UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the fiscal year ended

For the transition period from ________ to _________

Commission

file number

(Exact name of registrant as specified in charter)

| (State

or jurisdiction of Incorporation or organization) |

I.R.S.

Employer Identification No. |

| (Address of principal executive offices) | (Zip code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The

|

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐

The

aggregate market value of the voting stock and non-voting common equity held by non-affiliates of the registrant as of the last business

day of the registrant’s most recently completed second fiscal quarter ended June 30, 2023 was $

Number of common shares outstanding as of February 20, 2024 was .

Documents

Incorporated by Reference:

Table of Contents

| 2 |

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements may be identified by such forward-looking terminology as “may,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. Our forward-looking statements are based on a series of expectations, assumptions, estimates and projections about our company, are not guarantees of future results or performance and involve substantial risks and uncertainty. We may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements. Our business and our forward-looking statements involve substantial known and unknown risks and uncertainties, including the risks and uncertainties inherent in our statements regarding:

| ● | our projected financial position and estimated cash burn rate; |

| ● | our estimates regarding expenses, future revenues and capital requirements; |

| ● | our ability to continue as a going concern; |

| ● | our need to raise substantial additional capital to fund our operation; |

| ● | the success, cost and timing of our clinical trials; |

| ● | our dependence on third parties in the conduct of our clinical trials; |

| ● | our ability to obtain the necessary regulatory approvals to market and commercialize our product candidates; |

| ● | the impact of the COVID-19 pandemic, or any other health epidemic, on our business, our clinical trials, our research programs, healthcare systems or the global economy as a whole; |

| ● | the potential that results of pre-clinical and clinical trials indicate our current product candidates or any future product candidates we may seek to develop are unsafe or ineffective; |

| ● | the results of market research conducted by us or others; |

| ● | our ability to obtain and maintain intellectual property protection for our current and future product candidates; |

| ● | our ability to protect our intellectual property rights and the potential for us to incur substantial costs from lawsuits to enforce or protect our intellectual property rights; |

| 3 |

| ● | the possibility that a third party may claim we or our third-party licensors have infringed, misappropriated or otherwise violated their intellectual property rights and that we may incur substantial costs and be required to devote substantial time defending against claims against us; |

| ● | our reliance on third-party suppliers and manufacturers; |

| ● | the success of competing therapies and products that are or become available; |

| ● | our ability to expand our organization to accommodate potential growth and our ability to retain and attract key personnel; |

| ● | the potential for us to incur substantial costs resulting from product liability lawsuits against us and the potential for these product liability lawsuits to cause us to limit our commercialization of our product candidates; |

| ● | market acceptance of our product candidates, the size and growth of the potential markets for our current product candidates and any future product candidates we may seek to develop, and our ability to serve those markets; and |

| ● | the successful development of our commercialization capabilities, including sales and marketing capabilities. |

All of our forward-looking statements are as of the date of this Annual Report on Form 10-K only. In each case, actual results may differ materially from such forward-looking information. We can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence of, or any material adverse change in, one or more of the risk factors or risks and uncertainties referred to in this Annual Report on Form 10-K or included in our other public disclosures or our other periodic reports or other documents or filings filed with or furnished to the U.S. Securities and Exchange Commission (the “SEC”) could materially and adversely affect our business, prospects, financial condition and results of operations. Except as required by law, we do not undertake or plan to update or revise any such forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections or other circumstances affecting such forward-looking statements occurring after the date of this Annual Report on Form 10-K, even if such results, changes or circumstances make it clear that any forward-looking information will not be realized. Any public statements or disclosures by us following this Annual Report on Form 10-K that modify or impact any of the forward-looking statements contained in this Annual Report on Form 10-K will be deemed to modify or supersede such statements in this Annual Report on Form 10-K.

This Annual Report on Form 10-K may include market data and certain industry data and forecasts, which we may obtain from internal company surveys, market research, consultant surveys, publicly available information, reports of governmental agencies and industry publications, articles and surveys. Industry surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. While we believe that such studies and publications are reliable, we have not independently verified market and industry data from third-party sources.

“QUATRAMER” and “QUATRABODY” are pending trademarks of Tharimmune, Inc. in the United States. All other brand names or trademarks appearing in this Annual Report on Form 10-K are the property of their respective holders. Solely for convenience, the trademarks and trade names contained herein may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

| 4 |

RISK FACTOR SUMMARY

Our business is subject to significant risks and uncertainties that make an investment in us speculative and risky. Below we summarize what we believe are the principal risk factors but these risks are not the only ones we face, and you should carefully review and consider the full discussion of our risk factors in the section titled “Risk Factors,” together with the other information in this Annual Report on Form 10-K. If any of the following risks actually occurs (or if any of those listed elsewhere in this Annual Report on Form 10-K occur), our business, reputation, financial condition, results of operations, revenue, and future prospects could be seriously harmed. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business.

Risks Related to Our Financial Position and Need for Additional Capital

| ● | We have a limited operating history, and we have not initiated, conducted or completed any clinical trials, and have no products approved for commercial sale, which may make it difficult for you to evaluate our current business and likelihood of success and viability. |

| ● | We have incurred significant losses since inception, we expect to incur losses in the future and we may not be able to generate sufficient revenue to achieve and maintain profitability. |

| ● | We will require substantial additional capital to finance our operations in the future. If we are unable to raise such capital when needed, or on acceptable terms, we may be forced to curtail, delay or discontinue one or more of development programs or future commercialization efforts. |

| ● | Management has performed an analysis and concluded that there is a substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing on terms acceptable to us, if at all. |

Risks Related to the Discovery and Development of Our Product Candidates

| ● | We are substantially dependent on the success of our product candidates. If we are unable to complete development of, obtain approval for and commercialize our product candidates in a timely manner, our business may be harmed. |

| ● | Any delays in the commencement or completion, or termination or suspension, of our ongoing, planned or future clinical trials could result in increased costs to us, delay or limit our ability to generate revenue and adversely affect our commercial prospects. |

| ● | The outcome of pre-clinical testing and early clinical trials may not be predictive of the success of later clinical trials, and the results of our clinical trials may not satisfy the requirements of the U.S. Food and Drug Administration or other comparable foreign regulatory authorities. |

| ● | If we experience delays or difficulties in enrolling patients in our ongoing or planned clinical trials, our receipt of necessary regulatory approval could be delayed or prevented. |

| ● | We may be required to perform additional or unanticipated clinical trials to obtain approval or be subject to post-marketing testing requirements to maintain regulatory approval. If our candidates prove to be ineffective, unsafe or commercially unviable, our entire technology platform and pipeline would have little, if any, value, which would have a material and adverse effect on our business, financial condition, results of operations and prospects. |

| ● | Adverse side effects or other safety risks associated with our drug candidates could delay or preclude approval, cause us to suspend or discontinue clinical trials or abandon further development, limit the commercial profile of an approved label, or result in significant negative consequences following marketing approval, if any. |

| ● | Our products may never achieve market acceptance. |

| ● | We face significant competition, and if our competitors develop and market technologies or products more rapidly than we do or that are more effective, safer or less expensive than the products we develop, our commercial opportunities will be negatively impacted. |

Risks Related to Our Reliance on Third Parties

| ● | We rely on third parties to manufacture our product candidates and conduct our pre-clinical studies and clinical trials. If these third parties do not successfully perform their contractual and regulatory duties or meet expected deadlines, we may not be able to obtain regulatory approval for or commercialize our drug candidates and our business could be substantially harmed. |

| ● | We currently depend on sole source suppliers and manufacturers for certain ingredients, and the inability to obtain such ingredients as required could harm our business. |

Risks Related to Commercialization of Our Drug Candidates

| ● | Even if we are successful in completing all pre-clinical studies and clinical trials, we may not be successful in commercializing one or more of our drug candidates. |

| ● | The development and commercialization of pharmaceutical products are subject to extensive regulation, and we may not obtain regulatory approvals for our drug candidates on a timely basis, or at all. |

Risks Related to Our Intellectual Property

| ● | Our inability to protect our intellectual property and proprietary rights may have a material adverse effect on our business. |

Risks Related to Managing Our Business and Operations

| ● | We may encounter difficulties in managing our growth, which could adversely affect our operations. |

| ● | Our employees, independent contractors, consultants, commercial partners, collaborators and vendors may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements. |

| ● | Significant disruptions of information technology systems or breaches of data security could adversely affect our business. |

Risks Related to Our Common Stock

| ● | We are currently listed on The Nasdaq Capital Market. If we are unable to maintain listing of our securities on Nasdaq or any stock exchange, our stock price could be adversely affected and the liquidity of our stock and our ability to obtain financing could be impaired and it may be more difficult for our stockholders to sell their securities. |

| ● | We do not intend to pay dividends on our common stock so any returns will be limited to the value of our stock. |

| 5 |

PART I

Throughout this Annual Report on Form 10-K, references to “we,” “our,” “us,” the “Company,” or “Tharimmune,” refer to Tharimmune, Inc., individually, or as the context requires, collectively with its subsidiaries.

ITEM 1. BUSINESS

Overview

Tharimmune is a clinical-stage biotechnology company developing therapeutic candidates in inflammatory and immunologic conditions with high unmet need. On November 3, 2023, we entered into a patent license agreement (the “Avior Patent License Agreement”) with Avior, Inc. d/b/a Avior Bio, LLC (“Avior”) pursuant to which we received an exclusive sublicensable right and license to Licensed Patent Rights and Licensed Technology to, among other things, Develop, have Developed, make, have made, use, sell, import, export and commercialize TH104 and TH103 and to practice the Licensed Technology in connection with the foregoing, throughout the world. See “Recent Developments” below for additional information. In February 2023, the U.S. Food and Drug Administration (“FDA”) approved an investigational new drug (“IND”) application for TH104.

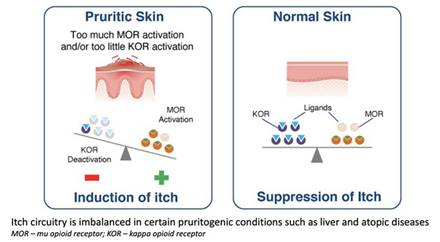

TH104 is a proprietary transmucosal buccal film embedded with the active compound nalmefene onto a thin film which easily adheres inside of the mouth on the cheek and biodegrades within minutes. This provides key features making TH104 an ideal product candidate for multiple liver-related and other pruritogenic inflammatory conditions. The molecule has a dual mechanism of action affecting both the µ-opioid and kappa opioid receptors with emerging data showing inhibition of interleukin-17, a pro-inflammatory cytokine. These well-known opioid receptors when stimulated and/or inhibited by the body’s endogenous ligands have been shown to be involved in the body’s itch circuitry for certain conditions, including cholestatic or dysregulated bile acid-related liver conditions.

According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), part of the National Institutes of Health, primary biliary cholangitis (“PBC”), is a chronic disease where the bile ducts in the liver eventually become dysfunctional and cause the buildup of bile which causes liver damage. The disease, believed to be an autoimmune condition, affects an estimated 58 out of every 100,000 U.S. women and about 15 out of every 100,000 U.S. men. Pruritus is one of the most common symptoms associated with PBC affecting up to 75% of individuals at some point during their disease course. It has a negative impact on health-related quality of life with limited treatment options. Published survey data of PBC respondents suffering from pruritus described their itch as “bugs crawling under the skin”. More than 65% of patients reported that the itch was worse at night, known as nocturnal pruritus, a high unmet need.

We are also developing an early-stage pipeline of novel therapeutic candidates targeting validated high value immune-oncology (“IO”) targets including human epidermal growth factor (“EGF”) receptor 2 (“HER2”), human EGF receptor 3 (“HER3”) and programmed cell death protein (“PD-1”). We are developing antibodies including bispecific antibodies, antibody drug conjugates (“ADCs”) and small molecular weight bovine- derived Picobodies™ or antibody “knob” domains which have the potential to target and bind more tightly to “undruggable” epitopes better than full sized antibodies. We are advancing TH3215, a bispecific against both HER2 and HER3 antibody which targets a novel “bridging epitope” encompassing multiple domains of the HER2 extracellular domain (“ECD”) as well as ligand-dependent and independent blocking of the ECD of HER3 into IND-enabling studies in 2024. In addition, we anticipate that TH0059, a HER2/HER3 bispecific ADC (“bsADC”), and TH1940, a PD-1 Picobody, will progress into IND-enabling studies in 2025.

The EGF subset known as the epidermal growth factor receptor (“ErbB”) family of receptors are a validated set of targets preferentially overexpressed on certain solid tumors which can be clinically exploited for the treatment of drug resistant cancers. The ErbB family is encompassed of four members that belong to the transmembrane tyrosine kinase receptors (“TKR”), including EGFR (“HER1”), HER2, HER3 and HER4. The most well-known member, HER2, encodes a transmembrane TKR which is comprised of three domains: an ECD, a transmembrane domain and an intracellular tyrosine kinase domain. Ligand binding results in heterodimerization or homodimerization between the ErbB receptors leading to excitation of the intracellular tyrosine kinase domain which then activates downstream signaling pathways concerning cellular proliferation, differentiation, migration and apoptosis.

HER2 is an orphan receptor lacking a unique endogenous ligand and preserves an active conformation, making it continuously available to dimerize and preferred as a partner for neighboring member receptors. Juxtaposed to this distinct HER2 characterization, HER3 has several ligands yet it lacks intrinsic tyrosine kinase activity.

| 6 |

Furthermore, HER2-HER3 pairing exhibits a favorable and more potent signaling, suggesting a corresponding action between both receptors.

HER2 is a known oncogene recognized in numerous cancer types and dysregulation of HER2 signaling can be caused by mutation, amplification and overexpression. Numerous cancers exhibit high levels of HER2 compared to normal tissue, specifically tumors of the breast, colorectal, bladder, gastric, esophageal, endometrial, and ovarian cancers, signifying that HER2 may be connected to the progression of these tumors. Additionally, following the discovery of HER2 in breast cancer, antibody drugs targeting HER2 were introduced into the clinic. HERCEPTIN® (trastuzumab), the first monoclonal antibody developed by Genentech/Roche was approved for the treatment of HER2-positive metastatic breast cancer in 1998. Subsequently, tyrosine kinase inhibitors (“TKIs”) and ADCs targeting HER2 have been approved. Another antibody, PERJETA® (pertuzumab) also developed by Genentech/Roche, used in combination with trastuzumab, and docetaxel was approved in 2012, indicated for the treatment of patients with HER2-positive metastatic breast cancer. The FDA subsequently also approved a third biologic from Genentech/Roche in 2013, KADCYLA® (trastuzumab emtansine or T-DM1), for the treatment of patients with HER2-positive metastatic breast cancer in patients previously treated with trastuzumab and a taxane. T-DM1 not only retains the target-selective benefit of trastuzumab, but also kills tumor cells by delivering a potent toxin which inhibits microtubule function and has become a classic example of a targeted ADC treatment. Another ADC, ENHERTU® (trastuzumab deruxtecan), developed by Daiichi Sankyo and AstraZeneca and approved in December 2019 for the treatment of unresectable or metastatic HER2-positive breast cancer has shown anti-tumor activity in HER2-positive cancers that were resistant or insensitive to T-DM1. We believe this development history of multiple approved drugs with different modalities and novel epitopes targeting HER2 has paved a de- risked regulatory pathway as well left significant room for continued innovation in this class of therapies. According to the Fierce Pharma, in 2022, Roche/Genentech had worldwide sales of over $8 billion with respect to their HER2 targeted therapies (Herceptin and Perjeta) as well as more than $500 million in worldwide sales of ENHERTU® in the first half of 2023 alone according to AstraZeneca.

The function of HER3 in tumor biology is multidimensional. Abundant HER3 expression is identified in various solid tumor types, with a proven role in disease progression. Overexpression of HER3 signaling is thought to be involved in resistance to other targeted therapies used for treating several cancers, including anti-EGFR therapies gefitinib and cetuximab. One of the many genomic changes known to be implicated in acquired resistance to anti-EGFR TKIs in patients with EGFR-mutated advanced non-small-cell lung cancer is HER3 up-regulation promulgated by osimertinib. Therefore, blocking HER3/EGFR dimerization complex is thought to prevent or slow down both acquired and primary resistance to EGFR inhibitors. We believe combining anti-HER2 with an anti-HER3 strategy as a bispecific multifunctional agent without a toxin (TH3215) as well as with a toxin (TH0059) could capitalize on some of the findings described in the literature to take advantage of precise tumor-killing through two important targets with different mechanisms of action.

PD-1 is an immunosuppressive checkpoint and seen in macrophages, B lymphocytes, dendritic cells, monocytes, tumor-specific activated T cells, myeloid cells and natural killer cells in circumstances of chronic antigen contact. PD-L1 is one of the PD-1 ligands. PD-L1 expression has been shown to be a valuable biomarker for the prognosis and prediction of the sensitivity of PD-1/PD-L1 inhibitors. The expression of PD-L1 is mainly expressed in tumor cells, tumor-infiltrating cells and antigen-presenting cells in many cancers. Despite the noteworthy efficacy of PD-1/PD-L1 immune checkpoint inhibitors (“ICI”) in the treatment of tumors, some problems remain such as drug resistance and adverse events. Acquired drug resistance may present despite resuming or continuing treatment with anti-PD-1/PD-L1 immunotherapy. The presence of drug resistance significantly reduces the efficacy of anti-PD-1/PD-L1 immunotherapy. We believe exploring the mechanisms of PD-1/PD-L1 ICI resistance may assist with the discovery of new immunotherapeutic strategies to control disease progression and provide a more sustainable survival benefit for patients. As such, we aim to further improve on PD-1 as a breakthrough technology by developing, TH1940, a proprietary PD-1 Picobody with unique binding affinity differently than currently available PD-1 drugs. We believe this unique binding difference allows for novel therapeutic possibilities both as a stand-alone agent and in combination and that our tumor immunotherapy based on PD-1 inhibition may become a future strategy for human cancers.

We have deprioritized our previous preclinical candidate, HSB-1216, due to a strategic reprioritization to focus on therapeutics in high unmet need cancers focused on novel epitopes of certain antitumor drug targets.

| 7 |

Our Portfolio

We currently have an IND-approved transmucosal film product, TH104 in Phase 1 clinical development, two bispecific candidates and a Picobody candidate in pre-clinical development. The following table summarizes our development candidate pipeline:

Our Strategy

Our goal is to become a leading biotechnology company developing novel treatments in inflammatory and immunologic conditions with high unmet needs. Our business strategy comprises the following components:

| 1. | Develop TH104 as a transmucosal buccal film product for the treatment of chronic pruritis in PBC and other inflammatory diseases. | |

| 2. | Continue to advance TH3215 as an anti-HER2/HER3 BspAb for multiple tumor types including high unmet need cancers. | |

| 3. | Effectively create a strategy to develop TH0059 as a bispecific monoclonal ADC specifically targeted to both HER2 and HER3 receptors in high unmet need standard-of-care resistant tumors with a high capacity to metastasize. | |

| 4. | Create a preclinical and clinical path forward for our third product candidate, TH1940, a unique PD-1 Picobody with unique binding differentiation compared to full length antibodies for IO vulnerable tumors. | |

| 5. | Hasten the discovery and development of next generation multi-specific (bi- and tri) antibodies with binding capabilities to novel epitopes of combinations of HER2, HER3, PD-1, PD-L1, TROP2 and other validated targets with and without toxin delivery capacity to multiple high unmet need rare cancers. | |

| 6. | Pursue strategic collaboration opportunities to maximize the value of our pipeline to bring novel therapies to patients suffering from high unmet need conditions. |

TH104 and moderate-to-severe chronic pruritis

According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), part of the National Institutes of Health, PBC, is a chronic disease in where the bile ducts in the liver eventually become dysfunctional and cause the buildup of bile which causes liver damage. The disease, believed to be an autoimmune condition, affects both men and women with a rate higher in women, estimated at 1 out of every 1,000 women over 40. Pruritus is one of the most common conditions associated with PBC affecting up to 75% of individuals at some point during their disease course. It has a negative impact on health-related quality of life with limited treatment options. In an on-line survey focusing on certain features of patients’ itch respondents described their itch as “bugs crawling” as well as more than 65% of participants reporting that the itch was worse at night, known as nocturnal pruritis.

| 8 |

Treatment Ladder for Pruritis in Primary Biliary Cholangitis

Source: Hegade VS, Bolier R, Oude Elferink RPJ, et. al. Frontline Gastroenterology 2016;7:158–166

ENBD, endobiliary nasal drainage; MARS, molecular adsorbent recirculating system; LT, liver transplantation

The current treatment ladder in pruritis for PBC shown above is the paradigm of therapy and if there is no response with one category of drugs, typically patients “move up” the ladder. A patient may need a combination of treatments to achieve and/or maintain symptom remission.

Endogenous opioid peptides are commonly believed to play a role in the modulation of cholestatic itch. In the late 1980s, data documented that nalmefene induced opiate-like withdrawal symptoms in individuals with cholestasis. Following this, research noted heightened levels of Met-enkephalin in the plasma of cholestatic patients. In animal experiments, the activation of μ-opioid receptors by agonists induced scratching behavior, while κ-opioid receptor agonists, on the contrary, reduced the sensation of itch.

Source: Kim BS, Inan S, Ständer S, Sciascia T,Szepietowski JC, Yosipovitch G. Role of kappa-opioid and mu-opioid receptors in pruritus: Peripheral and central itchcircuits. Exp Dermatol. 2022; 31:1900-1907. doi:10.1111/exd.14669

TH104 is a product which has been developed by embedding drug onto a proprietary transmucosal buccal film which adheres to the inside of the mouth. TH104 has key features which we believe make it an ideal product candidate for multiple liver-related and other pruritogenic inflammatory conditions. The active molecule, nalmefene, has a dual mechanism of action by affecting both the µ-opioid receptor and the kappa opioid receptor as well as inhibiting IL-17 inflammatory cytokine expression, a cytokine known to be overexpressed in PBC patient liver tissue and serum.

| 9 |

Sources: Moniaga CS, et. al. Plasma dynorphin A concentration reflects the degree of pruritus in CLD Acta Derm Venereol. 2019 Apr 1;99(4):442-443. doi: 10.2340/00015555-3139; Bergasa N et. al. Oral nalmefene therapy reduces scratching activity due to the pruritis of cholestasis: a controlled study J Am Acad Dermatol 1999;41:431-4

Previous data by Bergasa et. al, reported a study utilizing oral doses of nalmefene ranging from 40 to 240 mg twice-daily for 12 weeks in PBC patients. Eight patients who received at least 1 course of nalmefene were available for comparison with corresponding control data (a course of placebo and/or at baseline). Nalmefene therapy was associated with a 75% reduction in hourly scratching activity (P < .01). The study also achieved a decrease in the mean of a visual analogue score of the perception of pruritus in all 8 patients (mean decrease 77%, P < .01).

When the itch circuitry is imbalanced in diseased conditions, pharmacological intervention can help suppress this phenomenon which occurs in patients suffering from chronic pruritis. Nalmefene crosses into the circulation via a proprietary buccal delivery by adhering the drug-coated film inside the cheek where the film biodegrades in minutes and the drug is absorbed. The buccal delivery of the drug bypasses the liver’s first-pass metabolism thus creating high drug concentrations in the skin, an added benefit for treating conditions in which the liver may be impaired.

TH104 data from multiple phase 1 ex-US trials achieved the primary objective of predictable pharmacokinetic profiling with favorable safety and tolerability. The first human phase 1 trial was a single-dose, single-center, open-label, randomized, 2-way crossover study of TH104 transmucosal buccal film compared to a tablet formulation marketed in Europe and not the United States, with a 14-day washout period involving 12 normal healthy volunteers under fasting conditions. The primary outcome measure was to determine the pharmacokinetics of a buccal dose of TH104, while secondary objectives included establishing the relative bioavailability of TH104 and evaluating its’ tolerability for potential value in clinical efficacy studies. These data were also consistent with the comprehensive pre-clinical data package submitted to the FDA as an IND which was approved in February 2023, including pharmacokinetic profiling in beagle dog studies confirming once-daily dosing, fast or rapid onset and high bioavailability when comparing TH104 to intravenous nalmefene.

| 10 |

In this study, the pharmacokinetic evaluation of TH104 transmucosal film compared to an oral tablet marketed in Europe but not the United States, given as an equal-labelled dose in normal healthy volunteers under fasting conditions, was consistent and similar in comparison with results from the literature. The Cmax and AUC0-∞ of TH104 was observed to be higher than the tablet product because of a possible reduced presystemic metabolism in the lower GI and liver, which is potentially advantageous for patients with an impaired liver. The half-life and Tmax was observed to be similar for both products. There were no deaths, other serious adverse events, or other significant adverse events reported during the entire study with events consistent with the safety profile of the marketed tablet in the literature including mild dizziness, headache and somnolence, nausea and vomiting.

The second phase 1 study was a single-dose, single-center, open-label, parallel group design with 2 treatment groups of 2 different formulations of TH104 with variable pH in sixteen normal healthy volunteers under fasting conditions. The primary outcome measure was to determine the effect of pH in the transmucosal buccal film on drug absorption profile evaluated from serial blood sample collections.

In this study, the evaluation of TH104 transmucosal film given as an equal-labelled dose in 2 different pH formulations delivered buccally to normal healthy volunteers under fasting conditions, had an insignificant effect on the performance of the film as measured by drug concentrations in human plasma. The low impact on pH shows that variations of oral pH due to inter-patient variability in future studies would have a low impact on predictable drug absorption with regards to speed of delivery and drug action once absorbed into the systemic circulation.

There were no new adverse events in these studies with events correlated with the previous phase 1 study and a safety profile consistent with the literature.

We launched a phase 1 pharmacokinetic trial for TH104 in early 2024 and intend to complete the study with a topline readout in 2Q24. The clinical data package is strengthened by the phase 1 clinical trials previously conducted outside of the U.S., which showed reliable bioavailability of the active ingredient in TH104 via transmucosal film technology in healthy volunteers. We intend to provide topline data in 2024 for a phase 1 pharmacokinetic bridging study in the United States designed as a single-dose, single-center, open-label, randomized 2-way crossover study of TH104 transmucosal buccal film and an intravenous dose of drug administered under fasting conditions, with a 7 to 11-day washout period between doses. Sixteen normal healthy volunteers will participate in the study. The primary objective is to evaluate the absolute bioavailability of TH104 as well as assess safety and tolerability of the formulation.

| 11 |

We intend to complete a bridging pharmacokinetic phase 1 trial and a phase 2 proof-of-concept in PBC patients over approximately 12 months after aligning with FDA on trial design. We believe the completed phase 1 data coupled with the ongoing phase 1 pharmacokinetic bridging study in the United States may complement a phase 2a efficacy study to be initiated in 3Q24 in moderate-to-severe chronic pruritis in PBC as we begin engaging regulatory authorities in both the US and European Regulatory Authorities. The phase 2a trial is planned as a multiple ascending dose trial to assess the safety and tolerability of TH104 and will also evaluate the change from baseline in a validated endpoint for itch intensity in pruritis studies. Based on this data package, the Company expects to be able to initiate a registrational trial in 2025 pending an FDA discussion on phase 2 results.

According to the Centers for Disease control and Prevention Summary Health Statistics National Health Survey, more than 4 million patients suffer from liver disease in the U.S. and about 1.7 million suffer from pruritis, where PBC has the highest rate of prevalence. We believe TH104 may also be used for treating chronic pruritogenic conditions associated with cholestatic liver disease as well as other liver related and non-liver related diseases including fatty and alcoholic liver, non-alcoholic liver disease and certain types of hepatitis. Chronic pruritis is significant in liver diseases (40% chronic pruritis; 1.7 million patients affected) as well as chronic kidney diseases (24% chronic pruritis; 1.3 million patients affected), hemodialysis as well as atopic dermatitis (40% pruritis; 2.7 million patients affected).

Furthermore, we expect TH104 to be manufactured with a high speed of manufacturing with several features including very high content uniformity, prepared using scalable manufacturing methods and appropriate cost-of-goods. We intend to be able to create a highly reproducible product using a small manufacturing footprint with few contract drug manufacturing organizations in the marketplace which may allow limited entrants.

Background on Antibodies

Full-length human antibodies play a crucial role in drug development as therapeutic agents. Antibodies are large Y-shaped proteins produced by the immune system to identify and neutralize extraneous elements such as bacteria, viruses, and additional pathogens. Their capability to target particular molecules with high specificity and affinity are valuable tools in pharmaceutical therapeutics. For drug development, much research has enabled the generation of full-length human antibodies targeting a variety of pathophysiological agents, anomalous cells, or malfunctioning proteins associated in different diseases. Using an array of methodologies, these antibodies can be developed using different approaches, including phage display, hybridoma technology, and techniques involving novel antibody engineering focused on structural diversity. The realization of numerous therapeutic antibodies has considerably affected the treatment of diverse diseases, including cancer, autoimmune disorders, infectious, and inflammatory conditions. Their promising therapeutic properties, including decreased toxicity and augmented specificity compared to small molecules and other modalities with off-target effects, make them appealing candidates for human therapeutic development.

A large number of traditional antibodies are composed of immunoglobin G (IgG) format in a Y-shape molecule consisting of two heavy chains which are identical as well as two light chains also identical. A heavy chain pairs with a light chain to form two variable regions, or antibody binding fragment (Fab) which binds to antigens of the target. The constant region includes a region referred to as the fragment crystallizable (Fc) which binds to receptors present on cells in the immune system known as effector cells. In traditional full length monoclonal antibodies, the variable regions are identical and bind to the same target.

| 12 |

Bispecific antibodies are a specialized class of therapeutic antibodies designed to concurrently target two dissimilar antigens. Unlike traditional monoclonal antibodies that bind to a single target, bispecific antibodies can employ multi-specific targeting, offering distinctive benefits in drug development. By targeting two separate molecules involved in a disease process, bispecific antibodies enhance therapeutic efficacy, improve target specificity, and potentially overcome certain treatment resistance mechanisms. The development of bispecific antibodies involves different engineering strategies including quadroma technology, chemical conjugation-based methods and more recent technologies including Dual Variable Domain Immunoglobulin and two-in-one models can be employed to generate bispecific antibodies. These bispecific agents can target a diversity of disease-related pathways, creating adaptable molecules for numerous medical ailments, including cancer. Ongoing research and improvements over the last decade in antibody engineering allow for the design, optimization and scale-up of bispecific antibodies for human therapeutics development.

Our Pipeline Candidates

TH104

TH104 is a product which has been developed by embedding drug onto a proprietary transmucosal buccal film which adheres to the inside of the mouth. TH104 has key features which we believe make it an ideal product candidate for multiple liver-related and other pruritogenic inflammatory conditions. The active molecule, nalmefene, has a dual mechanism of action by affecting both the µ-opioid receptor and the kappa opioid receptor as well as inhibiting IL-17 inflammatory cytokine expression. We intend to complete a phase 1 pharmacokinetic trial for TH104 in second quarter 2024 as well as a phase 2 proof-of-concept in PBC patients over approximately 12 months after aligning with FDA on trial design by late 2024/early 2025. We believe TH104 may also be used for treating chronic pruritogenic conditions associated with cholestatic liver disease as well as other liver related and non-liver related diseases including fatty and alcoholic liver, non-alcoholic liver disease and certain types of hepatitis. Chronic pruritis is significant in liver diseases as well as chronic kidney diseases, hemodialysis and atopic dermatitis.

TH3215

Our pre-clinical, current lead product candidate, TH3215, is an anti-HER2/HER3 bispecific antibody candidate. The ErbB or HER family of cell surface proteins are some of the most well-known and validated oncology drug targets including ErbB2 or HER2 and Erb3 or HER3. Our antibodies against HER2 and HER3 bind to different domains of the extracellular portion of the proteins or epitopes with trastuzumab primarily binding the ECD IV of HER2. HER2 is a validated tumor antigen for antibody drug conjugates to treat HER2 positive cancers with two approved antibodies, Roche/Genentech’s KADCYLA® and Daiichi Sankyo/AstraZeneca’s ENHERTU®. Areas of interest for the development of TH3215 are as a treatment of solid tumors in which HER2 is overexpressed including breast cancer, colorectal cancer, endometrial cancer and gastroesophageal cancer.

The ErbB family of receptor tyrosine kinases, also known as Human Epidermal Growth Factor Receptor (“HER”) family, comprises four transmembrane receptors: HER1 (EGFR/ErbB1), HER2 (Neu/ErbB2), HER3 (ErbB3), and HER4 (ErbB4). These receptors play crucial roles in the regulation of cell proliferation, survival, differentiation, and migration. The ErbB family members are activated upon binding to specific ligands, including EGF, transforming growth factor-alpha (TGF-α), amphiregulin (“AR”), and others, resulting in receptor dimerization and autophosphorylation of specific tyrosine residues within their intracellular domains.

HER1, also known as EGFR, is the prototypical member of the ErbB family and is widely expressed in various tissues. Its activation initiates a downstream signaling cascade that involves the activation of the mitogen-activated protein kinase (“MAPK”) and phosphoinositide 3-kinase (“PI3K”)/AKT pathways, leading to cell proliferation and survival. HER1 dysregulation has been implicated in various cancers, making it an important therapeutic target.

| 13 |

HER2, also known as Neu or ErbB2, lacks a ligand-binding domain, and its activation is predominantly through heterodimerization with other ErbB family members. It is a key partner in heterodimerization with HER3, forming the most potent signaling complex among the ErbB receptors. This heterodimerization is thought to cause an oncogenic signal into cells overexpressing these receptors and cause tumorigenesis. HER2 is amplified and overexpressed in certain cancers, particularly breast cancer, contributing to aggressive tumor behavior and poor prognosis.

HER3, or ErbB3, possesses impaired tyrosine kinase activity, but its dimerization with other ErbB receptors, particularly HER2, leads to the activation of downstream signaling pathways. HER3 is a critical regulator of PI3K signaling, which is crucial for cell survival and proliferation. HER3 overexpression is associated with resistance to HER2-targeted therapies, making it an attractive target for cancer treatment. Furthermore, agents that may block both HER2 and HER3 signaling, in both ligand-dependent and independent pathways could be highly attractive strategies for human therapeutic development.

HER4, or ErbB4, exists in various isoforms and exhibits diverse functions depending on tissue context. HER4 activation can result in the activation of both the MAPK and PI3K/AKT pathways, but its signaling outcomes are complex and context-dependent. HER4 plays important roles in heart development, neural development, and breast tissue differentiation.

The ErbB family of receptor tyrosine kinases represent a closely synchronized signaling system that controls central cellular activities. Dysregulation of these receptors, either through mutations, amplifications, or overexpression, provides to the development and evolution of several cancers. Elucidating the elaborate signaling pathways and communications within the ErbB family is fundamental for developing targeted therapies to efficiently treat cancer and other diseases associated with aberrant ErbB signaling. Ongoing research continues to unveil the complexities of ErbB signaling, opening new avenues for innovative therapeutic strategies and personalized medicine approaches.

On July 5, 2023 (the “ABSI Effective Date”), we entered into a Research and Development Collaboration and License Agreement (the “ABSI Agreement”) with Applied Biomedical Science Institute (“ABSI”), pursuant to which ABSI granted us an exclusive royalty-bearing, sublicensable license to the ABSI Patents and a non-exclusive, royalty-bearing, sublicensable license to the ABSI Know-How to Exploit the ABSI Products for the treatment, diagnosis, prediction, detection or prevention of disease in humans and animals worldwide (as defined in the ABSI Agreement). Pursuant to the ABSI Agreement, the parties shall form a committee to manage the preclinical, investigational new drug enabling studies and such other activities as shall lead to the initiation of a Phase 1 clinical trial of the ABSI Product. The parties will collaborate on a Target-by-Target basis to identify and evaluate ABSI Products directed against such Target with a view to identifying or generating suitable Products (as defined in the ABSI Agreement) for our Company to Exploit. Upon completion of the Discovery Timeline (as defined in the ABSI Agreement) for a Target, subject to the terms and conditions of ABSI Agreement, we shall exclusively own any ABSI Products against such Target. In the event the committee determines that the discovery activities are unsuccessful with respect to a Target, we may propose an additional target, which, upon approval by ABSI, shall replace a failed Target. The antibodies from ABSI we are licensing are intended to be developed as unique from the currently approved anti-HER2 antibodies and may be incorporated into proprietary multi-format biologics (bi- and tri-specific antibodies, ADCs, CAR-T and CAR-NKs) against drug resistant cancers including HER2-positive metastatic breast cancer, gastric cancer, lung cancer and ovarian cancer.

| 14 |

In the past decade, cancer therapy has seen significant innovations, and one class of therapeutics gaining significant attention is bispecific antibodies. These specialized molecules are engineered to target two distinct antigens boosting their specificity and therapeutic potential. Among the most promising targets in oncology are HER2 and HER3 receptors, which play crucial roles in cell signaling and proliferation.

HER2 and HER3 are members of the ErbB family of receptor tyrosine kinases, and their dysregulation is associated with the development and progression of various cancers, including breast, ovarian, gastric, and lung cancers. HER2, also known as ErbB2, is overexpressed in approximately 20-30% of breast cancers and is linked to aggressive tumor behavior and poor prognosis. HER3, on the other hand, lacks intrinsic kinase activity but forms heterodimers with other ErbB family members, particularly HER2, leading to potent signaling through the PI3K/AKT pathway.

Traditional monoclonal antibodies targeting either HER2 or HER3 have shown promising clinical outcomes in some cancer patients; however, cancer cells often develop resistance mechanisms, leading to treatment failure. To overcome this challenge, researchers have turned to bispecific antibodies as a more effective approach to disrupt multiple signaling pathways simultaneously and prevent the emergence of resistance.

Bispecific antibodies that target both HER2 and HER3 receptors offer several advantages over traditional therapies. By simultaneously binding to both receptors, these antibodies can block the formation of heterodimers between HER2 and HER3, effectively inhibiting downstream signaling cascades that drive tumor growth and survival. Additionally, bispecific antibodies can also engage immune cells, such as T cells and natural killer cells, through their Fc region, promoting the destruction of cancer cells via antibody-dependent cell-mediated cytotoxicity and antibody-dependent cellular phagocytosis.

TH0059

Our second product candidate, TH0059, is a bispecific anti-HER2/anti-HER3 monoclonal ADC candidate. Research studies elucidating the biology of HER3 reveal that triggering of HER3 signaling stimulates tumor progression via augmentation of metastatic potential and induces treatment failure in human tumors. Mounting evidence supports HER3 as an important target and its activation is considered to be required to overcome therapeutic resistance, enhance efficacy, and increase patient survival. To date, to our knowledge, there is no FDA-approved HER3-targeted therapy for cancer treatment. Targeting both HER2 and HER3 with a blocking antibody is a strategy we intend to explore as we progress our pipeline.

| 15 |

TH1940

Our third product candidate, TH1940, is a proprietary IO biologic, in development targeting PD-1. On November 21, 2022, we entered into a research collaboration and product license agreement with Minotaur and a commercial license agreement with Taurus for use of certain technology, including OmniAb antibodies, to advance Picobodies against novel, unreachable and undruggable epitopes in high-value validated targets starting with PD-1. The research and collaboration agreement and product license agreement are for the development of proprietary targeted biologics, including TH 1940, against PD-1. It is anticipated that we will collaborate with Minotaur under the license from Taurus to discover, develop and advance biotherapeutics against high-value validated IO targets starting with PD-1. We extended this agreement in July of 2023 with an additional target (HER3) and an oncology target.

Picobodies are bovine-derived antibody “knob” domains comprised of cysteine-rich ultralong complementary determining region H3 sequences of 30-40 amino acids weighing ~3-4 KDa, which have the potential to access challenging undruggable epitopes better than full size antibodies can. By extending the half-life of knobs to create TH1940, we believe we can more efficiently target novel epitopes with greater binding affinity than approved anti-PD-1 antibodies. We further believe that the development of TH1940 is a step toward enabling us to enter the rapidly growing IO market with additional targets thereafter.

Source: Proceedings of the National Academy of Sciences of the United States of America “The smallest functional antibody fragment: Ultralong CDR H3 antibody knob regions potently neutralize SARS-CoV-2”

Our Other Product Candidates

We intend to further develop our pipeline with novel bispecific monoclonal antibodies. These bispecific antibodies are planned to simultaneously bind to two different antigens or to two different epitopes on the same antigen. Whether two different antigens or two epitopes on the same antigen, the bispecific antibody could bind its targets either on the same cell (cis) or on to different cells (trans). Our strategy involves targeting PD-1 combined with a known, validated undisclosed antigen or using HER2 instead of PD-1 while naturally occurring antibodies typically only target one epitope on one antigen.

Recent Developments

On the Avior Effective Date, we entered into the Avior Patent License Agreement with Avior pursuant to which we received an exclusive sublicensable right and license to Licensed Patent Rights and Licensed Technology to, among other things, Develop, have Developed, make, have made, use, sell, import, export and commercialize TH104 and TH103 and to practice the Licensed Technology in connection with the foregoing, throughout the world. Pursuant to the Avior Patent License Agreement, we shall pay Avior a mid six digit up front license fee within ten days of the Avior Effective Date and an additional mid six digit license fee which shall be paid in four equal installments within ten days of the end of each fiscal quarter following the Avior Effective Date. In addition, we shall pay Avior a high single digit percentage of any upfront payments received by us as a result of the grant of any sublicenses with respect to AV104. We shall also pay Avior milestone payments in the aggregate amount of $24,250,000 upon the occurrence of various development milestones. Furthermore, we shall pay Avior certain fees based upon sales milestones. The payments for such sales milestones range from the low seven digits to the low eight digits with higher sales being subject to higher fees. Finally, we shall pay Avior royalties based on net sales. Such royalties range from low single digit percentages to mid single digit percentages with higher sales being subject to lower percentages. The Avior Patent License Agreement shall expire upon the expiration of the final payment obligation due to Avior as set forth in such agreement. Upon the expiration of the Avior Patent License Agreement, we shall have a fully paid, irrevocable, freely transferable and sublicensable worldwide license to the Licensed Patent Rights and Licensed Technology to Develop, have Developed, make, have made, use, have used, sell, offer for sale, have sold, import, have imported, export, have exported, commercialize or have commercialized any and all Licensed Products and to practice the Licensed Technology worldwide. Pursuant to the Avior Patent License Agreement, we may terminate the agreement at any time without cause, upon 30 days’ prior written notice to Avior along with payment of the next unpaid Development Milestone Payment, if any. Furthermore, either we or Avior may terminate the Avior Patent License Agreement (i) on written notice to the other party if the other party materially breaches any provision of the Avior Patent License Agreement and fails to cure such breach within 30 days after the breaching party receives written notice thereof or (ii) on written notice in the event that either party (A) becomes insolvent or admits its inability to pay its debts generally as they become due; (B) becomes subject, voluntarily or involuntarily, to any proceeding under any domestic or foreign bankruptcy or insolvency law, which is not fully dismissed or vacated within 60 days; (C) is dissolved or liquidated or takes any corporate action for such purpose; (D) makes a general assignment for the benefit of creditors; or (E) has a receiver, trustee, custodian or similar agent appointed by order of any court of competent jurisdiction to take charge of or sell any material portion of its property or business. Upon termination of the Avior Patent License Agreement, the license granted pursuant to such agreement shall terminate and all rights in the Licensed Patent Rights and Licensed Products shall revert back to Avior.

| 16 |

Competition

The pharmaceutical and biotechnology industries are characterized by rapidly advancing technologies, intense competition, and a strong emphasis on proprietary products and intellectual property. We face competition from major multinational pharmaceutical companies, established biotechnology companies, specialty pharmaceutical companies, emerging and start-up companies, universities and other research institutions both in the United States and internationally. Any drug candidates that we successfully develop and commercialize will compete with existing therapies and new therapies that may become available in the future.

Many of our competitors have significantly greater financial resources and expertise in research and development, manufacturing, pre-clinical testing, conducting clinical trials, obtaining regulatory approvals and marketing approved products than we do. Mergers and acquisitions in the pharmaceutical, biotechnology and diagnostic industries may result in even more resources being concentrated among a smaller number of our competitors. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs. Earlier stage companies, such as smaller discovery phase biotechnology companies, may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. We anticipate some of our competitors for TH104 will include Mirum Pharma, Ipsen Pharma, Cara Therapeutics, Moonlake Therapeutics, Apogee Therapetuics, and Regeneron. In addition, some of our competitors for our early-stage pipeline include Bayer AG, Moderna Inc., Roche/Genentech, Daiichi Sankyo/Astra Zeneca, Merck, Bristol-Myers Squibb and Takeda Pharmaceutical Company.

Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are more effective, have fewer or less severe side effects, are more convenient or are less expensive than any products that we may develop. Our competitors also may obtain FDA or other regulatory approval for their products more rapidly than we may obtain approval for ours. In addition, our ability to compete may be affected in many cases by insurers or other third-party payers seeking to encourage the use of generic products. Generic products are currently on the market, including the active ingredients which may be used for the indications that we are pursuing, and additional products are expected to become available on a generic basis over the coming years. If our drug candidates achieve marketing approval, we expect that they will be priced at a significant premium over competitive generic products.

The most common methods of treating patients with cancer are surgery, radiation and drug therapy, including chemotherapy and targeted drug therapy. There are a variety of available drug therapies marketed for solid tumors. In many cases, these drugs are administered in combination to enhance efficacy. Some of these drugs are branded and subject to patent protection, and others are available on a generic basis, including drugs in the same therapeutic class as the payloads in product candidates contained in our pipeline.

Many of these approved drugs are well established therapies and are widely accepted by physicians, patients and third-party payers. In general, although there has been considerable progress over the past few decades in the treatment of solid tumors and the currently marketed therapies provide benefits to many patients, these therapies all are limited to some extent in their efficacy and frequency of adverse events, and none of them are successful in treating all patients. As a result, the level of morbidity and mortality from solid tumor cancers remains high.

There are also a number of products in clinical development to treat solid tumors including, but not limited to, Loxo Oncology (LOXO-292), Bristol-Myers Squibb (BMS-986016 and nivolumab) Mersana / GlaxoSmithKline (XMT-2056), Zymeworks (zenidatamab) and Eli Lilly & Co (sintilimab) in addition to those products already on the market such as Merck & Co Inc. (Keytruda), Bristol-Myers Squibb Co. (Opdivo), AbbVie Inc. (Imbruvica), Roche Group (Tecentiq), Regeneron Pharmaceuticals, Inc. (Libtayo). The products in development may provide efficacy, safety, convenience and other benefits that are not provided by currently marketed therapies. As a result, they may provide significant competition for our product candidates for which we obtain marketing approval.

| 17 |

Manufacturing

We do not own or operate any facilities in which we can formulate or manufacture our product candidates. We intend to rely on contract manufacturers to produce all materials required to conduct pre-clinical studies and clinical trials under current good manufacturing practice (“cGMP”), with oversight of these activities by our management team. We have identified alternate sources of supply and other contract manufacturers that can produce materials for our pre-clinical and clinical trial requirements on a timely basis. However, if an existing or future contract manufacturer fails to deliver on schedule, or at all, it may delay or interrupt the development process for our product candidates, which may have an adverse effect on our operating results and estimated timelines.

Intellectual Property

The intellectual property that is available to us is important for our business, and we strive to protect it, including by obtaining, maintaining, defending, and enforcing patent protection in the United States and internationally for our proprietary technology, improvements, platforms, products and components thereof, novel biological discoveries, new therapeutic approaches and potential indications, and other inventions that are important to our business. For our product candidates, generally we initially pursue patent protection covering compositions of matter, methods of production, and methods of use. Throughout the development of our product candidates and technologies, we will seek to identify additional means of obtaining patent protection.

Our patent portfolio includes 3 patent families with 2 issued U.S. patents and 14 pending applications related generally to treatment of pruritis. The claims of these patents and applications cover devices and their method of manufacture, as well as methods of treating. Specifically, our patent portfolio currently includes two issued U.S. patents, as well as a pending application in the U.S. and 13 pending applications abroad. Patent protection is expected to expire in 2039, absent any applicable patent term adjustments or extensions. We may file other patent applications in the future.

We also have issued patents and pending applications related generally to our polymeric nanoparticle technologies, methods of making our polymeric nanoparticle technologies, and methods of using our polymeric nanoparticles therapeutically (e.g., for delivery of therapeutic compounds). Patent protection for the earliest-filed family is expected to expire in 2033, absent any applicable patent term adjustments or extensions, with more recently filed families expiring approximately between 2033 and 2042. We have collaborations with Minotaur Therapeutics, Inc. and Applied Biomedical Science Institute regarding applications of this technology with a variety of multispecific binders including binders for HER2 and HER3, as well as an anti-PD-1 binder. These collaborations will likely lead to filing of additional patent applications in the future.

The term of individual patents depends upon the legal term for patents in the countries in which they are obtained. In most countries, including the U.S., the patent term is 20 years from the earliest filing date of a non-provisional patent application. In the U.S., the term of a patent may be lengthened by patent term adjustment (“PTA”), which compensates a patentee for administrative delays by the USPTO in examining and granting a patent or the term of a patent may be shortened if a patent is terminally disclaimed over an earlier filed patent. The term of a patent that covers a drug or biological product may also be eligible for patent term extension (“PTE”) after FDA approval for a portion of the term effectively lost as a result of the FDA regulatory review period, subject to certain limitations and provided statutory and regulatory requirements are met. PTE can be for no more than five years, typically only one patent per approved product can be extended, the extension cannot extend the total patent term beyond 14 years from approval, and only those claims covering the approved drug, a method for using it or a method for manufacturing it may be extended. In addition, the length of the adjustment or extension granted could be less than that requested, and we may not receive the full PTA or PTE available if we fail to exercise due diligence during the testing phase or regulatory review process, fails to apply within applicable deadlines, fails to apply prior to expiration of relevant patents, or otherwise fails to satisfy applicable requirements.

| 18 |

As with many biotechnology and pharmaceutical companies, our ability to maintain and solidify our proprietary and intellectual property position for our products will depend on our success in obtaining effective patent claims and enforcing those patent claims. However, our owned pending patent applications, and any patent applications that may be filed in the future or licensed from third parties, may not result in issuance. The breadth of claims that may be allowed or enforced in our patents also cannot be predicted. Any of our issued patents or patents obtained in the future may be challenged, invalidated, infringed or circumvented. In addition, because of the extensive time required for clinical development and regulatory review of a therapeutic product that may be developed, it is possible that, before any of our products can be commercialized, any related patent may expire or remain in force for only a short period following commercialization, thereby limiting the protection such patent would afford the respective product and any competitive advantage such patent may provide. Further, the collaborations we have entered into may not result in patentable subject matter or potential licensing agreements may not be successfully negotiated.

We intend to file an intent-to-use U.S. trademark application for “THARIMMUNE INC” (for “Pharmaceutical preparations for use in cancer treatment and therapies”) in International class 5.

Minotaur Research and Collaboration Agreement and Taurus License Agreement

We entered into a research collaboration and product license agreement with Minotaur Therapeutics, Inc. (“Minotaur”) and a commercial license agreement with Taurus Biosciences, LLC (“Taurus”) for use of certain technology, including OmniAb antibodies, to advance Picobodies against novel, unreachable and undruggable epitopes in high-value validated targets starting with PD-1. The research and collaboration agreement and product license agreement are for the development of proprietary targeted biologics, including TH1940, against PD-1.

The research collaboration between us and Minotaur will be executed under the license from Taurus to discover, develop and advance biotherapeutics against high-value validated IO targets. Picobodies are bovine-derived antibody “knob” domains comprised of cysteine-rich ultralong complementary determining region H3 sequences of 30-40 amino acids weighing ~3-4KDa, which have the potential to access challenging epitopes better than full size antibodies can.

By combining non-proprietary half-life extending methods which are linked to a PD-1 Picobody™ to create TH1940, we believe we could more efficiently target novel epitopes with greater binding affinity than currently approved anti-PD-1 antibodies. We further believe that the development of TH1940 is a step toward enabling us to enter the rapidly growing immune-oncology market with additional targets thereafter.

Applied Biomedical Research Institute Option Agreement

On July 5, 2023, the ABSI Effective Date, we entered into the ABSI Agreement with ABSI pursuant to which ABSI granted us an exclusive royalty-bearing, sublicensable license to the ABSI Patents and a non-exclusive, royalty-bearing, sublicensable license to the ABSI Know-How to Exploit the ABSI Products for the treatment, diagnosis, prediction, detection or prevention of disease in humans and animals worldwide (each as defined in the ABSI Agreement). Pursuant to the ABSI Agreement, the parties shall form a committee to manage the preclinical, IND- enabling studies and such other activities as shall lead to the initiation of a Phase 1 clinical trial of the ABSI Product. The parties will collaborate on a Target-by-Target basis to identify and evaluate ABSI Products directed against such Target with a view to identifying or generating suitable Products (as defined in the ABSI Agreement) for our Company to Exploit. “Target” means ErB2 (Her2) and ErbB3 (HER3). Upon completion of the Discovery Timeline (as defined in the ABSI Agreement) for a Target, subject to the terms and conditions of ABSI Agreement, we shall exclusively own any ABSI Products against such Target. In the event the committee determines that the discovery activities are unsuccessful with respect to a Target, we may propose an additional target, which, upon approval by ABSI, shall replace a failed Target.

Government Regulations

Governmental authorities in the U.S. and other countries extensively regulate the research, development, testing, manufacture, labeling, promotion, advertising, distribution and marketing of pharmaceutical products such as those being developed by us. In the U.S., the FDA regulates such products under the FDCA and its implementing regulations. Failure to comply with applicable FDA requirements, both before and after approval, may subject us to administrative and judicial sanctions, such as a delay in approving or refusal by the FDA to approve pending applications, warning or untitled letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions and/or criminal prosecution.

| 19 |

U.S. Food and Drug Administration Regulation

United States Drug Development

In the United States, the FDA regulates drugs, medical devices and combinations of drugs and devices, or combination products, under the FDCA and its implementing regulations. Drugs are also subject to other federal, state and local statutes and regulations. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations requires the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or after approval, may subject an applicant to administrative or judicial sanctions. These sanctions could include, among other actions, the FDA’s refusal to approve pending applications, withdrawal of an approval, a clinical hold, untitled or warning or untitled letters, requests for voluntary product recalls or withdrawals from the market, product seizures, total or partial suspension of production or distribution injunctions, fines, refusals of government contracts, restitution, disgorgement, or civil or criminal penalties. Any agency or judicial enforcement action could have a material adverse effect on us.

The process required by the FDA before a drug may be marketed in the United States generally involves the following:

| ● | completion of extensive pre-clinical laboratory tests, animal studies and formulation studies in accordance with applicable regulations, including the FDA’s Good Laboratory Practice regulations; |

| ● | submission to the FDA of an IND, which must become effective before human clinical trials may begin; |

| ● | performance of adequate and well-controlled human clinical trials in accordance with an applicable IND and clinical study related regulations, referred to as GCP, to establish the safety and efficacy of the proposed drug for its proposed indication; |

| ● | submission to the FDA of an NDA; |

| ● | satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities at which the product, or components thereof, are produced to assess compliance with the FDA’s cGMP requirements; |

| ● | potential FDA audit of the clinical trial sites that generated the data in support of the NDA; and |

| ● | FDA review and approval of the NDA prior to any commercial marketing or sale. |

Once a pharmaceutical product candidate is identified for development, it enters the pre-clinical testing stage. Pre-clinical tests include laboratory evaluations of product chemistry, toxicity, formulation and stability, as well as animal studies. An IND sponsor must submit the results of the pre-clinical tests, together with manufacturing information, analytical data and any available clinical data or literature, to the FDA as part of the IND. The sponsor must also include a protocol detailing, among other things, the objectives of the initial clinical trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated if the initial clinical trial lends itself to an efficacy evaluation. Some pre-clinical testing may continue even after the IND is submitted. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA raises concerns or questions related to a proposed clinical trial and places the trial on a clinical hold within that 30-day period. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. Clinical holds also may be imposed by the FDA at any time before or during clinical trials due to safety concerns or non-compliance and may be imposed on all drug products within a certain class of drugs. The FDA also can impose partial clinical holds, for example, prohibiting the initiation of clinical trials of a certain duration or for a certain dose.

All clinical trials must be conducted under the supervision of one or more qualified investigators in accordance with GCP regulations. These regulations include the requirement that all research subjects provide informed consent in writing before their participation in any clinical trial. Further, an IRB must review and approve the plan for any clinical trial before it commences at any institution, and the IRB must conduct continuing review and reapprove the study at least annually. An IRB considers, among other things, whether the risks to individuals participating in the clinical trial are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the information regarding the clinical trial and the consent form that must be provided to each clinical trial subject or his or her legal representative and must monitor the clinical trial until completed.

| 20 |

Each new clinical protocol and any amendments to the protocol must be submitted for FDA review, and to the IRBs for approval. Protocols detail, among other things, the objectives of the clinical trial, dosing procedures, subject selection and exclusion criteria, and the parameters to be used to monitor subject safety.

Human clinical trials are typically conducted in three sequential phases that may overlap or be combined:

| ● | Phase 1. The product is initially introduced into a small number of healthy human subjects or patients and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion and, if possible, to gain early evidence on effectiveness. In the case of some products for severe or life-threatening diseases, especially when the product is suspected or known to be unavoidably toxic, the initial human testing may be conducted in patients. |

| ● | Phase 2. Involves clinical trials in a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage and schedule. |