UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

OR

for

the fiscal year ended

OR

for the transition period from _________ to _________

OR

Date of event requiring this shell company report: _________

Commission File Number:

(Exact name of registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

CAP Business Center

(Address of principal executive offices)

Chief Executive Officer

MDxHealth, Inc.

United States

+1 949-812-6979

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| American Depositary Shares, each representing 10 ordinary shares, no nominal value per share | The Nasdaq Capital Market | |||

| * | The |

| * | Not for trading, but only in connection with the listing of the American Depositary Shares on The Nasdaq Stock Market LLC. |

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Indicate

the number of outstanding shares of each of the issuer’s class of capital or common stock as of the close of the period

covered by the annual report. Ordinary shares, no nominal value per share:

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Emerging Growth Company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards†

provided pursuant to Section 13(a) of the Exchange Act.

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ☐ Item 18 ☐

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ☐ No

TABLE OF CONTENTS

i

INTRODUCTION

Unless otherwise indicated or the context otherwise requires, references in this annual report to “we,” “our,” “us,” “MDxHealth,” or the “Company” refer to MDxHealth SA and its wholly owned subsidiaries.

We were incorporated on January 10, 2003 as a company with limited liability (naamloze vennootschap/société anonyme) incorporated and operating under the laws of Belgium. We are registered with the legal entities register (Liège) under enterprise number 0479.292.440. We were publicly listed on Euronext Brussels in June 2006. In October 2010 the Company’s name was changed from OncoMethylome Sciences SA to MDx Health SA. We have two wholly owned subsidiaries: MDxHealth, Inc., a Delaware company incorporated in April 2003, and MDxHealth B.V., a Dutch company incorporated in September 2015.

Our headquarters and principal executive offices are located at CAP Business Center, Zone Industrielle des Hauts-Sarts, Rue d’Abhooz 31, 4040 Herstal, Belgium, our telephone number is +32 4 257 70 21 and our email is info@mdxhealth.com. Our website address is www.mdxhealth.com. The information contained on, or accessible through, our website is not incorporated by reference into this annual report, and you should not consider any information contained in, or that can be accessed through, our website as part of this annual report.

Our American Depositary Shares, each representing 10 ordinary shares, began trading on the Nasdaq Capital Market on November 4, 2021. Throughout this annual report, references to ADSs mean American Depository Shares or ordinary shares represented by ADSs, as the case may be. All references in this annual report to “$” are to U.S. dollars and all references to “€” are to Euros. Solely for the convenience of the reader, certain Euro amounts herein have been translated into U.S. dollars at the official exchange rate quoted as of December 31, 2021, by the European Central Bank of €1.00 to 1.1326 These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or any other exchange rate as at that or any other date.

Trademarks and Service Marks

We own various trademark registrations and applications, and unregistered trademarks and service marks. “MDxHealth,” “ConfirmMDx,” “SelectMDx,” the MDxHealth logo and other trademarks or service marks of MDxHealth SA appearing in this annual report are the property of MDxHealth SA or its subsidiaries. Solely for convenience, the trademarks, service marks and trade names referred to in this annual report are listed without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. All other trademarks, trade names and service marks appearing in this annual report are the property of their respective owners. We do not intend to use or display other companies’ trademarks and trade names to imply any relationship with, or endorsement or sponsorship of us by, any other companies.

ii

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. All statements other than statements of historical facts contained in this annual report, including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, objectives of management and expected market growth are forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can find many (but not all) of these statements by looking for words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “would,” “should,” “could,” “may” or other similar expressions in this annual report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or projections, including, but not limited to, those identified under “Item 3.D. Risk Factors” in this annual report. Actual results may differ materially from those discussed as a result of various factors, including, but not limited to:

| ● | our plans relating to commercializing our products and services (collectively “solutions”) and the rate and degree of market acceptance of our solutions; |

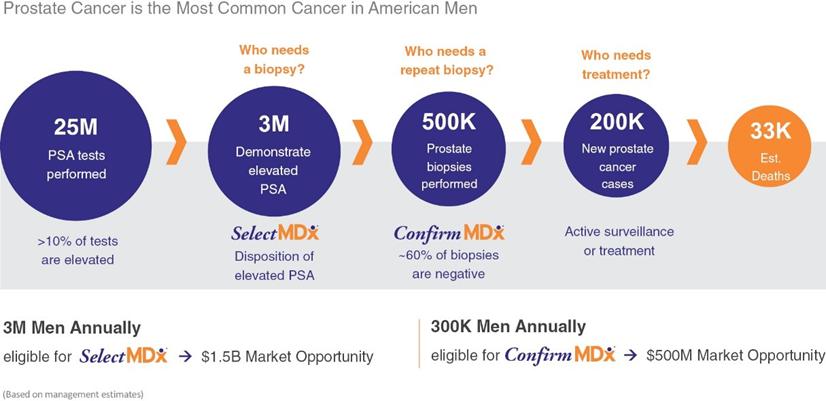

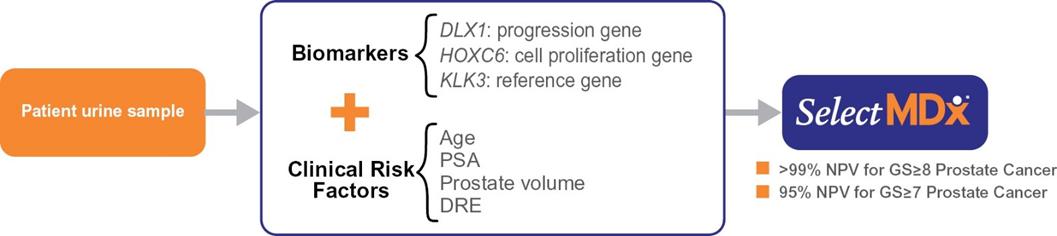

| ● | the size of the market opportunity for our ConfirmMDx and SelectMDx tests and other future tests and solutions we commercialize or may develop; |

| ● | our ability to achieve and maintain adequate levels of coverage or reimbursement for our ConfirmMDx and SelectMDx tests and any future other products solutions we commercialize or may seek to commercialize; |

| ● | our plans relating to the further development of solutions; |

| ● | existing regulations and regulatory developments in the United States, Europe and other jurisdictions; |

| ● | timing, progress and results of our research and development programs; |

| ● | the period over which we estimate our existing cash will be sufficient to fund our future operating expenses and capital expenditure requirements; |

| ● | our ability to attract and retain qualified employees and key personnel; |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights covering our products solutions and technology; |

| ● | our ability to operate our business without infringing the intellectual property rights and proprietary technology of third parties; |

| ● | cost associated with defending intellectual property infringement, product liability and other claims; |

| ● | the impact on our business, financial condition and results of operations from the ongoing and global COVID-19 pandemic, or any other pandemic, epidemic or outbreak of an infectious disease in the United States or worldwide; and |

| ● | other risks and uncertainties, including those listed under “Item 3.D. Risk Factors.” |

These statements reflect our views with respect to future events as of the date of this annual report and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. These forward-looking statements represent our estimates and assumptions only as of the date of this annual report and, except as required by law, we undertake no obligation to update or review publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this annual report. We anticipate that subsequent events and developments will cause our views to change. You should read this annual report and the documents referenced in this annual report and filed as exhibits to the annual report, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

iii

MARKET AND INDUSTRY DATA

Unless otherwise indicated, information contained in this annual report concerning our industry and the markets in which we operate, including our general expectations and market opportunity, is based on information from our own management estimates and research, as well as from industry and general publications, research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Where information has been sourced from third parties, this information has been accurately reproduced. As far as we are aware and are able to ascertain from information published by those third parties, no facts have been omitted which would render the reproduced information inaccurate or misleading. The industry publications and third-party studies generally state that the information that they contain has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this annual report. See “Special Note Regarding Forward-Looking Statements.” These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in our forecasts or estimates or those of independent third parties.

iv

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Our business and our industry are subject to significant risks. You should carefully consider the risks and uncertainties described below, together with all of the other information in this annual report, including our audited consolidated financial statements and related notes. This annual report also includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.” If any of the following risks are realized, our business, financial condition, operating results and prospects could be materially and adversely affected.

Summary of Risk Factors

| ● | The ongoing outbreak of the novel coronavirus (“COVID-19”) resulted in significant declines in sales of our ConfirmMDx and SelectMDx tests during 2020, adversely affected sales in 2021, and could continue to impact volumes in 2022, and our business may experience other adverse effects as a result of the pandemic. |

| ● | We have a history of losses and expect to incur net losses in the future and may never achieve profitability. |

| ● | We might require substantial additional funding to continue our operations and to respond to business needs or take advantage of new business opportunities, which may not be available on acceptable terms, or at all. |

| ● | Our commercial success will depend on the market acceptance and adoption of our current and future tests. |

| ● | Our financial results are largely dependent on sales of one test, and we will need to generate sufficient revenues from this and other future solutions to grow our business. |

| ● | We face uncertainties over the reimbursement of our tests by third party payors. |

| ● | Billing and collections processing for our tests is complex and time-consuming, and any delay in transmitting and collecting claims could have an adverse effect on revenue. |

1

| ● | Our business and reputation will suffer if we are unable to establish and comply with, stringent quality standards to assure that the highest level of quality is observed in the performance of our tests. |

| ● | We expect to make significant investments to research and develop new tests, which may not be successful. |

| ● | Failure to comply with governmental payor regulations could result in us being excluded from participation in Medicare, Medicaid or other governmental payor programs, which would adversely affect our business. |

| ● | We conduct business in a heavily regulated industry, and changes in regulations or violations of regulations may, directly or indirectly, adversely affect our results of operations and financial condition and harm our business. |

| ● | If the FDA were to begin requiring approval or clearance of our tests, we could incur substantial costs and time delays associated with meeting requirements for premarket clearance or approval. The dual listing of our ordinary shares and ADSs following the U.S. offering may adversely affect the liquidity and value of the ADSs. |

Risks Related to Our Business and Industry

The ongoing outbreak of COVID-19 resulted in significant declines in sales of our ConfirmMDx and SelectMDx tests during 2020, adversely affected sales in 2021, and could continue to impact volumes in 2022, and our business may experience other adverse effects as a result of the pandemic.

In March 2020, the World Health Organization declared COVID-19 as a global pandemic. COVID-19 variants, including the “delta” variant and the “omicron” variant have led to a resurgence of individuals affected by the virus and, as such, the pandemic continues to affect various industries, the financial markets globally, which may lead to a further economic downturn and increased market volatility, as well as renewed orders to shelter in place, travel restrictions, and mandated business closures. Economic and business prospects in the United States and other countries declined rapidly due to the COVID-19 pandemic and restrictions on individual and business activity to mitigate the pandemic. Because substantially all of our business operations and our workforce are concentrated in the United States, which has reported significant COVID-19 related cases and mortalities, our business, results of operations, and financial condition have been, and may continue to be, significantly adversely affected.

In terms of the impact of the COVID-19 pandemic on our operations, representative contact with clinicians began to decline in March 2020 due to COVID-19. This affected both ConfirmMDx and SelectMDx volumes and had a negative effect on our revenues and cash flows. Overall, ConfirmMDx and SelectMDx billed volumes declined by 18% and 39% for the full year 2020, respectively, compared to 2019 pre-pandemic volumes. In 2021, compared to 2019 pre-pandemic volumes, ConfirmMDx and SelectMDx billed volumes were lower by 16% and 37%, respectively.

Other impacts of COVID-19 on our business, financial condition, and results of operations have included, but are not limited to, the following:

| ● | although our laboratory facilities remain operational, we temporarily implemented staggered laboratory shifts and work-from-home policies for non-essential personnel beginning in March 2020 which reduced the level of laboratory throughput capacity available to process testing services by around 20% compared to 2019. During 2021, we began to relax our pandemic-related workplace controls with the implementation of our COVID-19 Reopen Plan, but staggered laboratory shifts, and work-from-home policies remain in place pending the continuing resolution of pandemic-related risks in the general population; |

| ● | we have adjusted, and expect to continue to adjust, our precautionary measures at our various locations based on our perception of local recovery levels and applicable governmental regulations and our business could be negatively affected if these precautionary measures prove to be excessive, ineffective or inadequate; |

| ● | while we believe that our laboratories’ current throughput capacity, which was temporarily reduced due to staggered shift policies implemented following the onset of the COVID-19 pandemic, is sufficient to handle current customer demand, there can be no assurance that further resource limitations or interruptions or increases in expected demand will not result in service delays or extended turn-around times for our testing services; |

2

| ● | while our inventories were not materially impacted and we believe that we have and maintain adequate inventories of critical components necessary to process our ConfirmMDx and SelectMDx tests in amounts sufficient to avoid potential disruptions for the next several months, there can be no assurance that our outstanding and future orders needed to maintain appropriate inventories with our component manufacturers will not be delayed or cancelled due to the COVID-19 pandemic; |

| ● | pandemic-related supply chain disruptions (whether caused by restrictions, congestion, or slowdowns in shipping or logistics, increases in demand for certain goods used on our operations, or otherwise) may hinder, or even force us to suspend, operations at some or all of our clinical laboratories; and |

| ● | the healthcare industry and our customers have been negatively impacted by the pandemic, shifting resources toward coronavirus care and limiting non-essential contact with patients, which reduced orders for our testing solutions beginning in March 2020. This has had a negative impact on volumes of our ConfirmMDx and SelectMDx tests. In light of the still high level of cases in the United States and other countries globally, there may be further negative impacts arising from the pandemic. The extent to which COVID-19 affects our operations in 2022 and beyond will ultimately depend on future developments, which remain uncertain and cannot be predicted with confidence, including the progress in vaccinations, the impact of any emerging variants and any additional information that may emerge concerning the severity of COVID-19 and ongoing actions to contain COVID-19 or mitigate its impact. |

These and other factors arising from the COVID-19 pandemic could worsen in the United States or locally at the location of our offices or the offices of our collaborator companies, each of which could further adversely impact our business generally and could have a material adverse impact on our operations and financial condition and results.

We have a history of losses and expect to incur net losses in the future and may never achieve profitability.

We have incurred substantial net losses since our inception, and there can be no assurance that we will achieve profitability. As of December 31, 2021, we had an accumulated deficit of 244.3 million and for the year ended December 31, 2021, we had a net loss of 29.0 million and net cash used in operating activities of $22.5 million. We expect our losses to continue as a result of costs relating to ongoing research and development and for increased sales and marketing costs for existing and planned solutions. These losses have had, and will continue to have, an adverse effect on our working capital, total assets, and stockholders’ equity. Even if we achieve significant revenues, we may not become profitable, and even if we achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Failure to become and remain consistently profitable could adversely affect the market price of our common stock and could significantly impair our ability to raise capital or expand our business in accordance with our growth strategy. Historically, we have been able to raise capital at regular occasions. If we are unable to continue to do this, our ability to operate as a going concern could be seriously compromised.

We may require substantial additional funding to continue our operations and to respond to business needs or take advantage of new business opportunities, which may not be available on acceptable terms, or at all.

Our capital outlays and operating expenditures are expected to increase over the next several years as commercial operations expand. We may require additional equity or debt funding from time to time in case of a shortfall in cash inflows from operations or to respond to business needs or take advantage of new business opportunities, which may not be available at acceptable terms, or at all. For more information about our cash and cash equivalent position or total liquidity position, see also Item 5.B. “Liquidity and Capital Resources.”

If additional funds are raised through the sale of equity, convertible debt or other equity-linked securities, our securityholders’ ownership will be diluted. Any equity securities issued also may provide for rights, preferences or privileges senior to those of holders of ordinary shares. If additional funds are raised by issuing debt securities, these debt securities would have rights, preferences and privileges senior to those of shareholders, and the terms of the debt securities issued could impose significant restrictions on our operations.

If adequate funds are not available, we may have to scale back our operations or limit our research and development activities, which may cause us to grow at a slower pace, or not at all, and our business could be adversely affected.

3

Our term loan contains restrictions that limit our flexibility in operating our business, and if we fail to comply with the covenants and other obligations under our loan agreement, the lenders may be able to accelerate amounts owed under the facility and may foreclose upon the assets securing our obligations.

In September 2019, we entered into a loan facility agreement with Kreos Capital VI (UK) Limited (“Kreos Capital”) which was amended in October 2020 and April 2021. As of December 31, 2021, the facility consisted of a total of €9.0 million ($10.2 million) in term loans, of which €382,500 ($433,220) is convertible into shares of the Company, and a €630,000 ($713,538) convertible loan. We are required to make monthly interest-only payments on the loan through July 2022. Beginning in August 2022 until maturity we are required to make monthly interest and principal payments. The loan matures in October 2023.

The loan agreement is collateralized by substantially all of our assets, including intellectual property related to our ConfirmMDx and SelectMDx tests. The loan agreement also subjects us to certain affirmative and negative covenants, including limitations on our ability to transfer or dispose of assets, merge with or acquire other companies, make investments, pay dividends, incur additional indebtedness and liens and conduct transactions with affiliates. As a result of these covenants, we have certain limitations on the manner in which we can conduct our business, and we may be restricted from engaging in favorable business activities or financing future operations or capital needs until our current debt obligations are paid in full or we obtain the consent of Kreos Capital, which we may not be able to obtain. We cannot be certain that we will be able to generate sufficient cash flow or revenue to meet the financial covenants or pay the principal and accrued interest on the debt.

In addition, upon the occurrence of an event of default, Kreos Capital, among other things, can declare all indebtedness due and payable immediately, which would adversely impact liquidity and reduce the availability of cash flows to fund working capital needs, capital expenditures and other general corporate purposes. An event of default includes, but is not limited to, our failure to pay any amount due and payable under the loan agreement, the breach of any representation or warranty in the loan agreement, the breach of any covenant in the loan agreement (subject to a cure period in some cases), a change in control as defined in the loan agreement, the default on any debt payments to a third party or any voluntary or involuntary insolvency proceeding. If an event of default occurs and we are unable to repay amounts due under the loan agreement, Kreos Capital could foreclose on substantially all of our assets, including secured intellectual property. We cannot be certain that future working capital, borrowings or equity financings will be available to repay or refinance our debt to Kreos Capital or any other debt we may incur in the future.

Our acceptance of a Paycheck Protection Program loan subjects us to a variety of federal regulations and although we may apply for forgiveness of this loan it may not be forgiven.

In April 2020, we qualified for a $2.3 million loan through the Paycheck Protection Program (the “PPP”) of the U.S. Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”), under a loan agreement administered by the U.S. Small Business Administration. By participating in a federal loan program, we become subject to increased governmental oversight and federal regulatory compliance obligations, including potential civil and criminal liability for making false claims or statements under the U.S. False Claims Act, 31 USC. § 3729 et seq. (the “FCA”). Liability under the FCA and similar federal statutes can carry significant potential monetary penalties and potential jail time, and can arise from both “knowing” and “willful” misstatements. FCA violations will result in a civil penalty per false claim, of not less than $11,181 and not more than $22,363, plus treble the government’s actual damages. A person who violates § 3729 will also be held liable for the government’s costs for bringing a civil action to recover any penalty or damages. If, despite our good faith belief that we satisfied all eligibility requirements for the PPP loan, we are found to have been ineligible to receive the PPP loan or in violation of any of the laws or regulations that apply to us in connection with the PPP loan, we may be subject to penalties, including under the FCA, and could be required to repay the PPP loan. Additionally, a review or audit by the SBA or other government entity in connection with any future forgiveness application (if we chose to apply for forgiveness) or claims under the False Claims Act could consume significant financial and management resources. Any of these events could harm our business, results of operations and financial condition.

We may engage in acquisitions that could disrupt our business, cause dilution to our stockholders and reduce our financial resources.

In addition to the acquisition of NovioGendix, a privately held company based in Nijmegen (The Netherlands), in September 2015, we may enter into other transactions in the future to acquire other businesses, products or technologies. We may be unable to realize the anticipated benefits of the acquisitions or do so within the anticipated timeframe. Any acquisitions may not strengthen our competitive position, and these transactions may be viewed negatively by customers or investors. We could incur losses resulting from undiscovered liabilities of the acquired business that are not covered by the indemnification we may obtain from the seller. In addition, we may not be able to successfully integrate the acquired personnel, technologies and operations into our existing business in an effective, timely and non-disruptive manner. If we are unable to do so, the disruption to our operations could result in additional costs or could distract management’s attention from other initiatives.

4

The molecular diagnostics industry is highly competitive and characterized by rapid technological changes and we may be unable to keep pace with our competitors.

The molecular diagnostics field is characterized by rapid technological changes, frequent new product introductions, changing customer preferences, emerging competition, evolving industry and regulatory compliance standards, reimbursement uncertainty and price competition. Moreover, the molecular diagnostics field is intensely competitive both in terms of service and price, and continues to undergo significant consolidation, permitting larger clinical laboratory service providers to increase cost efficiencies and service levels, resulting in more intense competition.

The market for assessing men at risk for prostate cancer is large. As a result, this market has attracted competitors, some of which possess substantially greater financial, selling, logistical and laboratory resources, more experience in dealing with third-party payors, and greater market penetration, purchasing power and marketing budgets, as well as more experience in providing diagnostic services. Some companies and institutions are developing serum-based tests and diagnostic tests based on the detection of proteins, nucleic acids or the presence of fragments of mutated genes in the blood that are associated with prostate cancer. These competitors could have technological, financial, reputational, and market access advantages over us.

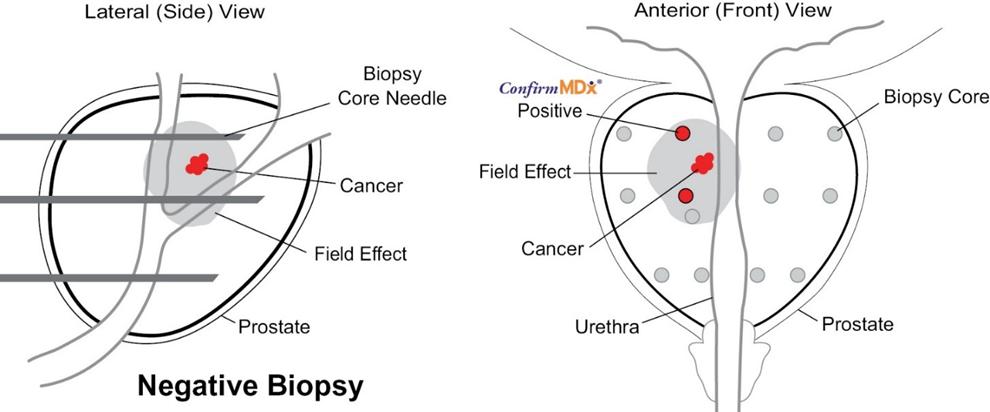

Regarding our ConfirmMDx for Prostate Cancer tissue-based test, several directly competitive products are currently commercially available. In 2014, OPKO Health, Inc., a NYSE listed company, launched the 4Kscore test, a blood based 4-plex test which combines the results of the blood test with clinical information in an algorithm that calculates a patient’s percent risk for aggressive prostate cancer prior to a biopsy. OPKO is the third largest clinical laboratory in the United States, with a significantly larger sales and marketing team than we have. The 4Kscore test obtained FDA marketing approval in December 2021. Offered at a lower price point, the 4Kscore test offers a competitive price advantage over the ConfirmMDx test. The PCA-3 test from Hologic, a urine-based test, is on the U.S. market as an FDA approved test, which may be perceived as providing a competitive advantage since the ConfirmMDx for Prostate Cancer test is not FDA approved. The PCA-3 test is intended for the same patient population as ConfirmMDx for Prostate Cancer, but our performance has only been established in men who were already recommended by urologists for repeat biopsy.

Regarding our SelectMDx for Prostate Cancer tissue-based test, several directly competitive products are currently commercially available. In 2016, ExosomeDx launched the ExoDx (Intelliscore), a urine-based test designed to assess whether a patient presenting for an initial biopsy is at greater risk for high-grade prostate cancer. The ExoDx test competes directly with SelectMDx. In 2018, Bio-Techne Corporation, a large U.S.-based, diversified life sciences company, acquired the ExoDx test. Bio-Techne has greater resources and a significantly larger sales and marketing team than we have. In addition, the ExoDx test may also provide a competitive advantage since, unlike the SelectMDx test, it does not require a prostate massage as part of its specimen collection procedures. In addition to ExoDx, the 4Kscore test offered by OPKO and the Prostate Health Index test, or the “phi score”, offered by Beckman Coulter, both compete directly with the SelectMDx test. Both OPKO and Beckman Coulter have greater resources and a significantly larger sales and marketing team than we do. As a result of these significantly greater resources, these competitors are able to make larger investments into the tests they produce and the sales and marketing of these tests, which may cause us to lose market share. In addition to competitive products, the ConfirmMDx and SelectMDx tests also face competition from multiparametric MRI (“mpMRI”), a clinical diagnostic imaging procedure available to and used by physicians for many years, which focuses on visual tissue analysis. The mpMRI procedure can visually reveal potential locations of abnormal and potentially cancerous prostate tissue characteristics that distinguish tumors from healthy tissue. The visual aspect of diagnostic imaging may feel more accessible and be considered preferable by some physicians over molecular analysis, and there likely is an economic incentive for some physicians to earn a professional fee from the performance of mpMRI procedures. It may be difficult to change the methods or behavior of physicians to incorporate our testing solutions into their practices in conjunction with, or instead of, mpMRI clinical diagnostic imaging procedures. In addition, companies developing or offering capital equipment or point-of-care kits to physicians represent another source of potential competition. These devices are used directly by the physicians or their institutions, which can facilitate adoption.

If we are unable to compete effectively with the abovementioned competitors and with new technologies and procedures such as mpMRI, we may lose market share, which could in turn adversely affect our revenues.

5

Our commercial success will depend on the market acceptance and adoption of our current and future tests.

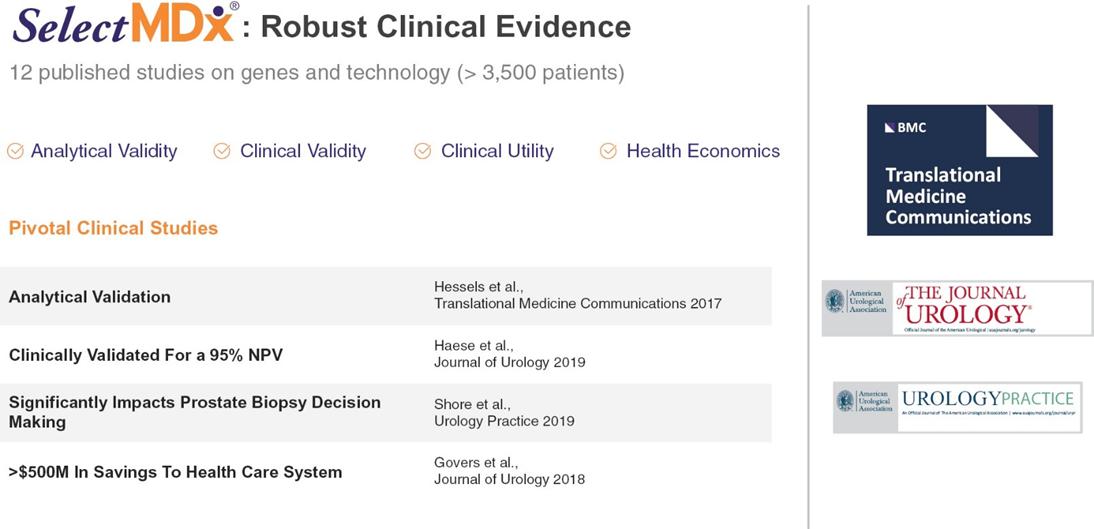

Healthcare providers typically take a long time to adopt new products, testing practices and clinical treatments, partly because of perceived liability risks and the uncertainty of third-party coverage and reimbursement. It is critical to the success of our sales efforts that we educate enough patients, clinicians and administrators about molecular diagnostics testing, in general, as well as about our ConfirmMDx and SelectMDx tests, and demonstrate their clinical benefits. It is likely that clinicians may not adopt, and third-party payors may not cover or adequately reimburse for, our tests unless they determine, based on published peer-reviewed journal articles and the experience of other clinicians, that they provide accurate, reliable and cost-effective information.

As the healthcare reimbursement system in the United States evolves to place greater emphasis on comparative effectiveness and outcomes data, we cannot predict whether we will have sufficient data, or whether the data we have will be presented to the satisfaction of any payors seeking such data, in the process of determining and maintaining coverage for our diagnostic tests. The administration of clinical and economic utility studies is expensive and demands significant attention from the management team. Our largest ongoing study, a multicenter U.S. observational study of ConfirmMDx and SelectMDx entitled a Prospective Validation of Prostate Biomarkers for Repeat Biopsy (“PRIORITY”), has encountered and is expected to continue to experience delays in enrolment and completion as a result of the COVID-19 pandemic. Additionally, we have several smaller post-marketing clinical studies ongoing or planned that are primarily intended to support expanded indications for our ConfirmMDx and SelectMDx tests. There can be no assurance that the PRIORITY study or our other clinical studies will be successfully initiated, enrolled or completed. Also, data collected from these studies may not be positive or consistent with our existing data or may not be statistically significant or compelling to the medical community. If the results obtained from ongoing or future studies are inconsistent with certain results obtained from previous studies, adoption of diagnostic services would suffer, and our business would be harmed.

If our tests or the technology underlying our current or future tests do not receive sufficient favorable exposure in peer-reviewed publications, the rate of clinician adoption of our tests and positive reimbursement coverage decisions for our tests could be negatively affected. See “Risk Factors — We face uncertainties over the reimbursement of our tests by third party payors”. The publication of clinical data in peer-reviewed journals is a crucial step in commercializing and obtaining reimbursement for diagnostic tests, and our inability to control when, if ever, our results are published may delay or limit our ability to derive sufficient revenue from any product that is the subject of a study.

Our financial results are largely dependent on sales of one test, and we will need to generate sufficient revenues from this and other future solutions to grow our business.

Revenues in 2021 and 2020 were largely dependent on the sales of our ConfirmMDx test for Prostate Cancer. Revenues from sales of ConfirmMDx accounted for approximately 91% and 94% of total revenues in 2021 and 2020, respectively. We launched our second test, SelectMDx for Prostate Cancer, in 2016 and we anticipate that sales of SelectMDx will increase and complement sales of ConfirmMDx; however, sales of ConfirmMDx are expected to continue to account for a substantial portion of total revenues for at least the next several years. The commercial success of the ConfirmMDx and SelectMDx tests and our ability to generate sales will depend on several factors, including:

| ● | acceptance by the medical community; |

| ● | the number of patients undergoing a prostate biopsy procedure; |

| ● | acceptance, endorsement and formal policy approval of favorable reimbursement for the test by Medicare and other third-party payors; |

| ● | our ability to successfully market the tests; |

| ● | the amount and nature of competition from other prostate cancer products and procedures; and |

| ● | our ability to establish and maintain commercial distribution, sales force and laboratory testing capabilities. |

Based on our expectation that reimbursement for SelectMDx will increase, we expect that sales of the ConfirmMDx test as a proportion of our total revenues will decrease over the next several years. However, there can be no assurance that SelectMDx will be successfully commercialized. If we are unable to increase sales and reimbursement of SelectMDx and ConfirmMDx or successfully develop and commercialize other solutions or enhancements, our revenues and our ability to achieve profitability would be impaired, and the market price of our shares could decline.

6

We face uncertainties concerning the coverage and reimbursement of our tests by third-party payors.

Successful commercialization of our tests depends, in large part, on the availability of coverage and adequate reimbursement from government and private payors. Favorable third-party payor coverage and reimbursement are essential to meeting our immediate objectives and long-term commercial goals. In the United States, for new diagnostic solutions, each private and government payor decides whether to cover the test, the amount it will reimburse clinical laboratories or other providers for a covered test, and any specific conditions for coverage and reimbursement. Providers may be unlikely to order a specific diagnostic test unless an applicable third-party payor offers meaningful reimbursement for the test. Therefore, adequate coverage and reimbursement is critical to the commercial success of a diagnostic product, and if we are unable to secure and maintain favorable coverage determinations and reimbursement, this will undermine our ability to earn revenue from our products.

Medicare

Reimbursement for diagnostic tests furnished to Medicare beneficiaries (typically patients aged 65 or older) is usually based on a fee schedule set by the U.S. Centers for Medicare & Medicaid Services (“CMS”), a division of the U.S. Department of Health and Human Services (“HHS”). As a Medicare-enrolled laboratory based in California, we bill Noridian Healthcare Solutions (“Noridian”), the Medicare Administrative Contractor (“MAC”), for California, and we are subject to Noridian’s local coverage and reimbursement policies. Noridian participates in the Molecular Diagnostic Services Program (“MolDX”), administered by Palmetto GBA, which handles technical assessments for U.S. laboratories that perform molecular diagnostic testing. In 2014, we obtained a positive LCD under the MolDX program, which provides coverage for ConfirmMDx testing of Medicare patients throughout the United States.

However, Medicare does not currently provide coverage and reimbursement for the SelectMDx test. In early 2019, we submitted clinical and outcomes data on our SelectMDx test to the MolDX program as part of a technical assessment process seeking Medicare coverage. In August 2019, Palmetto GBA issued a favorable draft LCD recommending coverage for the SelectMDx test. However, we were subsequently requested to and submitted an update to our technical assessment under the MolDX program for Medicare coverage of SelectMDx. On May 21, 2021, the MolDX Program issued a draft foundational LCD supporting the clinical utility of SelectMDx. This draft foundational LCD that identifies evidence supporting the clinical utility of the SelectMDx test and, if/when finalized, is expected to support coverage and reimbursement for SelectMDx testing for qualified Medicare patients throughout the United States. The final determination with respect to Medicare coverage and reimbursement of the SelectMDx test therefore remains pending, and there can be no assurance that such coverage and reimbursement will be granted or, if granted, that it will be maintained.

Commercial payors

Obtaining coverage and reimbursement by commercial payors is a time-consuming and costly process, without a guaranteed outcome, since each commercial payor makes its own decision with respect to whether to cover a particular test and, if so, at what rate to reimburse providers for that test. In addition, several payors and other entities conduct technology assessments of new medical tests and devices and provide the results of these assessments for informational purposes to other parties. These assessments may be used by third-party payors and healthcare providers as grounds to deny coverage for a particular test, or to refuse to use or order a particular test or procedure. The ConfirmMDx and SelectMDx tests have received initial negative technology assessments from several of these entities and are likely to receive more negative technology assessments. We continue to work with third-party payors to obtain coverage and reimbursement for our ConfirmMDx and SelectMDx tests and to appeal coverage denial decisions based on existing and ongoing studies, peer reviewed publications, and support from physician and patient groups. There are no assurances that commercial payors will continue to issue positive coverage and reimbursement policies and/or contracts and, if issued, that such policies and/or contracts will be maintained in the future. If our tests are considered on a policy-wide level by major third-party payors, whether at our request or on the payor’s own initiative, and the payor determines that such tests are ineligible for coverage and reimbursement, our revenue potential could be adversely impacted.

Outside the United States

Outside of the United States, various coverage, pricing and reimbursement approvals are required, including through coverage determinations made at the national level under public benefit programs. We expect that it will take several years to establish broad coverage and reimbursement for our tests with payors in countries outside of the United States where we commercialize our solutions, and our efforts may not be successful. Even if public or private reimbursement is obtained, it may cover competing tests, the reimbursement may be conditioned upon local performance of the tests or other requirements we may encounter difficulties in satisfying. Reimbursement levels outside of the United States may vary considerably from the reimbursement amounts we receive in the United States. In addition, because we plan in many circumstances to rely on distributors to obtain reimbursement for our tests, to the extent the distributor does not have direct reimbursement arrangements with payors, we may not be able to retain reimbursement coverage in certain countries with a particular payor; further, if our agreement with a particular distributor is terminated or expires or a distributor fails to pay for other reasons, we could lose reimbursement coverage in that jurisdiction.

Currently, we rely almost entirely on the sale of ConfirmMDx tests in the United States for our revenues, with these tests accounting for approximately 91% and 94% of total revenues in 2021 and 2020, respectively. As noted above, we have not yet obtained Medicare reimbursement for the SelectMDx test and hence the failure to receive a favorable Medicare reimbursement decision will mainly have an impact on our future prospects rather than resulting in an immediate decrease in revenues. If, however, reimbursement for the ConfirmMDx test were to be revoked either by CMS or any of the commercial payors, this could have an immediate impact on our revenues. While we do not believe that revocation of Medicare reimbursement for the ConfirmMDx test is likely, if this were to occur, the impact on us could be severe.

7

Risks Related to Our Intellectual Property

If we are unable to retain intellectual property protection in relation to our main test ConfirmMDx and our second test SelectMDx or if we are required to expend significant resources to protect our intellectual property position, our competitive position could be undercut.

Our ability to protect our discoveries, know-how and technologies affects our ability to compete and to achieve profitability. We rely on a combination of U.S. and foreign patents and patent applications, copyrights, trademarks and trademark applications, confidentiality or non-disclosure agreements, material transfer agreements, licenses and consulting agreements to protect our intellectual property rights. We also maintain certain company know-how, algorithms, and technological innovations designed to provide us with a competitive advantage in the marketplace as trade secrets. As of December 31, 2021, we owned or had exclusive rights to more than 22 patent families related to our molecular technology and cancer-specific biomarkers. Specifically, there are 116 granted or pending patent applications in this group comprised of 16 issued or allowed U.S. patents, 12 pending U.S. provisional or non-provisional applications, 51 pending international patent applications filed under the Patent Cooperation Treaty (“PCT”) and 40 granted or allowed patents in jurisdictions outside the United States, including Japan, Canada, Israel and the major European countries. Our issued U.S. patents expire at various times between 2024 and 2036. Of these issued patents, two cover intellectual property used in our ConfirmMDx test, one of which expires in November 2022 and the other of which expires in 2024, and one covers intellectual property used in our SelectMDx test which expires in 2036. When these patents expire other companies will no longer be prohibited from incorporating the subject intellectual property into competing tests they may seek to develop.

While we intend to pursue additional and future patent applications, it is possible that pending patent applications and any future applications may not result in issued patents. Even if patents are issued, third parties may independently develop similar or competing technology that avoids our patents. Third parties may also assert infringement or other intellectual property claims against us or against our licensors, licensees, suppliers or strategic partners. Any actions regarding patents could be costly and time-consuming and could divert the attention of management and key personnel from other areas of our business. Further, we cannot be certain that the steps we have taken will prevent the misappropriation of our trade secrets and other confidential information as well as the misuse of our patents and other intellectual property, particularly in foreign countries with no patent protection.

Although we have licensed and own issued patents in the United States and foreign countries, we cannot be certain the claims will continue to be considered patentable by the U.S. Patent and Trademark Office (the “USPTO”), U.S. courts patent offices and courts in other jurisdictions. The U.S. Supreme Court, other federal courts and/or the USPTO, may change the standards of patentability and any such changes could have a negative impact on our business. For instance, the Federal Circuit has recently ruled on several patent cases, such as Univ. of Utah Research Found. v. Ambry Genetics Corp., 774 F.3d 755 (Fed. Cir. 2014), Ariosa Diagnostics, Inc. v. Sequenom, Inc., 788 F.3d 1371 (Fed. Cir. 2015), Genetic Tech. Ltd. v. Merial LLC, 818 F.3d 1369 (Fed. Cir. 2016), and Cleveland Clinic Found. v. True Health Diagnostics, 859 F.3d 1352 (Fed. Cir. 2017), that some diagnostic method claims are not patent eligible. These decisions have narrowed the scope of patent protection available in certain circumstances or weakened the rights of patent owners in certain situations. Some aspects of our technology involve processes that may be subject to this evolving standard and we cannot guarantee that any of our issued or pending process claims will be patentable as a result of such evolving standards. In addition, this combination of decisions has created uncertainty as to the value of certain issued patents, in particular in the detection of prostate cancer and other cancers.

We may be subject to substantial costs and liabilities, or be prevented from using technologies incorporated in our ConfirmMDx and SelectMDx tests, as a result of litigation or other proceedings relating to patent rights.

Third parties may assert infringement or other intellectual property claims against us or our licensors, licensees, suppliers or strategic partners. We pursue a patent strategy that we believe provides us with a competitive advantage in the assessment of prostate cancer and is designed to maximize patent protection against third parties in the United States and, potentially, in certain foreign countries. In order to protect or enforce our patent rights, we may have to initiate actions against third parties. Any actions regarding patents could be costly and time-consuming and could divert the attention of management and key personnel from other areas of our business. Additionally, such actions could result in challenges to the validity or applicability of our patents. Because the USPTO maintains patent applications in secrecy until a patent application is published or the patent is issued, we have no way of knowing if others may have filed patent applications covering technologies used by us or our partners. Additionally, there may be third-party patents, patent applications and other intellectual property relevant our technologies that may block or compete with our technologies. Even if third-party claims are without merit, defending a lawsuit may result in substantial expense to us and may divert the attention of management and key personnel. In addition, we cannot provide assurance that we would prevail in any such suits or that the damages or other remedies, if any, awarded against us would not be substantial. Claims of intellectual property infringement may require us, or our strategic partners, to enter into royalty or license agreements with third parties that may not be available on acceptable terms, if at all. These claims may also result in injunctions which could prevent us from further developing and commercializing services or products containing our technologies, which could in turn adversely affect our ability to earn revenues from these services or products.

8

Also, patents and patent applications owned by us may become the subject of post grant challenges or interference proceedings in the USPTO to determine validity and the priority of invention, which could result in substantial cost as well as a possible adverse decision as to the validity or priority of invention of the patent or patent application involved. An adverse decision in an interference proceeding may result in the loss of rights under a patent or patent application subject to such a proceeding.

Ultimately, the potential weakening of our intellectual property position as a result of the evolution of case law or otherwise may make us more vulnerable to competition. While we are unable to quantify the impact of this risk given that our patents remain untested in the courts, the impact could be severe if our competitors are able to take advantage of any weakening of our intellectual property position.

We rely on strategic collaborative and license arrangements with third parties to develop critical intellectual property. We may not be able to successfully establish and maintain such intellectual property.

The development and commercialization of our products and services rely, directly or indirectly, upon strategic collaborations and license agreements with third parties. We have a license agreement with an academic institution pursuant to which we have incorporated licensed technology into our ConfirmMDx test and may incorporate licensed technology into our pipeline products. Our dependence on license, collaboration and other similar agreements with third parties may subject us to a number of risks. There can be no assurance that any current contractual arrangements between us and third parties or between our strategic partners and other third parties will be continued on materially similar terms and will not be breached or terminated early. Any failure to obtain or retain the rights to necessary technologies on acceptable commercial terms could require us to re-configure our products and services, which could negatively impact their commercial sale or increase the associated costs, either of which could materially harm our business and adversely affect our future revenues and ability to achieve sustained profitability.

We expect to continue and expand our reliance on collaboration and license arrangements. Establishing new strategic collaborations and license arrangements is difficult and time-consuming. Discussions with potential collaborators or licensors may not lead to the establishment of collaborations on favorable terms, if at all. To the extent we agree to work exclusively with one collaborator in a given area, our opportunities to collaborate with other entities could be limited. Potential collaborators or licensors may reject collaborations with us based upon their assessment of our financial, regulatory or intellectual property position or other factors. Even if we successfully establish new collaborations, these relationships may never result in the successful commercialization of any product or service. In addition, the success of the projects that require collaboration with third parties will be dependent on the continued success of such collaborators. There is no guarantee that our collaborators will continue to be successful and, as a result, we may expend considerable time and resources developing products or services that will not ultimately be commercialized.

9

Risks Related to Our Operations

Billing and collections processing for our tests is complex and time-consuming, and any delay in transmitting and collecting for claims could adversely impact revenue.

Substantially all of our current revenue is derived from the use of our ConfirmMDx test, which is billed on a fee-for-service basis and paid, for example by hospitals and direct payments from individual patients, and may be reimbursed by third-party payors, including Medicare and other governmental payor programs, private insurance plans and managed care organizations. Billing for molecular diagnostics testing services is complex, time-consuming, and expensive. We are often obligated to bill services in the specific manner required by each particular third-party payor. Failure to comply with these complex billing requirements (including complex federal and state regulations related to billing government health care programs, e.g., Medicare and Medicaid) may significantly hinder our collection and retention efforts, including not only potential write-offs of doubtful accounts and long collection cycles for accounts receivable, but also the potential disgorgement of previously paid claims based on third-party payor program integrity investigations into billing discrepancies, fraud, waste and abuse. With CMS’ recent implementation of a comprehensive oversight regime that consolidated program integrity powers into a single Unified Program Integrity Contractor (“UPIC”), audit and investigatory activity into billing fraud, waste and abuse in the industry has in recent years significantly increased. Responding to requests from a UPIC, or other auditor, is often time-consuming and requires dedication of internal, and sometimes external, resources. UPICs also have the authority to implement Medicare payment suspensions during the pendency of an audit, which could significantly impact cash flows, even where no improper billing is ultimately found to have occurred. Commercial payors may also engage in audit activity, requiring timely production of medical documentation in support of billed claims.

Among the potential factors that can complicate third-party payor billing are:

| ● | differences between the list price for our tests and the reimbursement rates of payors; |

| ● | compliance with complex federal and state regulations related to billing government health care programs, (e.g., Medicare and Medicaid); |

| ● | disputes among payors as to which party is responsible for payment; |

| ● | differences in coverage among payors and the effect of patient co-payments or co-insurance; |

| ● | differences in information and billing requirements among payors; |

| ● | incorrect or missing billing information; and |

| ● | the resources required to manage the billing and claims appeals process. |

During the fourth quarter of 2019, and based on recent and historical collections data, we updated certain assumptions to our estimates, which affected our revenues. These included a revision to the period that a vast majority of collections would occur (from 24 months to 12 months); an updated lookback period for historical collection experience in order to use more recent and relevant collection data; and recognition on a cash basis if no historical payment experience is available. Updating these revenue recognition estimates negatively affected our revenues in 2019 in the amount of $10.1 million.

We face an inherent risk of product liability claims.

The marketing, sale and use of our tests could lead to product or professional liability claims against us if someone were to allege that our tests failed to perform as they were designed, or if someone were to misinterpret test results or improperly rely on them for clinical decisions. Although we maintain product and professional liability insurance which is deemed to be appropriate and adequate, it may not fully protect us from the financial impact of defending against product liability or professional liability claims or any judgments, fines or settlement costs arising out of any such claims. Furthermore, any product liability lawsuit, with or without merit, could increase our insurance rates or prevent us from securing insurance coverage in the future. Additionally, any product liability lawsuit could harm our reputation, which could impact our results of operations, or cause collaboration partners to terminate existing agreements and potential partners to seek alternate partners, any of which could negatively impact our results of operations.

10

Failure to attract or retain key personnel or to secure the support of key scientific collaborators could materially adversely impact our business.

Our success in implementing our business strategy depends largely on the skills, experience, and performance of key members of our executive management team and others in key management positions, including Michael McGarrity, our Chief Executive Officer. The collective efforts of our executive management team are critical to us as we continue to develop our technologies, tests, and R&D and sales programs. As a result of the difficulty in locating qualified new management, the loss or incapacity of existing members of our executive management team could adversely affect our operations. If we were to lose one or more of these key employees, we could experience difficulties in finding qualified successors, competing effectively, developing our technologies and implementing our business strategy. Our executives have employment agreements; however, the existence of an employment agreement does not guarantee retention of members of our executive management team. We do not maintain “key person” life insurance on any of our employees.

We have established relationships with leading key opinion leaders and scientists at important research and academic institutions that we believe are key to establishing tests using our technologies as a standard of care for cancer assessment and diagnosis. If our collaborators determine that cancer testing using our technologies are not appropriate options for prostate cancer diagnosis, or superior to available prostate cancer methods, or that alternative technologies would be more effective in the early diagnosis of prostate cancer, we would encounter significant difficulty establishing tests using our technologies as a standard of care for prostate cancer diagnosis, which would limit our revenue growth and profitability.

Our results of operations can be adversely affected by labor shortages, turnover and labor cost increases.

Labor is a significant component of operating our business. A number of factors may adversely affect the labor force available to us or increase labor costs, including high employment levels, federal unemployment subsidies, including unemployment benefits offered in response to the COVID-19 pandemic, increased wages offered by other employers, vaccine mandates and other government regulations and our responses thereto. As more employers offer remote work, we may have more difficulty recruiting for jobs that require on-site attendance, such as certain clinical laboratory and sales roles. Although we have not experienced any material labor shortage to date, we have recently observed an overall tightening and increasingly competitive labor market. A sustained labor shortage or increased turnover rates within our employee base, caused by COVID-19 or as a result of general macroeconomic factors, could lead to increased costs, such as increased overtime or financial incentives to meet demand and increased wage rates to attract and retain employees, and could negatively affect our ability to efficiently operate our clinical laboratories and overall business. If we are unable to hire and retain employees capable of performing at a high-level, or if mitigation measures we may take to respond to a decrease in labor availability have unintended negative effects, our business could be adversely affected.

Additionally, the operations of our vendors and partners could also suffer from labor shortages, turnover and labor cost increases which could result in supply change disruptions and increases in the costs of the products and services we purchase, each of which could adversely affect our operations.

Our business and reputation will suffer if we are unable to establish and comply with, stringent quality standards to assure that the highest level of quality is observed in the performance of our tests.

Inherent risks are involved in providing and marketing cancer tests and related services. Patients and healthcare providers rely on us to provide accurate clinical and diagnostic information that may be used to make critical healthcare decisions. As such, users of our tests may have a greater sensitivity to errors than users of some other types of products and services.

Past or future performance or accuracy defects, incomplete or improper quality and process controls, excessively slow turnaround times, unanticipated uses of our tests or mishandling of samples or test results (whether by us, patients, healthcare providers, courier delivery services or others) can lead to adverse outcomes for patients and interruptions to our services. These events could lead to voluntary or legally mandated safety alerts relating to our tests or our laboratory facilities and could result in the removal of our products and services from the market or the suspension of our laboratories’ operations. Insufficient quality controls and any resulting negative outcomes could result in significant costs and litigation, as well as negative publicity that could reduce demand for our tests and payors’ willingness to cover our tests. Even if we maintain adequate controls and procedures, damaging and costly errors may occur.

11

Our laboratory facilities may become inoperable due to natural or man-made disasters or regulatory sanctions.

We currently perform all of our testing in our laboratory facilities located in Irvine, California, Plano, Texas and Nijmegen, The Netherlands. Our laboratory facilities could become inoperable due to circumstances that may be beyond our control, and such inoperability could adversely affect our business and operations. The facilities, equipment and other business process systems would be costly to replace and could require substantial time to repair or replace.

The facilities may be damaged or destroyed by natural or man-made disasters, including earthquakes, wildfires, floods, outbreak of disease (such as the ongoing COVID-19 pandemic), acts of terrorism or other criminal activities and power outages, which may render it difficult or impossible for us to perform our tests for some period.

The facilities may also be rendered inoperable because of regulatory sanction. In the United States, we are subject to federal and state laws and regulations regarding the operation of clinical laboratories. Our U.S. laboratory facilities in Irvine, California and Plano, Texas are certified under CLIA. CLIA and the laws of California and certain other states, impose certification requirements for clinical laboratories, and establish standards for quality assurance and quality control, among other things. Clinical laboratories are subject to inspection by regulators, and to sanctions for failing to comply with applicable requirements. Sanctions available under CLIA include prohibiting a laboratory from running tests, requiring a laboratory to implement a corrective action plan, and imposing civil monetary penalties. Our U.S. laboratory facility in Irvine, California holds a certificate of accreditation from CMS to perform high-complexity testing, which is managed by California Laboratory Field Services (“CA LFS”). To renew this certificate, the facility is subject to survey and inspection every two years. We also hold a certificate of accreditation from the College of American Pathologists (“CAP”), which sets standards that are higher than those contained in the CLIA regulations. CAP is an independent, non-governmental organization of board-certified pathologists that accredits laboratories nationwide on a voluntary basis. Because CAP has deemed status with CA LFS, biennial inspections will be performed by teams formed by CAP. Sanctions for failure to comply with CAP or CLIA requirements, including proficiency testing violations, may include suspension, revocation, or limitation of a laboratory’s CLIA certificate, which is necessary to conduct business, as well as the imposition of significant fines or criminal penalties. In addition, our Irvine facility is subject to regulation under state laws and regulations governing laboratory licensure. Two states, one of which is New York, have enacted state licensure laws that are more stringent than CLIA. Failure to maintain CLIA certification, CAP accreditation, or required state licenses could have a material adverse effect on the sales of our tests and results of operations. The Irvine facility receives samples from all 50 U.S. states and certain provinces in Canada. Many states maintain independent licensure, registration, or certification procedures with which our Irvine facility must maintain compliance in order to receive and test samples from that location.

Maintaining compliance with the myriad of governmental requirements is time and resource intensive, and failure to maintain compliance could result in sanctions.

We rely on a limited number of third-party suppliers for services and items used in the production and operation of our testing solutions, and some of those services and items are supplied from a single source. Disruption of the supply chain, unavailability of third-party services required for the performance of the tests, modifications of certain items or failure to achieve economies of scale could have a material adverse effect on us.

In connection with our role as a CLIA-certified provider of laboratory services, we assist healthcare providers with certain logistics related to the collection and return of samples for testing. To provide our ConfirmMDx and SelectMDx services, we are required to obtain customized components and services that are currently available from a limited number of sources. Most of these components and services are sourced externally from approximately 40 external suppliers. Many of the consumable supplies and reagents used as raw materials in our testing process are procured from a limited number of suppliers, some of which are single source. In addition, we rely on a limited number of suppliers, or in some cases a single supplier (for example, for the automation of our deparaffination steps for our ConfirmMDx test), for certain services and equipment with which we provide testing services. If we have to switch to a replacement supplier for any of these items that are sub-components or for certain services required for the performance of our tests, or if we have to commence our own manufacturing or testing to satisfy market demand, we may face additional delays. For example, in the past, a supplier has delivered critical non-conforming components that failed our acceptance testing, requiring us to audit the supplier and assist the supplier in improving our internal quality processes. In addition, third party suppliers may be subject to circumstances which impact their ability to supply, including enforcement action by regulatory authorities, natural disasters (e.g., hurricanes, earthquakes, disease and terrorism), epidemics (e.g., the ongoing COVID-19 pandemic), industrial action (e.g., strikes), financial difficulties including insolvency, among a variety of other internal or external factors. Any such supply disruptions could in turn result in service disruptions for an extended period of time, which could delay completion of our clinical studies or commercialization activities and prevent us from achieving or maintaining profitability. While we were able to qualify alternative suppliers to address COVID-19 related disruptions, in the future alternative suppliers may be unavailable, may be unwilling to supply, may not have the necessary regulatory approvals, or may not have in place an adequate quality management systems. Furthermore, modifications to a service or items or inclusions of certain services or items made by a third-party supplier could require new approvals from the relevant regulatory authorities before the modified service or item may be used, for example any modifications to the assembly and packaging of items for our testing services supplied to healthcare providers. While we have not experienced any material supply chain disruptions to date, if we were to experience such disruptions, whether as a result of the COVID-19 pandemic or otherwise, this could have an immediate impact on revenues if it related to the ConfirmMDx test, and the impact could be material depending on the length of the supply disruption.

12

Failures in our information technology, telecommunications or other systems could significantly disrupt our operations.

We use information technology and telecommunications systems across virtually all aspects of our business, including laboratory testing, sales, billing, customer service, logistics and management of data, including patient information. Our information technology, telecommunications and other systems, are vulnerable to damage and failure, computer viruses, acts of God and physical or electronic break-ins. Despite the precautionary measures we have taken to prevent breakdowns in our information technology and telecommunications systems, sustained or repeated system failures that interrupt our ability to process test orders, deliver test results or perform tests in a timely manner or that cause us to lose patient information could adversely affect our business, results of operations and financial condition.

Although we maintain cyber liability insurance which we believe to be appropriate and adequate, the levels and terms of coverage may not be adequate to compensate us for losses that may arise from any such disruption, failure or security breach. In addition, such insurance may not be available to us in the future on economically reasonable terms, or at all. Further, insurance may not cover all claims made against us and could have high deductibles in any event, and defending a suit, regardless of its merit, could be costly and divert management attention.

Security breaches or loss of data may harm our reputation, expose us to liability and adversely affect our business.

If we experience any security breaches or loss of data or if we fail to comply with data protection laws and regulations, we could be subject to government enforcement actions (which could include civil or criminal penalties), private litigation and/or adverse publicity, which could negatively affect our results of operations and business.

We face four primary risks relative to protecting sensitive and critical personally identifiable information, intellectual property or other proprietary business information about our customers, payors, recipients and collaboration partners, including test results: (1) loss of access risk, (2) inappropriate disclosure or access risk, (3) inappropriate modification risk, and (4) the risk of being unable to identify and audit controls over the first three risks. While we devote significant resources to protecting such information, the measures we introduce may not be sufficient to guard against security breaches, the loss or misappropriation of data, privacy violations or the failure to implement satisfactory remedial measures, which could in turn disrupt operations and lead to reputational damage, regulatory penalties and other material financial losses.