Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934 (Amendment No. )

Check the appropriate box:

¨ Preliminary Information Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

þ Definitive Information Statement

Ameren Illinois Company

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

þ No fee required

¨ Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

¨ Fee paid previously with preliminary materials.

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

AMEREN ILLINOIS COMPANY

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS.

To the Shareholders of

AMEREN ILLINOIS COMPANY

The Annual Meeting of Shareholders of Ameren Illinois Company will be held at Powell Symphony Hall, 718 North Grand Boulevard, St. Louis, Missouri, on Tuesday, April 23, 2013, at 9:00 A.M., for the purposes of:

| (1) | electing four directors of the Company for terms ending at the annual meeting of shareholders to be held in 2014; and |

| (2) | acting on other proper business presented to the meeting. |

The Board of Directors of the Company presently knows of no other business to come before the meeting.

If you owned shares of the Company’s capital stock at the close of business on February 25, 2013, you are entitled to vote at the meeting and at any adjournment thereof. Persons will be admitted to the meeting upon verification of their shareholdings in the Company. If your shares are held in the name of your broker, bank or other nominee, you must bring an account statement or letter from the nominee indicating that you were the beneficial owner of the shares on February 25, 2013, the record date for voting. Please note that cameras and other recording devices will not be allowed in the meeting.

THERE WILL BE NO SOLICITATION OF PROXIES BY THE BOARD OF DIRECTORS OF THE COMPANY.

By order of the Board of Directors.

/s/ Gregory L. Nelson

GREGORY L. NELSON

Secretary

St. Louis, Missouri

March 7, 2013

Table of Contents

| SECTION |

PAGE | |||

| FORWARD-LOOKING INFORMATION | 1 | |||

| INFORMATION ABOUT THE ANNUAL SHAREHOLDERS MEETING | 1 | |||

| VOTING | 2 | |||

| OTHER ANNUAL MEETING MATTERS | 3 | |||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| ITEMS YOU MAY VOTE ON | 3 | |||

| 3 | ||||

| 4 | ||||

| 7 | ||||

| 13 | ||||

| 18 | ||||

| 18 | ||||

| SECURITY OWNERSHIP | 19 | |||

| 19 | ||||

| 19 | ||||

| Stock Ownership Requirement for Members of the Ameren Leadership Team |

20 | |||

| 20 | ||||

| EXECUTIVE COMPENSATION | 21 | |||

| 21 | ||||

| 21 | ||||

| 37 | ||||

| Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table |

41 | |||

| 43 | ||||

| 46 | ||||

| 49 | ||||

| AUDIT AND RISK COMMITTEE REPORT | 57 | |||

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 59 | |||

| 59 | ||||

| 59 | ||||

| 60 | ||||

| 60 | ||||

| SHAREHOLDER PROPOSALS | 60 | |||

| FORM 10-K | 61 | |||

i

Table of Contents

INFORMATION STATEMENT OF AMEREN ILLINOIS COMPANY

(First sent or given to shareholders on or about March 11, 2013)

Principal Executive Offices:

6 Executive Drive

Collinsville, IL 62234

Statements in this information statement not based on historical facts are considered “forward-looking” and, accordingly, involve risks and uncertainties that could cause actual results to differ materially from those discussed. Although such forward-looking statements have been made in good faith and are based on reasonable assumptions, there is no assurance that the expected results will be achieved. These statements include (without limitation) statements as to future expectations, beliefs, plans, strategies, objectives, events, conditions, and financial performance. These statements are intended to constitute “forward-looking” statements in connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. We are providing this cautionary statement to disclose that there are important factors that could cause actual results to differ materially from those anticipated. Reference is made to our Annual Report on Form 10-K for the year ended December 31, 2012 (the “2012 Form 10-K”) filed with the Securities and Exchange Commission (the “SEC”) for a list of such factors.

INFORMATION ABOUT THE ANNUAL SHAREHOLDERS MEETING

This information statement is furnished in connection with the Annual Meeting of Shareholders of Ameren Illinois Company, doing business as Ameren Illinois (the “Company,” “Ameren Illinois,” “we,” “us” and “our”), to be held on Tuesday, April 23, 2013 (the “Annual Meeting”), and at any adjournment thereof. The Annual Meeting will be held at Powell Symphony Hall, 718 North Grand Boulevard, St. Louis, Missouri at 9:00 A.M. Central Time.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The Company; Union Electric Company, doing business as Ameren Missouri (“Ameren Missouri”); and Ameren Services Company (“Ameren Services”) are principal direct or indirect subsidiaries of Ameren Corporation (“Ameren”), a holding company.

Ameren has common equity securities listed on the New York Stock Exchange (“NYSE”) and holds either directly or indirectly more than 50 percent of the voting power of Ameren Illinois, Ameren Missouri and Ameren Services. Ameren Illinois has no securities listed on the NYSE and is therefore, exempt from all of the corporate governance rules of the NYSE (Section 303A of the NYSE’s Listed Company Manual). Ameren Illinois, however, voluntarily complies with certain of the NYSE’s listing standards relating to corporate governance, where such compliance is deemed to be in the best interest of Ameren Illinois’ shareholders.

Our 2012 Form 10-K is being sent, along with the Notice of Annual Meeting and this information statement, to all shareholders of record at the close of business on February 25, 2013, which is the record date for the determination of shareholders entitled to vote at the meeting. Note that the 2012 Form 10-K is a combined report for Ameren, Ameren Illinois and Ameren Missouri, which comprise all Ameren companies reporting under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Table of Contents

As information, Ameren Illinois’ Annual Meeting will be held in conjunction with the Ameren and Ameren Missouri annual meetings.

Only shareholders of record of our common stock, without par value (“Common Stock”) and our cumulative preferred stock, $100 par value (“Preferred Stock”) at the close of business on the record date, February 25, 2013, are entitled to vote at the Annual Meeting. Our two classes of outstanding voting securities on such date consisted of 25,452,373 shares of Common Stock, all of which were owned by Ameren, and 616,324 shares of Preferred Stock of various series. As provided in our Bylaws, in order to conduct the meeting, holders of more than one-half of the outstanding shares entitled to vote must be present in person or represented by proxy so that there is a quorum. Our Common Stock and Preferred Stock vote together as a single class on the election of directors. Each shareholder is entitled to one vote for each share of our stock held (whether Common Stock or Preferred Stock), on each matter submitted to a vote at the Annual Meeting, except that in the election of directors, each shareholder is entitled to vote cumulatively and therefore, may give one nominee votes equal to the number of directors to be elected, multiplied by the number of shares held by that shareholder, or those votes may be distributed among any two or more nominees.

In determining whether a quorum is present at the Annual Meeting, shares represented by a proxy which directs that the shares abstain from voting or that a vote be withheld on a matter, shall be deemed to be represented at the meeting for quorum purposes. Shares as to which voting instructions are given as to at least one of the matters to be voted on shall also be deemed to be so represented. If the proxy states how shares will be voted in the absence of instructions by the shareholder, such shares shall be deemed to be represented at the meeting.

In all matters, other than the election of directors, every decision of a majority of the shares entitled to vote on the subject matter and represented in person or by proxy at the meeting at which a quorum is present shall be valid as an act of the shareholders. In tabulating the number of votes on such matters (i) shares represented by a proxy which directs that the shares abstain from voting or that a vote be withheld on a matter shall be deemed to be represented at the meeting as to such matter, (ii) except as provided in (iii) below, shares represented by a proxy as to which voting instructions are not given as to one or more matters to be voted on shall not be deemed to be represented at the meeting for the purpose of the vote as to such matter or matters, and (iii) a proxy which states how shares will be voted in the absence of instructions by the shareholder as to any matter shall be deemed to give voting instructions as to such matter. In the election of directors, the four nominees who receive the most votes will be elected. Shareholder votes are certified by independent inspectors of election.

We have been informed that Ameren intends to cast the votes of all of the outstanding shares of our Common Stock for the election of the nominees for directors named in Item (1). Accordingly, this matter is expected to be approved. Therefore, the Board of Directors considered it unnecessary to solicit proxies for the Annual Meeting. However, if you wish to vote your shares of Preferred Stock, you may do so by attending the Annual Meeting in person and casting your vote by a ballot which will be provided for that purpose.

2

Table of Contents

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF INFORMATION STATEMENT AND 2012 FORM 10-K FOR THE ANNUAL MEETING TO BE HELD ON APRIL 23, 2013

This information statement and our 2012 Form 10-K, including our financial statements, are also available to you at http://www.ameren.com/AmerenIllinoisInfoStatement.

HOW YOU CAN REVIEW THE LIST OF SHAREHOLDERS

The names of shareholders of record entitled to vote at the Annual Meeting will be available at the Annual Meeting and, for 10 days prior to the Annual Meeting, at the Office of the Secretary of the Company.

The Annual Meeting will also be webcast on April 23, 2013. You are invited to visit http://www.ameren.com at 9:00 A.M. CT on April 23, 2013, to hear the webcast of the Annual Meeting. On the home page, you will click on “Live Webcast Annual Meeting April 23, 2013, 9:00 A.M. CT,” then the appropriate audio link. The webcast will remain on Ameren’s website for one year. You cannot record your vote on this webcast.

HOW YOU CAN CONTACT US ABOUT ANNUAL MEETING MATTERS

You may reach us:

- by mail addressed to

Office of the Secretary

Ameren Illinois Company

P.O. Box 66149, Mail Code 1370

St. Louis, MO 63166-6149

- by calling toll free 1-800-255-2237 (or in the St. Louis area 314-554-3502).

ITEM (1): ELECTION OF DIRECTORS

Four directors are to be elected at the Annual Meeting to serve until the next annual meeting of shareholders and until their respective successors have been duly elected and qualified. In the event that any nominee for election as director should become unavailable to serve, votes will be cast for such substitute nominee or nominees as may be nominated by the Nominating and Corporate Governance Committee of Ameren’s Board of Directors and approved by the Board of Directors. The Nominating and Corporate Governance Committee, as described below, performs its committee functions for our Board. The Board of Directors knows of no reason why any nominee will not be able to serve as director. The four nominees for director who receive the most votes will be elected.

Our Board of Directors is currently comprised of four directors (Daniel F. Cole, Martin J. Lyons, Jr., Richard J. Mark and Gregory L. Nelson), each of whom is an executive officer of the Company or its affiliates. As discussed below, the Audit and Risk Committee,

3

Table of Contents

as well as the Nominating and Corporate Governance Committee, Human Resources Committee, Nuclear Oversight and Environmental Committee and Finance Committee of Ameren’s Board of Directors, perform committee functions for our Board.

On June 12, 2012, Scott A. Cisel, previously Chairman, President and Chief Executive Officer of the Company, terminated employment with and resigned as a director of the Company. On June 13, 2012, the Company’s Board of Directors elected Richard J. Mark to the Board of Directors and to the positions of Chairman, President and Chief Executive Officer of the Company. In connection with this promotion, Mr. Mark relinquished his position as Senior Vice President of Customer Operations and resigned from the Board of Directors of Ameren Missouri. In addition, Ameren Missouri’s Board of Directors elected Michael L. Moehn to the Board of Directors and to the position of Senior Vice President, Customer Operations of Ameren Missouri. In connection with this election, Mr. Moehn relinquished his position as Senior Vice President of Customer Operations and resigned as a director of the Company. Mr. Mark has been nominated for election as a director of the Company at the Annual Meeting.

INFORMATION CONCERNING NOMINEES TO THE BOARD OF DIRECTORS

The nominees for our Board of Directors are listed below, along with their age as of December 31, 2012, tenure as director, other directorships held by such nominee during the last five years and business background for at least the last five years. Each nominee’s biography below also includes a description of the specific experience, qualifications, attributes or skills of each director or nominee that led Ameren’s Board to conclude that such person should serve as a director of the Company at the time that this information statement is filed with the SEC. The fact that we do not list a particular experience qualification, attribute or skill for a director nominee does not mean that nominee does not possess that particular experience, qualification, attribute or skill. In addition to those specific experiences, qualifications, attributes or skills detailed below, each director or nominee has demonstrated the highest professional and personal ethics, a broad experience in business, government, education or technology, the ability to provide insights and practical wisdom based on their experience and expertise, a commitment to enhancing shareholder value, compliance with legal and regulatory requirements, and the ability to develop a good working relationship with other Board members and contribute to the Board’s working relationship with senior management of the Company. In assessing the composition of the Board of Directors, Ameren’s Nominating and Corporate Governance Committee recommends Board nominees so that collectively, the Board is balanced by having the necessary experience, qualifications, attributes and skills and that no nominee is recommended because of one particular criterion. See “— CORPORATE GOVERNANCE — Consideration of Director Nominees” below for additional information regarding director nominees and the nominating process.

Each nominee has consented to being nominated for director and has agreed to serve if elected. No arrangement or understanding exists between any nominee and the Company or, to the Company’s knowledge, any other person or persons pursuant to which any nominee was or is to be selected as a director or nominee. All of the nominees are currently directors of the Company and have been previously elected by shareholders at our annual meeting of shareholders held on April 24, 2012 (the “2012 Annual Meeting”), except for Mr. Mark. As noted above, Mr. Mark is currently a director and executive officer of the Company and was initially recommended as a nominee to the Board of Directors by the then-current directors, all of whom are executive officers of the Company. There are no family relationships between any director, executive officer, or person nominated or chosen by us to become a director or executive officer. All of the nominees for election to the Board were unanimously

4

Table of Contents

recommended by the Nominating and Corporate Governance Committee of Ameren’s Board of Directors and were unanimously nominated by our Board of Directors. We have been informed that Ameren intends to cast the votes of all of the outstanding shares of our Common Stock for the election of the nominees named below.

DANIEL F. COLE

Chairman, President and Chief Executive Officer of Ameren Services and Senior Vice President of the Company and Ameren Missouri. Mr. Cole was employed by Ameren Missouri in 1976 as an engineer. He was elected Senior Vice President of Ameren Missouri and Ameren Services in 1999, at Central Illinois Public Service Company (a former Ameren subsidiary that merged with other former Ameren subsidiaries, Central Illinois Light Company (“CILCO”) and Illinois Power Company (“IP”), and then changed its name to Ameren Illinois) (“CIPS”) in 2001, at CILCO and CILCORP Inc. (a former Ameren subsidiary that merged into Ameren in 2010) (“CILCORP”) in 2003 and at IP in 2004. In 2009, Mr. Cole assumed the positions of Chairman, President and Chief Executive Officer of Ameren Services and remained Senior Vice President of Ameren Missouri, CIPS, CILCO, CILCORP and IP. Mr. Cole’s directorships and tenure as Senior Vice President of CILCORP (following the merger of CILCORP into Ameren) and of CILCO and IP (following the merger of those entities with and into CIPS) each ended in 2010. Mr. Cole continued as a director and the Senior Vice President of the Company following the consummation of the CIPS, CILCO and IP merger in 2010. Director of the Company since 2003. Director of the following former Ameren subsidiaries: CILCORP (2003-2010); CILCO (2003-2010); IP (2004-2010). Director of the following other Ameren subsidiaries: Ameren Energy Generating Company (“AEG”) (2000-present); Ameren Missouri (2005-present); Ameren Services (2009-present). Age: 59. Based primarily upon Mr. Cole’s significant executive management and directorship experience, strong strategic planning, engineering and administrative skills and experience, and extensive tenure with the Company (and its current and former affiliates), as well as those demonstrated attributes discussed in the first paragraph under “Information Concerning Nominees to the Board of Directors” above, Ameren’s Board concluded that Mr. Cole should serve as a director of the Company at the time that this information statement is filed with the SEC.

MARTIN J. LYONS, JR.

Executive Vice President and Chief Financial Officer of the Company, Ameren, Ameren Missouri and Ameren Services (effective January 1, 2013) (previously, Senior Vice President and Chief Financial Officer of the Company, Ameren, Ameren Missouri and Ameren Services through December 31, 2012). Mr. Lyons joined CIPS, Ameren, Ameren Missouri and Ameren Services in 2001 as controller. He was elected controller of CILCORP and CILCO in 2003. Mr. Lyons was also elected vice president of CIPS, Ameren, Ameren Missouri, CILCORP, CILCO and Ameren Services in 2003 and vice president and controller of IP in 2004. In 2007, his positions at Ameren Missouri were changed to vice president and principal accounting officer. In 2008, Mr. Lyons was elected senior vice president and principal accounting officer of the Ameren companies. In 2009, Mr. Lyons assumed the positions of Senior Vice President and Chief Financial Officer, while remaining as the principal accounting officer, of CIPS, Ameren, CILCORP, Ameren Missouri, CILCO, IP and Ameren Services. Mr. Lyons’ directorships and tenure as Senior Vice President and Chief Financial Officer of CILCORP (following the merger of CILCORP into Ameren) and of CILCO and IP (following the merger of those entities with and into CIPS) each ended in 2010. Mr. Lyons continued as a director and the Senior Vice President and Chief Financial Officer of the Company following the consummation of the CIPS, CILCO and IP merger in

5

Table of Contents

2010. Effective January 1, 2013, Mr. Lyons was elected Executive Vice President and Chief Financial Officer of the Company, Ameren, Ameren Missouri and Ameren Services. Director of the Company since 2009. Director of the following former Ameren subsidiaries: CILCORP (2009-2010); CILCO (2009-2010); IP (2009-2010). Director of the following other Ameren subsidiaries: AEG (2009-present); Ameren Missouri (2009-present). Age: 46. Based primarily upon Mr. Lyons’ executive management experience, strong accounting, financial and administrative skills and experience, and tenure with the Company (and its current and former affiliates), as well as those demonstrated attributes discussed in the first paragraph under “Information Concerning Nominees to the Board of Directors” above, Ameren’s Board concluded that Mr. Lyons should serve as a director of the Company at the time that this information statement is filed with the SEC.

RICHARD J. MARK

Chairman, President and Chief Executive Officer of the Company (effective June 13, 2012) (previously, Senior Vice President, Customer Operations of Ameren Missouri through June 12, 2012). Mr. Mark was elected Vice President-Customer Service of Ameren Services in 2002. In 2003, he was elected Vice President-Governmental Policy and Consumer Affairs at Ameren Services with responsibility for government affairs, economic development and community relations for Ameren’s utility subsidiaries, including the Company. Mr. Mark was elected to the Board of Directors and as Senior Vice President, Customer Operations of Ameren Missouri in 2005, with responsibility for Missouri energy delivery. In 2007, he relinquished his position at Ameren Services. In June 2012, Mr. Mark was elected to the Board of Directors and as Chairman, President and Chief Executive Officer of the Company, while relinquishing his directorship and position at Ameren Missouri. Director of the Company since June 2012. Director of the following other Ameren subsidiary: Ameren Missouri (2005–June 2012). Age: 57. Based primarily upon Mr. Mark’s executive management and directorship experience, significant consumer and regulatory affairs and administrative skills and experience, and tenure with Ameren Missouri (and its affiliates), as well as those demonstrated attributes discussed in the first paragraph under “Information Concerning Nominees to the Board of Directors” above, Ameren’s Board concluded that Mr. Mark should serve as a director of the Company at the time that this information statement is filed with the SEC.

GREGORY L. NELSON

Senior Vice President, General Counsel and Secretary of the Company, Ameren, Ameren Missouri and Ameren Services. Mr. Nelson joined Ameren Missouri in 1995 as a manager in the Tax Department and assumed a similar position with Ameren Services in 1998. Mr. Nelson was elected Vice President and Tax Counsel of Ameren Services in 1999, and Vice President of CIPS, Ameren Missouri, CILCO and CILCORP in 2003, and of IP in 2004. In 2010, Mr. Nelson was elected Vice President, Tax and Deputy General Counsel of Ameren Services, while remaining Vice President of CIPS, Ameren Missouri, CILCO, IP and CILCORP. Mr. Nelson relinquished his position with each of CILCORP (following the merger of CILCORP into Ameren) and with CILCO and IP (following the merger of those entities with and into CIPS) in 2010. In 2011, Mr. Nelson assumed the positions of Senior Vice President, General Counsel and Secretary of the Company, Ameren, Ameren Missouri and Ameren Services, while relinquishing his positions of Vice President, Tax and Deputy General Counsel of Ameren Services and Vice President of the Company and Ameren Missouri. Director of the Company since 2011. Director of the following Ameren subsidiaries: Ameren Missouri (2011-present); AEG (2011-present). Age: 55. Based primarily upon Mr. Nelson’s significant management experience, extensive legal, tax, regulatory and administrative skills and experience, and tenure with the Company (and its

6

Table of Contents

current and former affiliates), as well as those demonstrated attributes discussed in the first paragraph under “Information Concerning Nominees to the Board of Directors” above, Ameren’s Board concluded that Mr. Nelson should serve as a director of the Company at the time that this information statement is filed with the SEC.

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF THESE DIRECTOR NOMINEES.

Board and Committee Meetings and Annual Meeting Attendance — During 2012, the Board of Directors met or acted by unanimous written consent without a meeting 14 times. All directors attended or participated in 75 percent or more of the aggregate number of meetings of the Board and the Board Committees of which they were members.

The Company has adopted a policy under which Board members are expected to attend each shareholders’ meeting. At the 2012 Annual Meeting, all of the four then-incumbent directors and all of the five directors nominated for election in 2012 were in attendance.

Age Policy — Ameren’s directors who attain age 72 prior to the date of an annual meeting are required to submit a letter to Ameren’s Nominating and Corporate Governance Committee offering his or her resignation, effective with the end of the director’s elected term, for consideration by the Committee. The Nominating and Corporate Governance Committee will review the appropriateness of continued service on the Board of Directors by that director and make a recommendation to the Board of Directors and, if applicable, annually thereafter.

In addition, Ameren’s Corporate Governance Guidelines provide that an Ameren director who undergoes a significant change in professional responsibilities, occupation or business association is required to notify Ameren’s Nominating and Corporate Governance Committee and offer his or her resignation from Ameren’s Board. The Nominating and Corporate Governance Committee will then evaluate the facts and circumstances and make a recommendation to Ameren’s Board whether to accept the offered resignation or request that the director continue to serve on its Board.

Board Leadership Structure — The Company’s Bylaws give the Company’s Board of Directors the right to exercise its discretion to either separate or combine the offices of Chairman of the Board and Chief Executive Officer. The Board regularly considers the appropriate leadership structure for the Company and has concluded that the Company and its shareholders are best served by the Board retaining discretion to determine whether the same individual should serve as both Chairman of the Board and Chief Executive Officer. This decision is based upon the Board’s determination of what is in the best interests of the Company and its shareholders, in light of then-current and anticipated future circumstances and taking into consideration succession planning, skills and experience of the individual(s) filling those positions, and other relevant factors. The Board has determined that the Board leadership structure that is most appropriate at this time, given the specific characteristics and circumstances of the Company and the skills and experience of Mr. Mark, is a leadership structure that combines the roles of Chairman of the Board and Chief Executive Officer with Mr. Mark filling those roles for the following primary reasons:

| • | such a Board leadership structure has served the Company and its shareholders well and the Board believes this structure will continue to serve us well, based primarily on Mr. Mark’s background, skills and experience, as detailed in his biography above; |

7

Table of Contents

| • | since Ameren owns all of the Company’s Common Stock, the Company receives significant independent oversight by Ameren’s Board of Directors (for example, all of Ameren’s Board committees (i.e., Audit and Risk Committee, Human Resources Committee, Nominating and Corporate Governance Committee, Nuclear Oversight and Environmental Committee and Finance Committee) are currently comprised entirely of independent directors and perform committee functions for the Company (see “— Board Committees” below); Ameren’s Nominating and Corporate Governance Committee recommends to Ameren’s Board, and Ameren’s Board subsequently nominates, director candidates for the Company’s Board; and any Company director, as a result of Ameren’s ownership of all the Company’s Common Stock, may be removed by Ameren’s Board at any time, with or without cause); |

| • | the combined chairman and chief executive officer position continues to be the principal board leadership structure in corporate America and among Ameren’s peer companies; and |

| • | there is no empirical evidence that separating the roles of chairman and chief executive officer improves return for shareholders. |

Based on oversight by Ameren’s Board, as described above, Ameren’s ownership of all the Company’s Common Stock and the economic rights of the holders of the Preferred Stock being senior in priority to the Common Stock, and the Company’s current Board composition and leadership structure, the Board has not appointed a lead independent director. The Board recognizes that depending on the specific characteristics and circumstances of the Company, other leadership structures might also be appropriate. The Company is committed to reviewing this determination on an annual basis.

Risk Oversight Process — Given the importance of monitoring risks, Ameren’s Board has determined to utilize a committee specifically focused on oversight of the risk management of Ameren and its subsidiaries, including the Company. Ameren’s Board has charged its Audit and Risk Committee with oversight responsibility of Ameren’s and its subsidiaries’, including the Company’s, overall business risk management process, which includes the identification, assessment, mitigation and monitoring of risks for Ameren and its subsidiaries, including the Company. Ameren’s Audit and Risk Committee meets on a regular basis to review the business risk management processes, at which time applicable members of Ameren’s and the Company’s senior management provide reports to the Audit and Risk Committee. While Ameren’s Audit and Risk Committee retains this responsibility, it coordinates this oversight with other committees of Ameren’s Board having primary oversight responsibility for specific risks (see “— Board Committees — Ameren Committee and Function” below). Each of Ameren’s standing Board committees, in turn, receives regular reports from members of Ameren’s and the Company’s senior management concerning its assessment of Ameren and Company risks within the purview of such committee. Each such committee also has the authority to engage independent advisers. The risks that are not specifically assigned to an Ameren Board committee are considered by Ameren’s Audit and Risk Committee through its oversight of the business risk management process of Ameren and its subsidiaries, including the Company. Ameren’s Audit and Risk Committee then discusses with members of Ameren’s and the Company’s senior management methods to mitigate such risks.

Notwithstanding Ameren’s Board of Directors’ oversight delegation to Ameren’s Audit and Risk Committee, the entire Board is actively involved in risk oversight. Ameren’s Audit and Risk Committee annually reviews for Ameren’s Board which committees maintain oversight responsibilities described above and the overall effectiveness of the business risk

8

Table of Contents

management process. In addition, at each of its meetings, Ameren’s Board receives a report from the Chair of the Audit and Risk Committee, as well as from the Chair of each of the other standing committees of Ameren’s Board identified below, each of which is currently chaired by an independent director. Ameren’s Board then discusses and deliberates on the risk management practices of Ameren and its subsidiaries, including the Company. Through the process outlined above, Ameren’s Board believes that the leadership structure of Ameren’s Board supports effective oversight of the risk management of Ameren and its subsidiaries, including the Company.

Considerations of Risks Associated with Compensation — In evaluating the material elements of compensation available to executives and other Company employees, Ameren’s Human Resources Committee takes into consideration whether the compensation policies and practices of Ameren and certain of its subsidiaries, including the Company, may incentivize excessive risk behavior. In 2010, Ameren’s Human Resources Committee, with the assistance of its independent compensation consultant, Meridian Compensation Partners, LLC (“Meridian”) and Ameren management, reviewed the compensation policies and practices for certain design features that were identified by Meridian as having the potential to encourage excessive risk taking, including such features as high variable pay components and short performance periods. Meridian additionally provided Ameren’s Human Resources Committee in 2010 with a plan-by-plan risk analysis for each of Ameren’s short-term, long-term and severance plans (executive and broad-based) to determine if any practices might encourage excessive risk taking on the part of executives and other employees of Ameren and certain of its subsidiaries, including the Company. During 2012, Ameren’s Human Resources Committee updated its review of Ameren’s compensation policies, practices and plans, including the incentives that they create and the factors that may reduce the likelihood of excessive risk taking, to determine whether those compensation policies, practices and plans present a material risk to Ameren and certain of its subsidiaries, including the Company.

Ameren’s Human Resources Committee identified or implemented several compensation design features that effectively managed or mitigated these potential risks, including:

| • | an appropriate balance of fixed and variable pay opportunities; |

| • | caps on incentive plan payouts; |

| • | the use of multiple performance measures in the compensation program; |

| • | performance measured at the corporate level; |

| • | a mix between short-term and long-term incentives, with an emphasis for executives on rewarding long-term performance; |

| • | Ameren Human Resources Committee discretion regarding individual executive awards; |

| • | oversight by non-participants in the plans; |

| • | the code of conduct, internal controls and other measures implemented by Ameren and its subsidiaries, including the Company; |

| • | the existence of anti-hedging policies for executives; |

| • | annual incentive plan and long-term incentive plan performance grants are subject to a provision in the Ameren Corporation 2006 Omnibus Incentive Compensation Plan (the “2006 Omnibus Incentive Compensation Plan”) that |

9

Table of Contents

| requires a “clawback” of such incentive compensation in certain circumstances; and |

| • | the implementation of stock ownership and holding requirements that are applicable to all members of the Ameren Leadership Team, including the Executives (as defined below). |

In its plan-by-plan evaluation, Ameren’s Human Resources Committee noted several of the practices in those plans that mitigate risk, including the balance of fixed and variable pay, the use of multiple metrics, the use of different performance measures for the annual and long-term incentive compensation plans, Committee discretion in payment of incentives in executive plans and payment caps.

Based upon the above considerations, Ameren’s Human Resources Committee determined that Ameren’s compensation policies and practices are not reasonably likely to have a material adverse effect on Ameren.

Board Committees — The Board of Directors has a standing Executive Committee, with such duties as may be delegated to it from time to time by the Board and authority to act on most matters concerning management of the Company’s business during intervals between Board meetings. The Executive Committee did not meet or act by unanimous written consent without a meeting in 2012. The present members of this committee are Messrs. Mark, Lyons and Nelson.

In addition, as described below, the Board of Directors utilizes the Audit and Risk Committee, Human Resources Committee, Nominating and Corporate Governance Committee, Nuclear Oversight and Environmental Committee and Finance Committee of Ameren’s Board of Directors to perform such committee functions for the Company’s Board. The chairs and members of those committees are recommended by Ameren’s Nominating and Corporate Governance Committee, appointed annually by Ameren’s Board and are identified below. Ameren’s Audit and Risk Committee, Human Resources Committee, and Nominating and Corporate Governance Committee are comprised entirely of non-management directors, each of whom Ameren’s Board of Directors has determined to be “independent” as defined by the relevant provisions of the Sarbanes-Oxley Act of 2002, the NYSE listing standards and Ameren’s Policy Regarding Nominations of Directors (the “Director Nomination Policy”). In addition, Ameren’s Nuclear Oversight and Environmental Committee and Finance Committee are currently comprised entirely of non-management directors, each of whom Ameren’s Board has also determined to be “independent” under the Director Nomination Policy.

10

Table of Contents

| Ameren Committee and Function | Chair and Members | Meetings in 2012 | ||

| Ameren’s Audit and Risk Committee

Appoints and oversees the independent registered public

accountants; pre-approves all audit, audit-related services and non-audit engagements with independent registered public accountants; approves the annual internal audit plan, annual staffing plan and financial budget of the internal auditors;

reviews with management the design and effectiveness of internal controls over financial reporting; reviews with management and independent registered public accountants the scope and results of audits and financial statements, disclosures and

earnings press releases; reviews the appointment, replacement, reassignment or dismissal of the leader of internal audit or approves the retention of, and engagement terms for, any third-party provider of internal audit services; reviews the

internal audit function; reviews with management the business risk management processes, which include the identification, assessment, mitigation and monitoring of risks on an Ameren-wide basis; coordinates its oversight of business risk management

with other Ameren Board committees having primary oversight responsibilities for specific risks; oversees an annual audit of Ameren’s political contributions; performs other actions as required by the Sarbanes-Oxley Act of 2002, the NYSE

listing standards and its Charter; establishes a system by which employees may communicate directly with members of the Committee about accounting, internal controls and financial reporting deficiency; and performs its committee functions for all

Ameren subsidiaries, including the Company, which are registered companies pursuant to the Exchange Act. Walter J. Galvin qualifies as an “audit committee financial expert” as that term is defined by the SEC. A more complete description of

the duties of the Committee is contained in the Audit and Risk Committee’s Charter available at |

Walter J. Galvin, Chairman

Stephen F. Brauer Catherine S. Brune Ellen M. Fitzsimmons |

9 | ||

| Ameren’s Human Resources Committee

Reviews and approves objectives relevant to the compensation of Chief Executive

Officers of Ameren and its subsidiaries, including the Company, as well as other executive officers; administers and approves awards under Ameren’s incentive compensation plan; administers and approves incentive compensation plans, executive

employment agreements, if any, severance agreements, change in control agreements; reviews with management, and prepares an annual report regarding, the Compensation Discussion and Analysis section of Ameren’s Form 10-K and proxy statement

and the Form 10-K and information statement of the Company and other Ameren subsidiaries which are registered companies pursuant to the Exchange Act; acts on important policy matters affecting personnel; recommends to Ameren’s Board

amendments to those pension plans sponsored by Ameren or one or more of its subsidiaries, including the Company, except as otherwise delegated; performs other actions as required by the NYSE listing standards and its Charter; and performs its

committee functions for all Ameren subsidiaries, including the Company, which are registered companies pursuant to the Exchange Act. A more complete description of the duties of the Committee is contained in the Human Resources Committee’s

Charter available at |

Patrick T. Stokes, Chairman

James C. Johnson Steven H. Lipstein Jack D. Woodard |

5 |

11

Table of Contents

| Ameren Committee and Function | Chair and Members | Meetings in 2012 | ||

| Ameren’s Nominating and Corporate Governance Committee

Adopts policies and procedures for identifying and evaluating director nominees; identifies and evaluates individuals qualified to become Board members and director candidates, including individuals recommended by shareholders; reviews the Board’s policy for director compensation and benefits; establishes a process by which shareholders and other interested persons will be able to communicate with members of the Board; develops and recommends to the Board corporate governance guidelines; oversees Ameren’s code of business conduct (referred to as its Corporate Compliance Policy), its Code of Ethics for Principal Executive and Senior Financial Officers and its Policy and Procedures With Respect to Related Person Transactions (see “— CORPORATE GOVERNANCE” below) which are applicable to the Company as well as Ameren; assures that Ameren and its subsidiaries, including the Company, address relevant public affairs issues from a perspective that emphasizes the interests of its key constituents (including, as appropriate, shareholders, employees, communities and customers); reviews semi-annually with management the performance for the immediately preceding six months regarding constituent relationships (including, as appropriate, relationships with shareholders, employees, communities and customers); reviews requests for certain charitable contributions in accordance with Ameren’s Charitable Contribution Policy, which is applicable to the Company as well; performs other actions as required by the NYSE listing standards and its Charter; and performs its committee functions for all Ameren subsidiaries, including the Company, which are registered companies pursuant to the Exchange Act. A more complete description of the duties of the Committee is contained in the Nominating and Corporate Governance Committee’s Charter available at http://www.ameren.com/Investors. |

James C. Johnson, Chairman

Stephen F. Brauer Ellen M. Fitzsimmons Gayle P.W. Jackson |

5 | ||

| Ameren’s Nuclear Oversight and Environmental Committee

Provides Ameren Board-level oversight of Ameren Missouri’s nuclear power facility as well as long-term plans and strategies of Ameren’s nuclear power program and assists Ameren’s and the Company’s Boards in providing oversight of the policies, practices and performance relating to environmental affairs of Ameren and its subsidiaries, including the Company. A more complete description of the duties of the Committee is contained in the Nuclear Oversight and Environmental Committee’s Charter available at http://www.ameren.com/Investors. |

Jack D. Woodard, Chairman

Catherine S. Brune Gayle P.W. Jackson Stephen R. Wilson |

5 |

12

Table of Contents

| Ameren Committee and Function | Chair and Members | Meetings in 2012 | ||

| Ameren’s Finance Committee

Oversees overall financial policies and objectives of Ameren and its subsidiaries, including the Company, including capital project review and approval of financing plans and transactions, investment policies and rating agency objectives; reviews and makes recommendations regarding Ameren’s dividend policy; reviews and recommends to Ameren’s Board the capital budget of Ameren and its subsidiaries, including the Company; reviews, approves and monitors all capital projects with estimated capital expenditures of between $25 million and $50 million; recommends to Ameren’s Board and monitors all capital projects with estimated capital costs in excess of $50 million; reviews and evaluates potential mergers, acquisitions, participations in joint ventures, divestitures and other similar transactions; approves the investment strategy and asset allocation guidelines for those pension plans sponsored by Ameren and its wholly-owned subsidiaries, including the Company (“Ameren Pension Plans”); approves actions or delegates responsibilities for the investment strategy and asset allocation guidelines for the Ameren Pension Plans; monitors actuarial assumptions and reviews the investment performance, funded status and projected contributions for the Ameren Pension Plans; reviews and recommends to Ameren’s Board Ameren’s and its subsidiaries’, including the Company’s, debt and equity financing plans; and oversees the commodity risk assessment process, system of controls and compliance with established risk management policies and procedures for Ameren and its subsidiaries, including the Company. A more complete description of the duties of the Committee is contained in the Finance Committee’s Charter available at http://www.ameren.com/Investors. |

Stephen R. Wilson, Chairman

Walter J. Galvin Steven H. Lipstein Patrick T. Stokes |

5 |

Corporate Governance Guidelines and Policies, Committee Charters and Codes of Conduct

Ameren’s Board of Directors has adopted Corporate Governance Guidelines, a Director Nomination Policy, a Policy Regarding Communications to the Board of Directors, a Policy and Procedures With Respect to Related Person Transactions, each applicable to Ameren and certain of its subsidiaries, including the Company, and written charters for its Audit and Risk Committee, Human Resources Committee, Nominating and Corporate Governance Committee, Nuclear Oversight and Environmental Committee and Finance Committee. Ameren’s Board of Directors also has adopted a code of business conduct (referred to as its Corporate Compliance Policy) applicable to all of the directors, officers and employees of Ameren and its subsidiaries, including the Company, and a Code of Ethics for Principal Executive and Senior Financial Officers of all Ameren companies. These documents and other items relating to the governance of the Company can be found in the Investors’ section of Ameren’s website at http://www.ameren.com. These documents are also available in print free of charge to any shareholder who requests them from the Office of the Company’s Secretary.

Ameren Human Resources Committee Governance

Ameren’s Human Resources Committee focuses on good governance practices in its operation. In 2012, this included:

| • | considering compensation for the Executives (as defined below) in the context of all of the components of total compensation; |

13

Table of Contents

| • | requiring several meetings to discuss important decisions; |

| • | receiving meeting materials several days in advance of meetings; |

| • | conducting executive sessions with Committee members only; and |

| • | obtaining professional advice from an independent compensation consultant engaged directly by and who reports to the Committee. |

It is the Ameren Human Resources Committee’s view that its compensation consultant should be able to render candid and expert advice independent of management’s influence. In February 2012, Ameren’s Human Resources Committee approved the continued engagement of Meridian as its independent compensation consulting firm. In its decision to retain Meridian as its independent compensation consultant, the Committee gave careful consideration to a broad range of attributes necessary to assist the needs of the Committee in setting compensation, including, but not limited to, the following:

| • | a track record in providing independent, objective advice; |

| • | broad organizational knowledge; |

| • | industry reputation and experience; |

| • | in-depth knowledge of competitive pay levels and practices; and |

| • | responsiveness and working relationship. |

Meridian representatives attended all of the Ameren Human Resources Committee meetings during 2012. At the Committee’s request, the consultant met separately with the Committee members outside the presence of management at each meeting, and spoke separately with the Committee Chair and other Committee members between meetings, as necessary or desired.

During 2012, the Committee requested of Meridian the following items:

| • | competitive market pay and market trend analyses, which assist the Committee in targeting executive compensation at the desired level versus market; |

| • | comparisons of short-term incentive payouts and financial performance to utility peers, which the Committee uses to evaluate prior-year short-term incentive goals and set future short-term incentive goals; |

| • | preparation of tally sheets, which the Committee uses to evaluate the cumulative impact of prior compensation decisions; |

| • | review and advice on the Compensation Discussion and Analysis section included in Ameren’s proxy statement to ensure full and clear disclosure; |

| • | advice in connection with the Committee’s risk analysis of Ameren’s and its subsidiaries’, including the Company’s compensation policies and practices, in furtherance of the Committee’s responsibilities pursuant to its charter; |

| • | advice with respect to legal, regulatory and/or accounting considerations impacting Ameren’s compensation and benefit programs, to ensure the Committee is aware of external views regarding the program; and |

| • | other requests relating to executive compensation issues. |

14

Table of Contents

Other than services provided to Ameren’s Human Resources Committee as set forth above and for Ameren’s Nominating and Corporate Governance Committee as described below, Meridian did not perform any other services for Ameren or any of its subsidiaries, including the Company, in 2012.

Pursuant to its letter agreement with the Committee, if Ameren or management of Ameren proposes that Meridian perform services for Ameren or management of Ameren other than in Meridian’s retained role as consultant to the Committee and Ameren’s Nominating and Corporate Governance Committee, any such proposal is required to be submitted to the Committee for approval before such services begin.

In December 2012, Ameren’s Human Resources Committee established procedures for the purpose of determining whether the work of any compensation consultant raised any conflict of interest. Pursuant to such procedures, the Committee considered various factors, including six factors mandated by SEC rules, and determined that with respect to executive compensation-related matters, no conflict of interest was raised by the work of Meridian described in this information statement.

Delegation of Authority

Ameren’s Human Resources Committee has delegated authority to Ameren’s Administrative Committee, comprised of designated members of Ameren’s management, to approve changes, within specified parameters, to certain of Ameren’s and the Company’s retirement plans.

Role of Executive Officers

The role of executive officers in compensation decisions for 2012 is described below under “EXECUTIVE COMPENSATION — COMPENSATION DISCUSSION AND ANALYSIS —Role of Executive Officers.” Neither Mr. Mark, as Chief Executive Officer of the Company, nor Mr. Cisel, as former Chief Executive Officer of the Company, was involved in determining his own compensation. See “EXECUTIVE COMPENSATION —COMPENSATION DISCUSSION AND ANALYSIS — Timing of Compensation Decisions and Awards” below.

Human Resources Committee Interlocks and Insider Participation

The current members of Ameren’s Human Resources Committee of the Board of Directors, Messrs. Johnson, Lipstein, Stokes and Woodard, were not at any time during 2012 or at any other time an officer or employee of Ameren or its subsidiaries, including the Company, and no member had any relationship with Ameren or its subsidiaries, including the Company, requiring disclosure under applicable SEC rules.

No executive officer of Ameren or its subsidiaries, including the Company, has served on the board of directors or compensation committee of any other entity that has or has had one or more executive officers who served as a member of the Board of Directors of Ameren or its subsidiaries, including the Company or the Human Resources Committee during 2012.

Consideration of Director Nominees

Ameren’s Nominating and Corporate Governance Committee will consider director nominations from shareholders in accordance with Ameren’s Director Nomination Policy, which can be found in the Investors’ section of Ameren’s website at http://www.ameren.com. Briefly, the Committee will consider as a candidate any director of the Company who has indicated to the Committee that he or she is willing to stand for re-election as well as any other person who is recommended by shareholders of the Company who provide the required

15

Table of Contents

information and certifications within the time requirements, as set forth in the Director Nomination Policy. The Committee may also undertake its own search process for candidates and may retain the services of professional search firms or other third parties to assist in identifying and evaluating potential nominees. The Company does not normally pay any third-party search firm a fee to identify or evaluate or assist in identifying or evaluating potential director nominees and did not do so with regard to the nominees recommended for election in this information statement.

In considering a potential nominee for the Board, shareholders should note that in selecting candidates, Ameren’s Nominating and Corporate Governance Committee endeavors to find individuals of high integrity who have a solid record of accomplishment in their chosen fields and who display the independence to effectively represent the best interests of all shareholders. Candidates are selected for their ability to exercise good judgment, and to provide practical insights and diverse perspectives. Candidates also will be assessed in the context of the then-current composition of the Board, the operating requirements of the Company and the long-term interests of all shareholders. In conducting this assessment, Ameren’s Nominating and Corporate Governance Committee will, in connection with its assessment and recommendation of candidates for director, consider diversity (including, but not limited to, gender, race, ethnicity, age, experience and skills) and such other factors as it deems appropriate given the then-current and anticipated future needs of the Board and the Company, and to maintain a balance of perspectives, qualifications, qualities and skills on the Board. Although the Committee may seek candidates that have different qualities and experiences at different times in order to maximize the aggregate experience, qualities and strengths of the Board members, nominees for each election or appointment of directors will be evaluated using a substantially similar process and under no circumstances will the Committee evaluate nominees recommended by a shareholder of the Company pursuant to a process substantially different than that used for other nominees for the same election or appointment of directors.

Ameren’s Nominating and Corporate Governance Committee considers the following qualifications at a minimum in recommending to the Board potential new Board members, or the continued service of existing members:

| • | the highest professional and personal ethics; |

| • | broad experience in business, government, education or technology; |

| • | ability to provide insights and practical wisdom based on their experience and expertise; |

| • | commitment to enhancing shareholder value; |

| • | sufficient time to effectively carry out their duties; their service on other boards of public companies should be limited to a reasonable number; |

| • | compliance with legal and regulatory requirements; and |

| • | ability to develop a good working relationship with other Board members. |

Other than the foregoing, there are no stated minimum criteria for director nominees, although Ameren’s Nominating and Corporate Governance Committee may also consider such other factors as it may deem are in the best interests of the Company and its shareholders. In addition, because the Company is committed to maintaining its tradition of inclusion and diversity within the Board, each assessment and selection of director candidates will be made by Ameren’s Nominating and Corporate Governance Committee in compliance with Ameren’s policy of non-discrimination based on race, color, religion, sex, national origin, ethnicity, age, disability, veteran status, pregnancy, marital status, sexual orientation

16

Table of Contents

or any other reason prohibited by law. Ameren’s Nominating and Corporate Governance Committee considers and assesses the implementation and effectiveness of its diversity policy in connection with Board nominations annually to assure that the Board contains an effective mix of individuals to best advance the Company’s long-term business interests.

Director Independence

All nominees for director of the Company’s Board are executive officers of the Company or its affiliates and therefore, do not qualify as “independent” under the NYSE listing standards. As previously explained, the Company has no securities listed on the NYSE and therefore, is not subject to the NYSE listing standards.

Policy and Procedures With Respect to Related Person Transactions

Ameren’s Board of Directors has adopted the Ameren Corporation Policy and Procedures With Respect to Related Person Transactions. The policy applies to Ameren and its subsidiaries, including the Company, which are registered companies under the Exchange Act. This written policy provides that Ameren’s Nominating and Corporate Governance Committee will review and approve Related Person Transactions (as defined below); provided that Ameren’s Human Resources Committee will review and approve the compensation of each Company employee who is an immediate family member of a Company director or executive officer and whose compensation exceeds $120,000. The Chair of Ameren’s Nominating and Corporate Governance Committee has delegated authority to act between Committee meetings. References in this section to the Nominating and Corporate Governance Committee and the Human Resources Committee refer to Ameren’s Nominating and Corporate Governance Committee and Ameren’s Human Resources Committee, respectively.

For purposes of this policy, immediate family member means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law of the director, executive officer, nominee or more than five percent beneficial owner of the Company, and any person (other than a tenant or employee) sharing the household of such director, executive officer, nominee or more than five percent beneficial owner.

The policy defines a “Related Person Transaction” as a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which Ameren (including the Company and any of Ameren’s other subsidiaries) was, is or will be a participant and the amount involved exceeds $120,000 and in which any Related Person (as defined below) had, has or will have a direct or indirect material interest, other than (1) competitively bid or regulated public utility services transactions; (2) transactions involving trustee type services; (3) transactions in which the Related Person’s interest arises solely from ownership of Company equity securities and all equity security holders received the same benefit on a pro rata basis; (4) an employment relationship or transaction involving an executive officer and any related compensation solely resulting from that employment relationship or transaction if (i) the compensation arising from the relationship or transaction is or will be reported pursuant to the SEC’s executive and director compensation proxy statement disclosure rules, or (ii) the executive officer is not an immediate family member of another executive officer or director and such compensation would have been reported under the SEC’s executive and director compensation proxy statement disclosure rules as compensation earned for services to the Company if the executive officer was a named executive officer as that term is defined in the SEC’s executive and director compensation proxy statement disclosure rules, and such compensation has been or will be approved, or

17

Table of Contents

recommended to Ameren’s Board of Directors for approval, by the Human Resources Committee of Ameren’s Board of Directors; or (5) if the compensation of or transaction with a director is or will be reported pursuant to the SEC’s executive and director compensation proxy statement disclosure rules.

“Related Person” is defined as (1) each director, director nominee and executive officer of the Company, (2) five percent or greater beneficial owners, (3) immediate family members of the foregoing persons and (4) any entity in which any of the foregoing persons is a general partner or principal or in a similar position or in which such person and all other related persons to such person has a 10 percent or greater beneficial interest.

The Office of the Corporate Secretary of Ameren assesses whether a proposed transaction is a Related Person Transaction for purposes of the policy.

The policy recognizes that certain Related Person Transactions are in the best interests of the Company and its shareholders.

The approval procedures in the policy identify the factors the Nominating and Corporate Governance Committee will consider in evaluating whether to approve or ratify Related Person Transactions or material amendments to pre-approved Related Person Transactions. The Nominating and Corporate Governance Committee will consider all of the relevant facts and circumstances available to the Nominating and Corporate Governance Committee, including (if applicable) but not limited to: the benefits to the Company; the impact on a director’s independence in the event the Related Person is a director, an immediate family member of a director or an entity in which a director is a general partner, 10 percent or greater shareholder or executive officer; the availability and costs of other sources for comparable products or services; the terms of the transaction; the terms available to or from unrelated third parties or to employees generally; and an analysis of the significance of the transaction to both the Company and the Related Person. The Nominating and Corporate Governance Committee will approve only those Related Person Transactions (a) that are in compliance with applicable SEC rules and regulations, NYSE listing requirements and the Company’s policies, including but not limited to the Corporate Compliance Policy and (b) that are in, or are not inconsistent with, the best interests of the Company and its shareholders, as the Nominating and Corporate Governance Committee determines in good faith.

The policy provides for the annual pre-approval by the Nominating and Corporate Governance Committee of certain Related Person Transactions that are identified in the policy, as the policy may be supplemented and amended.

During 2012, other than employment by the Company or its affiliates, the Company had no business relationships with directors and nominees for director and no Related Person Transactions are currently proposed.

Directors who are employees or directors of Ameren or any of its subsidiaries receive no additional compensation for their services as Company directors. All nominees for director are executive officers of Ameren or its subsidiaries.

The Board of Directors does not know of any matter, other than the election of directors, which may be presented at the Annual Meeting.

18

Table of Contents

All of the outstanding shares of our Common Stock are owned by Ameren. Of the 616,324 outstanding shares of our class of Preferred Stock, no shares were owned by our directors, nominees for director and executive officers as of February 1, 2013. To our knowledge, there are no beneficial owners of five percent or more of the outstanding shares of our class of Preferred Stock as of February 1, 2013. As discussed under “VOTING” above, our Common Stock and Preferred Stock shareholders vote together as a single class on matters submitted to a vote at the Annual Meeting. No independent inquiry has been made to determine whether any shareholder is the beneficial owner of shares not registered in the name of such shareholder or whether any shareholder is a member of a shareholder group.

The following table sets forth certain information known to the Company with respect to beneficial ownership of Ameren Common Stock as of February 1, 2013 for (i) each director and nominee for director of the Company, (ii) each individual serving as the Company’s Chairman, President and Chief Executive Officer and the Company’s Chief Financial Officer during 2012 and the three most highly compensated executive officers of the Company (other than the individuals serving as Chairman, President and Chief Executive Officer and the Chief Financial Officer during 2012) who were serving as executive officers at the end of 2012, each as named in the Summary Compensation Table below (collectively, the “Executives”), and (iii) all executive officers, directors and nominees for director as a group.

| Name |

Number of Shares of Ameren Common Stock Beneficially Owned(1) |

Percent Owned(2) | ||

| Jerre E. Birdsong |

19,343 | * | ||

| Scott A. Cisel |

3,212 | * | ||

| Daniel F. Cole |

33,053 | * | ||

| Martin J. Lyons, Jr. |

12,901 | * | ||

| Richard J. Mark |

17,170 | * | ||

| Gregory L. Nelson |

11,598 | * | ||

| All directors, nominees for director and executive officers as a group (7 persons) |

102,737 | * |

| * | Less than one percent. |

| (1) | This column lists voting securities. None of the named individuals held shares issuable within 60 days upon the exercise of Ameren stock options. Reported shares include those for which a director, nominee for director or executive officer has voting or investment power because of joint or fiduciary ownership of the shares or a relationship with the record owner, most commonly a spouse, even if such director, nominee for director or executive officer does not claim beneficial ownership. |

| (2) | For each individual and group included in the table, percentage ownership is calculated by dividing the number of shares beneficially owned by such person or group as described above by the sum of the 242,666,961 shares of Ameren Common Stock outstanding on February 1, 2013 and the number of shares of Ameren Common Stock that such person or group had the right to acquire on or within 60 days of February 1, 2013. |

19

Table of Contents

Since 2003, Ameren has had a policy which prohibits directors and executive officers from engaging in pledges of Ameren securities or short sales, margin accounts and hedging or derivative transactions with respect to Ameren securities. In December 2012, Ameren’s Board of Directors approved an anti-hedging amendment to the Ameren Corporate Compliance Policy effective January 1, 2013. The Ameren Corporate Compliance Policy provides that directors and employees of Ameren and its subsidiaries, including the Company, may not enter into any transaction which hedges (or offsets) any decrease in value of Ameren equity securities that are (1) granted by Ameren to the director or employee as part of compensation or (2) held, directly or indirectly, by the director or employee.

The address of all persons listed above is c/o Ameren Illinois Company, 6 Executive Drive, Collinsville, Illinois 62234.

STOCK OWNERSHIP REQUIREMENT FOR MEMBERS OF THE AMEREN LEADERSHIP TEAM

The stock ownership requirements applicable to members of the Ameren Leadership Team, which includes the Executives and certain other employees of Ameren and Ameren’s subsidiaries, are described below under “EXECUTIVE COMPENSATION — COMPENSATION DISCUSSION AND ANALYSIS — Common Stock Ownership Requirement.”

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers and persons who own more than 10 percent of the Company’s Common Stock to file reports of their ownership in the Company’s Preferred Stock, and, in some cases, of its ultimate parent’s Common Stock, and of changes in that ownership with the SEC and the NYSE. SEC regulations also require the Company to identify in this information statement any person subject to this requirement who failed to file any such report on a timely basis. Based solely on a review of the filed reports and written representations that no other reports are required, each of the Company’s directors and executive officers complied with all such filing requirements during 2012.

20

Table of Contents

Notwithstanding anything to the contrary set forth in any of the Company’s filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate other filings with the SEC, including this information statement, in whole or in part, the following Ameren Human Resources Committee Report shall not be deemed to be incorporated by reference into any such filings.

HUMAN RESOURCES COMMITTEE REPORT

The Human Resources Committee of Ameren Corporation’s Board of Directors (the “Committee”) discharges the Board’s responsibilities relating to compensation of the Company’s executive officers. The Committee approves and evaluates all compensation of executive officers, including salaries, bonuses, and compensation plans, policies and programs of the Company.

The Committee also fulfills its duties with respect to the Compensation Discussion and Analysis and Human Resources Committee Report portions of the information statement, as described in the Committee’s Charter.

The Compensation Discussion and Analysis has been prepared by management of the Company and its affiliates. The Company is responsible for the Compensation Discussion and Analysis and for the disclosure controls relating to executive compensation.

The Committee met with management of the Company and its affiliates and the Committee’s independent consultant to review and discuss the Compensation Discussion and Analysis. Based on the foregoing review and discussions, the Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this information statement and the Company’s 2012 Form 10-K, and the Board approved that recommendation.

Ameren Human Resources Committee:

Patrick T. Stokes, Chairman

James C. Johnson

Steven H. Lipstein

Jack D. Woodard

COMPENSATION DISCUSSION AND ANALYSIS

2012 In Brief

During 2012, Ameren’s pay-for-performance program led to the following actual 2012 compensation being earned:

| • | 2012 annual incentive base awards were earned at 102.2 percent of target; this payout reflected strong operational performance by Ameren and its subsidiaries, including the Company, in 2012 that was attributed, in part, to continued disciplined cost management, strong energy center performance and regulated utility rate relief; and |

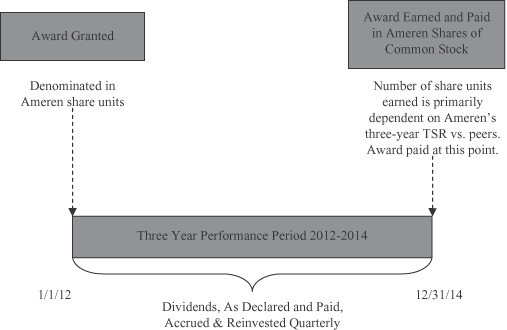

| • | only 30 percent of the target three-year incentive awards made in 2010 were earned (plus accrued dividends of approximately 5.2 percent) based on total |

21

Table of Contents

| shareholder return relative to the defined peer group over the three-year (2010-2012) measurement period. At the December 31, 2012 vesting date, the PSUs (as defined below) were valued at $30.72 per share rather than the $27.95 value at which such PSUs were granted; as a result, the actual earned amounts equaled 38.6 percent of the original target awards. |

In addition, Executives are required to own Ameren’s Common Stock through stock ownership requirements (see “— Common Stock Ownership Requirement” below). The value of those shares rose and fell in the same way and with the same impact that share value rose and fell for other shareholders.

In the remainder of this Compensation Discussion and Analysis (or “CD&A”), references to “the Committee” are to the Human Resources Committee of the Board of Directors of Ameren Corporation and references to Ameren are to Ameren Corporation and its subsidiaries, including the Company. We use the term “Executives” to refer to the employees listed in the Summary Compensation Table.

Guiding Objectives

The compensation paid to the Executives discussed in this information statement is for services rendered in all capacities to Ameren and its subsidiaries, including the Company. Ameren’s objective for compensation of the Executives is to provide a competitive total compensation program that is based on the size-adjusted median of the range of compensation paid by similar utility industry companies, adjusted for Ameren’s short- and long-term performance and the individual’s performance. The adjustment for Ameren’s performance aligns the long-term interests of management with that of Ameren’s shareholders to maximize shareholder value.

Overview of Executive Compensation Program Components

To accomplish this objective in 2012, Ameren’s compensation program for the Executives consisted of several compensation elements, each of which is discussed in more detail below. At Ameren, decisions with respect to one element of pay tend not to impact other elements of pay. The following are the material elements of Ameren’s compensation program for the Executives:

| • | base salary; |

| • | short-term incentives; |

| • | long-term incentives, specifically Ameren’s Performance Share Units Program; |

| • | retirement benefits; |

| • | limited perquisites; and |

| • | change of control protection. |

Ameren’s Common Stock ownership requirements applicable to the Executives are discussed in this CD&A.

Ameren also provides various welfare benefits to the Executives on substantially the same basis as it provides to all salaried employees. Ameren provides limited perquisites and personal benefits to the Executives. None of the Executives received perquisites or other personal benefits in an amount of $10,000 or more in 2012.

22

Table of Contents

Each element is reviewed individually and considered collectively with other elements of Ameren’s compensation program to ensure that it is consistent with the goals and objectives of that particular element of compensation as well as Ameren’s overall compensation program.

Market Data and Peer Group

In October 2011, for use in 2012, the Committee’s independent consultant collected and analyzed comprehensive market data, including base salary, target short-term incentives (non-equity incentive plan compensation) and long-term incentive opportunities. The market data was obtained from a proprietary database maintained by Aon Hewitt.

The elements of pay were benchmarked both individually and in total to the same comparator group.

To develop market figures, compensation opportunities for the Executives were compared to the compensation opportunities for comparable positions at companies similar to Ameren, defined as regulated utility industry companies in a revenue size range approximately one-half to double Ameren’s size. The consultant used statistical techniques to adjust the market data to be appropriate for Ameren’s revenue size.

Ameren provides compensation opportunities at the size-adjusted median of the above-described market data, and designs its incentive plans to pay significantly more or less than the target amount when performance is above or below target performance levels, respectively. Thus, Ameren’s plans are designed to result in payouts that are market-appropriate given its performance for that year or period.