As filed with the Securities and Exchange Commission on April 12, 2023

Registration No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

A2Z

Smart Technologies Corp.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | N/A | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification Number) |

1600-609

Granville Street

Vancouver, British Columbia

V7Y

1C3 Canada

(647) 558-5564

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

COGENCY

GLOBAL INC.

122 East 42nd Street, 18th Floor

New York, NY 10168

1-800-221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Gregory

Sichenzia, Esq.

Avital Perlman, Esq.

Sichenzia Ross Ference LLP

1185 Avenue of the Americas, 31st Floor

New York, NY 10036

(212) 930-9700

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment, which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this registration statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities or accept your offer to buy any of them until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

| SUBJECT TO COMPLETION, DATED APRIL 12, 2023 |

PROSPECTUS

A2Z Smart Technologies Corp.

$200,000,000

Common Shares

Preferred

Shares

Warrants

Rights

Units

A2Z Smart Technologies Corp. may offer, issue and sell, from time to time, in one or more offerings, the securities described in this prospectus. We may also offer securities of the types listed above that are convertible or exchangeable into one or more of the securities so listed. The total aggregate offering price for these securities will not exceed $200,000,000 (or the equivalent thereof in other currencies).

These securities may be offered or sold to or through one or more underwriters, dealers or agents, or directly to purchasers, on a continued or delayed basis. We will provide the names of any such agents and underwriters used in connection with the sale of any of these securities, as well as any fees, commissions or discounts we may pay to such agents and/or underwriters in connection with the sale of these securities, in the applicable prospectus supplement.

This prospectus describes the general terms of these securities and the general manner in which we will offer them. We will provide the specific terms of these securities, and the manner in which they are being offered, in supplements to this prospectus. You should read this prospectus, any post-effective amendment and the applicable prospectus supplement, as well as any documents we have incorporated into this prospectus by reference carefully before you invest. Where required by statute, regulation or policy, and where securities are offered in currencies other than United States dollars, appropriate disclosure of foreign exchange rates applicable to the securities will be included in the prospectus supplement describing the securities. This prospectus does not qualify in any of the provinces or territories of Canada the distribution of the securities to which it relates.

The aggregate market value of our outstanding common shares held by non-affiliates is $31,123,447 million based on 32,728,883 common shares outstanding as of April 6, 2023, of which 23,054,405 common shares are held by non-affiliates, at a price per common share of $1.35 based on the closing sale price of our common shares on the Nasdaq Capital Market on April 6, 2023. In addition, as of the date hereof, we have not offered any securities pursuant to General Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on and includes the date of this prospectus.

Our principal executive offices in Canada are located at 1600-609 Granville Street, Vancouver, British Columbia V7Y 1C3 Canada, and our telephone number is (647) 558-5564. The common shares of A2Z Smart Technologies Corp. are listed on the Nasdaq Capital Market under the symbol “AZ.” On April 6, 2023, the closing price of our common shares on the Nasdaq Capital Market was $1.35 per share. Our common shares are also listed on the TSX Venture Exchange under the symbol “AZ”. On April 6, 2023, the closing price of our common shares on the TSX Venture Exchange was CAD$1.75 per share.

We are an “emerging growth company” and a “foreign private issuer” under applicable Securities and Exchange Commission rules, and will be subject to reduced public company reporting requirements for this prospectus and future filings. See the section entitled “Prospectus Summary—Implications of Being an Emerging Growth Company and a Foreign Private Issuer” for additional information.

Investing in our securities involves a high degree of risk. Before buying our securities, you should consider carefully the risks described under the caption “Risk Factors” beginning on page 11 of this prospectus and in the documents incorporated by reference in this prospectus and refer to the risk factors that may be included in a prospectus supplement and in our reports and other information that we file with the U.S. Securities and Exchange Commission.

Neither the U.S. Securities and Exchange Commission nor any state or Canadian securities commission or regulator has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated _______, 2023.

| 2 |

TABLE OF CONTENTS

| 3 |

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (“SEC”) using a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or more offerings.

This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. Such prospectus supplement may also add, update or change information contained in this prospectus. If there is any inconsistency between the information in the prospectus and the applicable prospectus supplement, you should rely on the information in the prospectus supplement. You should read the information in this prospectus and the applicable prospectus supplement together with the additional information incorporated by reference herein as provided for under the heading “Incorporation of Certain Information by Reference.”

Owning securities may subject you to tax consequences in the United States and/or Canada. This prospectus or any applicable prospectus supplement may not describe these tax consequences fully. You should read the tax discussion in any prospectus supplement with respect to a particular offering and consult your own tax advisor with respect to your own particular circumstances.

You should rely only on the information contained in or incorporated by reference into this prospectus or in any prospectus supplement. We have not authorized anyone to provide you with different information. We are not making an offer to sell or soliciting an offer to buy these securities in any jurisdiction in which the offer or solicitation is not authorized or in which the person making the offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make the offer or solicitation. You should assume that the information contained in this prospectus and in any applicable prospectus supplement is accurate only as of the date on the front cover of this prospectus or prospectus supplement, as applicable, and the information incorporated by reference into this prospectus or any prospectus supplement is accurate only as of the date of the document incorporated by reference.

Any of the securities described in this prospectus and in a prospectus supplement may be convertible or exchangeable into other securities that are described in this prospectus or will be described in a prospectus supplement and may be issued separately, together or as part of a unit consisting of two or more securities, which may or may not be separate from one another. These securities may include new or hybrid securities developed in the future that combine features of any of the securities described in this prospectus.

The registration statement that contains this prospectus, including the exhibits to the registration statement, contains additional information about us and the securities offered under this prospectus. You can find the registration statement at the SEC’s website or at the SEC office mentioned under the heading “Where You Can Find More Information.”

Our consolidated financial statements that are incorporated by reference into this prospectus have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board, which we refer to as IFRS.

Unless the context otherwise indicates, the terms “us,” “we,” “our,” “A2Z” and the “Company” refer to A2Z Smart Technologies Corp. and our subsidiaries.

All trademarks, trade names and service marks appearing in this prospectus or the documents incorporated by reference herein are the property of their respective owners. Use or display by us of other parties’ trademarks, trade dress or products is not intended to and does not imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owner. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and trade names.

Unless stated otherwise or as the context otherwise requires, all references to dollar amounts in this prospectus and any prospectus supplement are references to United States dollars. References to “$”, “US$” or “USD” are to United States dollars and references to “CAD$” are to Canadian dollars.

| 4 |

Where You Can Find More Information

Statements included or incorporated by reference in this prospectus about the contents of any contract, agreement or other documents referred to are not necessarily complete, and in each instance an investor should refer to any such contracts, agreements or other documents incorporated by reference for a more complete description of the matter involved. Each such statement is qualified in its entirety by such reference.

We are subject to the information requirements of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and in accordance therewith file and furnish reports and other information with the SEC. As a foreign private issuer, certain documents and other information that we file and furnish with the SEC may be prepared in accordance with the disclosure requirements of Canada, which are different from those of the United States. In addition, as a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements, and our officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we are not required to publish financial statements as promptly as U.S. companies.

An investor may read and download the documents we have filed with the SEC under our corporate profile at www.sec.gov. An investor may read and download any public document that we have filed with the Canadian securities regulatory authorities under our corporate profile on the SEDAR website at www.sedar.com. An investor may also access our public filings through our website at www.a2zas.com. Information contained on, or that can be accessed through our website, is not incorporated by reference in this prospectus.

This prospectus is a part of a registration statement on Form F-3. This prospectus does not contain all of the information you can find in the registration statement or the exhibits to the registration statement. For further information about us and the securities offered under this prospectus, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement.

| 5 |

Incorporation of Certain Information by Reference

The SEC allows us to “incorporate by reference” information we have filed with the SEC into this prospectus. This means that we can disclose important information to you by referring to another document filed separately with the SEC. The information incorporated by reference is an important part of this prospectus, and the information we file subsequently with the SEC will automatically update and supersede the information in this prospectus. The information that we incorporate by reference in this prospectus is deemed to be a part of this prospectus. This prospectus incorporates by reference the documents listed below that we have previously filed with the SEC:

| ● | Our Annual Report on Form 20-F for the year ended December 31, 2022, filed with the SEC on March 27, 2023; | |

| ● | Our Reports on Form 6-K furnished to the SEC on January 11, 2023, February 8, 2023, February 15, 2023, March 10, 2023, March 17, 2023 and April 10, 2023; and | |

| ● | The description of our common shares contained in Exhibit 2.2 to our Annual Report on Form 20-F for the year ended December 31, 2022, filed with the SEC on March 27, 2023, including any subsequent amendment or any report filed for the purpose of updating such description. |

In addition, this prospectus shall also be deemed to incorporate by reference all subsequent annual reports filed on Form 20-F, Form 40-F or Form 10-K, and all subsequent filings on Forms 10-Q and 8-K (if any) filed by us pursuant to the U.S. Exchange Act prior to the termination of the offering made by this prospectus. We may also incorporate by reference into this prospectus any Form 6-K that is submitted to the SEC after the date of the filing of the registration statement of which this prospectus forms a part and before the date of termination of this offering. Any such Form 6-K that we intend to so incorporate shall state in such form that it is being incorporated by reference into this prospectus. The documents incorporated or deemed to be incorporated herein by reference contain meaningful and material information relating to us, and you should review all information contained in this prospectus and the documents incorporated or deemed to be incorporated herein by reference.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this prospectus, to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not constitute a part of this prospectus, except as so modified or superseded. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of such a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

Documents which we incorporate by reference are available from us without charge, excluding all exhibits, unless we have specifically incorporated by reference an exhibit in this prospectus. You may obtain documents incorporated by reference in this prospectus by requesting them in writing or by telephone from us at:

A2Z

Smart Technologies Corp.

Attention: Bentsur Joseph

1600-609 Granville Street

Vancouver, British Columbia

V7Y 1C3 Canada

(647) 558-5564

| 6 |

This prospectus, including the information incorporated by reference into this prospectus, contains forward-looking statements. These statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, and other future conditions. Forward-looking statements can be identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and other similar expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements include all matters that are not historical facts. They appear in many places throughout this prospectus and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, business prospects, growth, strategies, expectations regarding industry trends and the size and growth rates of addressable markets, our business plan and growth strategies, including plans for expansion to new markets and new products, and the industry in which we operate.

Risks which could affect future results and could cause results to differ materially from those expressed in the forward-looking statements contained in this prospectus, including the information incorporated by reference into this prospectus, include:

| ● | The Company has incurred significant losses and there can be no assurance when, or if, the Company will achieve or maintain profitability. | |

| ● | The Company expects that it will need to raise additional capital to meet the Company’s business requirements in the future, which is likely to be challenging, could be highly dilutive and may cause the market price of the common shares to decline. | |

| ● | The Company’s business is subject to risks arising from a widespread outbreak of an illness or any other communicable disease, or any other public health crisis, such as the COVID-19 pandemic, which has impacted and could continue to impact the business. | |

| ● | Failure to effectively develop and expand the Company’s sales and marketing capabilities could harm the ability to grow the business and achieve broader market acceptance of the Company’s products. | |

| ● | The Company expects the sales cycle to be long and unpredictable and require considerable time and expense before executing a customer agreement, which may make it difficult to project when, if at all, the Company will obtain new customers and when the Company will generate revenue from those customers. | |

| ● | If the Company is not able to enhance the brand and increase market awareness of the Company and products, then the business, results of operations and financial condition may be adversely affected. | |

| ● | If the Company does not develop enhancements to the technology and introduce new products that achieve market acceptance, the business, results of operations and financial condition could be adversely affected. | |

| ● | The technology markets in which the Company competes are both subject to rapid technological change and, to compete, the Company must continually enhance its products and services. | |

| ● | The Company’s growth depends, in part, on the success of the strategic relationships with third parties. | |

| ● | The Company’s future profitability depends, in part, on subcontractor and supplier performance and financial viability as well as component availability and pricing. | |

| ● | Information technology system failures or breaches of the Company’s network security could interrupt the operations and adversely affect the business. | |

| ● | Real or perceived errors, failures, or bugs in the technology could adversely affect the Company’s operating results and growth prospects. | |

| ● | The Company could be harmed by improper disclosure or loss of sensitive or confidential Company, employee, or customer data, including personal data. | |

| ● | A material breach in security relating to the Company’s information systems and regulation related to such breaches could adversely affect the Company. | |

| ● | The Company’s contracts may contain performance obligations that require innovative design capabilities, are technologically complex, require state-of-the-art manufacturing expertise or are dependent upon factors not wholly within the Company’s control. Failure to meet the contractual obligations could adversely affect the Company’s profitability, reputation and future prospects. | |

| ● | The Company’s insurance coverage, customer indemnifications or other liability protections may be unavailable or inadequate to cover all of the significant risks or the insurers may deny coverage of or be unable to pay for material losses the Company incurs, which could adversely affect the Company’s profitability and overall financial position. |

| 7 |

| ● | The Company may not be able to adequately protect its intellectual property, which, in turn, could harm the value of the brands and adversely affect the business. | |

| ● | The Company’s business operations and future development could be significantly disrupted if the Company loses key members of its management team. | |

| ● | The Company’s ability to meet the needs of its customers depends, in part, on the Company’s ability to maintain a qualified workforce. | |

| ● | If the Company is able to expand the operations, the Company may be unable to successfully manage its future growth. | |

| ● | The Company may become subject to various investigations, claims, disputes, enforcement actions, litigation, arbitration and other legal proceedings that could ultimately be resolved against the Company. | |

| ● | The Company’s reputation, the ability to do business and the Company’s financial position, results of operations and/or cash flows may be impacted by the improper conduct of employees, agents, subcontractors, suppliers, business partners or joint ventures in which the Company participates. | |

| ● | The Company’s principal offices and customers are located in Israel and, therefore, the business, financial condition and results of operation may be adversely affected by political, economic and military instability in Israel. | |

| ● | The Company’s operations may be disrupted as a result of the obligation of management or key personnel to perform military service. | |

| ● | It may be difficult to enforce a judgment of a Canadian court against the Company, certain of the Company’s officers and directors or the Israeli experts named in the prospectus are in Israel, to assert Canadian securities laws claims in Israel or to serve process on certain of the officers and directors and these experts. | |

| ● | The Company may become subject to claims for payment of compensation for assigned service inventions by the Company’s current or former employees, which could result in litigation and adversely affect the business. | |

| ● | A more active, liquid trading market for the common shares may not develop, and the price of the common shares may fluctuate significantly. | |

| ● | Concentration of ownership of the common shares may enable one shareholder or a small number of shareholders to significantly influence matters requiring shareholder approval. | |

| ● | Sales by the Company’s shareholders of a substantial number of the common shares in the public market could adversely affect the market price of the common shares. | |

| ● | The exercise of outstanding warrants and options will have a dilutive effect on the percentage ownership of the common shares by existing shareholders. | |

| ● | The common shares will be traded on more than one market and this may result in price variations. | |

| ● | The other factors discussed under “Item 3. Key Information – D. Risk Factors” in the Company’s Annual Report on Form 20-F for the year ended December 31, 2022 and other disclosure documents, which are available under the Company’s profile at www.sedar.com and www.sec.gov. |

This list of factors should not be construed as exhaustive. The Company does not intend to and does not assume any obligations to update forward-looking statements, except as required by applicable law.

The forward-looking statements made in this prospectus or any prospectus supplement, or the information incorporated by reference herein relate only to events or information as of the date on which the statements are made in such document. Except as required by U.S. federal securities law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and any prospectus supplement, and the information incorporated by reference herein, along with any exhibits thereto, completely and with the understanding that our actual future results may be materially different from what we expect. Other sections of this prospectus, prospectus supplement and the documents incorporated by reference herein include additional factors which could adversely impact our business and financial performance.

| 8 |

This summary highlights information contained elsewhere in this prospectus or incorporated by reference herein and does not contain all of the information that you should consider in making your investment decision. Before deciding to invest in our securities, you should read this entire prospectus and any applicable prospectus supplement carefully, including the sections of this prospectus entitled “Risk Factors”, “Forward-Looking Statements”, the section entitled “Risk Factors” in our Annual Report on Form 20-F for the most recent year incorporated by reference herein (together with any material changes thereto contained in subsequent filed reports on Form 6-K), our consolidated financial statements and the related notes incorporated by reference in this prospectus and all other information included or incorporated by reference in this prospectus.

Our Company

The Company was incorporated in British Columbia, Canada under the Business Corporations Act (British Columbia) (“BCBCA”), on January 15, 2018 under the name ECC Ventures 1 Corp. (“ECC1”). On July 20, 2020, the Company changed its name to “A2Z Smart Technologies Corp.” to better reflect the Company’s business plan.

The Company’s principal place of business and its registered and records office of the Company is located at 1600 - 609 Granville Street Vancouver, British Columbia, Canada V7Y 1C3; telephone +16475585564. The Company has appointed Cogency Global Inc., with an address at 122 East 42nd Street, 18th Floor, New York, NY 10168; telephone 1-800-221-0102, as its agent for service of process in the United States. The Company’s operational offices are located at Alon 2 Tower, 94 Yigal Alon St., TelAviv, Israel.

The Company is an innovative technology company specializing in the application of the Company’s existing military and civilisation technology for supermarket “smart carts” (the “Cust2Mate Carts”). The Company, through its subsidiaries, has four main business lines: (i) the development and commercialization of retail automation solutions, in particular for large grocery stores and supermarkets, including the Cust2Mate Carts (the “Cust2Mate Products”); (ii) manufacturing of precision metal parts (following the acquisition of a new subsidiary, Isramat, as outlined in further detail below); (iii) the provision of maintenance services utilizing the application of advanced engineering capabilities (the “Maintenance Services”); and (iv) the development of the Company’s FTICS technology and a vehicle device cover for the military and civilian automotive industry (collectively, the “Automotive Products”).

Historically, the Company’s revenues were principally generated from the maintenance services that are provided to the Israeli military/security market. The Company’s products, which have historically been sold to the Israeli military/security markets, include unmanned remote-controlled vehicles of various sizes and capabilities designed for intricate bomb disposal, counter terrorism, and firefighting, as well as energy storage power packs, all of which are fully commercialized for military use.

During 2020, the Company began to rapidly adapt its existing technology and know-how for the civilian markets, including the development of its Cust2Mate Products. This was in addition to the continuation of the Company’s existing sales to the Israeli military/security markets. The expansion into the civilian markets led to significantly increased expenditures which the Company was able to finance through a series of equity raises in 2021 and 2022. The Company has not, and does not intend to, export any military or defense related technology and accordingly, no approvals are required.

In 2022, and through 2023, the Company continues to focus its attention on its Cust2Mate Products division and aims to become the leading mobile self-checkout system in the international market, providing the optimum solution which simultaneously meets the needs of both shoppers and supermarket retailers. The Company will continue to sell its Maintenance Services in Israel only and has suspended the further development of its military products. The Maintenance Services division of the Company is self-sustaining financially. It provides a steady base for the Company’s operations and the Company intends to maintain this operation and expand it to cover the maintenance and support services required by the Cust2mate Products. To the extent that future research, development and marketing expenditures are concerned, the Company currently intends on investing the majority of its resources in the smart cart industry and towards the development of the Cust2Mate Products. The Company believes its current technological and operational capabilities are most effectively focused on growing the Company’s position in the smart cart industry.

| 9 |

During the first quarter of 2022, the Company completed the acquisition of 100% of the shares of Isramat, a privately held Israeli company. This acquisition vertically integrates certain manufacturing capabilities for the production of the Cust2Mate Products, such as precision metal fabrication of parts, while complementing existing contract manufacturing partnerships to support the Company’s growth.

The raw materials required by the Company’s subsidiaries are readily available from multiple suppliers worldwide and their purchase costs do not fluctuate more than standard raw materials.

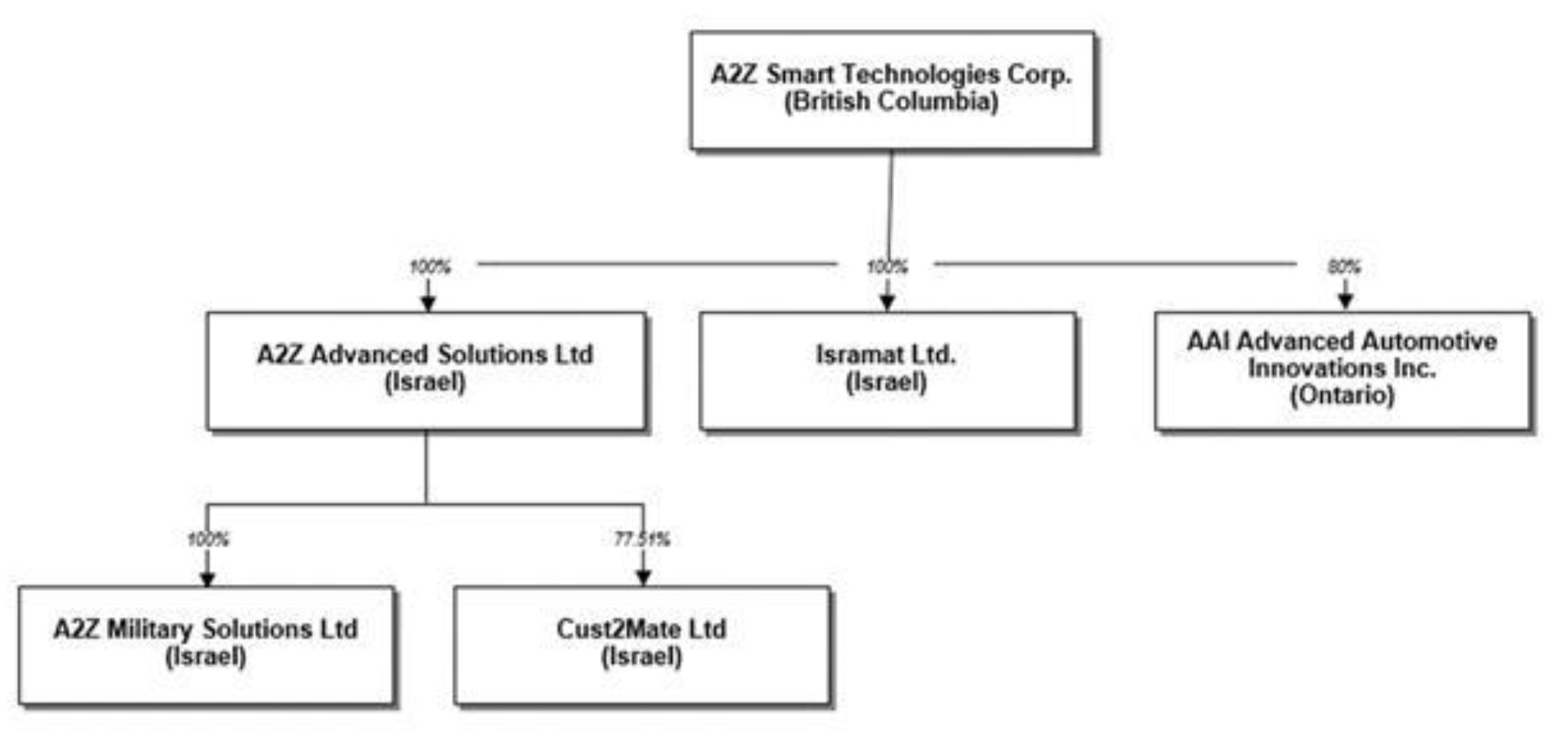

The following chart sets out all of the Company’s material subsidiaries as at the date hereof, their jurisdictions of incorporation and the Company’s direct and indirect voting interest in each of these subsidiaries:

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

Emerging Growth Company

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.235 billion in annual revenues; the date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day of the fiscal year ending after the fifth anniversary of our first sale of common equity securities pursuant to a U.S. registration.

As an emerging growth company, we may take advantage of certain exemptions from various reporting requirements that are applicable to other publicly traded entities that are not emerging growth companies. These exemptions include: (i) the option to present only two years of audited financial statements and related discussion in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our filings with the SEC; (ii) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002; (iii) not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board, or PCAOB, regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); (iv) not being required to submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay,” “say-on-frequency,” and “say-on-golden parachutes”; and (v) not being required to disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation.

Foreign Private Issuer

We report under the Exchange Act as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including: (i) the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; (ii) the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and (iii) the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specific information, and current reports on Form 8-K upon the occurrence of specified significant events.

| 10 |

Investing in our securities involves a high degree of risk. You should carefully review the risks and uncertainties described under the heading “Risk Factors” contained in the applicable prospectus supplement and under similar headings in our Annual Report on Form 20-F for the year ended December 31, 2022, as updated by our subsequent filings, some of which are incorporated by reference into this prospectus, before deciding whether to purchase any of the securities being registered pursuant to the registration statement of which this prospectus is a part. Each of the risk factors could adversely affect our business, results of operations, financial condition and cash flows, as well as adversely affect the value of an investment in our securities, and the occurrence of any of these risks might cause you to lose all or part of your investment.

Offer Statistics and Expected Timetable

We may sell from time to time pursuant to this prospectus (as may be detailed in prospectus supplements) an indeterminate number of securities as shall have a maximum aggregate offering price of $200,000,000. The actual per share price of the securities that we will offer pursuant hereto will depend on a number of factors that may be relevant as of the time of offer (see “Plan of Distribution” below).

Enforceability of Civil Liabilities

We are a company organized and existing under the Business Corporations Act (British Columbia). Substantially all of our assets are located outside the United States. In addition, several of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets may be located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon us or such persons or to enforce against them or against us, judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. In addition, investors should not assume that the courts of Canada (i) would enforce judgments of U.S. courts obtained in actions against us, our officers or directors, or other said persons, predicated upon the civil liability provisions of the U.S. federal securities laws or other laws of the United States; or (ii) would enforce, in original actions, liabilities against us or such directors, officers or experts predicated upon the United States federal securities laws or any securities or other laws of any state or jurisdiction of the United States.

In addition, there is doubt as to the applicability of the civil liability provisions of U.S. federal securities law to original actions instituted in Canada. It may be difficult for an investor, or any other person or entity, to assert U.S. securities laws claims in original actions instituted in Canada.

Unless we indicate a different use in an accompanying prospectus supplement, the net proceeds from our sale of the offered securities may be used for general corporate purposes, which may include working capital, capital expenditures, sales and marketing, research and development expenditures and acquisitions of new technologies and investments.

Until the net proceeds have been used, we may invest the net proceeds in short-term, investment grade, interest bearing instruments.

The applicable prospectus supplement will provide more details on the use of proceeds of any specific offering.

| 11 |

Capitalization and Indebtedness

The applicable prospectus supplement will describe any material change, and the effect of such material change, on our share and loan capitalization that will result from the issuance of securities pursuant to such prospectus supplement.

Since December 31, 2022, there have been no changes in our consolidated share or debt capital, other than as follows:

| ● | On January 4, 2023, the Company granted 1,027,000 Restricted Share Units (“RSUs”) to directors, officers and advisers, of which 250,000 RSU’s are to executives and directors, pursuant to the Company’s RSU Plan and in acknowledgment of the Company’s management recent success and increased future workload. The RSUs vest at each recipient’s discretion and taking into account personal tax implications and convert into 1,027,000 shares. The Company also granted 816,500 stock options to s directors, officers and advisers at an exercise price of CAD$1.65. 800,000 options vest immediately, and the remainder in eight equal installments every 3 months with the first installment on April 4, 2023. The options are exercisable for a period of 10 years from the date of issue. | |

| ● | On March 13, 2023, the Company announced that it has closed, in escrow, the issuance of 1,783,561 units at a price per unit of US$1.46 (CAD$1.95), for gross proceeds of US$2,604,000. Each unit consists of one common share and one half of one common share purchase warrant. Escrow was released in late March 2023. An aggregate of 891,778 warrants were issued and when exercised in accordance with the terms of the warrant certificates, and upon payment of an exercise price of CAD$2.35 (US$1.75), will result in the issuance of an additional 891,778 common shares. A finder’s fee of $208 (CAD$290,000) was paid in respect of the closing, and 142,685 warrants were issued to the finder. | |

| ● | On March 27, 2023, the Company announced that it extended the expiration dates of outstanding warrants to purchase 221,100 common shares by three years to April 22, 2026 and extended the expiration dates of outstanding warrants to purchase 1,084,562 common shares by three years to May 6, 2026. All other terms of the warrants, including the $11.04 exercise price, remain unchanged. |

| 12 |

Description of the Securities We May Offer

This prospectus contains summary descriptions of the common shares, warrants, rights and units that we may offer from time to time. These summary descriptions are not meant to be complete descriptions of each security. We will also set forth in the applicable prospectus supplement a description of the securities that may be offered under this prospectus. The applicable prospectus supplement may add, update or change the terms and conditions of the securities as described in this prospectus. The terms of the offering of securities, the initial offering price and the net proceeds to us will be contained in the prospectus supplement and/or other offering material relating to such offering. You should read the applicable prospectus supplement relating to the securities being offered pursuant to this prospectus and any other offering materials that we may provide.

Our authorized share capital consists of an unlimited number of common shares, no par value. At April 7, 2023, we had 32,728,883 issued and outstanding common shares and an unlimited number of preferred shares, of which none are outstanding.

The following description of our share capital and provisions of our articles are summaries of material terms and provisions and are qualified by reference to our articles, copies of which have been filed with the SEC as exhibits to the registration statement of which this prospectus is a part.

Common Shares

The holders of our common shares are entitled to one vote for each share held at any meeting of shareholders. The holders of our common shares are entitled to receive dividends as and when declared by our board of directors. Subject to the rights of the registered holders of the preferred shares, in the event of the liquidation, dissolution or winding-up or other distribution of the assets of the Company among its shareholders for the purpose of winding up the affairs of the Company, whether voluntary or involuntary, the registered holders of the Company’s common shares are entitled to share, pari passu, on a share for share basis, in the distribution of the remaining property or assets of the Company. There are no pre-emptive, redemption, purchase or conversion rights attaching to our common shares. There are no sinking fund provisions applicable to our common shares. The common shares offered in this offering, upon payment and delivery in accordance with the underwriting agreement, will be fully paid and non-assessable.

Listing

Our common shares are listed on Nasdaq Capital Market under the symbol “AZ.” Our common shares are also listed on the TSX Venture Exchange under the symbol “AZ” and on the Frankfurt Stock Exchange (the “FSE”) under the symbol “A23”.

Transfer Agent and Registrar

The transfer agent and registrar for our common shares is Capital Transfer Agency, ULC, located at 390 Bay Street West, Suite 920, Toronto, ON M5H 2Y2, Canada. The telephone number of Capital Transfer Agency, ULC at such address is 416-350-5007.

Description of Common Shares to be Issued

Subject to receipt of all applicable regulatory approvals, we may issue, separately or together with, or upon conversion, exercise or exchange of other securities, common shares from time to time, as set forth in the applicable prospectus supplement. Holders of common shares are entitled to receive notice of, to attend and to vote at any meetings of our shareholders, other than any meeting of holders of another class of our shares that are entitled to vote separately as a class at such meeting.

Subject to the rights of the holders of preferred shares, if any are authorized and outstanding, the holders of common shares are entitled to receive dividends when declared by the directors out of funds or assets properly available for the payment of dividends, in such amount and in such form as the directors may from time to time determine, provided however that such dividends shall not be paid if doing so would reduce the value of our net assets to less than the total redemption amount of all issued preferred shares (if any).

| 13 |

In the event of our dissolution, liquidation or winding-up and subject to the prior rights of the holders of the preferred shares, holders of common shares will be entitled to share equally in our remaining property and assets, if any, subject to the right of the holders of preferred shares, as a class, to receive, before any distribution of any part of our assets among the holders of common shares, the redemption amount in respect of such preferred shares, being that amount as determined by our directors at the time of the issuance of such preferred shares.

Description of Preferred Shares to be Issued

The preferred shares may be issued at any time, or from time to time, in one or more series. Before any preferred shares of a particular series are issued, our board of directors shall, by resolution, fix the number of preferred shares that will form such series and shall, by resolution, fix the designation, rights, privileges, restrictions and conditions to be attached to the preferred shares of such series. The preferred shares of each series shall rank on a parity with the preferred shares of every other series with respect to priority in payment of dividends and in the distribution of assets in the event of liquidation, dissolution or winding-up of the Company or other distribution of assets of the Company among its shareholders, for the purpose of winding-up of its affairs.

The preferred shares shall be entitled to preference over the common shares and any other shares of the Company ranking junior to the preferred shares with respect to the payment of dividends and the distribution of assets in the event of the liquidation, dissolution or winding-up of the Company, or any other distribution of the assets of the Company among its shareholders for the purpose of winding-up its affairs. The preferred shares may also be given such other preferences over the common shares and any other shares of the Company ranking junior to the preferred shares as may be fixed by our board of directors as to the respective series authorized to be issued.

As of the date hereof, the Company has no preferred shares issued and outstanding.

Description of Warrants to be Issued

Subject to receipt of all applicable regulatory approvals, we may issue warrants independently in one or more series to purchase common shares or preferred shares, or in any combination of those securities, as set forth in the applicable prospectus supplement. In addition, warrants may be issued independently or together with the underlying securities, and may be attached to or separate from the underlying securities. We may issue series of warrants under a separate warrant agreement between us and a warrant agent. The following summary outlines some of the general terms and provisions of the warrants that we may issue from time to time. Specific terms of a series of warrants and any related warrant agreement will be stated in the applicable prospectus supplement. The following summary does not purport to be complete and is subject to, and is qualified in its entirety by reference to, the terms and provisions of the warrants and any related warrant agreement, which we will file with the SEC in connection with the issuance of that series of warrants. You should carefully consider the actual provisions of the warrants and any related warrant agreement.

The applicable prospectus supplement will describe the following terms, where applicable, of warrants in respect of which this prospectus is being delivered:

| ● | the title of the warrants; | |

| ● | the designation, amount and terms of the securities for which the warrants are exercisable and the procedures and conditions relating to the exercise of such warrants; | |

| ● | the designation and terms of the other securities, if any, with which the warrants are to be issued and the number of warrants issued with each such security; | |

| ● | the price or prices at which the warrants will be issued; | |

| ● | the aggregate number of warrants; | |

| ● | any provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants or the exercise price of the warrants; |

| 14 |

| ● | the price or prices at which the securities purchasable upon exercise of the warrants may be purchased and the form of consideration that may be used to exercise the warrants; | |

| ● | the date on which the right to exercise the warrants shall commence and the date on which the right will expire; | |

| ● | the maximum or minimum number of warrants which may be exercised at any time; | |

| ● | the terms of any mandatory or option call provisions; | |

| ● | whether the warrants are to be issued in registered or bearer form; | |

| ● | whether the warrants are extendible and the period or periods of such extendibility; | |

| ● | the identity of any warrant agent; and | |

| ● | other terms of the warrants, including terms, procedures and limitations relating to the exchange, transfer and exercise of the warrants. |

Any material U.S. federal income tax consequences and other special considerations with respect to any warrants offered under this prospectus will also be described in the applicable prospectus supplement.

Before exercising their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon such exercise, including the right to receive dividends, if any, or payments upon our liquidation, dissolution or winding-up or to exercise voting rights, if any.

Description of Rights to be Issued

Subject to receipt of all applicable regulatory approvals, we may issue rights to our shareholders for the purchase of common shares or other securities, as set forth in the applicable prospectus supplement. These rights may be issued independently or together with any other security offered hereby and may or may not be transferable by the shareholder receiving the rights in such offering. In connection with any offering of such rights, we may enter into a standby arrangement with one or more underwriters or other purchasers pursuant to which the underwriters or other purchasers may be required to purchase any securities remaining unsubscribed for after such offering.

Each series of rights will be issued under a separate rights agreement which we will enter into with a bank or trust company, as rights agent, all as set forth in the applicable prospectus supplement. The rights agent will act solely as our agent in connection with the certificates relating to the rights and will not assume any obligation or relationship of agency or trust with any holders of rights certificates or beneficial owners of rights.

The applicable prospectus supplement will describe the specific terms of any offering of rights for which this prospectus is being delivered, including the following:

| ● | the date of determining the shareholders entitled to the rights distribution; |

| ● | the number of rights issued or to be issued to each shareholder; |

| ● | the exercise price payable for each share of common shares or other securities upon the exercise of the rights; |

| ● | the number and terms of the shares of common shares or other securities which may be purchased per each right; |

| ● | the extent to which the rights are transferable; |

| ● | the date on which the holder’s ability to exercise the rights shall commence, and the date on which the rights shall expire; |

| 15 |

| ● | the extent to which the rights may include an over-subscription privilege with respect to unsubscribed securities; |

| ● | if applicable, the material terms of any standby underwriting or purchase arrangement entered into by the Company in connection with the offering of such rights; and |

| ● | any other terms of the rights, including the terms, procedures, conditions and limitations relating to the exchange and exercise of the rights. |

Any material U.S. federal income tax consequences and other special considerations with respect to any rights offered under this prospectus will also be described in the applicable prospectus supplement.

Description of Units to be Issued

Subject to receipt of all applicable regulatory approvals, we may issue, separately or together with, or upon conversion, exercise or exchange of other securities, units comprised of one or more of the securities described in this prospectus in any combination, as set forth in the applicable prospectus supplement. Each unit will be issued so that the holder of the unit also is the holder of each security included in the unit. Thus, the holder of a unit will have the rights and obligations of a holder of each included security. The unit agreement under which a unit is issued may provide that the securities included in the unit may not be held or transferred separately at any time or at any time before a specified date.

The applicable prospectus supplement relating to the units we may offer will include specific terms relating to the offering, including, among others: the designation and terms of the units and of the securities comprising the units, and whether and under what circumstances those securities may be held or transferred separately; any provision for the issuance, payment, settlement, transfer or exchange of the units or of the securities comprising those units; and whether the units will be issued in fully registered or global form. This summary is therefore subject to and is qualified in its entirety by reference to all the provisions of any applicable unit agreement, including any definitions of terms used therein. Your rights will be defined by the terms of any applicable unit agreement, not the summary provided herein. This summary is also subject to and qualified by reference to the description of the particular terms of a particular unit described in the applicable prospectus supplement or supplements.

| 16 |

We may sell the securities covered by this prospectus from time to time by one or more of the following methods, or any combination thereof, or through any other method permitted by law: to or through underwriters, brokers or dealers, with or without an underwriting syndicate, for them to offer and sell to the public; directly to one or more purchasers in negotiated purchases or in competitively bid transactions; through designated agents; directly to holders of warrants exercisable for our securities upon the exercise of warrants; or through a combination of any of these methods of sale. We reserve the right to accept or reject, in whole or in part, any proposed purchase of securities, whether the purchase is to be made directly or through agents.

Each time that we use this prospectus to sell our securities, we will also provide a prospectus supplement that contains the specific terms of the offering, including the name or names of any underwriters, dealers or agents and the types and amounts of securities underwritten or purchased by each of them; the public offering price of the securities and the proceeds to us; any over-allotment options under which underwriters may purchase additional securities from us; any agency fees or underwriting discounts or other items constituting agents’ or underwriters’ compensation; any discounts, commissions or concessions allowed or reallowed or paid to underwriters, agents or dealers; any securities exchange or market on which the securities may be listed; and any delayed delivery arrangements.

The offer and sale of the securities described in this prospectus by us, the underwriters, or the third parties described above may be effected from time to time in one or more transactions: at a fixed price or prices, which may be changed; at market prices prevailing at the time of sale; in “at the market offerings” within the meaning of Rule 415(a)(4) of the Securities Act, to or through a market maker or into an existing trading market, on an exchange, or otherwise; at prices related to the prevailing market prices; or at negotiated prices.

Any public offering price and any discounts or concessions allowed or reallowed or paid to dealers may be changed from time to time.

Unless otherwise specified in the related prospectus supplement, each series of securities will be a new issue with no established trading market, other than our common shares, which are listed on the Nasdaq Capital Market. We may elect to list any securities on an exchange, but we are not obligated to do so. It is possible that one or more underwriters may make a market in the securities, but such underwriters will not be obligated to do so and may discontinue any market making at any time without notice. No assurance can be given as to the liquidity of, or the trading market for, any offered securities.

If underwriters are used in the sale of any securities, the securities will be acquired by the underwriters for their own account and may be resold from time to time in one or more transactions, including negotiated transactions, at a fixed public offering price or at varying prices determined at the time of sale. The securities may be either offered to the public through underwriting syndicates represented by managing underwriters, or directly by underwriters. Generally, the underwriters’ obligations to purchase the securities will be subject to certain conditions precedent set forth in the applicable underwriting agreement. We may offer the securities to the public through underwriting syndicates represented by managing underwriters or by underwriters without a syndicate. The underwriters will be obligated to purchase all of the securities if they purchase any of the securities. Only underwriters that we have named in the prospectus supplement will be underwriters of the securities offered by that prospectus supplement.

If we use dealers in the sale of securities, we may sell securities to such dealers as principals. The dealers may then resell the securities to the public at varying prices to be determined by such dealers at the time of resale. If we use agents in the sale of securities, unless otherwise indicated in the prospectus supplement, they will use their reasonable best efforts to solicit purchases for the period of their appointment. We may solicit offers to purchase the securities directly, and we may sell the securities directly to institutional or other investors, who may be deemed underwriters within the meaning of the Securities Act with respect to any resales of those securities. Unless otherwise indicated in a prospectus supplement, if we sell directly, no underwriters, dealers or agents will be involved. The terms of these sales will be described in the applicable prospectus supplement. We will not make an offer of securities in any jurisdiction that does not permit such an offer. We may authorize underwriters, dealers, or agents to solicit offers by certain types of institutional investors to purchase our securities at the public offering price set forth in the prospectus supplement pursuant to delayed delivery contracts providing for payment and delivery on a specified date in the future. The contracts will be subject only to those conditions set forth in the prospectus supplement, and the prospectus supplement will set forth any commissions or discounts we pay for solicitation of these contracts.

| 17 |

Agents and underwriters may be entitled to indemnification by us against civil liabilities, including liabilities under the Securities Act, or contribution with respect to payments that the agents or underwriters may make with respect to these liabilities. Agents and underwriters may engage in transactions with, or perform services for, us in the ordinary course of business.

In connection with any offering, the underwriters may purchase and sell securities in the open market. These transactions may include short sales, over-allotment, stabilizing transactions and purchases to cover positions created by short sales and penalty bids. Short sales involve the sale by the underwriters of a greater number of securities than they are required to purchase in an offering. Over-allotment involves sales in excess of the offering size, which create a short position. Stabilizing transactions consist of certain bids or purchases of the offered securities or any underlying securities made for the purpose of preventing or retarding a decline in the market price of the securities while an offering is in progress. Short-covering transactions involve purchases of the securities, either through exercise of the over-allotment option or in the open market after the distribution is completed, to cover short positions. Penalty bids permit the underwriters to reclaim a selling concession from a dealer when the securities originally sold by the dealer are purchased in a stabilizing or covering transaction to cover short positions. These activities by the underwriters may stabilize, maintain or otherwise affect the market price of the securities. As a result, the price of the securities may be higher than the price that otherwise might exist in the open market. If these activities are commenced, they may be discontinued by the underwriters at any time. These transactions may be effected on an exchange (if the securities are listed on an exchange) in the over-the-counter market or otherwise.

We may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement indicates in connection with those derivatives then the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of shares, and may use securities received from us in settlement of those derivatives to close out any related open borrowings of securities. The third party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement (or a post-effective amendment).

In connection with the distribution of the securities offered under this prospectus, we may enter into swap or other hedging transactions with, or arranged by, underwriters or agents or their affiliates. These underwriters or agents or their affiliates may receive compensation, trading gain or other benefits from these transactions.

Under the securities laws of some states, to the extent applicable, the securities may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the securities may not be sold unless such securities have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

| 18 |

Key Provisions of our Articles and the Business Corporations Act (British Columbia)

The following is a summary of certain key provisions of our articles and certain related sections of the Business Corporations Act (British Columbia) (the “BCBCA”). This is only a summary and is not intended to be exhaustive. For further information please refer to the full version of our articles attached as exhibits to our Annual Report on Form 20-F for the year ended December 31, 2022, filed with the SEC on March 27, 2023.

Stated Objects or Purposes

Our articles do not contain stated objects or purposes and do not place any limitations on the business that we may carry on.

Directors

Power to vote on matters in which a director is materially interested. Under the BCBCA a director who has a material interest in a contract or transaction, whether made or proposed, that is material to us, must disclose such interest to us, subject to certain exceptions such as if the contract or transaction: (i) is an arrangement by way of security granted by us for money loaned to, or obligations undertaken by, the director for our benefit or for one of our affiliates’ benefit; (ii) relates to an indemnity or insurance permitted under the BCBCA; (iii) relates to the remuneration of the director in his or her capacity as director, officer, employee or agent of our company or of one of our affiliates; (iv) relates to a loan to our company while the director is the guarantor of some or all of the loan; or (v) is with a corporation that is affiliated with us while the director is also a director or senior officer of that corporation or an affiliate of that corporation. Directors will also be required to comply with certain other relevant provisions of the BCBCA regarding conflicts of interest.

Under our articles, a director who holds a disclosable interest in a contract or transaction into which the Company has entered or proposes to enter is not entitled to vote on any directors’ resolution to approve that contract or transaction, unless all the directors have a disclosable interest in that contract or transaction, in which case any or all of those directors may vote on such resolution.

Directors’ power to determine the remuneration of directors. The remuneration of our directors, if any, may be determined by our directors subject to our articles. If the directors so decide, the remuneration of the directors, if any, will be determined by the shareholders. That remuneration may be in addition to any salary or other remuneration paid to any officer or employee of the Company as such, who is also a director.

Number of shares required to be owned by a director. Neither our articles nor the BCBCA provide that a director is required to hold any of our shares as a qualification for holding his or her office. To align the economic interests of directors with those of our shareholders, non-executive directors receive $1,150 CAD per month for their services.

Certain Amendments and Change of Control

In addition to any other voting right or power to which the holders of voting shares shall be entitled by law or regulation or other provisions of our articles from time to time in effect, but subject to the provisions of our articles, holders of voting shares shall be entitled to vote separately as a class, in addition to any other vote of our shareholders that may be required, in respect of any alteration, repeal or amendment of our articles which would adversely affect the rights or special rights of the holders of common shares or affect the holders of common shares differently, on a per share basis.

| 19 |

Our articles do not contain any change of control limitations with respect to a merger, acquisition or corporate restructuring that involves us.

Shareholder Meetings

Subject to applicable stock exchange requirements, we must hold a general meeting of our shareholders at least once every calendar year at a time and place determined by our board of directors, provided that the meeting must not be held later than 15 months after the preceding annual general meeting.

The Company must send notice of the date, time and location of any meeting of shareholders (including, without limitation, any notice specifying the intention to propose a resolution as an exceptional resolution, a special resolution or a special separate resolution, and any notice to consider approving an amalgamation into a foreign jurisdiction, an arrangement or the adoption of an amalgamation agreement, and any notice of a general meeting, class meeting or series meeting), in the manner provided in our Articles, or in such other manner, if any, as may be prescribed by ordinary resolution (whether previous notice of the resolution has been given or not), to each shareholder entitled to attend the meeting, to each director and to the auditor of the Company, unless our Articles otherwise provide, at least the following number of days before the meeting: (1) if and for so long as the Company is a public company, 21 days; (2) otherwise, 10 days. Under the BCBCA, shareholders entitled to notice of a meeting may waive or reduce the period of notice for that meeting, provided applicable securities laws are met. The accidental omission to send notice of any meeting of shareholders to, or the non-receipt of any notice by, any of the persons entitled to notice does not invalidate any proceedings at that meeting.

Subject to the special rights and restrictions attached to the shares of any class or series of shares and to Article 11.4 of our Articles, the quorum for the transaction of business at a meeting of shareholders is two persons who are, or who represent by proxy, shareholders who, in the aggregate, hold at least 5% of the issued shares entitled to be voted at the meeting. If there is only one shareholder entitled to vote at a meeting of shareholders: (1) the quorum is one person who is, or who represents by proxy, that shareholder, and (2) that shareholder, present in person or by proxy, may constitute the meeting.

Shareholder Proposals

Under the BCBCA, qualified shareholders holding shares that constitute (i) at least one percent (1%) of our issued voting shares or (ii) have a fair market value in excess of CAD$2,000 may make proposals for matters to be considered at the annual general meeting of shareholders. Such proposals must be sent to us in advance of any proposed meeting by delivering a timely written notice in proper form to our registered office in accordance with the requirements of the BCBCA. The notice must include information on the business the shareholder intends to bring before the meeting. To be a qualified shareholder, a shareholder must currently be and have been a registered or beneficial owner of at least one share of the company for at least two years before the date of signing the proposal.

Limitation on Rights to Own Securities

There are no limitations on rights to own or exercise voting rights on our securities by the BCBCA or our articles.

Limitation of Liability and Indemnification

Under the BCBCA, a company may indemnify: (i) a current or former director or officer of that company; (ii) a current or former director or officer of another corporation if, at the time such individual held such office, the corporation was an affiliate of the company, or if such individual held such office at the company’s request; or (iii) an individual who, at the request of the company, held, or holds, an equivalent position in another entity (an “indemnifiable person”) against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, reasonably incurred by him or her in respect of any civil, criminal, administrative or other legal proceeding or investigative action (whether current, threatened, pending or completed) in which he or she is involved because of that person’s position as an indemnifiable person, unless: (i) the individual did not act honestly and in good faith with a view to the best interests of such company or the other entity, as the case may be; or (ii) in the case of a proceeding other than a civil proceeding, the individual did not have reasonable grounds for believing that the individual’s conduct was lawful. A company cannot indemnify an indemnifiable person if it is prohibited from doing so under its articles or by applicable law. A company may pay, as they are incurred in advance of the final disposition of an eligible proceeding, the expenses actually and reasonably incurred by an indemnifiable person in respect of that proceeding only if the indemnifiable person has provided an undertaking that, if it is ultimately determined that the payment of expenses was prohibited, the indemnifiable person will repay any amounts advanced. Subject to the aforementioned prohibitions on indemnification, a company must, after the final disposition of an eligible proceeding, pay the expenses actually and reasonably incurred by an indemnifiable person in respect of such eligible proceeding if such indemnifiable person has not been reimbursed for such expenses, and was wholly successful, on the merits or otherwise, in the outcome of such eligible proceeding or was substantially successful on the merits in the outcome of such eligible proceeding. On application from an indemnifiable person or the company, a court may make any order the court considers appropriate in respect of an eligible proceeding, including the indemnification of penalties imposed or expenses incurred in any such proceedings and the enforcement of an indemnification agreement. As permitted by the BCBCA, our articles require us to indemnify our directors, former directors or alternate directors (and such individual’s respective heirs and legal representatives) and permit us to indemnify any person to the extent permitted by the BCBCA.

| 20 |

Expense of the Issuance and Distribution

The following table sets forth those expenses to be incurred by us in connection with the issuance and distribution of the securities being registered, other than underwriting discounts and commissions. All of the amounts shown are estimates, except the SEC registration fee.

| SEC registration fee | $ | 22,040 | ||

| Printing and postage expenses | (1) | |||

| Legal fees and expenses | (1) | |||

| Trustee fees and expenses | (1) | |||

| Accounting fees and expenses | (1) | |||

| Miscellaneous expenses | (1) | |||

| Total | $ | (1) |

| (1) | These expenses are not presently known and cannot be estimated at this time as they are based upon the amount and type of security being offered, as well as the number of offerings. The aggregate amount of these expenses will be reflected in the applicable prospectus supplement. |

Certain Income Tax Considerations

Our most recent Annual Report on Form 20-F provides a discussion of certain tax considerations that may be relevant to prospective investors in our securities. The applicable prospectus supplement may also contain information about certain material tax considerations relating to the securities covered by such prospectus supplement. Prospective investors should read the tax discussion in any prospectus supplement with respect to a particular offering and consult their own tax advisors with respect to their own particular circumstances.

Certain legal matters in connection with the securities offered hereby will be passed upon on behalf of the Company by Sichenzia Ross Ference LLP with respect to U.S. legal matters and by Bloch Legal with respect to Canadian legal matters. If legal matters in connection with any offering made pursuant to this prospectus are passed upon by counsel for underwriters, dealers or agents, if any, such counsel will be named in the prospectus supplement relating to such offering.