UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

For the transition period from to

Commission file number:

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

+86 (21) 5080-9696

(Address of principal executive offices)

Telephone: +

Email:

+

(Name, Telephone, Email and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

| ||||

|

* |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2023, there were

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ◻ Yes ⌧

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ◻ Yes ⌧

Note–Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ⌧

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ⌧

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ◻ | Accelerated filer ◻ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ◻

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

International Financial Reporting Standards as issued by the International Accounting Standards Board ◻ | Other ◻ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ◻ Item 17 ◻ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ◻ Yes ◻ No

TABLE OF CONTENTS

Page | ||

4 | ||

4 | ||

4 | ||

4 | ||

65 | ||

99 | ||

99 | ||

116 | ||

127 | ||

127 | ||

128 | ||

129 | ||

143 | ||

144 | ||

147 | ||

147 | ||

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 147 | |

147 | ||

149 | ||

149 | ||

149 | ||

149 | ||

149 | ||

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 149 | |

149 | ||

150 | ||

150 | ||

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | 150 | |

150 | ||

152 | ||

152 | ||

152 | ||

152 | ||

154 | ||

i

INTRODUCTION

Unless otherwise indicated or the context otherwise requires, references in this annual report on Form 20-F to:

| ● | “ADRs” are to the American depositary receipts that may evidence the ADSs; |

| ● | “ADSs” are to the American depositary shares, each of which represents thirty-five (35) Class A ordinary shares; |

| ● | “China” or “the PRC” are to the People’s Republic of China, including Hong Kong, Macau and Taiwan; and “mainland China” refers to the People’s Republic of China, excluding Hong Kong, Macau and Taiwan; |

| ● | “Class A ordinary shares” are to the Class A ordinary shares of ZKH Group Limited, par value US$0.0000001 per share; |

| ● | “Class B ordinary shares” are to the Class B ordinary shares of ZKH Group Limited, par value US$0.0000001 per share; |

| ● | “GBB customers” are to customers that we serve on our GBB platform, which mainly include micro businesses such as trading companies, distributors, local hardware stores, and small businesses which are end users; |

| ● | “GMV” are to the total transaction value of orders placed on our platform and shipped to customers, excluding taxes, net of the returned amount. We believe that GMV, as a key operating metric, provides a measure of the overall volume of transactions that took place on our platform in a given period; |

| ● | “MRO” or “maintenance, repair and operations” are to materials used for maintenance, repair and operation purposes and that do not directly constitute final products; |

| ● | “order” are to an order placed on our platform by our customer, regardless of whether any product in such order is ultimately sold or shipped or whether any product in such order is returned; |

| ● | “our platform” are to our ZKH platform, our GBB platform, and a variety of digital tools and intelligent services that we provide. Our ZKH platform includes our ZKH official website at www.zkh.com, mobile app, Weixin Mini-Program and various interfaces. Our GBB platform includes our GBB official website at www.gongbangbang.com, mobile app, and Weixin Mini-Program; |

| ● | “RMB” and “Renminbi” are to the legal currency of China; |

| ● | “shares” or “ordinary shares” are to the Class A and Class B ordinary shares of ZKH Group Limited, par value US$0.0000001 per share; |

| ● | “US$,” “U.S. dollars,” “$,” and “dollars” are to the legal currency of the United States; |

| ● | “ZKH” are to ZKH Group Limited, our Cayman Islands holding company; “ZKH Industrial Supply” are to ZKH Industrial Supply (Shanghai) Co., Ltd., the wholly foreign owned subsidiary of ZKH Group Limited in China; “we,” “us,” “our company,” and “our” are to ZKH Group Limited and its subsidiaries, including ZKH Industrial Supply and its subsidiaries; “our mainland China subsidiaries” are to ZKH Industrial Supply and its subsidiaries, including, but not limited to, Shanghai Gongbangbang Industrial Tech Co., Ltd., Shanghai Kunhe Supply Chain Management Co., Ltd. and Shenzhen Kuntong Smart Warehousing Technology Co., Ltd. Unless otherwise specified, in the context of describing our business and operations, we are referring to the business and operations conducted by our subsidiaries in mainland China; and |

| ● | “ZKH customers” are to customers that we serve on our ZKH platform, which mainly include enterprise customers in a variety of industries. |

1

Our reporting currency is Renminbi. This annual report also contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations from Renminbi to U.S. dollars are made at a rate of RMB7.0999 to US$1.00, the exchange rate in effect as of December 29, 2023 as set forth in the H.10 statistical release of The Board of Governors of the Federal Reserve System. We make no representation that any Renminbi or U.S. dollars amounts referred to in this annual report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, or at all.

Due to rounding, numbers presented throughout this annual report may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

2

FORWARD-LOOKING INFORMATION

This annual report on Form 20-F contains forward-looking statements that reflect our current expectations and views of future events. All statements other than statements of current or historical facts are forward-looking statements. These forward-looking statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigations Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, but are not limited to, statements relating to:

| ● | our mission, goals and strategies; |

| ● | our future business development, financial condition and results of operations; |

| ● | expected changes in our revenues, expenses or expenditures; |

| ● | the expected growth of the MRO procurement service industry in China and globally; |

| ● | changes in customer or product mix; |

| ● | our expectations regarding the prospects of our business model and the demand for and market acceptance of our products and services; |

| ● | our expectations regarding our relationships with customers, suppliers, and service providers on our platform; |

| ● | competition in our industry; |

| ● | government policies and regulations relating to our industry; |

| ● | general economic and business conditions in China and globally; |

| ● | the outcome of any current and future legal or administrative proceedings; and |

| ● | assumptions underlying or related to any of the foregoing. |

You should read this annual report and the documents that we refer to in this annual report with the understanding that our actual future results may be materially different from and worse than what we expect. Other sections of this annual report include additional factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

3

PART I

ITEM 1.IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2.OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3.KEY INFORMATION

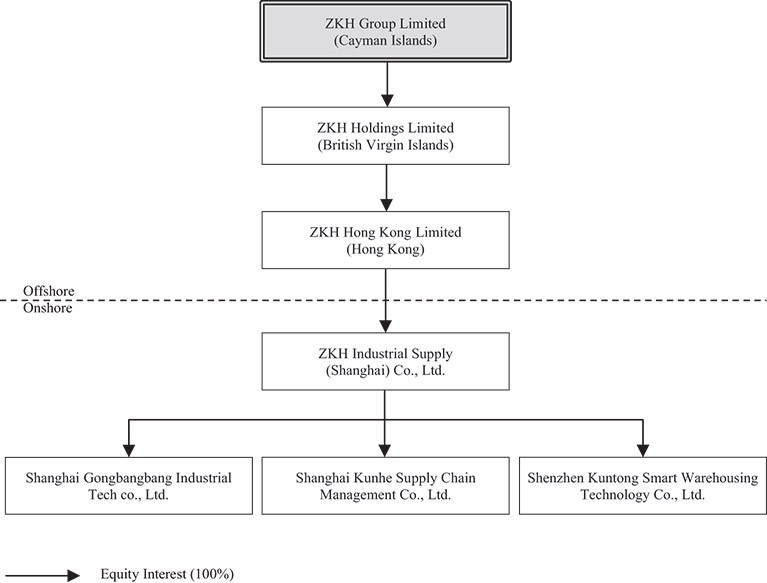

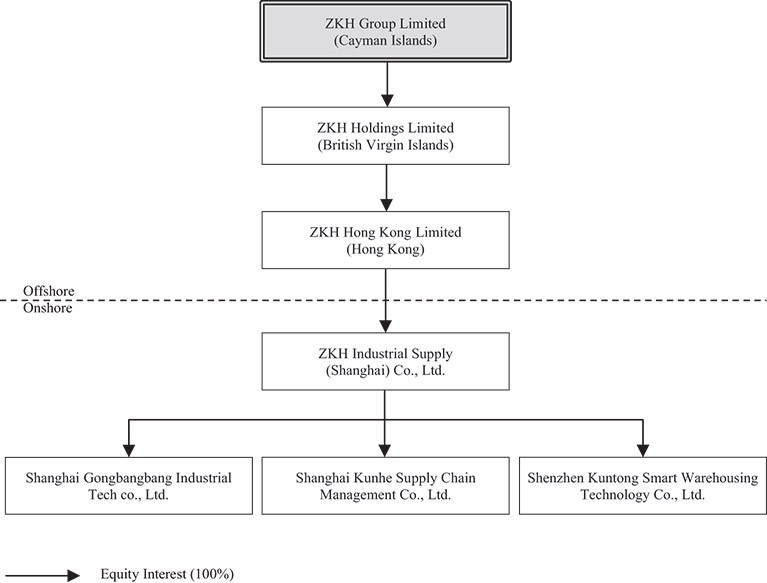

Our Holding Company Structure and Risks Related to Doing Business in China

ZKH Group Limited is not a Chinese operating company but a Cayman Islands holding company with operations primarily conducted through our mainland China subsidiaries. Under this holding company structure, investors in the ADSs are purchasing equity interests in the Cayman Islands holding company and obtaining indirect ownership interests in the operating companies in mainland China. This holding company structure involves unique risks to investors and investors may never hold equity interests in our operating companies in mainland China. While we do not operate in an industry that is currently subject to foreign ownership limitations in mainland China, PRC regulatory authorities could decide to limit foreign ownership in our industry in the future, in which case there could be a risk that we would be unable to do business in mainland China as we are currently structured. In such event, despite our efforts to restructure to comply with the then applicable laws and regulations in mainland China in order to continue our operations in mainland China, we may experience material changes in our business and results of operations, our attempts may prove to be futile due to factors beyond our control, and the value of the ADSs you invest in may significantly decline or become worthless. See “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Uncertainties exist with respect to how the PRC Foreign Investment Law may impact the viability of our current corporate structure and operations.” Unless otherwise indicated or the context otherwise requires, references in this annual report to “ZKH” are to ZKH Group Limited, our Cayman Islands holding company; “ZKH Industrial Supply” are to ZKH Industrial Supply (Shanghai) Co., Ltd., the wholly foreign owned subsidiary of ZKH Group Limited in mainland China; “we,” “us,” “our company,” and “our” are to ZKH Group Limited and its subsidiaries, including ZKH Industrial Supply and its subsidiaries; “our mainland China subsidiaries” are to ZKH Industrial Supply and its subsidiaries, including, but not limited to, Shanghai Gongbangbang Industrial Tech Co., Ltd., Shanghai Kunhe Supply Chain Management Co., Ltd. and Shenzhen Kuntong Smart Warehousing Technology Co., Ltd. Unless otherwise specified, in the context of describing our business and operations, we are referring to the business and operations conducted by our subsidiaries in mainland China.

We face various legal and operational risks and uncertainties associated with being based in or having the majority of our operations in mainland China and the complex and evolving laws and regulations in mainland China. For example, we face risks associated with regulatory approvals on offerings conducted overseas by and foreign investment in China-based issuers, anti-monopoly regulatory actions, oversight on cybersecurity, data privacy and personal information. These risks could result in a material adverse change in our operations and the value of the ADSs of ZKH Group Limited, significantly limit or completely hinder ZKH Group Limited’s ability to continue to offer securities to investors, or cause the value of such securities to significantly decline or be of little or no value. For a detailed description of risks related to doing business in mainland China, please refer to risks disclosed under “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China.”

4

The following diagram illustrates our corporate structure, including our principal subsidiaries, as of the date of this annual report:

We do not currently use, and have not used in the past, a variable interest entity structure.

ZKH Group Limited is not a Chinese operating company but a Cayman Islands holding company with operations primarily conducted through our mainland China subsidiaries. Under this holding company structure, investors in the ADSs are purchasing equity interests in the Cayman Islands holding company and are not purchasing equity securities of our operating subsidiaries in mainland China.

5

Permissions Required from the PRC Government Authorities for Our Operations

We conduct our business primarily through our mainland China subsidiaries. Our operations in mainland China are governed by laws and regulations in mainland China. As of the date of this annual report, certain leasehold interests in our leased properties have not been registered with the competent PRC government authorities as required by the laws and regulations in mainland China. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and Industry—Our use of some leased properties could be challenged by third parties or governmental authorities, which may cause interruptions to our business operations.” Except for such unregistered leasehold interests, as of the date of this annual report, our mainland China subsidiaries have obtained and have not been denied for the requisite licenses and permits from the PRC government authorities that are required for their business operations in mainland China, including, among other licenses, the Hazardous Chemical Operation License, the Value-Added Telecommunication License for online data processing and transaction processing businesses, the Medical Device Operation Permit, the Registration Certificate of Non-pharmaceutical Precursor Chemicals, the Transport Business Operations Permit and the Food Operation License. However, given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by the government authorities, we may be required to obtain additional licenses, permits, filings or approvals for the functions and services of our platform in the future. If (i) we or our subsidiaries do not receive or maintain any permission or approval required of us or our subsidiaries, (ii) we or our subsidiaries inadvertently concluded that certain permissions or approvals have been acquired or are not required, or (iii) applicable laws, regulations, or interpretations thereof change, and we or our subsidiaries become subject to the requirement of additional permissions or approvals in the future, we may have to expend significant time and costs to procure them. If we are unable to do so, in a timely manner or otherwise, we may become subject to sanctions imposed by the PRC regulatory authorities, which could include fines, penalties, and proceedings against us, and other forms of sanctions, and our ability to conduct our business, invest in mainland China as foreign investments or accept foreign investments, or list on a U.S. or other overseas exchange may be restricted, and our business, reputation, financial condition, and results of operations may be materially and adversely affected, and the value of our ADSs could significantly decline or become worthless. For more detailed information, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and Industry—Failure to obtain, renew, or retain licenses, permits or approvals may affect our ability to conduct or expand our business.”

Cash Flows through Our Organization

ZKH Group Limited is a holding company with no material operations of its own. We conduct our operations primarily through our mainland China subsidiaries. As a result, the ability of ZKH Group Limited to pay dividends depends upon dividends paid by its mainland China subsidiaries. If the existing subsidiaries in mainland China or any newly formed ones incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends to ZKH Group Limited. In addition, the wholly foreign-owned subsidiaries in mainland China are permitted to pay dividends to ZKH Group Limited only out of its retained earnings, if any, as determined in accordance with accounting standards in mainland China and regulations. Under laws and regulations in mainland China, each of our mainland China subsidiaries is required to set aside at least 10% of its after-tax profits each year, if any, to fund certain statutory reserve funds until such reserve funds reach 50% of their registered capital. In addition, our wholly foreign owned subsidiaries in mainland China may allocate a portion of their after-tax profits based on accounting standards in mainland China to enterprise expansion funds and staff bonus and welfare funds at their discretion. The statutory reserve funds and the discretionary funds are not distributable as cash dividends. See also “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Holding Company Structure.”

We have established controls and procedures for cash flows within our organization. Our fund management team is the special task force that manages and supervises the transfers of funds among ZKH Industrial Supply and its subsidiaries under the guidance of Company Fund Management System, an internal policy adopted by ZKH Industrial Supply. Under this policy, ZKH Industrial Supply is allowed to establish bilateral cash pooling programs between itself, on one hand, and its subsidiaries or branches, on the other hand, to satisfy cash requirements in the form of entrusted loans. The fund management team closely monitors and manages the cash transfers through our organization by preparing monthly reports and annual budget plans. Each transfer of cash between ZKH Group Limited, our Cayman Islands holding company, and a subsidiary or branch is also subject to internal report and approval process by reference to such policy. In addition, cash transfers between ZKH Group Limited, our subsidiaries, or investors shall follow the applicable laws and regulations in mainland China.

6

As part of our corporate restructuring throughout 2021 to 2022, the investors exited from ZKH Industrial Supply by way of capital reduction and received refunds for their original investments. Each of these investors paid the same amount of refunds it received as consideration for its subscription of the shares of ZKH Group Limited. ZKH Group Limited transferred to ZKH Hong Kong Limited an aggregate of US$833 million consisting of the proceeds from the issuance of Series F Convertible Notes and the issuance of preferred shares of ZKH Group Limited in connection with our corporate restructuring, part of which was subsequently transferred by ZKH Hong Kong Limited to ZKH Industrial Supply and Shanghai Kunshucai Supply Chain Management Co., Ltd. for general corporate purposes and the remaining fund was held by ZKH Hong Kong Limited. ZKH Group Limited transferred US$0.2 million in April 2023 and US$1.5 million in July 2023 to ZKH Hong Kong Limited, and ZKH Hong Kong Limited transferred US$1.6 million to ZKH Group Limited in July 2023, as ordinary intra-group fund transfers. ZKH Group Limited transferred US$57.7 million in December 2023 and US$6.6 million in January 2024, the net proceeds from our initial public offering and the underwriters’ partial exercise of their option to purchase additional ADSs after deducting underwriting commissions, to ZKH Hong Kong Limited following our internal foreign currency management policy. For a detailed discussion of our corporate restructuring, please see “Item 4. Information on the Company—History and Development of the Company.” Other than the cash transfers described above, no cash or other assets were transferred between the Cayman Islands holding company and its subsidiaries, no subsidiaries paid dividends or made other distributions to their respective holding company, and no dividends or distributions were paid or made to U.S. investors as of the date of this annual report. We currently intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business. See “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Dividend Policy.” For more details regarding our intragroup cash flow, see also our consolidated financial statements included elsewhere in this annual report.

Remittance of dividends by a wholly foreign-owned company out of mainland China is subject to examination by the banks designated by SAFE. Our mainland China subsidiaries have not paid dividends and will not be able to pay dividends until they generate accumulated profits and meet the requirements for statutory reserve funds. For more information on related risks, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—We may rely on dividends and other distributions on equity paid by our PRC subsidiaries in mainland China to fund any cash and financing requirements we may have, and any limitation on the ability of our mainland China subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business.” For the Cayman Islands, mainland China and United States federal income tax considerations in connection with an investment in the ADSs, see “Item 10. Additional Information—E. Taxation.”

Under the current laws of the Cayman Islands, we are not subject to tax on income or capital gains. Upon payments of dividends to our shareholders, no Cayman Islands withholding tax will be imposed. For purposes of illustration, the following discussion reflects the hypothetical taxes that might be required to be paid in mainland China and Hong Kong, assuming that: (i) we have taxable earnings, and (ii) we determine to pay a dividend in the future:

| Tax calculation(1) |

| |

Hypothetical pre-tax earnings |

| 100 | % |

Tax on earnings at statutory rate of 25%(2) |

| (25) | % |

Net earnings available for distribution |

| 75 | % |

Withholding tax at standard rate of 10%(3) |

| (7.5) | % |

Net distribution to Parent/Shareholders |

| 67.5 | % |

Notes:

| (1) | For purposes of this example, the tax calculation has been simplified. The hypothetical book pre-tax earnings amount, not considering timing differences, is assumed to equal taxable income in mainland China. |

| (2) | Certain of our subsidiaries qualifies for a 15% preferential income tax rate in mainland China. However, such rate is subject to qualification, is temporary in nature, and may not be available in a future period when distributions are paid. For purposes of this hypothetical example, the table above reflects a maximum tax scenario under which the full statutory rate would be effective. |

| (3) | The PRC Enterprise Income Tax Law imposes a withholding income tax of 10% on dividends distributed by a foreign-invested enterprise to its immediate holding company outside of mainland China. A lower withholding income tax rate of 5% is applied if the immediate holding company of the foreign-invested enterprise is registered in Hong Kong or other jurisdictions that have a tax treaty arrangement with mainland China, subject to a qualification review at the time of the distribution. For purposes of this hypothetical example, the table above assumes a maximum tax scenario under which the full withholding tax would be applied. |

7

In addition, our mainland China subsidiaries generate their revenue primarily in Renminbi, and cash transfers from our mainland China subsidiaries to their parent companies outside of mainland China are subject to PRC government control of currency conversion. As a result, any restriction on currency exchange may limit the ability of our mainland China subsidiaries to pay dividends to ZKH Group Limited. To the extent cash or assets in the business is in mainland China or a PRC entity, the funds and assets may not be available to fund operations or for other use outside of mainland China due to interventions in or the imposition of restrictions and limitations on the ability of ZKH or its subsidiaries by the PRC government to transfer cash or assets. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from making loans or additional capital contributions to our mainland China subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business.”

Permissions Required from the PRC Government Authorities for Overseas Securities Offering

We have completed the cybersecurity review by the Cyberspace Administration of China for our initial public offering in the United States and listing of our ADSs on the New York Stock Exchange, or the NYSE. We have also completed the filings with the CSRC for our initial public offering, and the CSRC has concluded the filing procedure and published the filing results on the CSRC website on November 3, 2023. As of the date of this annual report, we were not denied for or failed to complete any permissions, approvals or filings required from Chinese authorities to offer the securities being registered to foreign investors in our initial public offering. Therefore, we believe we have received all requisite permissions from and completed all filings with Chinese authorities in connection with our initial public offering explicitly required under current laws, regulations and rules in mainland China. However, given (i) the uncertainties of interpretation and implementation of the laws and regulations and the enforcement practice by the government authorities, (ii) the PRC government has significant oversight and discretion over the conduct of our business, and (iii) the rapid evolvement of laws, regulations and rules in mainland China which may be preceded with short advance notice, we may be required to obtain additional licenses, permits, registrations or approvals or complete additional filings for our initial public offering.

On December 28, 2021, the Cyberspace Administration of China and certain other PRC governmental authorities jointly released the Revised Cybersecurity Review Measures, which became effective on February 15, 2022. Pursuant to these measures, (i) operators of critical information infrastructure that intend to purchase network products and services and online platform operators that conduct data processing activities, in each case that affect or may affect national security, and (ii) operators of network platforms seeking listing abroad that are in possession of more than one million users’ personal information must apply for a cybersecurity review. These measures set out certain general factors which would be the focus in assessing the national security risk during a cybersecurity review, including, without limitation, risks of influence, control or malicious use of critical information infrastructure, core data, important data or large amounts of personal information by foreign governments in relation to listing abroad.

As a network platform operator who possesses personal information of more than one million users for purposes of the Revised Cybersecurity Review Measures, we have completed a cybersecurity review with respect to our initial public offering pursuant to the Revised Cybersecurity Review Measures.

On February 17, 2023, the CSRC issued the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Enterprises, which became effective on March 31, 2023, and five supporting guidelines on CSRC’s official website. Pursuant to these measures, PRC domestic enterprises conducting overseas securities offering and listing, either directly or indirectly, shall complete filings with the CSRC within three working days following the submission of application for an initial public offering or listing. These filings shall include, among other documents, (i) a filing report, (ii) regulatory opinions, filing or approval documents issued by the competent authorities of the industry concerned (if applicable), (iii) opinions on the security assessment and review issued by the competent department of the State Council (if applicable), (iv) legal opinions and undertakings issued by PRC counsel, and (v) the listing documents. We have completed the required filings with the CSRC for our initial public offering in accordance with the requirements under these measures and the supporting guidelines. The CSRC has concluded the filing procedure and published the filing results on the CSRC website on November 3, 2023.

8

However, any future securities offerings and listings outside of mainland China by our company, including, but not limited to, follow on offerings, secondary listings and going-private transactions, will be subject to the filing requirements with the CSRC under the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Enterprises and the supporting guidelines, and we cannot assure you that we will be able to comply with such filing requirements in a timely manner, or at all. If we fail to obtain the necessary approval or complete the filings and other regulatory procedures in a timely manner, we may face sanctions by the CSRC or other PRC regulatory agencies, which may include fines and penalties on our operations in mainland China, limitations on our operating privileges in China, restrictions on or prohibition of the payments or remittance of dividends by our mainland China subsidiaries, delay of or restriction on the repatriation of the proceeds from our initial public offering into mainland China, or other actions that could have a material and adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ADSs. The CSRC or other PRC regulatory authorities also may take actions requiring us, or making it advisable for us, to halt our offerings before settlement and delivery of the shares offered. Consequently, if investors engage in market trading or other activities in anticipation of and prior to settlement and delivery, they do so at the risk that settlement and delivery may not occur. In addition, if the CSRC or other regulatory authorities later promulgate new rules or explanations requiring that we obtain their approvals or accomplish the required filing or other regulatory procedures for our initial public offering, we may be unable to obtain a waiver of such approval requirements, if and when procedures are established to obtain such a waiver. Any uncertainties or negative publicity regarding such approval requirement could materially and adversely affect our business, prospects, financial condition, reputation, and the trading price of our ADSs.

For detailed information, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and Industry—Failure or perceived failure to comply with existing or future laws and regulations related to cybersecurity and data security could result in claims, changes to our business practices, negative publicity, legal proceedings, increased cost of operations, or declines in user growth or engagement, or otherwise harm our business,” “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and Industry—Failure or perceived failure to comply with existing or future laws and regulations related to personal information protection could lead to liabilities, administrative penalties or other regulatory actions, which could negatively affect our operating results and business” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The approval of the CSRC or other PRC government authorities may be required in connection with our future offerings under PRC laws and regulations, and if required, we cannot predict whether or for how long we will be able to obtain such approval.”

The Holding Foreign Companies Accountable Act

Pursuant to the Holding Foreign Companies Accountable Act, as amended by the Consolidated Appropriations Act, 2023, or the HFCAA, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the Public Company Accounting Oversight Board of the United States, or the PCAOB, for two consecutive years, the SEC will prohibit our shares or the ADSs from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong, including our auditor who is headquartered in mainland China. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. As of the date of this annual report, the PCAOB has not issued any new determination that it is unable to inspect or investigate completely registered public accounting firms headquartered in any jurisdiction. For this reason, we do not expect to be identified as a Commission-Identified Issuer under the HFCAA after we file this annual report on Form 20-F. On December 29, 2022, the Consolidated Appropriations Act, 2023, was signed into law, which amended the HFCAA (i) to reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years to two, and (ii) so that any foreign jurisdiction could be the reason why the PCAOB does not have complete access to inspect or investigate a company’s auditor. As it was originally enacted, the HFCAA applied only if the PCAOB’s inability to inspect or investigate was due to a position taken by an authority in the foreign jurisdiction where the relevant public accounting firm is located. As a result of the Consolidated Appropriations Act, 2023, the HFCAA now also applies if the PCAOB’s inability to inspect or investigate the relevant accounting firm is due to a position taken by an authority in any foreign jurisdiction. The denying jurisdiction does not need to be where the accounting firm is located.

9

Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions. If the PCAOB determines in the future that it no longer has full access to inspect and investigate completely accounting firms in mainland China and Hong Kong and we continue to use an accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA. Furthermore, whether the PCAOB will continue to conduct inspections and investigations completely to its satisfaction of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control, including positions taken by authorities of the mainland China or any other foreign jurisdiction. If authorities in the mainland China or another foreign jurisdiction were to take a position at any time in the future that would prevent the PCAOB from continuing to inspect or investigate completely registered public accounting firms headquartered in mainland China or Hong Kong, and if such lack of inspection were to extend for the requisite period of time under the HFCAA, our securities will be prohibited from being traded on U.S. markets and an exchange may determine to delist our securities. See “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Our ADSs may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

A.[Reserved]

B.Capitalization and Indebtedness

Not applicable.

C.Reasons for the Offer and Use of Proceeds

Not applicable.

D.Risk Factors

Summary of Risk Factors

Investing in our ADSs involves significant risks. You should carefully consider all of the information in this annual report before making an investment in our ADSs. Below please find a summary of the principal risks we face, organized under headings. With respect to the legal risks associated with being based in and having operations in mainland China as discussed in the risk factors under “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China,” the laws, regulations and the discretion of PRC governmental authorities discussed in this annual report are expected to apply to PRC entities and businesses, rather than entities or businesses in Hong Kong, which operate under a different set of laws from mainland China. These risks are discussed more fully in “Item 3. Key Information—D. Risk Factors.”

Risks Related to Our Business and Industry

| ● | Our business, financial condition and results of operations may be materially and adversely affected if we are unable to attract and retain customers and maintain satisfactory customer experience. |

| ● | The expansion into new product categories and services may expose us to new challenges and more risks. |

| ● | Uncertainties relating to the growth and profitability of the evolving and dynamic MRO procurement service industry could adversely affect our business, prospects and results of operations. We cannot guarantee that our current or future strategies will be successfully implemented or will generate sustainable profit. |

10

| ● | If we cannot manage the growth of our business or execute our strategies effectively, our business and prospects may be materially and adversely affected. |

| ● | If we fail to introduce digital solutions or intelligent services in a manner that responds to the evolving needs of suppliers and customers, our business may be adversely affected. |

| ● | If we fail to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform, our business may be adversely affected. |

| ● | We are exposed to fluctuations in the supply of, or demand for, MRO products inside and outside of China, along with the conditions underlying such fluctuations, which could adversely affect the trading volume and price of the MRO products on our platform. |

| ● | Changes in our business and product mix could cause changes in our revenue or gross margin, or affect our competitive position. |

| ● | Any quality issues of the products we or any third-party suppliers offered through our platform may materially and adversely affect our business and results of operations. |

| ● | Failure or perceived failure to comply with existing or future laws and regulations related to cybersecurity and data security could result in claims, changes to our business practices, negative publicity, legal proceedings, increased cost of operations, or declines in user growth or engagement, or otherwise harm our business. |

| ● | Failure or perceived failure to comply with existing or future laws and regulations related to personal information protection could lead to liabilities, administrative penalties or other regulatory actions, which could negatively affect our operating results and business. |

For more detailed information, see “—Risks Related to Our Business and Industry.”

Risks Related to Doing Business in China

| ● | Uncertainties exist with respect to how the PRC Foreign Investment Law may impact the viability of our current corporate structure and operations. |

| ● | Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business, financial conditions and results of operations. |

| ● | The PRC government may exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, which could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. For a detailed description of the underlying risks, see “—Risks Related to Doing Business in China—The approval of the CSRC or other PRC government authorities may be required in connection with our future offerings under PRC laws and regulations, and if required, we cannot predict whether or for how long we will be able to obtain such approval” on page 42 in this annual report. |

| ● | The PRC legal system is a civil law system based on written statutes, where prior court decisions have limited precedential value. The PRC legal system is evolving rapidly, and the interpretations of many laws, regulations and rules may contain inconsistencies and enforcement of these laws, regulations and rules involves uncertainties. As such, the enforcement of laws in the PRC legal system and rules and regulations in mainland China can change quickly with little advance notice. For a detailed description of the underlying risks, see “—Risks Related to Doing Business in China—Uncertainties with respect to the PRC legal system could adversely affect us” on page 43 in this annual report. |

11

| ● | We conduct our business primarily through our mainland China subsidiaries. Our operations in mainland China are governed by laws and regulations in mainland China. The PRC government has significant oversight and discretion over the conduct of our business, and it may intervene or influence our operations at any time, which could result in a material adverse change in our operations, and our Class A ordinary shares and ADSs may decline in value or become worthless. For a detailed description of the underlying risks, see “—Risks Related to Doing Business in China—The PRC government’s significant oversight and discretion over our business operations could result in a material adverse change in our operations and the value of our ADSs” on page 44 in this annual report. |

| ● | We may be adversely affected by the complexity, uncertainties and changes in PRC regulation of internet-related businesses and companies, and any lack of requisite approvals, licenses or permits applicable to our business may have a material adverse effect on our business and results of operations. |

| ● | The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections. |

| ● | Our ADSs may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in China. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. |

| ● | We may rely on dividends and other distributions on equity paid by our mainland China subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our mainland China subsidiaries to transfer cash or make payments to us could have a material and adverse effect on our ability to conduct our business. |

| ● | To the extent cash or assets in the business is in mainland China or a PRC entity, the funds and assets may not be available to fund operations or for other use outside of mainland China due to interventions in or the imposition of restrictions and limitations on the ability of ZKH or its subsidiaries by the PRC government to transfer cash or assets. For a detailed description of the underlying risks, see “—Risks Related to Doing Business in China—PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from making loans or additional capital contributions to our mainland China subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business” on page 55 in this annual report. |

For more detailed information, see “—Risks Related to Doing Business in China.”

Risks Related to Our ADSs

| ● | The trading price of our ADSs has been and is likely to continue to be volatile, which could result in substantial losses to investors. |

| ● | Our dual-class voting structure will limit your ability to influence corporate matters and could discourage others from pursuing any change of control transactions that holders of our Class A ordinary shares and ADSs may view as beneficial. |

For more detailed information, see “—Risks Related to Our ADSs.”

12

Risks Related to Our Business and Industry

Our business, financial condition and results of operations may be materially and adversely affected if we are unable to attract and retain customers and maintain satisfactory customer experience.

The success of our business depends on our ability to provide superior MRO procurement experience to expand our customer base, which in turn depends on a variety of factors. These factors include our ability to offer a wide array of high-quality MRO products with great value for money, optimize the product offering in response to the diverse and evolving demands of our customers, expand and maintain relationships with our customers, suppliers and service providers, offer timely and reliable fulfillment service, develop digital solutions and intelligent services and recommend suitable ones to our customers and suppliers, all of which will require us to incur substantial costs and expenses. If such costs and expenses fail to effectively translate into a larger customer base, we may not be able to achieve our business goals and our results of operations may be materially and adversely affected. Our efforts to grow our customer base may not lead to increased revenues in the immediate future. Even if they do, any increases in revenues may not offset the cost of revenues and the expenses incurred. If we are not successful in our efforts to retain existing customers, attract new customers, increase customer spending, and ensure the quality of services provided by third-party suppliers under our marketplace model, our revenues may decline and our results of operations may be materially and adversely affected.

Interruptions to or failures in the delivery services could prevent the timely or successful delivery of our products. These interruptions or failures may be due to unforeseen events that are beyond our control or the control of our third-party delivery service providers, such as inclement weather, natural disasters or labor unrest. If products sold on our platform are not delivered in a timely or reliable manner, or are delivered in a damaged state which we failed to detect, customers may refuse to accept these products and have less confidence in our products and services, furthermore we may face claims raised by our customers that we should be held liable for any losses and damages arising therefrom. As a result, our reputation, business, financial condition, and results of operations might suffer significantly.

We depend on our fulfillment service managers to provide the last-mile delivery services and we depend on our customer service team to provide pre-sale, sale and after-sales services and handle customer requests to return or exchange. If our fulfillment service managers and customer service team fail to provide satisfactory services, our brand and customer loyalty may be adversely affected. In addition, any negative publicity or poor feedback regarding our customer service may harm our brand and reputation and in turn cause us to lose customers and market share.

As a result, if we are unable to continue to maintain the quality of our customer experience and customer service, we may not be able to retain existing customers or attract new customers, which could have a material adverse effect on our business, financial condition and results of operations.

The expansion into new product categories and services may expose us to new challenges and more risks.

As our customer base and product mix change over time, we must identify new products and services that respond to the evolving industry trends and customer needs, especially for our ZKH Selection product lines that include products under our own brand names. Our inability to introduce new products and services that meet customers’ evolving demands and preferences, and effectively integrate them into our existing product and service mix could have a negative impact on future sales growth and our competitive position. Specifically, our lack of familiarity with new products and lack of relevant customer insights relating to these products may make it more difficult for us to anticipate customer demands and preferences or to ensure the quality of products and services. We may misjudge customer demands, resulting in inventory buildup and possible inventory write-down. This may also make it more difficult for us to inspect and control quality and ensure proper handling, storage and delivery. We may experience higher return rates on new products, receive more customer complaints about them and face costly product liability claims as a result of selling them, which would harm our brand and reputation as well as our financial performance. We may not have much bargaining power over suppliers in new categories of products and we may not be able to negotiate favorable terms with suppliers or ensure stable supplies of these new product categories. From time to time, we may need to price aggressively to gain market share or remain competitive in new categories. Furthermore, we may need to adjust our product mix from time to time in response to customers’ evolving procurement demands. It may be difficult for us to achieve profitability in new product categories and our profit margin, if any, may be lower than we anticipate, which would adversely affect our overall profitability and results of operations. We cannot assure you that we will be able to recoup our investments in introducing these new product categories.

13

Uncertainties relating to the growth and profitability of the evolving and dynamic MRO procurement service industry could adversely affect our business, prospects and results of operations. We cannot guarantee that our current or future strategies will be successfully implemented or will generate sustainable profit.

The online MRO procurement service industry is still in its early stage of development in China, which may not develop into the stage and scale we expect. We have a limited operating history of online MRO procurement services and limited experience in operating under our product sales and marketplace models. In addition, we have limited experience in providing digital solutions, intelligent services and warehousing, logistics and fulfillment services. As our business grows, or in response to fierce competition, we may continue to introduce new products and services, adjust our existing product and service offerings, or adjust our business operations in general to effectively withstand changes of purchase price of MRO products to maintain our growth and profitability, which may incur considerable costs with no obvious improvement in our operations or our financial results. For associated risks, see “—We may fail to compete effectively in the MRO procurement service industry.” We may also seek to expand our current customer base, which may result in additional costs and expenses. Furthermore, our ability to continuously attract funding sources on reasonable terms is critical to our business. Any significant change to our business model that does not achieve expected results may have a material and adverse impact on our financial condition and results of operations.

As the online MRO procurement services emerged in China only in recent years, the long-term viability and prospects of shifting the MRO procurement process from offline to online in China remain untested and subject to significant uncertainties. You should consider our business and prospects in light of the risks and challenges we encounter or may encounter given the rapidly evolving market in which we operate and our limited operating history. These risks and challenges include our ability to, among other things:

| ● | expand or optimize the product mix, sustain and improve the quality of MRO products and fulfillment solutions on our platform and provide a satisfying customer experience; |

| ● | maintain and enhance our relationship and business collaboration with suppliers, distributors, and warehousing and logistics service providers; |

| ● | attract new customers, retain existing customers and increase their spending on our platform; |

| ● | expand our prospective customer base further to include customers from overseas markets; |

| ● | develop and upgrade our SaaS-based offerings and intelligent services; |

| ● | enhance our technology infrastructure to support the growth of our business and maintain the security of our system; |

| ● | navigate the complex and evolving regulatory environment in mainland China, and geopolitical tensions in overseas markets; |

| ● | withstand fluctuations in the supply and demand and prices of MRO products and related raw materials; |

| ● | manage our strategic investments and alliances; |

| ● | respond to macroeconomic conditions and fluctuations; and |

| ● | defend ourselves against legal and regulatory actions, such as actions involving intellectual property. |

If we cannot manage the growth of our business or execute our strategies effectively, our business and prospects may be materially and adversely affected.

Our net revenues increased from RMB7,654.6 million in 2021 to RMB8,315.2 million in 2022, and further increased to RMB8,721.2 million (US$1,228.4 million) in 2023. However, our historical growth may not be indicative of our future growth. We cannot assure you that we will be able to achieve similar results or grow at the same rate as we did in the past.

14

Our business and prospects may be materially and adversely affected if we fail to manage our growth and to execute our strategies to attract and retain a critical mass of customers on our platform. Our business has become increasingly complex as the scale and geographic coverage of our business, diversity of our products and services, and our workforce continues to grow. We may face new challenges as we expand our service and product offerings to ZKH customers and GBB customers.

We also anticipate further expansion in overseas markets. Such expansion will increase the complexity of our operations and place a significant strain on our management, operational and financial resources. We are also exposed to the political, social or economic instability in foreign markets or regions in which we operate, and such tensions may impact our successful expansion into the overseas market. See also “—We face various challenges and risks in connection with our expansion into overseas markets.”

Moreover, our current and planned staffing, systems, policies, procedures and controls may not be adequate to support our future operations. To effectively manage the expected growth of our operations and personnel, we will need to continue to improve our transaction processing, operational and financial systems, policies, procedures and internal controls, which could be particularly challenging if we start new business operations in new sectors or geographic areas. These efforts will require significant managerial, financial and human resources. The emergence of new disruptive business models and technologies could also impose risks on our future growth. We may fail to compete effectively with such new models or technology. We cannot assure you that we will be able to effectively manage our growth or to implement all these systems, procedures, control measures, business models and technological developments successfully. If we are not able to manage our growth effectively, our business and prospects may be materially and adversely affected.

If we fail to introduce digital solutions or intelligent services in a manner that responds to the evolving needs of suppliers and customers, our business may be adversely affected.

We may experience difficulties with software development that could delay or prevent the development, introduction or implementation of new solutions and enhancements. The development of intelligent services involves a significant amount of time for our research and development team, as it can take our developers months to update, code and test new and upgraded solutions and integrate them into our platform. We must also continually update, test and enhance our software. For example, our research and development team spent a significant amount of time and resources monitoring the performance of our websites, mobile apps, Weixin Mini-Program and technology infrastructure to respond quickly to potential problems and incorporating various enhancements, such as product matching technology, intelligent order, order picking and inventory management function, and other features, into our platform. The continual improvement and enhancement of our platform require significant investment and we may not have the resources to make such investment. Our improvement and enhancement may not result in our ability to recoup our investments in a timely manner, or at all. We may make significant investments in new solutions or enhancements that may not achieve expected returns. The improvement and enhancement of the functionality, performance, reliability, design, security and scalability of our platform is expensive and complex, and to the extent we are not able to perform it in a manner that responds to our customers’ evolving needs, our business, operating results and financial condition will be adversely affected.

If we fail to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform, our business may be adversely affected.

The MRO procurement service market in China in which we operate is characterized by constant change and innovation and we expect it to continue to evolve rapidly. Our success has been based on our ability to identify and anticipate the needs of our customers and suppliers, design and maintain our platform and digital solutions that help them make MRO procurement transparently and efficiently. Our ability to attract new customers, retain existing customers and improve customer spending will depend in large part on our ability to continue to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform and to innovate and introduce new solutions. If we fail to anticipate customers’ rapidly changing needs and expectations or adapt to emerging trends, our market share and operating results and financial condition could suffer.

Furthermore, we expect that the number of suppliers and customers, including ZKH customers and GBB customers, on our platform to increase; as the number of our suppliers and customers with higher transaction volume increases, the need for us to offer increased functionality, scalability and support will increase accordingly, which requires us to devote additional resources to such efforts. We will need to expand our logistics and warehouse capabilities and maintain good business relationships with third-party service providers to meet the growing needs from customers and suppliers as well. To the extent we are not able to enhance our platform’s functionality in order to maintain its utility, enhance our platform’s scalability in order to maintain its performance and availability, or improve our support function in order to meet increased demands, our business, operating results and financial condition could be adversely affected.

15

We are exposed to fluctuations in the supply of, or demand for, MRO products inside and outside of China, along with the conditions underlying such fluctuations, which could adversely affect the trading volume and price of the MRO products on our platform.

The volume of supply and demand for MRO products varies from time to time resulting from changes in resource availability, government policies and regulations, costs of production, demand from customers, and technology development inside and outside China. In the event that the supply of MRO products decreases or the price of raw materials of MRO products increases so that our purchase price of MRO products increases, and that we are unable to pass on the entirety or a majority of such increase in costs to our customers, our financial performance may be adversely affected. If negative market and industry trends occur in the future, the sales price of MRO products on our platform could decrease, and our business and results of operations may be materially and adversely affected. If we further expand our business into overseas markets, we will be exposed to risks related to fluctuations in global production capacity and demand levels for MRO products, as well as global and regional economic conditions.

Changes in the conditions underlying the supply of, and demand for, MRO products may also result in fluctuations in prices of the MRO products which could adversely impact our results of operations and financial performance. For example, a decline in the global economy or the economic and financial conditions of any specific country, region or sector may cause decline in the supply of or demand for MRO products in the affected country, region or sector, thus negatively affecting our business, results of operations, and earnings. Other examples of conditions which might result in fluctuations in the supply of, or demand for, MRO products include but are not limited to (i) the insolvency of key suppliers, particularly those with whom we have long-term supply contracts, could result in supply chain difficulties and/or unmatched MRO products price exposure and/or a reduction in MRO products available for our platform; (ii) a significant reduction or increase in commodity prices could result in customers or suppliers, as the case may be, being unwilling or unable to honor their contractual commitments to purchase or sell MRO products on pre-agreed pricing terms; (iii) a decline in the value of inventories may result in write-downs; and (iv) a decline in customer needs due to macroeconomic restrictions imposed by national and local government or business shut-down due to natural disasters and pandemic.

Changes in our business and product mix could cause changes in our revenue or gross margin, or affect our competitive position.

Our results of operations are affected by the mix of business models that we operate. We currently operate a product sales model and a marketplace model. We derive a majority of our revenues from the sales price of the MRO products under our product sales model. We earn commission fees from suppliers who sell products to customers over our platform under our marketplace model. We currently observe significantly higher level of gross margin under our marketplace model than our product sales model. The changes and developments taking place in our industry may also require us to re-evaluate our business model and adopt significant changes to our long-term strategies and business plans. Our failure to innovate and adapt to these changes and developments would have a material adverse effect on our business, financial condition and results of operations. Even if we timely innovate and adopt changes in our strategies and plans, we may nevertheless fail to realize the anticipated benefits of these changes or even generate lower levels of revenue as a result.

In addition, changes in product mix result primarily from changes in customer demands, competition, and business acquisitions. Our product lines can be broadly divided into five categories: spare parts, chemicals, manufacturing parts, general consumables, and office supplies. Different products may have different gross margins. As we continue to broaden the mix of our MRO product offerings, we may see fluctuation or decrease in our gross margin in the foreseeable future. Whether and to what extent any adverse mix impact will result in a decline of our gross margin in any given period will depend on the extent to which they are, or are not, offset by positive impacts to gross margin during such period. Downward pressure on sales prices, changes in the volume or timing of our orders, and an inability to pass higher product costs on to customers could also cause our gross margin to fluctuate or decline, especially when the customers have alternative product or supplier in the market. We can experience downward pressure on sales prices as a result of deflation, pressure from customers to reduce costs, or increased competition.

Any quality issues of the products we or any third-party suppliers offered through our platform may materially and adversely affect our business and results of operations.

We believe that the market recognition and corporate reputation of our brands among suppliers and customers, including ZKH customers and GBB customers, have contributed significantly to the growth and success of our business. As we continue our growth in size, broaden the scope of our products and services, and expand into overseas markets, it will be increasingly difficult to control the quality of MRO products sold on our platform under both product sales and marketplace models, and to maintain the efficiency and quality of our services, failure of which may negatively impact our market recognition and corporate reputation. The failure to maintain and to further enhance our market recognition and corporate reputation may materially and adversely affect our business, financial condition and results of operations.

16

Many factors, some of which are beyond our control, may negatively impact corporate reputation if not properly managed. These factors include our ability to provide superior services to our customers, successfully conduct marketing and promotion activities, manage relationships with and among suppliers and warehousing and logistics service providers, control quality of the MRO products sold on our platform, monitor the quality of services provided by suppliers and warehousing and logistics service providers, deal with complaints timely, manage negative publicity of us as well as of suppliers and warehousing and logistics service providers on our platform, and maintain a positive perception of our company, our peers and the MRO procurement service industry in general. Any actual or perceived deterioration of our service quality, which is based on an array of factors including product quality, customer satisfaction, rate of complaints or rate of accidents, could subject us to damages such as loss of important customers. Any negative publicity directed against us, the MRO procurement service industry in general or our business partners could cause damages to our brand and reputation and lead to further changes to government policies and the regulatory environment. If we are unable to promote our market recognition and protect our brand and reputation, we may not be able to maintain and grow our customer base and closely cooperate with suppliers, and our business and growth prospects may be adversely affected.

Failure or perceived failure to comply with existing or future laws and regulations related to cybersecurity and data security could result in claims, changes to our business practices, negative publicity, legal proceedings, increased cost of operations, or declines in user growth or engagement, or otherwise harm our business.

The regulatory framework for the collection, use, safeguarding, sharing, transfer and other processing of data and personal information worldwide is rapidly evolving and is likely to remain uncertain for the foreseeable future. Regulatory authorities in virtually every jurisdiction in which we operate have implemented and are considering a number of legislative and regulatory proposals concerning data protection.

In recent years, PRC regulatory authorities have enhanced data protection and cybersecurity regulatory requirements. These laws continue to develop, and the PRC government may adopt other rules and restrictions in the future. Non-compliance could result in penalties or other significant legal liabilities.

The PRC Cybersecurity Law, which became effective in June 2017, created mainland China’s first national-level cybersecurity supervision framework for “network operators.” It is subject to interpretations by the regulator. It requires, among other things, that network operators take security measures to protect the network from interference, damage and unauthorized access and prevent data from being divulged, stolen or tampered with. Network operators are also required to collect and use personal information in compliance with the principles of legitimacy, properness and necessity, and strictly within the scope of authorization by the subject of personal information unless otherwise prescribed by laws or regulations. Significant capital, managerial and human resources are required to comply with legal requirements, enhance cybersecurity and address any issues caused by security failures.

In addition, a number of regulations, guidelines and other measures have been and are expected to be adopted under the PRC Cybersecurity Law. Pursuant to the Revised Cybersecurity Review Measures, which was promulgated in December 2021 and became effective in February 2022, (i) operators of critical information infrastructure that intend to purchase network products and services and online platform operators that conduct data processing activities, in each case that affect or may affect national security, and (ii) operators of network platforms seeking listing abroad that are in possession of more than one million users’ personal information must apply for a cybersecurity review. The Revised Cybersecurity Review Measures set out certain general factors which would be the focus in assessing the national security risk during a cybersecurity review, including, without limitation, risks of influence, control or malicious use of critical information infrastructure, core data, important data or large amounts of personal information by foreign governments in relation to a listing abroad. As a network platform operator who possesses personal information of more than one million users for purposes of the Revised Cybersecurity Review Measures, we have completed a cybersecurity review with respect to our initial public offering pursuant to the Cybersecurity Review Measures.

17