UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________________ to __________________

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

NA |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

☒ |

|

Smaller reporting company |

|

||

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes

As of November 8, 2022, the registrant had

Table of Contents

|

|

Page |

PART I. |

1 |

|

Item 1. |

1 |

|

|

1 |

|

|

Condensed Consolidated Statements of Operations and Comprehensive Loss |

2 |

|

3 |

|

|

4 |

|

|

5 |

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

14 |

Item 3. |

27 |

|

Item 4. |

27 |

|

PART II. |

28 |

|

Item 1. |

28 |

|

Item 1A. |

28 |

|

Item 2. |

29 |

|

Item 3. |

29 |

|

Item 4. |

29 |

|

Item 5. |

30 |

|

Item 6. |

31 |

|

32 |

||

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical fact contained in this Quarterly Report on Form 10-Q, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “should,” “would,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this Quarterly Report on Form 10-Q are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this Quarterly Report on Form 10-Q and are subject to a number of risks, uncertainties and assumptions described in the section titled “Risk Factors” and elsewhere in this Quarterly Report on Form 10-Q. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Some of the key factors that could cause actual results to differ from our expectations include:

ii

These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by these forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, among other things, those set forth in Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2021 and Part II, Item 1A - “Risk Factors” and for the reasons described elsewhere in this Quarterly Report on Form 10-Q. Any forward-looking statement in this Quarterly Report on Form 10-Q reflects our current view with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to our operations, results of operations, industry, and future growth. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

This Quarterly Report on Form 10-Q also contains estimates, projections, and other information concerning our industry, our business, and the markets for certain drugs, including data regarding the estimated size of those markets, their projected growth rates, and the incidence of certain medical conditions. Information that is based on estimates, forecasts, projections, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained these industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by third parties, industry, medical and general publications, government data, and similar sources. In some cases, we do not expressly refer to the sources from which these data are derived.

Except where the context otherwise requires, in this Quarterly Report on Form 10-Q, “we,” “us,” “our,” “IO Biotech,” and the “Company” refer to IO Biotech, Inc. and, where appropriate, its consolidated subsidiaries.

Trademarks

We have applied for various trademarks that we use in connection with the operation of our business. This Quarterly Report on Form 10-Q includes trademarks, service marks, and trade names owned by us or other companies. All trademarks, service marks, and trade names included in this Quarterly Report on Form 10-Q are the property of their respective owners. Solely for convenience, the trademarks and trade names in this report may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

iii

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

IO BIOTECH, INC.

Condensed Consolidated Balance Sheets

(In thousands, except share and per share amounts)

(unaudited)

|

|

September 30, |

|

|

December 31, |

|

||

Assets |

|

|

|

|

|

|

||

Current assets |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Restricted cash |

|

|

|

|

|

|

||

Property and equipment, net |

|

|

|

|

|

|

||

Right of use lease asset |

|

|

|

|

|

— |

|

|

Noncurrent assets |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

Liabilities, convertible preference shares and stockholders’ equity |

|

|

|

|

|

|

||

Current liabilities |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

|

|

$ |

|

||

Lease liability - current |

|

|

|

|

|

— |

|

|

Accrued expenses and other current liabilities |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Lease liability - noncurrent |

|

|

|

|

|

— |

|

|

Other long-term liabilities |

|

|

— |

|

|

|

|

|

Total liabilities |

|

|

|

|

|

|

||

|

|

— |

|

|

|

— |

|

|

Convertible preference shares |

|

|

— |

|

|

|

— |

|

Stockholders’ equity |

|

|

|

|

|

|

||

Preferred stock, par value of $ |

|

|

|

|

|

|

||

Common stock, par value of $ |

|

|

|

|

|

|

||

Additional paid-in capital |

|

|

|

|

|

|

||

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

Accumulated other comprehensive loss |

|

|

( |

) |

|

|

( |

) |

Total stockholders’ equity |

|

|

|

|

|

|

||

Total liabilities, convertible preference shares and stockholders’ equity |

|

$ |

|

|

$ |

|

||

See accompanying notes to the condensed consolidated financial statements.

1

IO BIOTECH, INC.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share amounts)

(unaudited)

|

|

For the Three Months |

|

|

Nine Months Ended |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Research and development |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Loss from operations |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Currency exchange (loss) gain, net |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||

Interest income |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

Interest expense |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Fair value adjustments on preference shares tranche obligations |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

Total other income (expense), net |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Loss before income tax expense |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Income tax expense |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

Net loss |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Cumulative dividends on class B and C preference shares |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Net loss attributable to common shareholders |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Net loss per common share, basic and diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Weighted-average number of shares used in computing net loss per common share, basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Foreign currency translation |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Total comprehensive loss |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

See accompanying notes to the condensed consolidated financial statements.

2

IO BIOTECH, INC.

(In thousands, except share amounts)

(unaudited)

|

|

Class B Convertible |

|

|

Class C Convertible |

|

|

|

Common Stock |

|

|

Class A |

|

|

Additional |

|

|

Other |

|

|

Accumulated |

|

|

Total |

|

||||||||||||||||||||||||

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Loss |

|

|

Deficit |

|

|

Equity (Deficit) |

|

||||||||||||

Balance, January 1, 2021 |

|

|

|

|

$ |

|

|

|

— |

|

|

$ |

— |

|

|

|

|

— |

|

|

$ |

— |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

||||||

Issuance of class C preference shares, net of issuance costs of $ |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

||

Equity-based compensation |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||||

Foreign currency translation |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

||

Net loss |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

||

Balance, September 30, 2021 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

— |

|

|

$ |

— |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Balance, January 1, 2022 |

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

|

|

|

— |

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

Equity-based compensation |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

||||

Foreign currency translation |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

||

Net loss |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

||

Balance, September 30, 2022 |

|

|

— |

|

|

$ |

— |

|

|

|

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

|

|

|

— |

|

|

$ |

— |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

|

||||

See accompanying notes to the condensed consolidated financial statements.

3

IO BIOTECH, INC.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(unaudited)

|

|

Nine Months Ended |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Cash flows from operating activities |

|

|

|

|

|

|

||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

Adjustment to reconcile net loss to net cash used in operating activities |

|

|

|

|

|

|

||

Depreciation |

|

|

|

|

|

— |

|

|

Equity-based compensation |

|

|

|

|

|

|

||

Fair value adjustments preference shares tranche obligations |

|

|

— |

|

|

|

|

|

Amortization of right of use lease asset |

|

|

|

|

|

— |

|

|

Foreign currency loss (gain) |

|

|

|

|

|

( |

) |

|

Changes in operating assets and liabilities |

|

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

( |

) |

|

Accounts payable |

|

|

( |

) |

|

|

|

|

Lease liability |

|

|

( |

) |

|

|

— |

|

Accrued expenses and other current liabilities |

|

|

( |

) |

|

|

|

|

Net cash used in operating activities |

|

|

( |

) |

|

|

( |

) |

Cash flows from investing activities |

|

|

|

|

|

|

||

Purchase of property and equipment |

|

|

( |

) |

|

|

( |

) |

Net cash used in investing activities |

|

|

( |

) |

|

|

( |

) |

Cash flows from financing activities |

|

|

|

|

|

|

||

Proceeds from issuance of preference shares |

|

|

— |

|

|

|

|

|

Preference shares issuance costs |

|

|

— |

|

|

|

( |

) |

Net cash provided by financing activities |

|

|

— |

|

|

|

|

|

Net (decrease) increase in cash, cash equivalents and restricted cash |

|

|

( |

) |

|

|

|

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

|

( |

) |

|

|

( |

) |

Cash, cash equivalents and restricted cash, beginning of period |

|

|

|

|

|

|

||

Cash, cash equivalents and restricted cash, end of period |

|

$ |

|

|

$ |

|

||

Components of cash, cash equivalents, and restricted cash |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

|

|

|

|

|

||

Restricted cash |

|

|

|

|

|

— |

|

|

Total cash, cash equivalents and restricted cash |

|

$ |

|

|

$ |

|

||

Supplemental disclosures of non-cash investing activities: |

|

|

|

|

|

|

||

Purchases of property and equipment in accounts payable |

|

$ |

|

|

$ |

— |

|

|

See accompanying notes to the condensed consolidated financial statements.

4

Notes to Condensed Consolidated Financial Statements

(unaudited)

1. Description of Business, Organization and Liquidity

Business

IO Biotech, Inc. is a clinical-stage biotechnology company dedicated to the identification and development of disruptive immune therapies for the treatment of cancer. As used in these financial statements, unless the context otherwise requires, references to the “Company”, “we,” “us,” and “our” refer to IO Biotech, Inc. and its subsidiaries. IO Biotech ApS was incorporated in Denmark in December 2014. We are developing novel, immune-modulating cancer therapies based on our T-win technology platform.

Corporate Reorganization

In November 2021, we completed a corporate reorganization whereby IO Biotech ApS became a wholly-owned subsidiary of the Company. In connection with the corporate reorganization, each issued and outstanding class A ordinary share ($

Risks and Uncertainties

We are subject to risks common to companies in the biotechnology industry including, but not limited to, new technological innovations, protection of proprietary technology, dependence on key personnel, compliance with government regulations and the need to obtain additional financing. Product candidates currently under development will require significant additional research and development efforts, including extensive pre-clinical and clinical testing and regulatory approval, prior to commercialization. These efforts require significant amounts of additional capital, adequate personnel infrastructure and extensive compliance reporting capabilities.

Our product candidates are in development. There can be no assurance that our research and development will be successfully completed, that adequate protection for our intellectual property will be obtained, that any products developed will obtain necessary government regulatory approval or that any approved products will be commercially viable. Even if our product development efforts are successful, it is uncertain when, if ever, we will generate significant revenue from product sales. We operate in an environment of rapid change in technology and substantial competition from pharmaceutical and biotechnology companies. In addition, we are dependent upon the services of our employees and consultants.

Liquidity Considerations

Since inception, we have devoted substantially all our efforts to business planning, conducting research and development, recruiting management and technical staff, and raising capital. We have financed our operations primarily through the issuance of convertible preference shares, convertible notes and, most recently, our initial public offering (IPO).

Our continued discovery and development of the Company's product candidates will require significant additional research and development efforts, including extensive preclinical and clinical testing and regulatory approval prior to commercialization. These efforts require significant amounts of additional capital, adequate personnel and infrastructure and extensive compliance-reporting capabilities. Even if product development efforts are successful, it is uncertain when, if ever, we will realize significant revenue from product sales.

As of September 30, 2022, we had an accumulated deficit of $

5

Coronavirus Pandemic

In March 2020, the World Health Organization declared the COVID-19 outbreak a pandemic. In order to mitigate the spread of COVID-19, governments have imposed unprecedented restrictions on business operations, travel and gatherings, resulting in a global economic downturn and other adverse economic and societal impacts. The COVID-19 pandemic has also overwhelmed or otherwise led to changes in the operations of many healthcare facilities, including clinical trial sites. As a result of the ongoing COVID-19 pandemic and continuing resource constraints on CROs, us, prospective clinical trial sites and others, we are currently experiencing longer than expected lead times in clinical trial site activation and patient enrollment in our clinical trials. We cannot predict the scope and severity of any further disruptions as a result of COVID-19 and continuing resource constraints or their impacts on CROs, us, clinical trial sites and others. But continuing resource constraints or business disruptions for us or any of the third parties with whom we engage, including the collaborators, contract organizations, third-party manufacturers, suppliers, clinical trial sites, regulators and other third parties with whom we conduct business could materially and negatively impact our ability to conduct our business in the manner and on the timelines presently planned.

2. Summary of Significant Accounting Policies

There have been no changes to the significant accounting policies as disclosed in Note 2 to the Company’s annual financial statements for the years ended December 31, 2021 and 2020 included in its annual report on Form 10-K filed with the Securities and Exchange Commission (SEC), other than those described below.

Unaudited Financial Information

The Company’s condensed consolidated financial statements included herein have been prepared in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP), and pursuant to the rules and regulations of the SEC. In the Company’s opinion, the information furnished reflects all adjustments, all of which are of a normal and recurring nature, necessary for a fair presentation of the financial position and results of operations for the reported interim periods. The Company considers events or transactions that occur after the balance sheet date but before the financial statements are issued to provide additional evidence relative to certain estimates or to identify matters that require additional disclosure. The results of operations for interim periods are not necessarily indicative of results to be expected for the full year or any other interim period.

Leases

In February 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2016 02, “Leases” (“ASC 842”) to enhance the transparency and comparability of financial reporting related to leasing arrangements. Under this new lease standard, most leases are required to be recognized on the balance sheet as right-of-use assets and lease liabilities. Disclosure requirements have been enhanced with the objective of enabling financial statement users to assess the amount, timing, and uncertainty of cash flows arising from leases. Prior to January 1, 2019, U.S. GAAP did not require lessees to recognize assets and liabilities related to operating leases on the balance sheet. The new standard establishes a right-of-use model (ROU) that requires a lessee to recognize a ROU asset and corresponding lease liability on the balance sheet for all leases with a term longer than 12 months. Leases will be classified as finance or operating, with classification affecting the pattern and classification of expense recognition in the income statement as well as the reduction of the right of use asset. The Company has adopted the standard effective January 1, 2022 and has chosen to use the effective date as our date of initial application. Consequently, financial information will not be updated and the disclosures required under the new standard will not be provided for dates and periods prior to January 1, 2022. The new standard provides a number of optional practical expedients in transition. The Company has elected to apply the ‘package of practical expedients’ which allow us to not reassess (i) whether existing or expired arrangements contain a lease, (ii) the lease classification of existing or expired leases, or (iii) whether previous initial direct costs would qualify for capitalization under the new lease standard. The Company has also elected to apply (i) the practical expedient which allows us to not separate lease and non-lease components, for new leases entered into after adoption and (ii) the short-term lease exemption for all leases with an original term of less than 12 months, for purposes of applying the recognition and measurements requirements in the new standard. For the impact to the Company’s condensed consolidated financial statement upon adoption of the new leasing standard, refer to Note 7, "Leases" in the accompanying notes to these condensed consolidated financial statements for the nine months ended September 30, 2022 and 2021 appearing elsewhere in this Quarterly Report on Form 10-Q.

At the inception of an arrangement, the Company determines whether the arrangement is or contains a lease based on specific facts and circumstances, the existence of an identified asset(s), if any, and the Company’s control over the use of the identified asset(s), if applicable. Operating lease liabilities and their corresponding ROU assets are recorded based on the present value of future

6

lease payments over the expected lease term. The interest rate implicit in lease contracts is typically not readily determinable. As such, the Company will utilize the incremental borrowing rate, which is the rate incurred to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment. As of the ASC 842 effective date, the Company’s incremental borrowing rate is approximately

The Company has elected to combine lease and non-lease components as a single component. Operating leases are recognized on the balance sheet as ROU lease assets, lease liabilities current and lease liabilities non-current. Fixed rents are included in the calculation of the lease balances while variable costs paid for certain operating and pass-through costs are excluded. Lease expense is recognized over the expected term on a straight-line basis.

Recently Issued Accounting Standards

In June 2016, the FASB issued Accounting Standards Update No. 2016-13, Financial Instruments-Credit Losses: Measurement of Credit Losses on Financial Instruments. ASU 2016-13 requires measurement and recognition of expected credit losses for financial assets. In April 2019, the FASB issued clarification to ASU 2016-13 within ASU 2019-04, Codification Improvements to Topic 326, Financial Instruments-Credit Losses, Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments, or ASU 2016-13. The guidance is effective for fiscal years beginning after December 15, 2022. We are currently assessing the potential impact of adopting ASU 2016-13 on our financial statements and financial statement disclosures.

In December 2019, the FASB issued ASU 2019-12, Simplifying the Accounting for Income Taxes, or ASU 2019-12. ASU 2019-12 eliminates certain exceptions related to the approach for intra-period tax allocation, the methodology for calculating income taxes in an interim period and the recognition of deferred tax liabilities for outside basis differences. It also clarifies and simplifies other aspects of the accounting for income taxes. This guidance is effective for fiscal years beginning after December 15, 2021, and interim periods within fiscal years beginning after December 15, 2022. Early adoption is permitted. We are currently assessing the impact adoption of ASU 2019-12 will have on our financial statements and disclosures.

In August 2020, the FASB issued ASU No. 2020-06, Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging Contracts in Entity s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity. ASU 2020-06 will simplify the accounting for convertible instruments by reducing the number of accounting models for convertible debt instruments and convertible preferred stock. Limiting the accounting models results in fewer embedded conversion features being separately recognized from the host contract as compared with current U.S. GAAP. Convertible instruments that continue to be subject to separation models are (i) those with embedded conversion features that are not clearly and closely related to the host contract, that meet the definition of a derivative, and that do not qualify for a scope exception from derivative accounting and (ii) convertible debt instruments issued with substantial premiums for which the premiums are recorded as paid-in capital. ASU 2020-06 also amends the guidance for the derivatives scope exception for contracts in an entity’s own equity to reduce form-over-substance-based accounting conclusions. ASU 2020-06 will be effective for us beginning after December 15, 2023. Early adoption is permitted, but no earlier than fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. We are currently assessing the impact adoption of ASU 2020-06 will have on our financial statements and disclosures.

Other than the items noted above, there have been no new accounting pronouncements not yet effective or adopted in the current year that we believe have a significant impact, or potential significant impact, to our unaudited interim condensed consolidated financial statements.

3. Fair Value Measurements

The following table presents information about our financial assets and liabilities measured at fair value on a recurring basis and indicate the level of the fair value hierarchy utilized to determine such fair values (in thousands):

|

|

September 30, 2022 |

|

|||||||||||||

|

|

Total |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Money market funds(1) |

|

$ |

|

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

||

Total assets measured at fair value |

|

$ |

|

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

December 31, 2021 |

|

|||||||||||||

|

|

Total |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Money market funds(1) |

|

$ |

|

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

||

Total assets measured at fair value |

|

$ |

|

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

||

7

(1) Money market funds with maturities of 90 days or less at the date of purchase are included within cash and cash equivalents in the accompanying consolidated balance sheets and are recognized at fair value.

The following table presents a roll-forward of the fair value of the preference shares tranche obligations for which fair value is determined by Level 3 inputs (in thousands):

|

|

Preference |

|

|

Balance, December 31, 2020 |

|

$ |

— |

|

Addition on issuance of class C preference shares |

|

|

|

|

Fair value adjustments |

|

|

|

|

Currency exchange |

|

|

( |

) |

Balance, September 30, 2021 |

|

$ |

|

|

Settlement of preference shares tranche obligation through issuance of preference shares |

|

|

( |

) |

Balance, December 31, 2021 |

|

$ |

— |

|

Valuation techniques used to measure fair value maximize the use of relevant observable inputs and minimize the use of unobservable inputs. Our convertible notes were classified within Level 3 of the fair value hierarchy because the fair value measurement was based, in part, on significant inputs not observed in the market.

Our class C Preference Shares Tranche Obligation was measured at fair value using a Black-Scholes option pricing valuation methodology. The fair value of class C Preference Shares Tranche Obligation included inputs not observable in the market and thus represents a Level 3 measurement. The option pricing valuation methodology utilized required inputs based on certain subjective assumptions, including (i) expected stock price volatility, (ii) calculation of an expected term, (iii) a risk-free interest rate, and (iv) expected dividends. The assumptions utilized to value the class C Preference Shares Tranche Obligation during 2021 were (i) expected stock price volatility of

There were

4. License and Collaboration Agreements

In February 2018, we entered into a clinical collaboration with MSD International GmbH ("MSDIG"), to evaluate IO102 in combination with KEYTRUDA® (pembrolizumab) in first-line treatment of patients with metastatic non-small cell lung cancer. Under the terms of the collaboration with MSDIG, we will conduct an international Phase 1/2 study to evaluate a combination therapy of IO102 and KEYTRUDA®. We will sponsor the clinical trials and MSDIG will provide KEYTRUDA® to be used in the clinical trials free of charge. We and MSDIG will be responsible for our own internal costs and expenses to support the study and we shall bear all other costs associated with conducting the study, including costs of providing IO102 for use in the study. The rights to the data from the clinical trials will be shared by us and MSDIG and we will maintain global commercial rights to IO102.

In September 2021, we entered into a clinical collaboration with MSDIG and MSD International Business GmbH (MSDIB), another affiliate of Merck, (collectively, "MSD") to evaluate IO102-IO103 in combination with KEYTRUDA® versus KEYTRUDA® alone in treatment of patients with metastatic (advanced) melanoma. Under the terms of the collaboration with MSD, we will conduct an international Phase 3 study to evaluate a combination therapy of IO102-IO103 and KEYTRUDA®. We will sponsor the clinical trials and MSD will provide KEYTRUDA® to be used in the clinical trials free of charge. We and MSD will be responsible for our own internal costs and expenses to support the study and we shall bear all other costs associated with conducting the study, including costs of providing IO102-IO103 for use in the study. The rights to the data from the clinical trials will be shared by us and MSD and we will maintain global commercial rights to IO102-IO103.

In December 2021, we entered into a clinical collaboration with MSD to evaluate IO102-IO103 in combination with KEYTRUDA® in previously untreated patients with three different tumor types— metastatic non-small cell lung cancer (NSCLC), squamous cell carcinoma of the head and neck (SCCHN), and metastatic urothelial bladder cancer (UBC). Under the terms of the collaboration with MSD, we will conduct an international Phase 2 study to evaluate a combination therapy of IO102-IO103 and KEYTRUDA®. We will sponsor the clinical trials and MSD will provide KEYTRUDA® to be used in the clinical trials free of charge. We and MSD will be responsible for our own internal costs and expenses to support the study and we shall bear all other costs associated with conducting the study, including costs of providing IO102-IO103 for use in the study. The rights to the data from the clinical trials will be shared by us and MSD and we will maintain global commercial rights to IO102-IO103.

8

5. Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consist of the following (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

Prepaid contract research and development costs |

|

$ |

|

|

$ |

|

||

Insurance |

|

|

|

|

|

|

||

Research and development tax credit receivable |

|

|

|

|

|

|

||

Value-added tax refund receivable |

|

|

|

|

|

|

||

Other |

|

|

|

|

|

|

||

Total prepaid expenses and other current assets |

|

$ |

|

|

$ |

|

||

6. Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consist of the following (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

Accrued contract research and development costs |

|

$ |

|

|

$ |

|

||

Professional fees |

|

|

|

|

|

|

||

Employee compensation costs |

|

|

|

|

|

|

||

Other liabilities |

|

|

|

|

|

|

||

Total accrued expenses and other current liabilities |

|

$ |

|

|

$ |

|

||

7. Leases

On January 1, 2022, the Company adopted ASC 842 using the modified retrospective transition approach allowed under ASU 2018-11 which releases companies from presenting comparative periods and related disclosures under ASC 842 and requires a cumulative-effect adjustment to the opening balance of accumulated deficit in the period of adoption (Note 2). The Company had an immaterial cumulative-effect adjustment to the opening balance of accumulated deficit as of January 1, 2022. The Company is party to

The Company is party to an operating lease in Copenhagen, Denmark for office and laboratory space that commenced in March 2021 with the initial term set to expire in January 2025. Base rent for this initial lease was approximately $

Quantitative information regarding the Company’s leases for the three and nine months ended September 30, 2022 is as follows (in thousands):

9

|

|

Three months ended |

|

|

Nine Months Ended |

|

||

Lease Cost |

|

September 30, 2022 |

|

|

September 30, 2022 |

|

||

Operating lease cost |

|

$ |

|

|

$ |

|

||

Operating cash flows paid for amounts included in the measurement of lease liabilities |

|

$ |

|

|

$ |

|

||

Operating lease liabilities arising from obtaining right‑of‑use assets |

|

$ |

|

|

$ |

|

||

Remaining lease term (years) |

|

|

|

|

|

|

||

Weighted average discount rate |

|

|

% |

|

|

% |

||

Future lease payments under noncancelable leases are as follows at September 30, 2022 (in thousands):

Future Lease Payments |

|

Amount |

|

|

2022 |

|

$ |

|

|

2023 |

|

|

|

|

2024 |

|

|

|

|

2025 |

|

|

|

|

2026 |

|

|

|

|

Thereafter |

|

|

|

|

Total |

|

$ |

|

|

The Company’s leases do not provide an implicit rate, therefore the Company used its incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. The Company used the incremental borrowing rate on January 1, 2022 for operating leases that commenced prior to that date, which is the rate incurred to borrow on a collateralized basis over a similar term an amount equal to the lease payments in a similar economic environment.

8. Commitments and Contingencies

Legal Proceedings

From time to time, we may be party to litigation arising in the ordinary course of its business. We were not subject to any material legal proceedings during the nine months ended September 30, 2022 and year ended December 31, 2021, and, to our knowledge, no material legal proceedings are currently pending or threatened.

Indemnification Agreements

We enter into certain types of contracts that contingently requires us to indemnify various parties against claims from third parties. These contracts primarily relate to procurement, service, consultancy or license agreements under which we may be required to indemnify vendors, service providers or licensees for certain claims, including claims that may be brought against them arising from our acts or omissions with respect to our products, technology, intellectual property or services. The Company, as permitted under Delaware law and in accordance with its certification of incorporation and bylaws and pursuant to indemnification agreements with certain of its officers and directors, indemnifies its officers and directors for certain events or occurrences, subject to certain limits, which the officer or director is or was serving at the Company’s request in such capacity.

From time to time, we may receive indemnification claims under these contracts in the normal course of business. In the event that one or more of these matters were to result in a claim against us, an adverse outcome, including a judgment or settlement, may cause a material adverse effect on our future business, operating results or financial condition. It is not possible to estimate the maximum amount potentially payable under these contracts since we have no history of prior indemnification claims and the unique facts and circumstances involved in each particular claim will be determinative.

9. Convertible Preference Shares

As of September 30, 2022 and December 31, 2

In January 2021, we completed an investment agreement, Class C Investment Agreement, for the sale and issuance of up to

10

We concluded that the Preference Shares Tranche Obligation met the definition of a freestanding financial instrument, as it is legally detachable and separately exercisable from the class C preference shares. Therefore, we allocated the proceeds received from the issuance of shares under the Class C Investment Agreement between the Preference Shares Tranche Obligation and the class C preference shares. The fair value of the Preference Shares Tranche Obligation of $

In March 2021, prior to a milestone closing, an investor elected to purchase and we issued

Immediately prior to consummation of our IPO, all outstanding class B and class C preference shares were converted into

10. Stockholders' Equity

Common and Preferred Stock

In November 2021, we completed our IPO selling an aggregate of

As of September 30, 2022 and December 31, 2021, the Company had

11. Equity-Based Compensation

Employee Equity Plan

Prior to our IPO, we issued warrants to certain employees, board members and advisors (Pre-IPO Plan). Each vested warrant entitled the warrant holder to a single class A ordinary share. Holders of stock warrants were entitled to exercise the vested portion of the stock warrant. Stock warrants generally vest over a

In November 2021, our Board adopted, and our stockholders approved, the 2021 Equity Incentive Plan (2021 Equity Plan), which became effective on November 4, 2021. The 2021 Equity Plan provides for the grant of incentive stock options, non-statutory stock options, stock appreciation rights, awards of restricted stock, restricted stock units and other stock-based awards. The number of shares of our common stock reserved for issuance under the 2021 Equity Plan is equal to

11

The following table summarizes our stock options activity:

|

|

Number of |

|

|

Weighted- |

|

|

Weighted- |

|

|

Aggregate |

|

||||

Outstanding, December 31, 2021 |

|

|

|

|

$ |

|

|

|

|

|

$ |

— |

|

|||

Granted |

|

|

|

|

$ |

|

|

|

|

|

|

|

||||

Cancelled or forfeited |

|

|

( |

) |

|

$ |

|

|

|

|

|

|

|

|||

Outstanding September 30, 2022 |

|

|

|

|

$ |

|

|

|

|

|

$ |

— |

|

|||

Exercisable at September 30, 2022 |

|

|

|

|

$ |

|

|

|

|

|

$ |

— |

|

|||

Equity-Based Compensation

All share-based awards granted are measured based on the fair value on the date of the grant and compensation expense is recognized with respect to those awards over the requisite service period, which is generally the vesting period of the respective award. Forfeitures related to equity-based compensation awards are recognized as they occur, and we reverse any previously recognized compensation cost associated with forfeited awards in the period the forfeiture occurs.

As of September 30, 2022, there was $

Equity-based compensation expense recorded as research and development and general and administrative expenses is as follows (in thousands):

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Research and development |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total equity-based compensation |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

We did

12. Income Taxes

We are subject to taxes for earnings generated in multiple jurisdictions, both inside and outside of the United States and our tax expense is primarily affected by unrecognized tax benefits in Denmark. We recorded a provision for income taxes of $

We have evaluated the positive and negative evidence involving our ability to realize our deferred tax assets. We have considered our history of cumulative net losses incurred since inception and our lack of any commercial products. We have concluded that it is more likely than not that we will not realize the benefits of our deferred tax assets in Denmark. We reevaluate the positive and negative evidence at each reporting period.

12

13. Net Loss Per Share

Basic and diluted net loss per common share is calculated as follows (in thousands except share and per share amounts):

|

|

For the Three Months |

|

|

Nine Months Ended |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Cumulative dividends on class B and C preference shares |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Net loss attributable to common shareholders |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Net loss per common share, basic and diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Weighted-average number of shares used in computing net loss per common share, basic and diluted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

The following outstanding potentially dilutive securities have been excluded from the calculation of diluted net loss per common share, as their effect is anti-dilutive:

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Convertible preference shares |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Stock options to purchase common stock |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

||

Stock warrants to purchase class A ordinary shares |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

14. Subsequent Events

In November 2022, we entered into a clinical collaboration with MSD to evaluate IO102-IO103 in combination with KEYTRUDA® as a neo-adjuvant/adjuvant therapy for patients with metastatic melanoma and SSCHN. Under the terms of the collaboration with MSD, we will conduct an international Phase 2 study to evaluate a combination therapy of IO102-IO103 and KEYTRUDA®. We will sponsor the clinical trials and MSD will provide KEYTRUDA® to be used in the clinical trials free of charge. We and MSD will be responsible for our own internal costs and expenses to support the study and we shall bear all other costs associated with conducting the study, including costs of providing IO102-IO103 for use in the study. The rights to the data from the clinical trials will be shared by us and MSD and we will maintain global commercial rights to IO102-IO103.

13

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and related notes included in this Quarterly Report on Form 10-Q. Some of the information contained in this discussion and analysis or set forth elsewhere in this Quarterly Report, including information with respect to our plans and strategy for our business and related financing, includes forward-looking statements that involve risks and uncertainties. As a result of many factors, including those factors set forth in Part I, Item 1A. “Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on March 31, 2022, our actual results could differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis. You should carefully read the section entitled “Risk Factors” in our Annual Report on Form 10-K to gain an understanding of the important factors that could cause actual results to differ materially from our forward- looking statements. Please also see the section entitled “Cautionary Note Regarding Forward-Looking Statements.”

Overview

We are a clinical-stage biopharmaceutical company developing novel, immune-modulating cancer therapies based on our T-win technology platform. Our product candidates are designed to induce the immune system to simultaneously target and disrupt multiple pathways that regulate tumor-induced immunosuppression. We believe this represents a paradigm shift in the management of cancer and that our product candidates have the potential to become cornerstones of the treatment regimens of multiple solid tumors. Our lead product candidate, IO102-IO103, is designed to target the immunosuppressive mechanisms mediated by key immunosuppressive proteins such as Indoleamine 2,3-dioxygenase (IDO) and programmed death ligand (PD-L1). In a single-arm Phase 1/2 clinical trial of 30 patients with metastatic melanoma with the primary objective to investigate safety and tolerability, secondary objective to investigate immunogenicity and tertiary objective to investigate clinical efficacy, IO102-IO103, in combination with nivolumab, demonstrated an ability to induce meaningful tumor regression and establish durable antitumor response while achieving a manageable tolerability profile for patients. The clinical efficacy endpoints in this trial include objective response (OR), progression free survival (PFS) and overall survival (OS). In this trial, we have observed a confirmed overall response rate (ORR) of 73% and a complete response rate (CRR) of 47%. Based on the results from this trial, IO102-IO103, in combination with pembrolizumab was granted BTD by the FDA for treatment of unresectable/metastatic melanoma and we are currently recruiting for a potentially registrational Phase 3 trial for IO102-IO103 in combination with pembrolizumab. During the last three months, we have made significant progress with the activation of clinical sites participating in our global Phase 3 combination trial of IOB102-IO103 with pembrolizumab as a potential first-line treatment in advanced melanoma. We ended October with 55 sites actively enrolling in study, compared to 19 actively enrolling sites at the end of July. We believe that the pace of site activation is a leading indicator of patient enrollment. We will provide an update on the anticipated timing of the interim data once we have sufficient information.

Our T-win platform is a novel approach to cancer immunotherapy designed to activate pre-existing T cells to target immunosuppressive mechanisms. Our T-win product candidates are designed to employ a dual mechanism of action: (1) direct killing of immunosuppressive cells, including both tumor cells and genetically stable cells in the tumor microenvironment (TME), that express IDO and PD-L1 and (2) modulation of the TME into a more pro-inflammatory, anti-tumor environment. Our T-win technology is built upon our team’s deep understanding of both TME and a tumor’s ability to evade surveillance and destruction by the immune system. Our approach is in contrast to previous methods that have sought to either block singular immunosuppressive pathways or to direct the immune system against specific identified antigens expressed by tumor cells.

14

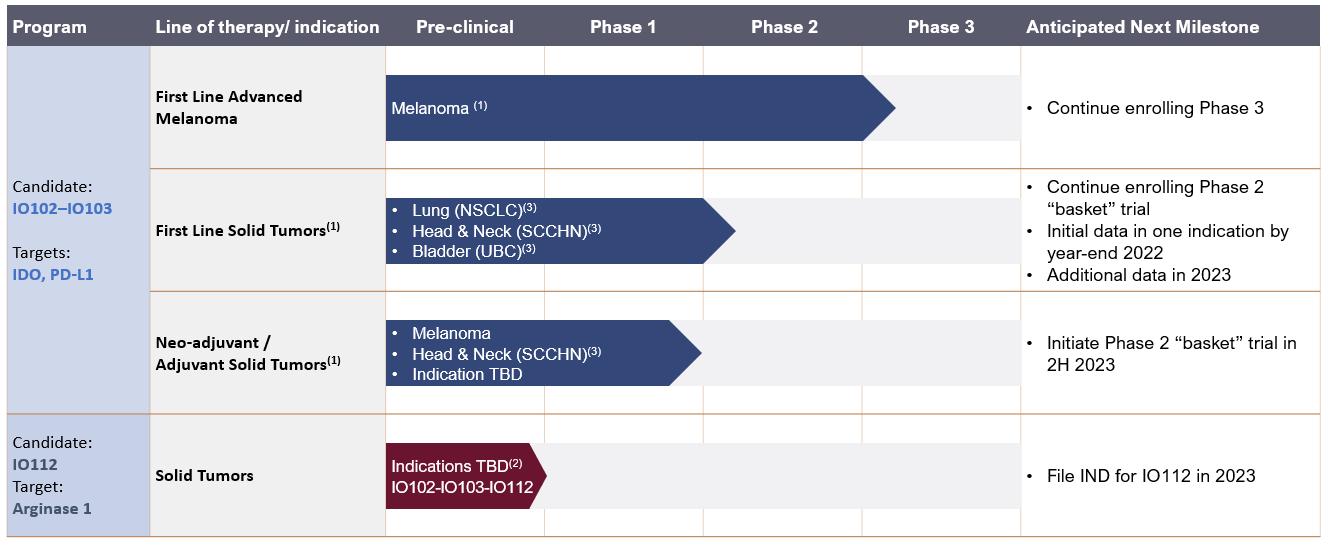

We are developing a pipeline of product candidates that leverage our T-win technology platform to address targets within the TME. In addition to melanoma, we plan to evaluate IO102-IO103 in multiple solid tumor indications to potentially expand the market opportunity for IO102-IO103. We are also focusing on additional targets that play key roles in immunosuppression and that are expressed in a broad range of solid tumors. Our pipeline of product candidates is summarized in the table below.

Our lead product candidate, IO102-IO103, combines our two fully-owned, novel immunotherapeutics, IO102 and IO103, which are designed to target IDO+ and PD-L1+ target cells, respectively. IDO and PD-L1 are often dysregulated and over-expressed in a wide range of solid tumors, and result in the inhibition of the body’s natural pro-inflammatory anti-tumor response within the TME. IO102-IO103 is designed to employ our novel dual mechanism of action approach. This is in contrast to previous approaches which have sought to block singular immunosuppressive pathways or to direct the immune system against specific identified antigens expressed by tumor cells. By combining IO102 and IO103 in a single treatment regimen, we also aim to provide a synergistic effect on tumors.

On December 14, 2020, the FDA granted us BTD for IO102-IO103 in combination with pembrolizumab for the treatment of patients with unresectable or metastatic melanoma based on data from the Phase 1/2 clinical trial, MM1636. BTD enables us to solicit more frequent and intensive guidance from the FDA as to how to conduct an efficient development program for IO102-IO103. The MM1636 trial is an investigator-initiated, single-arm Phase 1/2 trial of 30 anti PD-1/PD-L1 naïve patients with metastatic melanoma receiving IO102-IO103 and nivolumab, an anti-PD-1 monoclonal antibody. In this trial, investigators initially observed an ORR of 80% (24 out of 30 patients); however, two of 24 patients in which a response was observed progressed before subsequent radiological confirmation, which resulted in a confirmed ORR of 73%. In addition, 47% of patients achieved a CR, or complete elimination of their tumors based on RECIST 1.1 definitions. While a total of five patients (17%) experienced a high-grade adverse event (grade 3-5), based on the 17% discontinuation rate of treatment with both nivolumab and IO102-IO103, data from this trial suggests a manageable tolerability profile for patients. In addition, we have observed treatment-induced infiltration of CD3/CD8 T cells into the tumor site in responding patients and detected IO102+IO103-specific T cells in tumors after treatment in correlative biomarker data where this was analyzed. Consistent with the earlier reported data, with an additional 12 months of patient follow-up, results from a new October 2022 data cut for the MM1636 Phase 1/2 study with IO102-IO103 in combination with nivolumab for metastatic melanoma continue to be encouraging. As of that data cut-off, 30 PD-1 naïve patients were enrolled with a median follow-up time of 31.7 months. Median overall survival was reached at 46.8 months post first trial treatment, median progression free survival was 22.5 months, and 50% of patients (15/30) achieved a CR, or complete disappearance of their tumors. The ORR for the study was 73.3% as previously reported. Patients who were PD-1 refractory and enrolled in cohort B in this study had no response to therapy, which we believe shows that our vaccine works best in front-line metastatic melanoma patients, as we expected in this setting. We are currently recruiting for a Phase 3 potentially registrational trial for IO102-IO103, the IOB-013/KN-D18 trial, in combination with pembrolizumab in PD-1 naïve metastatic melanoma patients. While the MM1636 trial investigates IO102-IO103 in combination with nivolumab, we have made the commercial decision to investigate IO102-IO103 in combination with pembrolizumab in the Phase 3 trial. Nivolumab and pembrolizumab are both IgG4 subclass antibodies that target the PD-1 receptor. In a comparative data analysis

15

by Moser (Annals of Oncology 2020), researchers found no difference between the effectiveness of frontline pembrolizumab and nivolumab in patients with advanced melanoma. The Phase 3 trial will include a concurrent evaluation of the initial participants to allow for an assessment of safety, or safety run in. The pembrolizumab for this trial is being supplied by Merck pursuant to a Clinical Trial Collaboration and Supply Agreement that we entered into in September 2021.

We plan to broaden the development of IO102-IO103 to several other solid tumor indications. We are conducting a Phase 2 basket trial, the IOB-022 trial, which will enable us to investigate multiple first-line solid tumor indications in anti PD-1/PD-L1 treatment naïve patients with metastatic disease. Our planned basket trial will investigate the safety and efficacy of IO102-IO103 in combination with pembrolizumab in NSCLC with PD-L1 TPS 50%, SCCHN with CPS 20, and UBC with CPS 10. We have initiated this Phase 2 basket trial in solid tumors as of April 2022, and expect to receive preliminary data in one indication by the end of this year, with additional data expected in 2023. In addition to first-line cancer indications, we also plan to investigate IO102-IO103 when used before or after curatively intended surgery as a neo-adjuvant/adjuvant therapy. As with our targeted first-line cancer indications, we plan to conduct a Phase 2 basket trial, the IOB-032 trial, which will enable us to investigate multiple solid tumor indications in anti PD-1/PD-L1 naïve settings focused initially on melanoma and SCCHN. We expect to initiate this trial in the second half of 2023.

Our development of IO102-IO103 is based on our prior separate development of IO102 and IO103. IO102 is our fully-owned novel product candidate containing a single IDO-derived peptide sequence designed to engage and activate IDO-specific human T cells. IDO small molecule inhibitors have shown clinical potential in combination with PD-1 antibodies in early clinical trials, but have not been able to demonstrate the same level of efficacy in later-stage clinical trials. Our Phase 1 non-randomized trial of IO101, our first-generation IDO therapy, in NSCLC resulted in proof of concept for our approach, with 47% of patients displaying clinical benefit and an OS of 26 months in the treatment arm compared to 8 months in the group receiving standard of care. There were no grade 3 or higher adverse events (AEs). IO102 is currently being tested in a randomized Phase 1/2 trial in combination with pembrolizumab standard-of-care in first-line treatment of patients with metastatic NSCLC. IO103 is our fully-owned, novel product candidate containing a single PD-L1-derived peptide designed to engage and activate PD-L1 specific human T cells. Continued clinical development of IO102 and IO103 will be focused on their use in our dual- and multi-antigen approaches.

IO112 is our fully-owned, novel product candidate containing a single Arginase 1-derived peptide designed to engage and activate Arginase 1-specific human T cells. IO112 is designed to target T cells that recognize epitopes derived from Arginase 1, which is an immunoregulatory enzyme highly expressed in difficult-to-treat tumors associated with high levels of MDSCs including colorectal, breast, prostate and pancreatic and ovarian cancers. Arginase overexpression is a well-documented tumor escape mechanism. We plan to file an IND for IO112 in 2023 and, subject to receiving IND clearance from the FDA, thereafter moving into a clinical trial in combination with IO102 and IO103.

In addition to IO102, IO103 and IO112, we are evaluating additional potential product candidates that we believe have potential for use in solid tumors. All our compounds in preclinical development are designed to target well-documented immunosuppressive molecules that are known to be overexpressed in the TME across a wide range of tumors. These targets provide additional opportunities across multiple cancer indications.

We were established in December 2014 as a spin-off of National Center for Cancer Immune Therapy at Herlev University Hospital in Denmark. We have assembled a seasoned management team and Board with extensive experience in developing novel oncology therapies, including advancing product candidates from preclinical research through to clinical development and ultimately to regulatory approval. Our team is led by our founder and Chief Executive Officer, Mai-Britt Zocca, Ph.D., who has close to 20 years of experience as a biotech executive. Eva Ehrnrooth, MD, Ph.D., our Chief Medical Officer, is a clinical oncologist and has more than 20 years of experience in oncology and drug development. Mads Hald Andersen, Ph.D., our scientific founder and advisor, is a Professor and director at the National Center for Cancer Immune Therapy, Herlev University Hospital and an internationally recognized immunology researcher. Muhammad Al-Hajj, Ph.D., our Chief Scientific Officer, is a well-respected scientific leader with a proven-track record in the field of immuno-oncology and expertise in translational medicine and biomarker discovery. Our Board has deep expertise in the fields of immuno-oncology, business and finance.

Our ability to generate revenue from product sales sufficient to achieve profitability will depend heavily on the successful development and eventual commercialization of one or more of our product candidates. Our operations to date have been financed primarily by aggregate net proceeds of $288.7 million from the issuance of convertible preference shares, convertible notes, ordinary shares and, most recently, our IPO. On November 9, 2021, we completed an IPO of our common stock and issued and sold 8,222,500 shares of common stock at a public offering price of $14.00 per share, including 1,072,500 shares of common stock sold pursuant to the underwriters’ exercise of their option to purchase additional shares of common stock, resulting in net proceeds of $103.3 million after deducting underwriting discounts and commissions and estimated offering expenses. Since inception, we have had significant operating losses. Our net loss was $51.4 million for the nine months ended September 30, 2022 and $67.9 million and $12.0 million for the years ended December 31, 2021 and 2020, respectively. As of September 30, 2022, we had an accumulated deficit of $157.7 million and $151.2 million in cash and cash equivalents.

16

Cash used to fund operating expenses is impacted by the timing of when we pay these expenses, as reflected in the change in our accounts payable and accrued expenses. We expect to continue to incur net losses for the foreseeable future, and we expect our research and development expenses, general and administrative expenses, and capital expenditures will continue to increase. In particular, we expect our expenses to increase as we continue our development of, and seek regulatory approvals for, our product candidates, as well as hire additional personnel, pay fees to outside consultants, lawyers and accountants, and incur other increased costs associated with being a public company. In addition, if and when we seek and obtain regulatory approval to commercialize any product candidate, we will also incur increased expenses in connection with commercialization and marketing of any such product. Our net losses may fluctuate significantly from quarter-to-quarter and year-to-year, depending on the timing of our clinical trials and our expenditures on other research and development activities.

Based upon our current operating plan, we believe that our existing cash and cash equivalents of $151.2 million as of September 30, 2022, will be sufficient to continue funding our development activities into mid-2024. We have based this estimate on assumptions that may prove to be wrong, and we could exhaust our available capital resources sooner than we expect. To finance our operations beyond that point we will need to raise additional capital, which cannot be assured.