Table of Contents

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Large Accelerated Filer | ☐ | Accelerated Filer | ☐ | |||

Non-Accelerated Filer |

☒ | Smaller Reporting Company | ||||

| Emerging Growth Company | ||||||

Table of Contents

FRANKLIN RESPONSIBLY SOURCED GOLD ETF

A SERIES OF FRANKLIN TEMPLETON HOLDINGS TRUST

Table of Contents

Table of Contents

Page |

||||

2 |

||||

3 |

||||

4 |

||||

5 |

||||

6 |

||||

7 |

||||

September 30, 2022 |

||||

(Unaudited) |

||||

| Assets |

||||

| Investment in gold, at fair value (a) |

$ | | ||

| |

|

| ||

| Total assets |

| |||

| |

|

| ||

| Liabilities |

| |||

| Sponsor’s fee payable |

| |||

| Commitments and contingent liabilities (Note 7) |

| |||

| |

|

| ||

| Total liabilities |

| |||

| |

|

| ||

| Net assets |

$ | | ||

| |

|

| ||

| Shares issued and outstanding (b) |

| |||

| Net asset value per Share |

$ | | ||

| (a) | Cost of investment in gold bullion: $ |

| (b) | No par value, unlimited amount authorized. |

September 30, 2022 (Unaudited) |

||||||||||||||||

Ounces of Gold |

Cost |

Fair Value |

% of Net Assets |

|||||||||||||

| Investment in gold |

$ | $ | % | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total investments |

$ | $ | % | |||||||||||||

| Liabilities in excess of other assets |

( |

) | ( |

)% | ||||||||||||

| |

|

|

|

|||||||||||||

| Net assets |

$ | % | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, 2022 |

For the period from May 24, 2022 (Date of inception) to September 30, 2022 |

|||||||

(Unaudited) |

(Unaudited) |

|||||||

Expenses |

||||||||

Sponsor’s fee |

$ | $ | ||||||

Total expenses |

||||||||

Net investment loss |

( |

) | ( |

) | ||||

Net realized and change in unrealized gain (loss) on investment in gold |

||||||||

Net realized gain (loss) from gold sold for rebalancing and to pay expenses |

( |

) | ( |

) | ||||

Net change in unrealized appreciation (depreciation) on investment in gold |

( |

) | ( |

) | ||||

Net realized and change in unrealized gain (loss) on investment in gold |

( |

) | ( |

) | ||||

Net increase (decrease) in net assets resulting from operations |

$ | ( |

) | $ | ( |

) | ||

Net increase (decrease) in net assets per Share (a) |

$ | ( |

) | $ | ( |

) | ||

(a) Net increase (decrease) in net assets per Share based on average shares outstanding during the period. |

For the period from May 24, 2022 (Date of inception) to September 30, 2022 |

||||

(Unaudited) |

||||

| Cash Flows from Operating Activities: |

||||

| Proceeds from gold bullion sold to pay expenses |

$ | |||

| Expenses - Sponsor’s fee paid |

( |

) | ||

| |

|

|||

| Net cash provided by operating activities |

||||

| |

|

|||

| Increase (decrease) in cash |

||||

| Cash, beginning of period |

||||

| |

|

|||

| Cash, end of period |

$ | |||

| |

|

|||

| Reconciliation of Net Increase (Decrease) in Net Assets Resulting from Operations to Net Cash Provided by (Used in) Operating Activities: |

||||

| Net increase (decrease) in net assets resulting from operations |

$ | ( |

) | |

| Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash provided by (used in) operating activities: |

||||

| Proceeds from gold bullion sold to pay expenses |

||||

| Net realized gain (loss) |

||||

| Net change in unrealized appreciation (depreciation) |

||||

| Change in operating assets and liabilities: |

||||

| Sponsor’s fees payable |

||||

| |

|

|||

| Net cash provided by (used in) operating activities |

$ | |||

| |

|

|||

| Supplemental disclosure of non-cash information: |

||||

| Gold bullion contributed for Shares issued |

$ | |||

| Gold bullion distributed for Shares redeemed |

$ | |||

For the Three Months Ended September 30, 2022 |

For the period from May 24, 2022 (Date of inception) to September 30, 2022 |

|||||||

(Unaudited) |

(Unaudited) |

|||||||

Net assets, beginning of period |

$ | $ | ||||||

Net investment loss |

( |

) | ( |

) | ||||

Net realized gain (loss) from gold sold to pay expenses |

( |

) | ( |

) | ||||

Net change in unrealized appreciation (depreciation) on investment in gold |

( |

) | ( |

) | ||||

Net increase (decrease) in net assets resulting from operations |

( |

) | ( |

) | ||||

Capital Share Transactions: |

||||||||

Contributions for Shares issued |

||||||||

Distributions for Shares redeemed |

||||||||

Net increase in net assets from capital share transactions |

||||||||

Net assets, end of period |

$ | $ | ||||||

Shares |

Amount |

|||||||

| Balance at July 1, 202 2 |

$ |

|||||||

| Creation of Shares |

||||||||

| Redemption of Shares |

||||||||

| |

|

|

|

|||||

| Balance at September 30, 2022 |

$ |

|||||||

| |

|

|

|

|||||

Shares |

Amount |

|||||||

| Balance at May 24, 2022 * |

$ | |||||||

| Creation of Shares ** |

||||||||

| Redemption of Shares |

||||||||

| |

|

|

|

|||||

| Balance at September 30, 2022 |

$ | |||||||

| |

|

|

|

|||||

* |

The date represents the Initial Seed Creation. |

** |

Includes initial seed creation of |

Amount in ounces |

Amount in US$ |

|||||||

| Balance at July 1, 2022 |

$ |

|||||||

| Gold received for the creation of Shares |

||||||||

| Gold distributed for the redemption of Shares |

||||||||

| Principal on gold sales to pay expenses |

( |

) |

( |

) | ||||

| Net realized gain (loss) from gold transferred to pay expenses |

( |

) | ||||||

| Net change in unrealized appreciation (depreciation) on investment in gold |

( |

) | ||||||

| |

|

|

|

|||||

| Balance at September 30, 2022 |

$ |

|||||||

| |

|

|

|

|||||

Amount in ounces |

Amount in US$ |

|||||||

| Balance at May 24, 2022 * |

$ | |||||||

| Gold received for the creation of Shares** |

||||||||

| Gold distributed for the redemption of Shares |

||||||||

| Principal on gold sales to pay expenses |

( |

) | ( |

) | ||||

| Net realized gain (loss) from gold sold for rebalancing and to pay expenses |

( |

) | ||||||

| Net change in unrealized appreciation (depreciation) on investment in gold |

( |

) | ||||||

| |

|

|

|

|||||

| Balance at September 30, 2022 |

$ | |||||||

| |

|

|

|

|||||

* |

The date represents the Initial Seed Creation. |

** |

Includes gold received towards initial seed creation of |

For the Three Months Ended September 30, 2022 |

For the period from May 24, 2022 (Date of inception) to September 30, 2022 |

|||||||

(Unaudited) |

(Unaudited) |

|||||||

| Net asset value per Share, beginning of period |

$ | $ | (a) | |||||

| |

|

|

|

|||||

| Net investment loss (b) |

( |

) | ( |

) | ||||

| Net realized and unrealized gain (loss) on investment in gold |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Net change in net assets from operations |

( |

) | ( |

) | ||||

| |

|

|

|

|||||

| Net asset value per Share, end of period |

$ | $ | ||||||

| |

|

|

|

|||||

| Total return, at net asset value (c) |

( |

)% | ( |

)% | ||||

| Ratio to average net assets (d) |

||||||||

| Net investment loss |

( |

)% | ( |

)% | ||||

| Net expenses |

% | % | ||||||

| (a) | The amount represents the initial Seed Creation. |

| (b) | Calculated using average Shares outstanding. |

| (c) | Calculation based on the change in net asset value of a Share during the period. Total return for periods of less than a year are not annualized. |

| (d) | Annualized. |

Table of Contents

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

This information should be read in conjunction with the financial statements and notes included in Item 1 of Part I of this Form 10-Q. This Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such forward-looking statements involve risks and uncertainties. All statements (other than statements of historical fact) included in this Form 10-Q that address activities, events or developments that may occur in the future, including such matters as future gold prices, gold sales, costs, objectives, changes in commodity prices and market conditions (for gold and the shares), the Fund’s operations (including the effects thereon related to the coronavirus (“COVID-19”) pandemic), the Sponsor’s plans and references to the Fund’s future success and other similar matters are forward-looking statements. Words such as “could,” “would,” “may,” “expect,” “intend,” “estimate,” “predict,” and variations on such words or negatives thereof, and similar expressions that reflect our current views with respect to future events and Fund performance, are intended to identify such forward-looking statements. These forward-looking statements are only predictions, subject to risks and uncertainties that are difficult to predict and many of which are outside of our control, and actual results could differ materially from those discussed. Forward-looking statements involve risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed therein. We express our estimates, expectations, beliefs, and projections in good faith and believe them to have a reasonable basis. However, we make no assurances that management’s estimates, expectations, beliefs, or projections will be achieved or accomplished. These forward-looking statements are based on assumptions about many important factors that could cause actual results to differ materially from those in the forward-looking statements. Such factors are discussed in: Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Form 10-Q; Part II, Item 1A. Risk Factors of this Form 10-Q, and other parts of this Form 10-Q. We do not intend to update any forward-looking statements even if new information becomes available or other events occur in the future, except as required by the federal securities laws.

Organization and Trust Overview

The Franklin Templeton Holdings Trust (the “Trust”) was organized as a Delaware statutory trust on April 19, 2021. Franklin Holdings, LLC is the Sponsor of the Trust (the “Sponsor”). The Trust currently offers a single series, the Franklin Responsibly Sourced Gold ETF (the “Fund”). The Fund issues common units of beneficial interest (“Shares”), which represent units of fractional undivided beneficial interest in and ownership of the Fund. The Shares are listed on NYSE Arca, Inc. (“NYSE Arca”) under the symbol “FGLD.” Shares are not obligations of, and are not guaranteed by, the Sponsor or any of its subsidiaries or affiliates. The investment objective of the Fund is for the Shares to reflect the performance of the price of gold bullion, less the Fund’s expenses. The assets of the Fund include only gold bullion and cash, if any.

The Fund seeks to hold only responsibly sourced gold in the Fund’s allocated account. The Fund defines responsibly sourced gold for this purpose as London Good Delivery gold bullion bars that were refined on or after January 1, 2012 (also referred to herein as “post-2012 gold”). All post-2012 gold has been refined in accordance with London Bullion Market Association’s (“LBMA”) Responsible Gold Guidance (the “Gold Guidance”), described further herein. To facilitate this, in transferring gold into and out of the Fund’s allocated account, the Custodian will, on a best efforts basis and subject to available liquidity, seek to allocate post-2012 gold. If, due to a lack of liquidity, the Custodian is unable to allocate post-2012 gold to the Fund’s allocated account, the Custodian will do so as soon as reasonably practicable.

The Fund issues Shares on a continuous basis. Shares are issued by the Fund only in one or more blocks of 50,000 Shares (a block of 50,000 Shares is called a “Creation Unit”) in exchange for gold from Authorized Participants, which is then allocated to the Fund and stored safely by the Custodian. The Fund issues and redeems Creation Units on an ongoing basis at Net Asset Value to Authorized Participants who have entered into an agreement with the Sponsor and the Administrator.

The Fund pays the Sponsor a fee that will accrue daily at an annualized rate equal to 0.15% of the daily Net Asset Value of the Fund, paid monthly in arrears (the “Sponsor Fee”). The Sponsor Fee is accrued in and payable in U.S. dollars.

The NAV is computed based upon the total value of the assets of the Fund (i.e., gold and cash) less its liabilities. To determine the Fund’s NAV, the Administrator will generally value the gold bullion held by the Fund on the basis of the LBMA Gold Price PM as published by the IBA. IBA operates electronic auctions for spot, unallocated loco London gold, providing a market-based platform for buyers and sellers to trade. The auctions are run at 10:30 a.m. and 3:00 p.m. London time for gold. The final auction prices are published to the market as the LBMA Gold Price AM and the LBMA Gold Price PM, respectively. The Administrator will calculate the NAV on each day NYSE Arca is open for regular trading, at the earlier LBMA Gold Price PM for the day or 12:00 PM New York time. If no LBMA Gold Price (AM or PM) is made on a particular evaluation day or if the LBMA Gold Price PM has not been announced by 12:00 PM New York time on a particular evaluation day, the next most recent LBMA Gold Price AM or PM will be used in the determination of the NAV, unless the Sponsor determines that such price is inappropriate to use as the basis for such determination.

Once the value of the gold bullion has been determined, the Administrator subtracts all estimated accrued expenses and other liabilities of the Fund from the total value of the gold bullion and any cash of the Fund. The resulting figure is the NAV. The Administrator determines the NAV per Share by dividing the NAV of the Fund by the number of Shares outstanding as of the close of trading on NYSE Arca.

Results of Operations

For the Three Months Ended September 30, 2022

For the three months ended September 30, 2022, 1,750,000 Shares were issued in exchange for 23,429.704 ounces of gold. The Fund’s NAV per Share began the period at $24.33 and ended the period at $22.38. The decrease in NAV per Share was due to a lower price of gold of $1,671.75 at period end, which represented a decrease of (7.99)% from $1,817.00 at June 30, 2022.

The change in net assets from operations for the three months ended September 30, 2022 was $(2,367,293), which was due to (i) the Sponsor Fee of $(11,531), (ii) realized loss on sale of Gold to pay expenses of $(384) and (iii) a net change in unrealized appreciation (depreciation) on investments in gold bullion of $(2,355,378). Other than the Sponsor Fee the Fund had no expenses during the three months ended September 30, 2022.

For the Period May 24, 2022 to September 30, 2022

For the period from May 24, 2022 (Date of inception) to September 30, 2022, 1,850,000 Shares (inclusive of two Creation Units that were created upon the initial seeding of the Fund) were issued in exchange for 24,768.680 ounces of gold. The Fund’s NAV per Share began the period at $25.00 and ended the period at $22.38. The decrease in NAV per Share was due to a lower price of gold of $1,671.75 at period end, which represented a decrease of (10.46)% from $1,867.10 at May 24, 2022.

The change in net assets from operations for the period ended September 30, 2022 was $(2,434,384), which was due to (i) the Sponsor Fee of $(11,541), (ii) realized loss on sale of Gold to pay expenses of $(384) and (iii) a net change in unrealized appreciation (depreciation) on investments in gold bullion of $(2,422,459). Other than the Sponsor Fee the Fund had no expenses during the period ended September 30, 2022.

11

Table of Contents

At September 30, 2022, the Custodian held 24,764.544 ounces of gold on behalf of the Fund in its vault, with a market value of $41,400,126 (cost: $43,822,585) based on the LBMA PM Gold Price at period end.

Liquidity and Capital Resources

The Trust is not aware of any trends, demands, commitments, events or uncertainties that are reasonably likely to result in material changes to its liquidity needs. The Fund’s only ordinary recurring expense is the fee paid to the Sponsor at an annual rate of 0.15% of the daily net asset value of the Fund. The Sponsor’s annual fee accrues daily and is payable by the Fund monthly in arrears. In exchange for the Sponsor’s fee, the Sponsor has agreed to assume the ordinary fees and expenses incurred by the Fund, including but not limited to the following: fees charged by the Administrator, the Custodian and the Trustee, NYSE Arca listing fees, typical maintenance and transaction fees of the DTC, SEC registration fees, printing and mailing costs, audit fees and expenses, up to $500,000 per annum in legal fees and expenses and applicable license fees. The Sponsor may determine in its sole discretion to assume legal fees and expenses of the Fund in excess of the $500,000 per annum stipulated in the Sponsor Agreement.

The Sponsor is not required to pay any extraordinary or non-routine expenses. Extraordinary expenses are fees and expenses which are unexpected or unusual in nature, such as legal claims and liabilities and litigation costs or indemnification or other unanticipated expenses. Extraordinary fees and expenses also include material expenses which are not currently anticipated obligations of the Fund. The Fund will be responsible for the payment of such expenses to the extent any such expenses are incurred. Routine operational, administrative and other ordinary expenses are not deemed extraordinary expenses. The Fund will sell gold on an as-needed basis to pay the Sponsor’s fee.

The Administrator will, at the direction of the Sponsor, sell the Fund’s gold as necessary to pay the Fund’s expenses not otherwise assumed by the Sponsor. When selling gold to pay the Sponsor’s fee and other expenses, if any, the Administrator endeavors to sell the exact amount of gold needed to pay expenses to minimize the Fund’s holdings of cash. At September 30, 2022, the Fund did not have any cash balances.

The Fund as well as the Sponsor and its service providers are vulnerable to the effects of geopolitical events and the continuation of the war in Ukraine or other hostilities. Geopolitical events and the continuation of the hostilities in Ukraine or other hostilities could disrupt and potentially impact the business activities of the Sponsor and its service providers and have an adverse effect on the Fund.

Global or regional military conflicts or acts of aggression, including Russia’s military invasion of Ukraine in February 2022 as discussed further below, may negatively affect global expectations for economic growth, exacerbate inflationary pressures, disrupt trading markets and/or supply chains and result in protracted volatility, which could have an adverse effect on the value of the Fund’s investments. Specifically, in the aftermath of Russia’s invasion of Ukraine, gold prices experienced increased volatility. The extent and duration of Russia’s military actions and the repercussions of such actions (including any retaliatory actions or countermeasures that may be taken by countries or entities subject to sanctions, including cyber attacks) are impossible to predict. These and any related events could significantly impact the Fund’s performance and the value of an investment in the Fund. On March 7, 2022, the LBMA suspended six Russian gold and silver refiners from its Good Delivery List until further notice in light of sanctions imposed on Russia by the U.S., European Union and other countries in response to Russia’s invasion of Ukraine. As a result, while existing gold bars from these refiners are considered acceptable, newly minted gold bars produced by such refiners are effectively banned from trading in the loco London market. Russia is a significant producer of gold (estimates indicate Russia produces approximately 330 tonnes of gold per year, accounting for around 9% of global production); however, per the LBMA, as of the end April 2022, the amount of LBMA Good Delivery gold held in London vaults was 9,672 tonnes (an increase of 0.03% from the previous month), valued at $594.3 billion, which equates to approximately 773,735 gold bars. Accordingly, as of the date of this report, the Fund does not expect that the suspension of Russian refiners will have a material impact on the supply of LBMA Good Delivery gold available to the Fund and other market participants. Any potential escalation of the conflict could negatively impact the Fund. In addition, similar events in the future, particularly where unanticipated by markets, could cause volatility in precious metals markets and the price of gold and may have a negative impact on the Fund’s performance and the value of an investment in the Shares. Following an announcement at the G7 Summit to collectively ban the import of Russian gold, the UK passed regulations which prohibit the direct or indirect (i) import of gold that originated in Russia, (ii) acquisition of gold that originated in Russia or is located in Russia and (iii) supply or delivery of gold that originated in Russia, all after July 21, 2022. Similarly, US regulations prohibit the import of gold of Russian origin into the United States on or after June 28, 2022 and EU regulations prohibit the direct or indirect import, purchase or transfer of gold if it originates in Russia and has been exported from Russia after July 22, 2022. The responses of countries and political bodies to Russia’s actions, the larger overarching tensions, and Ukraine’s military response and the potential for wider conflict may increase financial market volatility generally, have adverse effects on regional and global economic markets, and cause volatility in the price of gold and the price of the Shares. In addition, the conflict in Ukraine, along with global political fallout and implications including sanctions, shipping disruptions, collateral war damage, and a potential expansion of the conflict beyond Ukraine’s borders, could disturb the gold market. War and other geopolitical events in eastern Europe, including but not limited to Russia and Ukraine, may cause volatility in commodity prices including precious metals prices. These events are unpredictable and may lead to extended periods of price volatility. As of the date of this report, the impact of the conflict in Ukraine, including the regulatory responses to such conflict, have not materially affected the operations of GLDM and have not materially impacted the price of gold or the share price of GLDM.

Analysis of Movements in the Price of Gold

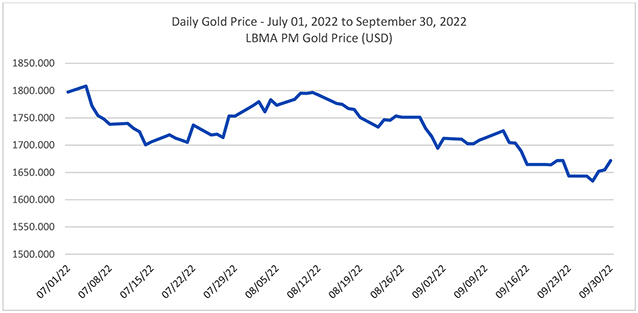

As movements in the price of gold are expected to directly affect the price of the Fund’s Shares, it is important for investors to understand and follow movements in the price of gold. Past movements in the gold price are not indicators of future movements.

The following chart shows movements in the price of gold based on the LBMA PM Gold Price in U.S. dollars per ounce over the period from July 1, 2022 to September 30, 2022.

12

Table of Contents

The average, high, low and end-of-period gold prices based on the LBMA PM Gold Price for are as below:

| Period |

Average | High | Date | Low | Date | End of period |

Last business day(1) | |||||||||||||||||||||

| July 1, 2022 to September 30, 2022 |

$ | 1,728.28 | $ | 1,808.40 | July 4, 2022 | $ | 1,634.30 | September 27, 2022 | $ | 1,671.75 | September 30, 2022 | |||||||||||||||||

| (1) | The end of period gold price is the LBMA PM Gold Price on the last business day of the period. |

Item 3. Quantitative and Qualitative Disclosures About Market Risk

The Fund is a passive investment vehicle. It is not actively managed. The investment objective of the Fund is for the Shares to reflect the performance of the price of gold bullion, less the Fund’s expenses. Accordingly, fluctuations in the price of gold will affect the value of the Fund’s Shares.

Item 4. Controls and Procedures

Disclosure Controls and Procedures

The duly authorized officers of the Sponsor, performing functions equivalent to those a principal executive officer and principal financial officer of the Trust would perform if the Trust had any officers, have evaluated the effectiveness of the Trust’s disclosure controls and procedures, and have concluded that the disclosure controls and procedures of the Trust were effective as of the end of the period covered by this report. Such disclosure controls and procedures are designed to provide reasonable assurance that information required to be disclosed in the reports that the Trust files or submits under the Securities Exchange Act of 1934, as amended, are recorded, processed, summarized and reported, within the time period specified in the applicable rules and forms, and that such information is accumulated and communicated to the duly authorized officers of the Sponsor performing functions equivalent to those a principal executive officer and principal financial officer of the Trust would perform if the Trust had any officers, as appropriate, to allow timely decisions regarding required disclosure.

Internal Control over Financial Reporting

There has been no change in the internal control over financial reporting that occurred during the fiscal period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

13

Table of Contents

Part II. OTHER INFORMATION

Item 1. Legal Proceedings

From time to time, the Trust and/or the Fund may be a party to certain legal proceedings in the ordinary course of business. As of November 10, 2022, the Trust and the Fund are not subject to any material legal proceedings, nor, to our knowledge, are any material legal proceeding threatened against the Trust or Fund.

Item 1A. Risk Factors

There have been no material changes to the Risk Factors in the registration statement on Form S-1, initially filed with the Securities and Exchange Commission on April 25, 2022, as amended and declared effective on June 27, 2022 (SEC Accession No. 0001794202-22-000135). Please carefully consider the information disclosed under the heading “Risk Factors” in the Fund’s prospectus dated June 27, 2022, filed with the SEC pursuant to Rule 424(b)(1) under the Securities Act of 1933, as amended (Registration No. 333-264468), which could materially affect the Fund’s business, financial condition or future results.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

a) None.

b) Not applicable.

c) Not applicable.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

None.

Item 5. Other Information

None.

Item 6. Exhibits

See the Exhibit Index below, which is incorporated by reference herein.

14

Table of Contents

EXHIBIT INDEX

| Exhibit |

Description of Exhibit | |

| 31.1* | Certification of Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

| 31.2* | Certification of Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

| 32.1* | Certification of Principal Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

| 32.2* | Certification of Principal Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

| 101.INS | Inline XBRL Instance Document | |

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document | |

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document | |

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document | |

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document | |

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | |

| * | Filed herewith. |

15

Table of Contents

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned in the capacities* indicated thereunto duly authorized.

Franklin Holdings, LLC

Sponsor of the Franklin Templeton Holdings Trust (registrant)

| By: | /s/ David Mann* | |

| David Mann | ||

| President and Chief Executive Officer | ||

| (serving in the capacity of principal executive officer) | ||

| By: | /s/ Matthew Hinkle* | |

| Matthew Hinkle | ||

| Chief Financial Officer | ||

| (serving in the capacity of principal financial officer) | ||

Date: November 14, 2022

| * | The registrant is a trust and the person is signing in his capacity as an officer of Franklin Holdings, LLC, the Sponsor of the registrant. |

16