UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission File Number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) |

(Address of principal executive offices) | (Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | ☒ | ||

Non-accelerated filer | ☐ | Smaller reporting company | ||

Emerging growth company |

If an emerging growth company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based

compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

Aggregate market value of Common Stock held by nonaffiliates as of June 30, 2023: $

As of February 26, 2024, the registrant had

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement for the 2024 Annual Meeting of Shareholders, which will be filed with the Securities and Exchange Commission within 120 days after December 31, 2023, are incorporated by reference into Part III of this Annual Report.

TABLE OF CONTENTS

2

GLOSSARY OF TERMS |

The terms and abbreviations defined in this section are used throughout this Annual Report. |

AMI. Area of mutual interest ASC. Accounting Standards Codification BGEPA. The Bald and Golden Eagle Protection Act. |

BLM. Bureau of Land Management. |

bwpd. Barrels of water per day. |

CAA. The United States Clean Air Act. |

CERCLA. The federal Comprehensive Environmental Response, Compensation and Liability Act, also known as the “Superfund law.” |

Code. The Internal Revenue Code of 1986, as amended. |

COVID-19. The infectious novel coronavirus disease caused by the “severe acute respiratory syndrome coronavirus 2” (SARS-CoV-2) virus, including variants such as Delta, Omicron and others. CPI. The Consumer Price Index. |

CWA. The Federal Water Pollution Control Act, also known as the Clean Water Act. |

Delaware Basin. A geologic depositional and structural basin in West Texas and Southeastern New Mexico which is a part of the Permian Basin, (see below). |

DGCL. Delaware General Corporation Law. E&P. Exploration and production. |

EPA. The United States Environmental Protection Agency. |

ESA. The Endangered Species Act. |

ESG. Environmental, social and governance. |

GAAP. Generally accepted accounting principles used in the United States. |

GHG. Greenhouse Gas. |

IPO. The initial public offering of equity of Aris Water Solutions, Inc. which was completed on October 26, 2021. |

IRS. The Internal Revenue Service. |

kbwpd. One thousand barrels of water per day. |

KPI. Key performance indicator. |

Legacy Owners. Owners of Solaris LLC units at the time of the IPO. |

LIBOR. London Inter-bank Offered Rate. |

Midland Basin. A geologic depositional and structural basin in West Texas which is a part of the Permian Basin (see below). |

MBTA. The federal Migratory Bird Treaty Act. |

MVC. Minimum volume commitment. |

NAAQS. The National Ambient Air Quality Standard. |

NGL. Natural gas liquids. NMOCD. The New Mexico Oil Conservation Division. NORM. Naturally occurring radioactive materials. |

NYSE. New York Stock Exchange. |

3

OPEC. The Organization of the Petroleum Exporting Countries. OPEC+. OPEC plus the countries of Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan and Sudan. |

OSHA. The United States Occupational Safety and Health Administration. |

PSU. Performance-based restricted stock unit. |

Permian Basin. A large sedimentary basin located in West Texas and Southeastern New Mexico. |

RCRA. The federal Resource Conservation and Recovery Act. |

Sarbanes-Oxley Act. The Sarbanes-Oxley Act of 2002. |

SDWA. The federal Safe Drinking Water Act. |

SEC. The United States Securities and Exchange Commission. SOFR. Secured Overnight Financing Rate. SRA. Seismic Response Area. |

TRA. Tax Receivable Agreement. TRC. The Texas Railroad Commission. |

TSCA. The Toxic Substances Control Act. |

UIC. Underground Injection Control. USFWS. The U.S. Fish and Wildlife Service WTI. West Texas Intermediate, a crude oil pricing index reference. |

Introductory Note Regarding Definitions

The registrant, Aris Water Solutions, Inc. (“Aris Inc.”), was incorporated on May 26, 2021 as a Delaware corporation. Aris Inc. was formed to serve as the issuer in an IPO of equity, which was completed on October 26, 2021. Concurrent with the completion of the IPO, Aris Inc. became the new parent holding company of Solaris Midstream Holdings, LLC (“Solaris LLC”), a Delaware limited liability company. Except as otherwise indicated or required by the context, all references to “Aris Inc.,” “Solaris LLC,” the “Company,” “we,” “our,” and “us” or similar terms refer to (i) Solaris LLC and its consolidated subsidiaries before the completion of the Corporate Reorganization, defined below, in connection with the IPO and (ii) Aris Inc. and its consolidated subsidiaries as of the completion of the Corporate Reorganization and thereafter.

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10‑K (the “Annual Report”) includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact contained in this Annual Report, including, without limitation, statements regarding our future results of operations or financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “guidance,” “preliminary,” “project,” “estimate,” “outlook,” “expect,” “continue,” “will,” “intend,” “plan,” “targets,” “believe,” “forecast,” “future,” “potential,” “should,” “may,” “possible,” “could” and variations of such words or similar expressions.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. The outcome of the events described in these forward-looking statements is subject to

4

risks, uncertainties and other factors described in the section titled “Risk Factors” and elsewhere in this Annual Report, including, but not limited to, the following:

| ● | the impact of the current Russia-Ukraine and Israel-Hamas conflicts on the global economy, including its impacts on financial markets and the energy industry; |

| ● | the level of capital spending and development by oil and gas companies, including potential reductions in capital expenditures by oil and gas producers in response to commodity price volatility and/or reduced demand; |

| ● | our reliance on a limited number of customers and a particular region for substantially all of our revenues; |

| ● | our ability to successfully implement our business plan; |

| ● | regional impacts to our business, including our infrastructure assets within the Delaware Basin and Midland Basin formations of the Permian Basin; |

| ● | our access to capital to fund expansions, acquisitions and our working capital needs and our ability to obtain debt or equity financing on satisfactory terms; |

| ● | the impact of competition on our operations, including our ability to renew or replace expiring contracts on acceptable terms; |

| ● | the degree to which our E&P customers may elect to operate their water-management services in-house rather than outsource these services to companies like us; |

| ● | changes in general economic conditions and commodity prices; |

| ● | our customers’ ability to complete and produce new wells; |

| ● | our ability to comply with covenants contained in our debt instruments; |

| ● | risks related to acquisitions and organic growth projects, including our ability to realize their expected benefits; |

| ● | capacity constraints on regional oil, natural gas and water gathering, processing and pipeline systems that result in a slowdown or delay in drilling and completion activity, and thus a slowdown or delay in the demand for our services; |

| ● | the degree to which consolidation among our customers may affect spending on U.S. drilling and completions in the near-term; |

| ● | the potential deterioration of our customers’ financial condition, including defaults resulting from actual or potential insolvencies; |

| ● | our ability to retain key management and employees and to hire and retain skilled labor; |

| ● | our health, safety and environmental performance; |

| ● | the impact of current and future laws, rulings and federal and state governmental regulations, including those related to hydraulic fracturing, accessing water, handling of produced water, carbon |

5

| pricing, taxation of emissions, seismic activity, drilling and right-of-way access on federal and state lands and various other matters; |

| ● | delays or restrictions in obtaining, utilizing or maintaining permits and/or rights-of-way by us or our customers; |

| ● | advances in technologies or practices that reduce the amount of water used or produced in the oil and gas production process, thereby reducing demand for our services; |

| ● | changes in global political or economic conditions, both generally, and in the specific markets we serve; |

| ● | physical, electronic and cybersecurity breaches; |

| ● | accidents, weather, seasonality or other events affecting our business; |

| ● | changes in tax laws, regulations or policies; |

| ● | the effects of litigation; |

| ● | the continued development of the COVID-19 pandemic; and |

| ● | plans, objectives, expectations and intentions contained in this report that are not historical. |

Many of the factors that will determine our future results are beyond the ability of management to control or predict. Should one or more of the risks or uncertainties described in this Annual Report occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, included in this Annual Report are expressly qualified in their entirety by this cautionary statement.

The forward-looking statements made in this Annual Report relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report to reflect events or circumstances after the date of this Annual Report or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments.

For the definitions of certain terms and abbreviations used in this Annual Report, see Glossary of Terms.

Summary of Our Risk Factors

An investment in our Class A common stock involves substantial risks and uncertainties that may materially adversely affect our business, financial condition and results of operations and cash flows. Some of the more significant challenges and risks relating to an investment in our Company are summarized below. The following is only a summary of the principal risks that may materially adversely affect our business, financial condition, results of operations and cash flows. The following should be read in conjunction with the more complete discussion of the risk factors we face, which are set forth in Part I, Item 1A ─ Risk Factors in this Annual Report.

6

Risks Related to Our Business

| ● | Our business depends on capital spending by the oil and gas industry in the Permian Basin, which could be negatively impacted by industry and market conditions over which we have no control. |

| ● | If oil prices or natural gas prices remain volatile or were to decline, the demand for our services could be adversely affected, and have an impact on our contract pricing and skim oil sales. |

| ● | We may be unable to implement price increases or maintain profit margins on our services. |

| ● | We operate in a highly competitive industry, which could negatively affect our ability to expand our operations, including limiting our access to rights-of-way. |

| ● | Growing or adapting our business by constructing new transportation systems and facilities subjects us to construction risks. |

| ● | We may face opposition to the operation of our water pipelines and facilities from various groups. |

| ● | Efforts among those in the investment community that are opposed to the oil and natural gas industry may adversely affect our business. |

| ● | We may be unable to attract and retain key members of management, qualified members of our Board of Directors (the “Board”) and other key personnel. |

| ● | Inherent risks associated with our operations may not be fully covered under our insurance policies. |

| ● | The loss of one or more of our customers could adversely affect our business. |

| ● | Because a significant portion of our revenues is derived from ConocoPhillips, any development that materially and adversely affects ConocoPhillips’ operations, financial condition or market reputation could have a material adverse impact on us. |

| ● | Our lack of diversification increases the risk of an investment in us and we are vulnerable to risks associated with operating primarily in one geographic area. |

| ● | We may not be able to keep pace with technological developments in our industry. |

| ● | We may be required to take write-downs of the carrying values of certain assets and goodwill. |

| ● | Restrictive covenants under our debt instruments may limit our financial flexibility. |

Legal and Regulatory Risks

| ● | Restrictions on the ability to procure water could decrease the demand for our services. |

| ● | We may face increased obligations relating to the closing of our water handling facilities. |

| ● | Fuel conservation measures could reduce demand for our services. |

| ● | Legislation or regulatory initiatives intended to address seismic activity could restrict our ability to handle produced water. |

7

| ● | Climate change legislation, laws, and regulations, including ESG-related disclosure requirements, could have a material adverse effect on our financial condition, results of operations and cash flows, as well as our reputation. |

| ● | A portion of our customers’ oil and gas leases are granted by the federal government, which may suspend or terminate such leases. |

| ● | Laws and regulations related to hydraulic fracturing could result in increased costs and additional operating restrictions that may reduce demand for our services. |

| ● | Delays or restrictions in obtaining or renewing permits by us for our operations or by our customers for their operations could impair our business. |

Risks Related to Our Class A Common Stock

| ● | Our sole material asset is our equity interest in Solaris LLC and we are accordingly dependent upon distributions from Solaris LLC to pay taxes and other expenses. |

| ● | For as long as we are an emerging growth company, we will not be required to comply with certain reporting requirements that apply to other public companies. |

| ● | Certain of our directors have significant duties with, and spend significant time serving, entities that may compete with us in seeking acquisitions and business opportunities and, accordingly, may have conflicts of interest in allocating time or pursuing business opportunities. |

| ● | Our governing organizational documents, as well as Delaware law, contain provisions that could discourage acquisition bids or merger proposals. |

| ● | We cannot assure that we will continue to pay any dividends on our Class A common stock, and our indebtedness could limit our ability to pay dividends on our Class A common stock. |

| ● | Payments under the Tax Receivable Agreement may be accelerated and/or significantly exceed the actual benefits, if any, we realize in respect of the tax attributes subject to the Tax Receivable Agreement. |

| ● | We may issue preferred stock whose terms could adversely affect the voting power or value of our Class A common stock. |

| ● | The market price per share of our Class A common stock is more volatile as there is a less active trading market for the shares. |

You should carefully read and consider the information set forth under “Item 1A. Risk Factors.”

Part I

Items 1. and 2. Business and Properties

Our Company

We are a leading, growth-oriented environmental infrastructure and solutions company that directly helps our customers reduce their water and carbon footprints. We deliver full-cycle water handling and recycling solutions that increase the sustainability of energy company operations. Our integrated pipelines and related

8

infrastructure create long-term value by delivering high-capacity, comprehensive produced water management, recycling and supply solutions to operators in the core areas of the Permian Basin.

We provide critical environmental solutions to many of the most active and well-capitalized companies operating in the Permian Basin, including the following companies and/or their affiliates: ConocoPhillips, Chevron Corporation and Mewbourne Oil Company, Inc. Operators are increasingly focused on minimizing their environmental impact as a measure of success with an emphasis on rapidly increasing the use of recycled produced water in their operations. Our expansive infrastructure, advanced logistics and water treatment methods allow us to reliably gather our customers’ produced water and recycle it for use in their operations. We believe our solutions make a significant contribution to the ability of our customers to achieve their sustainability-related objectives. Since inception, we have been committed to responsibly developing, operating and deploying technology to safely reduce our customers’ environmental footprint.

Our Commitment to Environmental, Social and Governance Leadership

Our business strategy and operations align with the increasing focus of local communities, regulators and stakeholders on ensuring the safety of oil and gas operations and minimizing environmental and local community impacts. We have a leading track record in social and environmental stewardship in the areas in which we operate by setting and meeting ambitious sustainability targets. This leadership highlights the strong technical, operational and financial capabilities of our management team that has decades of experience operating and leading companies in the environmental, infrastructure, water treatment and energy industries.

Our business provides reliable and sustainable water solutions which address the operational and environmental demands of the energy industry and actively reduce emissions. Through our significant investment in permanent pipeline infrastructure to safely gather and transport produced water, we minimize the need for produced water trucking, a major contributor of GHG emission, traffic congestion and road safety concerns in the communities in which we operate. Additionally, we are leaders in the evaluation, piloting and advancement of water treatment technologies, including the development of solutions for the use of treated produced water outside of the oil and gas industry. For example, we are piloting and developing proprietary processes for treating produced water for environmental, agricultural and industrial water demand, including evaluating the use of treated produced water as process water for recharging aquifer systems, carbon sequestration and direct air capture.

Our strong company culture includes commitments to our employees and our shareholders, which we believe will benefit all of our constituents. We have created a work environment that fosters a diverse and inclusive company culture with over 50% minority and/or female representation in our workforce as of December 31, 2023. Additionally, we prioritize safety in our operations through rigorous training, structured protocols and ongoing automation of our operations.

We believe alignment of our management and our Board with our shareholders, including the establishment of a diverse and independent Board, is conducive to creating long-term value. Additionally, through our management’s substantial ownership and our compensation and incentive programs, our management team remains highly motivated to continue creating shareholder value.

Our Full-Cycle Water Handling and Recycling Solutions

Produced Water

Produced water naturally exists in underground formations and is brought to the surface during crude oil and natural gas production. Produced water is produced throughout the entire life of the well and is of particular importance to operators in the Permian Basin given the high produced water-to-oil ratio prevalent across the basin. Many of our customers have stated goals of managing produced water volumes in an environmentally-responsible and cost-effective manner, highlighting the importance of our water management expertise and

9

integrated and extensive asset base. We believe they will increasingly outsource water management to integrated produced water infrastructure and recycling companies like us to manage their water-related needs in a cost and capital effective manner, creating new business development and acquisition opportunities for us.

Water Recycling

Recycling produced water displaces the use of scarce groundwater which would otherwise be used for oil and gas operations. Treatment of produced water is required prior to reuse, which involves the removal of residual hydrocarbons, reduction of free iron and other solids along with the removal of bacteria to customer specifications. We have made a significant investment in our vast network of produced water gathering pipelines and recycling facilities, which has positioned us as a leading independent third-party provider of recycled produced water gathered on a proprietary network in the Permian Basin. The scale of our system allows us to gather significant produced water volumes across a wide geographic area from multiple customers. The increasing volumes of produced water aggregated on our systems provide differentiated support for our recycling operations and ensures that sufficient volumes of recycled water are available to our customers when and where needed. Our expansive asset base allows us to deliver cost-effective, high-capacity and reliable produced water recycling solutions to operators, encouraging and enabling their rapid adoption of the use of recycled produced water while minimizing the use of groundwater in energy production.

Between July 2019 (the month which we began recycling at scale) and December 31, 2023, we recycled approximately 295 million barrels, or approximately 12.4 billion gallons, of produced water. We are committed to providing our customers with a more secure and sustainable alternative to fresh and other sources of groundwater through our innovative technologies and recycling capabilities. By reducing our customers’ dependence on groundwater, we can contribute to their sustainability efforts and the sustainability of the broader energy industry while also providing benefits to our stakeholders and the communities in which we operate.

Full-Cycle Water Management

The volume of water required for hydraulic fracturing and the volume of produced water generated from oil and gas production have significantly increased in the Permian Basin. Additionally, energy producers are increasingly focused on maximizing sustainability and minimizing the environmental impact in the areas in which they operate. These trends represent significant challenges for energy producers. We believe energy producers will increasingly depend on our expansive integrated produced water gathering and recycling assets that are designed specifically to meet these challenges. By developing these partnerships and outsourcing full-cycle produced water management, energy producers can preserve capital for their core operations and ultimately lower water management costs. We provide access to a substantial and growing source of produced water that can be recycled to support energy production, enabling energy producers to lower their water management costs and do so in an environmentally-responsible way.

10

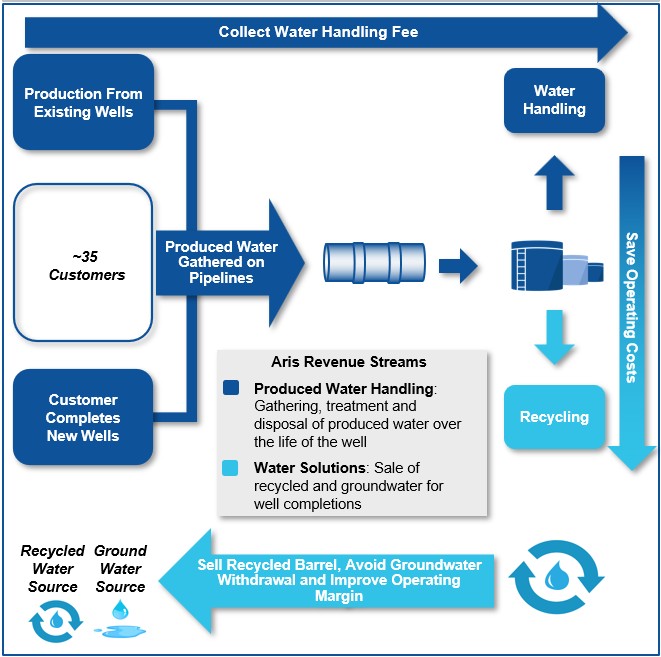

The figure below demonstrates the movement of produced water through our pipelines for handling or recycling and the multiple points at which we can collect fees on the same barrel of water:

Our Operations and Assets

Our Operations

We manage our business through a single operating segment comprising two primary revenue streams, Produced Water Handling and Water Solutions.

Our Produced Water Handling business gathers, transports and, unless recycled, handles produced water generated from oil and natural gas production. Our Produced Water Handling business is supported by long-term contracts with acreage dedications or MVCs, primarily with large, well-capitalized operators.

Our Water Solutions business develops and operates recycling facilities to treat, store and recycle produced water. By aggregating significant volumes of produced water from multiple customers on our connected pipeline networks, we can efficiently recycle large volumes of produced water and deliver this recycled water back to our customers in the time frames, volumes and specifications required by their operations. As needed, we also supplement our recycled produced water with non-potable groundwater to meet the demands of our customers’ operations.

11

Our business is driven by gathering produced water volumes for our Produced Water Handling business and delivering recycled water volumes to customers for our Water Solutions business. In our Produced Water Handling business, we grew our handling volumes from approximately 873,000 barrels per day for the year ended December 31, 2022 to approximately 1,042,000 barrels per day for the year ended December 31, 2023, an increase of 19%. Within our Water Solutions business, we grew our recycled volumes sold from approximately 300,000 barrels per day on average for the year ended December 31, 2022 to approximately 324,000 barrels per day on average for the year ended December 31, 2023, an increase of 8%, and we increased our groundwater volumes sold from approximately 105,000 barrels per day on average for the year ended December 31, 2022 to approximately 126,000 barrels per day on average for the year ended December 31, 2023, an increase of 20%.

Operating Metrics

Total volumes and per barrel operating metrics were as follows for the periods indicated:

(in thousands, except per barrel data) | Year Ended December 31, | ||||||||

| 2023 |

| 2022 | 2021 | |||||

Produced Water Handling Volumes (kbwpd) | 1,042 | 873 | 707 | ||||||

Water Solutions Volumes (kbwpd) (1) | 450 | 411 | 240 | ||||||

Total Water Volumes (kbwpd) | 1,492 | 1,284 | 947 | ||||||

Per Barrel Operating Metrics (2) | |||||||||

Produced Water Handling Revenue/Barrel | $ | 0.78 | $ | 0.77 | $ | 0.72 | |||

Water Solutions Revenue/Barrel | $ | 0.56 | $ | 0.51 | $ | 0.50 | |||

Revenue/Barrel of Total Volumes | $ | 0.72 | $ | 0.68 | $ | 0.66 | |||

Direct Operating Costs/Barrel (3) | $ | 0.33 | $ | 0.30 | $ | 0.26 | |||

Gross Margin/Barrel | $ | 0.25 | $ | 0.24 | $ | 0.22 | |||

Adjusted Operating Margin/Barrel (4) | $ | 0.39 | $ | 0.39 | $ | 0.41 | |||

| (1) | Includes recycled volumes sold of approximately 324,000, 300,000 and 123,000 barrels per day for the years ended December 31, 2023, 2022 and 2021, respectively. Also includes groundwater transfer volumes of approximately 6,000 and 44,000 barrels per day for the years ended December 31, 2022 and 2021, respectively, which related assets were sold in the first quarter of 2022. |

| (2) | Per barrel operating metrics are calculated independently. Therefore, the sum of individual amounts may not equal the total presented. |

| (3) | Direct operating costs include landowner royalties, power expenses for handling and treatment facilities, direct labor, chemicals for water treatment, water filtration expenses, workover expense, repair and maintenance of facilities, equipment rentals and environmental remediation. |

| (4) | Adjusted Operating Margin/Barrel is a Non-GAAP measure. See Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations ─ Non-GAAP Financial Measures. |

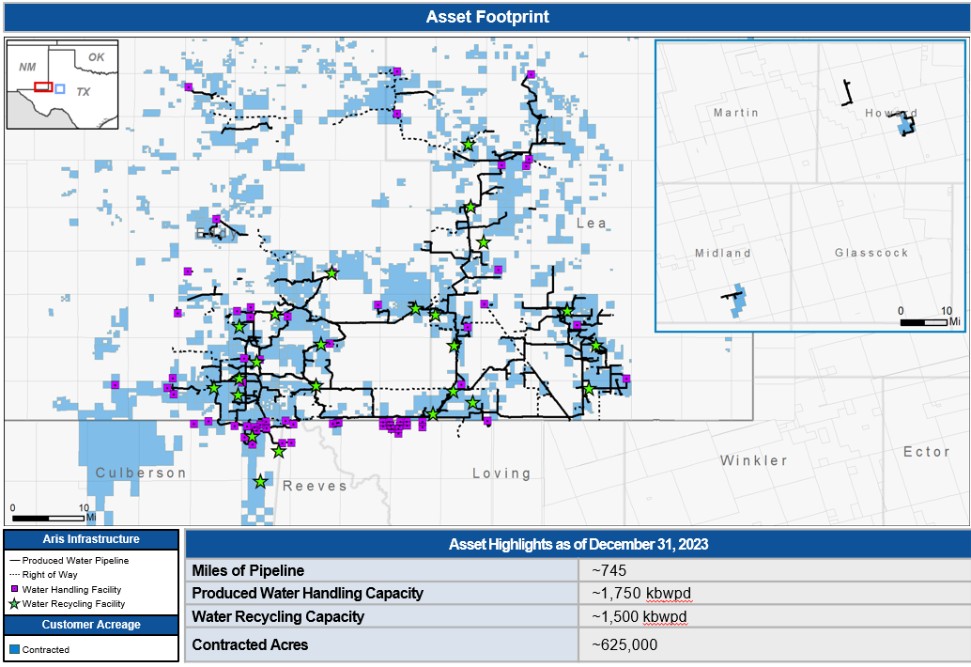

Asset Overview

Our recognized operational capability is supported by our automated and high-capacity integrated pipeline network. Our pipeline and water handling assets are comprised primarily of pipelines, pumps and handling and recycling facilities located entirely in the Delaware and Midland sub-basins of the broader Permian Basin. These interconnected assets support both our Produced Water Handling and Water Solutions businesses. We currently have approximately 745 miles of produced water pipeline, which includes approximately 550 miles of larger diameter (12- to 24-inch) pipelines. We have 66 produced water handling facilities and operate 23 high-capacity produced water recycling facilities. Our systems provide an alternative to operators managing their own produced water infrastructure.

12

The following map describes our active assets as of December 31, 2023:

Our Assets

Produced Water Handling Facilities

Our handling facilities, which are designed to process, store and/or dispose of produced water that is not recycled, are essential to our ability to deliver reliable and cost-effective water gathering services to existing and prospective customers across a large geographic footprint. As of December 31, 2023, we have 66 produced water handling facilities which had approximately 1.8 million barrels per day of capacity.

December 31, 2023 |

| Pipelines (Miles) |

| Number of Water Handling Facilities |

| Water Handling Capacity (kbwpd) |

Installed | 745 | 66 | 1,750 |

We have secured significant permits and rights-of-way for additional pipelines and water handling facilities. As of December 31, 2023, we had approximately 220 miles of additional permitted pipeline rights-of-way and approved permits for an additional 35 produced water handling facilities with approximately 1.2 million barrels per day of permitted handling capacity. This significant backlog of permitted handling capacity provides us with valuable optionality and a competitive advantage as it allows us to react quickly to meet existing and new customer demand without potential permitting delays.

13

December 31, 2023 |

| Pipelines (miles) |

| Number of Water Handling Facilities |

| Water Handling Capacity (kbwpd) |

Permitted, Not Installed | 220 | 35 | 1,180 |

Recycling Facilities

Our recycling facilities include water filtration, treatment, storage and redelivery assets. We construct our recycling facilities at strategic locations on our pipeline network where there is both significant customer demand for recycled produced water and high volumes of produced water available. As of December 31, 2023, we had 23 facilities operational in the Delaware Basin with approximately 1.5 million barrels per day of treatment capacity and access to approximately 19.5 million barrels of owned or leased storage capacity.

December 31, 2023 |

| Number of Water Recycling Facilities |

| Water Recycling Capacity (kbwpd) | ||

Active Facilities | 23 | 1,500 |

We also have the option to rapidly expand our recycling footprint as needed by developing an additional 21 locations that are either permitted or in the process of being permitted. We operate and construct both fixed treatment facilities and modular treatment systems that we can quickly assemble to capitalize on market opportunities.

December 31, 2023 |

| Number of Water Recycling Facilities |

| Water Recycling Capacity (kbwpd) | ||

Facilities Permitted or in Process of Permitting | 21 | 1,300 |

Our Customers and Contracts

Customers

We have long-term contracts with some of the most active and well-capitalized oil and gas operators in the Permian Basin that are increasingly focused on sustainability and minimizing the environmental impact of their operations. Since inception, we have consistently won new contracts and deepened relationships with existing customers, many of which have executed multiple contracts with us. As of December 31, 2023, we have approximately 95 contracts for our Produced Water Handling and Water Solutions businesses with approximately 35 different customers across approximately 625,000 dedicated acres.

As of December 31, 2023, the weighted average remaining life of our produced water handling acreage dedication contracts was approximately 7.8 years. Our largest customers for the year ended December 31, 2023 were affiliates of ConocoPhillips, Chevron Corporation and Mewbourne Oil Company, Inc. These customers represented approximately 62% of our revenue for the year ended December 31, 2023. See Part II, Item 8. Financial Statements and Supplementary Data – Note 3. Additional Financial Statement Information.

Contracts — Produced Water Handling

As produced water volumes from oil and natural gas production in the Permian Basin have significantly grown in recent years, long-term contract structures like those used in the hydrocarbon midstream sector have been adopted for water services. In our Produced Water Handling business, we primarily enter into two types of contracts with our customers: acreage dedications and MVCs. These contractual arrangements are generally long-term. All produced water transported on our gathering pipeline infrastructure for handling or recycling is subject to fee-based contracts, which are generally subject to limited annual CPI-based adjustments.

14

Acreage Dedications. Acreage dedications are term contracts pursuant to which a customer dedicates all water produced from current and future wells that they own or operate in a dedicated area to our system. In turn, we commit to gather and handle such produced water. During 2023, we added approximately 7,400 net dedicated acres and divested assets with approximately 34,500 net acres. As of December 31, 2023, our acreage dedications covered a total of approximately 625,000 acres and had a weighted average remaining life of approximately 7.8 years.

MVCs. Under our MVC contracts, our customers guarantee to (i) deliver a certain minimum daily volume of produced water to our pipeline network at an agreed upon fee, or (ii) pay a deficiency fee if the minimum daily volume is not met for a specified period. As of December 31, 2023, our contracted aggregate MVCs totaled approximately 130,000 bwpd of produced water, and the weighted average remaining life of our MVCs was 2.7 years.

Spot Arrangements. We also enter into spot arrangements whereby we can elect to gather and handle our customers’ produced water to the extent we have capacity on our systems when they request offtake capacity. We refer to these volumes as spot volumes. When producers have a need for produced water handling services at locations which are not otherwise contracted to us, we will enter into spot arrangements in order to utilize available capacity and increase volume throughput on our systems.

The following table provides an overview of our active contracts:

Year Ended December 31, | |||

Percentage of Produced Water Handling Revenue | 2023 | 2022 | 2021 |

Acreage Dedication | 72% | 67% | 70% |

Minimum Volume Commitments | 12% | 9% | 16% |

Spot Volumes | 6% | 13% | 9% |

Skim Oil Sales | 10% | 11% | 5% |

Total | 100% | 100% | 100% |

Acreage dedications and minimum volume commitments were as follows:

| December 31, 2023 | ||

Acreage Dedications | |||

Acreage Under Contract (thousands of acres) | 625 | ||

Weighted Average Remaining Life (years) | 7.8 | ||

Minimum Volume Commitments |

| ||

Volumetric Commitment (kbwpd) | 130 | ||

Weighted Average Remaining Life (years) | 2.7 |

Certain contracts included in the table above include both an acreage dedication and a minimum volume commitment. These contracts represent approximately 56,000 acres of the total acreage under contract and 85 kbwpd of the total volumetric commitment.

Delivery Commitment

During the first quarter of 2023, we entered into an agreement with an unaffiliated water disposal company to dispose a minimum volume of produced water over a term of seven years, for a total financial commitment of approximately $28.0 million, undiscounted. We began delivering produced water under this agreement in June 2023. As of December 31, 2023, the remaining minimum commitment was $25.8 million, undiscounted. See Part II, Item 1. Financial Statements – Note 13. Commitments and Contingencies for more information.

15

Contracts ─ Water Solutions

Our Water Solutions contracts are primarily structured as spot contracts or acreage dedications where we agree to supply water, including recycled water, to our customers for their operations.

We believe our integrated business model, history of operational execution, asset footprint and commitment to produced water recycling are important to current and prospective customers and support our leading position in water recycling in the Permian Basin.

Innovation in Recycling and Sustainable Water Management

Our goal is to maximize the amount of produced water we recycle as a percentage of the produced water we gather. We are partnering with leading oil and gas operators, scientists and universities in the field of water treatment to identify, adapt and pilot innovative technologies for beneficial reuse of produced water. We are actively working with the U.S. Department of Energy and the New Mexico Produced Water Research Consortium to advance certain initiatives related to produced water management, treatment technologies and beneficial reuse. We have identified potential opportunities to treat and discharge produced water for beneficial use including supplementing irrigation water demand, recharging aquifer systems, providing irrigation for range grasses for carbon sequestration and process water for direct air capture carbon sequestration.

Research Grant by the Department of Energy

In December 2023, we were selected by the Department of Energy (“DOE”) to receive a research grant related to the treatment and desalination of produced water as an irrigation source for non-consumptive agriculture. The terms and conditions of the grant are currently being negotiated and if awarded, would allow us to further expand our ongoing greenhouse study with Texas A&M AgriLife Extension Service, which uses treated and desalinated produced water to grow cotton and grasses. A wide range of partners from academia, agriculture and the oil and gas industry are expected to contribute to this ongoing study, which we will continue to lead. The study is designed to demonstrate and optimize field-scale produced water treatment and desalination which is customized for agricultural irrigation applications.

In addition, the study is expected to be expanded to evaluate the extraction of valuable minerals and constituents contained in the produced water, such as ammonia, with the objective of investigating direct-use products for the agriculture industry. Importantly, the study is expected to support further evaluation of carbon sequestration benefits that are related to specific agricultural applications using treated produced water.

Beneficial Reuse Strategic Agreement

In November 2022, we announced that we had entered into a strategic agreement (the “Beneficial Reuse Strategic Agreement”) with Chevron U.S.A. Inc. (“Chevron U.S.A.”) and ConocoPhillips to develop and pilot technologies and processes to treat produced water for potential beneficial reuse opportunities. In January 2023, ExxonMobil Corporation (“ExxonMobil”) joined the Beneficial Reuse Strategic Agreement to develop and pilot technologies and processes to treat produced water for potential beneficial reuse opportunities. Aris Inc., Chevron U.S.A., ConocoPhillips and ExxonMobil’s goal under the Beneficial Reuse Strategic Agreement is to develop cost effective and scalable methods of treating produced water to create a potential water source for industrial, commercial and non-consumptive agricultural purposes.

We are leading the engineering, construction and execution of the testing protocols and pilot projects, while leveraging the combined technical expertise of Chevron U.S.A., ConocoPhillips and ExxonMobil. We expect the treated water may be reused in a variety of research projects, including non-consumptive agriculture, low emission hydrogen production and the direct air capture of atmospheric carbon dioxide. Aris Inc., Chevron U.S.A., ConocoPhillips and ExxonMobil are working with appropriate regulators, with a goal to complete testing and performance evaluation of pilot technologies by the end of the third quarter of 2024.

16

Water Standard Asset Acquisition

In October 2022, we acquired certain intellectual property rights and related proprietary treatment technologies and assets from Water Standard Management (US), Inc. (“Water Standard”) that are currently being applied onsite in pilot operations to accelerate the advanced treatment and beneficial reuse of produced water in the Permian Basin. See Part II, Item 8. Financial Statements and Supplementary Data – Note 4. Acquisitions.

Our People

As of December 31, 2023, we had a total of 251 employees, 94 of which service our corporate function, and 157 work in field locations. We hire independent contractors on an as needed basis. We and our employees are not subject to any collective bargaining agreements.

Safety is one of our greatest priorities, and we have implemented safety management systems, procedures, trainings and other tools to help protect our employees and contractors. We strive to hire local employees and have provided mentoring programs for employees to develop specialized skills necessary for our industry. We also provide career development programs to create opportunities for advancement. We encourage development of local leadership and team-based collaboration at our worksites. Our benefits include (i) health care for full-time employees and their eligible dependents, (ii) access to a Safe Harbor 401(k) Plan with a company match of up to 4% of the employee’s salary, which increased to 6% effective January 1, 2024, (iii) basic life, accidental death and dismemberment, and short and long-term disability insurance, (iv) a family and medical leave policy which affords eligible (hourly and salaried) employees with up to 12 weeks leave for a serious health condition, the care of a family member, or the birth or adoption of a child, (v) wages that exceed state and federal standards and minimums, and (vi) our 2021 Equity Incentive Plan, which gives certain key employees an opportunity to share in our success.

We aim to attract and retain talented individuals. Our employee demographic profile aids us in promoting inclusion of thought, skill, knowledge and culture across our organization. As of December 31, 2023, greater than 50% of our workforce is minority and/or female. We also support local communities where we operate by giving to and volunteering with first responders and local charities.

Organizational Structure and Corporate Information

Initial Public Offering

On October 26, 2021, we completed the IPO of 20,297,500 shares of our Class A common stock, par value $0.01 per share (“Class A common stock”), which included 2,647,500 shares of Class A common stock issued and sold pursuant to the underwriters’ exercise of their option in full to purchase additional shares of Class A common stock, at a price to the public of $13.00 per share ($12.14 per share net of underwriting discounts and commissions and other issuance costs). After deducting underwriting discounts and commissions and offering expenses payable by us, we received net proceeds of approximately $246.4 million. We contributed all of the net proceeds of the IPO received to Solaris LLC in exchange for Solaris LLC units. Solaris LLC distributed approximately $213.2 million of the net proceeds to the Legacy Owners and retained the remaining $33.2 million of the net proceeds for general corporate purposes, which included capital expenditures, working capital and potential acquisitions and strategic transactions.

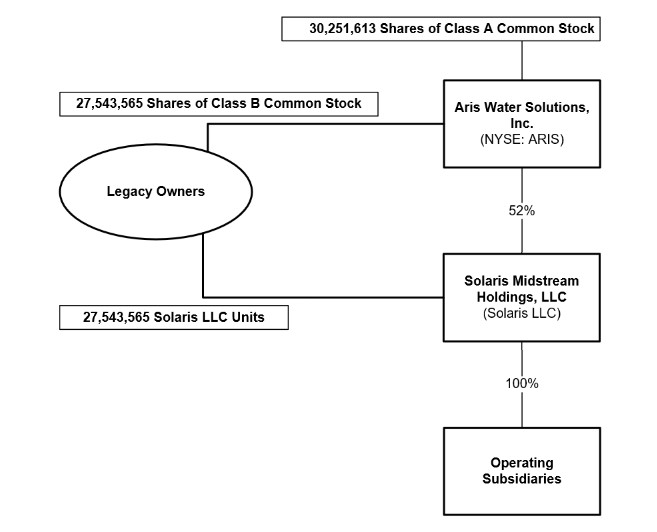

At the conclusion of the IPO, we owned an approximate 38% interest in Solaris LLC and the Legacy Owners owned an approximate 62% interest in Solaris LLC. We report a noncontrolling interest on our consolidated balance sheet related to the portion of Solaris LLC units not held by us. See Consolidation, below.

17

Consolidation

We are a holding company, and our principal asset is a membership interest in Solaris LLC. As the sole managing member of Solaris LLC, we operate and control all of the business and affairs of Solaris LLC, and through Solaris LLC and its subsidiaries, conduct its business. We are responsible for all operational, management and administrative decisions relating to Solaris LLC’s business. As a result, beginning in the fourth quarter of 2021, we consolidate the financial results of Solaris LLC and its subsidiaries and report a noncontrolling interest related to the portion of Solaris LLC units not owned by us, which reduces net income attributable to our Class A common stockholders.

Corporate Reorganization

The transactions described above (altogether, the “Corporate Reorganization”) have been accounted for as a reorganization of entities under common control. As a result, our consolidated financial statements recognize the assets and liabilities received in the Corporate Reorganization at their historical carrying amounts, as reflected in the historical financial statements of Solaris LLC. We consolidate Solaris LLC in our consolidated financial statements and record a noncontrolling interest related to the Solaris LLC units held by the Class B stockholders in our consolidated balance sheet and statement of operations.

Ownership Structure

The following diagram reflects our ownership structure as of December 31, 2023:

18

Redemption Rights

Under the Solaris LLC Agreement, Legacy Owners of Solaris LLC units, subject to certain limitations, have the right, pursuant to a redemption right, to cause Solaris LLC to acquire all or a portion of their Solaris LLC units for, at Solaris LLC’s election, (x) shares of our Class A common stock at a redemption ratio of one share of Class A common stock for each Solaris LLC unit redeemed, subject to conversion rate adjustments for stock splits, stock dividends and reclassifications or (y) an equivalent amount of cash. Alternatively, upon the exercise of the redemption right, we have the right, pursuant to a call right, to acquire each tendered Solaris LLC unit directly from the Legacy Owner for, at our election, (x) one share of Class A common stock or (y) an equivalent amount of cash.

During the years ended December 31, 2023 and 2022, 31,954 and 4,140,585 Solaris LLC units, respectively, were converted (together with an equal number of shares of Class B common stock) into shares of our Class A common stock. As of December 31, 2023, we owned an approximate 52% interest in Solaris LLC, and the Legacy Owners owned an approximate 48% interest in Solaris LLC.

Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). The JOBS Act provides that an emerging growth company may take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of this extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption is required for private companies.

Tax Receivable Agreement

At the closing of the IPO, we entered into a TRA with the Legacy Owners of Solaris LLC units (each such person, a “TRA Holder,” and together, the “TRA Holders”). The Tax Receivable Agreement generally provides for the payment by us to each TRA Holder of 85% of the net cash savings, if any, in U.S. federal, state and local income tax and franchise tax that we actually realize (computed using simplifying assumptions to address the impact of state and local taxes) or are deemed to realize in certain circumstances in periods after the IPO as a result of certain increases in tax basis that occur as a result of our acquisition or Solaris LLC’s redemption, respectively, of all or a portion of such TRA Holder’s Solaris LLC units in connection with the IPO or pursuant to the exercise of a redemption right or call right. We retain the remaining 15% of these cash savings. The future benefit of these cash savings is included, alongside other tax attributes, in our total deferred tax asset balances at December 31, 2023 and 2022. As of December 31, 2023, the TRA liability totaled $98.3 million.

We estimate that if all the remaining Solaris LLC units were converted to Class A common stock on December 31, 2023, the TRA liability would be approximately $208.5 million. If we experience a change of control (as defined under the TRA, which includes certain mergers, asset sales and other forms of business combinations and change of control events) or the TRA terminates early (at our election or as a result of our breach), we could be required to make an immediate lump-sum payment under the terms of the TRA. As of December 31, 2023, we estimate the liability associated with this lump-sum payment (or “early termination payment”) would be approximately $159.3 million, discounted. The amount of this liability for a change of control can be significantly impacted by the closing price of our Class A shares on the applicable exchange date. We currently do not anticipate experiencing a change of control or an early termination of the TRA.

See Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources – Tax Receivable Agreement.

19

Quarterly Dividends

For each quarter of the year ended December 31, 2023, our Board declared a dividend of $0.09 per share on our Class A common stock. In conjunction with the dividend payments, quarterly distributions of $0.09 per unit were paid to unit holders of Solaris LLC. The dividends and distributions were paid during the year ended December 31, 2023.

On February 23, 2024, our Board declared a dividend of $0.09 per share on our Class A common stock for the first quarter of 2024. In conjunction with the dividend payment, a distribution of $0.09 per unit will be paid to unit holders of Solaris LLC. The dividend will be paid on March 21, 2024 to holders of record of our Class A common stock as of the close of business on March 7, 2024. The distribution to unit holders of Solaris LLC will be subject to the same payment and record dates.

See Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources – Dividends and Distributions.

General

Aris Inc. was incorporated as a Delaware corporation on May 26, 2021. Our principal executive office is located at 9651 Katy Freeway, Suite 400, Houston, Texas 77024, and we have additional offices in Midland, Texas and Carlsbad, New Mexico.

Our website address is www.ariswater.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Exchange Act are available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC.

Also posted on our website under “Investor Relations – Corporate Governance – Governance Documents,” and available in print upon request made by any shareholder to the Investor Relations Department, are our Code of Business Conduct and Ethics and Principles of Corporate Governance, as well as our charters for our Nominating and ESG Committee, Compensation Committee and Audit Committee. Within the time period required by the SEC and the NYSE, as applicable, we will post on our website any modifications to the Codes and any waivers applicable to senior officers as defined in the applicable Code, as required by the Sarbanes-Oxley Act.

We webcast our earnings calls and certain events we participate in or host with members of the investment community on our investor relations website. Additionally, we provide notifications of news or announcements regarding our financial performance, including SEC filings, investor events and presentations and press and earnings releases, as part of our investor relations website. We intend for our website to be a forum of public dissemination for purposes of Regulation FD.

Information contained on our website or linked therein or otherwise connected thereto does not constitute part of and is not incorporated by reference into this Annual Report.

Competition

We compete with public and private water infrastructure companies as well as operators developing systems in-house for produced water handling and recycling in the areas in which we operate. Competition in the water infrastructure industry is based on the geographic location of facilities, business reputation, operating reliability and flexibility, business service offerings, available capacity and pricing arrangements for the services offered. We compete with other companies that provide similar services in our areas of operations, but we benefit from our relationships with large operators in the Permian Basin, including ConocoPhillips, and our reputation as a proven, reliable service provider and our deep commitment to recycling and sustainability.

20

As we seek to expand our water gathering, recycling and handling services to new customers, we will continue to face a high level of competition.

Seasonality

In general, seasonal factors have not had a significant direct effect on our business other than timing impacts of oil and gas completion activity that have historically been weighted to the back half of the year. However, extreme weather conditions during parts of the year could adversely impact the well-completion activities of our customers, who are oil and natural gas operators, thereby reducing the amount of produced water to be gathered and either recycled or handled, as well as the volume of Water Solutions barrels sold to our customers.

Insurance

Our assets may experience physical damage as a result of an accident or natural disaster. These hazards can also cause personal injury and loss of life, severe damage to and destruction of property and equipment, pollution or environmental damage and suspension of operations. Litigation arising from such an event may result in us being named a defendant in lawsuits asserting large claims. We maintain our own general liability, product liability, property, business interruption, directors’ and officers’ liability, workers compensation, cybersecurity and pollution liability insurance policies, among other policies, at varying levels of deductibles and limits that we believe are reasonable and prudent under the circumstances to cover our operations and assets. As we continue to grow, we will continue to evaluate our policy limits and retentions as they relate to the overall cost and scope of our insurance program.

Regulation

We are subject to a variety of laws in connection with our operations, including those related to the environment, health and safety, personal privacy and data protection, intellectual property, advertising and marketing, labor, competition and taxation. These laws and regulations are constantly evolving and may be interpreted, implemented or amended in a manner that could harm our business. It also is possible that as our business grows and evolves, we will become subject to additional laws and regulations. There is no assurance that compliance with current laws and regulations or amended or newly adopted laws and regulations can be maintained in the future or that future expenditures required to comply with all such laws and regulations in the future will not be material. In the course of implementing our programs to ensure compliance with applicable laws and regulations, certain instances of potential non-compliance may be identified from time to time. We cannot predict the outcome of these matters, and cannot estimate a range of reasonably possible losses, if any. This section sets forth the summary of material laws and regulations relevant to our business operations.

Environmental and Occupational Safety and Health Matters

Our operations and the operations of our customers are subject to federal, state and local laws and regulations in the U.S. relating to protection of natural resources and the environment, health and safety aspects of our operations and waste management, including the disposal of waste and other materials. Numerous governmental entities, including the EPA and analogous state agencies, have the power to enforce compliance with these laws and regulations and the permits issued under them, often requiring difficult and costly actions. These laws and regulations may, among other things (i) require the acquisition of permits to take fresh water from surface water and groundwater, construct pipelines or containment facilities, drill wells and other regulated activities; (ii) restrict the types, quantities and concentration of various substances that can be released into the environment or injected into non-producing belowground formations; (iii) limit or prohibit our operations on certain lands lying within wilderness, wetlands and other protected areas; (iv) require remedial measures to mitigate pollution from former and ongoing operations; (v) impose specific safety and health criteria addressing worker protection; and (vi) impose substantial liabilities for pollution resulting from our operations. Any failure on our part or the part of our customers to comply with

21

these laws and regulations could result in the impairment or cancellation of operations, assessment of sanctions, including administrative, civil and criminal penalties, injunctions, reputational damage, the imposition of investigatory, remedial, and corrective action obligations or the incurrence of capital expenditures; the occurrence of restrictions, delays or cancellations in the permitting, development or expansion of projects; and the issuance of injunctions restricting or prohibiting some or all of our activities in a particular area.

The trend in U.S. environmental regulation is typically to place more restrictions and limitations on activities that may affect the environment. Any new laws and regulations, amendment of existing laws and regulations, reinterpretation of legal requirements or increased governmental enforcement that result in more stringent and costly construction, completion or water-management activities, or waste handling, storage transport, disposal, or remediation requirements could have a material adverse effect on our financial position and results of operations. The following is a summary of the more significant existing environmental and occupational safety and health laws in the U.S., as amended from time to time, to which our operations are subject and for which compliance may have a material adverse impact on our capital expenditures, results of operations or financial position.

Hazardous substances and wastes. The RCRA, and comparable state statutes regulate the generation, transportation, treatment, storage, disposal and cleanup of hazardous and non-hazardous wastes. Pursuant to rules issued by the EPA, the individual states administer some or all of the provisions of RCRA, sometimes in conjunction with their own, more stringent requirements. Drilling fluids, produced waters, and most of the other wastes associated with the exploration, development, and production of oil or gas, if properly handled, are currently exempt from regulation as hazardous waste under RCRA, and instead are regulated under RCRA’s less stringent non-hazardous waste provisions, state laws or other federal laws. However, it is possible that certain oil and gas drilling and production wastes now classified as non-hazardous could be classified as hazardous wastes in the future. Any loss of the RCRA exclusion for drilling fluids, produced waters and related wastes could result in an increase in our and our oil and gas producing customers’ costs to manage and dispose of generated wastes, which could have a material adverse effect on our and our customers’ results of operations and financial position. Effective December 7, 2023, the EPA issued “technical corrections” to RCRA hazardous waste regulations, correcting and clarifying specific provisions promulgated in the Hazardous Waste Generator Improvements rule, the Hazardous Waste Pharmaceuticals rule, and the Definition of Solid Waste rule. States may adopt these rules and may also modify them to become more stringent.

Wastes containing NORM may also be generated in connection with our operations. Certain processes used to produce oil and gas may enhance the radioactivity of NORM, which may be present in oilfield wastes. NORM is subject primarily to individual state radiation control regulations. Texas and New Mexico have both enacted regulations governing the handling, treatment, storage and disposal of NORM. In addition, NORM handling and management activities are governed by regulations promulgated by OSHA. These state and OSHA regulations impose certain requirements concerning worker protection, the treatment, storage and disposal of NORM waste, the management of waste piles, containers and tanks containing NORM, as well as restrictions on the uses of land with NORM contamination.

CERCLA, also known as the Superfund law, and comparable state laws impose liability, without regard to fault or legality of conduct, on classes of persons considered to be responsible for the release of a “hazardous substance” into the environment. These persons include the current and past owner or operator of the site where the hazardous substance release occurred and anyone who disposed or arranged for the disposal of a hazardous substance released at the site. Under CERCLA, such persons may be subject to joint and several, strict liability for the costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources and for the costs of certain health studies. CERCLA also authorizes the EPA and, in some instances, third parties to act in response to threats to the public health or the environment and to seek to recover from the responsible classes of persons the costs they incur. In addition, neighboring landowners and other third parties may file claims for personal injury and property

22

damage allegedly caused by the hazardous substances released into the environment. We generate materials in the course of our operations that may be regulated as hazardous substances.

Water discharges and use. The Federal Water Pollution Control Act, also known as the Clean Water Act (“CWA”), and analogous state laws, impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of oil and hazardous substances, into state waters and waters of the U.S. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. Spill Prevention, Control and Countermeasure Plan requirements imposed under the CWA require appropriate containment berms and similar structures to help prevent the contamination of navigable waters in the event of a petroleum hydrocarbon tank spill, rupture or leak. In addition, the CWA and analogous state laws require individual permits or coverage under general permits for discharges of stormwater runoff from certain types of facilities. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with discharge permits or other requirements of the CWA and analogous state laws and regulations.

The CWA also prohibits the discharge of dredge and fill material into regulated waters, including wetlands, unless authorized by permit. In 2015, the EPA and the U.S. Army Corps of Engineers (the “Corps”) under the Obama Administration published a final rule attempting to clarify the federal jurisdictional reach over waters of the U.S. However, the EPA rescinded this rule in 2019 and promulgated the Navigable Waters Protection Rule in 2020. The Navigable Waters Protection Rule defined what waters qualify as navigable waters of the United States under Clean Water Act jurisdiction. This rule has generally been viewed as narrowing the scope of waters of the United States as compared to the 2015 rule, and litigation has been filed in multiple federal district courts challenging the rescission of the 2015 rule and the promulgation of the Navigable Waters Protection Rule. In June 2021, the Biden Administration announced plans to develop its own definition for such waters, and in August 2021, a federal judge for the U.S. District Court for the District of Arizona issued an order striking down the Navigable Water Protection Rule. On December 7, 2021, the U.S. Environmental Protection Agency and the Department of the Army (“the agencies”) announced a proposed rule to revise the definition of “waters of the United States.” The agencies propose to put back into place the pre-2015 definition of “waters of the United States,” updated to reflect consideration of Supreme Court decisions. The public comment period on the proposed rule closed on February 7, 2022. The final revised definition of “waters of the United States” was issued on December 30, 2022, which will be effective 60 days after its publication in the Federal Register at 33 C.F.R. 328.3 and 40 C.F.R. 120.2. The rule broadens the scope of the “waters of the United States” consistent with the framework of the pre-2015 regulations (also called the 1986 regulations). Expansion of the scope of the Clean Water Act’s jurisdiction in areas where we conduct operations could cause us to incur increased costs and restrictions, delays or cancellations in permitting or projects, which developments could expose us to significant costs and liabilities. For example, on January 24, 2022, the Supreme Court agreed to consider the scope of the Clean Water Act again in Sackett v. EPA. In its decision issued on May 25, 2023, however, the Supreme Court held that the Clean Water Act extends only to wetlands that have a continuous surface connection with “waters of the United States”—a narrowing (and reversal) of the Ninth Circuit’s decision.

Water handling facilities and seismicity. Saltwater disposal via underground injection is regulated pursuant to the UIC program established under the SDWA and analogous state and local laws and regulations. The UIC program includes requirements for permitting, testing, monitoring, recordkeeping and reporting of injection well activities, as well as a prohibition against the migration of fluid containing any contaminant into underground sources of drinking water. State regulations require a permit from the applicable regulatory agencies to operate underground injection wells. Although we monitor the injection process of our wells, any leakage from the subsurface portions of the injection wells could cause degradation of fresh groundwater resources, potentially resulting in suspension of our UIC permit, issuance of fines and penalties from governmental agencies, incurrence of expenditures for remediation of the affected resource and imposition of liability by third parties claiming damages for alternative water supplies, property and personal injuries. A change in UIC disposal well regulations or the inability to obtain permits for new disposal wells in the future may affect our ability to dispose of produced water and other substances, which could affect our business.

23

Furthermore, in response to seismic events in the past several years near underground disposal wells used for the disposal by injection of produced water resulting from oil and gas activities, federal and some state agencies are investigating whether such wells have caused or contributed to increased seismic activity, and some states have restricted, suspended, or shut down the use of disposal wells within the vicinity of seismic events. In response to these concerns, regulators in some states have imposed, or are considering imposing, additional requirements in the permitting of produced water disposal wells or otherwise to assess any relationship between seismicity and the use of such wells.

We currently operate in the states of New Mexico and Texas, where the NMOCD and the TRC, respectively, have the authority to regulate disposal activity, including the authority to address seismic activity in their respective states. For example, the TRC requires applicants for new disposal wells that will receive non-hazardous produced water or other oil and natural gas waste to conduct seismic activity searches utilizing the U.S. Geological Survey. The searches are intended to determine the potential for earthquakes within a circular area of 100 square miles around a proposed new disposal well. If the permittee or an applicant for a disposal well permit fails to demonstrate that the produced water or other fluids are confined to the disposal zone, or if scientific data indicates such a disposal well is likely to be, or determined to be, contributing to seismic activity, then the TRC may deny, modify, suspend or terminate the permit application or existing operating permit for that disposal well. The TRC has used this authority to deny permits for certain waste disposal wells.

Most recently, in 2021, the NMOCD and TRC created SRAs with action plans to address seismic activity as further discussed below.

New Mexico

The NMOCD has implemented a Seismic Response Protocol, which outlines certain reporting and curtailment requirements for operators in SRAs to follow in response to seismic events based on the magnitude and proximity to the event. The NMOCD created the Hat Mesa SRA in Northern Lea County, New Mexico in response to a seismic event that occurred in that area in the fourth quarter of 2021. The Hat Mesa SRA and associated Seismic Response Protocol resulted in additional reporting requirements, including more frequent reporting with daily injection volume and pressure data for operators within 10 miles of the seismic event, and the reduction of monthly injection volumes for wells within six miles of the seismic event. We operate four wells located within the Hat Mesa SRA that are subject to the protocol. In September 2023, we temporarily curtailed one of these wells in response to a seismic event on September 22, 2023, in Lea County, New Mexico. Due to the uncertainty regarding the causal factors of the event, the NMOCD did not create an SRA nor require the operators of disposal wells within 10 miles of the seismic event to follow the established Seismicity Response Protocol. Therefore, we returned the temporarily curtailed well to pre-curtailment levels beginning on November 1, 2023. As of December 31, 2023, we have partially curtailed injection in one of the wells by approximately 5 kbwpd and continue to operate the partially curtailed well. However, to date we have not had an operational impact on gathering volumes. We are also required to submit daily injection and pressure volumes on a weekly reporting basis. As there was no further seismic activity within the Hat Mesa SRA in 2022 or 2023, the NMOCD reduced curtailment requirements.

Texas

The TRC established the Gardendale SRA in September 2021, the North Culberson-Reeves SRA in October 2021 and the Stanton SRA in January 2022.

The Northern Culberson-Reeves SRA was expanded in 2022, which expansion partially overlaps our operations in Northern Culberson, Reeves, and Loving Counties, Texas. However, to date the Northern-Culberson-Reeves SRA has not had a material impact on our operations.

The Stanton SRA is located in Martin County and the western portion of Howard County. Saltwater disposal well operators within the Stanton SRA created a response plan which began on May 15, 2022. The plan

24

employed a two-tiered approach based on the depth of the disposal zone (shallow versus deep disposal wells) and includes expanded data collection efforts, contingency responses for future seismicity, and scheduled checkpoint updates with TRC staff. Following the sale of our assets located in Martin County in the third quarter of 2023, we no longer operate any wells within the Stanton SRA.

See Part I, Item 1A. Risk Factors ─ Legislation or regulatory initiatives intended to address seismic activity could restrict our ability to recycle or handle produced water gathered from our E&P customers and, accordingly, could have a material adverse effect on our business.

See also Part II, Item 7. Management’s Discussion and Analysis of Results of Operations ─ General Trends and Outlook – Seismicity for a discussion of the impact on our business.

Hydraulic fracturing activities. Hydraulic fracturing involves the injection of water, sand or other proppants and chemical additives under pressure into targeted geological formations to fracture the surrounding rock and stimulate production. Hydraulic fracturing is an important and common practice that is typically regulated by state oil and natural gas commissions or similar agencies. However, the practice continues to be controversial in certain parts of the country, resulting in increased scrutiny and regulation of the hydraulic fracturing process, including by federal agencies that have asserted regulatory authority or pursued investigations over certain aspects of the hydraulic fracturing process. For example, the EPA has asserted regulatory authority pursuant to the SDWA UIC program over hydraulic fracturing activities involving the use of diesel and issued guidance covering such activities, as well as published an Advanced Notice of Proposed Rulemaking regarding TSCA reporting of the chemical substances and mixtures used in hydraulic fracturing.