important to protect our drug candidates; and

• we may not be able to obtain and maintain coverage and adequate reimbursement from third party payors.

If any of these risks materializes, we could experience significant delays or an inability to successfully develop and commercialize our drug candidates we or our partners may develop, which would have a material adverse effect on our business, financial condition and results of operations.

Positive results from preclinical studies of our drug candidates are not necessarily predictive of the results of our planned clinical trials of our drug candidates.

Positive results in preclinical proof of concept and animal studies of our drug candidates may not result in positive results in clinical trials in humans. Many companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in clinical trials after achieving positive results in preclinical development or early stage clinical trials, and we cannot be certain that we will not face similar setbacks. These setbacks can be caused by, among other things, preclinical findings made while clinical trials were underway or safety or efficacy observations made in clinical trials, including adverse events. Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that believed their drug candidates performed satisfactorily in preclinical studies and clinical trials nonetheless failed to obtain FDA or other regulatory authority approval. If we fail to produce positive results in our clinical trials of our drug candidates, the development timeline and regulatory approval and commercialization prospects for our drug candidates, and, correspondingly, our business and financial prospects, would be negatively impacted.

Ongoing and future clinical trials of drug candidates may not show sufficient safety and efficacy to obtain requisite regulatory approvals for commercial sale.

Phase I and Phase II clinical trials are not primarily designed to test the efficacy of a drug candidate but rather to test safety and to understand the drug candidate’s side effects at various doses and schedules. Furthermore, success in preclinical and early clinical trials does not ensure that later large-scale trials will be successful nor does it predict final results. Acceptable results in early trials may not be repeated in later trials. Further, Phase III clinical trials may not show sufficient safety or efficacy to obtain regulatory approval for marketing. In addition, clinical results are frequently susceptible to varying interpretations that may delay, limit or prevent regulatory approvals. Negative or inconclusive results or adverse medical events during a clinical trial could require that the clinical trial be redone or terminated. The length of time necessary to complete clinical trials and to submit an application for marketing approval by applicable regulatory authorities may also vary significantly based on the type, complexity and novelty of the drug candidate involved, as well as other factors. If we suffer any significant delays, quality issues, setbacks or negative results in, or termination of, our clinical trials, we may be unable to continue the development of our drug candidates or generate revenue and our business may be severely harmed.

12

If we do not obtain the necessary regulatory approvals, we will be unable to commercialize our drug candidates.

The clinical development, manufacturing, sales and marketing of our drug candidates are subject to extensive regulation by regulatory authorities in the United States, the United Kingdom, the European Union, Australia and elsewhere. Despite the substantial time and expense invested in preparation and submission of a Biologic License Application or equivalents in other jurisdictions, regulatory approval is never guaranteed. The number, size and design of preclinical studies and clinical trials that will be required will vary depending on the product, the disease or condition for which the product is intended to be used and the regulations and guidance documents applicable to any particular product. Additionally, during the review process and prior to approval, the FDA and/or other regulatory bodies may require additional data, including with respect to whether our products have abuse potential, which may delay approval and any potential controlled substance scheduling processes. The FDA or other regulators can delay, limit or deny approval of a product for many reasons, including, but not limited to, the fact that regulators may not approve our or a third party manufacturer’s processes or facilities or that new laws may be enacted or regulators may change their approval policies or adopt new regulations requiring new or different evidence of safety and efficacy for the intended use of a product.

Successful results in clinical trials and in the subsequent application for marketing approval are not guaranteed. If we are unable to obtain regulatory approvals, we will not be able to generate revenue from our drug candidates. Even if we receive regulatory approval for any of our drug candidates, our profitability will depend on our ability to generate revenues from their sale or the licensing of our technology.

Even if our drug candidates receive regulatory approval, it may still face development and regulatory difficulties that may delay or impair future sales of drug candidates.

Even if we or our licensing partners receive regulatory approval to sell any drug candidates, the relevant regulatory authorities may, nevertheless, impose significant restrictions on the indicated uses, manufacturing, labelling, packaging, adverse event reporting, storage, advertising, promotion and record keeping or impose ongoing requirements for post-approval studies. In addition, regulatory agencies subject a marketed product, its manufacturer and the manufacturer’s facilities to continual review and periodic inspections. Previously unknown problems with the drug candidate, including adverse events of unanticipated severity or frequency, may result in restrictions on the marketing of the product, and could include withdrawal of the product from the market. In addition, new statutory requirements may be enacted or additional regulations may be enacted that could prevent or delay regulatory approval of our drug candidates.

We have limited manufacturing experience with our drug candidates.

We have no manufacturing capabilities and are dependent on third parties for cost effective manufacture and manufacturing process development of the company’s drug candidates. Problems with third party manufacturers or the manufacturing process, or the scaling up of manufacturing activities as such may delay clinical trials and commercialization of our drug candidates.

To the extent we rely significantly on contractors, we will be exposed to risks related to the business and operational conditions of our contractors.

We are a small company, with few internal staff and limited facilities. We are and will be required to rely on a variety of contractors to manufacture and transport our drug candidates, to perform clinical testing and to prepare regulatory dossiers. Adverse events that affect one or more of our contractors could adversely affect us, such as:

• a contractor is unable to retain key staff that have been working on our drug candidates;

• a contractor is unable to sustain operations due to financial or other business issues;

• a contractor loses their permits or licenses that may be required to manufacture our drug candidates; or

• errors, negligence or misconduct that occur within a contractor may adversely affect our business.

13

We depend on, and will continue to depend on, collaboration and strategic alliances with third partners. To the extent we are able to enter into collaborative arrangements or strategic alliances, we will be exposed to risks related to those collaborations and alliances.

An important element of our strategy for developing, manufacturing and commercializing our drug candidates is entering into partnerships and strategic alliances with other pharmaceutical companies or other industry participants.

Any partnerships or alliance we have or may have in the future may be terminated for reasons beyond our control or we may not be able to negotiate future alliances on acceptable terms, if at all. These arrangements may result in us receiving less revenue than if we sold our products directly, may place the development, sales and marketing of our products outside of our control, may require us to relinquish important rights or may otherwise be on unfavorable terms. Collaborative arrangements or strategic alliances will also subject us to a number of risks, including the risk that:

• we may not be able to control the amount and timing of resources that our strategic partner/collaborators may devote to the drug candidates;

• strategic partner/collaborators may experience financial difficulties;

• the failure to successfully collaborate with third parties may delay, prevent or otherwise impair the development or commercialization of our drug candidates or revenue expectations;

• products being developed by partners/collaborators may never reach commercial stage resulting in reduced or even no milestone or royalty payments;

• business combinations or significant changes in a collaborator’s business strategy may also adversely affect a collaborator’s willingness or ability to complete their obligations under any arrangement;

• a collaborator could independently move forward with a competing product developed either independently or in collaboration with others, including our competitors; and

• collaborative arrangements are often terminated or allowed to expire, which would delay the development and may increase the cost of developing drug candidates.

Because we rely on third party manufacturing and supply partners, our supply of research and development, preclinical and clinical development materials may become limited or interrupted or may not be of satisfactory quantity or quality.

We rely on third party supply and manufacturing partners to manufacture and supply the materials for our research and development and preclinical and clinical study supplies. We do not own manufacturing facilities or supply sources for such materials.

There can be no assurance that our supply of research and development, preclinical and clinical development biologics and other materials will not be limited, interrupted or restricted in certain geographic regions, be of satisfactory quality or continue to be available at acceptable prices. Replacement of a third party manufacturer could require significant effort, cost and expertise because there may be a limited number of qualified replacements.

The manufacturing process for a drug candidate is subject to FDA and foreign regulatory authority review. Suppliers and manufacturers must meet applicable manufacturing requirements and undergo rigorous facility and process validation tests required by regulatory authorities in order to comply with regulatory standards. In the event that any of our suppliers or manufacturers fails to comply with such requirements or to perform its obligations to us in relation to quality, timing or otherwise, or if our supply of components or other materials becomes limited or interrupted for other reasons, we may be forced to manufacture the materials ourselves or enter into an agreement with another third party, which would be costly and delay any future clinical trials.

Further, if any third-party provider fails to meet its obligations to manufacture our products, or fails to maintain or achieve satisfactory regulatory compliance, the development of such substances and the commercialization of any therapies, if approved, could be stopped, delayed or made commercially unviable, less profitable or may result in enforcement actions against us.

14

Our research and development efforts will be jeopardized if we are unable to retain key personnel and cultivate key academic and scientific collaborations.

Changes in our senior management may be disruptive to our business and may adversely affect our operations. For example, when we have changes in senior management positions, we may elect to adopt different business strategies or plans. Any new strategies or plans, if adopted, may not be successful and if any new strategies or plans do not produce the desired results, our business may suffer.

Moreover, competition among biotechnology and pharmaceutical companies for qualified employees is intense and as such we may not be able to attract and retain personnel critical to our success. Our success depends on our continued ability to attract, retain and motivate highly qualified management, clinical and scientific personnel, manufacturing personnel, sales and marketing personnel and on our ability to develop and maintain important relationships with clinicians, scientists and leading academic and health institutions. If we fail to identify, attract, retain and motivate these highly skilled personnel, we may be unable to continue our product development and commercialization activities.

In addition, biotechnology and pharmaceutical industries are subject to rapid and significant technological change. Our drug candidates may be or become uncompetitive. To remain competitive, we must employ and retain suitably qualified staff that are continuously educated to keep pace with changing technology, but may not be in a position to do so.

We may encounter difficulties in managing our growth, which could negatively impact our operations.

As we advance our clinical development programs for drug candidates, seek regulatory approval in the United States and elsewhere and increase the number of ongoing product development programs, we anticipate that we will need to increase our product development, scientific and administrative headcount. We will also need to establish commercial capabilities in order to commercialize any drug candidates that may be approved. Such an evolution may impact our strategic focus and our deployment and allocation of resources.

Our ability to manage our operations and growth effectively depends upon the continual improvement of our procedures, reporting systems and operational, financial and management controls. We may not be able to implement administrative and operational improvements in an efficient or timely manner and may discover deficiencies in existing systems and controls. If we do not meet these challenges, we may be unable to execute our business strategies and may be forced to expend more resources than anticipated addressing these issues.

We may acquire additional technology and complementary businesses in the future. Acquisitions involve many risks, any of which could materially harm our business, including the diversion of management’s attention from core business concerns, failure to effectively exploit acquired technologies, failure to successfully integrate the acquired business or realize expected synergies or the loss of key employees from either our business or the acquired businesses.

In addition, in order to continue to meet our obligations as a public listed company in both Australia and the United States and to support our anticipated long-term growth, we will need to increase our general and administrative capabilities. Our management, personnel and systems may not be adequate to support this future growth.

If we are unable to successfully manage our growth and the increased complexity of our operations, our business, financial position, results of operations and prospects may be harmed.

Future potential sales of our drug candidates may suffer if they are not accepted in the marketplace by physicians, patients and the medical community.

There is a risk that our drug candidates may not gain market acceptance among physicians, patients and the medical community, even if they are approved by the regulatory authorities. The degree of market acceptance of any of our approved drug candidates will depend on a variety of factors, including:

• timing of market introduction, number and clinical profile of competitive products;

• our ability to provide acceptable evidence of safety and efficacy and our ability to secure the support of key clinicians and physicians for our drug candidates;

15

• cost-effectiveness compared to existing and new treatments;

• availability of coverage, reimbursement and adequate payment from health maintenance organizations and other third party payers;

• prevalence and severity of adverse side effects; and

• other advantages over other treatment methods.

As controlled substances, the products may generate public controversy. Physicians, patients, payers or the medical community may be unwilling to accept, use or recommend our drug candidates which would adversely affect our potential revenues and future profitability. Adverse publicity or public perception regarding cannabis and psilocybin to our current or future investigational therapies using these substances may negatively influence the success of these therapies.

We face competition from entities that may develop drug candidates for our target disease indications, including companies developing novel treatments and technology platforms based on modalities and technology similar to ours.

The development and commercialization of drug candidates is highly competitive. Multinational pharmaceutical companies and specialized biotechnology companies could develop drug candidates and processes competitive with our drug candidates. Competitive therapeutic treatments include those that have already been approved and accepted by the medical community, patients and third party payers, and any new treatments that enter the market.

There may be a significant number of products that are currently under development, and may become commercially available in the future, for the treatment of conditions for which we are developing, and may in the future try to develop, drug candidates.

Multinational pharmaceutical companies and specialized biotechnology companies could have significantly greater financial, technical, manufacturing, marketing, sales and supply resources and experience than we have. If we successfully obtain approval for any drug candidate, we could face competition based on many different factors, including the safety and effectiveness of our drug candidates, the ease with which our drug candidates can be administered and the extent to which patients accept relatively new routes of administration, the timing and scope of regulatory approvals for these drug candidates, the availability and cost of manufacturing, marketing and sales capabilities, price, reimbursement coverage and patent position.

Competing products could present superior treatment alternatives, including by being more effective, safer, less expensive or marketed and sold more effectively than any products we may develop. Competitive products may make any products we develop obsolete or non-competitive before we recover the expense of developing and commercializing our drug candidates. Such competitors could also recruit our employees, which could negatively impact our level of expertise and our ability to execute our business plan.

If healthcare insurers and other organizations do not pay for our drug candidates or impose limits on reimbursement, our future business may suffer.

Our drug candidates may be rejected by the market due to many factors, including cost. The continuing efforts of governments, insurance companies and other payers of healthcare costs to contain or reduce healthcare costs may affect our future revenues and profitability. In Australia and certain foreign markets, the pricing of pharmaceutical products is subject to government control. We expect initiatives for similar government control to continue in the United States and elsewhere. The adoption of any such legislative or regulatory proposals could harm our business and prospects.

Successful commercialization of our drug candidates will depend in part on the extent to which reimbursement for the cost of our products and related treatment will be available from government health administration authorities, private health insurers and other organizations. Our drug candidates may not be considered cost-effective and reimbursement may not be available to consumers or may not be sufficient to allow our products to be marketed on a competitive basis. Third-party payers are increasingly challenging the price of medical products and treatment.

16

If third party coverage is not available for our drug candidates the market acceptance of these drug candidates will be reduced. Cost-control initiatives could decrease the price we might establish for drug candidates, which could result in product revenues lower than anticipated. If the price for our drug candidates decreases or if governmental and other third-party payers do not provide adequate coverage and reimbursement levels our potential revenue and prospects for profitability will suffer.

We may be exposed to product liability claims which could harm our business.

The testing, marketing and sale of therapeutic products entails an inherent risk of product liability. We rely on a number of third-party researchers and contractors to produce, collect, and analyze data regarding the safety and efficacy of our drug candidates. We also have quality control and quality assurance in place to mitigate these risks, as well as professional liability and clinical trial insurance to cover financial damages in the event that human testing is done incorrectly or the data is analyzed incorrectly.

Notwithstanding our control procedures, we may face product liability exposure related to the testing of our drug candidates in human clinical trials. If any of our drug candidates are approved for sale, we may face exposure to claims by an even greater number of persons than were involved in the clinical trials once marketing, distribution and sales of our drug candidates begin. Regardless of merit or eventual outcome, liability claims may result in:

• decreased demand for our drug candidates;

• injury to our reputation;

• withdrawal of clinical trial participants;

• costs of related litigation;

• substantial monetary awards to patients and others;

• loss of revenues; and

• the inability to commercialize drug candidates.

With respect to product liability claims, we could face additional liability beyond insurance limits if testing mistakes were to endanger any human subjects. In addition, if a claim is made against us in conjunction with these research testing activities, the market price of our ADSs may be negatively affected.

The outbreak of the novel strain of coronavirus, SARS-CoV-2, which causes COVID-19, could adversely impact our business, including our non-clinical studies and clinical trials.

Public health crises such as pandemics or similar outbreaks might adversely impact our business. In December 2019, a novel strain of coronavirus, SARS-CoV-2, which causes coronavirus disease 2019 (COVID-19), surfaced in Wuhan, China. Since then, COVID-19 has spread to most countries in the world.

As a result of the COVID-19 outbreak, or similar pandemics, we have and may in the future experience disruptions that could severely impact our business, preclinical studies and clinical trials, including: