3

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

or

Commission file number

(Exact Name of Registrant as Specified in Its Charter)

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

|

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (

Former Name, Former Address and Former Fiscal Year, If Changed Since Last Report.

Not Applicable

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

None |

|

None |

|

None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer: |

☐ |

Accelerated filer: |

☐ |

☒ |

Smaller reporting company: |

||

Emerging growth company: |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

As of June 30, 2022, there was

1

GOLDMAN SACHS MIDDLE MARKET LENDING CORP. II

Index to Annual Report on Form 10-K for

The fiscal year ended December 31, 2022

|

INDEX |

PAGE |

|

|

|

|

3 |

|

|

|

|

ITEM 1. |

4 |

|

ITEM 1A. |

30 |

|

ITEM 1B. |

61 |

|

ITEM 2. |

61 |

|

ITEM 3. |

62 |

|

ITEM 4. |

62 |

|

|

|

|

|

|

|

ITEM 5. |

63 |

|

ITEM 6. |

64 |

|

ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

65 |

ITEM 7A. |

76 |

|

ITEM 8. |

78 |

|

ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

112 |

ITEM 9A. |

112 |

|

ITEM 9B. |

112 |

|

ITEM 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

113 |

|

|

|

|

|

|

ITEM 10. |

114 |

|

ITEM 11. |

120 |

|

ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

121 |

ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

121 |

ITEM 14. |

122 |

|

|

|

|

|

|

|

ITEM 15. |

125 |

|

ITEM 16. |

127 |

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “target,” “estimate,” “intend,” “continue” or “believe” or the negatives of, or other variations on, these terms or comparable terminology. You should read statements that contain these words carefully because they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. We believe that it is important to communicate our future expectations to our investors. Our forward-looking statements include information in this report regarding general domestic and global economic conditions, our future financing plans, our ability to operate as a business development company (“BDC”) and the expected performance of, and the yield on, our portfolio companies. There may be events in the future, however, that we are not able to predict accurately or control. The factors listed under “Risk Factors” in this annual report on Form 10-K, as well as any cautionary language in this report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. The occurrence of the events described in these risk factors and elsewhere in this report could have a material adverse effect on our business, results of operations and financial position. Any forward-looking statement made by us in this report speaks only as of the date of this report. Factors or events that could cause our actual results to differ from our forward-looking statements may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. You are advised to consult any additional disclosures that we may make directly to you or through reports that we have filed or in the future may file with the U.S. Securities and Exchange Commission (the “SEC”), including annual reports on Form 10-K, registration statements on Form N-2, quarterly reports on Form 10-Q and current reports on Form 8-K. The safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which preclude civil liability for certain forward-looking statements, do not apply to the forward-looking statements in this annual report on Form 10-K because we are an investment company. The following factors are among those that may cause actual results to differ materially from our forward-looking statements:

3

PART I.

Unless indicated otherwise in this annual report on Form 10-K or the context so requires, the terms “Company,” “we,” “us” or “our” refer to Goldman Sachs Middle Market Lending Corp. II together with its consolidated subsidiary. The terms “GSAM,” our “Adviser” or our “Investment Adviser” refer to Goldman Sachs Asset Management, L.P., a Delaware limited partnership. The term “GS Group Inc.” refers to The Goldman Sachs Group, Inc. “GS & Co.” refers to Goldman Sachs & Co. LLC and its predecessors. The term “Goldman Sachs” refers to GS Group Inc., together with GS & Co., GSAM and its other subsidiaries and affiliates. Goldman Sachs advises clients in many markets and transactions and purchases, sells, holds and recommends a broad array of investments for its own accounts and for the accounts of clients and of its personnel, through client accounts and the relationships and products it sponsors, manages and advises (such Goldman Sachs or other client accounts (including us, Goldman Sachs BDC, Inc. (“GS BDC”), Goldman Sachs Private Middle Market Credit LLC (“GS PMMC”), Goldman Sachs Private Middle Market Credit II LLC (“GS PMMC II”) and Phillip Street Middle Market Lending Fund LLC (“PSLF”), relationships and products, collectively, the “Accounts”).

ITEM 1. BUSINESS

The Company

We are a specialty finance company focused on lending to middle-market companies. We are a closed-end management investment company that has elected to be regulated as a BDC under the Investment Company Act of 1940, as amended (the “Investment Company Act”). In addition, we have elected to be treated as a RIC, and we expect to qualify annually for tax treatment as a RIC, commencing with our taxable year ended December 31, 2021. From our commencement of investment operations on October 29, 2021 through December 31, 2022, we have originated $342.74 million in aggregate principal amount of debt and equity investments prior to any subsequent exits and repayments. We seek to generate current income and, to a lesser extent, capital appreciation primarily through direct originations of secured debt, including first lien, unitranche, including last-out portions of such loans, and second lien debt, and unsecured debt, including mezzanine debt, as well as through select equity investments.

“Unitranche” loans are first lien loans that may extend deeper in a borrower’s capital structure than traditional first lien debt and may provide for a waterfall of cash flow priority between different lenders in such loan. In a number of instances, we may find another lender to provide the “first-out” portion of a unitranche loan while we retain the “last-out” portion of such loan, in which case, the “first-out” portion of the loan would generally receive priority with respect to the payment of principal, interest and any other amounts due thereunder as compared to the “last-out” portion that we would continue to hold. In exchange for taking greater risk of loss, the “last-out” portion generally earns a higher interest rate than the “first-out” portion of the loan. We use the term “mezzanine” to refer to debt that ranks senior in right of payment only to a borrower’s equity securities and ranks junior in right of payment to all of such borrower’s other indebtedness. We may make multiple investments in the same portfolio company.

We may also originate “covenant-lite” loans, which are loans with fewer financial maintenance covenants than other obligations, or no financial maintenance covenants. Such covenant-lite loans may not include terms that allow the lender to monitor the performance of the borrower or to declare a default if certain criteria are breached. These flexible covenants (or the absence of covenants) could permit borrowers to experience a significant downturn in their results of operations without triggering any default that would permit holders of their debt (such as us) to accelerate indebtedness or negotiate terms and pricing. In the event of default, covenant-lite loans may recover less value than traditional loans as the lender may not have the opportunity to negotiate with the borrower prior to such default.

We invest primarily in U.S. middle-market companies, which we believe are underserved by traditional providers of capital such as banks and the public debt markets. In this report, we generally use the term “middle market companies” to refer to companies with between $5 million and $200 million of annual earnings before interest expense, income tax expense, depreciation and amortization (“EBITDA”) excluding certain one-time, and non-recurring items that are outside the operations of these companies. However, we may from time to time invest in larger or smaller companies. We generate revenues primarily through receipt of interest income from the investments we hold. In addition, we may generate income from various loan origination and other fees, dividends on direct equity investments and capital gains on the sales of investments. Fees received from portfolio companies (directors’ fees, consulting fees, administrative fees, tax advisory fees and other similar compensation) are paid to us, unless, to the extent required by applicable law or exemptive relief therefrom, we only receive our allocable portion of such fees when invested in the same portfolio company as another client account managed by our Investment Adviser (including collectively with us, the Accounts). The companies in which we invest use our capital for a variety of purposes, including to support organic growth, fund acquisitions, make capital investments or refinance indebtedness.

We expect to directly or indirectly invest at least 70% of our total assets in middle-market companies domiciled in the United States. However, we may from time to time invest opportunistically in large U.S. companies, non-U.S. companies, stressed or distressed debt, structured products, private equity or other opportunities, subject to limits imposed by the Investment Company Act.

4

While our investment program is expected to focus primarily on debt investments, our investments may include equity features, such as a direct investment in the equity or convertible securities of a portfolio company or warrants or options to buy a minority interest in a portfolio company. Any warrants we may receive with debt securities will generally require only a nominal cost to exercise, so as a portfolio company appreciates in value, we may achieve additional investment return from these equity investments. We may structure the warrants to provide provisions protecting our rights as a minority-interest holder, as well as puts, or rights to sell such securities back to the portfolio company, upon the occurrence of specified events. In many cases, we may also obtain registration rights in connection with these equity investments, which may include demand and “piggyback” registration rights.

For a discussion of the competitive landscape we face, please see “Item 1A. Risk Factors—Competition—We operate in a highly competitive market for investment opportunities” and “Item 1. Business—Competitive Advantages.”

EU Environmental Taxonomy Criteria

Our underlying investments do not take into account the EU criteria for environmentally sustainable economic activities.

Available Information

We file with or submit to the SEC periodic and current reports, proxy statements and other information meeting the informational requirements of the Exchange Act. The SEC maintains an Internet site at http://www.sec.gov that contains reports, proxy and information statements and other information filed electronically by us with the SEC. Copies of these reports, proxy and information statements and other information may be obtained by electronic request at the following e-mail address: publicinfo@sec.gov.

Investment Strategy

Our origination strategy focuses on leading the negotiation and structuring of the loans or securities in which we invest and holding the investments in our portfolio to maturity. In many cases, we are the sole investor in the loan or security in our portfolio. Where there are multiple investors, we generally seek to control or obtain significant influence over the rights of investors in the loan or security. We generally seek to make investments that have maturities between three and ten years and range in size between $10 million and $75 million, although we may make larger or smaller investments on occasion.

Investment Portfolio

Our portfolio (excluding our investment in a money market fund, if any, managed by an affiliate of GS Group Inc.) consisted of the following:

|

|

December 31, 2022 |

|

|||||

|

|

Amortized Cost |

|

|

Fair Value |

|

||

|

|

($ in millions) |

|

|||||

First Lien/Senior Secured Debt |

|

$ |

240.89 |

|

|

$ |

239.70 |

|

First Lien/Last-Out Unitranche |

|

|

6.35 |

|

|

|

6.29 |

|

Preferred Stock |

|

|

2.71 |

|

|

|

2.83 |

|

Common Stock |

|

|

0.67 |

|

|

|

0.77 |

|

Warrants |

|

|

0.22 |

|

|

|

0.07 |

|

Total investments |

|

$ |

250.84 |

|

|

$ |

249.66 |

|

As of December 31, 2022, our portfolio consisted of 97 investments in 34 portfolio companies across 12 different industries. The largest industries in our portfolio, based on fair value as of December 31, 2022, were Diversified Financial Services, Diversified Consumer Services, Software and Health Care Providers & Services, which represented 19.7%, 17.1%, 16.2% and 9.2%, respectively, of our portfolio at fair value.

The geographic composition of our portfolio at fair value as of December 31, 2022 was 80.4% invested in portfolio companies organized in the United States, 14.7% in portfolio companies organized in United Kingdom and 4.9% in portfolio companies organized in Canada.

The weighted average yield by asset type of our total portfolio (excluding investments in money market funds, if any), at amortized cost and fair value, was as follows:

|

|

December 31, 2022 |

|

|||||

|

|

Amortized Cost |

|

|

Fair Value |

|

||

Weighted Average Yield(1) |

|

|

|

|

|

|

||

First Lien/Senior Secured Debt(2) |

|

|

11.2 |

% |

|

|

11.3 |

% |

First Lien/Last-Out Unitranche(2)(3) |

|

|

13.2 |

% |

|

|

13.2 |

% |

Preferred Stock(4) |

|

|

— |

|

|

|

— |

|

Common Stock(4) |

|

|

— |

|

|

|

— |

|

Warrants(4) |

|

|

— |

|

|

|

— |

|

Total Portfolio |

|

|

11.1 |

% |

|

|

11.2 |

% |

5

The following table presents certain selected information regarding our investment portfolio (excluding investments in money market funds, if any):

|

|

|

December 31, 2022 |

|

|

Number of portfolio companies |

|

|

|

34 |

|

Percentage of performing debt bearing a floating rate (1) |

|

|

|

100.0 |

% |

Percentage of performing debt bearing a fixed rate (1) (2) |

|

|

—% |

|

|

Weighted average leverage (net debt/EBITDA)(3) |

|

|

|

5.7 |

x |

Weighted average interest coverage(3) |

|

|

|

1.7 |

x |

Median EBITDA(3) |

|

$ |

51.54 million |

|

|

For a particular portfolio company, we also calculate the level of contractual interest expense owed by the portfolio company, and compare that amount to EBITDA (“interest coverage ratio”). We believe this calculation method assists in describing the risk of our portfolio investments, as it takes into consideration contractual interest obligations of the portfolio company. Weighted average interest coverage is weighted based on the fair value of our performing debt investments, excluding investments where interest coverage may not be the appropriate measure of credit risk, such as cash collateralized loans and investments that are underwritten and covenanted based on recurring revenue.

Median EBITDA is based on our debt investments, excluding investments where net debt to EBITDA may not be the appropriate measure of credit risk, such as cash collateralized loans and investments that are underwritten and covenanted based on recurring revenue.

Portfolio company statistics are derived from the most recently available financial statements of each portfolio company as of the reported end date. Statistics of the portfolio companies have not been independently verified by us and may reflect a normalized or adjusted amount.

As of December 31, 2022, investments where net debt to EBITDA may not be the appropriate measure of credit risk represented 41.4% of total debt investments at fair value.

Corporate Structure and Private Offering

We were formed as a Delaware limited liability company on February 21, 2020 with the name Goldman Sachs Middle Market Lending LLC II and were converted to a Delaware corporation on November 23, 2021, at which time our name was changed to Goldman Sachs Middle Market Lending Corp. II. We have elected to be regulated as a BDC under the Investment Company Act. In addition, we have elected to be treated as a RIC, and we expect to qualify annually for tax treatment as a RIC, commencing with our taxable year ended December 31, 2021.

On October 4, 2021 (the “Initial Closing Date”), we began accepting subscription agreements (“Subscription Agreements”) from investors acquiring shares of our common stock in our continuous private offering in reliance on exemptions from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”). Pursuant to a Subscription Agreement entered into with us, each investor makes a capital commitment (a “Commitment”) to purchase shares of our common stock for an aggregate purchase price equal to equal to its Commitment. Each investor will be required to purchase shares of our common stock (up to the amount of their undrawn Commitment) each time we deliver a drawdown notice to our investors, which will be delivered in respect of such Commitment at least five business days (as defined in Rule 14d-1 of the Exchange Act) (“Business Days”) prior to the required funding date (the “Drawdown Date”). New shares of common stock will be issued on each Drawdown Date.

An affiliate of the Investment Adviser made a capital commitment to us of $100 on October 29, 2021 (commencement of operations) and served as our initial member (the “Initial Member”). We cancelled the Initial Member’s interest in us on November 23, 2021, the first date on which investors (other than the Initial Member) made their initial capital contribution to purchase shares of our common stock (the “Initial Drawdown Date”).

6

Subject to certain limited exceptions under the Investment Company Act, on each Drawdown Date, stockholders will be required to purchase shares of our common stock issued at a price equal to our then-current NAV per share as of the end of the most recent calendar month prior to the date of the applicable drawdown notice or issuance date, subject to the limitations of Section 23 under the Investment Company Act (which generally prohibits us from issuing shares of common stock at a price below the then-current NAV of the common stock as determined within 48 hours, excluding Sundays and holidays, of such issuance, subject to certain exceptions).

If a stockholder fails to purchase shares of common stock as part of a capital call or other required payment to us, in part or in full, and such failure remains uncured through the applicable Last Funding Date (the fifth calendar day following a Drawdown Date), such stockholder shall be delinquent in its obligations. Any payments made pursuant to a capital call by such stockholder after the applicable Last Funding Date will be applied to purchase shares of the Company at the next available NAV. With respect to the subsequent capital call with respect to such delinquent stockholder, such delinquent stockholder will be obligated, in addition to purchasing shares of common stock in respect of such subsequent capital call, to purchase shares of common stock in an amount equal to such unfulfilled capital call or other required payment in respect of the prior Last Funding Date, and to the extent such stockholder does not so, he, she or it will be delinquent again in its obligations.

If a stockholder is delinquent in funding a required drawdown upon three occasions at any point during the Investment Period (occasions do not have to be consecutive), such Defaulting Stockholder will be in default of its obligations to us and the following remedies shall be imposed on such stockholder:

We held, and expect to hold, a limited number of closings subsequent to the Initial Closing Date (each date on which a subsequent closing was held, a “Subsequent Closing Date”). The final date on which we will accept Subscription Agreements will occur no later than twenty-four months following the Initial Closing Date (the “Final Closing Date”), provided that our board of directors (the “Board of Directors” or the “Board”) may extend the Final Closing Date by up to an additional six month period in its discretion.

Stockholders are entitled to receive dividends or other distributions declared by the Board and are entitled to one vote for each share of common stock held on all matters submitted to a vote of our stockholders.

As of the date indicated, we had aggregate Commitments and undrawn Commitments from investors as follows:

|

|

December 31, 2022 |

|

|||||||||

|

|

Capital |

|

|

Unfunded |

|

|

% of Capital |

|

|||

Common Stock |

|

$ |

543.34 |

|

|

$ |

367.88 |

|

|

|

32 |

% |

The following table summarizes the total shares issued and proceeds received related to capital drawdowns:

Share Issue Date |

|

Shares Issued |

|

|

Proceeds |

|

||

For the year ended December 31, 2022 |

|

|

|

|

|

|

||

March 16, 2022 |

|

|

1,823,817 |

|

|

$ |

34.05 |

|

July 27, 2022 |

|

|

856,930 |

|

|

|

15.81 |

|

September 19, 2022 |

|

|

2,069,029 |

|

|

|

38.20 |

|

October 19, 2022 |

|

|

3,024,805 |

|

|

|

55.54 |

|

November 16, 2022 |

|

|

193,341 |

|

** |

|

3.58 |

|

Total capital drawdowns |

|

|

7,967,922 |

|

|

$ |

147.18 |

|

** Inclusive of 476 shares that were cancelled as a result of defaulting stockholders.

Investment Period

Our investment period commenced on the Initial Closing Date and will continue until the third anniversary of the Final Closing Date, provided that it may be extended by the Board of Directors, in its discretion, for one additional twelve-month period, and, with the approval of a majority-in-interest of the stockholders, for up to one additional year thereafter (such period, including any extensions, the “Investment Period”). In addition, the Board of Directors may terminate the Investment Period at any time in its discretion. Drawdowns may be issued at any time prior to the expiration of the Investment Period for any permitted purpose.

7

Following the end of the Investment Period, we will have the right to issue drawdowns only (i) to pay, and/or establish reserves for, actual or our anticipated expenses, liabilities, including the payment or repayment of Financings (as defined below) or other obligations, contingent or otherwise (including the Management Fee (as defined below), whether incurred before or after the end of the Investment Period, (ii) to fulfill investment commitments made or approved by the BDC Investment Committee (as defined below) prior to the expiration of the Investment Period, (iii) to engage in hedging transactions, or (iv) to make additional investments in existing portfolio companies, which may include new financings of such portfolio companies (each, an “Additional Investment”) (including transactions to hedge interest rate or currency risks related to an Additional Investment).

“Financings” are indebtedness for borrowed money (including through the issuance of notes and other evidence of indebtedness), other indebtedness, financings or extensions of credit.

Term

If we have not consummated an Exit Event (as defined below), by the sixth anniversary of the Final Closing Date (the “Wind-down Determination Date”), our Board of Directors (to the extent consistent with its fiduciary duties and subject to any necessary stockholder approvals and applicable requirements of the Investment Company Act and the Code) will meet to consider our potential wind down and/or liquidation and dissolution.

“Exit Event” means (i) any listing of the Company’s shares of common stock on a national securities exchange (a “listing”), including in connection with an initial public offering (“IPO”), (ii) merger with another entity, including an affiliated company, subject to any limitations under the Investment Company Act (a “Merger”) or (iii) the sale of all or substantially all of the assets of the Company (an “Asset Sale”).

Repurchase Offers

Our Board of Directors expects to consider, in its discretion, offers to repurchase shares of our common stock in an amount of up to 5% of our outstanding shares of common stock (with the exact amount to be set by our Board of Directors) at the end of each quarter following the expiration of the Investment Period and with such offers ending prior to the time of an Exit Event. If we were to engage in a share repurchase offer, our stockholders would be able to tender their shares at a price per share that reflects our NAV per share as of a recent date. Such offers to repurchase shares of our common stock will be subject to, and conducted in accordance with, the applicable requirements of the Exchange Act and the Investment Company Act. To the extent any such repurchase may lead to adverse tax, the U.S. Employee Retirement Income Security Act of 1974, as amended (“ERISA”), or other regulatory consequences for us or our stockholders, our Board of Directors may determine not to proceed with any such share repurchases.

Our Investment Adviser

GSAM serves as our Investment Adviser and has been registered as an investment adviser with the SEC since 1990. Subject to the supervision of the Board of Directors, a majority of which is made up of independent directors (including an independent Chairman), GSAM manages our day-to-day operations and provides us with investment advisory and management services and certain administrative services. GSAM is a subsidiary of GS Group Inc., a public company that is a bank holding company (a “BHC”), financial holding company (a “FHC”) and a world-wide, full-service financial services organization. GS Group Inc. is the general partner and owner of GSAM.

The Goldman Sachs Asset Management Private Credit Team

The Goldman Sachs Asset Management Private Credit Team is dedicated to the direct origination investment strategy of the Company and other Accounts that share a similar investment strategy with us. Goldman Sachs Asset Management Private Credit Team is comprised of approximately 185 investment professionals across 15 cities and four continents as of December 31, 2022. Within the Goldman Sachs Asset Management Private Credit Team, approximately 85 private credit investment professionals across six offices in the Americas led by Alex Chi and David Miller, our Co-CEOs and Co-Presidents, oversee and lead our day-to-day portfolio management. The Goldman Sachs Asset Management Private Credit Team is responsible for identifying investment opportunities, conducting research and due diligence on prospective investments, and negotiating, structuring, monitoring, and servicing our investments. In addition, the Investment Adviser and Goldman Sachs have risk management, legal, accounting, tax, information technology and compliance personnel, among other personnel, who provide services to us. We benefit from the expertise provided by these personnel in our operations.

The Goldman Sachs Asset Management Private Credit Team utilizes a bottom-up, fundamental research approach to lending. The managing directors of this team had an average industry experience of over 19 years coupled with an average tenure at Goldman Sachs of over 11 years as of December 31, 2022.

8

Investment Committee

All investment decisions are made by the investment committee of the Goldman Sachs Asset Management Private Credit Team that focuses on regulated fund investments (the “BDC Investment Committee”). The BDC Investment Committee currently consists of the following members: Justin Betzen, Alex Chi, David Miller, James Reynolds, Kevin Sterling and Greg Watts, along with members from Goldman Sachs’s Compliance, Legal, Tax and Controllers groups. The BDC Investment Committee is responsible for approving all of our investments. The BDC Investment Committee also monitors investments in our portfolio and approves all asset dispositions. We expect to benefit from the extensive and varied relevant experience of the investment professionals serving on the BDC Investment Committee, which includes expertise in privately originated and publicly traded leveraged credit, stressed and distressed debt, bankruptcy, mergers and acquisitions and private equity. The size, membership, authority and voting rights of members of the BDC Investment Committee are subject to change from time to time without prior notice

The purpose of our BDC Investment Committee is to evaluate and approve, as deemed appropriate, all investments by our Investment Adviser. Our BDC Investment Committee process is intended to bring the diverse experience and perspectives of our BDC Investment Committee’s members to the analysis and consideration of every investment. Our BDC Investment Committee also serves to provide investment consistency and adherence to our Investment Adviser’s investment philosophies and policies. Our BDC Investment Committee also determines appropriate investment sizing and suggests ongoing monitoring requirements.

Investments

We seek to create a portfolio that includes primarily direct originations of secured debt, including first lien, unitranche, including last-out portions of such loans, and second lien debt, and unsecured debt, including mezzanine debt, as well as through select equity investments. We expect to make investments through both primary originations and open-market secondary purchases. We currently do not limit our focus to any specific industry. If we are successful in achieving our investment objective, we believe that we will be able to provide our stockholders with consistent dividend distributions and attractive risk adjusted total returns.

As of December 31, 2022, our portfolio (which term does not include our investments in money market funds, if any) on a fair value basis, was comprised of approximately 98.5% secured debt investments (96.0% in first lien debt (including 2.5% in first lien/last-out unitranche loans), 1.1% in preferred stock, 0.3% in common stock and 0.1% in warrants. We expect that our portfolio will continue to include secured debt, including first lien, unitranche, including last-out portions of such loans, and second lien debt, unsecured debt (including mezzanine debt) and, to a lesser extent, equities. In addition to investments in U.S. middle-market companies, we may invest a portion of our capital in opportunistic investments, such as in large U.S. companies, foreign companies, stressed or distressed debt, structured products or private equity. Such investments are intended to enhance our risk adjusted returns to stockholders, and the proportion of these types of investments will change over time given our views on, among other things, the economic and credit environment in which we are operating, although these types of investments generally will constitute less than 30% of our total assets.

In the future, we may also securitize a portion of our investments in any or all of our assets. We expect that our primary use of funds will be to make investments in portfolio companies, distribute cash to holders of our common stock and pay our operating expenses, including debt service to the extent we borrow or issue senior securities to fund our investments.

In certain circumstances, we can make negotiated co-investments pursuant to an order from the SEC permitting us to do so. On November 16, 2022, the SEC granted to the Investment Adviser, the BDCs advised by the Investment Adviser and certain other affiliated applicants exemptive relief on which we expect to rely to co-invest alongside certain other Accounts, which may include proprietary accounts of Goldman Sachs, in a manner consistent with our investment objectives and strategies, certain Board-established criteria, the conditions of such exemptive relief and other pertinent factors (the “Relief”). Additionally, if our Investment Adviser forms other funds in the future, we may co-invest alongside such other affiliates, subject to compliance with the Relief, applicable regulations and regulatory guidance, as well as applicable allocation procedures. As a result of the Relief, there could be significant overlap in our investment portfolio and the investment portfolios of other Accounts, including, in some cases, proprietary accounts of Goldman Sachs.

In addition, we have filed an application to amend the Relief to permit us to participate in follow-on investments in our existing portfolio companies with certain affiliates covered by the Relief if such affiliates, that are not BDCs or registered investment companies, did not have an investment in such existing portfolio company. There can be no assurance if and when we will receive the amended exemptive order.

Investment Criteria

We are committed to a value-oriented philosophy implemented by our Investment Adviser, which manages our portfolio and seeks to minimize the risk of capital loss without foregoing the potential for capital appreciation. We have identified several criteria, discussed below, that GSAM believes are important in identifying and investing in prospective portfolio companies.

These criteria provide general guidelines for our investment decisions. However, not all of these criteria will be met by each prospective portfolio company in which we choose to invest. Generally, we seek to use our experience and access to market information to identify investment candidates and to structure investments quickly and effectively.

9

Our due diligence typically includes, but is not limited to:

The Investment Adviser may integrate ESG risk considerations within its process for originating loans to U.S. middle market companies, investing directly in middle market credit obligations and related instruments. As part of its due diligence process, the Investment Adviser may consider, alongside other relevant factors, ESG risks, events or conditions that have or could have a material negative impact on the operating and performance metrics of these borrowers in the portfolio. Depending on the circumstances, examples of ESG risks can include physical environmental risks, climate change transition risks, supply chain disruptions, improper labor practices, lack of board diversity and corruption. The Investment Adviser may utilize proprietary research to assess ESG risks that are relevant to our investment.

Upon the completion of due diligence and a decision to proceed with an investment in a company, the team leading the investment presents the investment opportunity to our BDC Investment Committee. This committee determines whether to pursue the potential investment. All new investments are required to be reviewed by the BDC Investment Committee. The members of the BDC Investment Committee are employees of our Investment Adviser and they do not receive separate compensation from us or our Investment Adviser for serving on the BDC Investment Committee.

Additional due diligence with respect to any investment may be conducted on our behalf (and at our expense) by attorneys prior to the closing of the investment, as well as other outside advisers, as appropriate.

Investment Structure

Once we determine that a prospective portfolio company is suitable for investment, we work with the management of that company and its other capital providers, including senior, junior and equity capital providers, to structure an investment. We negotiate among these parties and use creative and flexible approaches to structure our investment relative to the other capital in the portfolio company’s capital structure.

We expect our secured debt to have terms of approximately three to ten years. We generally obtain security interests in the assets of our portfolio companies that will serve as collateral in support of the repayment of this debt. This collateral may take the form of first or second priority liens on the assets of a portfolio company.

We use the term “mezzanine” to refer to debt that ranks senior only to a borrower’s equity securities and ranks junior in right of payment to all of such borrower’s other indebtedness. Mezzanine debt typically has interest-only payments in the early years, payable in cash or in-kind, with amortization of principal deferred to the later years of the mezzanine debt. In some cases, we may enter into mezzanine debt that, by its terms, converts into equity (or is issued along with warrants for equity) or additional debt securities or defers payments of interest for the first few years after our investment. Typically, our mezzanine debt investments have maturities of three to ten years.

10

We also invest in unitranche loans, which are loans that combine features of first-lien, second-lien and mezzanine debt, generally in a first-lien position. In a number of instances, we may find another lender to provide the “first-out” portion of such loan and retain the “last-out” portion of such loan, in which case, the “first-out” portion of the loan would generally receive priority with respect to payment of principal, interest and other amounts due thereunder over the “last-out” portion that we would continue to hold.

In the case of our secured debt and unsecured debt, including mezzanine debt investments, we seek to tailor the terms of the investments to the facts and circumstances of the transactions and the prospective portfolio companies, negotiating a structure that protects our rights and manages our risk while creating incentives for the portfolio companies to achieve their business plan and improve their profitability. For example, in addition to seeking a senior position in the capital structure of our portfolio companies, we seek to limit the downside potential of our investments by:

Our investments may include equity features, such as direct investments in the equity or convertible securities of portfolio companies or warrants or options to buy a minority interest in a portfolio company. Any warrants we may receive with our debt securities generally require only a nominal cost to exercise, so as a portfolio company appreciates in value, we may achieve additional investment return from these equity investments. We may structure the warrants to provide provisions protecting our rights as a minority-interest holder, as well as puts, or rights to sell such securities back to the company, upon the occurrence of specified events. In many cases, we may also obtain registration rights in connection with these equity investments, which may include demand and “piggyback” registration rights.

We expect to hold most of our investments to maturity or repayment, but may sell certain investments earlier if a liquidity event takes place, such as the sale or refinancing of a portfolio company. We also may turn over our investments to better position the portfolio as market conditions change.

Allocation of Investment Opportunities

Our investment objectives and investment strategies are similar to those of other Accounts, and an investment opportunity appropriate for us may also be appropriate for such other Accounts (which may include proprietary accounts of Goldman Sachs). This creates potential conflicts in allocating investment opportunities among us and such other Accounts, particularly in circumstances where the availability of such investment opportunities is limited, where the liquidity of such investment opportunities is limited or where co-investments by us and such other Accounts are not permitted under applicable law.

To address these and other potential conflicts, a selection of which are outlined below, the Investment Adviser has developed allocation policies and procedures that provide that personnel of the Investment Adviser making portfolio decisions for Accounts will make purchase and sale decisions and allocate investment opportunities among Accounts consistent with its fiduciary obligations. To the extent permitted by applicable law, these policies and procedures may result in the pro rata allocation of limited opportunities across eligible Accounts managed by a particular portfolio management team, but in many other cases, the allocations may reflect numerous other factors as described below. There will be cases where certain Accounts receive an allocation of an investment opportunity when we do not, and vice versa.

In some cases, due to information barriers that may be in place, other Accounts may compete with us for specific investment opportunities without being aware that we are competing against each other. Goldman Sachs has a conflicts system in place, in addition to these information barriers to identify potential conflicts early in the process and determine if an allocation decision needs to be made. If the conflicts system detects a potential conflict with respect to a particular investment opportunity, such investment opportunity will be assessed to determine whether it must be allocated to, or prohibited from being allocated to, a particular Account.

Personnel of the Investment Adviser involved in decision-making for Accounts may make allocation-related decisions in accordance with the Investment Adviser’s allocation policies and procedures for us and for other Accounts by reference to one or more factors, including but not limited to: the strategy, objectives, guidelines and restrictions (including legal and regulatory restrictions) of potentially in-scope Accounts, as well as those Accounts’ current portfolios and investment horizons; strategic fit and other portfolio management considerations, including different desired levels of investment for different strategies; the expected future capacity of the potentially in-scope Accounts; cash and liquidity considerations; and the availability of other appropriate investment opportunities. The Investment Adviser may also consider reputational matters and other factors. The application of these considerations may cause differences in the portfolios and performance of different Accounts that have similar strategies. In addition, in some cases the Investment Adviser may make investment recommendations to Accounts where the Accounts make the investment independently of the Investment Adviser, which may result in a reduction in the availability of the investment opportunity for other Accounts (including us), irrespective of the Investment Adviser’s policies regarding allocation of investments. Additional information about the Investment Adviser’s allocation policies is set forth in Item 6 (“Performance-Based Fees and Side-by-Side Management—Side-By-Side Management of Advisory Accounts; Allocation of Opportunities”) of the Investment Adviser’s Form ADV.

11

The Investment Adviser, including the Goldman Sachs Asset Management Private Credit Team, may develop and implement new trading strategies or seek to participate in new investment opportunities and strategies. These opportunities and strategies may not be employed in all Accounts even if the opportunity or strategy is consistent with the objectives of such Accounts.

During periods of unusual market conditions, the Investment Adviser may deviate from its normal trade allocation practices. For example, this may occur with respect to the management of unlevered and/or long-only Accounts that are typically managed on a side-by-side basis with levered and/or long-short Accounts.

We may or may not receive opportunities referred by Goldman Sachs businesses and affiliates, but in no event do we have any rights with respect to such opportunities. Subject to applicable law, including the Investment Company Act, such opportunities or any portion thereof may be offered to other Accounts, Goldman Sachs, certain of our investors, or such other persons or entities as determined by Goldman Sachs in its sole discretion. We will have no rights and will not receive any compensation related to such opportunities. Certain of such opportunities may be referred to us by employees or other personnel of Goldman Sachs, or by third parties. If we invest in any such opportunities, Goldman Sachs, may be entitled, to the extent permitted by applicable law, including the limitations set forth in Section 57(k) of the Investment Company Act, to receive compensation from us or from the borrowers in connection with such investments. Any compensation we pay in connection with such referrals will be an operating expense and will accordingly be borne by us (and will not serve to offset any Management Fee (as defined below) or Incentive Fee (as defined below) payable to the Investment Adviser).

In connection with certain of our investments, the Investment Adviser may determine that the appropriate amount to allocate to us and other Accounts may be less than the full amount of the investment opportunity, due to considerations related to, among other things, diversification, portfolio management, leverage management, investment profile, risk tolerance or other exposure guidelines or limitations, cash flow or other considerations. In such situations, “excess amounts” that can be allocated may be offered to other persons or entities. Subject to applicable law, such opportunities may be structured as an investment alongside us or as a purchase of a portion of the investment from us (through a syndication, participation or otherwise).

In all cases, subject to applicable law, the Investment Adviser has broad discretion in determining to whom and in what relative amounts to offer such opportunities, and factors the Investment Adviser may take into account, in its sole discretion, include whether such potential recipient is able to assist or provide a benefit to us in connection with the potential transaction or otherwise, whether the Investment Adviser believes the potential recipient is able to execute a transaction quickly, whether the potential recipient is expected to provide expertise or other advantages in connection with a particular investment, whether the Investment Adviser is aware of such potential recipient’s expertise or interest in these types of opportunities generally or in a subset of such opportunities or, the potential recipient’s target investment sizing. Recipients of these opportunities may, in accordance with applicable law, include one or more of our investors, one or more investors in other funds managed by the Goldman Sachs Asset Management Private Credit Team, clients or potential clients of Goldman Sachs, or funds or Accounts established for any such persons. These opportunities may give rise to potential conflicts of interest. These opportunities will be offered to the recipients thereof on such terms as the Investment Adviser determines in its sole discretion, subject to applicable law, including on a no-fee basis or at prices higher or lower than those paid by us. As a result of these and other reasons, returns with respect to an opportunity may exceed investors’ returns with respect to our investment in the same opportunity.

Transactions with affiliates. We are prohibited under the Investment Company Act from participating in certain transactions with our affiliates without the prior approval of our Independent Directors (as defined in “Item 10. Directors, Executive Officers and Corporate Governance”) and, in some cases, of the SEC. Any person that owns, directly or indirectly, five percent or more of our outstanding voting securities will be an affiliate of the Company for purposes of the Investment Company Act, and we are generally prohibited from buying or selling any assets from or to, or entering into certain “joint” transactions (which could include investments in the same portfolio company) with such affiliates, absent the prior approval of the Independent Directors. The Investment Adviser and its affiliates, including persons that control, or are under common control with, the Company or the Investment Adviser, are also considered to be our affiliates under the Investment Company Act, and we are generally prohibited from buying or selling any assets from or to, or entering into “joint” transactions with, such affiliates without exemptive relief from the SEC.

Co-Investments Alongside Goldman Sachs and Other Accounts, and the Relief. Subject to applicable law, we may invest alongside Goldman Sachs and other Accounts. In certain circumstances, we and such other Accounts (which may include proprietary accounts of Goldman Sachs) can make negotiated co-investments pursuant to an order from the SEC permitting us to do so. On November 16, 2022, the SEC granted the Relief to the Investment Adviser, the BDCs advised by the Investment Adviser, and certain other affiliated applicants. Additionally, if our Investment Adviser forms other funds in the future, we may co-invest alongside such other affiliates, subject to compliance with the Relief, applicable regulations and regulatory guidance, as well as applicable allocation procedures. Any such co-investments are subject to certain conditions, including that co-investments are made in a manner consistent with our investment objectives and strategies, certain Board-established criteria, and the other applicable conditions of the Relief. Under the terms of the Relief, a “required majority” (as defined in Section 57(o) of the Investment Company Act) of our Independent Directors must reach certain conclusions in connection with a co-investment transaction, including that: (i) the terms of the proposed transaction are reasonable and fair to us and our stockholders and do not involve overreaching in respect of us or our stockholders on the part of any person concerned; and (ii) the transaction is consistent with the interests of our stockholders and is consistent with our then-current investment objectives and strategies.

As a result of the Relief, there could be significant overlap in our investment portfolio and the investment portfolios of other Accounts, including, in some cases, proprietary accounts of Goldman Sachs.

12

If the Investment Adviser identifies an investment and we are unable to rely on the Relief for that particular opportunity, the Investment Adviser will be required to determine which Accounts should make the investment at the potential exclusion of other Accounts. In such circumstances, the Investment Adviser will adhere to its investment allocation policy in order to determine the Account to which to allocate investment opportunities. Accordingly, it is possible that we may not be given the opportunity to participate in investments made by other Accounts.

We may invest alongside other Accounts advised by the Investment Adviser and its affiliates in certain circumstances where doing so is consistent with applicable law and SEC staff guidance and interpretations. For example, we may invest alongside such Accounts consistent with guidance promulgated by the staff of the SEC permitting us and such other Accounts to purchase interests in a single class of privately placed securities so long as certain conditions are met, including that the Investment Adviser, acting on our behalf and on behalf of its other clients, negotiates no term other than price. We may also invest alongside the Investment Adviser’s other clients as otherwise permissible under SEC staff guidance and interpretations, applicable regulations and the allocation policy of the Investment Adviser.

In addition, we have filed an application to amend the Relief to permit us to participate in follow-on investments in our existing portfolio companies with certain affiliates covered by the Relief if such affiliates, that are not BDCs or registered investment companies, did not have an investment in such existing portfolio company. There can be no assurance if and when we will receive the amended exemptive order.

For a further explanation of the allocation of opportunities and other conflicts and the risks related thereto, please see “Item 1A. Risk Factors—Our Business and Structure—Potential conflicts of interest with other businesses of Goldman Sachs could impact our investment returns.”

Expenses are generally allocated to Accounts (including to us) based on whose behalf the expenses are incurred. Where we and one or more other Accounts participate in a particular investment or collectively incur other expenses, the Investment Adviser generally allocates investment-related and other expenses in a manner the Investment Adviser determines to be fair and equitable, which may be pro rata or on a different basis.

We and other Accounts may contract for and incur expenses in connection with certain services provided by third parties, including valuation agents, rating agencies, attorneys, accountants and other professional service providers, while other Accounts that did not contract for such services may not incur such expenses even though they directly or indirectly receive benefit from such services. For example, the work of valuation firms retained by the Company at the request of the Board benefit certain Accounts that invest in the same assets as the Company, but because such other Accounts did not request such services, they are not allocated any costs associated therewith. While it is generally expected that the Accounts requesting third-party services will bear the full expense associated therewith, GSAM may in its sole discretion determine to bear the portion of such expenses that would be allocable to the non-requesting Accounts had such Accounts requested the services.

13

Market Opportunity

The Goldman Sachs Asset Management Private Credit Team believes there is an attractive investment opportunity to invest in U.S. middle-market companies. Specifically:

_________________________________________________________________________________________________________________

1 As of year-end December 2022 according to the National Center for the Middle Market, which defined middle market as companies with annual revenue of $10 million—$1 billion. See http://www.middlemarketcenter.org (relying on data from the CIA World Factbook, available at https://www.cia.gov/the-world-factbook/). These websites are not incorporated by reference into this annual report on Form 10-K and you should not consider information contained on these websites to be part of this annual report on Form 10-K or any other report we file with the SEC.

14

Competitive Advantages

GS Group Inc. is a leading global financial institution that provides a broad range of financial services to a substantial and diversified client base, including companies and high-net-worth individuals, among others. The firm is headquartered in New York, and maintains offices across the United States and in all major financial centers around the world. Goldman Sachs, with approximately $2.55 trillion in firmwide assets under supervision as of December 31, 2022, provides investment management services to a diverse set of clients worldwide, including private institutions, public entities and individuals.

Within GSAM, the Goldman Sachs Asset Management Private Credit Team is the primary center for private credit investing. Since 1996, Goldman Sachs Asset Management Private Credit and its predecessors have invested over $170 billion, leveraging Goldman Sachs Asset Management Private Credit’s deep expertise and long-standing relationships with financial sponsors, companies, investors, entrepreneurs and financial intermediaries globally. Goldman Sachs Asset Management Private Credit invests across senior credit, mezzanine, hybrid capital and asset finance strategies and has significant experience investing in debt instruments across industries, geographic regions, economic cycles and financing structures.

Our investment strategy is consistent with that of the broader Goldman Sachs Asset Management Private Credit platform, with a focus on capital preservation and capital appreciation and includes:

15

Operating and Regulatory Structure

We have elected to be treated as a BDC under the Investment Company Act. As a BDC, we are generally prohibited from acquiring assets other than qualifying assets unless, after giving effect to any acquisition, at least 70% of our total assets are qualifying assets. Qualifying assets generally include securities of eligible portfolio companies, cash, cash equivalents, U.S. government securities and high-quality debt instruments maturing in one year or less from the time of investment. Under the rules of the Investment Company Act, “eligible portfolio companies” include (i) private U.S. operating companies, (ii) public U.S. operating companies whose securities are not listed on a national securities exchange (e.g., the New York Stock Exchange) or registered under the Exchange Act, and (iii) public U.S. operating companies having a market capitalization of less than $250 million. Public U.S. operating companies whose securities are quoted on the over-the-counter bulletin board and through OTC Markets are not listed on a national securities exchange and therefore are eligible portfolio companies. In addition, we currently are an “emerging growth company,” as defined in the JOBS Act. See “—Qualifying Assets.”

We have elected to be treated as a RIC, and we expect to qualify annually for tax treatment as a RIC, commencing with our taxable year ended December 31, 2021. As a RIC, we generally will not be required to pay corporate-level U.S. federal income taxes on any net ordinary income or capital gains that we timely distribute to our stockholders as dividends if we meet certain source of income, distribution, and asset diversification requirements. We intend to timely distribute to our stockholders substantially all of our annual taxable income for each year, except that we may retain certain net capital gains for reinvestment and we may choose to carry forward taxable income for distribution in the following year and pay any applicable tax. In addition, the distributions we pay to our stockholders in a year may exceed our net ordinary income and capital gains for that year and, accordingly, a portion of such distributions may constitute a return of capital for U.S. federal income tax purposes.

Ongoing Relationships with Portfolio Companies

Monitoring

Our Investment Adviser monitors our portfolio companies on an ongoing basis. It monitors the financial trends of each portfolio company to determine if they are meeting their respective business plans and to assess the appropriate course of action for each company. Our Investment Adviser has several methods of evaluating and monitoring the performance and fair value of our investments, which may include the following:

As part of the monitoring process, our Investment Adviser also employs an investment rating system to categorize our investments. In addition to various risk management and monitoring tools, our Investment Adviser grades the credit risk of all investments on a scale of 1 to 4 no less frequently than quarterly. This system is intended primarily to reflect the underlying risk of a portfolio investment relative to our initial cost basis in respect of such portfolio investment (i.e., at the time of origination or acquisition), although it may also take into account in certain circumstances the performance of the portfolio company’s business, the collateral coverage of the investment and other relevant factors. The grading system is as follows:

16

Our Investment Adviser grades the investments in our portfolio at least quarterly, and it is possible that the grade of a portfolio investment may be reduced or increased over time. For investments graded 3 or 4, our Investment Adviser enhances its level of scrutiny over the monitoring of such portfolio company.

Managerial Assistance

As a BDC, we must offer, and must provide upon request, significant managerial assistance to certain of our eligible portfolio companies within the meaning of Section 55 of the Investment Company Act. This assistance could involve, among other things, monitoring the operations of our portfolio companies, participating in board and management meetings, consulting with and advising officers of portfolio companies and providing other organizational and financial guidance. Our Investment Adviser or an affiliate thereof may provide such managerial assistance on our behalf to portfolio companies that request such assistance. We may receive fees for these services. See “—Managerial Assistance to portfolio companies.”

Competition

Our primary competitors provide financing to middle-market companies and include other BDCs, commercial and investment banks, commercial financing companies, collateralized loan obligations (“CLOs”), private funds, including hedge funds, and, to the extent they provide an alternative form of financing, private equity funds. Some of our existing and potential competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. For example, some competitors may have a lower cost of funds and access to funding sources that are not available to us.

In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships than us. Furthermore, many of our competitors are not subject to the regulatory restrictions that the Investment Company Act imposes on us as a BDC.

While we expect to use the industry information of GSAM’s investment professionals to which we have access to assess investment risks and determine appropriate pricing for our investments in portfolio companies, we do not seek to compete primarily based on the interest rates we offer and GSAM believes that some of our competitors may make loans with interest rates that are comparable to or lower than the rates we offer. Rather, we compete with our competitors based on our reputation in the market, our existing investment platform, the seasoned investment professionals of our Investment Adviser, our experience and focus on middle-market companies, our disciplined investment philosophy, our extensive industry focus and relationships and our flexible transaction structuring.

Staffing

We do not currently have any employees. Our day-to-day operations are managed by our Investment Adviser. Our Investment Adviser has hired and expects to continue to hire professionals with skills applicable to our business plan, including experience in middle-market investing, leveraged finance and capital markets.

Properties

We do not own any real estate or other properties materially important to our operations. Our principal executive offices are located at 200 West Street, New York, New York 10282. We believe that our office facilities are suitable and adequate for our business as it is contemplated to be conducted.

Legal Proceedings

We and our Investment Adviser are not currently subject to any material legal proceedings, although we may, from time to time, be involved in litigation arising out of operations in the normal course of business or otherwise.

Our Administrator

Pursuant to our Administration Agreement (as defined below), State Street Bank and Trust Company (the “Administrator”) is responsible for providing various accounting and administrative services to us. Our Administrator is entitled to fees as described in “—Administration Agreement.” To the extent that our Administrator outsources any of its functions, the Administrator will pay any compensation associated with such functions. See “—Administration Agreement.”

Management Agreements

Investment Management Agreement

The investment management agreement (the “Investment Management Agreement”) with our Investment Adviser was entered into as of November 1, 2021, pursuant to which the Investment Adviser manages our investment program and related activities.

17

The Investment Management Agreement will remain in full force and effect for two years initially and will continue for periods of one year thereafter but only so long as such continuance is specifically approved at least annually by (a) the vote of a majority of our Independent Directors and (b) by a vote of a majority of our Board of Directors or of a majority of our outstanding voting securities, as defined in the Investment Company Act. The Investment Management Agreement may, on 60 days’ written notice to the other party, be terminated in its entirety at any time without the payment of any penalty, by our Board of Directors, or by vote of a majority of our outstanding voting securities, on the one hand, or by the Investment Adviser, on the other hand. The Investment Management Agreement also will automatically terminate in the event of its assignment (as defined in the Investment Company Act). See “Item 1A. Risk Factors—Competition—We are dependent upon management personnel of our Investment Adviser for our future success.”

Management Services

Pursuant to the terms of the Investment Management Agreement, Goldman Sachs Asset Management, subject to the overall supervision of the Board of Directors, manages our day-to-day operations and provides investment advisory and management services to us. The Investment Adviser may also manage other investment funds and accounts that have investment programs that are similar to ours. “Item 1A. Risk Factors—Our Business and Structure — Our Investment Adviser, its principals, investment professionals and employees and the members of its BDC Investment Committee have certain conflicts of interest.”

Subject to compliance with applicable law and published SEC guidance, nothing contained in the Investment Advisory Agreement in any way precludes, restricts or limits the activities of our Investment Adviser or any of its respective subsidiaries or affiliated parties. The Investment Adviser will keep the Board of Directors well informed as to the identity and title of each member of the BDC Investment Committee and provide the Board of Directors such other information with respect to such persons and the functioning of the BDC Investment Committee as the Board of Directors may, from time to time, request.

For the year ended December 31, 2022 and for the period from October 29, 2021 (commencement of operations) to December 31, 2021, Management Fees (as defined below) amounted to $0.82 million and $0.01 million and the Investment Adviser waived $0.19 million and $0.01 million. As of December 31, 2022, $0.39 million remained payable.

Management Fee

Pursuant to the Investment Management Agreement, the Company pays to the Investment Adviser a management fee (the “Management Fee”) as follows:

The Management Fee is payable quarterly in arrears. Prior to the occurrence (if any) of a listing, the Management Fee will be equal to 0.1875% (i.e., an annual rate of 0.75%) of our average gross assets (excluding cash and cash equivalents but including assets purchased with borrowed amounts) at the end of the then-current calendar quarter and the prior calendar quarter. For the avoidance of doubt, the Management Fee for our first quarter (i.e., the period beginning on the Initial Drawdown Date and ending on the last day of the quarter in which the Initial Drawdown Date occurred) will be equal to 0.1875% (i.e., an annual rate of 0.75%) of our average gross assets (excluding cash and cash equivalents but including assets purchased with borrowed amounts) at the end of such quarter and zero. The Management Fee for any partial quarter will be appropriately prorated. The Investment Adviser waives a portion of its management fee payable by the Company in an amount equal to the management fees it earns as an investment adviser for any affiliated money market funds in which we invest.

Management Fees are generally expected to be paid using available funds, in which case these payments will not reduce Undrawn Commitments. However, we may draw down Undrawn Commitments for Management Fees, and any such amounts contributed would reduce Undrawn Commitments.

Following the occurrence (if any) of a listing, the Management Fee will be equal to 0.25% (i.e., an annual rate of 1.00%) of our average gross assets (excluding cash and cash equivalents but including assets purchased with borrowed amounts) at the end of the then-current calendar quarter and the prior calendar quarter (and, in the case of our first quarter-end following such event, our gross assets as of such quarter-end).

18

Incentive Fee

Pursuant to the Investment Management Agreement, we pay to our Investment Adviser an incentive fee (the “Incentive Fee”) as follows:

The Incentive Fee will consist of two components that are determined independently of each other, with the result that one component may be payable even if the other is not. A portion of the Incentive Fee will be based on our income and a portion will be based on our capital gains, each as described below.

Quarterly Incentive Fee Based on Income. Our Investment Adviser is entitled to receive the Incentive Fee based on income from us if our Ordinary Income (as defined below) exceeds a quarterly “hurdle rate” (as defined below) of 1.75%. For this purpose, the hurdle is computed by reference to our net asset value (“NAV”) and does not take into account changes in the market price of our common stock (if any). The Incentive Fee based on income will be determined and paid quarterly in arrears at the end of each calendar quarter by reference to our aggregate net investment income, as adjusted as described below, from the calendar quarter then ending and the eleven preceding calendar quarters (or if shorter, the number of quarters that have occurred since the Initial Drawdown Date). We refer to such period as the “Trailing Twelve Quarters.” However, following the occurrence (if any) of a listing, the Trailing Twelve Quarters will be “reset” so as to include, as of the end of any quarter, the calendar quarter then ending and the eleven preceding calendar quarters (or if shorter, the number of quarters that have occurred since the listing, rather than the number of quarters that have occurred since the Initial Drawdown Date).

We will pay our Investment Adviser a quarterly Incentive Fee based on the amount by which (A) Ordinary Income in respect of the relevant Trailing Twelve Quarters exceeds (B) the hurdle amount for such Trailing Twelve Quarters. The amount of the excess of (A) over (B) described in this paragraph for such Trailing Twelve Quarters is referred to as the “Excess Income Amount.”

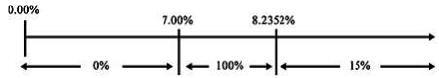

The “hurdle amount” for the Incentive Fee based on income is determined on a quarterly basis and is equal to 1.75% multiplied by our NAV at the beginning of each applicable calendar quarter comprising the relevant Trailing Twelve Quarters. The hurdle amount is calculated after making appropriate adjustments for subscriptions (which includes all issuances by us of shares of our common stock) and distributions that occurred during the relevant Trailing Twelve Quarters. The Incentive Fee for any partial period will be appropriately prorated. The Incentive Fee based on income for each quarter is determined as follows:

The amount of the Incentive Fee based on income that will be paid to our Investment Adviser for a particular quarter will equal the excess of the Incentive Fee so calculated minus the aggregate Incentive Fees based on income that were paid in respect of the first eleven calendar quarters (or the portion thereof) included in the relevant Trailing Twelve Quarters but will not exceed the Incentive Fee Cap (as described below).

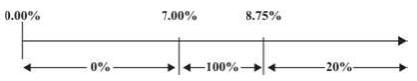

The Incentive Fee based on income that is paid to our Investment Adviser for a particular quarter is subject to the Incentive Fee Cap. The Incentive Fee Cap for any quarter is an amount equal to (a) 15% (which will be increased to 20% in the event of a listing) of the Cumulative Net Return (as defined below) during the relevant Trailing Twelve Quarters minus (b) the aggregate Incentive Fees based on income that were paid in respect of the first eleven calendar quarters (or the portion thereof) included in the relevant Trailing Twelve Quarters.

“Ordinary Income” means interest income, dividend income and any other income (including any accrued income that we have not yet received in cash and any other fees such as commitment, origination, structuring, diligence and consulting fees or other fees that we receive from portfolio companies) accrued during the calendar quarter minus our operating expenses accrued during the calendar quarter (including the Management Fee, administrative expenses and any interest expense and dividends paid on issued and outstanding preferred stock, but excluding the Incentive Fee).

“Cumulative Net Return” means (x) the Ordinary Income in respect of the relevant Trailing Twelve Quarters minus (y) any Net Capital Loss (as defined below), if any, in respect of the relevant Trailing Twelve Quarters.