UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

Amendment No.2

☒ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934.

OR

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended __________________

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________________ to ____________________

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Securities registered or to be registered pursuant to Section 12 (b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act: Common Shares

The number of outstanding common shares of GameSquare's only class of capital or common stock as at July July 30, 2021 was 243,901,900 common shares.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: Not applicable.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☐ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definition of "accelerated filer" and "large accelerated filer" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☐ Emerging growth company ☒ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP ☐ |

International Financial Reporting Standards as issued |

Other ☐ |

If "Other" has been checked in response to previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☐

TABLE OF CONTENTS

i

ii

In this Form 20-F, the terms "we", "our", "us" and "GameSquare" refer, unless the context requires otherwise, to GameSquare Esports Inc.

CURRENCY

All amounts are expressed in Canadian dollars ("C$") unless otherwise stated. See the information under the heading "Item 3.A. Selected Financial Data — Exchange Rates" for relevant information about the rates of exchange between Canadian dollars and the other functional currencies used by certain subsidiaries of GameSquare.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this registration statement on Form 20-F (this "Form 20-F") constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of Canadian provincial securities laws (such forward-looking statements and forward-looking information are referred to herein as "forward-looking statements"). These statements reflect our management's expectations with respect to future events, the Corporation's financial performance and business prospects. All statements other than statements of historical fact are forward-looking statements. The use of the words "anticipate", "believe", "continue", "could", "estimate", "expect", "intends", "may", "might", "plan", "possible", "potential", "predict", "project", "shall", "should", "will", "would", and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These statements involve known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those anticipated or implied in such forward-looking statement. No assurance can be given that these expectations will prove to be correct and such forward-looking statement included in this Form 20-F should not be unduly relied upon. Unless otherwise indicated, these statements speak only as of the date of this Form 20-F.

In particular, this Form 20-F contains forward-looking statements pertaining to, among other things, the factors discussed under "Item 3. Key Information — D. Risk Factors."

This list is not exhaustive of the factors that may affect any of our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the heading "Item 3. Key Information — D. Risk Factors.", If one or more of these risks or uncertainties materializes, or if underlying assumptions prove incorrect, our actual results may vary materially from those expected, estimated or projected. Forward-looking statements in this document are not a prediction of future events or circumstances, and those future events or circumstances may not occur. Given these uncertainties, users of the information included in this Form 20-F, including investors and prospective investors are cautioned not to place undue reliance on such forward-looking statements.

The forward-looking statements in this Form 20-F speak only as to the date hereof and are based on our beliefs, opinions and expectations at the time they are made. Except as required by applicable law, including the securities laws of the United States and Canada, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Any forward-looking statements included in this Form 20-F are expressly qualified by this cautionary statement, and except as otherwise indicated, are made as of the date of this Form 20-F. The Corporation does not assume or undertake any obligation to update or revise any forward-looking statements or departures from them, except as required by applicable law. New factors emerge from time to time, and it is not possible for our management to predict all such factors and to assess in advance the impact of each such factor on the business of the Corporation or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

Directors

The following table sets forth the names and positions of the members of our board of directors (the "Board") as of the date of this Form 20-F. The business address of all directors is: 65 Queen Street West, Suite 900, Toronto, Ontario M5H 2M5, Canada.

|

Name |

Position |

|

Neil Said |

Chairman of the Board |

|

Justin Kenna |

Executive Director and Chief Executive Officer |

|

Kevin Wright |

Executive Director and President |

|

Craig Armitage |

Independent Non-Executive Director |

|

Paul LeBreux |

Independent Non-Executive Director |

Senior Management

The following table sets forth the names and positions of the members of our senior management as of the date of this Form 20-F. The business address of all members of senior management is: 65 Queen Street West, Suite 800, Toronto, Ontario M5H 2M5, Canada.

|

Name |

Position |

|

Justin Kenna |

Chief Executive Officer |

|

Kevin Wright |

President |

|

Paul Bozoki |

Chief Financial Officer |

|

Aaron Atin |

Corporate Secretary |

|

Jan Neumeister |

Head of European Operations |

Service Agreements

The following describes the respective consulting agreements entered into by the Corporation as of the date of this Form 20-F. Other than as disclosed below, none of our officers or directors have compensation arrangements pursuant to any other arrangement or in lieu of any standard compensation arrangement.

|

Name |

Notice Period |

Monthly Fees |

Severance on Termination |

Severance on Change of Control |

|

Justin Kenna, Chief Executive Officer and Executive Director |

30 days |

US$50,000 |

Twelve months' fees |

36 months' base fees plus aggregate cash bonuses paid in the 36 months prior to the Change in Control. |

|

Paul Bozoki, Chief Financial Officer and Executive Director |

30 days |

C$8,333.33 |

Six months' fees |

24 months' base fees plus aggregate cash bonuses paid in the 24 months prior to the Change in Control. |

|

Kevin Wright, President |

30 days |

C$18,750 |

Twelve months' fees |

24 months' base fees plus aggregate cash bonuses paid in the 24 months prior to the Change in Control. |

|

Name |

Notice Period |

Monthly Fees |

Severance on Termination |

Severance on Change of Control |

|

Neil Said, Chairman of the Board |

30 days |

C$5,000 |

Six months' fees |

24 months' base fees plus aggregate cash bonuses paid in the 24 months prior to the Change in Control. |

|

Jan Neumeister, Head of European Operations |

30 days |

US$12,500 |

Three months' fees |

Nil |

|

Forbes & Manhattan Consulting Contract(1) |

30 days |

C$10,000 |

12 months' fees |

36 months' base fees plus aggregate cash bonuses paid in the 36 months prior to the Change in Control. |

|

Aaron Atin, Corporate Secretary |

30 days |

C$3,000 |

Six months' fees |

24 months' base fees plus aggregate cash bonuses paid in the 24 months prior to the Change in Control. |

____________________

(1) Forbes & Manhattan is a private merchant bank with a global focus on the resource, agriculture, technology and telecommunications sectors, headquartered in Toronto which provides management and financial consulting services for GameSquare. Neil Said, the Chairman of the Board, is a corporate lawyer for Forbes & Manhattan.

The estimated incremental payments, payables and benefits that might be paid to the officers pursuant to the above noted agreements in the event of termination without cause or after a Change in Control (assuming such termination or Change in Control is effective as of the date of this Form 20-F) are detailed below:

|

Named Executive Officer |

Termination not for Cause |

Termination on a Change of Control |

|

|

(C$) |

|

|

Justin Kenna |

|

|

|

Salary and Quantified Benefits |

362,000 |

1,085,000 |

|

Bonus |

Nil |

Nil |

|

Total |

362,000 |

1,085,000 |

|

Paul Bozoki |

|

|

|

Salary and Quantified Benefits |

50,000 |

200,000 |

|

Bonus |

Nil |

Nil |

|

Total |

50,000 |

200,000 |

|

Kevin Wright |

|

|

|

Salary and Quantified Benefits |

225,000 |

450,000 |

|

Bonus |

Nil |

Nil |

|

Total |

225,000 |

450,000 |

|

Neil Said |

|

|

|

Salary and Quantified Benefits |

30,000 |

72,000 |

|

Bonus |

Nil |

Nil |

|

Total |

30,000 |

72,000 |

|

Jan Neumeister |

|

|

|

Salary and Quantified Benefits |

45,250 |

45,250 |

|

Bonus |

18,100 |

18,100 |

|

Total |

63,350 |

63,350 |

|

Manhattan & Forbes |

|

|

|

Salary and Quantified Benefits |

120,000 |

360,000 |

|

Bonus |

Nil |

Nil |

|

Total |

120,000 |

360,000 |

|

Aaron Atin |

|

|

|

Salary and Quantified Benefits |

18,000 |

72,000 |

|

Bonus |

Nil |

Nil |

|

Total |

18,000 |

72,000 |

|

Total |

868,350 |

2,302,350 |

B. Advisers

Our external legal advisers are Nauth LPC, 17 Queen Street West, Suite 401 Toronto, Ontario M5V 0R2, Canada.

Our external financial advisers are Forbes & Manhattan, 65 Queen Street West Suite 805, P.O. Box 71, Toronto, Ontario M5H 2M5, Canada.

C. Auditors

Our auditors are Kreston GTA LLP, Chartered Accountants (“Kreston”), with its office located at 8953 Woodbine Avenue, Markham, ON, L3R 0J9, Canada. Kreston is a member of the Chartered Professional Accountants of Ontario and the Public Company Accounting Oversight Board.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The following tables present selected historical financial data for GameSquare and its subsidiaries (collectively, the "Group"). The balance sheet financial data as at November 30, 2020 and the three months ended February 28, 2021 and the income statement financial data for the year ended November 30, 2020 and the three months ended February 28, 2021, in each case as set forth below, has been derived from the Group's audited consolidated financial statements included by reference in this Form 20-F.

Balance Sheet

The following tables present the Group's balance sheet for the year ended November 30, 2020 and the three months ended February 28, 2021.

| Year Ended November 30, 2020 |

||

| (C$) | ||

| Assets | ||

| Current assets | ||

| Cash | 660,686 | |

| Amounts receivable | 381,749 | |

| Prepaid expenses and deposits | 109,142 | |

| Other investments | 62,635 | |

| Total current assets | 1,214,212 | |

| Equipment | 1,419 | |

| Intangibles | 2,361,567 | |

| Goodwill | 2,258,109 | |

| Reclamation deposits | 338,606 | |

| Total Assets | 6,173,913 | |

| Liabilities | ||

| Current liabilities | ||

| Accounts payable | 845,273 | |

| Deferred revenue | 104,630 | |

| Total current liabilities |

949,903 |

|

| Deferred consideration on acquisition of Code Red | 335,000 | |

| Loans | 40,000 | |

| Reclamation provision | 323,933 | |

| Deferred tax liability | 464,000 | |

| Total Liabilities | 2,112,836 | |

| Shareholders' Equity | ||

| Share capital | 6,340,328 | |

| Contributed surplus | 718,951 | |

| Warrants | 827,461 | |

| Accumulated other comprehensive income | 884 | |

| Accumulated deficit | (3,826,547 | ) |

| Total Shareholders' Equity | 4,061,077 | |

| Total Liabilities and Shareholders' Equity | 6,173,913 |

|

Three Months Ended |

||

| (C$) | ||

| Assets | ||

| Current assets | ||

| Cash | 1,133,220 | |

| Amounts receivable | 357,047 | |

| Prepaid expenses and deposits | 185,336 | |

| Other investments | 62,635 | |

| Total current assets | 1,738,238 | |

| Equipment | 1,286 | |

| Intangibles | 2,288,253 | |

| Goodwill | 2,320,812 | |

| Reclamation deposits | 434,320 | |

| Total Assets | 6,782,909 | |

| Liabilities | ||

| Current liabilities | ||

| Accounts payable | 977,778 | |

| Deferred revenue | 68,855 | |

| Deferred consideration on acquisition of Code Red | 335,000 | |

| Total Current Liabilities | 1,381,633 | |

| Long term loan | 60,000 | |

| Reclamation provision | 323,933 | |

| Deferred tax liability | 437,144 | |

| Total Liabilities | 2,202,710 | |

| Shareholders' Equity | ||

| Share capital | 7,111,358 | |

| Contributed surplus | 812,300 | |

| Warrants | 1,055,181 | |

| Accumulated other comprehensive income | 117,503 | |

| Accumulated deficit | (4,516,143 | ) |

| Total Shareholders' Equity | 4,580,199 | |

| Total Liabilities and Shareholders' Equity | 6,782,909 |

Income Statement

The following tables present the Group's statement of loss and comprehensive loss for the year ended November 30, 2020 and the three months ended February 28, 2021.

|

Year Ended |

||

| (C$) | ||

| Revenue | 488,774 | |

| Cost of sales | 331,228 | |

| Gross margin | 157,546 | |

| Consulting and salaries | 760,648 | |

| Professional fees | 8,323 | |

| Office and general | 202,569 | |

| Travel | 4,107 | |

| Depreciation | 81,433 | |

| Shareholder communications | 52,229 | |

| Bad debt expense | 74,581 | |

| Share based compensation | 709,953 | |

| Foreign exchange | 5,110 | |

| Change in fair value of reclamation provision | 6,308 | |

| Interest expense, net of interest income | 9,550 | |

| RTO transaction costs | 1,817,540 | |

| Total Expenses |

3,732,351 |

|

| Loss before taxes | (3,574,805 | ) |

| Income taxes | (1,697 | ) |

| Net loss | (3,573,108 | ) |

| Basic and diluted per share | (0.14 | ) |

| Weighted average number of common shares outstanding – basic and diluted | 24,995,371 |

| Three Months Ended February 28, 2021 |

||

| (C$) | ||

| Revenue |

1,045,255 |

|

| Cost of sales |

926,235 |

|

| Gross margin |

119,020 |

|

| Consulting and salaries |

524,212 |

|

| Professional fees |

50,166 |

|

| Office and general |

73,764 |

|

| Travel |

261 |

|

| Depreciation |

123,504 |

|

| Shareholder communications |

56,671 |

|

| Share based compensation |

93,349 |

|

| Foreign exchange |

21,414 |

|

| Change in fair value of reclamation provision |

(95,288 |

) |

| Interest expense, net of interest income |

(393 |

) |

| Total Expenses |

847,660 |

) |

| (Loss) before taxes |

(728,640 |

) |

| Income taxes |

(39,044 |

) |

| Net (loss) |

(689,596 |

) |

| Basic and diluted (loss) per share |

(0.01 |

) |

| Weighted average number of common shares outstanding – basic and diluted |

52,167,059 |

Exchange Rates

Our consolidated financial information is presented in Canadian dollars. However, the functional currency of Code Red Ltd. is the UK pound sterling ("GBP"). Transactions in foreign currencies, including GBP, are translated into the transacting entities' functional currency at the exchange rates at the dates of the transactions. Monetary assets and liabilities denominated in foreign currencies are retranslated at the rate of exchange ruling at the statement of financial position dates. Non-monetary items in a foreign currency are measured in terms of historical cost and are translated using the exchange rates on the dates of the initial transactions. All differences are taken to the statements of income in the periods in which they arise.

The assets and liabilities of foreign operations are translated at the exchange rates at the reporting date to the presentation currency. The income and expenses of foreign operations are translated at the exchange rates at the dates of the transactions. Foreign currency differences are recognized in other comprehensive income (loss) and accumulated in the translation reserve.

B. Capitalization and Indebtedness

The following table presents the Group's cash and cash equivalents and capitalization as at April 30, 2021.

| As at April 30, 2021 | ||

| (C$) | ||

| Cash and cash equivalents | 5,027,014 | |

| Borrowings: | ||

| Borrowings | 763,016 | |

| Total borrowings | 763,016 | |

| Equity: | ||

| Share capital | 26,244,618 | |

| Reserves | (1,316,387 | ) |

| Total Equity | 24,928,231 | |

| Total capitalization | 30,718,261 |

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our securities involves a high degree of risk and the securities must be considered highly speculative. You should consider carefully all of the risks described below, together with the other information contained in this Form 20-F, before making a decision to invest in our securities. If any of the following events occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline, and you could lose all or part of your investment.

The risk factors outlined below are not a definitive list of all risk factors associated with an investment in the securities offered hereunder. Additional risks and uncertainties not presently known to us, or which we currently deem not to be material, may also have a material adverse effect. Prospective investors and shareholders should consider carefully all of the information set out in this Form 20-F and the risks attaching to an investment in us before making any investment decision and consult with their own professional advisors where necessary.

Risks Related to Our Business

We are an early stage company with a limited operating history.

GameSquare Inc. was incorporated under the laws of the province of Ontario, Canada on December 13, 2018. GameSquare Inc. was acquired by oil and gas exploration company Magnolia Colombia Ltd. ("Magnolia") pursuant to a reverse-takeover transaction (the "RTO"), which was completed on October 2, 2020. On September 30, 2020, Magnolia changed its name to GameSquare Esports Inc.

Although GameSquare (formerly Magnolia) had decades of operating experience in the oil and gas industry prior to the RTO, it ceased all direct exploration activities in 2014 and had no experience in the esports industry prior to the RTO. GameSquare acquired its first revenue-generating asset, Code Red Ltd. ("Code Red"), on October 2, 2020. Prior to the acquisition of Code Red, GameSquare's operations were limited to identifying and acquiring target companies in the esports industry.

Consequently, we are subject to all the risks and uncertainties inherent in a new business and in connection with the development and sale of new services. As a result, we still must establish many corporate functions necessary to operate our business, including finalizing our administrative structure, assessing and expanding our marketing activities, implementing financial systems and controls and personnel recruitment. Accordingly, you should consider our prospects in light of the costs, uncertainties, delays, and difficulties frequently encountered by companies in this early stage of development. You should carefully consider the risks and uncertainties that a company, such as ours, with a limited operating history will face. In particular, you should consider that we cannot provide assurance that we will be able to:

● successfully implement or execute our current business plan;

● maintain our management team;

● raise sufficient funds in the capital markets to effectuate our business plan;

● attract, enter into or maintain contracts with, and retain clients; and/or

● compete effectively in the extremely competitive environment in which we operate.

If we cannot successfully accomplish any of the foregoing objectives, our business may not succeed.

We generate a significant portion of our revenue from representing esports players, influencers, gaming personalities and other on-screen talent through our wholly-owned subsidiary Code Red. If we fail to attract new clients or to successfully represent our existing clients, our revenue may be adversely affected.

Code Red represents esports players and influencers, including leading Twitch streamers, YouTubers and gaming personalities, as well as other on-screen talent, including commentators, analysts, event hosts, and production crew. Such representation includes soliciting and negotiating contracts with respect to sponsorships and endorsements and participation in esports tournaments, television shows and corporate events. Code Red currently represents 75 esports personalities. For the year ended November 30, 2020, and the three months ended February 28, 2021, representation of esports players, influencers and other on-screen talent and production crew generated approximately 28% and 19%, respectively, of Code Red's revenue.

The agency segment of the esports industry is highly competitive and there is no guarantee that we will succeed in attracting new clients to represent or that we will retain our existing clients. Factors that influence our success in attracting and retaining clients include our ability to:

-

successfully negotiate contracts on behalf of our clients;

-

secure sponsorships for our clients; and

-

secure event and tournament participation for our clients;

Failure to attract or retain clients would have a material, adverse effect on our business, financial condition and results of operations.

Code Red's business model may not remain effective and it cannot guarantee that its future monetization strategies will be successfully implemented or generate sustainable revenues and profit.

Code Red generates a portion of its revenue from securing talent for live esports events. Although we anticipate that the audience for such live esports will continue to grow, creating more opportunities for Code Red to provide services, such growth is not guaranteed and demand for Code Red's services may change, decrease substantially or dissipate, or it may fail to anticipate and serve client demands effectively. For example, the coronavirus pandemic ("COVID-19") has reduced demand for in-person esports events while increasing demand for online and broadcasted events. Although Code Red also provides a variety of services relating to online and broadcasted events, any decision to reduce or eliminate its service offering for live esports events in order to prioritize online and broadcasted events may be unsuccessful and would involve additional risks and costs that could materially and adversely affect our business, financial condition and results of operations.

Acquisitions may never materialize, may be subject to unexpected delays or may entail unexpected costs or prove unsuccessful.

We are engaged in identifying, acquiring and developing esports assets that we believe are a strategic fit for our business. However, we cannot predict what form future acquisitions might take or when such acquisitions will be consummated. We are likely to face significant competition in seeking appropriate acquisitions and these acquisitions can be complicated and time consuming to negotiate and document. We may not be able to negotiate acquisitions on acceptable terms, or at all, and we are unable to predict when, if ever, we will consummate such acquisitions due to the numerous risks and uncertainties associated with them.

Since we may not be able to accurately predict these difficulties and expenditures, these costs may outweigh the value we realize from a future acquisition. Future acquisitions could result in issuances of securities that would dilute shareholders' ownership interest, the incurrence of debt, contingent liabilities, amortization of expenses related to other intangible assets, and the incurrence of large, immediate write-offs.

Any of the forgoing could materially and adversely affect our business, financial condition and results of operations.

We have a history of accumulated deficits, recurring losses and negative cash flows from operating activities. We may be unable to achieve or sustain profitability or continue as a going concern.

If we are unable to increase revenues from our existing assets or from assets that we may acquire in the future, we will not be able to achieve and maintain profitability. Beyond this, we may incur significant losses in the future for a number of reasons including other risks described in this document, and we may encounter unforeseen expenses, difficulties, complications, delays and other unknown events. Accordingly, we may not ever be able to achieve profitability.

We incurred negative cash flows from operating activities and recurring net losses for the year ended November 30, 2020 and the three months ended February 28, 2021. Our working capital was C$264,309 as of November 30, 2020 and was C$356,605 as of February 28, 2021. As of November 30, 2020 and the three months ended February 28, 2021, our accumulated deficit was C$3,826,547 and C$4,516,143, respectively. These factors, among others, raise substantial doubt about our ability to continue as a going concern. The financial statements included in this prospectus do not include any adjustments that might result from the outcome of this uncertainty. In order for us to remove substantial doubt about our ability to continue as a going concern, we must achieve profitability, generate positive cash flows from operating activities and obtain necessary debt or equity funding. If we are unable to increase revenues or obtain additional financing, we may be unable to continue the development of our products and services and we may have to cease operations. In that event you could lose your entire investment.

Our consolidated financial statements have been prepared on the assumption that we will continue as a going concern. Our independent registered public accounting firms have included an explanatory paragraph in our consolidated financial statements for the year ended November 30, 2020 stating that our operating losses and limited working capital, raise substantial doubt about our ability to continue as a going concern. To date, it has been necessary to rely upon the sale of our equity securities to sustain operations. Our management anticipates that we will require additional capital to fund ongoing operations.

There can be no guarantee that we will be able to obtain such funds, or obtain them on satisfactory terms, and that such funds would be sufficient. If such additional funding is not obtained, we may be required to scale back or cease operations.

We will require additional financing and cannot be certain that such additional financing will be available on reasonable terms when required, or at all.

To date, we have relied primarily on equity financing to carry on our business. We have limited financial resources and operating cash flow and can make no assurance that sufficient funding will be available to us to fund our operating expenses and to further develop our business. As of February 28, 2021, we had cash of C$1.1 million. Additionally, the company closed a private placement equity offering for gross proceeds of C$7.0 million on March 4, 2021. We expect our current cash position will enable us to fund our operating expenses and capital expenditure requirements for at least the next 12 months. Thereafter, unless we achieve profitability, we anticipate that we will need to raise additional capital to fund our operations while we implement and execute our business plan.

We currently do not have any contracts or commitments for additional financing. Any additional equity financing may involve substantial dilution to then existing shareholders. There can be no assurance that such additional capital will be available, on a timely basis or on acceptable terms. Failure to obtain such additional financing could result in delay or indefinite postponement of operations or the further development of our business with the possible loss of such properties or assets. If adequate funds are not available or are not available on acceptable terms, we may not be able to fund our business or the expansion thereof, take advantage of strategic acquisitions or investment opportunities or respond to competitive pressures. Such inability to obtain additional financing when needed could have a material adverse effect on our business, financial condition and results of operations.

Future cash flows fluctuations may affect our ability to fund our working capital requirements or achieve our business objectives in a timely manner.

Our working capital requirements and cash flows are expected to be subject to quarterly and yearly fluctuations, depending on such factors as timing and size of capital expenditures, levels of sales and collection of receivables and client payment terms and conditions. We expect our current cash position, together with the proceeds of equity offerings, will enable us to fund our operating expenses and capital expenditure requirements for at least the next 12 months. However, a greater than expected slow-down in our clients' use of our services may require us to adjust our current business model. As a result, our revenues and cash flows may be materially lower than we expect and we may be required to reduce our capital expenditures and investments or take other measures in order to meet our cash requirements. We may seek additional funds from liquidity-generating transactions and other conventional sources of external financing (which may include a variety of debt, convertible debt and/or equity financings). We cannot provide any assurance that our net cash requirements will be as we currently expect. Our inability to manage cash flow fluctuations resulting from the above factors could have a material adverse effect on our ability to fund our working capital requirements from operating cash flows and other sources of liquidity or to achieve our business objectives in a timely manner.

If we fail to maintain and enhance our brands, our business, financial condition and results of operations may be materially and adversely affected.

We believe that maintaining and enhancing our brands, including GameSquare, Code Red and Reciprocity Corp. ("Reciprocity"), The Gaming Community Network ("GCN") and Rainbow7 and LGD Gaming franchises, as well as any other brands that we may acquire in the future, is important for our business to succeed by increasing our visibility and reputation in the esports industry and enabling us to attract new clients and retain existing clients for our businesses. Since we operate in a highly competitive industry, brand maintenance and enhancement directly affect our ability to maintain and enhance our market position. As we expand, we may conduct various marketing and brand promotion activities using various methods to continue promoting our brands, but we cannot assure you that these activities will be successful. In addition, negative publicity, regardless of its veracity, could harm our brands and reputation, which may materially and adversely affect our business, financial condition and results of operations.

The success of our business depends on our marketing efforts.

Achieving market success will require substantial marketing efforts and the expenditure of funds to inform potential clients of the distinctive benefits and characteristics of our products and services. Our long-term success will depend on our ability to expand current marketing capabilities. We will, among other things, need to attract and retain experienced marketing and sales personnel. No assurance can be given that we will be able to attract and retain such personnel or that any efforts undertaken by such personnel will be successful.

We are subject to privacy laws in each jurisdiction in which we operate and may face risks related to breaches of the applicable privacy laws.

We collect and store personal information about our users, clients and partners and are responsible for protecting that information from privacy breaches. A privacy breach may occur through procedural or process failure, information technology malfunction, or deliberate unauthorized intrusions. Theft of data for competitive purposes, particularly user and partner lists, is an ongoing risk whether perpetrated via employee collusion or negligence or through deliberate cyber-attack. Any such theft or privacy breach could have a material adverse effect on our business, financial condition or results of operations.

In addition, there are a number of Canadian federal and provincial laws protecting the confidentiality of personal information and restricting the use and disclosure of that protected information. In particular, the privacy rules under the Personal Information Protection and Electronics Documents Act (Canada) ("PIPEDA"), protect personal information by limiting its use and disclosure of personal information. If we are found to be in violation of the privacy or security rules under PIPEDA or other laws protecting the confidentiality of personal information, we could be subject to sanctions and civil or criminal penalties, which could increase our liability, harm our reputation and have a material adverse effect on our business, financial condition or results of operations.

We are exposed to cyber security incidents resulting from deliberate attacks or unintentional events.

Cyber security incidents can result from deliberate attacks or unintentional events, and may arise from internal sources (e.g., employees, contractors, service providers, suppliers and operational risks) or external sources (e.g., nation states, terrorists, hacktivists, competitors and acts of nature). Cyber incidents include, but are not limited to, unauthorized access to information systems and data (e.g., through hacking or malicious software) for purposes of misappropriating or corrupting data or causing operational disruption. Cyber incidents also may be caused in a manner that does not require unauthorized access, such as causing denial-of-service attacks on websites (e.g., efforts to make network services unavailable to intended users).

A cyber incident that affects our business or our service providers might cause disruptions and adversely affect their respective business operations and might also result in violations of applicable law (e.g., personal information protection laws), each of which might result in potentially significant financial losses and liabilities, regulatory fines and penalties, reputational harm and reimbursement and other compensation costs. In addition, substantial costs might be incurred to investigate, remediate and prevent cyber incidents.

We use third-party services and partnerships in connection with our business, and any disruption to these services or partnerships could result in a disruption to our business, negative publicity and a slowdown in the growth of our clients, materially and adversely affecting its business, financial condition and results of operations.

We depend upon third-party software and services to conduct business. The inability to access these services could result in a disruption while sourcing replacement service vendors. Additionally, we rely on contracted third-party partnerships to conduct our business. While we have minimized our reliance on any single vendor or partner, any disruption of service from our partners could have a material adverse effect on our business, financial condition or results of operations.

Failure to attract, retain and motivate key employees may adversely affect our ability to compete and the loss of the services of key personnel could have a material adverse effect on GameSquare's business.

We depend on the services of a few key executive officers. The loss of any of these key persons could have a material adverse effect on our business, financial condition and results of operations. Our success is also highly dependent on our continuing ability to identify, hire, train, motivate and retain highly qualified technical, marketing and management personnel. Competition for such personnel can be intense, and we cannot provide assurance that we will be able to attract or retain highly qualified technical, marketing and management personnel in the future. Stock options may comprise a significant component of key employee compensation, and if the price of our common shares declines, it may be difficult to retain such individuals. Similarly, changes in our share price may hinder our ability to recruit key employees, as they may elect to seek employment with other companies that they believe have better long-term prospects. Our inability to attract and retain the necessary technical, marketing and management personnel may adversely affect our future growth and profitability. Our retention and recruiting may require significant increases in compensation expense, which would adversely affect our results of operation.

Our executive officers and other members of senior management have substantial experience and expertise in our business and have made significant contributions to our growth and success. The unexpected loss of services of one or more of these individuals could also adversely affect the business, financial condition and results of operations. We are not protected by key man or similar life insurance covering members of senior management.

Our directors and officers may have conflicts of interest.

Our directors and officers are or may become directors or officers of other reporting companies or have significant shareholdings in other public companies and, to the extent that such other companies may participate in ventures in which we may participate, our directors and officers may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. We will, together with our directors and officers, attempt to minimize such conflicts. In the event that such a conflict of interest arises at a meeting of our directors, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. In appropriate cases, we will establish a special committee of independent directors to review a matter in which one or more directors, or officers, may have a conflict. In determining whether or not we will participate in a particular program and the interest therein to be acquired by it, the directors will primarily consider the potential benefits to our business, the degree of risk to which we may be exposed and our financial position at that time. Other than as indicated, we have no other procedures or mechanisms to deal with conflicts of interest.

Litigation costs and the outcome of litigation could have a material adverse effect on our business.

From time to time, we may be subject to litigation claims through the ordinary course of our business operations regarding, but not limited to, employment matters, security of client and employee personal information, contractual relations with clients, including gamers, influencers and other on-screen talent, production crew and sponsors, among others and marketing and infringement of trademarks. Litigation to defend against claims by third parties, or to enforce any rights that we may have against third parties, may be necessary, which could result in substantial costs and diversion of our resources, causing a material adverse effect on its business, financial condition and results of operations.

Other than as disclosed in our financial statements, we are not aware of any current material legal proceedings outstanding, threatened or pending as of the date hereof by or against us. However, given the nature of our business, we are, and may from time to time in the future be, party to various, and at times numerous, legal investigations, proceedings and claims that arise in the ordinary course of business. Because the outcome of litigation is inherently uncertain, if one or more of such legal matters were to be resolved against us for amounts in excess of our expectations, our business, financial condition and results of operations could be materially adversely affected.

We are exposed to foreign currency risk and we have not hedged against risk associated with foreign exchange rate exposure.

Although our functional currency is Canadian dollars, we expect to generate revenue and incur costs in foreign currencies. In particular, we expect to generate revenue and incur costs in GBP, the functional currency of Code Red, and euro, as well as, U.S. dollars, the functional currency of certain of Reciprocity's subsidiaries. Accordingly, we are subject to risk from fluctuations in the rates of currency exchange between such foreign currency and the Canadian dollar, and such fluctuations may materially adversely affect our business, financial condition and results of operations. We do not currently hedge against such currency fluctuations.

We are a holding company with our only asset being direct and indirect ownership of our operating subsidiaries.

As a holding company, we do not have any material non-financial assets other than our direct and indirect ownership of our operating subsidiaries. We have no independent means of generating revenue. To the extent that we will need funds beyond our own financial resources to pay liabilities or to fund operations, we may have to borrow or otherwise raise funds sufficient to meet these obligations and operate our business and, thus, our liquidity and financial condition could be materially adversely affected.

We currently maintain insurance coverage. However, any claims against us may result in our incurring substantial costs and a diversion of resources.

While we currently hold directors and officers liability insurance, we do not maintain key-man life insurance on any of our senior management or key personnel, business interruption insurance, employer's liability insurance or liability insurance. If and when we do obtain insurance coverage, it may be insufficient to cover any claim. Any liability or damage to, or caused by, our facilities or our personnel beyond our insurance coverage may result in our incurring substantial costs and a diversion of resources.

Risks Related to Our Industry

The esports industry is intensely competitive. We face competition from a growing number of companies and, if we are unable to compete effectively, our business could be negatively impacted.

The esports industry is in competition with other sporting and entertainment events, both live and delivered over television networks, radio, the Internet, mobile applications and other sources. As a result of the large number of options available and the global nature of the esports industry, we face strong competition for esports fans. There is also intense competition amongst businesses operating in the segments of the esports industry where we currently operate or may operate in the future, including esports agencies, influencer technology platforms, analytics technologies, content creation and media content assets.

As some of our competitors have financial resources that are greater than ours, they may spend more money and time on developing their products or services, undertake more extensive marketing campaigns, adopt more aggressive pricing policies or otherwise develop more commercially successful products or services, which could impact our ability to secure new clients or retain existing clients. Furthermore, new competitors may enter the segments of the esports industry where we currently operate or may operate in the future. If we are unable to obtain significant market presence or if we lose market share to our competitors, our business, financial condition and results of operations could be materially adversely affected. Finally, there are many companies with already established relationships with third parties, including sponsors, event and tournament organizers, influencers and esports organizations. Consequently, some competitors may be able to develop and expand their esports organization more quickly. Our success depends on our ability to develop and maintain relationships with such third parties.

Any failure to effectively compete with respect to the foregoing could materially and adversely affect our business, financial condition and results of operations.

Esports is a new and evolving industry, which presents significant uncertainty and business risks.

The esports industry is relatively new and continues to evolve. We have taken steps to diversify our business and continue to seek out new opportunities in the esports industry. However, whether this industry grows and whether our business will ultimately succeed will be affected by, among other things, the success of efforts to monetize the esports industry through tournament fees, live event ticket sales, advertising and sponsorships, spectator demand for in-person, online and televised esports events and tournaments, the success of industry marketing efforts, including on social media platforms, the development of new games and technologies to attract and retain gamers and spectators, data privacy laws and regulation and other factors that we are unable to predict and which are beyond our control. Given the dynamic evolution of this industry, it can be difficult to plan strategically, and it is possible that competitors will be more successful than us at adapting to change and pursuing business opportunities.

Our business is vulnerable to changing economic conditions and to other factors that adversely affect the industries in which it operates.

The demand for entertainment and leisure activities, including esports, tends to be highly sensitive to changes in consumers' disposable income, and thus can be affected by changes in the economy and consumer tastes, both of which are difficult to predict and beyond our control. Unfavorable changes in general economic conditions, including recessions, economic slowdown, sustained high levels of unemployment, and increasing fuel or transportation costs, may reduce customers' disposable income or result in fewer individuals attending ticketed in-person or online esports events or tournaments, paying for subscriptions to esports media channels or otherwise engaging in entertainment and leisure activities. As a result, we cannot ensure that demand for our services will remain constant. Continued or renewed adverse developments affecting economies throughout the world, including a general tightening of availability of credit, decreased liquidity in many financial markets, increasing interest rates, increasing energy costs, acts of war or terrorism, transportation disruptions, natural disasters, pandemics, declining consumer confidence, sustained high levels of unemployment or significant declines in stock markets, could lead to a further reduction in discretionary spending on leisure activities, such as esports. Any significant or prolonged decrease in consumer spending on entertainment or leisure activities could reduce demand for our services, which would have a material adverse effect on our business, financial condition and results of operations.

If we fail to anticipate, adopt and build expertise in to new esports technologies, our business may suffer.

Rapid technology changes in the esports gaming market requires us to anticipate which technologies we should adopt and build expertise in to remain competitive in the esports industry. We have invested, and in the future may invest, in new business strategies, technologies or services to engage a growing number of esports players, influencers and other on-screen talent, sponsors and others. For example, Code Red assists game publishers and developers such as Ubisoft and Massive Entertainment in designing broadcast-ready games by honing in-game spectator modes for improved viewing and commentating. Such advice typically relates to overlay placement, broadcasting options for streamers and commentators and scoreboard, replay and timer displays, as well as a number of other design elements. If Code Red or Reciprocity fails to anticipate, adopt or build expertise in new technologies which impact in-game spectator modes, it may fail to attract new or retain existing game publishers, developers, influencers and brands as clients.

Adopting new technologies involves significant risks and uncertainties, and no assurance can be given that we will successfully identify which technologies will complement our business. If we do not successfully implement new technologies, our reputation may be materially adversely affected and our business, financial condition and operating results may be impacted.

The COVID-19 pandemic could continue to have a material adverse effect on the esports industry and on our business.

In December 2019, the COVID-19 virus, commonly known as "coronavirus," surfaced in Wuhan, China. In March 2020, the World Health Organization declared the COVID-19 outbreak a pandemic. The COVID-19 virus has spread from China to many other countries including the United States and Canada, with the number of reported cases and related deaths increasing daily and, in many countries, at a very rapid pace.

Many governments, including in the United States, the United Kingdom and Canada, imposed stringent restrictions to seek to mitigate, or slow, the spread of COVID-19, including restrictions on international and local travel, public gatherings and participation in business meetings, as well as closures of workplaces, schools, and other public sites, and are continuing to encourage "social distancing." The duration of such measures is highly uncertain, but could be prolonged, and stricter measures may still be put in place or reintroduced in areas where such measures have very recently started to be gradually eased.

As a result of the COVID-19-related restrictions, in-person esports tournaments and other events have been cancelled or required to enforce social distancing and other policies designed to reduce the spread of the virus. The resulting loss of revenue from ticket sales has not been fully offset by a corresponding increase in paid online or televised esports event. There can be no guarantee that demand for in-person esports events will resume once a vaccination becomes widely available or COVID-19 is otherwise eliminated. Any continuation of COVID-19-related restrictions could have a material adverse effect on our business, financial condition and results of operations.

Risk Factors Related to Our Common Shares

Future sales or the issuances of our securities may cause the market price of our common shares to decline.

The market price of our common shares could decline as a result of issuances of securities (including our common shares) by us, exercises of outstanding options or warrants for additional common shares or sales by our existing shareholders of common shares in the market, or the perception that these issuances or sales could occur. Sales of common shares by shareholders may make it more difficult for us to sell equity securities at a time and price that we deem appropriate. As at the date hereof, there were a total of 7,685,345 outstanding share options issued under certain of our share option plans, 3,000,000 outstanding share options issued pursuant to the Reciprocity Acquisition (as defined under "Item 4. Information On the Company — A. History and Development of the Company") and 23,929,341 outstanding warrants issued pursuant to various private placement financings. Sales or issuances of substantial numbers of our common shares, including in the context of future acquisitions, or the perception that such sales or issuances could occur, may adversely affect prevailing market prices of our common shares. With any such sale or issuance of our common shares, investors may suffer dilution and we may experience dilution in our earnings per share.

We expect that the price of our common shares may fluctuate significantly.

The market price of securities of many companies, particularly development and early commercial stage esports companies, experience wide fluctuations in price that are not necessarily related to the operating performance, underlying asset values or prospects of such companies.

The market price of our common shares could be subject to wide fluctuations in response to many risk factors listed in this section, and others beyond our control. These and other market and industry factors may cause the market price and demand for our common shares to fluctuate substantially, regardless of our actual operating performance, which may limit or prevent investors from readily selling their common shares and may otherwise negatively affect the liquidity of our common shares. In addition, stock markets in general, and the Canadian Securities Exchange and the share prices of esports companies in particular, have experienced price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of these companies.

If equity research analysts do not publish research or reports about our business or if they issue unfavorable commentary or downgrade our common shares, the price of our common shares could decline.

The trading market for our common shares will rely in part on the research and reports that equity research analysts publish about us and our business, over which we have no control. The price of our common shares could decline if one or more equity analysts downgrade our common shares or if analysts issue other unfavorable commentary or cease publishing reports about us or our business.

We may be subject to securities litigation, which is expensive and could divert management attention.

The market price of our common shares may be volatile, and in the past companies that have experienced volatility in the market price of their shares have been subject to securities class action litigation. We may be the target of this type of litigation in the future. Litigation of this type could result in substantial costs and diversion of management's attention and resources, which could adversely impact our business. Any adverse determination in litigation could also subject us to significant liabilities.

We have never paid dividends on our common shares and we do not anticipate paying any dividends in the foreseeable future. Consequently, any gains from an investment in our common shares will likely depend on whether the price of our Common Shares increases.

We have not paid dividends on our common shares to date and we currently intend to retain our future earnings, if any, to fund the development and growth of our business. As a result, capital appreciation, if any, of our common shares will be your sole source of gain for the foreseeable future. Consequently, in the foreseeable future, you will likely only experience a gain from your investment in our common shares if the price of our common shares increases.

We may lose foreign private issuer status in the future, which could result in significant additional costs and expenses.

We may in the future lose foreign private issuer status if a majority of our common shares are held in the United States and we fail to meet the additional requirements necessary to avoid loss of foreign private issuer status, such as if: (i) a majority of our directors or executive officers are U.S. citizens or residents; (ii) a majority of our assets are located in the United States; or (iii) our business is administered principally in the United States. The regulatory and compliance costs to us under U.S. securities laws as a U.S. domestic issuer will be significantly more than the costs incurred as an SEC foreign private issuer. If we are not a foreign private issuer, we would be required to file periodic and current reports and registration statements on U.S. domestic issuer forms with the SEC, which are generally more detailed and extensive than the forms available to a foreign private issuer. In addition, we may lose the ability to rely upon exemptions from corporate governance requirements that are available to foreign private issuers.

It may be difficult for United States investors to effect services of process or enforcement of actions against us or certain of our directors and officers under U.S. federal securities laws.

We are incorporated under the laws of the Province of Ontario, Canada and our major assets, Code Red and Reciprocity, are incorporated under the laws of England and Wales and the Province of Ontario, Canada, respectively. A majority of our directors and officers reside in Canada. Because all or a substantial portion of our assets and these persons are located outside the United States, it will be difficult for United States investors to effect service of process in the United States upon us or our directors or officers, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under the U.S. Exchange Act or other United States laws. It may also be difficult to have a judgment rendered in a U.S. court recognized or enforced against us in Canada.

We may be a passive foreign investment company ("PFIC") for U.S. federal income tax purposes, which generally would result in certain adverse U.S. federal income tax consequences to our U.S. shareholders.

In general, a non-U.S. corporation is a PFIC for any taxable year in which (i) 75% or more of its gross income consists of passive income (the "income test") or (ii) 50% or more of the average quarterly value of its assets consists of assets that produce, or are held for the production of, passive income (the "asset test"). Generally, "passive income" includes interest, dividends, rents, royalties and certain gains, and cash is a passive asset for PFIC purposes. We have made no determination as to whether we are classified as a PFIC for U.S. federal income tax purposes. The determination of whether we are a PFIC depends on the particular facts and circumstances (such as the valuation of our assets, including goodwill and other intangible assets) and is also affected by the application of the PFIC rules, which are subject to differing interpretations. The fair market value of our assets is expected to depend, in part, upon (i) the market price of the Common Shares, which is likely to fluctuate, and (ii) the composition of our income and assets, which will be affected by how, and how quickly, we spend any cash that is raised in any financing transaction. If we were a PFIC for any taxable year during which a U.S. shareholder owned the Common Shares, such U.S. shareholder generally will be subject to certain adverse U.S. federal income tax consequences, including increased tax liability on gains from dispositions of the Common Shares and certain distributions and a requirement to file annual reports with the Internal Revenue Service. In light of the foregoing, no assurance can be provided that we are not currently a PFIC or that we will not become a PFIC in any future taxable year. Prospective investors should consult their own tax advisers regarding our PFIC status. See "Item 10. Additional Information — E. Taxation — Certain U.S. Federal Income Tax Considerations — Passive Foreign Investment Company Considerations."

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

History of GameSquare Inc.

GameSquare Inc. was incorporated under the laws of the province of Ontario, Canada on December 13, 2018 for the purposes of identifying, acquiring and developing esports-focused companies in the areas of agency, influencer technology platforms, analytics technologies, content creation and media content assets. On May 27, 2019, GameSquare Inc. changed its name to Octane Play Inc. On September 18, 2019, GameSquare Inc. changed its name back to GameSquare Inc.

On November 7, 2019, GameSquare Inc. and Code Red entered into a share purchase agreement pursuant to which GameSquare Inc. would acquire all outstanding common shares of Code Red (as amended on January 24, 2020 and February 18, 2020, the "Share Purchase Agreement").

On February 10, 2020, Magnolia signed a letter of intent pursuant to which Magnolia would acquire all of the issued and outstanding shares in the capital of GameSquare Inc. by way of a reverse-takeover transaction. The RTO was structured as a three-cornered amalgamation, pursuant to which 2631443 Ontario Inc. ("Magnolia Subco"), a wholly-owned subsidiary of Magnolia, and GameSquare Inc. amalgamated (the "Amalgamation") to form a new company, GameSquare (Ontario) Inc. ("Amalco"). Prior to the completion of the Amalgamation, the existing common shares in the capital of Magnolia were consolidated and GameSquare Inc.'s shareholders received one common share of Magnolia for each common share of GameSquare Inc. As a result, Amalco became a wholly-owned subsidiary of Magnolia.

Magnolia was previously involved in oil and gas exploration activities in Canada, the US and Colombia. Magnolia ceased all direct oil and gas exploration activities in 2014.

Magnolia completed the RTO on October 2, 2020. Effective September 30, 2020, Magnolia delisted its common shares from the TSX Venture Exchange and, effective October 8, 2020, listed them on the Canadian Securities Exchange. On September 30, 2020 Magnolia changed its name to GameSquare Esports Inc..On December 1, 2020, Amalco and GameSquare amalgamated to become GameSquare Esports Inc.

Pursuant to the Share Purchase Agreement, Amalco acquired all outstanding common shares of Code Red on October 2, 2020.

On December 31, 2020, GameSquare and Reciprocity, a gaming and esports company, entered into an arrangement agreement pursuant to which GameSquare would acquire all outstanding common shares in Reciprocity (the "Reciprocity Acquisition"). The Reciprocity Acquisition closed on March 16, 2021.

History of Magnolia Colombia Ltd.

Camflo Resources Ltd. (“Camflo”), a predecessor to Magnolia, was incorporated on March 21, 1997 under the Business Corporations Act (Alberta) (“ABCA”).

By articles of continuance dated May 24, 2001, Camflo was continued into Yukon Territory, and its name was changed to “Camflo International Inc.”

By articles of amendment dated November 22, 2001, each pursuant to the Business Corporations Act (Yukon). Camflo was continued back into Alberta by articles of continuance dated August 20, 2004 pursuant to the ABCA.

696406 Alberta Inc. (“Spearhead”), another predecessor to Magnolia, was incorporated on May 24, 1996 under the ABCA. By articles of amendment dated July 22, 1996, Spearhead changed its name to “Spearhead Resources Inc.”

By articles of amalgamation pursuant to the ABCA dated September 30, 2004, Camflo amalgamated with Spearhead to become “Arctos Petroleum Corp.” (“Arctos”).

By articles of amalgamation dated November 9, 2007, Arctos amalgamated with Stetson Oil & Gas Ltd. and changed its name to “Stetson Oil & Gas Ltd.” (“Stetson”).

By articles of amalgamation pursuant to the ABCA dated June 1, 2009, Stetson amalgamated with 1470975 Alberta Ltd. to become “Stetson Oil & Gas Ltd”. Stetson was then continued into Ontario pursuant to the provisions of the Business Corporations Act (Ontario) (the "OBCA") by articles of continuance dated August 21, 2014, and its name was changed to Magnolia Colombia Ltd. by articles of amendment dated June 14, 2017.

Following the completion of the RTO, Magnolia changed its name to GameSquare Esports Inc. by articles of amendment pursuant to the OBCA dated September 30, 2020.

B. Business Overview

We operate in the electronic sports or "esports" industry. Esports refers to competitive video gaming where gamers compete against one another individually or in teams. Typically, spectators can observe esports competitions by accessing different online viewing platforms, such as Twitch, or in person at live events. Esports gamers can now participate in regulated leagues, tournaments or other competitions for various games on different entertainment systems. Gamers, teams, team managers, streamers, game developers, online viewing platforms and other participants in the esports industry monetize such competitions through different means, including viewer subscriptions, marketing sponsorships and ticket sales for live events.

The esports industry is growing rapidly, with US$8.1 billion (approximately C$9.8 billion) of disclosed investment1 and over 100 billion hours watched2 in 2020. NewZoo predicts that by 2023, the global audience for esports will reach 600 million and the industry will generate US$218 billion (approximately C$264 billion) in revenue annually.

Our business is primarily carried out through three entities, GameSquare, Code Red and Reciprocity.

GameSquare

GameSquare is an international esports company incorporated under the laws of the province of Ontario, Canada on December 13, 2018 with registry ID 5041519 and its registered office at 65 Queen Street West, Suite 900, Toronto, Ontario M5H 2M5, Canada. GameSquare is engaged in identifying, acquiring and developing esports agencies, influencer technology platforms, analytics technologies, content creation and media content assets. GameSquare’s primary assets are Code Red, a UK-based esports agency, which generated 100% of GameSquare’s revenue for the year ended November 30, 2020 and the three months ended February 28, 2021, and Reciprocity, an Ontario-based gaming and esports company, which GameSquare acquired on March 16, 2021.

Code Red

Code Red is an international esports company incorporated under the laws of England and Wales on November 25, 2016, with registration number 10498527 and its registered address at 20-22 Wenlock Road, London N17GU, UK.

Code Red operates in four segments of the UK, EU and US esports markets: (i) representing players, influencers and other on-screen talent; (ii) consulting; and (iii) managing and brokering brand activations for influencers.

____________________

1 Seck, Tobias. December Investment Recap: Acquisitions, Growth Funding Rounds, and a Bidding War. The Esports Observer. January 5, 2021. https://archive.esportsobserver.com/december-2020-investment-recap/.

2 NewZoo. (2020). Global Esports Market Report.

Representing esports players, influencers and other on-screen talent.

Code Red represents esports players and influencers, including leading Twitch streamers, YouTubers and gaming personalities, as well as other on-screen talent, including commentators, analysts, event hosts, and production crew. Such representation includes soliciting and negotiating contracts with respect to sponsorships and endorsements and participation in esports tournaments, television shows and corporate events. Code Red currently represents 75 esports personalities.

For the year ended November 30, 2020 and the three months ended February 28, 2021, representation of esports players, influencers and other on-screen talent and production crew generated approximately 28% and 17%, respectively, of Code Red's revenue.

Consulting.

Code Red provides consulting services to individuals and businesses operating in a variety of roles in the esports industry, including (i) ventures, sponsors and investors; (ii) tournament organizers; (iii) game publishers and developers; and (iv) producers and broadcasters.

For the year ended November 30, 2020 and the three months ended February 28, 2021, consulting generated approximately 7% and 39%, respectively, of Code Red's revenue.

Ventures, Sponsors and Investors

Code Red advises esports organizations, sponsors and investors on a variety of esports industry-related matters, including:

-

industry networking;

-

content acquisition;

-

public relations;

-

marketing;

-

customer acquisition, product development and strategy for esports betting;

-

soliciting and negotiating sponsorships; and

-

team purchases and player movement.

Tournament Organizers

Code Red advises tournament organizers on tournament structure and rulesets for a range of tournament formats, from worldwide community-based tournaments to stadium esports formats, such as Blizzard's StarCraft II World Championship Series UK.

Game Publishers and Developers

Code Red advises game publishers and developers such as Ubisoft and Massive Entertainment on designing broadcast-ready games by honing in-game spectator modes for improved viewing and commentating. Such advice typically relates to overlay placement, broadcasting options for streamers and commentators and scoreboard, replay and timer displays, as well as a number of other design elements.

Producers and Broadcasters

Code Red leverages its experience assisting in the production of more than 100 esports shows, including online broadcasts via IPTV and Twitch, as well as traditional satellite and cable television broadcasts on channels including Sky Sports, Sky One, ESPN, Eurosport and DirecTV, to advise esports producers and broadcasters on esports-related matters. Typical advice covers a range of matters, including the preparation of show scripts and rundowns, esports event production, live streaming and talent hiring.

Managing and brokering of brand activations for influencers.

Code Red advises players, influencers and other on-screen talent in the esports industry on matters relating to the production of events and campaigns to generate brand awareness and build lasting connections with its clients' target audience. Most brand activations are interactive, allowing audiences to engage directly with our client's brand. For example, a global virtual private network provider contracts with Code Red influencers to generate brand awareness for its product. Influencers use or endorse this client’s products during streaming events.

For the year ended November 30, 2020 and the three months ended February 28, 2021, managing and brokering of brand activations for influencers generated approximately 65% and 44%, respectively, of Code Red's revenue.

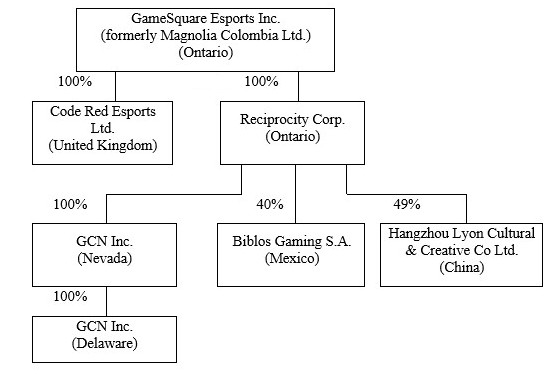

Reciprocity

Reciprocity is an international esports company incorporated under the laws of Ontario, with registration number 002584102 and its registered address at 2 Toronto Street, 4th Floor, Toronto, Ontario M5C 2B6, Canada.

Reciprocity owns US-based esports digital media agency GCN, which provides bespoke marketing services to brands seeking to access the esports market, as well as a 40% stake in Mexico-based esports franchise Rainbow7.

In addition, Reciprocity contractually owns a 49% interest in HangZhou Lyon Culture and Creativity Co, Ltd. (“Lyon”), a limited liability company duly incorporated and existing in the People’s Republic of China. Our Chinese local partner in this entity is LGD Gaming. Lyon owns a CrossFire game franchise spot and its esports team competes in China to win prize money. We have assessed the carrying amount of our investment in Lyon and, in consideration of losses sustained, expected recoverable values and the future direction of our business, recorded an impairment charge to reduce the carrying value to a nominal C$1.00.

Growth Strategy

Our growth strategy entails four elements: (i) focused execution of our esports agency and digital media businesses; (ii) scale organically by bridging the gap between global brands and gaming and esports communities; (iii) grow partnerships with major sports teams and leagues in North America and Europe; and (iv) pursue opportunistic and accretive acquisitions.

Focused execution of our digital media and agency businesses.

We intend to generate significant organic growth through Code Red’s representation business and through Reciprocity’s digital media agency, GCN. With respect to Code Red, continued expansion of on-screen talent represented with a focus on increasing the number of influencers is expected to accelerate sales within its brand activation segment. Code Red increased focus on the influencer segment during 2020 and added headcount to manage its representation business, enabling us to increase our efforts to broker new brand activations. We believe that Code Red is well positioned to capitalize on the significant growth potential of the esports industry as secular trends are driving increasing viewership, growing corporate sponsorships, and a sharp increase in media rights.

With respect to Reciprocity, GCN has increased headcount in sales, marketing and production to accelerate organic growth of the digital marketing group. GCN has dramatically increased its outbound sales calls, resulting in a growing project pipeline. In particular, it recently announced that it has been contracted by Van Wagner Sports and Entertainment for production and promotion of the largest national collegiate esports tournament series across ten National Collegiate Athletic Association conferences.

Scale organically by bridging the gap between global brands and gaming and esports communities.

Global brands are increasingly aware of the esports industry’s significant growth potential, resulting in greater opportunities for sponsorships of streamed and in-person esports events and esports teams, players, influencers and other on-screen talent, as well as other forms of advertising. In light of this trend, we intend to invest further in Code Red's and GCN’s sales, marketing and production activities. In doing so, we aim to attract new on-screen talent and global brands as clients and accelerate organic growth.

Grow partnerships with distribution partners and technology vendors in North America and Europe.