UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One) | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR SECTION 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

For the fiscal year ended

OR

For the transition period from to

OR

Date of event requiring this shell company report

Commission file number:

(Exact name of registrant as specified in its charter)

Not applicable |

|

| ||

(Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

Telephone: +357 22 418 200

(Address of principal executive offices)

Chief Executive Officer

Telephone: +

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered, pursuant to Section 12(b) of the Act

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

*American Depositary Receipts evidence American Depositary Shares, each American Depositary Share representing one ordinary share of the registrant.

**Nominal value EUR 0.0004 per ordinary share. Not for trading, but only in connection with the registration of the American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Note—Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☐ Large accelerated filer |

| ☐ Accelerated filer |

| ☒ |

| |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

☐ U.S. GAAP |

| ☒ |

| ☐ Other |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

TABLE OF CONTENTS

ABOUT THIS ANNUAL REPORT

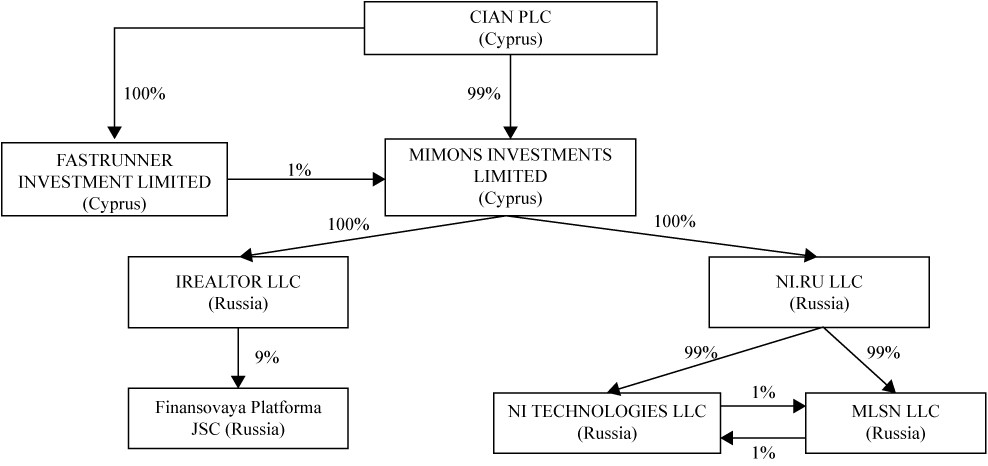

We have historically conducted our business through iRealtor LLC, a Russian limited liability company (“iRealtor”). iRealtor is a wholly owned subsidiary of Mimons Investments Limited, which in turn is a wholly owned subsidiary of the issuer, Cian PLC. On February 5, 2021, we acquired N1.RU LLC (“N1” and, together with its subsidiaries, the “N1 Group”), a real estate-focused classifieds business that primarily operates in regional cities in Russia, such as Novosibirsk, Ekaterinburg and Omsk (the “N1 Acquisition”).

Except where the context otherwise requires or where otherwise indicated, the terms “Cian,” the “Company,” the “Cian Group,” the “Group,” “we,” “us,” “our,” “our company” and “our business” refer to Cian PLC, in each case together with its consolidated subsidiaries as a consolidated entity, and the term “Issuer” refers to Cian PLC as a standalone company.

GLOSSARY OF KEY TERMS

“Average Unique Monthly Visitors (UMV)” means the average number of users and customers visiting our platform (websites and mobile application) per month in a particular period, excluding bots. Average UMV for a particular period is calculated by aggregating the UMV for each month within such period and dividing by the number of months. For 2020 and 2019, Average UMV is calculated based on Google Analytical data; for the 2021, Average UMV is calculated as a sum of Average UMV for the Cian Group (excluding N1 Group) based on Google Analytics data and Average UMV for the N1 Group based on Yandex.Metrica data. We calculate UMV using cookies and count the first time a computer or mobile device with a unique IP address accesses our platform during a month. If an individual accesses our platform using different IP addresses within a given month, the first access by each such IP address is counted as a separate unique visitor.

“Average daily revenue per listing” is calculated as listing revenue divided (i) by the total number of listings for the corresponding period and (ii) by the number of days during the period.

“Average revenue per lead to developers” is calculated as lead generation revenue (within the Core Business segment) for a period divided by the number of leads (to developers) during such period.

“Average revenue per paying account” is calculated as listing revenue in the secondary residential and commercial real estate verticals divided (i) by the number of paying accounts for the corresponding period and (ii) by the number of months during the period.

“C2C Rental” means the historically reported operating segment which comprised end-to-end solutions in property rentals, where commission was charged for digitalizing, facilitation and operating property rentals service (including tenant background checks, digital signing of agreements, online payments and insurance). We discontinued the services offered by our C2C Rental segment as of December 2021.

“Core Business” means the operating and reporting segment which comprises our core classifieds platform, including our listing and value-added services for secondary residential and commercial real estate customers as well as our lead generation solutions and value-added services for primary residential real estate customers, such as developers, as well as our advertising tools.

“Cumulative app downloads” means the number of times the Cian mobile application was downloaded via iOS and Android as of a particular date.

“Customers” means professional and private companies and individuals who list properties on our platform. Our customers include (i) professional listing customers, such as real estate agents (both agents working for real estate agencies and independent agents) and real estate developers, as well as (ii) private listing customers, such as individual sellers and renters who choose to list their property directly without any intermediary.

“End-to-End Offerings” means the operating and reporting segment which comprises Online Transaction Services, which enable online execution of real estate transactions (including document checking, verification, signing and storage, registration and tax refunds) and Home Swap service offerings, which facilitate simultaneous real estate sales and purchases.

“Leads to developers” means the number of paid target calls, lasting 30 seconds or longer, made through our platform by home searchers to real estate developers, for a particular period.

1

“Leads to agents and individual sellers” means the number of times our users clicked to “show” a customer’s phone number on our platform or sent chat messages to agents or property sellers through our platform in a month, calculated as a monthly average for a particular period.

“Listings” means the daily average number of real estate listings posted on our platform by agents and individual sellers for a particular period.

“Mortgage Marketplace” means the operating and reporting segment which comprises solutions for our partner banks for distributing their mortgage products through our advanced platform for mortgage price comparison, mortgage pre-approval and origination.

“Number of listings” is a metric presented in the Frost & Sullivan Report, which means the primary and secondary residential real estate listings for rent and purchase (excluding short-term rental) as of particular date.

“Paying accounts” means the number of registered accounts, which were debited at least once during a month for placing a paid listing on our platform or purchasing any value-added services, calculated as a monthly average for a particular period. We calculate the number of paying accounts to include both individual accounts and master accounts, but excluding subordinated accounts, which can be created under one master account by the real estate agencies for their individual agents as part of our virtual agency offering. For further descriptions of individual accounts, master accounts and subordinated accounts, see “Item 4. Information on the Company—B. Business Overview—Core Classifieds Business—Products and Services We Offer to Customers.”

“Share of leads to real estate agents and individual sellers” is a metric presented in the Frost & Sullivan Report, which means the share of calls made, and chat messages sent, through our platform in the total number of calls made, and chat messages sent, by property searchers to real estate agents and individual sellers during a particular period. Includes calls and chats related only to urban sale and purchase in secondary residential real estate vertical.

“Share of mobile in leads to agents and individual sellers” means the share of leads to agents and individual sellers, generated via the Cian mobile application and mobile website, as compared to total leads to agents and individual sellers through our platform. Calculated as a monthly average for a particular period.

“Share of mobile traffic” means the share of traffic generated via the Cian mobile application and mobile website as compared to the entire traffic of the Cian platform. Calculated per period (not average).

“Short term rental” means the leasing of a residential property with rental payments calculated on a per diem basis. This number is excluded from the “Number of listings” measure.

“Subscription model” means our monthly subscription model whereby our customers pay a fixed price to post real estate listings for a month-long period.

“Users” means the end users who use our platform, typically free of charge, to search for properties and a variety of information and services (including real estate listings) to help them navigate through various real estate transactions.

“Valuation and Analytics” means the operating and reporting segment which comprises our proprietary real estate market research, data analytics and market intelligence services.

2

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

We report under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (the “IASB”). Our financial statements included in this Annual Report are presented in rubles and, unless otherwise specified, all monetary amounts are in rubles. All references in this Annual Report to “₽,” “rubles” or “RUB” mean Russian rubles, all references to “$,” “dollars” or “USD” mean U.S. dollars and all references to “€,” “euro” or “EUR” mean euro, unless otherwise noted. We have made rounding adjustments to some of the figures included in this Annual Report. Accordingly, any numerical discrepancies in any table between totals and sums of the amounts listed are due to rounding.

Non-IFRS Financial Measures

Certain parts of this Annual Report contain non-IFRS financial measures, including Adjusted EBITDA, Core Business Adjusted EBITDA for Moscow and the Moscow region, Core Business Adjusted EBITDA for Other regions, Adjusted EBITDA Margin, Core Business Adjusted EBITDA Margin, Core Business Adjusted EBITDA Margin for Moscow and the Moscow region and Core Business Adjusted EBITDA Margin for Other regions. The non-IFRS financial measures are presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with IFRS and may be different from similarly titled non-IFRS measures used by other companies. See “Item 5. Operating and Financial Review and Prospects—B. Operating Results—Non-IFRS Measures.” for reconciliation of non-IFRS financial measures to the nearest IFRS measures.

Key Performance Indicators

Throughout this Annual Report, we provide a number of key performance indicators used by our management and often used by competitors in our industry. These and other key performance indicators are discussed in more detail in “Item 5. Operating and Financial Review and Prospects.” Our key performance indicators include the following (each, as defined under “Glossary of Key Terms” above):

| ● | Average UMV (Unique Monthly Visitors); |

| ● | Listings; |

| ● | Leads to agents and individual sellers; |

| ● | Paying accounts; |

| ● | Average revenue per paying account; |

| ● | Average daily revenue per listing; |

| ● | Leads to developers; and |

| ● | Average revenue per lead to developers. |

All key performance indicators and other data contained in this Annual Report, as of and for the periods prior to 2021, exclude the N1 Group data, unless stated otherwise.

3

MARKET AND INDUSTRY DATA

We obtained the industry, market and competitive position data in this Annual Report from our own internal estimates and research as well as from publicly available information, industry and general publications and research, surveys and studies conducted by third parties, such as SimilarWeb (“SimilarWeb”) and the other third parties stated below.

There are a number of market studies that address either specific market segments, or regional markets, within our industry. However, given the rapid changes in our industry and the markets in which we operate, no industry research that is generally available covers all of the digital real estate classifieds and adjacent market trends we view as key to understanding our industry and our place in Russia, in particular. We believe that it is important that we maintain as broad a view on industry developments as possible. To assist us in formulating our business plan and in anticipation of our initial public offering, we commissioned Frost & Sullivan, a third party market research company, to conduct an independent study of the digital real estate classifieds landscape in Russia, including an overview of macroeconomic, real estate and digital real estate classifieds market dynamics and their evolution over time, an analysis of underlying market trends and potential growth factors, an assessment of the current competitive landscape and other relevant topics, and prepare for us a report dated September 7, 2021, titled “Real Estate Advertising Market in Russia” (the “Frost & Sullivan Report”).

In connection with the preparation of the Frost & Sullivan Report, we furnished Frost & Sullivan with certain historical information about our Company and some data available on the competitive environment. Frost & Sullivan, in conjunction with third-party experts with extensive experience in the Russian real estate classifieds business, conducted research in preparation of the report, including a study of market reports prepared by other parties, interviews and a study of a broad range of secondary sources including other market reports, association and trade press publications, other databases and other sources. We used the data contained in the Frost & Sullivan Report to assist us in describing the nature of our industry and our position in it. Such information is included in this Annual Report in reliance on Frost & Sullivan’s authority as an expert in such matters.

Due to the evolving nature of our industry and competitors, we believe that it is difficult for any market participant, including us, to provide a precise data on the market or our industry. However, we believe that the market and industry data we present in this Annual Report provide accurate estimates of the market and our place in it. Industry publications and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this Annual Report.

TRADEMARKS, SERVICE MARKS AND TRADENAMES

We have proprietary rights to trademarks used in this Annual Report that are important to our business, many of which are registered under applicable intellectual property laws.

Solely for convenience, the trademarks, service marks, logos and trade names referred to in this Annual Report are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names. This Annual Report contains additional trademarks, service marks and trade names of others, which are the property of their respective owners. All trademarks, service marks and trade names appearing in this Annual Report are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

4

ENFORCEMENT OF CIVIL LIABILITIES

We are organized in Cyprus, and substantially all of our and our subsidiaries’ assets are located outside the United States, and all members of our board of directors are resident outside of the United States. As a result, it may not be possible to effect service of process within the United States upon us or any of our subsidiaries or such persons or to enforce U.S. court judgments obtained against us or them in jurisdictions outside the United States, including actions under the civil liability provisions of U.S. securities laws. In addition, it may be difficult to enforce, in original actions brought in courts in jurisdictions outside the United States, liabilities predicated upon U.S. securities laws.

Further, most of our and our subsidiaries’ assets are located in Russia. Judgments rendered by a court in any jurisdiction outside Russia will generally be recognized by courts in Russia only if (i) an international treaty exists between Russia and the country where the judgment was rendered providing for the recognition of judgments in civil cases and/or (ii) a federal law of Russia providing for the recognition and enforcement of foreign court judgments is adopted. No such federal law has been passed, and no such treaty exists, between Russia, on the one hand, and the United States, on the other hand. Even if an applicable international treaty is in effect or a foreign judgment might otherwise be recognized and enforced on the basis of reciprocity, the recognition and enforcement of a foreign judgment will in all events be subject to exceptions and limitations provided for in Russian law. For example, a Russian court may refuse to recognize or enforce a foreign judgment if its recognition or enforcement would contradict Russian public policy. In addition, Russian courts have limited experience in the enforcement of foreign court judgments.

In the absence of an applicable treaty, enforcement of a final judgment rendered by a foreign court may still be recognized by a Russian court on the basis of reciprocity, if courts of the country where the foreign judgment is rendered have previously enforced judgments issued by Russian courts. There are no publicly available judgments in which a judgment made by a court in the United States was upheld and deemed enforceable in Russia. In any event, the existence of reciprocity must be established at the time the recognition and enforcement of a foreign judgment is sought, and it is not possible to predict whether a Russian court will in the future recognize and enforce on the basis of reciprocity a judgment issued by a foreign court, including a U.S. court.

Russia is a party to the United Nations (New York) Convention on the Recognition and Enforcement of Foreign Arbitral Awards, but it may be difficult to enforce arbitral awards in Russia due to a number of factors, including compliance with the procedure for the recognition and enforcement of foreign arbitral awards by Russian courts established by the Arbitrazh Procedural Code of Russia, limited experience of Russian courts in international commercial transactions, official and unofficial political resistance to enforcement of awards against Russian companies in favor of foreign investors, Russian courts’ inability to enforce such orders and corruption. Furthermore, enforcement of any arbitral award pursuant to arbitration proceedings may be limited by the mandatory provisions of Russian laws relating to categories of non arbitrable disputes and the exclusive jurisdiction of Russian courts, and specific requirements to arbitrability of certain categories of disputes, including in respect of the ADSs (i.e., specific requirements in relation to a type of an arbitral institution, arbitration rules, seat of arbitration and parties to an arbitration agreement for consideration of so called corporate disputes in relation to Russian companies) and the application of Russian laws with respect to bankruptcy, winding up or liquidation of Russian companies.

Therefore, a litigant who obtains a final and conclusive judgment in the United States would most likely have to litigate the issue again in a Russian court of competent jurisdiction. The possible need to re-litigate a judgment obtained in a foreign court on the merits in Russia may also significantly delay the enforcement of such judgment. Under Russian law, certain amounts may be payable by the claimant upon the initiation of any action or proceeding in any Russian court. These amounts, in many instances, depend on the amount of the relevant claim.

Shareholders may originate actions in either Russia or Cyprus based upon either applicable Russian or Cypriot laws, as the case may be.

However, it is doubtful whether a Russian or Cypriot court would accept jurisdiction and impose civil liability in an original action commenced in Russia or Cyprus, as applicable, and predicated solely upon U.S. federal securities laws.

5

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements” (within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) that relate to our current expectations and views of future events. These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Item 3—Key Information—D. Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Item 3—Key Information—D. Risk Factors” and the following:

| ● | the negative impact on the Russian economy of the ongoing military operation in Ukraine; |

| ● | any negative effects of sanctions, export controls and similar measures targeting Russia as well as other responses to the military operation in Ukraine; |

| ● | our lack of historic profitability and any potential inability to achieve or maintain profitability; |

| ● | our ability to maintain our leading market positions, particularly in Moscow and St. Petersburg, and our ability to achieve and maintain leading market position in certain other regions; |

| ● | our ability to compete effectively with existing and new industry players in the Russian real estate classifieds market; |

| ● | any potential failure to adapt to any substantial shift in real estate transactions from, or demand for services in, certain Russian geographic markets; |

| ● | the health of the Russian real estate market and any positive or negative effects on our business performance as a result thereof, as well as general economic conditions in Russia; |

| ● | any effect on our operations due to cancellation of, or changes to the Russian mortgage subsidy program; |

| ● | further widespread impacts of the COVID-19 pandemic, or other public health crises, natural disasters or other catastrophic events which may limit our ability to conduct business as normal; |

| ● | our ability to establish and maintain important relationships with our customers and certain other parties; |

| ● | our ability to successfully implement our strategy; |

| ● | our ability to develop and implement new initiatives and to expand our presence in certain regional markets; |

| ● | the implementation of our subscription-based model may not materialize as expected; |

| ● | any negative effects resulting from updates or changes in search engine algorithms, other traffic-generating arrangements or adjacent products; |

6

| ● | any failure to establish and maintain proper and effective internal control over financial reporting; |

| ● | any failure to remediate existing deficiencies we have identified in our internal controls over financial reporting, including our information technology general controls; |

| ● | any new or existing government regulation in the area of data privacy, data protection or other areas; and |

| ● | our ability to protect our customer and user information stored by us from security breaches or administrative or technical failures. |

The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. The forward-looking statements made in this Annual Report relate only to events or information as of the date on which the statements are made in this Annual Report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this Annual Report and the documents that we reference in this Annual Report and have filed as exhibits to this Annual Report completely and with the understanding that our actual future results or performance may be materially different from what we expect.

7

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. | [Reserved] |

B. | Capitalization and Indebtedness |

Not applicable.

C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

D. | Risk Factors |

You should carefully consider the risks described below before making an investment decision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, results of operations, financial condition or prospects could be materially and adversely affected by any of these risks. This Annual Report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this Annual Report.

Summary of Risk Factors

The risks more fully described below that relate to our business include, but are not limited to, the following important risks:

| ● | The ongoing Russian military operation in Ukraine has negatively impacted the Russian economy and could adversely affect our business, financial condition and results of operations. |

| ● | Our business may be affected by sanctions, export controls and similar measures targeting Russia as well as other responses to the military operation in Ukraine. |

| ● | We have incurred operating losses in the past and may never achieve or maintain profitability. |

| ● | Our path to profitability greatly depends on us maintaining our leading market positions, particularly in Moscow, St. Petersburg and certain other regions, and achieving and maintaining leading market positions in certain other cities and regions |

| ● | The online classifieds market is competitive, and we may fail to compete effectively with existing and new industry players |

| ● | Our growth strategy is dependent on our marketing efforts and ability to attract new users. |

| ● | Our business is concentrated in certain geographic markets. |

8

| ● | We may be significantly impacted by the health of the Russian real estate market and may be negatively affected by downturns in this industry and general economic conditions. |

| ● | Our business and results of operations may be affected by the cancellation of, or any changes to, the Russian mortgage subsidy program and other government support programs. |

| ● | The COVID-19 pandemic and other public health crises, natural disasters or other catastrophic events may significantly limit our ability to conduct business as normal, disrupt our business operations and materially affect our financial condition. |

| ● | We may fail to establish and maintain important relationships with our customers and certain other parties. |

| ● | Technological changes may disrupt our business or the markets in which we operate and if we cannot keep pace our business could be harmed. |

| ● | Our continued growth depends on our ability to successfully implement our strategy, which is subject to a variety of risks and uncertainties, including regulatory risks. |

| ● | The implementation of our subscription model may not materialize as expected. |

| ● | If we fail to establish and maintain proper and effective internal control over financial reporting, our operating results and our ability to operate our business could be harmed. |

| ● | We may make acquisitions, divestments and investments, which could result in operating difficulties and other harmful consequences. |

| ● | We may face various risks relating to the N1 acquisition. |

| ● | The integrity of customer and user information stored by us, or the effectiveness of our platforms or systems in general, may be compromised |

| ● | Any significant disruption in the service of our websites or mobile applications could damage our business, reputation and brand. |

| ● | We may be unable to secure intellectual property protection for all of our technology, enforce our intellectual property rights, or protect our other proprietary business information. |

| ● | We may use open source software in a manner that could be harmful to our business. |

| ● | We may need to raise additional funds to finance our future capital needs, and we may not be able to raise additional funds on terms acceptable to us, or at all. |

| ● | We rely on assumptions, estimates and business data to calculate our key performance indicators and other business metrics. |

| ● | We operate in a rapidly evolving environment of increasing regulatory complexity |

| ● | If the Russian government were to apply existing limitations on foreign ownership to our business, or impose new limitations on foreign ownership of internet businesses in Russia, it could materially adversely affect our business. |

9

| ● | New or escalated tensions between Russia and neighboring states or other states could negatively affect the Russian economy. |

| ● | Because of their significant voting power and certain provisions of our articles of association, our principal shareholders will be able to exert control over us. |

| ● | A delisting of our ordinary shares from NYSE could have materially adverse effects on our business, financial condition and results of operations. |

Risks Related to the Russian Military Operation in Ukraine

The ongoing Russian military operation in Ukraine has negatively impacted the Russian economy and could adversely affect our business, financial condition and results of operations.

Deteriorating conditions in Russian economy

On February 24, 2022, Russian military forces commenced a special military operation in Ukraine and the length, prolonged impact and outcome of this ongoing military operation remains highly unpredictable. In response to the military operation in Ukraine, the United States, the United Kingdom, the European Union and other countries, have imposed unprecedented sanctions and export-control measures. The imposed sanctions have targeted large parts of the Russian’s economy and include, among others, blocking sanctions on some of the largest state-owned and private Russian financial institutions (and their subsequent removal from SWIFT), Russian businessmen and their businesses, some of which have significant financial and trade ties to the European Union, as well as blocking sanctions against Russian and Belarusian individuals, including the Russian President, other politicians and those with government connections or involved in Russian military activities, the blocking of Russia’s foreign currency reserves, expansion of sectoral sanctions and export and trade restrictions, limitations on investments and access to capital markets and bans on various Russian imports. For further details on sanctions, see also “—Our business may be affected by sanctions, export controls and similar measures targeting Russia as well as other responses to the military operation in Ukraine.”

As part of the measures introduced in response to the Ukrainian conflict, the United States and Canada announced a ban on importing Russian oil, liquefied natural gas and coal to the United States. While these countries account for a small portion of Russia’s oil and gas sales, since Russia produces and exports large quantities of crude oil and natural gas, a broader embargo may lead to production cuts and further worsening of the Russian economy. For instance, U.K. and EU authorities announce their plans to phase out their reliance on Russian fossil fuels. In response to the sanctions and export measures introduced by the Western countries, representatives of the Russian government have publically stated that Russia intends to strengthen trade ties with other countries that have not imposed sanctions on Russia, and to develop alternative export markets and trading partnerships. Should Russia fail to develop its trade relations with other countries, or should such developments fail to open alternative export markets, this may have negative effect on the Russian economy.

Due to public pressure and in protest of the Russian government’s actions, many U.S., European and other multi-national businesses across a variety of industries, including consumer goods and retail, food, energy, finance, media and entertainment, tech, travel and logistics, manufacturing and others, have indefinitely suspended their operations and paused all commercial activities in Russia and Belarus. These corporate boycotts have resulted in supply-chain disruptions and unavailability or scarcity of certain raw materials, technological and medical goods, component elements and various corporate and retail services, which may in turn have a spillover effect on the Russian economy. Fewer goods amid disruptions in supply chains are likely to affect consumers’ ability to purchase goods and amplify the sharp rise in inflation growth. In addition, suspension of operations by foreign businesses in Russia will likely lead to an increase in unemployment levels.

10

The conditions and outlook for the Russian economy deteriorated significantly since the beginning of the military conflict in Ukraine. In particular, the ruble to U.S. dollar exchange rate of the Central Bank of Russia (CBR) reached RUB 120.37 per U.S.$1.00 as of March 11, 2022 as compared to RUB 74.29 per U.S.$1.00 as of December 31, 2021. The CBR rate on April 29,2022 was RUB 72.30 per U.S.$1.00. Annual inflation in Russia accelerated to 9.15% in February 2022 and to 16.69% in March 2022. The geopolitical events have entailed significant volatility on the Russian financial markets, with the MOEX stock index declining by over 45.4% on February 24, 2022. On February 28, 2022, MOEX trading in all equity securities was suspended (including our ADSs), with limited exceptions and was fully resumed on March 28, 2022. Overall, MOEX trading was shut for four straight weeks, the longest in the country’s modern history. The stocks of Russian companies listed on the foreign stock exchanges faced an unprecedented decline in value with a number of stocks decreasing by almost 99% in value. The credit rating of the Russian Federation has been downgraded by each of Fitch Ratings CIS Limited (“Fitch”), Moody’s Investors Service, Inc. (“Moody’s”) and Standard & Poor’s Credit Market Services Europe Limited (“Standard & Poor’s”), as a result of the negative impact on the Russian economy from the new international sanctions imposed on Russia and the economic isolation by parts of the international business community, as well as countermeasures introduced by the Russian government. On March 3, 2022, Moody’s lowered its Russia’s long-term issuer rating to “B3” from “Baa3” and then further downgraded it to “Ca”. On March 2, 2022, Fitch downgraded its Russia’s long-term foreign currency rating from “BBB” to “B” and then further downgraded its rating to “C”. Standard & Poor’s gradually downgraded its Russian credit rating to “CC”. On March 11, 2022, the CBR published its first assessment of the outlook for the Russian economy and inflation growth based on its interview of economists and analysts. According to the World Bank, by the end of 2022, Russian GDP may decline by 11.5%, and inflation may reach 22%.

In response to accelerating inflation and a staggering depreciation of the ruble, on February 28, 2022, the CBR increased its key interest rate from to 9.5% to 20.0%, which was later decreased to 17.0% on April 8, 2022 and to 14.0% on April 29, 2022. Due to these monetary policy changes and the anticipated decline in the Russian economy, the domestic financial and banking markets may experience periodic shortages of liquidity. Lower money supply and higher funding costs may cause banks to cut their lending programs, decrease exposure limits and become significantly more risk averse. These factors may negatively affect the Russian banking sector as a whole and contribute to the worsening of economic conditions in the corporate sector, as well as lower household spending across various retail sectors of the economy.

The ability of Russian companies and banks to obtain funding from the international capital and loan markets has also been hampered as a result of sanctions and significant decreased demand from the international investor base. As Russia’s access to international debt markets become severely restricted and almost half of the Russia’s foreign currency reserves were blocked due to sanctions introduced by western countries, the Russian government would have to rely to a significant extent on its national welfare fund, export revenue and internal revenue sources to fund its anti-crisis measures, including potential recapitalization of Russian banks, support to the industrial sector and the real estate sector, import substitution measures, support for small businesses, and budget spending optimization. Although Russia’s current foreign currency and gold reserves may be sufficient to sustain the domestic currency market in the short term, there can be no assurance that the currency market will not further deteriorate in the medium or long term.

To stabilize and support the volatile Russian financial and currency markets and preserve foreign currency reserves, Russia’s authorities have imposed significant capital and currency control measures aimed at restricting the outflow of foreign currency and capital from Russia, imposed restrictions on repayments to foreign creditors in foreign currency, banned exports of various products and other economic and financial restrictions. For instance, Russian residents are prohibited from granting, in the absence of a permit of the special government commission, any loans to non-residents located in countries that introduced sanctions against Russia (“unfriendly foreign persons”) and foreign currency denominated loans to all non-residents and, in addition, from transferring of funds from accounts opened in Russia. Furthermore, a special procedure has been established for the fulfillment by Russian residents of their obligations in excess of 10 million rubles (or equivalent of this amount in foreign currency) per month on payment of dividends to unfriendly foreign persons. Payment of dividends in foreign currency may be conducted by a Russian company subject to a permit of the Central Bank of Russia (for credit organizations) or the Finance Ministry of the Russian Federation (for other debtors) or, in the absence of such permit, in rubles through special accounts of type “S”. The Russian authorities have also introduced a special temporary procedure for the payment of debts to foreign residents allowing Russian residents to repay debts to foreign creditors in rubles. Further measures taken by the Russian government and the CBR to address the depreciation of the ruble, including any capital controls, could contribute to a further deterioration of macro conditions and destabilize the financial and banking sectors.

11

In addition, on April 16, 2022, a new law was adopted requiring Russian companies to terminate foreign depositary programs under which the depositary receipts of such companies are listed on foreign stock exchanges. The termination of Russian companies’ depositary programs will result in the cancellation of the relevant depositary receipts and conversion of such receipts into shares of Russian companies. While the new law only applies to the Russian companies listed abroad, if any similar restrictions are introduced to cover Russian businesses with an offshore holding structure and such restrictions are signed into law, it could materially adversely affect the liquidity in, and the trading price of, our ADSs and ordinary shares.

We operate only in Russia and as a result, our business and results of operations are heavily dependent on the economic conditions in Russia. Any of the abovementioned factors may lead to further deterioration of economic conditions in Russia and adversely affect investments in Russian financial markets and the securities of Russian issuers, including our ADSs. Moreover, the continued impact of these events and any continuing or escalating military action, public protests, unrest, political instability or further sanctions could have a further adverse effect on the Russian economy and consequently, a material adverse effect on our business, financial condition and results of operations.

Impact on our business, financial condition and results of operations

We are actively monitoring the developing situation and assessing the impact of various economic and regulatory factors on our business. To date we have not experienced any material interruptions in our services, technology systems or networks needed to support our operations. We have no way to predict the progress or outcome of the military conflict in Ukraine or its short- or long-term impact on Russia as the conflict and government reactions are rapidly developing and beyond our control. For example, on February 28, 2022, NYSE has suspended trading of our ADSs amid escalation of the conflict between Russian and Ukraine and the rapidly evolving situation around sanctions. There can be no assurance that trading of our ADSs will be resumed by the NYSE and that the ADSs will not be delisted on the NYSE. See also “A delisting of our ordinary shares from NYSE could have materially adverse effects on our business, financial condition and results of operations.” As mentioned above, Russian equity prices on international stock markets that have not suspended trading have dropped dramatically. As trading of our ADSs on the NYSE is currently halted, we cannot predict with any degree of certainty what would be the trading price of our ADSs if and when the trading is resumed on this venue.

While the Russian counter measures did not have immediate effect on our business, there can be no assurance that the existing counter measures will not be expanded so as to include or affect our activity. For instance, the counter measures introduced by the Russian authorities prohibit granting of loans to the residents of unfriendly countries, which include Cyprus. There can be no assurance that new restrictions will not be introduced that would impede the Group’s ability to conduct intragroup transfers of funds, which is essential to ensure that each Group entity is in a position to meet its cash and liquidity needs. In addition, Russian countermeasures and currency control restrictions are passed very quickly, sometimes with no or limited official guidance, which can lead to misinterpretations and difficulties in enforcement. Furthermore, Russian authorities are currently developing various legislative and regulatory initiatives in response to recent geopolitical and economic events and some of these may be politically motivated or populistic in nature, including further restrictions on foreign businesses and nationalization. In particular, legislators are currently discussing a draft law aimed at forced alienation of property held by the residents of unfriendly countries without paying any compensation to its initial owners. The potential impact and the extent of such initiatives is difficult to determine at this stage.

A high level of inflation could lead to market instability, reductions in consumer purchasing power and an erosion of consumer confidence. This may adversely affect the Russian real estate market, as reduced disposable income and purchasing power is likely to have an adverse effect on consumers’ ability or willingness to invest in new housing or real estate, which would lead to a reduced demand for our services. We also expect the sharp rise in interest rates caused by the CBR’s key interest rate hike to have a materially negative impact on the Russian mortgage market. All major Russian banks have increased mortgage rates since January 2022 and, in some cases, have announced plans to significantly curtail or altogether suspend mortgage operations for the foreseeable future. Decreased availability of mortgage loans and high interest rates will directly impact the volume of mortgage deals on the market and, as a consequence, our revenue, specifically from the lead generation services for real estate developers and the growth of the Mortgage Marketplace.

12

Furthermore, the deterioration of the Russian economy will impact not only our users, but also real estate agencies and developers. A decrease in overall transaction volumes will result in lower earnings for real estate agencies and developers and, consequently, impair our ability to increase our lead generation fees in the short to medium-term. Additionally, during periods of deteriorating economic activity, our customers tend to optimize their marketing budgets and cut additional costs. We may therefore experience a decrease in demand for value-added services, which would negatively impact our revenues generally as well as the percentage of listing revenue represented by value-added services.

Any of the abovementioned factors could impact our revenue stream and could have a material adverse impact on our business, prospects, financial condition and operating results. Any such disruptions may also magnify the impact of other risks described in this Annual Report.

Our business may be affected by sanctions, export controls and similar measures targeting Russia as well as other responses to the military operation in Ukraine.

In March 2014, following a public referendum, the Crimean peninsula and the city of Sevastopol were proclaimed as new separate constituents of Russia by the governing authorities of Russia, Crimea and Sevastopol. In response to these events, the United States, the European Union and the United Kingdom, as well as other countries, imposed economic sanctions on certain Russian government officials, private individuals and Russian companies, as well as “sectoral” sanctions affecting specified types of transactions with named participants in certain industries, including named Russian financial state-owned institutions, and sanctions that prohibit most commercial activities of U.S. and EU persons in Crimea and Sevastopol.

On August 2, 2017, the U.S. enacted the Countering America’s Adversaries Through Sanctions Act (“CAATSA”) which, among other things, imposed sanctions against certain Russian entities, and provided for “secondary sanctions” targeting non-U.S. persons who engage in “significant transactions” with U.S. sanctions targets, whereby they may face adverse economic consequences in the form of denial of certain U.S. benefits or the designation on the U.S. Department of the Treasury, Office of Foreign Assets Control (“OFAC”) Specially Designated Nationals and Blocked Persons List (“SDN List”). In January 2018, pursuant to CAATSA, the U.S. administration submitted to the U.S. Congress a report on senior Russian political figures, “oligarchs” and “parastatal” entities. The identification of any individuals in the report did not, at that time, automatically lead to the imposition of new sanctions. Neither our directors, nor senior management are included in the report, or are otherwise currently the target of sanctions in the United States, the European Union or the United Kingdom.

More recently, as a result of Russia’s military conflict in Ukraine, governmental authorities in the United States, the European Union, the United Kingdom and other jurisdictions, have launched an unprecedented expansion of coordinated sanctions and export control measures, including:

| ● | blocking sanctions on some of the largest state-owned and private Russian financial institutions (and their subsequent removal from SWIFT); |

| ● | blocking sanctions against Russian and Belarusian individuals, including the Russian President, other politicians and those with government connections or involved in Russian military activities; |

| ● | blocking sanctions on Russian businessmen and their businesses, some of which have significant financial and trade ties to the European Union and the United Kingdom; |

| ● | blocking of Russia’s foreign currency reserves and prohibition on secondary trading in Russian sovereign debt and certain transactions with the Russian Central Bank, National Wealth Fund and the Ministry of Finance of the Russian Federation; |

| ● | expansion of sectoral sanctions in various sectors of the Russian and Belarusian economies and the defense sector; |

| ● | U.K. sanctions introducing restrictions on providing loans to, and dealing in securities issued by, persons connected with Russia; |

13

| ● | restrictions on access to the EU financial and capital markets, as well as prohibitions on leasing operations with aircraft; |

| ● | sanctions prohibiting most commercial activities of U.S. and EU persons in the so-called People’s Republic of Donetsk and the so-called People’s Republic of Luhansk (largely tracking prior prohibitions relating to Crimea and Sevastopol); |

| ● | enhanced export controls and trade sanctions targeting Russia’s imports of technological goods as a whole, including tighter controls on exports and re-exports of dual-use items, stricter licensing policy with respect to issuing export licenses, and/or increased use of “end-use” controls to block or impose licensing requirements on exports, as well as higher import tariffs; |

| ● | closure of airspace to Russian aircraft; |

| ● | ban on imports of Russian oil, liquefied natural gas and coal to the United States and “new investment” in Russia’s energy sector; |

| ● | ban on imports of Russian fish, seafood, and preparations thereof, alcoholic beverages, and non-industrial diamonds, as well as sanctions and export controls related to “luxury goods”; and |

| ● | ban on “new investment” in the Russian Federation by a U.S. person, which may be interpreted broadly. |

As the conflict in Ukraine continues, there can be no certainty regarding whether the governmental authorities in the United States, the European Union, the United Kingdom or other counties will impose additional sanctions, export controls or other measures targeting Russia, Belarus or other territories. To the extent applicable, existing and new or expanded future sanctions may negatively impact our revenue and profitability, and could impede our ability to effectively manage our legal entities and operations or raise funding from international financial institutions or the international capital markets. See “—The ongoing military actions between Russia and Ukraine have negatively impacted the Russian economy and could adversely affect our business, financial condition and results of operations.”

Although we have no facilities, assets or employees located in Crimea, customers and clients located in this region have access to our platform. Currently, less than one percent of our total revenue comes from the Crimea region. While we believe that the current United States, EU and U.K. sanctions do not preclude us from conducting our current business and do not create a material risk of application of any sanctions to us, new sanctions imposed by the United States, the United Kingdom and certain EU member states or other countries may restrict certain of our operations in the future.

14

Furthermore, in the ordinary course of business, our companies, like many Russian companies, have routine commercial operations with Russian persons and entities that are currently targeted by U.S. and other sanctions, including, for example, those designated on the OFAC SDN List or the Sectoral Sanctions Identifications List (“SSI List”), the EU Consolidated List of Financial Sanctions Targets (the “EU Consolidated List”) and the Consolidated List of Asset Freeze Targets maintained by Her Majesty’s Treasury (the “U.K. Consolidated List”). For example, we have closely engaged with Russian state-owned and other banks that are the target of U.S., EU, U.K. and other sanctions on our Mortgage Marketplace. In addition, because of the nature of our business, we do not generally know the identity of our customers. Therefore, we are not always able to screen them against the SDN List, the EU Consolidated List, the U.K. Consolidated List and other sanctions lists to confirm whether our customers are the target of sanctions. All dealings with sanctioned banks are conducted through our Russian operating companies. The Russian operating companies are not U.S., EU or U.K. persons and most of our employees, associates and affiliates are not U.S. EU or U.K. persons and, therefore, are generally restricted in dealings with U.S., EU or U.K. sanctioned persons only to the extent that those dealings involve a U.S., EU or U.K. nexus and are therefore subject to U.S., EU or U.K. jurisdiction. We do not believe that U.S., EU or U.K. persons are involved in activities with SDNs or persons on the EU Consolidated List or the U.K. Consolidated List, but if we are mistaken or if we cause a U.S., EU or U.K. person to violate applicable sanctions, then we could be exposed to legal risk under U.S., EU or U.K. sanctions. In some cases, non-U.S. companies are exposed to so-called “secondary sanctions” risk for doing business with U.S. sanctions targets including certain newly designated SDNs, which can include designation on the SDN List. The executive orders authorizing the U.S. sanctions provide that non-U.S. persons may be exposed to sanctions risk if, among other things, they materially assist, or provide financial, material or technological support for goods or services to, or in support of certain blocked or designated parties. Ongoing dealings with Russian banks, including certain banks designated as SDNs, on our Mortgage Marketplace may expose the Company to U.S. primary and secondary sanctions risk. Although our transactions and commercial relations with these entities are not legally prohibited by applicable sanctions, and we take steps to comply with applicable laws and regulations, should the sanctions regime with respect to these entities be widened, or should we fail to successfully comply with applicable sanctions, or become targeted by sanctions in the future, we may face negative legal and business consequences, including civil or criminal penalties, government investigations and reputational harm.

It is possible that existing sanctions regimes may be widened or that new sanctions may be imposed on our counterparties, or that we, our employees, associates or affiliates could become targeted by sanctions in the future, by the United States, the European Union, the United Kingdom or other jurisdictions, either as a result of the above activities or through a targeting of a broader segment of the Russian economy. This could have a material adverse effect on our business. For example, we might be unable to conduct business with persons or entities subject to the jurisdiction of the relevant sanctions regimes, including international financial institutions and rating agencies, transact in U.S. dollars, raise funds from international capital markets, acquire equipment from international suppliers or access assets held abroad. Moreover, if we become targeted by U.S., EU or U.K. sanctions, investors subject to the jurisdiction of an applicable sanctions regime may become restricted in their ability to sell, transfer or otherwise deal in or receive payments with respect to our ADSs, which could make the ADSs partially or completely illiquid and have a material adverse effect on their market value. We are also aware of initiatives by U.S. governmental entities and U.S. institutional investors, such as pension funds, to adopt or consider adopting laws, regulations, or policies prohibiting transactions with or investment in, or requiring divestment from, entities doing business with certain countries, which could limit the liquidity of the ADSs and thereby have an adverse impact on their value. There can be no assurance that the foregoing will not occur or that such occurrence will not have a material adverse effect on the price of the ADSs. Any of the above could have a material adverse impact on our business, financial condition, results of operations or prospects.

Risks Related to Our Business and Industry

We have incurred operating losses in the past and may never achieve or maintain profitability.

We incurred a loss of RUB 806 million, RUB 627 million and RUB 2,857 million in the years ended December 31, 2019, 2020 and 2021, respectively. We will need to generate and sustain increased revenue levels or decrease our expenses going forward to achieve profitability, and there can be no assurance that we will be successful in doing so, or that we will be able to maintain or increase profitability once achieved. We expect to continue the development and expansion of our business and anticipate additional costs in connection with legal, accounting and other administrative expenses related to operating as a public company. These expenses may prove higher than we anticipate, and we may not succeed in increasing our revenue sufficiently to offset the expenses associated with such development and operations as a public company. While our revenue has grown in recent years, if our revenue declines or fails to grow at a rate sufficient to offset increases in our operating expenses, we will not be able to achieve or maintain profitability in future periods. We cannot ensure that we will achieve profitability in the future or that, if we become profitable, we will be able to sustain or increase profitability.

15

Our path to profitability greatly depends on us maintaining our leading market positions, particularly in Moscow, St. Petersburg and certain other regions, and achieving and maintaining leading market positions in certain other cities and regions.

We own and operate a leading online real estate classifieds platform available primarily via our websites “Cian.ru” and “N1.ru” and via our Cian and N1 mobile applications. Through this platform, we offer (i) an opportunity to post real estate listings and to use our value-added services for both professional and private listing customers, which include real estate agents, real estate developers, individual sellers and renters (all referred to as “customers”); (ii) an opportunity to search real estate listings and to use our additional paid and free services for professional and private end-users visiting our platform (referred to as “users”) and (iii) additional services, such as advertisement placement, for third parties such as banks and other service providers for real estate transactions, as well as digital services facilitating transactions, such as Mortgage Marketplace and Online Transaction Services.

We believe that holding a leading position in an online real estate classifieds market significantly enhances our platform’s value proposition for our customers and users, as a high number of quality listings by customers attracts more users, helping to generate more leads for the customers, which, in turn, attracts more customers. As a result of these strong network effects, a market leader in this industry typically may benefit from operating leverage and greater potential opportunities to monetize its platform.

According to Company data, we believe that we currently have a leading position among online real estate classifieds platforms in the most populous Russian regions, including Moscow and the Moscow region, St. Petersburg and the Leningrad region, Ekaterinburg and Novosibirsk, based on (i) the share of leads to real estate agents and individual sellers (data for the first quarter of 2021; data for Ekaterinburg and Novosibirsk includes the N1 Group) and also (ii) the number of residential listings for purchases and for rent (excluding short term rentals) (as of April 1, 2021; data for Ekaterinburg and Novosibirsk includes the N1 Group). For further details, including definition and calculation of the number of leads, see “Presentation of Financial and Other information—Key Performance Indicators.” In line with our strategy, we also aim to achieve and maintain leading market positions in other regions, see “Business—Strategy— Continued expansion into Russian regions via organic growth and select M&A opportunities.”

Achieving or maintaining leading market positions is not guaranteed. For example, a decline in the number or quality of listings on our platform for any reason may render our platform less attractive to our users, which, in turn, may decrease the number of visitors to our platform and leads we generate for our customers. Average UMV is one of the key metrics of our platform traffic and our user engagement. Our average UMV consistently grew to 19.5 million in 2021 (including N1) from 16.5 million in 2020 and 13.4 million in 2019. If our average UMV stagnates or declines, it may have a significant negative effect on the development of our platform, our ability to generate leads to our customers and partners and, consequently, our business, results of operations, financial condition and prospects.

There is a general lack of exclusivity in the online real estate classifieds market, which allows the same property to be listed on multiple competing platforms simultaneously. Other platforms may offer superior interfaces, better overall experiences, or competitive features that we may not possess. Furthermore, those platforms may offer free listing services in markets where we do not. As a result of user churn due to these and other factors, such other platforms may become more attractive than ours for both customers and users due to their superior effectiveness in terms of number of users and, as a result, lead generation, as well as number of listings. If we are unable to maintain our current leading market positions, in particular, our leading market positions in Moscow and the Moscow region, St. Petersburg and the Leningrad region, Ekaterinburg and Novosibirsk, and if we are unable to achieve and maintain leading market positions in certain other regions, it could have a material adverse effect on our business, results of operations, financial condition and prospects.

The online classifieds market is competitive, and we may fail to compete effectively with existing and new industry players, which could have a material adverse effect on our business, results of operations, financial condition and prospects.

We operate in a competitive market that is characterized by the network effect, in which a high number of customers’ listings attracts user traffic, and higher traffic typically results in more leads for our customers, which, in turn, attracts more listings and advertising. Our ability to attract customers depends on a variety of factors, including our ability to generate leads for our customers, the number and quality of our listings, the costs of listing on our platform, reliability of our websites and mobile applications and user-friendly interface, the scope of our value-added service offerings as well as our marketing efforts. If we are unable to meet our customer and user demand, we may lose them to our competitors. Our current or future competitors may be able to better position themselves and it may be difficult for us to accurately assess current, or predict future, competitive environment and competitive threats that we may face.

16

We face competition from a variety of digital market players and, in the case of the primary real estate market, from offline advertising media, all of which provide platforms and advertising space to customers. Our key competitors are other vertical classifieds platforms (i.e., platforms specializing in a single category of classifieds), which focus on real estate classifieds, and horizontal classifieds platforms (i.e., generalist online classifieds platforms that offer listings across various product categories, including real estate). Vertical classifieds platforms operating in Russia include DomClick, Yandex.Nedvizhimost and Square Meter. Horizontal classifieds platforms include companies like Avito and Youla.

Some of our competitors may be able to leverage significant resources that are not available to us. For example, in the vertical classified space, DomClick is owned by Sberbank, the major banking group in Russia, and benefits from the extensive customer base of Sberbank, with a significant inflow of its users being acquired through cross-selling efforts directed at the mortgage audience within the Sberbank group. Similarly, Square Meter is owned by VTB, another large Russian banking group. In the horizontal classified space, Avito is owned by the international internet conglomerate, Naspers, which enhances its access to a large audience and high brand awareness. Avito has recently invested in key personnel, launched certain new products that compete directly with our own, and engaged in extensive marketing campaigns.

These and other platforms may enjoy additional competitive advantages, such as greater financial, technical, human and other resources. For example, Yandex continues to invest in its real estate classified services and recently, as part of Yandex.Nedvizhimost, launched Yandex. Arenda, which is a separate service facilitating long-term rentals. Competition against companies that also operate major internet search engines, such as Yandex, is particularly exacerbated by our reliance on paid search advertising to help direct users to our sites, since internet companies and aggregators that own real estate platforms could potentially divert users to other online classifieds platforms. See also “—Our business could be negatively affected by unavailability of search engines, or updates or changes in search engine algorithms and pricing model.”

Furthermore, we may also face competition from platforms that offer short-term rentals, such as Airbnb and Booking.com, if these platforms begin placing greater emphasis on more comprehensive real estate offerings that appeal to our current users. We may also face competition from new entrants into the online real estate classifieds market. For example, recently Ozon, one of the largest Russian e-commerce platforms, announced a launch of its real estate marketplace in partnership with a real estate developer.

Additionally, in organizing their real estate search, users may choose to participate in grassroots or community-based initiatives that are increasingly being organized on horizontal classifieds platforms and through social media, such as Facebook and VKontakte.

Industry consolidation could also significantly impact our business and operating results. There has been a relatively high amount of merger and acquisition activity in our market in recent years, which may continue. For example, on October 6, 2021, the Federal Antimonopoly Service of Russia (“FAS”) rejected a proposed business combination between us and Avito. While, as of the date of this annual report, we are not aware of any contemplated business combination involving the Cian Group, in the future, a competitor, private equity firm or any other company may make a merger or an unsolicited takeover proposal, which may create additional risks and uncertainties with respect to our financial position, operations, strategies and management. Any perceived uncertainties may also affect the market price and volatility of our ADSs. Additionally, if any of our competitors consolidate, we may experience increased competition with consolidated entities having enhanced market power.

Some of the real estate agents or real estate developers in Russia may also form associations and establish their own real estate platforms and advertising channels, including through social media. In addition, we also compete with regional and local players. Given Russia’s large geographical coverage, our competitors operating on regional and local levels may enjoy certain competitive advantages, including greater brand recognition, stronger presence in a particular region and understanding of the local market and local demands, more favorable pricing alternatives and lower operating costs.

There can be no assurance that we will be able to compete successfully against other companies that provide similar services in the competitive environment in which we operate. If we are not able to compete effectively, it could result in us having to make changes to our strategy and business model, and it could have a material adverse effect on our business, results of operations, financial condition and prospects.

17

We are heavily dependent on our brands and reputation.

Our success depends in large part on our “Cian” and “N1” brand family. In the markets where we are a market leader, our brands are particularly important as they benefit from, and are reinforced by, the network effects of our market-leading positions. We believe that our “Cian” brand enjoys market-leading brand awareness in Moscow and St. Petersburg, while our “N1” brand has a strong recognition in numerous regional markets, such as Ekaterinburg and Novosibirsk. However, our brands are also important in the markets where we are working to build our brand recognition and brand awareness.

Awareness and perceived quality and differentiation of our brands are critical aspects of our efforts to attract and expand the number of our customers and users. For example, it may be easier for our competition from horizontal platforms, such as Avito, to leverage their broader platform and build stronger brand awareness in the online real estate classifieds market. Furthermore, some of our competitors, particularly those owned by large Russian banking groups, such as DomClick, may benefit from larger marketing budgets and other resources in promoting their brand. See “—The online classifieds market is competitive, and we may fail to compete effectively with existing and new industry players, which could have a material adverse effect on our business, results of operations, financial condition and prospects.” If we fail to maintain, protect or enhance our brands, we may not be able to increase our prices if and as planned, or we may be required to increase our marketing or sales efforts, which could be costly or prove unsuccessful in avoiding customer and user churn.

Our reputation depends on the accuracy, completeness and timeliness of the listings information that we provide, although the accuracy and completeness of this data is often outside of our control. Furthermore, any events that cause our customers and users to believe that we have failed to maintain high standards of integrity, service, security and quality could affect our brand image or lead to negative publicity about the security, integrity or quality of our platform, which may damage our reputation or lead to loss of trust among our customers and users. We are susceptible to others damaging the reputation of our brands by, for example, posting low-quality listings, such as fraudulent or replicated listings, inappropriate content or inaccurate information on our platform. Such incidents may result in adverse publicity and harm our reputation and brands.

Furthermore, our brands and reputation also depend on our ability to maintain effective customer service, which requires significant personnel expense and which, if not managed properly, could significantly impact our profitability. If we are unable to properly manage or train our customer service representatives, it could compromise our ability to effectively handle our customers’ needs.

Our reputation further depends, in part, on positive customer reviews and ratings on social media platforms and application stores in respect of our mobile apps. In late 2021, we announced updates to our content policies to ban listings from our platforms that include discriminatory criteria. Several nationalist organizations responded by submitting negative comments and ratings on social media and in app stores (including GooglePlay and AppStore), which caused our app rating to decline significantly at a certain point. We have been actively working to have comments that violate the app stores’ policies removed, but we cannot provide any assurance that these measures will be sufficient for us to regain our app store ratings, or to thus repair any reputational harm that may have occurred. As social media use is prevalent and largely unpoliced in terms of type of comments that may be posted, there is the potential that additional negative reviews targeting our anti-discriminatory policy may negatively impact our brands and reputation in the future.

If we are unable to protect and maintain our brand recognition and reputation, or if we are required to make significant investments to protect our brands from competition or a deterioration in customer and user perception, we may experience a decline in demand for our services or an increase in operating costs, which, in turn, could have a material adverse effect on our business, results of operations, financial condition and prospects.

Our growth strategy is dependent on our marketing efforts and ability to attract new users.