Exhibit 99.1

BRAGG GAMING GROUP INC.

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2023

DATED: March 26, 2024

|

| Page |

| 1 | |

| 1 | |

| 2 | |

| 4 | |

| 4 | |

| 6 | |

| 10 | |

| 24 | |

| 47 | |

| 47 | |

| 48 | |

| 50 | |

| 53 | |

| 53 | |

| 53 | |

| 54 | |

| 54 | |

| 54 | |

| 57 | |

| A-1 |

-i-

EXPLANATORY NOTES AND OTHER INFORMATION

In this annual information form ("AIF" or "Annual Information Form"), unless the context otherwise requires, all references to the "Company", "Bragg", "we", "us", or "our" refers to Bragg Gaming Group Inc., together with its wholly-owned subsidiaries and entities.

In this AIF, unless the context otherwise requires, all references to "Oryx" refers to Oryx Gaming International LLC, together with its wholly-owned subsidiaries and entities on a consolidated basis.

This AIF applies to the business activities and operations of the Company for the year ended December 31, 2023, unless otherwise indicated.

This AIF contains company names, product names, trade names, trademarks and service marks of the Company and other organizations, all of which are the property of their respective owners.

Except as otherwise indicated in this AIF, references to "Canadian dollars" or "C$" are to the currency of Canada, references to "U.S. dollars" or "US$" are to the currency of the United States, references to "GBP" or "£" are to the currency of the United Kingdom and references to "EUR" or "€" are to European Euros.

The following table sets forth, for the periods indicated, the high, low, average and period-end rates of exchange for one U.S. dollar, expressed in Canadian dollars, published by the Bank of Canada (based on the daily average rates as reported by the Bank of Canada).

| | Year Ended | | Year Ended |

| | December 31, | | December 31, |

|

| 2023 |

| 2022 |

High |

| 1.3875 |

| 1.3856 |

Low |

| 1.3128 |

| 1.2451 |

Average rate per period |

| 1.3497 |

| 1.3013 |

Rate at end of period |

| 1.3226 |

| 1.3544 |

The following table sets forth, for the periods indicated, the high, low, average and period-end rates of exchange for one Euro, expressed in Canadian dollars, published by the Bank of Canada (based on the daily average rates as reported by the Bank of Canada).

| | Year Ended | | Year Ended |

| | December 31, | | December 31, |

|

| 2023 |

| 2022 |

High |

| 1.5053 |

| 1.4606 |

Low |

| 1.4211 |

| 1.2897 |

Average rate per period |

| 1.4596 |

| 1.3696 |

Rate at end of period |

| 1.4626 |

| 1.4458 |

The following table sets forth, for the periods indicated, the high, low, average and period-end rates of exchange for one British pound sterling, expressed in Canadian dollars, published by the Bank of Canada (based on the daily average rates as reported by the Bank of Canada).

| | Year Ended | | Year Ended |

| | December 31, | | December 31, |

|

| 2023 |

| 2022 |

High |

| 1.7281 |

| 1.7313 |

Low |

| 1.6115 |

| 1.4731 |

Average rate per period |

| 1.6783 |

| 1.6076 |

Rate at end of period |

| 1.6837 |

| 1.6322 |

1

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

This AIF contains certain "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") which are based upon the Company's current internal expectations, estimates, projections, assumptions and beliefs which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control and many of which, regarding future business decisions, are subject to change. Such forward-looking information may include information regarding our financial position, business strategy, growth strategies, status of acquisitions, status of licensing and certification in new markets, addressable markets, budgets, operations, financial results, taxes, dividend policy, plans and objectives. Particularly, statements regarding our expectations of future results, management's interpretation of laws, performance, achievements, prospects or opportunities or the markets in which we operate, as well as statements relating to expectations regarding industry trends, regulatory developments in new markets, our ability to continually diversify and reduce our exposure to any single market, our growth rates, the achievement of advances in and expansion of our platforms, expectations regarding our revenue and the revenue generation potential of our business, expected acquisition outcomes and synergies, management's interpretation of regulatory regimes and future developments, our business plans and strategies, and our competitive position in our industry are forward-looking statements.

In some cases, such statements can be identified by the use of forward-looking terminology such as "expect", "likely", "may", "will", "should", "would", "intend", or "anticipate", "potential", "proposed", "estimate" and other similar words, including negative and grammatical variations thereof, or statements that certain events or conditions "may" or "will" happen, or by discussions of strategy. Forward-looking statements include estimates, plans, expectations, opinions, forecasts, projections, targets, guidance, or other statements that are not statements of historical fact. Such forward-looking statements are made as of the date of this AIF.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. The Company is unable to guarantee future results, levels of activity, performance or achievements. Moreover, neither the Company nor any other person assumes responsibility for the outcome of the forward-looking statements. Many of the risks and other factors which could cause results to differ materially from those expressed in the forward-looking statements contained in this AIF are beyond the control of the Company. The risks and other factors include, but are not limited to:

| ● | volatility and fluctuation of the market price of the common shares of the Company (the "Common Shares"); |

| ● | increased costs as a result of being a public company in the United States; |

| ● | enforcing civil liabilities in Canada under United States securities laws; |

| ● | subordination of the rights of holders of Common Shares; |

| ● | the concentration of ownership of the Common Shares; |

| ● | negative cash flows from operations; |

| ● | dependence on a small number of significant customers for a large portion of revenue; |

| ● | reliance on third-parties for gaming content; |

| ● | the integrity, reliability, and operational performance of content aggregation, parsing and distribution; |

| ● | costs to maintain, transfer, and receive personal data; |

| ● | the potential registration of users or end users prior to accessing offerings; |

| ● | cyberattacks and security vulnerabilities; |

| ● | dependence on the services and performance of key executives; |

| ● | failure to adapt to rapid technological developments in the gaming industry; |

| ● | requirement for additional capital in order to carry out business objectives; |

| ● | potential future conflict of interest concerns with management, directors, and officers of the Company; |

| ● | current global financial conditions; |

| ● | the legal framework, ways of working, and conduct of business affairs in certain jurisdictions; |

| ● | growth-related risks; |

| ● | acquisition risks; |

2

| ● | online transaction risks including collusion to defraud, launder money, or other illegal activities; |

| ● | uncertainty surrounding the post Brexit Trade Agreement; |

| ● | reputational challenges of dealing in the gaming industry; |

| ● | concentration of credit risk; |

| ● | risk that the Company will not be able to meet its financial obligations as they fall due; |

| ● | unintended legal consequences of specific software use; |

| ● | the requirement to obtain government permits, approvals, or licences; |

| ● | requirements and legislation surrounding the need for formal responsible gaming initiatives though legislative, policy, and other processes; |

| ● | customers' provision of gaming services to players in unregulated markets; |

| ● | criminality of activities based on legislative interpretation; |

| ● | evolving regulatory perception of gaming operators and suppliers; |

| ● | deriving revenues from players located in jurisdictions in which the Company does not hold a licence; |

| ● | changes in taxation rates or law, or misinterpretation of the law; |

| ● | the loss of a license or registration from any of the Company's customers; and |

| ● | any other factors discussed under "Risk Factors" herein. |

Readers are cautioned that the foregoing list of factors is not exhaustive and that additional information on these and other factors that could affect the Company’s operations or financial results is discussed in this AIF. Copies of this AIF are available electronically under the Company’s profile on SEDAR+ at www.sedarplus.ca and from EDGAR at www.sec.gov. The above summary of risks related to forward-looking statements is included in this AIF in order to provide readers with a more complete perspective on the future operations of the Company. Readers are cautioned that this information may not be appropriate for other purposes.

With respect to forward-looking statements contained in this AIF, the Company has made assumptions regarding, among other things: the Company’s ability to obtain and maintain licenses; market demand for online gaming services; present and future business strategies; the impact of increasing competition; conditions in general economic and financial markets; the environment in which the Company will operate in the future, including the ability to obtain services and supplies in a timely manner to carry out the Company’s activities; current technology; cash flow; future exchange rates; timing and amount of capital expenditures; effects of regulation by governmental agencies; future operating costs; and the Company’s ability to obtain financing on acceptable terms.

If any of these risks or uncertainties materialize, or if the opinions, estimates or assumptions underlying the forward- looking statements prove incorrect, actual results or future events might vary materially from those anticipated in the forward-looking statements. The opinions, estimates or assumptions referred to above and described in greater detail in "Risk Factors" should be considered carefully by prospective investors.

In addition, statements that "we believe" and similar statements reflect our beliefs and opinions on the relevant subject. Forward-looking information is provided for the purpose of presenting information about management’s current expectations and plans relating to the future and allowing investors and others to get a better understanding of our anticipated financial position, results of operations and operating environment. Readers are cautioned that such information may not be appropriate for other purposes.

Although we have attempted to identify important risk factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other risk factors not presently known to us or that we presently believe are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking statements. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, prospective investors should not place undue reliance on forward-looking statements, which speak only as of the date made.

3

The forward-looking statements contained in this AIF are expressly qualified by this cautionary statement. The Company is not under any duty to update or revise any of the forward-looking statements except as expressly required by applicable securities laws.

This AIF makes reference to certain non-IFRS measures. These non-IFRS measures are not recognized measures under International Financial Reporting Standards ("IFRS") and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these non-IFRS measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management’s perspective. Accordingly, these non-IFRS measures should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS. The Company uses the non-IFRS financial measures "EBITDA" and "Adjusted EBITDA" (each defined below). These non-IFRS measures are used to provide investors with supplemental measures of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS measures. The Company also believes that securities analysts, investors and other interested parties frequently use non-IFRS measures in the evaluation of issuers. The Company's management uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation.

The Company defined such non-IFRS measures as follows:

"EBITDA" is calculated by adding back certain non-cash items to net income or loss from continuing operations and is used by management to measure operating performance. The Company defines EBITDA as earnings before interest, taxes, depreciation and amortization; provided that all revenue, costs and expenses shall be recorded on an accrual basis. The Company’s method of calculating EBITDA may differ from the method used by other issuers and, accordingly, the Company’s EBITDA calculation may not be comparable to similarly titled measures used by other issuers.

"Adjusted EBITDA" means earnings before interest, taxes, depreciation, and amortization after: (i) adding back share based compensation; (ii) adding back transaction and acquisition costs; (iii) adding back impairment of intangible assets and goodwill; (iv) deducting lease payments recorded as a depreciation and interest expense under IFRS; (v) adding back or deducting gain / loss on re-measurement of contingent and deferred consideration; (vi) adding back gain / loss on re-measurement of derivative liabilities; (vii) adding back loss on disposal of intangible assets; and (viii) adding back certain exceptional costs.

Name, Address and Incorporation

The Company was incorporated on March 17, 2004, under the name "Rockies Financial Corporation" pursuant to the Canada Business Corporations Act ("CBCA"). On December 21, 2018, the Company filed articles of amendment to change the name of the Company to "Bragg Gaming Group Inc.". The Common Shares trade on the Toronto Stock Exchange ("TSX") and on the Nasdaq Global Select Market ("Nasdaq") under the ticker symbol "BRAG".

The registered office of the Company is located 130 King Street West, Suite 1955, Toronto, Ontario M5X 1E3.

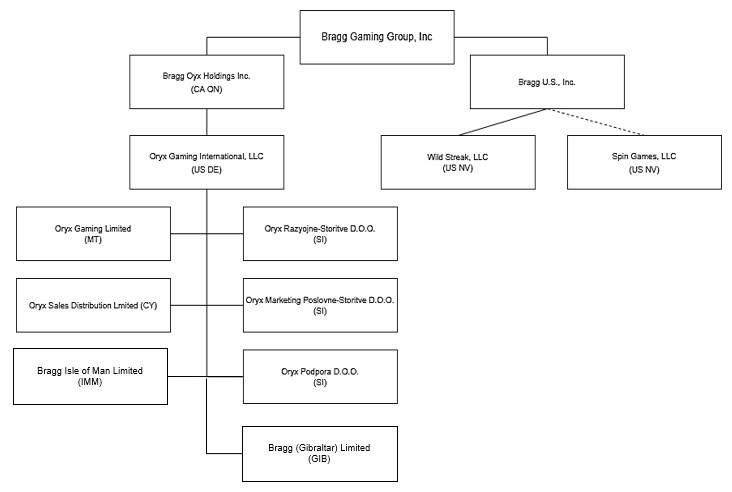

The Company's principal subsidiary is Oryx, which was incorporated in the State of Delaware and is headquartered in Las Vegas. Oryx is wholly-owned by the Company and, together with its subsidiaries, carries on substantially all of the business of the consolidated enterprise. Oryx's primary operations are provided through its wholly-owned subsidiaries in Cyprus, Malta, and Slovenia.

In June 2021, Bragg acquired Wild Streak Games LLC ("Wild Streak"), a leading iGaming content studio based in Las Vegas, Nevada with a portfolio of proprietary titles distributed globally, including in regulated markets in the United States and Europe.

4

In June 2022, Bragg acquired Spin Games, LLC ("Spin"), a Reno, Nevada-based iGaming technology supplier and content provider licensed and active in key regulated North American jurisdictions.

In June 2023, Bragg incorporated a new subsidiary, Bragg (Gibraltar) Limited (“Bragg Gib”). Bragg Gib is a Gibraltar-based licensed technology and content provider supplying Bragg proprietary content to key European markets.

In September 2023, Bragg incorporated a new subsidiary, Bragg Isle of Man Limited (“Bragg IOM”). Bragg IOM is an Isle of Man-based licensed technology and content provider supplying Bragg’ products and services to global operators.

The following table sets out material inter-corporate relationships of the Company as of the date of this AIF:

See “Description of the Business” below.

5

GENERAL DEVELOPMENT OF THE BUSINESS

This section discusses the major events or conditions that have influenced the general development of the Company.

2021

Financing – Common Shares

On January 13, 2021, the Company completed a non-brokered private placement. The Company raised gross proceeds of C$3,000,000 through the issuance of 247,934 Common Shares at a price of C$12.10 per Common Share. Insiders of the Company subscribed for 247,934 Common Shares.

Oryx Second Earn-Out

On January 18, 2021, the second earn-out payment was converted into €22 million worth of Common Shares at a conversion price of C$7.30 per Common Share (the “Second Earn-Out Payment”), subject to certain conditions, including the completion of a financing transaction and the entering into of an investor rights agreement with KAVO (the "KAVO Investor Rights Agreement"). The amending agreement further provided that KAVO was entitled to receive up to €1,500,000 in certain accounts receivable of the Company (the “Fifth Amending Agreement”)

Following the completion of the Second Earn-Out Payment, Matevž Mazij became a "control person" of the Corporation, and, as of the date of this AIF, exercises control or direction over 19.9% of the outstanding Common Shares on a non-diluted basis. The amalgamation and transaction were completed in compliance with applicable securities laws at the time, and the Fifth Amending Agreement does not substantially change the terms of the underlying Oryx Share Purchase Agreement (“Oryx SPA”). The common shares of the Corporation issued to satisfy the second earn-out payment are subject to a statutory four-month hold period. In connection with the settlement of the Second Earn-Out Payment, Matevž Mazij was appointed to the board of directors of the Company (the “Board”).

The full text of the Oryx SPA, the Fifth Amending Agreement, and the KAVO Investor Rights Agreement are filed under the Company’s profile on SEDAR+ at www.sedarplus.ca. Readers are encouraged to read the Oryx SPA (as amended by the Fifth Amending Agreement) and the KAVO Investor Rights Agreement in their entirety.

Acquisition

On June 2, 2021, the Company acquired 100% of the membership interests in Wild Streak, a Nevada-based content creation studio with a portfolio of 39 premium casino slot titles supported across online- and land-based applications (the "Wild Streak Acquisition"). Pursuant to the Wild Streak Acquisition, Doug Fallon, the founder and CEO of Wild Streak, joined the Company as Managing Director of Group Content. The Company agreed to pay a purchase price consisting of: (i) US$10 million in cash; and (ii) US$20 million in Common Shares, of which US$10 million worth of Common Shares will be payable on the first anniversary of the closing date of the Wild Streak Acquisition and US$5 million worth of Common Shares will be payable on each of the next two anniversaries of the closing date of the Wild Streak Acquisition.

Market Launches

In late March 2021, the Company launched its partnership with Grand Casino Baden. The operator’s online casino brand, jackpots.ch, provides content from the Company’s exclusive remote games server ("RGS") partner, Gamomat. This represents the Company’s entrance to the Swiss market.

6

In August 2021, the Company was granted a license to supply its RGS and casino content to operators in Greece by the Hellenic Gaming Commission. The Company’s customers in the territory include OPAP, Stoiximan, Novibet, Betsson and NetBet.

On October 4, 2021, the Company launched its platform in the newly regulated Dutch market after going live with the highly anticipated BetCity.nl brand under a full turnkey agreement with local operator BetEnt. BetEnt, the online arm of established Dutch land-based operator Casino City, selected the Company to provide it with a complete solution including its leading Player Account Management ("PAM") iGaming Platform and extensive content library.

On November 26, 2021, the Company launched a PAM iGaming platform and content in the Netherlands with JACKS.NL, the online brand of Jack’s Casino. The launch occurred after the Dutch Gaming Authority granted a license to JOI Gaming, part of the JVH Gaming & Entertainment Group, to operate JACKS.NL.

2022

In January 2022, the Company launched a new proprietary studio brand, Atomic Slot Lab, with the studio releasing eight slot titles in European markets and seven slot titles in North American markets during the year. In August 2022, the Company launched a second new proprietary studio brand, Indigo Magic, with the studio releasing three slot titles in European markets and one slot title in North American markets during the year.

On February 14, 2022, the Company announced entry into the Czech Republic market, taking its content live with the SYNOT Group. On March 29, 2022, the Company announced entry into the Bahamas market, taking its content live with Island Luck. On April 5, 2022, the Company announced entry into the Ontario market taking its content live with 888. On April 7, 2022, the Company announced entry into the Portugal market, taking its content live with Betclic. On September 7, 2022, the Company announced that it had enhanced its presence in the Czech Republic by launching its PAM offering with the Merkur Group.

Distribution Agreements

On January 18, 2022, the company went live with Swiss operator Casino Interlaken to supply its range of exclusive slots. The partnership with Interlaken marked the Company’s third in Switzerland following deals with leading operators Grand Casino Luzern and Grand Casino Baden.

On March 7, 2022, the Company announced that it went live in Spain with 888casino, expanding its relationship with the operator as well as its presence in the Spanish market.

On April 7, 2022, the Company announced that it went live with Betclic in Portugal, expanding its in house content relationship with its existing operator into the new Portuguese market.

On September 7, 2022, the Company announced that it went live Mercur into the Czech market expanding its relationship with its existing operator into the new PAM, turnkey solutions, aggregation and content.

On November 7, 2022, the Company announced that it went live Comeon into the Dutch market expanding its relationship with its existing operator into the new PAM, turnkey solutions, aggregation and content.

On December 1, 2022, the Company announced that it went live with Rush Street in New Jersey, expanding its in house content relationship with its existing operator into the new US market.

On December 12, 2022, the Company announced that it went live with BetMGM in Michigan, expanding its in house content relationship with its existing operator into the new US market.

7

Licensing Agreements

On February 7, 2022, the Company announced a content licensing agreement with slots developer Blue Guru Games, allowing it to release numerous exclusive game titles from the studio.

On September 21, 2022, the Company announced a content development agreement partnership with Bally’s allowing it to develop and distribute numerous exclusive game titles from prominent studios in the US market.

On October 10, 2022, the Company announced it secures Sega Sammy Creation content licencing agreement allowing it to release numerous exclusive game titles from the studio in the US market.

On November 4, 2022, the Company announced a content agreement partnership with Incredible Technology Games, allowing it to release numerous exclusive game titles from the studio in the US market.

New Gaming Licences

On March 1, 2022, the Company announced it had obtained a license to supply its technology, content and services in the Bahamas.

On March 8, 2022, the Company announced it had obtained a supplier license to offer its technology, content and services in Ontario, Canada, when the market opens.

Financing Arrangement – Convertible Debt

On September 5, 2022, the Company entered into a funding agreement for an investment of US$8.7 million by Lind Global Fund II LP, an investment entity managed by The Lind Partners, a New York-based institutional fund manager (together "Lind") (the "Funding Agreement").

Funding is in the form of a US$8.7 million convertible note bearing interest at an inherent rate of 7.5% (the "Convertible Debt") and has a face value of US$10.0 million (the "Face Value"). The Company received net proceeds of approximately US$8.0 million from the funding, after costs directly attributable to the Funding Arrangement. The Face Value of the Convertible Debt has a 24-month maturity date and can be paid in cash or be converted into Common Shares at a conversion price equal to 87.5% of the five-day volume weighted average price ("VWAP") immediately prior to each conversion. Shares issued upon conversion are subject to a 120-day lock-up period following deal close.

The Funding Agreement contains restrictions on how much may be converted in any particular month, which is limited to 1/20 of outstanding balance or US$1.0 million if exchange volume is above specified minimum, which conversions may be accelerated in certain circumstances. The Company also has the option at any time to buy back the entire remaining balance of the Convertible Debt, subject to a partial conversion right in favor of Lind to convert up to 1/3 of the outstanding amount into Common Shares in such circumstances. In connection with the funding, Lind was issued a warrant to purchase up to 979,048 Common Shares at a price of C$9.28 per share for a period of 60 months. The funding is secured by assets of the Company and some of its subsidiaries. The Funding Agreement and the issuance of securities thereunder was approved by the TSX.

2023

Distribution Agreements

On January 30, 2023, the Company launched new content with DraftKings in New Jersey.

On February 6, 2023, the Company signed a content distribution agreement with leading European operator Betsson.

On February 27, 2023, the Company launched additional new content in New Jersey with Caesar’s Sportsbook & Casino.

8

On March 1, 2023, the Company increased its presence in Switzerland, launching content with Swiss Casinos and Grand Casino Basel.

On March 6, 2023, the Company continued its new content rollout in New Jersey with launches on ResortsCasino.com and MoheganSunCasino.com.

On July 5, 2023, the Company entered the Georgian iGaming market with Adjarabet, the local market leader.

On July 12, 2023, the Company launched its content with Swiss4Win.ch, the online operation of Casino Lugano in Switzerland. The launch marked the Company’s ninth customer in the territory out of eleven total licensees, with the Company’s Swiss customers now representing an estimated 88% of the online casino market in Switzerland.

On July 26, 2023, the Company entered into new global distribution agreements with 888casino and William Hill, and PokerStars, launching in the Eurasian territory of Georgia for the first time, and growing its customer base in Switzerland and Spain. The new agreement with PokerStars will expand the reach of Bragg’s content.

On August 8, 2023, the Company entered into a global content distribution agreement with PokerStars, spanning the United Kingdom, Italy, Portugal, Spain, Denmark, Sweden and the Czech Republic, as well as regulated territories in the United States.

On August 16, 2023, the Company rolled out its content in the United Kingdom with Unibet, a leading brand from multi-national operator Kindred Group. The Company also launched content with leading online casino operator bet365 in Ontario, Canada. The Company also launched content with leading Italian online casino operator Snaitech.

On September 5, 2023, the Company obtained a business-to-business (“B2B”) remote gambling license in Gibraltar, home to multiple international online gambling businesses.

On November 2, 2023, the Company launched its new content and RGS technology with BetMGM in New Jersey. Through this launch, the Company has extended its existing collaboration with BetMGM, a leading operator in North America. Bragg also provides iGaming content for BetMGM players in Michigan and Pennsylvania.

On November 7, 2023, the Company extended its agreement with Entain Plc to supply Entain Plc’s Dutch iGaming operator, BetCity.nl, with the Company’s PAM platform until 2025. BetCity.nl will continue to utilize Bragg’s content and product delivery services on an exclusive basis for the duration of the extended PAM agreement, allowing Bragg to provide its proprietary, exclusive, and aggregated casino content as well as the delivery of sports betting products to customers of the leading Dutch market operator. In addition, Bragg will integrate with several new iGaming suppliers to further enhance the localized content portfolio the Company provides to the market in the Netherlands.

9

General

The Company is a content-driven iGaming technology provider, serving online and land-based gaming operators with its proprietary and exclusive content, and its cutting-edge technology. The Company's proprietary studios offer high-performing, data-driven and passionately crafted casino gaming titles from in-house brands Wild Streak, Spin, Atomic Slot Lab, Indigo Magic and Oryx Gaming. Its proprietary content portfolio is complemented by a range of exclusive titles from carefully selected studio partners which are Powered by Bragg: games built on Bragg's RGS technology, distributed via the Bragg Hub content delivery platform and available exclusively to Bragg’s customers. Bragg’s modern and flexible omnichannel “PAM” platform powers multiple leading iCasino and sportsbook brands and is supported by expert in-house managed operational and marketing services. All content delivered via the Bragg Hub, whether exclusive or from Bragg’s large, aggregated games portfolio, is managed from a single back-office and is supported by powerful data analytics tools, as well as Bragg’s Fuze™ player engagement toolset. Bragg is licensed or otherwise certified, approved and operational in multiple regulated iCasino markets globally, including in Colombia, Germany, Michigan, the Netherlands, New Jersey, Ontario, Pennsylvania, Spain, Sweden, and the United Kingdom.

Operating Segment

The Company has only one operating segment: B2B online gaming, and as of 2023 it derives 77.7% of its revenue from its games and content services, and 22.3% of its revenue from iGaming platform and Turnkey solutions. The Company’s customer base consists only of online gaming operators. The principal products and services provided by the Company are the licensing of its iGaming technology, games and content, and managed services. For the year ended December 31, 2023, the majority of the Company's operating revenue is geographically based in Europe, though this segmentation is not correlated to the geographical location of the Company's worldwide end-user base.

Products and Services

The Company offers a full range of games including slot games, table games, card games, video bingo, scratch card games, virtual sports, and live dealer games. These games are featured on the PAM and are also available for use on other gaming platforms offered by third parties.

PAM Platform Licensing

The Company offers a multi-channel and cross-product PAM that enables operators to manage their entire product suite using one shared account and one wallet for casino, lottery, sportsbook, and other operations. The PAM allows operators to maximize cross-sale opportunities and increase player value by using the fully-integrated set of tools and solutions to manage users, transactions, campaigns, reporting, and analytics. The PAM features games from proprietary studios and content developed by third parties. The PAM offers a full payment solution integrated with a large number of payment solution providers covering local and global markets; and it also includes a player risk profile level and an advanced rule engine for customization.

Through a single account across all products and channels, operators get a complete overview and history of customer activities, transactions, balance, and personal data. This enables a personalized approach in communication with players and tailor-made offers. The platform also offers player protection features such as deposit limits, play-time limits, loss limits, and reality checks to allow operators to encourage responsible gaming.

The PAM has an integrated chat function which enables quick access to customer data and enables operators to provide unrivaled customer support as well as up-selling and cross-selling opportunities. The platform also has bonus and wagering management, whereby the platform can enable automatically triggered bonuses for deposits and signup promotions, manual bonuses given to players by customer support, bonus code and many other flexible bonus configurations. In addition, the platform provides for loyalty management wherein operators can set different levels for different game limits, transaction limits, bonuses, levels of service and

10

predefined deposit amounts. The platform also allows for dynamic campaign management whereby operators can create automated or bespoke campaigns to maximize cross-selling opportunities to increase player value.

The PAM has a sophisticated business intelligence tool which can create insightful dashboards and reports on customer behavior, financial transactions, gaming income, bets, detailed statistics of gameplay, all with flexible filtering and grouping options, as well as campaign performance reporting. The PAM contains an affiliate management system and portal to enable operators to build productive relationships with affiliates using redirect or download links, coupon codes, and real-time earning and payment reporting. Further, the PAM provides for an integrated land-based, self-serve, betting system with support for anonymous play (cash and cashless play support), and account play (registration, login, deposit, and fund transfers). Development and maintenance of the PAM is completed in-house by employees and contractors of the Company and its subsidiaries.

Turnkey and Managed Services

The Company offers a complete solution for its PAM customers where it can manage an operator's customers and marketing communications. The operational managed services assist with hosting and security, know-your-client requirements, payment and transaction management, customer support, and risk and fraud management. The Company’s marketing managed services address retention and conversion marketing programs, VIP marketing and management, and provide a personalized approach to players. These services are based on player data and correspondence history and aim to create a strong relationship and customer loyalty. The Company’s analytics and business intelligence services aggregate, manage and utilize significant amounts of data and prepare periodic and per-request reports and insights.

Games and Content

The Company offers proprietary, exclusive, and third-party gaming content, all delivered through a single integrated platform and supported by data platform functionality and its FUZE™ player engagement toolset. The Company has five proprietary studios, two located in Europe and the other three in the United States, with a combined portfolio of over 60 casino gaming titles as of December 31, 2023.

The Company also holds exclusive content distribution rights through partnerships with selected third-party studios. These studios offer differentiated and localized content that is not available elsewhere in specific markets. The Company has such arrangements with several third-party studios including Gamomat, Kalamba Games, Bluberi, Gaming Arts, King Show Games, Sega Sammy Creation, Incredible Technologies and Galaxy Gaming, with over 250 Bragg-exclusive games from third-party partner studios live at the end of 2023.

To meet the needs of the market, the Company’s casino game aggregator is integrated with and distributes non-exclusive games from additional third-party studios including leading brands such as Evolution, Playtech and Play’N Go. Content is constantly updated on this platform, with over 2,000 distinct game titles added in 2023 and over 8,000 distinct game titles from 65 games studios live on the platform as at December 31, 2023.

Locations

The Company provides gaming services to its customers that operate in Belgium, Canada, Croatia, Denmark, Germany, Greece, the Netherlands, Romania, Serbia, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The Company is particularly focused on expanding its presence in growing markets such as Canada, Italy, Latin America, the United Kingdom, and the United States, and has made significant inroads towards delivering on its market expansion plan.

In 2023, the Company obtained licenses and appropriate certifications in the United States, Sweden, Gibraltar and the Isle of Man. The Company is also in active commercial discussions with several additional operators and it continues to monitor other markets for regulatory developments. The acquisitions of Spin and Wild Streak have accelerated the Company’s expansion into the United States through Connecticut, Michigan, New Jersey, and Pennsylvania.

11

Customers

As of December 31, 2023, the Company’s total customer base was over 260 customers (December 31, 2022: over 190 customers). The Company continues to strengthen its customer base, servicing leading business-to-consumer ("B2C") operators in the online casino industry such as Entain Plc, Gamesys, Betsson, Superbet, Mr. Green, Comeon, 888 , BetMGM, DraftKings , FanDuel, Golden Nugget, Hard Rock, and Penn National Gaming, among others.

Revenue

The Company derives its revenue from operators using its platforms and proprietary and third-party content, whereby it earns a percentage of the gross gaming revenue generated by the operators. As such, the success of Bragg is tied to the performance of its operators. For the year ended December 31, 2023, 64.9% of revenue was derived from ten clients, 67.3% for the twelve months ended December 31, 2022.

The Company’s revenue1 for the year ended December 31, 2023, increased from the same period in the previous year by 10.4.% to EUR 93.5 million (2022: EUR 84.7 million) continuing a yearly growth since FY2021. The Group’s year-over-year revenue growth was mainly organic through its existing customer base, with onboarding of new customers in various jurisdictions and a solid revenue performance from its proprietary Wild Streak casino games studio and Spin’s existing United States customer base.

The Company’s revenue growth was mainly derived from the games and content segment which amounted to EUR 72.6 million (2022: EUR 60.8 million) and accounted for 77.7% (2022: 71.7% ) of the total revenues, as demand for the Group’s unique games and content and technology proposition continues to grow. The Company’s growth has been underpinned by continued investment and innovation in its technology and product offering. These investments enhanced the roll out of the iGaming (PAM) product in new markets throughout the year including Oryx Hub, new data analytic tools and customer engagement platform.

Other financial information

Gross profit increased compared to the same period in the previous year by 10.8% to EUR 49.9 million (2022: EUR 45.1 million) with gross margins increasing by 0.2% to 53.4% (2022: 53.2%). Gross profits improved year over year primarily due improvement in revenue performance and the composition of revenue derived from our iGaming platform and managed services together with revenue from proprietary game studios which has no cost of sales compared to third party games and content which have associated third party costs.

The Company’s Adjusted EBITDA increased from the same period in the previous year by 26.3% to EUR 15.2 million (2022: EUR 12.1 million) with Adjusted EBITDA margins increasing by 210 bps to 16.3% (2022: 14.2%). The change in margin is mainly as a result of scale and a change in the product mix of iGaming and managed services, while maintaining higher investment in salaries and subcontractor costs as part of the Company’s strategy to expand software development, product, and senior management functions.

Total operating loss for the period amounted to EUR 0.8 million (2022: EUR 0.8 million).

Operations

Oryx Gaming Limited (Malta) ("OGL") is a wholly-owned subsidiary of Oryx, and holds its gaming supply license, being its Maltese B2B license ("Critical Gaming Supply License") to supply ‘Type 1’ games (casino-games), which is regulated by the Malta Gaming Authority ("MGA"), and its "class 2" Romanian license ("Class 2 License"), which is regulated by the Romanian Gaming Authority. OGL generates revenue for Oryx by being the main arm through which it uses its Critical Gaming Supply License to license and/or supply proprietary

1 Revenue includes group share in games and content, platform fees and management and turnkey solutions

12

and third-party gambling software products, but it does not supply Oryx Sportsbook to MGA license holders using its Critical Gaming License. OGL uses its Class 2 License to support Romanian-licensed operators.

Oryx Sales Distribution Limited (Cyprus)

Oryx Sales Distribution Limited (Cyprus) ("OSD"), is a wholly-owned subsidiary of Oryx, and is a sales and distribution company for the license and/or supply of proprietary and third-party gambling software products to operators in non regulated markets. OSD holds no gambling licence as this is not required for its operations. The purpose of OSD is the distribution and sale of gaming software and content to markets that are not regulated by the MGA. The regulatory framework of the MGA does not permit MGA licensees to provide services to businesses that do not hold a valid MGA license. The Company incorporated the OSD subsidiary to provide non-regulated services. OSD is managed in a similar fashion to OGL, since both subsidiaries provide many of the same services. OGL, however, sells gaming software and content to MGA licensees, while OSD sells gaming software and content to non-MGA licensees. OSD is unregulated, requires and retains no licensees or certificates, has no physical office space, and retains no employees. Oryx retains a corporate services firm in Cyprus that provides resident directors, as Cyprus has director residency requirements, and houses the minute book and constating documents of OSD. The nominee director of OSD can be removed or replaced by Oryx, the legal and beneficial owner of all of the issued and outstanding shares of OSD.

ORYX razvojne storitve d.o.o. (Slovenia)

ORYX razvojne storitve d.o.o. ("ORS") is a wholly-owned subsidiary of Oryx, and its principal function is as the development arm of the Company. ORS develops and implements the gambling software products for Oryx and other subsidiaries for further licensing and/or supply to operators. ORS holds no gambling licence as this is not required for its operations.

ORS holds, together with OGL, the ISO/IEC 27001 2022 certificate. The ISO/IEC 27001 is an international standard on how to manage information security. The standard was originally published jointly by the International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC) in 2005 and then revised in 2013 and 2022. It details requirements for establishing, implementing, maintaining and continually improving an information security management system (ISMS) – the aim of which is to help organizations make the information assets they hold more secure. A European update of the standard was published in 2017. Organizations that meet the standard's requirements can choose to be certified by an accredited certification body following successful completion of an audit.

The ISO/IEC 27001 certificate is widely known, providing requirements for an ISMS, though there are more than a dozen standards in the ISO/IEC 27000 family. Using them enables organizations of any kind to manage the security of assets such as financial information, intellectual property, employee details or information entrusted by third parties.

Wild Streak Games LLC

Wild Streak is a subsidiary of Bragg USA Inc. and is a Nevada-based content creation studio that is focused on the design and creation of premium and custom-slot content for the global online real money gaming and land base operators. Wild Streak generates revenue by contracting with leading operators for games royalties. In addition, Wild Streak contracts with land base operators for a development work for design of content and a fee for its deployment in the land base casinos.

Spin Games, LLC

Spin is a Nevada-based B2B content and distribution company. Spin builds a wide range of casino games focused on the United States market, including popular ‘stepper’ slots and table games. Spin delivers superior iGaming experience to its customers with its interactive technology and customized content.

13

Development

With respect to development, the Company develops some of its own products and subcontracts out certain development activities. Software development know-how and expertise for online gambling are contained within the Company. The main input into the development of its products is human capital in the form of employees or contractors. Bragg’s proprietary technology include its PAM, an omni-channel platform enabling the operation of casino, sports betting and lottery businesses, plus a fully owned RGS, its Bragg HUB content delivery and aggregation platform, data platform and its FUZE™ player engagement promotional toolset. In addition, the Company houses five proprietary online casino game studios:

| 1. | Atomic Slot Lab is the Company’s Las Vegas, Nevada-based and primarily United States targeted slots studio launched in 2022, and serving online casino operator customers located both in North America and in Europe |

| 2. | Indigo Magic is the Company’s online casino game studio based in Ljubljana, Slovenia, launched in 2022 and which primarily develops games with styles, mechanics and themes favored in European markets, but which also serves operators in both North America and in Europe |

| 3. | Wild Streak Gaming is the Company’s established slots studio based in Las Vegas, Nevada, which develops slots for both online and land-based casinos in North America and in Europe |

| 4. | Spin Games is the Company’s established online casino games studio based in Reno, Nevada, with a portfolio of online slots games, table games and keno games live in North America, but which is not actively developing and releasing new games |

| 5. | Oryx Gaming is the Company’s established online casino games studio based in Ljubljana, Slovenia, with a portfolio of online casino games active primarily in European markets, but which is not actively developing and releasing new games |

All intellectual property is owned by the Company, while physical assets for software development are owned by The Company's subsidiaries.

Real Property

The Company holds no real property or mortgages. The Company leases office space in Slovenia, Malta, London, Las Vegas, and Reno.

Employees

As at December 31, 2023, the Corporation employed 464 employees, contractors and sub-contractors (December 31, 2022: 428) across Canada, India, Israel, Malta, Slovenia, the United Kingdom, and the United States.

Bragg is a gaming solutions provider selling to gaming operators in Malta, Germany, the Netherlands, Greece, Romania, Croatia, the Czech Republic, Serbia, Colombia, United Kingdom, the United States of America, Canada, Sweden, and Denmark, among others. While a large portion of revenue derived from the Dutch facing operations in fiscal year 2023, the Company has seen growth in other markets, such as the Switzerland, Germany and the United States which demonstrates the Company's ability to continually diversify and reduce its exposure to any single country. The Company intends to maintain its position by providing compliant, localized, and unique solutions, highly adaptable to regulatory requirements and third-party integrations. See "Risk Factors – Risks Factors Related to the Company" for related risks including with respect to operating in different jurisdictions.

14

Competition

The online gaming market is growing rapidly and is extremely competitive. Bragg is a highly sought-after provider of content for operators targeting Netherland, Croatia, Serbia, Romania, Spain, Denmark, Sweden, Germany, Switzerland, the United Kingdom, the United States, Latin America and elsewhere in Southeastern Europe.

The Company’s major competitors in its market are:

| ● | EveryMatrix Software Limited |

| ● | Relax Gaming Limited |

| ● | Playtech Plc |

| ● | Light & Wonder Inc. |

| ● | Gaming Innovation Group |

| ● | GameAccount Network Limited |

| ● | Pragmatic Solutions MT Limited |

| ● | International Game Technology Plc |

| ● | Evolution Gaming Group |

Management believes that, while most of the customers have the option of internalizing their content development, it is not likely to happen given the specialized skills required to develop content and the need of operators to supply end-users with a large variety of games.

The Company licenses software that is copyright protected in favor of the software provider. In addition, the Company knowledge base is considered a trade secret and it imposes non-disclosure agreements on any party it transacts with. The Company has trademarks registered in various jurisdictions globally.

The Company's B2B services are licensed in the following jurisdictions:

| ● | Canada |

| ● | British Columbia |

| ● | Ontario |

| ● | The Bahamas |

| ● | The United States |

| ● | Connecticut |

| ● | Michigan |

| ● | New Jersey |

| ● | Pennsylvania |

| ● | Europe |

| ● | The United Kingdom |

| ● | Sweden |

| ● | Belgium |

| ● | Greece |

| ● | Malta |

| ● | Romania |

| ● | Gibraltar |

| ● | Isle of Man |

15

Bragg holds all necessary supplier’s gaming licenses and complies with its licenses’ conditions, all local regulations and legislations within its operating jurisdictions. It provides all required certificates with respect to its software and operations, delivering its fully certified products and services approved by either accredited independent testing labs or Gaming Boards/Commissions’ testing labs in every jurisdictions where it holds suppliers licenses, but also wherever else Bragg delivers its products and services, such as in the Balkans, Germany, Italy, the Netherlands, Portugal, Spain, Sweden, and Switzerland, among other jurisdictions.

The following table summarizes relevant information regarding Bragg’s operating licenses:

License Type | Issuing Authority | License Holder | Date Granted MM-DD-YYYY | Expiry Date | Jurisdiction |

|---|---|---|---|---|---|

Gaming-Related Supplier - Manufactures | Alcohol and Gaming Commission of Ontario - AGCO | Bragg Gaming Group Inc. | 04-25-2023 | 04-03-2025 | Ontario, Canada |

Supplier license | Gaming Board for Bahamas | Bragg Gaming Group Inc. | 02-22-2023 | Expected, 02-21-2025 | The Bahamas |

Casino Service Industry Enterprise | New Jersey Division of Gaming Enforcement | Transactional waivers to: • Spin Games, LLC • Oryx Gaming International, LLC | 11-29-2023 | 06-01-2024 | New Jersey, USA |

Interactive Gaming Manufacturer License | Pennsylvania Gaming Control Board | Spin Games, LLC | 04-25-2023 | 06-09-2025 | Pennsylvania, USA |

Affiliates of Spin Games, LLC | Pennsylvania Gaming Control Board | • Bragg Gaming Group Inc. • Bragg USA Inc. • K.A.V.O. Holdings, Ltd • Bragg Oryx Holdings Inc. • Oryx Gaming International LLC • Oryx Razvojne Storitve d.o.o. | 05-24-2023 | All licenses expire on | Pennsylvania, USA |

Internet Gaming Supplier License | Michigan Gaming Control Board | Oryx Gaming International, LLC | 08-09-2022 | 08-08-2027 | Michigan, USA |

Internet Gaming Supplier License | Michigan Gaming Control Board | Spin Games, LLC | 08-09-2022 | 08-08-2027 | Michigan, USA |

16

License Type | Issuing Authority | License Holder | Date Granted MM-DD-YYYY | Expiry Date | Jurisdiction |

|---|---|---|---|---|---|

Online Gaming Service Provider | Connecticut Department of Consumer Protection | Spin Games, LLC | 09-28-2023 | 09-27-2024 | Connecticut, USA |

Online Gaming Service Provider | Connecticut Department of Consumer Protection | Oryx Gaming International, LLC | 02-09-2024 | 02-09-2025 | Connecticut, USA |

Combined Remote Operating License | UK Gambling Commission | Oryx Gaming Ltd. | 11-19-2021 | 11-18-2026 | United Kingdom |

Remote Gambling Software | UK Gambling Commission | Oryx Razvojne Storitve d.o.o | 11-19-2021 | 11-18-2026 | United Kingdom |

Critical Gaming Supply license | Malta Gaming Authority | Oryx Gaming Ltd. | 08-01-2018 | 10-04-2025 | Malta |

Category A1 Manufacturer's License | Hellenic Gambling Commission | Oryx Gaming Ltd. | 08-05-2021 | 08-04-2028 | Greece |

RO Class 2_Software license RO Class 2_Platform license | The Romanian National Gambling Office | Oryx Gaming Ltd. | 04-27-2018 | 04-27-2028 | Romania |

Class E License | Belgium Gambling Commission | Oryx Gaming Ltd. | 11-16-2022 | 11-15-2032 | Belgium |

BC Supplier License | Gaming Policy and Enforcement Branch of British Columbia | Spin Games, LLC | 12-21-2018 | Expected, December 2029 | British Columbia, Canada |

Game Software License | Swedish Gaming Authority - Spelinspektionen | Oryx Gaming Limited Oryx razvojne storitve d.o.o. | 05-25-2023 | 06-30-2028 | Sweden |

Remote Gambling License | Gibraltar Licensing Authority | Bragg (Gibraltar) Limited | 08-21-2023 | 03-31-2024 (in process on renewal) | Gibraltar |

OGRA License | Isle of Man Gambling Supervision Commission | Bragg Isle of Man limited | 02-20-2024 | 02-19-2029 | Isle of Man |

17

Regulatory Environment and Regulatory Compliance

European Regulatory Landscape

All the Company’s European regulated activities are conducted through Bragg and its subsidiaries. Generally, the development, distribution and use of gaming software in the jurisdictions where the Company conducts business are subject to licensing and local regulation. Online casino gambling is generally authorized under local license, with local gaming authorities generating revenue from license fees and taxation. In order to develop and distribute the Company's software, which is targeted to the gaming operator market, the Company must comply with the applicable regulations of each jurisdiction in which the Company seeks to conduct business activities, which in some circumstances includes the jurisdictions from where the Company's customers, being operators, derive their revenues.

Most European jurisdictions have enacted legislation that specifically criminalizes the activities conducted by an unlicensed online gambling operator and supplier, and that we believe is not susceptible to challenge (e.g., on the basis that the legislation has been enacted in contravention of previously issued advice from the European Commission).

Other European jurisdictions, however, have enacted such legislation that may be susceptible to such a challenge. Moreover, in certain jurisdictions, a gaming operator without a local license who accepts business from players located in those jurisdictions would not necessarily contravene the laws of that jurisdiction (e.g., on the basis that there is a gap in the legislation because it has not been updated to contemplate remote supply of gaming services or it does not apply to extra-territorial gaming operators). In such scenarios, the risk to the Company (as a supplier of software, its technology and services to such an operator) of committing any accessory offenses is tied to whether the B2C operator is committing the underlying offense.

Nearly all of the jurisdictions in which the Company provides its products to B2C operators regulate B2B gaming software developers and distributors, such as the Company. Where B2B licensure is not required, the Company coordinates with B2C customers to deliver products to them in a way so they may comply with their local regulatory commitments. While certain jurisdictions require B2B gaming software companies, such as the Company, to be licensed, the focus, rigor, and licensure process, and ongoing regulation, is significantly more onerous for B2C businesses operating in those jurisdictions.

The Company also takes precautions through common industry contract provisions and the use of a compliance plan to only do business with customers who do not derive revenue from end users located in so-called prohibited jurisdictions. As the Company grows and expands into new markets or as jurisdictions regulate or change regulations for their markets, the Company may require additional gaming licenses and may be required to comply with different regulatory regimes.

Gaming regulations applicable to the Company are generally focused on two areas of the Company's operations:

In order to maintain the Company's licenses and registrations (the "Licenses and Registrations"), the Company must submit to regular monitoring of its business by gaming authorities, including regular compliance audits. In some jurisdictions, the Company is required to submit monthly, quarterly and annual reports that detail its business activity, financial matters, compliance processes and product certificates. Certain material events with respect to Bragg, such as key employee, director or officer appointments and dismissals,

18

regulatory actions, share transfers, material transactions and loans, or material litigation must be reported within short timeframes (typically within 5 and 30 days of the event).

The jurisdictions that have granted the Licenses and Registrations have regulations requiring B2B suppliers like the Company to establish internal controls to identify potential business circumstances, companies, and people that could be harmful to the gaming industry and to take appropriate action to avoid or remove themselves from such situations. As a result, the Company must monitor risks and review itself and its customers to avoid involvement in situations where the Company should reasonably know that its activities or the Company’s customers activities are incompatible with its licensing requirements, which includes the ongoing use or offering of the Company's ’products in jurisdictions where gambling or interactive gaming is prohibited.

The Company's compliance plan is a set of comprehensive internal policies and procedures that outline jurisdictional regulatory parameters for certain aspects of the Company’s business operations.

The Company maintains and regularly updates its restricted territories policy that includes the list for jurisdictions where gambling or interactive gaming is prohibited and regulated, which currently includes operating without a license in the United States, Canada, and France, among others. Some jurisdictions prohibit gaming in all or certain forms. In addition, by statute or other operation of law, certain jurisdictions provide a gaming licensee with a right to terminate a contract if a counterparty is determined by the gaming licensee to be unfit for the gaming industry. The Company does not permit its customers to offer its products to end users located in jurisdictions where there are prohibitions that clearly apply to their activities and the business models they have adopted. The Bragg PAM uses third party geo-IP services to reveal the location of the player, based on the IP address through which the player is accessing the platform. Geo-location of the player is checked at the time the player registers on the platform and at every login. The platform enforces geo-blocking procedures based on the identified location of the player and our list of prohibited jurisdictions. The Company also implements IP and RGS blocking based on business risks assessments and to prevent its own product and services to be available in the markets where iGaming is prohibited as well as to follow its own restricted territories policy.

The Company’s B2C customers are required by regulation to have certain protective measures to prevent fraud and money laundering. Therefore, the Company has adopted a fraud management policy and anti-money laundering policy to assist Bragg’s customers, partners and regulators to prevent or identify illegal activity. Measures adopted under such policies include the creation of a dedicated fraud management team to monitor suspected fraudulent activity, the implementation of internal fraud reporting procedures and the use of fraud management software to timely communicate relevant information to other stakeholders. The Company appointed CFT/MLRO officers wherever it holds its B2B license and as per local regulatory requirements. When contracting and integrating directly with licensed casino operators and/or third party content suppliers, the Company performs due diligence following the jurisdictional regulations and as part of the contracting process. If any suspicious activities are detected, the Company reports such activities to the relevant authorities and terminates the contracting process.

The Company, through its various subsidiaries, is either certified or licensed in: Malta, Ontario and British Columbia in Canada, Croatia, the Czech Republic, Denmark, Estonia, Germany, Latvia, Macedonia, the Netherlands, Portugal, Romania, Serbia, Spain, Sweden, Switzerland, Gibraltar, the Isle of Man, Bahamas, the United Kingdom, New Jersey, Pennsylvania, Michigan, Connecticut in the United States, amongst other jurisdictions. In these territories, Bragg is either certified and/or licensed to provide its products and services to locally licensed customers.

The MGA is the reputable regulatory body that is responsible for the governance of all gaming activities in Malta. The MGA issues licenses for the provision of gaming services (B2C) or the provision of a critical gaming supply (B2B), type 1 -4 depending on the gaming services. The MGA licenses cover all types of online gambling, from online casino games, games of chance, online sports betting and general games of chance that use a random number generator, to player-to-player games and controlled skill games. Pursuant to the Gaming Act 2018 and corresponding regulatory framework and directives, any person who provides or carries out a gaming service or provides a critical gaming supply from Malta or to any person in Malta, through a Maltese legal entity, must obtain the appropriate license from the MGA. To qualify for a license or recognition notice, an applicant must be a body corporate registered and incorporated

19

in the European Union (“EU”)/European Economic Area (EEA), or a state which is deemed by MGA to offer safeguards largely equivalent to those offered by Maltese law .

License applicants must provide information to MGA, for every director and key official of the applicant and for every ultimate beneficial owner with 10% or more ownership of, or controlling interest in, the applicant, including, but not limited to:

| ● | personal financial background information; |

| ● | interest in other commercial activities; |

| ● | criminal record information; |

| ● | information concerning all pecuniary and/or equity interests; and |

| ● | any other information that the MGA requires. |

The MGA may, at its sole discretion, require that all beneficial owners of shares in the applicant's company provide such information. The MGA does not request this information for publicly traded companies.

B2C operators are required to pay a gaming tax to the Maltese authorities of 5% on the gross gaming revenue generated from Malta. In addition, B2C operators are required to also pay a compliance contribution which varies depending on the type of games offered by the operator. B2B operators are not required to pay any gaming tax or compliance contribution.

A license must be renewed every ten years from the date of issue. The MGA requires that the licensee commence the renewal process at least 60 days from the date of expiry of the license. There is a mandatory compliance audit that has to be carried out by MGA before the renewal date and successfully passed as a prerequisite to proceed with the renewal.

Other Regulatory Regimes and Future Developments

While certain European countries, such as Malta, Gibraltar and isle of Man, have adopted "point-of-supply" regimes which generally permit their licensees to accept wagers from any jurisdiction that does not expressly prohibit the supply of online gaming from outside such jurisdiction, other countries, including for example the United Kingdom, Italy, the Netherlands, Sweden, France, Spain, and Denmark , have implemented, or are in the process of implementing, "point-of-consumption" regimes which only permit the targeting of the domestic market, provided the appropriate local license is obtained and local taxes accounted for (regardless of where the operator's legal entity is incorporated and their assets, infrastructure and employees may be located). Such licensing regimes can apply onerous compliance requirements and/or introduce product restrictions or advertising restrictions that could have an adverse effect on Bragg's operations (and correspondingly on its financial performance) were it to obtain and maintain such licenses.

In the Netherlands, B2C operators can only target the Dutch market if they have obtained a license by the Dutch regulator. For B2B gaming offering, no license is required. However, the B2B supply of remote gambling solutions to unlicensed operators, constitutes a violation under Dutch law.

Other European territories maintain limited licensing regimes that protect monopoly providers and, in certain jurisdictions, have combined this with an attempt to prohibit or otherwise restrict all other supplies into the territory. Restrictive approaches to the regulation of remote online gambling may yet be deemed to be in potential conflict (in any specific jurisdiction) with the Treaty for the Functioning of the European Union ("TFEU") treaty laws (governing the free movement of trade and services throughout the EU) and case law rendered by the European Court of Justice ("ECJ").

A challenge to the validity of any EU jurisdiction's approach to gambling regulation would focus on restrictions on the freedoms of establishment or the freedom to provide services. Restrictions usually take one of a number of forms, including: (i) granting exclusive rights in certain, or all, gambling activities to one or a few providers; (ii) implementing a blanket exclusion of all gambling activities; (iii) prohibiting, on pain of criminal penalties, the pursuit of activities in the betting and gaming sector without a license or police authorization issued by the relevant member state; (iv) limiting the number of licenses available to conduct particular gambling activities; (v) limiting the duration of licenses; (vi) unfair or discriminatory procedures for awarding licenses; and/or (vii) requirement for local establishment.

20

A series of ECJ decisions over the course of the last 15 years or so have given EU member states wide latitude in regulating the online gambling market. However, restrictions imposed by regulations established by a member state must meet four criteria in order to be justified: (i) non- discriminatory; (ii) for the public interest; (iii) suitable (i.e., that it achieves the purposes for which the restriction is introduced); and (iv) necessary (i.e., does not go beyond the intended purposes).

Initiatives of the European Commission over the last 10 years that would harmonize the regulation of online gambling within the EU in line with the TFEU's stated objective of encouraging a free and open cross-border market have been unsuccessful.

The European Commission has initiated infringement proceedings against various member states for allegedly presiding over legislation and/or regulations that do not comply with the relevant EU member states’ TFEU obligations. However, in 2017, the European Commission withdrew various infringement proceedings against various EU member states on the basis that complaints could be more efficiently handled by national courts. This may encourage certain EU member states (who no longer have infringement proceedings against them) to try to enforce their national legislation. There can be no assurance that the ECJ will continue to apply EU freedom principles to the online gambling industry in the future. Consequently, remote gambling operators could need to obtain any requisite local licenses in affected jurisdictions. There is uncertainty as to how jurisdictions regulate remote gambling, including product restrictions, licensing requirements and taxation regimes, any of which could limit or prevent the Company’s customers from being able to supply their services within such territories on profitable terms or at all. While we believe that we are in compliance in all material respects with all applicable iGaming laws, licenses and regulatory requirements, we cannot assure that our activities or the activities of our users will not become the subject of any regulatory or law enforcement, investigation, proceeding or other governmental action or that any such proceeding or action, as the case may be, would not have a material adverse impact on us or our business, financial condition or results of operations. See "Risk Factors".

United States Regulatory Landscape

Government Regulation

The Company is licensed in numerous American states such as Connecticut, Michigan, New Jersey, and Pennsylvania. The Company and certain subsidiaries are subject to various United States laws and regulations that affect its ability to operate in the iGaming industry.

The United States gaming industry (including Bragg’s iGaming product offerings) is highly regulated and Bragg is required to maintain licenses in each jurisdiction from which it operates, in order to continue its operations. The Company’s business is subject to extensive regulation under the laws, rules, and regulations of the jurisdictions from which it operates. These laws, rules, and regulations generally concern the responsibility, financial stability, integrity, and character of the owners, managers and persons with material financial interests in the gaming operations along with the integrity and security of the iGaming product offering. Violations of laws or regulations in one jurisdiction could result in disciplinary action in that and other jurisdictions.

United States gaming laws are generally based upon declarations of public policy designed to protect gaming consumers and the viability and integrity of the gaming industry. Gaming laws may also be designed to protect and maximize state and local tax revenues, as well as to enhance economic development and tourism. To accomplish these public policy goals, gaming laws establish stringent procedures to ensure that participants in the gaming industry meet certain standards of character and responsibility. Among other things, gaming laws require gaming industry participants to:

| ● | ensure that unsuitable individuals and organizations have no role in gaming operations; |

| ● | establish procedures designed to prevent cheating and fraudulent practices; |

| ● | establish and maintain anti-money laundering practices and procedures; |

| ● | establish and maintain responsible accounting practices and procedures; |

| ● | maintain effective controls over their financial practices, including establishing minimum procedures for internal fiscal affairs and the safeguarding of assets and revenues; |

| ● | maintain systems for reliable record keeping; |

21

| ● | file periodic reports with gaming regulators; |

| ● | establish programs to promote responsible gaming; and |

| ● | enforce minimum age requirements. |

Typically, a state regulatory environment is established by statute and underlying regulations and is administered by one or more regulatory agencies (typically a gaming commission or state lottery) which regulate the affairs of owners, managers and persons with financial interests in gaming operations. Among other things, gaming authorities in the various jurisdictions in which the Company conducts its business:

| ● | adopt rules and regulations under the implementing statutes; |

| ● | interpret and enforce gaming laws and regulations; |

| ● | impose fines and penalties for violations; |

| ● | review the character and fitness of participants in gaming operations and make determinations regarding their suitability or qualification for licensure; |

| ● | grant licenses for participation in gaming operations; |

| ● | collect and review reports and information submitted by participants in gaming operations; |

| ● | review and approve certain transactions, which may include acquisitions or change-of-control transactions of gaming industry participants and securities offerings and debt transactions engaged in by such participants; and |

| ● | establish and collect fees and taxes in jurisdictions where applicable. |

While the Company believes that it is in compliance in all material respects with all applicable iGaming laws, licenses and regulatory requirements, the Company cannot assure that its activities or the activities of its customers will not become the subject of any regulatory or law enforcement, investigation, proceeding or other governmental action or that any such proceeding or action, as the case may be, would not have a material adverse impact on the Company or its business, financial condition or results of operations. See "Risk Factors".

Licensing and Suitability Determinations

In order to operate in certain jurisdictions, the Company must obtain either a temporary or permanent license or determination of suitability from the responsible authorities. The Company seeks to ensure that it obtains all necessary licenses to develop and put forth its offerings in the jurisdictions in which its customers operate and where their end users are located.

Gaming laws require the Company, and each of its subsidiaries engaged in gaming operations, certain of its directors, officers and employees, and in some cases, certain shareholders, to obtain licenses from gaming authorities. Licenses typically require a determination that the applicant qualifies or is suitable to hold the license. Where not mandated by statute, rule or regulation, gaming authorities typically have broad discretion in determining who must apply for a license or finding of suitability and whether an applicant qualifies for licensing or should be deemed suitable to conduct operations within a given jurisdiction. When determining to grant a license to an applicant, gaming authorities generally consider: (i) the financial stability, integrity and responsibility of the applicant (including verification of the applicant’s sources of funding); (ii) the quality and security of the applicant’s online real-money gaming platform, hardware and related software, including the platform’s ability to operate in compliance with local regulation, as applicable; (iii) the applicant’s history; (iv) the applicant’s ability to operate its gaming business in a socially responsible manner; and (v) in certain circumstances, the effect on competition.

Gaming authorities may, subject to certain administrative procedural requirements, (i) deny an application, or limit, condition, revoke or suspend any license issued by them; (ii) impose fines, either on a mandatory basis or as a consensual settlement of regulatory action; (iii) demand that named individuals or shareholders be disassociated from a gaming business; and (iv) in serious cases, liaise with local prosecutors to pursue legal action, which may result in civil or criminal penalties.

Events that may trigger revocation of a gaming license or another form of sanction vary by jurisdiction. However, typical events include, among others: (i) conviction in any jurisdiction of certain persons with an interest in, or key personnel of, the licensee of an offense

22