Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This information should be read in conjunction with the financial statements and notes included in Item 1 of Part I of this Form 10-Q. This Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such forward-looking statements involve risks and uncertainties. All statements (other than statements of historical fact) included in this Form 10-Q that address activities, events or developments that may occur in the future, including such matters as future gold prices, gold sales, costs, objectives, changes in commodity prices and market conditions (for gold and the shares), the Fund’s operations (including the effects thereon related to the coronavirus (“COVID-19”) pandemic), the Sponsor’s plans and references to the Fund’s future success and other similar matters are forward-looking statements. Words such as “could,” “would,” “may,” “expect,” “intend,” “estimate,” “predict,” and variations on such words or negatives thereof, and similar expressions that reflect our current views with respect to future events and Fund performance, are intended to identify such forward-looking statements. These forward-looking statements are only predictions, subject to risks and uncertainties that are difficult to predict and many of which are outside of our control, and actual results could differ materially from those discussed. Forward-looking statements involve risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed therein. We express our estimates, expectations, beliefs, and projections in good faith and believe them to have a reasonable basis. However, we make no assurances that management’s estimates, expectations, beliefs, or projections will be achieved or accomplished. These forward-looking statements are based on assumptions about many important factors that could cause actual results to differ materially from those in the forward-looking statements. Such factors are discussed in: Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Form 10-Q; Part II, Item 1A. Risk Factors of this Form 10-Q, and other parts of this Form 10-Q. We do not intend to update any forward-looking statements even if new information becomes available or other events occur in the future, except as required by the federal securities laws.

Organization and Trust Overview

The Franklin Templeton Holdings Trust (the “Trust”) was organized as a Delaware statutory trust on April 19, 2021. Franklin Holdings, LLC is the Sponsor of the Trust (the “Sponsor”). The Trust currently offers a single series, the Franklin Responsibly Sourced Gold ETF (the “Fund”). The Fund issues common units of beneficial interest (“Shares”), which represent units of fractional undivided beneficial interest in and ownership of the Fund. The Shares are listed on NYSE Arca, Inc. (“NYSE Arca”) under the symbol “FGLD.” Shares are not obligations of, and are not guaranteed by, the Sponsor or any of its subsidiaries or affiliates. The investment objective of the Fund is for the Shares to reflect the performance of the price of gold bullion, less the Fund’s expenses. The assets of the Fund include only gold bullion and cash, if any.

The Fund seeks to hold only responsibly sourced gold in the Fund’s allocated account. The Fund defines responsibly sourced gold for this purpose as London Good Delivery gold bullion bars that were refined on or after January 1, 2012 (also referred to herein as “post-2012 gold”). All post-2012 gold has been refined in accordance with London Bullion Market Association’s (“LBMA”) Responsible Gold Guidance (the “Gold Guidance”), described further herein. To facilitate this, in transferring gold into and out of the Fund’s allocated account, the Custodian will, on a best efforts basis and subject to available liquidity, seek to allocate post-2012 gold. If, due to a lack of liquidity, the Custodian is unable to allocate post-2012 gold to the Fund’s allocated account, the Custodian will do so as soon as reasonably practicable.

The Fund issues Shares on a continuous basis. Shares are issued by the Fund only in one or more blocks of 50,000 Shares (a block of 50,000 Shares is called a “Creation Unit”) in exchange for gold from Authorized Participants, which is then allocated to the Fund and stored safely by the Custodian. The Fund issues and redeems Creation Units on an ongoing basis at Net Asset Value to Authorized Participants who have entered into an agreement with the Sponsor and the Administrator.

The Fund pays the Sponsor a fee that will accrue daily at an annualized rate equal to 0.15% of the daily Net Asset Value of the Fund, paid monthly in arrears (the “Sponsor Fee”). The Sponsor Fee is accrued in and payable in U.S. dollars.

The NAV is computed based upon the total value of the assets of the Fund (i.e., gold and cash) less its liabilities. To determine the Fund’s NAV, the Administrator will generally value the gold bullion held by the Fund on the basis of the LBMA Gold Price PM as published by the IBA. IBA operates electronic auctions for spot, unallocated loco London gold, providing a market-based platform for buyers and sellers to trade. The auctions are run at 10:30 a.m. and 3:00 p.m. London time for gold. The final auction prices are published to the market as the LBMA Gold Price AM and the LBMA Gold Price PM, respectively. The Administrator will calculate the NAV on each day NYSE Arca is open for regular trading, at the earlier LBMA Gold Price PM for the day or 12:00 PM New York time. If no LBMA Gold Price (AM or PM) is made on a particular evaluation day or if the LBMA Gold Price PM has not been announced by 12:00 PM New York time on a particular evaluation day, the next most recent LBMA Gold Price AM or PM will be used in the determination of the NAV, unless the Sponsor determines that such price is inappropriate to use as the basis for such determination.

Once the value of the gold bullion has been determined, the Administrator subtracts all estimated accrued expenses and other liabilities of the Fund from the total value of the gold bullion and any cash of the Fund. The resulting figure is the NAV. The Administrator determines the NAV per Share by dividing the NAV of the Fund by the number of Shares outstanding as of the close of trading on NYSE Arca.

Results of Operations

For the Three Months Ended September 30, 2022

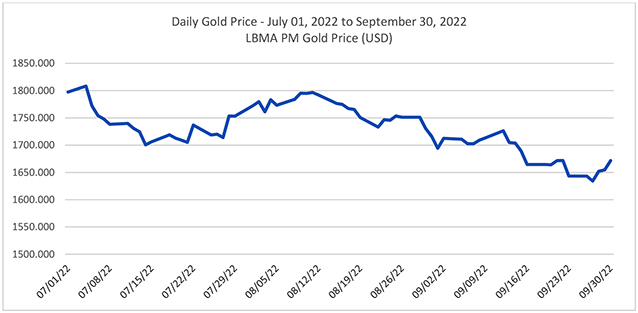

For the three months ended September 30, 2022, 1,750,000 Shares were issued in exchange for 23,429.704 ounces of gold. The Fund’s NAV per Share began the period at $24.33 and ended the period at $22.38. The decrease in NAV per Share was due to a lower price of gold of $1,671.75 at period end, which represented a decrease of (7.99)% from $1,817.00 at June 30, 2022.

The change in net assets from operations for the three months ended September 30, 2022 was $(2,367,293), which was due to (i) the Sponsor Fee of $(11,531), (ii) realized loss on sale of Gold to pay expenses of $(384) and (iii) a net change in unrealized appreciation (depreciation) on investments in gold bullion of $(2,355,378). Other than the Sponsor Fee the Fund had no expenses during the three months ended September 30, 2022.

For the Period May 24, 2022 to September 30, 2022

For the period from May 24, 2022 (Date of inception) to September 30, 2022, 1,850,000 Shares (inclusive of two Creation Units that were created upon the initial seeding of the Fund) were issued in exchange for 24,768.680 ounces of gold. The Fund’s NAV per Share began the period at $25.00 and ended the period at $22.38. The decrease in NAV per Share was due to a lower price of gold of $1,671.75 at period end, which represented a decrease of (10.46)% from $1,867.10 at May 24, 2022.

The change in net assets from operations for the period ended September 30, 2022 was $(2,434,384), which was due to (i) the Sponsor Fee of $(11,541), (ii) realized loss on sale of Gold to pay expenses of $(384) and (iii) a net change in unrealized appreciation (depreciation) on investments in gold bullion of $(2,422,459). Other than the Sponsor Fee the Fund had no expenses during the period ended September 30, 2022.

11