FORM

OR

For the fiscal year ended

OR

OR

Commission File No.:

(Exact name of registrant as specified in its charter)

Translation of registrant’s name into English: Not applicable

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Chief Executive Officer

Tel: +

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Warrants to Purchase Ordinary Shares | MTEKW | Nasdaq Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each

of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, “accelerated filer,” and emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | ☒ | |

| Emerging growth company |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange

Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has

filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its

audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐

Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company.

Yes ☐

No

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

TABLE OF CONTENTS

i

ii

Maris - Tech Ltd.

INTRODUCTION

In this Annual Report on Form 20-F, “we,” “us,” “our,” the “Company” and “MTEK” refer, to Maris-Tech Ltd.

Maris-Tech Ltd. was incorporated in Israel in 2008 under the name “Maris Technologies Marketing Ltd.” On November 4, 2020, we changed our name to “Maris-Tech Ltd.”

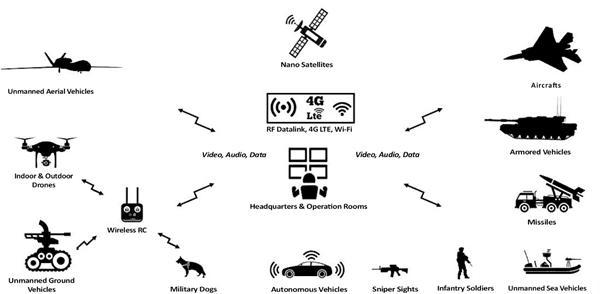

We are a business-to-business approach, or B2B, provider of intelligent video transmission technology with artificial intelligence, or AI, acceleration for edge platforms, using high-end digital video, audio and wireless communication technologies. We design, develop, manufacture and commercially sell miniature intelligent video and audio surveillance and communication systems with AI acceleration , which are offered as products and solutions for the professional as well as the civilian and home security markets. Our products and solutions are sold as off the shelf, standalone and ready to use products, or as customized components that meet our customers’ requirements and integrate into their systems and products. Our customers include companies operating in the drone, robotic, defense, homeland security, or HLS, intelligence gathering, autonomous vehicle and space markets.

All trademarks or trade names referred to in this Annual Report on Form 20-F are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Annual Report on Form 20-F are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Our reporting currency and functional currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references in this Annual Report on Form 20-F to “NIS” are to New Israeli Shekels, and references to “dollars” or “$” mean U.S. dollars.

We report our financial statements in accordance with generally accepted accounting principles in the United States, or U.S. GAAP.

This Annual Report on Form 20-F includes statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information contained in such publications.

iii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included or incorporated by reference in this Annual Report on Form 20-F may be deemed to be “forward-looking statements”. Forward-looking statements are often characterized by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,” “estimate,” “continue,” “believe,” “should,” “intend,” “project” or other similar words, but are not the only way these statements are identified.

These forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections of results of operations or of financial condition, expected capital needs, and expenses, statements relating to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments, and other factors they believe to be appropriate.

Important factors that could cause actual results, developments, and business decisions to differ materially from those anticipated in these forward-looking statements include, among other things:

| ● | our ability to raise capital through the issuance of additional securities; |

| ● | our planned level of revenues and capital expenditures; |

| ● | our belief that our existing cash and cash equivalents and short-term bank deposits, as of December 31, 2022, will be sufficient to fund our operations through the next twelve months; |

| ● | our ability to market and sell our products; |

| ● | our plans to continue to invest in research and development to develop technology for both existing and new products; |

| ● | our plans to collaborate, or statements regarding the ongoing collaborations, with partner companies; |

| ● | our ability to maintain our relationships with suppliers, manufacturers, and other partners; |

| ● | our ability to maintain or protect the validity of our European, U.S., and other patents and other intellectual property; |

| ● | our ability to retain key executive members; |

| ● | our ability to internally develop and protect new inventions and intellectual property; |

| ● | our ability to expose and educate the industry about the use of our products; |

| ● | our expectations regarding our tax classifications; |

| ● | how long we will qualify as an emerging growth company or a foreign private issuer; |

| ● | interpretations of current laws and the passages of future laws; |

| ● | the impact of COVID-19 and resulting government actions on us, our manufacturers, suppliers, and facilities; and |

| ● | those factors referred to in “Item 3. Key Information — D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects,” as well as in this Annual Report on Form 20-F generally. |

Readers are urged to carefully review and consider the various disclosures made throughout this Annual Report on Form 20-F which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

You should not put undue reliance on any forward-looking statements. Any forward-looking statements in this Annual Report on Form 20-F are made as of the date hereof, and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

iv

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds.

Not applicable.

D. Risk Factors.

Our business faces significant risks. You should carefully consider the risks described below, together with all of the other information in this Annual Report on Form 20-F. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. If any of these risks actually occurs, our business and financial condition could suffer and the price of our securities could decline. This Annual Report on Form 20-F also contains forward-looking statements that involve risks and uncertainties. Our results could materially differ from those anticipated in these forward-looking statements, as a result of certain factors including the risks described below and elsewhere in this report and our other Securities and Exchange Commission, or SEC, filings. See “Cautionary Note Regarding Forward-Looking Statements” above.

Summary Risk Factors

Risks Related to Our Business, Industry, Operations and Financial Condition

| ● | the COVID-19 pandemic has adversely affected, and will continue to affect, our business, financial condition, liquidity and results of operations; |

| ● | we are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability due to the ongoing military conflict between Russia and Ukraine; |

| ● | we have been operating at a loss since our inception and may never be profitable; |

| ● | amounts included in backlog may not result in actual revenue and are an uncertain indicator of our future earnings; |

| ● | we may not have sufficient manufacturing capabilities to satisfy any growing demand for our commissioned products. We may be unable to control the availability or cost of producing such products; |

| ● | we operate in an evolving industry and, as a result, our past results may not be indicative of future operating performance; |

| ● | our commercial success depends upon the degree of market acceptance by the professional, homeland security, or HLS, and defense markets as well as by other prospective markets and industries; |

| ● | we may not be able to introduce products acceptable to customers and we may not be able to improve the technology used in our current systems in response to changing technology and end-user needs; |

1

| ● | potential growth of our business is based on international expansion, making us susceptible to risks associated with international sales and operations; |

| ● | we expect to face significant competition. If we cannot successfully compete with new or existing technologies or future developed products, our marketing and sales will suffer and we may never be profitable; |

| ● | significant merchandise returns and recalls of our ready-made products could harm our business; |

| ● | if we fail to offer high-quality customer support, our business and reputation may suffer; |

| ● | our reliance on third-party suppliers for most of the component parts of our products could harm our ability to meet demand for our products in a timely and cost-effective manner; |

| ● | if we are unable to establish significant sales, marketing and distribution capabilities or enter into successful relationships with business targets and third parties to perform these services, we may not be successful in commercializing our products and technology; |

| ● | we may require substantial additional funding to grow our business, which may not be available to us on acceptable terms, or at all; |

| ● | we may not accurately forecast revenues, profitability and appropriately plan our expenses; |

| ● | we rely on highly skilled personnel, and, if we are unable to attract, retain or motivate qualified personnel, we may not be able to operate our business effectively; |

| ● | we may have difficulty in entering into and maintaining strategic alliances with third parties; |

| ● | we may not be able to obtain patents or other intellectual property rights necessary to protect our proprietary technology and business; |

| ● | we may be unable to keep pace with changes in technology as our business and market strategy evolves; |

| ● | significant disruptions of our information technology systems or breaches of our data security could adversely affect our business; |

| ● | we may be subject to general litigation, regulatory disputes and government inquiries; |

| ● | we have identified material weaknesses in our internal control over financial reporting that could, if not remediated, result in material misstatements in our financial statements. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, shareholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our ordinary shares; |

| ● | new regulation as well as regulation in new target territories, including regulation relating to unmanned platforms, video and audio systems, may create obstacles to our sales and marketing efforts; |

Risks Related to Israeli Law and our Operations in Israel

| ● | political, economic and military instability in Israel may impede our ability to operate and harm our financial results; |

| ● | exchange rate fluctuations between foreign currencies and the U.S. Dollar may negatively affect our earnings; |

2

| ● | we may become subject to claims for remuneration or royalties for assigned service invention rights by our employees, which could result in litigation and adversely affect our business; |

| ● | we received Israeli government grants for certain of our research and development activities, the terms of which may require us to pay royalties and to satisfy specified conditions in order to manufacture products and transfer technologies outside of Israel. If we fail to satisfy these conditions, we may be required to pay penalties and refund grants previously received; |

Risks Related to Our Status as a Public Company and Ownership of our Ordinary Shares and Warrants

| ● | As of December 31, 2022, our principal shareholders, officers and directors beneficially owned an aggregate of approximately 40.87% of our outstanding Ordinary Shares. They will therefore be able to exert significant control over matters submitted to our shareholders for approval; |

| ● | We cannot assure you that our Ordinary Shares and Warrants will remain listed on the Nasdaq Capital Market, or any other securities exchange; |

| ● | we are an emerging growth company and any decision on our part to comply only with certain reduced reporting and disclosure requirements applicable to emerging growth companies could make our securities less attractive to investors; |

| ● | we incur significant increased costs as a result of operating as a public company. Our management is required to devote substantial time to new compliance initiatives as well as compliance with ongoing U.S. requirements; |

| ● | the estimates of market opportunity, market size and forecasts of market growth included in our publicly-filed documents may prove to be inaccurate, and even if the market in which we compete achieves the forecasted growth, our business could fail to grow at similar rate, if at all; |

| ● | the market price of our Ordinary Shares and Warrants may be highly volatile and such volatility could cause you to lose some or all of your investment and also subject us to litigation; and |

| ● | your ownership in the Company may be diluted in the future. |

Risks Related to Our Business, Industry, Operations and Financial Condition

The COVID-19 pandemic has adversely affected, and will continue to affect, our business, financial condition, liquidity and results of operations.

The ongoing COVID-19 pandemic has resulted in a widespread health crisis that has adversely affected businesses, economies and financial markets worldwide, placed constraints on the operations of businesses, decreased consumer mobility and activity, and caused significant economic volatility globally. We have followed guidance issued by the U.S. and Israeli governments and the other local governments in territories in which we operate to protect our employees. Our financial condition and results of operations were not materially negatively impacted by the COVID-19 pandemic in the year ended December 31, 2022.

3

In addition, and most importantly, the electronics components shortage crisis, a unique result of the COVID-19 pandemic which affected our market segment, has increased the lead time to obtain and the purchase prices of the component parts required for certain of our products, which has also negatively impacted the delivery time of our products to customers and our revenues and profitability. As long as the COVID-19 pandemic continues, the components’ lead time may be longer than normal and shortage in components may continue or get worse. The Company maintains a comprehensive network of world-wide suppliers. In order to mitigate such risks, in cases where certain components are purchased from single source manufacturers, the Company has adjusted and modified it designs based on different components from different suppliers, to allow for more versatility and flexibility.

We cannot predict the other future potential impacts of the COVID-19 pandemic on our business or operations, and there is no guarantee that any near-term trends in our results of operations will continue, particularly if the COVID-19 pandemic and the adverse consequences thereof return. Additional waves of infections, a continuation of the current environment, or any further adverse impacts caused by the COVID-19 pandemic could further impact employment rates and the economy, affecting our consumer base and divert consumers’ discretionary income to other uses, including for essential items. These events could impact our cash flows, results of operations and financial conditions and heighten many of the other risks described in this Annual Report on Form 20-F.

We are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability due to the ongoing military conflict between Russia and Ukraine. Our business, financial condition and results of operations may be materially adversely affected by any negative impact on the global economy and capital markets resulting from the conflict in Ukraine or any other geopolitical tensions.

U.S. and global markets are experiencing volatility and disruption following the escalation of geopolitical tensions and the start of the military conflict between Russia and Ukraine. On February 24, 2022, a full-scale military invasion of Ukraine by Russian troops was reported. Although the length and impact of the ongoing military conflict is highly unpredictable, the conflict in Ukraine could lead to market disruptions, including significant volatility in credit and capital markets.

Additionally, Russia’s prior annexation of Crimea, recent recognition of two separatist republics in the Donetsk and Luhansk regions of Ukraine and subsequent military interventions in Ukraine have led to sanctions and other penalties being levied by the United States, European Union and other countries against Russia, Belarus, the Crimea Region of Ukraine, the so-called Donetsk People’s Republic, and the so-called Luhansk People’s Republic, including agreement to remove certain Russian financial institutions from the Society for Worldwide Interbank Financial Telecommunication payment system. Additional potential sanctions and penalties have also been proposed and/or threatened. Russian military actions and the resulting sanctions could adversely affect the global economy and financial markets.

Any of the abovementioned factors could affect our business, prospects, financial condition, and operating results. The extent and duration of the military action, sanctions and resulting market disruptions are impossible to predict, but could be substantial. Any such disruptions may also magnify the impact of other risks described in this Annual Report on Form 20-F.

We have been operating at a loss since our inception and may never be profitable.

We have been operating at a loss since our inception. In the fiscal years ended December 31, 2022, 2021, and 2020 we had a net loss of $3,688,346, $824,224 and $640,343, respectively.

We anticipate that our operating expenses will continue to increase as we expand our operations and continue to invest in developing our product pipeline. These expenses may exceed our budgeted amounts and our revenues may not increase sufficiently to turn an operating profit and become cash flow positive. If any of the foregoing occur, we may continue to incur losses and remain unprofitable.

4

Amounts included in backlog may not result in actual revenue and are an uncertain indicator of our future earnings.

As of January 1, 2023, our backlog was approximately $1.9 million. As of March 6, 2023, our backlog was approximately $2.6 million. We define backlog as the accumulation of all pending orders with a later fulfillment date for which revenue has not been recognized and we consider valid. Most of our backlog is comprised of executed purchase orders from high rated leading customers in the defense industries, also referred to as “triple A customers”, customers with which we have had long-standing relationships and governmental agencies. The disclosure of backlog aids in the analysis of the demand for the Company’s products, as well as the Company’s ability to meet that demand. However, because revenue will not be recognized until we have fulfilled our obligations to a customer, there may be a significant amount of time between executing a contract with a customer and delivery of the product to the customer and revenue recognition. In addition, backlog is not necessarily indicative of our revenues to be recognized in a specified future period and we cannot assure that we will recognize revenue with respect to each order included in backlog. Our customers may order products from multiple sources to ensure timely delivery and may cancel or defer orders without significant penalty. Our customers also may cancel orders when business is weaker and inventories are excessive. While as of the date of this Annual Report on Form 20-F, no orders were cancelled, should a cancellation occur, our backlog and anticipated revenue would be reduced unless we were able to replace the cancelled order. As a result, we cannot provide assurances as to the portion of backlog to be filled in a given year, and our backlog as of any particular date may not be representative of actual revenues for any subsequent period.

We may not have sufficient manufacturing capabilities to satisfy any growing demand for our commissioned products. We may be unable to control the availability or cost of producing such products.

Our current manufacturing capabilities may not reach the required production levels necessary in order to meet growing demands for any products we may commission or future products we may develop. There can be no assurance that our commissioned products can be manufactured at our desired commercial quantities, in compliance with our requirements and at an acceptable cost. Any such failure could delay or prevent us from shipping said products and marketing our technologies in accordance with our target growth strategies.

We operate in an evolving industry and, as a result, our past results may not be indicative of future operating performance.

We operate in a rapidly evolving industry that may not develop in a manner favorable to our business. Therefore, it may be difficult to assess our future performance. You should consider our business and prospects in light of the risks and difficulties we may encounter.

Our future success will depend in large part upon our ability to, inter alia:

| ● | manage our inventory effectively; |

| ● | successfully develop, retain and expand our consumer product offering and geographic reach; |

| ● | compete effectively; |

5

| ● | anticipate and respond to macroeconomic changes; |

| ● | effectively manage our growth; |

| ● | hire, integrate and retain talented people at all levels of our organization; |

| ● | avoid interruptions in our business from information technology downtime, cybersecurity breaches or labor stoppages; |

| ● | maintain the quality of our technology infrastructure; and |

| ● | develop new features to enhance functionality. |

Our commercial success depends upon the degree of market acceptance by the professional, HLS and defense markets as well as by other prospective markets and industries.

We provide intelligent video transmission and AI technologies for professional, HLS and defense applications. Our current business model is that of a B2B in which we seek to identify target businesses interested in integrating our technology, or commissioning individual projects using our technology. Any product that we commission or that is brought to the market may or may not gain market acceptance by prospective customers. The commercial success of our technologies, commissioned products and any future product that we may develop depends in part on the professional, HLS and defense community as well as other industries for various use cases, depending on the acceptance by such industries of our commissioned products as a useful and cost-effective solution compared to current technologies. Even though our B2B products are custom made, step by step with our customers in order to ensure compatibility and acceptance, if our technology or any future product that we may develop does not achieve an adequate level of acceptance, or does not garner significant commercial appeal, we may not generate significant revenue and may not become profitable. The degree of market acceptance will depend on a number of factors, including:

| ● | the cost, size, weight, efficacy, performance, and convenience of our technology in relation to alternative products; |

| ● | the ability of third parties to enter into relationships with us without violating their existing agreements; |

| ● | the effectiveness of our sales and marketing efforts; |

| ● | the strength of marketing and distribution support for competing technology and products; and |

| ● | publicity concerning our technology or commissioned products or competing technology and products. |

Our efforts to penetrate industries and educate the marketplace on the benefits of our technology, and reasons to seek the commissioning of products based on our technology, may require significant resources and may never be successful. Such efforts to educate the marketplace may require more resources than are required by conventional technologies.

We may not be able to introduce products acceptable to customers and we may not be able to improve the technology used in our current systems in response to changing technology and end-user needs.

The markets in which we operate are subject to rapid and substantial innovation and technological change, mainly driven by technological advances and end-user requirements and preferences, as well as the emergence of new standards and practices. Even if we are able to complete the development of our products in development, our ability to compete in the unmanned platform markets will depend, in large part, on our future success in enhancing our existing products and developing new systems that will address the varied needs of prospective end-users, and respond to technological advances and industry standards and practices on a cost-effective and timely basis to otherwise gain market acceptance.

6

Even if we successfully introduce our existing products in development, it is likely that new systems and technologies that we develop will eventually supplant our existing systems or that our competitors will create systems that will replace our systems. As a result, any of our products may be rendered obsolete or uneconomical by our or others’ technological advances.

Potential growth of our business is based on international expansion, making us susceptible to risks associated with international sales and operations.

Having consolidated our position in the local Israeli market, we have plans to expand internationally with broad range of the field-tested video and data analytics products. Conducting international operations subjects us to certain risks which include localization of solutions and products and adapting them to local practices and regulatory requirements, exchange rate fluctuations and unexpected changes in tax, trade laws, tariffs, governmental controls and other trade restrictions. To the extent that we do not succeed in expanding our operations internationally and managing the associated legal and operational risks, our results of operations may be adversely affected.

We expect to face significant competition. If we cannot successfully compete with new or existing technologies or future developed products, our marketing and sales will suffer and we may never be profitable.

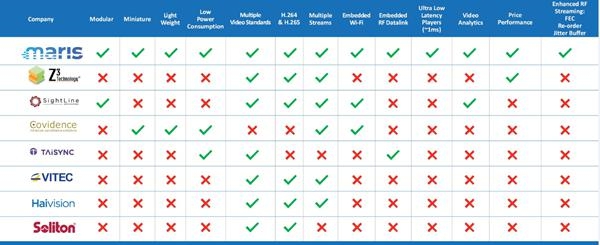

Based on product comparisons that we have conducted, and in reviewing our products against the comparable products offered by our leading competitors, we believe that our products have significant advantages compared to our competitors, both in terms of miniaturization, latency and functionality, and in our products’ ability to provide our customers with a single solution that addresses all their needs in a single customizable, modular product. Nonetheless, we are continuously competing against existing technologies in different industries and we cannot exclude the possibility of new technologies or innovations created by our competitors in the future. Some of these competitors, either alone or together with their collaborative partners, operate larger research and development programs than we do, and may have substantially greater financial resources than we do, which may, in the long run hinder us from competing effectively against our competitors, which could reduce our market share and ability to develop or secure new customers and adversely impact our business, results of operations, financial condition and prospects.

Significant merchandise returns and recalls of our ready-made products could harm our business.

Disruptions affecting the introduction, release or performance of our ready-made products may damage customers’ businesses and could harm their and our reputation. We may be subject to warranty and liability claims for damages related to defects in those products. In addition, if we do not meet industry or quality standards, if applicable, then the products may be subject to a recall, a material liability claim, or other occurrence that harms our reputation or decreases market acceptance of our products and could adversely impact our operating results.

If we fail to offer high-quality customer support, our business and reputation may suffer.

High-quality customer support is important for the successful retention of existing customers. Providing this support requires that our support personnel have specific knowledge and expertise of our products and markets, making it more difficult for us to hire qualified personnel and to scale up our support operations. The importance of high-quality customer support will increase as we expand our business and pursue new customers. If we do not provide effective and timely ongoing support, our ability to retain existing customers may suffer, and our reputation with existing or potential customers may be harmed, which would have a material adverse effect on our business, results of operations, financial condition and prospects.

7

Our reliance on third-party suppliers for most of the component parts of our products could harm our ability to meet demand for our products in a timely and cost-effective manner.

Though we attempt to ensure the availability of more than one supplier for each important component in any product that we commission, the number of suppliers engaged in the provision of the specified components suitable for our miniature intelligent video surveillance and communication technology products is limited, and therefore in some cases we engage with a single supplier, which may result in our dependency on such supplier. As such, we may be subject to disruptions in our operations if our sole or limited supply contract manufacturers decrease or stop production of components or do not produce components and products of sufficient quantity. Alternative sources for our component parts may not always be available. Many of our component parts are manufactured overseas, so they have long lead times, and events such as local disruptions, natural disasters or political conflict may cause unexpected interruptions to the supply of our products or components. As such, the loss of one or more of our specified suppliers, and our inability or delay in finding suitable replacement suppliers, could significantly affect our business, financial condition, results of operations and reputation.

If we are unable to establish significant sales, marketing and distribution capabilities or enter into successful relationships with business targets and third parties to perform these services, we may not be successful in commercializing our products and technology.

Given that we are currently a B2B company, our business is reliant on our ability to successfully attract potential business targets. Furthermore, we have a limited sales and marketing infrastructure and have limited experience in the sale, marketing or distribution of our technologies beyond the B2B model. To achieve commercial success for our technologies or any future developed product, we will need to expand our current sales and marketing infrastructure. There are risks involved with establishing and expanding our own sales, marketing and distribution capabilities. For example, recruiting and training additional sales force could be expensive and time consuming and could delay any product launch. In addition, our investment would be lost if we cannot retain or reposition our sales and marketing personnel.

Factors that may inhibit our efforts to commercialize any future products on our own include:

| ● | our inability to recruit, train and retain adequate numbers of effective sales and marketing personnel; |

| ● | the inability of sales personnel to obtain access to potential customers; |

| ● | the lack of complementary products to be offered by sales personnel, which may put us at a competitive disadvantage; and |

| ● | unforeseen costs and expenses associated with creating an independent sales and marketing organization. |

If we are unable to establish additional sales, marketing and distribution capabilities or enter into successful arrangements with third parties to perform these services, our revenues and our profitability may be materially adversely affected.

In addition, we may not be successful in entering into arrangements with third parties to sell, market and distribute our products inside or outside of Israel or may be unable to do so on terms that are favorable to us. We likely will have little control over such third parties, and any of them may fail to devote the necessary resources and attention to sell and market our products effectively. If we do not establish sales, marketing and distribution capabilities successfully, either on our own or in collaboration with third parties, we will not be successful in commercializing our technologies or any future products we may develop.

8

Changes in our insurance coverage may adversely affect our business, financial condition and operational results.

We maintain a public offering of securities insurance and appropriate policies of insurance consistent with those customarily carried by organizations in our industry sector. These increases in the cost of such insurance policies or the industry in which we operate could adversely affect our business, financial condition and operational results. Our insurance coverage may also be inadequate to cover losses it sustains. Uninsured loss or a loss in excess of our insured limits could adversely affect our business, financial condition and operational results.

We may require substantial additional funding to grow our business, which may not be available to us on acceptable terms, or at all.

As of December 31, 2022 and 2021, we had $255,530 and $49,126 in cash and cash equivalents, respectively. As of December 31, 2022, we had $9,084,082 short-term bank deposits. We had no short-term bank deposits as of December 31, 2021. While we expect that our existing cash and cash equivalents and our short-term bank deposit as of December 31, 2022 will be sufficient to fund our current operations and satisfy our obligations for the next twelve months, we may require additional funding to fund and grow our operations and to complete development of certain products and bring them to the market. There can be no assurance that any financing will be available in amounts or on terms acceptable to us, if at all. In the event we require additional capital, the inability to obtain additional capital will restrict our ability to grow and may reduce our ability to continue to conduct business operations. If we are unable to obtain additional financing, we will likely be required to curtail our development plans. In that event, shareholders would likely experience a loss of most or all of their investment. Any additional funding that we do obtain may be dilutive to the interests of existing shareholders.

We may not accurately forecast revenues, profitability and appropriately plan our expenses.

We base our current and future expense levels on our operating forecasts and estimates of future income and operating results. Income and operating results are difficult to forecast because they generally depend on the volume sales and timing, which are uncertain. Additionally, our business is affected by general economic and business conditions around the world. A softening in income, whether caused by changes in consumer preferences in the unmanned platform markets, or a weakening in global economies, may result in decreased net revenue levels, and we may be unable to adjust our expenses in a timely manner to compensate for any unexpected shortfall in income. This inability could cause our (loss)/income after tax in a given quarter to be (higher)/lower than expected. We also make certain assumptions when forecasting the amount of expense we expect related to our share-based payments, which includes the expected volatility of our share price, and the expected life of share options granted. These assumptions are partly based on historical results. If actual results differ from our estimates, our operating results in a given period may be lower than expected.

We rely on highly skilled personnel, and, if we are unable to attract, retain or motivate qualified personnel, we may not be able to operate our business effectively.

Our success depends in large part on the continued employment of senior management and key personnel who can effectively operate our business, as well as our ability to attract and retain skilled employees. Competition for highly skilled management, technical, research and development and other employees is intense and we may not be able to attract or retain highly qualified personnel in the future. In making employment decisions, candidates often consider the value of the equity awards they would receive in connection with their employment. Our long-term incentive programs may not be attractive enough or perform sufficiently to attract or retain qualified personnel.

If any of our employees leave us, and we fail to effectively manage a transition to new personnel, or if we fail to attract and retain qualified and experienced professionals on acceptable terms, our business, financial condition and results of operations could be adversely affected.

Our success also depends on our having highly trained financial, technical, recruiting, sales and marketing personnel. We will need to continue to hire additional personnel as our business grows. A shortage in the number of people with these skills or our failure to attract them to our company could impede our ability to increase revenues from our existing technology and services or launch new product offerings and would have an adverse effect on our business and financial results.

9

We may have difficulty in entering into and maintaining strategic alliances with third parties.

We may enter into strategic alliances with third parties to gain access to new and innovative technologies and markets. These parties are often large, established companies. Negotiating and performing under these arrangements involves significant time and expense, particularly those with companies that have significantly greater financial and other resources than we do. The anticipated benefits of these arrangements may never materialize, and performing under these arrangements may require significant resources which may affect our results of operations.

We may not be able to obtain patents or other intellectual property rights necessary to protect our proprietary technology and business.

The value of our products depends on our ability to protect our intellectual property, including trademarks, copyrights, patents and moral rights.

We currently have a patent application pending and may seek to patent additional concepts, components, processes, designs and methods, and other inventions and technologies that we consider to have commercial value or that will likely give us a technological advantage. Despite devoting resources to the research and development of proprietary technology, we may not be able to develop technology that is patentable or protectable. Patents may not be issued in connection with pending patent applications, and claims allowed may not be sufficient to allow them to use the inventions that they create exclusively.

Furthermore, any patents issued could be challenged, re-examined, held invalid or unenforceable or circumvented and may not provide sufficient protection or a competitive advantage. In addition, despite efforts to protect and maintain patents, competitors and other third parties may be able to design around their patents or develop products similar to our work products that are not within the scope of their patents. Finally, patents provide certain statutory protection only for a limited period of time that varies depending on the jurisdiction and type of patent.

Prosecution and protection of the rights sought in patent applications and patents can be costly and uncertain, often involve complex legal and factual issues and consume significant time and resources. In addition, the breadth of claims allowed in our patents, their enforceability and our ability to protect and maintain them cannot be predicted with any certainty. The laws of certain countries may not protect intellectual property rights to the same extent as the laws of Israel. Even if our patents are held to be valid and enforceable in a certain jurisdiction, any legal proceedings that we may initiate against third parties to enforce such patents will likely be expensive, take significant time and divert management’s attention from other business matters. We cannot assure that any of our issued patents or pending patent applications provide any protectable, maintainable or enforceable rights or competitive advantages to us.

In addition to patents, we will rely on a combination of proprietary know how, copyrights, trademarks, trade secrets and other related laws and confidentiality procedures and contractual provisions to protect, maintain and enforce our proprietary technology and intellectual property rights in Israel and other countries. However, our ability to protect our brands by registering certain trademarks may be limited. In addition, while we will generally enter into confidentiality and nondisclosure agreements with our employees, consultants, contract manufacturers, distributors and resellers and with others to attempt to limit access to and distribution of our proprietary and confidential information, it is possible that:

| ● | misappropriation of our proprietary and confidential information, including technology, will nevertheless occur; |

| ● | our confidentiality agreements will not be honored or may be rendered unenforceable; |

| ● | third parties will independently develop equivalent, superior or competitive technology or products; |

10

| ● | disputes will arise with our current or future strategic licensees, customers or others concerning the ownership, validity, enforceability, use, patentability or registrability of intellectual property; or |

| ● | unauthorized disclosure of our know-how, trade secrets or other proprietary or confidential information will occur. |

We cannot assure that we will be successful in protecting, maintaining or enforcing our intellectual property rights. If we are unsuccessful in protecting, maintaining or enforcing our intellectual property rights, then our business, operating results and financial condition could be materially adversely affected, which could:

| ● | adversely affect our reputation with customers; |

| ● | be time-consuming and expensive to evaluate and defend; |

| ● | cause product shipment delays or stoppages; |

| ● | divert management’s attention and resources; |

| ● | subject us to significant liabilities and damages; |

| ● | require us to enter into royalty or licensing agreements; or |

| ● | require us to cease certain activities, including the sale of products. |

If it is determined that we have infringed, violated or are infringing or violating a patent or other intellectual property right of any other person or if we are found liable in respect of any other related claim, then, in addition to being liable for potentially substantial damages, we may be prohibited from developing, using, distributing, selling or commercializing certain of our technologies unless we obtain a license from the holder of the patent or other intellectual property right. We cannot assure you that we will be able to obtain any such license on a timely basis or on commercially favorable terms, or that any such licenses will be available, or that workarounds will be feasible and cost-efficient. If we do not obtain such a license or find a cost-efficient workaround, our business, operating results and financial condition could be materially adversely affected and we could be required to cease related business operations in some markets and restructure our business to focus on our continuing operations in other markets.

We may be unable to keep pace with changes in technology as our business and market strategy evolves.

We will need to respond to technological advances in a cost-effective and timely manner in order to remain competitive. The need to respond to technological changes may require us to make substantial, unanticipated expenditures. There can be no assurance that we will be able to respond successfully to technological changes. If we will be unable to respond successfully to technological advance, we may lose our competitive advantage, which could adversely affect our business.

Significant disruptions of our information technology systems or breaches of our data security could adversely affect our business.

A significant invasion, interruption, destruction or breakdown of our information technology systems and/or infrastructure by persons with authorized or unauthorized access could negatively impact our business and operations. We could also experience business interruption, information theft and reputational damage from cyber-attacks, which may compromise our systems and lead to data leakage either internally or at our third-party providers. Our systems may be the target of malware and other cyber-attacks. Although we have invested in measures to reduce these risks, we cannot assure you that these measures will be successful in preventing compromise or disruption of our information technology systems a data.

11

We may be subject to general litigation, regulatory disputes and government inquiries.

As a growing company with expanding operations, we may in the future increasingly face the risk of claims, lawsuits, government investigations and other proceedings involving competition and antitrust, intellectual property, privacy, consumer protection, accessibility claims, securities, tax, labor and employment, commercial disputes, services and other matters. The number and significance of these disputes and inquiries have increased as the political and regulatory landscape changes, and as we have grown larger and expanded in scope and geographic reach, and our services have increased in complexity.

We cannot predict the outcome of such disputes and inquiries with certainty. Regardless of the outcome, these can have an adverse impact on us because of legal costs, diversion of management resources and other factors. Determining reserves for any litigation is a complex, fact-intensive process that is subject to judgment calls. It is possible that a resolution of one or more such proceedings could require us to make substantial payments to satisfy judgments, fines or penalties or to settle claims or proceedings, any of which could harm our business. These proceedings could also result in reputational harm, criminal sanctions, consent decrees or orders preventing us from offering certain products or services or requiring a change in our business practices in costly ways or requiring development of non-infringing or otherwise altered products or technologies. Litigation and other claims and regulatory proceedings against us could result in unexpected expenses and liabilities, which could have a material adverse effect on our business, results of operations, financial condition and prospects.

We have identified material weaknesses in our internal control over financial reporting that could, if not remediated, result in material misstatements in our financial statements. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. As a result, shareholders could lose confidence in our financial and other public reporting, which would harm our business and the trading price of our Ordinary Shares.

Effective internal controls over financial reporting are necessary for us to provide reliable financial reports and, together with adequate disclosure controls and procedures are designed to prevent fraud. Our management will be required to assess the effectiveness of our internal controls and procedures and disclose changes in these controls on an annual basis. However, for as long as we are an “emerging growth company” under the JOBS Act, our independent registered public accounting firm will not be required to attest to the effectiveness of our internal controls over financial reporting pursuant to Section 404.

Any failure to implement required new or improved controls, or difficulties encountered in their implementation could cause us to fail to meet our reporting obligations. In addition, any testing by us conducted in connection with Section 404, or any subsequent testing by our independent registered public accounting firm, may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses or that may require prospective or retroactive changes to our financial statements or identify other areas for further attention or improvement. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our Ordinary Shares.

We have identified material weaknesses in our internal control over financial reporting as of December 31, 2022. As defined in Regulation 12b-2 under the Exchange Act, a “material weakness” is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual financial statements will not be prevented, or detected on a timely basis. Specifically, we determined that the material weaknesses are related to having an insufficient number of financial reporting personnel with an appropriate level of knowledge, experience and training in the application of U.S. GAAP and SEC rules and regulations commensurate with our reporting requirements and inadequate segregation of duties consistent with control objectives.

12

We have taken action toward remediating these material weaknesses by hiring additional qualified personnel with U.S. GAAP accounting and reporting experience, and intend to provide enhanced training to existing financial and accounting employees on related U.S. GAAP issues. In addition, to remediate these material weaknesses, we are implementing measures including the following:

| ● | we have hired a chief financial officer with U.S. GAAP and SEC reporting experience and chief accountant and we are continuing to seek additional financial professionals to increase the number of qualified financial reporting personnel and implement segregation of duties; and |

| ● | we are developing, communicating and implementing an accounting policy manual for our financial reporting personnel for recurring transactions, period-end closing processes and policy relating to segregation of duties. |

However, the implementation of these initiatives may not fully address any material weakness or other deficiencies that we may have in our internal control over financial reporting.

Furthermore, we have not yet commenced the process of determining whether our existing internal control over financial reporting systems are compliant with Section 404 and whether there are any other material weaknesses in our existing internal controls. These controls and other procedures are designed to ensure that information required to be disclosed by us in the reports that we file with the SEC is disclosed accurately and is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms.

Even if we develop effective internal control over financial reporting, these controls may become inadequate because of changes in conditions or the degree of compliance with these policies or procedures may deteriorate, and material weaknesses and deficiencies may be discovered in them. We are working with our legal, independent accounting and financial advisors to identify those areas in which changes should be made to our financial and management control systems to manage our growth and our obligations as a public company. These areas include corporate governance, corporate control, disclosure controls and procedures and financial reporting.

We have made, and will continue to make, changes in these and other areas. In any event, the process of determining whether our existing internal controls are compliant with Section 404 and sufficiently effective will require the investment of substantial time and resources, including by our chief financial officer and other members of our senior management. As a result, this process may divert internal resources and take a significant amount of time and effort to complete, even more so after we are no longer an “Emerging Growth Company.” In addition, we cannot predict the outcome of this process and whether we will need to implement remedial actions in order to implement effective controls over financial reporting. The determination of whether or not our internal controls are sufficient and any remedial actions required could result in us incurring additional costs that we did not anticipate, including the hiring of outside consultants. We may also fail to complete our evaluation, testing and any required remediation needed to comply with Section 404 in a timely fashion. Irrespective of compliance with Section 404, any additional failure of our internal controls could have a material adverse effect on our stated results of operations and harm our reputation. As a result, we may experience higher than anticipated operating expenses, as well as higher independent auditor fees during and after the implementation of these changes. If we are unable to implement any of the required changes to our internal control over financial reporting effectively or efficiently or are required to do so earlier than anticipated, it could adversely affect our operations, financial reporting or results of operations and could result in an adverse opinion on internal controls from our independent auditors.

Furthermore, if we are unable to certify that our internal control over financial reporting is effective and in compliance with Section 404, we may be subject to sanctions or investigations by regulatory authorities, such as the SEC or stock exchanges, and we could lose investor confidence in the accuracy and completeness of our financial reports, which could hurt our business, the price of our Ordinary Shares and our ability to access the capital market.

13

New regulation as well as regulation in new target territories, including regulation relating to unmanned platforms, video and audio systems, may create obstacles to our sales and marketing efforts.

Other than the provisions of the Israeli Encouragement of Industrial Research, Development and Technological Innovation Law, 1984, as amended, and related regulations, or the Research Law, which may restrict our ability to move the production of products developed using grants received from the Israeli Innovation Authority, or the IIA (see “Risk Factors - Risks Related to Israeli Law and our Operations in Israel - We received Israeli government grants for certain of our research and development activities, the terms of which may require us to pay royalties and to satisfy specified conditions in order to manufacture products and transfer technologies outside of Israel. If we fail to satisfy these conditions, we may be required to pay penalties and refund grants previously received” for further information), our products currently are not required to comply with any regulatory obligations in Israel. In events where our products have been required to comply with any foreign regulation, these issues have been under the jurisdiction and responsibility of our local distributors or customers. However, expansion of our operation into new territories, enhancing our sales and marketing in existing foreign territories, as well as new regulations that might be enacted in the future which may apply to our technologies or market segment, may require us in the future to ensure that our products are in compliance with various regulatory constrains or technology standards imposed by local authorities. Such development may require us to make additional expenses in order to ensure compliance, as well as hinder or delay us from entering certain markets, thus adversely affecting our business, financial condition and operational results.

Risks Related to Israeli Law and our Operations in Israel

Political, economic and military instability in Israel may impede our ability to operate and harm our financial results.

Our offices and management team are located in Israel. Accordingly, political, economic, and military conditions in Israel and the surrounding region may directly affect our business and operations. In May and June 2021 and in recent years, Israel has been engaged in sporadic armed conflicts with Hamas, an Islamist terrorist group that controls the Gaza Strip, with Hezbollah, an Islamist terrorist group that controls large portions of southern Lebanon, and with Iranian-backed military forces in Syria. In addition, Iran has threatened to attack Israel and may be developing nuclear weapons. Some of these hostilities were accompanied by missiles being fired from the Gaza Strip against civilian targets in various parts of Israel, including areas in which our employees and some of our consultants are located, and negatively affected business conditions in Israel. Any hostilities involving Israel or the interruption or curtailment of trade between Israel and its trading partners could adversely affect our operations and results of operations.

Our commercial insurance does not cover losses that may occur as a result of events associated with war and terrorism. Although the Israeli government currently covers the reinstatement value of direct damages that are caused by terrorist attacks or acts of war, we cannot assure you that this government coverage will be maintained or that it will sufficiently cover our potential damages. Any losses or damages incurred by us could have a material adverse effect on our business. Any armed conflicts or political instability in the region would likely negatively affect business conditions and could harm our results of operations.

Further, in the past, the State of Israel and Israeli companies have been subjected to economic boycotts. Several countries still restrict business with the State of Israel and with Israeli companies. These restrictive laws and policies may have an adverse impact on our operating results, financial condition or the expansion of our business. A campaign of boycotts, divestment and sanctions has been undertaken against Israel, which could also adversely impact our business.

In addition, many Israeli citizens are obligated to perform several days, and in some cases more, of annual military reserve duty each year until they reach the age of 40 (or older, for reservists who are military officers or who have certain occupations) and, in the event of a military conflict, may be called to active duty. In response to increases in terrorist activity, there have been periods of significant call-ups of military reservists. It is possible that there will be military reserve duty call-ups in the future. Our operations could be disrupted by such call-ups, which may include the call-up of members of our management. Such disruption could materially adversely affect our business, prospects, financial condition and results of operations.

Furthermore, the newly elected Israeli government is currently pursuing extensive changes to Israel’s judicial system, including plans to significantly reduce the Israeli Supreme Court's ability to strike down legislation that it deems unreasonable, and plans to increase political influence over the selection of judges. In response to the foregoing developments, individuals, organizations and institutions, both within and outside of Israel, have voiced concerns that the proposed changes may negatively impact the business environment in Israel including due to reluctance of foreign investors to invest or conduct business in Israel, as well as to increased currency fluctuations, downgrades in credit rating, increased interest rates, increased volatility in securities markets, and other changes in macroeconomic conditions. Such proposed changes may also adversely affect the labor market in Israel or lead to political instability or civil unrest. To the extent that any of these negative developments do occur, they may have an adverse effect on our business, our results of operations and our ability to raise additional funds.

14

Exchange rate fluctuations between foreign currencies and the U.S. Dollar may negatively affect our earnings.

Our reporting and functional currency is the U.S. dollar. Our revenues are currently primarily payable in U.S. dollars and we expect our future revenues to be denominated primarily in U.S. dollars. However, certain amounts of our revenues and expenses are also in NIS and Euro. As a result, we are exposed to the currency fluctuation risks relating to the recording of our expenses in U.S. dollars. We may, in the future, decide to enter into currency hedging transactions. These measures, however, may not adequately protect us from material adverse effects.

We may become subject to claims for remuneration or royalties for assigned service invention rights by our employees, which could result in litigation and adversely affect our business.

A significant portion of our intellectual property has been developed by our employees in the course of their employment for us. Under the Israeli Patent Law, 1967, or the Patent Law, inventions conceived by an employee in the course and as a result of or arising from his or her employment with a company are regarded as “service inventions,” which belong to the employer, absent a specific agreement between the employee and employer giving the employee service invention rights. The Patent Law also provides that if there is no such agreement between an employer and an employee, the Israeli Compensation and Royalties Committee, or the Committee, a body constituted under the Patent Law, will determine whether the employee is entitled to remuneration for his inventions. Recent case law clarifies that the right to receive consideration for “service inventions” can be waived by the employee and that in certain circumstances, such waiver does not necessarily have to be explicit. The Committee will examine, on a case-by-case basis, the general contractual framework between the parties, using interpretation rules of the general Israeli contract laws. Further, the Committee has not yet determined one specific formula for calculating this remuneration (but rather uses the criteria specified in the Patent Law). Although we have entered into assignment-of-invention agreements with all our current and former employees pursuant to which such individuals assign to us all rights to any inventions created in the scope of their employment or engagement with us, we may still face claims demanding remuneration in consideration for assigned inventions. If such claims are found to have merit despite our assignment of invention agreements, we could be required to pay additional remuneration or royalties to our current and/or former employees, or be forced to litigate such claims, which could negatively affect our business.

We received Israeli government grants for certain of our research and development activities, the terms of which may require us to pay royalties and to satisfy specified conditions in order to manufacture products and transfer technologies outside of Israel. If we fail to satisfy these conditions, we may be required to pay penalties and refund grants previously received.

Our research and development efforts were financed in part through grants from the IIA. As of December 31, 2022, we received approximately $396,575 (including accumulated interest) in aggregate from the IIA for the development of our products.

With respect to such grants, in some cases, we are committed to pay royalties at a rate of 3% to 5% on sales proceeds from our products that were developed under IIA programs up to the total amount of grants received, linked to the U.S. dollar and bearing interest at an annual rate of LIBOR applicable to U.S. dollar deposits. As of March 6, 2023, we paid approximately $7,301 in connection with a single sale during 2012. Since 2013, the Company did not utilize the intellectual property that was developed using the governmental grant in any of its products. The total sum of royalties, including accumulated interest, we are required to repay the IIA, as of March 6, 2023, is approximately $285,204, net, after deducting the sums we paid as royalties to the IIA.

15

Regardless of any royalty payment, we are further required to comply with the requirements of the Research Law with respect to those past grants. When a company develops know-how, technology or products using IIA grants, the terms of these grants and the Research Law restrict the transfer of such know-how, and the transfer of manufacturing or manufacturing rights of such products, technologies or know-how outside of Israel, without the prior approval of the IIA. We may not receive those approvals. Furthermore, the IIA may impose certain conditions on any arrangement under which it permits us to transfer technology or development. This may restrict our ability to move the production of our products outside of Israel, or to sell intellectual property and other know-how.

It may be difficult to enforce a judgment of a U.S. court against us and our executive officers and directors and the Israeli experts named in this Annual Report on Form 20-F in Israel or the United States, to assert U.S. securities laws claims in Israel or to serve process on our executive officers and directors and these experts.

We were incorporated in Israel. Substantially all of our executive officers and directors reside outside of the United States, and all of our assets and most of the assets of these persons are located outside of the United States. Therefore, a judgment obtained against us, or any of these persons, including a judgment based on the civil liability provisions of the U.S. federal securities laws, may not be collectible in the United States and may not be enforced by an Israeli court. It also may be difficult for you to effect service of process on these persons in the United States or to assert U.S. securities law claims in original actions instituted in Israel. Additionally, it may be difficult for an investor, or any other person or entity, to initiate an action with respect to U.S. securities laws in Israel. Israeli courts may refuse to hear a claim based on an alleged violation of U.S. securities laws reasoning that Israel is not the most appropriate forum in which to bring such a claim. In addition, even if an Israeli court agrees to hear a claim, it may determine that Israeli law and not U.S. law is applicable to the claim. If U.S. law is found to be applicable, the content of applicable U.S. law must be proven as a fact by expert witnesses, which can be a time consuming and costly process. Certain matters of procedure will also be governed by Israeli law. There is little binding case law in Israel that addresses the matters described above. As a result of the difficulty associated with enforcing a judgment against us in Israel, you may not be able to collect any damages awarded by either a U.S. or foreign court (see “Enforceability of Civil Liabilities” for additional information on your ability to enforce a civil claim against us and our executive officers or directors named in this Annual Report on Form 20-F).

Your rights and responsibilities as a shareholder will be governed in key respects by Israeli laws, which differ in some material respects from the rights and responsibilities of shareholders of U.S. companies.

The rights and responsibilities of the holders of our Ordinary Shares are governed by our articles of association and by Israeli law. These rights and responsibilities differ in some material respects from the rights and responsibilities of shareholders in U.S. companies. In particular, a shareholder of an Israeli company has a duty to act in good faith and in a customary manner in exercising its rights and performing its obligations towards the company and other shareholders, and to refrain from abusing its power in such company, including, among other things, in voting at a general meeting of shareholders on matters such as amendments to a company’s articles of association, increases in a company’s authorized share capital, mergers and acquisitions and related party transactions requiring shareholder approval, as well as a general duty to refrain from discriminating against other shareholders. In addition, a shareholder who is aware that it possesses the power to determine the outcome of a vote at a meeting of the shareholders or to appoint or prevent the appointment of a director or executive officer in the company has a duty of fairness toward the company. There is limited case law available to assist us in understanding the nature of these duties or the implications of these provisions. These provisions may be interpreted to impose additional obligations and liabilities on holders of our ordinary shares that are not typically imposed on shareholders of U.S. companies.

16

Risks Related to Our Status as a Public Company and Ownership of our Ordinary Shares and Warrants

As of December 31, 2022, our principal shareholders, officers and directors beneficially owned approximately 40.87% of our outstanding Ordinary Shares. They will therefore be able to exert significant control over matters submitted to our shareholders for approval.

As of December 31, 2022, our principal shareholders, officers and directors, in the aggregate, beneficially owned approximately 40.87% of our outstanding Ordinary Shares. This significant concentration of share ownership may adversely affect the trading price for our Ordinary Shares because investors often perceive disadvantages in owning shares in companies with controlling shareholders. As a result, these shareholders, if they acted together, could significantly influence matters requiring approval by our shareholders, including the election of directors and the approval of mergers or other business combination transactions. The interests of these shareholders may not always coincide with our interests or the interests of other shareholders.

We are an emerging growth company and any decision on our part to comply only with certain reduced reporting and disclosure requirements applicable to emerging growth companies could make our securities less attractive to investors.

We are an emerging growth company and, for as long as we continue to be an emerging growth company, we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including:

| ● | not being required to have our independent registered public accounting firm audit our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act; |

| ● | permission to delay adopting new or revised accounting standards until such time as those standards apply to private companies; |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports and annual report on Form 20-F; and |

| ● | exemptions from the requirements of holding non-binding advisory votes on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We may take advantage some or all of these and other exemptions until we are no longer an “emerging growth company”. We could be an emerging growth company up to the end of the fiscal year in which the fifth anniversary of the completion of our initial public offering, although we expect to not be an emerging growth company sooner. Our status as an emerging growth company will end as soon as any of the following take place: