UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23701

| Name of Fund: | BlackRock ESG Capital Allocation Trust (ECAT) |

| Fund Address: | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock ESG Capital Allocation Trust, 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 12/31/2021

Date of reporting period: 12/31/2021

| Item 1 – | Report to Stockholders |

(a) The Report to Shareholders is attached herewith.

|

|

DECEMBER 31, 2021 |

| 2021 Annual Report

| ||

BlackRock Capital Allocation Trust (BCAT)

BlackRock ESG Capital Allocation Trust (ECAT)

|

Not FDIC Insured • May Lose Value • No Bank Guarantee

|

Supplemental Information (unaudited)

Section 19(a) Notices

BlackRock Capital Allocation Trust’s (BCAT) and BlackRock ESG Capital Allocation Trust’s (ECAT) (collectively the “Trusts” or individually a “Trust”) amounts and sources of distributions reported are estimates and are being provided to you pursuant to regulatory requirements and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon each Trust’s investment experience during its fiscal year and may be subject to changes based on tax regulations. Each Trust will provide a Form 1099-DIV each calendar year that will tell you how to report these distributions for U.S. federal income tax purposes.

December 31, 2021

| Total Cumulative Distributions for the Fiscal Period |

% Breakdown of the Total Cumulative Distributions for the Fiscal Period |

|||||||||||||||||||||||||||||||||||||||

| Trust Name |

|

Net Income |

|

|

Net Realized Capital Gains Short-Term |

|

|

Net Realized Capital Gains Long-Term |

|

|

Return of Capital |

(a) |

|

Total Per Common Share |

|

|

Net Income |

|

|

Net Realized Capital Gains Short-Term |

|

|

Net Realized Capital Gains Long-Term |

|

|

Return of Capital |

|

|

Total Per Common Share |

| ||||||||||

| BCAT |

$ | 0.477207 | $ | 0.107154 | $ | 0.019694 | $ | 0.645145 | $ | 1.249200 | 38 | % | 9 | % | 1 | % | 52 | % | 100 | % | ||||||||||||||||||||

| ECAT |

0.022234 | 0.077766 | — | — | 0.100000 | 22 | 78 | — | — | 100 | ||||||||||||||||||||||||||||||

| (a) | Each Trust estimates that it has distributed more than its net income and net realized capital gains; therefore, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment in a Trust is returned to the shareholder. A return of capital does not necessarily reflect a Trust’s investment performance and should not be confused with “yield” or “income.” When distributions exceed total return performance, the difference will reduce a Trust’s net asset value per share. |

Section 19(a) notices for the Trusts, as applicable, are available on the BlackRock website at blackrock.com.

Section 19(b) Disclosure

The Trusts, acting pursuant to a U.S. Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Trust’s Board of Trustees (the “Board”), each have adopted a managed distribution plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plans, the Trusts currently distribute the following fixed amounts per share on a monthly basis:

| Exchange Symbol | Amount Per Common Share |

|||

| BCAT |

$ | 0.1041 | ||

| ECAT |

0.1000 | |||

The fixed amounts distributed per share are subject to change at the discretion of each Trust’s Board. Under its Plan, each Trust will distribute all available net income to its shareholders as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient income (inclusive of net income and short-term capital gains) is not earned on a monthly basis, the Trusts will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board; however, each Trust may make additional distributions from time to time, including additional capital gain distributions at the end of the taxable year, if required to meet requirements imposed by the Code and/or the Investment Company Act of 1940, as amended (the “1940 Act”).

Shareholders should not draw any conclusions about each Trust’s investment performance from the amount of these distributions or from the terms of the Plan. Each Trust’s total return performance is presented in its financial highlights table.

The Board may amend, suspend or terminate a Trust’s Plan at any time without prior notice to the Trust’s shareholders if it deems such actions to be in the best interests of the Trust or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Trust’s stock is trading at or above net asset value) or widening an existing trading discount. The Trusts are subject to risks that could have an adverse impact on their ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, changes in interest rates, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code.

| 2 |

2 0 2 1 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Dear Shareholder,

The 12-month reporting period as of December 31, 2021 saw a continuation of the resurgent growth that followed the initial coronavirus (or “COVID-19”) pandemic reopening, albeit at a slower pace. The global economy weathered the emergence of several variant strains and the resulting peaks and troughs in infections amid optimism that increasing vaccinations and economic adaptation could help contain the pandemic’s disruptions. Continued growth meant that the U.S. economy regained and then surpassed its pre-pandemic output. However, a rapid rebound in consumer spending pushed up against supply constraints and led to elevated inflation.

Equity prices rose with the broader economy, as the implementation of mass vaccination campaigns and passage of an additional fiscal stimulus package and infrastructure bill further boosted stocks. In the United States, both large- and small-capitalization stocks posted a strong advance, and many equity indices neared or surpassed all-time highs late in the reporting period. International equities from developed markets also gained, although emerging market stocks declined, pressured by a strengthening U.S. dollar.

The 10-year U.S. Treasury yield (which is inversely related to bond prices) rose during the reporting period as the economy expanded rapidly and inflation reached its highest annualized reading in decades. In the corporate bond market, support from the U.S. Federal Reserve (the “Fed”) assuaged credit concerns and led to solid returns for high-yield corporate bonds, outpacing investment-grade corporate bonds, which declined.

The Fed maintained accommodative monetary policy during the reporting period by maintaining near-zero interest rates and by asserting that inflation could exceed its 2% target for a sustained period without triggering a rate increase. However, the Fed’s tone shifted late in the year, as it reduced its bond-buying program and used its market guidance to raise the prospect of higher rates in 2022.

Looking ahead, we believe that the global expansion will continue to broaden as Europe and other developed market economies gain momentum, although the Delta and Omicron variants of the coronavirus remain a threat, particularly in emerging markets. While we expect inflation to abate somewhat as supply bottlenecks are resolved, we anticipate that inflation will remain higher than the pre-COVID norm. The Fed is poised to raise interest rates next year in response, but the Fed’s policy shift means that tightening is likely to be less aggressive than what we’ve seen in previous cycles.

In this environment, we favor an overweight to equities, as we believe low interest rates and continued economic growth will support further gains, albeit likely more modest than what we saw in 2021. Sectors that are better poised to manage the transition to a lower-carbon world, such as technology and health care, are particularly attractive in the long term. U.S. and other developed-market equities have room for further growth, while we believe Chinese equities stand to gain from a more accommodative monetary and fiscal environment as the Chinese economy slows. We are underweight long-term credit, but inflation-protected U.S. Treasuries, Asian fixed income, and emerging market local-currency bonds offer potential opportunities. We believe that international diversification and a focus on sustainability can help provide portfolio resilience, and the disruption created by the coronavirus appears to be accelerating the shift toward sustainable investments.

In this environment, our view is that investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of December 31, 2021 | ||||||||

| 6-Month | 12-Month | |||||||

| U.S. large cap equities |

11.67 | % | 28.71 | % | ||||

| U.S. small cap equities |

(2.31 | ) | 14.82 | |||||

| International equities |

2.24 | 11.26 | ||||||

| Emerging market equities |

(9.30 | ) | (2.54 | ) | ||||

| 3-month Treasury bills (ICE BofA 3-Month U.S. Treasury Bill Index) |

0.02 | 0.05 | ||||||

| U.S. Treasury securities |

0.44 | (3.68 | ) | |||||

| U.S. investment grade bonds |

0.06 | (1.54 | ) | |||||

| Tax-exempt municipal bonds |

0.52 | 1.77 | ||||||

| U.S. high yield bonds |

1.59 | 5.26 | ||||||

|

Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| |||||||

| T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

3 |

| Page | ||||

| 2 | ||||

| 3 | ||||

| Annual Report: |

||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| Financial Statements: |

||||

| 11 | ||||

| 62 | ||||

| 64 | ||||

| 65 | ||||

| 67 | ||||

| 69 | ||||

| 71 | ||||

| 84 | ||||

| 85 | ||||

| Disclosure of Investment Advisory Agreement and Sub-Advisory Agreement |

86 | |||

| 89 | ||||

| 102 | ||||

| 103 | ||||

| 107 | ||||

| 110 | ||||

| 4 |

The Benefits and Risks of Leveraging

The Trusts may utilize leverage to seek to enhance the distribution rate on, and net asset value (“NAV”) of, their common shares (“Common Shares”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by a Trust on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Trust (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, each Trust’s shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage (after paying the leverage costs) is paid to shareholders in the form of dividends, and the value of these portfolio holdings (less the leverage liability) is reflected in the per share NAV.

To illustrate these concepts, assume a Trust’s capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If prevailing short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, a Trust’s financing costs on the $30 million of proceeds obtained from leverage are based on the lower short-term interest rates. At the same time, the securities purchased by a Trust with the proceeds from leverage earn income based on longer-term interest rates. In this case, a Trust’s financing cost of leverage is significantly lower than the income earned on a Trust’s longer-term investments acquired from such leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other costs of leverage exceed a Trust’s return on assets purchased with leverage proceeds, income to shareholders is lower than if a Trust had not used leverage. Furthermore, the value of the Trusts’ portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. In contrast, the amount of each Trust’s obligations under its leverage arrangement generally does not fluctuate in relation to interest rates. As a result, changes in interest rates can influence the Trusts’ NAVs positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that a Trust’s intended leveraging strategy will be successful.

The use of leverage also generally causes greater changes in each Trust’s NAV, market price and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV and market price of a Trust’s shares than if the Trust were not leveraged. In addition, each Trust may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Trust to incur losses. The use of leverage may limit a Trust’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Trust incurs expenses in connection with the use of leverage, all of which are borne by shareholders and may reduce income to the shareholders. Moreover, to the extent the calculation of each Trust’s investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to each Trust’s investment adviser will be higher than if the Trusts did not use leverage.

Each Trust may utilize leverage through a credit facility or reverse repurchase agreements as described in the Notes to Financial Statements, if applicable.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), each Trust is permitted to issue debt up to 33 1/3% of its total managed assets. A Trust may voluntarily elect to limit its leverage to less than the maximum amount permitted under the 1940 Act. In addition, a Trust may also be subject to certain asset coverage, leverage or portfolio composition requirements imposed by its credit facility, which may be more stringent than those imposed by the 1940 Act.

If a Trust segregates or designates on its books and records cash or liquid assets having a value not less than the value of a Trust’s obligations under a reverse repurchase agreement (including accrued interest), then such transaction is not considered a senior security and is not subject to the foregoing limitations and requirements imposed by the 1940 Act.

| T H E B E N E F I T S A N D R I S K S O F L E V E R A G I N G |

5 |

Overview

In general, the goal of each of the Trusts is to provide total return through a combination of current income and realized and unrealized gains (capital appreciation). The Trusts seek to pursue these goals primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) call and put options in an effort to generate current gains from option premiums and to enhance each Trust’s risk-adjusted return. Each Trust’s objectives cannot be achieved in all market conditions.

Each Trust primarily writes single stock covered call options and may also from time to time write single stock put options. When writing (selling) a covered call option, a Trust holds an underlying equity security and enters into an option transaction which allows the counterparty to purchase the equity security at an agreed-upon price (“strike price”) within an agreed-upon time period. The Trust receives cash premiums from the counterparties upon writing (selling) the option, which along with net investment income and net realized gains, if any, are generally available to support current or future distributions paid by the Trust. During the option term, the counterparty may elect to exercise the option if the market value of the equity security rises above the strike price, and the Trust is obligated to sell the equity security to the counterparty at the strike price, realizing a gain or loss. Premiums received increase gains or reduce losses realized on the sale of the equity security. If the option remains unexercised upon its expiration, the Trust realizes gains equal to the premiums received. Alternatively, an option may be closed out by an offsetting purchase or sale of an option prior to expiration. The Trust realizes a capital gain from a closing purchase or sale transaction if the premium paid is less than the premium received from writing the option. The Trust realizes a capital loss from a closing purchase or sale transaction if the premium received is less than the premium paid to purchase the option.

Writing covered call options entails certain risks, which include, but are not limited to, the following: an increase in the value of the underlying equity security above the strike price can result in the exercise of a written option (sale by a Trust to the counterparty) when the Trust might not otherwise have sold the security; exercise of the option by the counterparty may result in a sale below the current market value and a gain or loss being realized by the Trust; and limiting the potential appreciation that could be realized on the underlying equity security to the extent of the strike price of the option. The premium that a Trust receives from writing a covered call option may not be sufficient to offset the potential appreciation on the underlying equity security above the strike price of the option that could have otherwise been realized by the Trust. As such, an option over-writing strategy may outperform the general equity market in flat or falling markets but underperform in rising markets.

Option Over-Writing Strategy Illustration

To illustrate these concepts, assume the following: (1) a common stock purchased at and currently trading at $37.15 per share; (2) a three-month call option is written by a Trust with a strike price of $40 (i.e., 7.7% higher than the current market price); and (3) the Trust receives $2.45, or 6.6% of the common stock’s value, as a premium. If the stock price remains unchanged, the option expires and there would be a 6.6% return for the three-month period. If the stock were to decline in price by 6.6% (i.e., decline to $34.70 per share), the option strategy would “break-even” from an economic perspective resulting in neither a gain nor a loss. If the stock were to climb to a price of $40 or above, the option would be exercised and the stock would return 7.7% coupled with the option premium received of 6.6% for a total return of 14.3%. Under this scenario, the Trust loses the benefit of any appreciation of the stock above $40, and thus is limited to a 14.3% total return. The premium from writing the call option serves to offset some of the unrealized loss on the stock in the event that the price of the stock declines, but if the stock were to decline more than 6.6% under this scenario, the Trust’s downside protection is eliminated and the stock could eventually become worthless.

Each Trust intends to write covered call and other options to varying degrees depending upon market conditions. Please refer to each Trust’s Schedule of Investments and the Notes to Financial Statements for details of written options.

Derivative Financial Instruments

The Trusts may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Trusts’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Trust can realize on an investment and/or may result in lower distributions paid to shareholders. The Trusts’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| 6 | 2 0 2 1 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Trust Summary as of December 31, 2021 | BlackRock Capital Allocation Trust (BCAT) |

Investment Objective

BlackRock Capital Allocation Trust’s (BCAT) (the “Trust”) investment objectives are to provide total return and income through a combination of current income, current gains and long-term capital appreciation. The Trust invests in a portfolio of equity and debt securities. Generally, the Trust’s portfolio will include both equity and debt securities. At any given time, however, the Trust may emphasize either debt securities or equity securities. The Trust utilizes an option writing (selling) strategy in an effort to generate current gains from options premiums and to enhance the Trust’s risk-adjusted returns.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| Symbol on New York Stock Exchange |

BCAT | |

| Initial Offering Date |

September 28, 2020 | |

| Current Distribution Rate on Closing Market Price as of December 31, 2021 ($19.45)(a) |

6.42% | |

| Current Monthly Distribution per Common Share(b) |

$0.1041 | |

| Current Annualized Distribution per Common Share(b) |

$1.2492 | |

| Leverage as of December 31, 2021(c) |

23% |

| (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance is not an indication of future results. |

| (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. |

| (c) | Represents reverse repurchase agreements and bank borrowings as a percentage of total managed assets, which is the total assets of the Trust (including any assets attributable to any borrowings) minus the sum of its liabilities (other than borrowings representing financial leverage). Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

Market Price and Net Asset Value Per Share Summary

| 12/31/21 | 12/31/20 | Change | High | Low | ||||||||||||||||

| Closing Market Price |

$ 19.45 | $ 21.77 | (10.66) | % | $ 23.70 | $ 18.30 | ||||||||||||||

| Net Asset Value |

20.90 | 21.05 | (0.71) | 21.94 | 20.39 | |||||||||||||||

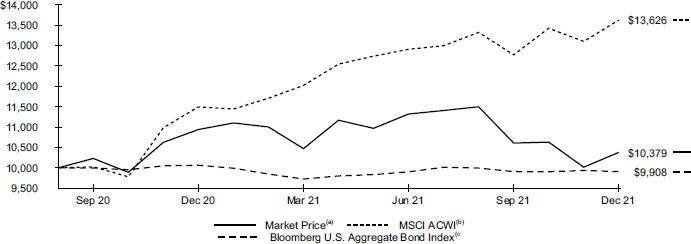

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| BCAT commenced operations on September 28, 2020. |

| (a) | Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

| (b) | An index that captures large- and mid-cap representation across certain developed and emerging markets. |

| (c) | Bloomberg U.S. Aggregate Bond Index (formerly Bloomberg Barclays U.S. Aggregate Bond Index), a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. |

| T R U S T S U M M A R Y |

7 |

| Trust Summary as of December 31, 2021 (continued) | BlackRock Capital Allocation Trust (BCAT) |

Performance

Returns for the period ended December 31, 2021 were as follows:

| Average Annual Total Returns | ||||||||

| |

1 Year |

|

|

Since Inception |

(a) | |||

| Trust at NAV(b)(c) |

5.44 | % | 9.06 | % | ||||

| Trust at Market Price(b)(c) |

(5.12 | ) | 3.00 | |||||

| MSCI ACWI(d) |

18.54 | 27.94 | ||||||

| Bloomberg U.S. Aggregate Bond Index(d) |

(1.54 | ) | (0.73 | ) | ||||

| MSCI World Index(e) |

21.82 | 29.97 | ||||||

| Bloomberg Global Aggregate Total Return Index (unhedged)(f) |

(4.71 | ) | (1.06 | ) | ||||

| (a) | BCAT commenced operations on September 28, 2020. |

| (b) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Trust’s use of leverage. |

| (c) | The Trust moved from a premium to NAV to a discount during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (d) | The Trust changed its reporting benchmarks from MSCI World Index and Bloomberg Global Aggregate Total Return Index (unhedged) to MSCI ACWI and Bloomberg U.S. Aggregate Bond Index. The investment adviser believes the new benchmarks are more appropriate reporting benchmarks for the Trust. |

| (e) | A broad global equity index that captures large- and mid-cap representation across certain developed markets countries. |

| (f) | Bloomberg Global Aggregate Total Return Index (unhedged) (formerly Bloomberg Barclays Global Aggregate Total Return Index (unhedged)), an index that is a flagship measure of global investment grade debt from approximately twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

The Trust is presenting the performance of one or more indices for informational purposes only. The Trust is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Trust’s investment strategies, portfolio components or past or future performance.

More information about the Trust’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Trust’s absolute performance based on NAV:

What factors influenced Trust performance?

Due to the nature of the Trust’s mandate, performance is reviewed on an absolute return basis. The Trust has an unconstrained approach (i.e., flexibility to invest across all equity and fixed income asset classes, spanning public and private markets). As such, the Trust is not managed specifically to a benchmark. The index returns listed above are for reference purposes only. Performance information below is expressed on a contribution to return basis.

Most of the Trust’s positive total return was driven by its allocation to equities. From a sector perspective, positioning in information technology, financials and health care were the primary contributors. Within fixed income, positioning in securitized assets was the largest driver of positive returns.

In equities, the use of index-related equity futures (mainly used to manage risk during periods of heightened market volatility) detracted. Positioning in sovereign bonds and high yield bonds detracted from absolute performance in fixed income.

The Trust uses derivatives, which may include options, futures, swaps and forward contracts, in an effort to enhance returns and manage the risk of adverse market movements. In the aggregate, the Trust’s use of derivatives detracted from performance during the period.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s options overlay strategy contributed to relative performance for the since inception period.

The Trust’s practice of maintaining a specified level of monthly distributions to shareholders did not have a material impact on the Trust’s investment strategy. The distribution policy resulted in return of capital for the period. Refer to the financial highlights and income tax information sections in this report for further information about the distributions.

Describe recent portfolio activity.

In terms of portfolio activity, the investment adviser completed the process of becoming fully invested following the Trust’s launch on September 28, 2020. The investment adviser invested the Trust’s remaining cash balance in both the equity and fixed income markets. In equities, it increased the Trust’s allocation to the consumer discretionary, information technology, financials and energy sectors, while reducing its weighting in consumer staples. The investment adviser also increased the allocation to fixed income by adding to a diversified basket of high yield bonds and securitized assets, primarily residential mortgage-backed securities.

The investment adviser used leverage to bring the Trust’s total capital invested to 125% of net assets at period end. The Trust used leverage in an effort to enhance the portfolio’s income and total return in the low yield environment.

| 8 | 2 0 2 1 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Trust Summary as of December 31, 2021 (continued) | BlackRock Capital Allocation Trust (BCAT) |

Describe portfolio positioning at period end.

The Trust had a 49% weighting in equities at the close of the year. It had allocations to all sectors, with the largest absolute weightings in information technology, consumer discretionary, health care and industrials. Within equities, the investment adviser used options as an additional source of income. As of December 31, 2021, the investment adviser had sold covered calls on approximately 10% of its equity positions.

The Trust finished the year with a weighting of 51% in fixed income, primarily high yield bonds and securitized assets. The investment adviser continued to emphasize these areas not only for their attractive yield potential, but also for each sector’s historical tendency to exhibit below-average interest rate sensitivity. The Trust also held a weighting in emerging market sovereign bonds where the investment adviser saw attractive yields relative to the underlying interest-rate risk.

The Trust’s weighting in private investments stood at 8.7% of total assets at year end.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| Security(a) | Percent of Total Investments |

|||

| Microsoft Corp. |

2 | % | ||

| SPDR S&P 500 ETF Trust |

1 | |||

| Amazon.com, Inc. |

1 | |||

| UnitedHealth Group, Inc. |

1 | |||

| Alphabet, Inc. |

1 | |||

| SPDR Bloomberg Barclays High Yield Bond ETF |

1 | |||

| AbbVie, Inc. |

1 | |||

| Thermo Fisher Scientific, Inc. |

1 | |||

| Enbridge, Inc. |

1 | |||

| Abbott Laboratories |

1 | |||

GEOGRAPHIC ALLOCATION

| Country/Geographic Region | 12/31/21 | 12/31/20 | ||||||

| United States |

63 | % | 61 | % | ||||

| Cayman Islands |

6 | 6 | ||||||

| Germany |

3 | 2 | ||||||

| United Kingdom |

3 | 2 | ||||||

| Netherlands |

2 | 3 | ||||||

| Mexico |

2 | 2 | ||||||

| France |

2 | 3 | ||||||

| Ireland |

1 | 1 | ||||||

| China |

1 | 3 | ||||||

| Canada |

1 | 1 | ||||||

| Luxembourg |

1 | 1 | ||||||

| India |

1 | 1 | ||||||

| Colombia |

1 | 1 | ||||||

| Italy |

1 | 1 | ||||||

| Brazil |

1 | 1 | ||||||

| Spain |

1 | — | ||||||

| Japan |

1 | 1 | ||||||

| Israel |

1 | — | ||||||

| Dominican Republic |

1 | — | ||||||

| Sweden |

1 | 1 | ||||||

| Indonesia |

1 | 1 | ||||||

| Egypt |

1 | 1 | ||||||

| Argentina |

1 | — | ||||||

| Taiwan |

1 | 1 | ||||||

| Macau |

1 | — | ||||||

| Saudi Arabia |

1 | 1 | ||||||

| Panama |

— | 1 | ||||||

| Hong Kong |

— | 1 | ||||||

| Ukraine |

— | 1 | ||||||

| Chile |

— | 1 | ||||||

| Switzerland |

— | 1 | ||||||

| Other# |

— | (b) | — | (b) | ||||

| (a) | Excludes short-term securities. |

| (b) | Rounds to less than 1% of total investments. |

| # | Includes holdings within countries/geographic regions that are less than 1% of total investments. Please refer to the Consolidated Schedule of Investments for such countries/geographic regions. |

| T R U S T S U M M A R Y |

9 |

| Trust Summary as of December 31, 2021 | BlackRock ESG Capital Allocation Trust (ECAT) |

Investment Objective

BlackRock ESG Capital Allocation Trust’s (the “Trust”) investment objectives are to provide total return and income through a combination of current income, current gains and long-term capital appreciation. The Trust will invest in a portfolio of equity and debt securities. Generally, the Trust’s portfolio will include both equity and debt securities. At any given time, however, the Trust may emphasize either debt securities or equity securities. In addition, the Trust may invest without limit in “junk bonds,” corporate loans and distressed securities. The Trust will invest at least 80% of its total assets in securities that, in the Adviser’s assessment, meet certain environmental, social and governance (“ESG”) criteria. The Trust utilizes an option writing (selling) strategy in an effort to generate current gains from options premiums and to enhance the Trust’s risk-adjusted returns.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| Symbol on New York Stock Exchange |

ECAT | |

| Initial Offering Date |

September 27, 2021 | |

| Current Distribution Rate on Closing Market Price as of December 31, 2021 ($18.65)(a) |

6.43% | |

| Current Monthly Distribution per Common Share(b) |

$0.1000 | |

| Current Annualized Distribution per Common Share(b) |

$1.2000 |

| (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | The distribution rate is not constant and is subject to change. |

Market Price and Net Asset Value Per Share Summary

| 12/31/21 | 09/27/21 | Change | High | Low | ||||||||||||||||

| Closing Market Price |

$ | 18.65 | $ | 20.00 | (6.75 | )% | $ | 20.15 | $ | 18.14 | ||||||||||

| Net Asset Value |

20.69 | 20.00 | 3.45 | 20.90 | 19.93 | |||||||||||||||

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| Security(a) | Percent of Total Investments |

|||

| NextEra Energy, Inc. |

4 | % | ||

| Thermo Fisher Scientific, Inc. |

3 | |||

| Marsh & McLennan Cos., Inc. |

3 | |||

| Microsoft Corp. |

3 | |||

| American Tower Corp. |

3 | |||

| InvesCo QQQ Trust |

2 | |||

| Alphabet, Inc. |

2 | |||

| salesforce.com, Inc. |

2 | |||

| Boston Scientific Corp. |

2 | |||

| Masco Corp. |

2 | |||

GEOGRAPHIC ALLOCATION

| Country/Geographic Region | 12/31/21 | |||

| United States |

85 | % | ||

| France |

4 | |||

| Germany |

2 | |||

| Taiwan |

2 | |||

| Cayman Islands |

1 | |||

| United Kingdom |

1 | |||

| Netherlands |

1 | |||

| Finland |

1 | |||

| South Korea |

1 | |||

| Israel |

1 | |||

| China |

1 | |||

| Other# |

— | (b) | ||

| (a) | Excludes short-term securities. |

| (b) | Rounds to less than 1% of total investments. |

| # | Includes holdings within countries/geographic regions that are less than 1% of total investments. Please refer to the Schedule of Investments for such countries/geographic regions. |

| 10 | 2 0 2 1 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Consolidated Schedule of Investments December 31, 2021 |

BlackRock Capital Allocation Trust (BCAT) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Asset-Backed Securities |

||||||||

| Canada — 0.0% | ||||||||

| Fairstone Financial Issuance Trust I, |

CAD | 1,270 | $ | 1,057,695 | ||||

|

|

|

|||||||

| Cayman Islands(a)(b) — 5.4% | ||||||||

| 522 Funding CLO Ltd., Series 2019-4A, Class DR, (3 mo. LIBOR US + 3.65%), 3.78%, 04/20/30 |

USD | 1,950 | 1,950,768 | |||||

| AGL CLO 5 Ltd., Series 2020-5A, Class ER, (3 mo. LIBOR US + 6.45%), 6.58%, 07/20/34 |

3,000 | 2,999,856 | ||||||

| AGL CLO Ltd. |

||||||||

| Series 2020-3A, Class D, (3 mo. LIBOR US + 3.30%), 3.42%, 01/15/33 |

550 | 550,029 | ||||||

| Series 2020-7A, Class DR, (3 mo. LIBOR US + 3.10%), 3.22%, 07/15/34 |

250 | 249,997 | ||||||

| Series 2020-9A, Class D, (3 mo. LIBOR US + 3.70%), 3.83%, 01/20/34 |

850 | 853,752 | ||||||

| Series 2020-9A, Class D, (3 mo. LIBOR US + 6.35%), 6.47%, 07/15/34 |

250 | 250,007 | ||||||

| AIG CLO, Series 2021-1A, Class E, (3 mo. LIBOR US + 6.60%), 6.73%, 04/22/34 |

250 | 248,278 | ||||||

| AIG CLO LLC, Series 2020-1A, Class ER, (3 mo. LIBOR US + 6.30%), 6.42%, 04/15/34 |

500 | 493,316 | ||||||

| AIMCO CLO, 2017-AA, (3 mo. LIBOR US + 3.15%), 3.28%, 04/20/34 |

250 | 250,671 | ||||||

| Allegany Park CLO Ltd., Series 2019-1A, Class D, (3 mo. LIBOR US + 3.70%), 3.83%, 01/20/33 |

600 | 600,308 | ||||||

| Apidos CLO XXII, 2015-22A, (3 mo. LIBOR US + 2.95%), 3.08%, 04/20/31 |

250 | 249,268 | ||||||

| Apidos CLO XXXII, Series 2019-32A, Class D, (3 mo. LIBOR US + 3.50%), 3.63%, 01/20/33 |

250 | 250,165 | ||||||

| Apidos CLO XXXV, Series 2021-35A, Class E, (3 mo. LIBOR US + 5.75%), 5.88%, 04/20/34 |

375 | 370,060 | ||||||

| Apidos CLO XXXVII, Series 2021-37A, Class E, (3 mo. LIBOR US + 6.30%), 6.43%, 10/22/34 |

750 | 736,076 | ||||||

| Apres Static CLO Ltd., Series 2019-1A, Class CR, (3 mo. LIBOR US + 4.25%), 4.37%, 10/15/28 |

3,000 | 3,000,885 | ||||||

| Ares LIX CLO Ltd., Series 2021-59A, Class E, (3 mo. LIBOR US + 6.25%), 6.37%, 04/25/34 |

700 | 684,954 | ||||||

| ARES Loan Funding I Ltd. |

||||||||

| Series 2021-ALFA, Class E, (3 mo. LIBOR US + 6.70%), 6.82%, 10/15/34 |

1,000 | 980,526 | ||||||

| Series 2021-ALFA, Class SUB, 0.00%, 10/15/34 |

2,150 | 1,900,902 | ||||||

| Ares LV CLO Ltd. |

||||||||

| Series 2020-55A, Class DR, (3 mo. LIBOR US + 3.15%), 3.27%, 07/15/34 |

1,500 | 1,504,696 | ||||||

| Series 2020-55A, Class ER, (3 mo. LIBOR US + 6.35%), 6.47%, 07/15/34 |

5,400 | 5,341,089 | ||||||

| Ares LVI CLO Ltd., Series 2020-56A, Class ER, (3 mo. LIBOR US + 6.50%), 6.63%, 10/25/34 |

625 | 618,790 | ||||||

| Balboa Bay Loan Funding Ltd., Series 2021-1A, Class E, (3 mo. LIBOR US + 6.16%), 6.29%, 07/20/34 |

250 | 249,973 | ||||||

| Ballyrock CLO Ltd. |

||||||||

| Series 2016-1A, Class DR2, (3 mo. LIBOR US + 3.15%), 3.27%, 10/15/28 |

500 | 500,048 | ||||||

| Series 2019-1A, Class CR, (3 mo. LIBOR US + 3.05%), 3.17%, 07/15/32 |

2,700 | 2,699,971 | ||||||

| Bardot CLO Ltd., Series 2019-2A, Class DR, (3 mo. LIBOR US + 3.00%), 3.13%, 10/22/32 |

250 | 249,998 | ||||||

| Security | Par (000) |

Value | ||||||

| Cayman Islands (continued) | ||||||||

| Battalion CLO IX Ltd., Series 2015-9A, Class DR, (3 mo. LIBOR US + 3.25%), 3.37%, 07/15/31 |

USD | 250 | $ | 248,774 | ||||

| Benefit Street Partners CLO XX Ltd., Series 2020-20A, Class ER, (3 mo. LIBOR US + 6.75%), 6.89%, 07/15/34 |

250 | 249,986 | ||||||

| Birch Grove CLO 2 Ltd. |

||||||||

| Series 2021-2A, Class D1, (3 mo. LIBOR US + 3.30%), 3.41%, 10/19/34 |

750 | 749,986 | ||||||

| Series 2021-2A, Class E, (3 mo. LIBOR US + 6.95%), 7.06%, 10/19/34 |

500 | 489,268 | ||||||

| Birch Grove CLO Ltd., Series 19A, Class DR, (3 mo. LIBOR US + 3.35%), 3.55%, 06/15/31 |

1,500 | 1,499,983 | ||||||

| BlueMountain CLO Ltd., Series 2016-2A, Class C1R2, (3 mo. LIBOR US + 3.10%), 3.26%, 08/20/32 |

1,000 | 999,990 | ||||||

| BlueMountain CLO XXX Ltd. |

||||||||

| Series 2020-30A, Class D, (3 mo. LIBOR US + 3.90%), 4.02%, 01/15/33 |

3,650 | 3,657,007 | ||||||

| Series 2020-30A, Class E, (3 mo. LIBOR US + 7.73%), 7.85%, 01/15/33 |

800 | 802,378 | ||||||

| Buttermilk Park CLO Ltd., (3 mo. LIBOR US + 3.10%), 3.22%, 10/15/31 |

250 | 250,019 | ||||||

| Canyon Capital CLO Ltd., Series 2021-2A, Class D, (3 mo. LIBOR US + 3.35%), 3.47%, 04/15/34 |

250 | 250,172 | ||||||

| Canyon CLO Ltd., Series 2020-3A, Class E, (3 mo. LIBOR US + 7.25%), 7.37%, 01/15/34 |

250 | 250,749 | ||||||

| CarVal CLO II Ltd., Series 2019-1A, Class DR, (3 mo. LIBOR US + 3.20%), 3.33%, 04/20/32 |

1,425 | 1,417,919 | ||||||

| CarVal CLO VC Ltd., Series 2021-2A, Class E, (3 mo. LIBOR US + 6.75%), 6.96%, 10/15/34 |

500 | 495,000 | ||||||

| CIFC Funding III Ltd., Series 2019-3A, Class CR, (3 mo. LIBOR US + 3.05%), 3.17%, 10/16/34 |

1,000 | 999,998 | ||||||

| CIFC Funding Ltd., Series 2014-2RA, Class B1, (3 mo. LIBOR US + 2.80%), 2.92%, 04/24/30 |

1,000 | 990,314 | ||||||

| Crown City CLO I, Series 2020-1A, Class DR, (3 mo. LIBOR US + 7.00%), 7.13%, 07/20/34 |

625 | 624,965 | ||||||

| Crown City CLO III |

||||||||

| Series 2021-1A, Class C, (3 mo. LIBOR US + 3.30%), 3.42%, 07/20/34 |

1,250 | 1,249,965 | ||||||

| Series 2021-1A, Class D, (3 mo. LIBOR US + 6.75%), 6.87%, 07/20/34 |

500 | 499,947 | ||||||

| Crown Point CLO 9 Ltd., Series 2020-9A, Class DR, (3 mo. LIBOR US + 3.75%), 3.88%, 07/14/34 |

500 | 499,994 | ||||||

| Diameter Capital Clo 2 Ltd., Series 2021-2A, Class D, (3 mo. LIBOR US + 6.06%), 6.18%, 10/15/36 |

250 | 240,062 | ||||||

| Dryden CLO Ltd., Series 2019-80A, Class D1, (3 mo. LIBOR US + 4.10%), 4.22%, 01/17/33 |

250 | 250,867 | ||||||

| Eaton Vance CLO Ltd., Series 2019-1A, Class ER, (3 mo. LIBOR US + 6.50%), 6.62%, 04/15/31 |

500 | 499,977 | ||||||

| Elmwood CLO I Ltd. |

||||||||

| Series 2019-1A, Class DR, (3 mo. LIBOR US + 4.40%), 4.53%, 10/20/33 |

5,750 | 5,850,689 | ||||||

| Series 2019-1A, Class ER, (3 mo. LIBOR US + 7.71%), 7.84%, 10/20/33 |

2,375 | 2,403,629 | ||||||

| Elmwood CLO II Ltd. |

||||||||

| Series 2019-2A, Class ER, (3 mo. LIBOR US + 6.80%), 6.93%, 04/20/34 |

2,500 | 2,510,751 | ||||||

| Series 2019-2A, Class SUB, 0.00%, 04/20/34 |

1,000 | 843,091 | ||||||

| Elmwood CLO V Ltd., Series 2020-2A, Class ER, (3 mo. LIBOR US + 6.10%), 6.23%, 10/20/34 |

250 | 242,582 | ||||||

| C O N S O L I D A T E D S C H E D U L E O F I N V E S T M E N T S |

11 |

| Consolidated Schedule of Investments (continued) December 31, 2021 |

BlackRock Capital Allocation Trust (BCAT) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Cayman Islands (continued) | ||||||||

| Elmwood CLO VIII Ltd., Series 2021-1A, Class E1, (3 mo. LIBOR US + 6.00%), 6.13%, 01/20/34 |

USD | 500 | $ | 480,835 | ||||

| Elmwood CLO X Ltd., Series 2021-3A, Class E, (3 mo. LIBOR US + 5.85%), 5.94%, 10/20/34 |

1,000 | 999,979 | ||||||

| Flatiron CLO 19 Ltd., Series 2019-1A, Class DR, (3 mo. LIBOR US + 3.00%), 3.16%, 11/16/34 |

700 | 700,036 | ||||||

| Goldentree Loan Management US CLO 6 Ltd., |

250 | 250,281 | ||||||

| Goldentree Loan Opportunities X Ltd., Series 2015-10A, Class DR, (3 mo. LIBOR US + 3.05%), 3.18%, 07/20/31. |

750 | 741,858 | ||||||

| GoldentTree Loan Management US CLO 1 Ltd., |

1,000 | 936,365 | ||||||

| Golub Capital Partners CLO 55B Ltd., |

500 | 495,091 | ||||||

| Gulf Stream Meridian 1 Ltd., Series 2020-IA, Class E, (3 mo. LIBOR US + 6.45%), 6.57%, 04/15/33 |

2,125 | 2,119,941 | ||||||

| Kayne CLO 9 Ltd., Series 2020-9A, Class E, (3 mo. LIBOR US + 7.59%), 7.71%, 01/15/34 |

5,000 | 5,035,667 | ||||||

| Kayne CLO III Ltd., Series 2019-3A, Class DR, (3 mo. LIBOR US + 2.75%), 2.87%, 04/15/32 |

250 | 249,998 | ||||||

| Madison Park Funding XLIX Ltd., Series 2021-49A, Class E, (3 mo. LIBOR US + 6.25%), 6.37%, 10/19/34 |

250 | 247,524 | ||||||

| Neuberger Berman CLO XXIII Ltd., Series 2016-23A, Class ER, (3 mo. LIBOR US + 5.75%), 5.87%, 10/17/27. |

650 | 649,082 | ||||||

| Neuberger Berman Loan Advisers CLO 34 Ltd., Series 2019-34A, Class E, (3 mo. LIBOR US + 7.80%), 7.93%, 01/20/33 |

500 | 503,687 | ||||||

| Niagara Park Clo Ltd., Series 2019-1A, Class ER, (3 mo. LIBOR US + 5.95%), 6.07%, 07/17/32 |

1,000 | 995,258 | ||||||

| Northwoods Capital 20 Ltd., Series 2019-20A, Class ER, (3 mo. LIBOR US + 7.85%), 7.97%, 01/25/32 |

1,250 | 1,251,274 | ||||||

| OCP CLO Ltd. |

||||||||

| Series 2015-9A, Class E, (3 mo. LIBOR US + 6.40%), 6.52%, 07/15/27 |

250 | 250,257 | ||||||

| Series 2019-16A, Class ER, (3 mo. LIBOR US + 6.35%), 6.47%, 04/10/33 |

750 | 744,662 | ||||||

| Series 2020-18A, Class DR, (3 mo. LIBOR US + 3.20%), 3.33%, 07/20/32 |

500 | 499,813 | ||||||

| Series 2020-20A, Class D1, (3 mo. LIBOR US + 3.95%), 4.07%, 10/09/33 |

3,500 | 3,524,381 | ||||||

| Series 2020-20A, Class E, (3 mo. LIBOR US + 7.66%), 7.78%, 10/09/33 |

2,250 | 2,267,731 | ||||||

| Series 2021-22A, Class E, (3 mo. LIBOR US + 6.60%), 6.72%, 12/02/34 |

350 | 346,502 | ||||||

| Octagon 54 Ltd., Series 2021-1A, Class D, (3 mo. LIBOR US + 3.05%), 3.18%, 07/15/34 |

250 | 250,099 | ||||||

| OSD CLO Ltd., Series 2021-23A, Class E, (3 mo. LIBOR US + 6.00%), 6.01%, 04/17/31 |

250 | 250,000 | ||||||

| Palmer Square CLO Ltd. |

||||||||

| Series 2018-2A, Class D, (3 mo. LIBOR US + 5.60%), 5.72%, 07/16/31 |

250 | 243,773 | ||||||

| Series 2021-2A, Class E, (3 mo. LIBOR US + 6.35%), 6.47%, 07/15/34 |

250 | 246,385 | ||||||

| Security | Par (000) |

Value | ||||||

| Cayman Islands (continued) | ||||||||

| Palmer Square Loan Funding Ltd. |

||||||||

| Series 2018-4A, Class D, (3 mo. LIBOR US + 4.25%), 4.41%, 11/15/26 |

USD 1,000 | $ | 1,000,893 | |||||

| Series 2019-2A, Class E, (3 mo. LIBOR US + 6.75%), 6.88%, 04/20/27 |

500 | 502,068 | ||||||

| Series 2019-3A, Class C, (3 mo. LIBOR US + 3.40%), 3.56%, 08/20/27 |

1,900 | 1,901,282 | ||||||

| Series 2019-3A, Class D, (3 mo. LIBOR US + 5.35%), 5.51%, 08/20/27 |

750 | 751,965 | ||||||

| Series 2019-4A, Class D, (3 mo. LIBOR US + 5.90%), 6.02%, 10/24/27 |

600 | 599,454 | ||||||

| Series 2020-1A, Class D, (3 mo. LIBOR US + 4.85%), 5.01%, 02/20/28 |

250 | 251,172 | ||||||

| Series 2020-4A, Class C, (3 mo. LIBOR US + 3.60%), 3.78%, 11/25/28 |

1,000 | 1,001,042 | ||||||

| Series 2021-1A, Class D, (3 mo. LIBOR US + 6.00%), 6.13%, 04/20/29 |

1,250 | 1,251,697 | ||||||

| Series 2021-3A, Class C, (3 mo. LIBOR US + 2.50%), 2.67%, 07/20/29 |

250 | 250,188 | ||||||

| Series 2021-3A, Class D, (3 mo. LIBOR US + 5.00%), 5.17%, 07/20/29 |

250 | 249,986 | ||||||

| Series 2021-4A, Class D, (3 mo. LIBOR US + 5.00%), 5.13%, 10/15/29 |

750 | 750,001 | ||||||

| Park Avenue Institutional Advisers CLO Ltd. |

||||||||

| Series 2021-1A, Class D, (3 mo. LIBOR US + 7.30%), 7.43%, 01/20/34 |

600 | 598,041 | ||||||

| Series 2021-2A, Class D, (3 mo. LIBOR US + 3.40%), 3.50%, 07/15/34 |

1,000 | 999,986 | ||||||

| Series 2021-2A, Class E, (3 mo. LIBOR US + 7.01%), 7.11%, 07/15/34 |

600 | 576,256 | ||||||

| Pikes Peak CLO 4, Series 2019-4A, Class DR, (3 mo. LIBOR US + 3.25%), 3.37%, 07/15/34 |

1,000 | 999,267 | ||||||

| Pikes Peak CLO 6, Series 2020-6A, Class ER2, (3 mo. LIBOR US + 6.43%), 6.59%, 05/18/34 |

500 | 497,545 | ||||||

| Post CLO Ltd. |

||||||||

| Series 2018-1A, Class D, (3 mo. LIBOR US + 2.95%), 3.07%, 04/16/31 |

500 | 500,009 | ||||||

| Series 2021-1A, Class E, (3 mo. LIBOR US + 6.45%), 6.58%, 10/15/34 |

750 | 749,773 | ||||||

| Regatta XVII Funding Ltd. |

||||||||

| Series 2020-1A, Class D, (3 mo. LIBOR US + 4.15%), 4.27%, 10/15/33 |

750 | 759,782 | ||||||

| Series 2020-1A, Class E, (3 mo. LIBOR US + 7.61%), 7.73%, 10/15/33 |

250 | 252,655 | ||||||

| Regatta XX Funding Ltd., Series 2021-2A, Class D, (3 mo. LIBOR US + 3.10%), 3.18%, 10/15/34 |

1,500 | 1,499,854 | ||||||

| Regatta XXIV Funding Ltd., Series 2021-5A, Class E, (3 mo. LIBOR US + 6.80%), 6.89%, 01/20/35(c) |

500 | 500,000 | ||||||

| Romark CLO IV Ltd., Series 2021-4A, Class D, (3 mo. LIBOR US + 6.95%), 7.10%, 07/10/34 |

750 | 742,712 | ||||||

| RR 19 Ltd., Series 2021-19A, Class D, (3 mo. LIBOR US + 6.50%), 6.62%, 10/15/35 |

250 | 247,510 | ||||||

| Sixth Street CLO XIX Ltd., Series 2021-19A, Class E, (3 mo. LIBOR US + 5.90%), 6.04%, 07/20/34 |

3,750 | 3,749,644 | ||||||

| Sixth Street CLO XVI Ltd., Series 2020-16A, Class E, (3 mo. LIBOR US + 7.32%), 7.45%, 10/20/32 |

1,480 | 1,484,814 | ||||||

| Sound Point CLO Ltd., Series 2020-1A, (3 mo. LIBOR US + 3.35%), 3.48%, 07/20/34 |

250 | 250,196 | ||||||

| 12 | 2 0 2 1 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Consolidated Schedule of Investments (continued) December 31, 2021 |

BlackRock Capital Allocation Trust (BCAT) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Cayman Islands (continued) | ||||||||

| Stratus CLO Ltd. |

||||||||

| Series 2021-1A, Class E, (3 mo. LIBOR US + 5.00%), 5.22%, 12/29/29 |

USD | 1,500 | $ | 1,495,079 | ||||

| Series 2021-1A, Class SUB, 0.00%, 12/29/29 |

1,000 | 862,078 | ||||||

| Series 2021-2A, Class E, (3 mo. LIBOR US + 5.75%), 5.97%, 12/28/29(c) |

1,000 | 1,000,000 | ||||||

| Series 2021-3A, Class E, (3 mo. LIBOR US + 5.75%), 5.97%, 12/29/29 |

500 | 500,000 | ||||||

| Symphony CLO Ltd., Series 2019-21A, (3 mo. LIBOR US + 3.30%), 3.42%, 07/15/32 |

500 | 500,246 | ||||||

| Symphony CLO XXIII Ltd., Series 2020-23A, Class ER, (3 mo. LIBOR US + 6.15%), 6.32%, 01/15/34 |

500 | 495,039 | ||||||

| TCW CLO Ltd. |

||||||||

| Series 2018-IIA, Class C, (3 mo. LIBOR US + 2.95%), 3.08%, 04/20/28 |

250 | 250,004 | ||||||

| Series 2019-2A, Class D1, (3 mo. LIBOR US + 3.95%), 4.08%, 10/20/32 |

1,400 | 1,402,941 | ||||||

| Series 2019-2A, Class D2A, (3 mo. LIBOR US + 4.89%), 5.02%, 10/20/32 |

750 | 750,685 | ||||||

| TICP CLO IX Ltd., Series 2017-9A, Class D, (3 mo. LIBOR US + 2.90%), 3.03%, 01/20/31 |

500 | 499,799 | ||||||

| TICP CLO VII Ltd., Series 2017-7A, Class ER, (3 mo. LIBOR US + 7.05%), 7.17%, 04/15/33 |

250 | 250,705 | ||||||

| TICP CLO XI Ltd. (3 mo. LIBOR US + 3.05%), 3.18%, 10/20/31 |

250 | 250,019 | ||||||

| Series 2018-11A, Class E, (3 mo. LIBOR US + 6.00%), 6.13%, 10/20/31 |

500 | 500,007 | ||||||

| TICP CLO XV Ltd. |

||||||||

| Series 2020-15A, Class D, (3 mo. LIBOR US + 3.15%), 3.28%, 04/20/33 |

250 | 250,532 | ||||||

| Series 2020-15A, Class E, (3 mo. LIBOR US + 6.15%), 6.28%, 04/20/33 |

500 | 488,659 | ||||||

| TRESTLES CLO Ltd., Series 2017-1A, Class CR, (3 mo. LIBOR US + 2.90%), 3.02%, 04/25/32 |

500 | 493,728 | ||||||

| Trimaran Cavu Ltd., Series 2019-1A, Class D, (3 mo. LIBOR US + 4.15%), 4.28%, 07/20/32 |

1,750 | 1,756,984 | ||||||

| Trinitas CLO XVI Ltd., Series 2021-16A, Class E, (3 mo. LIBOR US + 7.00%), 7.13%, 07/20/34 |

1,500 | 1,475,097 | ||||||

| Tryon Park CLO Ltd., Series 2013-1A, Class DR, (3 mo. LIBOR US + 5.95%), 6.07%, 04/15/29 |

250 | 250,832 | ||||||

| Venture 40 CLO Ltd., Series 2020-40A, Class D1, (3 mo. LIBOR US + 4.59%), 4.76%, 11/24/31 |

1,350 | 1,352,765 | ||||||

| Voya CLO Ltd., Series 2019-2A, Class E, (3 mo. LIBOR US + 6.60%), 6.73%, 07/20/32 |

250 | 248,696 | ||||||

| Whitebox Clo I Ltd. |

||||||||

| Series 2019-1A, Class CR, (3 mo. LIBOR US + 3.05%), 3.17%, 07/24/32 |

250 | 250,005 | ||||||

| Series 2019-1A, Class DR, (3 mo. LIBOR US + 6.40%), 6.52%, 07/24/32 |

1,300 | 1,287,406 | ||||||

| Series 2019-1A, Class SUB, 0.00%, 07/24/32 |

1,000 | 829,932 | ||||||

| Whitebox CLO II Ltd., Series 2020-2A, Class DR, (3 mo. LIBOR US + 3.35%), 3.47%, 10/24/34 |

2,750 | 2,750,196 | ||||||

| Security | Par (000) |

Value | ||||||

| Cayman Islands (continued) | ||||||||

| Whitebox CLO III Ltd. |

||||||||

| Series 2021-3A, Class D, (3 mo. LIBOR US + 3.35%), 3.47%, 10/15/34 |

USD | 500 | $ | 500,019 | ||||

| Series 2021-3A, Class E, (3 mo. LIBOR US + 6.85%), 6.97%, 10/15/34 |

250 | 247,497 | ||||||

|

|

|

|||||||

| 124,989,666 | ||||||||

| Europe(b) — 0.2% | ||||||||

| Ares European CLO VIII BV, Series 8X, Class DR, (3 mo. EURIBOR + 3.80%), 3.80%, 04/17/32(d) |

EUR | 1,905 | 2,166,515 | |||||

| Ares European CLO XII BV, Series 12X, Class E, (3 mo. EURIBOR + 6.10%), 6.10%, 04/20/32(d) |

675 | 764,735 | ||||||

| CIFC European Funding CLO III DAC, Series 3A, Class D, (3 mo. EURIBOR + 3.60%), 3.60%, 01/15/34(a) |

700 | 800,913 | ||||||

|

|

|

|||||||

| 3,732,163 | ||||||||

| Ireland(b) — 1.2% | ||||||||

| Anchorage Capital CLO Ltd., Series 4A, Class D, (3 mo. EURIBOR + 3.20%), 3.20%, 04/25/34(a) |

2,000 | 2,282,278 | ||||||

| Avoca CLO XXII DAC(a) |

||||||||

| Series 22A, Class D, (3 mo. EURIBOR + 2.90%), 2.90%, 04/15/35 |

1,500 | 1,704,449 | ||||||

| Series 22A, Class E, (3 mo. EURIBOR + 5.23%), 5.23%, 04/15/35 |

1,500 | 1,642,470 | ||||||

| Bain Capital Credit CLO Ltd., Series 2019-1X, Class C, (3 mo. EURIBOR + 2.40%), 2.40%, 04/15/32(d) |

1,000 | 1,138,874 | ||||||

| BlueMountain CLO Ltd.(a) |

||||||||

| Series 2021-1A, Class D, (3 mo. EURIBOR + 3.20%), 3.20%, 04/15/34 |

2,600 | 2,961,090 | ||||||

| Series 2021-1A, Class E, (3 mo. EURIBOR + 5.41%), 5.41%, 04/15/34 |

3,000 | 3,242,427 | ||||||

| CVC Cordatus Loan Fund XIX DAC, Series 19A, Class D, (3 mo. EURIBOR + 3.80%), 3.80%, 12/23/33(a) |

2,300 | 2,625,455 | ||||||

| CVC Cordatus Loan Fund XV DAC, Series 15X, Class E, (3 mo. EURIBOR + 5.78%), 5.78%, 08/26/32(d) |

675 | 758,633 | ||||||

| CVC Cordatus Loan Fund XVIII DAC, Series 18A, Class ER, (3 mo. EURIBOR + 6.06%), 6.06%, 07/29/34(a) |

1,750 | 1,972,451 | ||||||

| Dartry Park CLO DAC, Series 1A, Class CRR, (3 mo. EURIBOR + 3.35%), 3.35%, 01/28/34(a) |

1,000 | 1,136,920 | ||||||

| Goldentree Loan Management US CLO Ltd., |

||||||||

| Series 2X, Class E, (3 mo. EURIBOR + 5.25%), 5.25%, 01/20/32(d) |

1,000 | 1,068,939 | ||||||

| Henley CLO IV DAC, Series 4A, Class D, (3 mo. EURIBOR + 3.00%), 3.00%, 04/25/34(a)(c) |

1,000 | 1,138,511 | ||||||

| Invesco Euro CLO II DAC, (3 mo. EURIBOR + 3.80%), 3.80%, 01/15/34(a) |

3,150 | 3,587,709 | ||||||

| Marino Park CLO DAC, (3 mo. EURIBOR + 3.55%), 3.55%, 01/16/34(a)(c) |

1,500 | 1,715,605 | ||||||

| Prodigy Finance DAC(a) |

||||||||

| Series 2021-1A, Class C, (1 mo. LIBOR US + 3.75%), 3.85%, 07/25/51 |

USD | 340 | 341,249 | |||||

| Series 2021-1A, Class D, (1 mo. LIBOR US + 5.90%), 6.00%, 07/25/51 |

340 | 340,916 | ||||||

|

|

|

|||||||

| 27,657,976 | ||||||||

| C O N S O L I D A T E D S C H E D U L E O F I N V E S T M E N T S |

13 |

| Consolidated Schedule of Investments (continued) December 31, 2021 |

BlackRock Capital Allocation Trust (BCAT) (Percentages shown are based on Net Assets) |

| Security |

Par (000) |

Value |

||||||||||

| Netherlands(b) — 0.1% |

||||||||||||

| ALME Loan Funding BV, (3 mo. EURIBOR + 5.41%), 5.41%, 07/15/31(a) |

EUR | 2,250 | $ | 2,506,200 | ||||||||

| Ares European CLO VII DAC, Series 7X, Class DR, (3 mo. EURIBOR + 5.26%), 5.26%, 10/15/30(d) |

500 | 561,864 | ||||||||||

|

|

|

|||||||||||

| 3,068,064 | ||||||||||||

| United Kingdom — 0.0% | ||||||||||||

| Ares European CLO XII DAC, Series 12A, Class DR, (3 mo. EURIBOR + 3.00%), 3.00%, 04/20/32(a)(b)(c) |

875 | 984,532 | ||||||||||

|

|

|

|||||||||||

| United States — 4.0% | ||||||||||||

| 510 Loan Acquisition Trust, Series 2020-1, Class A, 5.11%, 09/25/60(a) |

USD | 5,278 | 5,364,204 | |||||||||

| Ajax Mortgage Loan Trust(a) |

||||||||||||

| Series 2020-C, Class A, 2.25%, 09/27/60 |

430 | 429,930 | ||||||||||

| Series 2020-C, Class B, 5.00%, 09/27/60 |

375 | 379,462 | ||||||||||

| Series 2020-C, Class C, 0.00%, 09/27/60 |

1,181 | 956,652 | ||||||||||

| Series 2020-D, Class B, 5.00%, 06/25/60 |

525 | 526,281 | ||||||||||

| Series 2020-D, Class C, 0.00%, 06/25/60 |

1,241 | 1,144,149 | ||||||||||

| Series 2021-E, Class B3, 4.30%, 12/25/60(b) |

955 | 464,257 | ||||||||||

| Series 2021-E, Class SA, 0.00%, 12/25/60(b) |

20 | 9,839 | ||||||||||

| Series 2021-E, Class XS, 0.00%, 12/25/60 |

15,679 | 464,153 | ||||||||||

| AMSR Trust, Series 2020-SFR5, Class G, 4.11%, 11/17/37(a) |

2,899 | 2,860,560 | ||||||||||

| Bilbao CLO II DAC, Series 2A, Class DR, (3 mo. EURIBOR + 5.97%), 5.97%, 08/20/35(a)(b) |

EUR | 2,000 | 2,241,895 | |||||||||

| Citigroup Mortgage Loan Trust(b) |

||||||||||||

| Series 2007-AHL2, Class A3B, (1 mo. LIBOR US + 0.20%), 0.30%, 05/25/37 |

USD | 5,003 | 4,163,946 | |||||||||

| Series 2007-AHL3, Class A3B, (1 mo. LIBOR US + 0.17%), 0.27%, 07/25/45 |

3,792 | 3,261,269 | ||||||||||

| College Ave Student Loans LLC, Series 2021-A, Class D, 4.12%, 07/25/51(a) |

310 | 310,480 | ||||||||||

| Credit Suisse ABS Repackaging Trust, |

5 | 3,700,320 | ||||||||||

| Home Partners of America Trust, |

2,499 | 2,453,795 | ||||||||||

| Lending Funding Trust(a) |

||||||||||||

| Series 2020-2A, Class C, 4.30%, 04/21/31 |

980 | 1,038,805 | ||||||||||

| Series 2020-2A, Class D, 6.77%, 04/21/31 |

2,830 | 3,084,300 | ||||||||||

| Lendmark Funding Trust, Series 2021-1A, Class D, 5.05%, 11/20/31(a) |

2,320 | 2,399,881 | ||||||||||

| Litigation Fee Residual Funding Trust, 4.00%, 10/30/27(c) |

4,488 | 4,403,850 | ||||||||||

| Mariner Finance Issuance Trust(a) |

||||||||||||

| 5.40%, 03/20/36 |

1,420 | 1,497,010 | ||||||||||

| Series 2021-BA, Class E, 4.68%, 11/20/36 |

540 | 539,118 | ||||||||||

| Navient Private Education Refi Loan Trust, Series 2021-DA, Class D, 4.00%, 04/15/60(a)(c) |

1,340 | 1,294,243 | ||||||||||

| Nelnet Student Loan Trust(a) |

||||||||||||

| Series 2021-A, Class D, 4.93%, 04/20/62 |

1,670 | 1,715,447 | ||||||||||

| Series 2021-BA, Class D, 4.75%, 04/20/62 |

340 | 339,784 | ||||||||||

| Series 2021-CA, Class D, 4.44%, 04/20/62 |

110 | 112,170 | ||||||||||

| Ocean Beach Spc, Series 2020-1I, Class A, 4.00%, 09/26/22 |

827 | 1,049,077 | ||||||||||

| OCP CLO Ltd., Series 2016-12A, Class CR, (3 mo. LIBOR US + 3.00%), 3.12%, 10/18/28(a)(b) |

1,550 | 1,551,194 | ||||||||||

| OneMain Financial Issuance Trust, Series 2019-1A, Class E, 5.69%, 02/14/31(a) |

850 | 854,832 | ||||||||||

| Security | Par (000) |

Value | ||||||||||

| United States (continued) |

||||||||||||

| Oportun Issuance Trust(a) |

||||||||||||

| Series 2021-B, Class D, 5.41%, 05/08/31 |

USD | 2,362 | $ | 2,362,700 | ||||||||

| Series 2021-C, Class D, 5.57%, 10/08/31 |

250 | 248,458 | ||||||||||

| Progress Residential Trust(a) |

4,555 | 4,583,419 | ||||||||||

| Series 2021-SFR1, Class G, 3.86%, 04/17/38 |

4,826 | 4,822,746 | ||||||||||

| Series 2021-SFR1, Class H, 5.00%, 04/17/38 |

750 | 758,458 | ||||||||||

| Series 2021-SFR3, Class G, 4.25%, 05/17/26 |

3,190 | 3,153,299 | ||||||||||

| Series 2021-SFR3, Class H, 4.75%, 05/17/26 |

1,140 | 1,116,140 | ||||||||||

| Regional Management Issuance, 3.88%, 10/17/33(c) |

4,780 | 4,744,150 | ||||||||||

| Regional Management Issuance Trust, Series 2020-1, Class D, 6.77%, 10/15/30(a) |

2,050 | 2,081,586 | ||||||||||

| Republic Finance Issuance Trust(a) |

||||||||||||

| Series 2020-A, Class D, 7.00%, 11/20/30 |

5,110 | 5,350,350 | ||||||||||

| Series 2021-A, Class D, 5.23%, 12/22/31 |

800 | 798,222 | ||||||||||

| SMB Private Education Loan Trust(a) |

||||||||||||

| Series 2021-A, Class D1, 3.86%, 01/15/53 |

3,500 | 3,446,466 | ||||||||||

| Series 2021-A, Class D2, 3.86%, 01/15/53 |

1,910 | 1,886,465 | ||||||||||

| Series 2021-C, Class D, 3.93%, 01/15/53(c) |

780 | 774,974 | ||||||||||

| SoFi Professional Loan Program LLC(a) |

||||||||||||

| Series 2015-D, Class RC, 0.00%, 10/26/37(c) |

|

— |

(e) |

1,927,493 | ||||||||

| Series 2017-A, Class R, 0.00%, 03/26/40(c) |

105 | 1,591,319 | ||||||||||

| Series 2018-A, Class R1, 0.00%, 02/25/42 |

115 | 3,184,165 | ||||||||||

| Structured Asset Securities Corp Mortgage Loan Trust, (1 mo. LIBOR US + 1.80%), 1.90%, 05/25/35(b) |

182 | 183,400 | ||||||||||

| Tricon Residential Trust(a) |

||||||||||||

| Series 2021-SFR1, Class F, 3.69%, 07/17/38 |

1,375 | 1,352,491 | ||||||||||

| Series 2021-SFR1, Class G, 4.13%, 07/17/38 |

887 | 870,611 | ||||||||||

|

|

|

|||||||||||

| 93,847,815 | ||||||||||||

|

|

|

|||||||||||

| Total Asset-Backed Securities — 10.9% | ||||||||||||

| (Cost: $258,918,912) |

255,337,911 | |||||||||||

|

|

|

|||||||||||

| Shares | ||||||||

| Common Stocks |

||||||||

| Argentina — 0.4% | ||||||||

| MercadoLibre, Inc.(f) |

7,001 | 9,440,148 | ||||||

|

|

|

|||||||

| Australia — 0.1% | ||||||||

| Glencore PLC |

650,961 | 3,316,827 | ||||||

|

|

|

|||||||

| Brazil — 0.1% | ||||||||

| NU Holdings Ltd.(f) |

141,621 | 1,328,405 | ||||||

|

|

|

|||||||

| Canada — 1.1% | ||||||||

| Cenovus Energy Inc. |

476,172 | 5,840,076 | ||||||

| Enbridge, Inc. |

466,756 | 18,231,878 | ||||||

| Shopify, Inc., Class A(f) |

1,907 | 2,626,683 | ||||||

|

|

|

|||||||

| 26,698,637 | ||||||||

| Cayman Islands(f) — 0.5% | ||||||||

| Diversey Holdings Ltd. |

526,297 | 7,005,013 | ||||||

| Hedosophia European Growth |

187,590 | 1,629,553 | ||||||

| Highland Transcend Partners I Corp. |

114,071 | 1,176,072 | ||||||

| Salt Pay Co., Ltd., (Acquired 11/16/21, Cost: $2,398,802)(c)(g) |

1,235 | 2,398,802 | ||||||

|

|

|

|||||||

| 12,209,440 | ||||||||

| China — 0.8% | ||||||||

| Alibaba Group Holding Ltd., ADR(f) |

41,841 | 4,970,292 | ||||||

| 14 | 2 0 2 1 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Consolidated Schedule of Investments (continued) December 31, 2021 |

BlackRock Capital Allocation Trust (BCAT) (Percentages shown are based on Net Assets) |

| Security | Shares | Value | ||||||

| China (continued) | ||||||||

| JD Health International, Inc.(a)(f) |

413,500 | $ | 3,261,868 | |||||

| Kindstar Globalgene Technology, Inc., (Acquired 07/08/21, Cost: $1,705,424)(g) |

1,341,000 | 985,429 | ||||||

| Kindstar Globalgene Technology, Inc.(a)(f) |

707,000 | 519,715 | ||||||

| Li Auto, Inc., ADR(f) |

73,466 | 2,358,259 | ||||||

| Tencent Holdings Ltd. |

125,400 | 7,317,228 | ||||||

|

|

|

|||||||

| 19,412,791 | ||||||||

| Finland — 0.2% | ||||||||

| Neste OYJ |

68,593 | 3,375,857 | ||||||

|

|

|

|||||||

| France — 2.0% | ||||||||

| Alstom SA |

146,920 | 5,217,194 | ||||||

| Arkema SA |

59,095 | 8,340,940 | ||||||

| BNP Paribas SA |

32,607 | 2,254,481 | ||||||

| Cie de Saint-Gobain |

76,691 | 5,394,948 | ||||||

| Danone SA |

111,887 | 6,954,835 | ||||||

| LVMH Moet Hennessy Louis Vuitton SE |

11,844 | 9,788,280 | ||||||

| Safran SA |

68,978 | 8,444,505 | ||||||

| Societe Generale SA |

26,548 | 912,421 | ||||||

|

|

|

|||||||

| 47,307,604 | ||||||||

| Germany — 2.7% | ||||||||

| Allianz SE, Registered Shares |

19,998 | 4,716,700 | ||||||

| Auto1 Group SE(a)(f) |

216,524 | 4,785,518 | ||||||

| Daimler AG, Registered Shares |

206,103 | 15,747,123 | ||||||

| Daimler Truck Holding AG(f) |

70,713 | 2,599,562 | ||||||

| Deutsche Telekom AG, Registered Shares |

529,607 | 9,785,806 | ||||||

| Puma SE |

47,338 | 5,781,117 | ||||||

| Siemens AG, Registered Shares |

65,108 | 11,276,886 | ||||||

| Vantage Towers AG |

224,398 | 8,216,267 | ||||||

|

|

|

|||||||

| 62,908,979 | ||||||||

| Hong Kong — 0.3% | ||||||||

| AIA Group Ltd.(a) |

788,200 | 7,955,177 | ||||||

|

|

|

|||||||

| India — 0.3% | ||||||||

| Think & Learn Private Ltd., (Acquired 12/11/20, Cost: $5,113,105)(c)(g) |

2,279 | 7,165,688 | ||||||

|

|

|

|||||||

| Ireland — 0.3% | ||||||||

| Aptiv PLC(f) |

36,446 | 6,011,768 | ||||||

| Trane Technologies PLC |

7,112 | 1,436,837 | ||||||

|

|

|

|||||||

| 7,448,605 | ||||||||

| Israel(f) — 0.7% | ||||||||

| Nice Ltd., ADR |

35,864 | 10,888,310 | ||||||

| Playtika Holding Corp. |

328,616 | 5,681,771 | ||||||

| SimilarWeb Ltd. |

29,929 | 536,028 | ||||||

|

|

|

|||||||

| 17,106,109 | ||||||||

| Italy — 1.0% | ||||||||

| Ariston Holding NV(f) |

480,872 | 5,551,372 | ||||||

| Enel SpA |

808,374 | 6,463,822 | ||||||

| Intesa Sanpaolo SpA |

3,951,996 | 10,207,702 | ||||||

|

|

|

|||||||

| 22,222,896 | ||||||||

| Japan — 0.9% | ||||||||

| Daifuku Co. Ltd. |

3,500 | 286,212 | ||||||

| Disco Corp. |

1,500 | 458,479 | ||||||

| FANUC Corp. |

37,500 | 7,971,071 | ||||||

| Hoya Corp. |

54,967 | 8,156,648 | ||||||

| Keyence Corp. |

1,300 | 817,386 | ||||||

| Security | Shares | Value | ||||||

| Japan (continued) | ||||||||

| Kose Corp. |

10,600 | $ | 1,202,485 | |||||

| Recruit Holdings Co. Ltd. |

14,500 | 882,407 | ||||||

| Sony Group Corp. |

8,100 | 1,022,853 | ||||||

|

|

|

|||||||

| 20,797,541 | ||||||||

| Luxembourg — 0.1% | ||||||||

| Arrival SA(f) |

214,096 | 1,588,592 | ||||||

|

|

|

|||||||

| Netherlands — 2.1% | ||||||||

| Adyen NV(a)(f) |

3,966 | 10,410,748 | ||||||

| ASML Holding NV |

18,976 | 15,200,152 | ||||||

| ING Groep NV |

941,583 | 13,090,831 | ||||||

| NXP Semiconductors NV |

43,675 | 9,948,292 | ||||||

|

|

|

|||||||

| 48,650,023 | ||||||||

| Norway — 0.0% | ||||||||

| LINK Mobility Group Holding ASA(f) |

53,629 | 116,585 | ||||||

|

|

|

|||||||

| South Korea — 0.2% | ||||||||

| Amorepacific Corp. |

40,489 | 5,682,044 | ||||||

|

|

|

|||||||

| Spain — 0.4% | ||||||||

| Cellnex Telecom SA(a) |

169,475 | 9,817,280 | ||||||

|

|

|

|||||||

| Sweden — 0.7% | ||||||||

| Sandvik AB |

255,217 | 7,113,798 | ||||||

| Volvo AB, B Shares |

372,232 | 8,608,418 | ||||||

|

|

|

|||||||

| 15,722,216 | ||||||||

| Switzerland — 0.3% | ||||||||

| Cie Financiere Richemont SA, Class A, Registered Shares |

11,817 | 1,765,871 | ||||||

| On Holding AG, Class A(f) |

104,674 | 3,957,724 | ||||||

|

|

|

|||||||

| 5,723,595 | ||||||||

| Taiwan — 0.5% | ||||||||

| Taiwan Semiconductor Manufacturing Co. Ltd., ADR |

96,512 | 11,611,359 | ||||||

|

|

|

|||||||

| United Kingdom — 2.1% | ||||||||

| Alphawave IP Group PLC(f) |

471,648 | 1,275,522 | ||||||

| AstraZeneca PLC |

78,447 | 9,160,204 | ||||||

| Barclays PLC |

263,573 | 671,389 | ||||||

| BP PLC |

95,034 | 425,811 | ||||||

| BP PLC, ADR |

65,040 | 1,732,015 | ||||||

| Capri Holdings Ltd.(f) |

31,756 | 2,061,282 | ||||||

| Compass Group PLC(f) |

256,885 | 5,783,428 | ||||||

| Genius Sports Ltd.(f) |

264,757 | 2,012,153 | ||||||

| Lloyds Banking Group PLC |

22,504,456 | 14,614,198 | ||||||

| THG PLC(f) |

290,128 | 900,075 | ||||||

| Unilever PLC |

183,430 | 9,840,368 | ||||||

|

|

|

|||||||

| 48,476,445 | ||||||||

| United States — 38.6% | ||||||||

| Abbott Laboratories |

129,399 | 18,211,615 | ||||||

| AbbVie, Inc. |

136,709 | 18,510,399 | ||||||

| ACV Auctions, Inc., Class A(f) |

200,364 | 3,774,857 | ||||||

| Advance Auto Parts, Inc. |

9,467 | 2,270,944 | ||||||

| Air Products & Chemicals, Inc. |

37,411 | 11,382,671 | ||||||

| Airbnb, Inc., Class A(f) |

4,083 | 679,779 | ||||||

| Albemarle Corp. |

27,578 | 6,446,909 | ||||||

| Alcoa Corp. |

9,565 | 569,883 | ||||||

| Alkami Technology, Inc.(f) |

119,197 | 2,391,092 | ||||||

| Alnylam Pharmaceuticals, Inc.(f) |

7,195 | 1,220,128 | ||||||

| Alphabet, Inc., Class A(f) |

85 | 246,248 | ||||||

| C O N S O L I D A T E D S C H E D U L E O F I N V E S T M E N T S |

15 |

| Consolidated Schedule of Investments (continued) December 31, 2021 |

BlackRock Capital Allocation Trust (BCAT) (Percentages shown are based on Net Assets) |

| Security | Shares | Value | ||||||

| United States (continued) |

||||||||

| Alphabet, Inc., Class C(f) |

8,819 | $ | 25,518,570 | |||||

| AltC Acquisition Corp., Class A(f) |

135,303 | 1,332,735 | ||||||

| Altice USA, Inc., Class A(f) |

44,000 | 711,920 | ||||||

| Altus Power, (Acquired 12/09/21, Cost: |

121,750 | 1,181,917 | ||||||

| Amazon.com, Inc.(f)(h) |

8,396 | 27,995,119 | ||||||

| American Tower Corp. |

59,531 | 17,412,817 | ||||||

| ANSYS, Inc.(f) |

1,173 | 470,514 | ||||||

| Apple, Inc. |

95,914 | 17,031,449 | ||||||

| Applied Materials, Inc. |

57,943 | 9,117,910 | ||||||

| Astra Space, Inc., (Acquired 08/20/21, Cost: |

205,519 | 1,424,247 | ||||||

| Autodesk, Inc.(f) |

37,536 | 10,554,748 | ||||||

| AvidXchange Holdings, Inc.(f) |

40,310 | 607,069 | ||||||

| Bank of America Corp. |

315,190 | 14,022,803 | ||||||

| Bath & Body Works, Inc. |

22,456 | 1,567,204 | ||||||

| Berkshire Grey, Inc. |

49,000 | 269,500 | ||||||

| Best Buy Co., Inc. |

17,391 | 1,766,926 | ||||||

| Boston Scientific Corp.(f) |

405,531 | 17,226,957 | ||||||

| Bristol-Myers Squibb Co. |

163,671 | 10,204,887 | ||||||

| California Resources Corp. |

62,728 | 2,679,113 | ||||||

| Cano Health, Inc., (Acquired 09/02/21, Cost: |

277,311 | 2,470,841 | ||||||

| Capital One Financial Corp. |

74,285 | 10,778,011 | ||||||

| CareMax, Inc., (Acquired 07/22/21, Cost: |

60,750 | 466,560 | ||||||

| Carrier Global Corp. |

31,136 | 1,688,817 | ||||||

| CF Industries Holdings, Inc. |

14,980 | 1,060,284 | ||||||

| Charles Schwab Corp. |

147,532 | 12,407,441 | ||||||

| Charter Communications, Inc., Class A(f) |

8,502 | 5,543,049 | ||||||

| Climate Real Impact Solutions II Acquisition Corp.(f) |

47,791 | 466,440 | ||||||

| Comcast Corp., Class A |

197,306 | 9,930,411 | ||||||

| ConocoPhillips(h) |

136,453 | 9,849,178 | ||||||

| Costco Wholesale Corp. |

24,941 | 14,159,006 | ||||||

| Crowdstrike Holdings, Inc., Class A(f) |

3,000 | 614,250 | ||||||

| Crown PropTech Acquisitions(f) |

133,056 | 1,321,246 | ||||||

| Crown Proptech Acquisitions Pvt Ltd.(c) |

51,000 | 122,910 | ||||||

| D.R. Horton, Inc. |

52,400 | 5,682,780 | ||||||

| Danaher Corp. |

2,409 | 792,585 | ||||||

| Davidson Kempner Merchant Co-investment |

5,016,900 | 3,488,802 | ||||||

| Deere & Co. |

1,365 | 468,045 | ||||||

| Delta Air Lines, Inc.(f) |

14,022 | 547,980 | ||||||

| Devon Energy Corp. |

23,019 | 1,013,987 | ||||||

| DexCom, Inc.(f) |

4,251 | 2,282,574 | ||||||

| Dick’s Sporting Goods, Inc. |

6,617 | 760,889 | ||||||

| Doma Holdings, Inc., (Acquired 09/08/21, Cost: $2,461,540)(g) |

246,154 | 1,250,462 | ||||||

| DoubleVerify Holdings, Inc.(f) |

22,188 | 738,417 | ||||||

| Edwards Lifesciences Corp.(f) |

23,509 | 3,045,591 | ||||||

| Element Solutions, Inc. |

61,328 | 1,489,044 | ||||||

| Energy Transfer LP |

116,685 | 960,318 | ||||||

| Enterprise Products Partners LP |

314,982 | 6,917,005 | ||||||

| Epic Games, Inc., (Acquired 03/29/21,

Cost: |

2,824 | 2,729,227 | ||||||

| EQT Corp.(f) |

773,411 | 16,868,094 | ||||||

| Exscientia Ltd., (Acquired 10/01/21, Cost: |

200,700 | 3,867,788 | ||||||

| Exxon Mobil Corp. |

15,095 | 923,663 | ||||||

| Fanatics Holdings Inc., (Acquired 12/15/21, |

126,282 | 8,566,971 | ||||||

| Security | Shares | Value | ||||||

| United States (continued) |

||||||||

| FedEx Corp. |