UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

April 16, 2024

Dear Shareholders:

Having recently passed the one-year mark in my return to Bausch + Lomb, I’m more excited than ever about what the future holds. Last May, I introduced the Roadmap to Accelerate Growth, a multi-year plan to help us realize our full potential through a thoughtful and phased approach. While it’s still early in the process, progress on our Roadmap is reflected in our 2023 performance. We saw 10 percent reported revenue growth and 12 percent constant currency revenue growth(1) for the full year, despite having to overcome several operational challenges. We expect that growth to continue in 2024, which we anticipate will be one of the most active launch years in company history.

None of this would be possible without the efforts and collective buy-in from our global workforce. Fundamentally changing how we operate takes time, but the benefits for all stakeholders are clear.

I encourage you to learn more about our 2023 performance by visiting the Investors section of www.bausch.com, and to attend Bausch + Lomb’s Annual Meeting of Shareholders on Wednesday, May 29, 2024, at 10:00 a.m. (Eastern Daylight Time). Bausch + Lomb’s Board of Directors has decided to conduct the meeting in an exclusively virtual format via a live internet webcast, which we believe will facilitate broader shareholder attendance and participation.

Details on the meeting, including how to vote, follow. We appreciate your continued support of Bausch + Lomb, and I hope you share my excitement for 2024 and beyond.

Sincerely,

Brenton L. Saunders Chairman of the Board and Chief Executive Officer |

| (1) | Constant currency revenue growth is a non-GAAP ratio - see Appendix C for more information on non-GAAP financial measures and ratios. |

2024 PROXY STATEMENT 1

To the Shareholders of Bausch + Lomb Corporation:

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Shareholders (the “Meeting”) of Bausch + Lomb Corporation, a Canadian corporation (the “Company,” “we” or “our”), will be conducted in an exclusively virtual format at www.virtualshareholdermeeting.com/BLCO2024 at 10:00 a.m. Eastern Daylight Time, on Wednesday, May 29, 2024, for the following purposes:

DATE AND TIME

To be held on Wednesday,

LOCATION

BAUSCH + LOMB CORPORATION |

Proposals | Board Vote Recommendation |

For Further Details | ||||||||

| 1 | to elect ten directors to serve on the Company’s board of directors (the “Board”) until the close of the 2025 Annual Meeting of Shareholders, their successors are duly elected or appointed, or such director’s earlier resignation or removal; | vote FOR all nominees | page 5 | ||||||||

| 2 | to approve, in an advisory vote, the compensation of our named executive officers; | vote FOR | page 40 | ||||||||

| 3 | to approve an amendment and restatement of the Bausch + Lomb Corporation 2022 Omnibus Incentive Plan to increase the number of common shares authorized for issuance thereunder; | vote FOR | page 72 | ||||||||

| 4 | to appoint PricewaterhouseCoopers LLP to serve as the Company’s auditor until the close of the 2025 Annual Meeting of Shareholders and to authorize the Board to fix the auditor’s remuneration; | vote FOR | page 81 | ||||||||

| Other Items of Business | |||||||||||

| 5 | to receive the audited consolidated financial statements of the Company for the year ended December 31, 2023, and the auditor’s report thereon; and | ||||||||||

| 6 | to transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. | ||||||||||

The record date for the Meeting is April 23, 2024. Only shareholders at the close of business on April 23, 2024 will be entitled to notice of, and to vote at, the Meeting. The management proxy circular and proxy statement that accompanies this Notice of Annual Meeting of Shareholders contains additional information regarding the proposals to be considered at the Meeting, and shareholders are encouraged to read it in its entirety before voting.

We encourage shareholders to vote as soon as possible.

To be valid, your vote or proxy appointment must be received by Broadridge Financial Solutions, Inc. by no later than 10:00 a.m. (EDT) on May 28, 2024, or, if the Meeting is adjourned or postponed, not less than 48 hours (not including Saturdays, Sundays or applicable Canadian holidays) prior to the reconvened Meeting (the “proxy deadline”). Nonregistered shareholders should return their voting instruction forms to their intermediary using one of the above methods by the date specified in their voting instruction form, and in any case at least one business day in advance of the proxy deadline (or such earlier deadline as your intermediary may specify on your proxy card or voting instruction form). For additional information on how to vote, please see “Questions About Voting” starting on page 91 in the accompanying management proxy circular and proxy statement.

By Order of the Board of Directors,

A. Robert D. Bailey

Executive Vice President and Chief Legal Officer

Dated: April 16, 2024

2

2

Table of Contents

This Management Proxy Circular and Proxy Statement (“Proxy Statement”) contains information about the 2024 Annual Meeting of Shareholders of Bausch + Lomb Corporation which will be held at 10:00 a.m. Eastern Daylight Time, on Wednesday, May 29, 2024, and at any adjournments or postponements thereof (the “Meeting”), for the purposes set forth in this Proxy Statement and in the accompanying Notice of Annual Meeting of Shareholders. In this document, the words “Bausch + Lomb,” “B+L,” the “Company,” “we,” “our,” “ours,” “us” and similar terms refer only to Bausch + Lomb Corporation and not to any other person or entity. References to “US$” or “$” are to United States dollars. Unless otherwise indicated, the statistical and financial data contained in this Proxy Statement are as of April 2, 2024. Links to websites included in this Proxy Statement are provided solely for convenience purposes. Content on the websites, including content on our Company website, is not, and shall not be deemed to be, part of this Proxy Statement or incorporated herein or into any of our other filings with the U.S. Securities and Exchange Commission (the “SEC”) or the Canadian Securities Administrators (the “CSA”).

This Proxy Statement may include forward-looking statements, which may generally be identified by the use of the words “anticipates,” “hopes,” “expects,” “intends,” “plans,” “should,” “could,” “would,” “may,” “believes,” “estimates,” “potential,” “target,” or “continue” and variations or similar expressions. These statements are based upon the current expectations and beliefs of management and are subject to certain risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These risks and uncertainties include, but are not limited to, the risks and uncertainties discussed in Bausch + Lomb’s filings with the SEC and the CSA, which factors are incorporated herein by reference. Readers are cautioned not to place undue reliance on any of these forward-looking statements. These forward-looking statements speak only as of the date hereof. Bausch + Lomb undertakes no obligation to update any of these forward-looking statements to reflect events or circumstances after the date of this Proxy Statement or to reflect actual outcomes, unless required by law.

2024 PROXY STATEMENT 3

PROPOSAL 1

|

Election of Directors

|

|||||

| + The Board of Directors of the Company (the “Board”), acting upon the recommendation of the Nominating and Corporate Governance Committee, has nominated the following ten directors to serve on the Board until the close of the Company’s 2025 Annual Meeting of Shareholders, their successors are duly elected or appointed, or such director’s earlier resignation or removal: | |||||

| + Thomas W. Ross, Sr. | + Sarah B. Kavanagh | + Russel C. Robertson | |||

| + Nathalie Bernier | + Karen L. Ling | + Brenton L. Saunders | |||

| + Gary Hu | + John A. Paulson | + Andrew C. von Eschenbach, M.D. | |||

| + Brett Icahn | |||||

+ Each nominee is highly qualified to serve through prior senior leadership roles and/or experience with other public companies.

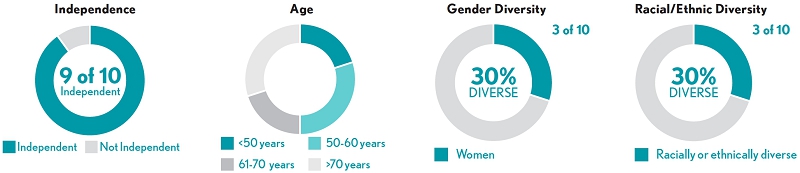

+ The nominees bring a wide range of attributes, competencies, and experiences to the Board, with 50% being gender and/or ethnically diverse.

|

|||||

|

The Board recommends a vote FOR each nominee for director. | See page 5 | |||

PROPOSAL 2

|

Advisory Vote on Executive Compensation

+ A significant portion of the compensation opportunity provided to our named executive officers is performance-based and linked to satisfying our financial targets and strategic initiatives.

+ We engage an independent compensation consultant and conduct ongoing shareholder engagement to inform our compensation program.

+ We maintain several shareholder-friendly compensation practices, which further align the interests of our executives with those of our shareholders, including among other things, performance-based equity grants, share ownership guidelines, and holding requirements.

|

|||||

|

The Board recommends a vote FOR this Proposal. | See page 40 | |||

PROPOSAL 3

|

Approval Vote of Amendment and Restatement of the Bausch + Lomb Corporation 2022 Omnibus Incentive Plan (“Omnibus Plan”) to Increase the Number of Common Shares Authorized for Issuance Thereunder

+ The Board, acting upon the recommendation of the Talent and Compensation Committee, is recommending an increase in the number of common shares of the Company (“B+L Common Shares”) authorized for issuance under the Omnibus Plan by an additional 14,000,000 B+L Common Shares.

+ The Board and Talent and Compensation Committee carefully considered anticipated future equity needs, historical equity incentive compensation practices and the advice of the independent compensation consultant before recommending this increase.

+ They concluded that this proposed increase represents a reasonable amount of additional equity dilution, while allowing the continued award of equity incentives, which is an important component of our compensation program.

|

|||||

|

The Board recommends a vote FOR this Proposal. | See page 72 | |||

PROPOSAL 4

|

Ratification of Appointment of Independent Registered Public Accounting Firm

+ The Board, acting upon the recommendation of the Audit and Risk Committee, is recommending that PricewaterhouseCoopers LLP (“PwC”) be appointed as our auditor until the close of the Company’s 2025 Annual Meeting of Shareholders.

+ Shareholders are asked to vote for the appointment of PwC as auditor and to authorize the Board to fix the auditor’s remuneration.

|

|||||

|

The Board recommends a vote FOR this Proposal. | See page 81 | |||

4

4

|

Election of Directors

Background

| ||

|

The Board recommends that you vote FOR each director nominee. | |

We have ten director nominees standing for election at the Meeting. Under the Canada Business Corporations Act (the “CBCA”), directors are elected annually. Directors elected at the Meeting will hold office until the close of the 2025 Annual Meeting of Shareholders of the Company, their successors are duly elected or appointed, or such director’s earlier resignation or removal. In an uncontested election, each director nominee is elected only if the number of votes cast in their favor represents a majority of the votes cast “for” and “against” them by the shareholders. In the event a director election becomes contested, votes “against” will be treated as votes “withheld”, with directors receiving the most “for” votes becoming elected.

Each of the ten director nominees has established his or her eligibility and willingness to serve on the Board. Set forth in the section titled “Director Nominees” beginning on page 7 are the names of the director nominees together with details about their backgrounds and experience. Also indicated is the number of the Company’s securities beneficially owned, controlled or directed, directly or indirectly, as of April 2, 2024, by each of the director nominees, as well as the aggregate value based on the $16.42 per share closing price B+L Common Shares as reported on the New York Stock Exchange (“NYSE”) on April 2, 2024. For each director nominee, you will find a record of attendance at meetings of the Board and the committees of the Board on which such director nominee served during 2023, if applicable.

The Board has determined that nine of the ten director nominees are independent within the meaning of all applicable securities regulatory and stock exchange requirements in Canada and the United States. In addition, in accordance with the applicable stock exchange requirements and Board committee charters, the Board has determined that all members of the Board’s Audit and Risk Committee, Talent and Compensation Committee and Nominating and Corporate Governance Committee are independent directors.

Unless otherwise instructed, the designated proxyholders intend to vote FOR the election of the ten director nominees proposed by the Board in this Proxy Statement. If, for any reason, at the time of the Meeting any of these director nominees are unable or unwilling to serve, the Board may choose to fix its size at a smaller number (so long as such number is within the range provided in the Company’s Articles of Incorporation (as amended)) or may appoint an additional director to fill the position following the Meeting.

2024 PROXY STATEMENT 5

| Skills and Experience |  |

|

|

|

|

|

|

|

|

| |

|

Accounting/Financial Has significant financial or accounting experience in positions requiring an understanding of financial reporting, internal controls and compliance requirements. |

|

|

|

|

||||||

|

Business Development/M&A Has significant experience evaluating, implementing or overseeing strategic business development opportunities. |

|

|

|

|

|

|

|

|||

|

CEO/President Has experience as a CEO or President at a company of comparable scale and complexity. |

|

|

|

| ||||||

|

Clinical Has an advanced scientific or technological degree and related work experience in a scientific or technological field. |

| |||||||||

|

Consumer Has strategic or management experience involving consumer marketing or brand management. |

|

|||||||||

|

Global Operations Has held a substantial leadership position in an organization that operates globally, particularly in regions in which the company operates. |

|

|

|

|

| |||||

|

Government/Regulatory Has worked closely with government organizations or has extensive legal, regulatory or public policy experience in highly regulated industries. |

|

|

|

|

|

|

| |||

|

Human Resources/Compensation Has significant experience with human capital management, including setting company culture and attracting, motivating, developing and retaining talent. |

|

|

||||||||

|

Pharmaceutical/Healthcare Industry Has held an executive or operational role at a company in the pharmaceutical or healthcare industry. |

|

|

||||||||

|

Risk Management Has extensive experience evaluating and managing a company’s significant risks and opportunities, including those relating to environmental, social and governance matters. |

|

|

|

|

|

|

|

|

| |

| Nathalie Bernier |

Gary Hu |

Brett Icahn |

Sarah B. Kavanagh |

Karen L. Ling |

John A. Paulson |

Russel C. Robertson |

Thomas W. Ross, Sr. |

Brenton L. Saunders |

Andrew C. von Eschenbach, M.D. | |

| Board Tenure - Full Years | 2 | 2 | 2 | 2 | < 1 | 2 | 2 | 2 | 2 | 2 |

| Age (as of April 2, 2024) - Years Old | 60 | 36 | 44 | 67 | 60 | 68 | 76 | 73 | 54 | 82 |

| Gender | Female | Male | Male | Female | Female | Male | Male | Male | Male | Male |

| Ethnically/Racially Diverse |  |

|

|

|||||||

| Geographic Diversity | Canada | United States | United States | Canada | United States | United States | Canada | United States | United States | United States |

6

6

Nine out of the ten proposed director nominees are incumbent directors from our 2023 Annual Meeting of Shareholders. Richard De Schutter decided to not seek re-election at the Meeting. As further discussed below, Karen Ling joined the Board on February 27, 2024. Each director elected at the Meeting will hold office until the close of the 2025 Annual Meeting of Shareholders, his or her successor is duly elected or appointed, or such director’s earlier resignation or removal.

The following narratives provide details about each of the director nominees’ background and experience, and summarize the specific attributes, competencies and characteristics that led to the determination of the Nominating and Corporate Governance Committee and the Board to nominate such individual as a director for election by the shareholders at the Meeting. In addition, each narrative lists the number of meetings of the Board and any applicable committee each director nominee attended during 2023, if applicable, and any public company directorships, other than with the Company, held by the nominees during the past five years. The narrative also sets out (i) the number of securities of the Company each director nominee beneficially owned, controlled or directed, directly or indirectly, as of April 2, 2024; (ii) the aggregate value of such securities based on the $16.42 per share closing price of B+L Common Shares on April 2, 2024, as reported on the NYSE; and (iii) the progress of each director nominee toward the director share ownership requirement established by the Board. For further detail regarding the share ownership requirement for non-employee directors, see the discussion in the section titled “Non-Employee Director Compensation Program — Directors’ Share Ownership” on page 37. For further detail regarding the share ownership requirement for Mr. Saunders, see the discussion in the section titled “Compensation Discussion and Analysis — Other Compensation Governance Practices — Share Ownership Guidelines” on page 57.

Messrs. Icahn and Hu were recommended by the Icahn Group (as defined below), a shareholder of ours and our parent company, Bausch Health Companies Inc. (“BHC”), and appointed to the Board on June 21, 2022 in connection with the amendment and restatement of the Director Appointment and Nomination Agreement originally entered into on April 28, 2022, copies of which are included as exhibits to our Annual Report on Form 10-K for the year ended December 31, 2023 (the “Annual Report”). Messrs. Ross, Paulson and Robertson, Dr. von Eschenbach and Mmes. Kavanagh and Bernier were recommended by our parent company, BHC, and appointed to the Board on April 28, 2022 in connection with the Master Separation Agreement originally entered into by BHC and the Company on March 30, 2022 and amended on April 28, 2022, copies of which are included as exhibits to our Annual Report. Mr. Saunders was recommended by the CEO Search Committee and appointed to the Board on February 15, 2023, effective March 6, 2023, to replace Mr. Joseph Papa who stepped down from his roles as CEO of the Company and member of the Board on March 6, 2023, as previously disclosed in our Current Report on Form 8-K filed with the SEC and on SEDAR+ on February 15, 2023. Ms. Ling was appointed to the Board on February 27, 2024, as previously disclosed in our Current Report on Form 8-K filed with the SEC and on SEDAR+ on February 28, 2024.

None of the directors or director nominees are related by blood, marriage or adoption to one another or to any executive officer of the Company.

2024 PROXY STATEMENT 7

|

Nathalie Bernier, FCPA, FCA Quebec, Canada | INDEPENDENT | ||

| Corporate Director | ||||

| Age: 60 | Director since: 2022 | |||

|

Background Ms. Bernier serves as an independent director of the Company having served as a director since April 2022. Ms. Bernier served as Chief Financial Officer and Senior Vice President Strategic and Business Planning at the Public Sector Pension Investment Board, a large Canadian pension investment manager from August 2015 to September 2019. Prior to this role, Ms. Bernier spent nearly 30 years as an Audit and Advisory Partner at Arthur Andersen LLP and at KPMG LLP, where she served as Regional Managing Partner (Quebec) and as a member of KPMG’s Canadian Leadership team. Ms. Bernier is currently a director of RF Capital Group Inc., a publicly traded company, where she is the Chair of the Risk Committee and member of the Audit Committee. Ms. Bernier is also a director of the board of Canada Enterprise Emergency Funding Corporation, a Canadian crown corporation, where she serves as Chair of the Audit Committee. She is also a director of the board of Les Proprieties Docteur Penfield Inc., a private company. Ms. Bernier holds a Bachelor of Commerce degree from McGill University. She is a fellow of the Chartered Professional Accountants in Canada.

The Board has determined that Ms. Bernier’s extensive experience as a public company board member and financial and accounting expertise qualify her to serve as a member of the Board.

|

||||

|

Current Public Company Directorships + RF Capital Group Inc.

2023 Meeting Attendance: + Board – 6/6 + Audit and Risk Committee – 8/8 + Science and Technology Committee – 4/4 |

Previous Public Company Directorships + None

Stock Ownership: + 197 B+L Common Shares – $3,235 + 34,432 restricted share units (21,575 vested – $354,262 and 12,857 unvested - $211,112) + Total Equity Value at Risk(1) – $357,497, representing 71% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee directors and 447% of the director’s annual retainer |

|||

| (1) | The “Total Equity Value at Risk” calculation for each director includes only B+L Common Shares and vested restricted share units held or controlled by the relevant director. It does not include the value of any options (as applicable) or unvested restricted share units. |

8

8

|

Gary Hu Florida, USA | INDEPENDENT | ||

| Portfolio Manager, Icahn Capital LP | ||||

| Age: 36 | Director since: 2022 | |||

|

Background Mr. Hu serves as an independent director of the Company having served as a director since June 2022. Mr. Hu has been a Portfolio Manager for Icahn Capital LP, a subsidiary of Icahn Enterprises L.P., a diversified holding company engaged in a variety of businesses, including investment, automotive, energy, food packaging, metals, real estate and home fashion, since 2020. Prior to joining Icahn Capital LP, he held investment management roles at Silver Point Capital LP, a credit-focused investment firm, from 2012-2020 and Stockbridge Investors, the public securities affiliate of Berkshire Partners LLC, from 2010-2012. Mr. Hu has also served on the board of Dana Incorporated since 2022 and the board of International Flavors & Fragrances Inc., since February 2023, and was previously on the boards of Occidental Petroleum Corporation, Cloudera Inc. and Newell Brands Inc. Mr. Hu graduated from the University of Pennsylvania with a B.S. Econ in Finance and Accounting from The Wharton School and a B.A.S. in Computer Science from the School of Engineering and Applied Science.

The Board has determined that Mr. Hu’s experience as a portfolio manager and other investment management roles has provided him with experience in investing and finance and complex credit matters, which qualifies him to serve as a member of the Board.

|

||||

|

Current Public Company Directorships + Dana Inc. + International Flavors & Fragrances Inc. |

Previous Public Company Directorships + Occidental Petroleum Corporation + Cloudera Inc. + Newell Brands Inc.

|

|||

2023 Meeting Attendance: + Board – 6/6 + Audit and Risk Committee – 8/8 + Talent and Compensation Committee – 8/8 + Science and Technology Committee – 4/4 |

Stock Ownership: + 13,256 B+L Common Shares – $217,664 + 12,857 restricted share units (0 vested – $0 and 12,857 unvested - $211,112) + Total Equity Value at Risk – $217,664, representing 44% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee directors and 272% of the director’s annual retainer |

|||

2024 PROXY STATEMENT 9

|

Brett Icahn Florida, USA | INDEPENDENT | ||

| Portfolio Manager, Icahn Capital LP | ||||

| Age: 44 | Director since: 2022 | |||

|

Background Mr. Icahn serves as an independent director of the Company having served as a director since June 2022. He has also served on the board of our parent, BHC, since March 2021. He has been a Portfolio Manager for Icahn Capital LP, a subsidiary of Icahn Enterprises L.P., a diversified holding company engaged in a variety of businesses, including investment, automotive, energy, food packaging, metals, real estate and home fashion, since October 2020. Before that, Mr. Icahn was a consultant for Icahn Enterprises L.P., where he exclusively provided investment advice to Carl C. Icahn with respect to the investment strategy for Icahn Enterprises’ Investment segment and with respect to capital allocation across Icahn Enterprises’ various operating subsidiaries from 2017 to 2020. Mr. Icahn was previously a member of the board of American Railcar Industries, Inc., Cadus Corporation, Dana Incorporated, Newell Brands Inc., Nuance Communications, Inc., Take-Two Interactive Software Inc., The Hain Celestial Group, Inc. and Voltari Corporation. Mr. Icahn received a B.A. from Princeton University.

The Board has determined that Mr. Icahn’s experience at the Icahn entities, his service as a director of multiple public company boards and his tenure as a Portfolio Manager provide him with expertise in investing and capital allocation, which qualifies him to serve as a member of the Board.

|

||||

|

Current Public Company Directorships + Bausch Health Companies Inc. |

Previous Public Company Directorships + American Railcar Industries, Inc. + Cadus Corporation + Dana Incorporated + Hain Celestial Group, Inc. + Newell Brands Inc. + Nuance Communications, Inc. + Take-Two Interactive Software Inc. + Voltari Corporation

|

|||

2023 Meeting Attendance: + Board – 6/6 + Nominating and Corporate Governance Committee – 4/4 |

Stock Ownership: + 13,256 B+L Common Shares – $217,664 + 12,857 restricted share units (0 vested – $0 and 12,857 unvested - $211,112) + Total Equity Value at Risk – $217,664, representing 44% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee directors and 272% of the director’s annual retainer |

|||

10

10

|

Sarah B. Kavanagh Ontario, Canada | INDEPENDENT | ||

| Corporate Director | ||||

| Age: 67 | Director since: 2022 | |||

|

Background Ms. Kavanagh serves as an independent director of the Company having served as a director since April 2022. She has also served on the board of our parent, BHC, since July 2016. From 2011 through May 2016, Ms. Kavanagh served as a Commissioner of the Ontario Securities Commission, where she also served as Chair of the audit committee starting in 2014. Between 1999 and 2010, Ms. Kavanagh served in various senior investment banking roles at Scotia Capital Inc. including Vice-Chair and Co-Head of Diversified Industries Group, Head of Equity Capital Markets, and Head of Investment Banking. Prior to Scotia Capital, she held several senior financial positions with operating companies. She started her career as an investment banker with a bulge bracket firm in New York. Since 2013, Ms. Kavanagh has been a director of Hudbay Minerals Inc., a publicly traded Canadian mining corporation. She also serves as a director of Sustainable Development Technology Canada. She previously served as a director of AST and AST Trust Company (Canada) (formerly Canadian Stock Transfer Company) and Cymax Technologies Group and as a member of the board of trustees of WPT Industrial REIT, formerly a publicly traded open-ended real estate investment trust. Ms. Kavanagh graduated from Harvard Business School with an MBA and received a Bachelor of Arts degree in Economics from Williams College.

The Board has determined that Ms. Kavanagh’s extensive experience of complex financial and capital markets issues at banking institutions and the Ontario Securities Commission, where she demonstrated leadership capability and extensive knowledge of complex financial and public policy issues, qualifies her to serve as a member of the Board.

|

||||

|

Current Public Company Directorships + Bausch Health Companies Inc. + Hudbay Minerals Inc.

|

Previous Public Company Directorships + WPT Industrial REIT (formerly publicly traded) |

|||

| 2023 Meeting Attendance: + Board – 6/6 + Audit and Risk Committee – 8/8 + Nominating and Corporate Governance Committee – 4/4 |

Stock Ownership: + 5,808 B+L Common Shares – $95,367 + 12,857 restricted share units (0 vested – $0 and 12,857 unvested - $211,112) + Total Equity Value at Risk – $95,367, representing 19% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee directors and 119% of the director’s annual retainer |

|||

2024 PROXY STATEMENT 11

|

Karen L. Ling New York, USA | INDEPENDENT | ||

| Corporate Director | ||||

| Age: 60 | Director since: 2024 | |||

|

Background Ms. Ling serves as an independent director of the Company having served as a director since February 2024. She has previously served as Executive Vice President and Chief Human Resources Officer at American International Group, Inc., a multinational finance and insurance corporation, from 2019 to 2021 and, prior to that, at Allergan, a pharmaceutical company, from 2014 to 2019. She previously held senior human resources roles at Merck and Wyeth (now Pfizer). Ms. Ling serves as a director and chair of the Compensation and Human Capital Management Committee of iRhythm Technologies, Inc. and as a member of the Advisory Committee of Galderma. She previously served on the Boards of Mallinckrodt Plc and TherapeuticsMD Inc. Additionally, Ms. Ling is a member of the board of two nonprofits: ExpandEd Schools and the JED Foundation. She holds a B.A. in Economics from Yale University and a J.D. from the Boston University School of Law.

The Board has determined that Ms. Ling’s extensive experience as an executive officer of a large public company and as a board member of a leading health care company qualifies her to serve as a member of the Board.

|

||||

|

Current Public Company Directorships + iRhythm Technologies, Inc. |

Previous Public Company Directorships + TherapeuticsMD Inc. + Mallinckrodt Plc

|

|||

2023 Meeting Attendance: + N/A |

Stock Ownership: + 0 B+L Common Shares – $0 + 2,642 restricted share units (0 vested – $0 and 2,642 unvested - $43,382) + Total Equity Value at Risk – $0, representing 0% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee directors and 0% of the director’s annual retainer |

|||

12

12

|

John A. Paulson New York, USA | INDEPENDENT | ||

| President, Paulson & Co. Inc. | ||||

| Age: 68 | Director since: 2022 | |||

|

Background Mr. Paulson serves as an independent director of the Company having served as a director since April 2022. He has also served on the board of our parent, BHC, from June 2017 to May 2022 and rejoined the board of BHC as its Chair on June 2022. Mr. Paulson is the President and Portfolio Manager and member of the Board of Paulson & Co. Inc., an SEC-registered investment management company specializing in global mergers, event arbitrage and credit strategies, which he founded in 1994. Prior to forming Paulson & Co. Inc., Mr. Paulson was a Partner of Gruss Partners and a Managing Director in mergers and acquisitions at Bear Stearns. Mr. Paulson has been a director of BrightSphere Investment Group Inc., a publicly traded asset management holding company, since November 2018, and has served as Chairman of the Board since April 2020. He is the also the Chairman of the Board (and majority owner) of private companies, Steinway Musical Instruments, Inc. and P.F. Chang’s. Mr. Paulson previously served as a director of American International Group Inc., a multinational finance and insurance corporation, from May 2016 to June 2017. Mr. Paulson graduated with a degree in finance from New York University in 1978 and his MBA from Harvard Business School in 1980.

The Board has determined that Mr. Paulson’s extensive experience as president and portfolio manager of an SEC-registered investment firm and his understanding of business and financial strategy in challenging environments qualify him to serve as a member of the Board.

|

||||

|

Current Public Company Directorships + Bausch Health Companies Inc. + BrightSphere Investment Group Inc.

|

Previous Public Company Directorships + American International Group Inc. |

|||

2023 Meeting Attendance: + Board – 6/6 + Nominating and Corporate Governance Committee – 3/4 |

Stock Ownership: + 12,500 B+L Common Shares – $205,250 + 19,038 restricted share units (6,181 vested – $101,492 and 12,857 unvested - $211,112) + Total Equity Value at Risk – $306,742, representing 61% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee directors and 383% of the director’s annual retainer |

|||

2024 PROXY STATEMENT 13

|

Russel C. Robertson Ontario, Canada | INDEPENDENT | ||

| Corporate Director | ||||

| Age: 76 | Director since: 2022 | |||

|

Background Mr. Robertson serves as an independent director of the Company having served as a director since April 2022. He has also served on the board of our parent, BHC, since June 2016 and will be retiring from the BHC board following its 2024 annual meeting. From 2013 through August 2016, Mr. Robertson served as Executive Vice President and Head, Anti-Money Laundering, at BMO Financial Group (“BMO”), a diversified financial services organization. Prior to that role, he served as Executive Vice President, Business Integration, at BMO Financial Group, and as Vice Chair at BMO Financial Corp. from 2011. He joined BMO as interim Chief Financial Officer, BMO Financial Group in 2008 and was appointed Chief Financial Officer, BMO Financial Group in 2009. Before joining BMO, Mr. Robertson spent over 35 years as a Chartered Public Accountant. In this capacity, he held various senior positions with a number of major accounting firms, including Vice Chair, Deloitte & Touche LLP in Toronto, Canada, from 2002 to 2008, and Canadian Managing Partner, Arthur Andersen LLP, from 1994 to 2002. Mr. Robertson previously served on the boards of Hydro One Limited, Turquoise Hill Resources Ltd. and Virtus Investment Partners, Inc. Mr. Robertson holds a Bachelor of Arts degree (Honours) from the Ivey School of Business at the University of Western Ontario.

The Board has determined that Mr. Robertson’s extensive experience of complex financial matters at Deloitte & Touche LLP and Arthur Andersen LLP, in-depth knowledge of financial and accounting matters, understanding of financial strategy in challenging environments, and leadership capabilities in senior finance positions qualify him to serve as a member of the Board.

|

||||

|

Current Public Company Directorships + Bausch Health Companies Inc. |

Previous Public Company Directorships + Hydro One Limited + Turquoise Hill Resources Ltd. (formerly publicly traded) + Virtus Investment Partners, Inc.

|

|||

| 2023 Meeting Attendance: + Board – 6/6 + Audit and Risk Committee – 8/8 + Talent and Compensation Committee – 8/8 |

Stock Ownership: + 5,808 B+L Common Shares – $95,367 + 20,098 restricted share units (7,241 vested – $118,897 and 12,857 unvested - $211,112) + Total Equity Value at Risk – $214,264, representing 43% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee directors and 238% of the director’s annual retainer |

|||

14

14

|

Thomas W. Ross, Sr. North Carolina, USA | INDEPENDENT | ||

| Lead Independent Director Director, Volcker Alliance and President Emeritus, University of North Carolina |

||||

| Age: 73 | Director since: 2022 | |||

|

Background Mr. Ross has served as Lead Independent Director of the Board since March 6, 2023. He served as Chairman of the Board from July 19, 2022 to March 6, 2023 and served as Lead Independent Director of the Company from May 2022 to July 18, 2022, having served as a director since April 2022. Mr. Ross has also served on the board of directors of Bausch Health Companies Inc. beginning in March 2016 and served as Bausch Health Companies Inc.’s Lead Independent Director from June 2016 to June 2022. Mr. Ross will be retiring from the BHC board following its 2024 annual meeting. He served as the President of Volcker Alliance from July 2016 until December 31, 2021. He now serves as a director to the Volcker Alliance. He is President Emeritus of the University of North Carolina (“UNC”), having served as President from January 2011 to January 2016. Mr. Ross was named the Sanford Distinguished Fellow in Public Policy at the Duke University Sanford School of Public Policy in 2016. Prior to becoming President of the UNC system, Mr. Ross served as President of Davidson College, Executive Director of the Z. Smith Reynolds Foundation, director of the North Carolina Administrative Office of the Courts, a Superior Court judge, chief of staff to U.S. Congressman Robin Britt, a member of the Greensboro, NC law firm Smith, Patterson, Follin, Curtis, James & Harkavy, and as an Assistant Professor of Public Law and Government at UNC Chapel Hill’s School of Government. Mr. Ross holds a B.A. in Political Science from Davidson College and a J.D. from University of North Carolina School of Law.

The Board has determined that Mr. Ross’s demonstrated leadership in senior management positions, extensive experience with corporate governance responsibilities and complex knowledge of legal, compliance and operational issues qualify him to serve as a member of the Board.

|

||||

|

Current Public Company Directorships + Bausch Health Companies Inc.

2023 Meeting Attendance: + Board – 6/6 + Nominating and Corporate Governance Committee – 4/4 + Talent and Compensation Committee – 8/8 |

Previous Public Company Directorships + None

Stock Ownership: + 12,500 B+L Common Shares – $205,250 + 12,857 restricted share units (0 vested – $0 and 12,857 unvested - $211,112) + Total Equity Value at Risk – $205,250, representing 41% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee directors and 257% of the director’s annual retainer |

|||

2024 PROXY STATEMENT 15

|

Brenton L. Saunders Florida, USA | NOT INDEPENDENT | ||

| Chairman of the Board and Chief Executive Officer, Bausch + Lomb Corporation |

||||

| Age: 54 | Director since: 2023 | |||

|

Background Mr. Saunders has served as our Chairman of the Board and Chief Executive Officer since March 2023. He is currently the Chairman of The Beauty Health Company. He was Co-Founder and Chairman of Vesper Healthcare Acquisitions Corp., a specialty purpose acquisition company from July 2020 to May 2021. He was Chairman, President and Chief Executive Officer of Allergan and served in the role of President and Chief Executive Officer from July 2014 to May 2020 and Chairman from October 2016 to May 2020, having previously served as Chief Executive Officer and President, and as director, of Forest Laboratories, Inc., prior to its acquisition by Allergan. Prior to that, he served as Chief Executive Officer of Bausch & Lomb Incorporated, serving in this capacity from March 2010 until August 2013. Mr. Saunders also held a number of leadership positions at Schering-Plough, including the position of President of Global Consumer Health Care and was named Head of Integration for the company’s merger with Merck & Co. and for Schering-Plough’s acquisition of Organon BioSciences. Before joining Schering-Plough, Mr. Saunders was a partner and Head of Compliance Business Advisory at PricewaterhouseCoopers LLP. Prior to that, he was Chief Risk Officer at Coventry Health Care and Senior Vice President, Compliance, Legal and Regulatory at Home Care Corporation of America. Mr. Saunders began his career as Chief Compliance Officer for the Thomas Jefferson University Health System. Mr. Saunders previously served on the Board of Directors of BridgeBio Pharma, Inc., Cisco Systems, Inc., Glo Pharma, Hugel and Osmind. In addition to his current public company director positions, he serves as a member of the board of private companies including Cambrian Pharma, OcuTerra Therapeutics, Nextech Systems, LLC, Rapalogix Health, Inc. and Roam HQ Inc., where he is Chairman of the board.

The Board has determined that Mr. Saunders’ extensive experience in various aspects of health care and his leadership roles at several prominent global pharmaceutical and healthcare companies qualify him to serve as a member of the Board.

|

||||

|

Current Public Company Directorships + ARS Pharmaceuticals, Inc. + Beauty Health Company + OcuTerra Therapeutics |

Previous Public Company Directorships + Allergan plc + BridgeBio Pharma, Inc. + Cisco Systems, Inc. + Hugel (a semipublic company on the Korean exchange)

|

|||

2023 Meeting Attendance: + Board – 4/4 |

Stock Ownership: + 0 B+L Common Shares – $0 + 562,919 restricted share units (0 vested – $0 and 562,919 unvested - $9,243,130) + 1,414,429 performance share units + 1,887,786 options + Total Equity Value at Risk – $0 based on the value of the B+L Common Shares and vested restricted shares beneficially owned by him, but excluding all options, performance share units and unvested restricted share units

Mr. Saunders is subject to share ownership guidelines under the terms of his employment agreement with the Company, as further described in the section titled “Compensation Discussion and Analysis—Other Compensation Governance Practices—Share Ownership Guidelines” on page 57. |

|||

16

16

|

Andrew C. von Eschenbach, M.D. Texas, USA | INDEPENDENT | ||

| President, Samaritan Health Initiatives, Inc. | ||||

| Age: 82 | Director since: 2022 | |||

|

Background Dr. von Eschenbach serves as an independent director of the Company having served as a director since April 2022. Dr. von Eschenbach has been the President of Samaritan Health Initiatives, Inc., a health care policy consultancy, and an Adjunct Professor at University of Texas MD Anderson Cancer Center, since 2010. He has served in advisory roles at Roivant Sciences Ltd, a pharmaceutical preparations company, since February 2023, a Senior Advisor of Orcosa, a clinical-stage life sciences company, since July 2022, the Milken Institute from 2011 to present and the Bipartisan Policy Center from 2019 to present. He served in the Davos Alzheimer’s collaborative group from December 2021 to December 2022. From 2005 to 2009, Dr. von Eschenbach served as Commissioner of the U.S. Food and Drug Administration (the “FDA”). He was appointed Commissioner of the FDA after serving for four years as Director of the National Cancer Institute at the National Institutes of Health. As a researcher, clinician and administrator, Dr. von Eschenbach served for twenty-six years at the University of Texas MD Anderson Cancer Center as Chairman of Urology, Director of the Prostate Cancer Research Program and Executive Vice President and Chief Academic Officer. He has served as a director of TriSalus Life Sciences, a publicly traded company engaged in medical equipment manufacture, and as a director of Wavebreak (formerly Wren Therapeutics, Ltd.), a private biopharmaceutical company. Dr. von Eschenbach is also a member of the board of the Regan Udall Foundation of the FDA, a non-profit organization formed to advance regulatory science and a member of the Advisory Board of Arbital Health. Dr. von Eschenbach previously served as a director on the boards of Radius Health Inc., Celularity, Inc., Bausch Health Companies Inc. and the Prostrate Cancer Foundation. He earned a B.S. from St. Joseph’s University and a medical degree from Georgetown University School of Medicine in Washington, D.C. He completed his residency in surgery and urology at Pennsylvania Hospital and University of Pennsylvania, respectively, and his urologic oncology fellowship at University of Texas MD Anderson Cancer Center.

The Board has determined that Dr. von Eschenbach’s extensive leadership experience in the public sector and at prominent medical systems in the United States and his understanding of operations and healthcare strategy in challenging environments qualify him to serve as a member of the Board.

|

||||

|

Current Public Company Directorships + TriSalus Life Sciences |

Previous Public Company Directorships + Bausch Health Companies Inc. + Celularity, Inc. + Radius Health, Inc.

|

|||

| 2023 Meeting Attendance: + Board – 6/6 + Nominating and Corporate Governance Committee – 4/4 + Science and Technology Committee – 4/4 |

Stock Ownership: + 12,500 B+L Common Shares – $205,250 + 12,857 restricted share units (0 vested – $0 and 12,857 unvested - $211,112) + Total Equity Value at Risk – $205,250, representing 41% of the Company’s current aggregate amount of $500,000 required under the share ownership guidelines for non-employee directors and 257% of the director’s annual retainer |

|||

2024 PROXY STATEMENT 17

The Board is responsible for nominating director candidates for election to the Board, and for appointing directors to the Board to fill any vacancies that may occur in between annual elections of directors. The Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become directors and recommending to the Board director candidates for nomination either for election by shareholders or for appointment by the Board. In fulfilling this responsibility, the Nominating and Corporate Governance Committee considers, among other things, (i) the independence, skills, qualifications and experience of director candidates in a manner consistent with the selection criteria approved by the Board from time to time; (ii) the composition, competencies and skills of the Board as a whole, and the needs of the individual Board committees; (iii) the wide range of attributes, competencies, characteristics, experiences and backgrounds contemplated by the Company’s Board Diversity Policy, as described below; and (iv) in evaluating incumbent directors for re-nomination, the performance of such directors.

Earlier this year, our director nomination process resulted in the appointment of Karen Ling to the Board on February 27, 2024. We believe Ms. Ling’s background, skillset and experience will help bring a unique perspective to the Board and the Company.

The Company does not have a director retirement policy or set term limits for independent directors, because the Board does not believe either is necessary to provide for adequate Board refreshment. The Nominating and Corporate Governance Committee actively considers this issue in recommending to the Board director candidates for nomination for election by shareholders. Our current Board is comprised of directors who have served on our Board, including, as applicable, the board of BHC, the parent company of Bausch + Lomb, from less than one year to more than fifteen years.

At Bausch + Lomb, we recognize diversity and inclusion as a business imperative and strategic asset to our investors. In July 2023, upon the recommendation of the Nominating and Corporate Governance Committee, the Board amended its Corporate Governance Guidelines to incorporate the board diversity policy, which had previously been a standalone document. Diversity includes, but is not limited to, gender (including gender identity and expression), sexual orientation, disability, age, ethnicity (including visible minorities), aboriginal identity, religion, business experience, functional expertise, culture and geography. The Board and the Nominating and Corporate Governance Committee consider a wide range of attributes, competencies, characteristics, experiences and backgrounds, including specifically considering the number of diverse directors on the Board, when reviewing the Board composition in the director nomination and re-nomination process. The Nominating and Corporate Governance Committee oversees and annually evaluates the implementation and effectiveness, both as measured annually and cumulatively, of the board diversity policy (as it is incorporated in the Corporate Governance Guidelines), in conjunction with its director evaluation and nomination process and assesses effectiveness by reference to, among other things, the extent to which the current board and the nominees for election to the Board reflect stated diversity objectives. Any search firm engaged to assist in identifying candidates for appointment to the Board will be directed to consider the desire of the Company to have its board reflect a wide range of attributes, competencies, characteristics and backgrounds, including, but not limited to, gender (including gender identity and expression), sexual orientation, disability, age, ethnicity (including visible minorities), aboriginal identity, religion, business experience, functional expertise, culture and geography.

The Board has adopted a target of being composed of directors of whom at least 30% identify as women or otherwise identify as from a diverse community, including but not limited to directors who identify as aboriginal, a member of a visible minority or disabled. In 2023, the Board achieved 40% diversity, including gender and minority representation. Currently, three of our eleven directors are women, representing 27% of our directors and three directors represent visible minorities, representing 27% of our directors. None of our directors identify as a person with a disability or as an Aboriginal person. If all of our director nominees are elected by shareholders at the Meeting, three directors, representing 30% of our directors, will be women, three directors, representing 30% of our directors will be a member of a visible minority, and no directors will be a person with a disability or Aboriginal person. For a discussion of the Company’s policy regarding the level of diversity in executive officer positions, please see “Corporate Governance—Succession Planning; Diversity of Executive Leadership Team” on page 32.

18

18

The Nominating and Corporate Governance Committee will also consider director recommendations submitted by the Company’s shareholders. Shareholders who wish to have the Nominating and Corporate Governance Committee consider their recommendations should submit their recommendation in writing to the Nominating and Corporate Governance Committee, attention: Chair, Nominating and Corporate Governance Committee, Bausch + Lomb Corporation, 520 Applewood Crescent, Vaughan, Ontario, Canada L4K 4B4.

Director recommendations made by shareholders in such manner will undergo the same evaluation by the Nominating and Corporate Governance Committee and the Board as all other director nominees. For more detailed information on this evaluation process, please refer to the charter of the Nominating and Corporate Governance Committee, which is available on the Company’s website at www.bausch.com (under the tab “Investors” and under the subtab “Corporate Governance—Governance Documents”). For additional information regarding our director standards, please refer to our Corporate Governance Guidelines, which are available on the Company’s website at www.bausch.com (under the tab “Investors” and under the subtab “Corporate Governance—Governance Documents”).

In order for a director candidate nominated by a shareholder to be included as a nominee in the management proxy circular and proxy statement for an Annual Meeting of Shareholders of Bausch + Lomb, such shareholder’s nomination must satisfy the criteria and procedures prescribed under the CBCA and in Bausch + Lomb’s by-laws. For additional information regarding the deadlines and procedures for submitting such nominations to Bausch + Lomb, please see the discussion on page 90 under “Other Shareholder Proposals and Director Nominations for the 2025 Annual Meeting of Shareholders.”

The Board believes that, in order to be effective, our Board must be able to operate independently of management. As described in our Corporate Governance Guidelines, available on our website at www.bausch.com (under the tab “Investors” and under the subtab “Corporate Governance—Governance Documents”), a sufficient number of directors must satisfy the applicable tests of independence, such that the Board complies with all independence requirements under corporate and securities laws and stock exchange requirements applicable to the Company. The Corporate Governance Guidelines further provide that the Nominating and Corporate Governance Committee, as well as the Board, reviews the relationships that each director has with the Company in order to satisfy itself that these independence criteria have been met. On an annual basis, as part of our disclosure procedures, all directors complete a questionnaire pertaining to, among other things, share ownership, family and business relationships, and director independence standards. The Board must then disclose in the Company’s annual management proxy circular and proxy statement the identity of each of the independent directors and the basis for the Board’s determination for each of the directors who are not independent.

The Board is currently comprised of eleven members, but will revert to ten members upon Mr. De Schutter’s retirement. The Board has determined that ten of our eleven current directors (or 91%) are “independent directors” within the meaning of applicable regulatory and stock exchange requirements in Canada and the United States, as none of them have a material relationship with the Company that could be reasonably expected to interfere with their exercise of independent judgment. The ten independent directors currently on the board are:

| Mr. Ross (Lead Independent Director) | Mr. Icahn | Mr. Paulson |

| Ms. Bernier | Ms. Kavanagh | Mr. Robertson |

| Mr. De Schutter | Ms. Ling | Dr. von Eschenbach |

| Mr. Hu |

None of our current directors (all of whom are director nominees, with the exception of Mr. De Schutter) have entered into employment, service or similar contracts with us, with the exception of Mr. Saunders. On February 14, 2023, Mr. Saunders entered into an employment agreement with the Company to serve as the Company’s Chairman of the Board and Chief Executive Officer. Because Mr. Saunders is the Chief Executive Officer of the Company, the Board has determined that Mr. Saunders is not an independent director and will not be eligible to serve on the Audit and Risk Committee, the Talent and Compensation Committee, or the Nominating and Corporate Governance Committee.

2024 PROXY STATEMENT 19

The Board is committed to sound and effective corporate governance practices with the goal of ensuring the Company’s financial strength and overall business success. Our governance practices are periodically assessed against those practices suggested by recognized governance authorities and are designed to maintain alignment with shareholder interests and key governance best practices.

| Brenton

L. Saunders Chairman of the Board and Chief Executive Officer |

Thomas

W. Ross, Sr. Lead Independent Director | |||||

| Independent Committee Chairs and Directors | ||||||

Our Corporate Governance Guidelines provide that our Board may determine from time to time the most effective leadership structure for the Company, including whether the same individual should serve both as Chairman of the Board and the CEO. Mr. Saunders, our CEO, also serves as Chairman of the Board. Due to his in-depth knowledge of the healthcare industry, Mr. Saunders is well positioned to identify and lead Board deliberations regarding important matters relating to the Company’s operations, strategic priorities, and overall development. The Board believes that serving as both CEO and Chairman of the Board enables Mr. Saunders to facilitate effective communication between Company management and the Board and to help ensure key issues and recommendations are brought to the attention of the Board. The Board believes that this leadership structure, in conjunction with the appointment of a Lead Independent Director, is the most effective for the Company at this time, and that the existing corporate governance practices effectively achieve independent oversight and management accountability.

Our Corporate Governance Guidelines also provide that, if the same individual serves as Chairman of the Board and the CEO, or if the Chairman of the Board is otherwise not independent, our Board shall appoint a Lead Independent Director. Our independent directors annually appoint a Lead Independent Director. Mr. Ross has been appointed to serve as Lead Independent Director. Mr. Ross has served in this role since the Bausch + Lomb Initial Public Offering (the “B+L IPO”) in May 2022, with a short stint as independent chairman, and previously served in such role with our parent, BHC. His extensive experience with our business and his corporate governance background have provided him with unique capabilities and insight which have positioned him well for this role.

The responsibilities of the Chairman of the Board are set forth in the Company’s Position Description for the Chairman of the Board, and the responsibilities of the Lead Independent Director are set forth in the Company’s Position Description for the Lead Independent Director. The Position Description for the Chairman of the Board is Exhibit A and the Position Description for the Lead Independent Director is Exhibit B to the Corporate Governance Guidelines, which are posted on the Company’s website at www.bausch.com (under the tab “Investors” and under the subtab “Corporate Governance—Governance Documents”). Mr. Saunders’ responsibilities as CEO are specified in the CEO Position Description, which was approved by the Board.

The responsibilities of the Lead Independent Director include: (i) fostering processes that allow the Board to function independently of management and encouraging open and effective communication between the Board and management of the Company; (ii) providing input to the Chairman on behalf of the independent directors with respect to Board agendas; (iii) presiding at all meetings of the Board at which the Chairman is not present, as well as regularly scheduled executive sessions of independent directors; (iv) in the case of a conflict of interest involving a director, if appropriate, asking the conflicted director to leave the room during discussion concerning such matter and, if appropriate, asking such director to recuse himself or herself from voting on the relevant matter; (v) communicating with the Chairman and the CEO, as appropriate, regarding meetings of the independent directors and resources and information necessary for the Board to effectively carry out its duties and responsibilities; (vi) serving as liaison between the Chairman and the independent directors; (vii) being available to directors who have concerns that cannot be addressed through the Chairman; (viii) calling meetings of the independent directors, as needed or when appropriate; (ix) being available for consultation and direct communication if requested by major shareholders; and (x) performing other functions as may reasonably be requested by the Board or the Chairman. In the event the Company appoints an independent Chairman of the Board, the responsibilities of the Lead Independent Director will be assumed by the independent Chairman of the Board.

20

20

|

||||

Chairman Responsibilities |

||||

The Chairman will provide leadership to the Board in discharging its mandate as set out in the Charter, including by: |

||||

| + | leading, managing and organizing the Board consistent with the approach to corporate governance adopted by the Board from time to time | |||

| + | guiding the Board’s deliberations so that appropriate strategic and policy decisions are made | |||

| + | promoting cohesiveness among the directors | |||

| + | satisfying himself that the responsibilities of the Board and its committees are well understood by the Board and acting as spokesperson for the Board | |||

During 2023, the Board had four standing committees: the Audit and Risk Committee, the Talent and Compensation Committee, the Nominating and Corporate Governance Committee, and the Science and Technology Committee. During 2022, the Board created an ad hoc CEO Search Committee, which was disbanded in early 2023 following the selection of Mr. Saunders as our Chairman of the Board and Chief Executive Officer. The specific responsibilities of each of the Audit and Risk Committee, the Talent and Compensation Committee, the Nominating and Corporate Governance Committee, and the Science and Technology Committee are identified in the respective committee’s charter. Copies of the charters for each of the foregoing committees are available on our website at www.bausch.com (under the tab “Investors” and under the subtab “Corporate Governance—Governance Documents”) and are also available in print to shareholders upon request submitted to Investor Relations, Bausch + Lomb Corporation, 520 Applewood Crescent, Vaughan, Ontario, Canada L4K 4B4.

The Board has developed written position descriptions for the Chairs of each standing committee. The position description for the Chair of each standing committee is appended to the relevant committee’s charter. No position description was adopted for the Chair of the CEO Search Committee given the relatively short duration of its mandate.

The Chairman of the Board and representatives of the Company are expected to be available to respond to questions from shareholders at the Meeting.

The table below sets forth each current director’s membership on our Board committees:

|

Audit and Risk Committee |

Talent and Compensation Committee |

Nominating and Corporate Governance Committee |

Science and Technology Committee |

||||

| Nathalie Bernier |  |

| |||||

| Richard U. De Schutter(1) |  |

| |||||

| Gary Hu |  |

|

| ||||

| Brett Icahn |  |

||||||

| Sarah B. Kavanagh |  |

|

|||||

| Karen L. Ling(2) | |||||||

| John A. Paulson |  |

||||||

| Russel C. Robertson |  |

|

|||||

| Thomas W. Ross, Sr. |  |

|

|||||

| Brenton L. Saunders(3)(4) | |||||||

| Andrew C. von Eschenbach, M.D. |  |

|

| (1) | Mr. De Schutter will not stand for re-election at the Meeting. |

| (2) | Ms. Ling joined the Board on February 27, 2024 and has not yet been appointed to any committee. |

| (3) | Chief Executive Officer |

| (4) | Chairman of the Board |

|

Chair |

|

Member |

2024 PROXY STATEMENT 21

| Audit and Risk Committee | |

| Members |

Principal Responsibilities: As described in the Audit and Risk Committee Charter, the key responsibilities of the Audit and Risk Committee include:

+ responsibility for reviewing and recommending to the Board our annual financial statements and management’s discussion and analysis of results of operation and financial condition (“MD&A”) and reviewing and approving our interim financial statements and MD&A; + periodically meeting with our internal auditor and with our external auditor without management being present as contemplated in the Audit and Risk Committee Charter;

+ recommending to the Board the external auditor to be nominated for approval by the Company’s shareholders, as well as the compensation of the external auditor; and

+ establishing procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing practices.

In accordance with the Audit and Risk Committee Charter, the Audit and Risk Committee also provides assistance to the Board in fulfilling its oversight function, including with respect to:

+ the quality and integrity of our financial statements;

+ compliance with the Code of Conduct and legal and regulatory requirements, including with respect to disclosure of financial information;

+ the qualifications, performance and independence of our external auditor;

+ the performance of our senior finance employees and internal audit function;

+ internal controls and certifications;

+ monitoring the appropriateness and effectiveness of the Company’s risk management systems and policies, including evaluating on a regular basis the effectiveness and prudence of senior management in managing the Company’s operations and the risks to which it is exposed; and

+ overseeing the Company’s compliance programs, policies and procedures, and investigating compliance matters. | |||

Sarah B. Kavanagh (Chair) |

||||

Nathalie Bernier |

Gary Hu |

Russel C. Robertson |

||

| Meetings

in 2023: 8 |

||||

The Audit and Risk Committee is comprised of four independent directors: Ms. Kavanagh (Chair), Ms. Bernier, Mr. Hu and Mr. Robertson.

The responsibilities, powers and operation of the Audit and Risk Committee are set out in the written charter of the Audit and Risk Committee. Pursuant to the Audit and Risk Committee Charter, each member of the Audit and Risk Committee is an independent director as defined and required by applicable regulatory and stock exchange rules. The Board has concluded that each member of the Audit and Risk Committee is “financially literate” as defined under National Instrument 52-110 — Audit Committees and as required under NYSE rules, and each of Ms. Bernier, Ms. Kavanagh and Mr. Robertson qualify as an “audit committee financial expert” under the regulations promulgated by the SEC.

The Audit and Risk Committee Charter provides that no member of the Audit and Risk Committee may hold 10% or more of the Company’s outstanding B+L Common Shares or serve simultaneously on the audit committee of more than two other public companies unless the Board determines that such simultaneous service would not impair his or her ability to serve effectively on the Audit and Risk Committee.

22

22

| Talent and Compensation Committee | |

| Members | Principal Responsibilities: As described in the Talent and Compensation Committee Charter, the key responsibilities of the Talent and Compensation Committee include:

+ reviewing and approving corporate goals and objectives in connection with the compensation of our CEO, evaluating the CEO’s performance in light of those goals and objectives, and (either as a committee or together with the other independent directors who satisfy the independence, “non-employee” and “outside director” requirements under the Talent and Compensation Committee Charter) determining and approving the compensation of the CEO based on such evaluation;

+ reviewing and approving each element of total compensation for all officers (as such term is defined in Rule 16a-1(f) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”));

+ reviewing and making recommendations to the Board regarding the adoption, amendment or termination of equity-based compensation plans;

+ reviewing and approving arrangements with executive officers relating to their employment relationships with us;

+ reviewing and approving any policies of the Company relating to the clawback, forfeiture, recoupment or recovery of any compensation;

+ administering clawback policies and taking any actions as permitted or required to facilitate the clawback, forfeiture, recoupment or recovery of compensation received by employees of the Company in accordance with such policies;

+ taking any actions as permitted or required by applicable law or the listing rules promulgated by the NYSE, TSX or any other stock exchange under which the common stock of the Company may be listed to facilitate the clawback, forfeiture, recoupment or recovery of compensation received by employees of the Company;

+ reviewing talent management and succession planning materials for key roles;

+ providing strategic supervision of our benefit plans, programs and policies; and

+ reviewing and recommending to the Board for approval the Compensation Discussion and Analysis to be included in the Company’s annual management proxy circular and proxy statement and/or annual report on Form 10-K and preparing the Talent and Compensation Committee Report. | |||

Richard U. De Schutter (Chair) |

||||

Gary Hu |

Russel C. Robertson |

Thomas W. Ross, Sr. |

||

| Meetings

in 2023: 8 |

||||

The Talent and Compensation Committee is comprised of four independent directors: Mr. De Schutter (Chair), Mr. Hu, Mr. Robertson and Mr. Ross. The responsibilities, powers and operation of the Talent and Compensation Committee are set out in the written charter of the Talent and Compensation Committee. In accordance with the Talent and Compensation Committee Charter, each member of the Talent and Compensation Committee is an independent director as defined and required by applicable regulatory and stock exchange rules.

Each of Mr. De Schutter, Mr. Hu, Mr. Robertson and Mr. Ross, representing all of the directors who served on the Talent and Compensation Committee during 2023, is (i) a non-employee director for purposes of Rule 16b-3 of the Exchange Act, as amended and (ii) an independent director. None of the members of the Talent and Compensation Committee is a current or former officer of the Company. There were no compensation committee interlocks with other companies in 2023 within the meaning of Item 407(e)(4)(iii) of Regulation S-K. See “Other Matters — Certain Related-Party Transactions” on page 84 for a description of related-party transactions.

2024 PROXY STATEMENT 23

For details on the philosophy and approach adopted by the Talent and Compensation Committee with respect to compensation of our officers, please see “Compensation Discussion and Analysis” beginning on page 41.

The Talent and Compensation Committee has the authority to retain and compensate any consultants and advisors it considers necessary to fulfill its mandate. It shall, annually, or on an as-needed basis, specify the work to be performed by, and agree on the associated fees to be paid to, the compensation consultants. It shall also review annually the work performed and fees paid. In addition, the Talent and Compensation Committee Charter provides that the Talent and Compensation Committee shall report to the Board, on an annual basis, the nature of any additional work or non-Board based services conducted by any such compensation consultant and associated fees paid, if approved by the Chair of the Talent and Compensation Committee.

Periodically, and at least annually, the Talent and Compensation Committee selects and retains independent consultants to conduct comprehensive reviews and assessments of our policies, procedures and internal controls for setting compensation of the CEO and other members of senior management. The consultant prepares and submits relevant information and analyses to the Talent and Compensation Committee. As discussed below under “Compensation Discussion and Analysis,” in 2023, the Talent and Compensation Committee retained Pay Governance LLC (“Pay Governance”), as its independent consultant to provide advice on compensation matters. Pay Governance’s services included the following: (i) periodically reviewing our executive compensation programs, including base salary, short-term incentives, equity-based incentives, total cash compensation levels and total direct compensation of certain senior positions, against those of a peer group; (ii) advising the Talent and Compensation Committee with regard to the compensation packages of the CEO and other members of senior management; (iii) reviewing the proxy circular and proxy statement and specifically the Compensation Discussion and Analysis; and (iv) preparing materials for and attending select Talent and Compensation Committee Meetings. Pay Governance did not provide any additional services to the Company during the fiscal year 2023. The Talent and Compensation Committee has assessed, at the relevant times, the independence of Pay Governance and concluded that its engagement of Pay Governance did not raise any conflict of interest with the Company or any of the Company’s directors or executive officers.

The Talent and Compensation Committee considers the advice and analysis of the independent compensation consultants, together with other factors the Talent and Compensation Committee considers appropriate (including feedback from shareholders and corporate governance groups, market data, knowledge of the comparator group and personal knowledge and experience of the Talent and Compensation Committee members), in reaching its decisions and making compensation determinations for the CEO and executive officers.

24

24

| Nominating and Corporate Governance Committee | |

| Members | Principal Responsibilities: As described in the Nominating and Corporate Governance Committee Charter, the key responsibilities of the Nominating and Corporate Governance Committee include:

+ identifying individuals qualified to become directors and recommending to the Board new nominees for election by shareholders or for appointment by the Board, and engaging the services of third party search firms to assist in identifying such individuals;

+ providing recommendations to the Board regarding the competencies and skills the Board should possess, and the qualifications of its directors;

+ making recommendations to the Board with respect to director compensation;

+ recommending for Board approval, if appropriate, revisions to our corporate governance practices and procedures;

+ developing new charters for any new committees established by the Board, if not otherwise mandated by the Board;

+ monitoring relationships and communication between management and the Board and monitoring emerging best practices in corporate governance;

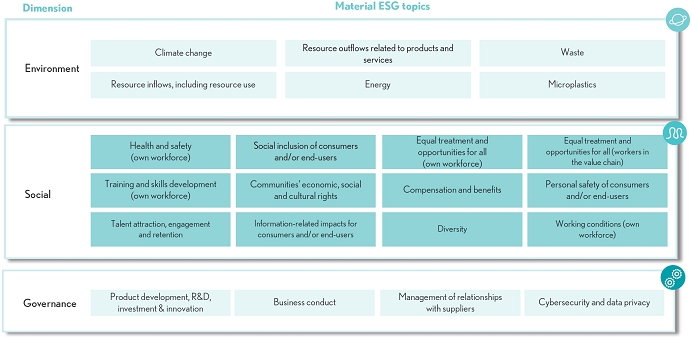

+ assisting the Board in fulfilling its oversight responsibilities with respect to environmental, social and governance (“ESG”) programs and initiatives by overseeing management’s plans with respect to the identification and measurement of short- and long-term sustainability and other ESG-related objectives for the Company;

+ approving any material ESG-related commitments of the Company;

+ assessing compliance with the Company’s equity ownership guidelines for non-management directors;

+ reviewing the composition and mandate of the Board and each committee of the Board annually and, if appropriate, recommending to the Board any changes it considers desirable with respect thereto; and

+ overseeing our orientation process for new directors and our continuing education program for all directors. | |||

Thomas W. Ross, Sr. (Chair) |

||||

Brett Icahn |

Sarah B. Kavanagh |

|||

John A. Paulson |

Andrew C. von Eschenbach, M.D. |

|||

| Meetings

in 2023: 4 |

||||

The Nominating and Corporate Governance Committee is comprised of five independent directors: Mr. Ross (Chair), Mr. Icahn, Ms. Kavanagh, Mr. Paulson and Dr. von Eschenbach. The responsibilities, powers and operation of the Nominating and Corporate Governance Committee are set out in the committee’s written charter. As required by the Nominating and Corporate Governance Committee Charter, each member of the Nominating and Corporate Governance Committee is an independent director as defined and required by applicable regulatory and stock exchange rules.

2024 PROXY STATEMENT 25

| Science and Technology Committee | |

| Members |