UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended | |||||

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________to__________ | |||||

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report __________ | |||||

Commission File Number: 001-41576

(Exact Name of Registrant as Specified in Its Charter)

______________________________________

N/A

(Translation of Registrant’s Name into English)

(Jurisdiction of Incorporation or Organization)

(Address of Principal Executive Offices)

______________________________________

Telephone: +86 (571) 8530-6942

Email: phil.zhou@ecarxgroup.com

(Name, Telephone, Email and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12 (b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||||||||||||

The | ||||||||||||||

The | ||||||||||||||

Securities registered or to be registered pursuant to Section 12 (g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15 (d) of the Act:

None

(Title of Class)

_____________________________________

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report : 288,989,049 Class A ordinary shares and 48,960,916 Class B ordinary shares, par value US$0.000005 per share, as of December 31, 2023.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes x No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated filer | o | x | Non-Accelerated Filer | o | |||||||||||||

| Emerging Growth Company | |||||||||||||||||

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. o

______________________________________

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

International Financial Reporting Standards as issued by the International Accounting Standards Board o | Other o | |||||||

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

o Yes o No

TABLE OF CONTENTS

| 79 | ||||||||

i

INTRODUCTION

In this annual report, unless otherwise indicated or unless the context otherwise requires:

•“ADAS” means advanced driver assistance system;

•“Business Combination” means the transactions contemplated by the Agreement and Plan of Merger, dated as of May 26, 2022 by and among COVA, ECARX Holdings, Ecarx Temp Limited, and Ecarx&Co Limited;

•“Class A Ordinary Shares” means Class A ordinary shares of ECARX Holdings, par value US$0.000005 per share;

•“Class B Ordinary Shares” means Class B ordinary shares of ECARX Holdings, par value US$0.000005 per share;

•“COVA” means COVA Acquisition Corp., a blank check company that was incorporated as a Cayman Islands exempted company for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization, or similar business combination with one or more businesses or entities;

•“ECARX,” “we,” or “our company” means ECARX Holdings and its subsidiaries (and, in the context of describing ECARX’s historical operations and consolidated financial information, also the former VIEs for the periods prior to the Restructuring), and references to “our” financial statements, share capital, securities (including shares, options, and warrants), shareholders, directors, board of directors, and auditors are to those of ECARX Holdings, respectively;

•“ECARX Holdings” means ECARX Holdings Inc., an exempted company limited by shares incorporated under the laws of the Cayman Islands;

•“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder;

•“Geely Auto” means Geely Automobile Holdings Limited, which manages brands including Geely, Lynk & Co, Geometry, and Zeekr, among others;

•“Geely ecosystem” means Geely Auto, Volvo Car, Polestar, smart, Lotus, Proton, LEVC, and other automotive OEMs that are affiliated with or are investee companies of Geely Holding;

•“Geely Holding” means Zhejiang Geely Holding Group Co., Ltd.;

•“Investor Notes” means the convertible notes issued by ECARX Holdings to certain institutional investors in the aggregate principal amount of US$65 million pursuant to the convertible note purchase agreement dated October 25, 2022 between ECARX Holdings and certain institutional investors;

•“Lotus Note” means the convertible note issued by ECARX Holdings to Lotus Technology Inc. in the aggregate principal amount of US$10 million pursuant to the convertible note purchase agreement dated May 9, 2022 between ECARX Holdings and Lotus Technology Inc.;

•“Nasdaq” means The Nasdaq Stock Market LLC;

•“Ordinary Shares” means, collectively, Class A Ordinary Shares and Class B Ordinary Shares;

•“PCAOB” means the Public Company Accounting Oversight Board;

•“Public Warrants” means warrants to purchase Class A Ordinary Shares at an exercise price of US$11.50 per share, which were issued upon the closing of the Business Combination in exchange for the public warrants of COVA that were issued in COVA’s initial public offering that was consummated on February 9, 2021;

•“Renminbi” or “RMB” means the legal currency of China;

•“Restructuring” means a series of transactions that ECARX implemented to restructure its organization and business operations in early 2022, through which the contractual arrangements that allowed us to consolidate the former VIE were terminated;

1

•“SEC” means the U.S. Securities and Exchange Commission;

•“SoC” means system on a chip;

•“Sponsor” means COVA Acquisition Sponsor LLC, a Cayman Islands limited liability company;

•“Sponsor Warrants” means warrants to purchase Class A Ordinary Shares at an exercise price of US$11.50 per share, which were issued to the Sponsor upon the closing of the Business Combination;

•“U.S. dollars” or “US$” means United States dollars, the legal currency of the United States;

•“U.S. GAAP” means accounting principles generally accepted in the United States of America;

•“VIE” means variable interest entity. “The former VIE” or “Hubei ECARX” means Hubei ECARX Technology Co., Ltd., a former consolidated variable interest entity of ECARX, and “the former VIEs” means Hubei ECARX Technology Co., Ltd. and its subsidiaries;

•“Warrant Agreement” means the Warrant Agreement dated February 4, 2021 by and between COVA and Continental Stock Transfer & Trust Company, as warrant agent, as amended and assigned to ECARX Holdings pursuant to the Assignment, Assumption and Amendment Agreement dated December 20, 2022 by and between COVA, ECARX Holdings, and Continental Stock Transfer & Trust Company; and

•“Warrants” means, collectively, the Public Warrants and the Sponsor Warrants.

Any discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

Our reporting currency is Renminbi. This annual report contains translations from Renminbi to U.S. dollars solely for the convenience of the reader. Unless otherwise stated, all translations from Renminbi to U.S. dollars were made at a rate of RMB7.0999 to US$1.00, which was the exchange rate in effect as of December 29, 2023 as set forth in the H.10 statistical release of The Board of Governors of the Federal Reserve System. The exchange rate in effect as of March 29, 2024 was RMB7.2203 to US$1.00. We make no representation that any Renminbi amounts referred to in this annual report could have been, or could be, converted into U.S. dollars at any particular rate, or at all.

2

FORWARD-LOOKING INFORMATION

This annual report contains statements that are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are based on management’s beliefs and expectations as well as on assumptions made by and data currently available to management, appear in a number of places throughout this document and include statements regarding, amongst other things, results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate. The use of words “expects,” “intends,” “anticipates,” “estimates,” “predicts,” “believes,” “should,” “potential,” “may,” “preliminary,” “forecast,” “objective,” “plan,” or “target,” and other similar expressions are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to a number of risks and uncertainties that could cause actual results to differ materially, including, but not limited to statements regarding our intentions, beliefs or current expectations concerning, among other things, results of operations, financial condition, liquidity, prospects, growth, strategies, future market conditions or economic performance and developments in the capital and credit markets and expected future financial performance, and the markets in which we operate.

Forward-looking statements involve a number of risks, uncertainties and assumptions, and actual results or events may differ materially from those projected or implied in those statements. Important factors that could cause such differences include, but are not limited to:

•the regulatory environment and changes in laws, regulations or policies in the jurisdictions in which we operate;

•the overall economic environment and general market and economic conditions in the jurisdictions in which we operate and beyond;

•the progress and results of the research and development of our products and services, as well as of their manufacturing, launch, commercialization and delivery;

•the conditions and outlook of the automobile and automotive intelligence industries in China and globally;

•our relationships with automotive OEMs, Tier 1 suppliers, and our other customers, suppliers, other business partners and stakeholders;

•our ability to successfully compete in highly competitive industries and markets;

•our ability to continue to adjust our offerings to meet market demand, attract customers to choose our products and services, and grow our ecosystem;

•our ability to execute our strategies, manage growth, and maintain our corporate culture as we grow;

•our anticipated investments in new products, services, collaboration arrangements, technologies and strategic acquisitions, and the effect of these investments on our results of operations;

•changes in the needs for capital and the availability of financing and capital to fund these needs;

•anticipated technology trends and developments and our ability to address those trends and developments with our products and services;

•the safety, price-competitiveness, quality, and breadth of our products and services;

•the loss of key personnel and the inability to replace such personnel on a timely basis or on acceptable terms;

•man-made or natural disasters, health epidemics, and other outbreaks including war, acts of international or domestic terrorism, civil disturbances, occurrences of catastrophic events, and acts of God such as floods, earthquakes, wildfires, typhoons, and other adverse weather and natural conditions that affect our business or assets;

•exchange rate fluctuations;

3

•changes in interest rates or rates of inflation;

•legal, regulatory, and other proceedings;

•the results of future financing efforts; and

•all other risks and uncertainties described in “Item 3. Key Information—D. Risk Factors” and “Item 5. Operating and Financial Review and Prospects.”

We would like to caution you not to place undue reliance on these forward-looking statements and you should read these statements in conjunction with the risk factors disclosed in “Item 3. Key Information— D. Risk Factors.” Those risks are not exhaustive. We operate in a rapidly evolving environment. New risks emerge from time to time and it is impossible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in any forward-looking statement. We do not undertake any obligation to update or revise the forward-looking statements except as required under applicable law.

4

PART I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

Item 3. KEY INFORMATION

Our Holding Company Structure and China Operations

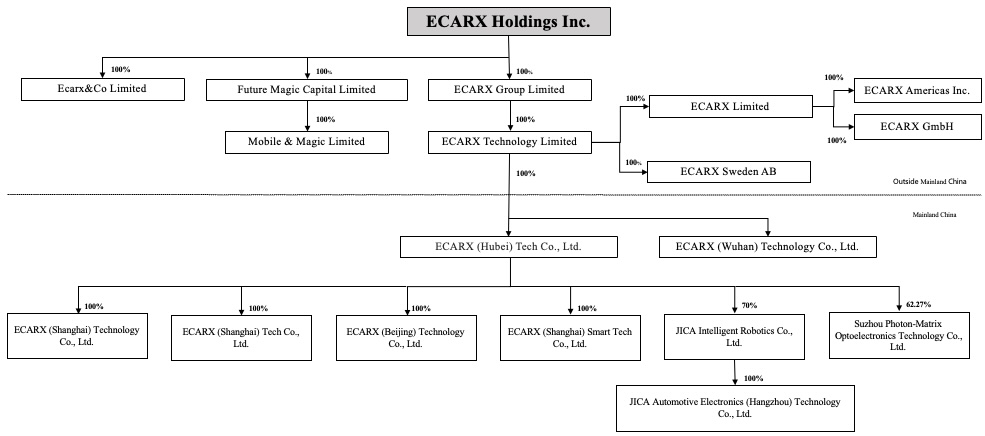

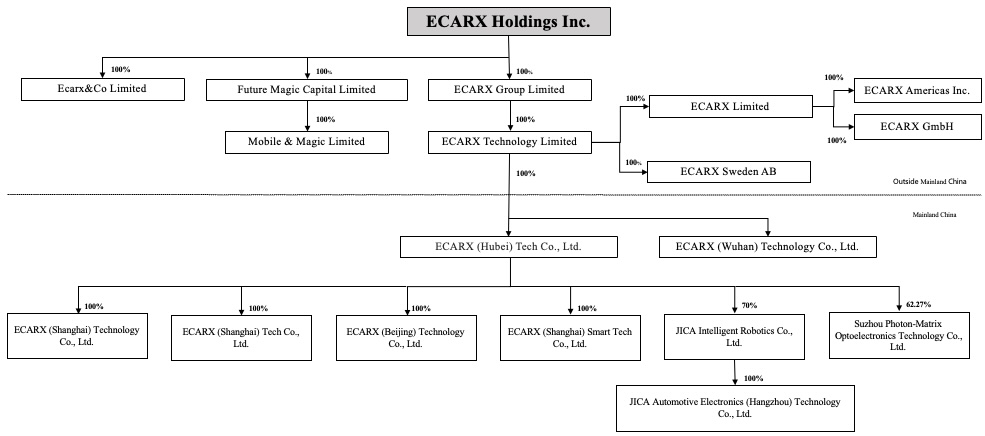

The following diagram illustrates our corporate structure, including our principal and other subsidiaries as of the date of this annual report.

ECARX Holdings is not an operating company but a Cayman Islands holding company. We conduct operations through our subsidiaries, with our operations in China currently being conducted by our PRC subsidiaries. Investors in the Class A Ordinary Shares or in ECARX Holdings are not acquiring equity interest in any operating company but instead are acquiring interest in a Cayman Islands holding company. This holding company structure involves unique risks to investors. As a holding company, ECARX Holdings may rely on dividends from its subsidiaries for cash requirements, including any payment of dividends to its shareholders. The ability of our subsidiaries to pay dividends or make distributions to ECARX Holdings may be restricted by laws and regulations applicable to them or the debt they incur on their own behalf or the instruments governing their debt. In addition, PRC regulatory authorities could disallow this holding company structure and limit or hinder our ability to conduct our business through, receive dividends or distributions from, or transfer funds to, the operating companies or list on a U.S. or other foreign exchange, which could cause the value of our securities to significantly decline or become worthless.

Prior to 2022, we conducted our operations in China through our PRC subsidiaries and through Hubei ECARX Technology Co., Ltd., the former VIE, with which we, our subsidiary, and the nominee shareholders of the former VIE entered into certain contractual arrangement. PRC laws, regulations, and rules restrict and impose conditions on foreign investment in certain types of businesses, and we operated certain businesses, including businesses that were subject to such restrictions and conditions in China such as surveying and mapping services and ICP businesses, through the former VIE. We did not own any equity interest in the former VIEs and relied on the contractual arrangements to direct their business operations. Such structure enables investors to invest in China-based companies in sectors where foreign direct investment is prohibited or restricted under PRC laws and regulations. Following the Restructuring in 2022, the contractual arrangement was terminated and currently we do not have any VIE in China.

5

We face various legal and operational risks and uncertainties relating to doing business in China. Our business operations are primarily conducted in China, and we are subject to complex and evolving PRC laws and regulations. For example, the PRC government has issued statements and regulatory actions relating to areas such as regulatory approvals on overseas offerings and listings by, and foreign investment in, China-based issuers, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy. It remains uncertain how PRC government authorities will regulate overseas listings and offerings in general and whether we can fully comply with applicable regulatory requirements, including completing filings with the China Securities Regulatory Commission, or the CSRC, and whether we are required to complete other filings or obtain any specific regulatory approvals from the CSRC, the Cyberspace Administration of China, or the CAC, or any other PRC government authorities for our overseas offerings and listings, as applicable. In addition, if future regulatory developments mandate clearance of cybersecurity review or other specific actions to be completed by China-based companies listed on foreign stock exchanges, such as us, we face uncertainties as to whether such clearance can be timely obtained, or at all. These risks may impact our ability to conduct certain businesses, accept foreign investments, or list and conduct offerings on a stock exchange in the United States or any other foreign country. These risks could result in a material adverse change in our operations and the value of our Class A Ordinary Shares, significantly limit or completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline or become worthless. For a detailed description of risks relating to doing business in China, see “Item 3. Key Information— D. Risk Factors—Risks Relating to Doing Business in China.”

The PRC government’s significant authority in regulating our operations and its oversight and control over offerings conducted overseas by, and foreign investment in, China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. Implementation of industry-wide regulations in this nature, such as data security or anti-monopoly related regulations, may cause the value of such securities to significantly decline. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in China—The PRC government has significant oversight and discretion over our business operations, and it may influence our operations as part of its efforts to enforce PRC law, which could result in a material adverse change in our operations and the value of our securities.”

Risks and uncertainties regarding the interpretation and enforcement of laws and quickly evolving rules and regulations in China, could result in a material adverse change in our operations and the value of our Class A Ordinary Shares. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in China—Risks and uncertainties regarding the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us, hinder our ability and the ability of any holder of our securities to offer or continue to offer such securities, result in a material adverse change to our business operations, and damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our securities to significantly decline in value or become worthless.”

The Holding Foreign Companies Accountable Act

Pursuant to the Holding Foreign Companies Accountable Act, or the HFCAA, as amended by the Consolidated Appropriations Act, 2023, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by the PCAOB for two consecutive years, the SEC will prohibit our securities from being traded on a national securities exchange or in the over-the-counter trading market in the United States. On December 16, 2021, the PCAOB issued a report to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong, including our auditor. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms. As of the date of this annual report, the PCAOB has not issued any new determination that it is unable to inspect or investigate completely registered public accounting firms headquartered in any jurisdiction. For this reason, we do not expect to be identified as a Commission-Identified Issuer under the HFCAA after we file our annual report on Form 20-F for the fiscal year ended December 31, 2023. Each year, the PCAOB will determine whether it can inspect and investigate completely registered public accounting firms in mainland China and Hong Kong, among other jurisdictions. If PCAOB determines in the future that it no longer has full access to inspect and investigate completely registered public accounting firms in mainland China and Hong Kong and we continue to use a registered public accounting firm headquartered in one of these jurisdictions to issue an audit report on our financial statements filed with the SEC, we would be identified as a Commission-Identified Issuer following the filing of the annual report on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a Commission-Identified Issuer for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA. See “Item 3. Key Information—D. Risk Factors—Risks

6

Relating to Doing Business in China—The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections,” and “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in China—Our securities may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in mainland China and Hong Kong. The delisting of our securities, or the threat of their being delisted, may materially and adversely affect the value of your investment.”

Permission Required from the PRC Authorities for Our Operations

We conduct our operations in China through our PRC subsidiaries. Each of our mainland China subsidiaries is required to obtain, and has obtained, a business license issued by PRC authorities such as the State Administration for Market Regulation and its local counterparts. Our mainland China subsidiaries are also required to obtain, and have obtained, additional operating licenses and permits in connection with their operations, including but not limited to the model confirmation, compulsory product certifications, and network connection licenses for certain of our products. None of our mainland China subsidiaries has been subject to any penalties or other disciplinary actions from any authority in mainland China for the failure to obtain or insufficiency of any approvals or permits in connection with the conduct of its business operations as of the date of this annual report.

The PRC government has sought to exert more control and impose more restrictions on China-based issuers raising capital overseas and such efforts may continue or intensify in the future. On July 6, 2021, the Opinions on Severely Cracking Down on Illegal Securities Activities According to Law, which emphasized the need to strengthen the supervision over overseas listings by mainland China-based companies, was enacted. Effective measures, such as promoting the establishment of regulatory frameworks, are to be taken to deal with the risks and incidents of mainland China-based overseas-listed companies, cybersecurity and data privacy protection requirements, and similar matters. The revised Measures for Cybersecurity Review issued by the CAC, and several other administrations on December 28, 2021 (which took effect on February 15, 2022) require that, both critical information infrastructure operators purchasing network products or services that affect or may affect national security and “online platform operators” carrying out data processing activities that affect or may affect national security should be subject to the cybersecurity review. On February 17, 2023, the CSRC released several regulations regarding the filing requirements for overseas offerings and listings by mainland China-based issuers, including the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies and five supporting guidelines, or collectively the Overseas Listing Filing Rules, which took effect on March 31, 2023. According to the Overseas Listing Filing Rules, for an issuer which is already listed, it should make filing in accordance with the Overseas Listing Filing Rules if: (i) it issues additional convertible bonds, exchangeable bonds or preferred shares, (ii) it issues additional securities in the same overseas market, excluding securities issued for the purpose of implementing equity incentive, distribution of stock dividends, share split, etc., (iii) it issues additional securities in several offerings within its authorized scope; or (iv) it conducts a secondary listing or primary listing in any other overseas market. Failure to comply with the filing requirements may result in fines, suspension of their businesses, revocation of their business licenses and operation permits and fines on the controlling shareholder and other responsible persons. On February 17, 2023, the CSRC issued the Notice on Administrative Arrangements for the Filing of Domestic Enterprise’s Overseas Offering and Listing, which stipulates that mainland China-based issuers like us that have completed overseas listings prior to March 31, 2023 are not required to file with CSRC immediately, but must carry out filing procedures as required if we conduct refinancing or if other circumstances arise, which will require us to make a filing with the CSRC.

Based on the opinion of Han Kun Law Offices, our legal counsel as to the law of mainland China, according to its interpretation of the laws and regulations of mainland China currently in effect, we believe that, as of the date of this annual report, our past offerings do not require the application or completion of any cybersecurity review or any other permission or approval from any government authorities in mainland China including the CSRC. For more detailed information, see “Item 3. Key Information—D. Risk Factors — Risks Relating to Doing Business in China — The approval of and filing with the CSRC or other PRC government authorities may be required in connection with the Business Combination, our previous offerings and listing under PRC law, and, if so required, we cannot predict whether or when we will be able to obtain such approval or complete such filing, and even if we obtain such approval, it could be rescinded.” in this annual report. Any failure to obtain or delay in obtaining the required approvals or completing the required procedures could subject us to restrictions and penalties imposed by the CSRC, the CAC, or other PRC regulatory authorities, which could include fines and penalties on our operations in China, delays of or restrictions on the repatriation of the proceeds from our overseas offerings into China, or other actions that could materially and adversely affect our business, financial condition, results of operations, and prospects.

7

If (i) we do not receive or maintain any permits or approvals required of us, (ii) we inadvertently concluded that certain permits or approvals have been acquired or are not required, or (iii) applicable laws, regulations, or interpretations thereof change and we become subject to the requirement of additional permits or approvals in the future, we may have to expend significant time and costs to procure them. If we are unable to do so, on commercially reasonable terms, in a timely manner or otherwise, we may become subject to sanctions imposed by the PRC regulatory authorities, which could include fines and penalties, proceedings against us, and other forms of sanctions, and our ability to conduct our business, invest into China as foreign investments or accept foreign investments, or list on a U.S. or other overseas exchange may be restricted, and our business, reputation, financial condition, and results of operations may be materially and adversely affected. For more detailed information, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in China—Risks and uncertainties regarding the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us, hinder our ability and the ability of any holder of our securities to offer or continue to offer such securities, result in a material adverse change to our business operations, and damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our securities to significantly decline in value or become worthless.”

Arrangements with Respect to Certain Personal Data

In response to the move by PRC government authorities to tighten the regulatory framework governing data security, cybersecurity and privacy, in September 2021 we initiated an internal process to transfer the rights of our mainland China subsidiaries and of the former VIE to access and process personal data relevant to their respective business operations to Zhejiang Huanfu Technology Co., Ltd., or Zhejiang Huanfu. The transfer was completed in December 2021 and as of the date of this annual report, our mainland China subsidiaries do not have any right to access or process any personal data other than certain employee personal data and certain vehicle identification numbers provided by automotive OEMs in association with our provision of product repair and maintenance services. In January 2022, we entered into a procurement framework agreement with Zhejiang Huanfu and concluded several procurement-related contracts pursuant to the procurement framework agreement for the sole purpose of contracting Zhejiang Huanfu to discharge our outstanding obligations to provide certain data-related services to our PRC customers.

Cash Transfers and Dividend Distribution

Cash is transferred from ECARX Holdings to our subsidiaries through capital contributions, loans, and inter-company advances. In addition, cash may be transferred among our subsidiaries, through capital contributions, loans and settlement of transactions. Under our cash management policy, the amount of inter-company transfers of funds is determined based on the working capital needs of the subsidiaries and inter-company transactions, and is subject to internal approval processes and funding arrangements. Our management regularly reviews and monitors the cash flow forecast and working capital needs of our subsidiaries.

Advances and loans. In 2021, (i) ECARX Holdings made advances in the principal amount of US$478.5 million to ECARX Technology Limited and provided loans in the principal amount of US$11.0 million to our subsidiaries ECARX Limited and ECARX Sweden AB, and (ii) ECARX Technology Limited provided a loan in the principal amount of US$2.3 million to our subsidiary, ECARX Sweden AB, which has been fully repaid. In 2022, (i) ECARX Holdings made advances in the principal amount of US$50.9 million to ECARX Technology Limited; (ii) ECARX Holdings provided loans in the principal amount of US$3.0 million to ECARX Sweden AB; (iii) ECARX Holdings provided loans in the principal amount of US$35.0 million to ECARX (Hubei) Tech Co., Ltd.; (iv) ECARX Holdings made advances in the principal amount of US$21.0 million to ECARX Group Limited; (v) ECARX Holdings received US$8.8 million as repayment from ECARX Sweden AB; and (vi) JICA Intelligent Robotics Co., Ltd., or JICA Intelligent, provided loans in the principal amount of RMB150.0 million to ECARX (Hubei) Tech Co., Ltd. In 2023, (i) ECARX Technology Limited repaid US$119.3 million to ECARX Holdings, (ii) ECARX Holdings made advances in the principal amount of US$115.0 million to ECARX Group Limited and US$2.7 million to ECARX Technology Limited, (iii) ECARX Group Limited repaid US$33.4 million to ECARX Holdings, (iv) ECARX Holdings provided loans in the principal amount of US$15.0 million to ECARX (Hubei) Tech Co., Ltd., (v) ECARX Technology Limited provided loans in the principal amount of US$0.4 million to ECARX Limited, which has been fully repaid, and (vi) ECARX (Hubei) Tech Co., Ltd. repaid RMB150.0 million to JICA Intelligent.

Capital contribution. In 2021, ECARX Technology Limited made capital contribution of US$7.6 million, US$250.0 million, and US$75.0 million to our subsidiaries, ECARX Sweden AB, ECARX (Wuhan) Technology Co., Ltd., and ECARX (Hubei) Tech Co., Ltd., respectively. In 2021, ECARX (Wuhan) Technology Co., Ltd., a subsidiary of ours, made capital contribution of RMB10.0 million to ECARX (Shanghai) Technology Co., Ltd., another subsidiary of ours. In 2022, ECARX Technology Limited made capital contribution of US$14.6 million and US$25.0 million to its subsidiaries, ECARX Limited and ECARX (Hubei) Tech Co., Ltd., respectively. In 2023, (i) ECARX Group Limited made capital

8

contribution of US$100.0 million to ECARX Technology Limited; (ii) ECARX Technology Limited made capital contribution of US$60.0 million to ECARX (Hubei) Tech Co., Ltd., and US$31.5 million to its subsidiary, ECARX Limited; (iii) ECARX (Hubei) Tech Co., Ltd. made capital contribution of RMB51.0 million to its subsidiary, JICA Intelligent; and (iv) ECARX Holdings converted its £3.0 million loan to ECARX Limited into equity. In 2021, 2022, and 2023, Hubei ECARX received RMB2.1 billion, RMB157.0 million, and nil in the form of loans from our subsidiaries, respectively. (v) ECARX Limited made capital contribution of US$2.7 million to ECARX Americas Inc.

Cash transfers involving Hubei ECARX, the former VIE. In 2021 and 2022, Hubei ECARX received RMB2.1 billion and RMB157.0 million in the form of loans from our subsidiaries, respectively. In 2021, subsidiaries of Hubei ECARX made payments totaling US$1.7 million to ECARX Technology Limited relating to certain sales transactions. In 2021, Hubei ECARX received RMB270.0 million in the form of loans from JICA Intelligent. In 2022, Hubei ECARX, ECARX Technology, and ECARX (Hubei) Tech Co., Ltd. made payments totaling RMB36.1 million, US$2.2 million, and RMB60.0 million, respectively, to ECARX Sweden AB relating to certain research and development expense. In 2022, Hubei ECARX made payments totaling RMB270.0 million to JICA Intelligent. In 2023, ECARX Technology and ECARX (Hubei) Tech Co., Ltd. made payments totaling US$1.2 million and RMB204.7 million, respectively, to ECARX Sweden AB relating to certain research and development expense. Following the Restructuring in 2022, we no longer have any VIE in China.

We, our subsidiaries, and, for the periods ended prior to the Restructuring, the former VIEs, have not declared or paid dividends or made any distributions as of the date of this annual report. We do not intend to declare dividends or make distributions in the near future. Any determination to pay dividends in the future will be at the discretion of our board of directors.

We are subject to various restrictions on inter-company fund transfers and foreign exchange control.

Dividends. ECARX Holdings is a holding company and may rely on dividends and other distributions on equity paid by our subsidiaries for its cash and financing requirements. Restrictions on the ability of our mainland China subsidiaries to pay dividends to an offshore entity primarily include: (i) our mainland China subsidiaries may pay dividends only out of their accumulated after-tax profits upon satisfaction of applicable statutory conditions and procedures, if any, determined in accordance with accounting standards and regulations in China; (ii) each of our mainland China subsidiaries is required to set aside at least 10% of its after-tax profits each year, if any, to fund certain reserve funds until the total amount set aside reaches 50% of its registered capital; (iii) our mainland China subsidiaries are required to complete certain procedural requirements related to foreign exchange control in order to make dividend payments in foreign currencies; and (iv) a withholding tax, at the rate of 10% or lower, is payable by our mainland China subsidiary upon dividend remittance. Such restrictions could have a material and adverse effect on the ability of ECARX Holdings to distribute profits to its shareholders. Under Cayman Islands law, while there are no exchange control regulations or currency restrictions, ECARX Holdings is also subject to certain restrictions under Cayman Islands law on dividend distribution to its shareholders, namely that it may only pay dividends out of profits or share premium account, and provided always that in no circumstances may a dividend be paid if this would result in ECARX Holdings being unable to pay its debts as they fall due in the ordinary course of business.

Capital expenses. Approval from or registration with appropriate government authorities is required where Renminbi is to be converted into foreign currency and remitted out of mainland China to pay capital expenses, such as the repayment of loans denominated in foreign currencies. As a result, our mainland China subsidiaries are required to obtain approval from the State Administration of Foreign Exchange, or SAFE, or complete certain registration process in order to use cash generated from their operations to pay off their respective debt in a currency other than Renminbi owed to entities outside mainland China, or to make other capital expenditure payments outside mainland China in a currency other than Renminbi.

Shareholder loans and capital contributions. Loans by us to our mainland China subsidiaries to finance their operations shall not exceed certain statutory limits and must be registered with the local counterpart of SAFE, and any capital contribution from us to our mainland China subsidiaries is required to be registered with the competent government authorities in mainland China.

Financial Information Relating to the Former VIEs

In December 2019, ECARX (Wuhan) Technology Co., Ltd., or the WFOE, was established in China as a wholly owned subsidiary of ECARX Holdings. ECARX Holdings, through the WFOE, is the primary beneficiary of the former VIEs. Since early 2022, ECARX Holdings has implemented the Restructuring. In association with the Restructuring, in April 2022 ECARX Holdings, Hubei ECARX and shareholders of Hubei ECARX entered into a VIE Termination Agreement, pursuant to which, the VIE Agreements were terminated with immediate effect.

9

Selected Condensed Consolidating Statements of Comprehensive Income/Loss Information

The following tables present our condensed consolidating schedule depicting the consolidated statements of comprehensive loss for the fiscal years ended December 31, 2021 and 2022.

| Year Ended December 31, 2022 | |||||||||||||||||||||||||||||||||||

| (RMB in thousands) | |||||||||||||||||||||||||||||||||||

| ECARX Holdings | WFOE | Former VIEs | Other Subsidiaries | Elimination adjustments | Consolidated | ||||||||||||||||||||||||||||||

| Revenues | — | — | 936,520 | 2,927,944 | (302,470) | (1) | 3,561,994 | ||||||||||||||||||||||||||||

| Cost of revenues | — | — | (680,699) | (2,189,886) | 302,470 | (1) | (2,568,115) | ||||||||||||||||||||||||||||

| Gross profit | — | — | 255,821 | 738,058 | — | 993,879 | |||||||||||||||||||||||||||||

| Operating expenses | (26,005) | (299) | (253,107) | (2,440,297) | 97,608 | (5) | (2,622,100) | ||||||||||||||||||||||||||||

| Loss from operation | (26,005) | (299) | 2,714 | (1,702,239) | 97,608 | (1,628,221) | |||||||||||||||||||||||||||||

| Interest income | 6,565 | 7,741 | 1,448 | 7,255 | (9,189) | (3) | 13,820 | ||||||||||||||||||||||||||||

| Interest expense | (3,132) | — | (17,370) | (33,230) | 9,189 | (3) | (44,543) | ||||||||||||||||||||||||||||

| Share of loss of subsidiaries and former VIEs | (1,511,004) | — | — | — | 1,511,004 | (4) | — | ||||||||||||||||||||||||||||

| Income (loss) from equity method investments | — | — | (86,588) | 14,660 | — | (71,928) | |||||||||||||||||||||||||||||

| Gain/(Loss) on the Restructuring | — | (1,337,832) | 1,639,979 | (302,147) | — | — | |||||||||||||||||||||||||||||

| Gains on intellectual property transfers | — | — | 1,171,300 | — | (1,171,300) | (5) | — | ||||||||||||||||||||||||||||

| Other non-operating (expenses) income, net | (31,302) | (5,178) | 81,818 | 107,453 | — | 152,791 | |||||||||||||||||||||||||||||

| Loss before income taxes | (1,564,878) | (1,335,568) | 2,793,301 | (1,908,248) | 437,312 | (1,578,081) | |||||||||||||||||||||||||||||

| Income tax expenses | — | (19,263) | — | (9,802) | — | (29,065) | |||||||||||||||||||||||||||||

| Net loss | (1,564,878) | (1,354,831) | 2,793,301 | (1,918,050) | 437,312 | (1,607,146) | |||||||||||||||||||||||||||||

| Foreign currency translation adjustments, net of nil income taxes | (391,934) | — | — | (96,181) | 96,181 | (4) | (391,934) | ||||||||||||||||||||||||||||

| Comprehensive loss | (1,956,812) | (1,354,831) | 2,793,301 | (2,014,231) | 533,493 | (1,999,080) | |||||||||||||||||||||||||||||

10

| Year Ended December 31, 2021 | |||||||||||||||||||||||||||||||||||

| (RMB in thousands) | |||||||||||||||||||||||||||||||||||

| ECARX Holdings | WFOE | Former VIEs | Other Subsidiaries | Elimination adjustments | Consolidated | ||||||||||||||||||||||||||||||

| Revenues | — | — | 2,755,780 | 120,224 | (96,941) | (1)(2) | 2,779,063 | ||||||||||||||||||||||||||||

| Cost of revenues | — | (400) | (1,938,222) | (56,841) | 33,463 | (1) | (1,962,000) | ||||||||||||||||||||||||||||

| Gross profit | — | (400) | 817,558 | 63,383 | (63,478) | 817,063 | |||||||||||||||||||||||||||||

| Operating expenses | (17,660) | (1) | (1,726,430) | (136,628) | 63,478 | (2) | (1,817,241) | ||||||||||||||||||||||||||||

| Loss from operation | (17,660) | (401) | (908,872) | (73,245) | — | (1,000,178) | |||||||||||||||||||||||||||||

| Interest income | 885 | 20 | 11,696 | 2,020 | (966) | (3) | 13,655 | ||||||||||||||||||||||||||||

| Interest expense | (514) | — | (131,152) | (885) | 966 | (3) | (131,585) | ||||||||||||||||||||||||||||

| Share of loss of subsidiaries and former VIEs | (1,170,450) | — | — | — | 1,170,450 | (4) | — | ||||||||||||||||||||||||||||

| Income (loss) from equity method investments | — | — | 14,433 | (16,952) | (1,372) | (6) | (3,891) | ||||||||||||||||||||||||||||

| Other non-operating (expenses) income, net | 12,478 | — | (89,641) | 29,265 | — | (47,898) | |||||||||||||||||||||||||||||

| Loss before income taxes | (1,175,261) | (381) | (1,103,536) | (59,797) | 1,169,078 | (1,169,897) | |||||||||||||||||||||||||||||

| Income tax expenses | — | — | (3,329) | (3,532) | — | (6,861) | |||||||||||||||||||||||||||||

| Net loss | (1,175,261) | (381) | (1,106,865) | (63,329) | 1,169,078 | (1,176,758) | |||||||||||||||||||||||||||||

| Foreign currency translation adjustments, net of nil income taxes | 4,551 | — | — | (20,310) | 20,310 | (4) | 4,551 | ||||||||||||||||||||||||||||

| Comprehensive loss | (1,170,710) | (381) | (1,106,865) | (83,639) | 1,189,388 | (1,172,207) | |||||||||||||||||||||||||||||

___________________________

(1)To eliminate the inter-company sales of goods transactions between subsidiaries of ECARX Holdings and the former VIEs.

(2)To eliminate the inter-company sales of services transactions between subsidiaries of ECARX Holdings and the former VIEs.

(3)To eliminate the interest income and interest expense recognized in ECARX Holdings and subsidiaries of ECARX Holdings respectively for the loans that ECARX Holdings has provided to its subsidiaries and for the loans that a subsidiary of ECARX Holdings has provided to the former VIEs.

(4)To reflect the elimination on share of comprehensive loss that ECARX Holdings picked up from its subsidiaries and former VIEs.

(5)To eliminate the gains, related intangible assets and amortization expenses relating to the inter-company transfer of intellectual properties from Hubei ECARX to ECARX (Hubei) Tech.

(6)To reflect the reversal of income (loss) from equity method investments that the former VIEs picked up from JICA Intelligent.

Selected Condensed Consolidating Balance Sheets Information

The following tables present our condensed consolidating schedule depicting the consolidated balance sheets as of December 31, 2022. As a result of the Restructuring, ECARX Holdings did not consolidate Hubei ECARX as of December 31, 2022.

11

| As of December 31, 2022 | |||||||||||||||||||||||||||||||||||

| (RMB in thousands) | |||||||||||||||||||||||||||||||||||

| ECARX Holdings | WFOE | Former VIEs | Other Subsidiaries | Elimination adjustments | Consolidated | ||||||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||||||||

| Current assets | |||||||||||||||||||||||||||||||||||

| Cash | 119,022 | 330 | — | 741,120 | — | 860,472 | |||||||||||||||||||||||||||||

| Restricted cash | — | — | — | 40,957 | — | 40,957 | |||||||||||||||||||||||||||||

| Accounts receivable - related parties, net | — | — | — | 835,320 | — | 835,320 | |||||||||||||||||||||||||||||

| Amounts due from related parties | 4,168,615 | 520 | — | 932,117 | (4,189,523) | (1)(2) | 911,729 | ||||||||||||||||||||||||||||

| Other current assets | 35 | 125 | — | 1,204,695 | — | 1,204,855 | |||||||||||||||||||||||||||||

| Total current assets | 4,287,672 | 975 | — | 3,754,209 | (4,189,523) | 3,853,333 | |||||||||||||||||||||||||||||

| Non-current assets | |||||||||||||||||||||||||||||||||||

| Investment in WFOE | — | — | — | 1,724,298 | (1,724,298) | (4) | — | ||||||||||||||||||||||||||||

| Long-term investments | 69,319 | — | — | 284,536 | — | 353,855 | |||||||||||||||||||||||||||||

| Intangible assets, net | — | — | — | 1,118,553 | (1,073,692) | (5) | 44,861 | ||||||||||||||||||||||||||||

| Other non-current assets | — | 213,695 | — | 265,288 | — | 478,983 | |||||||||||||||||||||||||||||

| Total non-current assets | 69,319 | 213,695 | — | 3,392,675 | (2,797,990) | 877,699 | |||||||||||||||||||||||||||||

| Total assets | 4,356,991 | 214,670 | — | 7,146,884 | (6,987,513) | 4,731,032 | |||||||||||||||||||||||||||||

| LIABILITIES | |||||||||||||||||||||||||||||||||||

| Current liabilities | |||||||||||||||||||||||||||||||||||

| Share of losses in excess of investments in subsidiaries and former VIEs | 3,948,086 | — | — | — | (3,948,086) | (3) | — | ||||||||||||||||||||||||||||

| Accounts payable - related parties | — | — | — | 241,773 | — | 241,773 | |||||||||||||||||||||||||||||

| Amounts due to related parties | 18,925 | 1,446 | — | 4,211,995 | (4,189,523) | (1)(2) | 42,843 | ||||||||||||||||||||||||||||

| Other current liabilities | 146,507 | 24,664 | — | 3,471,654 | — | 3,642,825 | |||||||||||||||||||||||||||||

| Total current liabilities | 4,113,518 | 26,110 | — | 7,925,422 | (8,137,609) | 3,927,441 | |||||||||||||||||||||||||||||

| Non-current liabilities | |||||||||||||||||||||||||||||||||||

| Total non-current liabilities | 439,869 | — | — | 398,178 | — | 838,047 | |||||||||||||||||||||||||||||

| Total liabilities | 4,553,387 | 26,110 | — | 8,323,600 | (8,137,609) | 4,765,488 | |||||||||||||||||||||||||||||

| MEZZANINE EQUITY | — | — | — | — | — | — | |||||||||||||||||||||||||||||

| SHAREHOLDERS’ DEFICIT | |||||||||||||||||||||||||||||||||||

| Ordinary Shares | — | 1,600,105 | — | — | (1,600,105) | (3)(4) | — | ||||||||||||||||||||||||||||

| Class A Ordinary Shares | 9 | — | — | — | — | 9 | |||||||||||||||||||||||||||||

| Class B Ordinary Shares | 1 | — | — | — | — | 1 | |||||||||||||||||||||||||||||

| Additional paid-in capital | 5,919,660 | — | — | 916,555 | (916,555) | (3) | 5,919,660 | ||||||||||||||||||||||||||||

| Accumulated deficit | (5,730,180) | (1,411,545) | — | (2,138,709) | 3,550,254 | (3) | (5,730,180) | ||||||||||||||||||||||||||||

| Accumulated other comprehensive income / (loss) | (385,886) | — | — | (116,502) | 116,502 | (3)(4) | (385,886) | ||||||||||||||||||||||||||||

Non-redeemable non-controlling interests | — | — | — | 161,940 | — | 161,940 | |||||||||||||||||||||||||||||

| Total shareholders’ deficit | (196,396) | 188,560 | — | (1,176,716) | 1,150,096 | (34,456) | |||||||||||||||||||||||||||||

| Total liabilities, mezzanine equity and shareholders’ deficit | 4,356,991 | 214,670 | — | 7,146,884 | (6,987,513) | 4,731,032 | |||||||||||||||||||||||||||||

12

___________________________

(1)To eliminate the balances resulted from related party transactions between subsidiaries of ECARX Holdings as of December 31, 2022.

(2)To eliminate the amounts related to the loans provided by ECARX Holdings to its subsidiaries as of December 31, 2022.

(3)To eliminate ECARX Holdings’ equity pick-up from consolidated entities under respective equity accounts with corresponding long-term investment balances.

(4)To eliminate the ordinary shares of WFOE and the investment made by ECARX Technology Limited to WFOE upon consolidation.

(5)To eliminate the gains, related intangible assets and amortization expenses relating to the inter-company transfer of intellectual properties from Hubei ECARX to ECARX (Hubei) Tech.

(6)To eliminate the accumulated equity pick-up of equity method investments that represented our equity interest in JICA Intelligent.

Selected Condensed Consolidating Cash Flows Information

The following tables present our condensed consolidating schedule depicting the consolidated cash flows for the fiscal years ended December 31, 2021 and 2022 of ECARX Holdings, the WFOE, the former VIEs, other subsidiaries, and corresponding eliminating adjustments separately.

| Year Ended December 31, 2022 | |||||||||||||||||||||||||||||||||||

| (RMB in thousands) | |||||||||||||||||||||||||||||||||||

| ECARX Holdings | WFOE | Former VIEs | Other Subsidiaries | Elimination adjustments | Consolidated | ||||||||||||||||||||||||||||||

| Operating activities: | |||||||||||||||||||||||||||||||||||

| Net cash generated from / (used in) operating activities | (22,893) | 324 | 224,031 | (662,799) | — | (461,337) | |||||||||||||||||||||||||||||

| Investing activities: | |||||||||||||||||||||||||||||||||||

| Purchase of property, equipment and intangible assets | — | — | (36,074) | (121,212) | — | (157,286) | |||||||||||||||||||||||||||||

| Proceeds from disposal of property, equipment and intangible assets | — | — | — | 1,732 | — | 1,732 | |||||||||||||||||||||||||||||

| Cash paid for acquisition of equity investments | (67,790) | — | — | (11,652) | — | (79,442) | |||||||||||||||||||||||||||||

| Cash disposed in deconsolidation of Suzhou Photon-Matrix | — | — | (22,643) | — | — | (22,643) | |||||||||||||||||||||||||||||

| Proceeds from (cash paid for) transfer of long-term investments in the Restructuring | — | — | 234,949 | (234,949) | — | — | |||||||||||||||||||||||||||||

| Cash received on deconsolidation of Hubei Dongjun | — | — | 1,000 | — | — | 1,000 | |||||||||||||||||||||||||||||

| Financial support to an equity method investee | — | — | (28,500) | — | — | (28,500) | |||||||||||||||||||||||||||||

| Loans to related parties | (251,470) | — | (8,060) | (406,200) | 608,470 | (1)(3)(5) | (57,260) | ||||||||||||||||||||||||||||

| Repayment received of loans to related parties | 61,803 | — | 25,000 | 324,360 | (381,803) | (1)(5) | 29,360 | ||||||||||||||||||||||||||||

| Advances to related parties | (476,842) | — | — | — | 476,842 | (2) | — | ||||||||||||||||||||||||||||

| Net cash (used in) / provided by investing activities | (734,299) | — | 165,672 | (447,921) | 703,509 | (313,039) | |||||||||||||||||||||||||||||

13

| Financing activities: | |||||||||||||||||||||||||||||||||||

| Proceeds from issuance of Series B Convertible Redeemable Preferred Shares | 159,485 | — | — | — | — | 159,485 | |||||||||||||||||||||||||||||

| Cash contributed by redeemable non-controlling shareholders | — | — | 10,000 | — | — | 10,000 | |||||||||||||||||||||||||||||

| Proceeds from short-term borrowings | — | — | 400,000 | 870,000 | — | 1,270,000 | |||||||||||||||||||||||||||||

| Repayment for short-term borrowings | — | — | (1,332,000) | — | — | (1,332,000) | |||||||||||||||||||||||||||||

| Borrowings from related parties | — | — | 157,000 | 1,151,470 | (608,470) | (1)(3)(5) | 700,000 | ||||||||||||||||||||||||||||

| Repayment of borrowings from related parties | — | — | (270,000) | (811,803) | 381,803 | (1)(5) | (700,000) | ||||||||||||||||||||||||||||

| Proceeds from advances from related parties | — | — | — | 476,842 | (476,842) | (2) | — | ||||||||||||||||||||||||||||

| Cash disposed in the Restructuring | — | — | (20,000) | — | — | (20,000) | |||||||||||||||||||||||||||||

| Proceeds from issuance of convertible notes | 527,281 | — | — | — | — | 527,281 | |||||||||||||||||||||||||||||

| Payment for issuance costs of convertible notes | (2,938) | — | — | — | — | (2,938) | |||||||||||||||||||||||||||||

| Cash proceeds from COVA | 43,724 | — | — | — | — | 43,724 | |||||||||||||||||||||||||||||

| Cash proceeds from Geely strategic investment | 139,200 | — | — | — | — | 139,200 | |||||||||||||||||||||||||||||

| Cash paid for costs of the Merger | (136,985) | — | — | — | — | (136,985) | |||||||||||||||||||||||||||||

| Net cash provided by / (used in) financing activities | 729,767 | — | (1,055,000) | 1,686,509 | (703,509) | 657,767 | |||||||||||||||||||||||||||||

| Effect of foreign currency exchange rate changes on cash and restricted cash | (12,308) | — | — | 41,214 | — | 28,906 | |||||||||||||||||||||||||||||

| Net increase (decrease) in cash and restricted cash | (39,733) | 324 | (665,297) | 617,003 | — | (87,703) | |||||||||||||||||||||||||||||

| Cash and restricted cash at the beginning of the year | 158,755 | 6 | 665,297 | 165,074 | — | 989,132 | |||||||||||||||||||||||||||||

| Cash and restricted cash at the end of the year | 119,022 | 330 | — | 782,077 | — | 901,429 | |||||||||||||||||||||||||||||

14

| Year Ended December 31, 2021 | |||||||||||||||||||||||||||||||||||

| ECARX Holdings | WFOE | Former VIEs | Other Subsidiaries | Elimination adjustments | Consolidated | ||||||||||||||||||||||||||||||

| Operating activities: | |||||||||||||||||||||||||||||||||||

| Net cash generated from/(used in) operating activities | (22,741) | 20 | (817,989) | (66,573) | — | (907,283) | |||||||||||||||||||||||||||||

| Investing activities: | |||||||||||||||||||||||||||||||||||

| Purchase of property, equipment and intangible assets | — | — | (69,419) | (16,317) | — | (85,736) | |||||||||||||||||||||||||||||

| Cash contribution to subsidiaries | — | (10,000) | — | (1,600,105) | 1,610,105 | (4) | — | ||||||||||||||||||||||||||||

| Acquisition of long-term investments | — | — | (400,000) | (945,637) | 200,000 | (6) | (1,145,637) | ||||||||||||||||||||||||||||

| Cash surrendered from deconsolidation of a subsidiary | — | — | (8,360) | — | — | (8,360) | |||||||||||||||||||||||||||||

| Loans to related parties | (70,365) | (1,590,119) | (28,850) | (747,149) | 2,407,633 | (1)(3)(5) | (28,850) | ||||||||||||||||||||||||||||

| Advances to related parties | (3,050,956) | — | (19,806) | — | 3,050,956 | (2) | (19,806) | ||||||||||||||||||||||||||||

| Proceeds from collection of advances to a related party | — | — | 90,155 | — | — | 90,155 | |||||||||||||||||||||||||||||

| Net cash used in investing activities | (3,121,321) | (1,600,119) | (436,280) | (3,309,208) | 7,268,694 | (1,198,234) | |||||||||||||||||||||||||||||

| Financing activities: | |||||||||||||||||||||||||||||||||||

| Proceeds from issuance of Convertible Redeemable Preferred Shares | 3,222,206 | — | — | — | — | 3,222,206 | |||||||||||||||||||||||||||||

| Refundable deposits in connection with the issuance of Convertible Redeemable Preferred Shares | — | — | 461,849 | — | — | 461,849 | |||||||||||||||||||||||||||||

| Repayment of refundable deposits in connection with the issuance of Convertible Redeemable Preferred Shares | — | — | (1,493,953) | — | — | (1,493,953) | |||||||||||||||||||||||||||||

| Payment for issuance cost of Convertible Redeemable Preferred Shares | — | — | — | (10,000) | — | (10,000) | |||||||||||||||||||||||||||||

| Cash contributed by the respective parent companies | — | 1,600,105 | — | 210,000 | (1,810,105) | (4)(6) | — | ||||||||||||||||||||||||||||

| Cash contributed by non-controlling shareholders | — | — | 32,000 | 200,000 | — | 232,000 | |||||||||||||||||||||||||||||

| Proceeds from short-term borrowings | — | — | 947,000 | — | — | 947,000 | |||||||||||||||||||||||||||||

| Repayment for short-term borrowings | — | — | (91,000) | — | — | (91,000) | |||||||||||||||||||||||||||||

| Borrowings from related parties | 45,152 | — | 2,337,268 | 70,365 | (2,407,633) | (1)(3)(5) | 45,152 | ||||||||||||||||||||||||||||

| Repayment of borrowings from related parties | (45,152) | — | (20,000) | — | — | (65,152) | |||||||||||||||||||||||||||||

| Proceeds from advances from related parties | — | — | — | 3,050,956 | (3,050,956) | (2) | — | ||||||||||||||||||||||||||||

| Repayment of long-term debt | — | — | (1,125,310) | — | — | (1,125,310) | |||||||||||||||||||||||||||||

| Net cash provided by financing activities | 3,222,206 | 1,600,105 | 1,047,854 | 3,521,321 | (7,268,694) | 2,122,792 | |||||||||||||||||||||||||||||

| Effect of foreign currency exchange rate changes on cash and restricted cash | (17,660) | — | — | (14,359) | — | (32,019) | |||||||||||||||||||||||||||||

| Net increase (decrease) in cash and restricted cash | 60,484 | 6 | (206,415) | 131,181 | — | (14,744) | |||||||||||||||||||||||||||||

| Cash and restricted cash at the beginning of the year | 98,271 | — | 871,712 | 33,893 | — | 1,003,876 | |||||||||||||||||||||||||||||

| Cash and restricted cash at the end of the year | 158,755 | 6 | 665,297 | 165,074 | — | 989,132 | |||||||||||||||||||||||||||||

15

___________________________

(1)For the year ended December 31, 2021, ECARX Holdings provided loans in the amount of US$11.0 million (equivalent to RMB70.4 million) to its two subsidiaries, ECARX Sweden AB and ECARX Limited. For the year ended December 31, 2022, ECARX Holdings provided loans in the amount of US$3.0 million (equivalent to RMB19.2 million) to ECARX Sweden AB, and US$35.0 million (equivalent to RMB232.3 million) to ECARX (Hubei) Tech Co., Ltd.. For the year ended December 31, 2022, ECARX Sweden AB repaid loans in the amount of US$8.8 million (equivalent to RMB61.8 million) to ECARX Holdings. These transactions were eliminated as inter-company transactions upon preparation of the consolidated information.

(2)For the year ended December 31, 2021, ECARX Holdings paid advances of US$478.5 million (equivalent to RMB3,051.0 million) to its subsidiary, ECARX Technology Limited. For the year ended December 31, 2022, ECARX Holdings paid advances of US$50.9 million (equivalent to RMB337.4 million) to ECARX Technology Limited, and US$21.0 million (equivalent to RMB139.4 million) to ECARX Group Limited. These transactions were eliminated as inter-company transactions upon preparation of the consolidated information.

(3)For the year ended December 31, 2021, the WFOE and ECARX (Hubei) Tech respectively provided loans in the amount of RMB1,590.1 million and RMB477.1 million to the former VIEs. For the year ended December 31, 2022, ECARX (Hubei) Tech provided loans in the amount of RMB157.0 million to the former VIEs. These transactions were eliminated as inter-company transactions upon preparation of the consolidated information.

(4)For the year ended December 31, 2021, ECARX Technology Limited made capital contribution of RMB1,600.1 million to WFOE, and the WFOE made capital contribution of RMB10.0 million to ECARX (Shanghai) Technology Co., Ltd. The cash transfer among the subsidiaries were eliminated upon consolidation.

(5)For the year ended December 31, 2021, JICA Intelligent provided loans in the amount of RMB270 million to the former VIEs, which were fully repaid in 2022. For the year ended December 31, 2022, JICA Intelligent provided loans in the amount of RMB200 million to ECARX (Hubei) Tech. ECARX (Hubei) Tech repaid RMB50 million in September 2022. These transactions were eliminated as inter-company transactions upon preparation of the consolidated information.

(6)For the year ended December 31, 2021, the former VIEs contributed RMB200,000 in cash to JICA Intelligent, and it was eliminated as inter-company transactions upon preparation of the consolidated information.

A.[Reserved]

B.Capitalization and Indebtedness

Not applicable.

C.Reasons for the Offer and Use of Proceeds

Not applicable.

D.Risk Factors

Summary of Risk Factors

Risks Relating to Our Business and Industry

•We have a relatively limited operating history and face significant challenges in a fast-developing industry;

•If our solutions do not effectively address the evolution of the automotive industry or automotive intelligence technologies, our business could be adversely affected;

•Changes in automobile sales and market demand can adversely affect our business;

•Disruptions in the supply of components or the underlying raw materials used in our products may materially and adversely affect our business and profitability;

•A reduction in the market share or changes in the product mix offered by our customers could materially and adversely affect our business, financial condition, and results of operations;

•The automotive intelligence industry is highly competitive, and we may not be successful in competing in this industry;

•We had negative net cash flows from operations in the past and have not been profitable, which may continue in the future;

•We currently have a concentrated customer base with a limited number of key customers, particularly including certain of our related parties such as Geely Holding’s subsidiaries. The loss of one or more of our

16

key customers, or a failure to renew our agreements with one or more of our key customers, could adversely affect our results of operations and ability to market our products and services;

•We are subject to risks and uncertainties associated with international operations, which may harm our business;

•Our automotive intelligence technologies and related hardware and software could have defects, errors, or bugs, undetected or otherwise, which could create safety issues, reduce market adoption, damage our reputation with current or prospective customers, or expose us to product liability and other claims that could materially and adversely affect our business, financial condition, and results of operations;

•We rely on our business partners and other industry participants. Business collaboration with partners is subject to risks, and these relationships may not lead to significant revenue. Any adverse change in our cooperation with our business partners could harm our business;

•Our business plans require a significant amount of capital. In addition, our future capital needs may require us to sell additional equity or debt securities that may dilute our shareholders or introduce covenants that may restrict our operations or our ability to pay dividends;

•A severe or prolonged downturn in the Chinese or global economy could materially and adversely affect our business and financial condition;

•We are subject to risks relating to the Restructuring;

•We may not be able to realize the potential financial or strategic benefits of business ventures, acquisitions or strategic investments and we may not be able to successfully integrate acquisition targets, which could impact our ability to grow our business, develop new products or sell our products;

•We may incur material losses and costs as a result of warranty claims, product recalls, and product liabilities that may be brought against us; and

•Our business is subject to complex and evolving laws and regulations regarding cybersecurity, privacy, data protection and information security in China and elsewhere. Any privacy or data security breach or any failure to comply with these laws and regulations could damage our reputation and brand, result in negative publicity, legal proceedings, increased cost of operations, warnings, fines, service or business suspension, or otherwise harm our business and results of operations.

Risks Relating to Doing Business in China

•The PRC government has significant oversight and discretion over our business operations, and it may influence on our operations as part of its efforts to enforce PRC law, which could result in a material adverse change in our operations and the value of our securities;

•Risks and uncertainties regarding interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us, hinder our ability and the ability of any holder of our securities to offer or continue to offer such securities, result in a material adverse change to our business operations, and damage our reputation, which would materially and adversely affect our financial condition and results of operations and cause our securities to significantly decline in value or become worthless;

•The approval of and filing with the CSRC or other PRC government authorities may be required in connection with our offerings under PRC law, and, if so required, we cannot predict whether or when we will be able to obtain such approval or complete such filing, and even if we obtain such approval, it could be rescinded. Any failure to or delay in obtaining such approval or complying with such filing requirements in relation to our offerings, or a rescission of such approval, could subject us to sanctions imposed by the CSRC or other PRC government authorities;

•The PCAOB had historically been unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections of our auditor in the past has deprived our investors with the benefits of such inspections;

•Our securities may be prohibited from trading in the United States under the HFCAA in the future if the PCAOB is unable to inspect or investigate completely auditors located in mainland China and Hong Kong. The delisting of our securities, or the threat of their being delisted, may materially and adversely affect the value of your investment;

•Additional disclosure requirements to be adopted by and regulatory scrutiny from the SEC in response to risks related to companies with substantial operations in China, which could increase our compliance costs, subject us to additional disclosure requirements, and/or suspend or terminate our future securities offerings, making capital-raising more difficult;

17

•The M&A Rules and certain other PRC regulations establish complex procedures for certain acquisitions of mainland China companies, which could make it more difficult for us to pursue growth through acquisitions in China; and

•Substantial uncertainties exist with respect to the interpretation and implementation of 2019 PRC Foreign Investment Law and its Implementation Rules.

Risks Relating to Our Securities

•The price of our securities may be volatile, and the value of our securities may decline;

•A market for our securities may not develop or be sustained, which would adversely affect the liquidity and price of our securities;

•If we do not meet the expectations of equity research analysts, if they do not publish research reports about our business or if they issue unfavorable commentary or downgrade our securities, the price of our securities could decline;

•Sales of a substantial number of our securities in the public market could cause the price of our securities to fall; and

•Future issuance of Ordinary Shares will result in additional dilution of the percentage ownership of our shareholders and could cause our share price to fall.

Risks Relating to Our Business and Industry

We have a relatively limited operating history and face significant challenges in a fast-developing industry.

We commenced operations in 2017. As we have a relatively limited operating history, it is difficult to predict our future revenues and appropriately budget for our expenses, and we may have limited insight into trends that may emerge and affect our business. You should consider our business and prospects in light of the risks and challenges that we face as a new entrant into a fast-developing industry, including with respect to our ability to:

•advance our technologies;

•design and deliver intelligent, reliable, and quality solutions that appeal to customers;

•establish, expand, and diversify our customer base;

•build a well-recognized and respected brand cost-effectively;

•market our products and services;

•optimize our pricing strategy;

•maintain a reliable, secure, high-performance, and scalable technology infrastructure;

•enhance our cybersecurity and data security;

•attract, retain, and motivate talented employees;

•improve and maintain our operating efficiency;

•compete in our industries;

•navigate an evolving and complex regulatory environment; and

•manage supply chain effectively; and manage our growth effectively.

If we fail to address any or all of these risks and challenges, our business, financial condition, and results of operations could be materially and adversely affected.

If our solutions do not effectively address the evolution of the automotive industry or automotive intelligence technologies, our business could be adversely affected.

The automotive industry and automotive intelligence technologies are rapidly evolving. Our business and prospects will depend on our ability to identify consumer needs, and to develop, introduce, and achieve market acceptance of our new and enhanced products in a cost-effective manner. We cannot assure you that our products and services will be or will continue to be accepted by the market.

We have invested and will continue to invest significantly in research and development and we are in the process of developing a myriad of automotive computing platform, SoC core module, and software solution and products. Our investment in research and development may not result in marketable products or services or may result in products and

18

services that generate less market acceptance and revenues than we anticipate. Although we believe that our technologies and products are promising, we cannot assure you that we can achieve our development goals and successfully commercialize all of these automotive intelligence technologies. In addition, we cannot assure you that, once commercialized, these technologies can stand the test of time.

We believe that the confidence and trust of our customers are essential in the success of our automotive intelligence technologies. Customers will be less likely to purchase our products if they are not convinced of the technical or functional superiority of our technologies. Any defects in or significant malfunctioning of our automotive intelligence products and services, or any negative perceptions of such, with or without any grounds, may weaken such confidence and trust in us, which may materially and adversely affect our reputation, financial condition, and results of operations. Similarly, suppliers and other third parties will be less likely to invest time and resources in developing business relationships with us if they are not convinced that our business or our technologies will succeed.

Changes in automobile sales and market demand can adversely affect our business.

Our business is directly related to automobile sales and production by automotive OEMs. Automobile sales and production could sometimes be highly cyclical and, in addition to general economic conditions, also depend on other factors such as consumer confidence and preferences. Lower automobile sales would be expected to result in substantially all of our automotive OEM customers lowering vehicle production schedules, which has a direct impact on our earnings and cash flows. In addition, automobile sales and production can be affected by labor relations issues, regulatory requirements, trade agreements, the availability of consumer financing, and other factors. Economic declines that result in a significant reduction in automobile sales and production by automotive OEMs could materially and adversely affect our business, financial condition, and results of operations.

The demand for our products and services is also dependent on consumers’ demand for and adoption of intelligent vehicles, in general. The market for intelligent vehicles is still rapidly evolving, characterized by rapidly changing technologies, intense competition, evolving government regulation and industry standards, and changing consumer demands and behaviors. If the market for intelligent vehicles does not develop as we expect or develops more slowly than we expect, our business, financial condition, results of operations, and prospects will be affected.

In addition, there has also been a change in consumer preferences favoring mobility on demand services, such as car- and ride-sharing, as opposed to automobile ownership, which may result in a long-term reduction in the number of vehicles per capita.

Disruptions in the supply of components or the underlying raw materials used in our products may materially and adversely affect our business and profitability.

Our hardware products are comprised of electronic and mechanical components sourced from various third-party suppliers. A significant disruption in the supply of these components or the underlying raw materials, such as metals, petroleum-based resins, and chemicals, for any reason could impede production and delivery levels, which could materially increase our operating costs and materially decrease our profit margins.