| As filed with the U.S. Securities and Exchange Commission on July 22, 2024 Registration No. 333- |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ADURO CLEAN TECHNOLOGIES INC.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

|

British Columbia |

2800 |

Not applicable |

|

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

|

542 Newbold St.

London, Ontario N6E 2S5, Canada

Telephone (604) 362-7011

(Address, including zip code, and telephone number,

including area code, of Registrant's principal executive offices)

GKL Corporate/Search, Inc.

One Capitol Mall, Suite 660

Sacramento, California 95814

Telephone: (910) 442-7652

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy of Communications To:

|

Andrew Stewart Jun Ho Song Clark Wilson LLP |

Ross Carmel Matthew Siracusa Sichenzia Ross Ference Carmel LLP 1185 Avenue of the Americas, 31st Floor New York, NY 10036 Tel: (212) 930-9700 Fax: (212) 930 9725 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging Growth Company [X]

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided to Section 7(a)(2)(B) of the Securities Act.

[ ]

†The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| The information in this preliminary prospectus is not complete and may be changed. We may not sell the securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting any offer to buy. |

SUBJECT TO COMPLETION, DATED JULY 22, 2024

PRELIMINARY PROSPECTUS

♦ common shares

ADURO CLEAN TECHNOLOGIES INC.

___________________________________________________________

This is the initial public offering of common shares of Aduro Clean Technologies Inc. in the United States. We are offering an aggregate ♦ common shares in this offering. We currently estimate that the initial offering price will be between US$♦ and US$♦ per common share. The actual public offering price per common share will be determined between us and the underwriter at the time of pricing and may be at a discount to the current market price. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price.

Although this is our initial public offering of our common shares in the United States, our common shares are listed in Canada on the Canadian Securities Exchange under the symbol "ACT", quoted on the OTC Markets Group Inc.'s OTCQX under the symbol "ACTHF", and the Frankfurt Exchange in Germany under the symbol "9D50". The last reported sale price of the common shares on the Canadian Securities Exchange on ♦, 2024 was $♦. The last reported sale price of our common shares on the OTCQX on ♦, 2024 was US$♦.

We have applied to list our common shares on the NYSE American under the symbol "♦". At this time, the NYSE American has not yet approved our application to list our common shares. It is a condition to the closing of this offering that our common shares qualify for listing on a national securities exchange in the United States, and there is no guarantee or assurance that our common shares will be approved for listing on the NYSE American. If our common shares are approved for listing on the NYSE American, trading of our common shares will cease on the OTCQX.

Investing in the common shares is highly speculative and involves a high degree of risk, including the risk of losing your entire investment. See "Risk Factors" beginning on page 13 to read about factors you should consider before buying our common shares.

We are an "emerging growth company" as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements. Please read the disclosures beginning on page 7 of this prospectus for more information.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per common share | Total | |

| Public offering price | US$♦ | US$♦ |

| Underwriting discounts and commissions(1) | US$♦ | US$♦ |

| Proceeds to our company before expenses | US$♦ | US$♦ |

(1) We have agreed to pay EF Hutton LLC a fee equal to (i) 7% of the gross proceeds of the offering. We have also agreed to issue to the underwriter warrants to purchase 5% of the number of common shares sold in the offering and to reimburse the underwriter for certain expenses. For a description of the compensation to be received by the underwriter, see "Underwriting" beginning on page 89.

The underwriter may also purchase up to an additional ♦ common shares from us at the public offering price, less the underwriting discounts and commissions, within 45 days from the date of this prospectus.

The underwriter expects to deliver the common shares against payment on or about ♦, 2024.

|

Sole Book-Running Manager |

|

EF HUTTON LLC |

|

|

The date of this prospectus is [♦], 2024.

Table of Contents

About This Prospectus

You should rely only on the information that we have provided in this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus and any applicable prospectus supplement. You must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus and any applicable prospectus supplement is accurate only as of the date on the front of the document, regardless of the time of delivery of this prospectus, any applicable prospectus supplement, or any sale of a security.

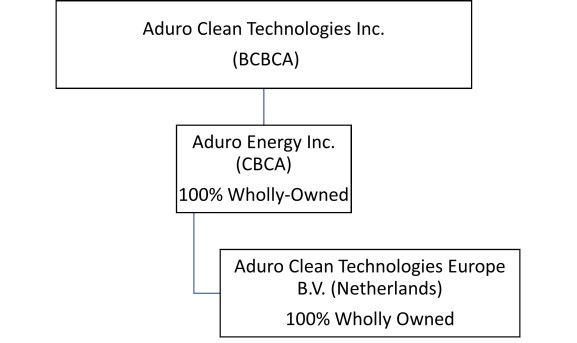

As used in this prospectus, the terms "we", "us" "our" and "Aduro" refer to Aduro Clean Technologies Inc., a British Columbia corporation, and its wholly-owned subsidiary, Aduro Energy Inc., a corporation incorporated under the Business Corporations Act (Canada), unless otherwise specified.

Presentation of Financial and Other Information

Our financial statements and other financial information are prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board, or "IFRS", in Canadian dollars. None of our consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles, and our financial statements may therefore not be comparable to financial statements of United States companies.

We intend to implement a consolidation, or a reverse stock split, of our issued and outstanding common shares to be effective at the ratio and date to be determined by our board of directors. Except where indicated, all share and per share data in this prospectus do not reflect such consolidation.

In this prospectus, the terms "US dollar" or "US$" refer to United States dollars and the terms "$", "dollar" or "C$" refers to Canadian dollars.

Exchange Rates

All dollar amounts in this prospectus are expressed in Canadian dollars unless otherwise indicated. Our accounts are maintained in Canadian dollars and our consolidated financial statements are prepared in accordance with IFRS as issued by the IASB.

The following tables set forth, the annual average exchange rates for the years ended May 31, 2023 and 2022, and the monthly average exchange rates for each month during the previous twelve months, as supplied by the Bank of Canada. These exchange rates are expressed as one Canadian dollar converted into United States dollars.

|

Year Ended |

Average |

|

May 31, 2023 |

0.7492 |

|

May 31, 2022 |

0.7935 |

|

Month Ended |

Average |

| June 30, 2024 | 0.7296 |

|

May 31, 2024 |

0.7333 |

|

April 30, 2024 |

0.7314 |

|

March 31, 2024 |

0.7386 |

|

February 29, 2024 |

0.7407 |

|

January 31, 2024 |

0.7449 |

|

December 31, 2023 |

0.7446 |

|

November 30, 2023 |

0.7294 |

|

October 31, 2023 |

0.7291 |

|

September 30, 2023 |

0.7388 |

|

August 31, 2023 |

0.7416 |

|

July 31, 2023 |

0.7568 |

Prospectus Summary

Our Business

We are an early-stage, Ontario-based clean technology company that has developed a highly flexible chemical recycling platform featuring three unique technologies: Hydrochemolytic™ Plastics Upcycling, Hydrochemolytic™ Bitumen Upgrading, and Hydrochemolytic™ Renewables Upgrading. As of today, through acquisition and development, we own eight US-based patents, seven granted and one pending.

Our future business model is based principally on licensing, royalties, and research and development. However, we are still investigating different business models that may be a better fit to our operations and bring greater value to our stakeholders. Monetization of our platform through a licensing model reduces our need for capital while enabling a pathway to commercialization that management of our company believes is relatively straightforward, timely, and capital efficient.

We are developing commercial partnerships by means of demonstration projects. Management believes this strategy has been demonstrated to be very effective for building a pipeline of customer interests and agreements. Deliverables include reports that detail: the technology; its performance; the key parameters and operational variables; economic considerations; operational considerations, and environmental considerations including greenhouse gases ("GHG") footprint and life cycle analysis. Among the intended business benefits are developing long-term customer and partner relationships, a better understanding of geographical territories, behaviors, and characteristics and the potential impact of the technology from environmental, social, and governance (ESG) criteria.

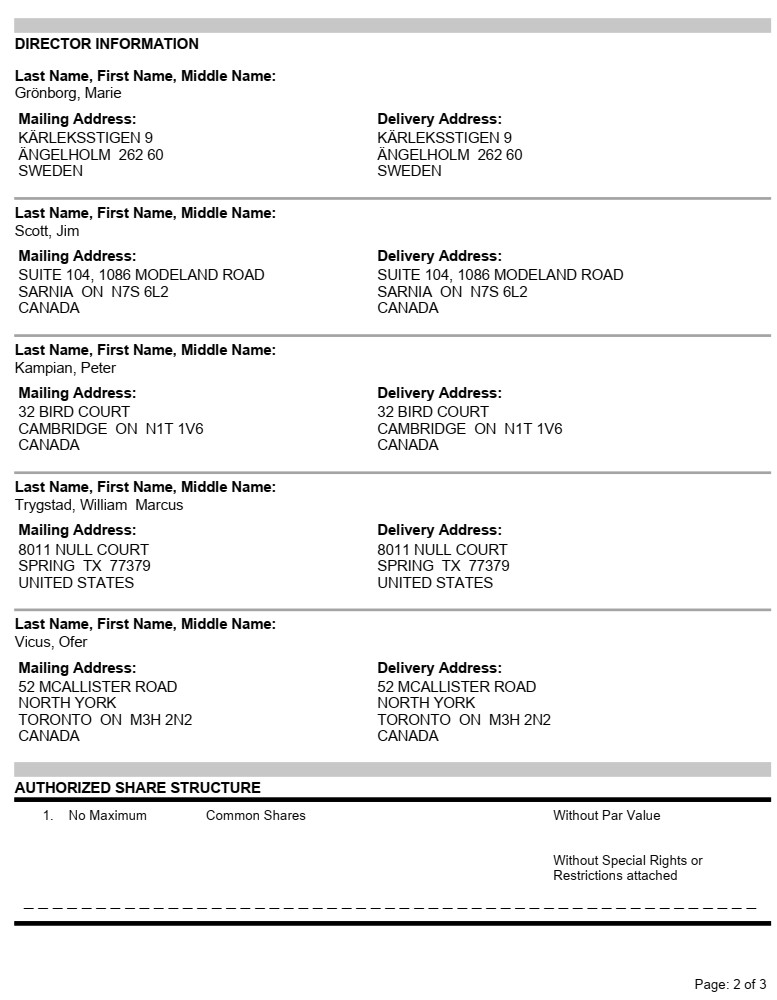

For our founders, Ofer Vicus, Chief Executive Officer (“CEO”), and W. Marcus Trygstad, Principal Scientist, the impetus for our formation was the vision to develop hydrothermal upgrading technology for upgrading heavy oils. But through scientific research and development efforts, our management found that hydrothermal upgrading technology also could be applied beneficially in the seemingly unrelated fields of plastic and rubber tire upcycling and renewable oil upgrading. Moreover, discoveries made while pursuing those new applications provided management with deeper insights into fundamental chemistry, including operating in connection with the original work on heavy oil. From this work, we developed our current and versatile intellectual property, including our Hydrochemolytic™ Technology platform, as well as developing eight patents (7 granted and one pending). With support from industry participants as early as 2015, our technology demonstration projects have provided validation of Hydrochemolytic™ Technology in key applications to support pre-commercial, pilot-scale demonstrations.

We currently direct our Hydrochemolytic™ Technology platform toward Hydrochemolytic™ Plastics Upcycling, Hydrochemolytic™ Bitumen Upgrading, and Hydrochemolytic™ Renewables Upgrading. Our technology transforms lower-value feedstocks into useful, higher- value chemical feedstocks and fuels. Although our technology can be implemented in stand-alone operations, management believes its greatest economic relevance and impact is achieved through integration into thermal operation infrastructure at existing plants. Accordingly, we will aim to create strategic partnerships to demonstrate and implement the technology through licensing arrangements.

We have developed our technology platform to address different applications and market sectors. We are currently in the stage of scaling up our technology to a commercial process for our plastic and bitumen applications. Our first significant scale-up step is the development of a semi commercial process which will be designed, built and tested on a pilot scale and subsequently scaled up further to demonstrate on a commercial scale. We have incurred recurring losses since inception and our technology platform has not yet been tested in a commercial setting. Commercializing our technology platform presents several challenges, including that the technology may not perform as expected under real-world conditions, rapid advancements in chemical recycling technology may result in new, more efficient technologies emerging, potentially rendering parts of our technology platform as less efficient, and securing funding may be difficult given the substantial investment required to scale up the technology platform on a commercial scale. We do not have a definitive timeline for scaling up our technology to a commercial process for our plastic and bitumen applications. In the meantime, we are continuing to engage with prospective customers through technology evaluation projects to guide ongoing development.

We face a number of challenges since our technology is different from existing approaches in our industry. In particular, we are a new and different concept from the existing approaches in our industry and our technology is not yet tested in a commercial setting. We also face many of the common challenges in upscaling of chemical processes, including challenges related to mass- and heat transfer, and equipment design. Some particular challenges include the handling of solid or semi-solid feedstock (plastic waste, bitumen), and the high degree of contamination (especially in waste plastic). In addition, our industry has a significant amount of unsettled regulation and many different approaches and strategies.

To deal with these various challenges, we have adopted an early stage approach to connecting with our prospective customers and potential partners on our path towards the commercial development of our technology. The primary objective of these connections, which we describe as customer engagements, is to provide us with guidance for the development of our technology and business. Apart from the invaluable guidance in our technological development, we regard the connections in our "Customer Engagement Program" as an endorsement of our efforts by reputable and established organizations.

While we have been successful with these engagements for the evaluation of our technology so far, and we are currently in discussions with a number of prospective customers and potential partners for possible collaboration, we currently do not have any definitive partnership agreements in place.

Corporate Information

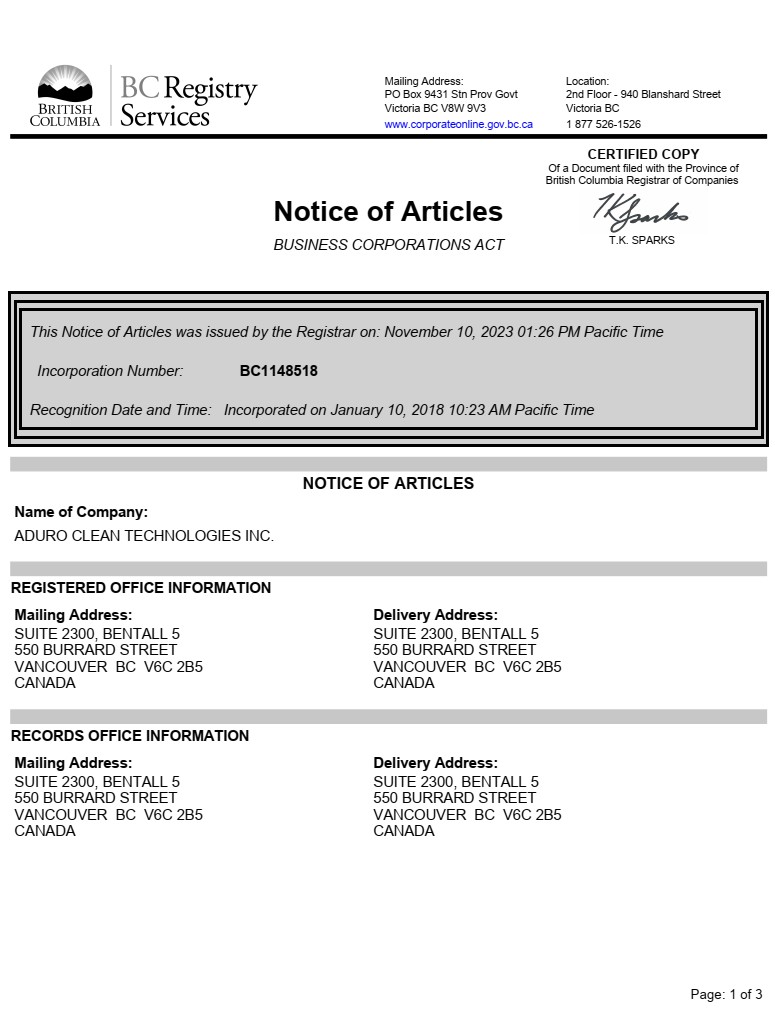

Our company was incorporated under the Business Corporations Act (British Columbia) in British Columbia, Canada under the name "Aduro Clean Technologies Inc."

Our principal place of business is located at 542 Newbold St., London, Ontario, N6E 2S5, Canada and our telephone number is 226-784-8889.

Our registered records office is located at Suite 2300, Bentall 5, 550 Burrard Street, Vancouver, British Columbia, Canada V6C 2B5 and its telephone number is 604-683-6498.

On April 23, 2021, we consolidated our issued and outstanding common shares on the basis of one (1) new common share for every three (3) old common shares (the "Consolidation") resulting in a reduction in our issued and outstanding capital to 30,073,489 common shares as of April 23, 2021. The common shares reserved under our equity and incentive plans were adjusted to reflect the Consolidation. All common share and per share data presented in this registration statement have been retroactively adjusted to reflect the Consolidation unless otherwise noted.

Risks Associated with Our Business

Our business is subject to a number of risks which you should be aware before making an investment decision. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under "Risk Factors" in deciding whether to invest in our shares. These risks include but are not limited to the following:

-

You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

-

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

-

We may need to raise additional funds to support our business operations or to finance future acquisitions, including through the issuance of equity or debt securities, which could have a material adverse effect on our ability to grow our business.

-

We will incur increased costs as a result of operating as a U.S. public reporting company and maintaining a dual listing on the NYSE American and the Canadian Securities Exchange (the "CSE"), and our management is required to devote substantial time to new compliance initiatives.

-

Our inability to comply with the NYSE American continued listing requirements could result in our common shares being delisted, which could affect the market price and liquidity of our common shares and reduce our ability to raise capital.

-

We have not reached profitability and currently have negative operating cash flows and we have a negative net tangible book value.

-

We operate in a capital-intensive industry and will require a significant amount of capital to continue operations.

-

We depend on certain key personnel who hold substantial knowledge and know-how related to our technology, and our success will depend on our continued ability to retain and attract such qualified personnel.

-

We may be involved in litigation or legal proceedings that are deemed to be material and may require recognition as a provision or a contingent liability on our financial statements.

-

It may be difficult for non-Canadian investors to obtain and enforce judgments against us because of our Canadian incorporation and presence.

-

We are an "emerging growth company," and we cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our common shares less attractive to investors.

-

As a foreign private issuer, we are not subject to certain United States securities law disclosure requirements that apply to a domestic United States issuer, which may limit the information that would be publicly available to our shareholders.

-

The market price of our common shares may be volatile and may fluctuate in a way that is disproportionate to our operating performance.

-

Volatility in our common share price may subject us to securities litigation.

-

A prolonged and substantial decline in the price of our common shares could affect our ability to raise further working capital, thereby adversely impacting our ability to continue operations.

-

The Financial Industry Regulatory Authority sales practice requirements may also limit a shareholder's ability to buy and sell our common shares.

-

Issues arising from supply chain disruptions and significantly delayed lead times to obtain components and projects.

Implications of Being an Emerging Growth Company

As a company with less than US$1.235 billion in revenue during our last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the "JOBS Act." An "emerging growth company" may take advantage of reduced reporting requirements that are otherwise applicable to larger public companies. In particular, as an emerging growth company, we:

-

may present only two years of audited financial statements and only two years of related Management's Discussion and Analysis of Financial Condition and Results of Operations;

-

are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as "compensation discussion and analysis";

-

are not required to obtain an attestation and report from our auditors on our management's assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

-

are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the "say-on-pay," "say-on frequency," and "say-on-golden-parachute" votes);

-

are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and chief executive officer pay ratio disclosure;

-

are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and

-

will not be required to conduct an evaluation of our internal control over financial reporting until our second annual report on Form 20-F following the effectiveness of our initial public offering.

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions until we no longer meet the definition of an emerging growth company. The JOBS Act provides that we would cease to be an "emerging growth company" at the end of the fiscal year in which the fifth anniversary of our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended, occurred, if we have more than US$1.235 billion in annual revenue, have more than US$700 million in market value of our common shares held by non-affiliates, or issue more than US$1 billion in principal amount of non-convertible debt over a three-year period.

Foreign Private Issuer Status

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

-

we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company;

-

for interim reporting, we are permitted to comply solely with our home country requirements, which may be less rigorous than the rules that apply to domestic public companies in certain aspects;

-

we are not required to provide the same level of disclosure on certain issues, such as executive compensation;

-

we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information;

-

we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; and

-

we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any "short-swing" trading transaction.

-

we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any "short-swing" trading transaction.

We will be required to file an annual report on Form 20-F within four months of the end of each fiscal year. Press releases relating to financial results and material events will also be furnished to the U.S. Securities and Exchange Commission ("SEC") on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information that would be made available to you were you investing in a U.S. domestic issuer.

The Offering

|

Securities offered by us |

♦ common shares (plus an additional ♦ common shares if the underwriters exercise their option to purchase additional common shares, in full). |

|

Underwriter's option |

We have granted the underwriter an option, exercisable for 45 days from the closing of the offering, to purchase up to an aggregate of 15% additional common shares at the initial public offering price, less underwriting discounts |

|

Price per common share |

We currently estimate that the initial public offering price will be in the range of US$♦ to US$♦ per common share. |

|

Common shares outstanding prior to completion of this offering |

♦ common shares. |

|

Common shares outstanding immediately after this offering |

♦ common shares, or ♦ common shares if the underwriters exercise their option to purchase additional common shares, in full. |

|

Symbol and Listing |

We have applied for listing of our common shares on the NYSE American under the symbol "♦". No assurance can be given that our application will be approved. Our common shares are listed on the Canadian Securities Exchange under the symbol "ACT", the OTC Markets Group's OTCQX under the symbol "ACTHF" and the Börse Frankfurt under the symbol "9D50". If our common shares are approved for listing on the NYSE American, trading of our common shares will cease on the OTCQX. |

|

Transfer Agent |

Computershare Investor Services Inc. |

|

Use of proceeds

|

We intend to use the proceeds from this offering for ongoing research and development costs and expenditures related to the construction of our planned semi-commercial pilot, with the remainder, if any, for general corporate purposes and working capital. See "Use of Proceeds" on page 41 for more information. |

|

Lock-up

|

All of our executive officers, directors and holders of 5% or more of our outstanding common shares as of the effective date of the registration statement of which this prospectus forms a part have agreed to enter into customary "lock-up" agreements in favour of EF Hutton LLC, for a period of 182 days after the closing of this offering, subject to certain exempt securities which shall not be subject to lock-up agreements, that they shall not offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any shares of capital stock of our company or any securities convertible into or exercisable or exchangeable for shares of capital stock of our company. We have also agreed with EF Hutton LLC, subject to certain limited exceptions and for a period of 182 days after the closing date of this offering, not to i) offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any shares of capital stock of our company or any securities convertible into or exercisable or exchangeable for shares of capital stock of our company; (ii) file or caused to be filed any registration statement with the SEC relating to the offering of any shares of capital stock of our company or any securities convertible into or exercisable or exchangeable for shares of capital stock of our company; (iii) complete any offering of debt securities of our company, other than entering into a line of credit with a traditional bank, or (iv) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of capital stock of our company, whether any such transaction described in clause (i), (ii), (iii) or (iv) above is to be settled by delivery of shares of capital stock of our company or such other securities, in cash or otherwise. See "Underwriting" beginning on page 89 for more information. |

|

Representative's Warrants

|

The registration statement of which this prospectus is a part also registers for sale warrants (the "Representative's Warrants") to purchase ♦ common shares (5% of the common shares sold in this offering) to the Representative of the underwriters, as a portion of the underwriting compensation payable in connection with this offering and the common shares issuable upon exercise of the Representative's Warrants. The Representative's Warrants will be exercisable at any time, and from time to time, in whole or in part, during the four and a half year period commencing six (6) months following the effective date of the registration statement of which this prospectus is a part at an exercise price of 110% of the public offering price of the Class A ordinary shares. Please see "Underwriting - Representative's Warrants" for a description of these warrants. |

|

Risk Factors |

Investing in our common shares involves a high degree of risk. See "Risk Factors" in this prospectus for a discussion of factors you should carefully consider before investing in our common shares. |

(1) The number of common shares shown above to be outstanding after this offering is based on 74,304,381 common shares of our company outstanding as of the date of this prospectus.

Summary Financial Data

The following information represents selected financial information for our company for the years ended May 31, 2023 and 2022 from our audited financial statements, as well as for the three-month and nine-month periods ended February 29, 2024 and February 28, 2023 from our unaudited financial statements. The summarized financial information presented below is derived from and should be read in conjunction with our financial statements, including the notes to those financial statements which are included elsewhere in this prospectus along with the section entitled "Operating and Financial Review and Prospects".

|

Consolidated |

Three Month Period |

Three Month |

Nine Month Period |

Nine Month |

|

Revenue |

$103,628 |

$58,290 |

$235,266 |

$58,290 |

|

Expenses |

$2,131,011 |

$1,904,203 |

$5,907,918 |

$4,323,489 |

|

Loss before other items |

$(2,027,383 ) |

$(1,845,913) |

$(5,672,652) |

$(4,265,199) |

|

Loss and comprehensive loss |

$(2,027,383 ) |

$(1,845,913 ) |

$(5,675,164 ) |

$(4,265,199 ) |

|

Basic and diluted loss per share |

$(0.03) |

$(0.03) |

$(0.09) |

$(0.08) |

|

Consolidated Statements of |

Year Ended May 31, |

Year Ended May 31, |

|

Revenue |

$109,629 |

- |

|

Expenses |

$(5,863,317) |

$(4,835,238) |

|

Loss before other items |

$(5,863,317) |

$4,835,238) |

|

Loss and comprehensive loss |

$(5,863,317) |

$(5,080,551) |

|

Basic and diluted loss per share |

$(0.10) |

$(0.13) |

|

Consolidated Statements of |

As of |

As of |

As of |

|

Cash and cash equivalents |

$2,156,359 |

$4,046,634 |

$2,110,785 |

|

Working Capital |

$2,490,664 |

$4,386,363 |

$1,919,672 |

|

Total Assets |

$6,163,894 |

$7,580,826 |

$3,221,375 |

|

Total Liabilities |

$527,346 |

$613,025 |

$826,748 |

|

Accumulated Deficit |

$(21,134,379) |

$(15,459,215) |

$(9,595,898) |

|

Shareholder's Equity |

$5,636,548 |

$6,967,801 |

$2,394,627 |

Risk Factors

An investment in our common shares involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this prospectus in evaluating our company and our business before making an investment decision about our company. Our business, operating results and financial condition could be seriously harmed as a result of the occurrence of any of the following risks. You could lose all or part of your investment due to any of these risks.

Risks Related to This Offering

You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

You will incur immediate and substantial dilution as a result of this offering. After giving effect to the assumed sale by us of ♦ common shares at an assumed public offering price of US$♦ per common share, excluding the exercise of the underwriters' option to purchase additional common shares, and after deducting underwriting discounts, commissions and estimated offering expenses payable by us, investors in this offering can expect an immediate dilution of US$♦ per common share. In addition, you may experience further dilution if the underwriters exercise its option to purchase additional common shares. To the extent any warrants or options that we have issued, are exercised, or convertible debentures that we have issued, is converted, you will sustain future dilution. We may also acquire other assets or businesses by issuing equity, which may result in additional dilution to our stockholders.

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion as to the use of the net proceeds from any offering by us and could use them for purposes other than those contemplated at the time of this offering. Accordingly, you will be relying on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that the proceeds will be invested in a way that does not yield a favorable, or any, return for our company.

We may need to raise additional funds to support our business operations or to finance future acquisitions, including through the issuance of equity or debt securities, which could have a material adverse effect on our ability to grow our business.

If we do not generate sufficient cash from operations or do not otherwise have sufficient cash and cash equivalents to support our business operations or to finance future acquisitions, we may need to raise additional capital through the issuance of debt or equity securities. We may not be able to raise cash in future financing on terms acceptable to us, or at all.

Financings, if available, may be on terms that are dilutive to our shareholders, and the prices at which new investors would be willing to purchase our securities may be lower than the current price of our common shares. The holders of new securities may also receive rights, preferences or privileges that are senior to those of existing holders of our common shares. If new sources of financing are required but are insufficient or unavailable, we would be required to modify our plans to the extent of available funding, which could harm our ability to grow our business.

We will incur increased costs as a result of operating as a U.S. public reporting company and maintaining a dual listing on the NYSE American and the CSE, and our management is required to devote substantial time to new compliance initiatives.

As a U.S. public reporting company, we anticipate that we will incur, particularly after we are no longer an "emerging growth company," significant legal, accounting and other expenses that we did not incur as a company listed solely on the CSE. In addition, the Sarbanes-Oxley Act of 2002 and rules subsequently implemented by the SEC and exchange have imposed various requirements on U.S. public companies, including establishment and maintenance of effective disclosure and financial controls and corporate governance practices. We may have to hire additional accounting, finance, and other personnel to assist us with becoming a U.S. public reporting company, and our efforts to comply with U.S. public company reporting requirements, and our management and other personnel will need to devote a substantial amount of time towards maintaining compliance with these requirements. These requirements increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

We have no operating experience as a publicly traded company in the U.S.

We have no operating experience as a publicly traded company in the U.S. Although the individuals who now constitute our management team have experience managing a publicly-traded company, there is no assurance that the past experience of our management team will be sufficient to operate our company as a publicly traded company in the United States, including timely compliance with the disclosure requirements of the SEC. Following the completion of this offering, we will be required to develop and implement internal control systems and procedures in order to satisfy the periodic and current reporting requirements under applicable SEC regulations and comply with the exchange listing standards. These requirements will place significant strain on our management team, infrastructure and other resources. In addition, our management team may not be able to successfully or efficiently manage our company as a U.S. public reporting company that is subject to significant regulatory oversight and reporting obligations.

Our inability to comply with the continued exchange listing requirements could result in our common shares being delisted, which could affect the market price and liquidity of our common shares and reduce our ability to raise capital.

We have applied for listing of our common shares on the NYSE American under the symbol "♦." No assurance can be given that our application will be approved. However, if such listing is approved, upon completion of this offering, we will be required to meet certain qualitative and financial tests to maintain the listing of our common shares on the NYSE American. If we do not maintain compliance with continued exchange listing requirements within specified periods and subject to permitted extensions, our common shares may be recommended for delisting (subject to any appeal we would file). No assurance can be provided that we will comply with these continued listing requirements. If our common shares were delisted, it could be more difficult to buy or sell our common shares and to obtain accurate quotations, and the price of our common shares could suffer a material decline. Delisting would also impair our ability to raise capital.

Risks Related to Our Business

We have not reached profitability and currently have negative operating cash flows and a negative net tangible book value.

For the fiscal year ended May 31, 2023, we generated a loss of $(5,863,317), bringing our accumulated deficit to $(15,459,215). For the nine-month period ended February 29, 2024, we generated a loss of $(5,675,164), bringing our accumulated deficit to $(21,134,379).

We have minimal revenues and expect significant increases in costs and expenses as we invest in expanding our research and development, and operations. Even if we are successful in increasing revenues from sales of licensing our technologies, we may be unable to achieve positive cash flow or profitability for a number of reasons, including but not limited to, an inability to control research and development costs, increases in our general and administrative expenses, and a reduction in our licensing revenues price due to competitive or other factors. An inability to generate positive cash flow and profitability until we reach a sufficient level of sales with positive gross margins that cover operating expenses, or an inability to raise additional capital on reasonable terms, will adversely affect our viability as an operating business.

We operate in a capital-intensive industry and will require a significant amount of capital to continue operations.

If the revenue from our operations, if any, is not sufficient to cover our cash requirements, we will need to raise additional funds through the sale of equity or other securities, or the issuance of additional debt. Financing may not be available at terms that are acceptable to us, if at all.

Our ability to obtain the necessary financing for our business is subject to a number of factors, including general market conditions and investor acceptance of our business plan. These factors may make the timing, amount, terms and conditions of such financing unattractive or unavailable to us. If we are unable to raise sufficient funds, we will have to significantly reduce our spending, delay or cancel our planned activities, or substantially change our current operations and plans in order to reduce our cost structure. Our competitors, many of which have raised or who have access to significant capital, may be able to compete more effectively in our markets given their access to capital, if our access to capital does not improve or is further limited. We might not be able to obtain any funding, and we might not have sufficient resources to conduct our business as projected, both of which could mean that we would be forced to curtail or discontinue our operations.

We may need to defend ourselves against intellectual property infringement claims, which may be time-consuming and could cause us to incur substantial costs.

Others, including our competitors, may hold or obtain patents, copyrights, trademarks or other proprietary rights that could prevent, limit or interfere with our ability to develop, market and license our technologies, which could make it more difficult for us to operate our business. From time to time, the holders of such intellectual property rights may assert their rights and urge us to take licenses, and/or may bring suits alleging infringement or misappropriation of such rights. We may consider entering into licensing agreements with respect to such rights, although no assurance can be given that such licenses can be obtained on acceptable terms or that litigation will not occur, and such licenses could significantly increase our operating expenses. In addition, if we are determined to have infringed upon a third party's intellectual property rights, we may be required to cease developing, marketing and/or licensing our intellectual properties, to pay substantial damages and/or license royalties, to redevelop or redesign our technologies, and/or to establish and maintain alternative branding for our technologies. In the event that we were required to take one or more such actions, our business, prospects, operating results and financial condition could be materially adversely affected. In addition, any litigation or claims, whether or not valid, could result in substantial costs, negative publicity and diversion of resources and management attention.

Patent applications for pending and future patents which are necessary to our commercial operations may be rejected by the US Patent and Trademark Office and we may have to invest significant time and resources in prosecuting our patents, including negotiating rejections.

Patent applications for our pending and future patents which are necessary to our ongoing commercial operations may be rejected by the US Patent and Trademark Office and we may have to invest significant time and resources in prosecuting our patents, including negotiating application rejections. The patent examination process is inherently subjective. Different patent examiners may interpret prior art and patent claims differently. Their opinions on novelty, non-obviousness, and adequacy of disclosure can vary. This subjectivity increases the risk of rejection, as it depends on the examiner's perspective. To be patentable, an invention must be novel (not previously disclosed) and non-obvious (not an obvious variation of existing technology). If the patent office determines that the invention lacks novelty or is too obvious, it may reject the application. Companies invest substantial time and resources in preparing patent applications. A rejection means wasted effort, delays and increased expenditures in protecting valuable innovations.

We depend on certain key personnel who hold substantial knowledge and know-how related to our technology, and our success will depend on our continued ability to retain and attract such qualified personnel

Much of the knowledge and related know-how that are foundational to our unique Hydrochemolytic™ Technology chemistry, being a core aspect of our company's value, is held in the collective development history and experience of our technology and executive team, including our CEO and co-founder, Ofer Vicus, and our Principal Scientist and co-founder, Marcus Trygstad.

As a result of this, our future success depends substantially on the continued services of these and other executive officers and key development personnel. If one or more of our executive officers or key development personnel were unable to or unwilling to continue in their present positions, we might not be able to replace them easily or at all. In addition, if any of our executive officers or key employees joins a competitor or forms a competing company, we may lose the historical and experiential knowledge and know-how that these key professionals and team members have developed and possess.

Conflicts of interest may arise due to our directors and officers serving, or serving in the future, as directors and officers of other companies.

Certain directors and officers of our company also serve, or may serve in the future, as directors and/or officers of other companies, or have significant shareholdings in other technology companies, and consequently conflicts of interest may arise between their duties as officers and directors of our company and as officers and directors of such other companies. There can be no assurance such conflicts of interests will be resolved to the benefit of our company. However, any decision made by any of these directors and officers involving our company must be made in accordance with their duties and obligations to deal fairly and in good faith with a view to the best interests of our company and our shareholders. In addition, each of the directors is required to declare and refrain from voting on any matter in which these directors may have a conflict of interest in accordance with, and subject to such other procedures and remedies as applicable, under the Business Corporations Act (Canada) and other applicable laws.

We are subject to numerous environmental and health and safety laws and any breach of such laws may have a material adverse effect on our business and operating results.

We are subject to numerous environmental and health and safety laws, including statutes, regulations, bylaws and other legal requirements. These laws relate to the generation, use, handling, storage, transportation and disposal of regulated substances, including hazardous substances (such as batteries), dangerous goods and waste, emissions or discharges into soil, water and air, including noise and odors (which could result in remediation obligations), and occupational health and safety matters, including indoor air quality. These legal requirements vary by location and can arise under federal, provincial, state or municipal laws. Any breach of such laws, regulations or requirements would have a material adverse effect on our company and its operating results.

In particular, our current and planned operations are and will be subject to environmental, health and safety regulation and standards in the jurisdictions in which we and any of our facilities operate, including but not limited to the Canadian Environmental Protection Act and the Environmental Protection Act of Ontario. These regulations require us to obtain certain approvals and permits to operate our facilities as well as mandate, among other things, the maintenance of air, water, and soil quality standards. These regulations also establish limitations on emissions and discharges to water, air and land, the generation, handling, transportation, storage and disposal of solid and hazardous waste, and employee health and safety. The time required to obtain approvals and permits by such regulatory authorities is unpredictable. Any delay in obtaining the necessary approvals and permits, or failure to obtain such approvals and permits, may significantly delay or impact our business and could have a material adverse effect on our operating results. Failure to comply with applicable environmental, health and safety laws may result in significant fines or other enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and require us to take corrective measures including significant additional capital expenditures for installation of additional equipment. We may also be required to compensate those suffering environmental loss or damage by reason of our operations and may have civil or criminal fines or penalties imposed on it for violations of applicable environmental laws or regulations. Our management believes that environmental legislation is evolving in a manner that will impose strict standards and enforcement, increased fines and penalties for any non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Changes to environmental or employee health and safety laws or more vigorous enforcement thereof could require extensive changes our operations, give rise to material liabilities or result in additional costs or delays.

Security breaches and other disruptions to our information technology networks and systems could substantially interfere with our operations and could compromise the confidentiality of our proprietary information, notwithstanding the fact that no such breaches or disruptions have materially impacted us to date.

We rely upon information technology systems and networks, some of which are managed by third-parties, to process, transmit and store electronic information, and to manage or support a variety of business processes and activities, including supply chain management, manufacturing, invoicing and collection of payments from our customers. Additionally, we collect and store sensitive data, including intellectual property, proprietary business information, the proprietary business information of our suppliers, as well as personally identifiable information of our employees, in data centers and on information technology systems. The secure operation of these information technology systems, and the processing and maintenance of this information, is critical to our business operations and strategy. Despite security measures and business continuity plans, our information technology systems and networks may be vulnerable to damage, disruptions or shutdowns due to attacks by hackers or breaches due to errors or malfeasance by employees, contractors and others who have access to our networks and systems, or other disruptions during the process of upgrading or replacing computer software or hardware, hardware failures, software errors, third-party service provider outages, power outages, computer viruses, telecommunication or utility failures or natural disasters or other catastrophic events. The occurrence of any of these events could compromise our systems and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, liability or regulatory penalties under laws protecting the privacy of personal information, disrupt operations and reduce the competitive advantage we hope to derive from our investment in technology. Our insurance coverage may not be available or adequate to cover all the costs related to significant security attacks or disruptions resulting from such attacks.

Risks Related to Our Company

It may be difficult for non-Canadian investors to obtain and enforce judgments against us because of our Canadian incorporation and presence.

We are a corporation existing under the laws of British Columbia, Canada. Some of our directors and officers, and the experts named in this prospectus, are residents of Canada, and all or a substantial portion of their assets, and a substantial portion of our assets, are located outside the United States. Consequently, although we have appointed an agent for service of process in the United States, it may be difficult for holders of our common shares who reside in the United States to effect service within the United States upon our directors and officers and experts who are not residents of the United States. It may also be difficult for holders of our common shares who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon our civil liability and the civil liability of our directors, officers and experts under the United States federal securities laws. Investors should not assume that Canadian courts (i) would enforce judgments of United States courts obtained in actions against us or our directors, officers or experts predicated upon the civil liability provisions of the United States federal securities laws or the securities or "blue sky" laws of any state within the United States or (ii) would enforce, in original actions, liabilities against us or our directors, officers or experts predicated upon the United States federal securities laws or any such state securities or "blue sky" laws.

We are an "emerging growth company," and we cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our common shares less attractive to investors.

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act of 2012, or the "JOBS Act". For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

We will cease to be an emerging growth company upon the earliest of:

- the last day of the fiscal year during which we have total annual gross revenues of US$1,000,000,000 (as such amount is indexed for inflation every five years by the SEC or more);

- the last day of our fiscal year following the fifth anniversary of the completion of our first sale of common equity securities pursuant to an effective registration statement under the Securities Act of 1933;

- the date on which we have, during the previous three-year period, issued more than US$1,000,000,000 in non- convertible debt; or

- the date on which we are deemed to be a "large accelerated filer", as defined in Rule 12b-2 of the Securities Exchange Act of 1934.

We cannot predict if investors will find our common shares less attractive because we may rely on these exemptions. If some investors find our common shares less attractive as a result, there may be a less active trading market for our common shares and our share price may be more volatile.

Our company is an early-stage technology business that faces the risks of product and technology failure, unforeseen research and development delays, weak market acceptance, possible change in government regulatory and competition from new entrants.

Our strategy is to focus on developing our clean technology platform. Our technology platform is an early-stage technology platform developed to upgrade renewable oils as well as waste plastics, rubber, and bitumen into higher value products. We have invested and continue to invest a significant portion of our resources into this segment and will need to raise additional financing to pursue our business strategy. As with other comparable early-stage technology businesses, we face the risks of product and technology failure, unforeseen research and development delays, weak market acceptance, possible change in government regulatory and competition from new entrants. Realization of any of these risks could have a significant negative impact on our anticipated future cash flows and its growth strategy.

Our company's products and services are dependent upon advanced developments in our technologies which are susceptible to the impact of rapid technological change.

Our products and services are dependent upon advanced developments in its technologies which are susceptible to the impact of rapid technological change. There can be no assurance that our products and services will not be seriously affected by, or become obsolete as a result of, such technological changes. Further, some of our applications are currently under development and there can be no assurance that these development efforts will result in a viable product or service as conceived by our company or at all.

Given the highly competitive and rapidly evolving clean energy technology environment in which we operate in, where our products and services are subject to rapid technological change and evolving industry standards, it is important for us to constantly enhance our existing product offerings, as well as develop new product offerings to meet strategic opportunities as they evolve. Our ability to enhance our technologies, products, and services and to develop and introduce new innovative products and services to keep pace with technological developments and industry standards and the increasingly sophisticated needs of our clients and their customers will significantly affect its future success.

Our future success depends on the commercialization of our technology, including ability to design and produce new products and services, deliver enhancements to our existing products and services, accurately predict and anticipate evolving technology and respond to technological advances in our industry, and respond to our customers' shifting needs. While we anticipate that our research and development experience will allow us to explore additional business opportunities, there is no guarantee that those business opportunities will be realized. If we are unable to respond to technological changes, or if we fail to or are delayed in developing products and services in a timely and cost-effective manner, our products and services may become obsolete, which would negatively impact potential sales, profitability and the continued viability of the business.

Since developing new products and services in the clean energy sector is very expensive, we may encounter delays when developing new technology solutions and services, and the investment in technology development may involve a long payback cycle. Our future plans include significant investment in technology solutions, research and development and related product opportunities. The failure to properly manage the expanding offering of products and services as well as the failure to develop and successfully market new products and services at favourable margins could have an adverse effect on our business.

The reliability of our technology will be critical to our success.

Our reputation and ability to attract, retain and serve our customers is dependent upon the reliable performance of our technology, products and services. Our technology is new, and as such it has no history on which we can build or rely. We may experience interruptions, outages and other performance problems related to our technology, products or services. Such disruptions may be due to a variety of factors, including infrastructure changes, human or software errors, capacity constraints and inadequate design. A future rapid expansion of our business could increase the risk of such disruptions. In some instances, we may not be able to identify the cause or causes of these performance problems within an acceptable period of time. Any errors, defects or security vulnerabilities discovered in our offerings could result in loss of revenue or delay in revenue recognition, loss of customers and increased service and warranty cost, any of which could adversely affect our business, results of operations and financial condition.

We face competition within our industry that may pose significant risk to our market position, revenue potential, and overall business performance.

The clean technology industry is highly competitive, and we compete with a substantial number of companies that have greater financial, technical and marketing resources. As such, we are exposed to competition which could lead to loss of contracts or reduced margins and could have an adverse effect on our business. Our competitors may offer better solutions or value to our prospective customers or substantially increase the resources devoted to the development and marketing of products and services that compete with those of our company. There can be no assurance that we will be able to compete successfully against current or future competitors or that competitive pressures faced by us in the markets in which we operate will not have a material adverse effect on our business. If our competitors are successful in offering better pricing, service or products than our company, this could render our product and services offerings less desirable to merchant customers, resulting in the loss of merchant customers or a reduction in the price it could earn for its offerings.

We face vulnerability due to fluctuations in commodity prices, impacting profit margins and overall financial stability.

The potential profitability of our operations will be significantly affected by changes in the market price of various renewable fuels and other commodity prices. The level of interest rates, the rate of inflation, world supply of these minerals and stability of exchange rates can all cause significant fluctuations in renewable fuel and other commodity prices. Such external economic factors are in turn influenced by changes in international investment patterns and monetary systems and political developments. The price of diesel fuel has fluctuated widely in recent years, and future significant price declines could cause continued commercial production to be impracticable. Depending on the price of diesel fuels, potential cash flow from future operations may not be sufficient. Market fluctuations and the price of renewable fuels may render refining uneconomical. Short-term operating factors relating to the production of renewable fuels, such as the increased feedstock costs or drop in renewable fuel prices, could cause a proposed refining operation to be unprofitable in any particular period.

As a foreign private issuer, we are not subject to certain United States securities law disclosure requirements that apply to a domestic United States issuer, which may limit the information that would be publicly available to our shareholders.

As a foreign private issuer, we will be exempt from certain rules under the Securities Exchange Act of 1934 that impose disclosure requirements as well as procedural requirements for proxy solicitations under Section 14 of the Securities Exchange Act. In addition, our officers, directors and principal shareholders will be exempt from the reporting and "short-swing" profit recovery provisions of Section 16 of the Securities Exchange Act of 1934. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as a company that files as a U.S. domestic issuer whose securities are registered under the Securities Exchange Act of 1934, nor are we generally required to comply with the SEC's Regulation FD, which restricts the selective disclosure of material non-public information. For as long as we are a "foreign private issuer" we intend to file our annual financial statements on Form 20-F and furnish our quarterly updates on Form 6-K to the SEC. However, the information we file or furnish is not the same as the information that is required in annual and quarterly reports on Form 10-K or Form 10-Q for U.S. domestic issuers. Accordingly, there may be less information publicly available concerning us than there is for a company that files as a U.S. domestic issuer.

Risks Related to Our Common Shares

Because we can issue additional common shares or preferred shares, our shareholders may experience dilution in the future.

We are authorized to issue an unlimited number of common shares without par value and an unlimited number of preferred shares without par value. Our board of directors has the authority to cause us to issue additional common shares or preferred shares and to determine the special rights and restrictions of the shares of one or more series of our preferred shares, without consent of our shareholders. The issuance of any such securities may result in a reduction of the book value or market price of our common shares. Given the fact that we have not achieved profitability or generated positive cash flow historically, and we operate in a capital-intensive industry with significant working capital requirements, we may be required to issue additional common equity or securities that are dilutive to existing common shares in the future in order to continue its operations. Our efforts to fund our intended business plan may result in dilution to existing shareholders. Further, any such issuances could result in a change of control or a reduction in the market price for our common shares.

Volatility in our common share price may subject us to securities litigation.

The market for our common shares may have, when compared to seasoned issuers, significant price volatility, and we expect that our share price may continue to be more volatile than that of a seasoned issuer for the foreseeable future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management's attention and resources away from the day-to-day business operations.

A prolonged and substantial decline in the price of our common shares could affect our ability to raise further working capital, thereby adversely impacting our ability to continue operations.

A prolonged and substantial decline in the price of our common shares could result in a reduction in the liquidity of our common shares and a reduction in our ability to raise capital. Because we plan to acquire a significant portion of the funds we need in order to conduct our planned operations through the sale of equity securities, a decline in the price of our common shares could be detrimental to our liquidity and our operations because the decline may cause investors not to choose to invest in our shares. If we are unable to raise the funds we require for all our planned operations and to meet our existing and future financial obligations, we may be forced to reallocate funds from other planned uses and may suffer a significant negative effect on our business plan and operations, including our ability to develop new products and continue our current operations. As a result, our business may suffer, and we may go out of business.

Because we do not intend to pay any cash dividends on our common shares in the near future, our shareholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common shares in the near future. The declaration, payment and amount of any future dividends will be made at the discretion of our board of directors, and will depend upon, among other things, the results of operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and if dividends are paid, there is no assurance with respect to the amount of any such dividend. Unless we pay dividends, our shareholders will not be able to receive a return on their shares unless they sell them.

We may be classified as a "passive foreign investment company," which may have adverse U.S. federal income tax consequences for U.S. shareholders.

We will be a "passive foreign investment company," or "PFIC," if, in any particular taxable year, either (a) 75% or more of our gross income for such year consists of certain types of "passive" income or (b) 50% or more of the average quarterly value of our assets (as determined on the basis of fair market value) during such year produce or are held for the production of passive income (the "asset test"). In determining whether we are a PFIC, we are permitted to take into account the assets and income of our wholly owned subsidiaries because we own 100% of their stock. However, even if we take into account the assets and income of our subsidiaries, we may still be considered a PFIC for this year and possibly later years, depending on a number of factors, including the composition of our income and assets, how quickly we use our liquid assets, including the cash raised pursuant to this offering (if we determine not to, or are unable to, deploy significant amounts of cash for active purposes our risk of being a PFIC will substantially increase), the market price of our common shares, and fluctuations in that price. Because there are uncertainties in the application of the relevant rules and PFIC status is a factual determination made annually after the close of each taxable year, there can be no assurance that we will not be a PFIC for this year or any future taxable year. Please refer to the paragraph titled "Taxation - Certain United States Federal Income Tax Considerations".

If we are a PFIC in any taxable year, a U.S. holder may incur significantly increased United States income tax on gain recognized on the sale or other disposition of the common shares and on the receipt of distributions on the common shares to the extent such gain or distribution is treated as an "excess distribution" under the United States federal income tax rules. A U.S. holder may also be subject to burdensome reporting requirements. Further, if we are a PFIC for any year during which a U.S. holder holds our common shares, we generally will continue to be treated as a PFIC with respect to that U.S. Holder for all succeeding years during which such U.S. holder holds our common shares. Please refer to the paragraph titled "Taxation - Certain United States Federal Income Tax Considerations".

Forward-Looking Statements

This prospectus contains forward-looking statements. Forward-looking statements are projections in respect of future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "intend", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential", or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, including the risks in the section entitled "Risk Factors", uncertainties and other factors, which may cause our company's or our industry's actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. Except as required by applicable law, including the securities laws of the United States and Canada, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Information on Our Company

History and Development of Our Company

Our company was incorporated under the Business Corporations Act (British Columbia) on January 10, 2018 under the name "Dimension Five Technologies Inc." and it has been operating for six years. On April 23, 2021, we changed our name to "Aduro Clean Technologies Inc". Our principal place of business is located at 542 Newbold St., London, Ontario, N6E 2S5, Canada and our telephone number is 604-362-7011. The registered records office is located at Suite 2300, Bentall 5, 550 Burrard Street, Vancouver, British Columbia V6C 2B5, Canada and its telephone number is 604 683-6498.

Since our inception until June 30, 2020, our initial business was as a technology company focused on developing, marketing, and acquiring software in the investment and securities trading industries. In July 2018, while pursuing our previous business, we purchased a software application, including source code, website and other intellectual property rights, from Zimtu Capital Corp. in exchange for the issuance of 10,000,000 pre-Consolidation common shares valued at $0.03 per common share for a total value of $300,000. The application was developed to provide investors an advantage when following the stock market, including receiving stock alerts and special notifications for public companies. We also entered into a previous licensing agreement in respect of our former software application and an application development agreement to further develop and market our software. These agreements were subsequently all cancelled by June 2020 as we looked to pursue more viable opportunities.

We also pursued several other business opportunities between September 2019 until June 2020, including entering a share exchange agreement dated December 11, 2019 with Digital Cavalier Technology Services Inc., an artificial intelligence software developer. For various reasons, including due diligence matters and economic conditions, we did not proceed with this transaction and the agreement was terminated.

Acquisition of Aduro Energy Inc.

On July 13, 2020, we entered into a letter of intent with Aduro Energy Inc. ("Aduro Energy") pursuant to which we agreed to acquire all of the issued and outstanding shares of Aduro Energy. Pursuant to the letter of intent, we agreed to advance a bridge loan to Aduro Energy in the principal amount of $500,000 payable through a series of promissory notes.