As filed with the Securities and Exchange Commission on June 28, 2023

Registration No. 333-271307

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

reAlpha Tech Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 6500 | 86-3425507 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

6515 Longshore Loop, Suite 100

Dublin, OH 43017

(707) 732-5742

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Giri Devanur

Chief Executive Officer

reAlpha Tech Corp.

6515 Longshore Loop, Suite 100

Dublin, OH 43017

Tel.: (707) 732-5742

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

Nimish Patel, Esq.

Blake Baron, Esq.

Mitchell Silberberg & Knupp LLP

437 Madison Ave., 25th Floor

New York, New York 10022

Tel.: (212) 509-7239

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold by the selling stockholders until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| Preliminary Prospectus | Subject to Completion, dated June 28, 2023 |

4,151,519 shares of common stock

reAlpha Tech Corp.

This prospectus relates to the registration of the resale of up to 4,151,519 shares of our common stock, $0.001 par value per share (the “common stock”), by our stockholders identified in this prospectus, or their permitted transferees (the “Registered Stockholders”), in connection with our direct listing (the “Direct Listing”) on the Nasdaq Capital Market (“Nasdaq”).

Unlike an initial public offering, the resale of the common stock by the Registered Stockholders is not being underwritten by any investment bank. The Registered Stockholders may, or may not, elect to sell their shares of common stock covered by this prospectus, as and to the extent they may determine. The Registered Stockholders may offer, sell or distribute all or a portion of the shares of common stock hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will pay certain costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The Registered Stockholders will bear all commissions and discounts, if any, attributable to their sale of shares of common stock (see the “Plan of Distribution” section). If the Registered Stockholders choose to sell or distribute, as applicable, their shares of common stock, we will not receive any proceeds from the sale or distribution, as applicable, of shares of our common stock by the Registered Stockholders.

No public market exists for our common stock. Further, the listing of our common stock on Nasdaq, without a firm-commitment underwritten offering, is a novel method for commencing public trading in shares of our common stock, and consequently, the trading volume and price of shares of our common stock may be more volatile than if shares of our common stock were initially listed in connection with an initial public offering underwritten on a firm-commitment basis.

On the day that our shares of common stock are initially listed on Nasdaq, Nasdaq will begin accepting, but not executing, pre-opening buy and sell orders and will begin to continuously generate the indicative Current Reference Price (as defined below) on the basis of such accepted orders. The Current Reference Price is calculated each second and, during a 10-minute “Display Only” period, is disseminated, along with other indicative imbalance information, to market participants by Nasdaq on its NOII and BookViewer tools. Following the “Display Only” period, a “Pre-Launch” period begins, during which Maxim Group LLC (the “Advisor” or “Maxim”), in its capacity as our financial advisor, must notify Nasdaq that our shares are “ready to trade.” Once the Advisor has notified Nasdaq that our shares of common stock are ready to trade, Nasdaq will confirm the Current Reference Price for our shares of common stock, in accordance with the Nasdaq rules. If the Advisor then approves proceeding at the Current Reference Price, the applicable orders that have been entered will be executed at such price and the regular trading of our shares of common stock on Nasdaq will commence, subject to Nasdaq conducting validation checks in accordance with the Nasdaq rules. Under the Nasdaq rules, the “Current Reference Price” means: (i) the single price at which the maximum number of orders to buy or sell can be matched; (ii) if there is more than one price at which the maximum number of orders to buy or sell can be matched, then it is the price that minimizes the imbalance between orders to buy or sell (i.e. minimizes the number of shares that would remain unmatched at such price); (iii) if more than one price exists under (ii), then it is the entered price (i.e. the specified price entered in an order by a customer to buy or sell) at which our shares of common stock will remain unmatched (i.e. will not be bought or sold); and (iv) if more than one price exists under (iii), a price determined by Nasdaq in consultation with the Advisor in its capacity as our financial advisor. In the event that more than one price exists under (iii), the Advisor will exercise any consultation rights only to the extent that it can do so consistent with the anti-manipulation provisions of the federal securities laws, including Regulation M, or applicable relief granted thereunder. The Registered Stockholders will not be involved in Nasdaq’s price-setting mechanism, including any decision to delay or proceed with trading, nor will they control or influence the Advisor in carrying out its role as a financial adviser. The Advisor will determine when our shares of common stock are ready to trade and approve proceeding at the Current Reference Price primarily based on considerations of volume, timing and price. In particular, the Advisor will determine, based primarily on pre-opening buy and sell orders, when a reasonable amount of volume will cross on the opening trade such that sufficient price discovery has been made to open trading at the Current Reference Price. For more information, see “Plan of Distribution.”

We have applied to have our common stock listed on Nasdaq under the symbol “AIRE.”

If our Nasdaq application is not approved or we otherwise determine that we will not be able to secure the listing of our common stock on Nasdaq, we will not complete this Direct Listing. This listing is a condition to the offering. No assurance can be given that our Nasdaq application will be approved and that our common stock will ever be listed on Nasdaq. If our listing application is not approved by Nasdaq, we will not be able to consummate the offering and we will terminate this Direct Listing.

We will be deemed to be a “controlled company” under the Nasdaq listing rules because Giri Devanur, our chief executive officer and chairman, owns approximately 65.0% of our outstanding common stock. As a controlled company, we are not required to comply with certain of Nasdaq’s corporate governance requirements; however, we do not currently intend to take advantage of any of these exceptions. See “Prospectus Summary — Controlled Company.”

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock in “Risk Factors” beginning on page 8 of this prospectus.

We are an “emerging growth company,” as defined under U.S. federal securities laws and, as such, are eligible and have elected to comply with certain reduced public company reporting requirements for this prospectus and for future filings.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements, which involve risks and uncertainties. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believe,” “estimate,” “project,” “anticipate,” “expect,” “seek,” “predict,” “continue,” “possible,” “intend,” “may,” “might,” “will,” “could,” would” or “should” or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our products, product development, prospects, strategies, the industry in which we operate and potential acquisitions. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results. Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will be achieved. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

Forward-looking statements speak only as of the date of this prospectus. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

You should read this prospectus and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect. All forward-looking statements are based upon information available to us on the date of this prospectus. Important factors that could cause our results to vary from expectations include, but are not limited to:

| ● | We are employing a business model with a limited track record, which makes our business difficult to evaluate; |

| ● | We intend to utilize a significant amount of indebtedness in the operation of our business; |

| ● | Our ability to retain our executive officers and other key personnel; |

| ● | Our real estate investments are and will continue to be concentrated in certain markets and in the single-family properties sector of the real estate industry, thus, exposing us to risk concentrations, which, in turn, exposes us to risk caused by seasonal fluctuations in short-term rental demand and downturns in certain markets or in the single-family properties sector; |

| ● | We face significant competition in the short-term rental market for guests, which may limit our ability to rent our properties on favorable terms; and |

| ● | The impact of laws and regulations regarding privacy, data protection, consumer protection, and other matters. Many of these laws and regulations are subject to change and uncertain interpretation, and could result in claims, changes to our business practices, monetary penalties, or otherwise harm to our business. |

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition, business and prospects may differ materially from those made in or suggested by the forward-looking statements contained in this prospectus. In addition, even if our results of operations, financial condition, business and prospects are consistent with the forward-looking statements contained in this prospectus, those results may not be indicative of results in subsequent periods.

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with. Forward-looking statements necessarily involve risks and uncertainties, and our actual results could differ materially from those anticipated in the forward-looking statements due to a number of factors, including those set forth below under “Risk Factors” and elsewhere in this prospectus. The factors set forth below under “Risk Factors” and other cautionary statements made in this prospectus should be read and understood as being applicable to all related forward-looking statements wherever they appear in this prospectus. The forward-looking statements contained in this prospectus represent our judgment as of the date of this prospectus. We caution readers not to place undue reliance on such statements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout this prospectus.

i

TABLE OF CONTENTS

ii

About this Prospectus

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration or continuous offering process. Under this process, the Registered Stockholders may, from time to time, sell the common stock covered by this prospectus in the manner described in the section titled “Plan of Distribution.” Additionally, we may provide a prospectus supplement to add information to, or update or change information contained in, this prospectus, including the section titled “Plan of Distribution.” You may obtain this information without charge by following the instructions under the section titled “Where You Can Find Additional Information” appearing elsewhere in this prospectus. You should read this prospectus and any prospectus supplement before deciding to invest in our common stock.

As of June 28, 2023, we have a total of 42,522,091 shares of our common stock issued and outstanding.

Certain amounts, percentages, and other figures presented in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals, dollars, or percentage amounts of changes may not represent the arithmetic summation or calculation of the figures that precede them.

iii

This prospectus summary highlights certain information contained elsewhere in this prospectus. As this is a summary, it does not contain all of the information that you should consider in making an investment decision. You should read the entire prospectus carefully, including the information under the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes thereto included in this prospectus, before investing. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Information Regarding Forward-Looking Statements.” Unless the context otherwise requires, we use the terms “reAlpha,” the “Company,” “we,” “us” and “our” in this prospectus to refer to reAlpha Tech Corp. and any and all of our subsidiaries.

Overview

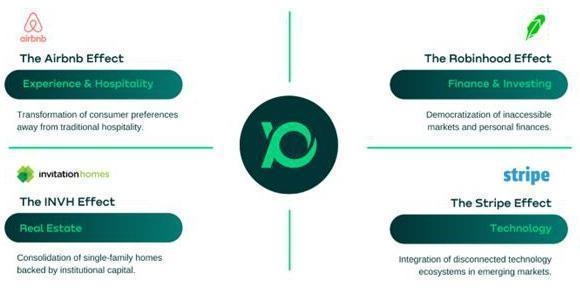

We are a real estate technology company with a mission to develop, utilize and commercialize our artificial intelligence (“AI”) focused technology stack to empower retail investor participation in short-term rental properties. Short-term rentals are utilized for various purposes, including vacations, relocations, renovations, extended work trips, special events, temporary work assignments, or seasonal activities.

We were founded on the belief that every person should have the access and the freedom to pursue wealth creation through real estate. However, we believe there are significant entry barriers for the average individual and that the lucrative returns are currently taken mainly by private equity firms and larger-scale developers. We intend to develop and buy technologies to democratize access to short-term rental investments. To support this goal, we are creating a new model, powered by our AI focused technologies, for property ownership and real estate investment.

Our Business Model

Our business model is built with technologies for analyzing and acquiring short-term rental properties that meet the Investment Criteria (as defined in the “Business” section of this prospectus) for syndication purposes, and which we call Target Properties. Once the Target Properties are acquired, they are prepared for rent and listed on short-term rental sites. Our technologies help us not only identify properties with the most short-term rental profitability potential, but also optimize their profitability by generating listing descriptions using the surrounding attractions of the location, analyzing guest reviews in the area, and suggesting improvements. Once our technologies are fully developed and ready to be commercialized, we intend to make some of these technologies available for commercial use by other customers on a software as a service (“SAAS”) fee basis, pay-per-use basis or other fee arrangements.

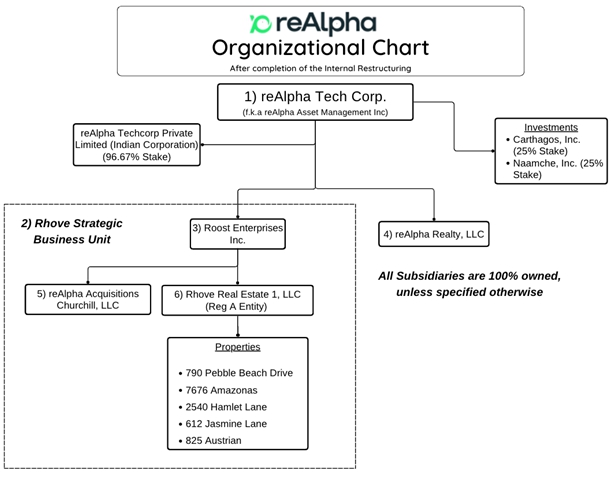

The Company plans to make Target Properties available to investors via the Company’s subsidiary, Roost Enterprises, Inc. (“Rhove”). Rhove will create and manage limited liability companies (“Syndication LLCs”) to syndicate one or more of the Target Properties through exempt offerings. Once the Syndication LLCs are in place, Rhove will launch exempted offerings to sell membership interests in such properties to investors, through the purchase of membership interests in the Syndication LLCs, pursuant to Regulation A or Regulation D, each as promulgated under the Securities Act of 1933, as amended (the “Securities Act”) (each, a “Syndication”). We refer to properties that have been offered through a Syndication LLC as “Syndicated” properties throughout this prospectus. To further facilitate the investment process in the Syndication LLCs, the Company is currently working on the reAlpha App (hereafter referred to as the “reAlpha App,” “App” or “app”).

The membership interests will provide an ownership stake in the Syndication LLC and in turn in the Target Properties. We refer to such investors as Syndicate Members, who differ significantly to the holders of our common stock. To date, we have not yet developed a secondary trading market for equity interests in our Syndication LLCs. While the potential establishment of such a market is under consideration, no final decision has been made to implement a secondary trading market at this time.

Rights among Syndicate Members may vary among each other depending on the specific terms and conditions agreed to in the offering documents pursuant to which the holder becomes a Syndicate Member. By becoming a Syndicate Member, the holder will not acquire any rights to the Company’s common stock and, therefore, will not be entitled to vote, receive a dividend or exercise any other rights of a stockholder of the Company. Likewise, acquiring shares of common stock of the Company will not provide the stockholders the status of Syndicate Member.

1

Recent Developments

Regulation A Offering

To finance our operations, from September 21, 2021, through January 31, 2023, we issued 905,537 shares of common stock at a per share price of $10, for total cash proceeds of $9,055,370, pursuant to our Regulation A offering. As noted, this offering concluded on January 31, 2023. These shares of common stock were issued in reliance on the exemption provided by Regulation A under the Securities Act. Holders of common stock who invested in this Regulation A offering are entitled to certain free stays in our short-term rental properties, subject to certain limitations.

reAlpha Acquisitions Churchill, LLC

reAlpha Acquisitions Churchill, LLC, a wholly-owned subsidiary of the Company was formed on May 17, 2022, to hold the properties acquired utilizing financing provided by Churchill Finance I, LLC. reAlpha Acquisitions Churchill, LLC, executed a master credit facility worth up to $200 million on August 18, 2022. This credit facility allows a loan-to-cost ratio of up to 80% and is at a fixed rate of 12%. Access to this credit facility will allow us to acquire properties with the intention of utilizing them as short-term rental properties.

reAlpha Realty, LLC

Realpha Realty, LLC, formed on September 12, 2021, is a Florida Limited Liability Company whose principal office is located at 3350 SW 148th Ave Suite 110, Miramar FL 33027. reAlpha Asset Management Inc. is the registered member and Jorge Aldecoa is the registered manager. The entity operates as a registered Florida brokerage whereby Jorge Aldecoa is the registered broker (License number BK3326044). The registered license number of the Florida brokerage is CQ1066329. reAlpha Realty, LLC is a member of the Miami Association of Realtors.

Tree Houses Partnership

In July 2022, we signed a partnership with Free Spirit Spheres, a developer of tree houses that can be used for short-term rental. We intend to utilize this partnership for the development of tree houses in the United States for short-term rental to allow guests unique experiences consistent with our brand development strategy.

SAIML Capital Pte. Limited Joint Venture

On November 17, 2022, the Company (f/k/a reAlpha Asset Management, Inc.) and SAIML Capital Pte. Limited, a Singapore-based asset management firm, signed a binding term sheet to form a joint venture to invest $40.8 million in equity in rent-ready short-term rental properties. Balaji Swaminathan, who was appointed as a member of our board of directors in April 2023, is the chief executive officer and director of SAIML Capital Pte. Limited. The joint venture, once formed, would have a 51% stake held by the Company and a 49% stake held by SAIML. The joint venture planned to make up to $200 million in investments across California, Arizona, Florida, and Tennessee, leveraging reAlphaBRAIN to identify properties that meet its investment criteria pursuant to the terms and conditions of a definitive joint venture agreement to be entered into on or before January 31, 2023. When formed, this joint venture may also expand its partnership by contributing an additional $61.2 million of equity, with the potential to invest up to $500 million in rent-ready short-term rental properties through additional debt financing. As of the date hereof, the definitive joint venture agreement has not been entered into and, therefore, this joint venture has not been formed. Mr. Swaminathan received no compensation under the term sheet while it was outstanding.

GEM Global Yield LLC Capital Commitment

On December 1, 2022, the Company entered into an agreement with GEM Global Yield LLC SCS (“GEM”) a Luxembourg-based private alternative investment group, for a $100 million capital commitment, which includes a share subscription facility of up to $100 million for a 36-month term following a public listing by reAlpha Tech Corp. (the “GEM Agreement”). The Company will have control in terms of timing and, within certain limits, the maximum amount of each individual drawdown. There is no minimum drawdown obligation.

2

Pursuant to the GEM Agreement, the Company can issue a Drawdown Notice (“Drawdown Notice”) at any time (the “Draw Down”) for a specified Draw Down amount, subject to certain conditions, which will trigger the commencement of a Pricing Period (“Pricing Period”). The Pricing Period will last for the following thirty (30) consecutive trading days, and the Draw Down will close on the first trading day following the end of the Pricing Period. GEM will honor Drawdown Notices from the Company based upon a per-share subscription price equal to ninety percent (90%) of the average closing bid price during the Pricing Period (“Purchase Price”). The GEM Agreement also provides that there may only be one Draw Down allowed in each Pricing Period, and that each Draw Down is settled on the first trading day after the end of each Pricing Period. Each Draw Down automatically expires immediately after the last trading day of each Pricing Period.

As a condition to the exercise of any Draw Down, the Company has to: (i) provide notice to the purchaser(s) of the Company’s exercise of any Draw Down before the commencement after the first trading day of the Draw Down covered in such notice; and (ii) deliver the shares of common stock to the purchaser(s) via DWAC, if applicable, in the amount equal to the Draw Down amount requested.

If ninety percent (90%) of the closing bid price on a given Pricing Period is less than the threshold price (or floor price) set by the Company (the “Threshold Price”), then the Investor’s payment obligation under the DrawDown will be reduced by 1/30th, and the closing bid price for that day will not be factored into the Purchase Price calculation. The Threshold Price will be set prior to using this facility. For each Draw Down, the Company may issue a Drawdown Notice for up to four hundred percent (400%) of the average daily trading volume for the Pricing Period.

First Syndication of the Jasmine property

On March 3, 2023, we opened our first Regulation CF offering listed under reAlpha 612 Jasmine Lane Inc., a reAlpha subsidiary (also referred to herein as “Jasmine Holdco”) through the web version of our reAlpha App (A.K.A. Initial Property Offering™ platform), whereby we offered to investors the opportunity to buy equity interests in our property located 612 Jasmine Lane, Davenport, FL 33897. Currently, the property is held by reAlpha Acquisitions WF LLC, a wholly owned subsidiary of reAlpha. Upon successful completion of the offering, the property will be transferred to Jasmine Holdco. The minimum offering amount is $388,639 and the maximum is $614,036.50, inclusive of investor payment processing fees. The minimum investment is $500 plus the 2.5% investor transaction fee. We intend to terminate this Regulation CF offering by June 30, 2023, and as a result, the $330,030 we have raised in this exempt offering will be withdrawn from escrow and returned in full to investors. After effectiveness of this Registration Statement, the Company will no longer be able to conduct Regulation CF offerings per Rule 227.100(b)(2) of Regulation CF.

reAlpha Asset Management Inc. merges with reAlpha Tech Corp.

On March 21, 2023 (the “Effective Time”), reAlpha Tech Corp. (the “Parent”), merged with and into reAlpha Asset Management, Inc. (the “Subsidiary”), pursuant to a short-form merger in accordance with Section 253 of the Delaware General Corporate Law (“DGCL”) (the “Downstream Merger”), with the Subsidiary surviving the Merger (the “Surviving Corporation”). This Downstream Merger has resulted in reAlpha Asset Management, Inc. gaining access to all of the technologies and intellectual property owned by reAlpha Tech Corp.

Prior to the Downstream Merger, the Parent owned more than 90% of the issued and outstanding shares of common stock of the Subsidiary. As of the Effective Time, by virtue of the Downstream Merger and without any action on the part of the Parent, Subsidiary or Surviving Corporation, each share of the Subsidiary’s common stock issued and outstanding immediately prior to the Effective Time (other than shares of the Subsidiary common stock that were canceled, as described below) were automatically converted into one validly issued, fully paid and nonassessable share of common stock of the Surviving Corporation. Further, each share of the Subsidiary’s common stock issued and outstanding immediately prior to the Effective Time that was held by the Parent or the Subsidiary (as treasury stock or otherwise) was automatically canceled and returned to the status of authorized but unissued shares of the Subsidiary. And, lastly, as of the Effective Time, all of the shares of common stock of the Parent issued and outstanding immediately prior to the consummation of the Merger were automatically converted into a number of shares of common stock of the Surviving Corporation, prorated for the number of shares of the Subsidiary’s common stock held by the Parent at such time.

3

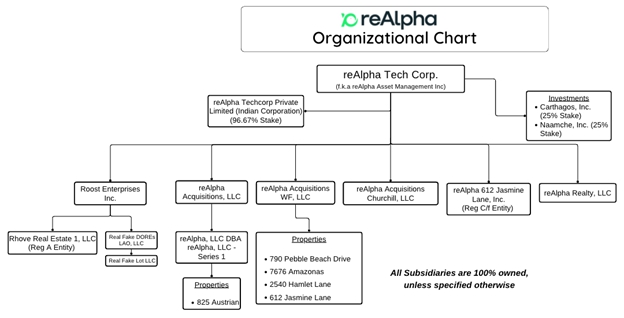

The Downstream Merger has resulted in the Company gaining ownership of a 25% stake in Naamche Inc., an artificial intelligence (“AI”) studio, a 25% stake in Carthagos Inc., a design and branding studio and a 96.67% stake in reAlpha Techcorp India Private Limited. Naamche, Inc. has assisted us in researching and developing our proprietary algorithms and other technologies (see “Research and Development” section below for more details). Carthagos Inc. is assisting the Company with marketing activities (see “Sales and Marketing” section below for more details). reAlpha Techcorp India Private Limited is a subsidiary that provides business support services for finance, marketing and technology.

This acquisition is expected to enhance our technological capabilities, broaden our portfolio of services, and contribute towards cost savings, positioning for growth and success in the future.

The Downstream Merger is significant as it will enable reAlpha AMI to further enhance its offerings and provide customers with a broader range of AI solutions. With access to reAlpha Tech Corp’s advanced technologies and intellectual property, reAlpha AMI can now offer more comprehensive solutions that cater to a wider range of industries and use cases.

reAlpha Asset Management Inc. is renamed to reAlpha Tech Corp.

In connection with the Downstream Merger, on March 21, 2023, reAlpha Asset Management Inc. changed its name to reAlpha Tech Corp. The name change reflects the Company’s evolution and expansion beyond asset management into broader areas of financial technology and innovation.

The name change to reAlpha Tech Corp. is a strategic move that reflects the Company’s broader focus on delivering cutting-edge solutions across a wider range of property management and financial services. The Company’s new name highlights its commitment to leveraging advanced technologies, including AI and machine learning, to deliver innovative solutions to clients.

Rhove Acquisition

On March 24, 2023, the Company acquired Rhove (as defined above), a leading provider of real estate technology solutions. The Rhove acquisition included technology developed for the purpose of syndicating real estate properties for investment by retail and institutional investors (the “Syndication Platform”). Pursuant to the Stock Purchase Agreement entered into in connection with the Rhove acquisition (the “Stock Purchase Agreement”) among the Company, Rhove and certain investor sellers in Rhove (the “Sellers”), we acquired all the intellectual property related to the Syndication Platform and other related intangible property and proprietary information of Rhove.

The purchase price under the Stock Purchase Agreement for the Rhove acquisition included: (1) payment to Silicon Valley Bridge Bank, N.A. (“SVBB”), of $25,000 in cash and the issuance of 49,029 shares of our common stock (collectively the “SVBB Consideration”), (2) 1,263,000 shares of our common stock for Sellers and the issuance of option letters to Sellers (on a pro rata basis) to purchase in aggregate 1,263,000 shares of our common stock for $10.00 per share with an expiration date of two years from the date of issuance; and (3) payment of certain transaction expenses of Rhove totaling $50,000.

As part of the transaction, Rhove’s major investor, Drive Capital and certain of its funds, became stockholders of reAlpha. As of the date of acquisition, Rhove has over 5,000 users that will join the reAlpha ecosystem. As part of the transaction, Calvin Cooper, the chief executive officer of Rhove, joined reAlpha in an advisory role.

4

Rhove’s Syndication Platform enables us to offer a more seamless and efficient real estate investment experience to Syndicate Members. It processes and handles investment in a property offering internally without the use of a white-label technology. The Syndication Platform includes Rhove’s SEC-qualified Regulation A filing for offering membership interests in Syndication LLCs. When fully integrated with reAlpha’s platform, among other improvements, it will streamline the investment process and make the interface more user friendly. Further, it will allow us to offer unique features such as the ability to earn rent rewards. The integration of the reAlpha and Rhove platforms is expected to be completed by the end of the third quarter of 2023.

Board of Director Changes

Effective April 1, 2023, Brent Crawford resigned as our Chairman of the Board of Directors. Mr. Crawford’s decision to resign was not as a result of a disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Effective April 1, 2023, Art Langer resigned as our Chairman of the Board of Directors. Mr. Langer’s decision to resign was not as a result of a disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Management Changes

On April 11, 2023, the Company entered into an employment agreement with Jorge Aldecoa to act as the Company’s Chief Operating Officer, replacing Michael J. Logozzo as interim chief operating officer. Pursuant to Mr. Aldecoa’s employment agreement, he will serve as the Company’s chief operating officer until his agreement is terminated by either Mr. Aldecoa or the Company, and he will receive a yearly salary of $200,000 for the fiscal year ended April 30, 2023 and a prorated amount of such base salary for the year ended April 30, 2022.

Mr. Aldecoa’s employment agreement also provides for a base salary adjustment to $215,000 upon a successful follow-on offering of the Company’s securities for an amount of $8 million or more, subject to the compensation committee’s approval. Further, Mr. Aldecoa is entitled to additional compensation in the form of a discretionary bonus of up to $50,000 based on the achievement of certain established performance targets, which is payable annually, and certain benefits such as unlimited vacation, health insurance and others. Further, Mr. Aldecoa is eligible to participate in the Plan (as defined below). Mr. Aldecoa or the Company may terminate the employment agreement at any time upon written notice to the other party. Mr. Aldecoa’s employment agreement has a confidentiality provision and a non-compete for a period of two (2) years following the termination of his employment.

On May 5, 2023, Christine Currie notified the Company of her decision to resign as chief marketing officer of the Company, effective as of May 7, 2023. Ms. Currie’s resignation is not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. The Company’s marketing team will temporarily report to Jorge Aldecoa, chief operating officer of the Company, in accordance with the bylaws of the Company. At this time, the Company is deciding whether Ms. Currie’s successor or a different role will be needed.

Sale of myAlphie LLC

Effective May 17, 2023, the Company (the “Seller”) entered into a Second Amendment to an agreement (the “Second Amendment”) to finalize a transaction that was originally agreed to through a Membership Interest Purchase Agreement dated December 31, 2022 (the “Purchase Agreement”), with Turnit Holdings, LLC, an Ohio limited liability company (the “Buyer”). The Buyer is an indirect subsidiary of Crawford Hoying, which is owned and partially controlled by Brent Crawford, former chairman of the Company’s board of directors. CH REAlpha Investments, LLC, and CH REAlpha Investments II, LLC are also managed by Mr. Crawford. The Purchase Agreement was previously amended by a Letter Agreement dated March 11, 2023 (the “First Amendment”), which was entered into between the Buyer and Seller. The Purchase Agreement provided for the Buyer’s acquisition of all the issued and outstanding membership interests of myAlphie, LLC (the “Subsidiary”).

Prior to the execution of the Purchase Agreement and pursuant to the Downstream Merger, the Company held myAlphie LLC as a subsidiary, along with (a) all its technology and intellectual property, and (b) two on-demand promissory notes in the amounts of $975,000 and $4,875,000 payable to CH REAlpha Investments, LLC, and CH REAlpha Investments II, LLC, respectively (together, the “Promissory Notes”). Upon closing of the Purchase Agreement (a) the Seller sold all of its interests in myAlphie LLC, and (b) the Buyer assumed the Seller’s remaining liabilities and outstanding obligations under the Promissory Notes.

5

Malpractice Lawsuit

On May 8, 2023, the Company filed a malpractice lawsuit with the United States District Court for the Southern District of Ohio, Eastern Division, against Buchanan, Ingersoll & Rooney, PC (“Buchanan”), Rajiv Khanna (“Khanna”) and Brian S. North (“North,” together with Buchanan and Khanna, the “Buchanan Legal Counsel”). The complaint alleges that the Buchanan Legal Counsel failed to provide proper and timely legal advice during the Company’s Tier 2 Regulation A offering, resulting in late Blue Sky notice filings with all required states prior to the Company offering and selling securities in those states. As a result, the Company was subject to a number of inquiries, investigations, and subpoenas by the various states, incurring significant legal fees and fines, lost opportunity due to pausing its Regulation A campaign, in addition to the loss of a $20 million institutional investment. The Company is seeking the forfeit of all legal fees associated with this matter, the award of legal fees to bring this matter to action, and further legal and equitable relief as the Court deems just and proper.

For additional information on recent developments, please see the discussion in “Legal Proceedings” below.

Summary of Risk Factors

Investing in our common stock involves a high degree of risk. You should carefully consider all the information in this prospectus prior to investing in our common stock. These risks are discussed more fully in the section entitled “Risk Factors” immediately following this prospectus summary. These risks and uncertainties include, but are not limited to, the following:

| ● | We are employing a business model with a limited track record, which makes our business difficult to evaluate; |

| ● | We incurred net losses of approximately $3.19 million and $3,413 for the years ended April 30, 2022 and 2021, respectively, and our outstanding indebtedness was approximately $1.65 million as of January 31, 2023. |

| ● | Our technology that is currently being developed may not yield expected results or be delivered on time; |

| ● | We intend to utilize a significant amount of indebtedness in the operation of our business; |

| ● | The implementation of artificial intelligence (“AI”) into our technologies may prove to be more difficult than anticipated; |

| ● | The inability to protect our intellectual property rights could harm our reputation, damage our business or interfere with our competitive position; |

| ● | A significant portion of our portfolio properties’ costs and expenses are fixed and we may not be able to adapt our cost structure to offset declines in our revenue; |

| ● | We may in the future be subject to claims that we or others violated certain third-party intellectual property rights, which, even where meritless, can be costly to defend and could materially adversely affect our business, results of operations, and financial condition; |

| ● | Our ability to retain our executive officers and other key personnel of our advisors and their affiliates; |

| ● | Global economic, political and market conditions and economic uncertainty caused by the recent outbreak of coronavirus (COVID-19) may adversely affect our business, results of operations and financial condition; |

| ● | Our investments are and will continue to be concentrated in certain markets and in the single-family properties sector of the real estate industry, thus, exposing us to risk concentrations, which, in turn, exposes us to risk caused by seasonal fluctuations in short-term rental demand and downturns in certain markets or in the single-family properties sector; |

6

| ● | Contingent or unknown liabilities could adversely affect our financial condition, cash flows and operating results; |

| ● | We are subject to certain risks associated with bulk portfolio acquisitions and dispositions; |

| ● | Availability of appropriate property acquisition targets; |

| ● | Our dependence upon third parties for key services may have an adverse effect on our operating results or reputation if the third parties fail to perform; |

| ● | We face significant competition in the short-term rental market for guests, which may limit our ability to short-term rent our properties on favorable terms; |

| ● | Compliance with governmental laws, regulations and covenants that are applicable to our properties or that may be passed in the future, including permit, license and zoning requirements, may adversely affect our ability to make future acquisitions or renovations, result in significant costs or delays, and adversely affect our growth strategy. |

| ● | Failure to integrate any acquisitions successfully; |

| ● | Our business is subject to laws and regulations regarding privacy, data protection, consumer protection, and other matters. Many of these laws and regulations are subject to change and uncertain interpretation, and could result in claims, changes to our business practices, monetary penalties, or otherwise harm our business; |

| ● | We may not be able to attract investors to invest in our portfolio properties; |

| ● | If we fail to attract guests, or if we fail to provide high-quality stays and experiences, our business, results of operations, and financial condition would be materially adversely affected; |

| ● | If we fail to retain guests or add new guests, our business, results of operations, and financial condition would be materially adversely affected; and |

| ● | Our listing differs significantly from an initial public offering conducted on a firm-commitment basis. |

7

An investment in our shares of common stock involves significant risks. Before making an investment in our shares of common stock, you should carefully consider the risks and uncertainties discussed below under “Information Regarding Forward-Looking Statements,” and the specific risks set forth herein. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, prospects, financial condition, results of operations, cash flows and ability to pay dividends. In any such case, the market price of our shares of common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business

We have a limited operating history and may not be able to operate our business successfully or generate sufficient cash flows to accomplish our business objectives.

We have a limited operating history. As a result, an investment in our common stock entails more risk than an investment in the common stock of a company with a substantial operating history. If we are unable to operate our business successfully, you could lose all or a portion of your investment in our common stock. Our ability to successfully operate our business and implement our operating policies and investment strategy depends on many factors, including:

| ● | our ability to obtain additional capital; |

| ● | our ability to effectively manage renovation, maintenance, marketing and other operating costs for our properties; |

| ● | economic conditions in the markets where we operate or hold an interest in real estate (“our markets”), including changes in employment and household earnings and expenses, as well as the condition of the financial and real estate markets and the economy, in general; |

| ● | our ability to maintain high occupancy rates and target rent levels; |

| ● | the availability of, and our ability to identify, attractive acquisition opportunities consistent with our investment strategy; |

| ● | our ability to compete with other investors entering the sector for short-term Target Properties; |

| ● | costs that are beyond our control, including title litigation, litigation with guests, legal compliance, real estate taxes, HOA fees and insurance; |

| ● | judicial and regulatory developments affecting landlord-guest relations that may affect or delay our ability to dispose of our properties, evict occupants or increase rental rates; |

| ● | population, employment or homeownership trends in our markets; and |

| ● | interest rate levels and volatility, such as the accessibility of short-term and long-term financing on desirable terms. |

We have a history of operating losses, and we may not be able to generate sufficient revenue to achieve and sustain profitability.

We have not yet achieved profitability. We incurred net losses of approximately $3.19 million and $3,413 for the years ended April 30, 2022 and 2021, respectively. As of January 31, 2023, we had an accumulated deficit of $6.34 million and outstanding indebtedness of $1.65 million. While we have experienced some revenue growth over recent periods, we may not be able to sustain or increase our growth or achieve profitability in the future. We intend to continue to invest diligently in sales and marketing efforts. In addition, we expect to incur significant additional legal, accounting, and other expenses related to our being a public company as compared to when we were a private company. While our revenue has grown since our inception, if our revenue declines or fails to grow at a rate faster than these increases in our operating expenses, we will not be able to achieve and maintain profitability in future periods. As a result, we may continue to generate losses. We cannot assure you that we will achieve profitability in the future or that, if we do become profitable, we will be able to sustain profitability. Additionally, we may encounter unforeseen operating expenses, difficulties, complications, delays, and other unknown factors that may result in losses in future periods. If these losses exceed our expectations or our revenue growth expectations are not met in future periods, our financial performance will be harmed.

8

Our lack of a long operating history could adversely impact us.

As a start-up business, we do not have a long operating history. Accordingly, we face challenges that companies with a long track record do not. Start-ups are considered to carry a “higher risk profile.” For instance, it is more difficult for us to bind coverage with insurance carriers, achieve better rates from service providers or lenders, attract talent, and in times of high interest rates and mounting inflation, to obtain new capital, maintain high credit rating, and utilize leverage. Each and all of these factors combined hinder our ability to achieve our goals.

Our audited financial statements indicate that there is a substantial doubt about our ability to continue as a going concern.

Our audited financial statements as of and for the year ended April 30, 2022 were prepared on the assumption that we would continue as a going concern. Those financial statements and the accompanying opinion of our auditor expressed a substantial doubt about our ability to continue as a going concern. Those audited financial statements did not include any adjustments that might result from the outcome of this uncertainty. We will need additional capital for full commencement of our planned operations and we are subject to significant risks and uncertainties, including failing to secure funding to commence our planned operations or failing to profitably operate the business. We intend to raise funds through various potential sources, such as equity or debt financings; however, we can provide no assurance that such financing will be available on acceptable terms, or at all. If adequate financing is not available, we may be required to significantly curtail or cease our operations, and our business would be jeopardized.

We have minimal operating capital and minimal revenue from operations.

We have minimal operating capital and for the foreseeable future will be dependent upon our ability to finance our operations from the sale of equity or other financing alternatives. There can be no assurance that we will be able to successfully raise operating capital. The failure to successfully raise operating capital, and the failure to attract qualified real estate companies and sufficient investor purchase commitments, could result in our bankruptcy or other event which would have a material adverse effect on us and our stockholders.

We are employing a business model with a limited track record, which makes our business difficult to evaluate.

A component of our business strategy involves purchasing, renovating, maintaining and managing a large number of residential properties and renting them short-term to guests. We believe that entry into this market by large, well-capitalized investors is a relatively recent trend, so few peer companies exist and none have yet established long-term track records that might assist us in predicting whether our business model and investment strategy can be implemented and sustained over an extended period of time. It may be difficult for you to evaluate our potential future performance without the benefit of established long-term track records from companies implementing a similar business model. We may encounter unanticipated problems as we continue to refine our business model, which may adversely affect our results of operations and ability to make distributions to our stockholders and cause our share price to decline significantly.

We intend to utilize a significant amount of indebtedness in the operation of our business.

We intend to employ prudent leverage, to the extent available, to fund the acquisition of residential assets, refinancing existing debt and for other corporate and business purposes deemed advisable by us. In determining to use leverage, we assess a variety of factors, including without limitation the anticipated liquidity and price volatility of the assets in our investment portfolio, the cash flow generation capability of our assets, the availability of credit on favorable terms, any prepayment penalties and restrictions on refinancing, the credit quality of our assets and our outlook for borrowing costs relative to the unlevered yields on our assets. We may continue to employ portfolio financing and expect to utilize credit facilities or other bank or capital markets debt financing, if available. We may consider seller or in-place financing, if available, from sellers of portfolios of residential assets and potentially financing from government sponsored enterprises if attractive programs are available. We may also utilize other financing alternatives such as securitizations, depending upon market conditions, and other capital raising alternatives such as follow-on offerings of our common shares, preferred shares and hybrid equity, among others. We have no limitation under our organizational documents or any contract on the amount of funds that we may borrow for any single investment or that may be outstanding at any one time in the aggregate. We may significantly increase the amount of leverage we utilize at any time without approval of our board of trustees.

9

Incurring substantial debt could subject us to many risks that, if realized, would adversely affect us, including the risk that: (i) our cash flow from operations may be insufficient to make required payments of principal and interest on the debt, which is likely to result in acceleration of such debt; (ii) our debt may increase our vulnerability to adverse economic and industry conditions with no assurance that investment yields will increase with higher financing cost; (iii) we may be required to dedicate a portion of our cash flow from operations to payments on our debt, thereby reducing funds available for distributions to our stockholders, operations and capital expenditures, future acquisition opportunities, or other purposes; and, (iv) the terms of any refinancing may not be as favorable as the terms of the debt being refinanced.

If we do not have sufficient funds to repay our debt at maturity, it may be necessary to refinance the debt through additional debt financings or additional capital raising. If, at the time of any refinancing, prevailing interest rates or other factors result in higher interest rates on refinancing, increases in interest expense could adversely affect our cash flows, and, consequently, cash available for distribution to our stockholders. If we are unable to refinance our debt on acceptable terms, we may be forced to dispose of substantial numbers of homes on disadvantageous terms, potentially resulting in losses. To the extent we cannot meet any future debt service obligations, we will risk losing some or all of our homes that may be pledged to secure our obligations to foreclosure. Any unsecured debt agreements we enter into may contain specific cross-default provisions with respect to specified other indebtedness, giving the unsecured lenders the right to declare a default if we are in default under other loans in some circumstances. Defaults under our debt agreements could materially and adversely affect us and cause the value of our common shares to decline.

Our technology that is currently being developed may not yield expected results or be delivered on time.

We could face delays, bugs, or crashes during and after the development process of any of our technologies that could cause adverse results on our timelines and ability to perform. We rely on our technology for our business model and scalability. Should the technology not yield the expected results, we may not be able to achieve scalability on the time-line or at all that we have forecasted. We rely on the ability of our employees to develop our technologies to achieve desired results.

The implementation of artificial intelligence (“AI”) into our technologies may prove to be more difficult than anticipated.

Our business relies on the use of AI to improve our product development and business operations, including through the usage of our reAlpha Score. However, the implementation of AI poses certain risks that need to be carefully considered. The use of AI can potentially lead to unintended consequences, ethical concerns, and data privacy issues. Additionally, reliance on AI can lead to a lack of human oversight and control, which can have negative implications for our organization.

We are highly dependent on information systems and systems failures could significantly disrupt our business, which may, in turn, negatively affect us and the value of our common stock.

Our operations are dependent upon our internal operating systems, and property management platforms, as well as external short-term rental platforms, like Airbnb and similar digital hospitality platforms, which include certain automated processes that require access to telecommunications or the internet, each of which is subject to system security risks. Certain critical components are dependent upon third party service providers and a significant portion of our business operations are conducted over the internet. As a result, we could be severely impacted by a catastrophic occurrence, such as a natural disaster or a terrorist attack, or a circumstance that disrupted access to telecommunications, the internet or operations at our third-party service providers, including viruses or experienced computer programmers that could penetrate network security defenses and cause system failures and disruptions of operations. Even though we believe we utilize appropriate duplication and back-up procedures, a significant outage in telecommunications, the internet or at our third-party service providers could negatively impact our operations.

10

Security breaches and other disruptions could compromise our information systems and expose us to liability, which would cause our business and reputation to suffer.

Information security risks have generally increased in recent years due to the rise in new technologies and the increased sophistication and activities of perpetrators of cyberattacks. In the ordinary course of our business, we acquire and store sensitive data, including intellectual property, our proprietary business information and personally identifiable information of our prospective and current residents, employees and third-party service providers. The secure processing and maintenance of such information is critical to our operations and business strategy. Despite our security measures, our information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. Any such breach could compromise our networks and the information stored therein could be accessed, publicly disclosed, misused, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, liability under laws that protect the privacy of personal information, regulatory penalties, disruption to our operations and the services we provide to customers or damage our reputation, any of which could adversely affect our results of operations, reputation and competitive position.

We rely upon Amazon Web Services to operate certain aspects of our service and any disruption of or interference with our use of the Amazon Web Services operation would impact our operations and our business would be adversely impacted.

Amazon Web Services (“AWS”) provides a distributed computing infrastructure platform for business operations, or what is commonly referred to as a “cloud” computing service. Our software and computer systems have been designed to utilize data processing, storage capabilities and other services provided by AWS. Currently, we run the vast majority of our computing on AWS. Given this, along with the fact that we cannot easily switch our AWS operations to another cloud provider, any disruption of or interference with our use of AWS would impact our operations and our business would be adversely impacted.

If we are unable to adapt to changes in technology and the evolving demands of our customers, our business, results of operations, and financial condition could be materially adversely affected.

The industries in which we compete are characterized by rapidly changing technology, evolving industry standards, consolidation, frequent new offering announcements, introductions, and enhancements, and changing consumer demands and preferences. Our future success will depend on our ability to adapt our technologies and services to evolving industry standards and local preferences and to continually innovate and improve the performance, features, and reliability of our technologies and services in response to competitive offerings and the evolving demands of customers. Our future success will also depend on our ability to adapt to emerging technologies such as tokenization, cryptocurrencies, new authentication technologies, such as biometrics, distributed ledger and blockchain technologies, artificial intelligence, virtual and augmented reality, and cloud technologies. As a result, we intend to continue to spend significant resources maintaining, developing, and enhancing our technologies and platform; however, these efforts may be more costly than expected and may not be successful. For example, we may not make the appropriate investments in new technologies, which could materially adversely affect our business, results of operations, and financial condition. Further, technological innovation often results in unintended consequences such as bugs, vulnerabilities, and other system failures. Any such bug, vulnerability, or failure, especially in connection with a significant technical implementation or change, could result in lost business, harm to our brand or reputation, consumer complaints, and other adverse consequences, any of which could materially adversely affect our business, results of operations, and financial condition.

Our use of “open source” software could adversely affect our ability to offer our platform and services and subject us to costly litigation and other disputes.

We have in the past incorporated and may in the future incorporate certain “open source” software into our code base as we continue to develop our platform and services. Open source software is generally licensed by its authors or other third parties under open source licenses, which in some instances may subject us to certain unfavorable conditions, including requirements that we offer our products that incorporate the open source software for no cost, that we make publicly available the source code for any modifications or derivative works we create based upon, incorporating or using the open source software, or that we license such modifications or derivative works under the terms of the particular open source license. From time to time, companies that use open source software have faced claims challenging the use of open source software or compliance with open source license terms. Furthermore, there is an increasing number of open-source software license types, almost none of which have been tested in a court of law, resulting in a dearth of guidance regarding the proper legal interpretation of such licenses. We could be subject to suits by parties claiming ownership of what we believe to be open source software or claiming noncompliance with open source licensing terms.

11

While we employ practices designed to monitor our compliance with the licenses of third-party open source software and protect our proprietary source code, inadvertent use of open source software is fairly common in software development in the Internet and technology industries. Such inadvertent use of open source software could expose us to claims of non-compliance with the applicable terms of the underlying licenses, which could lead to unforeseen business disruptions, including being restricted from offering parts of our product which incorporate the software, being required to publicly release proprietary source code, being required to re-engineer parts of our code base to comply with license terms, or being required to extract the open source software at issue. Our exposure to these risks may be increased as a result of evolving our core source code base, introducing new offerings, integrating acquired-company technologies, or making other business changes, including in areas where we do not currently compete. Any of the foregoing could adversely impact the value or enforceability of our intellectual property, and materially adversely affect our business, results of operations, and financial condition.

If internet search engines’ methodologies or other channels that we utilize to direct traffic to our website are modified, or our search result page rankings decline for other reasons, our user growth could decline.

We depend in part on various internet search engines, such as Google and Bing, as well as other channels to direct a significant amount of traffic to our website. Our ability to maintain the number of visitors directed to our website is not entirely within our control. For example, our competitors’ search engine optimization and other efforts may result in their websites receiving a higher search result page ranking than ours, internet search engines or other channels that we utilize to direct traffic to our website could revise their methodologies in a manner that adversely impacts traffic to our website, or we may make changes to our website that adversely impact our search engine optimization rankings and traffic. As a result, links to our website may not be prominent enough to drive sufficient traffic to our website, and we may not be able to influence the results.

We may experience a decline in traffic to our website if third-party browser technologies are changed, or search engine or other channels that we utilize to direct traffic to our website change their methodologies or rules, to our disadvantage. We expect the search engines and other channels that we utilize to drive users to our website to continue to periodically change their algorithms, policies, and technologies. These changes may result in an interruption in users’ ability to access our website or impair our ability to maintain and grow the number of users who visit our website. We may also be forced to significantly increase marketing expenditures in the event that market prices for online advertising and paid listings escalate or our organic ranking decreases. Any of these changes could have an adverse impact on our business and operating results.

Our cash flows and operating results could be adversely affected by required payments of debt or related interest and other risks of our debt financing.

We are generally subject to risks associated with debt financing. These risks include: (1) our cash flow may not be sufficient to satisfy required payments of principal and interest; (2) we may not be able to refinance existing indebtedness or the terms of the refinancing may be less favorable to us than the terms of existing debt; (3) required debt payments are not reduced if the economic performance of any property declines; (4) debt service obligations could reduce funds available for distribution to our stockholders and funds available for capital investment; (5) any default on our indebtedness could result in acceleration of those obligations and possible loss of property to foreclosure; and (6) the risk that necessary capital expenditures cannot be financed on favorable terms. If a property is pledged to secure payment of indebtedness and we cannot make the applicable debt payments, we may have to surrender the property to the lender with a consequent loss of any prospective income and equity value from such property. Any of these risks could place strains on our cash flows, reduce our ability to grow and adversely affect our results of operations.

12

We may be unable to obtain financing through the debt and equity markets, which would have a material adverse effect on our growth strategy and our financial condition and results of operations.

We cannot assure you that we will be able to access the capital and credit markets to obtain additional debt or equity financing or that we will be able to obtain financing on terms favorable to us. Our inability to obtain financing could have negative effects on our business. Among other things, we could have great difficulty acquiring, re-developing or maintaining our properties, which would materially and adversely affect our business strategy and portfolio, and may result in our: (1) liquidity being adversely affected; (2) inability to repay or refinance our indebtedness on or before its maturity; (3) making higher interest and principal payments or selling some of our assets on terms unfavorable to us to service our indebtedness; or (4) issuing additional capital stock, which could further dilute the ownership of our existing stockholders.

Secured indebtedness exposes us to the possibility of foreclosure on our ownership interests in our short-term rental homes.

Incurring mortgage and other secured indebtedness increases our risk of loss of our ownership interests in our rental homes because defaults thereunder, and the inability to refinance such indebtedness, may result in foreclosure action initiated by lenders. For tax purposes, a foreclosure of any of our short-term rental homes would be treated as a sale of the home for a purchase price equal to the outstanding balance of the indebtedness secured by such rental home. If the outstanding balance of the indebtedness secured by such short-term rental homes exceeds our tax basis in the short-term rental home, we would recognize taxable income on foreclosure without receiving any cash proceeds.

Covenants in our debt agreements may restrict our operating activities and adversely affect our financial condition.

The financing arrangements that we have entered into contain (and those we may enter into in the future likely will contain) covenants affecting our ability to incur additional debt, make certain investments, reduce liquidity below certain levels, make distributions to our stockholders and otherwise affect our distribution and operating policies.

If we fail to meet or satisfy any of these covenants in our debt agreements, we will be in default under these agreements, which could result in a cross-default under other debt agreements, and our lenders could elect to declare outstanding amounts due and payable, terminate their commitments, require the posting of additional collateral and enforce their respective interests against existing collateral. Additionally, borrowing base requirements associated with our financing arrangements may prevent us from drawing upon our total maximum capacity under these financing arrangements if sufficient collateral, in accordance with our facility agreements, is not available. Further, debt agreements entered into in the future may contain specific cross-default provisions with respect to other specified indebtedness, giving the lenders the right to declare a default if we are in default under other loans in some circumstances. A default also could significantly limit our financing alternatives, which could cause us to curtail our investment activities and/or dispose of assets when we otherwise would not choose to do so. If we default on several of our debt agreements or any single significant debt agreement, we could be materially and adversely affected.

Aspects of our business are subject to privacy, data use and data security regulations, which may impact the way we use data to target customers.

Privacy and security laws and regulations may limit the use and disclosure of certain information and require us to adopt certain cybersecurity and data handling practices that may affect our ability to effectively market our manufacturing capabilities to current, past or prospective customers. In many jurisdictions consumers must be notified in the event of a data security breach, and such notification requirements continue to increase in scope and cost. The changing privacy laws in the U.S., Europe and elsewhere, including the General Data Protection Regulation (“GDPR”) in the European Union, which became effective May 25, 2018, and the California Consumer Privacy Act of 2018, which was enacted on June 28, 2018 and became effective on January 1, 2020, create new individual privacy rights and impose increased obligations, including disclosure obligations, on companies handling personal data. . In addition, the California Consumer Privacy Act of 2018 (“CCPA”) took effect on January 1, 2020, which broadly defines personal information, gives California residents expanded privacy rights and protections, and provides for civil penalties for certain violations. Furthermore, in November 2020, California voters passed the California Privacy Rights and Enforcement Act of 2020 (“CPRA”), which amends and expands CCPA with additional data privacy compliance requirements and establishes a regulatory agency dedicated to enforcing those requirements. Additional countries and states, including Nevada, Virginia, Colorado, Utah, and Connecticut, have also passed comprehensive privacy laws with additional obligations and requirements on businesses. These laws and regulations are increasing in severity, complexity and number, change frequently, and increasingly conflict among the various jurisdictions in which we operate, which has resulted in greater compliance risk and cost for us. In addition, we are also subject to the possibility of security breaches and other incidents, which themselves may result in a violation of these laws. The impact of these continuously evolving laws and regulations could have a material adverse effect on the way we use data to digitally market and pursue our customers.

13

Future changes to our pricing model could adversely affect our business.

We may from time to time decide to make changes to our pricing model for our Syndications and technologies due to a variety of reasons, including changes to the market for our products and services, and as competitors introduce new products and services. Changes to any components of our pricing model may, among other things, result in user dissatisfaction and could lead to a loss of users of our technologies and could negatively impact our operating results, financial condition, and cash flows.

Global economic, political and market conditions and economic uncertainty caused by the recent outbreak of coronavirus (COVID-19) may adversely affect our business, results of operations and financial condition.