UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

OR

For

the transition period from

Commission

file number

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices)

(Zip Code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports);

and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its

internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public

accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the issuer is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes ☐ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

As of June 30, 2023, the last business day of the Registrant’s

most recently completed second fiscal quarter, there was no public market for the Registrant’s common stock. The Registrant’s

common stock began trading on the Nasdaq Capital Market on October 23, 2023. The aggregate market value of voting and non-voting common

equity held by non-affiliates of the Registrant, based on the closing price of the Registrant’s common stock on the Nasdaq Capital

Market on March 7, 2024, was approximately $

As

of March 7, 2024, the registrant has

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION

CONTAINED IN THIS REPORT

This Transition Report on Form 10-KT, or this “report,” contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these statements by looking for words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “would,” “should,” “could,” “may,” “will” or other similar expressions in this report. In particular, these include statements relating to future actions; prospective products, applications, customers and technologies; future performance or results of any products; anticipated expenses; and future financial results. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or projections. Factors that could cause actual results to differ materially from those discussed in the forward-looking statements include, but are not limited to:

| ● | We are employing a business model with a limited track record, which makes our business difficult to evaluate; | |

| ● | Our technology that is currently being developed may not yield expected results or be delivered on time; | |

| ● | Failure to integrate any acquisitions successfully; |

| ● | We intend to utilize a significant amount of indebtedness and raise capital through public offerings for the operation of our business; | |

| ● | The implementation of artificial intelligence (“AI”) into our technologies may prove to be more difficult than anticipated; | |

| ● | The real estate technology industry in which we participate are highly competitive, and we may be unable to compete successfully with our current or future competitors; |

| ● | Our ability to retain our executive officers and other key personnel; |

| ● | If we fail to attract or retain customers and users of our technologies, or if we fail to provide high-quality real estate industry solutions, our business, results of operations, and financial condition would be materially adversely affected; |

| ● | Our real estate investments are currently on hold, and there is no assurance we will resume our short-term rental operations. We may restart these operations depending on macroeconomics factors, such as high interest rates, and general factors such as real estate investment demand, capital availability, investment yields, regulatory changes, competitive landscape and others; and |

| ● | The impact of laws and regulations regarding privacy, data protection, consumer protection, and other matters. Many of these laws and regulations are subject to change and uncertain interpretation, and could result in claims, changes to our business practices, monetary penalties, or otherwise harm to our business. |

Forward-looking statements may appear throughout this report, including without limitation, the following sections: Item 1“Business,” Item 1A “Risk Factors,” and Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The forward-looking statements are based upon management’s beliefs and assumptions and are made as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statements included in this report. You should not place undue reliance on these forward-looking statements.

Unless otherwise stated or the context otherwise requires, the terms “reAlpha,” “we,” “us,” “our” and the “Company” refer to reAlpha Tech Corp. and its subsidiaries, as applicable.

TRADEMARKS AND TRADE NAMES

We own or have registered rights to certain trademarks, trade names and other intellectual property used in our business, including reAlpha, ReAlpha HUMINT, Invest in real, Vacation Capitalist, BnBGPT and Gena.AI, each of which is considered a trademark or a trade name. All other company names, product names and trademarks included in this report are trademarks, registered trademarks or trade names of their respective owners.

ii

MARKET AND INDUSTRY DATA AND FORECASTS

In this report, we present certain market and industry data and statistics. This information is based on third-party sources, which we believe to be reliable. We have not independently verified data from these sources and cannot guarantee their accuracy or completeness. While we are not aware of any misstatements regarding industry data provided herein, our estimates involve risks and uncertainties and are subject to change based upon various factors, including those discussed in this report under “Special Note Regarding Forward-Looking Statements and Other Information Contained in this Report” and Part I, Item 1A. “Risk Factors.” Additionally, some data in this report is based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. Similarly, we believe our internal research is reliable, however, such research has not been verified by any independent sources.

EXPLANATORY NOTE

Unless otherwise indicated, references to our fiscal year 2022 and prior years mean the fiscal year ended on April 30 of such year. As disclosed in our Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”) on December 18, 2023, we changed our fiscal year end to December 31 effective as of December 31, 2023. As a result, references to our fiscal year 2023 and beyond mean the fiscal year ended on December 31 of such year. In addition, in transitioning to our new fiscal year end, references to the transition period mean the eight-month transition period between May 1, 2023 and December 31, 2023 covered in this report.

iii

PART I

ITEM 1. BUSINESS

Overview

We are a real estate technology company with a mission to shape the property technology market, or “proptech,” landscape through the commercialization of artificial intelligence (“AI”) technologies and strategic synergistic acquisitions that complement our business model. We believe we can leverage our AI-powered technologies to provide innovative solutions in this industry and to advance our vision to become a global leader in the proptech solutions sector, focusing on the short-term rentals and real estate professional solutions.

We were founded in 2020 with the goal of providing short-term rental investment opportunities to everyday investors. To that end, since our inception, we developed technologies and tools that allowed for analysis of short-term-rentals using AI to provide insight into that property’s potential profitability and ways to increase such profitability; are developing an app for investment into the properties we purchased aimed at retail investors; and created a listing description generator powered by AI to create or refresh the descriptions of our listings or those of other hosts. We intend to continue developing cutting-edge technologies and to pursue complementary business or technologies acquisitions that we believe will seamlessly integrate this fragmented market.

Our Business Model and Focus on AI Technologies

Originally, our operational model was asset-heavy and built on utilizing our proprietary AI-powered technology tools for the acquisition of real estate, converting them into short-term rentals, and enabling individual investors to acquire fractional interests in these real estate properties, allowing such investors to receive distributions based on the property’s performance as a short-term rental.

Due to current macroeconomic conditions, such as higher interest rates, inflation, and elevated property prices, our real estate acquisition operations have been halted. Instead, our current focus will be directed towards the continuous enhancement and refinement of our AI technologies for commercial use to generate technology-derived revenue. For instance, in November 2023 we announced the launch of GENA, an AI-powered technology that develops or enhances already existing personalized listing descriptions for residential properties to be listed in real estate online platforms, such as Airbnb, Inc.’s (Airbnb), Zillow and others. Since then, GENA’s subscription has been under limited availability to a select group of real estate professionals to ensure the platform’s scalability to a larger number of users. Although we have not yet generated revenue through GENA since its launch, we intend to continue commercializing our technologies to further add technology-derived revenue streams.

We may resume the complementary asset-heavy model from our rental business segment if the prevailing interest rates and other macroeconomic factors align more favorably with such business model. In the meantime, our growth strategy will encompass both organic and inorganic methods through commercialization of our AI technologies that are in varying stages of development and acquisitions of complementary businesses and technologies. In particular, we have recently entered into a letter of intent to acquire United Software Group and certain of its subsidiaries (collectively, “USG”), a multi-industry information technology consulting company. Although we are still conducting due diligence in connection with this proposed acquisition, we believe that USG’s operations will complement our business model and accelerate our proposition to expand our technology offerings to customers by offering IT services, staffing and accounting services and others.

Our reportable segments consist of (i) platform services and (ii) rental business. Our platform services segment offers and develops AI-based products and services to customers in the real estate industry. We are actively developing four operating technologies that are in varying stages of development: reAlpha BRAIN, GENA, AIRE and reAlpha App. Our rental business segment, to the extent we resume operations, focuses on purchasing properties for syndication, which process is powered by our platform services technologies.

Segments

Platform Services

Overview

Our platform services segment technologies include: (i) reAlpha BRAIN, (ii) reAlpha HUMINT, (iii) GENA, (iv) AIRE, (v) reAlpha App and (vi) myAlphie.

1

myAlphie was sold on May 17, 2023, and it stopped contributing to our revenues as of such date, except for the revenue generated for the ongoing technical support we are providing to the buyer of myAlphie. Although we have not yet generated revenues from our technologies, we expect that once our technologies are fully operational and available for commercial use by customers, we will generate revenue through subscriptions, licensing fees, pay-per-use basis or other fee arrangements. To the extent we resume operations of our short-term rental operations, we expect to receive fee-based revenues from customers that would utilize the reAlpha App for participating and investing in our Syndications (as defined below).

Each of our technologies and platforms are more fully described below.

reAlpha BRAIN

reAlpha BRAIN will utilize a natural language processing (“NLP”) program to scan through large quantities of data regarding properties and machine learning (“ML”) algorithms to choose the properties that have higher than expected industry standard return on investment. For this, it will gather and integrate a variety of data relevant to the properties from multiple sources including wholesalers, various multiple listing service (“MLS”) data sources, realtors, small Airbnb “mom and pop” operators, and other larger property owners. For instance, it will collect data on the properties’ price, house structure and sale history from different MLS’ listings in the U.S. This data, combined with public information about the neighborhood appeal, accessibility and safety of the neighborhood surrounding the properties, enables the algorithm to analyze the data and predict how likely and when a property is expected to become profitable. This will allow reAlpha to predict how likely a particular property will generate expected profitability. The platform will convey this knowledge by assigning each property with a “reAlpha Score” ranging from 0-100. The higher the value, the more favorable a property is for investment.

Currently, the process of analyzing a property as a potential investment typically begins with an email received from a real estate agent’s distribution list to which reAlpha has subscribed. However, we use multiple other sources outside of inbound emails to identify properties, including, but not limited to, MLS, proprietary data sellers such as AirDNA, and others. In the email scenario, the reAlpha BRAIN will include an AI email parser based on NLP that looks for the property of concern within the unstructured email and extracts its street address. This address will then be used to query various data providers for a detailed description of the property’s structure, neighborhood and finances. This ML model, which is being built and will be hosted on the Amazon Sagemaker platform provided by Amazon Web Services (“AWS”), will then calculate the reAlpha Score for that property.

Further, the reAlpha BRAIN technology will also provide us information about future properties that could be utilized for Syndications, provided they satisfy our internal investment criteria for short-term rentals (the “Investment Criteria”). reAlpha BRAIN’s analysis and data will allow us to not only identify properties with high short-term rental viability, but also optimize their performance by generating listing descriptions using the surrounding attractions of the location, analyzing guest reviews in the area, and suggesting improvement to the acquired properties that will be listed on the reAlpha App for Syndication. The reAlpha BRAIN model will also continuously improve and learn over time. As we make its decision to invest in properties, the model will check the effectiveness of its recommendations to reduce false positives and false negatives. As of the date of this report, the reAlpha BRAIN has analyzed over 1,500,000 homes.

reAlpha BRAIN is currently operational internally within reAlpha. However, new developments on the AI system are expected to improve its accuracy, available markets, and ability to analyze long-term rentals. reAlpha BRAIN is expected to be released publicly for commercial use in the second quarter of 2024 on a licensing fee basis.

reAlpha HUMINT

In addition to the AI being utilized in our technologies, we added a human factor that analyzes short-term rental profitability. There are various qualitative features of a short-term rental property that affect its profitability. For instance, the aesthetics of the interiors, as well as the color, decoration and design of the property’s exteriors, the look and feel of its neighborhood, condition of the amenities, etc. A property that is well-designed and tastefully decorated, coupled with amenities in good condition, requires less renovation and repair work before it is ready to be listed on platforms such as Airbnb. Such features can be collected by manually observing the photos, videos and the street view of the property and cannot be automatically fetched from a third party source.

reAlpha HUMINT is a platform that complements reAlpha BRAIN by providing its own score based on qualitative data the reAlpha BRAIN does not analyze. This platform allows the analysts at Naamche (as defined below) to input qualitative features about a property, such as curb appeal, repairs needed, interior design, paint job, room layout and others, and factor it into property evaluation. reAlpha HUMINT is operational for our internal use and is not currently under further active development for commercialization purposes as a result of our recent strategy shift to put our rental segment operations on hold.

2

GENA

GENA, formerly known as “BnBGPT”, is an AI tool that is powered by a “Generative Pre-trained Transformer” language model, or “GPT.” GENA is intended to complement our other AI and non-AI technologies and be used internally to simplify the process of generating personalized and effective home descriptions. GENA is designed for both realtors and hosts (e.g., someone that owns a property listed on Airbnb’s platform, or any other online marketplaces for short- and long-term properties), that creates personalized descriptions that we believe will give users a competitive edge in the marketplace.

For Realtors. Our app offers a feature that generates advertising content directly from uploaded images and they can be used by realtors to advertise their listed properties, eliminating the need for professional copywriters and other costly marketing tools.

For Hosts. Our app offers features that simplify the process of creating descriptions for listings in online marketplaces for real estate properties, such as Airbnb, VRBO, Booking.com, and other such platforms. Our app will automatically organize these descriptions into sections, making it easy to highlight key features of a space and provide important information about guest access. Additionally, the app will include the proximity data of attractions near the property (e.g., restaurants, museums, areas of interest for tourists in the area and others), making it easier to highlight those for the host.

GENA was released under limited availability on November 1, 2023, and we expect to allow additional users to subscribe to GENA by the end of the second quarter of 2024. The current revenue model for GENA is pay-per-use with an initial free credit for new users, but this model is not final and is subject to change once GENA becomes fully available for commercial use.

AIRE

AIRE is currently under development, and it is a web-based AI application that provides data and insights about the real estate market. Its purpose is to greatly facilitate how investors search for properties when researching the market or for personal purchases and dispositions, understand market dynamics, and access critical investment insights from publicly available data sources, such as active inventory, months of active supply, median income, income trends, historical appreciation, local destinations and nearby attractions. AIRE has the ability to provide property level data points including, but not limited to, school districts and their scores, construction type, property tax estimates, and the distance to local attractions. AIRE uses large language models (LLMs) to answer user queries on real estate property searches and market trends. This web-based application will be available 24/7 and will offer a user-friendly interface where investors can interact with real estate data using plain English. Customers will be able to interact with the AI interface by asking questions related to real estate, and AIRE will provide the needed information for the customer to begin their real estate purchase journey. AIRE will then provide specific steps and relevant information based on the questions customers input in the application, which will remove much of the user sophistication needed when beginning the process of buying a house or investment property. This approach allows users to efficiently source leads and filter them based on various criteria, and access detailed property-specific data, including comprehensive market-level insights. Currently, the language model AIRE uses is limited to the Florida, U.S. market, but we are actively finding new solutions to build or buy a dataset that will expand into a wider range of markets.

AIRE is currently in alpha testing for our internal use. We plan to commercialize this technology in the second or third quarter of 2024.

reAlpha App

The reAlpha App, or the “App,” was designed to make real estate ownership accessible and user friendly. The App allows Syndicate Members to acquire equity interests in the Syndication LLCs, which are the entities that hold the ownership of the Target Properties. Both the Syndicate Members that have access to the reAlpha App, or our website, and holders of our common stock will have access to certain quarterly financial metrics of the Syndicated properties, including: (i) occupancy rates of the property; (ii) average daily rental rates of the property; and (iii) periodical information of each property, such as gross revenue, total expenses, net revenue, cash flows, and others. This information will be made available to both Syndicate Members and the general public through the reAlpha App, our website, which is available to holders of our common stock that are non-Syndicate Members, and upon release of our consolidated quarterly results via press release or other appropriate method. This feature is not operational given that we do not have any currently Syndicated properties, but we intend to make available such quarterly financial metrics to the extent we resume our rental segment operations. Other personalized financial information that will be available only to Syndicate Members through our App and website, include their total shares owned in the Syndication LLC, expressed in dollar and percentage values, dividends paid under that specific Syndication LLC, based on that Syndicate Member’s ownership percentage, and others. Holders of our common stock will not have access to this personalized information available in the App, unless they are also Syndicate Members. Finally, the App will also fetch property listing data as well as data on short-term rental market trends from multiple third-party application programming interface (API) providers and display the consolidated data for a particular property in an easily accessible format.

3

At this time, we do not plan on becoming a licensed broker-dealer. Further, to the extent we resume our short-term rental operations, the App will be managed by us, but we may utilize third party broker-dealers, such as Dealmaker Securities LLC, which broker-dealer would be licensed with the SEC and FINRA to conduct the exempt Syndication offerings. We currently have an agreement in place with Dealmaker Securities, LLC, to conduct exempt offerings, but we do not intend to conduct such offerings while our short-term rental operations are on hold.

While the mobile version of the App is still under development, the web version is already operational. As part of our internal restructuring changes described above, the App will be combined with the Syndication Platform technology acquired through the Rhove acquisition if and when we resume our rental operations. This new platform will facilitate all future offerings of Syndicate LLCs and will be renamed as “reAlpha Rhove” to the extent we resume the rental operations segment. We expect the integration of these technologies to be completed by the end of 2024, or at a later time if we do not resume rental operations until then. Due to current market conditions, we expect to pause the acquisition of any real estate and launching of any Syndication offerings, and we will continue to evaluate when and if we will resume these operations as market conditions continue to evolve. Currently, we expect all Syndications to be paused until the first quarter of 2025, and we are committed to closely monitor the short-term rental market conditions between now and 2025 by conducting regular assessments of factors such as real estate investment demand, capital availability, investment yields, regulatory changes, competitive landscape and others. This analysis will inform if and when we will restart our short-term rental operations, but there is no assurance we will do so.

We are currently not utilizing the reAlpha App for Syndications, and have put the integration with Rhove on hold while we have halted our short-term rental operations. To the extent we resume our rental segment operations, we expect to earn revenue from the App on a fee basis from customers that would utilize the App for investing in the Syndications conducted through the platform, which will be derived from the short-term rental’s Gross Receipts (as defined below). These fees currently include property management fees, asset management fees and sourcing fees.

myAlphie

myAlphie was a digital platform that facilitates connections between local vendors and multi-family home real estate communities, particularly for the process of apartment turnovers. Apartment turnovers occur when one tenant vacates a unit and a new one moves in. Traditionally, various disparate and outdated tools have been used by apartment management companies to manage this turnover process. We developed myAlphie to provide a consolidated solution through its mobile app and portal. myAlphie incorporates various features, including in-app payments, task workforce management, shared calendars, and a vendor-client rating system. The platform’s design aims to create an efficient and user-friendly digital marketplace for those that seek to find home service solutions. myAlphie facilitates all in-app payments using Stripe, an online payment processing solutions company, as a payment gateway to transfer money from property managers, to the application, to the vendors. Through myAlphie’s app, we previously generated revenue by receiving fees for connecting, via the app, multi-family home real estate communities and local vendors offering home services.

We sold myAlphie on May 17, 2023, as further described above under “Recent Developments – Sale of myAlphie LLC” below.

Rental Business

Overview

Our rental business segment operations are currently on hold due to current macroeconomic conditions, such as escalating interest rates, inflation, and elevated property prices. We anticipate resuming operations within this segment through the acquisition of properties and Syndications when the prevailing interest rates and other macroeconomic factors align more favorably with such business model.

To the extent we resume our short-term rental operations, we plan to utilize our AI-powered technologies to analyze and acquire short-term rental properties that meet our internal investment criteria, or the “Investment Criteria,” which is analyzed and determined by our technologies, for syndication purposes, which short-term rental properties are referred to as “Target Properties.” Once the Target Properties are acquired, they are prepared for rent and listed on short-term rental sites, and, when warranted, disposed of for profits. We plan to make investing in our Target Properties available to investors via our subsidiary, Roost Enterprises, Inc. (“Rhove”). Rhove, along with Rhove Real Estate 1, LLC, reAlpha Acquisitions Churchill, LLC and future Syndication LLCs (the “Rhove SBU”), will create and manage limited liability companies (each, a “Syndication LLC”) to syndicate one or more of the Target Properties through exempt offerings. Once the Syndication LLCs are in place, Rhove will launch exempted offerings to sell membership interests in such properties to investors, through the purchase of membership interests in the Syndication LLCs, pursuant to Regulation A or Regulation D, each as promulgated under the Securities Act of 1933, as amended (the “Securities Act”) (each, a “Syndication”). We refer to such investors as “Syndicate Members.” To further facilitate the investment process in the Syndication LLCs, our reAlpha App will work parallel with the Syndication process to allow investors to purchase membership interests in those properties and become Syndicate Members. We intend to generate revenue through our property Syndications on the reAlpha App to the extent we resume these operations.

4

Syndicate Members differ significantly to the holders of our common stock. Rights among Syndicate Members may also vary among each other depending on the specific terms and conditions agreed to in the offering documents pursuant to which the holder becomes a Syndicate Member. By becoming a Syndicate Member, the holder will not acquire any rights to the Company’s common stock and, therefore, will not be entitled to vote, receive a dividend or exercise any other rights of a stockholder of the Company. Likewise, acquiring shares of our common stock will not provide the stockholders the status of Syndicate Member. Both Syndicate Members and our stockholders will receive the same quarterly financial metric information of our listed properties through the reAlpha App and the reAlpha website, which will also be available to the general public without a login, concurrently with our consolidated quarterly results (as more fully described under “Segments – Platform Services” above), to the extent we resume these operations. Syndicate members that have access to the reAlpha App will only receive personalized financial information respective to their individual holdings in each of our Syndications. To date, we have not developed a secondary trading market for equity interests in our Syndication LLCs. While the potential establishment of such a market may be considered in the future, we have not made any decisions to develop a secondary trading market at this time.

In addition to managing the property operations, whether internally or through third-parties, we will also manage the financial performance of the asset, such as evaluating if the after-repair value or appreciated value of the property is higher than the purchase price, or whether the property is ready to generate the expected profitability. Once our business model is fully implemented, we expect that Syndicate Members will hold up to 100% ownership of the Syndication LLC, and we would generate revenue through fees from the reAlpha App.

Through these property acquisition investments, our goal is to obtain: (i) consistent cash flow from short-term tenants; (ii) long-term capital appreciation of our properties’ value after repair and/or renovations in appreciating markets; and (iii) favorable tax treatment of long-term capital gains. To finance these property acquisition investments, we may engage in leverage financing to enhance total returns to our Syndicate Members and investors through a combination of senior financing on our real estate acquisitions, secured facilities, and capital markets financing transactions. We will seek to secure conservatively structured leverage that is long-term, non-recourse, non-mark-to-market financing to the extent obtainable on a cost-effective basis.

Our Properties

We have historically targeted certain markets in the single-family property sector of the real estate industry, which markets and properties are determined by our technologies (see “Segments – Platform Services” section above, and “Investment Criteria for Properties to be Syndicated” and “Market Selection for Properties to be Syndicated” below). These properties are designed to be short-term rental properties, which are acquired for Syndication purposes and held for a period of one to six years, then potentially disposed of once that property has generated our internal target returns, which may also depend on various other factors, including, but not limited to, the appreciation value of such property over time, economic conditions, interest rate fluctuations and others. Short-term rentals are utilized for various purposes, including vacations, relocations, renovations, extended work trips, special events, temporary work assignments, or seasonal activities. During the transition period ended December 31, 2023, we sold four properties as part of our effort to re-evaluate our business strategy.

As of December 31, 2023, we owned and operated one property located in Texas, which has since been sold on March 6, 2024.

Property Improvements

Our Syndication model will focus on acquiring rent-ready properties. Such rent-ready properties may not need a significant upgrade. A “significant upgrade” is defined as an upgrade to a property valued at more than 15% of the total purchase price for such property. However, even rent-ready properties may need some modifications and/or refreshing of fittings/furnishings. We determine the budgets and the need for such upgrades on a case-by-case basis, and the Syndication LLC bears the cost of such upgrades. If the Syndication LLC is managed by Rhove or another third-party, we will provide guidance on the budget and needs for improvements in each individual instance, and the Managing Member of the Syndication LLC will require our approval for certain matters that exceed the agreed upon budget. In some situations, we may still buy properties which may need significant upgrades, if we believe that the long-term potential of such properties outweighs its initial upgrade costs. Currently, only one of the properties that we own was significantly upgraded.

5

Syndication of Properties

Investment Criteria for Properties to be Syndicated

We continuously evolve our investment strategies depending on the market conditions. Currently, we are not purchasing real estate, but, if and when we resume these operations, we will be focusing on rent-ready properties, which may not need “significant upgrades” described above.

We determine our Target Properties utilizing our Investment Criteria, which evaluates acquisition investments using our proprietary algorithms. Investment decisions made pursuant to our Investment Criteria may include single-family homes, multifamily units, experiential properties, golf resort homes, resort communities and others.

We plan to have continuously assess property acquisition investments using our Investment Criteria and intend to purchase properties that include, but are not limited to, the following primary characteristics:

| ● | Target Properties identified by our reAlpha Score algorithms (described below) are considered for acquisition; and |

| ● | Target Properties with a minimum of three (3) bedrooms and two (2) bathrooms per unit. |

We also intend to regularly consider syndicating properties outside of these ranges depending on market conditions, uniqueness, and condition of the Target Property.

Business Process for Syndications

Once we have decided to acquire a property using our Investment Criteria, we intend to use the following steps to maximize its value:

| 1. | A Syndication LLC buys the Target Property using short-term leverage provided by one of our lending partners. Specifically, we currently have a master credit facility of up to $200 million with Churchill Funding I LLC, which has yet to be utilized (see “reAlpha Acquisitions Churchill, LLC” above), and both W Financial Fund, LP and Select Portfolio Servicing, Inc., commercial loan companies, have previously assisted us in the acquisition of our properties. |

| 2. | Rhove will act as the initial managing member of each Syndication LLC (the “Managing Member”), pursuant to each of the Syndication LLC’s operating agreements, and will arrange for the renovation of the purchased Target Property in accordance with our property improvement policy, at the cost of that Syndication LLC, if needed. Each of the Syndication LLC’s operating agreements will indicate that the Managing Member will hold a “Managing Membership Interest” in the Syndication LLC, which includes any and all rights, powers and benefits to which the Syndication LLC members are entitled under the Syndication LLC’s operating agreement, together with all obligations of the Managing Member to comply with the terms and provisions of the Syndication LLC’s operating agreement. The Managing Member Interest, however, does not include rights to ownership or profits or losses or any rights to receive distributions from operations or upon the liquidation or winding-up of such Syndication LLC, except for a property management fee of 15-30% of the purchased property’s rental revenue (more fully described below).The Managing Member Interests may be assigned without the consent of the other Syndication LLC members. |

| 3. | Within a reasonable period, which we expect to be between 1 to 12 months, the Managing Member will refinance the Target Property by swapping the short-term loan with a long-term loan from any one of our lending partners. If current market conditions or lending opportunities are poor, we may choose to not refinance or refinance out of the respective reasonable time frame. |

| 4. | The new Syndication LLC will offer up to 100% of its membership interests for purchase through an offering on the reAlpha App. Rhove, or the Managing Member, will continue to hold the membership interests of the Syndication LLC that are not purchased by investors through our offerings until we sell the full 100% to investors through the reAlpha App. However, such membership interests may never be sold, in which case those interests will continue to be held by Rhove, or the Managing Member. |

6

| 5. | Our Syndicate Members may receive distributions proportional to their membership, on a quarterly basis, based on the free cash flows after taxes from the overall performance of the property on Airbnb and similar digital hospitality platforms. |

| 6. | After the Target Property has generated the target returns the property may be sold to book the profit for the Syndication LLC. |

| 7. | This profit, if any, may be used to purchase further properties in the same Syndication LLC for our benefit and the benefit of the Syndicate Members. The Syndicate Members may choose to invest further in new properties or redeem their investments. |

Although we may sell properties, we intend to hold and manage the Syndications for a period of one to six years. The Managing Member may receive a gross fee of 15% to 30% of the Syndicated property’s rental revenue as a property management fee pursuant to the Syndication LLC’s operating agreement. The 15 to 30% fee is of gross receipts generated by the property. “Gross Receipts” includes: (i) receipts from the short-term or long-term rental of the property; (ii) receipts from rental escalations, late charges and/or cancellation fees; (iii) receipts from tenants for reimbursable operating expenses; (iv) receipts from concessions granted or goods or services provided in connection with the property or to the tenants or prospective tenants; (v) other miscellaneous operating receipts; and (vi) proceeds from rent or business interruption insurance, excluding (A) tenants’ security or damage deposits until the same are forfeited by the person making such deposits, (B) property damage insurance proceeds, and (C) any award or payment made by any governmental authority in connection with the exercise of any right of eminent domain.

As each of our syndicated properties reaches what we believe to be its appropriate disposition value, based on internal metrics, we will consider disposing of the property. The determination of when a particular property should be sold or otherwise disposed of will be made after consideration of relevant factors, including prevailing and projected economic conditions, whether the value of the property is anticipated to appreciate or decline substantially, and how any existing leases on a property may impact the potential sales price. The Managing Member will utilize the reAlpha Score to measure properties against set key performance indexes and determine when to objectively dispose of a property. The Managing Member may determine that it is in the best interests of stockholders to sell a property earlier than one year or to hold a property for more than six years. When we determine to sell a particular property, we intend to achieve a selling price that captures the capital appreciation for investors based on then-current market conditions. We cannot assure you that this objective will be realized.

Each Syndication LLC will be charged a market rate property disposition fee that is paid by the seller at the time of the sale, consisting of realtor fees and closing costs (taxes and other related costs). This disposition fee should cover property sale expenses such as brokerage commissions, and title, escrow and closing costs upon the disposition and sale of a property. It is expected that this disposition fee charged will range from 6% to 8% of the property sale price. Following the sale of a property, the Company expects to re-invest the proceeds of such sale, minus the property disposition fee described in this paragraph, into more properties for our portfolio and for the Syndicate Members to have the opportunity to invest in.

Further, the properties may be also managed by third-party property management firms at the Managing Member’s discretion. The services provided by such third-party property manager would include (i) ensuring compliance with local and other applicable laws and regulations; (ii) handling tenant access to properties; (iii) and any other action deemed necessary by the property manager or desirable for the performance of any of the services under our respective management agreement. Customarily, these management agreements are subject to a property management fee between 15% and 30% of the short-term rental gross revenue generated. As we achieve scale in the number of properties owned and operated, we may seek to bring property management in-house. In the event we manage a property, such property management fees would then be retained by us. If a short-term rental property is vacant and not producing rental income, the property management fee will not be paid during any such period of vacancy, including properties managed by third-parties.

The operating expenses that each Syndication LLC will be responsible for, as described above, include, but is not limited to: (i) mortgage principal and interest; (ii) property tax; (iii) homeowner insurance; (iv) utilities; (v) landscaping; (vi) pool maintenance costs; (vii) routine maintenance and repairs; (viii) HOA fees; and (ix) pest control. We will share the expenses related to the short-term rental properties with the Syndicate Members and will bear its own operating and management expenses in proportion to the ownership of the Syndication LLC.

7

Syndicate Member Exempt Offerings

To make the business model available to retail investors, the Company, will launch in exempt offerings conducted pursuant to Regulation A or Regulation D, each as promulgated under the Securities Act of 1933, as amended.

To achieve this goal, the Company’s subsidiary, Rhove, will create and manage Syndication LLCs to syndicate one or more of the Target Properties. Once the Syndication LLCs are in place, Rhove will launch exempted offerings to sell equity interests in such properties to investors pursuant to Regulation A or Regulation D, each as promulgated under the Securities Act of 1933, as amended. To further facilitate the investment process in the Syndication LLCs, the Company is currently working on the reAlpha App.

We expect that Rhove, as the Managing Member, or one of the subsidiaries of the Rhove SBU, will maintain management control of each of the Syndication LLCs by holding a Managing Membership Interest, as discussed above. When this phase is fully implemented, we expect Syndicate Members to collectively own 100% of the Syndication LLC membership interests, excluding Managing Membership Interests, and we shall account for the Syndication LLCs in accordance with applicable U.S. GAAP.

Market Selection for Properties to be Syndicated

We intend to focus our business efforts on the markets in which Airbnb and similar platforms operate, which include some or all of the following characteristics:

| ● | sufficient inventory to make it feasible to achieve scale in the local market (100 – 500 homes); |

| ● | large universities and skilled workforce; |

| ● | popular with travelers; |

| ● | favorable competitive landscape with respect to other institutional residence buyers; and/or |

| ● | hotel room capacity and occupancy rates in given destinations. |

During our testing phase, we acquired properties in Dallas, Texas, which was our initial target market. We have expanded our target market to include Florida, Georgia, South Carolina, North Carolina, Alabama, Texas, Tennessee, Nevada, and Arizona (the “Sunbelt States”), with a strong focus in Florida.

According to Roofstock’s “Sun Belt real estate: Stats and trends for 2022” the Sunbelt States have experienced significant recent growth, providing opportunities in real estate investment. Home appreciation rates in these states have been higher than the national average, increasing the value of real estate assets. The population in these states has also grown rapidly, driven by factors such as job opportunities, lower cost of living, and favorable climate.

As noted by U.S. News its recent article from August 2023, “Growth in Major States Bodes Well for National Economy,” certain states, most notably Florida and Texas, had impressive gains in their economies during 2023, which was predominantly driven by the continuous trend of overall migration to the Sunbelt States, strong labor markets and tourism industries. This has created opportunities for real estate investors to purchase properties for short-term rental use, generating higher rental income than traditional long-term rentals.

Additionally, household incomes in the Sunbelt States have increased at a faster pace than the national average, providing a larger pool of potential homebuyers and renters. The desirability of living in these states has also increased, with many individuals and families seeking a better quality of life, warmer weather, and outdoor recreational opportunities.

Overall, the recent growth in the Sunbelt States has created numerous opportunities for real estate investment, particularly in the short-term rental market. Investors can benefit from the high demand for properties in these states, generating strong rental income and capital appreciation over time. Now, we have moved into the Orlando, Florida market. We believe that this market offers strong growth in population, jobs, rental rates, and value appreciation. To the extent we resume our operations within this segment, we expect to re-evaluate these trends and markets to acquire properties that we believe will be the most profitable as a short-term rental.

8

Investment Decisions For Properties to be Syndicated

While we will employ our proprietary AI-based technologies and platform, and our real estate professionals, to identify suitable properties for Syndication acquisition, we will be responsible for final decisions. We will use the methodology described below and our technologies to reach buy or sell decisions. We have developed an investment approach that combines the experience of our management, the reAlpha Score and an approach that emphasizes market research, underwriting standards and down-side analysis of the risks of each investment.

Notwithstanding, the Company accounts for unknown or contingent liabilities arising out of the properties that we finally acquire. For any assets acquired not currently operating as rent-ready properties, an amount up to six (6) months of recurring operating expenses will be set aside as reserves. This reserve amount is in addition to any proposed, budgeted and/or actual expenses incurred related to the renovation of a property.

To execute our investment approach, we plan to closely monitor the profit and loss of each investment.

We also research the acquisition and underwriting of each transaction. The research focuses on finding any “red flags” that may influence the decision to acquire a property. A red flag is a notification for further scrutiny of such properties. These “red flags’’ include (i) heavy regulation on short-term rentals at a state, county, or homeowner’s association (“HOA”) level; (ii) homes that have been on the market for longer than a year, or (iii) areas where natural disasters are common and damaging. The red flags analysis related to extreme weather conditions helps us estimate potential damages and related insurance costs to make better decisions. Additionally, we consider things such as tourist numbers and market size, seasonality, walkability, proximity to airports, restaurants and entertainment and events that would attract renters.

Once a deeper analysis of such red flagged properties is completed, the management team may or may not decide to purchase such properties.

Our Growth Strategies

Our growth strategies are focused on the development, acquisition, and deployment of cutting-edge AI-based technologies to serve the real estate industry. We are committed to continuous innovation and a strong focus on research and development (“R&D”), which is done through our internal research and development efforts, as well as strategic acquisition and investments into AI-related companies, with the goal of creating sophisticated AI algorithms that optimize property management, pricing strategies and customer satisfaction. We intend to continuously improve and develop technologies to advance our business model and expand our revenue streams. We recognize that the field of AI is rapidly evolving, and by actively seeking out opportunities to acquire complementary technologies, we intend to position ourselves as a leader in leveraging AI to drive growth and add value to our stockholders.

We also intend to provide investors an opportunity to invest in these short-term rental properties. Although these operations are on hold, to the extent we resume our real estate acquisitions, we plan to Syndicate these properties through our reAlpha App and generate revenue through such offerings. For more detail on our real estate acquisition methodology and Syndication offerings process, see “Segments – Rental Business” above.

Innovation in the Proptech Market

To achieve our intended growth trajectory, and to seek synergistic technologies in the proptech market, we are pursuing a balanced opportunistic approach that includes (i) organic, (ii) inorganic, and (iii) partner-driven components. We believe that this balanced approach to growth will allow us to achieve our goal of becoming a leading provider of AI-driven solutions for the real estate rental industry.

| ● | Organic growth. Achieved through our own internal development efforts. We are constantly working to develop new AI-based technologies, and we are investing continuously in R&D. We are also focused on continuous improvement and innovation, with the goal of providing our customers with the best possible experience. | |

| ● | Inorganic growth. Achieved through strategic acquisitions. We are actively seeking out opportunities to acquire either AI-driven technologies that complement our existing capabilities. By strategically integrating these acquisitions into our portfolio, we can leverage their expertise and intellectual property to accelerate our growth and expand our competitive advantage in the market. | |

| ● | Partner-driven growth. Achieved through strategic investments in promising companies. We have made strategic investments in two promising companies that align with our vision and augment our AI-centric growth strategy. These investments not only provide us with access to additional AI expertise and technologies, but they also create mutually beneficial partnerships that fuel innovation and collaborative growth within the industry (see “Research and Development” below). |

9

Deepen our Technology Offerings to Customers

To complement our internal research and development efforts, in an effort to pursue proptech opportunities, we will be focusing on pursuing acquisitions of revenue-generating entities falling into two primary categories: (i) services and (ii) products.

| ● | Services. These acquisitions will serve the purpose of solidifying our foundational base of providing proptech-related services. We intend to focus on entities that offer various services related to buying or selling properties. These services may include, but are not limited to, mortgage and financing services, title insurance and lookup, home inspection services, agencies/brokerages and escrow services. In addition, to further optimize the integration of the acquisitions within this category into our business, we may acquire companies that provide complementary services to our acquired companies, such as entities providing IT services, staffing, and accounting. | |

| ● | Products. We intend to pursue opportunities to acquire smaller proptech companies focused on distinct stages of the real estate life cycle, from acquisition, to listing as a rental or for sale, and ultimately the sale of the property. We believe these smaller entities will further advance our goal to ultimately develop a one-stop-shop AI-powered solution software for this industry, which we believe will serve as a centralized resource for real estate professionals, facilitating the management of their property business endeavors, from acquisition to sale. |

Moreover, we believe these opportunistic acquisitions will also serve the purpose of broadening the reach of our services and technologies by integrating the existing customer base of each of these acquired companies, which may include larger real estate enterprise clients, or to at least facilitate our entry into the market for such larger clients. We believe this approach will also lower our expenses related to obtaining real estate industry clients, given the high cost associated with acquiring larger clients as a first time client, since these acquisitions will bring us already existing clientele in this market, or, alternatively, serve as way for us to enter this market without the high costs associated with initial barriers to entry or to acquire such clients for the first time.

To further assist our growth, in August 2021, we acquired a 25% equity stake in Naamche Inc., a Nepal-based company that provides services related to the development of technology, AI and applications, as well as other technology support as needed (“Naamche”). Since then, in December 2023 we executed definitive agreements to acquire, subject to certain outstanding conditions, the remaining stake in Naamche, along with its Nepal counterpart Naamche, Inc. Pvt. Ltd. In September 2021, we acquired a 25% stake in Carthagos Inc. (“Carthagos”), a company headquartered in Brazil. Carthagos provides services related to branding, marketing, and design. Also in 2021, we opened an international office located in Bengaluru, India operating under the entity reAlpha Techcorp Private Limited. The purpose of this office is to provide back-office support such as marketing, search engine optimization, finance, and accounting. These smaller investments and acquisitions are just the first steps towards expanding our footprint and realizing our vision for growth, and we intend to continue seeking opportunities in this industry to strengthen our position as a provider of real estate solutions.

Real Estate Acquisitions

To the extent we resume our rental operations segment, we expect to utilize a credit line to facilitate funding and acquisition of Target Properties. As we grow and develop additional funding sources, we may set up additional subsidiaries to further facilitate funding and credit opportunities available to us through each of these additional subsidiaries. Due to macroeconomic conditions, growth and expansion of the Rhove SBU and our rental operations segment has been put on pause until conditions are more favorable to this segment of our business. We will allocate more resources and time towards expanding our technology offerings until conditions are more favorable.

As described above, the Rhove SBU will become the entity that will conduct our Syndication offerings. To facilitate such Syndication process, we will change our internal organizational structure to the extent we resume our rental segment operations and begin Syndicating short-term rental properties through our reAlpha App. We expect this internal restructuring change to be completed by the end of the third quarter of 2024. We expect these changes will have no material effect on our financial statements or accounting policies.

10

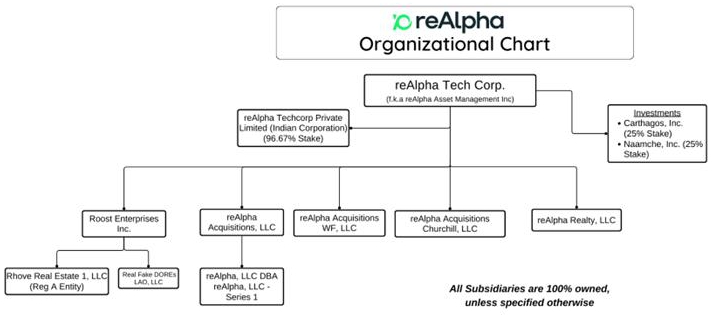

The following diagram summarizes our internal restructuring by legal entity after completion of our internal restructuring to better reflect our business model(1)(2):

| (1) | Explanatory Note: |

| 1. | ReAlpha Tech Corp. or the Company (f.k.a. reAlpha Asset Management Inc.) is the entity that resulted from the Downstream Merger. Also, as a result of the Downstream Merger, the Company owns a 25% stake in Naamche, a 25% stake in Carthagos Inc. and a 96.67% stake in reAlpha Techcorp India Private Limited, a subsidiary that provides business support services for finance, marketing and technology. | |

| 2. | Roost, Inc., Rhove Real Estate 1, LLC, reAlpha Acquisitions Churchill, LLC, and future Syndication LLCs are collectively known as the “Rhove Strategic Business Unit” or the “Rhove SBU”. The purpose of Rhove SBU is to perform Syndications. | |

| 3. | Roost Enterprises, Inc. (“Rhove”) is a wholly-owned subsidiary of the Company that provides real estate technology solutions. | |

| 4. | ReAlpha Realty, LLC is a wholly-owned subsidiary of the Company registered in Florida as a real estate brokerage. Its primary function is to act as agent and/or advisor to acquisitions completed by the Rhove SBU, the Company or any affiliated companies. | |

| 5. | reAlpha Acquisitions Churchill, LLC is a wholly-owned subsidiary of the Company that was created to hold the properties acquired by the Company utilizing financing provided by Churchill Finance I, LLC (“Churchill”). | |

| 6. | Rhove Real Estate 1, LLC is a wholly-owned subsidiary of the Company that was created to offer securities pursuant to Regulation A before the reAlpha acquisition of Rhove. After we complete our internal restructuring changes, we intend to use this entity for future property Syndications using the SEC qualified Regulation A offering. We refer to properties that have been offered through a Syndication LLC as a “Syndicated” property. |

11

| (2) | Explanatory Note: The following entities will be dissolved to effectuate our internal restructuring changes: |

| 1. | reAlpha, LLC dba reAlpha Series 1, LLC is a wholly-owned subsidiary of the Company that was created to hold the property located at 825 Austrian Rd, Grand Prairie TX 75050, which has since been sold; and | |

| 2. | reAlpha Acquisitions, LLC is a wholly-owned subsidiary of the Company that holds reAlpha, LLC dba reAlpha Series 1, LLC. |

Our Industries

The real estate technology industry is navigating a complex and fragmented landscape, characterized by the presence of thousands of solutions, each addressing a specific component within the life cycle of a real estate asset. This market has been in a period of transition, which is now adjusting to rising interest rates, inflationary pressures and broader economic uncertainty following a period of significant growth. This transition resulted in a slowdown in market activity, particularly in the single-family home segment, while demand in certain segments like multifamily housing remains relatively stable.

Proptech Market Recent Trends and Developments

Real estate technology, or proptech, refers to the application of technology solutions within the real estate industry. According to a report by Ascendix, the total global proptech market size reached $34.99 billion in 2023, and they anticipate that this market may grow to an estimated value of $133.05 billion by 2032. The industry is split into a wide range of categories including solutions for real estate professionals, financial technology software, brokerage and agent software, construction technologies, property and facility management, applications for investors and venture capitalists, and climate-related technologies.

The proptech market includes a wide range of innovative solutions that we believe have the potential to provide significant benefits to real estate professionals and in various aspects of such market, including:

| ● | Increased Efficiency. Proptech solutions can streamline processes such as property search, transaction management, and property management, potentially leading to cost savings and improved operational efficiency for all its intended users, such as buyers, sellers, brokers, and investors. |

| ● | Enhanced Transparency. Technologies like virtual tours and data analytics platforms can increase transparency for buyers and renters, allowing for more informed decision-making. |

| ● | Improved Accessibility. Proptech platforms can make access to the real estate market easier, particularly for first-time buyers or those in remote locations. |

| ● | Disruption of Traditional Models. Proptech has the potential to disrupt traditional brokerage models, with online platforms offering more cost-effective alternatives. |

According to the mostly recent yearly report published by Houlihan Lokey, despite the macroeconomic uncertainty in the real estate market, increasing interest rates and high inflation, there was a $4.7 billion growth in equity and debt investments into U.S. proptech companies and start-ups. However, year over year, the average proptech investment size into these U.S. proptech companies decreased from approximately $30.5 million to $16.8 million, or 45%. The mergers and acquisitions market for proptech companies, however, remained active with continued growth in 2023. For instance, in 2023, 94 mergers and acquisitions were completed, compared to 99 in 2022.

12

Macroeconomic factors also play a major role in the demand and financing for real estate investments, and, in turn, a demand for solutions provided by proptech, which include:

| ● | Interest Rates. Due to the Federal Reserve’s monetary policy tightening, interest rates are currently at 5.5%, which high interest rates significantly impacted the affordability of homeownership, leading to a decrease in buyer demand. |

| ● | Inflation. Inflationary pressures are eroding purchasing power and impacting the affordability of real estate, potentially leading to a moderation in property value growth in the future. As of January 2024, the Consumer Price Index (CPI) for all items in the United States increased by 3.9% compared to the same period in the previous year. This represents a significant decrease compared to the peak of 9.1% in June 2022, but still remains above the Federal Reserve’s target of 2%. |

| ● | Maturing Debt. According to the Mortgage Bankers Association, approximately $929 billion of commercial real estate debt in the United States is maturing in 2024. The effect of this debt maturing could lead to significant challenges and impacts on the commercial real estate market and financial sector. This substantial amount of debt maturing in a single year raises concerns about refinancing, potential defaults, and broader economic repercussions. The maturity of such a large volume of commercial real estate debt can strain borrowers who may face difficulties refinancing or repaying these loans, potentially leading to an increase in defaults. This situation could trigger a ripple effect across the real estate market, impacting property values, investment decisions, and overall market stability. |

Real Estate Market Recent Trends and Developments

The real estate market was deeply affected by the COVID-19 pandemic. As a result of the record low borrowing rates during such period, which encouraged real estate property purchases by first-time buyers, and a lack of supply due to a lower number of houses built recently, properties significantly increased in value between 2020 and 2023. However, as the situation stabilized due to the current high interest rate regime and inflation, several key trends emerged. With the rise of remote work, many people sought homes with more space, particularly in less urban and lower-cost areas, leading to increased demand in suburban and rural markets. The COVID-19 pandemic also saw a surge in the house flipping practice and residential real estate investing, with investors accounting for a significant portion of home purchases.

Additionally, the more recent high mortgage rates as a result of the recent interest rate increases lead to a decrease in affordability for homebuyers and contributing to properties being listed for a longer period of time when listed for sale, and an overall lower sales volume. In response to certain policies adopted during the COVID-19 pandemic, certain technological advancements became more prevalent in this market, such as virtual listings, viewings, and closings, which facilitated the home buying and selling process even further, and we believe that the integration of technological advancements and improvements in the real estate market is likely to persist.

Overall, the COVID-19 pandemic has reshaped the housing market in various ways, from shifting buyer preferences to accelerating technological advancements and overall affordability challenges. As the market continues to evolve, we will continue to monitor and understand these trends to better understand consumer behavior patterns and demand preferences to continuously improve our products and offerings in this market.

Research and Development

The industry in which we plan to operate and compete is subject to rapid technological developments, evolving industry standards, changes in customer requirements and competitive new products and features. As a result, we believe our success, in part, will depend on our ability to build and enhance our technology and artificial intelligence capabilities in a timely and efficient manner and to develop and introduce those technologies. To achieve these objectives, we have made research and development investments and acquisitions to facilitate the development of our technologies, and we may explore in the future third-party licensing agreements.

An example of our third-party acquisitions include our recent announcement that we intend to acquire, subject to certain conditions, Naamche and Naamche, Inc. Pvt. Ltd., an AI development studio, and a 25% equity stake in Carthagos Inc., a design studio. Naamche has assisted us in research and development of our proprietary algorithms and other technologies. This acquisition is expected to enhance our technological capabilities, broaden its portfolio of services, and contribute towards cost savings, positioning them for growth and success in the future.

13

Competition and Competitive Strengths

We face competition from different sources in our platform services and short-term rental operations segment. We believe that we will continue to face competition from other firms, including large technology companies and smaller, new real estate technology entrants while developing our AI-based technologies.

Proptech Market

This market is rapidly evolving, competitive and has relatively low barriers to entry. As a result, there are a number of established and emerging competitors in the proptech market. For instance, we would face competition from other real estate platform companies such as Opendoor Technologies Inc. (NASDAQ: OPEN), Roofstock, Inc., Fundrise LLC, Invitation Homes, Pacaso, as well as a range of emerging new entrants. These platforms offer a variety of investment opportunities into real estate properties, and we may compete with these companies in both the real estate professional solutions industry and real estate investment platform market. To the extent we resume our short-term rental operations, we would also compete with these companies in the market of acquiring real estate property.

Our key competitive factors in the real estate technology market include:

| ● | our technology’s features, quality and functionality being developed; | |

| ● | security and trust; | |

| ● | cloud-based architecture; | |

| ● | our proprietary technology to make objective and strategic investments in property and market selection. |

We seek to differentiate ourselves from competitors primarily through the integration of AI into our technologies for the real estate technology market. We believe that our integration of AI into our technologies will be a significant differentiator from our competitors’ potential offerings for our target audience of real estate professionals and investors.

Our technologies are continuously developed to provide exceptional quality and functionality. We believe this dedication to innovation sets us apart from competitors and allows us to deliver superior user experiences. We also prioritize the security and trust of our users and investors. By implementing robust security measures and ensuring data integrity, we instill confidence in our platform, which we believe sets us apart as a trustworthy and reliable choice in the real estate technology market.

Further, our cloud-based architecture offers scalability, flexibility, and seamless accessibility. This infrastructure enables us to handle increasing volumes of data and transactions efficiently, empowering us to deliver a seamless user experience and respond swiftly to evolving market demands.

We believe that our focus on innovation, security, and scalability gives us a competitive edge in the real estate technology space. As we navigate the competitive landscape, we remain committed to continuously enhancing our technology offerings, fortifying our security measures, and leveraging cloud-based advantages. We believe that these efforts position us as a frontrunner in transforming the financial investment and services landscape through our AI-driven solutions.

Short-Term Rental Market

To the extent we resume operations in this market, our primary competitors in acquiring properties for investment purposes will include large and small private equity investors, public and private REITs, and other sizable private institutional investors. These same competitors may also compete with us for investors. Competition may increase the prices for properties that we would like to purchase, reduce the amount of rent we may charge for our properties, reduce the occupancy of our portfolio, and adversely impact our ability to achieve attractive total returns.

14

Although our competitors may be more established and better funded than we are, we believe that, once fully developed and implemented, our business model consisting of our acquisition platform, Investment Criteria, extensive in-market property operations infrastructure, and local expertise in our markets will provide us with competitive advantages against such competitors. We consider our competitive differentiators in our market to primarily be:

| ● | our focus on the short-term rental market, compared to other established players in the industry that focus on long-term rentals; |

| ● | Syndicate Member rewards program that allows for utilization of properties when they are unoccupied, which is currently being developed; | |

| ● | consistent short-term rental income with use of optimum amounts of leverage; | |

| ● | lower minimum investment amounts; and | |

| ● | favorable tax treatment associated with long-term capital gains. |

Intellectual Property

We are currently developing five technologies, as described above. Rights to those technologies belong only to us. To protect our intellectual property, we have filed for trademarks and patents, when possible, and protect our intellectual property as trade-secrets where meaningful patent protection cannot be achieved. We strive to continue innovating by using better wealth-creation tools, as well as generating returns by leveraging new technologies to optimize guest experience.

Trademarks

As of the date of this report, we have two registered trademarks and four pending trademark applications in the United States, and have filed a non-provisional patent application for the reAlpha BRAIN. Our U.S. trademark registrations and applications are reflected in the chart below. We are using certain other marks that have not been registered, such as reAlpha M3, reAlpha AI, reAlpha BRAIN, and reAlpha Hub. We may choose to add new or retire old patents or trademarks for these technologies as the landscape of such technologies keeps changing rapidly.

U.S. Trademark Registrations and Applications

| Mark | Class(es) | App. No. | Filing Date | Status | Next Deadline(1) |

Applicant/Registrant | ||||||||||

| ReAlpha | 036, 037 | 90670051 | 2021-04-25 | Registered | 2027-11-30 | reAlpha Tech Corp. | ||||||||||

| Invest in real | 036 | 90796901 | 2021-06-26 | Registered | 2028-04-12 | reAlpha Tech Corp. | ||||||||||

| ReAlpha HUMINT | 035, 042 | 90670061 | 2021-04-25 | Registered | N/A | reAlpha Tech Corp. | ||||||||||

| Vacation Capitalist | 036 | 97703446 | 2022-12-05 | Pending | N/A | reAlpha Tech Corp. | ||||||||||

| BnBGPT | 042 | 97938022 | 2023-05-16 | Pending | N/A | reAlpha Tech Corp. | ||||||||||

| Gena.AI | 042 | (2) | 2023-09-15 | Applied | N/A | reAlpha Tech Corp. | ||||||||||

| (1) | A trademark registration does not expire after a set period of time, and may remain in effect as long as the owner continues to use the trademark in commerce and timely files the required registration maintenance documents. |

| (2) | Company has applied for the trademark but has not yet received an application number. |

Patents

We currently maintain one non-provisional patent application, and we intend to continue to apply to patents when applicable to create significant trade-secret intellectual property regarding our technologies, algorithms and platforms. Our current patent application for reAlpha BRAIN is based on a system for analyzing, evaluating, and ranking properties using artificial intelligence. If granted, this patent will expire 20 years from the date of its original filing date.

| ● | Patent Application Number 17944255: “reAlpha BRAIN” (filed September 14, 2022). |

15

Sales and Marketing

We have a dedicated marketing department responsible for various aspects of our marketing initiatives and strategies. The department’s primary responsibilities include: