Table of Contents

As filed with the Securities and Exchange Commission on May 31, 2024.

Registration No. 333-257667

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 7 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Clarios International Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 3714 | 86-3573574 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

5757 N Green Bay Avenue

Florist Tower Glendale, Wisconsin, 53209-4408 (414) 214-6500

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

| Claudio Morfe Florist Tower |

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Michael Kaplan Marcel Fausten |

David Lopez Helena Grannis Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated , 2024

Preliminary Prospectus

Shares

Clarios International Inc.

Common Stock

Clarios International Inc. is offering shares of its common stock.

This is our initial public offering and no public market exists for our common stock. We anticipate that the initial public offering price will be between $ and $ per share.

Our Sponsor (as defined herein) has indicated that it or its affiliates may purchase in this offering up to $ , or up to approximately of our shares of common stock (based on the midpoint of the price range set forth above), at the same price as the price paid by the underwriters in this offering. The shares acquired by our Sponsor or its affiliates will be subject to the lock-up restrictions described in “Underwriting.” The underwriters will not receive any underwriting discounts or commissions on any shares of common stock sold to our Sponsor or its affiliates. The number of shares of common stock available for sale to the general public will be reduced to the extent our Sponsor or its affiliates purchase such shares of common stock. See “Underwriting.” However, because indications of interest are not binding agreements or commitments to purchase, our Sponsor or its affiliates may determine to purchase fewer shares than it indicates an interest in purchasing or not to purchase any shares in this offering. It is also possible that our Sponsor or its affiliates could indicate an interest in purchasing more shares of our common stock or that the underwriters could elect to sell fewer shares to our Sponsor or its affiliates.

Our shares of common stock have been approved for listing on the New York Stock Exchange (“NYSE”) under the symbol “BTRY.”

After the completion of this offering, certain entities affiliated with Brookfield Business Partners LP (“Brookfield”) and Caisse de dépôt et placement du Québec (collectively, our “Sponsor” or the “Sponsor Group”) will continue to own a majority of the voting power of shares eligible to vote in the election of our directors, representing approximately % of the combined voting power of our outstanding common stock assuming no exercise of the underwriters’ option to purchase additional shares of common stock. As a result, we will be a “controlled company” within the meaning of the corporate governance standards of the NYSE. See “Management—Controlled Company Exception” and “Principal Stockholders.” Following the completion of the offering, public investors will own approximately %, representing approximately % of the combined voting power, of our outstanding shares of common stock assuming no exercise of the underwriters’ option to purchase additional shares of common stock (excluding any shares of common stock our Sponsor purchases in this offering).

Investing in our common stock involves risks. See “Risk Factors” beginning on page 30.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total (2) | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds to us before expenses(1) |

$ | $ | ||||||

| (1) | See “Underwriting” for a description of compensation to be paid to the underwriters. |

| (2) | Assumes our Sponsor or its affiliates have not purchased shares of common stock in this offering, for which the underwriters would not receive any underwriting discounts or commissions. |

At our request, the underwriters have reserved up to shares of common stock, or % of the shares of common stock to be offered by this prospectus, for sale at the initial public offering price through a reserved share program for certain individuals associated with us. See “Underwriting—Reserved Share Program.”

We have granted the underwriters an option for a period of 30 days to purchase up to an additional shares of common stock solely to cover over-allotments, if any. See “Underwriting.”

The underwriters expect to deliver the shares to purchasers on or about , 2024.

| Morgan Stanley |

Citigroup |

The date of this prospectus is , 2024

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| PAGE | ||||

| 1 | ||||

| 30 | ||||

| 62 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 68 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

70 | |||

| 101 | ||||

| 127 | ||||

| 135 | ||||

| 151 | ||||

| 155 | ||||

| 162 | ||||

| 164 | ||||

| Material U.S. Federal Tax Considerations for Non-U.S. Holders of Common Stock |

172 | |||

| 175 | ||||

| 177 | ||||

| 187 | ||||

| 187 | ||||

| 187 | ||||

| F-1 | ||||

In this prospectus, “Clarios,” the “Company,” “our company,” “we,” “us” and “our” refer to Clarios International Inc., together with its consolidated subsidiaries.

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for and can provide no assurance as to the reliability of, any other information that others may provide you. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

Market and Industry Data

This prospectus includes industry and market data that we obtained from periodic industry publications, third-party studies and surveys, as well as from filings of public companies in our industry and internal company surveys. These sources include government and industry sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this prospectus, this information could prove

to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the

| i |

Table of Contents

availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein.

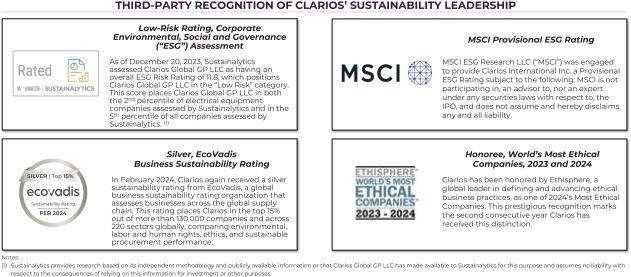

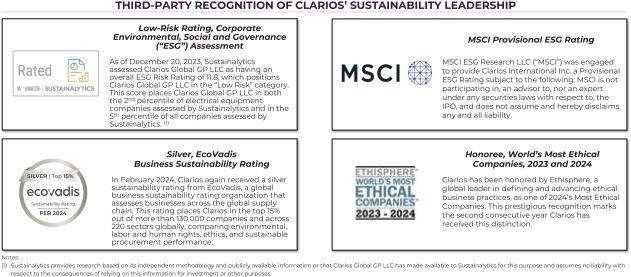

This prospectus includes references to various ratings and assessments from third-party sustainability ratings providers. These ratings and assessments are not part of any offering, nor shall they be considered as an offer to buy a security, investment advice, or an assurance letter, and no information provided by such providers shall be considered as being a statement, representation, warranty, or argument either in favor or against the truthfulness, reliability, or completeness of any facts or statements that the Company has made available to such providers for the purpose of their ratings and assessments, in light of the circumstances under which such facts or statements have been presented. Furthermore, such ratings and assessments shall not constitute nor do they represent an “expert opinion” or “negative assurance letter.” These ratings and assessments have not been submitted to, nor received approval from, the Securities and Exchange Commission (the “SEC”) or any other regulatory body.

Trademarks and Trade Names

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

Basis of Presentation and Other Information

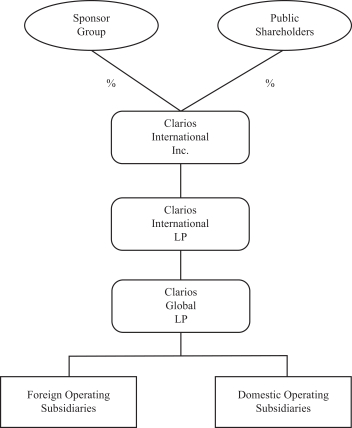

On April 14, 2021, Clarios International Inc., a Delaware corporation (the “Company”) controlled by investment funds managed by Brookfield Business Partners L.P. (our “Sponsor” or the “Sponsor Group”), was formed. As a result of a reorganization of legal entities controlled by the Sponsor Group (the “Reorganization”), the Company became the sole ultimate equity holder of Clarios Global LP as of July 27, 2021 (the “Reorganization Date”), and consolidated Clarios Global LP within the Company’s financial statements as a transaction between entities under the common control of the Sponsor Group. The historical financial statements and data included herein are those of Clarios International Inc. and its consolidated subsidiaries after the Reorganization Date and are those of Clarios Global LP and its consolidated subsidiaries prior to the Reorganization Date.

| ii |

Table of Contents

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before deciding to invest in our common stock. You should read this entire prospectus carefully, including the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections and our consolidated financial statements and the notes related to those financial statements included elsewhere in this prospectus, before investing in our common stock.

Our Company

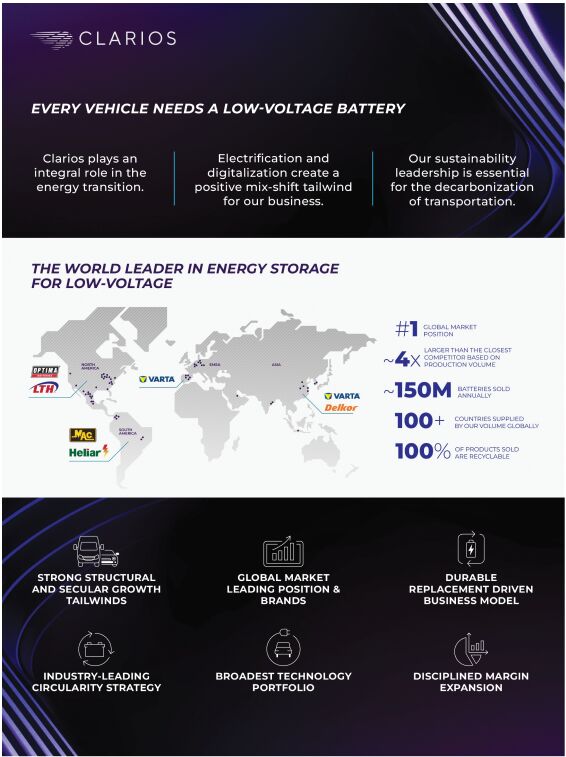

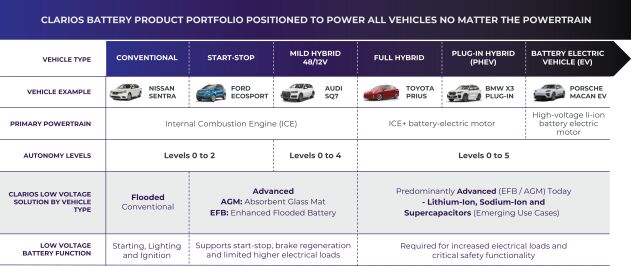

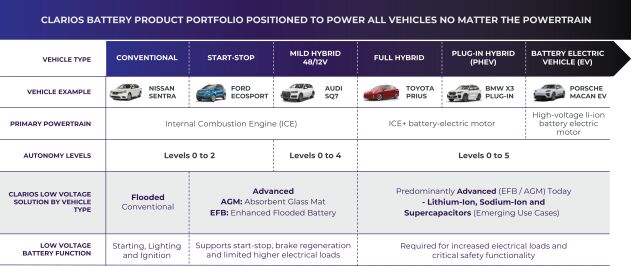

We are the Global Market Leader in Low-Voltage Energy Solutions

Clarios is the world’s largest manufacturer and supplier of low-voltage batteries and solutions – we estimate that we are approximately four times larger than our closest competitor based on total low-voltage battery production volume for the mobility end market. We primarily serve the passenger vehicle end market and its large installed base, which drives volume in our highly durable aftermarket business. Our extensive aftermarket presence and deep relationships in the original equipment manufacturer (“OEM”) channel leads to our batteries powering approximately one in every three passenger vehicles worldwide. In addition to passenger vehicles, our products serve the commercial vehicle, motorcycle, marine equipment, powersports vehicle and other end markets. Our products are essential for moving the world. The low-voltage battery is powertrain-agnostic – it provides power to the growing energy demand across the low-voltage network, regardless of whether it is in a traditional internal combustion engine (“ICE”), hybrid (“HEV”) or fully battery electric vehicle (“EV”). Continuing focus on reduction of CO2 emissions (“decarbonization”) and the movement towards a software-defined vehicle architecture (where electronics and software are primarily used to operate the vehicle versus traditional mechanical systems), are leading to higher electrical content across vehicles. Higher power loads are driving the demand for more sophisticated low-voltage advanced battery solutions (“Advanced Batteries”), including enhanced flooded batteries (“EFB”), absorbent glass mat (“AGM”), and lithium-ion batteries, as well as emerging technologies such as sodium-ion and supercapacitors. We believe we are well-positioned to address this increasing demand for power, with our global scale, resilient aftermarket business model, comprehensive product offering (including our capabilities in low-voltage Advanced Batteries), systems-focused approach, deep OEM relationships and circular operations expertise.

Our global scale provides multiple advantages that allow us to better serve our customers, support our attractive margin profile and address long-term market trends. Clarios is the only low-voltage battery player with a global manufacturing presence, enabling us to serve customers across more than 100 countries. We have leading global market share in low-voltage mobility batteries based on unit volumes sold, with number one

1

Table of Contents

market positions in both the Americas and Europe, Middle East and Africa (“EMEA”) and the number three market position in Asia. Our footprint enables our “in-the region for-the region” strategy. We have both proximity to our customers as well as flexibility across our global manufacturing network to support a high level of product availability for both our aftermarket and OEM customers. For example, we can react to both near-term fluctuations (i.e., extreme weather and temperature, which shortens battery life) and longer-term shifts in demand (i.e., increased adoption of Advanced Batteries) from our aftermarket customers. Additionally, our scale and vertical integration contribute to our leading profitability. We are able to procure raw input materials and services more cost-effectively than less scaled players. Our successful circular operations, which include in-house battery recycling, enable us to secure stable and cost advantaged feed stock for new battery production. Lastly, our scale helps us generate significant cash flow, which allows us to invest in our capabilities to effectively address the evolving and increasing low-voltage power demands of the future. We continue to strategically invest in projects with high return potential to enhance our chemistry-agnostic Advanced Battery portfolio, low-voltage systems offerings, and Advanced Battery production capabilities, specifically focused on AGM production in the near-term. Our estimates suggest we represent approximately 50% of the global AGM production capacity, which we believe positions us to address the long-cycle growth in Advanced Battery demand moving forward.

Our leading market position and scale is underpinned by our robust technical offering. With over 130 years of low-voltage experience and a talented world-class organization, we continue to innovate our technology and solutions to address the future low-voltage architecture needs of the mobility sector. As electrical architecture for vehicles becomes more complicated and power demands increase, so does the complexity of the low-voltage system design, requiring many OEMs to continually evaluate the low-voltage systems across their vehicle platforms. Our chemistry-agnostic battery portfolio, systems integration expertise, and growing software capabilities allow us to partner with OEMs as they evaluate and design low-voltage systems for their vehicles, to help provide them with a cost-effective, system-optimized battery technology solution.

Our chemistry-agnostic low-voltage battery portfolio is comprised of commercialized Advanced Batteries such as EFB, AGM, and lithium-ion batteries, as well as traditional starting, lighting and ignition batteries (“SLI”). In the future, we anticipate low-voltage batteries produced with emerging technologies such as sodium-ion and supercapacitors to further evolve the low-voltage networks of tomorrow’s vehicles. Both our aftermarket customers and OEM partners recognize our leading battery performance and high-quality track record. Additionally, the breadth of our product portfolio enables us to effectively support the long-term aftermarket replacement trends in the global car parc for passenger vehicles as Advanced Battery demand continues to increase in the coming decades.

2

Table of Contents

Our focus on battery innovation has led to deep low-voltage system expertise. In the pursuit of creating industry-leading technology, we have honed our ability to model and simulate the dynamic operating scenarios across the low-voltage system, including profiling low-voltage power demand from key-off to peak loads. This insight enables us to partner with OEMs early in the vehicle development cycle, typically three to five years ahead of start of production. Our understanding of future vehicle needs drives our technology roadmap. We are actively expanding and enhancing our low-voltage system solutions, including multi-battery and multi-voltage configurations, which we believe will increase our content per vehicle (i.e., the number of Clarios batteries installed within a vehicle). Our systems expertise also drives our ability to provide optimized electronics and software systems solutions. We have multiple decades of experience in developing and selling embedded software and electronics, such as battery management systems (“BMS”), to support various chemistries throughout a broad range of use cases. We are also building capabilities beyond embedded software, such as developing solutions that leverage machine learning and artificial intelligence to further optimize the overall low-voltage system and total cost of ownership.

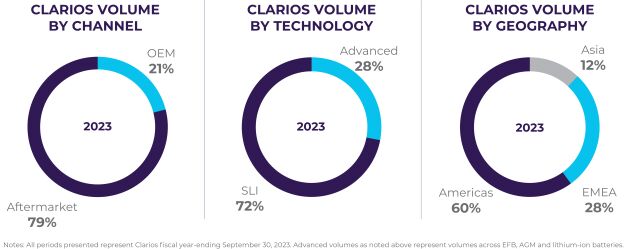

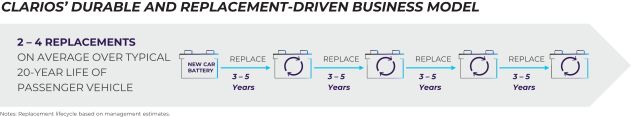

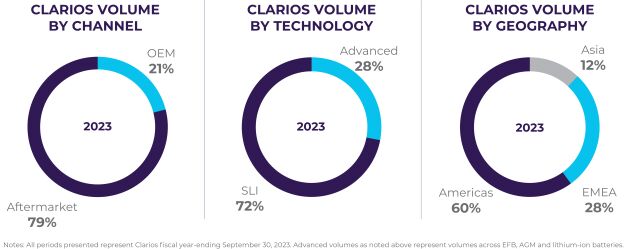

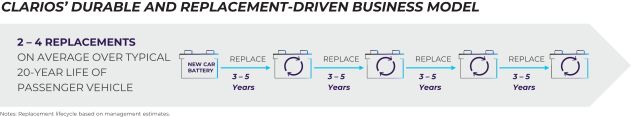

In the fiscal year ended September 30, 2023, approximately 79% of our unit volume demand came from aftermarket sales serving the large global car parc. These aftermarket volumes are driven by non-discretionary replacement demand for the low-voltage battery since vehicle ignition, as well as other systems critical to vehicle operations, cannot function once the low-voltage battery has reached its end of life. On average, the low-voltage battery requires replacement every three to five years, which translates to two to four replacements over the typical 20-year useful life of a vehicle. Passenger vehicles’ long useful life creates a slow-moving installed base that provides long-term visibility into future aftermarket demand dynamics. The replacement demand for low-voltage batteries is highly recurring and relatively resilient to economic conditions, providing Clarios with a stable demand base.

Within the aftermarket channel, we serve a diverse group of customers including OEM service networks (“OES”), wholesale distributors, auto retailers, big-box retailers and independent workshops that replace batteries for consumers. We offer these aftermarket customers leading global brands, comprehensive training, insights on car parc evolution based on our OEM “first fit” insights, category management, logistics, and service support. For example, we provide tools to our aftermarket customers to help them select the right replacement to ensure the battery delivers the required performance level for the vehicle. We also provide training workshops and step-by-step instructions and tools on how to locate and replace the battery within the vehicle. We believe these customer-centric offerings, as well as our ability to ensure product availability across our global footprint and offer an end-of-life recycling solution for lead acid batteries, differentiate us and create loyalty within our aftermarket customer base.

The remaining approximately 21% of our unit sales volume for the fiscal year ended September 30, 2023, is generated through sales to OEM customers to support their new unit production. Sales to the OEM channel are highly complementary to our aftermarket strategy. We have deep relationships with OEMs globally and partner with nearly all the passenger vehicle OEMs. When OEMs award us business, we typically enter into multi-year contracts for a given vehicle platform. Our engagement with OEMs provides us with early insights into low-voltage system and battery requirements for three to five years in the future. The low-voltage architecture trends that we see in today’s development cycle have the potential to translate into a long tail of aftermarket replacement demand for multiple decades after initial vehicle production. As of March 31, 2024, we have been awarded over 375 xEV platforms (i.e., vehicles including full HEVs, plug-in HEVs and EVs), of which over 175 are EVs, with a target to win 600 xEV platforms by fiscal 2027. We believe our robust technical offering, total systems approach, leading quality that minimizes warranty liability for OEMs, and our consistent on-time delivery performance differentiates us from our competitors.

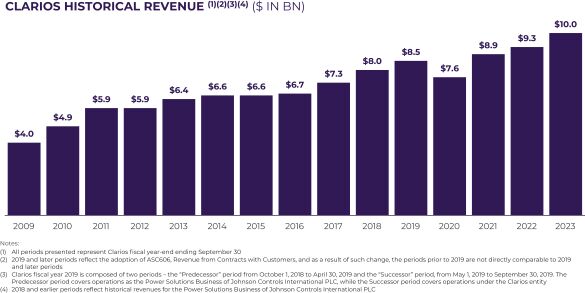

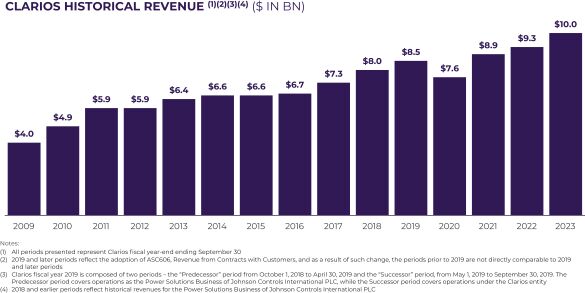

3

Table of Contents

Our presence in multiple key parts of the battery value chain provides us with a unique position to provide sustainability stewardship for the ecosystem. All of our batteries are recyclable. We recycle approximately 8,000 batteries per hour, twenty-four hours a day, seven days a week and 365 days a year within our network. As a result, 76% of the lead and 54% of the polypropylene (“plastic”) used within our batteries are from recycled or remanufactured content. The recycled materials in our batteries require approximately 90% less energy to process and generate approximately 90% fewer life cycle greenhouse gas (“GHG”) emissions than virgin materials. We have a long track record and expertise in successfully operating a circular economy, which we believe provides a structural cost advantage and positive financial impact for our company. Deploying a “life cycle” approach is key to our sustainability-based business model. We start with the raw materials that we select during the battery design stage and end with reuse of recyclable battery material to create a new battery. Our life cycle approach not only provides a stable supply of cost advantaged local recycled materials for our new battery production, but it also reduces waste to landfill and lowers our reliance on the supply of virgin materials. Importantly, we reinforce circularity throughout each step of the value chain. For example, in the aftermarket channel we pioneered an incentive structure to encourage the return of spent batteries to the point of sale, minimizing the leakage of materials from our circular system. We leverage our deep aftermarket network to implement reverse logistics and minimize transportation costs in select markets, while also reducing transportation-related fuel consumption and associated GHG emissions. We continue to execute on our long and consistent track record of delivering revenue growth, margin improvement and robust free cash flow generation. For the fiscal year ended September 30, 2023, our business generated $10,031 million in revenue, $346 million in net income, $1,810 million in Total Adjusted EBITDA (18% Total Adjusted EBITDA as a percentage of revenue), and $1,086 million in net cash flows from operating activities. For the fiscal year ended September 30, 2022, our business generated $9,260 million in revenue, $1 million in net income, $1,598 million in Total Adjusted EBITDA (17% Total Adjusted EBITDA as a percentage of revenue), and $649 million in net cash flows from operating activities. This performance represents a year over year revenue growth rate of approximately 8% and a Total Adjusted EBITDA growth rate of approximately 13% between fiscal year 2022 and 2023 (our year over year net income growth rate is not shown as it is not a meaningful metric due to a relatively low base in 2022).

Our sustained performance has allowed us to generate significant cash flow, which we have used to both invest in our business, as well as de-lever our balance sheet, having paid down total debt by over $2.1 billion over the last four years. As we move forward, we will continue to prioritize investment into our business to enhance our market leadership and technological capabilities to meet the evolving power needs of our customers, as well as to continue to deleverage our balance sheet.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—How We Assess Our Performance” regarding the definition, limitations and use of Total Adjusted EBITDA as a non-U.S. GAAP financial measure and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity—Total Adjusted EBITDA and Indenture EBITDA” for a reconciliation of Total Adjusted EBITDA to net income for the periods presented.

4

Table of Contents

The Critical Role of Low-Voltage Batteries

Although the role of the battery is evolving, low-voltage batteries are essential for all vehicles, no matter the powertrain. The low-voltage battery system is distinct and separate from the high-voltage system associated with HEVs and EVs. The low-voltage battery was initially introduced into vehicles to provide an instantaneous power source for the electric starter motor, which helps initiate combustion in a traditional ICE vehicle. In modern vehicles, including HEVs and EVs, the low-voltage battery continues to serve as the initial power source to start motion, but its role has evolved to also support the growing electrification and digitalization of systems, supporting vehicle connectivity, higher levels of autonomy, and new safety-critical design features.

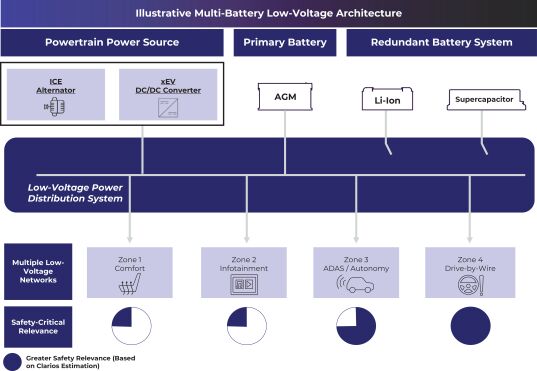

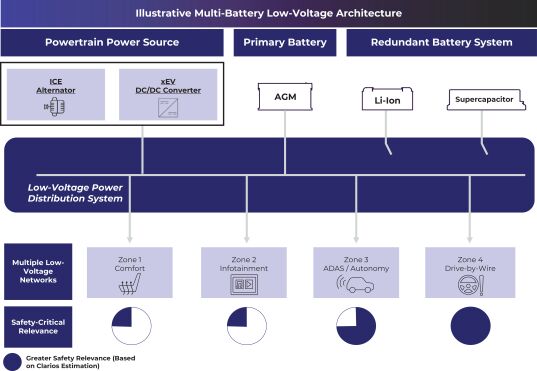

High-voltage batteries serve as the primary power source for high power components including traction inverters, onboard chargers, direct current to direct current (“DC/DC”) converters and heating, ventilation, and air conditioning (“HVAC”) systems in EVs. However, the voltage within these batteries, which typically operate between 300-and 800-volts, carries inherent safety concerns. The Occupational Safety and Health Administration (“OSHA”) defines safe voltage levels for human contact as under 50-volts. As a result, these high-power components require additional safety protection features including insulation, which adds to the volume, weight, and cost of these components. Our low-voltage products have an operating range from 12- to 48-volts and are responsible for powering electronic control units, perception systems, infotainment systems, sensors, actuators (brakes, door modules, valves, etc.), relays (high-voltage / low-voltage contactors), motors (steering, fans), low power heating/cooling devices, and security systems. A growing number of these features are active in both a key-off state (i.e., when the electric motor / high-voltage battery is off) and while the vehicle is in motion. While it is possible to use a high-voltage battery to provide low-voltage power supply using a DC/DC converter, the low-voltage battery is still required to provide safety-critical redundancy in the event of a high-voltage battery malfunction, powering critical functions to get the vehicle to the side of the road, including power steering and braking, unlocking the vehicle, lighting, and global positioning system (“GPS”) tracking. As higher levels of connectivity, autonomy and software-enabled functions are introduced in vehicles, the repercussions of power failure are even more significant. We believe the low-voltage system architecture, including multiple networks and battery power sources, will be increasingly important for powering critical fail-safe features and ensuring redundancy in vehicle electrical systems moving forward.

5

Table of Contents

Our Industry and Opportunity

In the broader mobility industry, the demand for electrical power consumption within a vehicle is increasing due to two distinct but often intertwined megatrends: decarbonization and the rise of the software-defined vehicle.

First, governments around the world are adopting regulatory frameworks and policies that aim to reduce the environmental impact of the transportation sector. Two key areas of focus include reduction of GHG emissions from new vehicle sales and total life cycle GHG impact. In order to comply with these increasingly stringent emissions standards and to meet the demand for lower emissions / more fuel efficient vehicles generally, OEMs are developing and selling a spectrum of alternative powertrain architectures that can either improve fuel efficiency, such as a start-stop or mild HEV powertrain, or significantly reduce or fully eliminate vehicle emissions by utilizing stored electrical energy to propel the vehicle, such as a full HEV or full battery electric powertrain. The alternative powertrain architectures require low-voltage batteries to handle higher electrical loads associated with the increased electrical content, while maintaining similar life despite more demanding operating conditions. Alternative powertrains often require the low-voltage battery to withstand higher cycling rates (i.e., frequency of discharge and charge), deeper discharge (i.e., the amount of power provided by the battery as compared to its base capacity) and higher charge acceptance (i.e., the ability to quickly receive energy and effectively store it). The increased low-voltage battery demands have led to the adoption of Advanced Batteries to support the penetration of alternative powertrain models. Advanced Batteries enable superior performance and life in these more demanding applications compared to traditional SLI batteries.

Raw materials and supply chains represent the second largest life cycle GHG source for OEMs. OEMs face additional requirements to reduce their materials and supply chain carbon footprint, which is fostering the increased use of recycled materials and implementation of greater circularity across their supply chains. Managing the total life cycle impact across both the low-voltage and high-voltage systems, including disposition of batteries at end of life, are key to further decarbonization of the transportation sector. We believe OEMs are expanding the envelope of considerations when selecting a battery technology, often taking into account raw material sourcing and supply chain sustainability. For example, lithium-ion battery technology utilizes metals that are relatively scarce and are often concentrated in limited number of regions, which introduces supply chain risk. The battery demand generated by the EV high-voltage system alone is placing a strain on the existing supply chain and metal mining operations. Furthermore, given relatively early stages of global EV adoption, the circular system for lithium-ion recycling has not yet been established at scale to address the disposition of fully spent lithium-ion batteries. Our broad chemistry-agnostic battery portfolio and well-established track record of circular operations positions us to be the trusted partner for OEMs, the aftermarket channel, and other key stakeholders to create sustainable solutions for the ecosystem’s evolving needs.

Second, OEMs are increasingly focused on the user experience in the vehicle as they seek to increase their level of engagement with the consumer over the lifetime of the vehicle. The proliferation of more capable electronic devices and increased connectivity have influenced consumers’ expectations of a vehicle, increasing penetration of features that enhance comfort, connectivity, and safety. These vehicle trends are converging to give rise to the software-defined vehicle design approach. A software-defined vehicle is one where electronics and software are primarily used to operate the vehicle versus the traditional mechanical systems. Successful transition to a software-defined vehicle requires electrification of the mechanical systems and digitalization of controls. An example of this shift is the increasing prevalence of throttle-by-wire, steer-by-wire, and brake-by-wire systems, in which the traditional mechanical linkages between the operator and the vehicle’s throttle, steering, and braking systems are replaced by interconnected electrical systems, driving the need for redundant power in the low-voltage power system. Increased electrical device content, electrical control units (“ECUs”) and software in the vehicle translates to increased total power demand and more complex power demand profiles for the low-voltage system to address. Separately, the increase in smart safety features in vehicles, such as advanced

6

Table of Contents

driving assistance systems (“ADAS”) and autonomous operations, which require their own dedicated suite of sensors, controllers, and onboard compute capability, is another driver of increasing demand for electrical power across low-voltage battery systems.

Together we believe these two megatrends signal strong future demand for more capable Advanced Batteries and new solutions, such as multiple battery configurations, real-time battery state monitoring software (i.e., health and power availability), and system optimization, which is expected to drive significant growth in our addressable content per vehicle. We believe we sit at the forefront of this industry transformation with our leading chemistry-agnostic portfolio of Advanced Batteries, industry leading product development capabilities, low-voltage system integration expertise, sustainability leadership and life cycle management approach.

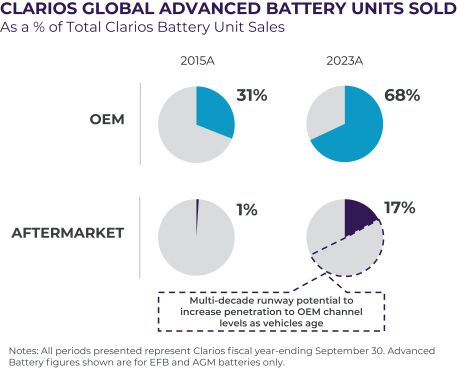

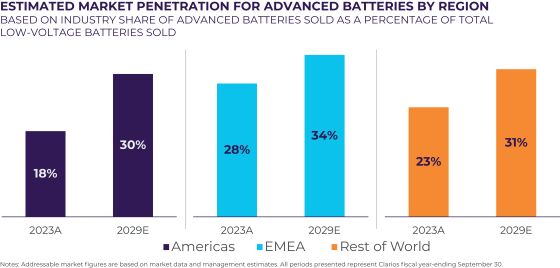

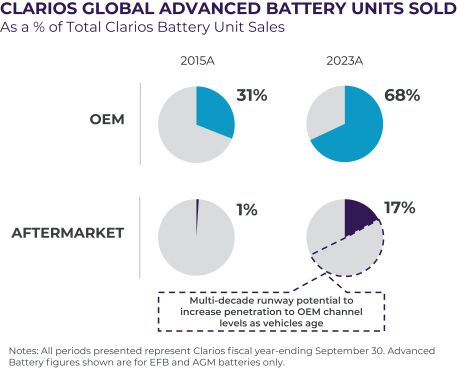

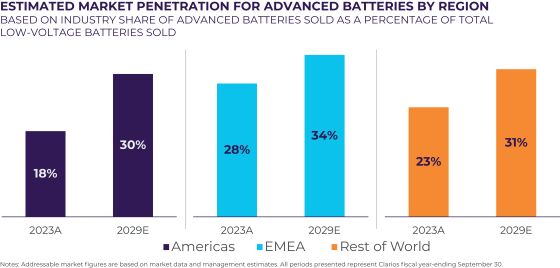

While we anticipate the market demand for low-voltage batteries to grow in-line with the overall car parc, we are strategically focused on the growth in sales of Advanced Batteries, which are expected to grow at an approximate 7% CAGR from 2023 to 2030, across our addressable market. We estimate global low-voltage battery sales across our addressable market in 2023 were approximately 430 million batteries and we expect that this will grow to 464 million batteries per year by 2030. Meanwhile, we estimate global low-voltage sales of Advanced Batteries in 2023 were approximately 106 million batteries, representing approximately 25% penetration of total low-voltage battery sales across our addressable market, and we expect this penetration rate to reach approximately 35% by 2030. We anticipate this shift in product mix toward Advanced Batteries will provide a long tailwind for our business as Advanced Batteries such as AGM and EFB generate over 50% higher revenue and are approximately twice as profitable as a SLI battery. While Advanced Batteries (and more specifically, AGM and EFB) volumes comprised approximately 68% of our total unit volume sales within our OEM channel in the fiscal year ended September 30, 2023, they only accounted for approximately 17% of total unit volume sales within the aftermarket channel. We believe the pace of AGM and EFB replacements within the aftermarket channel will continue to accelerate in the coming years as these batteries, already sold through the OEM channel, approach their first natural replacement cycle, providing meaningful potential growth within our aftermarket channel.

7

Table of Contents

We expect the demand for Advanced Batteries to proliferate across regions at varying rates, driven by adoption timing of alternative powertrains to comply with CO2 emission reduction regulations and the increased features of mass market vehicles. In the near-term, we expect an attractive growth opportunity in our Americas segment as the market is in the early stages of adoption for alternative powertrains compared to our EMEA and Asia segments, which we believe are further along the adoption curve.

Our Capabilities and Total Systems Approach

We are the only global provider to offer a comprehensive approach to the low-voltage battery value chain.

Chemistries

Our chemistry-agnostic approach provides us the flexibility to serve our customers with a variety of solutions to meet their platform-specific and expanding low-voltage system needs. Leveraging our rich heritage in low-voltage systems, as well as lead acid and lithium-ion based chemistry expertise, we are developing, expanding, and commercializing a portfolio of Advanced Batteries to serve the growing power demand within vehicles.

Our patented EFB battery design and our certified non-spillable AGM batteries provide better performance across power, cycling and life compared to similar competitor products. In addition, our EFB and AGM batteries are sustainably designed utilizing our proprietary PowerFrame® technology and our supporting precision manufacturing capabilities, resulting in lower raw material usage, the use of approximately 20% less energy and release of approximately 25% less GHG emissions as compared to traditional plate making manufacturing methods, ultimately benefiting our product margins.

8

Table of Contents

We have over 15 years of experience in designing and producing low-voltage lithium-titanium-oxide (“LTO”) cells in our Holland, MI facility. Globally, the low-voltage lithium-ion passenger vehicle end market is still developing, as AGM batteries are capable of meeting current power demands in pace-setting vehicles (i.e., luxury EVs) and hold both a sustainability, as well as cost advantage over low-voltage lithium-ion batteries. Up to 99% of the materials in all lead acid batteries (including AGM batteries) can be recovered, recycled and reused (something that cannot be said about lithium-ion batteries at this stage), and a low-voltage lithium-ion battery is typically more than three times as expensive as a comparable AGM battery depending on the low-voltage system configuration.

To address the anticipated electrical system demands of future software defined vehicles, we are architecting optimized system solutions capable of delivering power to safety critical consumers in any circumstance. These architectures will leverage multi-battery systems to overcome a single point failure and deliver operational robustness. Multi-battery systems may leverage a wide range of chemistry solutions and technologies to deliver specific power and energy profiles while balancing cost, weight and packaging volume. One example is our supercapacitor product that is currently under development. Supercapacitors are a proven technology within the transportation sector and can rapidly store energy and dispense bursts of high power. This capability may be deployed to supply instantaneous peak power demanded by functions like steer-by-wire while minimizing incremental packaging volume and adding less than one kilogram of weight to the vehicle.

Lastly, recognizing the current lithium-ion challenges of raw material availability and cost, supply chain security and end of life disposition, we continue to foster and develop alternative chemistries that can address both performance requirements and life cycle considerations. We believe sodium-ion represents a potentially attractive alternative to lithium-ion for low-voltage applications. Sodium is abundant, globally present and if handled properly can have a low environmental impact at the end of a sodium-ion battery’s life. We have partnered with Altris, a leader in sodium-ion battery cell technology, to exclusively develop sodium-ion cells specifically adapted to the needs of the low-voltage automotive battery market. We are excited by the prospects this technology holds for creating a sustainable alternative to low-voltage lithium-ion and expect it will be introduced in a global vehicle platform by the end of the decade.

Integration and Systems Solution

Our continued focus on battery innovation has naturally led to our deep understanding of the low-voltage system. We have deep know-how and expertise in modeling the different types of electrical application demands from applications and devices such as sensors, ECUs, onboard computers, power-controlled systems, heated-systems, smart safety systems, over-the-air updates, etc., which draw on power from the low-voltage network. We are also able to simulate how these electrical devices will interact throughout the operating cycle of a vehicle (i.e., from key-on to various operating modes and conditions to eventual key-off). This allows us to not only recommend the right type of battery to handle the dynamic power load and software design configurations, but it also enables us to provide deeper insights to OEMs on how to optimize a smart and safe low-voltage system. For example, we work with OEMs in the development phase of their vehicles to diagnose the electrical power demand in their vehicle design and pinpoint certain electronics that can unexpectedly strain the low-voltage system. This diagnostic capability allows us to work with OEMs to help them avoid developing a vehicle design that might experience failures in the field. Paired with our ability to simulate the power source dynamics by chemistry and configuration, we are well-positioned to deliver additional value to OEMs through further optimization of the low-voltage system.

With our total systems approach, we also expect to increase our addressable content per vehicle by expanding beyond the battery into additional low-voltage content, hardware, software and integration capabilities. With the shift to more software-defined vehicles comes growing complexity and electrical needs, which are expected to drive an estimated 15% CAGR in power consumption demand between 2020 and 2030. The increase comes as mechanical

9

Table of Contents

legacy systems convert to electrical equivalent replacements, such as steer-, throttle-, and brake-by-wire, as well as the growing power needs around comfort, vehicle autonomy and functional safety. Accordingly, we expect vehicles will increasingly require multiple low-voltage networks to optimize the power system and address these growing demands, resulting in multiple low-voltage batteries and higher low-voltage battery content per vehicle.

The illustrative diagram below shows a potential multi-battery low-voltage architecture that utilizes an AGM battery, a low-voltage lithium-ion battery, as well as a supercapacitor. The multiple networks, chemistries, and software work together to power safety-critical, autonomous, and comfort applications as well as provide the necessary redundancy for these applications and features. We believe our total systems and chemistry-agnostic approach positions us to continue to be our customers’ partner of choice for next generation vehicles, further differentiates us from the competition, and positions us well to take advantage of this expected long-term growth trend.

Software and Diagnostics

Our combined battery health and simulation expertise uniquely positions us to provide software solutions. We have multiple decades of experience in embedded software capabilities, developing BMS for lithium-ion battery chemistry, both in low and high-voltage systems and across a broad range of end markets. This experience forms the foundation of our electronics expertise and software development capability. We have further expanded our software and integration capabilities to address the emerging low-voltage lithium-ion opportunity with our acquisition of the power business unit of Paragon GmbH & Co. KGaA (“Paragon Power BU”). We are also exploring connected services business models, where we utilize proprietary algorithms to provide enhanced communication of state of charge and health monitoring capabilities for AGM batteries to enable proactive and planned battery replacements and avoid costly downtime, most notably in fleet applications. Our model-based software is architected to be highly reusable across chemistry and customer applications while achieving the most stringent industry standards for software quality and cybersecurity.

10

Table of Contents

Manufacturing and Operations

The size and scale of our global manufacturing network and our “in-the-region, for-the region” strategy enables us to meet regional specific demand trends, while providing the flexibility to load balance across our global system. We have 53 manufacturing, distribution and recycling facilities supplying over 100 countries across each of the regions in which we operate (i.e., Americas, EMEA and Asia). We believe our leading AGM production capacity, which we estimate represents approximately 50% of the global capacity, will help drive the growth of our business. We are also able to leverage best practices across the regions. Today, the Americas market is in the early stages of Advanced Battery adoption. To address this market and long-cycle growth in Advanced Batteries, we are leveraging learnings from our prior expansions in EMEA and Asia and continuing to add to our knowledge base.

We recognize our operational performance has direct impact on our OEM and aftermarket customers. Quality and availability are paramount to ensure safe and reliable operations of the car parc, minimize warranty liabilities for OEMs, and maximize customer satisfaction for the point of sale in the aftermarket channel. Our high-quality track record is foundational for our reputation and enables us to be forward looking on innovation and growth. We are focused on deploying our battery operations playbook to continuously improve our manufacturing operations and workforce productivity. The way we operate is integral to our customers’ experience and we continue to improve our sales, inventory, operations and planning processes to deliver the best-in-class product, availability and aftermarket support. We are investing in our organization and infrastructure to increase automation in our production facilities, maximize line utilization and continue to reduce scrap throughout our global operations.

We continue to foster a culture that prioritizes safety and talent development. With industry leading low-incident rates, we are concentrating our efforts to prevent accident occurrence through proactive and preventative performance tracking. We also recognize the importance of our global team in achieving our growth, driving sustainability, and supporting our mission to power the movement of the world.

Commercial Excellence

Customer-centricity is foundational to how we operate at Clarios, including early engagement with our OEM and aftermarket customers through the development and life cycle of the vehicle. Our commercial excellence is built on the pillars of quality, leading brands, product availability, value-add services, and continued innovation.

Aftermarket Channel

In the aftermarket channel, we sell our products through several leading, well-recognized global and regional brands such as VARTA®, LTH®, Heliar®, OPTIMA®, Delkor® and MAC® that are known for quality and performance. We also provide private labels to our aftermarket customers including DieHard®, Interstate®, Duralast®, Bosch® and Everstart®. We also perform centralized marketing for our brands, which creates a pull effect for our distributors and independent workshops from the consumer, so when they arrive at a point-of-sale they specifically request our brands to replace their battery.

11

Table of Contents

Across our markets, batteries represent the largest and one of the most important product categories for our aftermarket customers. Our global footprint and extensive distribution network enable us to quickly respond to store-level demand in a timely manner and at a competitive cost, helping to make sure that batteries are delivered in optimal condition and retailers or workshops have the highest level of product availability to avoid missed sales.

Leveraging our market intelligence, we aim to deliver value beyond the supply of our batteries through a robust set of practices and tools to address the diversity of aftermarket partners and the car parc. One of our key aftermarket efficiency tools is the VARTA® Partner Portal, which assists our customers in diagnosis, selection of the right replacement battery and step-by-step instructions on how to perform installation. Leveraging our insight coming from our deep partnerships with OEMs, we supplement these tools with ongoing training to support battery installations, as low-voltage network designs become increasingly complex, such as the fitting of Advanced Batteries outside of the engine compartment as in the traditional ICE design. We also leverage our extensive distribution network for timely delivery at the store-level and arrange for efficient pickup of spent batteries.

Lastly, we continue to find ways to innovate our go-to-market practices and expand the reach of our products. For example, in select countries, we are enhancing our e-commerce channel capabilities to better serve the end consumer. We have developed the online platform and supporting distribution and delivery network, so consumers can order a battery online and have it quickly delivered onsite or to a nearby workshop for installation.

The combination of these factors creates a strong value proposition to our aftermarket channel partners and we believe enables us to maintain our premium pricing strategy in the market.

OEM Channel

Our global footprint provides proximity to our OEM customers, allowing us to collaborate closely during the development phase of vehicle platforms and improve our response time and shipping costs to the OEM manufacturing plants. We believe we are a trusted partner across nearly all OEMs and have a leading reputation for performance and quality and have won several supplier awards. We continuously maintain high on-time delivery, including during the disruptions in the OEM channel recently caused by the coronavirus (“COVID-19”) pandemic and the following semi-conductor shortage.

Our expertise and ability to expand beyond the scope of a traditional battery supplier to a low-voltage systems solution provider enhances our value proposition for our OEM customers. This aligns with the design trend to focus on the low-voltage system and power source sooner in the vehicle development process versus the historical practice of specifying the battery in isolation at a later stage.

Our scale, robust technical organization and innovative mindset allows us to partner with OEMs to push technical boundaries and focus on product development with known commercial opportunity. We have multiple early development product programs with large OEMs that we expect will result in several launches of new products in the coming years.

We expect our chemistry-agnostic technology portfolio, systems-based approach and global manufacturing capabilities will continue to drive our strong market share within the OEM channel against the backdrop of increasing complexity, safety criticality and overall importance of the low-voltage system.

Circular Operations

Our stewardship of the batteries that we produce extends well beyond the initial sale to our OEM channel or aftermarket channel partners. We leverage our scale and expertise to provide a full life cycle solution for our

12

Table of Contents

ecosystem. Our circular approach creates value for our customers, improves our cost structure, provides resiliency in raw material supply, and reduces our waste and GHG emissions.

We have a long history of operating a closed-loop system via the use of both our in-house recycling and collection capabilities, as well as the use of third-party recyclers. Our scale and market leadership positions us to be the natural aggregator of spent batteries. We have implemented wide reaching and longstanding incentive programs to encourage our customers to return the spent batteries when purchasing new batteries. We believe this point-of-sale exchange is the most effective and environmentally preferrable way to close the loop and prevent improper disposal of batteries. Our customers value this service because they receive credit for the raw materials collected and are assured the spent batteries will be safely and responsibly recycled in accordance with regulatory requirements. We are able to reduce transportation costs and GHG emissions by pairing the delivery of new batteries with the reverse logistics of collecting spent batteries. Regulatory frameworks such as restrictions on reverse logistics in some regions we serve have led to indirect or open circular systems. While we still secure recycled materials for our batteries within these regions, independent service providers collect spent batteries at the point of sale. In such situations, we drive responsible recycling practices while supporting regional governments efforts to unlock the potential of closed-loop circularity through regulatory reform.

Our batteries are designed so that 100% of products sold are recyclable. Lead and plastic, which forms the case of the battery, are two key materials that comprise our SLI, EFB and AGM batteries. Our ability to recycle the spent batteries within our owned and third-party operated recycling networks provides us with a cost structure advantage and security of supply for raw materials. We operate recycling facilities in the Americas and EMEA. In 2024, we are celebrating 120 years of recycling excellence in Germany. Through our recycling operations and sourcing of secondary materials, we are able to source 76% of the lead and 54% of the plastic used in our batteries from recycled or remanufactured sources, reducing our reliance on virgin material. Recycled materials in our batteries require approximately 90% less energy to process and generate approximately 90% fewer life cycle GHG emissions than virgin materials.

Our Competitive Strengths

We are the market leader in critical low-voltage battery technologies and the only low-voltage industry player with a global footprint.

We are the world’s largest manufacturer and supplier of low-voltage energy solutions, which power nearly every type of vehicle on the road today and play a critical role in the safety of all vehicles. We are a scaled player, and we believe that we are approximately four times larger than our nearest competitor based low-voltage battery production volume for the mobility end market. We are also the only low-voltage battery manufacturer with a global presence, serving more than 100 countries. We have leading global market share across the markets we serve, with our business holding the number one market position in both the Americas and EMEA segments and the number three market position in Asia across both the OEM and aftermarket channels.

Our products power one in every three vehicles worldwide, as we sell our products to almost every passenger vehicle OEM in the world. Many of our OEM customers design common vehicle architectures across their global platforms. Our global scale and supply chain capabilities provide us with a competitive advantage, allowing us to serve as the central source of consistent and reliable low-voltage battery supply across all regions in which the OEM’s vehicle platform is sold.

In the aftermarket channel, we go to market through our leading global first-line brands and through the brands of our partners via our private label business, most notably in the Americas. Our portfolio of leading brands includes many of the world’s most recognized and trusted battery brands, based on aided brand awareness and consumer preference studies in regions where we operate. We believe consumers trust the brands we produce to deliver best-in-class operating life, performance, safety and reliability. In addition to offering trusted brands

13

Table of Contents

and a high-quality product, our global footprint allows us to operate an entire logistics network for battery delivery (in some cases, direct to store) and for the recovery of spent batteries to be recycled, often through our in-house recycling network.

Finally, our flexible manufacturing approach allows us to tap into our regional manufacturing capabilities to provide in-market manufacturing for our customers to minimize transportation costs and reduce delivery lead times. At the same time, our global scale also allows us to tap into available capacity across our entire manufacturing footprint as needed to balance global customer demand and optimize production. This drives product availability and insulates our customers from any regional supply chain challenges, helping make us the supplier of choice for their low-voltage battery needs.

Our business is replacement-driven – our scale and focus on commercial excellence allows us to continue growing within the attractive, recurring and resilient vehicle aftermarket channel

We consistently generate strong cash flow through stable, recurring, non-discretionary demand for our products, combined with leading manufacturing capabilities. Our significant aftermarket exposure, making up approximately 79% of total unit volume sales in the fiscal year ended September 30, 2023, provides a resilient and consistently growing demand base for our business. Automotive batteries are typically replaced two to four times over a vehicle’s typical 20-year life and purchases cannot be delayed due to the critical nature of the product. The importance of our products and our high-touch level of service have positioned us as a key supplier to large aftermarket retailers in one of their most significant product categories. We also benefit in this category through a “first fit” advantage given our relationships with OEMs. Our OEM supplier relationships give us critical market intelligence on the evolving low-voltage power needs of vehicles entering the market, which in turn allows us to educate our aftermarket customers on how best to service and support these vehicles as they come in for servicing, as well as support their demand planning and inventory management. The insight and knowledge we share with our customers fosters loyalty and increases retention throughout the aftermarket channel.

Margins in the aftermarket channel are significantly higher than the OEM channel on similar products and the recurring nature of our aftermarket presence insulates our business from potential market downturns. Given the complex logistics and high service levels required by our aftermarket customers, we believe the size and scale of our circular, vertically integrated product distribution network for battery delivery (in some cases direct to store) and for the recovery of spent batteries to be recycled, often through our in-house recycling network, is unique, highly valued by our customers and difficult to replicate by our competitors.

We have the broadest low-voltage technology portfolio across our industry, with chemistry-agnostic and powertrain-agnostic solutions aligned to meet our customer needs

We believe our product portfolio is well positioned to meet the current and evolving needs of our mobility customers. Low-voltage batteries play a critical role in powering every vehicle – including ICE, HEVs and EVs – as they all need a low-voltage power source to get them started, power various electrical functions (i.e., lights, infotainment, autonomous features) and support key safety functionality within the vehicle. As the power needs of future vehicles continue to evolve and grow, the need for more advanced low-voltage batteries is expected to

14

Table of Contents

continue to accelerate. Our chemistry-agnostic approach allows us to offer a wide breadth of low-voltage solutions ranging from 12- to 48-volts, covering traditional lead acid (SLI) batteries, which are well suited to meet the power needs of conventional ICE vehicles, to Advanced Batteries such as AGM, EFB and lithium-ion, which are particularly well suited to meet the growing power needs of the increasing amount of start-stop, electric, connected and automated vehicles being introduced today. Our technology portfolio is further enhanced by our ongoing investment into and development of emerging chemistries like sodium-ion, and the complementary use of supercapacitors. These innovation efforts are supported by approximately 350 engineers across our research, advanced development, materials and manufacturing efforts, as well as by more than 2,000 patent assets, including active patents and patent applications currently pending. Our broad product portfolio allows us to fulfill the spectrum of powertrain needs of our customers and serve as a powertrain-agnostic low-voltage partner across all vehicle platforms.

Our total systems approach allows us to partner with our OEM customers on low-voltage system design, development and integration from the very start of their vehicle design journey

Our chemistry-agnostic product portfolio is further supported by our software and integration services, providing us the flexibility to offer a total systems solution, rather than a standalone product. As power needs for vehicles have continued to evolve and as electrical networks within these vehicles get more complex, OEMs increasingly need a more system-focused approach for designing low-voltage battery solutions within their vehicle platforms. Responding to this trend, we are investing to enhance our capabilities from both a software and electronics perspective. These broader capabilities enable us to conduct simulations for OEMs globally and ultimately recommend optimized low-voltage battery solutions to meet their unique application needs and that effectively integrate into the vehicle’s broader electrical architecture. These simulations are backed by years of data, sophisticated tools and proprietary algorithms allowing us to provide customizations as requested by our customers. We believe this unique expertise along with our chemistry-agnostic portfolio make it difficult for competitors to match our offering.

In addition to these simulation capabilities, we have continued to invest in, and enhance our capabilities across lithium-ion batteries, building on our over 15 years of manufacturing expertise to date. This includes our development of BMS, as well as real-time battery diagnostic and low-voltage systems control optimization tools. We recently added to these software and integration capabilities with the acquisition of the Paragon Power BU. As a result of our systems-based approach and growing capabilities, we are continuing to build on our long-standing track record of commercial excellence with our OEM customers – expanding our role from selling batteries to designing low-voltage vehicle systems, including battery, software and integration services. We believe our holistic approach gives us a competitive advantage over other suppliers, as it allows us to engage earlier and more deeply with our OEM customers, leveraging our low-voltage expertise in the design and development of their new vehicle platforms.

We are well positioned to benefit from the secular tailwinds driving a mix-shift toward higher value Advanced Batteries with continued long-cycle growth in the aftermarket channel

New vehicle sales and the evolution of the existing car parc towards next-generation vehicles are expected to accelerate the needs of OEMs and consumers for Advanced Batteries. We expect unit sales of Advanced Batteries to increase from approximately 25% of total low-voltage battery sales as of 2023 to approximately 35% of low-voltage batteries sold by 2030 (based on internal Company estimates), and we believe we are well-positioned to capture the growing mix-shift to Advanced Batteries. Our product development strategy is based on understanding OEM application needs and partnering with them to select the optimal low-voltage battery solution for each application. We maintain commercial relationships with almost all major OEMs and have active dialogue with them on both commercial and technological matters. Our team has developed a robust pipeline of Advanced Batteries to address future levels of start-stop, electrification, and autonomous capabilities and is well-positioned to be the leading low-voltage battery supplier to the next-generation of vehicles across all powertrains.

15

Table of Contents

We expect these new products to enhance our share of business with OEMs and to be higher-margin contributors to our bottom line.

Given the growing demand for Advanced Batteries, we have strategically invested in growing our global manufacturing capacity accordingly (and in particular AGM batteries), having invested approximately $907 million between September 2014 and March 2024. Our investments to date have allowed us to build a large manufacturing base, with our operations making up approximately 50% of installed AGM capacity globally. We believe this significant scale advantage in manufacturing capacity, as well as continued investment into our manufacturing base will allow us to capitalize on the growing demand for Advanced Batteries globally and remain at the forefront of these evolving low-voltage solutions. In addition to our leadership within EFB and AGM Batteries we are also one of the world’s largest low-voltage lithium-ion manufacturer in the automotive industry, shipping over 200,000 low-voltage lithium-ion batteries per year.

Lastly, we anticipate this shift in product mix towards Advanced Batteries —in particular EFB and AGM— to significantly enhance our financial profile. Currently, EFB and AGM batteries generate over 50% higher revenue and are approximately twice as profitable as a SLI battery. We expect that the continued penetration of these products into the higher-margin aftermarket channel will significantly enhance our profitability. While volumes for these products comprised approximately 68% of our total unit volume sales within our OEM channel in the fiscal year ended September 30, 2023, they accounted for only 17% of total unit sales within the aftermarket channel over the same period. As we have seen over the past decade, we expect the pace of replacements for these Advanced Batteries within the aftermarket channel to continue to accelerate in the coming years as these batteries already sold through the OEM channel approach their first natural replacement cycle. We believe this has the potential to result in a higher penetration of Advanced Batteries sales within our aftermarket channel moving forward, driving an increasing share of attractive, higher revenue and higher-margin product sales as a part of our overall business

Our scale and vertical integration provide us with a best-in-class cost structure

We believe our scale and vertical integration help us maintain a low-cost profile, while our technology leadership allows us to capitalize on the continued mix shift towards higher-margin Advanced Batteries such as EFB & AGM across our markets. These factors combined help drive a meaningfully higher margin profile for our business relative to our competitors. We believe our cost structure benefits from superior design, scaled manufacturing plants, optimized footprint, automation, plant efficiencies and purchasing synergies.

Our circular supply chain and recycling infrastructure serve as a key pillar for our best-in-class cost structure. Across our global operations, 76% of the lead and 54% of the plastic used within our batteries is from recycled or remanufactured content. We are able to leverage long-term agreements with third-party recyclers, to whom we provide used batteries collected through our distribution network for processing and recycling. The resulting recycled material allows us to ensure a diversified supply of raw materials, across our footprint while limiting our raw material supply risk and reducing our raw material input costs. This cost advantage is further enhanced by our expansive in-house recycling capabilities across the Americas and EMEA segments, where our vertical integration model is able to drive further cost savings. As an example of the benefits of our vertically integrated model, in fiscal year 2023, our Mexico recycling facilities were able to operate at a cost basis approximately 75% of the cost of our average third-party recycling contract. Our cost structure is further advantaged by our ability to pass through lead costs to our customers via pass through provisions within a majority of our customer contracts. These provisions allow us to pass on changes in raw lead material costs based on indexed pricing, significantly limiting our exposure to lead price volatility.

While the size of these cost advantages depends on the region and competitor, we believe each is durable and together provide a strong base to continue building our leadership position. Our leading margins allow us to generate consistent and meaningful cash flow on a re-occurring basis, enabling us to thoughtfully invest in capacity across our global manufacturing facilities to keep up with evolving market demand and a growing need for Advanced Batteries.

16

Table of Contents

We have a relentless focus on driving continuous improvement across our operations and have a proven track record of achieving operational efficiencies

Continuous operational improvement is a core competency. We have achieved significant annualized cost savings through initiatives related to manufacturing and recycling efficiencies, (i.e., reducing bottlenecks and throughput in our plants, and increasing utilization rates), procurement, SG&A, and logistics (i.e., optimizing shipping routes and external services, transforming into a lean, regionally focused organization).

One such driver of improvement has been our investment in advanced manufacturing across our AGM lines. We continue to expand our ability to serve growing AGM demand by increasing throughput at existing sites, activating production lines on-standby, and adding entirely new capacity within reconfigured plants. We are also integrating higher levels of automation, use of machine learning and artificial intelligence. We take an all-enterprise approach, focused on serving local demand first, but also supporting cross-regional demand as required. Since 2019 these measures have resulted in a sustained 11% year-on-year production increase of our AGM production at an enterprise level.

As we move forward, we will continue to evaluate our operations and aim to further improve our manufacturing lines to increase throughput and productivity. We believe there remains a material opportunity to further optimize our costs and drive efficiencies across our footprint both in the U.S. and globally.

Our commitment to setting high sustainability standards is core to both our business philosophy and operations

As a global leader, Clarios helps to shape and define energy solutions across the mobility sector not just for today, but tomorrow. We have a unique view of the rapid transformation undergoing the mobility industry broadly, and as a leader in low-voltage battery solutions, we are well positioned to facilitate and support the industry’s drive toward decarbonization. That is why we initially developed our Clarios Sustainability Blueprint and ultimately our Blueprint 2030 (the “Blueprint”), to continue to guide our roadmap to build a company and a world that is able “to sustain and grow indefinitely.”

17

Table of Contents

Our Blueprint begins with our responsibility and focus on continuously improving and accelerating our solutions and aligns our efforts with specific UN Sustainable Development Goals (“UN SDGs”) to maximize our impact. Through these efforts, we work to unlock our capabilities in battery innovation, design, materials sourcing, manufacturing, distribution, and circular systems (including recycling networks). We believe that our efforts to exceed industry-leading environmental and safety standards globally have been a key driver of our success. Through our business practices, we have aimed to demonstrate a dedication to sustainability by seeking continued improvement in our GHG emissions performance. We reduced our fiscal year 2023 Scope 1 GHG emissions, or GHG emitted directly by our operations, and Scope 2 GHG emissions, or the indirect GHG emissions associated with the production of the energy we use, by nearly 7% from our fiscal year 2021 baseline emissions level. For example, from fiscal year 2022 to fiscal year 2023 we reduced our Scope 2 emissions by over 55,000 metric tonnes of carbon dioxide equivalent (“MT/CO2e”) as a result of our efforts including a first of its kind zero carbon energy agreement for our facilities in Mexico. This long-term contract supplies 100% of base-load electricity to all manufacturing plants in Mexico, including expansion projects, from nuclear power. Lead is one of the world’s most recycled materials with lead acid batteries being the most recycled consumer product globally, and our batteries are designed so that 100% of products sold are recyclable. The recycled materials in our batteries require approximately 90% less energy to process and generate approximately 90% fewer life cycle GHG emissions as compared to virgin materials. In addition, our PowerFrame® technology embedded in Clarios batteries uses approximately 20% less energy to make and releases approximately 25% less GHG emissions than traditional plate making manufacturing methods.

Our circular recycling system encompasses more than the physical process of recycling. We manage all aspects of the supply chain, including the delivery of batteries and collection of spent batteries. We believe the holistic management of the entire program establishes a significant competitive advantage in that it provides an overall raw material cost advantage, ensures sustainability of supply, helps insulate the business from raw material price fluctuations, strengthens ties with aftermarket customers, and provides them with a cost-advantaged, environmentally preferrable return process, including in some cases, a credit for replacement Clarios batteries. In fact, in February 2022, the United Laboratories certified our AGM batteries produced under the DieHard® brand as the world’s first automotive battery under the circular economy validation—a distinct honor that we are proud of. Furthermore, we believe our commitment to safe and responsible practices helps mitigate potential environmental risks and associated compliance costs. We endeavor to pursue key growth opportunities at the intersection of sustainability and leading technology, including enabling the global car parc’s electrification with Advanced Batteries, our involvement in expanding the recycling of lithium-ion batteries and our general pursuit of identifying future solutions to continue to improve fuel economy and reduce GHG emissions (i.e., sodium-ion batteries). Our revenue from clean tech projects and products (i.e., fuel efficient or emissions reducing) have increased from $1.8 billion in fiscal year 2020 to $3.4 billion in fiscal year 2023.

In addition to these commercial goals, we founded the Responsible Battery Coalition, led the creation of the Global Battery Alliance and have developed unique public/private partnerships with UNICEF, including in collaboration with Pure Earth—Protecting Every Child’s Potential, and UNICEF’s Healthy Environments for Healthy Children initiative. These efforts, which help set global standards are an extension of our Blueprint and help us to continue advancing our industry’s commitment to sustainable practices.

18

Table of Contents

We have a strong financial profile and track record of consistent growth that position us for sustained cash flow generation