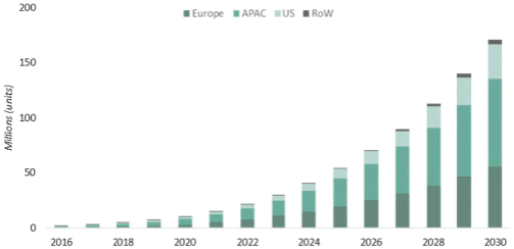

Cumulative number of electric vehicles per region

Source: BNEF Electric Vehicle Outlook 2021

An important driver of car fleet electrification is the financial and legal support governments are providing for the deployment of EVs and charging infrastructure. Several countries are banning the sales of internal combustion engine (“ICE”) vehicles over the period from 2030 or 2035, stimulated notably by bonus-malus tax systems in numerous European countries to make EVs more affordable while charging higher tax rates on polluting ICE vehicles. Globally, there are regulatory support packages that will boost the sector significantly, including the European Green Deal—a stimulus package of at least EUR 1 trillion for investments in the climate-neutral and circular economy in Europe. Overall, these commitments should contribute significantly to the CO2 emission reduction goals as part of the Paris Agreement to cut emissions by at least 55% in Europe by 2030. In the United States, the Biden administration has committed $174 billion towards investments in EVs, consisting of sale rebates and tax incentives for consumers and grant and incentive programs for state and local governments to expand the charging infrastructure across the country significantly. Furthermore, according to state-owned media, China will invest up to $900 billion between 2021 and 2025 in the development of the power grids with a focus on EV charging and smart infrastructure.

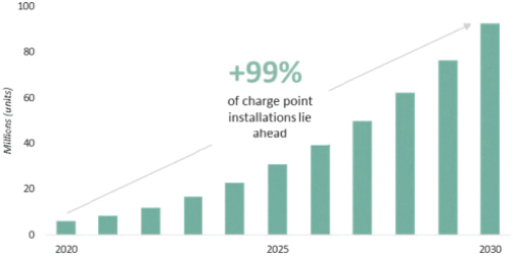

Due to these drivers, Wallbox believes the global automotive industry is transforming and committing to rapidly invest in expansion of their EV offering range—more than 100 new models have been announced to hit the market by 2024—while simultaneously being able to produce them at lower prices. Certain automakers, such as Jaguar, Volvo, and GM, aim to stop selling ICE vehicles by 2025, 2030, and 2035, respectively. This is induced, among other factors, by a similar development in the battery manufacturing industry, which is continuously competing to develop more efficient batteries at lower costs. By 2024, BNEF believes the price of

lithium-ion

battery packs will drop below $100 per kWh as a result of reduced costs, improvements in energy density and more efficient production. At this price point, EVs will be able to better compete with ICE vehicles, thus further advancing the demand. Regionally, the United States is behind Europe and China in terms of EV penetration, but is expected to accelerate quickly due to the improving unit economics of EVs, the high number of households with two or more vehicles and access to home charging, and the climate change initiatives of the Biden Administration. The EV uptake in the rest of the world will take longer due to limited policy support and

low-cost

ICE vehicles, but sales are expected by BNEF to grow rapidly in the 2030s. To get back on track for a net-zero

emission system by 2050—an objective at the heart of the European Green Deal and in line with the Paris Agreement, International Energy Agency (“IEA”) forecasted that it would require zero-emission

vehicles to represent almost 60% of global new passenger vehicles sales by 2030. 58