Table of Contents

As confidentially submitted with the Securities and Exchange Commission on June 17, 2021

as Amendment No. 1 to the initial confidential submission.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WCG Clinical, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 8731 | 84-3769177 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

212 Carnegie Center, Suite 301

Princeton, NJ 08540

(609) 945-0101

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Laurie L. Jackson

Chief Financial Officer and Chief Administration Officer

212 Carnegie Center, Suite 301

Princeton, NJ 08540

(609) 945-0101

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Howard A. Sobel John Giouroukakis Benjamin J. Cohen Alison A. Haggerty Latham & Watkins LLP 1271 Avenue of the Americas New York, New York 10020 (212) 906-1200 |

Barbara J. Shander Chief Legal Officer 212 Carnegie Center, Suite 301 Princeton, NJ 08540 (609) 945-0101 |

William B. Brentani David W. Azarkh Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 (212) 455-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed maximum aggregate |

Amount of registration fee | ||

| Common stock, par value $0.01 per share |

$ | $ | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the offering price of shares of common stock that may be sold if the underwriters fully exercise their option granted by the Registrant to purchase additional shares of common stock. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated , 2021.

|

Shares |

WCG Clinical, Inc.

Common Stock

This is an initial public offering of shares of common stock of WCG Clinical, Inc. We are offering shares of our common stock.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . We intend to apply to list our common stock on the under the symbol “WCGC.”

After the completion of this offering, certain affiliates of our Sponsors will together own % of our outstanding common stock (or % if the underwriters exercise their option to purchase additional shares in full) and will be parties to a voting agreement. As a result, we will be a “controlled company” within the meaning of the corporate governance rules of and we will rely on certain exemptions from the corporate governance requirements of . See “Management—Director Independence and Controlled Company Exception.”

We are an “emerging growth company” under the federal securities laws and, as such, may elect to comply with certain reduced public reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company.”

Investing in our common stock involves risk. See “Risk Factors” beginning on page 19 of this prospectus to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission (the “SEC”), nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

The underwriters have the option to purchase up to an additional shares of our common stock from us at the initial price to public less the underwriting discount within 30 days of the date of this prospectus.

The underwriters expect to deliver the shares of common stock against payment in New York, New York on , 2021.

| Goldman Sachs & Co. LLC | Morgan Stanley | BofA Securities | Barclays |

| Jefferies | William Blair | BMO Capital Markets | ||

| UBS Investment Bank | SVB Leerink | HSBC | ||

Prospectus dated , 2021.

Table of Contents

| ii | ||||

| ii | ||||

| ii | ||||

| iv | ||||

| iv | ||||

| A Letter from WCG Founder, Executive Chairman & Chief Executive Officer, Donald A. Deieso |

1 | |||

| 2 | ||||

| 19 | ||||

| 52 | ||||

| 53 | ||||

| 55 | ||||

| 56 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

58 | |||

| 81 | ||||

| 100 | ||||

| 107 | ||||

| 116 | ||||

| 119 | ||||

| 122 | ||||

| 128 | ||||

| 132 | ||||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders |

134 | |||

| 138 | ||||

| 139 | ||||

| 144 | ||||

| 144 | ||||

| 144 | ||||

| F-1 | ||||

i

Table of Contents

You should rely only on the information included in this prospectus and any free writing prospectus prepared by or on behalf of us that we have referred to you. Neither we nor the underwriters have authorized anyone to provide you with additional information or information different from that included in this prospectus or in any free writing prospectus prepared by or on behalf of us that we have referred to you. If anyone provides you with additional, different or inconsistent information, you should not rely on it. Offers to sell, and solicitations of offers to buy, shares of our common stock are being made only in jurisdictions where offers and sales are permitted.

No action is being taken in any jurisdiction outside the United States to permit a public offering of common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restriction as to this offering and the distribution of this prospectus applicable to those jurisdictions.

This prospectus includes estimates regarding market and industry data that we prepared based on our management’s knowledge and experience in the markets in which we operate, together with information obtained from various sources, including publicly available information, industry reports and publications, surveys, our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets which we believe to be reasonable.

In presenting this information, we have made certain assumptions that we believe to be reasonable based on such data and other similar sources and on our knowledge of, and our experience to date in, the markets we serve. Market share data is subject to change and may be limited by the availability of raw data, the voluntary nature of the data gathering process and other limitations inherent in any statistical survey of market share. In addition, customer preferences are subject to change. Accordingly, you are cautioned not to place undue reliance on such market share data.

Our previous parent company, WCG HoldCo IV LLC (the “Seller”), entered into a Stock Purchase Agreement on November 6, 2019, with WCG Purchaser Corp. (formerly known as Da Vinci Purchaser Corp.) (the “Purchaser” or “Operating Company”), pursuant to which the Purchaser purchased all of the issued and outstanding equity interests in WCG Holding IV Inc. and WCG Market Intelligence & Insights Inc. (collectively, the “Acquiree”) from the Seller (the “Transaction”). In connection with the Transaction, a new parent entity, Da Vinci Purchaser Holdings LP (the “Parent”), was formed, together with two new entities, WCG Clinical, Inc. (formerly known as WCG Purchaser Holdings Corp.), the issuer in this offering, and WCG Purchaser Intermediate Corp., the direct subsidiary of the issuer, to act as intermediate holding companies between the Parent and the Operating Company. On January 8, 2020, the Transaction closed, resulting in a change to our corporate structure. Unless otherwise indicated or the context otherwise requires, references in this prospectus to the terms “WCG,” “we,” “us,” “our,” or the “Company” refer to the Seller and its consolidated subsidiaries prior to the Transaction, and WCG Clinical, Inc. and its consolidated subsidiaries following the completion of the Transaction.

The consolidated financial statements included in this prospectus reflect the consolidated historical results of operations of WCG and its subsidiaries. WCG’s consolidated financial statements prior to and including

ii

Table of Contents

December 31, 2019 represent the financial information of the Acquiree and its consolidated subsidiaries prior to the Transaction, and such financial information is labeled as “Predecessor.” The Seller had no operations other than its ownership of the Acquiree and its consolidated subsidiaries, and, as a result, the same information has been presented as would be presented if the Acquiree were deemed to be the predecessor entities. The consolidated financial information for the periods beginning on and subsequent to January 1, 2020 represent the financial information of WCG Clinical Inc. and its consolidated subsidiaries subsequent to the Transaction, and such financial information is labeled as “Successor.” We determined that the operational activities from January 1, 2020 through the close of the Transaction on January 8, 2020 (the “effective date”) were immaterial to the financial statements for the year ended December 31, 2020, and do not result in material differences in the amounts recognized on the Balance Sheet, Statement of Operations, or Statement of Cash Flows. In light of the proximity of the effective date to the start of our January accounting period (i.e. only four business days from January 1, 2020 to the effective date, during which the Predecessor did not have material operations), we elected to present the activities from January 1, 2020 through January 7, 2020 in the Successor period (including the year ended December 31, 2020). See Note 1 to WCG’s audited consolidated financial statements included elsewhere in this prospectus.

Prior to the completion of this offering, the Parent will be liquidated and the unit holders of our Parent will receive shares of our common stock in exchange for their units of the Parent. See “Prospectus Summary—Distribution.”

Certain monetary amounts, percentages, and other figures included elsewhere in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables or charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

As used in this prospectus, unless the context otherwise requires, references to:

| • | “Amended and Restated Registration Rights Agreement” means the registration rights agreement to be effective upon the consummation of this offering, by and between the Sponsors, certain other existing stockholders and the Company; |

| • | “Arsenal” means investment funds affiliated with or advised by Arsenal Capital Partners; |

| • | “client retention ratio” means the ratio of clients retained by the Company over a specified period of time, and is calculated by dividing the number of retained clients in the current period that were also clients as of the end of the comparable prior year period by the total number of clients at the end of the comparable prior year period. The client retention ratio excludes clients with total annual revenue less than $20 thousand (and account for less than 1% of total revenues) to isolate the churn related to very small, one-time IRB customers that are not considered part of the Company’s normal customer base; |

| • | “Credit Facilities” means our First Lien Facilities and Second Lien Term Loan Facility; |

| • | “DGCL” means the Delaware General Corporation Law; |

| • | “Exchange Act” means the Securities Exchange Act of 1934, as amended; |

| • | “First Lien Facilities” means the First Lien Term Loan Facility and the Revolving Credit Facility; |

| • | “First Lien Term Loan Facility” means our senior secured first lien term loan facility in an initial principal amount of $920.0 million entered into on January 8, 2020, as amended by the incremental term loan facility in an initial amount of $150.0 million entered into on November 2, 2020; |

| • | “GAAP” means U.S. generally accepted accounting principles; |

| • | “GIC Investor” means Dein Investment Pte. Ltd; |

iii

Table of Contents

| • | “LGP” means investment funds affiliated with or advised by Leonard Green & Partners, L.P.; |

| • | “Novo” means investment funds affiliated with or advised by Novo Holdings A/S; |

| • | “Organic Revenue Growth” means internally-generated growth measured by comparable sales of products and services year over year, excluding the impact of acquisitions until they have been under our ownership for at least four full fiscal quarters at the start of a fiscal reporting period; |

| • | “Revolving Credit Facility” means our $125.0 million revolving credit facility entered into on January 8, 2020; |

| • | “Second Lien Term Loan Facility” means our senior secured second lien term loan facility in an initial principal amount of $345.0 million entered into on January 8, 2020; |

| • | “Sponsors” means LGP, Arsenal, Novo and the GIC Investor; and |

| • | “Voting Agreement” means the voting agreement to be effective upon the consummation of this offering, by and among the Sponsors and the Company. |

This prospectus includes trademarks and service marks owned by us, including AIMS™, Avoca™, Connexus 5.0™, InvestigatorSpace™, IRBNet™, Pharmaseek™, KMR™, MCC™, My-Patient.com™, Safety Portal™, The WCG Patient Experience™, Velos™, Virgil™, WCG Clinical Trial Ecosystem™, WCG Knowledge Base™ and WCG Predict™. This prospectus also contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ®, ™ or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties.

We report our financial results in accordance with GAAP. In addition to our GAAP financial results, we believe the non-GAAP financial measure, Adjusted EBITDA, is useful in evaluating our performance. Adjusted EBITDA should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for information about why we consider Adjusted EBITDA useful and a discussion of the material risks and limitations of this measure, as well as a reconciliation of Adjusted EBITDA to net (loss) income, the most directly comparable financial measure prepared in accordance with GAAP.

iv

Table of Contents

A LETTER FROM WCG FOUNDER, EXECUTIVE CHAIRMAN & CHIEF EXECUTIVE OFFICER, DONALD A. DEIESO

WCG has embraced its role as a “Servant to Mankind”, with the ultimate aim of improving global public health. At the core of our mission, we apply leading scientific knowledge and proprietary technology to advance life-saving innovations. By helping to improve the clinical trial process, we allow valuable therapies to be delivered to patients sooner and at a lower cost. WCG is proud to serve the individuals on the frontlines of science and medicine, and the organizations that strive to develop new products and therapies to improve the quality of human health. We believe that it is our role to empower the scientific advancement of human health, while ensuring that the risks of progress never outweigh the value of human life.

As a mission-driven organization at heart with a strong commitment to the highest ethical standards, WCG is focused on safeguarding the interests of all stakeholders engaged with our Company, including clients, patients, employees and shareholders.

Strategically positioned at the very center of the clinical trial ecosystem, we act as the key point of connectivity among our various clients, who leverage our solutions to inform the critical decisions that save significant time and expense, enhance drug safety and efficacy, and ultimately improve millions of lives.

With 2.5 million patients enrolled in WCG-supported studies, our relationship with patients is also key to our mission, as demonstrated by our commitment to champion a new and improved paradigm for treating trial participants, The WCG Patient Experience™. Beyond raising patient awareness for clinical studies, we are shifting the clinical trial framework from treating participants as “subjects” to placing a greater focus on the patient experience, one which should rely on empathy from start to finish.

Our employees bring their heads and hearts to the mission, acting as change agents to serve a greater societal purpose. We maintain a leading employee retention ratio of 92% by selectively recruiting individuals who align with our core mission, and by providing differentiated compensation and benefits packages. We are proud of our Diversity and Inclusion culture with its emphasis on ensuring that we maintain an environment of mutual respect and equal opportunity for all.

The COVID-19 pandemic highlighted our organization’s remarkable dedication to its mission. Despite facing the challenges of remote working and the personal impacts of the pandemic, our team supported and contributed to over 723 COVID-19 trials, including many of the most highly impactful vaccines and antivirals.

It is our role to empower our team to accelerate advancement. We firmly believe that we must have the clinical insight to develop, the courage to advance, and the persistence to transform a change-resistant industry, while never compromising the highest level of ethical standards.

I am grateful that you are considering an investment in WCG’s initial public offering, and excited that as a result, you are thinking of supporting our mission to accelerate the scientific advancement of human health.

1

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all the information that may be important to you. You should read the entire prospectus carefully, especially “Risk Factors” beginning on page 17 of this prospectus, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 56 of this prospectus, and our consolidated financial statements and related notes included elsewhere in this prospectus, before deciding to invest in our common stock.

Overview

Our Mission

WCG’s mission is to provide clinical trial stakeholders with the highest-quality service, accelerate the scientific advancement of human health, and ensure that the risks of progress never outweigh the value of human life.

Our Company

We believe we are a leading provider of clinical trial solutions, focused on providing solutions that are designed to measurably improve the quality and efficiency of clinical research, stimulate growth and foster compliance. Our transformational solutions enable biopharmaceutical companies, contract research organizations (“CROs”), and institutions to accelerate the delivery of new treatments and therapies to patients, while maintaining the highest standards of human protection. We leverage our differentiated strategic position at the center of the clinical trial ecosystem to provide new types of technology-enabled solutions to all stakeholders involved, with the aim to address the key critical pain points throughout the clinical trial process.

Clinical trials are an essential part of the drug and device development process, but ineffective trial design and management continues to delay much-needed therapies from being made available to patients. Delayed patient enrollment, slow trial startup, burdensome administrative processes, use of disparate technologies, and under-representation of minority patients are a few of the key critical pain points our clients face in running clinical trials today. As a result, clinical trials are increasingly more expensive to conduct, are regularly delayed, and often face regulatory and data quality challenges.

WCG was founded in 2012, backed by Arsenal Capital Partners, with the goal of systematically transforming drug development by addressing the key critical pain points adversely affecting clinical trial performance. Our proprietary suite of technology-enabled solutions provides ethical review services as well as broader clinical trial solutions including study planning and optimization, patient engagement, and scientific and regulatory review services. We serve all stakeholders in the clinical trial ecosystem, including biopharmaceutical companies and CROs, trial sites, institutions and investigators, as well as patients and advocacy groups. Our solutions include software as well as technology-enabled clinical services that provide integrated, end-to-end support along the clinical trial process. Our clients leverage our solutions to inform the critical decisions that are key to saving significant time and expense, enhancing drug safety and efficacy, and ultimately allowing for the improvement of millions of lives.

Starting with our first and oldest business, Western IRB, we believe WCG has built a 50-year reputation for excellence in the performance of ethical reviews to become a partner of choice to some of the most sophisticated biopharmaceutical companies, regulators, and investigators. We have expanded our platform’s capabilities over the years and presently enjoy a differentiated strategic position at the center of the clinical trial ecosystem, enhancing efficiency and connectivity by uniting all stakeholders through our integrated technology platform. Since our founding, our end-to-end solutions have benefitted over 5,000 biopharmaceutical companies and

2

Table of Contents

CROs, of which 4,000 are small and mid-cap biopharmaceutical companies, 10,000 research sites, and several million patients. Our management estimates that over the last two years ended December 31, 2020, WCG supported approximately 90% of all global clinical trials, across a broad array of therapeutic areas and trial phases and, over the same period, our solutions have been leveraged by 87% of all new drugs and therapeutic biologics approved by the U.S. Food and Drug Administration (“FDA”). With a global workforce of over 4,000 individuals who are core to our mission and our platform, we have a presence in 71 countries. Our significant expertise is evidenced by our track record of supporting over 4,000 global clinical trials from March 2020 through February 2021. We expect to continue to expand our operations at home and abroad as needed to service our increasingly diverse and international client base. We believe our clinical professionals are industry thought-leaders who provide expert consultation on ethical standards, trial operations, and regulatory submissions for drugs and devices. We believe our strategic position at the center of the clinical trial ecosystem provides us with the breadth and depth of knowledge and insight to serve our mission, and confidently develop new products and services to enhance our value proposition and growth trajectory.

We believe we have a proven track record of consistent growth and strong financial performance. We serve a high-growth market, and have outperformed through organic expansion of our portfolio, cross-selling of our solutions into our large client base and the strategic acquisition of complementary capabilities.

| • | From 2018 to 2020, our revenues increased by approximately 16% per year, from $345.6 million to $463.4 million, with an Adjusted EBITDA margin (defined as Adjusted EBITDA divided by revenue) reaching 47% in 2020. Our revenues increased by approximately 33%, from $103.5 million to $137.6 million, for the three months ended March 31, 2021 compared to the three months ended March 31, 2020, with Adjusted EBITDA margin reaching 43% in the first quarter of 2021. |

| • | For 2019 and 2020, 74% and 69% of the Company’s revenue growth, respectively, was organic. |

| • | We had a net loss of $2.6 million in 2018, net income of $18.2 million in 2019, and a net loss of $95.3 million in 2020 primarily due to the impact of the Transaction. In addition, we had a net loss of $20.6 million and $30.1 million in the three months ended March 31, 2021 and 2020, respectively. Our Adjusted EBITDA increased by approximately 50%, from approximately $146.0 million in 2018 to approximately $218.4 million in 2020. Our Adjusted EBITDA increased by approximately 24%, from $47.6 million to $59.1 million, for the three months ended March 31, 2021 compared to the three months ended March 31, 2020. |

| • | From 2019 to 2020, our bookings increased by approximately 12%, from $555.2 million to $621.8 million. Our bookings increased by approximately 55%, from $171.8 million to $266.2 million, for the three months ended March 31, 2021 compared to the three months ended March 31, 2020. |

| • | As of March 31, 2021, our top 25 clients each purchased on average more than four of our solutions, and each contributed revenues of over $2 million. We estimate the current opportunity from further cross selling our existing solutions to these clients to be over $1.6 billion. |

| • | WCG has a strong track record of acquiring and integrating leading technologies and solutions into our platform, having closed 30 acquisitions since 2012. |

See “—Summary Consolidated Financial and Operating Data” below and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information regarding bookings and Adjusted EBITDA, including a reconciliation of Adjusted EBITDA to net (loss) income.

Our Differentiated Platform of Integrated Solutions

WCG’s Clinical Trial Ecosystem™—A Key Differentiator

For decades, the biopharmaceutical industry has approached clinical trials on a trial-by-trial basis, with each new trial requiring a one-time assembly of research sites, patient participants, and supporting technologies. When

3

Table of Contents

a trial ends, the teams organized to carry it out are disbanded. Each trial becomes a one-time and episodic collaboration of the operational expertise, human capital, and specific technology used in the trial. This single-trial model has discouraged many organizations from making long-term investments in unifying the end-to-end trial process given the required investment horizon. Yet, many of the operational challenges affecting clinical trials today, including high costs, long duration, and poor patient enrollment, are the direct results of this lack of continuity and connectivity. WCG has created a more permanent alignment of interest across stakeholders and improved consistency of workflows through the WCG Clinical Trial Ecosystem™, which leverages our expansive client relationships and deep data-driven insights to enhance the connectivity and efficiency throughout the clinical trial process. We believe our strategic position at the center of the clinical trial ecosystem provides us with differentiated breadth and depth of knowledge and insight to serve our clients, fulfill our mission, and confidently develop new products and services to enhance our value proposition and growth trajectory.

Positioned at the center of the clinical trial ecosystem, WCG acts as a single point of connectivity among all stakeholders involved, a large number of which are clients that we have relationships with and that we serve:

| * | Based on revenue. |

| ** | Based on management estimates. |

Each of these stakeholders benefits from WCG’s differentiated platform of end-to-end solutions:

| • | patients benefit from the ability to access life-saving therapies sooner and may participate in clinical trials with increased safety through faster enrollment, improved engagement and increased awareness; |

| • | sites, institutions and investigators benefit by having access to a unified and interconnected network, allowing them to enhance their visibility to sponsors, more effectively recruit the appropriate group of patients, and therefore more efficiently conduct clinical trials; and |

4

Table of Contents

| • | sponsors and CROs benefit from the ability to select strong performing sites with greater precision and to more efficiently enroll patients, by leveraging unified workflows, interconnected sites, and integrated technology-enabled solutions. This in turn allows them to conduct clinical trials faster and at a lower overall cost. |

WCG’s Knowledge Base™—Comprehensive Real-Time Trial Data

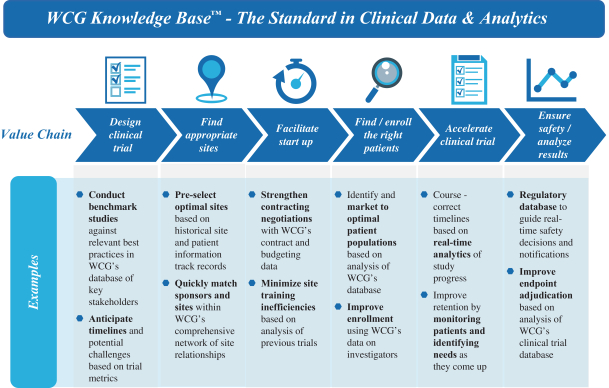

Leveraging the WCG Knowledge Base™, our management estimates that over the last two years ended December 31, 2020, WCG participated in over 90% of all global clinical trials, across a broad array of therapeutic areas and trial phases, which provides us with unique access to clinical trial data and deep insights in the industry. WCG’s Knowledge Base™ is a primary dataset which was purpose-built to aggregate a wide array of clinical trial performance data assembled over the years. WCG has strategically developed proprietary algorithms that query WCG Knowledge Base™ and provide authoritative insights into the matters that are central to effective clinical trial decisions. We leverage the WCG Knowledge Base™ across our businesses, from generating client insights to informing our new product innovation and broader business development.

A selection of direct applications of the WCG Knowledge Base™ are provided below.

How We Serve Our Clients

In order to best serve our clients’ needs throughout the clinical trial continuum, WCG is organized into two segments:

Ethical Review segment. Our Ethical Review (“ER”) segment provides technology-enabled services that ensure clinical trials respect the rights and protect the welfare of patient participants. Over the last two decades,

5

Table of Contents

WCG has performed over 58,000 ethical reviews, developing specialized expertise and capabilities that we believe are differentiated in the industry. Federal regulations require clinical trial sponsors, including CROs and biopharmaceutical companies, to submit specific documentation related to the conduct of the clinical trial to a qualified IRB. The IRB is an independent committee established to review and approve research involving human participants, whose primary purpose is to protect the rights and welfare of the participating patients. The IRB has the authority to approve, require modifications in, or disapprove clinical trials. It is responsible for reviewing key aspects of the clinical trial, including trial protocols, investigators, and participant informed consent.

Clinical Trial Solutions segment. Our Clinical Trial Solutions (“CTS”) segment provides an integrated suite of over 40 technology-enabled solutions that support the conduct of effective clinical trials, including study planning and site optimization, patient engagement, and scientific and regulatory review. Study Planning and Site Optimization provides integrated, turnkey services to identify, activate, and benchmark sites. Patient Engagement improves patient-related activities in a clinical trial. Scientific & Regulatory Review ensures that the data recorded in a clinical trial can support effective regulatory submissions. These solutions include proprietary software and specialty clinical consulting services which provide integrated, end-to-end support of workflows along the clinical trial process and have been designed with the specific objective to optimize efficiency. Using the WCG Clinical Trial Ecosystem™ we are able to offer clients a fit-for-purpose suite of the solutions that match the specific needs of a project, optimizing cost and efficiency.

Our revenues consist of fees for the review of clinical research trial protocols and investigators, technology-enabled specialty clinical consulting services which support various steps of the clinical trial process that are designed to optimize efficiency, sale of software licenses and hosted SaaS software applications which support the conduct of effective clinical trials. Because many of our agreements with our customers contain performance obligations over a period of years, spanning the life of a clinical trial, our backlog provides us, at any point in time, with visibility into approximately 75% of our revenues for the next twelve months.

Our Market Opportunity

Traditional drug development has led to immeasurable public health benefits, but challenging diseases persist while many patients await life-saving medicines. Developing a new drug can take over 10 years and cost more than $2 billion to bring to market, according to Tufts Center for the Study of Drug Development (“CSDD”). While investments in research and development (“R&D”) have reached new highs, the returns on investment have steadily declined. In 2021, global biopharmaceutical R&D expenditures are expected to reach $195 billion according to EvaluatePharma. However, according to the Deloitte Center for Health Solutions, each of the 12 leading biopharmaceutical companies realized, on average, a return on R&D investment of approximately 2% in 2018, down from 10% in 2010.

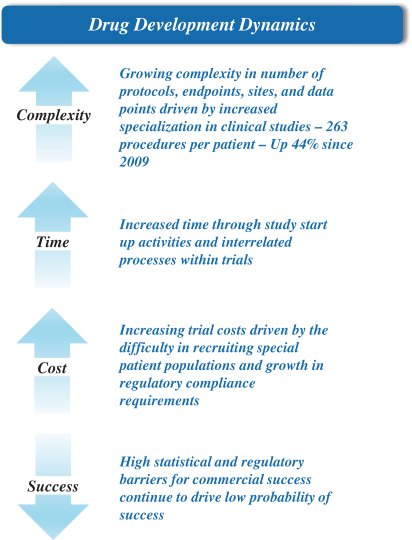

This decreasing return on drug R&D is driving a transformation of the industry’s approach to drug development, especially as it relates to clinical trials, which represent the most costly and time-consuming stage of the R&D process and therefore bear the greatest investment risk. Tufts CSDD reports that, in 2020, there were 6,500 total active drugs in clinical trial phases each drug having less than 12% probability of receiving regulatory approval. Contributing to this unfavorable trend, the costs of clinical trials are escalating, trial timelines are being extended, and data quality issues result in undesirable delays in regulatory approvals. In addition, new therapeutic categories and scientific advances, including cell and gene therapy, and precision medicine, are emerging at a rapid pace and have stimulated new and innovative approaches for addressing oncology and rare diseases. These advances have the potential to bring significant benefits, but also result in greater trial complexity and related expenses. As of December 31, 2020, the average trial protocol requires 263 procedures per patient, up 44% since 2009, as reported by Tufts CSDD. This increasing complexity is fueling the demand for the new type of outsourced, data-driven and science-based trial solutions that we provide, therefore expanding the size of our market opportunity.

6

Table of Contents

The key critical pain points that contribute to this time and cost burden are ethical review, study planning and site optimization, patient engagement, scientific and regulatory review, amongst others. Leveraging our strategic position at the center of the clinical trial ecosystem, we have developed a suite of integrated and technology-enabled solutions that we believe have had a significant impact on these existing hurdles, and in turn have created value to all stakeholders, including:

| • | increasing speed to market for treatments and reducing costs to healthcare systems by removing unnecessary delays; |

| • | increasing trial access for patients with rare diseases by utilizing our proprietary data and clinical insights solutions; and |

| • | providing thought leadership through publications and information services. |

These key critical pain points in the clinical trial process impact both costs and timelines, which are key focus areas for industry participants, allowing for WCG’s addressable market to rapidly expand. Our integrated suite of solutions includes both proprietary technologies and services, including research compliance and quality management services, as well as specialty clinical expertise, all of which address the key requirements for effective end-to-end clinical trials. According to EvaluatePharma, the total global pharmaceutical research and development spend is expected to reach approximately $195 billion in 2021. Approximately half of that spend, or $89 billion, represents clinical trial spend across phases I through IV, of which approximately $48 billion is conducted by pharmaceutical companies and $41 billion is outsourced to CROs. As part of this clinical trial market, the specific segments which WCG addresses, including IRB, study planning and site optimization, patient engagement, and scientific and regulatory review, account for approximately $9 billion in 2021, which is projected to grow at 14% annually between 2021 and 2023.

WCG captures an increasing share of the drug development being conducted by small and mid-cap biopharmaceutical companies, which accounted for approximately 63% of all clinical trials in 2019. These earlier stage companies typically rely on fewer internal resources and are subject to shorter competitive timeframes. We believe WCG’s fit-for-purpose solutions have positioned us as a partner of choice for these emerging players in the clinical trial ecosystem. This growing client segment accounted for 20% of our annual bookings growth in 2020, and we believe will continue to drive increased activity, fueled by record levels of funding. U.S. listed biotechnology companies raised a record of over $63 billion in 2020, representing more than twice the funds raised a year earlier.

As clinical trials have become more complex and costly, clients rely increasingly on our expert clinical insights and proprietary technology-enabled applications, a trend which has increased the size of our market opportunity and which we expect to persist.

Our Contributions to Society

During our 50-year history through our predecessor companies, WCG has embraced its role as a “Servant to Mankind.” At the core of our mission, we apply leading scientific knowledge and proprietary technology to advance life-saving innovations. By helping to improve the clinical trial process, we allow valuable therapies to be delivered to patients sooner and at a lower cost. WCG is proud to serve the individuals on the frontlines of science and medicine, and the organizations that strive to develop new products and therapies to improve the quality of human health. We believe that it is our role to empower the scientific advancement of human health, while ensuring that the risks of progress never outweigh the value of human life.

As a mission-driven organization at heart with a strong commitment to the highest ethical standards, WCG is focused on safeguarding the interests of all stakeholders engaged with our Company, including clients, patients, employees and shareholders.

7

Table of Contents

In 2002, in partnership with the World Health Organization and the National Institutes of Health, WCG established the International Fellows Program to provide clinical professionals from both developed and emerging economies with the knowledge necessary to create, manage and administer Institutional Review Boards (“IRBs”) within their own countries. WCG sponsors these Fellows to travel to the United States and attend six-month IRB training programs provided twice a year. Since inception, 200 program graduates, representing over 26 countries across four continents, have returned to their home countries with the requisite knowledge to improve the quality of clinical research and to ensure patient protection in their clinical trials, demonstrating WCG’s continued commitment to a 50-year long legacy of protecting the interests of patients in clinical research.

The COVID-19 pandemic also highlighted our organization’s remarkable dedication to its mission. Despite facing the challenges of remote working and the personal impacts of the pandemic, our team supported and contributed to over 723 COVID-19 trials, including many of the most highly impactful vaccines and antivirals.

Our Competitive Strengths

We compete by offering a specialized and integrated suite of technology applications and expert clinical services across all stages of the clinical trial continuum. We differentiate ourselves through our competitive strengths, which include:

A Leading Position with a Long-standing Reputation: Through our predecessor companies, we have been serving the clinical trial community for over 50 years and have positioned ourselves as a leading provider of clinical trial solutions. Our strong reputation is evidenced by our client retention ratio of 99% as of December 31, 2020. The average tenure for our top 30 clients is more than 14 years. WCG has conducted over 58,000 ethical reviews over the past two decades, providing highly differentiated clinical trial services to stakeholders across the ecosystem.

Our Large, Growing and Diversified Client Base: Uniquely positioned at the center of the clinical trial ecosystem, we have provided our solutions and services to over 5,000 biopharmaceutical companies and CROs, 10,000 research sites, and several million patients over the past nine years. Addressing a broad array of therapeutic areas and trial phases, we serve a diversified base of clients, including all of the top 50 biopharmaceutical companies by revenue, all of the top eight CROs by revenue, and approximately 4,000 small and midcap biopharmaceutical companies. Additionally, WCG is contracted to provide services to 3,300 institutions, hospitals, and academic medical centers, representing virtually all participants in FDA-regulated research. Our top five clients represented less than 25% of our total revenues for the year ended December 31, 2020.

Our Differentiated and Integrated End-to-End Platform: We believe WCG has developed a powerful and differentiated platform, the WCG Clinical Trial Ecosystem™, allowing for better connectivity among the three principal clinical trial stakeholders – sponsors and CROs, research sites, and patients. WCG has built on its unique position at the center of the clinical trial ecosystem, leveraging its long-term client relationships and a 50-year reputation.

Our Proprietary Technology Applications: Our proprietary clinical technology applications have been built to address the key requirements of clinical trials, from start to end. These end-to-end applications have been designed by clinicians who have a deep understanding of the workflows involved at each stage of clinical trial execution. We offer 30 client-facing and purpose-built applications which are integrated into a single platform, with over 93% of WCG engagements delivered through our proprietary technology. Leveraging our technology, we maintain real-time connectivity to our clients and their clinical trial activity on a day-to-day basis and are strategically positioned to assemble large amounts of data which we believe provides us with differentiated insights.

8

Table of Contents

The Deep Expertise of Our People and Our Culture of Quality and Innovation: We are led by a diverse, global, and talented team of scientists, software engineers, and subject matter experts who not only advance our solutions but also seek to understand and tackle the industry’s greatest challenges. We believe that the extraordinary expertise of our teams and our high employee retention provide a powerful competitive advantage and remain focused on investing in individual employee development programs.

Our Growth Strategy

Our future growth strategy relies on four key drivers:

Capitalize on Our Large and High-Growth Markets: As clinical trials have become more complex and costly, clients rely increasingly on our expert clinical insights and proprietary technology-enabled applications, a trend which has increased the size of our market opportunity and which we expect to persist. WCG has demonstrated approximately 16% revenue growth per year between 2018 and 2020, representing a significantly faster rate than our total market, which is projected to grow at a rate of 7% from 2018 through 2023.

Grow Within Our Existing Client Base: Our strong growth is driven in large part by increasing penetration of our solutions within our existing client base. WCG has a proven track record of cross-selling its solutions, with our top 25 clients purchasing at least four of our solutions as of March 31, 2021. We believe that we have significant opportunity to expand our revenues with existing clients and estimate the additional market opportunity from expanding our existing solutions within our top 25 clients to surpass $1.6 billion.

Further Leverage the WCG Clinical Trial Ecosystem™, the WCG Knowledge Base™ and Our Proprietary Technology Platform: The improvement and optimization of clinical trial processes is being realized through operational transparency, which is only made possible by real-time data-driven analysis. Positioned at the core of our clinical trial platform, the WCG Knowledge Base™ is a central repository of data, assembled by leveraging our role as the point of connectivity between all stakeholders of the clinical trial ecosystem. WCG Knowledge BaseTM includes 31 terabytes of real-time, regulatory-grade data. Our ubiquitous involvement in 90% of all global clinical trials over the last two years ended December 31, 2020, as estimated by our management, provides us with a unique access to data which, when combined with our clinical expertise, delivers actionable trial insights to our clients.

Continuously Expand Our Platform Through the Acquisition of New Capabilities: Since 2012, we have acquired and successfully integrated 30 companies, which have allowed us to further expand our suite of solutions and capabilities. Acquiring and integrating additional capabilities are part of our core competencies and will remain an important pillar of our growth strategy. We expect to continue to rely on strategic acquisitions to enhance our capabilities and will leverage our business development team to drive further cross-selling in with the aim to supplement our organic growth.

Summary Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or that may adversely affect our business, financial condition and results of operations. You should carefully consider the risks discussed in the section titled “Risk Factors,” including the following risks, before investing in our common stock:

| • | our continued revenue growth depends on our ability to successfully increase our client base and expand our relationships and the products, technologies and services we provide to our existing clients; |

| • | we have experienced rapid growth, and if we fail to manage our growth effectively, we may be unable to execute our business plan and our recent growth may also not be sustainable or indicative of future growth; |

9

Table of Contents

| • | as our costs increase, we may not be able to sustain the level of profitability we have achieved in the past; |

| • | the markets in which we participate are highly competitive, and if we do not compete effectively, our business and operating results could be materially adversely affected; |

| • | as clients increase their utilization of our products and services, we may be subject to additional pricing pressures; |

| • | an inability to attract and retain highly skilled employees and contingent workers could materially adversely affect our business; |

| • | defects or disruptions in our solutions could result in diminished demand for our solutions, a reduction in our revenues, and subject us to substantial liability; |

| • | we may acquire other companies or technologies, which could divert on management’s attention, result in additional dilution to our stockholders and otherwise disrupt our operations and adversely affect our operating results; |

| • | our business could be materially adversely affected if our clients are not satisfied with the professional services provided by us or our partners, or with our technical support services; |

| • | we are subject to laws and regulations related to compliance with economic sanctions that could impair our ability to compete in international markets in which our products may not be sold or subject us to liability if we violate these laws and regulations; |

| • | our estimate of the market size for our solutions we have provided publicly may prove to be inaccurate, and even if the market size is accurate, we cannot assure you our business will serve a significant portion of the market; |

| • | our bookings, backlog and client engagements might not accurately predict our future revenue, and we might not realize all or any part of the anticipated revenues reflected in our bookings, backlog and client engagements; |

| • | our business may be subject to risks arising from natural disasters and epidemic diseases, such as the recent COVID-19 pandemic; |

| • | nearly all of our revenues are generated by sales of our products and services to clients in, or connected to, the biopharmaceutical industry, and factors that adversely affect this industry, including mergers within the biopharmaceutical industry or regulatory changes, could also adversely affect us; |

| • | increasing competition within the biopharmaceutical industry, as well as delays in the drug discovery and development process, may reduce demand for our products and services and negatively impact our results of operations and financial condition; |

| • | our clients may delay or terminate contracts, or reduce the scope of work, for reasons beyond our control, potentially resulting in financial losses; |

| • | we may be sued by third parties for alleged infringement of their proprietary rights or misappropriation or other violation of intellectual property and we may suffer damages or other harm from such proceedings; |

| • | we are subject to complex and evolving laws and regulations related to privacy and data protection, our violation of which could result in penalties and other regulatory enforcement action, reputational damage or other negative impacts on our results of operations or financial condition; and |

| • | current and future litigation against us, which may arise in the ordinary course of our business, could be costly and time consuming to defend. |

10

Table of Contents

Our business also faces a number of other challenges and risks discussed throughout this prospectus. You should read the entire prospectus carefully, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and our consolidated financial statements and related notes included elsewhere in this prospectus, before deciding to invest in our common stock.

Our Corporate Information

Our principal executive office is located at 212 Carnegie Center, Suite 301, Princeton, NJ 08540 and our telephone number at that address is (609) 945-0101. We maintain a website on the Internet at www.wcgclinical.com. We have included our website address in this prospectus as an inactive textual reference only. The information contained on, or that can be accessed through, our website is not a part of, and should not be considered as being incorporated by reference into, this prospectus.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable, in general, to public companies that are not emerging growth companies. These provisions include:

| • | the option to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus; |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding nonbinding, advisory stockholder votes on executive compensation or on any golden parachute payments not previously approved. |

We will remain an emerging growth company until the earliest to occur of: (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion; (ii) the date that we become a “large accelerated filer,” with at least $700.0 million of equity securities held by non-affiliates as of the end of the second quarter of that fiscal year; (iii) the date on which we have issued, in any three-year period, more than $1.0 billion in non-convertible debt securities; and (iv) the last day of the fiscal year ending after the fifth anniversary of the completion of this offering.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide may be different than the information you receive from other public companies in which you hold stock.

An emerging growth company can also take advantage of the extended transition period provided in Section 13(a) of the Exchange Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of this extended transition period and, as a result, our operating results and financial statements may not be comparable to the operating results and financial statements of companies who have adopted the new or revised accounting standards.

11

Table of Contents

As a result of these elections, some investors may find our common stock less attractive than they would have otherwise. The result may be a less active trading market for our common stock, and the price of our common stock may become more volatile.

Distribution

Prior to the closing of this offering, the Parent will be liquidated and its sole asset, the shares of our common stock it holds, will be distributed to its equity holders based on their relative rights under its limited partnership agreement. The equity holders of Parent will receive the number of shares of our common stock in the liquidation of Parent that they would have held had they held our common stock directly immediately before the distribution, with no issuance of additional shares by us. Each holder of vested units of Parent will receive shares of our common stock in the distribution. Each holder of unvested units of Parent that are subject to time-vesting conditions will receive unvested restricted shares of our common stock in the distribution.

We refer to these transactions collectively as the “Distribution.” Unless otherwise indicated, all information in this prospectus assumes the completion of the Distribution prior to the closing of this offering and a public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus. The Distribution will not affect our operations, which we will continue to conduct through our operating subsidiaries.

Recent Developments

Acquisition of Intrinsic Imaging LLC

On June 1, 2021, we completed the acquisition of Intrinsic Imaging LLC, a comprehensive medical imaging and cardiac safety core lab services firm. Intrinsic provides these services to customers in support of clinical trials across all therapeutic areas and device and software validation studies, including but not limited to advisory services, consulting services, data acquisition, data centralization and harmonization, data analysis, quality control, data processing, data review, data transfer, query management, and reader management and oversight. The total purchase price was $80 million and was funded entirely by the Company’s cash on hand, with the potential for earn-outs totaling $12.1 million in the aggregate.

12

Table of Contents

The Offering

| Common stock offered by us |

shares. |

| Common stock to be outstanding after this offering |

shares (or shares, if the underwriters exercise in full their option to purchase additional shares of common stock). |

| Option to purchase additional shares |

The underwriters have an option to purchase up to an aggregate of additional shares of common stock from us. The underwriters can exercise this option at any time within days from the date of this prospectus. |

| Use of proceeds |

We estimate that the net proceeds to us from the sale of shares of our common stock in this offering will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares in full, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. |

| We intend to use the net proceeds from this offering for general corporate purposes to support the growth of our business. We may also use a portion of the proceeds to repay indebtedness and/or for the acquisition of, or investment in, technologies, solutions and/or businesses that complement our business. However, we do not have binding agreements or commitments for any acquisitions or investments outside the ordinary course of business at this time. See “Use of Proceeds.” |

| Dividend policy |

We do not expect to pay any dividends on our common stock for the foreseeable future. See “Dividend Policy.” |

| Symbol |

“WCGC.” |

| Controlled company |

Following this offering, we will be a “controlled company” within the meaning of the corporate governance rules of the . See “Management—Director Independence and Controlled Company Exception.” |

| Risk factors |

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 17 of this prospectus for a discussion of factors you should carefully consider before investing in our common stock. |

The number of shares of common stock to be outstanding after this offering is based on shares of common stock outstanding as of March 31, 2021, and excludes:

| • | additional shares of common stock reserved for future issuance under our 2021 Incentive Award Plan (the “2021 Plan”). |

13

Table of Contents

Unless otherwise indicated, all information contained in this prospectus:

| • | assumes the completion of the Distribution prior to the closing of this offering, including the issuance of shares of restricted common stock to be issued to certain current holders of unvested units of Parent in the Distribution; |

| • | assumes an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus; |

| • | assumes the underwriters’ option to purchase additional shares will not be exercised; |

| • | gives effect to a -for- stock split effected on , 2021; and |

| • | gives effect to our amended and restated certificate of incorporation and our second amended and restated bylaws. |

14

Table of Contents

Summary Consolidated Financial and Operating Data

The following tables summarize our consolidated financial and operating data for the periods and as of the dates indicated. We derived our summary consolidated statement of operations data and cash flows data for the years ended December 31, 2020 and 2019 from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statement of operations data and cash flows data for the three months ended March 31, 2021 and 2020 and the summary consolidated balance sheet data as of March 31, 2021 have been derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus.

The summary audited consolidated statement of operations data and cash flows data are presented for two periods, Successor and Predecessor, which relate to the period succeeding the Transaction and the period preceding the Transaction, respectively. See “Basis of Presentation” and Note 1 to our audited consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited interim consolidated financial statements on the same basis consistent with the presentation of our audited consolidated financial statements that are included elsewhere in this prospectus. We have included in our opinion, all adjustments necessary to state fairly our results of operations for these periods.

Our historical results are not necessarily indicative of the results to be expected in the future and our results of operations for the three months ended March 31, 2021 are not necessarily indicative of the results that may be expected for the full year or any other future period. You should read the following information in conjunction with the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the accompanying notes and other financial information included elsewhere in this prospectus.

| Successor | Predecessor | |||||||||||||||||||

| Year Ended December 31, |

Three Months Ended March 31, |

|||||||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||||||

| (in thousands, except share/unit and per share/unit data) | ||||||||||||||||||||

| Consolidated Statement of Operations Data |

||||||||||||||||||||

| Revenues |

$ | 463,441 | $ | 412,846 | $ | 137,642 | $ | 103,499 | ||||||||||||

| Cost of revenues (exclusive of depreciation and amortization) |

169,131 | 157,686 | 51,561 | 37,264 | ||||||||||||||||

| Operating expenses |

||||||||||||||||||||

| Selling, general and administrative expenses |

90,036 | 90,397 | 28,602 | 21,245 | ||||||||||||||||

| Depreciation and amortization |

205,697 | 64,602 | 53,044 | 50,924 | ||||||||||||||||

| Acquisition-related expenses |

38,469 | 26,789 | 9,062 | 17,463 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating expenses |

334,202 | 181,788 | 90,708 | 89.632 | ||||||||||||||||

| Operating (loss) income |

(39,892 | ) | 73,372 | (4,627 | ) | (23,397 | ) | |||||||||||||

| Other expense |

||||||||||||||||||||

| Interest expense |

91,310 | 55,415 | 21,735 | 22,794 | ||||||||||||||||

| Other expense (income) |

2,976 | 43 | 25 | (8 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total other expense |

94,286 | 55,458 | 21,760 | 22,786 | ||||||||||||||||

| (Loss) income before income taxes |

(134,178 | ) | 17,914 | (26,387 | ) | (46,183 | ) | |||||||||||||

| Income tax benefit |

(38,904 | ) | (279 | ) | (5,763 | ) | (16,091 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net (loss) income |

$ | (95,274 | ) | $ | 18,193 | $ | (20,624 | ) | $ | (30,092 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

15

Table of Contents

| Successor | Predecessor | |||||||||||||||||||

| Year Ended December 31, |

Three Months Ended March 31, |

|||||||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||||||

| (in thousands, except share/unit and per share/unit data) | ||||||||||||||||||||

| Net loss per common share:(6) |

||||||||||||||||||||

| Basic and diluted |

$ | (95,083.83 | ) | $ | (20,419.80 | ) | $ | (30,092.00 | ) | |||||||||||

| Weighted average common shares outstanding:(6) |

||||||||||||||||||||

| Basic and diluted |

1,002 | 1,010 | 1,000 | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||

| Net income per common unit: |

||||||||||||||||||||

| Basic and diluted |

12.59 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

| Weighted average common units outstanding: |

||||||||||||||||||||

| Basic and diluted |

610,971 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

| As of March 31, 2021 | ||||||||||||

| Actual |

|

As Adjusted(1) | ||||||||||

| (in thousands) | ||||||||||||

| Consolidated Balance Sheet Data |

||||||||||||

| Cash and cash equivalents |

$ | 174,988 | $ | |||||||||

| Total assets |

3,811,638 | |||||||||||

| Total debt |

1,366,034 | |||||||||||

| Total liabilities |

1,892,817 | |||||||||||

| Total stockholders’ equity |

1,918,821 | |||||||||||

| Total liabilities and stockholders’ equity |

3,811,638 | |||||||||||

| Successor | Predecessor | |||||||||||||||||||

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Consolidated Cash Flows Data |

||||||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||||||

| Operating activities |

$ | 124,201 | $ | 61,390 | $ | 16,316 | $ | 651 | ||||||||||||

| Investing activities |

(3,055,651 | ) | (101,864 | ) | (14,882 | ) | (2,905,898 | ) | ||||||||||||

| Financing activities |

3,109,528 | 38,747 | (4,532 | ) | 3,098,713 | |||||||||||||||

| Successor | Predecessor | |||||||||||||||||||

| Year Ended December 31, |

Three Months Ended March 31, | |||||||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

| Other Financial and Operating Data |

||||||||||||||||||||

| Adjusted EBITDA(2) |

$ | 218,363 | $ | 168,718 | $ | 59,124 | $ | 47,600 | ||||||||||||

| Bookings(3) |

$ | 621,823 | $ | 555,194 | $ | 266,190 | $ | 171,787 | ||||||||||||

| Backlog(4) |

$ |

701,720 |

|

$ | 595,526 | |||||||||||||||

| Client engagements(5) |

12,706 | 10,782 | 13,441 | 11,075 | ||||||||||||||||

| (1) | The as adjusted consolidated balance sheet data reflects the Distribution, the filing and effectiveness of our amended and restated certificate of incorporation and amended and restated bylaws and the sale and issuance by us of shares of common stock in this offering at an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses |

16

Table of Contents

| payable by us. A $1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) each of cash and cash equivalents, total assets and total stockholders’ equity by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

The as adjusted data discussed above is illustrative only and will be adjusted based on the actual initial public offering price and other terms of our initial public offering determined at pricing.

| (2) | We define Adjusted EBITDA, which is a non-GAAP measure, as net (loss) income excluding interest expense, income taxes, depreciation and amortization, stock option expense, integration costs, acquisition related adjustments, restructuring costs, litigation costs, change in value of contingent consideration, management fees, charitable contributions and other items not indicative of our ongoing operating performance. For information about why we consider Adjusted EBITDA useful and a discussion of the material risks and limitations of this measure, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Measures.” |

The following table reconciles net (loss) income to Adjusted EBITDA.

| Successor | Predecessor | |||||||||||||||||||

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||||||

| 2020 | 2019 | 2021 | 2020 | |||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Net (loss) income |

$ | (95,274 | ) | $ | 18,193 | $ | (20,624 | ) | $ | (30,092 | ) | |||||||||

| Interest expense |

91,310 | 55,415 | 21,735 | 22,794 | ||||||||||||||||

| Income tax benefit |

(38,904 | ) | (279 | ) | (5,763 | ) | (16,091 | ) | ||||||||||||

| Depreciation and amortization |

205,697 | 64,602 | 53,044 | 50,924 | ||||||||||||||||

| Stock option expense |

4,594 | — | 1,285 | — | ||||||||||||||||

| Integration cost(a) |

20,172 | 12,241 | 6,072 | 6,213 | ||||||||||||||||

| Acquisition-related adjustments(b) |

21,242 | 14,913 | (59 | ) | 13,797 | |||||||||||||||

| Restructuring costs(c) |

5,169 | (3 | ) | 530 | — | |||||||||||||||

| Litigation(d) |

2,829 | — | (22 | ) | — | |||||||||||||||

| Change in value of contingent consideration(e) |

1,358 | 1,011 | 2,926 | |||||||||||||||||

| Management fees(f) |

55 | 2,125 | — | 55 | ||||||||||||||||

| Charitable contribution(g) |

— | 500 | — | — | ||||||||||||||||

| Other(h) |

115 | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 218,363 | $ | 168,718 | $ | 59,124 | $ | 47,600 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Includes certain integration costs in connection with mergers and acquisitions, including the Transaction, the acquisition of Trifecta Multimedia, LLC (“Trifecta”), and other acquisitions made by WCG. These costs include system integration costs, marketing and rebranding costs, and certain payroll and employee related expenses. |

| (b) | Includes legal and professional costs related to the Company’s mergers and acquisitions. Costs related to the Transaction for the years ended December 31, 2020 and 2019, and the three months ended March 31, 2020, were $15.0 million, $10.2 million and $11.8 million, respectively. Costs related to the Trifecta acquisition were $0.9 million, which occurred during the year ended December 31, 2020. Costs related to other acquisitions made by WCG were $5.3 million for the year ended December 31, 2020 and $4.7 million for the year ended December 31, 2019. |

| (c) | Includes costs related to restructuring initiatives and the closing of a product line, and impairment of related assets. |

17

Table of Contents

| (d) | Includes litigation costs outside of the ordinary course of business related to settlement with certain employees. |

| (e) | Includes valuation adjustments for acquisition-related contingent consideration, which is subject to remeasurement at each balance sheet date. Any change in the fair value of such acquisition-related contingent consideration is reflected in our condensed consolidated statements of operations as a change in fair value of the liability. We adjust the carrying value of the acquisition-related contingent consideration until the contingency is finally determined or final payment is made. |

| (f) | Includes management fee paid to our prior sponsor in 2019 and 2020. Upon completion of the Transaction on January 8, 2020, this management fee was eliminated. |

| (g) | Includes a contribution to the WCG Foundation, a charitable organization for developing grants and programs for education. |

| (h) | Reflects one-time costs related to the preparation for this offering. |

| (3) | Bookings represents the dollar value of all new signed contracts, purchase orders, and site notifications of required ethical review services during a period. |

| (4) | Backlog represents the dollar value of all unsatisfied performance obligations at a point in time as well as revenue expected to be recognized in the next twelve months from IRB recurring services. |

| (5) | Client engagements represent the number of all active client contracts as of the periods ended shown above, between the Company and a CRO, clinical research site, partner organization or biopharmaceutical sponsor. Through these client engagements, the Company delivers value in exchange for direct remuneration or establishes or supports the contractual frameworks for the delivery of solutions to be provided by the Company. |

| (6) | We have made a correction to previously disclosed amounts to correct for an error related to the basic and diluted net (loss) per share for the year ended December 31, 2020 (Successor). The correction of this presentation error had no impact on the Successor’s previously reported consolidated net (loss) and comprehensive (loss) for the year ended December 31, 2020 (Successor). Refer to Note 9. Earnings (Loss) per Share/Unit to the audited Consolidated Financial Statements for additional information. |

18

Table of Contents