UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(X) | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2016. | |

OR | ||

( ) | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to . | |

|  |  |

Commission File Number | Exact name of registrant as specified in its charter; State of Incorporation; Address and Telephone Number | IRS Employer Identification No. | ||

1-14756 | Ameren Corporation | 43-1723446 | ||

(Missouri Corporation) | ||||

1901 Chouteau Avenue | ||||

St. Louis, Missouri 63103 | ||||

(314) 621-3222 | ||||

1-2967 | Union Electric Company | 43-0559760 | ||

(Missouri Corporation) | ||||

1901 Chouteau Avenue | ||||

St. Louis, Missouri 63103 | ||||

(314) 621-3222 | ||||

1-3672 | Ameren Illinois Company | 37-0211380 | ||

(Illinois Corporation) | ||||

6 Executive Drive | ||||

Collinsville, Illinois 62234 | ||||

(618) 343-8150 | ||||

Securities Registered Pursuant to Section 12(b) of the Act:

The following security is registered pursuant to Section 12(b) of the Securities Exchange Act of 1934 and is listed on the New York Stock Exchange:

Registrant | Title of each class | ||

Ameren Corporation | Common Stock, $0.01 par value per share | ||

Securities Registered Pursuant to Section 12(g) of the Act:

Registrant | Title of each class | ||

Union Electric Company | Preferred Stock, cumulative, no par value, stated value $100 per share | ||

Ameren Illinois Company | Preferred Stock, cumulative, $100 par value per share Depositary Shares, each representing one-fourth of a share of 6.625% Preferred Stock, cumulative, $100 par value per share | ||

Indicate by checkmark if each registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Ameren Corporation | Yes | (X) | No | ( ) |

Union Electric Company | Yes | ( ) | No | (X) |

Ameren Illinois Company | Yes | (X) | No | ( ) |

Indicate by checkmark if each registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Ameren Corporation | Yes | ( ) | No | (X) |

Union Electric Company | Yes | ( ) | No | (X) |

Ameren Illinois Company | Yes | ( ) | No | (X) |

Indicate by checkmark whether the registrants: (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) have been subject to such filing requirements for the past 90 days.

Ameren Corporation | Yes | (X) | No | ( ) |

Union Electric Company | Yes | (X) | No | ( ) |

Ameren Illinois Company | Yes | (X) | No | ( ) |

Indicate by checkmark whether each registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Ameren Corporation | Yes | (X) | No | ( ) |

Union Electric Company | Yes | (X) | No | ( ) |

Ameren Illinois Company | Yes | (X) | No | ( ) |

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of each registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Ameren Corporation | (X) | |

Union Electric Company | (X) | |

Ameren Illinois Company | (X) | |

Indicate by checkmark whether each registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | Accelerated Filer | Non-accelerated Filer | Smaller Reporting Company | |||||

Ameren Corporation | (X) | ( ) | ( ) | ( ) | ||||

Union Electric Company | ( ) | ( ) | (X) | ( ) | ||||

Ameren Illinois Company | ( ) | ( ) | (X) | ( ) | ||||

Indicate by checkmark whether each registrant is a shell company (as defined in Rule 12b-2 of the Act).

Ameren Corporation | Yes | ( ) | No | (X) |

Union Electric Company | Yes | ( ) | No | (X) |

Ameren Illinois Company | Yes | ( ) | No | (X) |

As of June 30, 2016, Ameren Corporation had 242,634,798 shares of its $0.01 par value common stock outstanding. The aggregate market value of these shares of common stock (based upon the closing price of the common stock on the New York Stock Exchange on June 30, 2016) held by nonaffiliates was $13,000,372,477. The shares of common stock of the other registrants were held by Ameren Corporation as of June 30, 2016.

The number of shares outstanding of each registrant’s classes of common stock as of January 31, 2017, were as follows:

Ameren Corporation | Common stock, $0.01 par value per share: 242,634,798 |

Union Electric Company | Common stock, $5 par value per share, held by Ameren Corporation (parent company of the registrant): 102,123,834 |

Ameren Illinois Company | Common stock, no par value, held by Ameren Corporation (parent company of the registrant): 25,452,373 |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement of Ameren Corporation and portions of the definitive information statements of Union Electric Company and Ameren Illinois Company for the 2017 annual meetings of shareholders are incorporated by reference into Part III of this Form 10-K.

This combined Form 10-K is separately filed by Ameren Corporation, Union Electric Company, and Ameren Illinois Company. Each registrant hereto is filing on its own behalf all of the information contained in this annual report that relates to such registrant. Each registrant hereto is not filing any information that does not relate to such registrant, and therefore makes no representation as to any such information.

TABLE OF CONTENTS

Page | ||

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

Item 16. | ||

This report contains “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements should be read with the cautionary statements and important factors under the heading “Forward-looking Statements.” Forward-looking statements are all statements other than statements of historical fact, including those statements that are identified by the use of the words “anticipates,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” and similar expressions.

GLOSSARY OF TERMS AND ABBREVIATIONS

We use the words “our,” “we” or “us” with respect to certain information that relates to Ameren, Ameren Missouri, and Ameren Illinois, collectively. When appropriate, subsidiaries of Ameren Corporation are named specifically as their various business activities are discussed.

2006 Incentive Plan – The 2006 Omnibus Incentive Compensation Plan, which provided for compensatory stock-based awards to eligible employees and directors and was replaced prospectively for new grants by the 2014 Incentive Plan.

2014 Incentive Plan – The 2014 Omnibus Incentive Compensation Plan, which provides for compensatory stock-based awards to eligible employees and directors, effective in April 2014.

AER – Ameren Energy Resources Company, LLC, a former Ameren Corporation subsidiary that consisted of non-rate-regulated operations. In December 2013, AER contributed substantially all of its assets and liabilities, including its ownership interests in Genco, AERG, and Marketing Company, to New AER.

Ameren – Ameren Corporation and its subsidiaries on a consolidated basis. In references to financing activities, acquisition activities, or liquidity arrangements, Ameren is defined as Ameren Corporation, the parent.

Ameren Companies – Ameren Corporation, Ameren Missouri, and Ameren Illinois, collectively, which are individual registrants within the Ameren consolidated group.

Ameren Illinois Electric Distribution – An Ameren and Ameren Illinois financial reporting segment consisting of the rate-regulated electric distribution business of Ameren Illinois.

Ameren Illinois Transmission – An Ameren Illinois financial reporting segment consisting of the rate-regulated electric transmission business of Ameren Illinois.

Ameren Illinois Natural Gas – An Ameren and Ameren Illinois financial reporting segment consisting of the rate-regulated natural gas distribution business of Ameren Illinois.

Ameren Illinois – Ameren Illinois Company, an Ameren Corporation subsidiary that operates rate-regulated electric and natural gas transmission and distribution businesses in Illinois, doing business as Ameren Illinois.

Ameren Missouri – Union Electric Company, an Ameren Corporation subsidiary that operates a rate-regulated electric generation, transmission, and distribution business and a rate-regulated natural gas transmission and distribution business in Missouri, doing business as Ameren Missouri. Ameren Missouri is also defined as a financial reporting segment of Ameren.

Ameren Services – Ameren Services Company, an Ameren Corporation subsidiary that provides support services to Ameren and its subsidiaries.

Ameren Transmission – An Ameren financial reporting segment primarily consisting of the aggregated electric transmission businesses of Ameren Illinois and ATXI.

AMIL – The MISO balancing authority area operated by Ameren, which includes the load of Ameren Illinois and ATXI.

AMMO – The MISO balancing authority area operated by Ameren, which includes the load and energy centers of Ameren Missouri.

ARO – Asset retirement obligations.

ATXI – Ameren Transmission Company of Illinois, an Ameren Corporation subsidiary that is engaged in the construction and operation of electric transmission assets.

Baseload – The minimum amount of electric power delivered or required over a given period of time at a steady rate.

Btu – British thermal unit, a standard unit for measuring the quantity of heat energy required to raise the temperature of one pound of water by one degree Fahrenheit.

CCR – Coal combustion residuals, which include fly ash, bottom ash, boiler slag, and flue gas desulfurization materials generated from burning coal to generate electricity.

CILCO – Central Illinois Light Company, a former Ameren Corporation subsidiary that was merged with CIPS and IP to form Ameren Illinois.

CIPS – Central Illinois Public Service Company, a predecessor to Ameren Illinois.

Clean Power Plan – “Carbon Pollution Emission Guidelines for Existing Stationary Sources: Electric Utility Generating Units,” an EPA rule that establishes emission guidelines for states to follow in developing plans to reduce CO2 emissions from existing fossil-fuel-fired electric generating units.

CO2 – Carbon dioxide.

COL – Nuclear energy center combined construction and operating license.

Cooling degree-days – The summation of positive differences between the average daily temperature and a 65-degree Fahrenheit base. This statistic is useful as an indicator of electricity demand by residential and commercial customers for summer cooling.

Credit Agreements – The Illinois Credit Agreement and the Missouri Credit Agreement, collectively.

CSAPR – Cross-State Air Pollution Rule, an EPA rule that requires states that contribute to air pollution in downwind states to limit air emissions from fossil-fuel-fired electric generating units.

CT – Combustion turbine used primarily for peaking electric generation capacity.

Dekatherm – A standard unit of energy equivalent to one million Btus.

DOE – Department of Energy, a United States government agency.

DRPlus – Ameren Corporation’s dividend reinvestment and direct stock purchase plan.

Dynegy – Dynegy Inc.

EPA – Environmental Protection Agency, a United States government agency.

ERISA – Employee Retirement Income Security Act of 1974, as amended.

Exchange Act – Securities Exchange Act of 1934, as amended.

FAC – Fuel adjustment clause, a fuel and purchased power cost recovery mechanism that allows Ameren Missouri to recover or refund through customer rates 95% of changes in net energy costs greater or less than the amount set in base rates without a traditional rate proceeding, subject to MoPSC prudence reviews.

FASB – Financial Accounting Standards Board, a rulemaking organization that establishes financial accounting and reporting standards in the United States.

1

FEJA – Future Energy Jobs Act, a 2016 Illinois law affecting electric distribution utilities. This law allows Ameren Illinois to earn a return on its electric energy efficiency investments, decouples electric distribution revenues from sales volumes, offers customer rebates for installing distributed generation, and includes extensions and modifications of certain IEIMA performance-based framework provisions, among other things.

FERC – Federal Energy Regulatory Commission, a United States government agency.

FTRs – Financial transmission rights, financial instruments that specify whether the holder shall pay or receive compensation for certain congestion-related transmission charges between two designated points.

GAAP – Generally accepted accounting principles in the United States.

Heating degree-days – The summation of negative differences between the average daily temperature and a 65-degree Fahrenheit base. This statistic is useful as an indicator of demand for electricity and natural gas for winter heating by residential and commercial customers.

IBEW – International Brotherhood of Electrical Workers, a labor union.

ICC – Illinois Commerce Commission, a state agency that regulates Illinois utility businesses, including Ameren Illinois and ATXI.

IEIMA – Illinois Energy Infrastructure Modernization Act, an Illinois law that established a performance-based formula process for determining electric distribution service rates. By its election to participate in this regulatory framework, Ameren Illinois is required to make incremental capital expenditures to modernize its electric distribution system, to meet performance standards, and to create jobs in Illinois, among other requirements.

Illinois Credit Agreement – Ameren's and Ameren Illinois' $1.1 billion senior unsecured credit agreement. The agreement was amended and restated in December 2016 and, unless extended, will expire in December 2021.

IP – Illinois Power Company, a former Ameren Corporation subsidiary that was merged with CIPS and CILCO to form Ameren Illinois.

IPA – Illinois Power Agency, a state government agency that has broad authority to assist in the procurement of electric power for residential and small commercial customers.

IPH – Illinois Power Holdings, LLC, an indirect wholly owned subsidiary of Dynegy.

IRS – Internal Revenue Service, a United States government agency.

ISRS – Infrastructure system replacement surcharge, a cost recovery mechanism that allows Ameren Missouri to recover natural gas infrastructure replacement costs from customers without a traditional rate proceeding.

IUOE – International Union of Operating Engineers, a labor union.

Kilowatthour – A measure of electricity consumption equivalent to the use of 1,000 watts of power over one hour.

LIUNA – Laborers’ International Union of North America, a labor union.

MATS – Mercury and Air Toxics Standards, an EPA rule that limits emissions of mercury and other air toxics from coal- and oil-fired

electric generating units.

Medina Valley – AmerenEnergy Medina Valley Cogen, LLC, an Ameren Corporation subsidiary.

MEEIA – Missouri Energy Efficiency Investment Act, a Missouri law that allows electric utilities to recover costs related to MoPSC-approved customer energy efficiency programs.

MEEIA 2013 – Ameren Missouri's portfolio of customer energy efficiency programs, net shared benefits, and performance incentive for 2013 through 2015, pursuant to the MEEIA, as approved by the MoPSC in August 2012.

MEEIA 2016 – Ameren Missouri's portfolio of customer energy efficiency programs, throughput disincentive, and performance incentive for March 2016 through February 2019, pursuant to the MEEIA, as approved by the MoPSC in February 2016.

Megawatthour or MWh – One thousand kilowatthours.

MGP – Manufactured gas plant.

MISO – Midcontinent Independent System Operator, Inc., an RTO.

Missouri Credit Agreement – Ameren's and Ameren Missouri's $1 billion senior unsecured credit agreement. The agreement was amended and restated in December 2016 and, unless extended, will expire in December 2021.

Missouri Environmental Authority – Environmental Improvement and Energy Resources Authority of the state of Missouri, a governmental body authorized to finance environmental projects by issuing tax-exempt bonds and notes.

Mmbtu – One million Btus.

Money pool – Borrowing agreements among Ameren and its subsidiaries to coordinate and provide for certain short-term cash and working capital requirements.

Moody’s – Moody’s Investors Service Inc., a credit rating agency.

MoOPC – Missouri Office of Public Counsel.

MoPSC – Missouri Public Service Commission, a state agency that regulates Missouri utility businesses, including Ameren Missouri.

MTM – Mark-to-market.

MW – Megawatt.

Native load – End-use retail customers whom we are obligated to serve by statute, franchise, contract, or other regulatory requirement.

NAV - Net asset value per share.

NEIL – Nuclear Electric Insurance Limited, which includes all of its affiliated companies.

NERC – North American Electric Reliability Corporation.

Net energy costs – Net energy costs, as defined in the FAC, which include fuel and purchased power costs, including transportation, net of off-system sales. Since May 30, 2015, transmission revenues and substantially all transmission charges are excluded from net energy costs as a result of the April 2015 MoPSC electric rate order.

Net shared benefits – Ameren Missouri's share of the present value of lifetime energy savings, net of program costs, designed to offset sales volume reductions resulting from MEEIA 2013 customer energy efficiency programs.

New AER – New Ameren Energy Resources Company, LLC, a limited liability company formed as a direct wholly owned subsidiary of AER. New AER, acquired by IPH in December 2013, included substantially all of the assets and liabilities of AER, except for certain assets and liabilities retained by Ameren.

2

New Madrid Smelter – Aluminum smelter located in southeast Missouri that was owned by Noranda and is now owned by ARG International AG.

NOx – Nitrogen oxides.

Noranda – Noranda Aluminum, Inc.

NPNS – Normal purchases and normal sales.

NRC – Nuclear Regulatory Commission, a United States government agency.

NSPS – New Source Performance Standards, provisions under the Clean Air Act.

NSR – New Source Review provisions of the Clean Air Act, which include Nonattainment New Source Review and Prevention of Significant Deterioration regulations.

NWPA – Nuclear Waste Policy Act of 1982, as amended.

NYMEX – New York Mercantile Exchange.

NYSE – New York Stock Exchange, Inc.

OATT – Open Access Transmission Tariff.

OCI – Other comprehensive income (loss) as defined by GAAP.

Off-system sales revenues – Revenues from other than native load sales, including wholesale sales.

OTC – Over-the-counter.

PGA – Purchased Gas Adjustment tariffs, which permit prudently incurred natural gas costs to be recovered directly from utility customers without a traditional rate proceeding.

PUHCA 2005 – The Public Utility Holding Company Act of 2005.

QIP – Qualifying infrastructure plant. Costs of qualifying infrastructure natural gas plant are included in an Ameren Illinois recovery mechanism.

Rate base – The basis on which a public utility is permitted to earn an allowed rate of return. This basis is the net investment in assets used to provide utility service, which generally consists of in-service property, plant, and equipment, net of accumulated depreciation and accumulated deferred income taxes, inventories, and, depending on jurisdiction, construction work in progress.

Regulatory lag – The exposure to differences in costs incurred and actual sales volume levels as compared with the associated amounts included in customer rates. Rate increase requests in traditional rate case proceedings can take up to 11 months to be acted upon by the MoPSC and the ICC. As a result, revenue increases authorized by regulators will lag behind changing costs and sales volume levels when based on historical periods.

Revenue requirement – The cost of providing utility service to customers, which is calculated as the sum of a utility's recoverable operating and maintenance expenses, depreciation and amortization expense, taxes, and an allowed return on rate base.

RFP – Request for proposal.

Rockland Capital – Rockland Capital, LLC, together with the special-purpose entity affiliated with and formed by Rockland Capital, LLC, that acquired the Elgin, Gibson City, and Grand Tower natural-gas-fired energy centers in January 2014.

RTO – Regional transmission organization.

S&P – Standard & Poor’s Ratings Services, a credit rating agency.

SEC – Securities and Exchange Commission, a United States government agency.

SERC – SERC Reliability Corporation, one of the regional electric reliability councils organized for coordinating the planning and operation of the nation’s bulk power supply.

SO2 – Sulfur dioxide.

Test year – The selected period of time, typically a 12-month period, for which a utility's historical or forecasted operating results are used to determine the appropriate revenue requirement.

Throughput disincentive – Ameren Missouri's reduced margin caused by the current period's lower sales volume resulting from MEEIA 2016 customer energy efficiency programs. Recovery of this disincentive is designed to make Ameren Missouri earnings neutral each period from the lost margins caused by its MEEIA 2016 customer energy efficiency programs.

UA – United Association of Plumbers and Pipefitters, a labor union.

VBA – A volume balancing adjustment for Ameren Illinois' natural gas operations. As a result of this adjustment, revenues from residential and small nonresidential customers will increase or decrease as billing determinants differ from filed amounts. This adjustment ensures that changes in sales volumes, including deviations from normal weather conditions, do not result in an over- or under-collection of natural gas revenues for these rate classes.

3

FORWARD-LOOKING STATEMENTS

Statements in this report not based on historical facts are considered “forward-looking” and, accordingly, involve risks and uncertainties that could cause actual results to differ materially from those discussed. Although such forward-looking statements have been made in good faith and are based on reasonable assumptions, there is no assurance that the expected results will be achieved. These statements include (without limitation) statements as to future expectations, beliefs, plans, strategies, objectives, events, conditions, and financial performance. In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we are providing this cautionary statement to identify important factors that could cause actual results to differ materially from those anticipated. The following factors, in addition to those discussed within Risk Factors under Part I, Item 1A, of this report, and elsewhere in this report and in our other filings with the SEC, could cause actual results to differ materially from management expectations suggested in such forward-looking statements:

• | regulatory, judicial, or legislative actions, including any federal income tax reform and changes in regulatory policies and ratemaking determinations, such as those that may result from the complaint case filed in February 2015 with the FERC seeking a reduction in the allowed base return on common equity under the MISO tariff, the unanimous stipulation and agreement filed with the MoPSC in February 2017 that settles Ameren Missouri’s July 2016 electric rate case, and future regulatory, judicial, or legislative actions that change regulatory recovery mechanisms; |

• | the effect of Ameren Illinois participating in a performance-based formula ratemaking process under the IEIMA, including the direct relationship between Ameren Illinois' return on common equity and 30-year United States Treasury bond yields, and the related financial commitments required by the IEIMA; |

• | our ability to align overall spending, both operating and capital, with frameworks established by our regulators in our attempt to earn our allowed return on equity; |

• | the effects of changes in federal, state, or local laws and other governmental actions, including monetary, fiscal, and energy policies; |

• | the effects of changes in federal, state, or local tax laws, regulations, interpretations, or rates and any challenges to the tax positions taken by the Ameren Companies; |

• | the effects on demand for our services resulting from technological advances, including advances in customer energy efficiency and private generation sources, which generate electricity at the site of consumption and are becoming more cost-competitive; |

• | the effectiveness of Ameren Missouri's customer energy efficiency programs and the related revenues and performance incentives earned under its MEEIA plans; |

• | the effect of the FEJA on Ameren Illinois, including on the allowed return earned on its customer energy efficiency investments and its ability to achieve the electric energy efficiency saving goals established by the FEJA; |

• | the timing of increasing capital expenditure and operating |

expense requirements and our ability to recover these costs in a timely manner;

• | the cost and availability of fuel, such as ultra-low-sulfur coal, natural gas, and enriched uranium used to produce electricity; the cost and availability of purchased power and natural gas for distribution; and the level and volatility of future market prices for such commodities, including our ability to recover the costs for such commodities and our customers' tolerance for the related rate increases; |

• | disruptions in the delivery of fuel, failure of our fuel suppliers to provide adequate quantities or quality of fuel, or lack of adequate inventories of fuel, including ultra-low-sulfur coal used for Ameren Missouri’s compliance with environmental regulations; |

• | the effectiveness of our risk management strategies and our use of financial and derivative instruments; |

• | the ability to obtain sufficient insurance, including insurance for Ameren Missouri’s Callaway energy center, or in the absence of insurance the ability to recover uninsured losses from our customers; |

• | business and economic conditions, including their impact on interest rates, collection of our receivable balances, and demand for our products; |

• | disruptions of the capital markets, deterioration in credit metrics of the Ameren Companies, or other events that may have an adverse effect on the cost or availability of capital, including short-term credit and liquidity; |

• | the actions of credit rating agencies and the effects of such actions; |

• | the impact of adopting new accounting guidance and the application of appropriate accounting rules and guidance; |

• | the impact of weather conditions and other natural phenomena on us and our customers, including the impact of system outages; |

• | the construction, installation, performance, and cost recovery of generation, transmission, and distribution assets; |

• | the effects of breakdowns or failures of equipment in the operation of natural gas transmission and distribution systems and storage facilities, such as leaks, explosions, and mechanical problems, and compliance with natural gas safety regulations; |

• | the effects of our increasing investment in electric transmission projects, our ability to obtain all of the necessary approvals to complete the projects, and the uncertainty as to whether we will achieve our expected returns in a timely manner; |

• | operation of Ameren Missouri's Callaway energy center, including planned and unplanned outages, and decommissioning costs; |

• | the effects of strategic initiatives, including mergers, acquisitions, and divestitures; |

• | the impact of current environmental regulations and new, more stringent, or changing requirements, including those related to CO2, other emissions and discharges, cooling water intake structures, CCR, and energy efficiency, that are enacted over time and that could limit or terminate the operation of certain of Ameren Missouri’s energy centers, increase our costs or investment requirements, result in an |

4

impairment of our assets, cause us to sell our assets, reduce our customers' demand for electricity or natural gas, or otherwise have a negative financial effect;

• | the impact of complying with renewable energy portfolio requirements in Missouri; |

• | labor disputes, work force reductions, future wage and employee benefits costs, including changes in discount rates, mortality tables, and returns on benefit plan assets; |

• | the inability of our counterparties to meet their obligations with respect to contracts, credit agreements, and financial instruments; |

• | the cost and availability of transmission capacity for the |

energy generated by Ameren Missouri's energy centers or required to satisfy Ameren Missouri's energy sales;

• | legal and administrative proceedings; |

• | the impact of cyber attacks, which could result in the loss of operational control of energy centers and electric and natural gas transmission and distribution systems and/or the loss of data, such as customer data and account information; and |

• | acts of sabotage, war, terrorism, or other intentionally disruptive acts. |

New factors emerge from time to time. Management cannot predict all such factors, nor can it assess the impact of each such factor on the business or the extent to which any such factor, or combination of factors, may cause actual results to differ materially from those contained or implied in any forward-looking statement. Given these uncertainties, undue reliance should not be placed on these forward-looking statements. Except to the extent required by the federal securities laws, we undertake no obligation to update or revise publicly any forward-looking statements to reflect new information or future events.

PART I

ITEM 1. | BUSINESS |

GENERAL

Ameren, headquartered in St. Louis, Missouri, is a public utility holding company under PUHCA 2005. Ameren was formed in 1997. Ameren’s primary assets are its equity interests in its subsidiaries, including Ameren Missouri, Ameren Illinois, and ATXI. Ameren’s subsidiaries are separate, independent legal entities with separate businesses, assets, and liabilities. Dividends on Ameren’s common stock and the payment of expenses by Ameren depend on distributions made to it by its subsidiaries.

Below is a summary description of Ameren's principal subsidiaries. Ameren also has various other subsidiaries that conduct other activities, such as the provision of shared services. A more detailed description can be found in Note 1 – Summary of Significant Accounting Policies under Part II, Item 8, of this report.

• | Ameren Missouri operates a rate-regulated electric generation, transmission, and distribution business and a rate-regulated natural gas distribution business in Missouri. |

• | Ameren Illinois operates rate-regulated electric distribution, electric transmission and natural gas distribution businesses in Illinois. |

• | ATXI operates a FERC rate-regulated electric transmission business. ATXI is developing MISO-approved electric transmission projects, including the Illinois Rivers, Spoon River, and Mark Twain projects. ATXI is also evaluating competitive electric transmission investment opportunities outside of MISO as they arise. |

The following table presents our total employees at December 31, 2016:

Ameren Missouri | 3,707 | |

Ameren Illinois | 3,429 | |

Ameren Services | 1,493 | |

Ameren | 8,629 | |

At December 31, 2016, the IBEW, the IUOE, the LIUNA, and the UA labor unions collectively represented about 53% of Ameren’s total employees. They represented 63% and 58% of the employees at Ameren Missouri and Ameren Illinois, respectively. The collective bargaining agreements have terms ranging from two and one half years to six years; they expire between 2017 and 2020.

For additional information about the development of our businesses, our business operations, and factors affecting our operations and financial position, see Management’s Discussion and Analysis of Financial Condition and Results of Operations under Part II, Item 7, of this report and Note 1 – Summary of Significant Accounting Policies under Part II, Item 8, of this report.

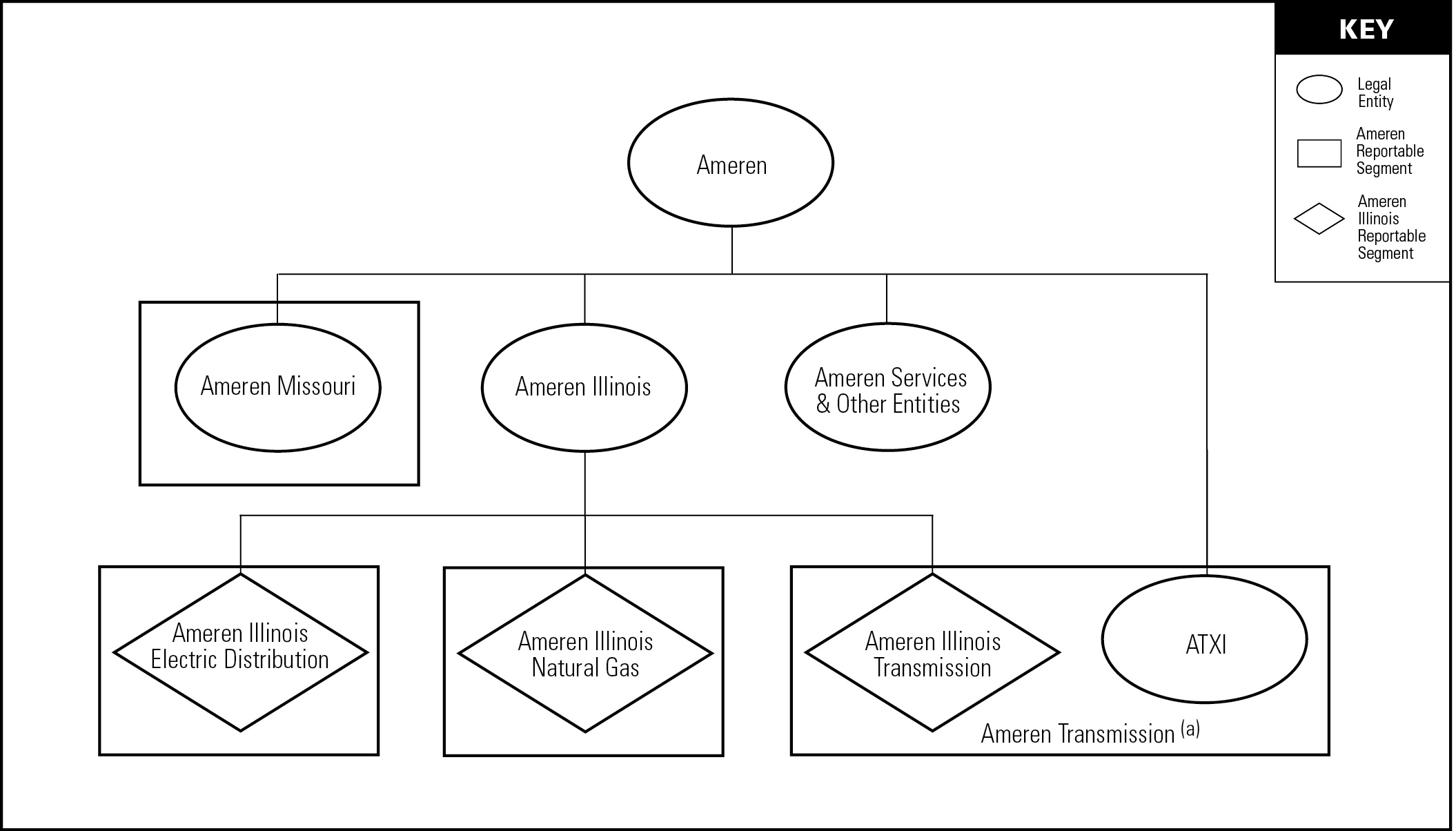

BUSINESS SEGMENTS

In the fourth quarter of 2016, Ameren determined it had four segments: Ameren Missouri, Ameren Illinois Electric Distribution, Ameren Illinois Natural Gas, and Ameren Transmission. The Ameren Missouri segment includes all of the operations of Ameren Missouri. Ameren Illinois Electric Distribution consists of the electric distribution business of Ameren Illinois. Ameren Illinois Natural Gas consists of the natural gas business of Ameren Illinois. Ameren Transmission is primarily composed of the aggregated electric transmission businesses of Ameren Illinois and ATXI.

Ameren Missouri has one segment. Ameren Illinois has

5

three segments: Ameren Illinois Electric Distribution, Ameren Illinois Natural Gas, and Ameren Illinois Transmission.

An illustration of Ameren and Ameren Illinois' reporting structures is provided below. For additional information on

reporting segments, see Note 1 – Summary of Significant Accounting Policies and Note 16 – Segment Information under Part II, Item 8, of this report.

(a) Ameren Transmission segment includes associated Ameren (parent) interest charges. It also includes Ameren Transmission Company, LLC, ATX East, LLC and ATX Southwest, LLC.

RATES AND REGULATION

Rates

The rates that Ameren Missouri, Ameren Illinois, and ATXI are allowed to charge for their utility services significantly influence the results of operations, financial position, and liquidity of these companies and Ameren. The electric and natural gas utility industry is highly regulated. The utility rates charged to customers are determined by governmental entities, including the MoPSC, the ICC, and the FERC. Decisions by these entities are influenced by many factors, including the cost of providing service, the prudency of expenditures, the quality of service, regulatory staff knowledge and experience, customer intervention, and economic conditions, as well as social and political views. Decisions made by these governmental entities regarding rates are largely outside of our control. These decisions, as well as the regulatory lag involved in the process of getting new rates approved, could have a material adverse effect on the results of operations, financial position, and liquidity of the Ameren Companies. The extent of the regulatory lag varies for

each of Ameren's electric and natural gas jurisdictions, with the Ameren Transmission and Ameren Illinois Electric Distribution businesses experiencing the least amount of regulatory lag. Depending on the jurisdiction, the effects of regulatory lag are mitigated by various means, including the use of a future test year, the implementation of trackers and riders, the level and timing of expenditures, and regulatory frameworks that include annual revenue requirement reconciliations.

The MoPSC regulates rates and other matters for Ameren Missouri. The ICC regulates rates and other matters for Ameren Illinois, as well as non-rate utility matters for ATXI. ATXI does not have retail distribution customers; therefore, the ICC does not have authority to regulate ATXI's rates. The FERC regulates Ameren Missouri's, Ameren Illinois', and ATXI's cost-based rates for the wholesale transmission and distribution of energy in interstate commerce and various other matters discussed below under General Regulatory Matters.

The following table summarizes, by rate jurisdiction, the key terms of the rate orders in effect for customer billings for each of Ameren's rate-regulated utilities as of January 1, 2017:

6

Rate Regulator | Allowed Return on Equity | Percent of Common Equity | Rate Base (in billions) | Portion of Ameren's 2016 Operating Revenues(a) | |

Ameren Missouri | |||||

Electric service(b)(c) | MoPSC | 9.53% | 51.8% | $7.0 | 55% |

Natural gas delivery service(d) | MoPSC | (d) | 52.9% | $0.2 | 2% |

Ameren Illinois | |||||

Electric distribution delivery service(e) | ICC | 8.64% | 50.0% | $2.6 | 26% |

Natural gas delivery service(f) | ICC | 9.60% | 50.0% | $1.2 | 12% |

Electric transmission service(g) | FERC | 10.82% | 51.6% | $1.4 | 3% |

ATXI | |||||

Electric transmission service(g) | FERC | 10.82% | 56.3% | $1.1 | 2% |

(a) | Includes pass-through costs recovered from customers, such as purchased power for electric distribution delivery service and natural gas purchased for resale for natural gas delivery service, and intercompany eliminations. |

(b) | Ameren Missouri's electric generation, transmission, and delivery service rates are bundled together and charged to retail customers under a combined electric service rate. |

(c) | Based on the MoPSC's April 2015 rate order. Pending MoPSC approval of a stipulation and agreement filed in February 2017, Ameren Missouri may have new electric service rates effective on or before March 20, 2017. The February 2017 stipulation and agreement did not specify the common equity percentage, the rate base, or the allowed return on common equity. |

(d) | Based on the MoPSC's January 2011 rate order. This rate order did not specify the allowed return on equity. It includes the impacts on rate base and operating revenues relating to the ISRS for investments after the January 2011 rate order. |

(e) | Based on the ICC's December 2016 rate order. Ameren Illinois electric distribution delivery service rates are updated annually and become effective each January. The December 2016 rate order was based on 2015 recoverable costs, expected net plant additions for 2016, and the monthly yields during 2015 of the 30-year United States Treasury bonds plus 580 basis points. Ameren Illinois' 2017 electric distribution delivery service revenues will be based on its 2017 actual recoverable costs, rate base, common equity percentage, and return on common equity, as calculated under the IEIMA's performance-based formula ratemaking framework. |

(f) | Based on the ICC's December 2015 rate order. The rate order was based on a 2016 future test year and established the VBA. |

(g) | Transmission rates are updated annually and become effective each January. They are determined by a company-specific, forward-looking rate formula based on each year's forecasted information. The 10.82% return, which includes the 50 basis points incentive adder for participation in an RTO, could be lowered by a FERC complaint proceeding that is challenging the allowed return on common equity for MISO transmission owners and will require customer refunds if the FERC approves the administrative law judge's decision in the February 2015 complaint case. |

Ameren Missouri

Ameren Missouri’s electric operating revenues are subject to regulation by the MoPSC. If certain criteria are met, Ameren Missouri’s electric rates may be adjusted without a traditional rate proceeding. For example, Ameren Missouri's MEEIA customer energy efficiency program costs, net shared benefits or throughput disincentive, and any performance incentive are recoverable through a rider that may be adjusted without a traditional rate proceeding, subject to MoPSC prudence reviews. Likewise, the FAC permits Ameren Missouri to recover or refund, through customer rates, 95% of changes in net energy costs greater than or less than the amount set in base rates without a traditional rate proceeding, subject to MoPSC prudence reviews. Net energy costs, as defined in the FAC, include fuel and purchased power costs, including transportation, net of off-system sales. Under certain conditions, a provision of the FAC allows Ameren Missouri to retain a portion of the revenues from any off-system sales it makes as a result of reduced sales to the New Madrid Smelter.

In addition to the FAC and the MEEIA recovery mechanisms, Ameren Missouri employs other cost recovery mechanisms, including a pension and postretirement benefit cost tracker, an uncertain tax position tracker, a renewable energy standards cost tracker, and a solar rebate program tracker. Each of these trackers allows Ameren Missouri to record the difference between the level of incurred costs under GAAP and the level of such costs included in rates as a regulatory asset or regulatory liability, which will be included in base rates in a subsequent MoPSC rate order.

Ameren Missouri is a member of MISO, and its transmission rate is calculated in accordance with the MISO OATT. The FERC regulates the rates charged and the terms and conditions for electric transmission service. The transmission rate update each June is based on Ameren Missouri’s filings with the FERC. This rate is not directly charged to Missouri retail customers because, in Missouri, bundled retail rates include an amount for transmission-related costs and revenues.

Ameren Missouri’s natural gas operating revenues are subject to regulation by the MoPSC. If certain criteria are met, Ameren Missouri’s natural gas rates may be adjusted without a traditional rate proceeding. PGA clauses permit prudently incurred natural gas supply costs to be passed directly to customers. The ISRS also permits certain prudently incurred natural gas infrastructure replacement costs to be recovered from customers on a more timely basis between rate cases. The return on equity currently used by Ameren Missouri for purposes of the ISRS tariff is 10%.

Ameren Illinois

Ameren Illinois Electric Distribution

Ameren Illinois' electric distribution delivery service operating revenues are regulated by the ICC. In 2016, Ameren Illinois' electric distribution delivery service revenues accounted for 89% of Ameren Illinois' total electric operating revenues.

Ameren Illinois participates in the performance-based formula ratemaking process established pursuant to the IEIMA.

7

The IEIMA was designed to provide for the recovery of actual costs of electric delivery service that are prudently incurred and to reflect the utility's actual regulated capital structure through a formula for calculating the return on equity component of the cost of capital. The return on equity component of the formula rate is equal to the calendar year average of the monthly yields of the 30-year United States Treasury bonds plus 580 basis points. The IEIMA provides for an annual reconciliation of the revenue requirement necessary to reflect the actual costs incurred in a given year with the revenue requirement included in customer rates for that year, including an allowed return on equity. This annual revenue requirement reconciliation adjustment will be collected from or refunded to customers within two years.

The FEJA revised certain portions of the IEIMA, including extending the IEIMA formula ratemaking process through 2022, and clarifying that a common equity ratio of up to and including 50% is prudent. Also, beginning in 2017, the FEJA decouples electric distribution revenues established in a rate proceeding from actual sales volumes by providing that any revenue changes driven by actual electric distribution sales volumes differing from sales volumes reflected in that year's rates will be collected from or refunded to customers within two years. This portion of the law extends beyond the end of the IEIMA in 2022. Through 2022, revenue differences will be included in the annual IEIMA revenue requirement reconciliation. Additionally, this law creates a customer surcharge relating to certain nuclear energy centers located in Illinois that, like the cost of power purchased by Ameren Illinois on behalf of its customers, will be passed through to electric distribution customers with no effect on Ameren Illinois' earnings.

Ameren Illinois is also subject to performance standards under the IEIMA. Failure to achieve the standards would result in a reduction in the company's allowed return on equity calculated under the formula. The performance standards include improvements in service reliability to reduce both the frequency and duration of outages, a reduction in the number of estimated bills, a reduction of consumption on inactive meters, and a reduction in uncollectible accounts expense. The IEIMA provides for return on equity penalties totaling up to 34 basis points through 2018 and up to 38 basis points in 2019 through 2022 if the performance standards are not met.

Under the IEIMA, Ameren Illinois is also subject to capital spending levels. Between 2012 and 2021, Ameren Illinois is required to invest a total of $625 million in capital projects to modernize its distribution system incremental to its average annual electric distribution service capital projects of $228 million for calendar years 2008 through 2010. Through 2016, Ameren Illinois has invested $383 million in IEIMA capital projects toward its $625 million requirement.

Ameren Illinois employs cost recovery mechanisms for power procurement, customer energy efficiency program costs, certain environmental costs, and bad debt expense not recovered in base rates. Ameren Illinois also has a tariff rider to recover the costs of certain asbestos-related claims.

Ameren Illinois Natural Gas

Ameren Illinois’ natural gas operating revenues are regulated by the ICC. In December 2015, the ICC issued a rate order that approved an increase in revenues for Ameren Illinois' natural gas delivery service based on a 2016 future test year. The rate order also approved the VBA for residential and small nonresidential customers. If certain criteria are met, Ameren Illinois’ natural gas rates may be adjusted without a traditional rate proceeding as PGA clauses permit prudently incurred natural gas costs to be passed directly to customers. Also, Ameren Illinois employs cost recovery mechanisms for customer energy efficiency program costs, certain environmental costs, and bad debt expenses not recovered in base rates.

Illinois has a law that encourages natural gas utilities to accelerate modernization of the state's natural gas infrastructure through a QIP rider. Ameren Illinois' QIP rider allows a surcharge to be added to customers' bills to recover depreciation expenses and to earn a return on qualifying natural gas investments that were not previously included in base rates. Recovery begins two months after the natural gas investments are placed in service and continues until the investments are included in base rates in a future natural gas rate order.

Ameren Illinois Transmission

Ameren Illinois' transmission operating revenues are regulated by the FERC. In 2016, Ameren Illinois' transmission service revenues accounted for 11% of Ameren Illinois' electric operating revenues. See Ameren Transmission below for additional information regarding Ameren Illinois' transmission business.

Ameren Transmission

Ameren Transmission is primarily composed of the aggregated electric transmission businesses of Ameren Illinois and ATXI. Both Ameren Illinois and ATXI are members of MISO; their transmission rates are calculated in accordance with the MISO OATT. The FERC-allowed return on common equity for MISO transmission owners of 12.38% was challenged by customer groups in two complaint cases filed in November 2013 and in February 2015. In September 2016, the FERC issued a final order in the November 2013 complaint case, which lowered the allowed base return on common equity to 10.32%, or a 10.82% total return on common equity with the inclusion of the 50 basis point adder for participation in an RTO. This September 2016 order required the issuance of customer refunds, with interest, for the 15-month period ended February 2015. The refunds are expected to be issued in the first half of 2017. The new allowed return on common equity is reflected in rates prospectively from the September 2016 effective date of the order. In June 2016, an administrative law judge issued an initial decision in the February 2015 complaint case, which if approved by FERC, would lower the allowed base return on common equity to 9.70%, or a 10.20% total return on equity with the inclusion of the 50 basis point incentive adder for participation in an RTO. It would also require the issuance of customer refunds, with interest, for the 15-month period ended May 2016. The FERC is

8

expected to issue a final order in the February 2015 complaint case in the second quarter of 2017. That final order will determine the allowed return on common equity for the 15-month period ended May 2016. That final order will also establish the allowed return on common equity that will apply prospectively from its expected second quarter 2017 effective date, replacing the current 10.82% total return on common equity, which became effective in September 2016.

Ameren Illinois and ATXI have received FERC approval to use a company-specific, forward-looking rate formula framework in setting their transmission rates. These forward-looking rates are updated each January with forecasted information. A reconciliation during the year, which adjusts for the actual revenue requirement and actual sales volumes, is used to adjust billing rates in a subsequent year. Ameren Illinois Transmission earns revenue from transmission service provided to Ameren Illinois Electric Distribution. The transmission expense for Illinois customers who have elected to purchase their power from Ameren Illinois is recovered through a cost recovery mechanism with no net effect on Ameren Illinois Electric Distribution earnings, as costs are offset by corresponding revenues. Transmission revenues from these transactions are reflected at Ameren Transmission and Ameren Illinois Transmission.

The FERC has approved transmission rate incentives relating to the three MISO-approved multi-value projects discussed below, which allow construction work in progress to be included in rate base, thereby improving the timeliness of cash recovery.

The three MISO-approved multi-value projects are primarily being developed by ATXI and are referred to as the Illinois Rivers, Spoon River, and Mark Twain projects. The Illinois Rivers project involves the construction of a 345-kilovolt line from western Indiana across Illinois to eastern Missouri. ATXI has obtained a certificate of public convenience and necessity and project approvals from the ICC and the MoPSC for each state's portion of the Illinois Rivers project. The last section of this project is expected to be completed in 2019. The Spoon River project is located in northwest Illinois. The Mark Twain project is located in northeast Missouri. In 2015, ATXI obtained a certificate of public convenience and necessity and project approval from the ICC for the Spoon River project and construction activities are continuing on schedule. In April 2016, the MoPSC granted ATXI a certificate of convenience and necessity for the Mark Twain project. Before starting construction, ATXI must obtain assents for road crossings from the five counties where the line will be constructed. None of the five county commissions have approved ATXI’s requests for the assents. In October 2016, ATXI filed suit in each of the five county circuit courts to obtain the assents. A decision in each of the five lawsuits is expected in 2017. ATXI plans to complete the Spoon River project in 2018 and the Mark Twain project in 2019; however, further delays in obtaining the consents could delay the completion date of the Mark Twain project. ATXI's total investment in the three projects is expected to be more than $1.6 billion.

For additional information on Ameren Missouri, Ameren

Illinois, and ATXI rate matters, including the FERC complaint case challenging the allowed return on common equity for MISO transmission owners, see Results of Operations and Outlook in Management’s Discussion and Analysis of Financial Condition and Results of Operations under Part II, Item 7, Quantitative and Qualitative Disclosures About Market Risk under Part II, Item 7A, and Note 2 – Rate and Regulatory Matters under Part II, Item 8, of this report.

General Regulatory Matters

Ameren Missouri, Ameren Illinois, and ATXI must receive FERC approval to enter into various transactions, such as issuing short-term debt securities and conducting certain acquisitions, mergers, and consolidations involving electric utility holding companies. In addition, Ameren Missouri, Ameren Illinois, and ATXI must receive authorization from the applicable state public utility regulatory agency to issue stock and long-term debt securities (with maturities of more than 12 months) and to conduct mergers, affiliate transactions, and various other activities.

Ameren Missouri, Ameren Illinois, and ATXI are also subject to mandatory reliability standards, including cybersecurity standards adopted by the FERC, to ensure the reliability of the bulk power electric system. These standards are developed and enforced by NERC pursuant to authority delegated to it by the FERC. If Ameren Missouri, Ameren Illinois, or ATXI are determined not to be in compliance with any of these mandatory reliability standards, they could incur substantial monetary penalties and other sanctions.

Under PUHCA 2005, the FERC and any state public utility regulatory agency may access books and records of Ameren and its subsidiaries that are determined to be relevant to costs incurred by Ameren’s rate-regulated subsidiaries that may affect jurisdictional rates. PUHCA 2005 also permits the MoPSC and the ICC to request that the FERC review cost allocations by Ameren Services to other Ameren companies.

Operation of Ameren Missouri’s Callaway energy center is subject to regulation by the NRC. The license for the Callaway energy center expires in 2044. Ameren Missouri’s Osage hydroelectric energy center and Taum Sauk pumped-storage hydroelectric energy center, as licensed projects under the Federal Power Act, are subject to FERC regulations affecting, among other aspects, the general operation and maintenance of the projects. The license for the Osage hydroelectric energy center expires in 2047. The license for the Taum Sauk pumped-storage hydroelectric energy center expires in 2044. Ameren Missouri’s Keokuk energy center and its dam in the Mississippi River between Hamilton, Illinois, and Keokuk, Iowa, are operated under authority granted by an Act of Congress in 1905.

For additional information on regulatory matters, see Note 2 – Rate and Regulatory Matters, Note 10 – Callaway Energy Center, and Note 15 – Commitments and Contingencies under Part II, Item 8, of this report.

Environmental Matters

9

Certain of our operations are subject to federal, state, and local environmental statutes and regulations relating to the safety and health of personnel, the public, and the environment. These environmental statutes and regulations include requirements relating to identification, generation, storage, handling, transportation, disposal, recordkeeping, labeling, reporting, and emergency response in connection with hazardous and toxic materials; safety and health standards; and environmental protection requirements, including standards and limitations relating to the discharge of air and water pollutants and the management of waste and byproduct materials. Failure to comply with these statutes or regulations could have material adverse effects on us. We could be subject to criminal or civil penalties by regulatory agencies, or we could be ordered by the courts to pay private parties. Except as indicated in this report, we believe that we are in material compliance with existing statutes and regulations that currently apply to our operations.

The EPA has promulgated environmental regulations that have a significant impact on the electric utility industry. Over time, compliance with these regulations could be costly for Ameren Missouri, which operates coal-fired power plants. As of December 31, 2016, Ameren Missouri’s fossil-fueled energy centers represented 18% and 34% of Ameren’s and Ameren Missouri’s rate base, respectively. Regulations impacting the electric utility industry include the regulation of CO2 emissions from existing power plants through the Clean Power Plan and from new power plants through the revised NSPS; the CSAPR, which requires further reductions of SO2 emissions and NOx emissions from power plants; a regulation governing management and storage of CCR; the MATS, which requires reduction of emissions of mercury, toxic metals, and acid gases from power plants; revised NSPS for particulate matter, SO2, and NOx emissions from new sources; effluent standards applicable to wastewater discharges from power plants; and regulations under the Clean Water Act that could require significant capital expenditures, such as modifications to water intake structures at Ameren Missouri’s energy centers. The EPA also periodically reviews and revises national ambient air quality standards, including those standards associated with emissions from power plants, such as particulate matter, ozone, SO2 and NOx. Certain of these regulations are being or are likely to be challenged through litigation, so their ultimate implementation, as well as the timing of any such implementation, is uncertain. Although many details of future regulations are unknown, the individual or combined effects of recent environmental regulations could result in significant capital expenditures and increased operating costs for Ameren and Ameren Missouri. Compliance with these environmental laws and regulations could be prohibitively expensive, result in the closure or alteration of the operation of some of Ameren Missouri’s energy centers, or require further capital investment. Ameren and Ameren Missouri expect that these costs would be recoverable through rates, subject to MoPSC prudence review, but the nature and timing of costs and their recovery could result in regulatory lag. These environmental regulations could also affect the availability of, the cost of, and the demand for power and natural gas that is acquired for Ameren Missouri's natural gas customers and Ameren Illinois' electric and natural gas customers.

For additional discussion of environmental matters, including NOx and SO2 emission reduction requirements, reductions to CO2 emissions, wastewater discharge standards, remediation efforts, CCR management regulations, and a discussion of the EPA’s allegations of violations of the Clean Air Act and Missouri law in connection with projects at Ameren Missouri's Rush Island energy center, see Note 15 – Commitments and Contingencies under Part II, Item 8, of this report.

TRANSMISSION

Ameren owns an integrated transmission system that is composed of the transmission assets of Ameren Missouri, Ameren Illinois, and ATXI. Ameren also operates two balancing authority areas: AMMO and AMIL. During 2016, the peak demand was 7,681 megawatts in AMMO and 8,868 megawatts in AMIL. The Ameren transmission system directly connects with 15 other balancing authority areas for the exchange of electric energy.

Ameren Missouri, Ameren Illinois, and ATXI are transmission-owning members of MISO. Ameren Missouri is authorized by the MoPSC to participate in MISO through May 2018. In 2017, Ameren Missouri expects to file a study required by MoPSC, as it has done periodically since it joined MISO, that evaluates the costs and benefits of Ameren Missouri's continued participation in MISO beyond May 2018.

Ameren Missouri, Ameren Illinois, and ATXI are members of the SERC. The SERC is responsible for ensuring the reliable operation of the bulk electric power system in all or portions of 16 central and southeastern states. Owners and operators, including the Ameren Companies, of the bulk electric power system are subject to mandatory reliability standards promulgated by the NERC and its regional entities, such as the SERC, which are all enforced by the FERC.

SUPPLY OF ELECTRIC POWER

Ameren Missouri

Ameren Missouri’s electric supply is primarily generated from its energy centers. Factors that could cause Ameren Missouri to purchase power include, among other things, energy center outages, the fulfillment of renewable energy portfolio requirements, the failure of suppliers to meet their power supply obligations, extreme weather conditions, the availability of power at a cost lower than its generation cost, and absence of sufficient owned generation.

Ameren Missouri continues to evaluate its longer-term needs for new generating capacity. The potential need for new energy center construction is dependent on several key factors, including continuation of, and customer participation in, energy efficiency programs and distributed generation, load growth, technological advancements, costs of generation alternatives, environmental regulation of coal-fired power plants, and state renewable portfolio standards, which could lead to the retirement of current baseload assets or alterations in the manner in which those assets operate. Because of the significant time required to plan, acquire permits for, and build a baseload energy center,

10

Ameren Missouri continues to study alternatives and to take steps to preserve options to meet future demand. Steps include evaluating the potential for additional customer energy efficiency programs and options for renewable energy generation, and maintaining options for natural-gas-fired generation to further diversify Ameren Missouri's generation portfolio.

Ameren Missouri files a nonbinding integrated resource plan with the MoPSC every three years and will file its next plan in 2017. Ameren Missouri's integrated resource plan filed with the MoPSC in October 2014, prior to the issuance of the Clean Power Plan, was a 20-year plan that supported a more diverse energy portfolio in Missouri, including coal, solar, wind, natural gas, hydro, and nuclear power. The plan involves expanding renewable generation, retiring coal-fired generation as those energy centers reach the end of their useful lives, expanding customer energy efficiency programs, and adding natural-gas-fired combined cycle generation.

See also Outlook in Management’s Discussion and Analysis of Financial Condition and Results of Operations under Part II, Item 7, Note 2 – Rate and Regulatory Matters, Note 10 – Callaway Energy Center, and Note 15 – Commitments and Contingencies under Part II, Item 8, of this report.

Ameren Illinois

In Illinois, electric transmission and distribution service rates are regulated, but power supply prices are not regulated. Although electric customers are allowed to purchase power from an alternative retail electric supplier, Ameren Illinois is required to serve as the provider of last resort for its electric distribution customers. In 2016, Ameren Illinois supplied power for 23% of its kilowatthour sales. Power purchased by Ameren Illinois for its electric distribution customers who do not elect to purchase their power from an alternative retail electric supplier comes either through procurement processes conducted by the IPA or through markets operated by MISO. The IPA administers an RFP process through which Ameren Illinois procures its expected supply obligation. The power and related procurement costs incurred by Ameren Illinois are passed directly to its electric distribution customers through a cost recovery mechanism and are reflected in the Ameren Illinois Electric Distribution's results of operations, but do not affect Ameren Illinois Electric Distribution's earnings as any cost is offset by a corresponding revenue. Ameren Illinois charges transmission and distribution service rates to electric distribution customers who purchase electricity from alternative retail electric suppliers, which does affect Ameren Illinois Electric Distribution's earnings.

See Note 14 – Related Party Transactions and Note 15 – Commitments and Contingencies under Part II, Item 8, of this report for additional information on power procurement in Illinois.

POWER GENERATION

Ameren Missouri owns energy centers that rely on a diverse fuel portfolio, including coal (Ameren Missouri's primary fuel source), nuclear, and natural gas, as well as renewable sources of generation, which include hydroelectric, methane gas, and

solar. All of Ameren Missouri's coal-fired energy centers were constructed prior to 1978. The Callaway nuclear energy center began operation in 1984. As of December 31, 2016, Ameren Missouri's fossil-fueled energy centers represented 18% and 34% of Ameren's and Ameren Missouri's rate base, respectively. See Item 2 – Properties under Part I of this report for information regarding Ameren Missouri's electric generation energy centers.

Coal

Ameren Missouri has an ongoing need for coal as fuel for generation, so it pursues a price-hedging strategy consistent with this requirement. Ameren Missouri has agreements in place to purchase and transport coal to its energy centers. As of December 31, 2016, Ameren Missouri had price-hedged its expected coal supply and coal transportation requirements for generation in 2017. Ameren Missouri has additional coal supply under contract through 2020. The coal transport agreements that Ameren Missouri has with Union Pacific Railroad and Burlington Northern Santa Fe Railway are currently set to expire at the end of 2019. Ameren Missouri burned 17 million tons of coal in 2016.

About 98% of Ameren Missouri’s coal is purchased from the Powder River Basin in Wyoming. The remaining coal is typically purchased from the Illinois Basin. Inventories may be adjusted because of generation levels or uncertainties of supply due to potential work stoppages, delays in coal deliveries, equipment breakdowns, and other factors. Deliveries from the Powder River Basin have occasionally been restricted because of rail congestion and maintenance, derailments, and weather. As of December 31, 2016, coal inventories for Ameren Missouri were near targeted levels. Disruptions in coal deliveries could cause Ameren Missouri to pursue a strategy that could include reducing sales of power during low-margin periods, buying higher-cost fuels to generate required electricity, and purchasing power from other sources.

Nuclear

The production of nuclear fuel involves the mining and milling of uranium ore to produce uranium concentrates, the conversion of uranium concentrates to uranium hexafluoride gas, the enrichment of that gas, the conversion of the enriched uranium hexafluoride gas into uranium dioxide fuel pellets, and the fabrication into fuel assemblies. Ameren Missouri has entered into uranium, uranium conversion, uranium enrichment, and fabrication contracts to procure the fuel supply for its Callaway nuclear energy center.

The Callaway energy center requires refueling at 18-month intervals. The last refueling was completed in May 2016. The next refueling will be in fall 2017. As of December 31, 2016, Ameren Missouri has agreements or inventories to price-hedge 97% of Callaway's fall 2017 refueling requirements. Ameren Missouri has inventories and supply contracts sufficient to meet all of its uranium (concentrate and hexafluoride), conversion, and enrichment requirements at least through the 2020 refueling. Ameren Missouri has fuel fabrication service contracts through at least 2022.

11

Natural Gas Supply for Generation

To maintain deliveries to natural-gas-fired energy centers throughout the year, especially during the summer peak demand, Ameren Missouri’s portfolio of natural gas supply resources includes firm transportation capacity and firm no-notice storage capacity leased from interstate pipelines. Ameren Missouri primarily uses the interstate pipeline systems of Panhandle Eastern Pipe Line Company, Trunkline Gas Company, Natural Gas Pipeline Company of America, and Mississippi River Transmission Corporation to transport natural gas to energy centers. In addition to physical transactions, Ameren Missouri uses financial instruments, including some in the NYMEX futures market and some in the OTC financial markets, to hedge the price paid for natural gas.

Ameren Missouri’s natural gas procurement strategy is designed to ensure reliable and immediate delivery of natural gas to its energy centers. This strategy is accomplished by optimizing transportation and storage options and by minimizing cost and price risk through various supply and price-hedging agreements that allow access to multiple natural gas pools, supply basins, and storage services. As of December 31, 2016, Ameren Missouri had price-hedged about 21% of its expected natural gas supply requirements for generation in 2017.

Renewable Energy

The states of Illinois and Missouri have enacted laws requiring electric utilities to include renewable energy resources in their portfolios.

Illinois required renewable energy resources to equal or exceed 2% of the total electricity that Ameren Illinois supplied to its eligible retail customers as of June 1, 2008, with that percentage increasing to 13% by June 1, 2017. For the 2016 plan year, Ameren Illinois met its requirement that 11.5% of its total electricity for eligible retail customers be procured from renewable energy resources. Starting June 1, 2017, after a transition period, Ameren Illinois will be required to procure renewable energy resources for all of its electric distribution customers, regardless if Ameren Illinois or an alternative retail electric supplier provides power to customers. This requirement will be satisfied through future IPA procurement events.

The FEJA requires Ameren Illinois to offer distributed generation rebates for all classes of customers, including customers who share common solar facilities through a subscription arrangement. The cost of the rebates will be recorded as a regulatory asset, which will be included in rate base and earn a return based on the utility’s weighted average cost of capital. Customers with distributed generation will also be eligible for net metering provisions, subject to certain customer participation levels. Beginning in 2017, the FEJA decouples electric distribution revenues established in a rate proceeding from actual sales volumes, which ensures that Ameren Illinois’ earnings will not be harmed by a reduction in sales volumes.

In Missouri, utilities are required to purchase or generate electricity equal to at least 2% of native load sales from

renewable sources beginning in 2011, with that percentage increasing to at least 15% by 2021, subject to a 1% annual limit on customer rate impacts. At least 2% of each renewable energy portfolio requirement must be derived from solar energy. In 2016, Ameren Missouri met its requirement to purchase or generate at least 5% of its native load sales from renewable energy resources. Ameren Missouri expects to satisfy the nonsolar requirement into 2018 with its Keokuk energy center, and its Maryland Heights energy center and through a 102-megawatt power purchase agreement with a wind farm operator. The Maryland Heights energy center generates electricity by burning methane gas collected from a landfill. Ameren Missouri is meeting the solar energy requirement by purchasing solar-generated renewable energy credits from customer-installed systems and by generating its own solar energy at the O'Fallon energy center and at its headquarters building.

Energy Efficiency

Ameren Missouri and Ameren Illinois have implemented energy efficiency programs to educate and help their customers become more efficient users of energy. In Missouri, the MEEIA established a regulatory framework that, among other things, allows electric utilities to recover costs related to MoPSC-approved customer energy efficiency programs. The law requires the MoPSC to ensure that a utility’s financial incentives are aligned to help customers use energy more efficiently, to provide timely cost recovery, and to provide earnings opportunities associated with cost-effective energy efficiency programs. Missouri does not have a law mandating energy efficiency standards.

From 2013 through 2015, Ameren Missouri invested $134 million in customer energy efficiency programs and realized $174 million of net shared benefits under the MEEIA 2013 performance plan approved in August 2012.

In February 2016, the MoPSC issued an order approving Ameren Missouri's MEEIA 2016 plan, which included a portfolio of customer energy efficiency programs along with a rider to collect the program costs, the throughput disincentive, and any performance incentive earned from customers. The throughput disincentive recovery will replace the net shared benefits that were collected under the MEEIA 2013 plan. The MEEIA rider will allow Ameren Missouri to collect the throughput disincentive without a traditional rate proceeding, until lower volumes resulting from the MEEIA programs are reflected in base rates. Customer rates, based upon both forecasted program costs and throughput disincentive, will be reconciled annually to actual results. Ameren Missouri intends to invest $158 million in MEEIA 2016 customer energy efficiency programs. In addition, similar to the MEEIA 2013 plan that ended in December 2015, the MoPSC's order approved a performance incentive that would provide Ameren Missouri an opportunity to earn additional revenues by achieving certain MEEIA 2016 customer energy efficiency goals, including $27 million if 100% of the goals are achieved during the three-year period. Ameren Missouri can earn more if its energy savings exceed those goals. Ameren Missouri must achieve at least 25%

12

of its energy efficiency goals before it earns a MEEIA 2016 performance incentive.

State law requires Ameren Illinois to offer customer energy efficiency programs. The ICC has issued orders approving Ameren Illinois’ electric and natural gas energy efficiency plans, as well as mechanisms by which program costs can be recovered from customers. For the 12-month period ending May 31, 2016, the ICC authorized electric and natural gas energy efficiency program expenditures of $87 million and $16 million, respectively. Additionally, as part of its IEIMA capital project investments, Ameren Illinois expects to invest $438 million in smart-grid infrastructure from 2012 to 2021, including smart meters that enable customers to improve their energy efficiency.

Historically, Ameren Illinois has recovered the cost of its energy efficiency programs as they were incurred. Beginning as early as June 2017, the FEJA will allow Ameren Illinois to earn a return on its electric energy efficiency program investments. Ameren Illinois electric energy efficiency investments will be deferred as a regulatory asset and will earn a return at the company’s weighted average cost of capital, with the equity return based on the monthly average yield of the 30-year United States Treasury bonds plus 580 basis points. The equity portion of Ameren Illinois’ return on electric energy efficiency investments can also be increased or decreased by 200 basis points based on the achievement of annual energy savings goals. The FEJA increased the level of electric energy efficiency saving targets through 2030. Based on a formula provided in the act, Ameren Illinois estimates it can annually invest up to $100 million from 2018 through 2021, up to $107 million annually from 2022 through 2025, and up to $114 million annually from 2026 through 2030. The ICC has the ability to lower the electric energy efficiency saving goals if there are insufficient cost effective measures available. The electric energy efficiency program investments and the return on those investments will be recovered through a rider, and will not be included in the IEIMA formula rate process.

NATURAL GAS SUPPLY FOR DISTRIBUTION