Fundrise Growth Tech Fund, LLC SC TO-I

Exhibit (a)(1)

FUNDRISE GROWTH TECH FUND, LLC

NOTICE OF Offer to Repurchase shares of Beneficial Interest

**IF YOU DO NOT WISH TO SELL YOUR SHARES AT THIS TIME, PLEASE DISREGARD THIS NOTICE**

The Offer and Withdrawal Rights Will Expire at

11:59 p.m., Eastern Time, on March 29, 2024

Unless the Offer is Extended

February 29, 2024

Dear Fundrise Growth Tech Fund, LLC shareholder:

Thank you for your investment. The purpose of this notice is to announce an offer to repurchase shares of Fundrise Growth Tech Fund, LLC (the “Fund”). The Fund is a closed-end, non-diversified management investment company organized as a Delaware limited liability company. To provide shareholders with a level of liquidity, beginning February 29, 2024, the Fund is offering to repurchase outstanding shares pursuant to tenders by holders of the Fund’s shares in an amount up to approximately 5% of the Fund’s net assets, calculated as of the next business day following the Expiration Date (as defined below) or as reasonably practicable thereafter (the “Valuation Date”). This offer is currently scheduled to expire at 11:59 p.m., Eastern Time, on March 29, 2024 (the “Expiration Date”), but the Fund may extend this date; if it does, the Valuation Date may be changed.

If you are not interested in tendering your shares for repurchase at this time, you may disregard this notice and take no action.

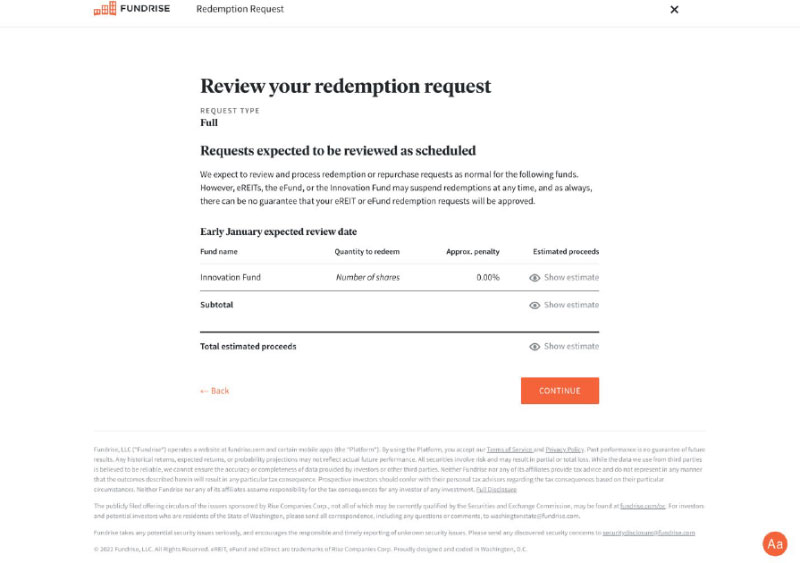

Shares accepted for repurchase by the Fund will be repurchased on the Valuation Date at a price equal to their net asset value determined as of the Valuation Date. This offer is being made to all shareholders of the Fund and is not conditioned on any minimum amount of shares being tendered, but is subject to certain conditions described below. Shares are not traded on any established trading market and are subject to strict restrictions on transferability pursuant to the Fund’s current prospectus, as amended and/or supplemented from time to time (“Prospectus”).

Shareholders should realize that the value of the shares tendered in this offer will likely change between the most recent time the net asset value of the shares was calculated and communicated to them and the Valuation Date (the relevant date for determining the value of the shares tendered to the Fund for purposes of calculating the purchase price of such shares) and such change could be material. The Fund calculates its net asset value as of the close of business on the last business day of each calendar month, each date that shares are sold or repurchased, as of the date of any distribution and at such other times as the Fund’s board of directors (the “Board”) shall determine.

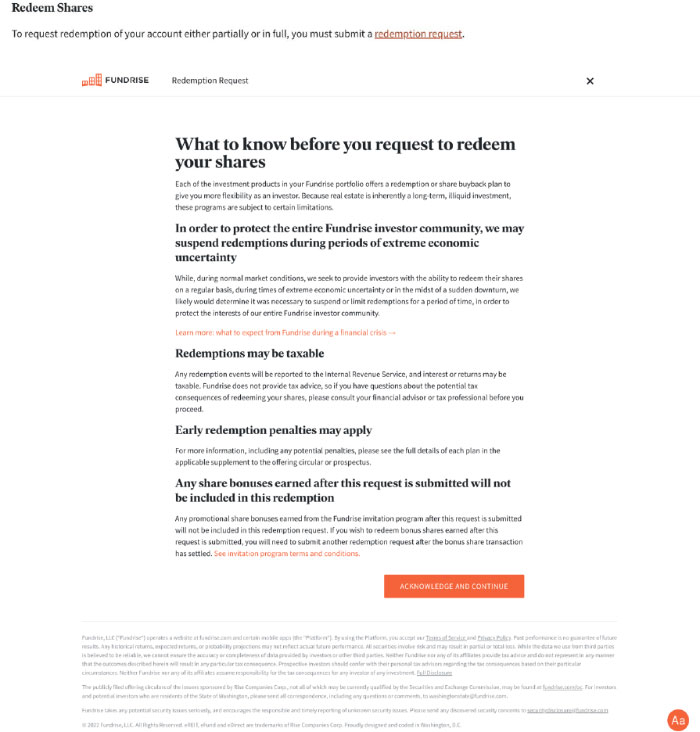

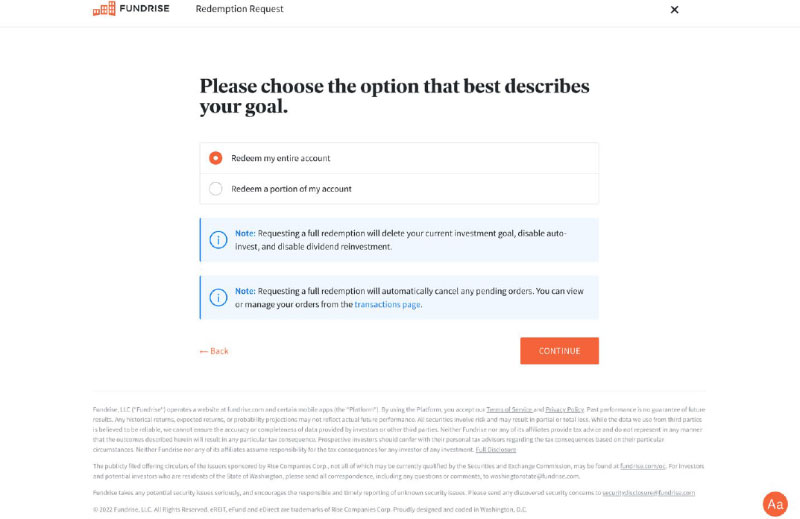

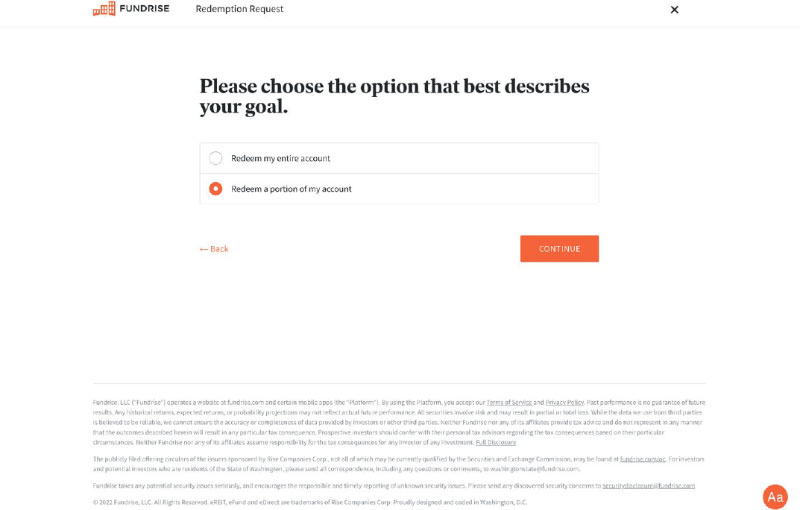

If you wish to tender shares, you may do so by submitting a repurchase request from the settings section of your Fundrise account (“Repurchase Request”). If your shares are held through a financial advisor, broker-dealer or other financial intermediary and you wish to tender shares, please ask your financial advisor, broker-dealer or other financial intermediary to submit a Repurchase Request for you.

All Repurchase Requests must be received by the Fund by 11:59 p.m., Eastern Time, on the Expiration Date to be effective.

Any sale of shares to the Fund pursuant to this repurchase offer is a taxable event. Consult your financial advisor or tax advisor for more information.

For details of the offer, please refer to the attached Repurchase Offer document, or you may contact us by calling (202) 584-0550 or by visiting www.fundrisegrowthtechfund.com.

Sincerely,

Fundrise Growth Tech Fund, LLC

The Expiration Date will be strictly observed. If you fail to submit your request prior to the Expiration Date, the Fund will not repurchase any of your shares until a subsequent repurchase offer. Additional repurchases will be made at such times and on such terms as may be determined by the Board. Shares would be subject to net asset value fluctuation during that time.

IMPORTANT INFORMATION

The Fund reserves the absolute right to reject shares determined not to be tendered in appropriate form.

None of the Fund, Fundrise Advisors, LLC (the “Adviser”) or the Board makes any recommendation to any shareholder as to whether to tender or refrain from tendering their shares. Because each shareholder’s investment decision is a personal one, based on its financial circumstances, shareholders must make their own decisions whether to tender their shares and, if so, the portion of their shares to tender.

No person has been authorized to make any recommendation on behalf of the Fund as to whether shareholders should tender their shares pursuant to this offer. No person has been authorized to give any information or to make any representations in connection with the offer other than those contained herein. If given or made, such recommendation and such information and representations must not be relied on as having been authorized by the Fund.

This transaction has not been approved or disapproved by the Securities and Exchange Commission (the “Commission”) nor has the Commission or any state securities commission passed on the fairness or merits of such transaction or on the accuracy or adequacy of the information contained in this document. Any representation to the contrary is unlawful.

The Fund has filed with the Commission a Tender Offer Statement on Schedule TO under the Securities Exchange Act of 1934, as amended, relating to this offer.

The making of this offer may, in some jurisdictions, be restricted or prohibited by applicable law. This offer is not being made, directly or indirectly, in or into, and may not be accepted from within, any jurisdiction in which the making of the offer or the acceptance of the offer would, absent prior registration, filing or qualification under applicable laws, not be in compliance with the laws of that jurisdiction. Accordingly, shareholders are required to inform themselves of and observe any such restrictions.

FUNDRISE GROWTH TECH FUND, LLC

REPURCHASE OFFER

TABLE OF CONTENTS

| Summary Term Sheet | 1 | |||||

| 1. | Background and Purpose of the Offer | 1 | ||||

| 2. | Offer to Repurchase and Price | 2 | ||||

| 3. | Amount of Tender | 2 | ||||

| 4. | Procedure for Tenders | 3 | ||||

| 5. | Withdrawal Rights | 4 | ||||

| 6. | Purchases and Payment | 4 | ||||

| 7. | Certain Conditions of the Offer | 4 | ||||

| 8. | Certain Information About the Fund | 5 | ||||

| 9. | Certain Federal Income Tax Consequences | 5 | ||||

| 10. | Miscellaneous | 8 | ||||

SUMMARY TERM SHEET

This is a summary of the features of the Fundrise Growth Tech Fund, LLC (the “Fund”) offer to repurchase outstanding shares pursuant to tenders by holders of the Fund’s shares, as discussed below (the “Offer”). To understand the Offer fully and for a more complete discussion of the terms and conditions of the Offer, you should carefully read this entire Offer.

| ● | As disclosed in the Prospectus, the Fund may from time to time offer to repurchase a portion of its outstanding shares pursuant to written tenders by shareholders. Accordingly, the Fund is offering to repurchase shares in an amount up to approximately 5% of the Fund’s net assets, as calculated as of the next business day following the Expiration Date (as defined below) or as reasonably practicable thereafter (the “Valuation Date”). The Offer, which begins on February 29, 2024, will remain open until 11:59 p.m., Eastern Time, on March 29, 2024 (the “Expiration Date”). The Fund reserves the right to adjust the Valuation Date to correspond to any extension of the Offer. | ||

| ● | The Offer is being made to all shareholders and is not conditioned on any minimum amount of shares being tendered. Shareholders may tender all or a portion of their shares. |

| ● | If you tender shares and the Fund purchases those shares, the Fund will effect payment for those shares by issuing cash equal to 100% of the unaudited net asset value of the shares tendered and accepted for purchase by the Fund, determined as of the Valuation Date, which, unless the existence of changes in tax or other laws or regulations or unusual market conditions result in a delay, will be paid to you on the Valuation Date. |

| ● | If the Fund accepts the tender of any of your shares, your proceeds will be funded from cash on hand. |

| ● | The Expiration Date will be strictly observed. If you fail to submit your request to have the Fund repurchase your shares prior to the Expiration Date, the Fund will not repurchase any of your shares until a subsequent repurchase offer. Additional repurchases will be made at such times and on such terms as may be determined by the Board. | ||

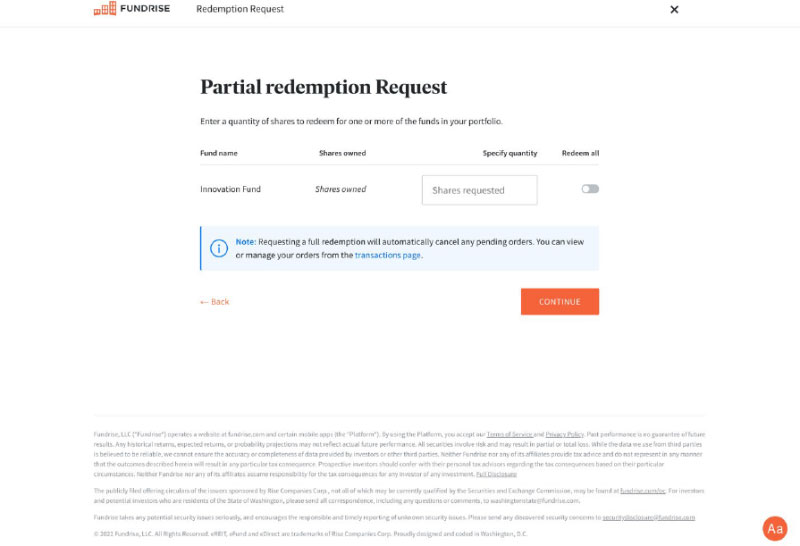

| ● | If you would like to tender your shares, you must submit a repurchase request from the settings section of your Fundrise account (“Repurchase Request”). A form of Repurchase Request is included in this Offer for your reference. Repurchase Requests must be received by the Fund and tendering shareholders must agree to comply with the procedures set forth in Section 4 of this Offer. The Fund must receive these materials prior to the date and time the Offer expires. All shareholders tendering shares should carefully review their Repurchase Request and follow the delivery instructions therein. | ||

| ● | Following this summary is a formal notice of the Offer, which remains open until the Expiration Date, unless extended. You have the right to change your mind and withdraw your tendered shares any time until the Expiration Date or, if such tendered shares have not been accepted by the Fund, until the expiration date of the next tender offer conducted by the Fund. |

| ● | The value of your shares will likely change between the most recent time the net asset value of the shares was calculated and communicated to you and the Valuation Date (the date when the value of your investment will be determined for purposes of calculating your purchase price). |

| ● | Please note that just as you have the right to withdraw your tender of shares, the Fund has the right to cancel, amend or postpone this offer at any time on or before the Expiration Date. |

1. Background and Purpose of the Offer.

The purpose of the Offer is to provide liquidity to shareholders. Because there is no secondary trading market for shares and shares may not be transferred or resold except as permitted under the LLC Agreement, the Board has determined, after consideration of various matters, that the Offer is in the best interests of shareholders to provide liquidity for shares as contemplated in the Prospectus. The Board intends to consider the continued desirability of the Fund making an offer to repurchase shares four times each year, but the Fund is not required to make any such offer.

The purchase of shares pursuant to the Offer will have the effect of increasing the proportionate interest in the Fund of shareholders who do not tender shares. shareholders who retain their shares may be subject to increased risks that may possibly result from the reduction in the Fund’s aggregate assets resulting from payment for the shares tendered. These risks include the potential for greater volatility due to decreased diversification. A reduction in the aggregate assets of the Fund may result in shareholders who do not tender shares bearing higher costs to the extent that certain expenses borne by the Fund are relatively fixed and may not decrease if assets decline. These effects may be reduced or eliminated to the extent that additional purchases of shares are made by new and existing investors from time to time, although there can be no assurances that such new or additional purchases will occur.

1

Shares that are tendered to the Fund in connection with the Offer, if accepted for repurchase, will be repurchased, resulting in a change in the income ratio and an increase in the expense ratios of shares owned by shareholders remaining in the Fund (assuming no further issuances of shares).

2. Offer to Repurchase and Price.

The Fund will purchase, upon the terms and subject to the conditions of the Offer, shares tendered to the Fund for repurchase before the Expiration Date and not properly withdrawn (in accordance with Section 5 below) in an amount up to approximately 5% of the Fund’s net assets, as calculated on the Valuation Date.

The Fund reserves the right to extend, amend or cancel the Offer as described in Sections 3 and 7 below. The purchase price of a share tendered will be the net asset value per share on the Valuation Date, payable as set forth in Section 6. The Fund reserves the right to adjust the Valuation Date to correspond with any extension of the Offer.

As of the close of business on February 28, 2024, there were approximately 12,236,446 shares issued and outstanding, with an unaudited net asset value per share of $10.21. Of course, the value of the shares tendered by shareholders likely will change between the most recent time net asset value was calculated and communicated to you and the Valuation Date.

3. Amount of Tender.

Subject to the limitations set forth below, shareholders may tender all or a portion of their shares. The Offer is being made to all shareholders and is not conditioned on any minimum amount of shares being tendered.

If shares representing less than 5% of the Fund’s net assets are tendered to the Fund for repurchase before the Expiration Date and not properly withdrawn, the Fund will, on the terms and subject to the conditions of the Offer, purchase all of the shares so tendered unless the Fund elects to cancel or amend the Offer, or postpone acceptance of tenders made pursuant to the Offer, as provided in Section 7 below. If shares representing more than 5% of the Fund’s net assets are duly tendered to the Fund before the Expiration Date and not properly withdrawn pursuant to Section 5 below, the Fund will, in its sole discretion, either (a) accept the additional shares permitted to be accepted pursuant to Rules 13e-4(f)(1) and 13e-4(f)(3) under the Securities Exchange Act of 1934, as amended; (b) extend the Offer, if necessary, and increase the number of shares that the Fund is offering to purchase to a number it believes sufficient to accommodate the excess shares tendered, as well as any shares tendered during the extended Offer; or (c) accept shares tendered on or before the Expiration Date for payment on a pro rata basis (disregarding fractions) based on the number of tendered shares. The unaccepted portion of any tender of shares made by a shareholder pursuant to this Offer shall be automatically carried forward in connection with any future tender offer made by the Fund and subject to the terms and conditions of any such offer. Shares carried forward to any future tender offer made by the Fund will not be given any priority over shares requested to be repurchased by other shareholders in connection with any such offer.

The Fund may extend the Offer period at any time. The Fund may extend the period of time the Offer will be open by issuing a press release or making some other public announcement by no later than 9:00 a.m. Eastern time on the next business day after the Offer otherwise would have expired.

4. Procedure for Tenders.

A. Proper Tender of Shares.

Shareholders wishing to participate in the Offer must cause a properly completed Repurchase Request to be submitted from the settings section of their Fundrise account.

2

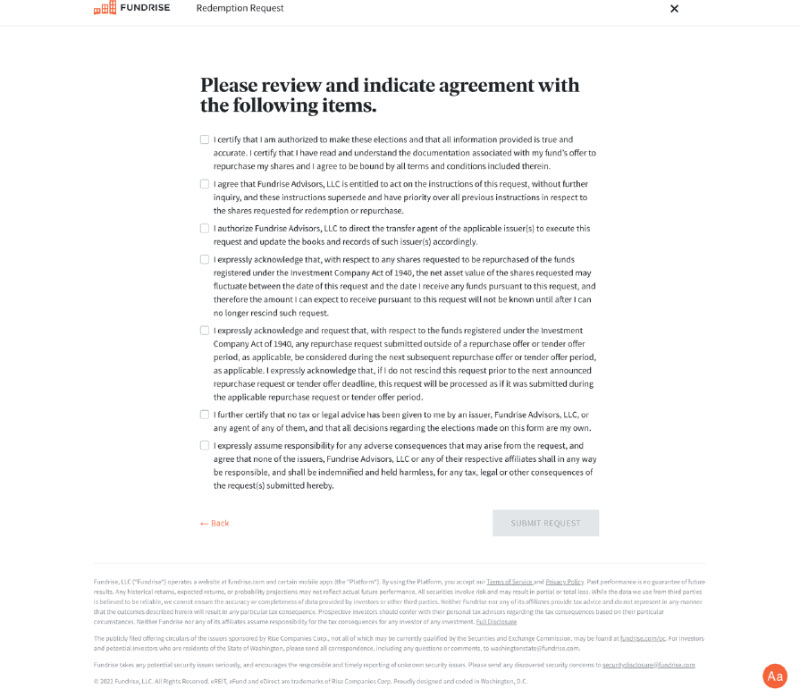

By submitting the Repurchase Request, subject to and effective upon acceptance for payment of the shares tendered, a tendering shareholder sells, assigns and transfers to, or upon the order of, the Fund all right, title and interest in and to all the shares that are being tendered (and any and all dividends, distributions, other shares or other securities or rights declared or issuable in respect of such shares after the Expiration Date) and authorizes and instructs the Fund and its transfer agent, Computershare, Inc. and its wholly-owned subsidiary Computershare Trust Company, N.A. (together with Computershare, Inc., “Computershare”), which has its principal office at 250 Royall Street, Canton, Massachusetts 02021, with respect to such shares (and any such dividends, distributions, other shares or securities or rights) to (a) transfer ownership of such shares (and any such other dividends, distributions, other shares or securities or rights), together with all accompanying evidences of transfer and authenticity to or upon the order of the Fund, upon receipt by the Fund of the purchase price, (b) present such shares (and any such other dividends, distributions, other shares or securities or rights) for transfer on the books of the Fund, and (c) receive all benefits and otherwise exercise all rights of beneficial ownership of such shares (and any such other dividends, distributions, other shares or securities or rights), all in accordance with the terms of the Offer. Upon such acceptance for payment, all prior powers of attorney given by the tendering shareholder with respect to such shares (and any such dividends, distributions, other shares or securities or rights) will, without further action, be revoked and no subsequent powers of attorney may be given by the tendering shareholder with respect to the tendered shares (and, if given, will be null and void).

By submitting a Repurchase Request, and in accordance with the terms and conditions of the Offer, a tendering shareholder represents and warrants that: (a) the tendering shareholder has full power and authority to tender, sell, assign and transfer the tendered shares (and any and all dividends, distributions, other shares or other securities or rights declared or issuable in respect of such shares after the Expiration Date); (b) when and to the extent the Fund accepts the shares for purchase, the Fund will acquire good, marketable and unencumbered title thereto, free and clear of all liens, restrictions, charges, proxies, encumbrances or other obligations relating to their sale or transfer, and not subject to any adverse claim; (c) on request, the tendering shareholder will execute and deliver any additional documents deemed by the Fund or Computershare to be necessary or desirable to complete the sale, assignment and transfer of the tendered shares (and any and all dividends, distributions, other shares or securities or rights declared or issuable in respect of such shares after the Expiration Date); and (d) the tendering shareholder has read and agreed to all of the terms of the Offer.

All authority conferred or agreed to be conferred in connection with a Repurchase Request shall be binding upon the successors, assigns, heirs, executors, administrators and legal representatives of the tendering shareholder and shall not be affected by, and shall survive, the death or incapacity of such shareholder.

B. Determinations of Validity.

All questions as to the validity, form, eligibility (including time of receipt) and acceptance of tenders will be determined by the Fund, in its sole discretion, which determination shall be final and binding. The Fund reserves the absolute right to reject any or all tenders determined not to be in appropriate form or to refuse to accept for payment or purchase, or pay for, any shares if, in the opinion of the Fund’s counsel, accepting, purchasing or paying for such shares would be unlawful. The Fund also reserves the absolute right to the extent permitted by law to waive any of the conditions of the Offer or any defect in any tender, whether generally or with respect to any particular share(s) or shareholder(s). The Fund’s interpretations of the terms and conditions of the Offer shall be final and binding.

None of the Fund, the Adviser, Computershare or any other person is or will be obligated to give any notice of any defect or irregularity in any tender, and none of the foregoing persons will incur any liability for failure to give any such notice.

C. Requests for Assistance.

Requests for assistance should be directed to, and copies of this Offer and the Repurchase Request form may be obtained from, the Fund. If applicable, the Fund will also provide shareholders, upon request, with a Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) (W-8BEN), a Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) (W-8BEN-E) or a Certificate of Foreign Person’s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States (W-8ECI).

3

5. Withdrawal Rights.

Any shareholder tendering shares pursuant to this Offer may withdraw tendered shares at any time before the Expiration Date or, if such tendered shares are not accepted by the Fund during this Offer, until the expiration date of the next tender offer conducted by the Fund. To be effective, a written notice of withdrawal must be timely submitted via the settings section of your Fundrise account.

All questions as to the form and validity (including time of receipt) of notices of withdrawal will be determined by the Fund, in its sole discretion, and such determination shall be final and binding. None of the Fund, the Adviser, Computershare or any other person shall be under any duty to give notification of any defects or irregularities in any notice of withdrawal nor shall any of the foregoing incur any liability for failure to give such notification.

Any shares properly withdrawn will be deemed not to have been validly tendered for purposes of the Offer. However, withdrawn shares may be re-tendered prior to the Expiration Date by following the procedures for tenders described above.

6. Purchases and Payment.

For purposes of the Offer, the Fund will be deemed to have accepted shares that are tendered as, if and when it gives written notice to the tendering shareholder of its election to purchase such shares.

If you tender shares and the Fund purchases those shares, the Fund will effect payment for those shares by issuing cash equal to 100% of the unaudited net asset value of the shares tendered and accepted for purchase by the Fund, determined as of the Valuation Date, which, unless the existence of changes in tax or other laws or regulations or unusual market conditions result in a delay, will be paid to you on the Valuation Date.

Each shareholder whose shares (or portion thereof) have been accepted for repurchase will accrue dividends, if any, until the shareholder’s request that the Fund repurchase its shares (or a portion thereof) is accepted on the Expiration Date.

The Fund does not presently intend to impose any charges (other than direct costs and expenses, such as wiring fees) on the repurchase of shares.

The Fund expects that the purchase price for shares acquired pursuant to the Offer will be derived from cash on hand.

7. Certain Conditions of the Offer.

The Fund reserves the right, at any time and from time to time, to extend the period of time during which the Offer is pending by notifying shareholders of such extension.

If the Fund elects to extend the tender period, the Valuation Date for purposes of determining the purchase price for tendered shares will be determined approximately eleven business days after the actual Expiration Date. During any such extension, all shares previously tendered and not withdrawn will remain subject to the Offer. The Fund also reserves the right, at any time and from time to time, up to and including acceptance of tenders pursuant to the Offer, to: (a) cancel the Offer and in the event of such cancellation, not to purchase or pay for any shares tendered pursuant to the Offer; (b) amend the Offer; or (c) postpone the acceptance of shares tendered. If the Fund determines to amend the Offer or to postpone the acceptance of shares tendered, it will, to the extent necessary, extend the period of time during which the Offer is open as provided above and will promptly notify shareholders.

Please note that just as you have the opportunity to withdraw shares that you have tendered under certain circumstances, the Fund has the right to cancel, amend or postpone the Offer at any time before accepting tendered shares. The Fund may suspend, postpone or terminate the Offer in certain circumstances upon the determination of a majority of the Board, including a majority of the Directors who are not “interested persons,” as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), that such suspension, postponement or termination is advisable for the Fund and its shareholders, including, without limitation, circumstances as a result of which it is not reasonably practicable for the Fund to dispose of its investments or to determine its net asset value, and other unusual circumstances.

4

8. Certain Information About the Fund.

The Fund is registered under the 1940 Act, as a closed-end, non-diversified management investment company and is organized as a Delaware limited liability company. The principal executive office of the Fund is located at 11 Dupont Circle NW, 9th Floor Washington, D.C. 20036 and the telephone number is (202) 584-0550. Shares are not traded on any established trading market and are subject to strict restrictions on transferability pursuant to the Prospectus.

The Fund does not have any plans or proposals that relate to or would result in: (a) the acquisition by any person of additional shares (other than the Fund’s intention to accept purchases for shares from time to time or otherwise in the discretion of the Fund) or the disposition of shares (except for periodic discretionary solicitations of tender offers); (b) an extraordinary transaction, such as a merger, reorganization or liquidation, involving the Fund; (c) any material change in the present distribution policy or indebtedness or capitalization of the Fund; (d) any change in the identity of the Adviser or Directors of the Fund, or in the management of the Fund including, but not limited to, any plans or proposals to change the number or the term of the Directors, or to change any material term of the investment advisory arrangements with the Adviser; (e) a sale or transfer of a material amount of assets of the Fund (other than as the Directors determine may be necessary or appropriate to fund any portion of the purchase price for shares acquired pursuant to this Offer or in connection with the ordinary portfolio transactions of the Fund); (f) any other material change in the Fund’s structure or business, including any plans or proposals to make any changes in its fundamental investment policy for which a vote would be required by Section 13 of the 1940 Act; or (g) any changes in the Prospectus or other actions that may impede the acquisition of control of the Fund by any person.

As of February 29, 2024, the officers and Directors of the Fund, as a group, beneficially owned less than 1% of the outstanding shares of the Fund.

None of the officers and Directors of the Fund intends to tender any of his or her shares in the Offer.

Other than the issuance of shares by the Fund in the ordinary course of business, there have been no transactions in the Fund’s shares effected during the past 60 days by the Fund, the Adviser, or any Director or officer of the Fund, or any person controlling the Fund or the Adviser.

9. Certain Federal Income Tax Consequences.

The following discussion is a general summary of the U.S. federal income tax consequences of the purchase of shares by the Fund from shareholders pursuant to the Offer. This summary is based on U.S. federal income tax law as of the date the Offer begins, including the Internal Revenue Code of 1986, as amended (the “Code”), applicable Treasury regulations, Internal Revenue Service (“IRS”) rulings, judicial authority and current administrative rulings and practice, all of which are subject to change, possibly with retroactive effect. There can be no assurance that the IRS would not assert, or that a court would not sustain, a position contrary to any of those set forth below, and the Fund has not obtained, nor does the Fund intend to obtain, a ruling from the IRS or an opinion of counsel with respect to any of the consequences described below. Shareholders should consult their own tax advisors regarding their particular situation and the potential tax consequences to them of a purchase of their shares by the Fund pursuant to the Offer, including potential state, local and foreign taxation, as well as any applicable transfer taxes.

As used herein, the term “U.S. Shareholder” refers to a shareholder who is (i) a citizen or resident of the United States, (ii) a corporation (or other entity taxable as a corporation) created or organized in or under the laws of the United States or any state thereof or the District of Columbia, (iii) an estate the income of which is subject to U.S. federal income tax regardless of the source of such income, or (iv) a trust if (x) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons (as defined in the Code) have the authority to control all substantial decisions of the trust or (y) the trust has a valid election in effect under applicable U.S. Treasury regulations to be treated as a U.S. person. If an entity or arrangement treated as a partnership for U.S. federal income tax purposes holds our shares, the tax treatment of an owner of such an entity or arrangement will depend on the status of the owner, the activities of the entity or arrangement and certain determinations made at the owner level. The term “Non-U.S. Shareholder” refers to a shareholder who is not a U.S. Shareholder.

5

Sale or Exchange of shares. A shareholder whose shares are repurchased pursuant to the Offer generally will be treated as having sold the shares and (other than a tax-exempt shareholder) will recognize gain or loss for U.S. federal income tax purposes, so long as either (a) such shareholder tenders, and the Fund repurchases, all of such shareholder’s Fund shares (i.e., reduces its percentage ownership of the Fund to 0%) or meets certain numerical safe harbors with respect to percentage voting interest and reduction in ownership of the Fund following the completion of the Offer, or (b) the tender otherwise is treated as being “not essentially equivalent to a dividend” under current U.S. federal income tax law, which determination depends on a shareholder’s particular facts and circumstances. For these purposes, a shareholder’s ownership of the Fund is determined after applying the ownership attribution rules under Section 318 of the Code. Such gain or loss will equal the difference between the price paid by the Fund for the shares pursuant to the Offer and the shareholder’s adjusted tax basis in the shares sold. A shareholder’s holding period in shares repurchased pursuant to the Offer will terminate as of the Valuation Date. A tendering shareholder’s gain or loss will generally be capital gain or loss if the shares sold are held by the shareholder at the time of sale as capital assets and will be treated as long-term capital gain if the shares have been held for more than one year or as short-term if the shares have been held for one year or less. It is expected that, if a shareholder is treated as having sold shares pursuant to the Offer and realizes a gain upon such sale, and if one or more payments are received after the close of the taxable year of the shareholder in which the Valuation Date occurs, unless the shareholder elects otherwise, the gain will be accounted for under the installment sale rules for U.S. federal income tax purposes and the shareholder will generally recognize any such gain as and when proceeds are received, likely allocating tax basis according to the presumed percentage of the total payment received in each installment. To the extent that a portion of any such gain is treated as interest, that portion will be taxed to the shareholder as ordinary income.

The Fund intends to take the position that shareholders tendering shares will qualify for sale or exchange treatment for U.S. federal income tax purposes, unless the Fund knows that a tendering shareholder’s percentage ownership of the Fund has increased as a result of the tender.

The maximum U.S. federal income tax rate applicable to short-term capital gains recognized by a non-corporate shareholder is currently the same as the applicable ordinary income rate, whereas long-term capital gains are taxed to such shareholders at reduced rates. In addition, the Code generally imposes a 3.8% Medicare contribution tax on the net investment income of certain individuals, estates and trusts to the extent their income exceeds certain threshold amounts. For these purposes, “net investment income” generally includes, among other things, (i) distributions paid by the Fund of net investment income and capital gains, and (ii) any net gain from the sale, exchange or other taxable disposition of shares.

In the event that a tendering shareholder’s ownership of the Fund were not reduced to the extent required under the tests described above, such shareholder would be deemed to receive a distribution from the Fund under Section 301 of the Code with respect to the shares held (or deemed held under Section 318 of the Code) by the shareholder after the tender (a “Section 301 distribution”). Such distribution would equal the price paid by the Fund to such shareholder for the shares sold, and would be taxable as a dividend to the extent of the Fund’s current and accumulated earnings and profits allocable to such distribution, with the excess treated as a return of capital reducing the shareholder’s tax basis in the shares held after the Offer (but not below zero), and thereafter as capital gain. In the case of a tendering shareholder that is a corporation treated as receiving a Section 301 distribution from the Fund in connection with the transaction, special basis adjustments may also apply with respect to any shares of such shareholder not repurchased in connection with the Offer.

For U.S. federal income tax purposes, such a dividend will generally be taxable to shareholders as ordinary income, except to the extent such dividend is otherwise designated by the Fund, as described below. Taxes on the portion of such dividend derived from the Fund’s capital gains will be determined by how long the Fund owned (or is deemed to have owned) the investments that generated them, rather than how long the shareholder has owned its shares. In general, the Fund will recognize long-term capital gain or loss on investments it has owned for more than one year, and short-term capital gain or loss on investments it has owned for one year or less. Tax rules can alter the Fund’s holding period in investments and thereby affect the tax treatment of gain or loss on such investments. To the extent the dividend is based on net capital gain (that is, the excess of net long-term capital gain over net short-term capital loss, in each case determined with reference to any loss carryforwards) and is properly reported by the Fund as a capital gain dividend, the distribution will be treated as long-term capital gains includible in a shareholder’s net capital gain. To the extent the dividend is based on net short-term capital gain (as reduced by any net long-term capital loss for the taxable year), it will be taxable to the shareholders as ordinary income.

6

Provided that no tendering shareholder is treated as receiving a Section 301 distribution as a result of the Offer, shareholders whose percentage ownership of the Fund increases as a result of the Offer will not be treated as realizing constructive distributions by virtue of that increase. In the event that any tendering shareholder is deemed to receive a Section 301 distribution as a result of the Offer, it is possible that non-tendering shareholders whose percentage ownership of the Fund increases as a result of the Offer will be deemed to receive a constructive distribution under Section 305(c) of the Code in an amount determined by the increase in their percentage ownership of the Fund as a result of the Offer. Such constructive distribution will be treated as a dividend to the extent of current and accumulated earnings and profits allocable to it. If the tender is treated as an “isolated redemption” within the meaning of the U.S. Treasury regulations, such dividend treatment will not apply.

Under the “wash sale” rules under the Code, provided the tender of shares pursuant to the Offer is treated as a sale or exchange (and not a distribution as described above), loss recognized on shares sold pursuant to the Offer will ordinarily be disallowed to the extent the shareholder acquires other shares of the Fund (whether through automatic reinvestment of dividends or otherwise) or substantially identical stock or securities within 30 days before or after the date the tendered shares are purchased pursuant to the Offer and, in that event, the basis and holding period of the shares acquired will be adjusted to reflect the disallowed loss. Any loss realized by a shareholder on the sale of a share held by the shareholder for six months or less will be treated for U.S. federal income tax purposes as a long-term capital loss to the extent of any distributions or deemed distributions of long-term capital gains received by the shareholder with respect to such share. A shareholder’s ability to utilize capital losses may be limited under the Code.

Non-U.S. Shareholders. Generally, provided the sale of shares pursuant to the Offer is not effectively connected with a trade or business carried on in the U.S. by such Non-U.S. Shareholder, any gain realized by a Non-U.S. Shareholder upon the tender of shares pursuant to the Offer that is respected as a sale or exchange for U.S. federal income tax purposes will not be subject to U.S. federal income tax or to any U.S. tax withholding. If, however, all or a portion of the proceeds received by a tendering Non-U.S. Shareholder is treated for U.S. federal income tax purposes as a distribution by the Fund that is a dividend, or if a Non-U.S. Shareholder is otherwise treated as receiving a deemed distribution that is a dividend by reason of the shareholder’s increase in its percentage ownership of the Fund resulting from other shareholders’ sale of shares pursuant to the Offer, and absent a statutory exemption, the dividend received or deemed received by the Non-U.S. Shareholder will be subject to a U.S. withholding tax at the rate of 30% (or such lower rate as may be applicable under a tax treaty). If any gain or dividend income realized in connection with the tender of shares by a Non-U.S. Shareholder is effectively connected with a trade or business carried on in the U.S. by the Non-U.S. Shareholder, such gain or dividend will be taxed at rates applicable to U.S. Shareholders. If a Non-U.S. Shareholder is eligible for the benefits of a tax treaty, any gain or dividend income that is effectively connected with a U.S. trade or business will generally be subject to U.S. federal income tax on a net basis only if it is also attributable to a permanent establishment maintained by such Non-U.S. Shareholder in the U.S. In addition, if the Non-U.S. Shareholder is a non-U.S. corporation, it may be subject to a 30% (or such lower rate as may be applicable under a tax treaty) branch profits tax on such effectively connected income.

In order to qualify for any exemptions from withholding described above or for lower withholding tax rates under income tax treaties, or to establish an exemption from backup withholding, a Non-U.S. Shareholder must comply with special certification and filing requirements relating to its non-U.S. status (including, in general, by furnishing an IRS Form W-8BEN, W-8BEN-E or substitute form). Non-U.S. Shareholders are urged to consult their tax advisors regarding the application of U.S. federal income tax rules, including withholding, to their tender of shares.

FATCA. Sections 1471–1474 of the Code and the U.S. Treasury regulations and IRS guidance issued thereunder (collectively, “FATCA”) generally require the Fund to obtain information sufficient to identify the status of each of its shareholders under FATCA or under an applicable intergovernmental agreement (an “IGA”) between the United States and a foreign government. If a shareholder fails to provide the requested information or otherwise fails to comply with FATCA or an IGA, the Fund may be required to withhold under FATCA at a rate of 30% with respect to that shareholder on ordinary dividends it pays. The IRS and the Department of Treasury have issued proposed regulations providing that these withholding rules will not apply to the gross proceeds of share redemptions or capital gain dividends the Fund pays. If a payment by the Fund is subject to FATCA withholding, the Fund is required to withhold even if such payment would otherwise be exempt from withholding (e.g., short-term capital gain dividends and interest-related dividends).

7

Certain Non-U.S. Shareholders may fall into certain exempt, excepted or deemed-compliant categories as established by U.S. Treasury regulations, IGAs, and other guidance regarding FATCA. In order to qualify for any such exception, a Non-U.S. Shareholder generally must provide the Fund with the applicable IRS Form W-8 (W-8BEN-E, W-8ECI, W-8EXP or W-8IMY) properly certifying the shareholder’s status under FATCA.

Backup Withholding. The Fund generally is required to withhold and remit to the IRS a percentage of the taxable distributions and redemption proceeds paid to any individual shareholder who fails to properly furnish the Fund with a correct taxpayer identification number, who has under-reported dividend or interest income, or who fails to certify to the Fund that he or she is not subject to such withholding. If the Fund or Computershare is not provided with the correct taxpayer identification number, the shareholder may be subject to a penalty imposed by the IRS in addition to being subject to backup withholding.

Shareholders should provide the Fund with a completed IRS Form W-9, W-8BEN, W-8BEN-E, as applicable, or other appropriate form in order to avoid backup withholding on the distributions they receive from the Fund regardless of how they are taxed with respect to their tendered shares. Backup withholding is not an additional tax and any amounts withheld may be credited against a shareholder’s U.S. federal income tax liability, provided the appropriate information is furnished to the IRS.

A SHAREHOLDER SHOULD CONSULT HIS OR HER TAX ADVISOR AS TO HIS OR HER QUALIFICATION FOR EXEMPTION FROM THE BACKUP WITHHOLDING REQUIREMENTS AND THE PROCEDURE FOR OBTAINING AN EXEMPTION.

Other Tax Consequences. The Fund’s purchase of shares in the Offer may directly result in, or contribute to a subsequent, limitation on the Fund’s ability to use capital loss carryforwards to offset future gains. Therefore, in certain circumstances, shareholders who remain shareholders following completion of the Offer may pay taxes sooner, or pay more taxes, than they would have had the Offer not occurred.

Any sales of securities by the Fund to raise cash to meet repurchase requests could result in increased taxable distributions to shareholders, including distributions taxable as ordinary income.

Under Treasury regulations directed at tax shelter activity, if a shareholder recognizes a loss of $2 million or more for an individual shareholder or $10 million or more for a corporate shareholder, such shareholder must file with the IRS a disclosure statement on Form 8886. Direct holders of portfolio securities are in many cases excepted from this reporting requirement. The fact that a loss is reportable under these regulations does not affect the legal determination of whether the taxpayer’s treatment of the loss is proper. Shareholders should consult their own tax advisors concerning any possible disclosure obligation with respect to their investment in shares.

10. Miscellaneous.

The Offer is not being made to, nor will tenders be accepted from, shareholders in any jurisdiction in which the Offer or its acceptance would not comply with the securities or Blue Sky laws of such jurisdiction. The Fund is not aware of any jurisdiction in which the Offer or tenders pursuant thereto would not be in compliance with the laws of such jurisdiction. However, the Fund reserves the right to exclude shareholders from the Offer in any jurisdiction in which it is asserted that the Offer cannot lawfully be made. The Fund believes such exclusion is permissible under applicable laws and regulations, provided the Fund makes a good faith effort to comply with any state law deemed applicable to the Offer.

The Fund has filed an Issuer Tender Offer Statement on Schedule TO with the SEC, which includes certain information relating to the Offer summarized herein. A free copy of such statement may be obtained from the Fund by contacting the Fund at (202) 584-0550, referring to the Literature section of the Fund’s website at www.fundrisegrowthtechfund.com or from the SEC’s website, http://www.sec.gov.

8

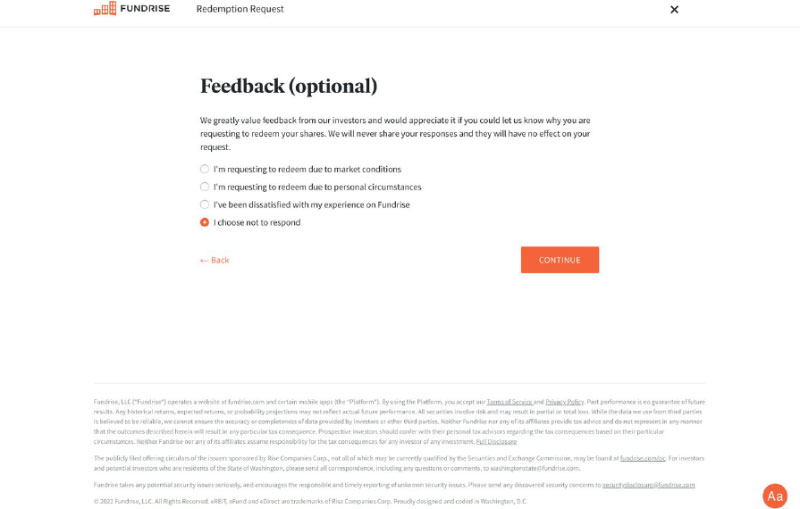

FORM OF REPURCHASE REQUEST

9

10

11

12

13

14

15