UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

OR

For the transition period from _____ to _____

Commission File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The | ||||

| Warrants, each to purchase one share of Common Stock | NNAVW | The Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Smaller reporting company | |

| Accelerated filer | ☐ | Emerging growth company | |

| ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to Section 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

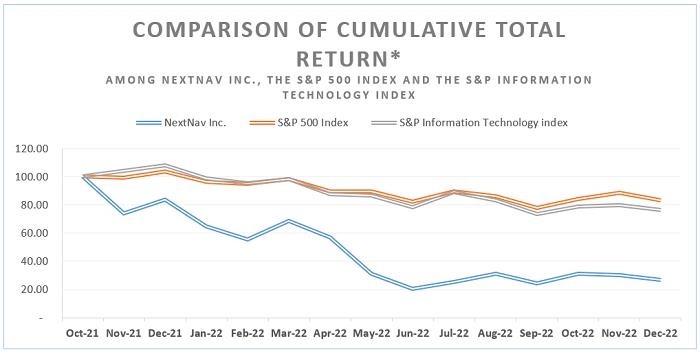

As of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of common stock held by non-affiliates of the registrant was $

There were

Documents Incorporated by Reference

Portions of the registrant’s Definitive Proxy Statement relating to the 2023 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2022, are incorporated by reference into Part III of this Annual Report on Form 10-K.

NEXTNAV INC.

Annual Report on Form 10-K for the Fiscal Year ended December 31, 2022

Table of Contents

Unless the context otherwise requires, all references in this Annual Report on Form 10-K to “NextNav,” the “Company,” “we,” “us,” and “our” include NextNav Inc. and its subsidiaries.

| i |

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include, but are not limited to, statements regarding our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future, projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, and are not guarantees of future performance. The words “may,” “will,” “anticipate,” “believe,” “expect,” “continue,” “could,” “estimate,” “future,” “expect,” “intends,” “might,” “plan,” “possible,” “potential,” “aim,” “strive,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements in this Annual Report on Form 10-K include, among other things, statements about:

| 1. | expectations regarding our strategies and future financial performance, including our future business plans or objectives, expected functionality of our geolocation services, anticipated timing and level of deployment of our services, anticipated demand and acceptance of our services, prospective performance and commercial opportunities and competitors, the timing of obtaining regulatory approvals, ability to finance our research and development activities, commercial partnership acquisition and retention, products and services, pricing, marketing plans, operating expenses, market trends, revenue, liquidity, cash flows and uses of cash, capital expenditures, and our ability to invest in growth initiatives; | |

| 2. | our ability to recognize the anticipated benefits of the Business Combination (as defined below), our ability to realize the anticipated technical and business benefits associated with the acquisition of Nestwave (as defined below), and any subsequent mergers, acquisitions, or other similar transactions, which may be affected by, among other things, competition, and the ability of the combined business to grow and manage growth profitably; | |

| 3. | factors relating to our future operations, projected capital resources and financial position, estimated revenue and losses, projected costs and capital expenditures, prospects and plans, including the potential increase in customers on our Pinnacle network, the expansion of our services in Japan through MetCom, and expectations about other international markets; | |

| 4. | projections of market growth and size, including the level of market acceptance for our services; | |

| 5. | our ability to adequately protect key intellectual property rights or proprietary technology; | |

| 6. | our ability to maintain our Location and Monitoring Service (“LMS”) licenses and obtain additional LMS licenses as necessary; | |

| 7. | our ability to maintain adequate operational financial resources or raise additional capital or generate sufficient cash flows, including the adequacy of our financial resources to meet our operational and working capital requirements for the 12-month period following the issuance of this report; | |

| 8. | our ability to develop and maintain effective internal controls; | |

| 9. | our success in recruiting and/or retaining officers, key employees or directors; | |

| 10. | expansion plans and opportunities; | |

| 11. | costs related to being a public company; | |

| 12. | our ability to maintain the listing of our securities on Nasdaq; and | |

| 13. | the outcome of any known and unknown litigation and regulatory proceedings. |

We have included important factors in the cautionary statements included in this Annual Report on Form 10-K, particularly in “Item 1A. Risk Factors”, that could cause actual results or events to differ materially from the forward-looking statements that we make. You should read this Annual Report on Form 10-K and the documents that we have filed as exhibits to this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. These forward-looking statements are based on information available as of the date of this annual report on Form 10-K, and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update or revise any forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

| ii |

The following summarizes the principal factors that make an investment in us speculative or risky, all of which are more fully described in “Item 1A. Risk Factors” below. This summary should be read in conjunction with “Item 1A. Risk Factors” and should not be relied upon as an exhaustive summary of the material risks facing our business.

Risks Related to the Business and the Industry

| ● | We have incurred significant losses since inception. We expect to incur losses in the future and may not be able to achieve or maintain profitability, and may need to raise additional capital to maintain our operations in the future. |

| ● | Unsettled conditions in the financial and capital markets may restrict our access to funds or cause our associated borrowing costs increase, which might adversely affect our operations. | |

| ● | Our limited operating history makes it difficult to evaluate our future prospects and the risks and challenges we may encounter. |

| ● | Pinnacle z-axis is a new capability, and adoption may be delayed by our potential customers’ unfamiliarity with 3D position, a lack of ecosystem support (e.g., specific device sensors, 3D routing) and/or other factors. |

| ● | Our business plan and, in turn, our ability to generate revenue, depends in large part on end users accessing our services through our customers’ platforms. |

| ● | We face intense competition in our market, especially from competitors that offer their location services for free, which could make it difficult for us to acquire and retain customers and end users. |

| ● | We are heavily reliant on third parties, including AT&T, Verizon and Amazon Web Services for a variety of our products and business operations, as well as on a limited number of key vendors for timely supply of components necessary for our offerings. | |

| ● | Our Pinnacle service in smartphones relies on the availability of barometric pressure measurements and 2D location being made available to us or our customers. |

| ● | We may not be successful in the evolution of our TerraPoiNT technology to utilize LTE/5G signals, which will increase our costs and may increase the challenge of adopting our services. | |

| ● | Our hybrid architecture, which depends on the use of our transmitters and our ability to calibrate signals transmitted by third parties, is unproven, may not perform well and may cost significantly more than our initial estimates. | |

| ● | Our services’ full potential is contingent on our distribution partners’ and customers’ access to a variety of third-party platforms, which creates a number of uncertainties and potential risks. | |

| ● | Our services are available within defined network footprints, and if we are not able to deploy new infrastructure, we will not be able to expand our service area. | |

| ● | There is no guarantee that TerraPoiNT service will be sold to commercial or additional government users or achieve broad commercial support in the United States or internationally. |

| ● | There is no guarantee that Federal and state government resilient PNT programs will result in procurements that result in the adoption of our services or revenue to us, and the process that may result in such adoption or revenue may be delayed. | |

| ● | Our solutions depend on the use of location by a wide range of applications. Related privacy concerns could damage our reputation and deter current and potential users from using our products and applications. | |

| ● | Natural or man-made disasters, including cyber security attacks or terrorist attacks could have an adverse effect on our business. | |

| ● | Actual or perceived disruptions of our information technology systems or data security incidents could have an adverse effect on our business. |

| iii |

| ● | We may become subject to litigation arising out of any security breaches, which may adversely affect our business. Our insurance policies’ limits may not be sufficient to cover any related liabilities we may face. | |

| ● | We depend on the availability of personnel with the requisite level of technical expertise in the telecommunications industry, as well as on key members of our senior management team, and our performance could be adversely impacted if we fail to retain such key members and/or fair to find suitable replacements. |

| ● | The failure to successfully obtain, maintain and enforce intellectual property rights and defend against challenges to our intellectual property rights could adversely affect us. | |

| ● | Strategic transactions involve significant risks and uncertainties that could adversely affect our business. | |

| ● | Our results could be adversely impacted as a result of increased inflation and supply chain pressures. | |

| ● | The effects of the COVID-19 pandemic could continue to have material adverse impacts on our business. | |

| ● | Military action in Ukraine, including the resulting geopolitical effects beyond Ukraine, may directly or indirectly increase our risks from supply chain, cybersecurity, foreign currency fluctuations, or other factors. |

Risks Related to Legal and Regulatory Matters

| ● | Our business depends on access to radio spectrum to provide certain of our location services and access to such spectrum on a nationwide basis is not a certainty. | |

| ● | Our ability to fully utilize our hybrid TerraPoiNT system by leveraging LTE/5G signals to provide voice and data services unrelated to position location will require spectrum license modifications, which will require FCC approvals that are not a certainty. |

| ● | Our FCC licenses authorize the use of radio frequencies that are shared with other radio services, which could result in harmful interference and impairment to our use of our licensed spectrum. |

| ● | Our LMS licenses are subject to renewal and end-of-term build-out requirements maintained by the FCC and no certainty exists that we will be able to secure ongoing renewals or comply with such build-out requirements. | |

| ● | Our retention and use of our LMS licenses has been the subject of ongoing objections by third parties that could result in the revocation or non-renewal of our LMS licenses, and may impact our ability to modify our licenses. |

| ● | A portion of our business plan targets government customers, which subjects us to risks, including early termination, audits, investigations, sanctions and penalties. |

| ● | We and our service providers handle personal information, which creates legal obligations and may give rise to additional costs and liability. |

| ● | We are subject to stringent U.S. export control and economic sanctions laws and regulations. |

| ● | We are exposed to risks related to geopolitical and economic factors, laws and regulations and our international business subjects us to numerous risks associated with doing business globally. |

Risks Related to our Common Stock

| ● | If we issue and sell additional shares of our Common Stock in the future, our existing stockholders will be diluted and our stock price could fall. Further, certain of our Warrants are exercisable, which could increase the number of shares eligible for future resale in the public market and result in dilution to our stockholders. |

| ● | Our principal stockholders and management own a significant percentage of our stock and will be able to exert significant control over matters subject to stockholder approval. |

| ● | We have never paid dividends on our capital stock, and we do not anticipate paying any cash dividends in the foreseeable future. |

| iv |

Item 1. Business.

Overview

We are the market leader in delivering next generation positioning, navigation and timing (“PNT”) solutions that overcome the limitations of existing space-based global positioning system (“GPS”). The impact of GPS on the U.S. economy is approaching $1 trillion annually, according to a NextNav extrapolation of our data from a National Institute of Standards and Technology (“NIST”) sponsored study conducted by RTI International (“RTI”), and the European Commission has estimated a similar impact on the economy of the European Union in its 2018 budget process. Based on the increasing reliance on PNT across many facets of the global economy, the world increasingly requires more accurate and resilient PNT capabilities. PNT resiliency has recently emerged as a priority of the U.S. Federal Government, including as a key cyber security vulnerability. Higher performance will continue to expand the reach and value of PNT solutions, while resilience is essential to protect the vast economic activity that is reliant on GPS. We are targeting a global addressable market that is greater than $100 billion.

We currently deliver differentiated PNT solutions through our network-based Pinnacle and TerraPoiNT solutions. Our Pinnacle system provides “floor-level” altitude service to any device with a barometric pressure sensor, including most off-the-shelf Android and iOS smartphones. This service enables full 3D location at national scale for the first time. Public safety, autonomous vehicles, electric vertical takeoff and landing vehicles (“eVTOLs”), unmanned aerial vehicles (“UAVs”), and the app economy all require precise 3D location solutions. Paramedics need to know which apartment a 911 call originated from, ride hailing and delivery apps need to know precisely where a customer is standing and game developers need precise 3D location data to deliver next generation augmented reality experiences.

In early 2021, we launched the first element of our next generation GPS service through initial commercial launch of our nationwide Pinnacle network that was deployed in partnership with AT&T Services, Inc. (“AT&T”). The Pinnacle network provides “floor-level” altitude data to over 90% of commercial structures over three stories in the U.S. Pinnacle is being utilized by FirstNet® for public safety. We are currently providing service to Verizon Communications, Inc. ("Verizon") as a customer for enhanced 911 (“E911”) services, using our Pinnacle 911 solution. Pinnacle has also been adopted by a growing number of public safety apps, commercial apps and app development platforms, including Unity Engine, CRG, GeoComm, Rapid Deploy, Central Square, NGA 911, Qualcomm, and the Unreal Engine. We believe that ramp up of customers using our existing Pinnacle network will support revenue growth over the coming year.

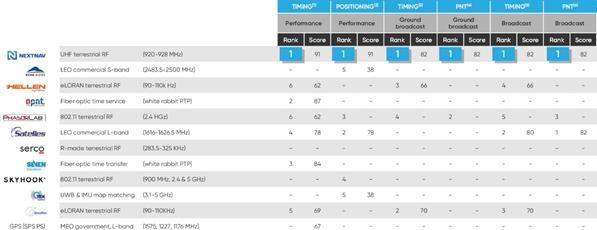

Our TerraPoiNT system is a terrestrial-based, encrypted network designed to overcome the limitations inherent in the space-based nature of GPS. GPS is a faint, unencrypted signal, which is often unavailable indoors, distorted in urban areas and vulnerable to both jamming and spoofing. TerraPoiNT overcomes these limitations through a network of specialized wide area location transmitters that broadcast an encrypted PNT signal on our licensed 900 MHz LMS spectrum with a signal that is 100,000 times stronger than GPS. Unlike GPS, the TerraPoiNT signal can be reliably received indoors and in urban areas and is difficult to jam or spoof. Further, the TerraPoiNT signal embeds Pinnacle information to provide a full 3D solution. In addition, TerraPoiNT provides redundancy for GPS by offering positioning, navigation and NIST-traceable timing services independently. We believe that this backup capability is essential due to the economy’s reliance on GPS for location and precision timing. GPS redundancy is increasingly a U.S. national security priority, and is rising in priority in the European Union, non-EU countries in Eastern Europe and in other parts of the world due to both the demonstrated vulnerability and lack of local control of space-based signals and systems, highlighted by recent events in the Ukraine. Critical infrastructure, including communications networks and power grids, require a reliable GPS signal for accurate timing. A failure of GPS could be catastrophic, and there is no comprehensive, terrestrial backup that is widely deployed today. TerraPoiNT received the highest scores in testing by the U.S. Department of Transportation reported in 2021 regarding potential PNT backup solutions, in each category tested, and was the only solution evaluated capable of providing the full set of services provided by GPS.

As of March 2023, TerraPoiNT is deployed and available, with metro-wide service in the San Francisco Bay Area and select services available in 85 total markets nationally. It is also in use by the National Aeronautics and Space Administration (“NASA”) at its Langley Research Center in Hampton, VA for drone operations research and at its Ames facility in Mountain View, CA, leveraging our deployed network in the Bay Area.

| 1 |

On October 31, 2022, we acquired Nestwave, SAS, a French société par actions simplifiée (“Nestwave”), a privately held global leader in low-power geolocation. Based in Neuilly-sur-Seine, France, Nestwave provides advanced geolocation solutions to Internet of Things (“IoT”) modem and digital signal processor vendors and end IoT users. We believe that the combination of our technology with Nestwave’s LTE/5G capabilities will allow us to intelligently combine signals from existing terrestrial LTE/5G networks with our own highly synchronized TerraPoiNT system to deliver resilient 3D PNT capabilities with expanded geographic scale at significantly lower deployment costs than a standalone TerraPoiNT system. We also expect the integration of the Nestwave technology to significantly improve the spectral efficiency of our transmissions and may allow downlink data capacity similar to other LTE/5G systems operating over similar spectrum bandwidth. Nestwave is adopting NextNav’s name and has been substantially integrated into existing TerraPoiNT engineering and technology efforts.

We acquired Nestwave for an enterprise value of $18.0 million and gross consideration value of $19.3 million, consisting of $4.3 million in cash and $15.0 million in our common stock. The transaction resulted in the issuance of 4.0 million shares of our common stock upon close, and up to 1.1 million shares of common stock upon exercise of certain Nestwave employee options. All such shares are subject to a lock-up expiring on the first anniversary of transaction close.

Since the inception of NextNav, LLC in 2007, we have secured valuable Federal Communications Commission (“FCC”) licenses for a contiguous 8 MHz band of 900 MHz LMS spectrum covering approximately 93% of the U.S. population, been granted more than 150 patents related to our systems and services, and standardized our TerraPoiNT technology in 3GPP, the global telecommunications standards-setting body.

We believe our unique approach to PNT, relying on terrestrial infrastructure deployed at existing wireless tower or antenna locations, provides an unrivaled quality-of-service and would be difficult to replicate.

Our Strategy

Domestically, we operate primarily as a facilities-based service provider. Our target customers include businesses, including applications developers, and adjacent businesses selling PNT products and systems to end users, and Federal, state and local governmental entities. We deploy sensor and broadcast network capabilities, and licenses access to our customers for the data generated by our networks. Internationally, we provide equipment, software and services to our customers to enable them to partner in the operation of our systems in their home markets. The key elements of our strategy include:

| ● | Establish TerraPoiNT as the leader in resilient PNT. We anticipate that the expanded availability of our TerraPoiNT system will provide enhanced value to existing customers and open new verticals. We have entered into agreements related to the commercialization of TerraPoiNT in the burgeoning urban air mobility space, and are working with the U.S. Department of Transportation, U.S. Department of Homeland Security and the U.S. Congress to assess the suitability of TerraPoiNT as a national backup capability to GPS. Redundancy to space-based PNT systems is rising in priority in the European Union, non-EU countries in Eastern Europe and in other parts of the world due to both the demonstrated vulnerability and lack of local control of space-based signals and systems, highlighted by recent events in the Ukraine. We also anticipate enterprise, IOT and critical infrastructure customers for TerraPoiNT, especially those that require either timing or dynamic navigation capabilities, or reliable urban and indoor reception of its signal. This includes industries such as transportation and telecommunications, which rely on position, navigation and timing to provide service and sectors such as the electrical grid which require timing — nearly every segment of the U.S. economy, most of which rely on GPS or GPS-derived services in one form or another. | |

| ● | Optimize the Full Value of our Spectrum, including maximizing Spectral Efficiency and Throughput of Our Spectrum.We anticipate adopting 4G LTE and 5G technologies as a core element of our TerraPoiNT PNT offering, including through the integration of technologies acquired from Nestwave. We believe that this will improve the data carrying capacity of our spectrum without impacting our core PNT services, which will allow us to expand our service offering and the potential uses for our spectrum. |

| 2 |

| ● | Expand our Global Reach. In pursuit of our vision for our services to form the standard for global PNT, we have commenced distribution of our services outside of the United States. We are focused on working with partners that can bring local scale as well as access to local authorities responsible for spectrum allocation and national critical infrastructure. Our joint venture in Japan, MetCom, backed by Sony and Kyocera, is emblematic of this approach. MetCom has access to significant local facilities to host our Pinnacle and TerraPoiNT infrastructure and has secured initial access to the required spectrum resources from the Japanese government for TerraPoiNT operations. Pinnacle was launched in November 2022 in Japan and we anticipate expanded geographic coverage in 2023. Following the launch of service in Japan, and our successful operations in the U.S., we anticipate interest from other international markets in the future. | |

| ● | Ensure 3D Location is Market Standard. Our PNT services offer improved accuracy, resiliency and service availability compared to GPS-based services. We have developed our services to be easily integrated into applications, and sold to end users either as part of a standalone application or for intermediate services used as part of a system or application (e.g., software development kits (“SDK”) based products for mass-market apps or the NASA drone system used as part of their aircraft systems). Our pricing plans are designed to encourage usage and adoption, and are tailored to the use case and business operations of our customers. Given the increasing importance of geolocation services to society and economy, we believe that our offerings should become the new standard in geolocation. |

| ● | Enable a Suite of Complementary Products. As the first to market with a scalable 3D location service, we provide or partner with companies to deliver products and services that are adjacent to our basic location service. Our first product supporting 3D location is our altimeter software bundled with our SDK that enables a quick reference to a user’s relative height. We anticipate building additional tools and capabilities to improve access and usability to application developers to both accelerate adoption and the use of full 3D location. |

| ● | Enhance Adoption, Distribution and Scale with Strategic Partners. We launched our services after securing our strategic agreement with AT&T to deploy the Pinnacle altitude network and to begin offering services to public safety customers. This relationship provided us with a platform to offer a nationwide service capability and to deliver a crucial situational awareness capability to public safety customers as part of AT&T’s FirstNet® operations. Our public safety presence is supported by our own marketing, awareness built through AT&T’s marketing campaigns and its presence on the FirstNet® API Catalog. |

| ● | Expand the use of our service for E911 in the U.S. In October 2021, we entered into an agreement with Qualcomm to make our Pinnacle software and services available with the Qualcomm Location Suite, which will make it easier for device vendors to integrate vertical location capabilities into existing carrier E911 infrastructure. We are currently providing service to Verizon as a customer for E911 services, using our Pinnacle 911 solution for its customers, and the first device (in partnership with Sonim Technologies Inc.) leveraging this technology became available in December 2022. We believe that our service may be attractive to other wireless carriers based on our high performance, system availability and FCC requirements for wireless carriers to provide accurate vertical location to first responders during E911 calls. |

| 3 |

Industry Background

PNT services are used in nearly every facet of our economy. Cellular and electrical distribution systems depend on GPS-based timing, the mobile app economy relies on location to create innovative services and to drive data and advertising revenue, and public safety and E911 saves lives every day with the use of location services.

GPS has powered the global economy for nearly 40 years. Without high-precision timing from GPS, cellular systems would quickly fail and the distribution of electricity would be impacted, while GPS-based location powers everything from aviation and wireless 911 location to the mobile app economy. Based on research performed for NIST by RTI in 2019, for example, GPS alone is calculated to have provided nearly $1.4 trillion to the U.S. economy between 1984 and 2017, with nearly a quarter of that value, exceeding $300 billion, delivered in the last year of their analysis. Applying the average 2015-2017 growth rate from the NIST RTI analysis implies that the 2021 domestic value provided by GPS was approximately $700 billion and the 2023 value is expected to be approximately $1.1 trillion. This is consistent with analysis performed by the European Commission, which estimated the contribution of global navigation satellite services (“GNSS”) in the European Union was approximately EUR 1.2 trillion in 2018.

GPS and GNSS services have inherent limitations due to their faint signal and the geometry of the orbital satellites especially near the Earth’s surface. This results in poor performance, especially in urban environments, indoors, and other locations where precise altitude determination is essential. The increasing demand for location services has resulted in the development of a number of supplements and alternatives to traditional GPS.

NextNav Market Opportunity

We believe that the market opportunity for our services is significant, with a total addressable market of over $50 billion in the United States and over $100 billion globally. Nearly every segment of the global economy relies on geolocation or high-precision timing, directly or indirectly, and in general those services are either: (a) expensive; (b) of limited performance; or (c) are derived only from GPS or global navigation satellite system (“GNSS”), and suffer from the limitations and vulnerabilities of those services.

We have divided the broad application of our services into five major verticals:

| 1) | mission critical public safety and E911; |

| 2) | mass market, mobile apps, and data analytics; |

| 3) | eVTOLs, UAVs and autonomous vehicles; |

| 4) | IOT critical infrastructure and resilient PNT; and |

| 5) | global expansion. |

Mission Critical Public Safety and E911

Our solutions provide valuable services in the public safety market. Our Pinnacle service is currently being used by first responders enabling them to more accurately locate a user with our 3D location services. The launch of our service for E911 callers with Verizon provides more accurate information to first responders about callers’ locations during a wireless 911 call. When TerraPoiNT becomes broadly available, it is expected to provide significant additional value to first responders.

Based on information from the Bureau of Labor Statistics and the National Fire Protection Agency, we believe there are approximately 10 million primary first responders, extended primary first responders and non-military federal employees addressable by FirstNet®. We believe that these potential customers represent a total addressable market of approximately $1.2 billion.

According to the National Emergency Number Association (NENA), E911, which is a FCC required service provided by telecommunications carriers to their subscribers, is dialed approximately 240 million times each year as citizens seek to summon aid for emergencies, including medical emergencies, fires and other incidents. Because FCC rules require E911 services to convey the caller’s telephone number and detailed location information to emergency responders, geolocation is an essential element of emergency response. Currently wireless customers pay through their wireless carrier approximately $0.70 per month, depending on the jurisdiction in which they reside, into state and local E911 pools. A vast majority of those fees collected are directed towards E911 call center equipment. Based on a state-by-state review of E911 and other regulatory fees collected by wireless carriers we estimate a total addressable market for E911 location services in the United States of approximately $2.3 billion.

The FCC’s rules require wireless carriers to provide altitude information along with horizontal location information with E911 calls in urban markets, with this requirement expanding to a nationwide basis in 2025. We have the opportunity to sell our services to wireless carriers to satisfy their regulatory obligations, improve the safety of their customers, and offer certain related services to Public Safety Answering Points to enhance the usability of E911 location services directly and in partnership with other service providers.

Mass Market, Mobile Apps, and Data Analytics

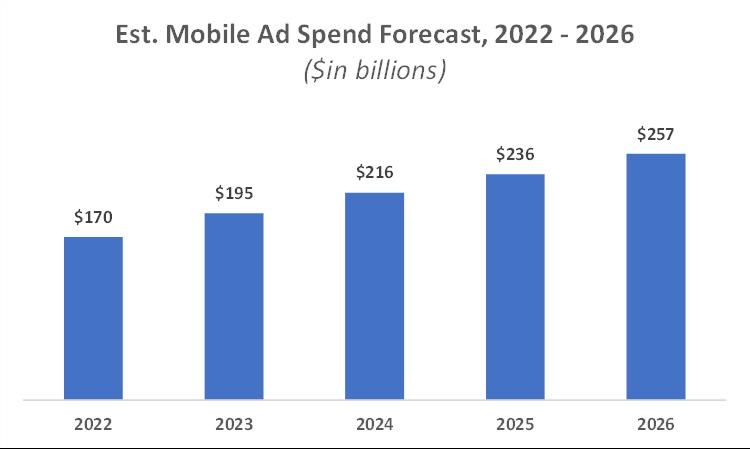

The mobile app economy relies on the availability of location data for direct services to consumers, emerging augmented reality applications and for advertising, marketing and analytics-driven monetization. Mobile advertising in the United States alone is projected by eMarketer to reach nearly $257 billion by 2026, from approximately $170 billion in 2022, and according to customer discussions approximately 40% of ad inventory is location-enabled.

| 4 |

Mobile Ad Spending

Source: eMarketer, “Mobile Ad Spending, US 2022-2026,” October 2022

Beyond mobile advertising, mobile applications use location services to enable a wide range of capabilities. According to Google, one-third, or approximately 1 million out of 3 million, apps on the Google Play Store use location. In 2019, nearly $1 billion was spent in app stores on approximately 10,000 applications hosting at least one direct location services software development kit (“SDK”) (e.g., a mapping SDK and SDKs to enhance user experiences in venues), a small subset of the total apps using location, according to Apptopia data.

Mobile gaming also increasingly relies on location. One example is Niantic’s Pokemon Go™, the location-based game that captured national attention in 2016 and continues to be the leading mobile game by revenue. Pokemon Go™ generated over $3 billion in revenue between 2016 and 2019 according to SensorTower research. According to Statista research, this augmented reality trend is expected to accelerate, from approximately 10% of mobile gaming revenue in 2020 to 75% in 2025, or approximately $7.5 billion in annual spend on augmented reality titles.

Aggregated data gathered from mass-market applications is also utilized for analytics, including foot-traffic and related analysis. Based on customer interactions and internal analysis, we believe that the total addressable market value of location-enabled analytics data and reports exceeds $6 billion.

Finally, mCommerce in the U.S. is expected to reach nearly $700 billion in 2025 according to eMarketer, growing at a compound annual growth rate (“CAGR”) of approximately 16% and is expected to result in significant online-to-offline and related opportunities.

Collectively, we believe that the total addressable market for the mass-market segment in the United States is approximately $24 billion, and is characterized by multiple high-growth sectors.

eVTOLs, UAVs and Autonomous Vehicles

eVTOLs, UAVs and autonomous vehicles require reliable, accurate location data for navigation and timing services for control system synchronization.

Based on discussions with potential customers, including leading urban air mobility (“UAM”) providers, we believe that our Pinnacle service will provide a superior altitude or pressure reference both to airframe, autopilot and autonomous systems providers, and to air traffic control and air data providers. We believe that, when deployed broadly, our TerraPoiNT service will provide a resilient, supplementary signal for urban navigation, landing and takeoff. We anticipate selling our services through a mix of per vehicle, monthly recurring and per-usage access fees.

| 5 |

According to a study by Booz Allen Hamilton in September 2019, the infrastructure-constrained UAM market in the United States could result in 1 million eVTOL trips per day. With this volume, which requires approximately 80,000 eVTOLs to be in operation, We believe that the value of enhanced navigation and air traffic control could result in an addressable market of nearly $4 billion per year.

For autonomous vehicles, sensor-based approaches that do not incorporate reliable, independent location references are challenged in poor weather, ambiguous conditions, and GPS is vulnerable especially in urban environments.

We have estimated the total addressable market in the United States for autonomous vehicle systems to be over $6 billion by 2030, based on research published by the Gartner Group and McKinsey, with over 5 million fully autonomous vehicles on the road. We believe that each of these vehicles is a potential user of our services.

Enterprise, IOT and Critical Infrastructure

Enterprise and IOT services enable connectivity and coordination within a business or governmental agency. These systems enable intelligent machines, devices and fixed or mobile assets to communicate information from the machine, device, or fixed or mobile asset to and from back-office information systems of businesses and government agencies, as applicable, that track, monitor, control and communicate with them. Location and timing services are a critical element of these systems, and apply to a wide range of use cases including asset tracking, inventory management, patient monitoring in healthcare, people and pet tracking, smart grid applications, smart parking applications, and health and well-being-oriented wearables, among others.

According to ABI Research’s “IOT Market Tracker,” as of the first quarter of 2018 there are expected to be nearly 1.3 billion connected devices in this sector by 2024, resulting in over $10 billion in service value in the United States – excluding equipment and data connectivity, and other enterprise and IOT applications. The number of devices in these areas is expected to grow at a CAGR of nearly 70% between 2020 and 2026, while addressable service revenue is expected to grow at a CAGR of 53% over the same period.

We also believe that there is a significant market for our services on a private network basis, at ex-urban college campuses and industrial facilities. We believe the total addressable market in enterprise and IOT in the United States is over $10 billion per year and growing rapidly.

GPS plays an outsized role in the U.S. economy and our critical infrastructure, including communications networks and power grids, require a reliable GPS signal for accurate timing. Given its importance, the U.S. Federal Government is actively exploring backup solutions to ensure that interruptions to GPS service do not impair the operation of critical infrastructure across various sectors identified by the U.S. Department of Homeland Security as well as other critical consumer sectors.

In a recent report published by the U.S. Department of Transportation, we offered the highest performance among technologies tested for “alternate PNT.” We are actively marketing our TerraPoiNT service to the U.S. Federal Government and other firms as a solution to ensure continuity of service across various industries including power generation and transmission, telecommunications, and aviation amongst others.

Global Expansion

We have initiated marketing of our Pinnacle and TerraPoiNT services to potential partners and customers in Canada, East Asia, Europe and the Middle East, with a focus on countries with a high reliance on GPS and location services across highly urbanized populations. We are seeing a similar emphasis globally on PNT services in: (i) mission critical public safety and E911; (ii) mass market, mobile apps, and data analytics; (iii) autonomous vehicles, eVTOLs and UAVs; and (iv) enterprise, IOT and critical infrastructure.

Our services have been piloted in multiple countries already, and in Japan, our joint venture partner MetCom has begun the process of securing a license to operate on the spectrum required for a TerraPoiNT system. We have commenced a pilot program for Pinnacle through our MetCom joint venture as well, and anticipate moving forward with a deployment of Pinnacle services in Japan. MetCom’s access to facilities through its primary backers, Sony and Kyocera, create a strong opportunity for a nationwide deployment in Japan.

Based on our analysis, we believe that the international market for its services, excluding China, Russia and Africa, is similar in size to that of the United States, and exceeds $50 billion.

| 6 |

Our Solutions

Our location systems have been engineered and deployed to provide comprehensive solutions to the limitations and vulnerabilities inherent in GPS-based services. Key GPS limitations include:

| ● | Low signal strength resulting in poor building/indoor penetration, limitations in urban areas; |

| ● | Vulnerability to jamming; |

| ● | Poor vertical accuracy in most devices, which impacts any service where altitude is relevant (e.g., multi-level structures, vertical separation in low-altitude aviation); |

| ● | The primary consumer GPS signal is unencrypted, resulting in poor location security and spoofing; |

| ● | Inherent physical vulnerability due to few, isolated transmitters; and |

| ● | Single point of failure for a wide range of PNT services. |

Isolated solutions to various aspects of the limitations to GPS-based positioning have been deployed, but none carry the primary benefit of GPS, which is high performance across a wide area.

Our current service platforms include Pinnacle, our altitude (z-axis) solution, and TerraPoiNT, which is similar to a terrestrial GPS constellation. Both systems offer metro-wide service, are inherently secure and can provide universal service access to all types of appropriately-equipped devices that use location services.

Pinnacle

Pinnacle is our z-axis service, a dedicated vertical positioning network to cover entire metropolitan areas. Pinnacle provides devices equipped with a barometric pressure sensor with the highest quality wide-area altitude service available in the U.S. market today based on a CTIA/FCC “911 Location Test Bed, LLC Report on Stage Z” from 2018. Our service is now available in the top 105 major U.S. markets, which include over 4,400 cities and over 90% of commercial buildings that exceed three stories. In November 2022, Pinnacle service was launched by MetCom in Japan, and we anticipate MetCom will expand their service area in 2023.

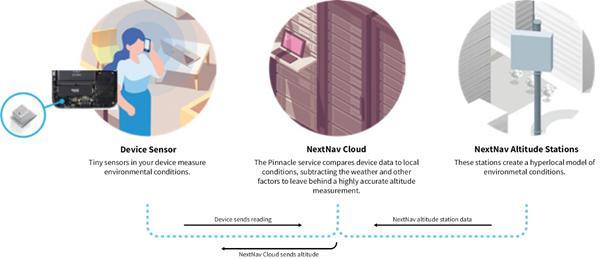

The Pinnacle service is based three primary components:

| 1) | An altitude station network, a managed network that consists of equipment designed, manufactured, deployed and operated by us, which measures key environmental variables associated with altitude to enable “floor level” altitude determination; |

| 2) | Device software, which supports delivery of our z-axis service to mobile apps and other devices, calibration of the pressure sensors on individual devices and receipt of z-axis data from our cloud services platform; and |

| 3) | A secure cloud services platform, which actively manages our altitude station network, synthesizes data from our network and devices to enable service delivery, and performs access management functions. |

The diagram below illustrates the basic process flow of the z-axis service.

| 7 |

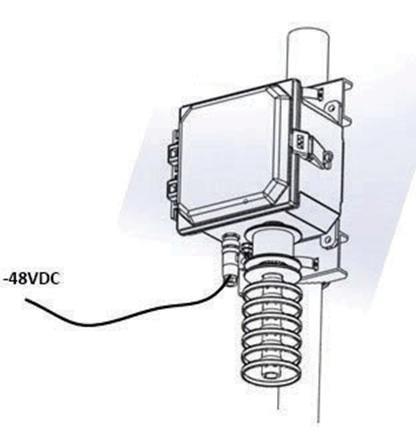

Pinnacle works by leveraging the physical principal that barometric pressure declines as altitude increases. By measuring the barometric pressure at a device, and comparing that measurement to the measurements from our network, we can accurately compute the altitude of the sensor. A Pinnacle altitude station is depicted below, and measures approximately 16” x 6” x 4”.

Because our Pinnacle technology relies on barometric pressure measurement, it works with the hardware currently used in most mobile phones and tablets. Our Pinnacle service can be delivered to customers in this segment over an applications programming interface (“API”) or via an SDK integrated into the relevant applications.

In order to expand access to and use of our Pinnacle services, we work closely with sensor vendors to provide input on key sensor performance factors necessary to produce optimal Pinnacle services. We also recently launched the NextNav Certified™ program. The NextNav Certified™ program allows pressure sensor vendors to perform a set of tests monitored by us. If a vendor meets the criteria for performance while adhering to the test procedures, the vendor can display the NextNav badge on its website and use the endorsement in its marketing to device vendors. Bosch Sensortec, InvenSense Goertek and ST Microelectronics currently offer NextNav Certified™ sensors.

TerraPoiNT

TerraPoiNT is our full 3D PNT system, standardized in the global telecommunications standards group, 3GPP Release 13 as Metropolitan Beacon System (“MBS”). The current technical specification for the standard MBS signal, or Interface Control Document, can be downloaded from ATIS, the North American affiliate to 3GPP. We are in the process of evolving our transmission and this technical specification, subject to the successful integration of technologies acquired from Nestwave. We license elements of our receiver technology to third-party chipset providers and device vendors, typically with no per device royalty, to enable the reception of our signal on their devices.

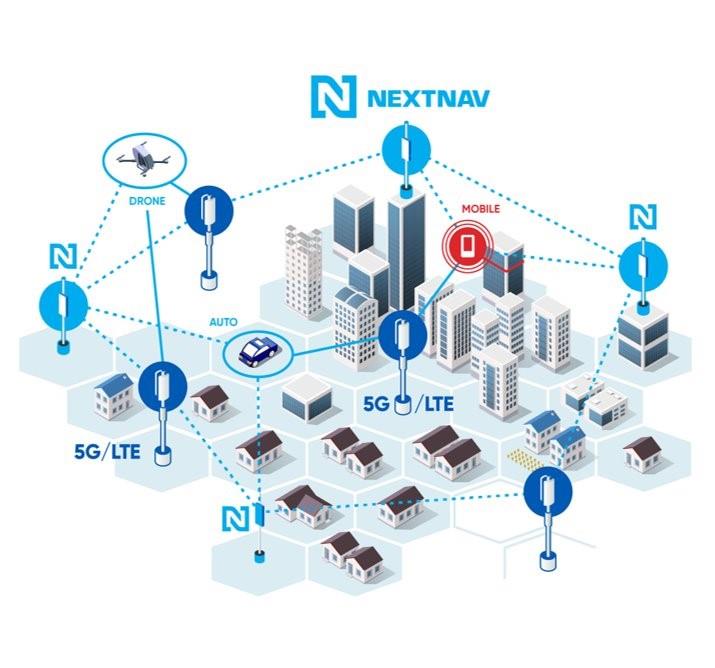

Positioning, navigation and timing are the core services provided by GPS, and TerraPoiNT can be thought of as a land-based GPS satellite constellation, but with the broadcast transmitters, which we call “beacons.” In the United States, this service operates on 8 MHz of contiguous LMS spectrum licensed to us in the 900 MHz band, and covering approximately 93% of the U.S. population (see “Radio Spectrum” for more information about these licenses). We have deployed a wide area, commercial grade TerraPoiNT network in 2 markets in the San Francisco Bay Area and in smaller networks in 83 additional markets throughout the U.S. We are also conducting a pilot program with our joint venture partner MetCom in Japan to support a possible spectrum allocation.

| 8 |

The key elements of the TerraPoiNT service are:

| ● | TerraPoiNT beacons and signal measurement units, which include high-precision timing and synchronization capabilities, designed, manufactured in the United States, deployed and operated by us; |

| ● | Devices equipped to receive the TerraPoiNT signal, which include an appropriately-designed chip and 900 MHz radio elements; and |

| ● | Cloud services platform, which in the case of TerraPoiNT services provides high quality positioning, timing calibration of third party signals, network management and service access functions to certain types of devices. |

The TerraPoiNT beacons each include a high-precision atomic clocking source, and the ability to synchronize locally with nearby beacons by sharing their timing signals. The beacon network is also synchronized to Coordinated Universal Time, the global time standard broadcast by GPS and other NIST-traceable sources.

This architecture is naturally resilient to service disruption and significantly more resistant to jamming than GPS. If GPS is disrupted, or completely eliminated, a TerraPoiNT transmitter continues to operate and provide similar service within the TerraPoiNT service area. If one TerraPoiNT beacon is disrupted, service continues from other nearby beacons. Thus, there is both local and national resilience embedded in the basic system design. By operating terrestrially in the 900 MHz LMS band, the TerraPoiNT signal is approximately 100,000 times stronger than GPS, and thus is significantly more difficult to disrupt.

| 9 |

TerraPoiNT was initially designed for maximum compatibility with GPS and other GNSS receivers, previously demonstrated by Broadcom on a version of their 4775 platform and GCT’s GDM7243i. We expect TerraPoiNT's signal waveform to evolve to be compatible with standard LTE/5G receivers. This evolution will enable the TerraPoiNT signal to be processed by the hardware used to process LTE and 5G signals. Separately, hybrid operation of our system will allow us to rely in part on third party cellular signals that have been calibrated by our network. We anticipate that such a signal evolution would increase our spectral efficiency significantly, allowing us to offer a data capacity equivalent to other LTE/5G signals for the same bandwidth. This increased data transmission capacity could be used, subject to FCC approval, to provide other types of LTE/5G-based two-way voice and data transmission services while maintaining our PNT capabilities.

The expansion of the TerraPoiNT network build-out will require significant investment, however, compared to prior estimates, we believe that the hybrid operation of our network will require significantly less capital than that required by our historical network architecture. Once it is fully built-out, we expect to incur minimal ongoing maintenance capital expenditures to maintain the network. As a result, our business model provides significant operating leverage as the business scales due to low variable costs to adding incremental network traffic.

Privacy and Data Security

We understand that protection of data and privacy is critically important to the end-users of our services. Our core privacy principles are:

| 1. | Transparency: We are transparent about our data practices, and we comply with our privacy policies and agreements so customers and business partners can make informed decisions. |

| 2. | Control: We have implemented appropriate means for our customers and business partners to control relevant personal and business information. |

| 3. | Security: We endeavor to protect the data entrusted to us by using strong security protocols. |

| 4. | Compliance: We respect and comply with local privacy laws, ensuring that privacy-by-design is a core consideration as we develop our products and services. |

| 5. | Consent: We require appropriate opt-in consent for the provision of all of our services, consistent with the requirements of local law. |

Based on industry best-practices, we have implemented multilayered administrative, physical, and technical security measures to protect data. Data access is implemented with the rule of “least privilege,” and we isolate data by service, business function and customer agreement. Our data is encrypted both at rest (locally on the device and on the server) and in transit.

Manufacturing and Network Operations

Manufacturing

Our services are provided in part through equipment we design, generally manufactured under contract by domestic vendors in the United States. The Pinnacle altitude stations were designed to provide a very high performance reference for altitude determination at a low cost. The TerraPoiNT beacons are sophisticated broadcast transmitters that incorporate a very accurate timing system to provide a signal that is similar to that provided by GPS in a terrestrial transmitter. These units are designed to be integrated with our cloud services platform, and managed by software that we designed and created for these systems.

Network Operations

We operate two separate and distinct networks. The Pinnacle network is primarily operated in partnership with AT&T. The Pinnacle altitude stations are co-located at AT&T wireless sites and take advantage of the power systems, including battery backup and generators, at the AT&T sites. We monitor the Pinnacle network health through our network operations center (“NOC”) and work with AT&T to resolve any issues that may arise. Connectivity among the Pinnacle altitude stations, our cloud service platform, and our NOC are enabled through wireless connections, currently provided by AT&T.

We are not required to use AT&T wireless sites for network expansion, and may establish new service areas through independently-acquired site leases or with other partners.

Our TerraPoiNT network is deployed, operated, and maintained by us. The equipment is installed at traditional wireless sites with a mix of towers and rooftops. We monitor the network health through the same NOC as the Pinnacle network and directly dispatch our maintenance contractors if needed.

AT&T Relationship

We have entered into a series of agreements with AT&T to provide our Pinnacle services to FirstNet®, built with AT&T, and to enable the co-location of elements of our network at AT&T’s wireless sites. By co-locating the Pinnacle equipment at AT&T wireless sites, we were able to accelerate the nationwide deployment of our services and significantly reduce the ongoing operating costs associated with the Pinnacle system.

| 10 |

Our AT&T agreements provide for: (i) AT&T’s marketing and resale of Pinnacle services to FirstNet® subscribers and certain pricing requirements for our SDKs based on the quantity of usage, revenue sharing, compliance with data rights and privacy, and support requirements; and (ii) AT&T hosting of Pinnacle equipment for altitude determination at AT&T sites, at no recurring cost to us.

We have provided AT&T with performance assurances and certain intellectual property and transition support rights in the event we are unable to continue providing services to AT&T, have significant service outages, or engage in transactions with certain persons. The parties also entered into escrow arrangements on customary terms for intellectual property storage and verification of the deposited escrow materials in various different escrow “lockers,” which could be accessed by AT&T based on different conditions on which the draw down could be made.

In 2019, we entered into an equipment hosting agreement with AT&T that has a seven-year term (subject to earlier termination after three years in certain circumstances), expiring in October 2026. Under the terms of the equipment hosting agreement, AT&T is providing all site related services during AT&T’s continued use of the service. However, if AT&T ceases to use our services after the first three years (i.e. October 2022), then we may terminate the equipment hosting agreement or if we are not in breach of the agreement we may continue the agreement for the remainder of the term and we will have to pay for power and, LTE connectivity and incremental lease costs incurred by AT&T to host the equipment, if any. Our services agreement with AT&T for distribution of our services to FirstNet® customers, which was scheduled to expire in October 2022, has been extended to January 7, 2024.

Competition and Competitive Advantages

The geolocation industry is highly competitive and we compete with incumbent geolocation services like GPS, Wi-Fi, and cellular signals, augmented by other sensor inputs, as well as other companies who are new entrants into the market seeking to provide a solution to the same needs as we are.

The increasing demand for location services has resulted in the development of a number of supplements and alternatives to traditional GPS. The primary candidates for GPS backup technologies are based on approaches that are significantly different than the technical approach adopted by us. These competitive technologies include:

| ● | eLORAN. eLORAN is an advanced version of the World War II-era hyperbolic radio navigation system that was developed in response to the perceived vulnerability of the GNSS systems. eLORAN, like its predecessor uses very low frequencies (in the 100 kHz range), but has an advanced receiver design and transmission characteristics, which increase the accuracy and usefulness of traditional LORAN. These enhancements make it a suitable substitute for GPS. Because eLORAN requires larger antennas and form factor for its receivers, it does not have the same reach as our solutions. It is more suitable for more rural and maritime types of environment. |

| ● | LEO Satellite Systems. Low Earth orbit (“LEO”) satellite systems offer primarily timing service based on signals transmitted from low earth orbit satellite constellations, transmitted in the L-Band. Because it is in a lower orbit, the LEO signal is much stronger than GPS, allowing for improved reception in urban areas and limited indoor reception. The primary limitation of LEO-based systems is that they remain a satellite-based signal, so the signal is not as strong as a terrestrial-based system. In addition, as an add-on technology, its design is not as flexible as a dedicated system. |

| ● | Commercial Location Systems. Commercial location systems generally include cellular systems, crowd-sourced systems and locally managed systems. Cellular systems may use localized millimeter wave transmitters in 5G which provides location performance in the immediate vicinity of such 5G transmitters, but the service area of this capability, if deployed, is expected to be limited. Cellular systems are typically used as a fallback when the GPS signal is not available (e.g., indoors), but do not provide the same accuracy that our solutions provide and are ultimately dependent on GPS. Crowd-sourced systems, such as those provided by Google and Apple through APIs in their mobile operation system platforms, rely on the application of machine learning techniques to location information gathered from mobile devices. These systems are “best-efforts systems” that compare GPS measurements to Wi-Fi access point signal strength, cellular signals and other signals gathered from millions of devices to estimate the location of the access points. Crowd-sourced systems vary considerably in accuracy, offer less accurate vertical positioning information and are subject to degradation if there is an issue with local power and local access points. Locally Managed Systems are systems that rely on the management of lower-power signals, managed WiFi, Bluetooth Low Energy, dedicated beacons with large bandwidth requirements and Ultrawideband to provide location services. These systems are centrally managed by the enterprise or a vendor, and typically offer high accuracy and reliability, but are expensive to deploy and manage, offer only limited coverage, are dependent upon local power sources and are usually only available to the entity that deployed them. Most commercial locations systems do not provide an independent timing source, so are limited in their ability to be a viable backup to GPS. |

We believe our 3D solutions offer a superior alternative to each of these services. A summary of a report published in 2021 by the U.S. Department of Transportation characterizes and ranks the different available systems.

| 11 |

| (1) | Weighted score based upon accuracy, availability, product readiness, resilience and security. |

| (2) | Weighted score based upon accuracy, availability, product readiness, resilience and security. |

| (3) | Market readiness of Timing Performance using terrestrial RF broadcast. |

| (4) | Mass market readiness for Position AND Timing using terrestrial RF broadcast. |

| (5) | Mass market readiness of timing using RF broadcast. |

| (6) | Mass market readiness for Timing AND Positioning using RF broadcast. |

As indicated by the aforementioned results, our solutions offer a differentiated quality over our competitors. We offer significantly better indoor and outdoor performance with receivers that, at production scale, have reduced power consumption and no incremental cost or size difference with GPS. Our system is also significantly more resilient due to its distributed, metro-oriented architecture. We offer better performance and a much stronger signal, due to its terrestrial deployment. It is also more resilient, and has greater design flexibility as a dedicated system as opposed to a feature added to a legacy communications satellite network. Our solutions are not impacted by the density of third party access points, building power, or other issues, and are suitable for any device — from an airplane to a phone to an IOT tracking module.

While various competitors may provide individual elements such as altitude, or timing-only capability, we believe that we provide the only solutions addressing full customer requirements around positioning, navigation and timing. Our solutions are consistently accurate in nearly all environments and conditions. We are well-positioned to compete in our industry based on our core competencies and on the following competitive strengths:

| ● | Physical altitude network that covers over 4,400 U.S. cities and towns and 90% of all commercial building in excess of three stories |

| ● | Unique nationwide spectrum asset of 8MHz of contiguous, 900MHz LMS spectrum, covering 93% of the U.S. population and representing 2.4 billion MHz-PoPs |

| ● | Technological innovation |

| ● | Highest performing GPS backup solution provider as determined by Department of Transportation |

| ● | Global IP portfolio of more than 150 patents that covers the core technology, network design and services capability |

| ● | Visionary and experienced management team |

The combination of these elements puts us in a unique position that cannot be easily replicated. We believe that our collective expertise, coupled with the aforementioned strengths, will allow us to build our business and expand our market opportunity and addressable markets.

| 12 |

Intellectual Property

Our ability to drive innovation in PNT services depends in part upon our ability to protect our core technologies and intellectual property. We rely upon a combination of patent, trademark and trade secret laws in the United States and abroad, as well as license agreements and other contractual protections. In addition, we seek to protect our intellectual property rights through nondisclosure and invention assignment agreements with our employees and consultants and through non-disclosure agreements with business partners and other third parties.

We regularly file applications for patents and have a significant number of patents in the United States and other countries where we do business.

As of December 31, 2022, we had approximately 153 issued patents domestically and internationally, which includes approximately 104 issued patents in the US. In addition, we had approximately 87 pending patent applications, which includes approximately 38 pending patent applications in the U.S.

Sales and Marketing

We sell our solutions directly to customers or through partners. We plan to scale and accelerate our sales and marketing efforts and leverage our recent customer wins to grow our customer base using a global network of sales professionals and distribution relationships. Additionally, we expect existing customers to expand their contracts with us for the deployment of additional services. New service offerings and product features will be introduced over time to increase market share and grow the total addressable market for our services.

Our marketing strategies are focused on supporting sales growth by (i) driving awareness; (ii) developing comprehensive sales and marketing content; and (iii) scaling our efforts with our partners and customers. We drive awareness for our solutions and our customers’ successes through communications efforts and participation to leading industry standards.

In addition, our key customers have held webinars, issued press releases and raised the awareness of our service availability with their customers and in the public safety market. For example, AT&T may make further introductions to app developers and other service providers, and we believe that AT&T’s adoption and marketing activities are resulting in the broader adoption of our services in the public safety market.

We also seek partnership to offer service internationally. For example, we have formed a joint venture in Japan with MetCom to operate our TerraPoiNT system and Pinnacle system for commercial services, leveraging Sony and Kyocera network infrastructure.

Research and Development

We have significant in-house capabilities in the engineering and development of location-based technology. The services that we provide are largely based on designs and technologies developed by us for our use, some of which we subsequently standardized. We invest significant resources into research and development programs because we believe our ability to maintain and extend our market share depends, in part, on our continuous innovations. These innovations offer a unique value proposition for our customers and differentiate us from our competitors. Our research and development team, which consists of 73 employees, is responsible for the development of both the Pinnacle and TerraPoiNT solutions. Our research and development team consists of talented engineers, scientists, and professionals who have been pioneers in location-based services. Our primary areas of focus in research and development include, but are not limited to:

| ● | Radiolocation position and navigation technologies; |

| ● | Precision timing and time distribution; |

| ● | Hybrid positioning and timing systems; |

| ● | Altitude determination, including barometric altitude determination; and |

| ● | Location verification techniques, including techniques to mitigate spoofing. |

| 13 |

Human Capital

We pride ourselves on the quality of our world-class team and seek to hire employees dedicated to our strategic mission. Our employees typically have significant experience working with location systems. As of December 31, 2022, we employed 106 full-time employees, the majority in our headquarters in McLean, Virginia and in our facility in Sunnyvale, California. Of our employee base, 45 employees are located outside the U.S. – two in Canada, 25 in India, and 18 in France. Over 73 of our employees are engaged in research and development and related functions, and more than half of these employees hold advanced engineering and scientific degrees, including many from the world’s top universities.

To date, we have not experienced any work stoppages and consider our relationship with our employees to be good. None of our employees are either represented by a labor union or subject to a collective bargaining agreement.

Facilities

We maintain a distributed workforce with facilities in McLean, Virginia, Sunnyvale, California, Neuilly-sur-Seine, France, Noida, India and Bangalore, India. Our principle executive office is in McLean, Virginia. Our corporate offices in Virginia include finance, regulatory and network deployment functions, while our California facility hosts our technology development functions, among other functions. Our French and Indian locations house a mix of employees and contractors focused on software development and research and development functions. We may add additional facilities in other locations in the future.

Regulatory

There are government regulations pertaining to our operation, use, and export of our vertical location and PNT solutions, some of which are currently applicable to us and others that will become applicable to us as we expand our operations. As we expand service to additional countries and regions, we will become subject to additional governmental approvals and regulations.

Radio Spectrum

Certain of our services rely on the use of radio communications spectrum, which is regulated in the United States and in most other countries. In the United States, spectrum access is licensed and regulated by the FCC. We hold radio licenses issued by the FCC that authorize the use of 8 MHz of contiguous spectrum in the 900 MHz band covering approximately 93% of the population in the United States. These licenses and the FCC rules impose obligations on us regarding the use of this spectrum, including power and operational limits, spectrum sharing and interference restrictions, build out and usage requirements, and a license renewal obligation. We must comply with these requirements in order to retain access and use of its spectrum resources.

Privacy

In developing highly accurate location information, we collect, process, transmit and store personal information, such as certain individual geolocation information, and other personal information relating to its business contacts, personnel, end users, and website visitors. A variety of federal and state laws and regulations govern the collection, use, retention, sharing and security of this information. The U.S. privacy and data protection legal landscape continues to evolve, with California and Virginia having enacted broad-based data privacy and protection legislation and with states and the federal government continuing to consider additional data privacy and protection legislation. As we expand overseas, our joint venture partners will be subject to foreign data privacy and protection legislation, and we may be as well.

| 14 |

Export

Our business plans are based in part on the distribution of its services worldwide. We are required to comply with U.S. export control laws and regulations, including the Export Administration Regulations (“EAR”) administered by the U.S. Department of Commerce’s Bureau of Industry and Security and the foreign asset control regulations administered by the U.S. Department of the Treasury’s Office of Foreign Assets Control. Pursuant to these foreign trade control laws and regulations, we are required, among other things, to (i) determine the proper licensing jurisdiction and export classification of products, software, and technology, (ii) obtain licenses or other forms of U.S. government authorization, or qualify for exceptions, to export our products, software, and technology outside the United States, and (iii) avoid engaging in unauthorized transactions with certain sanctioned countries, territories, entities, and individuals. Violations of applicable export control and sanctions laws and related regulations, which are enforced on a strict liability basis, could result in criminal and administrative penalties, including fines and possible denial of export privileges. U.S. export licenses or license exceptions are required to transfer or make accessible certain of our software source code and technology to our non-U.S. employees. In addition, U.S. export control laws and related licensing policies continue to change, further regulating the export and re-export of our products, services, and technology from the United States and abroad, and increasing our costs and the time necessary to obtain required authorization.

See the section entitled “Risk Factors — Risks Related to Legal and Regulatory Matters” for additional information regarding the regulatory requirements applicable to us.

Business Combination

On October 28, 2021 (the “Closing Date”), we consummated business combination pursuant to the terms of the Agreement and Plan of Merger, dated as of June 9, 2021, by and among us, Spartacus Acquisition Corporation, a Delaware special purpose acquisition company (“Spartacus”), NextNav Holdings, LLC, a Delaware limited liability company (“Holdings”) and the other parties thereto (the “Business Combination”). As a result of the Business Combination, certain blocker entities formed by Holdings equity holders, Holdings and the various operating subsidiaries of Holdings became our wholly owned subsidiaries, with the equity holders of each of such blocker entities and Holdings and Spartacus’ stockholders becoming our stockholders. In connection with the Business Combination, we changed our name to NextNav Inc. and the Nasdaq ticker symbols for our Common Stock and warrants to “NN” and “NNAVW,” respectively.

Corporate Information and Access to SEC Reports

We were incorporated under the laws of the State of Delaware in May 2021 under the name “Spartacus Acquisition Shelf Corp.” by Spartacus Acquisition Corporation, a Delaware special purpose acquisition company, for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or other similar business combination with one or more businesses or assets. On October 28, 2021, in connection with the closing of the Business Combination, we changed our name to “NextNav Inc.”

Our principal executive office is located at 1775 Tysons Blvd., 5th Floor, McLean, VA 22102. Our telephone number is (800) 775-0982, and our website address is www.nextnav.com. Information contained on, or accessible through, our website is provided for textual reference only and does not constitute part of, and is not incorporated by reference into, this Annual Report on Form 10-K.

Our operating subsidiary, NextNav, LLC (a wholly owned subsidiary of NextNav Holdings, LLC), was formed in October 2007 under the laws of the State of Delaware. In connection with the Business Combination, the various operating subsidiaries of NextNav Holdings, LLC became our wholly owned subsidiaries.

We make our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports, available free of charge in the “Investors” section of our website as soon as reasonably practicable after we file these reports with the SEC. We routinely post these reports, recent news and announcements, financial results and other important information about our business on our website at www.nextnav.com. Information contained on our website is not a part of this Annual Report on Form 10-K.

In addition, the United States Securities and Exchange Commission (“SEC”) maintains an Internet website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

| 15 |

An investment in our securities involves a high degree of risk. You should carefully consider the following risk factors, together with all of the other information included in this Annual Report on Form 10-K, before you decide whether to invest in our securities. We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial, which may also impair our business. The following discussion should be read in connection with the financial statements and notes to the financial statements contained elsewhere in this Annual Report on Form 10-K. You should consult your own financial and legal advisors as to the risks entailed by an investment in our securities and the suitability of investing in our securities in light of your particular circumstances. Some statements in this Annual Report on Form 10-K, including such statements in the following risk factors, constitute forward-looking statements. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to the Business and the Industry

We have incurred significant losses since inception. We expect to incur losses in the future, may not be able to achieve or maintain profitability, and may need to raise additional capital to maintain our operations in the future.

We have incurred significant losses since inception and until the second quarter of 2021 had not widely commercially sold our solutions. For the years ended December 31, 2022, 2021 and 2020, we incurred net losses of $40.1 million, $144.7 million and $137.3 million, respectively. Furthermore, any expansion of our TerraPoiNT services will result in increased operating costs. As a result, our losses are expected to continue and we may not achieve profitability when expected, or at all. Even if we do, we may not be able to maintain or increase profitability.