UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under § 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | A Message from Our Chairman and Chief Executive Officer | | |  | |

Dear Fellow Stockholders,

On behalf of the entire Kyndryl Board of Directors, I am pleased to invite you to Kyndryl’s 2024 Annual Meeting of Stockholders on July 25, 2024 at 1:00 p.m. Eastern Daylight Time. In order to enable all of our stockholders to participate fully and equally from any place in the world at little to no cost, the Annual Meeting will once again be held as a virtual live audio webcast.

You will be able to attend the virtual Annual Meeting, vote your shares electronically and submit questions both during and prior to the Annual Meeting by visiting virtualshareholdermeeting.com/KD2024.

MARTIN SCHROETER

As we have done each year, we are furnishing our proxy materials to stockholders primarily over the Internet. This process expedites your receipt of the proxy materials, reduces the cost of the Annual Meeting and conserves natural resources. Stockholders of record as of the close of business on May 28, 2024 will either receive a Proxy Card or a Notice of Internet Availability of Proxy Materials for the Annual Meeting. The notice contains instructions on how to access our Proxy Statement and Annual Report for the fiscal year ended March 31, 2024 and submit your proxy online.

Your vote is important to us. Even if you plan to attend the Annual Meeting, we recommend that you promptly submit your proxy with your voting instructions. You may do this over the Internet, as well as by telephone or mail. Please review the instructions regarding each of these options on your Proxy Card or Notice of Internet Availability of Proxy Materials.

I hope that you can join us for our 2024 Annual Meeting so that you can hear firsthand about our strong execution and the accelerated progress we are making as the world's largest IT infrastructure services provider. Our scale, our know-how, our indispensability and our freedom of action as an independent company have given us opportunities to return to profitable growth, while continuing to serve our customers extremely well. We’re driving powerful business dynamics for value creation, and we’ll continue to be bold and ambitious about how we come together to deliver value with our partners for our customers.

Thank you for your continued confidence in Kyndryl.

Sincerely,  Martin Schroeter Chairman of the Board and Chief Executive Officer Kyndryl June 12, 2024 | | |

| | Notice of Annual Meeting of Stockholders | | |  | |

Date and Time Date and Time | | |  Record Date Record Date | | |  Access Access |

July 25, 2024 1:00 p.m. Eastern Daylight Time | | | Close of business on May 28, 2024 | | | You can attend the Annual Meeting, vote your shares and submit your questions by visiting virtualshareholdermeeting.com/KD2024. |

Items of Business | | |||

1 | | | Election of the four Class III directors named herein for a three-year term | |

2 | | | Approval, in an advisory, non-binding vote, of the compensation of our named executive officers | |

3 | | | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2025 | |

• | | | Transaction of any other business properly presented at the meeting | |

To participate in the virtual-only Annual Meeting, you will need your individual 16-digit control number included on your Notice of Internet Availability of Proxy Materials or on your proxy card.

| | How to Vote | | | Your Vote Is Important | | ||||||

| |  | | | Go to www.proxyvote.com, 24/7 | | ||||||

| |  | | | Call toll-free, 24/7 1-800-690-6903 | | ||||||

| |  | | | Complete, date and sign your proxy card or voting instruction form and mail in the postage-paid envelope | | ||||||

| |  | | | Scan the QR code | | |  | | |||

| |  | | | Attend the Annual Meeting virtually and cast your ballot | | ||||||

| | IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 25, 2024 | |

| | The Kyndryl Proxy Statement and Annual Report to stockholders for the fiscal year ended March 31, 2024 are available at www.proxyvote.com. | |

By Order of the Board of Directors,  EDWARD SEBOLD General Counsel and Secretary New York, NY June 12, 2024 | | |  |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

| | Proxy Summary | | |  | |

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider. You should read the entire Proxy Statement carefully before voting. The proxy materials, including this Proxy Statement, the Annual Report for the fiscal year ended March 31, 2024 and the Proxy Card, or the Notice of Internet Availability of Proxy Materials, as applicable, are being distributed beginning on or about June 12, 2024 to all stockholders entitled to vote.

Stockholders will be asked to vote on the following matters at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we encourage you to promptly submit your proxy with your voting instructions. You may do this over the Internet, as well as by telephone or mail. See “Frequently Asked Questions—8. Can I vote my shares without attending the Annual Meeting?”

| | Items of Business | | | Board Recommendations | | | For More Information, See Page | | ||||||

| | 1 | | | Election of the four Class III director nominees named herein for a three-year term | | |  | | | FOR each nominee | | | | |

| | 2 | | | Approval, in an advisory, non-binding vote, of the compensation of our named executive officers (Say-on-Pay Proposal) | | |  | | | FOR | | | | |

| | 3 | | | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2025 (fiscal 2025) (Auditor Ratification Proposal) | | |  | | | FOR | | | | |

| | • | | | Transaction of any other business properly presented at the meeting | | | | | | | | |||

KYNDRYL 2024 PROXY STATEMENT | 1 |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

ABOUT US

Kyndryl is the world’s largest IT infrastructure services provider, serving thousands of enterprise customers in more than 60 countries. The Company designs, builds, manages and modernizes the complex, mission-critical information systems that the world depends on every day.

OUR GLOBAL BUSINESS PRACTICE AREAS

| | Cloud | | | | | Security & Resiliency | | | | | Network & Edge | ||

| | Delivering seamless, integrated, multicloud management in a hybrid model | | | | | Delivering a full line of cybersecurity, business continuity and disaster recovery services to help customers continuously adapt to new threats and regulatory standards | | | | | Providing unified network services for cloud and data center connectivity |

| | Applications, Data & AI | | | | | Digital Workplace | | | | | Core Enterprise & zCloud | ||

| | Providing full application platform hosting and expert assistance for application modernization | | | | | Enhancing user experience and work location flexibility by providing a consumer experience to employees | | | | | Providing secure, unified and fault-tolerant mainframe services for our customers’ core infrastructure |

OUR FISCAL 2024 BUSINESS HIGHLIGHTS

| | Further Solidifying IT Services Leadership Position | | | | | Strong Investment-Grade Balance Sheet | |||||||

| | $16.1 billion Fiscal 2024 Revenue | | | | | $1.6 billion Cash | | | | | $4.7 billion Available Liquidity* | ||

OUR STRATEGIC FOCUS AREAS

| | Significant Progress on our Three A's Initiatives | ||||||||||||

| | Alliances | | | | | Advanced Delivery | | | | | Accounts | ||

| | Our alliances initiative is driving signings, certifications and revenues with our new ecosystem partners and capabilities | | | | | Our advanced delivery initiative is transforming service delivery through upskilling and automation | | | | | Our accounts initiative is addressing elements of the business with substandard margins | ||

| | Engaging with Customers with New Innovations and Technical Expertise | ||||||||||||

| |  | | | | |  | | | | |  | ||

| | Business outcomes-led consulting | | | | | An open integration digital business platform | | | | | Design-led co-creation experience | ||

| | | | | | | ||||||||

| | Providing our customers access to proven expertise to address their most vexing technology challenges | | | | | Giving our customers real-time insights into their complex IT estates and unprecedented control over customizing their mission-critical operations | | | | | Redefining how we engage and co-create solutions with customers and partners on new innovative solutions through a design-led approach | ||

| | Building a Culture of Shared Success | ||||||||||||

| | We have built a differentiated, services-based culture — that we call The Kyndryl Way — to attract, retain, develop and engage a highly skilled workforce. Core to that culture is maintaining an inclusive, engaging and flexible work environment that supports our ability to deliver for customers. | ||||||||||||

| | Aligning our Corporate Citizenship Strategy with our Mission | ||||||||||||

| | We are powering human progress to drive a positive impact on our business aligned with our corporate values by embracing environmental stewardship, fostering social inclusivity and promoting good governance practices. | ||||||||||||

* | Consists of $1.6 billion of cash and $3.2 billion of undrawn senior unsecured credit facility; numbers may not add due to rounding. |

2 | KYNDRYL 2024 PROXY STATEMENT |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

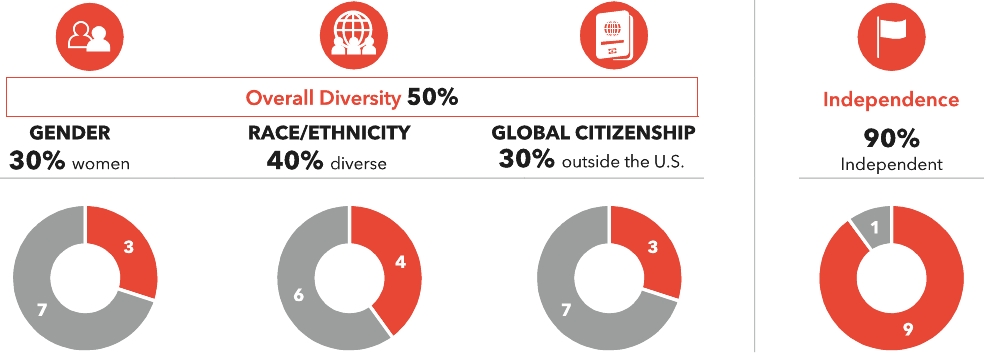

| | Effective Board Leadership, Independent Oversight and Strong Corporate Governance | | | Stockholder Rights and Accountability | |||

| |  50% of directors are racially, ethnically and/or gender diverse 50% of directors are racially, ethnically and/or gender diverse  100% of Committee members are independent 100% of Committee members are independent  Lead Independent Director tasked with robust and well-defined responsibilities Lead Independent Director tasked with robust and well-defined responsibilities  Annual election of Chairman and Lead Independent Director Annual election of Chairman and Lead Independent Director  Executive sessions led by Lead Independent Director or Committee Chair at each Board and Committee meeting Executive sessions led by Lead Independent Director or Committee Chair at each Board and Committee meeting | | |  Annual review of board leadership structure Annual review of board leadership structure  Annual director self-evaluation and committee assessment to ensure board effectiveness Annual director self-evaluation and committee assessment to ensure board effectiveness  No “overboarded” directors No “overboarded” directors  Robust Code of Conduct Robust Code of Conduct  Commitment to, and oversight of, corporate social responsibility and ESG principles, including publication of Corporate Citizenship Report Commitment to, and oversight of, corporate social responsibility and ESG principles, including publication of Corporate Citizenship Report | | |  Majority voting for directors in uncontested elections with director resignation policy Majority voting for directors in uncontested elections with director resignation policy  Single voting class Single voting class  Proxy access Proxy access  No stockholder rights plan No stockholder rights plan  No supermajority voting provisions No supermajority voting provisions  Phase-out for staggered board with all directors to be elected annually beginning in 2027 Phase-out for staggered board with all directors to be elected annually beginning in 2027  Stockholders have ability to call special meetings Stockholders have ability to call special meetings |

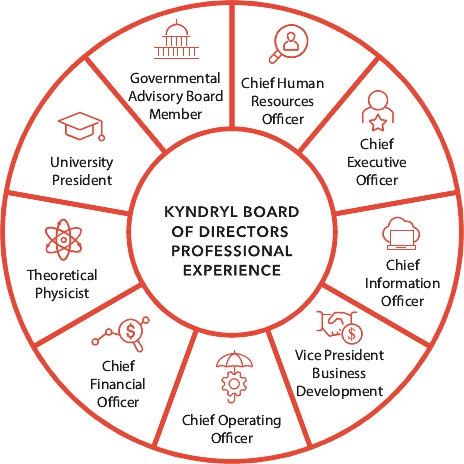

BOARD ATTRIBUTES

| | |  |

KYNDRYL 2024 PROXY STATEMENT | 3 |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

KYNDRYL BOARD

| | | Director | | | Age | | | Director Since | | | Independent | | | COMMITTEE MEMBERSHIP | |||||||

| | Audit | | | Compensation and Human Capital | | | Nominating and Governance | ||||||||||||||

| | | Dominic J. Caruso Retired Executive Vice President and Chief Financial Officer Johnson & Johnson | | | 66 | | | 2021 | | |  | | |   | | | | | ||

| | | John D. Harris II Former Vice President of Business Development Raytheon Company Former Chief Executive Officer Raytheon International Inc. | | | 63 | | | 2021 | | |  | | | | | | |  | ||

| | | Stephen A.M. Hester  Chairman easyJet plc Chairman Nordea Bank Abp | | | 63 | | | 2021 | | |  | | | | | | |  | ||

| | | Shirley Ann Jackson Retired President Rensselaer Polytechnic Institute | | | 77 | | | 2021 | | |  | | | | | | |  | ||

| | | Janina Kugel Former Chief Human Resources Officer and member of the Managing Board Siemens AG | | | 54 | | | 2021 | | |  | | | | |  | | | ||

| | | Denis Machuel Chief Executive Officer The Adecco Group | | | 60 | | | 2021 | | |  | | |   | | | | | ||

| | | Rahul N. Merchant Former Senior Executive Vice President and Head of Client Services and Technology TIAA-CREF | | | 67 | | | 2021 | | |  | | |   | | | | | ||

| | | Jana Schreuder Retired Executive Vice President and Chief Operating Officer Northern Trust Corporation | | | 65 | | | 2021 | | |  | | | | |  | | | ||

| | | Martin Schroeter  Chairman and Chief Executive Officer Kyndryl Holdings, Inc. | | | 59 | | | 2021 | | | | | | | | | ||||

| | | Howard I. Ungerleider Retired President and Chief Financial Officer Dow Inc. | | | 55 | | | 2021 | | |  | | | | |  | | | ||

| | | Chairman of the Board | | | | |  | | | Lead Independent Director | | | | |  | | | Committee Chair | | | | |  | | | Committee Member | | | | |  | | | Audit Committee Financial Expert |

4 | KYNDRYL 2024 PROXY STATEMENT |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

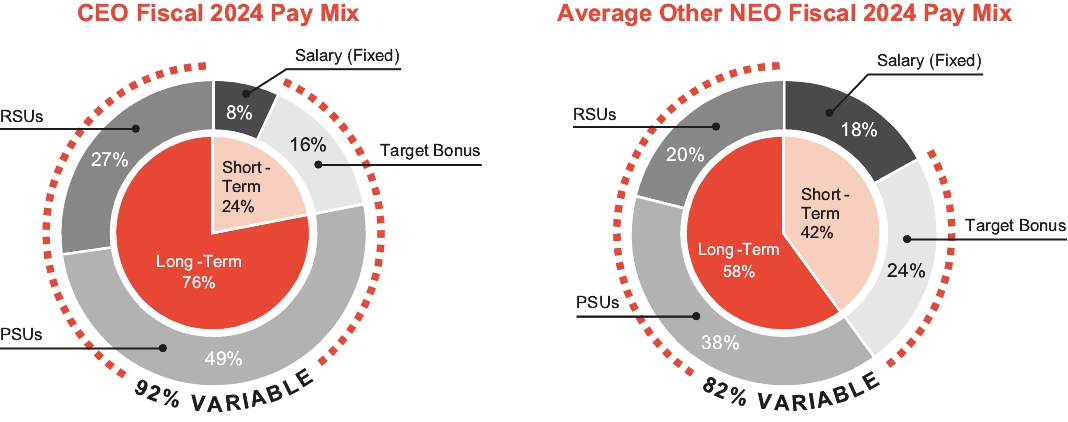

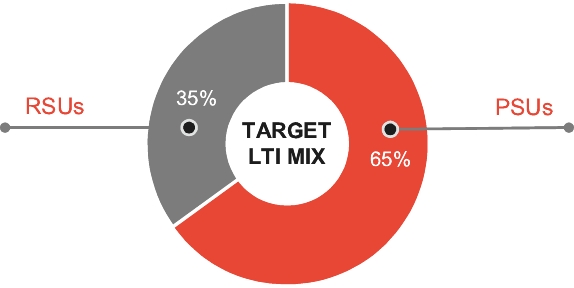

COMPENSATION PHILOSOPHY AND OBJECTIVES

Our executive compensation philosophy is governed by three key principles:

| | |  | | | | |  | | | | |  | | | ||||

| | | PAY FOR PERFORMANCE | | | | | ALIGN WITH STOCKHOLDERS | | | | | PAY COMPETITIVELY | | | ||||

| | | • At target, 75%-90% of our named executive officers’ (NEOs) compensation opportunity is performance-based • Incentive compensation is tied to our business results and individual performance | | | | | • Incentives are tied to both short-term and long-term performance goals to balance risk while rewarding for delivering financial, operating and strategic performance aligned with our business strategy and stockholder interests • A significant portion of NEO compensation is delivered in equity, further aligning their interests with stockholders • NEOs are required to retain shares earned until minimum share ownership levels are achieved per our stock ownership guidelines | | | | | • Total target compensation levels are competitive to attract and retain high-performing talent • Actual pay levels will vary based on performance results | | | ||||

| | | | | | | | | | | | |

OUR EXECUTIVE COMPENSATION BEST PRACTICES

What We Do | | | What We Don’t Do |

Significant percentage of target annual compensation delivered in the form of variable compensation tied to performance Significant percentage of target annual compensation delivered in the form of variable compensation tied to performance  Long-term objectives aligned with the creation of stockholder value Long-term objectives aligned with the creation of stockholder value  Market comparison of executive compensation against a relevant peer group Market comparison of executive compensation against a relevant peer group  Use of an independent compensation consultant reporting directly to the Compensation and Human Capital Committee and providing no other services to the Company Use of an independent compensation consultant reporting directly to the Compensation and Human Capital Committee and providing no other services to the Company  Robust stock ownership guidelines (6 times base salary for CEO and 3 times base salary for other NEOs) Robust stock ownership guidelines (6 times base salary for CEO and 3 times base salary for other NEOs)  Stringent clawback policies and provisions, including a policy consistent with SEC rules and NYSE listing standards, as well as an additional supplemental policy Stringent clawback policies and provisions, including a policy consistent with SEC rules and NYSE listing standards, as well as an additional supplemental policy  Non-competition and non-solicitation agreements for senior executives where not prohibited by applicable law Non-competition and non-solicitation agreements for senior executives where not prohibited by applicable law  Limited perquisites as approved by the CHC Committee Limited perquisites as approved by the CHC Committee  One-year minimum vesting condition under our long-term incentive plan One-year minimum vesting condition under our long-term incentive plan  Annual compensation risk review and assessment Annual compensation risk review and assessment | | |  No tax gross-ups No tax gross-ups  No “single-trigger” change in control severance benefits No “single-trigger” change in control severance benefits No excessive severance benefits No excessive severance benefits No “single-trigger” change in control equity vesting No “single-trigger” change in control equity vesting No hedging or pledging of Company shares by our executive officers No hedging or pledging of Company shares by our executive officers No evergreen provision in our long-term incentive plan No evergreen provision in our long-term incentive plan No repricing of underwater stock options permitted without stockholder approval No repricing of underwater stock options permitted without stockholder approval No multi-year employment agreements No multi-year employment agreements No guaranteed annual bonuses or incentive awards for executive officers No guaranteed annual bonuses or incentive awards for executive officers |

KYNDRYL 2024 PROXY STATEMENT | 5 |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

| | Corporate Governance and Board Matters | | |  | |

Our Board currently consists of 10 members and, until the conclusion of our 2027 Annual Meeting of stockholders, will be divided into three classes, with each class consisting, as nearly as possible, of one-third of the total number of directors. This temporary classified Board structure is intended to provide continuity of leadership during Kyndryl’s first years of operation as an independent, public company. The directors designated as Class I directors have terms expiring at the 2025 Annual Meeting, the directors designated as Class II directors have terms expiring at the 2026 Annual Meeting and the directors designated as Class III directors have terms expiring at the 2024 Annual Meeting. Any director elected at the 2024 Annual Meeting will belong to the class whose term expires at such Annual Meeting and will hold office for a three-year term or until his or her successor has been duly elected and qualified.

| | CLASS I | CLASS II | CLASS III | | ||

| | TERMS EXPIRING AT THE 2025 ANNUAL MEETING | TERMS EXPIRING AT THE 2026 ANNUAL MEETING | NOMINEES FOR ELECTION AT THE 2024 ANNUAL MEETING | | ||

| | • Janina Kugel • Denis Machuel • Rahul N. Merchant | • John D. Harris II • Jana Schreuder • Howard I. Ungerleider | • Dominic J. Caruso • Stephen A.M. Hester • Shirley Ann Jackson • Martin Schroeter | |

Beginning at the 2025 Annual Meeting, and at each annual meeting thereafter, all of our directors up for election at such meeting will be elected annually and will hold office until the following Annual Meeting or until his or her successor has been duly elected and qualified or until his or her earlier resignation or removal. Effective as of the conclusion of the 2027 Annual Meeting, our Board will therefore no longer be divided into three classes.

Our Company’s Board Corporate Governance Guidelines provide that, subject to review by the Nominating and Governance Committee and the Board, at the first annual meeting after turning age 75, non-management directors shall not stand for reelection. With respect to Shirley Ann Jackson, the Board unanimously approved a waiver to this policy and strongly believe she should continue on the Kyndryl Board due to her extensive leadership experience, as well as her performance and contributions to the Board and the Nominating and Governance Committee. Dr. Jackson’s leadership experience as former president of a preeminent science and technology university, government and regulatory experience, outside board experience and technological expertise gives Kyndryl an important unique perspective on the Board.

Upon the recommendation of the Nominating and Governance Committee, the Board has considered and nominated the following slate of Class III nominees for a three-year term expiring at our 2027 Annual Meeting or until their successors are duly elected and qualified: Dominic J. Caruso, Stephen A.M. Hester, Shirley Ann Jackson and Martin Schroeter.

Unless otherwise instructed, the persons named in the form of Proxy Card (proxyholders) attached to this Proxy Statement intend to vote the proxies held by them for the election of Dominic J. Caruso, Stephen A.M. Hester, Shirley Ann Jackson and Martin Schroeter. If any of these nominees ceases to be a candidate for election by the time of the 2024 Annual Meeting (a contingency which the Board does not expect to occur), such proxies may be voted by the proxyholders in accordance with the recommendation of the Board.

| |  | | | The Board recommends that you vote FOR the election of each of the Class III nominees set forth above. | |

6 | KYNDRYL 2024 PROXY STATEMENT |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

| | DOMINIC J. CARUSO | | | INDEPENDENT DIRECTOR since 2021 | | | AGE 66 | |

| |  Retired Executive Vice President and Chief Financial Officer, Johnson & Johnson, a global healthcare products company COMMITTEE: Audit (Chair) | | | Qualifications, Attributes and Skills • Global business experience as former chief financial officer of Johnson & Johnson • Financial expertise as former chief financial officer of Johnson & Johnson • Affiliation with leading business and public policy association as former co-chair of the U.S. Chamber of Commerce Global Initiative on Health and the Economy • Outside board experience as a director of McKesson Corporation | | | Relevant Experience Mr. Caruso served as the executive vice president and chief financial officer of Johnson & Johnson from 2007 until his retirement in 2018. Earlier in his career, Mr. Caruso served Centocor, Inc. as vice president, finance and chief financial officer from 1994 to 1998, and as senior vice president and chief financial officer from 1998 until the acquisition of Centocor by Johnson & Johnson in 1999. Mr. Caruso then joined Johnson & Johnson and served in various executive positions until his appointment as the executive vice president and chief financial officer in 2007. Mr. Caruso is a director of McKesson Corporation. Mr. Caruso previously served as the co-chair of the U.S. Chamber of Commerce Global Initiative on Health and the Economy and currently serves on the Board of Trustees and Advisors of the Cystic Fibrosis Foundation. Mr. Caruso is trustee emeritus of the Children’s Hospital of Philadelphia. | |

| | STEPHEN A.M. HESTER | | | LEAD INDEPENDENT DIRECTOR since 2021 | | | AGE 63 | |

| |  Chairman, easyJet plc, a leading international airline Chairman, Nordea Bank Abp, a leading Nordic financial services group COMMITTEE: Nominating and Governance (Chair) | | | Qualifications, Attributes and Skills • Global business experience as former group chief executive of RSA Insurance Group, of Royal Bank of Scotland Group and of British Land plc • Financial expertise as former chief financial officer of Abbey National plc and Credit Suisse First Boston • Outside board experience as chairman of easyJet plc, chairman of Nordea Bank Abp, former senior independent director of Centrica plc, former director of RSA Insurance Group plc and former deputy chairman of Northern Rock | | | Relevant Experience Sir Stephen Hester currently serves as chairman of easyJet plc and as chairman of Nordea Bank Abp. In 2024, he was knighted for services to business and to the economy in the United Kingdom’s New Year Honours list. Sir Stephen Hester served as chief executive officer of RSA Insurance Group from 2014 until his retirement in June 2021. Prior to joining RSA, he was group chief executive of Royal Bank of Scotland from 2008 to 2013, chief executive of British Land plc from 2004 to 2008, and chief operating officer and chief financial officer of Abbey National plc from 2002 to 2004. Sir Stephen Hester began his career at Credit Suisse First Boston in 1982 and held positions of increasing responsibility, including chief financial officer and global head of the fixed income division. Additionally, during the past five years, he served as senior independent director of Centrica plc and as a director of RSA Insurance Group plc. | |

KYNDRYL 2024 PROXY STATEMENT | 7 |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

| | SHIRLEY ANN JACKSON | | | INDEPENDENT DIRECTOR since 2021 | | | AGE 77 | |

| |  Retired President, Rensselaer Polytechnic Institute, a leading science and technology university that brings technical innovation to the marketplace COMMITTEE: Nominating and Governance | | | Qualifications, Attributes and Skills • Leadership and technology, digital and/or cybersecurity experience as former president of Rensselaer Polytechnic Institute • Industry and research experience as a theoretical physicist at the former AT&T Bell Laboratories • Government service as a member of the United States Secretary of Energy Advisory Board, the Defense Science Board, the International Security Advisory Board to the United States Secretary of State, former chairman of the U.S. Nuclear Regulatory Commission and co-chair of the President’s Intelligence Advisory Board and former member of the President’s Council of Advisors on Science and Technology • Regulatory experience as a former member of the board of governors of the Financial Industry Regulatory Authority (FINRA) and as former chairman of the U.S. Nuclear Regulatory Commission • Affiliation with leading business and public policy associations as a member of the Council on Foreign Relations, former university vice chair of the Council on Competitiveness and former member of the board of the World Economic Forum USA • Formerly tenured professor at Rensselaer Polytechnic Institute and Rutgers University • Outside board experience as a former director of a number of corporations including FedEx Corporation, Public Service Enterprise Group Incorporated (PSEG) and International Business Machines Corporation (IBM) | | | Relevant Experience Dr. Jackson was a theoretical physicist at the former AT&T Bell Laboratories from 1976 to 1991, consultant to the former AT&T Bell Laboratories from 1991 to 1995, professor of theoretical physics at Rutgers University from 1991 to 1995 and chairwoman of the U.S. Nuclear Regulatory Commission from 1995 to 1999. Dr. Jackson was president of Rensselaer Polytechnic Institute for more than two decades, from 1999 until her retirement in 2022. Dr. Jackson’s distinguished career in science and technology includes being a member of the United States Secretary of Energy Advisory Board, the Defense Science Board and the International Security Advisory Board to the United States Secretary of State. She has also served as co-chair of the President’s Intelligence Advisory Board. Dr. Jackson is a fellow of the Royal Academy of Engineering (U.K.), the American Academy of Arts and Sciences, the American Association for the Advancement of Science and the American Physical Society. She is a member of the U.S. National Academy of Engineering and the American Philosophical Society. Dr. Jackson is a recipient of the National Medal of Science, the highest award in science and engineering awarded by the U.S. Government. Dr. Jackson is currently a member of the Memorial Sloan Kettering Cancer Center Board of Trustees. Dr. Jackson is a member of the Council on Foreign Relations. She is a Regent Emerita and former Vice-Chair of the Board of Regents of the Smithsonian Institution, a past president of the American Association for the Advancement of Sciences and an honorary trustee of the Brookings Institution. Additionally, during the past five years, she served as a director of FedEx Corporation, PSEG and IBM. | |

8 | KYNDRYL 2024 PROXY STATEMENT |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

| | MARTIN SCHROETER | | | CHAIRMAN since 2021 | | | AGE 59 | |

| |  Chairman and Chief Executive Officer, Kyndryl | | | Qualifications, Attributes and Skills • Global business and leadership experience as chief executive officer of Kyndryl and former senior vice president of global markets of IBM • Technology, digital and/or cybersecurity experience as chief executive officer of Kyndryl and service in various roles at IBM • Financial expertise as former senior vice president and chief financial officer of IBM • Affiliation with leading business and public policy association as a member of the Business Roundtable and the Council on Foreign Relations | | | Relevant Experience Mr. Schroeter was named the first chief executive officer of Kyndryl in January 2021. Previously, Mr. Schroeter served in a variety of business line and finance executive positions at IBM including senior vice president of global markets from 2018 until 2020, responsible for IBM’s global sales, customer relationships and satisfaction and worldwide geographic operations and overseeing IBM’s marketing and communication functions and building IBM’s brand and reputation globally, and senior vice president and chief financial officer from 2014 until 2017, leading IBM’s finance function. Earlier in his career, Mr. Schroeter served as general manager of IBM global financing, managing a total asset base in excess of $37 billion, and had served in numerous roles in Japan, the United States and Australia. Mr. Schroeter is a member of the Business Roundtable and the Council on Foreign Relations. | |

KYNDRYL 2024 PROXY STATEMENT | 9 |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

CLASS I DIRECTORS, WITH TERMS EXPIRING AT THE 2025 ANNUAL MEETING

| | JANINA KUGEL | | | INDEPENDENT DIRECTOR since 2021 | | | AGE 54 | |

| |  Former Chief Human Resources Officer, Siemens AG, a diversified manufacturing and technology company COMMITTEE: Compensation and Human Capital | | | Qualifications, Attributes and Skills • Global business experience as former chief human resources officer of Siemens AG • Government service as a former member of the Innovation Council for the Federal Ministry of Digitization and the Council of Future of Work for the Federal Ministry of Labor and Social Affairs of Germany • Technology, digital and/or cybersecurity experience as the chairwoman of Seatti GmbH • Affiliation with a leading business and public policy association as the co-chair of the Digital Council of the Confederation of German Employers’ Associations • Academic experience as a member of the International Advisory Board of the IESE Business School in Spain, the University Council of the Technical University of Munich and the Global Navigation Board of the University of Tokyo • Outside board experience as a director of TUI AG | | | Relevant Experience Ms. Kugel served as the chief human resources officer and member of the managing board of Siemens AG from 2015 until 2020. Ms. Kugel joined Siemens AG in 2001 as vice president of group strategy in the communications sector and in 2005, was appointed director of global commercial excellence before becoming director of human resources in 2009. In 2012, Ms. Kugel joined Osram where she served as chief human resources officer until 2013, when she returned to Siemens AG to serve as corporate vice president of human resources and chief diversity officer. Ms. Kugel currently serves as chairwoman of Seatti GmbH, a leading desk booking software company. Ms. Kugel serves on the Board of, and is the co-chair of, the Digital Council of the Confederation of German Employers’ Associations (Bundesvereinigung der Deutschen Arbeitgeberverbände). Ms. Kugel is also a member of the International Advisory Board of the IESE Business School in Spain, the University Council of the Technical University of Munich and the Global Navigation Board of the University of Tokyo. Since 2020, Ms. Kugel has served as senior advisor to EQT, AB Group and is a senior advisor for Boston Consulting Group, Inc. Ms. Kugel is also a member of the Board of Trustees of Deutsche AIDS Stiftung (German AIDS Foundation). | |

10 | KYNDRYL 2024 PROXY STATEMENT |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

| | DENIS MACHUEL | | | INDEPENDENT DIRECTOR since 2021 | | | AGE 60 | |

| |  Chief Executive Officer, The Adecco Group, a leading human resources and temporary staffing firm COMMITTEE: Audit | | | Qualifications, Attributes and Skills • Global business experience as chief executive officer of The Adecco Group and former chief executive officer of Sodexo S.A. • Technology and digital experience as the former chief digital officer of Sodexo S.A. • Affiliation with leading business and public policy associations as a former member of the G7 Business for Inclusive Growth coalition and the Consumer Goods Forum | | | Relevant Experience Mr. Machuel has served as chief executive officer of The Adecco Group since July 2022. Prior to this, Mr. Machuel served as the chief executive officer of Sodexo S.A. from 2018 until 2021. Mr. Machuel joined Sodexo in 2007 as the managing director of benefits and rewards services for central and eastern Europe. In 2012, he became chief executive officer of Sodexo benefits and rewards worldwide. Mr. Machuel joined the Sodexo Group Executive Committee in 2014 and from 2015 until 2018 served as group chief digital officer and from 2017 until 2018, served as deputy chief executive officer of Sodexo. Additionally, between 2016 and 2017, Mr. Machuel served as chief executive officer of personal and home services at Sodexo. Mr. Machuel has also served as a member of the G7 Business for Inclusive Growth coalition and the Consumer Goods Forum. | |

| | RAHUL N. MERCHANT | | | INDEPENDENT DIRECTOR since 2021 | | | AGE 67 | |

| |  Former Senior Executive Vice President and Head of Client Services & Technology, TIAA-CREF, a financial services company COMMITTEE: Audit | | | Qualifications, Attributes and Skills • Global business experience as former senior executive vice president and head of client services and technology at TIAA • Technology, digital and/or cybersecurity experience as former executive vice president and chief information and operations officer at Federal National Mortgage Association (Fannie Mae) and former senior vice president, chief information officer and chief technology officer at Merrill Lynch, Pierce, Fenner & Smith Incorporated • Government service as former citywide chief information and innovation officer of New York City • Outside board experience as a director of Juniper Networks, Inc. | | | Relevant Experience Mr. Merchant served as a senior executive vice president at TIAA from 2015 until his retirement in April 2022. While at TIAA, Mr. Merchant led a variety of organizations including chief information officer, client services and digital transformation. Prior to serving in this role, Mr. Merchant served as citywide chief information and innovation officer for the City of New York from 2012 until 2014. From 2006 until 2009, Mr. Merchant served as executive vice president, chief information and operations officer and member of the executive committee at Fannie Mae and senior vice president, chief information officer and chief technology officer at Merrill Lynch, Pierce, Fenner & Smith Incorporated from 2000 until 2006. Mr. Merchant also serves as a director for Juniper Networks, Inc. | |

KYNDRYL 2024 PROXY STATEMENT | 11 |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

| | JOHN D. HARRIS II | | | INDEPENDENT DIRECTOR since 2021 | | | AGE 63 | |

| |  Former Vice President of Business Development, Raytheon Company and Chief Executive Officer, Raytheon International Inc., a multinational aerospace and defense company COMMITTEE: Nominating and Governance | | | Qualifications, Attributes and Skills • Global business experience as former chief executive officer of Raytheon International Inc. and vice president of business development of Raytheon Company • Technology, digital and/or cybersecurity experience as former president of the Raytheon Technical Services Company and as former general manager of Raytheon’s Intelligence, Information and Services business • Government service as former member of the National Advisory Council on Minority Business Enterprise with the U.S. Department of Commerce and Radio Technical Commission for Aeronautics (RTCA) NexGen Advisory Committee of the U.S. Department of Transportation • Outside board experience as a director of Cisco Systems Inc., Flex Ltd., and Exxon Mobil Corporation | | | Relevant Experience Mr. Harris served as chief executive officer of Raytheon International Inc. from 2013 until 2020, where he led significant business transformations. Mr. Harris also served as vice president of business development for Raytheon Company during his tenure, a global technology and innovation-driven company with offerings such as intelligence services and cybersecurity solutions. Mr. Harris joined Raytheon in 1983 and held positions of increasing responsibility, including vice president of operations and contracts for Raytheon’s former electronic systems business, vice president of contracts for the company’s government and defense businesses until 2003 and vice president of contracts and supply chain for Raytheon Company until 2010, when he was named president of the Raytheon Technical Services Company, a role he served in until 2013. Mr. Harris served on the RTCA NextGen Advisory Committee, the National Advisory Council on Minority Business Enterprise with the U.S. Department of Commerce and the Association of the United States Army’s Council of Trustees. Mr. Harris serves as a board member for Cisco Systems Inc., Flex Ltd., and Exxon Mobil Corporation. | |

12 | KYNDRYL 2024 PROXY STATEMENT |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

| | JANA SCHREUDER | | | INDEPENDENT DIRECTOR since 2021 | | | AGE 65 | |

| |  Retired Executive Vice President, Chief Operating Officer, Northern Trust Corporation, a financial services company COMMITTEE: Compensation and Human Capital (Chair) | | | Qualifications, Attributes and Skills • Global business experience as former chief operating officer of Northern Trust Corporation • Technology, digital and/or cybersecurity experience as former president of operations and technology at Northern Trust Corporation • Financial experience as former chief risk officer and head of corporate risk management and president of wealth management at Northern Trust Corporation • Affiliation with leading business association as a member of Women Corporate Directors • Outside board experience as a director of The Bank of N.T. Butterfield & Son Limited | | | Relevant Experience Ms. Schreuder served as executive vice president and chief operating officer of Northern Trust Corporation from 2014 until she retired from that role in 2018. Ms. Schreuder joined Northern Trust in 1980 and during her tenure held multiple roles as a member of the management team, including service as chief risk officer from 2005 to 2006, president of operations and technology from 2006 to 2011 and president of wealth management from 2011 to 2014. Ms. Schreuder is a member of Women Corporate Directors. Ms. Schreuder currently sits on the board of The Bank of N.T. Butterfield & Son Limited. Additionally, during the past five years, she served as a director of Avantax, Inc. | |

| | HOWARD I. UNGERLEIDER | | | INDEPENDENT DIRECTOR since 2021 | | | AGE 55 | |

| |  Retired President and Chief Financial Officer, Dow Inc., a materials, polymer, chemicals and biological sciences enterprise COMMITTEE: Compensation and Human Capital | | | Qualifications, Attributes and Skills • Global business experience as former president and chief financial officer of Dow Inc. • Financial expertise as former chief financial officer of Dow Inc., DowDuPont and The Dow Chemical Company • Managed the financial complexities of the historic merge-and-spin of DowDuPont, an $86 billion holding company comprised of The Dow Chemical Company and DuPont from September 2017 to April 2019 • Financial leadership for The Dow Chemical Company’s strategic ownership restructuring of its Dow Corning Corporation silicones business joint venture completed in 2016 • Affiliation with leading business and public policy associations as Chair of the Business Leaders for Michigan business roundtable and the Michigan Climate Executive Advisory Group • Outside board experience as a former director of Wolverine Bancorp, Inc. | | | Relevant Experience Mr. Ungerleider served as president and chief financial officer of Dow Inc. from April 2019 until November 2023, and he retired from the company in January 2024. In 1990, he joined The Dow Chemical Company and subsequently held various positions, including chief financial officer from 2014 to 2015. In 2016, he was appointed chief financial officer of DowDuPont effective upon the merger of The Dow Chemical Company and E.I. du Pont de Nemours and Company (DuPont). Mr. Ungerleider served in this role from 2017 until April of 2019, when Dow Inc. separated from DowDuPont. In January 2024, Mr. Ungerleider was appointed as an Operating Advisor to Clayton, Dubilier & Rice funds. Mr. Ungerleider previously served as chairman of the Dow Company Foundation. He currently serves on the Board of Directors of FCLTGlobal, the Michigan Israel Business Bridge and the Rollin M. Gerstacker Foundation. Mr. Ungerleider is also Chair of the Business Leaders for Michigan business roundtable and the Michigan Climate Executive Advisory Group. | |

KYNDRYL 2024 PROXY STATEMENT | 13 |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

| |  | | | Our Board of Directors has strong leadership skills, extensive transformation experience and wide diversity of background and experiences to help drive our strategy of returning to profitable growth | |

Kyndryl’s Board of Directors brings together ten leaders with a variety of backgrounds in key industries and professions from a wide array of senior executive and leadership roles. Our directors empower our Board with operational experience, financial expertise and academic leadership, as well as extensive research and innovation experience. In addition, many of our directors have a background in facilitating technological change in their organizations and possess digital and cybersecurity experience. Together, they bring a well-rounded perspective and offer a wealth of knowledge for understanding and navigating contemporary business issues so that we can continue to focus on our growth as an independent company.

| | Director | | | Client Industry Expertise | | | Technology, Cybersecurity and/or Innovation | | | Organizational Leadership and Global Operations Management | | | Financial Experience/ Expertise | | | Risk Management | | | Academia | | | Government/ Regulatory, or Business/ Public Policy Associations | | | Public Board | | | Gender/ Racial/ Ethnic Diversity | |

| | Dominic J. Caruso | | | | | | |  | | |  | | |  | | | | |  | | |  | | | | ||||

| | John D. Harris II | | | | |  | | |  | | |  | | |  | | | | |  | | |  | | |  | | ||

| | Stephen A.M. Hester | | | | | | |  | | |  | | |  | | | | |  | | |  | | | | ||||

| | Shirley Ann Jackson | | | | |  | | |  | | |  | | |  | | |  | | |  | | |  | | |  | | |

| | Janina Kugel | | | | |  | | |  | | | | |  | | |  | | |  | | |  | | |  | | ||

| | Denis Machuel | | | | |  | | |  | | |  | | |  | | | | |  | | | | | | ||||

| | Rahul N. Merchant | | | | |  | | |  | | |  | | |  | | | | |  | | |  | | |  | | ||

| | Jana Schreuder | | | | |  | | |  | | |  | | |  | | | | |  | | |  | | |  | | ||

| | Martin Schroeter | | | | |  | | |  | | |  | | |  | | | | |  | | | | | | ||||

| | Howard I. Ungerleider | | | | | | |  | | |  | | |  | | | | |  | | |  | | | |

Industry Expertise

| | Healthcare | | | | |

| | Services and Facilities Mgmt. | | | | |

| | Financial Services & Insurance | | | | |

| | Manufacturing | | | | |

| | Information Technology | | | | |

| | Aerospace & Defense | | | | |

| | Research & Development | | | | |

| | Chemicals | | | |

Effective Board Leadership, Independent Oversight and Strong Corporate Governance |

50% of directors are racially, ethnically and/or 50% of directors are racially, ethnically and/or gender diverse  100% of Committee members are independent 100% of Committee members are independent | | |  100% of directors attended our 2023 Annual 100% of directors attended our 2023 Annual Meeting of stockholders  Our directors attended Our directors attended 100% of the Board and Committee meetings in fiscal year 2024 | |

14 | KYNDRYL 2024 PROXY STATEMENT |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

OVERVIEW

Our Nominating and Governance Committee is responsible for recommending qualified candidates for election to the Board, consistent with the criteria approved by the Board and set forth in our Board Corporate Governance Guidelines and Nominating and Governance Committee Charter. The Board is responsible for selecting nominees for election.

Our Nominating and Governance Committee and the Board seek to ensure that the Board, as a whole, possesses the expertise, qualifications, attributes and skills to carry out its oversight responsibilities effectively and to align with our long-term strategies. Accordingly, our Board Corporate Governance Guidelines provide that individuals are nominated to join the Board based on all appropriate criteria, which may include strength of character, mature judgment, familiarity with our business and industry, independence of thought, ability to work collegially, existing commitments to other businesses, potential conflicts of interest with other pursuits, legal considerations such as antitrust issues, business or professional experience, the diversity of their background and their array of talents and perspectives.

Our directors invest the time and effort necessary to understand the Company’s business and financial strategies and challenges, a policy reflected in our Board Corporate Governance Guidelines. Our directors’ commitment to their oversight responsibilities is reflected by the 100% attendance of directors at Board and Committee meetings in fiscal year 2024. As part of the process, the Nominating and Governance Committee, pursuant to its charter, reviews directors’ service on other boards, as well as other engagements, to ensure directors have sufficient time to devote to the Company and re-assess this information before nomination to the Board. Since our inception as a public company, we do not believe that any one of our directors have served on more than four public company boards or have been otherwise “overboarded”. Further, our guidelines provide that no member of the Audit Committee will serve on more than three public company audit committees, including the Company’s, without prior approval of the Board or unless disclosed on our website or Proxy Statement.

| | | Business or Professional Experience Industry and/or other relevant business or professional experience, including leadership experience, corporate governance background, financial and accounting background, compliance background and/or executive compensation background | | |  | | | Array of Talents and Perspectives The particular talents, areas of expertise and diverse perspectives, including international perspectives, relevant technical skills and/or relevant business or government acumen they bring to the Board |

| | | Technology or Cybersecurity Background Experience in managing technological services, information security risks or leadership experience in the technology space | | |  | | | Diversity Diversity of experience and background |

Because the evaluation of these criteria involves the exercise of careful business judgment, the Nominating and Governance Committee and the Board do not have specific minimum qualifications that are applicable to all director candidates.

DIVERSITY

The Nominating and Governance Committee Charter provides that, as part of its ongoing responsibility to search for qualified individuals for election as directors, the Committee recruits talented candidates for the Board. While there is no formal diversity policy, the Committee and the Board carefully consider work experiences along with a range of backgrounds and perspectives, including gender, race, ethnicity, culture, nationality and geography, when evaluating whether the Board has the right mix of skills, experience and expertise to effectively oversee the management and governance of the Company.

KYNDRYL 2024 PROXY STATEMENT | 15 |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

DIRECTOR CANDIDATE SEARCH

The Nominating and Governance Committee and the Board identify candidates through a variety of means, including:

Recommendations from the Committee and the full Board | | |  | | |  Recommendations from stockholders | | |  | | |  Suggestions from management | | |  | | |  A third-party search firm, periodically |

In identifying prospective director candidates, the Nominating and Governance Committee may seek referrals from other members of the Board, management, stockholders and other sources. The Nominating and Governance Committee also may, but is not required to, retain a third-party search firm in order to assist it in identifying qualified candidates. The Nominating and Governance Committee and the Board use the same criteria for evaluating director candidates regardless of the source of the referral.

The Nominating and Governance Committee will consider director candidates recommended by stockholders. Any recommendation submitted to the Secretary of the Company should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation, but must include information that would be required under the rules of the SEC to be included in a Proxy Statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected.

All recommendations for nomination received by the Secretary that satisfy our Bylaw requirements relating to director nominations will be presented to the Nominating and Governance Committee for its consideration. Stockholders must also satisfy the notification, timeliness and information requirements set forth in our Bylaws. See “Frequently Asked Questions—18. How do I submit an item of business for the 2025 Annual Meeting?”

Stockholders wishing to propose a candidate for consideration may do so by submitting the information described in this section to: Kyndryl Holdings, Inc., Attention: Corporate Secretary’s Office, One Vanderbilt Avenue, 15th Floor, New York, New York 10017.

In addition, our Bylaws permit a stockholder, or a group of up to 20 stockholders, that has continuously owned for three years at least 3% of the Company’s outstanding common stock, to nominate and include in the Company’s annual meeting proxy materials up to the greater of two directors or 20% of the number of directors to be elected at the annual meeting (Proxy Access), provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in our Bylaws, which are posted on our investor relations website at investors.kyndryl.com. Stockholder requests to include stockholder-nominated directors in the Company’s proxy materials for our 2025 Annual Meeting of stockholders pursuant to our Proxy Access bylaw must be received by the Company no earlier than January 13, 2025 and no later than February 12, 2025.

All directors are expected to make every effort to attend all meetings of the Board, meetings of the committees of which they are members and the Annual Meeting of Stockholders. In the Company’s 2024 fiscal year:

• | The Board met 6 times and the committees collectively met 14 times; |

• | Each director attended 100% of the total number of meetings of the Board and of the Committees on which each such director served; |

• | All 10 of our directors attended the Company’s 2023 Annual Meeting of Stockholders. |

16 | KYNDRYL 2024 PROXY STATEMENT |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

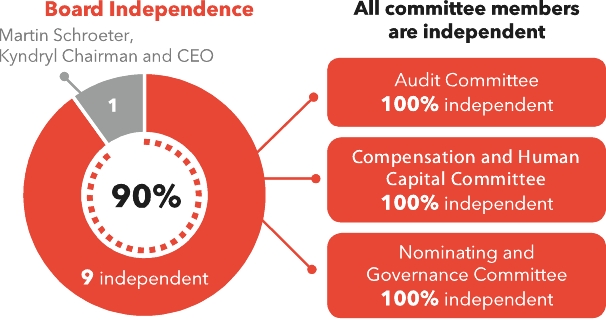

Under our Board Corporate Governance Guidelines and NYSE rules, a director is not independent unless our Board affirmatively determines that he or she does not have a direct or indirect material relationship with us or any of our subsidiaries.

Our Board Corporate Governance Guidelines define independence in accordance with current NYSE standards for listed companies and require that our Nominating and Governance Committee and our Board review the independence of all directors at least annually.

After review of all relevant facts and circumstances, our Board has affirmatively determined that each of Dominic J. Caruso, John D. Harris II, Stephen A.M. Hester, Shirley Ann Jackson, Janina Kugel, Denis Machuel, Rahul N. Merchant, Jana Schreuder and Howard I. Ungerleider is independent under the guidelines for director independence set forth in the Board Corporate Governance Guidelines and under all applicable NYSE rules, including with respect to committee membership. | | |  |

In making its independence determinations, our Board reviewed all information known to it (including information identified through annual directors’ questionnaires), including the various commercial transactions and relationships between us and our subsidiaries and the entities with which certain of our directors are or have been affiliated. The Board determined that the transactions identified were not material and did not affect the independence of any of our non-employee directors under either our Board Corporate Governance Guidelines or the applicable NYSE rules.

| | | | |  | |

| | | | | |||

MARTIN SCHROETER | | | | | STEPHEN A.M. HESTER | |

Chairman of the Board and Chief Executive Officer | | | | | Lead Independent Director |

Selecting a company’s leadership structure is one of the most important tasks of any Board. There is not a one-size-fits-all model for board leadership, which is why our Bylaws provide that the Board has the duty to elect a Chairman of the Board from among its members annually. The Board believes that Kyndryl and its stockholders are best served by maintaining this flexibility and that a permanent leadership policy is not appropriate. Therefore, our governing documents enable the Board to determine the appropriate Board leadership structure for the Company and allow the roles of Chairman of the Board and Chief Executive Officer to be filled by the same or different individuals. Additionally, our Board Corporate Governance Guidelines provide that the Company will have a Lead Independent Director whenever the Chairman of the Board is a non-independent director.

Currently, Mr. Schroeter serves as Chairman of the Board and Chief Executive Officer. Combining the role of Chairman and Chief Executive Officer at this time ensures that the Chairman has significant experience in the technology services business and ongoing executive responsibility for the Company. In the Board’s view, this approach enables the Board to better understand the Company and work with management to

KYNDRYL 2024 PROXY STATEMENT | 17 |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

enhance stockholder value. In addition, the Board believes that this structure enables it to better fulfill its risk oversight responsibilities and allows the Chief Executive Officer to more effectively communicate the Board’s view to management.

The Lead Independent Director position provides strong, independent leadership for the Board. It is the opinion of the Board that Mr. Hester’s diverse, international executive leadership and public company board experience make him exceptionally qualified to lead the independent members of the Board in their oversight of management. Mr. Hester’s leadership experience includes roles as a Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, as well as serving as Chairman of the Board for multiple companies in diverse industries. Under our Board Corporate Governance Guidelines, Mr. Hester as the Lead Independent Director has significant and robust duties and responsibilities, including:

• | presiding at all meetings of the Board at which the Chair is not present, including executive sessions of the independent directors; |

• | serving as liaison between the Chair and the independent directors; |

• | approving information sent to the Board; |

• | approving meeting agendas for the Board; |

• | approving meeting schedules to assure that there is sufficient time for discussion of all agenda items; |

• | authority to call meetings of the independent directors; and |

• | if requested by major stockholders, ensuring that he is available, as necessary after discussions with the Chairman and Chief Executive Officer, for consultation and direct communication. |

The Board considers its current leadership structure to be appropriate for the Company at this time. The Board believes that the responsibilities of the Lead Independent Director and the highly independent composition of the Board help to ensure appropriate oversight of the Company’s management by the Board and optimal functioning of the Board.

The Board is responsible for the overall oversight of management in the execution of its responsibilities. In this oversight role, the Board regularly reviews the Company’s long-term business strategy and works with management to set the short-term and long-term strategic objectives of the Company and to monitor progress on those objectives. Strategy discussions are an integral part of each Board meeting. In addition, on an annual basis, the Company devotes significant time to a full strategic review with senior management and other subject matter experts.

One of the significant important oversight responsibilities for our Board is with respect to risk management related to us and our business. The Board executes this oversight with a multi-tiered approach through oversight by the entire Board, as well as through its Audit Committee, Compensation and Human Capital Committee and Nominating and Governance Committee, each of which assists the Board in overseeing a part of our overall risk management and regularly reports to the Board, as discussed below. In that way, risk oversight responsibilities are shared by all committees of the Board, with each committee responsible for oversight of matters most aligned with the responsibilities set forth in its charter. We believe that allocating responsibility to a committee with relevant knowledge and experience provides a more focused and deeper oversight of risk. This allows for a multi-tiered approach to risk oversight, with the full Board retaining overall oversight responsibility.

Our senior leadership team is responsible for managing our enterprise risk management program under the oversight of the Audit Committee. Responsibility for managing each of our highest priority risks is assigned to one or more members of our senior leadership team. Our enterprise risk management program is designed to identify, assess and manage our risk exposures, and management regularly reports to the Board and its committees on our material operational, strategic and financial risks (over the short-, intermediate- and long-term) and plans to monitor, manage and mitigate these risks, as described below.

18 | KYNDRYL 2024 PROXY STATEMENT |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

Each committee also, when desired by the applicable committee, meets with outside advisors (including consultants and experts) in executing its risk oversight responsibilities.

The Board is responsible for the overall oversight of our enterprise risk management program and receives regular updates from management on our material operational, strategic and financial risks (over the short-, intermediate- and long-term) and plans to monitor, manage and mitigate these risks. With respect to operational and strategic risks, the Board receives periodic updates from: our Chief Information Security Officer, Chief Information Officer, Security & Resiliency global practice leader and other senior leaders with respect to cybersecurity and data privacy matters; our Chief Human Resources Officer on inclusion, diversity and equity matters; and our Global Head of Corporate Affairs and Senior Vice President, Sustainability & Impact Officer with respect to environmental and corporate responsibility matters. The Board considers the foregoing matters so critical to our business that it maintains concurrent oversight over them with its Audit Committee, Compensation and Human Capital Committee and Nominating and Governance Committee, respectively.

The Audit Committee periodically reviews our accounting, reporting and financial practices and risk exposures, including with respect to the integrity of our financial statements, our financial reporting, our administrative, financial and disclosure controls, our enterprise risk management program, compliance with legal and regulatory requirements, our engagement with Kyndryl’s independent auditor and our cybersecurity and data privacy controls. Through its regular meetings with management, including the finance, legal, internal audit and information security functions, and Kyndryl’s independent registered public accounting firm, the Audit Committee reviews and discusses all significant areas of our business and related risks and summarizes for the Board areas of risk, including cyber risk, and any mitigating factors. With respect to compliance matters, the Audit Committee receives regular updates from our Chief Compliance Officer, who reports to our General Counsel. With respect to enterprise risk management, the Audit Committee receives regular updates from our Senior Vice President & General Auditor. With respect to cybersecurity-related matters, the Audit Committee receives periodic updates from our Chief Information Security Officer, Chief Information Officer, Security & Resiliency global practice leader and other senior leaders.

The Compensation and Human Capital Committee considers, and discusses with management, management’s assessment of certain risks, including whether any risks arising from our compensation structure, policies and programs for our employees are reasonably likely to have a material adverse effect on us. The Compensation and Human Capital Committee also receives input from its independent compensation consultant as to whether any risks arising from our compensation structure, policies and programs for our employees are reasonably likely to have a material adverse effect on us. The Compensation and Human Capital Committee also reviews and assesses risks relating to our human capital practices. In this capacity, the Compensation and Human Capital Committee oversees management succession planning, oversees human capital management and our inclusion, diversity and equity practices and assesses the ability of our compensation programs to attract and retain high-performing talent.

The Nominating and Governance Committee oversees and evaluates programs and risks associated with Board organization, membership and structure and corporate governance, including director independence and related person transactions. The Nominating and Governance Committee also oversees and assesses risks associated with our corporate responsibility initiatives, including our environmental and sustainability goals and initiatives.

KYNDRYL 2024 PROXY STATEMENT | 19 |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

Succession planning is a key component of our talent strategy and the Board, and the Compensation and Human Capital Committee actively to provide oversight of management’s succession planning process. Our Board is actively engaged in discussions and periodically reviews senior leadership succession planning and development, including annually with the CEO. The Compensation and Human Capital Committee oversees the management continuity planning process, is responsible for reviewing and evaluating the succession plans relating to all executive officer positions and for making recommendations to the Board on individuals to occupy these positions.

As part of its strong governance practices and policies, the Company has a robust board and committee self-evaluation process. Our multi-part process is designed to elicit honest and candid feedback from directors in multiple formats and at different times to ensure that the Board and its committees are operating effectively and that its processes reflect best practices. The steps below outline the formal evaluation process; however, the totality of the evaluation process is dynamic and ongoing with feedback discussed among Board members throughout the year.

Process | | | | | Kyndryl Leadership | | | | | Key Events | |||||

| | | | | | | | | | | ||||||

1 | | | One-on-one Interviews | | |  | | | Chairman of the Board | | |  | | | Prior to the formal self-evaluation, the Chairman solicits feedback from individual directors in a one-on-one format enabling directors to discuss their views on an individual basis. |

2 | | | Each Individual Committee Conducts Annual Self-Evaluation | | |  | | | Committee Chairs | | |  | | | Each committee performs its own self-evaluation in an executive session on an annual basis. These committee sessions are led by the Chair of each committee and promote candid discussion in a smaller committee setting of matters that are specific to each committee. |

3 | | | Full Board Conducts Annual Self-Evaluation | | |  | | | Lead Independent Director | | |  | | | The Lead Independent Director leads the entire Board in an annual self-evaluation to review the effectiveness of the Board. Among other items, the Board focuses on areas such as: • Board composition, including the diversity of skills and experience of our directors; • Board culture and rapport among directors; • Scope and quality of the Board meeting materials; • Board access to the Company’s management team; • Appropriateness of the Company’s controls environment; and • Overall Board performance and effectiveness of the Board and each of its committees. |

4 | | | Evaluation of Feedback | | |  | | | Full Board | | |  | | | At a subsequent meeting, the full Board collectively discusses insights from each of these evaluation sessions. |

5 | | | Board and Committee Enhancements | | |  | | | Full Board | | |  | | | After discussion of the feedback from the Board and committees’ annual self-evaluations, the Board and/or its committees implement enhancements to its existing policies and practices, as appropriate. |

20 | KYNDRYL 2024 PROXY STATEMENT |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

Our Board has three standing committees—Audit Committee, Compensation and Human Capital Committee and Nominating and Governance Committee. Each Committee is comprised solely of directors who satisfy the independence criteria established by the Board, which reflect the standards of the NYSE and the rules of the SEC, including the heightened independence requirements that apply to Audit Committee and Compensation and Human Capital Committee members. Each Committee has a written charter that sets forth the Committee’s duties and responsibilities.

| | Director | | | Independent | | | Kyndryl Committees | | ||||||

| |  | | |  | | |  | | ||||||

| | Audit | | | Compensation and Human Capital | | | Nominating and Governance | | ||||||

| | Dominic J. Caruso | | |  | | |   | | | | | | ||

| | John D. Harris II | | |  | | | | | | |  | | ||

| | Stephen A.M. Hester  | | |  | | | | | | |  | | ||

| | Shirley Ann Jackson | | |  | | | | | | |  | | ||

| | Janina Kugel | | |  | | | | |  | | | | ||

| | Denis Machuel | | |  | | |   | | | | | | ||

| | Rahul N. Merchant | | |  | | |   | | | | | | ||

| | Jana Schreuder | | |  | | | | |  | | | | ||

| | Howard I. Ungerleider | | |  | | | | |  | | | | ||

| | Number of Committee Meetings in fiscal year 2024 | | | 5 | | | 6 | | | 3 | | |||

| | | Lead Independent Director | | |  | | | Committee Chair | | |  | | | Committee Member | | |  | | | Audit Committee Financial Expert |

Each committee reviews its charter at least annually to ensure such charters reflect evolving trends and best practices. The Charter of each committee can be found on our website, investors.kyndryl.com, under Corporate Responsibility: Governance: Governance Documents: Committee Charters.

KYNDRYL 2024 PROXY STATEMENT | 21 |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

| | AUDIT COMMITTEE | | | | |||||||

| | Members and Qualifications | | | Key Responsibilities | | ||||||

| | DOMINIC J. CARUSO—CHAIR | | | The Committee is responsible for overseeing reports of our financial results, audit reporting, internal controls, adherence to our code of ethics and compliance with applicable laws and regulations. Concurrent with that responsibility, as set out more fully in the Committee’s Charter, the Committee has other key responsibilities, including: • selecting the independent registered public accounting firm, approving all related fees and compensation, overseeing such firm’s work and reviewing its selection with the Board; • preapproving the proposed services to be provided by the independent registered public accounting firm; • reviewing the procedures of the independent registered public accounting firm to ensure its independence and other qualifications for services performed for us; • reviewing any significant changes in accounting principles or developments in accounting practices and the effects of those changes on our financial reporting; • assessing the effectiveness of our internal audit function and overseeing the adequacy of internal controls, key controls and processes in specific areas, including cybersecurity, and enterprise risk management processes; • overseeing the Company’s efforts to develop and implement policies, procedures and strategies for identifying, managing and monitoring cybersecurity and data privacy matters; and • meeting with management prior to each quarterly earnings release and periodically to discuss the appropriate approach to earnings press releases and the type of financial information and earnings guidance to be provided to analysts and rating agencies. | | ||||||

| |  | | | Mr. Caruso has many years of experience as a public company chief financial officer, including direct involvement in the preparation of financial statements and setting financial disclosure policy and as chair of another public company audit committee. | | ||||||

| | DENIS MACHUEL | | |||||||||

| |  | | | Mr. Machuel, in his role as chief executive officer, has valuable experience overseeing a chief financial officer and the financial reporting process of public companies. | | ||||||

| | RAHUL N. MERCHANT | | |||||||||

| |  | | | Mr. Merchant has many years of experience in the financial services industry, as well as prior service as the chair of the audit committee of another public company board. Mr. Merchant has technology, digital and cybersecurity experience through his roles as CIO and CTO at major financial entities. | | ||||||

22 | KYNDRYL 2024 PROXY STATEMENT |

| | PROXY SUMMARY | | | | | CORPORATE GOVERNANCE & BOARD MATTERS | | | | | 2024 EXECUTIVE COMPENSATION | | | | | AUDIT MATTERS | | | | | STOCK OWNERSHIP INFORMATION | | | | | FREQUENTLY ASKED QUESTIONS | |

| | NOMINATING AND GOVERNANCE COMMITTEE | | | | |||||||

| | Members and Qualifications | | | Key Responsibilities | | ||||||

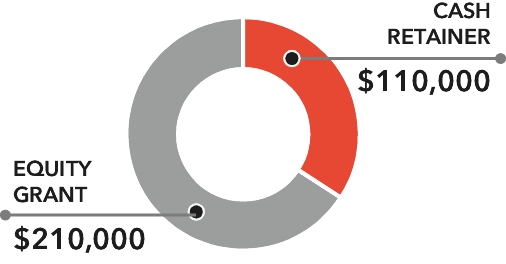

| | STEPHEN A.M. HESTER—CHAIR | | | The Committee is devoted to the continuing review, definition and articulation of our governance structure and practices. Concurrent with that responsibility, as set out more fully in the Committee’s Charter, the Committee has other key responsibilities, including: • leading the search for qualified individuals for election as our directors based on all appropriate criteria, including candidates’ business or professional experience, the diversity of their background and their talents and perspectives, technology or cybersecurity experience; reviewing and assessing the independence of each director nominee; and planning for future Board and Committee refreshment actions; • advising on all matters concerning directorship practices, and on the function, composition and duties of the committees of the Board; • reviewing and assessing the independence of all of our non-management directors, heightened standards for Audit and Compensation and Human Capital Committee members and assessing transactions with related persons annually; • developing and making recommendations to the Board regarding a set of corporate governance guidelines; • reviewing and recommending to the Board the form and amount of our non-management director compensation; • reviewing our position and practices on significant corporate political or charitable contributions, environmental matters and corporate responsibility matters; and • reviewing and considering stockholder proposals. | | ||||||

| |  | | | Mr. Hester has valuable international governance experience gained through serving as the chief executive officer of public companies in Europe and serving as a member of multiple public company boards in the role of chairman worldwide. | | ||||||

| | JOHN D. HARRIS II | | |||||||||