Exhibit 99.2

A2Z Smart Technologies Corp.

MANAGEMENT’S DISCUSSION AND ANALYSIS

For the Three and Nine Months Ended September 30, 2023

(Expressed in U.S. Dollars)

November 14, 2023

The following Management’s Discussion and Analysis (“MD&A”) for A2Z Smart Technologies Corp (“A2Z” or the “Company”) is prepared as of November 14, 2023, and relates to the financial condition and results of operations of the Company for the three and nine months ended September 30, 2023. Past performance may not be indicative of future performance. This MD&A should be read in conjunction with the Company’s audited consolidated annual financial statements for the year ended December 31, 2022, and with the Company’s condensed consolidated interim financial statements for the three and nine months ended September 30, 2023, which have been prepared using accounting policies consistent with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”).

All amounts are presented in United States dollars (“USD” or “$”), the Company’s presentation currency, unless otherwise stated.

Statements are subject to the risks and uncertainties identified in the “Risks and Uncertainties”, and “Cautionary Note Regarding Forward-Looking Statements” sections of this document. Readers are cautioned not to put undue reliance on forward-looking statements.

COMPANY OVERVIEW

The Company was incorporated on January 15, 2018, under the laws of British Columbia. The head office is located at 1600 – 609 Granville Street, Vancouver, British Columbia V7Y 1C3, and the records and registered office is located at 2200 HSBC Building 885 West Georgia Street, British Columbia, V6C 3E8.

Our common shares (the “Common Shares”) are listed for trading on the TSX Venture Exchange (the “TSXV”) under the trading symbol “AZ”, and in the United States, on the Nasdaq Capital Market (“Nasdaq”) under the trading symbol “AZ”.

We are an innovative technology company operating the following four complementary business lines through our subsidiaries: (i) development and commercialization of retail “smart cart” solutions designed primarily for use in large grocery stores and supermarkets (“Cust2Mate Carts” or “Cust2Mate Products”); (ii) manufacture of precision metal parts; (iii) provision of maintenance services in Israel (“Maintenance Services”); and (iv) development of our Fuel Tank Inertia Capsule System (“FTICS”) technology and a vehicle device cover for the military and civilian automotive industry (collectively, “Automotive Products”).

In 2020, we began to rapidly develop smart carts for the retail industry, with the aim of becoming the leading mobile checkout system in the international market by providing the optimal solution for shoppers and supermarket retailers. We have since focused the majority of our strategic planning, investment, research, development and marketing efforts on our Cust2Mate Products, as management currently believes our operational capabilities are most effectively leveraged by growing market share in the smart cart industry.

| 1 |

During the first quarter of 2022, the Company completed the acquisition of 100% of the shares of Isramat, a privately held Israeli company. This acquisition vertically integrates certain manufacturing capabilities for the production of the Cust2Mate Products, such as precision metal fabrication of parts, while complementing existing contract manufacturing partnerships to support the Company’s growth.

The raw materials required by the Company’s subsidiaries are readily available from multiple suppliers worldwide and their purchase costs do not fluctuate more than standard raw materials.

Smart Cart Products and Services

Cust2Mate is a mobile self-checkout shopping cart solution that streamlines the retail shopping experience. With a user-friendly smart algorithm, touch screen and computer vision technology, our Cust2Mate smart cart scans, recognizes and adds to a displayed shopping list, each item placed in the cart, providing the shopper with real-time information regarding items in the cart and tabulating the total cost of purchase. Our in-cart solution also enables shoppers to use the cart as the point of sale by use of mobile payment applications, e-wallets and other financial services. Cust2Mate’s point of sale feature effectively increases overall efficiency of the shopping experience, by expanding payment options for shoppers and retailers alike, reducing the need for cashiers, and reducing checkout wait times, which ultimately leads to improved customer engagement and satisfaction.

We combine scanning, computer vision, security scales and other anti-fraud/theft technologies, with a large screen tablet capable of relaying real-time shopping information and value-added digital services. Our solution is stackable and lightweight, with a robust recognition platform that provides a higher level of accuracy in product identification, leveraging in-store Wi-Fi and cutting edge software.

For retailers, Cust2Mate enables improved inventory management, increased efficiency, reduced labor costs, increased anti-fraud protection, reduced theft and real-time data analytics and insights regarding consumer behavior. Our solutions are designed to easily integrate with existing store systems.

The Cust2Mate touch screen allows for the display of advertisements, promotions and other digital services which can bring added value to shoppers and additional revenue sources to retailers.

Our largest smart carts are available in 212 liter and 275 liter sizes, with or without a produce scale (for on-cart weighing of fruit, vegetables and other items priced based on weight), as customized at the discretion of retailers. Ideal for larger stores, our smart carts are presently deployed in the Yochananof retail chain in Israel and in pilot programs throughout the world.

We also offer smaller, lighter smart carts, available in 180 liter and 75 liter sizes, with the same touch screen and security features of our larger carts. Our smaller carts are ideal for urban groceries and supermarkets, drugstores and duty-free shops, where aisles space tends to be limited.

We are presently launching a modular version of the Cust2Mate smart cart, allowing local set-up with modular parts, making mass production and deployment of our smart carts faster and more efficient. With a detachable control unit, our modular offering will employ the same technologies as our current offerings.

We leverage third-party partners for the manufacture of our Cust2Mate Products in the locations we serve.

| 2 |

Our Customers

M. Yochananof and Sons (1988) Ltd., or Yochananof, a large Israeli retailer, has been our largest Cust2Mate customer to date. Yochananof placed an initial order for an aggregate of 1,300 Cust2Mate smart carts which we are in the process of fulfilling. As of September 30, 2023, we have delivered all the smart carts in connection with Yochananof’s initial purchase order. On April 27, 2023, Yochananof delivered a non-binding letter of intent to purchase up to an additional 1,700 smart carts on terms and conditions to be agreed by definitive agreement. In addition, we have entered into a maintenance and support agreement with Yochananof. Our Maintenance Services division handles the maintenance and support services required for Cust2Mate Products deployed in Israel.

HaStok Concept Ltd., one of Israel’s leading home design and household essentials retail chain with approximately 40 stores across Israel, delivered a purchase order on April 20, 2023. The agreement marked a significant expansion for our smart cart solution into a new vertical outside of grocery retail. The Hastok purchase order was for up to 1,000 smart carts and is comprised of an upfront payment, a guaranteed monthly payment, and a revenue share agreement on added value solutions, such as advertising. On October 31, 2023, Hastok increased its order by an additional 1,000 smart carts, to a total of 2,000 smart carts.

On May 29, 2023, the Company signed an agreement with Morton Williams Supermarkets, a U.S. supermarket with locations throughout the New York City metropolitan area, for the order for up to 100 Cust2Mate smart carts. The Morton Williams order follows our successful pilot of Cust2Mate smart carts at the grocer’s West End Avenue store in Manhattan.

On June 13, 2023 the Company entered into a significant partnership with IR2S, which is intended to deploy 30,000 smart carts between 2023 and 2025 across renowned retail chains in France. With IR2S providing integration and other services, including Monoprix and the Casino Group (who operate over 700 and over 10,500 stores respectively), the logistics and service support for the smart carts will be efficiently carried out. IR2S, a leading integrator of advanced retail technologies (including integration and other services) to many prestigious clients in France, will play a pivotal role in managing the installation, support, and maintenance of the smart carts. IR2S is well-positioned to manage and integrate Cust2Mate’s smart cart solution, providing local hardware and software support to ensure a seamless customer experience. The definitive agreement with IR2S was signed in September 2023. The first purchase order to deliver 250 smart carts to Monoprix stores was received in October, 2023, with anticipation for deployment at 20 select Monoprix locations. The first batch of smart carts is scheduled to be delivered to the Monoprix Monop Malakoff store near the Champs Elysées, Paris in the fourth quarter of 2023.

On September 14, 2023, the Company entered into a definitive agreement with HEX 1011, a leading integrator of technological solutions for retail chains, intended to deploy 20,000 smart carts across Asia Pacific (APAC) from 2023 through 2025. The first delivery of Cust2Mate’s smart carts is scheduled for this year. HEX 1011 will ensure the efficient rollout and maintenance of the carts for elite retail chains in Thailand and Malaysia.

Since March 2023, as part of the Carrefour’s Connected Cart Project, the Cust2mate smart carts have undergone rigorous testing at Carrefour’s flagship Hypermarket store in Ste Genevieve Des Bois, near Paris, receiving overwhelmingly positive feedback and achieving excellent customer satisfaction reviews. We have currently entered the rollout stage of Carrefour’s Connected Cart Project.

Our objective is to generate orders of several thousand Cust2Mate smart carts in 2023.

Our Markets

We aspire to be the global leading provider of smart carts and associated technology solutions, providing a superior customer experience and cutting-edge platform for digital value-added services, easing the pain points for all stakeholders in the retail industry.

The market for smart carts is large and diverse, and includes grocery stores, hardware stores, household essentials, “do it yourself (DIY)” retailers, discount stores, warehouse stores, convenience stores, drug stores, duty free shops and similar outlets.

We have designed the range of our Cust2Mate smart carts to accommodate the needs of a varied customer base: large carts for hypermarkets or large stores, medium carts for supermarkets or medium sized stores, and small carts for city stores, drug stores, duty free shops, etc. We are also able to customize our carts with a “look and feel” unique to each retailer as requested.

| 3 |

Business Model

We envision deriving several distinct revenue streams from our Cust2Mate Products:

| ● | Outright Purchase Model. The outright purchase of the smart carts by customers and payment of a monthly maintenance fee has been the business model to date. For example, the first 1,300 carts ordered by Yochananof were sold to it outright with revenue recognized upon delivery. We intend to move away from this model, however it will remain available as some retailers prefer this option. | |

| ● | Subscription Based Model. We intend to retain title to our smart carts and make them available to customers on a multiyear subscription basis, against payment of a one-time up-front payment and monthly fees to cover hardware and software maintenance, service and version updates. The length of the subscription period depends on many variables unique to each customer, including the design and customization required by the customer, and the size of the up-front payment. We intend to fund the manufacture of our smart carts at scale, against orders, through loans against receivables from such orders, whilst looking to lower per unit manufacturing costs and increase margin as unit sales increase. The subscription model would also enable us to charge additional fees for add-on features such as store navigation maps, shopping lists, etc. The subscription model should also facilitate the provision of the smart carts to customers and, as revenue would be recognized monthly, would allow for a sustained increase of revenue in conjunction with the increase in the installed base of the smart carts. | |

| ● | Digital Services. As our smart carts are fully integrated into the retailers’ systems, we envision them serving as a de-facto marketplace, which we refer to as a Smart Cart Marketplace, for all retail directed apps and digital services. Our Cust2Mate smart carts incorporate a large touch screen, and can present to the shopper additional information at the discretion of the retailer, such as details of the shopper’s purchases, ingredients of goods purchased, allergy information, shopping lists, in-store navigation for goods, and many more applications, while simultaneously facilitating the provision of real-time personalized and directed promotions, advertisements, e-coupons and other digital services by all stakeholders in the retail industry (such as the retailer, consumer product and other manufacturers and advertisers and any third party service provider that joins the Smart Cart Marketplace). As these promotions, advertisements, coupons, etc., are displayed to the shopper when the shopper is deciding what to buy (and not, for example, when the shopper is paying for products already purchased), we believe that digital services will be of considerable value to shoppers, retailers, manufacturers and other third parties. We intend to enter into revenue sharing agreements with stakeholders, allowing us, our customers and relevant third parties to all enjoy increased revenue streams, whilst simultaneously providing shoppers with significant added value. We believe that digital revenues from the Smart Cart Marketplace can become considerable. As the revenue to retailers from digital services increases, the net cost of our smart carts to retailers is expected to decrease. | |

| ● | Big Data Analytics. At present, in many instances the retailer has limited information regarding the actions and decisions of the shopper until the actual time of payment. The retailer may often not know when a shopper has entered the store, how much time a shopper has spent in the store, the route the shopper takes, or where a shopper spends most or as little time in the store, how decisions are actually made by the shopper, and similar customer behavioral information. We are developing software for our smart carts to generate a wealth of data on such shopping behavior which can be mined, analyzed and monetized through data as a service or product offerings tailored to each of the stakeholders in the retail industry. |

Competition and Competitive Strengths

There are a number of companies currently offering smart carts to the retail industry in one form or another. Our Cust2Mate Products, and a small minority of other industry players, offer mobile self-checkout smart carts in which goods are scanned when placed in the smart cart. Most other industry participants offer solutions based on “Scan and Go” or image recognition technologies. We believe we are only smart cart providing a full end-to-end turnkey solution for all customers. Below is a brief summary of the various technologies:

● “Scan and Go” comprises a scanner and small screen, either on cart or connected to an app on the mobile phone. These solutions generally come without large screens and thus cannot efficiently provide information and digital services, without on cart anti-fraud protection and without on cart payment capabilities. Though inexpensive, the scan and go carts do not provide the full user experience and retailer added value offered by our Cust2Mate Products.

| 4 |

● Image Recognition. Many companies are trying to offer smart carts which do not require the scanning of products but instead claim to utilize software which recognizes the products as they are being placed in the smart cart (“one to many”). We believe that there remain technological hurdles to adopting image recognition software both on a practical and conceptual level. On a practical level, every store contains at least several tens of thousands of SKUs which have to be accurately recognized every time in all configurations, from all angles and in different lighting backgrounds, within a very short time without charging the shopper for products not purchased, while charging the shopper for all products purchased. This is a significant technological challenge. On a conceptual level, we believe many types of products are not easily adapted to image recognition, such as clothing size, and meats and cheeses purchased over the counter.

In addition, in an attempt to mitigate the increasing frustration of shoppers at the lengthening queues in the stores, many retailers have installed self-checkout (SCO) stations with the aim that these would lead to a quicker checkout and reduced labor cost. However, these SCO stations have not adequately solved such problems, as check-out queues have not disappeared, and the SCO stations have been accompanied by equipment issues, high up-front costs, consumer confusion, sub-optimal use of space and increased risk of theft.

We believe that our Cust2Mate Products have, and can further develop, the following competitive strengths:

● our smart carts utilize existing technologies proven to work—there is no technological risk to overcome; barcode scanning is a tried and tested, easy to use technology which can easily be adapted for use in a smart cart;

● our software, hardware and customer success teams have, among them, decades of experience in retail technology, supporting our efforts to design one stop shop smart cart solutions which answer the needs of the shopper, retailer and other stakeholders in the retail industry;

● our smart carts have a proven track record with hundreds of smart carts deployed in multiple sites and markets, enabling us to provide the most comprehensive working solution, customer experience and digital platform;

● our smart carts have multiple anti-fraud/theft capabilities which significantly reduce shrinkage from the carts without harming the shopping experience;

● we have successfully completed an initial trial of a computer vision product recognition solution, capable of matching the product put into our smart cart with the product scanned (“one to one” as opposed to “one to many”);

● we intend to continue the development of “one to one” computer vision software and incorporate the solution in future Cust2Mate smart cart offerings. The solution will supplement the smart car’s other anti-theft and fraud protection components;

● a barcode can provide additional information, over and above product identification; for example, by providing details of the expiry or best before date which could allow dynamic pricing based on proximity of such date;

● our smart carts can provide the retail industry with new revenue streams and insights; and

● our contemplated installed base subscription model allows for consistent revenue growth in a very large addressable market.

We continue to improve our smart carts. We have developed a lighter and easier to maneuver model of the Cust2Mate smart cart. In addition, as our carts are expensive, retailers do not allow carts to leave a store’s premises. To alleviate this, we have developed a modular smart cart with a detachable control unit, allowing the cart, without its expensive components, to leave the store premises.

Marketing and Sales

We are currently marketing directly to targeted customers and indirectly through local partners. In Israel, we sell our Cust2Mate Products directly to our retailer customers. Outside of Israel, our local partners are responsible for support, training, implementation and sales of our Cust2Mate Products, while we focus on product development and direct marketing with strategic customers.

We currently have local distribution and service partners in the United States, Mexico, France and Romania. In the United States, we have a non-exclusive relationship with our distributor, who provides products and services to several thousands of stores nationally. On July 12, 2023, Cust2mate established a wholly owned subsidiary Cust2mate USA Inc. (“Cust2Mate USA”) as a strategic move to serve the thriving U.S. retail market more effectively and appointed Joe Szala as General Manager. Joe Szala brings a wealth of experience in retail, grocery, and consumer packaged goods.

| 5 |

Throughout Mexico, our non-exclusive distributor provides information technology services and information technology consulting to stores. In France, our distributor (exclusive for certain chains) is a leading supplier and integrator of retail technologies throughout the country. Lastly, in Romania, we have an exclusive distributor relationship with a leading recognized information technology provider to the retail industry in Romania.

Our go-to-market strategy is built on the retail, grocery, and DIY markets, with a focus on supermarkets and hypermarket food chains within Tier 1 (thousands of stores) and Tier 2 (hundreds of stores). We will manage targeted customers for Cust2Mate Products in selected regions directly, leveraging select local partners for sales and distribution to chains in Tier 2 and Tier 3 (tens of stores). Our local partners will take full responsibility for support, training, implementation and sales, while we will focus on product development and direct contact with strategic customers.

We presently contemplate that Cust2Mate would (directly or through subsidiaries which it would establish for each country), be the provider of the smart carts to the retailers and that Cust2Mate would enter into a revenue share or other commercial arrangement with its local distribution and service partners.

Pilot Projects

The Company is presently in deployment and scale up stage and no longer views pilots, to the extent any are run, as part of its sales strategy or as significant to its business overview.

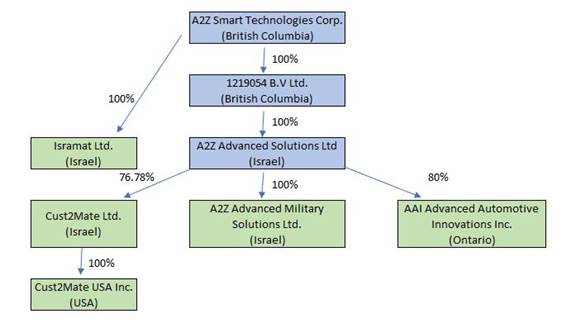

C. Organizational Structure

The following chart lists our material subsidiaries for the three and nine months ended September 30, 2023 and as at the date of this quarterly report, their respective jurisdictions of incorporation and our direct and indirect ownership interest in each of these subsidiaries:

| 6 |

Advisory Board

In September 2023, Cust2Mate formed an advisory board, to help guide strategic initiatives and drive company growth. A2Z is leveraging its advisory board to help scale and expand its Cust2Mate solution.

In September, 2023 the Company appointed Steve Robinson as a member of the advisory board. With over 30 years of experience in supply chain and operations, Mr. Robinson brings a deep understanding of the retail industry from his roles at Walmart and Starbucks. Mr. Robinson previously served as the Vice President of Global Supply Chain at Walmart Inc., one of the world’s largest and most influential retailers. In this role, he oversaw the management of the company’s supply chain, driving operational efficiencies and ensuring seamless logistics across Walmart’s extensive network. In a similar role at the Starbucks Corporation as the Vice President of the Starbucks Center of Supply Chain Excellence, he played a key part in fueling hyper-growth and delivering substantial value, contributing significantly to Starbucks’ global success.

In September, 2023, the Company appointed Scott Ukrop as a member of the advisory board. With a wealth of experience in retail grocery, consumer packaged goods, venture capital, and strategic advisory services, Mr. Ukrop will play a pivotal role by aligning A2Z’s Cust2Mate unit and offerings with the dynamic and evolving needs of major retailers. Mr. Ukrop’s extensive 35-year experience spanning across retail and food will help the company in its efforts to elevate the customer experience and deliver substantial value to its clients. Mr. Ukrop has achieved significant milestones in the retail grocery industry as he led the evolution of Ukrop’s Super Markets’ valued customer program.

BUSINESS DEVELOPMENTS DURING THE PERIOD

On January 4, 2023, the Company granted 1,027,000 Restricted Share Units (“RSUs”) to directors, officers and advisers, of which 250,000 RSUs are to executives and directors, pursuant to the Company’s RSU Plan and in acknowledgment of the Company’s management recent success and increased future workload. The RSUs vest at each recipient’s discretion and taking into account personal tax implications and convert into 1,027,000 shares. The Company also granted 816,500 stock options to directors, officers and advisers at an exercise price of CAD$1.65. 800,000 Options vest immediately, and the remainder in eight equal installments every 3 months with the first installment on April 4, 2023. The options are exercisable for a period of 10 years from the date of issue.

On March 20, 2023, the Company closed a private placement for gross proceeds of $2,604 through the issuance of 1,783,561 units (“March 2023 Units”) at a price per Unit of US$1.46 (CAD$1.95). Each March 2023 Unit consists of one Common Share and one half of one Common Share purchase warrant (each whole such warrant a “Warrant”). An aggregate of 891,778 Warrants were issued with an exercise price of CAD$2.35 (US$1.75) The Warrants have a term of two years and if fully exercised, will result in the issuance of an additional 891,778 Common Shares (“March 2023 Private Placement Warrants”). A finder’s fee of $208 (CAD$290) was paid and 142,685 March 2023 Private Placement Warrants were issued in connection with the private placement.

On April 18, 2023, the Company granted 116,250 Restricted Share Units (“RSUs”) to employees, pursuant to the Company’s RSU Plan. The RSUs will vest at each recipient’s discretion and taking into account personal tax implications and convert into 116,250 Common Shares.

On June 15 and June 20, 2023, the Company closed registered direct offerings for gross proceeds of $6,873 through the issuance of 3,818,275 units (“Units”) at a price per Unit of US$1.80 (CAD$2.41). Each Unit consists of one Common Share and one half of one Common Share purchase warrant (each whole such warrant a “Warrant”). An aggregate of 1,909,134 Warrants were issued with an exercise price of CAD$2.93 (US$2.20) The Warrants have a term of two years and if fully exercised, will result in the issuance of an additional 1,909,134 Common Shares (“June 2023 Private Placement Warrants”). A finder’s fee of $550 (CAD$733) was paid and 305,462 June 2023 Private Placement Warrants were issued in connection with the private placement.

On June 28, 2023, the Company granted 165,000 Restricted Share Units (“RSUs”) to officers, pursuant to the Company’s RSU Plan. The RSUs will vest at each recipient’s discretion and taking into account personal tax implications and convert into 116,250 Common Shares of no-par value in the Company (“Common Shares”). The Company also granted 245,000 stock options to officers at an exercise price of CAD$2.45. The stock options will vest at each recipient’s discretion and taking into account personal tax implications and convert into 245,000 Common Shares of no-par value in the Company (“Common Shares”). The options are exercisable for a period of 5 years from the date of issue.

On August 10, 2023, Cust2mate announced the launch of Cust2mate USA Inc., a subsidiary incorporated on July 12, 2023, under the laws of Delaware. The expansion comes in response to the increasing demand from U.S. retailers for Cust2Mate’s cutting-edge solutions.

| 7 |

On November 7, the board of directors of the Company approved a plan to spin off its 80% interest in Advanced Automotive Innovations Inc (“AAI”). As part of the restructuring, AAI is expected to become a publicly traded company, such that all shareholders in A2Z will receive an equivalent pro-rata shareholding in AAI. The restructuring is subject to receipt of all corporate and shareholder approvals as well as receipt of all regulatory approvals including that of the TSX Venture Exchange. The Company anticipates that the restructuring will be completed by June 30, 2024. AAI specializes in the automotive safety sector and is currently developing a groundbreaking “Fuel Tank Inertia Capsule System” (“FTICS”) designed to prevent fuel combustion in the event of a vehicle collision. AAI holds a patent with the U.S. Department of Commerce for FTICS and is actively working towards the commercialization of a product that can be seamlessly integrated into automobile gasoline tanks.

EQUITY ISSUANCES DURING THE NINE MONTHS ENDED SEPTEMBER 30, 2023 AND THROUGH TO THE DATE OF THIS REPORT

| ● | On March 13, 2023, the Company issued 1,783,561 Common Shares to investors in respect of a private placement for gross proceeds of $2,604 thousand. | |

| ● | On June 15 and June 20, 2023, the Company issued 3,818,275 Common Shares to investors in respect of registered direct offerings for gross proceeds of $6,873 thousand. | |

|

● | During the nine months ended September 30, 2023, the Company issued 92,000 shares in respect of 92,000 warrants that were exercised for gross proceeds of $140 thousand. |

| ● | During the nine months ended September 30, 2023, and through to the date of this report, the Company issued 447,499 shares in respect of 447,499 RSUs that were exercised. |

Use of Proceeds Disclosure

The section below describes the difference between the Company’s anticipated use of proceeds from private placements completed during the nine months ended September 30, 2023.

The intended principal uses of proceeds were for the continued development and expansion of existing business and for working capital purposes. During the nine months ended September 30, 2023, the Company raised net proceeds of $8,556 thousand, of which approximately $5,870 thousand has been used for this purpose and the balance will be used over the next 12 months.

The Company has negative cash flow from operating activities and has historically incurred net losses. To the extent that the Company has negative operating cash flows in future periods, it may need to deploy a portion of its existing working capital to fund such negative cash flows. The Company may be required to raise additional funds through the issuance of additional equity securities, through loan financing, or other means, such as through partnerships with other companies and research and development reimbursements. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favorable to the Company as those previously obtained.

The expected use of proceeds represents the Company’s current intentions based upon its present plans and business condition, which could change in the future as its plans and business conditions evolve. The amounts and timing of the actual use of the net proceeds will depend on multiple factors and there may be circumstances where, for sound business reasons, a reallocation of funds may be necessary in order for the Company to achieve its stated business objectives. The Company may also require additional funds in order to fulfill its expenditure requirements to meet existing and any new business objectives, and the Company expects to either issue additional securities or incur debt to do so. As a result, management will retain broad discretion in the application of the net proceeds, and investors will be relying on management’s judgment regarding the application of the net proceeds.

The actual amount that the Company spends in connection with each of the intended uses of proceeds will depend on a number of factors, including those listed under “Cautionary Note Regarding Forward-Looking Information”.

| 8 |

DISCUSSIONS OF OPERATIONS

Nine months ended September 30, 2023, compared to the nine months ended September 30, 2022

Revenues

| Nine months ended | ||||||||

| September 30, | ||||||||

| 2023 | 2022 | |||||||

| Services | 1,520 | 1,224 | ||||||

| Smart Carts | 6,142 | 1,415 | ||||||

| Precision Metal Parts | 2,394 | 2,887 | ||||||

| 10,056 | 5,526 | |||||||

Revenues for the nine months ended September 30, 2023, were $10,056 thousand as compared to $5,526 thousand for the nine months ended September 30, 2022. The increase is due primarily to the increase in sales from the Company’s smart cart segment as the Company continues delivering its purchase order to Yochananof. Revenues from the Company’s smart cart segment for the nine months ended September 30, 2023, were $6,142 thousand as compared to $1,415 thousand for the nine months ended September 30, 2022. Revenues from the Company’s traditional operations have increased as well in comparison with the nine months ended September 30, 2022. Revenues from the Company’s precision metal parts segment have decreased in comparison with the nine months ended September 30, 2022.

While revenues from the smart cart division are currently derived from only one customer, revenues from the Company’s services and precision metal parts segments are derived from hundreds of customers.

Cost of revenues

Cost of revenues for the nine months ended September 30, 2023, was $8,029 thousand as compared to $4,609 thousand for the nine months ended September 30, 2022. The increase is due primarily to the increase in sales from the Company’s smart cart segment. Cost of revenues in the Company’s smart cart segment for the nine months ended September 30, 2023, were $5,350 thousand as compared to $1,047 thousand for the nine months ended September 30, 2022. Cost of revenues from the Company’s precision metal parts segment remains largely consistent with the nine months ended September 30, 2022.

The Company’s gross margin in the services segment fluctuates depending on the level of revenue, since a large component relates to fixed payroll costs, and the nature of the project, as some project types have higher margins than others.

| 9 |

Research and development expenses

| Nine months ended | ||||||||

| September 30, | ||||||||

| 2023 | 2022 | |||||||

| Payroll and related expenses | 1,281 | 814 | ||||||

| Subcontractor and outsourced work | 2,073 | 2,151 | ||||||

| Other | 90 | 414 | ||||||

| 3,444 | 3,379 | |||||||

Research and development expenses related to the Company’s Cust2Mate product. Most of these expenses relate to outsourced software engineers that work on integrating future customers’ point of sales systems to the Company’s software.

Research and development expenses were $3,444 thousand for the nine months ended September 30, 2023, as compared to $3,379 thousand for the nine months ended September 30, 2022.

Sales and marketing expenses

Sales and marketing expenses were $757 thousand for the nine months ended September 30, 2023, as compared to $351 thousand for the nine months ended September 30, 2022. The increase is mainly due to the increase in marketing expenses relating to the smart cart segment, particularly in North America and Europe.

General and administrative expenses

| Nine months ended | ||||||||

| September 30, | ||||||||

| 2023 | 2022 | |||||||

| Payroll and related | 3,177 | 2,243 | ||||||

| Professional fees | 1,637 | 1,572 | ||||||

| Share-based compensation | 4,098 | 4,046 | ||||||

| Depreciation and amortization | 345 | 244 | ||||||

| Rent and related expenses | 550 | 320 | ||||||

| Investor relations | 174 | - | ||||||

| Travel | 109 | 164 | ||||||

| Public company related expenses | 781 | 311 | ||||||

| Other | 675 | 518 | ||||||

| 11,546 | 9,418 | |||||||

| 10 |

General and administrative expenses were $11,546 thousand for the nine months ended September 30, 2023, as compared to $9,418 thousand for the nine months ended September 30, 2022. The increase is primarily due to the increase in payroll and related expenses which amounted to $3,177 thousand for the nine months ended September 30, 2023, compared to $2,243 thousand for the nine months ended September 30, 2022. The increase in payroll is mainly due to the growth of operating activities of the Company’s smart cart segment. Another significant factor to the rise in general and administrative expenses is the increase in public company related expenses, which amounted to $780 thousand for the nine months ended September 30, 2023, compared to $311 thousand for the nine months ended September 30, 2022. The increase in public company related expenses is due mainly to private placement expenses from the private placements that occurred during the nine months ended September 30, 2023.

Loss on revaluation of warrant liability

Loss on revaluation of warrant liability for the nine months ended September 30, 2023, was $84 as compared to a loss of $nil for the nine months ended September 30, 2022.

Financial expenses

Financial expenses, net for the nine months ended September 30, 2023, were $49 thousand as compared to financial expenses of $132 thousand for the nine months ended September 30, 2022. Financial expenses comprise interest on loans and leases, interest and accretion in respect of application of IFRS 16, revaluation of a contingent liability, and credit card charges.

Three months ended September 30, 2023, compared to the three months ended September 30, 2022

Revenues

| Three months ended | ||||||||

| September 30, | ||||||||

| 2023 | 2022 | |||||||

| Services | 365 | 427 | ||||||

| Smart Carts | 1,442 | 1,208 | ||||||

| Precision Metal Parts | 781 | 1,015 | ||||||

| 2,588 | 2,650 | |||||||

Revenues for the three months ended September 30, 2023, were $2,588 thousand as compared to $2,650 thousand for the three months ended September 30, 2022. The decrease is due primarily to the decrease in sales from the Company’s precision metal parts segment. Revenues from the Company’s traditional operations have decreased as well in comparison with the three months ended September 30, 2023.

While revenues from the smart cart division are currently derived from only one customer, revenues from the Company’s services and precision metal parts segments are derived from hundreds of customers.

Cost of revenues

Cost of revenues for the three months ended September 30, 2023, was $2,220 thousand as compared to $2,220 thousand for the three months ended September 30, 2022. Cost of revenues in the Company’s smart cart segment for the three months ended September 30, 2023, were $1,335 thousand as compared to $886 for the three months ended September 30, 2022. Cost of revenues from the Company’s precision metal parts segment remains largely consistent with the three months ended September 30, 2022.

| 11 |

The Company’s gross margin in the services segment fluctuates depending on the level of revenue, since a large component relates to fixed payroll costs, and the nature of the project, as some project types have higher margins than others.

Research and development expenses

| Three months ended | ||||||||

| September 30, | ||||||||

| 2023 | 2022 | |||||||

| Payroll and related expenses | 550 | 311 | ||||||

| Subcontractor and outsourced work | 640 | 745 | ||||||

| Other | 11 | 152 | ||||||

| 1,201 | 1,208 | |||||||

Research and development expenses related to the Company’s Cust2Mate product. Most of these expenses relate to outsourced software engineers that work on integrating future customers’ point of sales systems to the Company’s software.

Research and development expenses were $1,201 thousand for the three months ended September 30, 2023, as compared to $1,208 thousand for the three months ended September 30, 2022.

Sales and marketing expenses

Sales and marketing expenses were $275 thousand for the three months ended September 30, 2023, as compared to $69 thousand for the three months ended September 30, 2022. The increase is mainly due to the increase in marketing expenses relating to the Smart cart segment, particularly in North America and Europe.

General and administrative expenses

| Three months ended | ||||||||

| September 30, | ||||||||

| 2023 | 2022 | |||||||

| Payroll and related | 1,217 | 728 | ||||||

| Professional fees | 534 | 282 | ||||||

| Share-based compensation | 1,131 | 3,935 | ||||||

| Depreciation and amortization | 113 | 81 | ||||||

| Rent and related expenses | 222 | 61 | ||||||

| Investor relations | 97 | - | ||||||

| Travel | 14 | 37 | ||||||

| Public company related expenses | 83 | 112 | ||||||

| Other | 433 | 60 | ||||||

| 3,844 | 5,296 | |||||||

General and administrative expenses were $3,844 thousand for the three months ended September 30, 2023, as compared to $5,296 thousand for the three months ended September 30, 2022. The decrease is primarily due to the decrease in share-based compensation which amounted to $1,131 thousand for the three months ended September 30, 2023, compared to $3,935 thousand for the three months ended September 30, 2022. The decrease in share-based compensation was offset in part due to the increase in payroll and related expenses, which amounted to $1,217 thousand for the three months ended September 30, 2023, compared to $728 thousand for the three months ended September 30, 2022.

| 12 |

Gain on revaluation of warrant liability

Gain on revaluation of warrant liability for the three months ended September 30, 2023, was $2,260 as compared to a $nil for the three months ended September 30, 2022.

Financial expenses

Financial income, net for the three months ended September 30, 2023, was $104 thousand as compared to financial expenses of $139 thousand for the three months ended September 30, 2022. Financial expenses comprise interest on loans and leases, interest and accretion in respect of application of IFRS 16, revaluation of a contingent liability, and credit card charges.

Trends, demands, commitments, events or uncertainties

Current overall economic conditions together with market uncertainty and volatility may have an adverse impact on the demand for the Company’s products and services as industry may adjust quickly to exercise caution on capital spending. This uncertainty may impact the Company’s revenue.

Our financial performance, share price, business prospects and financial condition are subject to numerous risks and uncertainties, and are affected by various factors outside the control of management. Prior to making any investment decision regarding the Company, investors should carefully consider, among other things, the risks described herein and the risk factors set forth in our annual information form dated December 31, 2022, for our most recently completed fiscal year. These risks and uncertainties are not the only ones that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business. If any of these risks occurs, our financial performance, share price, business prospects and financial condition could be materially adversely affected.

REVIEW OF QUARTERLY RESULTS

| (In Thousands) | 30/09/2023 | 30/06/2023 | 31/03/2023 | 31/12/2022 | ||||||||||||

| Total revenues | $ | 2,588 | $ | 2,860 | $ | 4,608 | $ | 3,825 | ||||||||

| Gross profit (loss) | $ | 368 | $ | 638 | $ | 1,021 | $ | 917 | ||||||||

| Total comprehensive loss | $ | (2,290 | ) | $ | (6,394 | ) | $ | (4,192 | ) | $ | (5,600 | ) | ||||

| Basic and diluted loss per share | $ | (0.06 | ) | $ | (0.19 | ) | $ | (0.11 | ) | $ | (0.19 | ) | ||||

| 30/09/2022 | 30/06/2022 | 31/03/2022 | 31/12/2021 | |||||||||||||

| Total revenues | $ | 2,650 | $ | 1,430 | $ | 1,446 | $ | 487 | ||||||||

| Gross profit | $ | 430 | $ | 211 | $ | (276 | ) | $ | (554 | ) | ||||||

| Total comprehensive loss | $ | (6,009 | ) | $ | (2,955 | ) | $ | (2,919 | ) | $ | (3,380 | ) | ||||

| Basic and diluted loss per share | $ | (0.21 | ) | $ | (0.11 | ) | $ | (0.09 | ) | $ | (0.14 | ) | ||||

The loss per quarter and related net loss per share is a function of the level of activity that took place during the relevant quarter. Operating losses in the first three quarters of 2023 and throughout four quarters in 2022 remained consistent. The reason for the losses is due to increased research and development expenses and general and administrative costs, largely due to the Company’s expansion ahead of expected increased revenues in future periods.

| 13 |

LIQUIDITY AND CAPITAL RESOURCES

Liquidity is a measure of a company’s ability to meet potential cash requirements. The Company has historically met its capital requirements through the issuance of Common Shares and securing bank loans.

The Company’s financial statements have been prepared assuming that the Company will continue as a going concern. The Company has incurred recurring losses and negative cash flows from operating activities since inception, such that as of September 30, 2023, the Company had accumulated losses of $79,841 and a net loss in the amount of $13,853 for the nine months ended September 30, 2023. As of the date of the issuance of these financial statements, the Company has not yet commenced generating sufficient revenues to fund its operations, and therefore depends on fundraising from new and existing investors to finance its activities.

Considering the above, the Company’s dependency on external funding for its operations raises a substantial doubt about the Company’s ability to continue as a going concern. The condensed consolidated financial statements for the nine months ended September 30, 2023 do not include any adjustments that might result from the outcome of these uncertainties.

Working capital (In Thousands)

| September 30, 2023 | December 31, 2022 | |||||||

| Cash and cash equivalents | 1,656 | 2,616 | ||||||

| Restricted cash | 72 | 8 | ||||||

| Inventories | 340 | 375 | ||||||

| Trade receivables | 1,466 | 1,373 | ||||||

| Other accounts receivable | 1,504 | 2,570 | ||||||

| Total current assets | 5,038 | 6,942 | ||||||

| Short term loan and current portion of long-term loans | 1,115 | 1,403 | ||||||

| Lease liability | 257 | 281 | ||||||

| Trade payables | 2,641 | 2,224 | ||||||

| Deferred revenues | - | 1,373 | ||||||

| Other accounts payable | 856 | 956 | ||||||

| Total current liabilities | 4,869 | 6,237 | ||||||

| Working capital | 169 | 705 | ||||||

| 14 |

Cash flow (In Thousands)

| Nine months ended September 30, | ||||||||

| 2023 | 2022 | |||||||

| Net cash used in operating activities | (9,133 | ) | (8,069 | ) | ||||

| Net cash used in investing activities | (255 | ) | (1,410 | ) | ||||

| Net cash provided from financing activities | 8,587 | 2,238 | ||||||

| Increase (decrease) in cash | (801 | ) | (7,241 | ) | ||||

Cash position

During the nine months ended September 30, 2023, the Company’s overall cash position decreased by $801 thousand as compared to a decrease of $7,241 thousand for the nine months ended September 30, 2022. This increase can be attributed to the following activities:

Operating activities

The Company’s net cash used in operating activities during the nine months ended September 30, 2023, was $9,133 thousand as compared to $8,069 thousand for the nine months ended September 30, 2022.

Investing activities

Cash used in investing activities for the nine months ended September 30, 2023, was $255 thousand as compared to $1,410 thousand used in investing activities during the nine months ended September 30, 2022. Cash used in investing activities for the nine months ended September 30, 2022, was due primarily to the acquisition of Isramat, a newly purchased subsidiary.

Financing activities

Cash provided from financing activities for the nine months ended September 30, 2023, was $8,587 thousand, and was mainly due to the issuance of shares and warrants in the amount of $9,058, offset by repayment of loans in the amount of $519 thousand. Cash provided from financing activities for the nine months ended September 30, 2022, was $2,238 thousand, and was mainly due to the exercise of warrants in the amount of $1,377 thousand and proceeds from receipt of loans in the amount of $1,094 thousand, offset by repayment of loans in the amount of $394 thousand.

| 15 |

Capital resources

The Company’s financial statements have been prepared assuming that the Company will continue as a going concern. The Company has incurred recurring losses and negative cash flows from operating activities since inception, such that as of September 30, 2023, the Company had accumulated losses of $79,841 and a net loss in the amount of $13,853 for the nine months ended September 30, 2023. As of the date of the issuance of these financial statements, the Company has not yet commenced generating sufficient revenues to fund its operations, and therefore depends on fundraising from new and existing investors to finance its activities.

Considering the above, the Company’s dependency on external funding for its operations raises a substantial doubt about the Company’s ability to continue as a going concern. The condensed consolidated financial statements for the nine months ended September 30, 2023 do not include any adjustments that might result from the outcome of these uncertainties.

On March 20, 2023, the Company closed a private placement for gross proceeds of $2,604 through the issuance of 1,783,561 units (“March 2023 Units”) at a price per March 2023 Unit of US$1.46 (CAD$1.95). Each March 2023 Unit consists of one Common Share and one half of one Common Share purchase warrant (each whole such warrant a “March 2023 Investor Warrant”). An aggregate of 891,778 March 2023 Investor Warrants were issued with an exercise price of CAD$2.35 (US$1.75) The Warrants have a term of two years and if fully exercised, will result in the issuance of an additional 891,778 Common Shares (“March 2023 Private Placement Warrants”). A finder’s fee of $208 (CAD$290) was paid and 142,685 March 2023 Private Placement Warrants were issued in connection with the private placement.

On June 15 and on June 20, 2023, the Company closed registered direct offerings for gross proceeds of $6,873 through the issuance of 3,818,275 units (“June 2023 Units”) at a price per June 2023 Unit of US$1.80 (CAD$2.41). Each June 2023 Unit consists of one Common Share and one half of one Common Share purchase warrant (each whole such warrant a “June 2023 Warrant”). An aggregate of 1,909,134 June 2023 Warrants were issued with an exercise price of CAD$2.93 (US$2.20) The June 2023 Warrants have a term of two years and if fully exercised, will result in the issuance of an additional 1,909,134 Common Shares (“June 2023 Registered Direct Offerings Warrants”). A finder’s fee of $550 (CAD$733) was paid and 305,462 June 2023 Registered Direct Offerings Warrants were issued in connection with the Registered Direct Offerings.

Short-term borrowings

Short term borrowing relates to bank loans which will be repaid in over the following 12 months. The Company requires short-term borrowing from time to time to accommodate urgent requests from customers that require an initial outlay of cash by the Company.

Long-term borrowings

Long-term borrowing relates to bank loans which will be repaid after the following 12 months. Currently, the nature of cash requirements by the Company can fluctuate greatly from year to year as the Company is reliant on a relatively small pool of customers that have shifting needs. As contracts can vary greatly from year to year the Company is sometimes required to take on long term debt.

No history of dividends

Since incorporation, the Company has not paid any cash or other dividends on its Common Shares and does not expect to pay such dividends in the foreseeable future.

Management of Capital

The Company’s main use for liquidity is to fund the development of its programs and working capital purposes. These activities include staffing, and administrative costs. The primary source of liquidity has been from financing activities to date. The ability to fund operations, to make planned capital expenditures and execute the growth/acquisition strategy depends on the future operating performance and cash flows, which are subject to prevailing economic conditions, regulatory and financial, business and other factors, some of which are beyond the Company’s control.

| 16 |

The Company intends to grow rapidly and expand its operations within the next 12 to 24 months. This growth, along with the expectation of operating at a loss for at minimum the next 12 months, will diminish the Company’s working capital. As such, substantial additional financing may be required if the Company is to be successful in continuing to develop its business, meet ongoing obligations and discharge its liabilities in the normal course of business. No assurances can be given that the Company will be able to raise the additional capital that it may require for its anticipated future development. Any additional equity financing may be dilutive to investors and debt financing, if available, may involve restrictions on financing and operating activities. There is no assurance that additional financing will be available on terms acceptable to the Company, if at all. If the Company is unable to obtain additional financing as needed, it may be required to reduce the scope of its operations or anticipated expansion.

The Company defines its capital as share capital plus warrants. To effectively manage the Company’s capital requirements, the Company has a planning and budgeting process in place to ensure that adequate funds are available to meet its strategic goals. The Company monitors actual expenses to budget to manage its costs and commitments. The Company manages liquidity risk by reviewing, on an ongoing basis, its sources of liquidity and capital requirements. In evaluating the Company’s capital requirements and its ability to fund the execution of its business strategy, the Company believes that it has adequate available liquidity to enable it to meet its working capital and other operating requirements, and other capital expenditures and settle its liabilities for at least the next 12 months. The Company’s objective is to maintain sufficient cash to fund the Company’s operating requirements and expansion plans identified from time to time. While the Company expects to incur losses for at minimum the next 12 months, management of the Company continues to work towards the success and eventual profitability of the business.

The Company’s capital management objective is to maximize investment returns to its equity-linked stakeholders within the context of relevant opportunities and risks associated with the Company’s operations. Achieving this objective requires management to consider the underlying nature of research and development and sales and marketing activities, the availability of capital, the cost of various capital alternatives and other factors. Establishing and adjusting capital requirements is a continuous management process.

The Company’s ability to access both public and private capital is dependent upon, among other things, general market conditions and the capital markets generally, market perceptions about the Company and its business operations, and the trading prices of the Company’s securities from time to time. When additional capital is required, the Company intends to raise funds through the issuance of equity or debt securities. Other possible sources include the exercise of stock options of the Company. There can be no assurance that additional funds can be raised upon terms acceptable to the Company, or at all, as funding for early-stage companies remain challenging generally. Given the nature of the Company’s business as of the date of this MD&A, and in particular, the fact that its operations are undertaken exclusively within a foreign jurisdiction, the Company may face difficulty in accessing traditional sources of financing, notwithstanding that its business operations are conducted in a regulatory environment within which the Company’s activities are neither illegal nor subject to conflicting laws.

OFF BALANCE SHEET ARRANGEMENTS

There are no off-balance sheet arrangements to which the Company is committed.

| 17 |

TRANSACTIONS WITH RELATED PARTIES

Parties are considered to be related if one party has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making operating and financial decisions. This would include the Company’s senior management, who are considered to be key management personnel by the Company.

Parties are also related if they are subject to common control or significant influence. Related parties may be individuals or corporate entities. A transaction is considered to be a related party transaction when there is a transfer of resources or obligations between related parties.

The following transactions arose with related parties: (in Thousands of US$)

| Nine months ended September 30, 2023 | ||||||||||||||||||||

| Directors Fees | Consulting Fees / | Share based awards | Total | Amounts the Company as of | ||||||||||||||||

| Director, CEO and companies controlled by the CEO | $ | - | $ | 1,068 | $ | - | $ | 1,068 | $ | (33 | ) | |||||||||

| CFO | - | 69 | - | 69 | (9 | ) | ||||||||||||||

| Directors | 24 | 247 | 264 | 535 | (28 | ) | ||||||||||||||

| $ | 24 | $ | 1,384 | $ | 264 | $ | 1,672 | $ | (70 | ) | ||||||||||

| Three months ended September 30, 2023 | ||||||||||||||||||||

| Directors Fees | Consulting Fees / Salaries | Share based awards | Total | Amounts owing by the Company (to) as of September 30, 2023 | ||||||||||||||||

| Director, CEO and companies controlled by the CEO | $ | - | $ | 404 | $ | - | $ | 404 | $ | (33 | ) | |||||||||

| CFO | - | 27 | - | 27 | (9 | ) | ||||||||||||||

| Directors | 8 | 80 | 139 | 227 | (28 | ) | ||||||||||||||

| $ | 8 | $ | 511 | $ | 139 | $ | 658 | $ | (70 | ) | ||||||||||

| 18 |

| Nine months ended September 30, 2022 | ||||||||||||||||||||

| Directors Fees | Consulting Fees / Salaries | Share based awards | Total | Amounts Company (to) as of | ||||||||||||||||

| Director, CEO and companies controlled by the CEO | $ | - | $ | 784 | $ | - | $ | 784 | $ | (628 | ) | |||||||||

| CFO | - | 84 | 22 | 106 | (7 | ) | ||||||||||||||

| Directors | 18 | - | 69 | 87 | (2 | ) | ||||||||||||||

| $ | 18 | $ | 868 | $ | 91 | $ | 977 | $ | (637 | ) | ||||||||||

| Three months ended September 30, 2022 | ||||||||||||||||||||

| Directors Fees | Consulting Fees / Salaries | Share based awards | Total | Amounts Company (to) as of | ||||||||||||||||

| Director, CEO and companies controlled by the CEO | $ | - | $ | 271 | $ | - | $ | 271 | $ | (628 | ) | |||||||||

| CFO | - | 21 | 5 | 26 | (7 | ) | ||||||||||||||

| Directors | 6 | - | 46 | 52 | (2 | ) | ||||||||||||||

| $ | 6 | $ | 292 | $ | 51 | $ | 349 | $ | (637 | ) | ||||||||||

| (1) | The Company’s CEO has a consulting agreement with the Company pursuant to which he earns $70,000 per month. |

| (2) | The Company’s CFO has a consulting agreement with the Company pursuant to which he earns $9,000 per month. |

| (3) | The Company’s president has a consulting agreement with the Company pursuant to which he earns $30,000 per month. |

| (4) | Three non-executive directors earn directors’ fees of $1,000 per month |

Financial Instruments and Financial Risk Exposure

The Company is exposed to a variety of financial risks, which results from its financing, operating and investing activities. The objective of financial risk management is to contain, where appropriate, exposures in these financial risks to limit any negative impact on the Company’s financial performance and position.

The Company’s financial instruments are its cash, trade and other receivables, payables, other payables and loans. The main purpose of these financial instruments is to raise finance for the Company’s operation. The Company actively measures, monitors and manages its financial risk exposures by various functions pursuant to the segregation of duties and principals. The risks arising from the Company’s financial instruments are mainly credit risk and currency risk. The risk rate on loans is fixed. The risk management policies employed by the Company to manage these risks are discussed below.

| 19 |

Liquidity Risk:

The Company’s approach to managing liquidity risk is to ensure that it will have sufficient liquidity to meet liabilities as they come due. As of September 30, 2023, the Company has a working capital balance of $169 thousand (December 31, 2022 – working capital of $705 thousand). The table below presents the maturity profile of the Company’s financial liabilities based on contractual undiscounted payments:

| Contractual | ||||||||||||

| Carrying amounts | Within 1 year | over 1 year | ||||||||||

| Trade payables | $ | 2,641 | $ | 2,641 | $ | - | ||||||

| Other accounts payable | 856 | 856 | - | |||||||||

| Loans | 1,388 | 1,115 | 273 | |||||||||

| Lease liability | 536 | 257 | 279 | |||||||||

| Total | $ | 5,421 | $ | 4,869 | $ | 552 | ||||||

Credit risk:

Credit risk arises when a failure by counterparties to discharge their obligations could reduce the amount of future cash inflows from financial assets on hand at the balance sheet date. The Company closely monitors the activities of its counterparties and controls the access to its intellectual property which enables it to ensure the prompt collection of customers’ balances. The Company’s main financial assets are cash and cash equivalents, trade receivables, as well as other receivables and represent the Company’s maximum exposure to credit risk in connection with its financial assets.

Wherever possible and commercially practical the Company holds cash with major financial institutions in Israel.

Market risks:

That part of the Company’s business of providing maintenance services of various electronic systems is highly competitive and involves a certain degree of risk. The Company’s business operations will depend largely upon the outcome of continued sales and services to security establishments and the commercialization of its products and services currently in development.

The Company’s Cust2Mate smart cart platform is new and the Company is aware of competitors in the market. In addition to the regular management oversight and skills required, success in this segment will require the Company to penetrate the market as rapidly as possible.

Critical Accounting Policies and Estimates

The preparation of the Company’s financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and reported amounts of expenses during the reporting period. Actual outcomes could differ from these estimates. The Company’s financial statements include estimates which, by their nature, are uncertain. The impacts of such estimates are pervasive throughout the Company’s financial statements and may require accounting adjustments based on future occurrences. Revisions to accounting estimates are recognized in the period in which the estimate is revised and also in future periods when the revision affects both current and future periods.

| 20 |

The functional currency for each of the Company’s subsidiaries is the currency of the primary economic environment in which the respective entity operates; the Company has determined the functional currency of each entity to be the new Israeli Shekel. Such determination involves certain judgements to identify the primary economic environment. The Company reconsiders the functional currency of its subsidiaries if there is a change in events and/or conditions which determine the primary economic environment. The Company’s functional and presentation currency is the U.S. dollar.

The critical judgments and significant estimates in applying accounting policies that have the most significant effect on the amounts recognized in the financial statements are the same as at December 31, 2022:

| a) | The useful life of property and equipment |

Property and equipment are amortized or depreciated over their useful lives. Useful lives are based on management’s estimates of the period that the assets will generate revenue, which are periodically reviewed for continued appropriateness. Changes to estimates can result in significant variations in the amounts charged to the consolidated statement of comprehensive income in specific periods.

| b) | Determining the fair value of share-based payment transactions |

The fair value of share-based payment transactions is determined upon initial recognition by the Binomial model. The Binomial model is based on share price and exercise price and assumptions regarding expected volatility, term of share option, dividend yield and risk-free interest rate.

| c) | Intangible assets and goodwill |

Intangible assets and goodwill are tested for impairment annually or more frequently if three is an indication of impairment. The carrying value of intangibles with definite lives is reviewed each reporting period to determine whether there is any indication of impairment. If there are indications of impairment the impairment analysis is completed and if the carrying amount of an asset exceeds its recoverable amount, the asset is impaired and impairment loss is recognized.

| d) | Derivative liability – Warrants |

The Company uses the Black-Scholes option-pricing model to estimate fair value at each reporting date. The key assumptions used in the model are the expected future volatility in the price of the Company’s Common Shares and the expected life of the warrants.

| e) | Going concern |

In order to assess whether it is appropriate for the Company to continue as going concern, management is required to apply judgements and make estimates with regards to future cash flow projections. In arriving at this judgement there were several assumptions and estimates involved in calculating the future cash flow projections. These includes making estimates regarding the timing and amounts of future expenditures and the ability and timing to raising additional financing.

| 21 |

New Accounting Standards

Amendments to IAS 12, Income Taxes

On May 6, 2021, the IASB released Deferred Tax Related to Assets and Liabilities Arising from a Single Transaction (Amendments to IAS 12). The amendment relates to the recognition of deferred tax when an entity accounts for transactions, such as leases or decommissioning obligations, by recognizing both an asset and a liability. The objective of this amendment is to narrow the initial recognition exemption in paragraphs 15 and 24 of IAS 12, so that it would not apply to transactions that give rise to both taxable and deductible temporary differences, to the extent the amounts recognized for the temporary differences are the same. The adoption of the amendments as of January 1, 2023 did not have an impact on the Company’s financial statements.

Initial and early application of new accounting standards and interpretations in the reporting standards

Amendments to IAS 1, Presentation of Financial Statements and IFRS Practice Statement 2, Making Materiality Judgement

On February 11, 2021, the IASB issued amendments to IAS 1, Presentation of Financial Statements and IFRS Practice Statement 2, Making Materiality Judgement, to provide guidance in determining which accounting policy to disclose. The amendments require entities to disclose material accounting policies rather than significant policies. The amendments clarify that accounting policy information is material if users of an entity’s financial statements would need it to understand other material information in the financial statements. In assessing the materiality of accounting policy information, entities need to consider both size of the transaction, other events or conditions and the nature of them, even if the related amounts are immaterial. The adoption of the amendments as of January 1, 2023 did not have an impact on the Company’s financial statements.

MANAGEMENTS RESPONSIBILITY FOR FINANCIAL STATEMENTS

Evaluation of disclosure controls and procedures

Our Chief Executive Officer and Chief Financial Officer are responsible for establishing and maintaining disclosure controls and procedures for the Company. As such, we maintain a set of disclosure controls and procedures designed to ensure that information required to be disclosed in filings is recorded, processed, summarized, and reported within the time periods specified by the Canadian Securities Administrators rules and forms. In designing and evaluating the disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management necessarily is required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

Management’s report on internal controls over financial reporting

Our Chief Executive Officer and Chief Financial Officer are responsible for establishing and maintaining effective internal controls over financial reporting. Our internal controls over financial reporting are designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS. Because of their inherent limitations, internal controls over financial reporting may not prevent or detect misstatements. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation.

As identified in the Company’s MD&A as of December 31, 2022, our Chief Executive Officer and Chief Financial Officer evaluated the effectiveness of our internal controls over financial reporting, and identified the material weakness outlined below and therefore concluded our internal controls over financial reporting were not effective. Management identified that we did not have sufficient accounting resources with relevant technical accounting skills to address issues related to the financial statement close process because of the size of the Company and its staff complement. We were also not able to sufficiently design internal controls to provide the appropriate level of oversight regarding the financial recordkeeping and review of the Company’s financial reporting. This weakness is being addressed in 2023 with external consultants who are advising the Company in these matters.

| 22 |

Changes in internal control over financial reporting

To remediate the material weakness in our internal controls over financial reporting described above, during the nine months ended September 30, 2023, the Company has initiated remedial measures and are taking additional measures to remediate this material weakness. First, the Company is continuing to roll out an enhanced financial and accounting system. Second, the Company has hired additional personnel. Third, the Company is strengthening the controls over financial reporting, with the assistance of outside consultants and experts in the controls and procedures over financing reporting. Consistent with the Company’s stage of development, the Company continues to rely on risk-mitigating procedures during the financial closing process in order to provide comfort that the financial statements are presented fairly in accordance with IFRS.

There were no other changes in internal control over financial reporting during the most recent interim period that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

CURRENT SHARE DATA

A2Z is authorized to issue an unlimited number of Common Shares. As of the date of this MD&A there were 36,964,991 Common Shares issued and outstanding. In addition, the following warrants and options were outstanding:

| Outstanding as of the date of this report | Date of expiry | Exercise price USD | ||||||||||||

| 2,658,313 | Warrants | November 10, 2025 | $ | 1.87 | ||||||||||

| 1,366,631 | Warrants | December 24, 2025 | $ | 1.87 | ||||||||||

| 221,100 | Warrants | April 18, 2026 | $ | 7.59 | ||||||||||

| 1,084,562 | Warrants | May 28, 2026 | $ | 7.59 | ||||||||||

| 1,634,366 | Warrants | November 8, 2024 | $ | 1.60 | ||||||||||

| 1,034,463 | Warrants | March 13, 2025 | $ | 1.75 | ||||||||||

| 2,214,596 | Warrants | June 15, 2025 | $ | 2.20 | ||||||||||

| 543,333 | Options | August 20, 2025 | $ | 1.11 | ||||||||||

| 33,333 | Options | January 28, 2025 | $ | 2.23 | ||||||||||

| 50,000 | Options | June 3, 2026 | $ | 6.24 | ||||||||||

| 16,677 | Options | October 28, 2026 | $ | 5.95 | ||||||||||

| 900,000 | Options | August 2, 2032 | $ | 2.65 | ||||||||||

| 300,000 | Options | August 21, 2032 | $ | 2.97 | ||||||||||

| 4,125 | Options | January 4, 2033 | $ | 1.23 | ||||||||||

| 550,000 | Options | January 4, 2033 | $ | 1.23 | ||||||||||

| 250,000 | Options | January 4, 2033 | $ | 1.23 | ||||||||||

| 100,000 | Options | November 25, 2027 | $ | 1.49 | ||||||||||

| 423,750 | Options | April 18, 2033 | $ | 1.19 | ||||||||||

| 245,000 | Options | June 28, 2028 | $ | 1.82 | ||||||||||

| 13,630,249 | ||||||||||||||

RISKS

Dilution

The Company has limited financial resources and has financed its operations primarily through the sale of securities such as Common Shares. The Company will need to continue its reliance on the sale of such securities for future financing, resulting in dilution to the Company’s existing shareholders.

Capital and Liquidity Risk

The amount of financial resources available to invest for the enhancement of shareholder value is dependent upon the size of the treasury, profitable operations, and a willingness to utilize debt and issue equity. Due to the size of the Company, financial resources are limited and if the Company exceeds growth expectations or finds investment opportunities it may require debt or equity financing. There is no assurance that the Company will be able to obtain additional financial resources that may be required to successfully finance transactions or compete in its markets on favorable commercial terms

| 23 |

Acquisition and Expansion Risk

The Company intends to expand its operations through organic growth, adaptation of its technology and products to the civilian markets, development of new technologies and depending on certain conditions, by identifying a proposed acquisition.

Dependence on Key Personnel

Loss of certain members of the executive team or key operational leaders of the company could have a disruptive effect on the implementation of the Company’s business strategy and the efficient running of day-to-day operations until their replacement is found. Recruiting personnel is time consuming and expensive and the competition for professionals is intense.

The Company may be unable to retain its key employees or attract, assimilate, retain or train other necessary qualified employees, which may restrict its growth potential.

Global economic uncertainty and financial market volatility

The Company’s ability to raise capital is subject to the risk of adverse changes in the market value of the Company’s share price. Periods of macroeconomic weakness or recession and heightened market volatility caused by adverse geopolitical developments could increase these risks, potentially resulting in adverse impacts on the Company’s ability to raise further capital on favorable terms. The impact of geopolitical tension, such as rising tensions in the Middle East, a deterioration in the bilateral relationship between the US and China or an escalation in conflict between Russia and Ukraine, including any resulting sanctions, export controls or other restrictive actions that may be imposed by the US and/or other countries against governmental or other entities in, for example, Russia, also could lead to disruption, instability and volatility in global trade patterns, which may in turn impact the Company’s ability to source necessary raw materials and other inputs for manufacturing or the Company’s ability to close new revenue generating orders.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS