The change in net assets from operations for the three months ended September 30, 2023 was $(1,329,179), which was due to (i) the Sponsor Fee of $(26,489), (ii) realized gain on sale of gold to pay expenses of $1,507,791 and (iii) a net change in unrealized appreciation (depreciation) on investment of gold of $(2,810,481). Other than the Sponsor Fee the Fund had no expenses during the three months ended September 30, 2023.

For the Three Months Ended September 30, 2022

For the three months ended September 30, 2022, 1,750,000 Shares were issued in exchange for 23,429.704 ounces of gold. The Fund’s NAV per Share began the period at $24.33 and ended the period at $22.38. The decrease in NAV per Share was due to a lower price of gold of $1,671.75 at period end, which represented a decrease of (7.99)% from $1,817.00 at June 30, 2022.

The change in net assets from operations for the three months ended September 30, 2022 was $(2,367,293), which was due to (i) the Sponsor Fee of $(11,531), (ii) realized loss on sale of gold to pay expenses of $(384) and (iii) a net change in unrealized appreciation (depreciation) on investment of gold of $(2,355,378). Other than the Sponsor Fee the Fund had no expenses during the three months ended September 30, 2022.

For the Six Months Ended September 30, 2023

For the six months ended September 30, 2023, 100,000 Shares were issued in exchange for 1,337.286 ounces of gold and (1,800,000) Shares were redeemed in exchange for (24,067.816) ounces of gold. The Fund’s NAV per Share began the period at $26.48 and ended the period at $25.00. The decrease in NAV per Share was due to a lower price of gold of $1,870.50 at period end, which represented a decrease of (5.52)% from $1,979.70 at March 31, 2023.

The change in net assets from operations for the six months ended September 30, 2023 was $(4,644,402), which was due to (i) the Sponsor Fee of $(65,071), (ii) realized gain on sale of gold to pay expenses of $3,249,259 and (iii) a net change in unrealized appreciation (depreciation) on investment of gold of $(7,828,590). Other than the Sponsor Fee the Fund had no expenses during the six months ended September 30, 2023.

For the Period May 24, 2022 to September 30, 2022

For the period from May 24, 2022 (Date of inception) to September 30, 2022, 1,850,000 Shares (inclusive of two Creation Units that were created upon the initial seeding of the Fund) were issued in exchange for 24,768.680 ounces of gold. The Fund’s NAV per Share began the period at $25.00 and ended the period at $22.38. The decrease in NAV per Share was due to a lower price of gold of $1,671.75 at period end, which represented a decrease of (10.46)% from $1,867.10 at May 24, 2022.

The change in net assets from operations for the period ended September 30, 2022 was $(2,434,384), which was due to (i) the Sponsor Fee of $(11,541), (ii) realized loss on sale of gold to pay expenses of $(384) and (iii) a net change in unrealized appreciation (depreciation) on investment of gold of $(2,422,459). Other than the Sponsor Fee the Fund had no expenses during the period ended September 30, 2022.

Liquidity and Capital Resources

The Fund is not aware of any trends, demands, commitments, events or uncertainties that are reasonably likely to result in material changes to its liquidity needs. The Fund’s only ordinary recurring expense is the fee paid to the Sponsor at an annual rate of 0.15% of the daily net asset value of the Fund. The Sponsor’s annual fee accrues daily and is payable by the Fund monthly in arrears. In exchange for the Sponsor’s fee, the Sponsor has agreed to assume the ordinary fees and expenses incurred by the Fund, including but not limited to the following: fees charged by the Administrator, the Custodian and the Trustee, NYSE Arca listing fees, typical maintenance and transaction fees of the DTC, SEC registration fees, printing and mailing costs, audit fees and expenses, up to $500,000 per annum in legal fees and expenses and applicable license fees. The Sponsor may determine in its sole discretion to assume legal fees and expenses of the Fund in excess of the $500,000 per annum stipulated in the Sponsor Agreement.

The Sponsor is not required to pay any extraordinary or non-routine expenses. Extraordinary expenses are fees and expenses which are unexpected or unusual in nature, such as legal claims and liabilities and litigation costs or indemnification or other unanticipated expenses. Extraordinary fees and expenses also include material expenses which are not currently anticipated obligations of the Fund. The Fund will be responsible for the payment of such expenses to the extent any such expenses are incurred. Routine operational, administrative and other ordinary expenses are not deemed extraordinary expenses. The Fund will sell gold on an as-needed basis to pay the Sponsor’s fee.

The Administrator will, at the direction of the Sponsor, sell the Fund’s gold as necessary to pay the Fund’s expenses not otherwise assumed by the Sponsor. When selling gold to pay the Sponsor’s fee and other expenses, if any, the Administrator endeavors to sell the exact amount of gold needed to pay expenses to minimize the Fund’s holdings of cash. At September 30, 2023, the Fund did not have any cash balances.

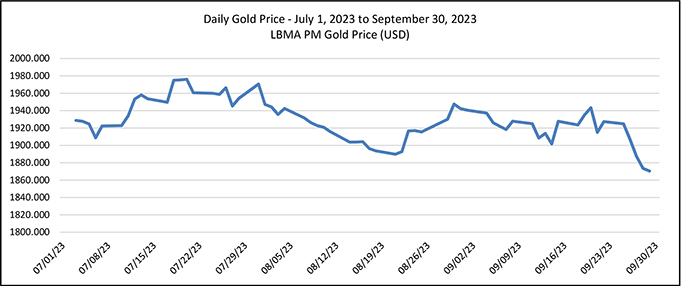

Analysis of Movements in the Price of Gold

As movements in the price of gold are expected to directly affect the price of the Fund’s shares, it is important for investors to understand and follow movements in the price of gold. Past movements in the gold price are not indicators of future movements.

The following chart shows movements in the price of gold based on the LBMA PM Gold Price in U.S. dollars per ounce over the period from July 1, 2023 to September 30, 2023.

15