As filed with the Securities and Exchange Commission on December 14, 2022

Registration No. 333-[●]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact Name of Registrant as Specified in Its Charter)

| (State

or Other Jurisdiction of Incorporation or Organization) |

(I.R.S.

Employer Identification No.) |

(

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Chief Executive Officer

(

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copy to:

Evan M. D’Amico

Gibson, Dunn & Crutcher LLP

1050 Connecticut Ave. NW

Washington, D.C. 20036

Tel: (202) 955-8500

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 under the Securities Exchange Act of 1934:

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling securityholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION — DATED DECEMBER 14, 2022

PRELIMINARY PROSPECTUS

Up to 24,616,551 Shares of Class A Common Stock

This prospectus relates to the resale from time to time by the selling securityholders named in this prospectus (the “Selling Securityholders”) of up to an aggregate of 24,616,551 shares of Class A Common Stock (as defined below), including (i) 19,800,000 shares of Class A Common Stock underlying those certain convertible debentures (the “YA Convertible Debentures”) issued and issuable pursuant to a Securities Purchase Agreement, dated November 30, 2022, entered into by and between Rubicon Technologies, Inc. (“Rubicon”) and YA II PN, Ltd. (the “Yorkville Investor”), (ii) 443,341 shares of Class A Common Stock (the “Cowen Deferred Fee Shares”) issued to Cowen Investments II LLC (“Cowen”) in satisfaction of outstanding amounts owed to Cowen and Company, LLC for financial advisory services provided in connection with the Business Combination (as defined below), comprised of (a) 440,529 shares of Class A Common Stock issued to Cowen on November 18, 2022 and (b) 2,812 shares of Class A Common Stock issued to Cowen on December 6, 2022 (the “Cowen Deferred Fee Arrangement”) and (iii) 4,373,210 shares of Class A Common Stock (the “Moelis Deferred Fee Shares”) issued to Moelis & Company Group LP (“Moelis”) on December 13, 2022 in satisfaction of outstanding amounts owed to Moelis & Company LLC for financial advisory services provided in connection with the Business Combination (the “Moelis Deferred Fee Arrangement”).

The shares of Class A Common Stock being offered for resale in this prospectus represent, as of the date of this prospectus, approximately 13.2% of our total outstanding shares of Common Stock (as defined below) (after giving effect to the conversion of the YA Convertible Debentures into all of the YA Conversion Shares (as defined below) registered for resale in this prospectus). The sale of some or all of the securities being offered in this prospectus, following the satisfaction of any applicable conditions, could have adverse effects on the market for our Class A Common Stock, including increasing volatility, limiting the availability of an active market and/or resulting in a significant decline in the public trading price. Despite any potential adverse effects, the Selling Securityholders may still experience a positive rate of return on the securities they purchased due to the differences in the purchase prices at which they purchased the securities described above. See the sections entitled “Summary—Information Related to Offered Securities” and “Risk Factors — Risks Related to Ownership of Our Securities.”

We will not receive any proceeds from the sale of shares of Class A Common Stock by the Selling Securityholders pursuant to this prospectus.

Each Selling Securityholder will pay any underwriting discounts and commissions and expenses incurred by the Selling Securityholder for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Securityholder in disposing of its securities; provided, however, that pursuant to the Deferred Fee Arrangements and the YA Registration Rights Agreement (each as defined below), we will bear the costs, fees and expenses incurred in effecting the registration of the securities covered by this prospectus, including all registration and filing fees, New York Stock Exchange (“NYSE”) listing fees and fees and expenses of our counsel and our independent registered public accounting firm, and certain fees incurred in connection with a Selling Securityholder’s exercise of certain block trade, piggyback and underwritten offering rights.

We are registering the securities for resale pursuant to the Selling Securityholders’ registration rights under certain agreements between us and the Selling Securityholders. Our registration of the securities covered by this prospectus does not mean that either we or the Selling Securityholders will offer or sell any of the shares of Class A Common Stock. The Selling Securityholders or their permitted transferees may offer, sell or distribute all or a portion of their shares of Class A Common Stock publicly or through private transactions at prevailing market prices or at negotiated prices. We provide more information about how the Selling Securityholders may sell the Class A Common Stock in the section entitled “Plan of Distribution.”

You should read this prospectus, any prospectus supplements and the documents filed as exhibits to the registration statement of which this prospectus forms a part carefully before you invest in our securities.

Our Class A Common Stock and our Public Warrants are listed on the NYSE, under the symbols “RBT” and “RBT WS,” respectively. On December 13, 2022, the closing price of our Class A Common Stock was $2.47 and the closing price of our Public Warrants was $0.0575.

We are an “emerging growth company” and a “smaller reporting company” under federal securities laws and are subject to reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 13 of this prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.

TABLE OF CONTENTS

| i |

INTRODUCTORY NOTE REGARDING THE BUSINESS COMBINATION AND CERTAIN OTHER TRANSACTIONS

On August 15, 2022 (the “Closing” and such date, the “Closing Date”), we consummated the business combination (the “Business Combination”) pursuant to that certain Agreement and Plan of Merger, dated December 15, 2021 (the “Merger Agreement”), by and among Founder SPAC, a Cayman Islands exempted company (together with its successors, including after the Domestication (as defined below), “Founder”), Ravenclaw Merger Sub LLC, a Delaware limited liability company and wholly owned subsidiary of Founder (“Merger Sub”), Ravenclaw Merger Sub Corporation 1, a Delaware corporation and wholly owned subsidiary of Founder (“Merger Sub Inc. 1”), Ravenclaw Merger Sub Corporation 2, a Delaware corporation and wholly owned subsidiary of Founder (“Merger Sub Inc. 2”), Ravenclaw Merger Sub Corporation 3, a Delaware corporation and wholly owned subsidiary of Founder (“Merger Sub Inc. 3” and, together with Merger Sub Inc. 1 and Merger Sub Inc. 2, each a “Blocker Merger Sub”), Boom Clover Business Limited, a British Virgin Islands corporation (“Blocker Company 1”), NZSF Frontier Investments Inc., a Delaware corporation (“Blocker Company 2”), PLC Blocker A LLC, a Delaware limited liability company (“Blocker Company 3” and, together with Blocker Company 1 and Blocker Company 2, each a “Blocker Company” and collectively, the “Blocker Companies”), and Rubicon Technologies, LLC, a Delaware limited liability company (“Holdings LLC”).

Pursuant to the Merger Agreement, among other things, (a) Founder deregistered as an exempted company under the Cayman Islands Companies Act (As Revised) and continued and domesticated as a Delaware corporation under Section 388 of the Delaware General Corporation Law (the “Domestication”), and in connection therewith, changed its name from Founder SPAC to Rubicon Technologies, Inc. (“Rubicon”), (b) Merger Sub merged with and into Holdings LLC (the “Merger”), with Holdings LLC surviving the Merger as a wholly owned subsidiary of Rubicon, and (c) in a series of sequential two-step mergers (i) each Blocker Merger Sub merged with and into its corresponding Blocker Company, with each Blocker Company surviving as a wholly owned subsidiary of Rubicon, following which (ii) each surviving Blocker Company merged with and into Rubicon, with Rubicon surviving the merger (collectively the “Blocker Mergers” and, together with the Merger, the “Mergers”). The transactions contemplated by the Merger Agreement, including the Mergers, are collectively referred to in this prospectus as the “Business Combination”.

As a result of and upon the effective time of the Domestication, (a) each then-issued and outstanding Class A ordinary share, par value $0.0001 per share, of Founder (“Founder Class A Shares”) automatically converted into one share of Class A common stock, par value $0.0001 per share, of Rubicon (“Class A Common Stock”), (b) each then-issued and outstanding Class B ordinary share, par value $0.0001 per share, of Founder (“Founder Class B Shares” and, together with Founder Class A Shares, “Founder Ordinary Shares”), converted into one share of Class A Common Stock, pursuant to the Sponsor Agreement, dated December 15, 2021, by and among Founder, Founder SPAC Sponsor LLC (“Sponsor”), Holdings LLC, and certain insiders of Founder (the “Sponsor Agreement”), (c) each then-issued and outstanding public warrant of Founder, each representing a right to acquire one Founder Class A Share for $11.50 (a “Founder Public Warrant”), converted automatically, on a one-for-one basis, into a public warrant of Rubicon (a “Public Warrant”) that represents a right to acquire one share of Class A Common Stock for $11.50 pursuant to Section 4.5 of the Warrant Agreement, dated October 14, 2021, by and between Founder and Continental Stock Transfer and Trust Company (as amended by the Warrant Agreement Amendment (as defined below), the “Warrant Agreement”), (d) each then-issued and outstanding private placement warrant of Founder, each representing a right to acquire one Founder Class A Share for $11.50 (a “Founder Private Placement Warrant”), converted automatically, on a one-for-one basis, into a private placement warrant of Rubicon (the “Private Warrant” and together with the Public Warrants, the “Warrants”) that represents a right to acquire one share of Class A Common Stock for $11.50 pursuant to Section 4.5 of the Warrant Agreement, and (e) each then-issued and outstanding unit of Founder, each representing a Founder Class A Share and one-half of a Founder Public Warrant (a “Founder Unit”), that had not been previously separated into the underlying Founder Class A Share and one-half of one Founder Public Warrant upon the request of the holder thereof, was separated and automatically converted into one share of Class A Common Stock and one-half of one Public Warrant. No fractional Public Warrants were issued upon separation of the Founder Units. In addition, the certificate of incorporation of Rubicon (the “Charter”) authorizes Class V common stock, par value $0.0001 per share (“Class V Common Stock” and together with the Class A Common Stock, “Common Stock”). Class A Common Stock is entitled to economic rights and one vote per share and Class V Common Stock is entitled to one vote per share with no economic rights. In connection with the consummation of the Business Combination, Continental Stock Transfer and Trust Company and Rubicon amended the Warrant Agreement, to among other things, reflect the change in name and the Domestication (the “Warrant Agreement Amendment”).

| ii |

Following the Merger, among other things, Rubicon was issued Class A Units in Holdings LLC (“Class A Units”) and all preferred units, common units, and incentive units of Holdings LLC (including such convertible instruments, the “Rubicon Interests”) outstanding as of immediately prior to the Merger were automatically recapitalized into Class A Units and Class B Units of Holdings LLC (“Class B Units”), as authorized by the Eighth Amended and Restated Limited Liability Company Agreement of Holdings LLC (“A&R LLCA”) that was adopted at the time of the Merger. Following the Blocker Mergers, (a) holders of Rubicon Interests immediately before the Closing, other than the Blocker Companies (the “Blocked Unitholders”), were issued Class B Units (the “Rubicon Continuing Unitholders”), (b) Rubicon Continuing Unitholders were issued a number of shares of Class V Common Stock equal to the number of Class B Units issued to the Rubicon Continuing Unitholders, (c) Blocked Unitholders were issued shares of Class A Common Stock (as a result of the Blocker Mergers), and (d) following the adoption of the equity incentive award plan of Rubicon adopted at the Closing (the “2022 Plan”) and the effectiveness of a registration statement on Form S-8 filed by Rubicon on October 19, 2022, holders of phantom units of Holdings LLC immediately prior to the Closing (“Rubicon Phantom Unitholders”) and those current and former directors, officers and employees of Holdings LLC entitled to certain cash bonuses (the “Rubicon Management Rollover Holders”) were awarded restricted stock units of Rubicon (“RSUs”) or deferred stock units (“DSUs”) (in each case depending on their employment status at the time of the award), and such RSUs and DSUs will vest into shares of Class A Common Stock on February 11, 2023, the date that is 180 days following the Closing. In addition to the securities issuable at the Closing and pursuant to the 2022 Plan, certain of the Rubicon Management Rollover Holders received one-time cash payments (the “Cash Transaction Bonuses”). In addition, pursuant to the Merger Agreement, (i) Blocked Unitholders immediately before the Closing received a right to receive a pro rata portion of 1,488,519 shares of Class A Common Stock (the “Earn-Out Class A Shares”) and (ii) Rubicon Continuing Unitholders immediately before the Closing received a right to receive a pro rata portion of 8,900,840 Class B Units (“Earn-Out Units”) and an equivalent number of shares of Class V Common Stock (“Earn-Out Class V Shares”, and together with Earn-Out Class A Shares and Earn-Out Units, “Earn-Out Interests”), in each case, depending upon the performance of Class A Common Stock during the five (5) year period after the Closing.

Concurrent with the execution of the Merger Agreement, Founder entered into certain Subscription Agreements, dated as of December 15, 2021, by and between Founder, on the one hand, and certain investors (“PIPE Investors”) on the other hand (collectively, the “Subscription Agreements”), pursuant to which, among other things, concurrent with the Closing, Rubicon issued and sold to the PIPE Investors an aggregate of 11,100,000 shares of Class A Common Stock, at a per share price of $10.00, for an aggregate purchase price of $111,000,000, on the terms and subject to the conditions set forth therein. On August 12, 2022, certain of the current PIPE Investors and new PIPE Investors entered into additional Subscription Agreements to purchase an aggregate of 1,000,000 shares of Class A Common Stock, at a per share price of $10.00, for an aggregate purchase price of $10,000,000 (together with the original Subscription Agreements, the “PIPE Financing” or “PIPE Investment”).

Concurrent with the execution of the Merger Agreement, the Sponsor and certain insiders of Founder (the “Insiders”) entered into the Sponsor Agreement with Founder and Holdings LLC, pursuant to which the Sponsor and the Insiders agreed, among other things, not to transfer any Class A Common Stock or Private Warrants (or any shares of Class A Common Stock issuable upon conversion or exercise thereof) until the earlier of (i) February 11, 2023 (180 days after the Closing Date) and (ii) the date after the Closing Date on which Rubicon completes a liquidation, merger, or similar transaction that results in all of Rubicon’s stockholders having the right to exchange their shares of Class A Common Stock for cash, securities or other property. In the event that Rubicon waives, releases, or terminates a Lock-Up Agreement (as defined below) with respect to any shares or holders, the Sponsor and the Insiders will be granted a similar waiver, release, or termination with respect to a pro rata portion of the securities held by them and subject to the foregoing restrictions.

Concurrent with the execution of the Merger Agreement, certain holders of Rubicon Interests entered into lock-up agreements with Founder and Holdings LLC (the “Lock-Up Agreements”). Pursuant to the Lock-Up Agreements, each holder agreed to certain transfer restrictions with respect to the securities such holder received as transaction consideration pursuant to the Merger Agreement, until the earlier of (i) February 11, 2023 (180 days after the Closing Date) and (ii) the date after the Closing on which Rubicon completes a liquidation, merger, or similar transaction that results in all of Rubicon’s stockholders having the right to exchange their equity holdings for cash, securities or other property. The holders of Rubicon Interests further agreed pursuant to the Lock-Up Agreements not to exchange Class B Units for Class A Common Stock during this restricted period. In the event that Rubicon waives, releases, or terminates the lock-up provision in any other Lock-Up Agreement, then the other holders subject to the Lock-Up Agreements will be granted a similar waiver, release or termination with respect to a pro rata portion of the securities held thereby and subject to the foregoing restrictions. Between entry into the Merger Agreement and Closing, additional holders of Rubicon Interests entered into Lock-Up Agreements on the same terms.

| iii |

Pursuant to that certain Rubicon Equity Investment Agreement entered into on May 25, 2022 (the “Rubicon Equity Investment Agreement”), by and among Holdings LLC and certain of its equityholders (the “New Equity Holders”) who are affiliated with Andres Chico (a member of our board of directors) and Jose Miguel Enrich (a beneficial owner of greater than 10% of the issued and outstanding Common Stock). Concurrent with the Closing and in satisfaction of the obligations thereunder, (a) Rubicon caused to be issued to the New Equity Holders 880,000 Class B Units pursuant to the Merger Agreement, (b) Rubicon issued 160,000 shares of Class A Common Stock to the New Equity Holders, and (c) Sponsor forfeited 160,000 Founder Class B Shares.

In connection with the extraordinary general meeting of Founder held on August 2, 2022 to approve the Business Combination and other related matters (the “Founder Special Meeting”), holders of 31,260,777 Founder Class A Shares (or approximately 98.8% of the issued and outstanding Founder Class A Shares on such date) exercised their right to redeem those shares for cash at a price of approximately $10.176 per share. On August 4, 2022, Founder, Holdings LLC and ACM ARRT F LLC, a Delaware limited liability company (“ACM Seller”, together with such other parties to which obligations of ACM Seller were novated, the “FPA Sellers”), entered into an agreement (the “Forward Purchase Agreement”) for an OTC Equity Prepaid Forward Transaction. The primary purpose of entering into the Forward Purchase Agreement was to help ensure that Founder’s initial listing application with the NYSE was approved, increasing the likelihood that the transaction would close. Pursuant to the Forward Purchase Agreement, prior to the consummation of the Business Combination, at an average purchase price of $10.15 per share, the FPA Sellers purchased an aggregate of 7,082,616 Founder Class A Shares from certain holders that elected to redeem Founder Class A Shares for cash and reversed such election (the “Redeeming Holders”), of which 666,667 shares were Share Consideration (as defined in the Forward Purchase Agreement). Pursuant to the Forward Purchase Agreement, each of the FPA Sellers waived its redemption rights under the governing documents of Founder in connection with the Closing. As a result of the Forward Purchase Agreement, at the Business Combination, holders of 24,178,161 Founder Class A Shares (or approximately 76.5% of the issued and outstanding Founder Class A Shares on such date) exercised their right to redeem those shares for cash at a price of approximately $10.176 per share, resulting in an aggregate redemption payment of approximately $246.0 million from Founder’s trust account. Following these redemptions, at the Closing we received approximately $75.8 million from Founder’s trust account, without accounting for the payment of transaction costs, payments under the Forward Purchase Agreement and Cash Transaction Bonuses. As a result of consummation of the Mergers and accounting for the foregoing redemption payments and receipt of funds from Founder’s trust account, we received approximately $73.8 million in net proceeds from the Business Combination after accounting for our payment of approximately $25.4 million of transaction costs, aggregate payments of $68.7 million by us to the FPA Sellers under the Forward Purchase Agreement, net proceeds of $121.0 million from the PIPE Investment, and the payment by us of an aggregate of $28.9 million in Cash Transaction Bonuses.

On August 15, 2022, prior to the Closing, Founder, Sponsor, and Holdings LLC entered into a forfeiture agreement (the “Sponsor Forfeiture Agreement”), whereby Sponsor forfeited 1,000,000 Founder Class B Shares immediately prior to the Closing.

At the Closing, Rubicon and Holdings LLC entered into a Tax Receivable Agreement (the “Tax Receivable Agreement” or “TRA”) with Rubicon Continuing Unitholders and Blocked Unitholders (the “TRA Holders”). Pursuant to the Tax Receivable Agreement, among other things, Rubicon is required to pay to the TRA Holders 85% of certain of Rubicon’s realized (or in certain cases deemed realized) tax savings as a result of certain tax benefits related to the transactions contemplated by the Merger Agreement and future exchanges of Class B Units for Class A Common Stock or cash.

At the Closing, Founder entered into an amended and restated registration rights agreement (the “A&R Registration Rights Agreement”) with the Sponsor, Holdings LLC, and certain holders of Rubicon Interests (the “Rubicon Legacy Holders” and together with the Sponsor and any persons who thereafter become party to the agreement, the “RRA Holders”). Pursuant to the A&R Registration Rights Agreement, within 30 days of the Closing Date, Rubicon was required to file a registration statement under the Securities Act of 1933, as amended (the “Securities Act”), registering for resale (i) all outstanding shares of Class A Common Stock held by the RRA Holders immediately following the Closing, (ii) all shares of Class A Common Stock issuable upon exercise, conversion or exchange of any option, warrant or convertible security held directly or indirectly by a RRA Holder immediately following the Closing, (iii) any Warrants or shares of Class A Common Stock that may be acquired by the RRA Holders upon the exercise of a Warrant or other right to acquire Class A Common Stock held by a RRA Holder immediately following the Closing, (iv) any shares of Class A Common Stock or Warrants otherwise acquired or owned by a RRA Holder following the date of the A&R Registration Rights Agreement to the extent that such securities are “restricted securities” (as defined in Rule 144 promulgated under the Securities Act (“Rule 144”)) or are otherwise held by an “affiliate” (as defined in Rule 144) of Rubicon, and (v) any other equity security of Rubicon or its subsidiaries issued or issuable with respect to any of the foregoing pursuant to a reorganization, stock split, stock dividend, or like transaction. Rubicon thereafter is required to maintain a registration statement that is continuously effective and to cause the registration statement to regain effectiveness in the event that it ceases to be effective. The RRA Holders have certain “demand” and “piggyback” registration rights under the agreement. Rubicon will bear the expenses incurred in connection with the filing of any registration statements pursuant to the A&R Registration Rights Agreement.

| iv |

On August 31, 2022, Rubicon entered into a Standby Equity Purchase Agreement (the “SEPA”) with the Yorkville Investor, pursuant to which (a) Rubicon issued the Yorkville Investor 200,000 shares of Class A Common Stock, which represented an initial up-front commitment fee (the “Yorkville Commitment Shares”), and (b) assuming satisfaction of certain conditions and subject to the limitations set forth in the SEPA, Rubicon has the right, from time to time to issue and sell to the Yorkville Investor up to $200.0 million in shares of Class A Common Stock until the earlier of September 1, 2025 (the first day of the month next following the 36-month anniversary of the SEPA) or the date on which the facility has been fully utilized, in each case, with such sales first subject to the Securities and Exchange Commission (the “SEC”) declaring effective a registration statement covering the resale of such shares of Class A Common Stock (such registration statement, the “SEPA Registration Statement”).

On November 30, 2022, Rubicon and the Yorkville Investor entered into a letter agreement to amend the SEPA (the “SEPA Amendment”). Pursuant to the SEPA Amendment, the parties agreed that Rubicon will not file the SEPA Registration Statement until there is an effective registration statement covering the resale of at least 18,000,000 YA Conversion Shares (as defined below). The registration statement of which this prospectus forms a part is being filed in respect of this obligation.

On November 30, 2022, Rubicon terminated the Forward Purchase Agreement with the FPA Sellers pursuant to termination agreements with each of ACM Seller and Vellar Opportunity Fund SPV LLC – Series 2 (“Vellar”), an FPA Seller that was assigned and novated a portion of the Forward Purchase Agreement pursuant to that certain Assignment and Novation Agreement, dated August 5, 2022, by and among Rubicon, Holdings LLC, Vellar and ACM Seller. Pursuant to the termination agreement with ACM Seller (the “Atalaya Termination Agreement”), Rubicon, among other things, made a one-time $6.0 million cash payment to ACM Seller and ACM Seller forfeited, for no additional consideration, 2,222,119 shares of Class A Common Stock and further agreed to certain lock-up and transfer restrictions with respect to the remaining 500,000 shares of Class A Common Stock that it holds pursuant to the Forward Purchase Agreement. Pursuant to the termination agreement with Vellar (the “Vellar Termination Agreement” and, together with the Atalaya Termination Agreement, the “FPA Termination Agreements”), Vellar retained 1,640,848 shares of Class A Common Stock (the “Previously Owned Shares”) it holds pursuant to the Forward Purchase Agreement (subject to certain lock-up and transfer restrictions) and Rubicon agreed to make a $2.0 million payment to Vellar which can be settled, at Rubicon’s sole option, in cash or shares of Class A Common Stock, subject to certain adjustments.

On November 30, 2022, we entered into a securities purchase agreement (the “YA SPA”) with the Yorkville Investor, whereby we agreed to issue and sell to the Yorkville Investor (i) YA Convertible Debentures in the aggregate principal amount of up to $17.0 million, which are convertible into shares of Class A Common Stock (as converted, the “YA Conversion Shares”), and (ii) a pre-funded common stock purchase warrant (the “YA Warrant”), which is exercisable into $20.0 million of shares of Class A Common Stock (the “YA Warrant Shares”), in each case, on the terms and subject to the conditions set forth therein. Upon signing the YA SPA, we (i) issued and sold to the Yorkville Investor (a) a YA Convertible Debenture in the principal amount of $7.0 million for a purchase price of $7.0 million (the “First YA Convertible Debenture”), and (b) the YA Warrant for a pre-funded purchase price of $6.0 million, and (ii) paid the Yorkville Investor a cash commitment fee equal to $2.04 million, with such amount being deducted from the proceeds of the First YA Convertible Debenture, netting Rubicon approximately $10.96 million in total proceeds. Pursuant to the YA SPA, the parties further agreed that we will issue and sell to the Yorkville Investor and the Yorkville Investor will purchase from us a second YA Convertible Debenture in the principal amount of $10.0 million for a purchase price of $10.0 million (the “Second YA Convertible Debenture”), upon the satisfaction of certain conditions. The YA Convertible Debentures have a maturity date of May 30, 2024 and accrue interest at the rate of 4% per annum (provided that the interest rate will increase to 15% per annum in the event of certain defaults). The YA Warrant and YA Convertible Debentures may be exercised or converted, as applicable, into shares of Class A Common Stock, in each case to be issued at a variable rate dependent on the future volume-weighted average price (“VWAP”) of the Class A Common Stock, and subject to certain other adjustments as set forth therein. Concurrent with the entry into the YA SPA, we entered into a registration rights agreement with the Yorkville Investor (the “YA Registration Rights Agreement”), whereby, we agreed to, among other things, register for resale all of the YA Conversion Shares and YA Warrant Shares.

The descriptions of the agreements set forth above are not complete and are subject to and qualified in their entirety by reference to the full text of the applicable agreements, copies of which are filed as exhibits to the registration statement of which this prospectus forms a part and are incorporated herein by reference. For additional information regarding the transactions and agreements discussed above, see the sections entitled “Unaudited Pro Forma Condensed Combined Financial Information,” “Certain Financing Transactions,” “Certain Relationships and Related Party Transactions,” “Description of Securities” and “Securities Eligible for Future Sale.”

| v |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC using a “shelf” registration process. Under this shelf registration process, we and the Selling Securityholders may, from time to time, issue, offer and sell, as applicable, any combination of the securities described in this prospectus in one or more offerings from time to time through any means described in the section entitled “Plan of Distribution” of this prospectus or any prospectus supplement. More specific terms of any securities that the Selling Securityholders offer and sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the Class A Common Stock being offered and the terms of the offering.

A prospectus supplement may also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus and any applicable prospectus supplement. See “Where You Can Find More Information.”

Neither we nor the Selling Securityholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus and any accompanying prospectus supplement. We and the Selling Securityholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus or any applicable prospectus supplement. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement is accurate only as of the date on the front of those documents, regardless of the time of delivery of this prospectus or any applicable prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

For investors outside the United States: neither we nor the Selling Securityholders have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus outside the United States.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

| vi |

MARKET, RANKING AND OTHER INDUSTRY DATA

Certain information contained in this document relates to or is based on studies, publications, surveys, and other data obtained from third-party sources and Rubicon’s own internal estimates and research. While we believe these third-party sources to be reliable as of the date of this prospectus, we have not independently verified the market and industry data contained in this prospectus or the underlying assumptions relied on therein. Finally, while we believe our own internal research is reliable, such research has not been verified by any independent source. These estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus.

TRADEMARKS

This prospectus contains references to trademarks, trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

| vii |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements about the anticipated benefits of the Business Combination and the financial condition, results of operations, earnings outlook, and prospects of Rubicon. Forward-looking statements appear in a number of places in this prospectus including, without limitation, in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. You should understand that the following important factors, in addition to those factors described elsewhere in this prospectus, could affect the future results of Rubicon and could cause those results or other outcomes to differ materially from those expressed or implied in such forward-looking statements, including Rubicon’s ability to:

| ● | access, collect and use personal data about consumers; |

| ● | execute its business strategy, including monetization of services provided and expansions in and into existing and new lines of business; |

| ● | anticipate the impact of the coronavirus disease 2019 (“COVID-19”) pandemic and its effect on business and financial conditions; |

| ● | manage risks associated with operational changes in response to the COVID-19 pandemic; |

| ● | realize the benefits expected from the Business Combination; |

| ● | anticipate the uncertainties inherent in the development of new business lines and business strategies; |

| ● | retain and hire necessary employees; |

| ● | increase brand awareness; |

| ● | attract, train and retain effective officers, key employees or directors; |

| ● | upgrade and maintain information technology systems; |

| ● | acquire and protect intellectual property; |

| ● | meet future liquidity requirements and comply with restrictive covenants related to long-term indebtedness; |

| ● | effectively respond to general economic and business conditions; |

| ● | maintain the listing of the Company’s securities on the NYSE or an inability to have its securities listed on another national securities exchange; |

| ● | obtain additional capital, including use of the debt market; |

| ● | enhance future operating and financial results; |

| ● | anticipate rapid technological changes; |

| viii |

| ● | comply with laws and regulations applicable to its business, including laws and regulations related to data privacy and insurance operations; |

| ● | stay abreast of modified or new laws and regulations applying to its business; |

| ● | anticipate the impact of, and respond to, new accounting standards; |

| ● | anticipate the rise in interest rates and other inflationary pressures which increase the cost of capital; |

| ● | anticipate the significance and timing of contractual obligations; |

| ● | maintain key strategic relationships with partners and distributors; |

| ● | respond to uncertainties associated with product and service development and market acceptance; |

| ● | manage to finance operations on an economically viable basis; |

| ● | anticipate the impact of new U.S. federal income tax law, including the impact on deferred tax assets; |

| ● | successfully defend litigation; and |

| ● | successfully deploy the proceeds from the Business Combination, the YA Warrant, the YA Convertible Debentures and any proceeds from shares of Class A Common Stock sold pursuant to the SEPA. |

These and other factors that could cause actual results to differ from those implied by the forward-looking statements in this prospectus are more fully described under the heading “Risk Factors” and elsewhere in this prospectus. Forward-looking statements are not guarantees of performance and speak only as of the date hereof. The forward-looking statements are based on the current and reasonable expectations of Rubicon’s management but are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statements. There can be no assurance that future developments will be those that have been anticipated or that we will achieve or realize these plans, intentions or expectations.

All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements. The Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, statements of belief and similar statements reflect the beliefs and opinions of the Company on the relevant subject. These statements are based upon information available to the Company as of the date of this prospectus, and while the Company believes such information forms a reasonable basis for such statements, such information may be limited or incomplete, and statements should not be read to indicate that the Company has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements.

| ix |

SUMMARY

This summary highlights certain significant aspects of our business and the offering and is a summary of information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read this entire prospectus, including the information presented under the sections titled “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Condensed Combined Financial Information,” and the consolidated financial statements and the related notes thereto included elsewhere in this prospectus before making an investment decision. Unless the context indicates otherwise, references in this prospectus to the “Company,” “we,” “us,” “our” and similar terms prior to the Closing are intended to refer to Founder SPAC, and after the Closing, to Rubicon Technologies, Inc. and its consolidated subsidiaries.

Business Summary

Overview

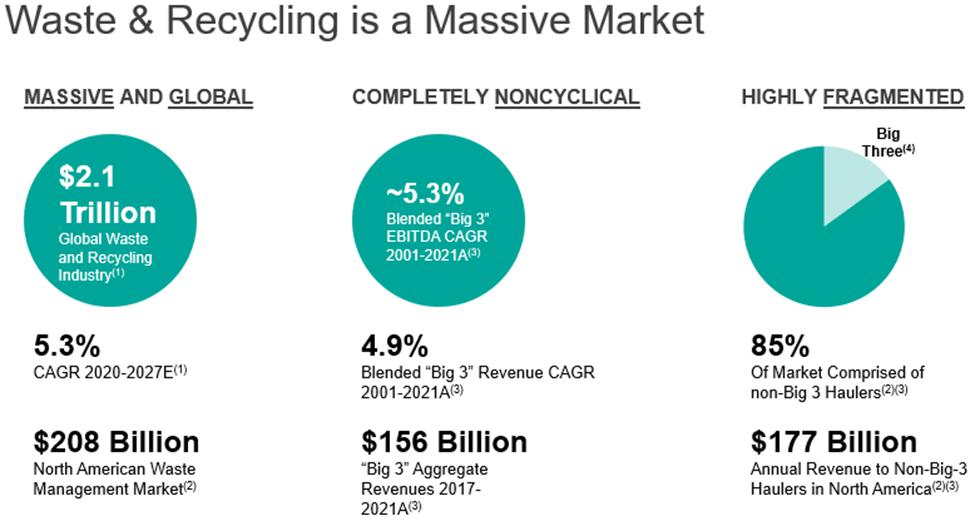

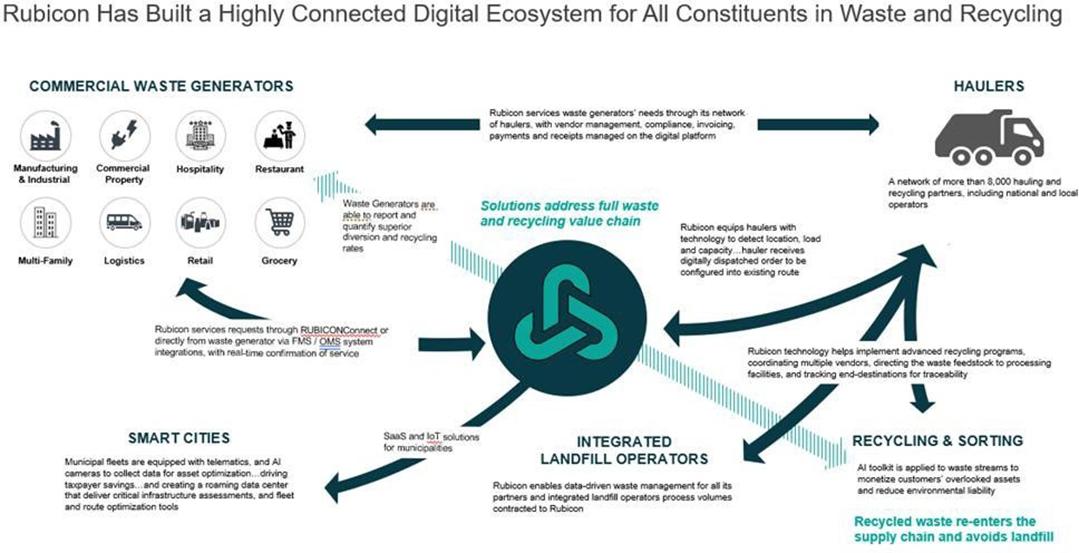

Founded in 2008, we are a digital marketplace for waste and recycling and provide cloud-based waste and recycling solutions to businesses and governments. As a digital challenger to status quo waste companies, we have developed and commercialized a proven, cutting-edge platform that brings transparency and environmental innovation to the waste and recycling industry, enabling customers and hauling and recycling partners to make data-driven decisions that can lead to more efficient and effective operations and yield more sustainable outcomes.

Underpinning this marketplace is a cutting-edge, modular platform that powers a modern, digital experience and delivers data-driven insights and transparency for our customers and hauling and recycling partners. We provide our waste generator customers with a digital marketplace that delivers pricing transparency, self-service capabilities, and a seamless customer experience while helping them achieve their environmental goals. We enhance our hauling and recycling partners’ economic opportunities by democratizing access to large, national accounts that typically engage suppliers at the corporate level. By providing telematics-based and waste-specific solutions as well as access to group purchasing efficiencies, we help large national accounts optimize their businesses. We help governments provide more advanced waste and recycling services that allow them to serve their local communities more effectively by digitizing their routing and back-office operations and using our computer vision technology to combat recycling material contamination at the source.

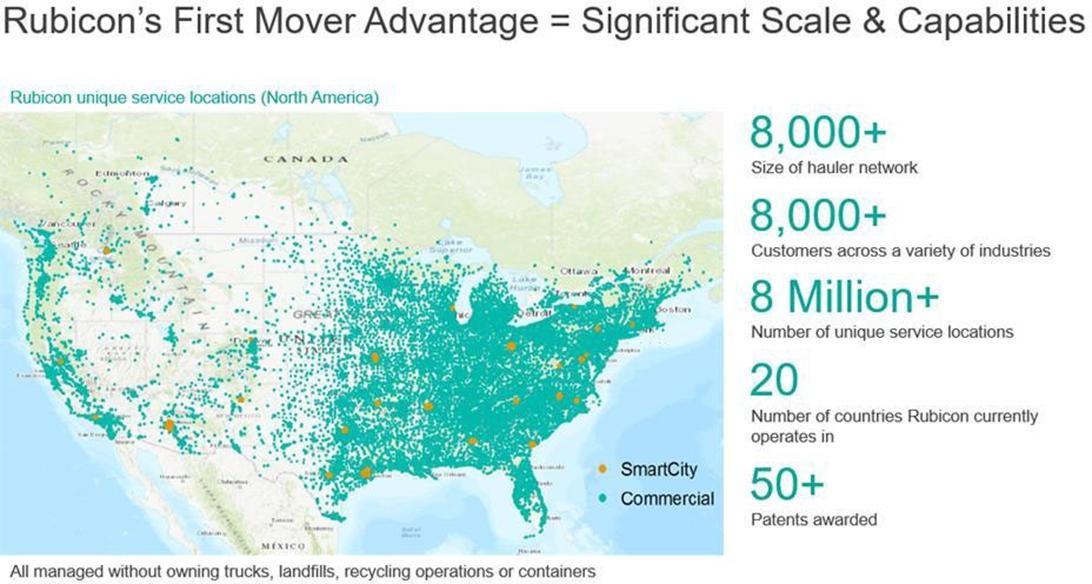

Over the past decade, this value proposition has allowed us to scale our platform considerably. Our digital marketplace now services over 8,000 customers, including numerous large, blue-chip customers such as Apple, Dollar General, Starbucks, Walmart, Chipotle, and FedEx, which together are representative of our broader customer base, which encompasses over 8,000 hauling and recycling partners across North America. We have also deployed our technology in over 70 municipalities within the United States and operate in 20 countries. Furthermore, we have secured a robust portfolio of intellectual property, having been awarded more than 50 patents, with over 100 pending, and 20 trademarks.

Strengths and Competitive Advantages

Our business model provides a transparent marketplace that digitizes the waste and recycling sector for private companies and municipalities. We gain, maintain, and grow our customer relationships by providing what we believe are superior solutions that can help waste generators and government entities save money. We believe we have expertise and competitive advantages that will allow us to continue to maintain and grow our market share.

Cloud-Based Model Reduces Costs and Benefits from the Network Effect

Our business model is highly scalable because of its digital, cloud-based nature; it does not depend on owning any physical infrastructure such as trucks or waste facilities. Without any physical infrastructure and the working capital requirements inherent in those operations, we can efficiently and effectively deploy our platform around the world without the capital investment or the exposure that comes along with owning and operating this infrastructure.

Our platform also benefits from significant network effects. As more waste generator customers join our platform, increased waste and recycling volumes improve our ability to negotiate with haulers and recyclers. Increased waste and recycling volumes also create efficiencies within haulers’ and recyclers’ routes and operations, because the marginal cost of servicing additional locations within an existing route is comparatively low, which can improve service and pricing for our customers. Additionally, as the network expands, the amount of data we collect increases, allowing us to learn and further improve our solutions, benefiting all network participants. As our pricing improves with haulers and recyclers and as our expanding data asset improves its ability to deliver new circular solutions, our overall value proposition improves for our waste generator customers.

| 1 |

Business Model and Customer Interests are Aligned Benefiting Us and Providing Greater Value to Customers

Our platform provides service and cost transparency to both our customers and partners along with automated business processes, allowing them to make informed decisions based on their priorities, whether it’s business growth, cost savings, or environmental outcomes.

Our incentives are aligned with our customers, both economically and environmentally. Landfill owners and operators often generate revenues through collection volumes and tipping fees, so they are incentivized to collect bins more frequently than necessary even when they are not full. Because we do not own landfills, we are not motivated by maximizing volumes and / or tipping fees. Therefore, we can work with our customers to optimize service levels for their business needs. In practice, we advise our waste generator customers on the implementation of new source separated recycling programs and educate store-level employees on how to safely and efficiently manage such program implementation and execution. Additionally, we will work upstream with our customers to design and effect reverse supply chain programs to aggregate valuable waste stream materials at central locations, or even to design programs that create internalized, circular solutions or reduce waste at the source.

Further, using our proprietary computer vision-based technology and our team of subject matter experts to examine the contents of a waste stream, we can assess the material composition of the waste stream. This information provides multiple benefits, including providing more detailed information about the contents and allowing customers to identify opportunities to divert certain materials from landfills. Using this information, we and our customers can generate better environmental outcomes, and, to the extent we can sell the materials to recycling and processing facilities, we can also create significant economic benefits.

For RUBICONPro, RUBICONPremier, and RUBICONSmartCity, our SaaS offerings, the core of services is about maximizing the use of scarce resources. We do this by optimizing routes and full fleet operations, by providing data for preventative vehicle maintenance, and by focusing on improving driver safety and behavior, which can improve outcomes for all constituents: drivers, supervisors, governments officials, and residents.

Superior Technology

Our user-friendly platform is vertically integrated and gives us control of all critical operations and transaction elements, which facilitates a fast, simple, and consistent user experience. We believe our ground-breaking technology is what the industry has needed for many years.

Our technology can affect all parties within the waste and recycling ecosystem:

| ● | We service waste generators’ needs through our network of haulers and recyclers and with vendor management, compliance, invoicing, payments, and receipts managed on our digital platform. We service requests through our proprietary customer portal RUBICONConnect or directly from waste generators via FMS / OMS system integrations, with real-time confirmation of service. |

| ● | We equip haulers and recyclers with technology to detect location, load, and capacity. Haulers and recyclers digitally receive dispatched orders to be configured into their existing routes. |

| ● | Municipal fleets are equipped with telematics and AI cameras to collect data for asset optimization. The resultant operational efficiencies can drive taxpayer savings, turning a garbage truck into a “roaming data center” that can deliver critical infrastructure assessments for governments all while performing its primary functions. |

| ● | Our technology also helps implement advanced recycling programs, coordinating multiple vendors, directing the waste feedstock to specific processing facilities, and tracking end-destinations for traceability. |

| ● | We enable data-driven waste management for all our partners, and integrated landfill operators process volumes contracted to us. |

| 2 |

Depth & Quality of Hauling & Recycling Network Benefits All Constituent Parties

We work with a network of more than 8,000 hauling and recycling partners. The scale of our network means we have access to vastly more hauling and recycling options through our digital platform. Our ability to access this extensive network benefits our customers and enables us to mitigate business risks for our customers associated with sole sourcing, including labor shortages, cost offsets (overages, contamination, etc.), and unaccommodating supplier scheduling.

The stickiness of the supplier side of our marketplace is ensured by the valuable services we provide them. Foremost is that we offer our hauling and recycling partners new business opportunities to service our waste generator customers. Given that many of our customers have a national or even global presence, often the only way a local supplier can get access to these important locations is through us.

We also offer our hauling and recycling partners a digital platform that is simple and efficient and can help them improve their routing, fleet operations, and driver behavior.

Lastly, we offer the benefits of scale to even the smallest hauler/recycler through a buying consortium where haulers and recyclers can save money on items critical to their businesses (fuel, parts, tires, insurance, etc.). We have not yet monetized this buying consortium but have plans to do so in the near term.

Number of Blue-chip Customers Creating Barrier to Entry

Our platform has been validated by a diverse group of over 8,000 customers in businesses and governments, most of which are under long-term contracts. Our typical customer agreement has a term of 3 years, providing confidence in and visibility towards future revenue streams. Our large and national accounts have also attracted many haulers and recyclers to the platform. Some of our blue-chip customers include Apple, Starbucks, Walmart, Dollar General, Chipotle, and FedEx.

Our Growth Strategies

The foundation of our business is our digital marketplace platform where it seamlessly transacts with our customers and hauling and recycling partners. The majority of our revenue is generated via this digital marketplace, which allows us to capture additional revenue streams through solutions designed to modernize hauling and recycling operations. We believe we have multiple proven avenues for future growth, including through increasing our geographic reach and the depth of our customer, hauling, and recycling networks in those markets.

Organic Customer Growth Through New Customer and Contract Wins Based on the Strengths of our Solutions

We have built a first-class sales and marketing organization that has helped build our base of more than 8,000 customers. We combine cutting-edge and sorely needed technology solutions with deep subject matter expertise in a mission-critical sector. Our products are designed to save customers money, provide for a more transparent and seamless customer experience, and help customers achieve positive environmental outcomes. This differentiated proposition creates a strong product-market fit within an industry that is ripe for change.

Additionally, we are uniquely capable of providing a “one-stop-shop” solution for all the waste generator customers’ waste and recycling needs. We offer a tiered solution, beginning with simply auditing and administering an incumbent hauler’s existing program for waste generators, through to the creation and provisioning of a full zero-waste program.

Organic customer growth is expected to continue to be a core driver of growth for us for the foreseeable future as a result of these and other strengths.

Growing Revenues with Existing Customers

We have proven our ability to expand our customer relationships. This is achieved both by expanding our geographic penetration across a customer’s footprint over time as well as by working collaboratively with our customers to identify incremental services that can be offered to further enhance their waste and recycling programs. Our waste generator account managers are empowered and incentivized to expand our existing customer relationships. Underscoring our ability to expand our existing customer relationships, revenue net retention stood at approximately 118% as of September 30, 2022.

| 3 |

Adding More Service Capabilities

We have demonstrated our ability to expand our capabilities in the past. We have expanded our waste marketplace service capabilities to over 150 material types and multiple fleet types, and even beyond waste and recycling. We intend to continue to add service capabilities and invest in product development and have the platform, vision, and data to fuel growth.

From a customer perspective, we currently service national and SMB waste generator accounts, predominately within the U.S. market. Through our SaaS-based offerings, we have already expanded our footprint internationally and expect to continue this expansion – first by leading with technology, then by building out digital marketplace offerings in these markets.

As our business expands in its breadth and depth, we will continue to refine how we monetize our products and relationships. Today we earn money from licensing our technology, from waste and recycling services within our digital marketplace, and by participating in recyclable commodity sales transactions. By servicing all the constituents within the waste and recycling ecosystem, we have gathered valuable datasets that we have begun and will continue to offer on their own as data subscriptions. Further, we expect to be a larger player in establishing recycling and recyclable commodity marketplaces.

International Expansion within Existing Markets and into New Markets

We believe we are a global innovator in the waste and recycling industry and have successfully deployed our solutions in 20 countries though we currently generate the vast majority of our revenue within the United States. We intend to continue selling our solutions globally.

Strategic Acquisitions

We intend to grow by acquiring other businesses and the customers they serve. We have proven our ability to identify and execute on attractive acquisition targets. We have acquired and successfully integrated multiple businesses and have established a repeatable process for identifying and integrating complementary companies. Furthermore, we have spent considerable efforts building relationships across the industry, helping to build a large pipeline of additional acquisition opportunities.

| 4 |

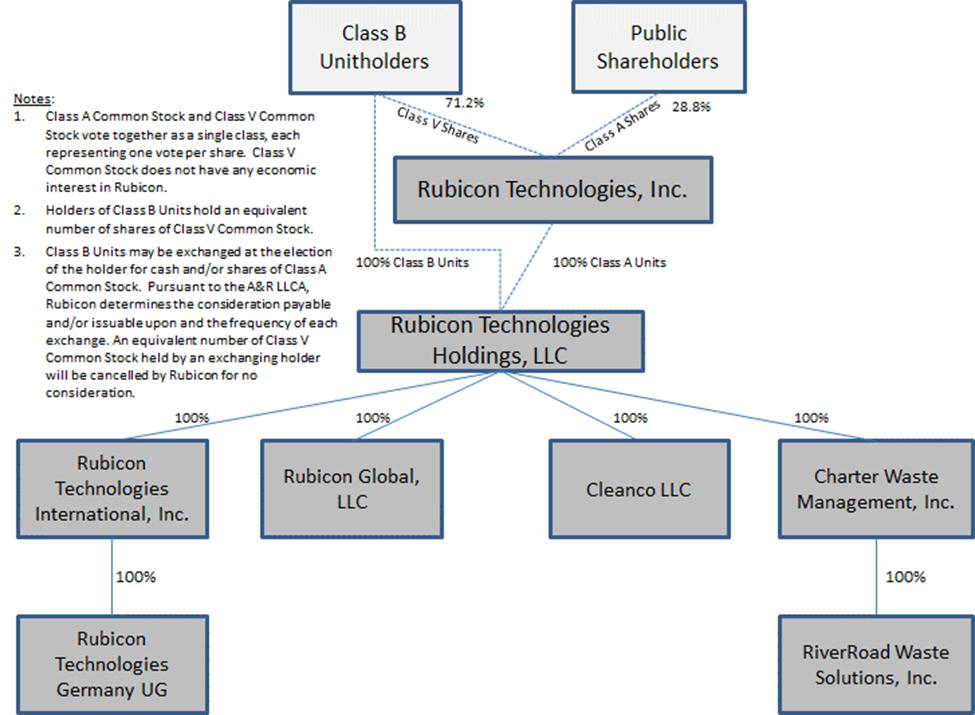

Organizational Structure

The diagram below depicts a simplified version of our equity ownership and organizational structure immediately following the Business Combination, assuming no Warrant exercises and not accounting for any issuances of shares of Class A Common Stock to the Yorkville Investor pursuant to the SEPA, YA Convertible Debentures or YA Warrant. For more information regarding the Business Combination, see “Introductory Note Regarding the Business Combination and Certain Other Transactions.” Percentages set forth below reflect the voting power and implied ownership interest in Rubicon, but do not give effect to the exercise of Warrants or exchange of any Class B Units.

| 5 |

Summary of Risk Factors

An investment in our securities involves risks and uncertainties. You should carefully consider the following risks as well as the other information included in this prospectus, including “Cautionary Note Regarding Forward-Looking Statements,” “Unaudited Pro Forma Condensed Combined Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto included elsewhere in this prospectus, before investing in our securities. See “Risk Factors” for a more detailed discussion of the risk factors listed below.

Risk Related to Our Business and Industry

| ● |

We have a history of net losses and project net losses in future periods. We may not appropriately manage our expenses, nor achieve nor maintain profitability in the future. |

| ● |

We may be unable to manage our growth effectively. |

| ● |

The waste and recycling industry is highly competitive, and if we cannot successfully compete in the marketplace, our business, financial condition and operating results may be materially adversely affected. |

| ● |

Our sales cycles can be long and unpredictable, and our sales efforts require considerable investment of time and expense. If our sales cycle lengthens or we invest substantial resources pursuing unsuccessful sales opportunities, our operating results and growth would be harmed. |

| ● |

Our customers and the third parties with whom we contract, including waste haulers, are participants in the waste and recycling industry and are therefore subject to a number of unique risks specific to this industry, which directly or indirectly subjects our business to many of the same risks to which their respective operations are subject. |

| ● |

Demand for our solutions is subject to volatility in our accounts’ and our haulers’ underlying businesses. |

| ● | Demand for our solutions can be affected by changes in recyclable commodity prices and quantities. |

Risks Related to Ownership of Our Securities

| ● | Certain existing shareholders purchased securities in Rubicon at a price below the current trading price of such securities, and may experience a positive rate of return based on the current trading price. Future investors in Rubicon may not experience a similar rate of return. |

| ● | Substantial future sales of shares of Class A Common Stock could cause the market price of our shares of Class A Common stock to decline. |

| ● | The issuances of additional shares of Class A Common Stock under certain of our contracts and arrangements may result in dilution of holders of Class A Common Stock and have a negative impact on the market price of the Class A Common Stock. |

| ● | A significant portion of the total outstanding shares of Class A Common Stock (or shares of Class A Common Stock that may be issued in the future pursuant to an exchange or redemption of Class B Units) are subject to lock-up restrictions, but may be sold into the market in the near future. This could cause the market price of our securities to drop significantly. |

| ● | The Public Warrants may never be in the money and they may expire worthless, and the terms of the Public Warrants may be amended in a manner adverse to a holder if holders of at least a majority of the then-outstanding Public Warrants approve of such amendment. |

| ● | There can be no assurance that the Class A Common Stock and Public Warrants will continue to be listed on NYSE and that we will continue to comply with the continued listing standards of NYSE. |

| ● | The market price and trading volume of Class A Common Stock may be volatile and could decline significantly following the Business Combination. |

| ● | Rubicon may be subject to securities litigation, which is expensive and could divert management attention. |

| 6 |

Risks Related to Operating as a Public Company

| ● | Our management does not have prior experience in operating a public company. |

| ● | Rubicon will depend on distributions from Holdings LLC to pay any taxes and other expenses, including payments under the Tax Receivable Agreement. |

| ● | Rubicon is required to pay to the TRA Holders most of the tax benefits Rubicon receives from tax basis step-ups (and certain other tax benefits) attributable to its acquisition of Legacy Rubicon Units (as defined below) in connection with the Business Combination and in the future, and the amount of those payments is expected to be substantial. |

| ● | In certain circumstances, Holdings LLC will be required to make distributions to us and the continuing members of Holdings LLC, and the distributions that Holdings LLC will be required to make may be substantial. |

Risks Related to our Indebtedness

| ● | Our current liquidity, including negative cash flows and a lack of existing financial resources, raises substantial doubt about our ability to continue as a going concern, which may materially and adversely affect our business, financial condition, results of operations and prospects. |

| 7 |

Corporate Information

We were incorporated on April 26, 2021 as a Cayman Islands exempted company, and on August 15, 2022, in connection with the Domestication and the Business Combination, became a Delaware corporation and changed our name to Rubicon Technologies, Inc. See “Introductory Note Regarding the Business Combination and Certain Other Transactions.” Our principal executive office is located at 100 W Main Street, Suite 610, Lexington, Kentucky 40507, and our telephone number is (844) 479-1507. Our website address is www.rubicon.com. The information contained in or accessible from our website does not constitute part of and is not incorporated into this prospectus or the registration statement of which it forms a part, and you should not consider it part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

| 8 |

THE OFFERING

| Issuer |

Rubicon Technologies, Inc. | |

|

Shares of Class A Common Stock offered by the Selling Securityholders

|

Up to an aggregate of 24,616,551 shares of Class A Common Stock, including (i) 19,800,000 shares of Class A Common Stock underlying the YA Convertible Debentures, (ii) 443,341 shares of Class A Common Stock issued pursuant to the Cowen Deferred Fee Arrangement, and (iii) 4,373,210 shares of Class A Common Stock issued pursuant to the Moelis Deferred Fee Arrangement. | |

|

Shares of Common Stock outstanding prior to exercise of all Warrants |

167,195,124 shares of Common Stock, which represents 52,308,671 shares of Class A Common Stock and 114,886,453 shares of Class V Common Stock (as of December 13, 2022). | |

|

Shares of Common Stock outstanding assuming exercise of all Warrants |

197,211,975 shares of Common Stock, which represents 82,325,522 shares of Class A Common Stock and 114,886,453 shares of Class V Common Stock (based on total shares outstanding as of December 13, 2022). |

| Use of Proceeds |

We will not receive any proceeds from the sale of shares of Class A Common Stock by the Selling Securityholders. See “Use of Proceeds.” | |

| Market for Common Stock and Warrants |

Our Class A Common Stock and Public Warrants are currently traded on the NYSE under the symbols “RBT” and “RBT WS,” respectively. | |

| Risk Factors | See “Risk Factors” and other information included in this prospectus for a discussion of factors you should consider before investing in our securities. |

| 9 |

INFORMATION RELATED TO OFFERED SECURITIES

The following table includes information relating to the shares of Class A Common Stock being registered for resale by the Selling Securityholders, including the average price each Selling Securityholder paid for such securities and the potential profit relating to the sale of such securities. The following table is in part based off the Company’s internal records and is for illustrative purposes only. The table should not be relied upon for any purpose outside of its illustrative nature. For more information regarding the composition of each Selling Securityholder’s securities registered for resale, see the section entitled “Selling Securityholders”.

| Selling Securityholder | Number of Offered Securities |

Effective

Purchase Price per Offered Security |

Potential

Profit Per Offered Security (1) |

|||||||||

| YA Conversion Shares (2) | 19,800,000 | $ | 0.86 | $ | 1.61 | |||||||

| Cowen Deferred Fee Shares (3) | 443,341 | $ | 2.26 | $ | 0.21 | |||||||

| Moelis Deferred Fee Shares (4) | 4,373,210 | $ | 2.29 | $ | 0.18 | |||||||

| (1) | Based on the closing price of our shares of Class A Common Stock on December 13, 2022 of $2.47. |

| (2) | Represents shares of Class A Common Stock issuable upon conversion of the YA Convertible Debentures at an effective Conversion Price of approximately $0.86 per share (as determined by dividing the aggregate principal amount of the YA Convertible Debentures issued or to be issued to the Yorkville Investor pursuant to the YA SPA by the number of YA Conversion Shares being registered for resale pursuant to this prospectus). The $0.86 per share figure is presented for illustrative purposes only. The actual Conversion Price at which YA Conversion Shares are issued to the Yorkville Investor will be determined in accordance with the terms of the YA Convertible Debentures. |

| (3) | Represents shares of Class A Common Stock issued pursuant to the Cowen Deferred Fee Arrangement. |

| (4) | Represents shares of Class A Common Stock issued pursuant to the Moelis Deferred Fee Arrangement. |

| 10 |

SUMMARY HISTORICAL FINANCIAL INFORMATION OF RUBICON

The following table sets forth selected historical financial information derived from Holdings LLC’s (i) unaudited condensed consolidated statements of operations for the three and nine months ended September 30, 2022 and 2021, (ii) unaudited condensed consolidated balance sheets as of September 30, 2022 and 2021, (iii) audited consolidated statements of operations for the years ended December 31, 2021 and 2020, and (iv) audited consolidated balance sheets as of December 31, 2021 and 2020, each of which is included elsewhere in this prospectus. The unaudited condensed consolidated financial statements were prepared on a basis consistent with our audited consolidated financial statements and, in the opinion of management, include all adjustments of a normal, recurring nature that are necessary for the fair presentation of the financial statements.

The historical results included below and elsewhere in this prospectus are not necessarily indicative of the future performance of Rubicon. The information presented below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the consolidated financial statements and related notes appearing elsewhere in this prospectus.

Selected Consolidated Statement of Operations Data:

| For the Nine Months Ended September 30, |

For the Years Ended December 31, |

|||||||||||||||

| (in thousands, except unit data) |

2022 (unaudited) |

2021 (unaudited) |

2021 | 2020 | ||||||||||||

| Total Revenue | $ | 509,395 | $ | 419,762 | $ | 583,050 | $ | 539,373 | ||||||||

| Total Costs and Expenses | 747,761 | 466,265 | 655,657 | 590,774 | ||||||||||||

| Loss from operations | (238,366 | ) | (46,503 | ) | (72,607 | ) | (51,401 | ) | ||||||||

| Other Income (Expense) | ||||||||||||||||

| Gain on forgiveness of debt | - | 10,900 | 10,900 | - | ||||||||||||

| Other expense | (1,994 | ) | (730 | ) | (1,055 | ) | (427 | ) | ||||||||

| Interest expense, net | (12,264 | ) | (7,461 | ) | (11,453 | ) | (8,209 | ) | ||||||||

| Total Other Income (Expense) | (25,312 | ) | 2,711 | (2,214 | ) | (8,636 | ) | |||||||||

| Loss Before Income Tax Expense (Benefit) | (263,678 | ) | (43,792 | ) | (74,821 | ) | (60,037 | ) | ||||||||

| Income Tax Expense (Benefit) | 60 | (961 | ) | (1,670 | ) | (1,454 | ) | |||||||||

| Net Loss | $ | (263,738 | ) | $ | (42,831 | ) | $ | (73,151 | ) | $ | (58,583 | ) | ||||

Selected Consolidated Balance Sheet Data:

| As of September 30, |

As of December 31, |

|||||||||||||||

| (in thousands) |

2022 (unaudited) |

2021 (unaudited) |

2021 | 2020 | ||||||||||||

| Cash and cash equivalents | $ | 4,464 | $ | 7,638 | $ | 10,617 | $ | 6,021 | ||||||||

| Accounts receivable, net | 58,662 | 47,649 | 42,660 | 45,019 | ||||||||||||

| Total Assets | 191,859 | 173,555 | 175,641 | 159,899 | ||||||||||||

| Accounts payable | 58,498 | 53,688 | 47,531 | 41,915 | ||||||||||||

| Line of credit | 30,095 | 25,000 | 29,916 | 29,373 | ||||||||||||

| Accrued expenses | 162,428 | 54,685 | 65,538 | 48,990 | ||||||||||||

| Long-term debt, net of debt issuance costs | 69,543 | 52,291 | 51,000 | 47,024 | ||||||||||||

| Total Liabilities | 346,488 | 204,596 | 236,945 | 181,085 | ||||||||||||

| Stockholders’/Members’ (Deficit) Equity | (154,629 | ) | (31,041 | ) | (61,304 | ) | (21,186 | ) | ||||||||

| 11 |

SUMMARY UNAUDITED CONDENSED COMBINED PRO FORMA FINANCIAL INFORMATION

The following summary unaudited pro forma condensed combined financial data gives effect to the Merger and the other transactions contemplated by the Merger Agreement described in the section entitled “Unaudited Pro Forma Condensed Combined Financial Information.” Founder was treated as the “acquired” company for financial reporting purposes. Accordingly, for accounting purposes, the Mergers were treated as the equivalent of Holdings LLC issuing stock for the net assets of Founder, accompanied by a recapitalization. The net assets of Founder were stated at their historical value within the pro forma financial statements with no goodwill or other intangible assets recorded.

The summary unaudited pro forma condensed combined statement of operations for the nine months ended September 30, 2022 combines the historical unaudited statement of operations of Founder for the six months ended June 30, 2022 with the historical unaudited condensed consolidated statement of operations of Rubicon for the nine months ended September 30, 2022.

The summary unaudited pro forma condensed combined statement of operations for the fiscal year ended December 31, 2021 combines the historical audited statement of operations of Founder for the period from April 26, 2021 (inception) through December 31, 2021 with the historical audited consolidated statement of operations of Holdings LLC for the fiscal year ended December 31, 2021. The unaudited pro forma statements of operations give effect to the relevant transactions as if they had been consummated on January 1, 2021.

The summary unaudited pro forma condensed combined financial information was derived from and should be read in conjunction with the historical financial statements of Rubicon, Holdings LLC, and Founder and the accompanying notes, which are included elsewhere in this prospectus.

| Statement of Operations Data for the Nine Months Ended September 30, 2022 | ||||

| Revenue | $ | 509,395 | ||

| Net loss attributable to Rubicon Technologies, Inc. | (22,082 | ) | ||

| Net loss per share attributable to common stockholders - basic and diluted | (0.45 | ) | ||

| Weighted average common shares outstanding - basic and diluted | 48,670,776 | |||

| Statement of Operations Data for the Year Ended December 31, 2021 | ||||

| Revenue | $ | 583,050 | ||

| Net loss attributable to Rubicon Technologies, Inc. | (83,609 | ) | ||

| Net loss per share attributable to common stockholders - basic and diluted | (1.72 | ) | ||

| Weighted average common shares outstanding - basic and diluted | 48,670,776 | |||

| 12 |

RISK FACTORS